Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.114 n.11 Johannesburg Nov. 2014

GENERAL PAPERS

Optimizing value on a copper mine by adopting a geometallurgical solution

A.S. MacfarlaneI; T.P. WilliamsII

ITomahee Consulting

IIMetorex

SYNOPSIS

This paper describes how knowledge of the orebody morphology and ore morphology can be used to optimize the planning, mining, and metallurgical output from an open pit copper mining operation, such as to significantly increase the stability of the whole value chain process, and increase the reliability and value of the process outputs. In the case under consideration, the orebody contains both copper and cobalt. This in itself provides a challenge, in that the two metals do not occur in consistent ratios across the orebody as a whole. Furthermore, mineralogical differences within the orebody have a significant impact on plant performance in terms of throughput rates, acid consumption, and recoveries. In order to stabilize and optimize the plant performance, it is necessary to firstly have a complete understanding of the geometallurgical factors that affect performance, and then to have a sound knowledge of how these are distributed within the orebody. These models then inform the mine planning strategy that optimizes cash flow and NPV, and also allow the development of a stockpiling strategy that not only stabilizes the plant, but also allows variations in the plant feed according to ore type and grade in volatile price scenarios. Integral to the realization of these opportunities is the establishment of an appropriate measuring, control, and reconciliation system, customized to the optimization objectives. The paper describes how all of these factors and strategies can be integrated to produce optimal value from the orebody through to final dispatched product. It also shows the significant value that can be released through such an approach.

Keywords: Central African Copperbelt, Ruashi, morphology, geometallurgy, cut-off grades, stockpile management.

Background

Ruashi is an opencast copper and cobalt mine situated near Lubumbashi in the Katanga province of the Democratic Republic of Congo. The mine produces copper cathode and cobalt carbonate/hydroxide, which are sold under offtake contracts. Copper is produced by a hydrometallurgical process that incorporates leaching-decantation, solvent extraction and electrowinning(SX-EW), and cobalt precipitation operations.

The property has been prospected and operated intermittently since its discovery in 1919, being operated as a quarry-type operation, before extensive drilling was carried out during the feasibility process under Metorex, in 2005/06. A first-phase oxide flotation concentration plant was commissioned in 2006, and subsequently put on care and maintenance once replaced by the phase 2 hydrometallurgical plant in 2008.

Mining is by conventional open pit means, with truck and shovel operation (Figure 1). The softness of the oxide ore allows a considerable amount of free-dig operation, while harder strata require drilling and blasting.

The relatively low rock mass rating also results in shallow pit slopes, which produces a constraint on the operation, given that the mine borders on urban development from Lubumbashi.

The mine operates with 5 m bench heights and 40 t articulated dump trucks. This allows a reasonable amount of flexibility and grade control.

Grade control is done using initial grid drilling, followed by infill drilling to improve confidence and detail. Thereafter, production drill-holes are sampled to provide dig plans and polygons, which are laid out by the mine surveyors. This allows the grade control model to be approximately 4 months ahead of mining, which now appears to be insufficient, given the orebody complexity.

A limited amount of in-pit mapping has been done, and models and estimates have been updated on an annual basis. Again, given the complexity of the orebody, this is too infrequent.

As more information has become available, the structural and mineralogical complexity of the orebody has become increasingly apparent.

Among the various geological units and ore types, copper and cobalt grades are variable, and generally, inversely correlated. Cobalt tends to be concentrated in the Black Mineralized Ore Zone (BOMZ) ore, which carries relatively low copper grades.

As a result, equivalent grades have been applied to optimization and planning work.

The CMN ore carries high-grade malachite stringers, but the average ore grade based on 'normal' drill-hole spacings has meant that modelling has 'smeared' grades and underestimated the CMN ore grade on an equivalent basis.

Copper and cobalt prices have been volatile (Figure 2), with copper at record highs in early 2011, followed by a slide and a slight recovery in 2012, before a further slide to current levels.

Cobalt prices have been on a constant downward trend, with further pressure coming from oversupply into a relatively small market. The lower price has resulted in a significant increase in the cut-off grade for cobalt, as well as in the equivalent cut-off grade. This has impacted on the payability of BOMZ ore.

