Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Acta Structilia

versão On-line ISSN 2415-0487

versão impressa ISSN 1023-0564

Acta structilia (Online) vol.30 no.2 Bloemfontein 2023

http://dx.doi.org/10.38140/as.v30i2.7523

RESEARCH ARTICLE

The impact of foreign exchange rate on building materials and residential building construction cost in Nigeria (1999-2021)

Oluwasinaayomi KasimI, *; Samson AjayiII; Olayide OmirinIII; Adekunle AlabiIV

IDepartment of Geography, University of Guyana, Georgetown, Guyana. Email: <Kasim.faith@uog.edu.gy>, ORCID: https://orcid.org/0000-0002-5985-1534

IIDepartment of Urban and Regional Planning, University of Ibadan, Nigeria. Email: <samson.o.ajayi@firstbanknigeria.com>, ORCID: https://orcid.org/0000-0003-3282-2618

IIIDepartment of Urban and Regional Planning, University of Ibadan, Nigeria. Email: <joeomirin@yahoo.com>, ORCID: https://orcid.org/0000-0001-6203-6840

IVDepartment of Urban and Regional Planning, University of Ibadan, Nigeria. Email: <morufalabi@ymail.com>, ORCID: https://orcid.org/0000-0002-0137-7390

ABSTRACT

Nigeria has a housing deficit of over 17.5 million. Over the years, the government has articulated several policies to encourage investment and development of the housing sector. However, the housing construction sector imports most of the building materials which is affected by the various government directives on foreign exchange policies, with significant impact on the cost of housing production. This study examined the impact of foreign exchange rates on the costs of residential building materials in Ibadan, with a view to proposing policy directives on the local production of building materials in Nigeria. A survey research design was adopted and the retrospective longitudinal approach was employed to obtain data for the study. It was revealed that two types of rates (the fixed exchange rate and the floating exchange rate) dominated the trend of foreign exchange in Nigeria. The prices of building materials indicate an upward price movement and correlations exist between changes in exchange rates and changes in the price of building materials. A unit increase in the foreign exchange rate affects the price of building materials as seen in this study, where the foreign exchange rate positively increased by 1 value, the interbank and the parallel market exchange rates rose by exchange rate values of 0,807 and 0,705, respectively. To reverse the current trend of dependence of prospective house owners on foreign materials for housing production, the use of quality-assured local building materials in housing development should be encouraged.

Keywords: Foreign exchange, building materials, housing construction cost, importation, Central Bank of Nigeria, unit price

ABSTRAK

Nigerië het 'n behuisingstekort van meer as 17,5 miljoen. Oor die jare het die regering verskeie beleide geartikuleer om belegging en ontwikkeling van die behuisingsektor aan te moedig. Die behuisingskonstruksie-sektor voer egter die meeste van die boumateriaal in wat geraak word deur die verskillende regeringsvoorskrifte oor buitelandse valutabeleide met 'n beduidende impak op die koste van behuisingproduksie. Hierdie studie het die impak van buitelandse wisselkoerse op die koste van residensiële boumateriaal in Ibadan ondersoek, met die oog daarop om beleidsvoorskrifte oor die plaaslike produksie van boumateriaal in Nigerië voor te stel. 'n Opname navorsingsontwerp is aangeneem en die retrospektiewe longitudinale benadering is aangewend om data vir die studie te verkry. Twee tipes koerse (die vaste wisselkoers en die swewende wisselkoers) het die tendens van buitelandse valuta in Nigerië oorheers. Die pryse van boumateriaal dui op 'n opwaartse prysbeweging en korrelasies bestaan tussen veranderinge in wisselkoerse en veranderinge in die pryse van boumateriaal. 'n Eenheidsverhoging in die buitelandse wisselkoers beïnvloed die pryse van boumateriaal soos vir hierdie studie wanneer die buitelandse wisselkoers positief met 1 waarde toegeneem het, het die interbank- en die parallelmarkwisselkoerse gestyg met wisselkoerswaardes van onderskeidelik 0,807 en 0,705. Om die huidige tendens van afhanklikheid van voornemende huiseienaars van buitelandse materiaal vir behuisingsproduksie om te keer, moet die gebruik van gehalteversekerde plaaslike boumateriaal in behuisingsontwikkeling aangemoedig word.

