Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.116 n.3 Johannesburg Mar. 2016

http://dx.doi.org/10.17159/2411-9717/2016/v116n3a3

PAPERS - MINE PLANNING AND EQUIPAMENT SELECTION (MPES)

Determination of value at risk for long-term production planning in open pit mines in the presence of price uncertainty

M. Rahmanpour; M. Osanloo

Department of Mining and Metallurgical Engineering, Amirkabir University of Technology, Tehran, Iran

SYNOPSIS

Mine planning is a multidisciplinary procedure that aims to guarantee the profitability of a mining operation in changing and uncertain conditions. Mine plans are normally classified as long-term, intermediate-term, and short-term plans, and many factors affect the preciseness of these plans and cause deviations in reaching the objectives. Commodity price is the heart of mine planning, but it has a changing and uncertain nature. Therefore, the determination of mine plans in the presence of uncertain mineral price is a challenge. A robust mine plan reduces the risk of early mine closure. A procedure is presented to determine the value at risk (VaR) in any possible mine planning alternative. VaR is considered together with downside risk and upside potential in order to select the most profitable and least risky plan. The model is tested on a small iron ore deposit.

Keywords: mine planning, value at risk, downside risk, upside potential, price uncertainty.

Introduction

Mining projects are normally evaluated with the objective of maximizing economic value, as measured by the net present value (NPV). The aim of mine planning is to develop a yearly extraction plan that guides the mining operation to the highest NPV (Dagdelen, 2007; Yarmuch and Ortiz, 2011). This plan considers the technical constraints such as blending requirements, block sequencing, and pit slope (Caccetta and Hill 2003). Thus, the mine plan affects the economics and the payback period of mining operations.

Mine planning is a procedure based on which the profitability of the mining operation is guaranteed in changing and uncertain conditions (McCarter, 1992). However, conventional mine planning ignores the volatility and uncertainty of future commodity prices and does not allow for managerial flexibility. It is common practice to assume a deterministic and constant commodity price through the mine life. The problem with this approach is that the commodity price is the heart of the mine planning procedure and governs the profitability and feasibility of the operation; thus ignoring price volatility will result in a sub-optimal mine plan.

Note that the NPV of a mining project is highly sensitive to the future commodity price estimates, therefore any decision in the context of mining should be take price uncertainty into consideration. The question here is whether a mine plan that is optimal for an estimated future commodity price will also be reasonably optimal when price uncertainty is accounted for. To answer the question, this paper presents an approach to select a mine design under mineral price uncertainty.

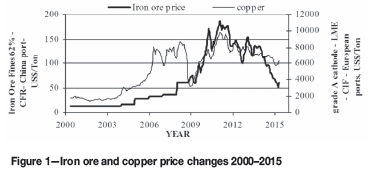

The essential data required for mine planning comprises geological, geo-mechanical, hydrological, economic, environmental, and infrastructural information, and knowledge of mining engineering. These factors contribute to a greater or lesser degree to the mine planning procedure and mine plans. The characteristics of future mining activities, and also inherited uncertainty in the data (such as commodity price, ore grade, mining costs, and recoveries), highlights the importance of mine planning under conditions of uncertainty. As shown in Figure 1, mineral prices have a changing and volatile nature. In this figure, the price changes for iron ore and copper are given from the year 2000.

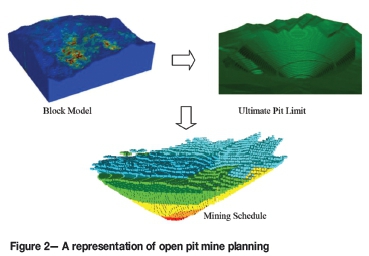

Open pit mine production planning is a multi-period precedence-constraint knapsack problem, and it normally fits into the mixed integer linear programming (MILP) framework (Osanloo et al., 2008; Newman et al., 2010). This problem is defined on a spatial representation of the mining area called a block model (Hustrulid etal., 2013). Considering the exploration drilling pattern, geological conditions, and the size of mining equipment to be used, the size of the blocks in a block model will be determined (Figure 2). After determining the block dimensions, the geological characteristics of each block are assigned using any available estimation techniques (Journel and Kyriakidis, 2004). By considering the economic parameters such as commodity selling price, operating costs, and overall recovery, one can calculate the economic value of each block. The aim of the mine planner is to determine whether a given set of blocks should be mined or not; if so, at which time it should be mined, and once it is mined, how it should be processed to maximize the NPV of the operation (Dagdelen, 2007). Once a block is earmarked for mining, different destinations or processing methods can be determined for that block. The process of determining the time and extraction sequence of blocks through the mine life is referred to as mine production planning (Johnson, 1968). This procedure is represented in Figure 2.

