Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Business Management

On-line version ISSN 2078-5976

Print version ISSN 2078-5585

SAJBM vol.54 n.1 Cape Town 2023

http://dx.doi.org/10.4102/sajbm.v54i1.3802

ORIGINAL RESEARCH

Leveraging resources and dynamic capabilities for organizational resilience amid COVID-19

Ning Ning YouI; Yitian LouII; Wuke ZhangIII; Dezhi ChenI; Luyao ZengIV

IDepartment of Innovation and Strategy, Antai College of Economics and Management, Shanghai Jiao Tong University, Shanghai, China

IIDepartment of Psychology, University of Toronto, Toronto, Canada

IIIDepartment of Economics, Antai College of Economics and Management, Shanghai Jiao Tong University, Shanghai, China

IVDepartment of Public Administration, School of Public Administration, Sichuan University, Sichuan, China

ABSTRACT

PURPOSE: The aim of this study was to explore the effectiveness of the resource-based view (RBV) and dynamic capabilities (DCs) to settle the problem of how and why a firm could achieve successful resilience under the context of the COVID-19

DESIGN/METHODOLOGY/APPROACH: A survey was conducted among 596 Chinese firms, and a structural equation model was applied

FINDINGS/RESULTS: The empirical results indicate that both valuable, rare, inimitable, and non-substitutable (VRIN) and non-VRIN resources can promote better organisational resilience (OR). Moreover, DCs could mediate the relationship between the RBV and OR. Specifically, DCs could fully mediate the connection between non-VRIN resources and OR, while they can only partially mediate the relationship between VRIN resources and OR

PRACTICAL IMPLICATIONS: The results of this study provide recommendations for how to proceed in environments where significant crises and outbreaks may occur. These findings are useful for business decision-making and enabling companies to develop new business strategies

ORIGINALITY/VALUE: Previous studies have investigated the drivers of OR from the perception of business strategies and practices. This study is the first to empirically test DCs as intermediary variable from RBV to promote the resilience of enterprises in the context of COVID-19

Keywords: COVID-19 pandemic; VRIN resources; non-VRIN resources; organisational resilience; dynamic capabilities.

Introduction

The outbreak of COVID-19, which developed into a pandemic, affected several social and environmental factors in human society, altering the regular flow of human life and production, posing significant difficulties and hindering the growth of businesses, particularly small and medium-sized enterprises (SMEs) (Bashir et al., 2020a, 2020b, 2020c; Bilal et al., 2020). For example, the outbreak of the COVID-19 pandemic seriously affected local enterprises in Shanghai and the surrounding areas. After 28 March 2022, Shanghai entered the static management phase of the COVID-19 outbreak, SMEs in the entire region completely stopped work and production for more than 1 month. When faced with various difficulties, uncertainties and policy changes, some enterprises can resolve the problem and seek opportunities within the crisis, whereas other enterprises become stagnant and face bankruptcy. Companies must have the ability to recover from and cope with adversity, constant upheavals and uncertainties, and business resilience is the ability of businesses to respond, adapt and change in the face of emergencies (Bhamra et al., 2011). Some companies are resilient and have the necessary preparations for sudden shocks and protracted crises. Resilience reflects not only an ability to survive in adversity but also a strategic plan that requires both proactive and reactive processes (Menéndez Blanco & Montes Botella, 2016). Therefore, it is important to study how companies can improve their anti-risk capabilities to cope with the economic crisis caused by the pandemic.

This article builds on the extensive literature on organisational resilience (OR) under sudden events (De Oliveira Mota et al., 2022; Hougaard et al., 2020; Xie, 2022). However, previous studies have not considered the essential factors that affect OR under unexpected events (Bhamra et al., 2011; Polyviou et al., 2020). The literature in recent years indicates the need for more research, and empirical evidence is required on OR and its antecedents (Linnenluecke, 2017; Ozanne et al., 2022; Verreynne et al., 2018). Although several research studies have focused on the effect of some specific characteristics of resource-based view (RBV) on the resilience of enterprises (Do et al., 2022; Ozanne et al., 2022), exploration of the effect of different resources on OR is still limited. Moreover, there may be differences in resources or capabilities between enterprises of different sizes. Such discrepancies must be identified and addressed through further research (Polyviou et al., 2020). In particular, studying firms of different sizes under the same external adversity during the same period could better facilitate an understanding of the causal mechanisms between RBV and OR.

Although it is important to unravel the connection between RBV and OR, critics of the RBV theory argue that its static nature fails to consider external factors that may affect a firm's competitive advantage (Priem & Butler, 2001; Wright et al., 2001). Similarly, researchers believe that the complex nature of resilience, influenced by external pressures, such as COVID-19, cannot be fully understood merely through the RBV's static lens (Do et al., 2022). To shed light on the antecedents and outcomes of resilience, incorporating theoretical insights that consider the dynamic nature of resources could be helpful. Therefore, scholars have suggested that the RBV could benefit from a dynamic perspective on resources (Bowman & Ambrosini, 2003; Helfat & Peteraf, 2003; Wu, 2010). Many studies have demonstrated that RBV could affect dynamic capabilities (DCs) and that DCs could affect OR (Barney, 1991; Lin & Wu, 2014; Ozanne et al., 2022). Based on these studies, this study verified the effectiveness of the influence of different types of RBV on OR, while such influence is generated through DC in the context of sudden events. This is the first study to empirically test the intermediating effect of DC on promoting the different types of RBVs on the resilience of enterprises in the context of COVID-19. Hence, we addressed the following research questions: (1) What are the most vital types of resources to be reformed into OR through DCs? (2) What roles do enterprises' DCs play in the relationship between RBV and OR?

The results showed that these resources had direct and mediating effects on DCs and OR. This study seeks to demonstrate that valuable, rare, inimitable and non-substitutable (VRIN) resources, such as reputation and cooperation, have significantly greater impact on OR than non-VRIN resources, such as equipment and real estate. Unlike non-VRIN resources, VRIN resources are relatively more changeable and flexible, making it feasible for enterprises to continuously cultivate these characteristics during normal times to prepare for possible crises and other inevitable factors in the environment, such as the COVID-19 pandemic. Thus, companies can maintain a strong OR to minimise the impact of any future crisis rather than improve it after urgent issues have arisen.

This study makes three contributions. Firstly, it explores the differential impacts of two dimensions of RBV - VRIN resources and non-VRIN resources on OR. We theoretically propose and empirically test how VRIN resources, non-VRIN resources and DCs affect OR in the context of the COVID-19 pandemic, thereby deepening the study of resilience. Secondly, this study examines how DCs affect the OR of companies with VRIN resources and non-VRIN resources in the context of the COVID-19 pandemic, advancing the research on strategic corporate management during crises. Thirdly, the findings of the study, which was conducted in China (the largest developing country), can be applied to other developing countries' contexts, providing them with valuable guidance when upgrading their industries. By focusing on the development of specific resources, developing countries can have clear directions on how to enhance their OR and better prepare for future challenges.

Theoretical background and hypotheses development

Resource-based view

This article is based on RBV theory. Research has been conducted on the definition, importance, role and possibility of the RBV. Studies have shown that further research on RBVs should focus on epidemic situations (Zhao & Kim, 2021) for which this article provides supplementary information.