Geology and geological setting (Metorex, 2009)

The Ruashi deposits are stratiform, sediment-hosted copper deposits (SSCs) located in the Central African Copperbelt. The Copperbelt forms one of the world's largest metallogenic provinces, containing over one-third of the world's cobalt mineral reserves and one-tenth of the world's copper mineral reserves.

The copper-cobalt deposits of the Central African Copperbelt are hosted within a strongly deformed, arcuate belt of rocks that extends from northeastern Angola through southern DRC and into Zambia, referred to as the Lufilian Arc. The Katangan Sequence is divided into three supergroups separated by two marker conglomerates, which are described briefly below (from youngest to oldest).

> The Upper Kundelungu Supergroup (Ks) consists of detrital marine sediments, predominantly dolomitic, and is divided into three groups (Ks3, Ks2, and Ksl) based on sedimentary cycles. Minor sandstone units are scattered through the succession, as follows.

> The Lower Kundelungu Supergroup (Ki) consists of detrital marine sediments, again predominantly dolomitic but with limestones and dolostone in the south (the Kakontwe Limestone) The sequence is divided into two groups (Ki 2 and Ki 1), based on sedimentary cycles, and is up to 3000 m thick

> The Roan Supergroup (R) consists of lagoonal and fluvial marine sediments (dolostone, dolomitic siltstones, and black shales) with interstratified collapse breccias formed by the dissolution of evaporitic horizons, arkosic sandstones, and conglomerate units, and has a total thickness of 1500 m.

In the DRC, the Roan Supergroup is divided into the Roches Argileuses Talceuse (RAT), Mines, Dipeta, and Mwachya groups. The Mines Group is frequently referred to as the Series des Mines.

The different nomenclature for the basal Roan Supergroup reflects not only the different geological history of the belt but also a lack of correlation across national boundaries. Consequently, two sub-types of SSC deposits are distinguished in the rocks of the Central African Copperbelt. These are divided on geographical lines into a northwest district in the DRC ('Congolese Copperbelt') and a southeast district in Zambia ('Zambian Copperbelt').

The metasedimentary successions in the DRC are strongly thrusted and folded into a series of broken anticlines and synclines that are commonly overturned towards the north. Despite the obvious disruption of the sequence, the pre-Katangan basement is not exposed anywhere along the belt in the DRC.

The stratiform ores in the DRC occur within two principal formations confined to a 40 m thick succession at the base of the Mines Series. The upper formation is a sandy shale containing some carbonates, and the lower is a bedded dolomitic sandstone. The ore formations average approximately 10 m in thickness, separated by 20 m to 30 m of siliceous dolomite. Ore grades commonly vary between 4% and 6% copper and around 0.4% cobalt, with the ratio of copper to cobalt in the order of 8:1.

The weathered oxide zone generally extends to a depth of between 70 m and 150 m, but this may vary considerably between deposits. The weathering process commonly gives rise to high-grade supergene deposits near surface, but may also result in leaching of the mineralization in places and/or concentration in otherwise barren horizons.

At depth, a mixed oxide-sulphide zone grades into sulphide ore, sometimes at depths greater than 250 m.

Local geology and mineralization

The Ruashi deposits are typical of the Congolese Copperbelt deposits and are geologically similar to the Tenke Fungurume and Kamoto deposits. The stratiform Cu-Co deposits represent the largest and most important of the ore types, covering the area from Kasumbalesa in the southeast to Kolwezi in the northwest.

The detailed stratigraphy of the Lower Roan Group, Series des Mines, is shown in Table I.

The Ruashi copper-cobalt orebodies are situated within a 24 km long by 2 km wide, northwest to southeast-trending fold structure. The Lukuni-Ruashi-Etoile trend consists of a recumbent, synclinal fold, with flanks made up of Kundelungu rocks and the core by the Mines Group, all occurring to the southwest of a prominent northwest to southeast-trending thrust fault. Three orebodies have been identified at Ruashi, namely Ruashi I, Ruashi II, and Ruashi III. Historically, mining by UMHK focused on near-surface oxide copper in the form of malachite and chrysocolla mineralization (Figure 3). The high-grade oxides formed a 30 m to 60 m supergene mineralization blanket in the saprolitic rock close to surface, overlying the primary sulphide orebodies. This irregular blanket of mineralization extended beyond the limits of the underlying primary sulphide ores, as is schematically portrayed in the respective cross sections below.