The problem of production planning in open pit mines has been studied by many researchers (Dowd and Onur, 1992; Tolwinski and Underwood, 1996; Denby and Schofield, 1996; Kumral, 2003; Ramazan and Dimitrakopoulos, 2004; Menabde et al., 2007; Boland et al., 2008; Dimitrakopoulos and Ramazan, 2008; Elkington and Durham, 2009; Sattarvand, 2009; Bley et al., 2010; Kumral, 2010; Groeneveld and Topal, 2011; Murakami et al., 2011; Gholamnejad and Moosavi, 2012; Lamghari and Dimitrakopoulos, 2012; Moosavi et al., 2014). These studies aimed to maximize the NPV of the operation while satisfying all the operational constraints.

There are two optimization approaches to solve the production planning problem in open pit mines, named deterministic and uncertainty-based approaches (Osanloo et al., 2008). In deterministic models, all the inputs are assumed to have fixed known real values (e.g. Tan and Ramani, 1992; Akaike and Dagdelen, 1999; Zhang, 2006; Elkington and Durham, 2009; Cullenbine et al., 2011). However, this assumption is not always realistic and some data such as ore grades, future product demand, future product price, and production costs can vary throughout the mine life. Researchers (Albach, 1976; Rovenscroft, 1992; Smith, 2001; Godoy and Dimitrakopoulos, 2004; Zhang et al., 2007, Abdel Sabour et al., 2008; Abdel Sabour and Dimitrakopoulos, 2011; to name a few) have developed various models based on MILP, meta-heuristics, heuristics and simulation, chance constraint linear programming, and stochastic programming to determine the mine plan in uncertain conditions.

In this paper price uncertainty and its affect on mine planning is studied. To do so, a simple integer linear programming model is formulated to determine the production planning and mining sequence of blocks.

Method description

The mineral or commodity price affects the mining cut-off grade, mineable reserve, mine size, and mine life. Any longterm change in commodity price will affect the cut-off grade and amount of mineable reserve. For example, in the case of a price fall, the ultimate pit limit shrinks, cut-off grade increases, low-grade ore blocks will be classified as waste, and the mineable reserve decreases. All these factors will change the long-term and short-term plans of the mine. Short-term changes in commodity price will affect the shortterm plans (Tulp, 1999). In these conditions, short-term plans must be changed cautiously because short-term gains may cause other problems in long-term plans (Hall, 2009a).

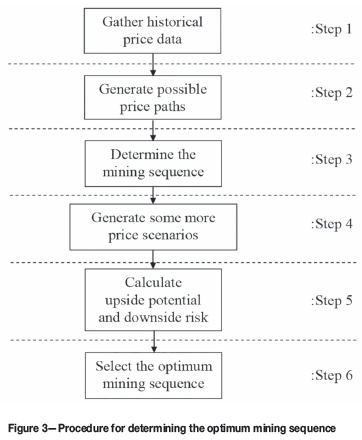

This paper studies the effects of price uncertainty on mine planning and aims to minimize the risks from price changes throughout the mine life. Figure 3 shows the procedure of the proposed algorithm. Based on historical price data, scenarios are generated. Then in the third step of the procedure, mine plans are optimized based on each price scenario. The plans are analysed to check their behaviour with respect to different price forecasts. In the fifth step of the procedure, the downside risk and upside potential of each mine plan are determined. These two criteria will indicate the optimum mining schedule among the different mine plans.

This approach leads to the selection of a mining schedule that captures the upside potential and minimizes the downside risk of the mining operation associated with price uncertainty. For that purpose, the available price data, its volatility, and its simulated values are integrated into the process. The practical aspects of the approach are illustrated in a simple example.