Firstly, the importance of the RBV for businesses is widely recognised among academics. According to Barney (1991), the RBV can effectively explain how companies gain and maintain competitive advantages. Experts have studied the RBV from different perspectives for decades (Barney, 1986, 1991; Dierickx & Cool, 1989). From the perspective of companies' internal organisations, the RBV conceptualises a company as a bundle of resources. Resources can also be classified as VRIN or non-VRIN. To gain a durable competitive edge, organisations with VRIN resources can develop novel value-creation tactics, which are challenging for other companies to imitate (Barney, 1986, 1991; Dierickx & Cool, 1989). Armstrong and Shimizu (2007), Daft (2010), Freeman et al. (2021) and Kraaijenbrink et al. (2010) reported that the RBV has become one of the most influential management theories from the perspective of strategic business management, which explains a firm's internal resources as a condition for sustained competitive advantage and effectiveness. This means that the RBV offers a valuable framework for the role of resources in generating and sustaining competitive advantages (Zahra, 2021). Secondly, the existing literature defines RBV as the assets, skills, capabilities and knowledge of a company, whose strategies and success are based on its resource profile. Resources can provide a firm with a unique service or capability (Coates & McDermott, 2002). Thirdly, the unique resource profile of each firm enhances inter-firm heterogeneity and enables companies to access unique opportunities (Nason & Wiklund, 2018; Rugman & Verbeke, 2002). Specifically, organisations should use their existing resources and develop new ones to gain a competitive advantage that requires both existing and new resources (Barney, 1991; Hunt & Morgan, 1996; Wernerfelt, 1984).

Scholars have also recommended the measurement of VRIN and non-VRIN resources. As a primary reference in forming firm strategies, the central concern of the RBV is the resources that meet the VRIN criteria (Barney, 1986, 1991; Dierickx & Cool, 1989; Grant, 1991). In addition, VRIN resources are generally measured in three dimensions: the firm's expertise (Amit & Schoemaker, 1993; Leonard-Barton, 1992), reputation (Deephouse, 2000; Gulati, 1998; Obloj & Capron, 2011) and cooperative alliance experience (Gulati, 1998; Hess & Rothaermel, 2011). Furthermore, non-VRIN resources include the firm's capital (Bhide, 1996; Chatterjee & Wernerfelt, 1991; Nahapiet & Ghoshal, 1998), the firm's real estate properties and the firm's equipment (Barney, 1991). In this study, Zhao and Kim (2021) argued that the RBV requires understanding to determine available resources during and after a pandemic.

Organisational resilience

This section mainly describes the three dimensions for measuring OR and proposes the hypothesis that a relationship exists between RBV and OR.

Firstly, resilience, as mentioned in psychology, refers to the ability of individuals to show flexibility and adaptability in the face of adversity, stress and threats (Zott, 2003). In the management literature, the concept of resilience usually refers to an organisation's ability to survive in the face of unexpected change (Jia et al., 2020). Depending on the disaster's lifecycle stage, resilience activities comprise readiness, response and recovery (Bode & Macdonald, 2017; Pettit et al., 2010). Hillmann and Guenther (2021) analysed firms' readiness and concluded that OR indicates how prepared firms are to face unexpected events or catastrophes in an unstable world environment. Secondly, Polman and Winston (2021) studied firms' responses and argued that companies need six types of resilience to cope with increasingly complex environments and increasing corporate competition: financial flexibility, portfolio diversification, organisational agility, purpose, trust and stakeholders. Thirdly, Bhamra et al. (2011) opined that OR is a multifaceted and multidisciplinary concept that embodies an organisation's ability to embed and recover to a previous state after an interruption. Based on the existing literature, we considered why some companies can recover quickly while others end up in ruins. It is essential to explore whether this has to do with the company's internal management or its resources.

In line with the existing literature, we assessed OR based on three dimensions: readiness, response and recovery. The readiness aspect usually refers to pre-disruption activities related to the assessment of the external environment, the likelihood of potential outages and the possible impact of the outages that are carried out so that the contingency plans could be designed to improve prevention capabilities (Bode & Macdonald, 2017). The response aspect is often reflected in the ability to collect and use information and knowledge. Recovery reflects the ability of teams to proactively respond to emergencies to reduce the occurrence of disruptive events (Bode & Macdonald, 2017; Jia et al., 2020).

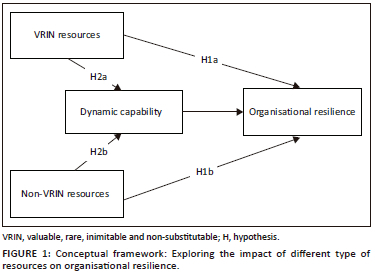

As mentioned previously, organisations with VRIN and non-VRIN resources can continue developing their innovative value-creation tactics and maintain a durable competitive edge, while other companies imitate them (Barney, 1986, 1991; Dierickx & Cool, 1989). Therefore, we examined the relationship between companies' RBV and OR during the COVID-19 pandemic. According to Richtnér and Lofsten (2014), corporate resilience is created by using a firm's different resources. The RBV includes VRIN and non-VRIN resources, which allow companies to use spare resources to survive outages. We believe that these two dimensions of the RBV facilitate the development of OR. Firstly, VRIN resources refer to irreplaceable resources for a business, such as the company's expertise, reputation within the industry and experience in cooperation. Secondly, non-VRIN resources usually refer to a company's substitute resources, such as capital, properties and equipment (Lin & Wu, 2014). In addition, OR has three dimensions: readiness, response and recovery (Bode & Macdonald, 2017; Pettit et al., 2010). Therefore, during the disruptions, we suppose that the business's resources help companies to obtain sustainable competition (Barney, 1991), recognise valuable information and knowledge, respond swiftly and expedite the recovery process. Thus, as shown in Figure 1, we propose the following hypotheses:

H1a: VRIN resources have a positive impact on OR.

H1b: Non-VRIN resources have a positive impact on OR.

Mediating effects of dynamic capabilities

As discussed in the previous sections, we believe that VRIN and non-VRIN resources can enable businesses to build resilience to respond effectively to sudden crises. However, even if companies have VRIN and non-VRIN resources that can enhance their OR, they still need the capabilities to use these resources effectively. Thus, some researchers have criticised that because of its static nature, the RBV is limited in considering the external factors that may affect firms' competitive advantages (Priem & Butler, 2001; Wright et al., 2001). Other researchers believe that resilience, which is often influenced by external pressures or triggers, such as the COVID-19 pandemic, is a complex phenomenon that cannot be fully understood through the static lens of the RBV alone (Do et al., 2022). Therefore, incorporating theoretical insights that consider the dynamic nature of resources could help elucidate the antecedents and outcomes of resilience. Hence, some scholars have suggested that the RBV could benefit from a dynamic perspective on resources (Bowman & Ambrosini, 2003; Helfat & Peteraf, 2003; Wu, 2010).

From our perspective, DC serves as a mechanism for companies to mobilise essential resources related to resilience and represents the process of obtaining, assimilating and reallocating resources in response to market shifts (Eisenhardt & Martin, 2000). Teece et al. (1997) posited that DC could explain why certain businesses achieve greater success in gaining a competitive advantage over competitors. Teece (2007) recommended that companies should develop, merge and restructure their internal and external resources to adapt to evolving business landscapes. In addition, DC encompasses sensing, seizing and reconfiguring dimensions (Teece, 2012). Sensing capability refers to a company's ability to identify and assess opportunities (Teece, 2012) by gathering market data, uncovering opportunities and innovating products or services (Carlos, 2011; Mikalef & Pateli, 2017; Su & Linderman, 2016). Seizing capability involves organising resources not only to capture opportunities and generate value (Teece, 2012) but also to mitigate disruptions. Reconfiguration entails continually updating the business in response to changes in the company's external environment (Teece, 2012). By adapting to shifting customer needs, a company can continuously enhance its products and processes and react positively to external threats and fluctuating business environments (Mikalef & Pateli, 2017; Su & Linderman, 2016). Using DCs, a firm can adjust its strategy and resources to maintain and sustain its competitive advantage (Bhamra et al., 2011; Teece, 2007; Teece et al., 1997). To substantiate the rationale for DCs mediating the relationship between VRIN or non-VRIN resources and OR, we present the following two arguments.