Oxide minerals at Ruashi include malachite, chrysocolla, cuprite, cornetite, and heterogenite. Native copper also occurs. Trace quantities of oxidized uranium minerals have been observed but are very uncommon.

Bornite and chalcopyrite dominate the sulphide zone. Cobalt sulphides in the form of linnaeite and carrollite are irregularly distributed in intimate mixtures with the copper sulphides, with sporadic abnormal concentrations. Pyrite is found disseminated in small quantities in all the formations and occurs as small amorphous masses in the grey RAT. Chalcocite, together with malachite, occurs below the water table in the transition zone as replacement rims on primary bornite and chalcopyrite sulphides. Cobalt sulphides generally decrease with depth beyond the transition zone.

The current life of mine

Previous life-of-mine (LoM) plans had been run using a Whittle optimization process, which essentially created a mine-to-plant profile. This, although optimized on the basis of net present value, did not create a constant metal profile.

Instead, it created a profile that mined from the pits in a logical sequence, and delivered the mining profile directly to the plant.

In a way, this created a 'just-in-time' approach to plant feed, meaning that the plant had to deal with what it was given.

Stockpiling strategy has previously relied upon 'strategic' stockpile levels on the run-of-mine stockpiles, which allows a 'buffer' of four months of ore stocks. These stocks have been separated into low-grade, medium-grade, high-grade, and super-grade, with a separate stockpile for the cobalt-enriched BOMZ ore. However, these stockpiles have rarely been able to sustain the strategic levels, apart from the low-grade and BOMZ stockpiles. Furthermore, 'fingers' were established on the ROM stockpiles to attempt to control the acid consumption in the plant, and the talcose ore feed, by loading these ores into the plant in a controlled manner. However, the volumes and inconsistent feed from the mine have meant that this is a 'hand-to-mouth' solution, which does not result in consistent performance.

The consequences of this strategy can be summarized as follows:

> The ex-pit mining sequence is not necessarily optimal

> Various optimization opportunities are not evaluated

> The plan is based on a 'balanced system' approach which assumes that all parts of the system operate optimally, and coincidentally

> Variability in various input and performance factors may result in serious under-performance, unless smoothed

> The plant feed is not smoothed in terms of geometal-lurgical or mineralogical characteristsics

> As a result of inconsistent feed, plant performance is not stable in terms of acid and reagent consumption, throughput, and recovery

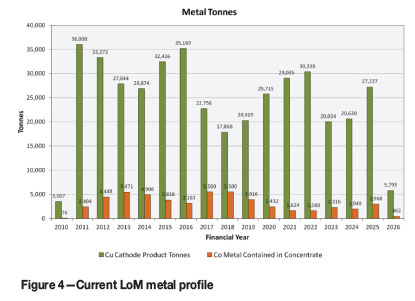

> The resultant life-of-mine profile for metal production is variable, resulting in inconsistent copper and cobalt production, as shown in the profile in Figure 4.

The business target for the operation is 36 000 t of copper production per annum, but the profile clearly shows a shortfall in most years as a result of the ex-pit grade and mineralogy, and an inconsistent cobalt production profile. It was realized that these profiles would not produce the business cash flow required, and left the operation vulnerable. This required a new assessment of the LoM strategy.

Geometallurgical issues

The constraint on acid availability and cost, coupled with the need to stabilize plant performance, indicated that there was a need to focus on geometallurgical issues within the orebody that affect plant performance (Table II).

Initial discussions indicated that the issues that were of immediate importance were as follows:

> The amount of feed of talcose material, mainly from the CMN ore, which impacts on circuit densities, in that lower densities in the leach circuits reduce throughput and recoveries. It is optimal to reduce this ore type to a maximum of 15-20% of the feed

> The BOMZ ore, which consists of manganiferous earth material, increases manganese in the circuit, resulting in contamination of the organics by permanganate in the electrowinning circuit, with resultant loss of recovery. This requires the addition of iron to the circuit to restore the design Fe:Mn ratio. This ore type should also be limited to 15% of plant feed

> Dolomitic ores are generally harder, and consume higher amounts of acid in the leach circuit (given the constraint and cost of acid, this is significant)

> Other geometallurgical issues associated with the mineralogy (for example, the presence of chrysocolla and other copper minerals) have not been assessed as yet.