Bootstrapping

According to Figure 3, in the first step the historical changes in mineral price are collected in order to simulate future possible price forecasts. There are various methods to generate different price paths, including bootstrapping and geometric Brownian motion (GBM). In the second step of the procedure, the bootstrapping method is applied to determine some scenarios to model future price trends and changes. Generally, bootstrapping is a sampling method. Assuming a given data-set of historical mineral prices, the yearly or monthly returns (i.e. rate of monthly/yearly price change in each period) are calculated. The return of a mineral price is equal to the natural logarithm of the division of two consecutive prices (Equation [1]).

where μ is the return, and St, St-1represent the mineral price in periods t and t-1, respectively.

In order to predict future mineral prices or to generate a new sequence of price path using bootstrapping, the individual returns should be calculated for each period. It should be noted that to generate a price path for the next 10 years, the returns for the previous 10 years should be calculated. When the historical returns are calculated, then by selecting the returns arbitrarily from the historical data and putting them together, many price paths can be generated.

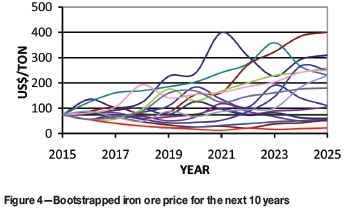

The main advantage of this method is that it does not need any assumptions about the distribution of the returns, and the empirical distribution of the returns is inherited in the sampling procedure. Using the historical data in Figure 1 and applying the bootstrapping method, several scenarios are generated for the iron ore price (Figure 4). In the traditional approach, the mineral price is assumed constant through the mine life. In order to have a benchmark to compare the results with the traditional approaches, another scenario with the assumption of fixed price throughout the mine life is generated.

Mathematical model ofblock sequencing

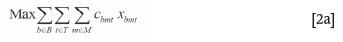

According to the procedure, in the third step, the optimum block sequencing should be determined for each price scenario. For that purpose, production planning and block sequencing in open pit mines is formulated in an integer linear programming model (Equation [2]). This model is capable of determining the time of extraction of each block. It also determines the destination or processing method of each block such that it maximizes the total NPV. The notation used in the model in Equation [2] is as follows:

B The set of all blocks in the block model

Pb The set of blocks that cover or precede block b

t,t' The time indices

T The mine life or number of the periods to be planned

M The number of possible destinations or processing alternatives

cbmt The discounted economic value of block b mined at time t and sent to destination m

Xbmt The decision variable, which is equal to unity if block b is mined at time t and sent to destination m; otherwise it is equal to zero

MCt, MCtThe minimum and maximum mining rate at time t, respectively

Xb The amount or tonnage of rock in block b

gb The grade of commodity in block b (normally expressed as a percentage of the total block tonnage)

Gt,mmin, Gt,mmax The minimum and maximum acceptable grades at destination m at time t, respectively

PCmt, PCmtThe minimum and maximum processing capacities at destination m at time t, respectively

Objective function:

subject to:

In Equation [2a], the objective function of the model is defined as the maximization of the total discounted economic value or the NPV of the mining operation. Constraint [2b] ensures that if block b is to be mined then it could only be mined once and sent to destination m at time t. Constraints [2c] and [2d] ensure that the total amount of rock mined and processed at time t does not exceed the prescribed lower and upper bounds on mining and processing capacities, respectively. Constraints [2e] and [2f] ensure that the average grade of material sent to each destination is within the prescribed lower and upper bounds. Constraint [2g] is known as the slope or proceeding constraint. This constraint ensures that wall slope restrictions are obeyed and block b can be mined only if all the overlying or covering blocks are removed beforehand. The model in Equation [2] is programmed in Visual Studio version.2012 and solved using the CPLEX 12.5 solver.

The term Cbmt in the objective function is a function of mining time and the mineral price in that period. The scenarios in Figure 4 are used to calculate the block values in different periods. In this figure, 16 price paths are generated. Using these price paths and applying the model in Equation [2], one can optimize the production plans for each price path. At the end of this step, different options for mine plans are generated for the ore deposit. The block sequencings in these plans differ from each other due to different and variable mineral prices in each period. The next step aims to select the optimum block sequencing for the deposit by applying a simulation-based approach.

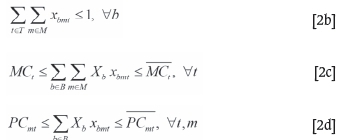

Optimizations of the mine plan for each of the price paths are generated based on the parameters given in Table I.

These parameters are the same for each mine plan, and the only difference is the iron ore price trend. The price trend in each mine plan is taken from the generated price paths in Figure 4.