1. INTRODUCTION

With a population of over 200 million, Nigeria has a housing deficit of approximately 20 million (Oyediran, 2019: 39). To address the deficit, successive governments have formulated various housing-related policies to stimulate investment and development in the housing sector (Alabi, Muraina & Kasim, 2018: 47; Kasim, 2018: 955). For example, the government policy directives on foreign exchange policies have affected the housing market (ITA, 2019). It is believed that the housing market is driven by institutional, foreign, local and private businesses, as well as the growth of locally established businesses (Alabi, 2015: 103). The development of the housing market is dependent on the price of building materials, which are mainly imported, and exchange rates determined in a largely dollarised economy in Nigeria.

The exchange rate is the price of one currency against another. In Nigeria, the exchange rate evolved from a fixed rate in 1960 to a pegged structure between the 1970s and the mid 1980s and finally to the Second Tier Foreign Exchange Market (SFEM) in 1986. Before adopting the Structural Adjustment Programme (SAP) in 1986, the foreign exchange rate was administratively determined. The introduction of SFEM, in 1986, allowed the exchange rate to find a realistic or appropriate level, thus eliminating various distortions in resource allocations (Alabi, 2015: 104; IMF, 2016; ITA, 2019).

Since the adoption of SFEM, the Nigeria Naira has continued to depreciate against international currencies. Over the years, Nigeria was presumed to be facing the challenge of a dwindling Naira rate in the international market (Ugochukwu, Ogbuagu & Okechukwu, 2014: 872-873). This was manifested in the sharp rate of depreciation of the Naira to USD, as a result of the fall in the oil price in the global market in 2015 (Isibor, Ojo & Ikpefan, 2017: 2340; Umaru et al., 2023: 186). As a result of the continued depreciation of the Naira, the prices of residential building materials, mostly imported, have been on the increase and these have, in turn, discouraged many individuals from starting or continuing the construction of new houses (Agbola, 2005; Uma et al., 2019: 113). Ugochukwu et al. (2017: 886) noted that the reliance of housing developers on the use of imported building materials has led to an increase in the cost of housing supply.

With the increasing population coupled with the inability of the government to meet the widening gap of housing deficit in Nigeria, many of the citizens have been using self-help to meet their housing needs (Onibokun, 1998; Taiwo, Yusoff & Abdul Aziz, 2018: 3770-3771; Adegun & Olawale, 2019: 332). The self-help strategy has been constrained by the inadequacy of locally produced building materials and the high dependency on imported materials (Alabi et al., 2018: 47; Uma et al., 2019: 119). Studies have been done on factors influencing housing production and delivery in Nigeria (Agbola, 2005; Agbola & Kasim, 2017: 19; Makinde, 2014; Iheme, Ekung & Effiong, 2015; Ugochukwu et al., 2017; Alabi, Omirin & Kasim, 2017; Kasim, 2018; Taiwo & Misnan, 2020). The investigation also revealed that, since the adoption of financial liberalisation policies in 1987, the foreign exchange market in Nigeria has witnessed changes that affect the cost of construction materials and the overall cost of housing projects (Dada & Oyeranti, 2012; Ugochukwu et al., 2014; Alabi, 2015: Ajayi, 2017; Izobo-Martins, Ekhaese & Ayo-Vaughan, 2018). Guided by the listed studies, this research adopted a streamlined approach to examine the impact of changes in foreign exchange rate policies on the prices of residential building materials in Ibadan, Nigeria. Since Nigeria's housing sector depends heavily on foreign materials for housing construction, the study provides a policy direction for import substitution and the investment in, and development of local production of most of the imported building materials to cushion the effects of the variations in the foreign exchange rates.