In order to manage the ratios of these ore types in the feed to the plant, it is clear that stockpiling is necessary, from which the correct ratios can be drawn. This indicates that over-mining from the pits will be necessary on the one hand to create the necessary volumes on these stockpiles, while on the other hand ensuring that sufficient ore in the various grade categories is stockpiled. In this way it is then possible to better manage plant feed grade.

The revised life of mine

The considerations of ensuring a consistent metal production profile, as a result of managed plant feed, in terms of grade and geometallurgical characteristics, indicated that a mine to stockpile to plant philosophy should be built into the LoM plans.

The implications of such a change are:

> The requirement for an increased mining rate from the pits

> The need to establish minimum levels of tonnage on the various stockpiles

> The requirement to revisit cut-off grades and grade intervals for the stockpiles

> The need to modify the mining plan to allow high-grade ore to be mined at a higher rate, to ensure sufficient high grade feed in the early years (to maximize NPV), and to allow the high-grade stockpiles to build up

> The need to increase waste stripping rates as a result of the higher mining rate

> A reduction in the life of the pits as a result of higher volumes from the pits

> The establishment of large stocks of medium- and low-grade ore, which then are fed to the plant once the pits deplete. At this time, these stocks carry the marginal cost of re-handling and treatment only, thus allowing the lower grades to be processed.

Cut-off grades

A recalculation of cut-off grades was necessary, primarily to establish the lower limit of the categorization of ore. This raised the issue of whether an equivalent cut-off grade, or a copper-only, and cobalt-only cut-off, should be applied.

Lane (1988) recommends that equivalent grades should be used in the following circumstances.

Firstly, when mineral association is reasonably consistent. This is not the case at Ruashi, due to the multiple ore types.

Secondly, when market predictability of both or all metals is reasonable consistent. This is also not the case at Ruashi, since the cobalt price does not correlate with the copper price.

Additionally, in the case of Ruashi, the following conclusions were drawn:

> Copper is the prime product that defines profitability in the short/medium term, and the focus on cash flow indicates that consistent copper production is essential

> The equivalent grade has value in the long term, and should therefore be used in the LoM scenarios

> Cobalt-enriched material that is below the budget cutoff grade but above the cobalt breakeven should be stockpiled.

Cut-off grades were therefore calculated for the definition of ore at the low grade. Classically, for open pit operations, a marginal cut-off grade would be calculated, based on variable cost only. Previously, this material was termed 'mineralized waste' and was stockpiled for later treatment. This applied to this ore, which would have to be mined anyway, in order to expose higher grade ore.

However, once the new LoM was run, it became apparent that this material would consume valuable stockpiling space, and therefore it was decided that this material should be placed in a 'quarantined' area of the waste dump.

Grade intervals for the stockpiles were then defined, using intervals that defined low grade, medium grade, and high grade. The low grade was then further subdivided into low grade and intermediate grade, to allow more control over the plant feed grade.

Within these intervals, ore types are to be stockpiled separately, and BOMZ is to be stockpiled in its own area. The advantage of this is that this cobalt-enriched material can be fed to the plant once cobalt prices recover.

The category 'super grade' was abandoned, since from a cash flow point of view it does not seem logical to stockpile this material, as opposed to feeding it directly to the plant.

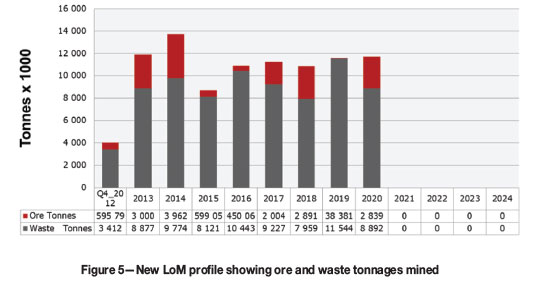

The LoM profile that has been developed as a result of a number of scenario analyses is shown in Figure 5. This indicates an accelerated mining rate from the pits in the first two years, in order to build stockpiles, while still feeding the plant with relatively high grade. Waste stripping is also accelerated, through additional pushbacks that are required to expose higher grade ore earlier in the LoM.