The ultimate pit limit in all the cases is the same, and only the block sequencing differs due to the embedded price scenario. As mentioned, production planning and block sequencing for each of the simulated price paths are optimized using the model in Equation [2]. The planning period is 10 years for all the cases. Differences in the block sequencing and the schedules result in significant variations in expected cash flow returns. In the example presented here, 16 price paths are used to illustrate different aspects of the suggested approach. The experiments show that nine different mine plans could be generated in this case study. The question is: which of these mine plans is the optimum mining schedule? To answer this question, a simulation-based approach is conducted.

Geometric Brownian motion

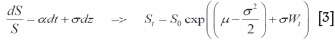

In order to select the optimal mining schedule, the generated mine plans in the previous section are analysed to check their behaviour with respect to different price forecasts. For this purpose, geometric Brownian motion is applied to define some more scenarios based on which the behaviour of each mine plan should be determined. Geometric Brownian motion (GBM) is one of the most common methods for price modelling and scenario generation (Erlwein et al., 2012; Hall 2009b). In this method, the stock or the mineral price is modelled as a Wiener process and is a function of return and volatility of the mineral price (Equation [3]).

where S0 and Stare the current mineral price and the mineral price in period t, and μ is the return of the mineral price and is calculated using Equation [1]. The terms a and dz are the expected growth rate and an increment in a standard Weiner process, respectively. Also, a is the volatility of the mineral price, and the Wiener process Wtis discretized using Equation [4].

The price volatility is calculated from the historical data using Equation [5].

where n is the number of historical data, and t is the time length for which the volatility is calculated. When the volatility of the mineral price is calculated, then it could be estimated for the coming periods using the generalized autoregressive conditional heteroskedasticity (GARCH) method. In this method, the volatility of the mineral price is a function of its previous conditions, and is calculated using Equation [6].

In this equation, VLis the long-term volatility of the mineral price. The parameters γ, α, β are defined such that they maximize the model in Equation [7].

Then, the GARCH model can be applied to estimate the future volatility of the mineral price (Equation [8]).

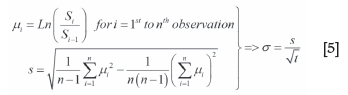

Using the model in Equation [8], the volatility of the iron ore price in the coming years is estimated. Combining the result of the GARCH model and the GBM method, it is possible to simulate more scenarios for future prices. The result of 50 simulations is shown in Figure 5.

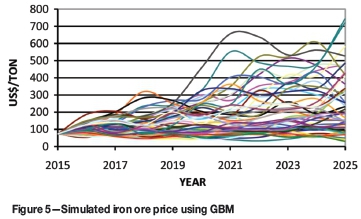

This simulation-based risk analysis discussed can be used to choose the best mine design from the available designs. The best design is the one that minimizes the potential for losses while maximizing the possibility of better financial performance (Dimitrakopoulos et al., 2007; Azimi et al., 2013). For the iron ore case considered in this study, the key project indicator is NPV. For a given mine design, a distribution of NPV is calculated using the 200 price paths generated by the GBM method. The cumulative probability distributions of NPV for the two of the mine plans (plan 1 and plan 2) are represented in Figure 6.

Downside risk, upside potential, and value at risk

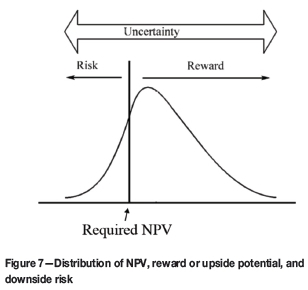

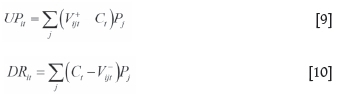

In the fifth step of the procedure, the downside risk and upside potential of each mine plan should be determined (Figure 7). These two criteria will indicate the optimum mining schedule. The selected mining schedule maximizes the upside potential and minimizes the downside risk of the mining operation associated with price uncertainty.