Firstly, we investigate the relationship between VRIN and non-VRIN resources and DC. Martinelli et al. (2018) proposed that entrepreneurs organise and reorganise resources and capabilities to respond to adverse events. Therefore, DCs are considered transformers that convert resources into performance. Because of the characteristics of VRIN resources, DCs can be effectively extracted from their competitive portfolios to improve a company's performance. For example, faced with containing the COVID-19 pandemic, companies constantly sensed changes in their external business environments and seized opportunities according to their own VRIN and non-VRIN resources to adjust their business practices.

Secondly, we investigate the connection between DCs and OR. The current literature supports the idea that sensing, seizing and reconfiguring capabilities can enhance the readiness, response and recovery components of OR during unforeseen events. Dynamic capabilities represent higher-level competencies that encompass both internal organisational resources and external stakeholder relationships. In addition, they govern a company's ability to integrate, develop and restructure internal and external resources or capabilities to adapt to the rapidly evolving business landscape (Teece, 2007; Teece et al., 1997). As a result, they can boost organisational readiness, response and recovery (Bhamra et al., 2011). In a volatile and uncertain environment, a company's knowledge of the market can help build awareness of disruptions within the company, motivate employees to take action and improve contingency planning and the ability to prevent disruptions (North & Varvakis, 2016). Martinelli et al. (2018) contended that businesses can swiftly incorporate new evidence with extant knowledge, share this knowledge and seize opportunities to anticipate customer needs as they respond to and regain from disruptions (Kurtz & Varvakis, 2016). Mikalef and Pateli (2017) demonstrated that reconfiguration capabilities assist firms in aligning their existing resources to generate new value.

We suggest that DCs play a mediating role, based on the two sets of justifications presented earlier. Little evidence supports the indirect effect of the RBV on OR through DCs. Thus, this study quantitatively tested the mediating role of DCs between VRIN and non-VRIN resources and OR, especially during the COVID-19 crisis, focusing on the indirect relationship between VRIN and non-VRIN resources and the OR achieved through DCs. Accordingly, we propose the following hypotheses:

H2a: DCs mediate the relationship between VRIN resources and OR.

H2b: DCs mediate the relationship between non-VRIN resources and OR.

Methodology

This survey aimed to investigate the DCs and OR generated by enterprises using their resources during the Shanghai lockdown because of the COVID-19 pandemic from March to June 2022.

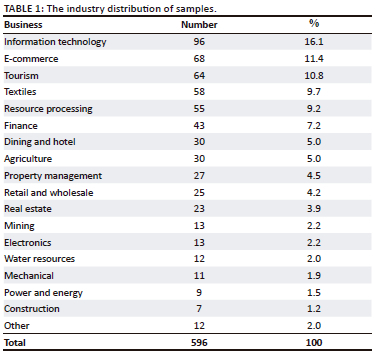

Data collection

Firstly, we designed a questionnaire for Chinese companies based on standard scales. Secondly, we released the questionnaires on 'Credamo', a professional data collection platform, from June 2022 to July 2022. Credamo is a data platform that integrates professional research and modelling. It can meet complicated research needs, such as multi-phase targeted follow-up research, paired sample research and global sample research services. The data collected by Credamo were authoritative and of high quality. When we collected data through Credamo, we limited the questionnaire to the companies' senior managers. To a certain extent, these senior managers understood the strategic deployment and development of their respective companies. Therefore, our data were highly representative, reflecting companies' real situations. Many scholars have used the Credamo platform to collect and conduct scientific research (Ding et al., 2021; Ren et al., 2022), and their studies have been published in Production and Operations Management, the Journal of Management and other authoritative journals in management. Therefore, the quality of the data used in this study was reliable. The respondents were middle or senior managers or managers at grassroots enterprises. A total of 800 questionnaires were distributed and 596 were recovered, with an effective recovery rate of 74.5%. The business distribution of the 596 enterprises is shown in Table 1.

As Table 1 shows, our sample mostly included companies in the manufacturing and service industries (51.68% and 43.46%, respectively), and agricultural enterprises accounted for only 4.87% of the sample. The main sub-sectors were information technology, E-commerce, tourism and so on. These industries were also relatively sensitive to the impact of the pandemic because they relied more on logistics and transportation.

Variables and measures

Dependent variable: Organisational resilience

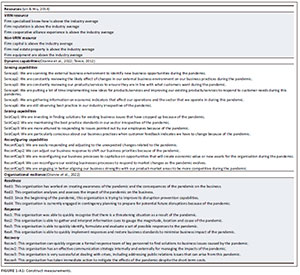

Following Ozanne et al. (2022), OR was assessed using three measures: readiness, response and recovery (see Figure 1-A1 in the Appendix 1). Each measure was evaluated based on four-question items, which were gauged using a 5-point Likert-type scale defined as follows: 1 = completely disagree and 5 = completely agree. Each measure was generated by determining the average score of all corresponding items.

Independent variables: Valuable, rare, inimitable and non-substitutable resources and non-valuable, rare, inimitable and non-substitutable resources

Following Lin and Wu (2014), VRIN resources were evaluated using three measures: (1) the company's patents or technology, (2) reputation and (3) cooperative alliance experience. Non-VRIN resources were also evaluated using three measures: (1) the company's capital, (2) real estate property and (3) equipment (see Figure 1-A1 in the Appendix 1). These measures were directly assessed using a 5-point Likert-type scale.

Mediator variable: Dynamic capabilities

Following Ozanne et al. (2022) and Teece (2012), DCs were evaluated using three measures: sensing capabilities, seizing capabilities (ability to seize opportunities) and reconfiguring capabilities (ability to reconfigure). Sensing capabilities were comprised six-question items while seizing and reconfiguring capabilities consisted of four- and five-question items, respectively (see Figure 1-A1 in the Appendix 1). Each question item was assessed using a 5-point Likert-type scale. Each measure was evaluated by determining the average score of all corresponding items.

Analytical method

We used structural equation modelling (SEM) to confirm the assumption that DC mediates the relationship between RBV and OR because SEM provides a suitable framework for mediation and various causal analyses (Gunzler et al., 2013). To ensure scale consistency and construct validity, the data were examined for reliability and validity. A factor analysis was conducted prior to constructing the structural equation model to ensure proper dimension division.

Model fit and path analyses were performed for VRIN resources, non-VRIN resources, DCs and OR. Furthermore, the research hypotheses were tested.

Results

Correlation analysis of the variables

A correlation analysis was performed for the measures of each construct. All correlation coefficients were greater than 0.2 but less than 0.7 and suggested strong significance (see Table 2), indicating that the constructs between each other were conceptually and empirically distinct (Bashir et al., 2020b, 2020c; Wang et al., 2004).