As discussed previously, the profile shows that the LoM has been reduced by three years, although metal production from stockpiles continues until 2024.

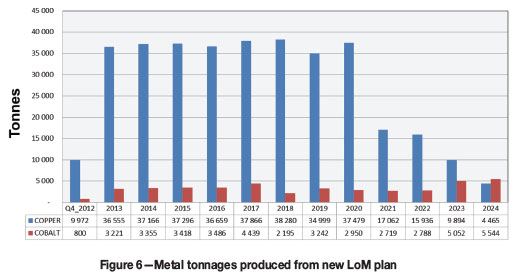

The resultant metal profile is shown in Figure 6. This indicates a relatively constant 36 000 t of copper cathode per annum, and a relatively constant cobalt profile.

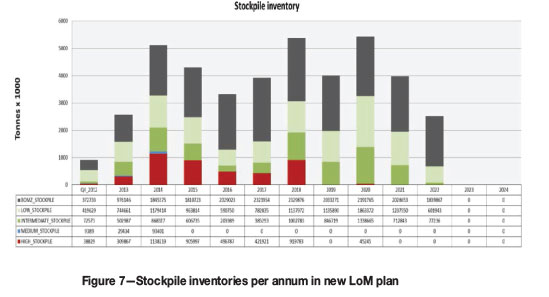

The stockpiling volumes have been calculated on an annualized basis in order to ascertain the stockpiling space that is required and the re-handling arrangements (Figure 7). The graph shows the establishment of the high-grade stockpile in the earlier years, and the considerable build-up of the cobalt-enriched BOMZ material.

The revised LoM plan, incorporating these considerations, and the stockpiling strategy, has been evaluated from a cash flow point of view.

It would be expected that the change to a grade profile with an emphasis on high grade at the front end would increase the NPV of the LoM compared with the previous LoM. Also, the higher copper production would be expected to increase the annual cash flow, and the NPV. Indeed, runs conducted using discounted cash flow analysis at a 10% discount rate have indicated that the new LoM adds $127 million in free cash flow.

This includes the extra stripping costs, and the re-handling costs associated with stockpiling.

This confirms that, from an economic perspective, costs involved in the achievement of more consistent and controlled plant feed, including the costs associated with increased mining rates, are exceeded in the circumstances by the revenue achieved by the strategy.

However, significant increases in mining costs in the early years are not fully recovered by revenue, since ore is mined and stockpiled without treatment or sale. This indicates that, from a pure cash flow perspective, there may be further opportunity for optimization.

Management considerations

The change from the traditional approach to the stockpiling strategy, and the management of the system, represents a significant change in the way in which the operation is to be managed. This required that an extensive risk assessment be conducted, and that identified risks are managed effectively. The principal risks that were identified were as follows.

1. Knowledge of the orebody will be critical in terms of the geological and mineralogical boundaries. This will require increased infill drilling and geological modelling to determine geological units and boundaries, and to define the geometallurgical inputs that can form the basis of a geometallurgical model. Failure to do so could result in ore being misclassified, and sent to the wrong destinations. As a result, a more detailed drilling and mapping programme has been instituted

2. Grade control procedures and technologies need to be appropriate for the level of control that is required, to ensure the management control required over the identification of ore units, and their dispatch to the correct destinations. This requires proactive sampling and mapping, and quick turnaround for model updates. It also requires that the grade control 'front' is extended to at least six months ahead of mining. Current grade control procedures rely on manual dispatch of trucks to stockpiles, whereas the new LoM requires automatic dispatch of loads, and management control systems which track and monitor ore movements

3. Stockpile management must be adequate to ensure that stockpile volumes and grades are monitored and controlled on a real-time basis. This includes the monitoring of movements on and off stockpiles, and the maintenance of inventory stocks in terms of tons and grade. It also requires that geometallurgical units are demarcated adequately, and that feed to the plant is controlled in response to plant requirements

4. Mine planning must ensure that the requirements identified through the LoM are translated into medium- and short-term plans. Additionally, more emphasis is required on planning compliance, in terms of plan to actual comparisons. Mine planning must also ensure that planning ensures that extraction is scheduled, as far as possible, so that that grade and mineralogy are extracted from the pits in such a way as to enhance the requirements of the LoM (although stockpiling is designed to smooth any variations that occur)