2. LITERATURE REVIEW

2.1 Purchasing power parity

A series of concepts and theories could be used to explain the impact of foreign exchange rates on the cost of residential building materials. However, for this study, emphasis is placed on the theory of foreign exchange behaviour. The origins of the Purchasing Power Parity (PPP) concept can be traced back to the Salamanca School in 16th-century Spain. Its modern use as a theory of exchange rate determination begins with the work of Gustav Cassel (1918), who proposed PPP as a means of adjusting pre-World War I exchange rates or parities for countries intending to return to the gold standard system after hostilities ended (Dornbusch, 1987).

According to this theory, the purchasing power of countries is one of the key determinants of foreign exchange rates at a particular point in time. PPP deals with how inflation or deflation affects exchange rate determination (Ajayi, 2017: 49; World Bank, 1997). This implies that inflation or deflation determine the exchange rate under the theory of foreign exchange behaviour. The PPP is based on the notion that high domestic inflation rates will, ultimately, make exports, investments, and tourism more expensive to foreigners. There are two variants of PPP; the absolute PPP and the relative PPP (Vo & Vo, 2023: 447). The absolute PPP predicts that the exchange rate should adjust to equate the prices of national goods and services between two countries because of market forces driven by arbitrage (Schreyer & Koechlin, 2002: 1). Under absolute PPP, the exchange rate is simply equal to the ratio of the domestic to the foreign price of a given aggregate bundle of commodities (Schreyer & Koechlin, 2002: 1). The relative PPP implies that the exchange rate between two countries should eventually adjust to account for differences in their inflation rates when prices of similar products in different countries are measured in the common currency (Schmitt-Grohe, Uribe & Woodford, 2022: 193-210; Schreyer & Koechlin, 2002: 1).

With the PPP in operation, the exchange rates will continue to adjust according to global demands, driving the domestic currency's price downward/upward by as much as it takes to equal the difference in inflation rates (Manzur, 2018: 217). However, many factors affect short-term exchange rates in addition to differential inflation rates (Argyropoulos et al., 2021: 253-254). Some of the factors include the existence of non-traded goods and services that preclude arbitrage and the presence of significant transactions costs for traded goods, including transport costs, tariffs, taxes, information costs, and other non-tariff trade barriers that make arbitrage costly (Manzur, 2018: 217; Vo & Vo, 2023: 447).

PPP has some inherent shortcomings as a particularly good predictor of short-term exchange rate movements. Nonetheless, it does a fairly good job of predicting general dynamics in exchange rates over the longer term (Barguellil, Ousama Ben-Salha & Zmami, 2018: 1302-1303). In the short term, exchange rates are affected by factors other than inflation differentials but income level, government control or the interest rate and movements of capital (Ke, Shabbir & Corona, 2018: 369). As a result, many studies have highlighted the non-reliability of this theory, and it should only be used in conjunction with other methods (Engel, 2019: 22; Nakamura, 2022). Hence, the relevance of the supply shock concept.

2.2 Supply-side shock

Supply-side shocks, which are events external to an economy, but which affect its production of goods and services, are sudden and unexpected changes in cost variables such as oil prices, commodity prices, and wages (Peersman & Van Robays, 2012: 1544; Umoru et al., 2023: 186). The macroeconomic effect of supply shock on the cost of building materials depends on whether the shock is positive or negative (Ugochukwu et al., 2017; Umoru et al., 2023). When there is a positive shock, the supply curve for building materials shifts from its original place to the right. As a result of the positive oil shocks of 1973/1974 and 1978/1979, the Naira became greatly overvalued. At the height of the oil boom, in 2013-2014, Nigeria's economy grew rapidly and overtook South Africa as the continent's largest economy. But when the oil price plummeted, the country's weaknesses were exposed.