Assessing price uncertainty and the risks associated with it suggests that there is a probability that a given mine plan may perform better in other scenarios as well. Figure 7 elucidates the concept of maximum upside and minimum downside based on the risk associated with price (Dimitrakopoulos et al., 2007; Azimi et al., 2013). The figure shows the distribution of NPV for a mine plan that can be generated from simulated price paths. With a defined point of reference such as the minimum acceptable NPV, the distribution that minimizes risk and maximizes the reward or upside potential leads to the selection of a suitable mine plan. The upside potential (UPit) and the downside risk (DRit) during period t are formulated in Equations [9] and [10].

where the term Ct is the accepted NPV of the mine plan during a period of t years, and V jtand V j represent the total net present value of th mine plan generated for jth simulated price paths during period t, where V+ijt> Ctand V]-jt < Ct, respectively. Using Equations [9] and [10], one can calculate the upside potential and the downside risk criteria.

The other useful criterion is the value at risk, VaR. This is a widely used risk management tool, and is a measure of the worst expected loss under normal market conditions that is calculated for a specific time period at a given confidence level. VaR answers the questions like: with a probability of x%, how much can I lose over a pre-set horizon?' (Benninga, 2008). This means that VaR (1%) is the 1% quintile point of the probability distribution function of mine value. VaR provides the answer of two questions: (1) what is the distribution of the mine value at the end of its life; and (2) with a probability of 1 %, what is the maximum loss at the end of mine life? The main drawback of VaR is that it does not consider the tail of distributions, thus the result may be misleading. Therefore, it should be complemented with other tools.

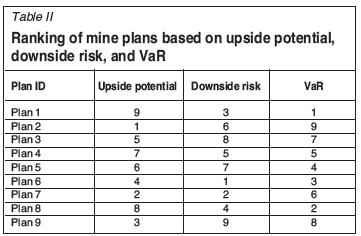

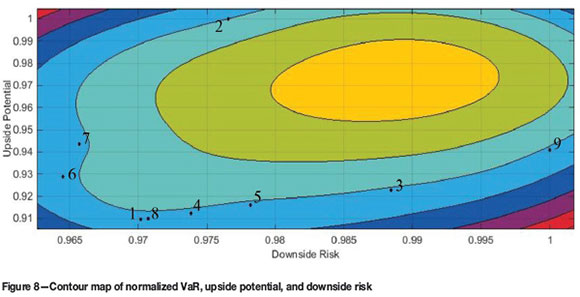

Now the decision-maker has to choose among the available options with regard to the three criteria. The three criteria of downside risk, upside potential, and value at risk are used to rank the mine plans. The result is given in Table II. According to the results, plan 2 has the maximum upside potential, plan 6 has the minimum downside risk, and plan 1 and plan 8 have the lowest VaR. The VaR in case of plan 1 and plan 8 is about 10.8% of the initial capital cost. Also, plan 2 has the highest expected NPV. In this step, selection of the optimal mine plan is converted into a multi-criteria decision-making problem. The selection procedure depends on the decision-maker and his risk-taking behaviour. The risk-taking behaviour of the decision-maker is called the 'utility function' and is beyond the scope of the current paper.

In this example there are two negative criteria (i.e. VaR and downside risk) and one positive criterion (i.e. upside potential). Assuming that the importance weights of these positive and negative criteria are identical, these weights can be calculated. In this example the weights of VaR, upside potential, and downside risk are 25%, 50%, and 25%, respectively. Finally, plan 6 seems to be the ideal mine plan. The plan has the minimum downside risk. Moreover, the rank of plan 6 is among the top five considering the other criteria. Therefore, plan 6 is suggested as the optimal mining schedule in this case study.

Discussion and conclusions

Financial uncertainty has a significant impact on the value of mining projects. In this paper a new framework was proposed to optimize mine schedules based on price uncertainty. The procedure is an iterative implementation of block sequencing optimization under varied price forecasts and market conditions. The approach is based on criteria that include maximum upside potential, minimum downside risk, and value at risk. The approach provides a set of mining scheduling options for the mine planner. Selecting the optimal solution is a multi-criteria decision-making problem.

The main weakness of the approach is that it is hard to implement, particularly in the case of larger ore deposits where the number of block is very large. This suggests the application of blocks aggregation methods that reduce the size of the problem, such as the fundamental tree algorithm. The other limitation of the procedure is the difficulties in determination of price scenarios. The generated price scenarios must be a representative sample of future price outcomes. Also, the number of price paths must be low in order to reduce the complexity of the mine scheduling models.