5. Waste and ore stockpiling space is critical to the success of the plan. Increased waste stripping tonnages must be accommodated on limited physical space within the boundaries of the property. Thus, detailed planning, design, and scheduling of waste dumps is essential. Similarly, ore stockpiles will be considerably larger than currently, with the result that footprints need to be designed and prepared, and that detailed scheduling of tonnages onto stockpiles needs to be done at all levels of planning

6. The changes in scheduling and ore handling require that changes be made to the contract, and that the contractor is fully involved in the planning and scheduling of ore movements

7. In order to maintain control of ore movements, depletions, and discrepancies, a full reconciliation system is required, that monitors ore and waste movement from end to end, and allows reconciliation across identified arcs along the value chain (Macfarlane, 2011)

8. Management information systems must be integrated such as to ensure 'one version of the truth' and realtime monitoring and control. This involves the establishment of a central control room, and dashboard control of critical variables and value drivers

9. All of the above require a realignment of the roles, responsibilities, and structures in the organization. Management control needs to become process-based and value-chain aligned, with areas such as grade control and reconciliation requiring an integrated and multidisciplinary 'community of practice' approach

10. Change management initiatives are necessary to constantly reinforce the strategy and objectives of the exercise, and to ensure that all departments are aligned to the process of implementation of the new plan. If this is not the case, functional and personal intervention will result in regression to previous practices. This change includes the development of appropriate procedures and protocols, and the establishment of key performance indicators that can be incorporated into performance management systems.

Further opportunities

The development of an integrated and optimized LoM based on full value chain optimization results in a constant search for further optimization opportunities.

In the case of Ruashi Mining, these include:

> Smoothing of stockpiling volumes over the LoM

> Optimizing on the basis of cash flow over the first five years

> Identification of optimization opportunities associated with debottlenecking of plant capacities

> Further geometallurgical considerations could result in further optimization and selectivity.

Subsequent interventions

Since this work was completed, a number of situations have occurred that have modified the approach described above. These include:

> Electrical power interruptions, due to the inability of the national power utility to supply the required power consistently

> A drop in the copper price, which has affected the cutoff grade, and thus the pit limits.

Although these two factors have affected the plan to some extent, the principle of stockpiling and grade control as described still remains. Indeed, it becomes more critical as margins become reduced as a result of price volatility. The power shortages have been addressed by the addition of power generators, but this comes at a cost, further affecting the optimal pit outlines and the LoM plans.

Tthe revised plan now delivers a marginally higher grade to the plant, for a slightly shorter life, but still with strategic stockpiling.

Conclusions

Over the history of the Ruashi deposit and mining operations, it has become increasingly apparent that the orebody is considerably more complex than was originally anticipated in terms of structure, morphology, mineralogy, and geotechnical characteristics.

This is not atypical of Copperbelt orebodies, and leads to the clear conclusion that optimization of the extraction of the orebody will always depend on a critical level of knowledge of the orebody and ore morphology.

This requires detailed understanding of the mineralogy and the geometallurgical characteristics that impact on the plant performance.

This is also essential in order to plan the extraction in such a way as to ensure a realistically consistent feed to the plant in terms of geometallurgical characteristics and grade. This can be enhanced through the application of a stockpiling strategy that allows, through effective stockpile management, a consistent feed to the plant.

This approach creates an over-mining situation, where mining capacity exceeds plant capacity, resulting in building of stockpile volumes while at the same time maintaining plant feed volume and grade.

Such a stockpiling and grade management programme requires tight management of ore movements, stockpile additions and depletions, cut-off grades, grade control, and contractor discipline.

These matters have all been addressed at Ruashi Mining, whereby a US$127 million improvement in the NPV of the operation is apparent in the revised plan.

References

Lane, K.F. 1988. The Economic Definition of Ore. Mining Journal Books Ltd, London. [ Links ]

Macfarlane, A.S. 2011. Reconciliation along the base metals value chain. Sixth Southern African Base Metals Conference, Phalaborwa, South Africa, July 2011. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 429-442. [ Links ] ♦

© The Southern African Institute of Mining and Metallurgy, 2014. ISSN2225-6253. Paper received Dec. 2013; revised paper received Jun. 2014.