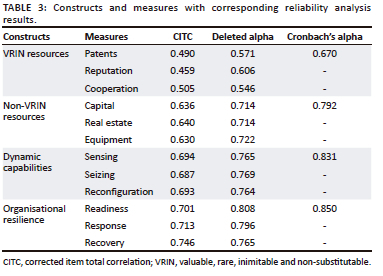

Reliability and validity analysis

The reliability analysis was performed using Cronbach's alpha values for each construct. Table 3 shows that both DCs and OR have Cronbach's alpha values exceeding 0.8, which indicates acceptable reliability (Eisinga et al., 2013). For the resource construct, the Cronbach's alpha values of both the VRIN and non-VRIN resources were above 0.6 but lower than 0.8. We retested the Cronbach's alpha value by deleting each measure and discovered that Cronbach's alpha did not increase, which means that all measures should be retained. The corrected item total correlation (CITC) for each measure was higher than 0.4, which indicates high reliability (Ahorsu et al., 2022; Howard & Forehand, 1962).

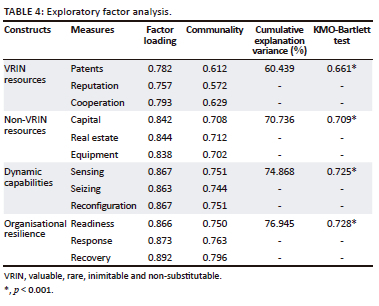

As a modified construct measure, we tested the structural validity of each construct through an exploratory factor analysis (Fabrigar & Wegener, 2011). Table 4 shows that the Kaiser-Meyer-Olkin (KMO) values of all constructs were higher than 0.6, and the Bartlett's sphericity test results were all significant, which suggests that the data were suitable for extracting useful information (Tobias & Carlson, 1969). The communality of all measures was higher than 0.4, which means that none of the measures should be deleted (Hogarty et al., 2005). The cumulative explanation variance for each construct exceeded 50%, which indicates an appreciable division of dimensions on one factor (see Table 4) (Fabrigar & Wegener, 2011; Williams et al., 2010).

Analysis of the mediating effects

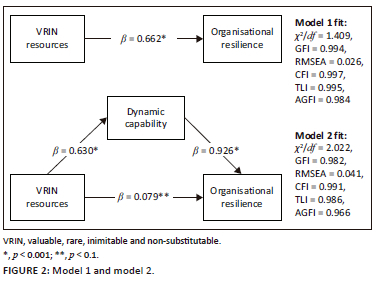

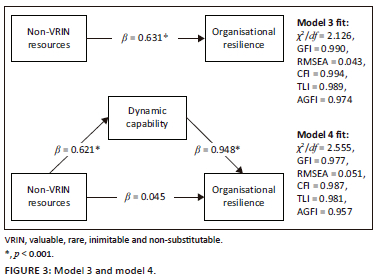

To analyse the mediating effects, we first launched the test of the direct effect between both resources and OR. The direct effects of VRIN on OR were significant (β = 0.662, p < 0.001, see Figure 2), as was the direct effect of non-VRIN on OR (β = 0.631, p < 0.001, see Figure 3). Thus, Hypotheses 1a and 1b were supported. To examine the mediating effect of DCs, Models 2 and 4 were established by adding DCs to the analysis (Preacher & Hayes, 2004). Model 2 produced an adequate fit (χ2/df = 2.022, Goodness of Fit Index [GFI] = 0.982, Root Mean Square Error of Approximation [RMSEA] = 0.041, Comparative Fit Index [CFI] = 0.991, Tucker-Lewis Index [TLI] = 0.986 and Adjusted Goodness of Fit Index [AGFI] = 0.966). The path coefficient of VRIN on OR in Model 2 was smaller than that of Model 1 and had a mild significance (β = 0.079, p = 0.093) which suggests that the direct effect between VRIN and OR diminished when DCs were added to the model. Thus, the results indicated a partial mediating effect of DCs between VRIN and OR (the weight of the mediating effect of DCs was approximately 88.12%) (Cheung & Lau, 2008). Thus, Hypothesis 2a was partially supported. Similarly, Model 4 produced an adequate fit (χ2/df = 2.555, GFI = 0.977, RMSEA = 0.051, CFI = 0.987, TLI = 0.981 and AGFI = 0.957). Although the path coefficient of non-VRIN on OR was smaller than that of Model 3, the path did not reveal the significance (β = 0.045, p = 0.286). Hence, Model 4 demonstrated that DCs have a full mediating effect between non-VRIN and OR. Therefore, Hypothesis 2b was fully supported (Cheung & Lau, 2008). The details of each model are shown in Table 5.

Discussion and conclusions

With the growing interest in unravelling the mechanism of OR (Bhamra et al., 2011; Duchek et al., 2020; Seville et al., 2015; Williams et al., 2017), our study focuses on RBV resources and DCs to solve the problem of how and why firms achieve successful resilience. Many studies have examined the factors that affect the performance of companies in terms of OR, including social capital, business networks, human resources and innovations (Menéndez Blanco & Montes Botella, 2016; Ozanne et al., 2022; Seville et al., 2015; Xie, 2022). Rather than focusing on a particular resource or ability, our research, grounded on the RBV, empirically and comprehensively examined the effect of DCs on OR under the external shock of the COVID-19 lockdown in Shanghai in 2022. China is almost the only country with significant markets and a conservative pandemic prevention policy. Compared with other literature that collected data from enterprises facing other forms of crises (Carlos, 2011; Khurana et al., 2022), our research used first-hand data on Chinese enterprises affected by recent regulations and is among the first to investigate the relationship between different types of RBV resources on OR and the impacts of DCs. This article proved that: (1) VRIN resources positively impact OR. (2) Non-VRIN resources have a significant effect on OR. The results of this investigation also demonstrated the mediating role of DCs in the relationship between RBV and OR: (1) DCs partially mediate VRIN resources and OR and (2) DCs fully mediate non-VRIN resources and OR.

From the results of modelling, we found that, in addition to the previous conclusions, social capital could enhance the performance of OR (Ozanne et al., 2022). Considering broader factors, both VRIN and non-VRIN resources positively affect OR. They promote a firm's capability to navigate the impacts of lockdowns and shifting policies following the unforeseen prevalence of a disease that occurred sporadically. A strong RBV could lead a firm to survive in a dangerous business environment during the pandemic (Kraaijenbrink et al., 2010; Ozanne et al., 2022). The effect size indicated that VRIN resources have a more substantial impact on OR. As VRIN resources are represented by patents, reputations and cooperation, a company with strong techniques and solid partners could have better recovery abilities than those that hold cash or fixed assets (i.e. non-VRIN resources such as capital, real estate or equipment). However, when we considered the effect of DCs, the results showed that neither VRIN nor non-VRIN resources have a substantial direct effect on OR, which also aligns with the findings of other studies that focused on the effect of a particular RBV factor (Hillmann & Guenther, 2021; Nahapiet & Ghoshal, 1998; Ozanne et al., 2022; Xie et al., 2022). Mainly, if a firm only holds cash and fixed assets, it will require DCs to fully mediate the relationship between the RBV and OR, which means that the firm can only recover from the pandemic if it has a strong DC. Nevertheless, although firms with strong patents and robust cooperators also need DCs to mediate the relationship between their resources and OR, their patents, reputation and cooperation could still lead them to good resilience directly to some extent.

In the following sections, we discuss the theoretical contributions and practical values of this study in detail.

Theoretical implication

This research unravelled the antecedents and prerequisites of OR. Through this study, we provided broader insights into the internal complexities of the causes and factors influencing OR. This study contributes to the existing theory in two ways. Firstly, the study enables the investigation of the relationship between the RBV and OR. It tackles the crucial problem of how organisations can currently adapt to precarious business environments to strategically survive and further improve their performance (Hansen et al., 2004). However, previous studies have investigated only the drivers of OR from the perspective of corporate strategy and management practices, including social capital (Jia et al., 2020; Ozanne et al., 2022), supply chain resilience (Bode & Macdonald, 2017; Eryarsoy et al., 2022; Ponomarov & Holcomb, 2009; Wieland & Durach, 2021), employee participations (Kleinknecht, 2015) and business survival chances (Chhatwani et al., 2022). Only a few empirical studies have examined the effectiveness of the RBV on corporate resilience during the COVID-19 pandemic.