Considering the bootstrapped price scenarios, nine options for mining plan are generated. Then, using a combination of GARCH and GBM methods several (200 scenarios) price scenarios are generated to analyse the behaviour of each individual mine plan through the mine life. The result of this analysis represents the probability distribution function of NPV for each mine plan. These mine schedules have some important characteristics. Firstly, an optimal mine schedule based on a given simulated price path is not necessarily optimal for other price scenarios. Secondly, besides the fact that the price scenarios are equally probable, the corresponding mine plans are not equally probable. According to the optimization results, 16 price scenarios are considered but only nine different mine plans are generated. Careful analysis of the mine plans shows that plan 1 and plan 8 are approximately the same, with a difference of less than 5%. In these two plans, the block sequencing has changed in the 8th year. This is true also for the case of plan 4 and plan 5, where the difference is also less than 5%. This is confirmed by the results in Table II, where it can be seen that the rankings of these plans are virtually the same.

The method aims to determine the optimum mining sequence with minimal risk. In that regard, three attributes are calculated for each mining scenarios, namely 'upside potential', 'downside risk', and 'VaR'. First, the plans are evaluated based on VaR. The contour map of normalized VaR, upside potential, and downside risk shows the relationship among these three criteria (Figure 8). The data is normalized with respect to the maximum values. In Figure 8, the x-axis is the downside risk and the y-axis is the upside potential; the contour lines represent VaR. According to the results, plan 6 is suggested as the optimum mining sequence in this case. Analysing the price scenario on which plan 6 is optimized, it can be seen that, in this scheduling scenario, the mineral price has a falling trend compared with the other scenarios. Under a falling price trend, high-grade ore blocks will be mined earlier in order to gain the maximum possible NPV. Conclusively, those mine plans that are determined based on the falling price scenarios always have the lowest value at risk compared with other plans.

References

Abdel Sabour, S.A. and Dimitrakopoulos, R. 2011. Incorporating geological and market uncertainties and operational flexibility into open pit mine design. Journal of Mining Science, vol. 47, no. 2. pp. 191-201. [ Links ]

Abdel Sabour, S.A., Dimitrakopoulos, R., and Kumral, M. 2008. Mine design selection under uncertainty. Mining Technology, vol. 117, no. 2. pp. 53-64. [ Links ]

Akaike, A. and Dagdelen, Κ. 1999. A strategic production scheduling method for an open pit mine, Proceedings of the 28th International Symposium on Application of Computers and Operations Research in the Mineral Industry, Golden, Colorado. Colorado School of Mines. pp. 729-738. [ Links ]

Albach, H. 1976. Long range planning in open pit mining. Management Science, vol. 13, no. 10. pp. B549-B568. [ Links ]

Azimi, Y., Osanloo, M., and Esfahanipour, A. 2013. An uncertainty based multi-criteria ranking system for open pit mining cut-off grade strategy selection. Resources Policy, vol. 38. pp. 212-223. [ Links ]

Benninga, S. 2008. Financial Modeling. 3rd edn. MIT Press, Cambridge, Massachusetts and London, UK. 1133 pp. [ Links ]

Bley, Α., Boland, N., Fricke, C., and Froyland, G. 2010. A strengthened formulation and cutting planes for the open pit mine production scheduling problem. Computers and Operation Research, vol. 37, no. 9. pp. 1641-1647. [ Links ]

Boland, N., Dumitrescu, I., and Froyland, G. 2008. Α multistage stochastic programming approach to open pit mine production scheduling with uncertain geology. Optimization Online. http://www.optimization-online.org/DB_FILE/2008/10/2123.pdf [ Links ]

Caccetta, L. and Hill, S. P. 2003. An application of branch and cut to open pit mine scheduling. Journal of Global Optimization, vol. 27. pp. 349-365. [ Links ]

Cullenbine, C., Wood, R.K., and Newman, Α. 2011. Α sliding time window heuristic for open pit mine block sequencing. Optimization Letters, vol. 5, no. 3. pp. 365-377. [ Links ]

Dagdelen, Κ. 2007. Open pit optimization - strategies for improving economics of mining projects through mine planning. Orebody Modelling and Stochastic Mine Planning. 2nd edn. Dimitrakopoulos, R. (ed.). Spectrum Series no. 14. Australasian Institute of Mining and Metallurgy, Melbourne. pp. 145-148. [ Links ]

Denby, B. and Schofield, D. 1996. Open pit design and scheduling by use of genetic algorithms. Transactions of the Institute of Mining and Metallurgy Section A: Mining Industry, vol. 103. pp. A21-A26. [ Links ]

Dimitrakopoulos, R., Martiez, L., and Ramazan, S. 2007. Α maximum upside / minimum downside approach to the traditional optimization of open pit mine design. Journal of Mining Science, vol. 43, no. 1. pp. 73-82. [ Links ]

Dimitrakopoulos, R. and Ramazan, S. 2008. Stochastic integer programming for optimizing long term production schedules of open pit mines, methods, application and value of stochastic solutions. Mining Technology, vol. 117, no. 4. pp. 155-160. [ Links ]

Dowd, P.A. and Onur, A.H. 1992. Optimizing open pit design and sequencing. Proceedings of the 23rd International Symposium on Application of Computers and Operations Research in the Mineral Industry, Tuczon, Az. Society for Mining, Metallurgy and Exploration, Littleton, CO. pp. 411-422. [ Links ]

Elkington, T. and Durham, R. 2009. Open pit optimization - modelling time and opportunity costs, Mining Technology, vol. 118, no. 1. pp. 25-32. [ Links ]

Erlwein C., Mitra G, and Roman D. .2012. HMM based scenario generation for an investment optimization problem. Annals of Operations Research, vol. 193, no. 1. pp. 173-192. [ Links ]

Gholamnejad, J. and Moosavi, E. 2012. Α new mathematical programming model for long-term production scheduling considering geological uncertainty. Journal of the Southern African Institute of Mining and Metallurgy, vol. 112, no. 2. pp. 77-81. [ Links ]

Godoy, M. and Dimitrakopoulos, R. 2004. Managing risk and waste mining in long-term production scheduling of open-pit mines. SME Transactions, vol. 316, no. 3. pp. 43-50. [ Links ]

Groeneveld, B. and Topal, E. 2011. Flexible open-pit mine design under uncertainty. Journal of Mining Science, vol. 47, no. 2. pp. 212-226. [ Links ]

Hall, B. 2009a. Short-term gain for long-term pain - how focusing on tactical issues can destroy long-term value. Journal of the Southern African Institute of Mining and Metallurgy, vol. 109, no.3. pp. 147-156. [ Links ]

Hall, J. 2009b. Options, Futures, and Other Derivatives. 7th edn. Pearson Educational; 814 pp. [ Links ]

Hustrulid, W., Kuchta, M., and Martin, R. 2013. Open Pit Mine Planning and Design. 3rd edn. CRC Press, Boca Raton, Florida and Taylor and Francis, London, UK. pp. 245-249 [ Links ]

Johnson, T.B. 1968. Optimum open pit mine production scheduling, PhD thesis, Dept. of IEOR, University of California, Berkeley. 131 pp. [ Links ]

Journel, A. and Kyriakidis, P.C. 2004. Evaluation of Mineral Reserves: a Simulation Approach. Oxford University Press. 215 pp. [ Links ]

Kumral, M. 2003. Application of chance-constrained programming based on multi-objective simulated annealing to solve a mineral blending problem. Engineering Optimization, vol. 35, np. 6. pp. 661-673. [ Links ]

Kumral, M. 2010. Robust stochastic mine production scheduling. Engineering Optimization, vol. 42, no. 6. pp. 567-579. [ Links ]

Lamghari, A., and Dimitrakopoulos, R. 2012, A diversified Tabu search approach for the open-pit mine production scheduling problem with metal uncertainty. European Journal of Operations Research, vol. 222, no. 3. pp. 642-652 [ Links ]

McCarter, M.K. 1992. Surface mining- deferred reclamation. SME Mining Engineering Handbook. Hartman, H.L. (ed.). Society for Mining, Metallurgy, and Exploration (SME), Littleton, Colorado. 2260 pp. [ Links ]

Menabde, M., Froyland, G., Stone, P., and Yeates, G.A. 2007. Mining schedule optimization for conditionally simulated ore bodies. Orebody Modelling and Stochastic Mine Planning. 2nd edn. Dimitrakopoulos, R. (ed.). Spectrum Series no. 14. Australasian institute of Mining and Metallurgy, Melbourne. pp. 379-383. [ Links ]