Although a recent work first considered resource-based managerial initiatives (RBMIs) as the antecedent of OR (Do et al., 2022), our work, which considered both VRIN and non-VRIN resources, provides a more detailed analysis of the relationship between the RBV and OR. In addition, by considering DCs as the dynamic perspective to resolve the challenges of the static attribute of the RBV, our findings also demonstrate the effectiveness of VRIN and non-VRIN resources in influencing OR. Therefore, by quantitatively analysing how VRIN resources, non-VRIN resources and DCs affected OR during the COVID-19 pandemic, our study further expanded the existing literature on this topic and furnished the current theory on OR with a more comprehensive panorama under the parallel analysis of two facets of the RBV. Meanwhile, through our empirical study, contrary to existing criticisms that the RBV lacks consideration of the external environment or the dynamic nature of competition (Kraaijenbrink et al., 2010; Miller, 2019), we still discovered that VRIN resources could have a partial but significant direct effect on firms' OR. Such results could enrich our understanding of the mechanism behind the reinforcement of OR. Thus, this study further strengthens the theory regarding the relationship between RBV and OR by demonstrating the different effects of VRIN and non-VRIN resources on the resilience of firms in an uncertain business market.

Secondly, this study advances research on corporate strategic management during a crisis. Contrary to previous research that studied the antecedents of OR with combined RBV and DC (both as factors of RBMI), this study separated DC and further investigated its mediating role between RBV and OR. Meanwhile, most existing literature focused on the role of DCs in enhancing firms' performance (Lin & Wu, 2014; Teece, 2007), business innovation (Kim et al., 2015) and competitive performance (Mikalef & Pateli, 2017). We are among the first to explain the role of holistic DCs (sensing, seizing and reconfiguring) (Teece, 2012) in the path leading from the RBV to OR during the COVID-19 pandemic. Although DCs have attracted widespread attention from scholars, their influence on the RBV and OR remains unclear. Our findings demonstrate the critical mediating role of DCs in the relationship between RBV (especially non-VRIN resources) and firms' resilience under COVID-19 disruption. This empirical study demonstrates that the mediating effect of DCs could behave slightly differently on two distinct types of RBV resources. The findings of this study on DCs provide a new approach to facilitating RBV transformation into business resilience and could guide firms with different RBV resources to consider different strategies to achieve resilience. Moreover, this study, which investigated the impact of DCs on OR for two distinct RBV resources, contributes to the limited research on unpacking the complexity of resilience while contextualising the COVID-19 pandemic. Our findings broaden the discussion on the relationship between RBV and OR by emphasising the mediating role of DCs in the context of the COVID-19 outbreak.

Managerial implication

This study could have implications for managers and policymakers. Firstly, enterprises continue to strengthen resource integration and improve resource utilisation and allocation efficiency. During the COVID-19 pandemic, businesses can successfully achieve resilience through the RBV (VRIN and non-VRIN resources). The RBV shows great potential as an important business tool for firms to respond comprehensively to crises and post-pandemic innovative developments. Therefore, in the future, enterprises in various industries should further strengthen the collection of resources, particularly the development, collection and utilisation of resources in key fields. For example, as per Richtnér and Lofsten (2014), business resilience is created through different business resources. These findings guide business decisions and enable companies to develop new business strategies. Resource integration is not the simple accumulation of individual resources, but the organic integration of all selected resources into an orderly whole to achieve the amplification effect of '1 + 1 > 2' and guide and support enterprises to increase the degree of resource collection continuously through various forms. Furthermore, the government should also strengthen the investment and construction of enterprise resources to provide a solid foundation for improving the flexibility of enterprise organisations. For example, they should increase infrastructure construction and improve the quality of services provided to enterprises. The continuous learning of the concept of resources will improve the utilisation efficiency of resources and the efficiency of resource allocation to achieve high-quality enterprise development.

Secondly, the government should optimise its resource support policy and promote the improvement of the quality of enterprise resources. By establishing an optimal allocation mechanism for resource elements, the government prioritises the resource elements of high-quality enterprises. The external environment of an enterprise is complex and changeable. It is only by improving internal resource capacity and ensuring the quality of resources that an enterprise can adapt to environmental changes and take the lead in these changes. Martinelli et al. (2018) argued that entrepreneurs should mobilise and rearrange their resources and capabilities in response to unexpected adverse events. For enterprises with weak DCs, enhancing VRIN resources may be more practical and effective in improving resilience. However, companies with strong non-VRIN resources should prioritise the role of DCs when seeking to translate RBV into resilience. It is also necessary to clarify the core resources of the enterprise, strengthen the investments, innovations and allocation of the core resources and effectively integrate and allocate the human resources, corporate culture, brand resources, business resources, land resources, capital resources, social public resources and organisational structure resources of the enterprise from its industrial, resource value chain and internal levels. This is to achieve the aim of improving resource quality.

Thirdly, enterprises should strengthen the organic combination of VRIN and non-VRIN resources to improve their own risk resistance. In the post-COVID-19 era, the internal and external environment and growth drivers for the survival and development of enterprises underwent significant changes. Therefore, enterprises should understand the current situation and strengthen the organic combination of VRIN and non-VRIN resources to achieve sustainable development. According to DC theory, enterprises can accumulate knowledge, technology and skills through organisational learning to overcome their own limitations. A growing body of literature has begun to focus on organisational models of corporate learning and learning facilitation. Hammer (1990), Mody (1993) and Prahalad and Hamel (1997) argued that accumulating and internalising knowledge via organisational learning serves as the driving force, process and outcome of strategic technology alliances. The broad application of various resources demonstrates that companies use them not only for resource exchange but also for learning to frequently bolster their core competitiveness. Developing an enterprise's core competitiveness necessitates a unique learning mechanism. Cultivating cooperation consciousness and the responsibility consciousness of 'openness, cooperation, and win-win' will further improve the efficiency of VRIN and non-VRIN resource allocations, improve the flexibility of enterprise organisations and enhance the core competitiveness of enterprises.

Limitations and future research

While this study offers valuable insights for both theory and practice, it has some limitations. Firstly, our data were obtained from only a sample of Chinese firms; therefore, they might have country specificity. Secondly, given that this study utilised a questionnaire approach to gather data, there could be an element of subjectivity in the responses received. Thirdly, we examined the mediating role of DCs as the primary variable between RBV and OR in the context of the COVID-19, without considering other factors during the crisis.

Consequently, future research should focus on three areas. Firstly, future scholars could extend this study to different countries to further investigate the topic. For example, a comparative study of firm resilience can be conducted in developing countries and developed countries. Secondly, we can use public panel data (e.g. stock price, return on assets, return on equity and other business performance indicators) in future research to reflect OR. Thirdly, other factors, such as business ecosystem strategies and sustainability effects, including economic, social and environmental aspects (Arslan et al., 2021; Bashir et al., 2020b, 2020c; Bilal et al., 2020), may also affect the relationship between RBV and OR during the COVID-19 pandemic. Thus, an investigation into other factors may expand this topic.

Acknowledgements

The authors would like to extend our appreciation to all those who participated and contributed to this study.

Competing interests

The author(s) declare that they have no financial or personal relationship(s) that may have inappropriately influenced them in writing this article.

Authors' contributions

N.Y. and W.K.Z. co-wrote the article; Y.T.L. formal analysis; D.Z.C. supervised the research; L.Y.Z. reviewed and edited the article.

Ethical considerations

This article followed all ethical standards for research without direct contact with human or animal subjects.

Funding information

This research received no specific grant from any funding agency in the public, commercial or not-for-profit sectors.

Data availability

The data that support the findings of this study are available from the corresponding author, N.N.Y., upon reasonable request.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Ahorsu, D.K., Lin, C.-Y., Imani, V., Saffari, M., Griffiths, M.D., & Pakpour, A.H. (2022). The fear of COVID-19 scale: Development and initial validation. International Journal of Mental Health and Addiction, 20(3), 1537-1545. https://doi.org/10.1007/s11469-020-00270-8 [ Links ]

Amit, R., & Schoemaker, P.J.H. (1993). Strategic assets and organizational rent: Strategic assets. Strategic Management Journal, 14(1), 33-46. https://doi.org/10.1002/smj.4250140105 [ Links ]

Armstrong, C.E., & Shimizu, K. (2007). A review of approaches to empirical research on the resource-based view of the firm. Journal of Management, 33(6), 959-986. https://doi.org/10.1177/0149206307307645 [ Links ]

Arslan, H., Bilal, --, & Bashir, M. (2021). Contemporary research on spillover effects of COVID-19 in stock markets. A systematic and bibliometric review. In Proceedings of the 3rd International Electronic Conference on Environmental Research and Public Health - Public Health Issues in the Context of the COVID-19 Pandemic, 11-25 January 2021 (p. 9103). MDPI.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120. https://doi.org/10.1177/014920639101700108 [ Links ]

Barney, J.B. (1986). Strategic factor markets: Expectations, luck, and business strategy. Management Science, 32(10), 1231-1241. https://doi.org/10.1287/mnsc.32.10.1231 [ Links ]

Bashir, M.F., Ma, B., Bilal, Komal, B., Bashir, M.A., Tan, D., & Bashir, M. (2020a). Correlation between climate indicators and COVID-19 pandemic in New York, USA. Science of the Total Environment, 728, 138835. https://doi.org/10.1016/j.scitotenv.2020.138835 [ Links ]

Bashir, M.F., Ma, B.J., Bilal, Komal, B., Bashir, M.A., Farooq, T.H., Iqbal, N., & Bashir, M. (2020b). Correlation between environmental pollution indicators and COVID-19 pandemic: A brief study in Californian context. Environmental Research, 187, 109652. https://doi.org/10.1016/j.envres.2020.109652 [ Links ]

Bashir, M.F., Ma, B.J., & Shahzad, L. (2020c). A brief review of socio-economic and environmental impact of covid-19. Air Quality, Atmosphere & Health, 13(12), 1403-1409. https://doi.org/10.1007/s11869-020-00894-8 [ Links ]

Bhamra, R., Dani, S., & Burnard, K. (2011). Resilience: The concept, a literature review and future directions. International Journal of Production Research, 49(18), 5375-5393. https://doi.org/10.1080/00207543.2011.563826 [ Links ]

Bhide, A. (1996). The questions every entrepreneur must answer. Harvard Business Review, 74(6), 120-130. [ Links ]

Bilal, Latif, F., Bashir, M.F., Komal, B., & Tan, D. (2020). Role of electronic media in mitigating the psychological impacts of novel coronavirus (COVID-19). Psychiatry Research, 289, 113041. https://doi.org/10.1016/j.psychres.2020.113041 [ Links ]

Bode, C., & Macdonald, J.R. (2017). Stages of supply chain disruption response: Direct, constraining, and mediating factors for impact mitigation: Stages of supply chain disruption response. Decision Sciences, 48(5), 836-874. https://doi.org/10.1111/deci.12245 [ Links ]

Bowman, C., & Ambrosini, V. (2003). How the resource-based and the dynamic capability views of the firm inform corporate-level strategy. British Journal of Management, 14(4), 289-303. https://doi.org/10.1111/j.1467-8551.2003.00380.x [ Links ]

Carlos, M.J. (2011). Social capital and dynamic capabilities in international performance of SMEs. Journal of Strategy and Management, 4(4), 404-421. https://doi.org/10.1108/17554251111181034 [ Links ]

Chatterjee, S., & Wernerfelt, B. (1991). The link between resources and type of diversification: Theory and evidence. Strategic Management Journal, 12(1), 33-48. https://doi.org/10.1002/smj.4250120104 [ Links ]

Cheung, G.W., & Lau, R.S. (2008). Testing mediation and suppression effects of latent variables: Bootstrapping with structural equation models. Organizational Research Methods, 11(2), 296-325. https://doi.org/10.1177/1094428107300343 [ Links ]

Chhatwani, M., Mishra, S.K., Varma, A., & Rai, H. (2022). Psychological resilience and business survival chances: A study of small firms in the USA during COVID-19. Journal of Business Research, 142(1), 277-286. https://doi.org/10.1016/j.jbusres.2021.12.048 [ Links ]

Coates, T.T., & McDermott, C.M. (2002). An exploratory analysis of new competencies: A resource based view perspective. Journal of Operations Management, 20(5), 435-450. https://doi.org/10.1016/S0272-6963(02)00023-2 [ Links ]

Daft, R.L. (2010). Organization theory and design (10th ed.). South-Western Cengage Learning.

Deephouse, D.L. (2000). Media reputation as a strategic resource: An integration of mass communication and resource-based theories. Journal of Management, 26(6), 22. https://doi.org/10.1177/014920630002600602 [ Links ]

De Oliveira Mota, R., Bueno, A., Gonella, J.D.S.L., Ganga, G.M.D., Godinho Filho, M., & Latan, H. (2022). The effects of the COVID-19 crisis on startups' performance: The role of resilience. Management Decision, 60(12), 3388-3415. https://doi.org/10.1108/MD-07-2021-0998 [ Links ]

Dierickx, I., & Cool, K. (1989). Asset stock accumulation and sustainability of competitive advantage. Management Science, 35(12), 1504-1511. https://doi.org/10.1287/mnsc.35.12.1504 [ Links ]

Ding, Y., Tu, Y., Pu, J., & Qiu, L. (2021). Environmental factors in operations management: The impact of air quality on product demand. Production and Operations Management, 30(9), 2910-2924. https://doi.org/10.1111/poms.13410 [ Links ]

Do, H., Budhwar, P., Shipton, H., Nguyen, H.-D., & Nguyen, B. (2022). Building organizational resilience, innovation through resource-based management initiatives, organizational learning and environmental dynamism. Journal of Business Research, 141, 808-821. https://doi.org/10.1016/j.jbusres.2021.11.090 [ Links ]

Duchek, S., Raetze, S., & Scheuch, I. (2020). The role of diversity in organizational resilience: A theoretical framework. Business Research, 13(2), 387-423. https://doi.org/10.1007/s40685-019-0084-8 [ Links ]

Eisenhardt, K.M., & Martin, J.A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10-11), 1105-1121. https://doi.org/10.1002/1097-0266(200010/11)21:10/11<1105::AID-SMJ133>3.0.CO;2-E [ Links ]

Eisinga, R., te Grotenhuis, M., & Pelzer, B. (2013). The reliability of a two-item scale: Pearson, Cronbach, or Spearman-Brown? International Journal of Public Health, 58(4), 637-642. https://doi.org/10.1007/s00038-012-0416-3 [ Links ]

Eryarsoy, E., Özer Torgalöz, A., Acar, M.F., & Zaim, S. (2022). A resource-based perspective of the interplay between organizational learning and supply chain resilience. International Journal of Physical Distribution & Logistics Management, 52(8), 614-637. https://doi.org/10.1108/IJPDLM-07-2021-0299 [ Links ]

Fabrigar, L.R., & Wegener, D.T. (2011). Exploratory factor analysis. Oxford University Press.