Moosavi, E., Gholamnejad, J., Ataee-Pour, M., and Khorram, E. 2014. Optimal extraction sequence modeling for open pit mining operation considering the dynamic cut off grade, Gospodarka Surowcami Mineralnymi - Mineral Resources Management, vol. 30, no. 2. pp. 173-186. [ Links ]

Murakami, S., Tamanishi, Y., Miwa, S., and Yamatomi, J. 2011. Four-dimensional network relaxation method for long-term open pit mine scheduling. Proceedings of the 35th International Symposium on Application of Computers and Operations Research in the Mineral Industry, Wollongong, Australia. Baafi, E.Y., Kininmonth, R.J., and Porter, i. (eds). Australasian institute of Mining and Metallurgy, Melbourne. pp. 311-318. [ Links ]

Newman, A.M., Rubio, E., Caro, R., Weintraub, A., and Eurek, K. 2010. A review of operations research in mine planning. Interfaces, vol. 40, no. 3. pp. 222-245. [ Links ]

Noble, A.C. 2011. Mineral resource estimation. SME Mining Engineering Handbook. 3rd edn. Darling, P. (ed.). Society for Mining, Metallurgy, and Exploration inc. (SME), Littleton, Colorado. Chapter 4.5, pp. 203-217. [ Links ]

Osanloo, M., Gholamnejad, J., and Karimi, B. 2008. Long-term open pit mine production planning: a review of models and algorithms. International Journal of Mining, Reclamation and Environment, vol. 22, no. 1. pp. 3-35. [ Links ]

Ramazan, S., and Dimitrakopoulos, R. 2004. Traditional and new MiP models for production scheduling with in-situ grade variability. International Journal of Mining, Reclamation and Environment, vol. 18. pp. 85-98. [ Links ]

Rovenscroft, P.J. 1992. Risk analysis for mine scheduling by conditional simulation. Transactions of the Institute of Mining and Metallurgy Section A: Mining. Industry, vol. 101. pp. A82-A88. [ Links ]

Sattarvand J. 2009. Long term open pit planning by ant colony optimization. PhD thesis, RWTH Aachen University. pp. 1-8. [ Links ]

Smith, M.L. 2001. integrating conditional simulation and stochastic programming: an application in production scheduling. Proceedings of the 29th International Symposium on Application of Computers and Operations Research in the Mineral Industry, Beijing. Xie, L. (ed.). Balkema. pp. 203-208. [ Links ]

Tan, S. and Ramani, R.V. 1992. Optimization model for scheduling ore and waste production in open pit mines. Proceedings of the 23rd International Symposium on Application of Computers and Operations Research in the Mineral Industry, Tucson, AZ. Kim, Y.C. (ed.). Society for Mining, Metallurgy, and Exploration inc. (SME), Littleton, Colorado. pp. 781-792. [ Links ]

Tolwinski, B. and Underwood, R. 1996. A scheduling algorithm for open pit mines. Journal of Mathematics Applied in Business and Industry. pp. 247-270. [ Links ]

Topal, E., 2008. Early start and late start algorithms to improve the solution time for long-term underground mine production scheduling. Journal of the Southern African Institute of Mining and Metallurgy, vol. 108, no. 2. pp. 99-107. [ Links ]

Tulp, T. 1999, Economic change and pit design. Optimizing with Whittle. Australasian institute of Mining and Metallurgy, Melbourne. pp. 151-157. [ Links ]

Yarmuch, J. and Ortiz, J. 2011. A novel approach to estimate the gap between the middle- and short-term plans. Proceedings of the 35th International Symposium on Application of Computers and Operations Research in the Mineral Industry, Wollongong, Australia. Baafi, E.Y., Kininmonth, R.J., and Porter i. (eds). Australasian institute of Mining and Metallurgy, Melbourne. pp. 419-425. [ Links ]

Zhang, M. 2006. Combining genetic algorithms and topological sort to optimize open-pit mine plans. Proceedings of Mine Planning and Equipment Selection 2006, Torino, italy. pp. 1234-1239. [ Links ]

Zhang, M., Middleton, R. H., Stone, P., and Menabde, M. 2007. A reactive approach for mining project evaluation under price uncertainty. Proceedings of the 33rd International Symposium on Application of Computers and Operations Research in the Mineral Industry, Santiago, Chile. Magri, E.J. (ed.). Gecamin Ltda. pp. 709-716. [ Links ]