Freeman, R.E., Dmytriyev, S.D., & Phillips, R.A. (2021). Stakeholder theory and the resource-based view of the firm. Journal of Management, 47(7), 1757-1770. https://doi.org/10.1177/0149206321993576 [ Links ]

Grant, R.M. (1991). The resource-based theory of competitive advantage: implications for strategy formulation. California Management Review, 33(3), 114-135. [ Links ]

Gulati, R. (1998). Alliances and networks. Strategic Management Journal, 19(4), 293-317. https://doi.org/10.1002/(SICI)1097-0266(199804)19:4<293::AID-SMJ982>3.0.CO;2-M [ Links ]

Gunzler, D., Chen, T., Wu, P., & Zhang, H. (2013). Introduction to mediation analysis with structural equation modeling. Shanghai Archives of Psychiatry, 25(6), 390-394. https://doi.org/10.3969/j.issn.1002-0829.2013.06.009 [ Links ]

Hammer, M. (1990). Reengineering work: Don't automate, obliterate. Harvard Business Review, 68(4), 104-112. [ Links ]

Hansen, M.H., Perry, L.T., & Reese, C.S. (2004). A Bayesian operationalization of the resource-based view. Strategic Management Journal, 25(13), 1279-1295. https://doi.org/10.1002/smj.432 [ Links ]

Helfat, C.E., & Peteraf, M.A. (2003). The dynamic resource-based view: Capability lifecycles. Strategic Management Journal, 24(10), 997-1010. https://doi.org/10.1002/smj.332 [ Links ]

Hess, A.M., & Rothaermel, F.T. (2011). When are assets complementary? Star scientists, strategic alliances, and innovation in the pharmaceutical industry. Strategic Management Journal, 32(8), 895-909. https://doi.org/10.1002/smj.916 [ Links ]

Hillmann, J., & Guenther, E. (2021). Organizational resilience: A valuable construct for management research? International Journal of Management Reviews, 23(1), 7-44. https://doi.org/10.1111/ijmr.12239 [ Links ]

Hogarty, K.Y., Hines, C.V., Kromrey, J.D., Ferron, J.M., & Mumford, K.R. (2005). The quality of factor solutions in exploratory factor analysis: The influence of sample size, communality, and overdetermination. Educational and Psychological Measurement, 65(2), 202-226. https://doi.org/10.1177/0013164404267287 [ Links ]

Hougaard, R., Carter, J., & Mohan, M. (2020). Build your resilience in the face of a crisis. Harvard Business Review. Retrieved 23 October 2023, from https://hbr.org/2020/03/build-your-resiliency-in-the-face-of-a-crisis

Howard, K.I., & Forehand, G.A. (1962). A method for correcting item-total correlations for the effect of relevant item inclusion. Educational and Psychological Measurement, 22(4), 731-735. https://doi.org/10.1177/001316446202200407 [ Links ]

Hunt, S.D., & Morgan, R.M. (1996). The resource-advantage theory of competition: Dynamics, path dependencies, and evolutionary dimensions. Journal of Marketing, 60(4), 107-114. https://doi.org/10.1177/002224299606000410 [ Links ]

Jia, X., Chowdhury, M., Prayag, G., & Hossan Chowdhury, M.M. (2020). The role of social capital on proactive and reactive resilience of organizations post-disaster. International Journal of Disaster Risk Reduction, 48(1), 101614. https://doi.org/10.1016/j.ijdrr.2020.101614 [ Links ]

Khurana, I., Dutta, D.K., & Singh Ghura, A. (2022). SMEs and digital transformation during a crisis: The emergence of resilience as a second-order dynamic capability in an entrepreneurial ecosystem. Journal of Business Research, 150(1), 623-641. https://doi.org/10.1016/j.jbusres.2022.06.048 [ Links ]

Kim, M., Song, J., & Triche, J. (2015). Toward an integrated framework for innovation in service: A resource-based view and dynamic capabilities approach. Information Systems Frontiers, 17(3), 533-546. https://doi.org/10.1007/s10796-014-9505-6 [ Links ]

Kleinknecht, R.H. (2015). Employee participation in corporate governance: Implications for company resilience. European Journal of Industrial Relations, 21(1), 57-72. https://doi.org/10.1177/0959680114523820 [ Links ]

Kraaijenbrink, J., Spender, J.-C., & Groen, A.J. (2010). The resource-based view: A review and assessment of its critiques. Journal of Management, 36(1), 349-372. https://doi.org/10.1177/0149206309350775 [ Links ]

Kurtz, D.J., & Varvakis, G. (2016). Dynamic capabilities and organizational resilience in turbulent environments. In K. North & G. Varvakis (Eds.), Competitive strategies for small and medium enterprises: Increasing crisis resilience, agility and innovation in turbulent times (pp. 19-37). Springer International Publishing.

Leonard-Barton, D. (1992). Core capabilities and core rigidities: A paradox in managing new product development. Strategic Management Journal, 13(S1), 111-125. https://doi.org/10.1002/smj.4250131009 [ Links ]

Lin, Y., & Wu, L.-Y. (2014). Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. Journal of Business Research, 67(3), 407-413. https://doi.org/10.1016/j.jbusres.2012.12.019 [ Links ]

Linnenluecke, M.K. (2017). Resilience in business and management research: A review of influential publications and a research agenda. International Journal of Management Reviews, 19(1), 4-30. https://doi.org/10.1111/ijmr.12076 [ Links ]

Martinelli, E., Tagliazucchi, G., & Marchi, G. (2018). The resilient retail entrepreneur: Dynamic capabilities for facing natural disasters. International Journal of Entrepreneurial Behavior & Research, 24(7), 1222-1243. https://doi.org/10.1108/IJEBR-11-2016-0386 [ Links ]

Menéndez Blanco, J.M., & Montes Botella, J.L. (2016). What contributes to adaptive company resilience? A conceptual and practical approach. Development and Learning in Organizations: An International Journal, 30(4), 17-20. https://doi.org/10.1108/DLO-10-2015-0080 [ Links ]

Mikalef, P., & Pateli, A. (2017). Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. Journal of Business Research, 70, 1-16. https://doi.org/10.1016/j.jbusres.2016.09.004 [ Links ]

Miller, D. (2019). The resource-based view of the firm. In Oxford Research Encyclopedia of Business and Management. Retrieved May 24, 2023, from https://doi.org/10.1093/acrefore/9780190224851.013.4

Mody, A. (1993). Learning through alliances. Journal of Economic Behavior & Organization, 20(2), 151-170. https://doi.org/10.1016/0167-2681(93)90088-7 [ Links ]

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital, and the organizational advantage. The Academy of Management Review, 23(2), 242. https://doi.org/10.2307/259373 [ Links ]

Nason, R.S., & Wiklund, J. (2018). An assessment of resource-based theorizing on firm growth and suggestions for the future. Journal of Management, 44(1), 32-60. https://doi.org/10.1177/0149206315610635 [ Links ]

North, K., & Varvakis, G. (2016). Introduction: What is a 'dynamic SME'. In K. North & G. Varvakis (Eds.), Competitive strategies for small and medium enterprises: Increasing crisis resilience, agility and innovation in turbulent times (pp. 1-17). Springer International Publishing.

Obloj, T., & Capron, L. (2011). Role of resource gap and value appropriation: Effect of reputation gap on price premium in online auctions: Research notes and commentaries. Strategic Management Journal, 32(4), 447-456. https://doi.org/10.1002/smj.902 [ Links ]

Ozanne, L.K., Chowdhury, M., Prayag, G., & Mollenkopf, D.A. (2022). SMEs navigating COVID-19: The influence of social capital and dynamic capabilities on organizational resilience. Industrial Marketing Management, 104(1), 116-135. https://doi.org/10.1016/j.indmarman.2022.04.009 [ Links ]

Pettit, T.J., Fiksel, J., & Croxton, K.L. (2010). Ensuring supply chain resilience: Development of a conceptual framework. Journal of Business Logistics, 31(1), 1-21. https://doi.org/10.1002/j.2158-1592.2010.tb00125.x [ Links ]

Polman, P., & Winston, A. (2021). 6 Types of resilience companies need today - Lessons in crisis management and agility from Unilever. Harvard Business Review. Retrieved 18 August 2022, from https://hbr.org/2021/11/6-types-of-resilience-companies-need-today

Polyviou, M., Croxton, K.L., & Knemeyer, A.M. (2020). Resilience of medium-sized firms to supply chain disruptions: The role of internal social capital. International Journal of Operations and Production Management, 40(1), 68-91. https://doi.org/10.1108/IJOPM-09-2017-0530 [ Links ]

Ponomarov, S.Y., & Holcomb, M.C. (2009). Understanding the concept of supply chain resilience. The International Journal of Logistics Management, 20(1), 124-143. https://doi.org/10.1108/09574090910954873 [ Links ]

Prahalad, C.K., & Hamel, G. (1997). The core competence of the corporation. Springer.

Preacher, K.J., & Hayes, A.F. (2004). SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behavior Research Methods, Instruments, & Computers, 36(4), 717-731. https://doi.org/10.3758/BF03206553 [ Links ]

Priem, R.L., & Butler, J.E. (2001). Is the resource-based 'view' a useful perspective for strategic management research? Academy of Management Review, 26(1), 22-40. https://doi.org/10.5465/amr.2001.4011928 [ Links ]

Ren, S., Sun, H., & Tang, Y. (2022). CEO's hometown identity and corporate social responsibility. Journal of Management, 0(0), 014920632211049. https://doi.org/10.1177/01492063221104988 [ Links ]

Richtnér, A., & Löfsten, H. (2014). Managing in turbulence: How the capacity for resilience influences creativity: How the capacity for resilience influence creativity. R&D Management, 44(2), 137-151. https://doi.org/10.1111/radm.12050 [ Links ]

Rugman, A.M., & Verbeke, A. (2002). Edith Penrose's contribution to the resource-based view of strategic management. Strategic Management Journal, 23(8), 769-780. https://doi.org/10.1002/smj.240 [ Links ]

Seville, E., Van Opstal, D., & Vargo, J. (2015). A primer in resiliency: Seven principles for managing the unexpected. Global Business and Organizational Excellence, 34(3), 6-18. https://doi.org/10.1002/joe.21600 [ Links ]

Su, H.-C., & Linderman, K. (2016). An empirical investigation in sustaining high-quality performance: An empirical investigation in sustaining high-quality performance. Decision Sciences, 47(5), 787-819. https://doi.org/10.1111/deci.12210 [ Links ]

Teece, D.J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319-1350. https://doi.org/10.1002/smj.640 [ Links ]

Teece, D.J. (2012). Dynamic capabilities: Routines versus entrepreneurial action: Routines versus entrepreneurial action. Journal of Management Studies, 49(8), 1395-1401. https://doi.org/10.1111/j.1467-6486.2012.01080.x [ Links ]

Teece, D.J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533. https://doi.org/10.1002/(SICI)1097-0266(199708)18:7<509::AID-SMJ882>3.0.CO;2-Z [ Links ]

Tobias, S., & Carlson, J.E. (1969). Brief report: Bartlett's test of sphericity and chance findings in factor analysis. Multivariate Behavioral Research, 4(3), 375-377. https://doi.org/10.1207/s15327906mbr0403_8 [ Links ]

Verreynne, M.-L., Ho, M., & Linnenluecke, M. (2018). Editorial for the special issue on: Organizational resilience and the entrepreneurial firm. International Journal of Entrepreneurial Behavior & Research, 24(7), 1122-1128. https://doi.org/10.1108/IJEBR-11-2018-533 [ Links ]

Wang, Y., Lo, H.-P., & Yang, Y. (2004). The constituents of core competencies and firm performance: Evidence from high-technology firms in China. Journal of Engineering and Technology Management, 21(4), 249-280. https://doi.org/10.1016/j.jengtecman.2004.09.001 [ Links ]

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171-180. https://doi.org/10.1002/smj.4250050207 [ Links ]

Wieland, A., & Durach, C.F. (2021). Two perspectives on supply chain resilience. Journal of Business Logistics, 42(3), 315-322. https://doi.org/10.1111/jbl.12271 [ Links ]

Williams, B., Onsman, A., & Brown, T. (2010). Exploratory factor analysis: A five-step guide for novices. Australasian Journal of Paramedicine, 8(3), 1-13. https://doi.org/10.33151/ajp.8.3.93 [ Links ]

Williams, T.A., Gruber, D.A., Sutcliffe, K.M., Shepherd, D.A., & Zhao, E.Y. (2017). Organizational response to adversity: Fusing crisis management and resilience research streams. Academy of Management Annals, 11(2), 733-769. https://doi.org/10.5465/annals.2015.0134 [ Links ]

Wright, P.M., Dunford, B.B., & Snell, S.A. (2001). Human resources and the resource based view of the firm. Journal of Management, 27(6), 701-721. https://doi.org/10.1177/014920630102700607 [ Links ]

Wu, L. (2010). Applicability of the resource-based and dynamic-capability views under environmental volatility. Journal of Business Research, 63(1), 27-31. https://doi.org/10.1016/j.jbusres.2009.01.007 [ Links ]

Xie, X. (2022). Business networks and organizational resilience capacity in the digital age during COVID-19: A perspective utilizing organizational information processing theory. Technological Forecasting, 16. https://doi.org/10.1016/j.techfore.2022.121548 [ Links ]

Xie, X., Wu, Y., & Blanco-Gonzalez Tejerob, C. (2022). How responsible innovation builds business network resilience to achieve sustainable performance during global outbreaks: An extended resource-based view. IEEE Transactions on Engineering Management, PP(99), 1-15. https://doi.org/10.1109/TEM.2022.3186000 [ Links ]

Zahra, S.A. (2021). The resource-based view, resourcefulness, and resource management in startup firms: A proposed research agenda. Journal of Management, 47(7), 1841-1860. https://doi.org/10.1177/01492063211018505 [ Links ]

Zhao, L., & Kim, K. (2021). Responding to the COVID-19 pandemic: Practices and strategies of the global clothing and textile value chain. Clothing and Textiles Research Journal, 39(2), 157-172. https://doi.org/10.1177/0887302X21994207 [ Links ]

Zott, C. (2003). Dynamic capabilities and the emergence of intraindustry differential firm performance: Insights from a simulation study. Strategic Management Journal, 24(2), 97-125. https://doi.org/10.1002/smj.288 [ Links ]

Correspondence:

Correspondence:

Ning Ning You

sunnyningyou@163.com

Received: 14 Nov. 2022

Accepted: 04 May 2023

Published: 13 July 2023

Appendix 1