Due to the oil glut that crept into the Nigerian economy in 1981, as well as the collapse of the international oil market in 1986 (negative shocks), the revenue generated by the "black gold" has continued to decrease. According to Olowe (2009: 379), the introduction of the SAP in Nigeria in 1986 led to the deregulation of the foreign exchange market and the introduction of the market-determined exchange rate. This created uncertainty in the exchange rate, thus leading to volatility. Deregulation of foreign exchange rates has led to the scarcity of dollars. That in turn, led to the development of a parallel dollar market as an alternative to the formal sector market. When dollars are scarce, the dollar exchange rate market is illiquid, making it difficult to pay dollar commitments (Ajayi, 2017; Ugochukwu et al., 2017: 97). The illiquidity and the difficulty to service foreign debt prompted the state to respond by floating the currency's exchange rate, with the aim to discourage importations induced by the parallel market by devaluing the Naira.

The devaluation of the currency in 2014, due to falling oil prices driven by a global supply glut and declining world demand for crude oil, created a steep difference in Naira/USD parity (Ajayi, 2017: 50; Ugochukwu et al., 2017: 96-97). As the Nigerian dollar receipt dropped, due to lower oil prices, the Naira also weakened and the trend continues to date. Construction projects are a high-risk business activity influenced by both internal and external factors, for example, foreign exchange fluctuations (Kulemeka, Kululanga & Morton, 2015). When undertaking projects within a local context with international influence, the construction cost may be significantly affected and complicated by the risk of fluctuations in the foreign exchange rates (Izobo-Martins et al., 2018: 194; Kanu & Nwadiubu, 2020: 59-60). As noted by Olawale & Sun (2010) and Kulemeka et al. (2015) the fluctuations affect progress and cause delays. This, in turn, creates problems for subcontractors, namely cost overruns, disputes, arbitration, total abandonment, and litigation. It has been reported that deficit foreign exchange fluctuations may cause the price of, especially imported raw materials to increase, leading the cost overruns (Musarat, Alaloul & Liew, 2021: 408; Oluyemi-Ayibiowu, Aiyewalehinmi & Omolayo, 2019).

2.3 Exchange rate policy and construction cost

Alabi (2015: 103) states that Nigeria, like many other low-income open economies of the world, has adopted the two main exchange rate regimes to gain internal and external balance. The regimes are direct administrative control exchange rate policy and market-oriented exchange rate policy. The arguments and conditions for and against each of the regimes are clear, given that the two regimes are aimed at maintaining stability in exchange rates (Alabi, 2015). Direct administrative control exchange rate policy was used to manage Nigeria's foreign exchange from independence in 1960 until 1986, when the SFEM was introduced as a fallout of the adoption of SAP (Alabi, 2015).

Since the adoption of financial liberalisation policies, most of the developing countries have been exposed to sharp exchange rate fluctuations (Barguellil et al., 2018: 1302). Therefore, in an attempt to achieve an optimal level of foreign exchange efficiency, several policy guidelines and requirements were introduced to manage the nation's foreign exchange market. The prominent policies emerged in 1986 when Nigeria shifted to a market-oriented economy to promote the productive sector and enhance the facilitation of Foreign Direct Investment (FDI) influx into the country. The Nigeria foreign exchange market has witnessed tremendous changes since the introduction of SFEM in September 1986; the unified official market in 1987; the Autonomous Foreign Exchange Market (AFEM) in 1995; the Inter-bank Foreign Exchange Market (IFEM) in 1999 (Alabi, 2015), and the floating and flexible regime in 2015. A floating and flexible regime led to the emergence of the Investors and Exporters (I&E) Market, which was introduced in the first quarter of 2017 to stabilise the forex market and provide liquidity in the market for Forex in Nigeria (Ajayi, 2017).

The various organised market arrangements for selling and buying foreign exchange under the floating regime are convoluted (Alabi, 2015). However, it is clear that the volatility, frequency, and instability of the exchange rate movement, since the beginning of the floating exchange rate, raises concern about the impact of such movements on construction materials and commercial real estate returns in Nigeria. As observed by Dada & Oyeranti (2012: 231), the flexible forex market becomes a factor that can affect the cost of real estate development and may give rise to uncertainty in attempting to estimate the cost of developing projects.

Nigerians rely on imported goods and services in all sectors of the economy, housing production inclusive. The fluctuation in the foreign exchange rate has been presumed to be one of the causes of an increase in housing production cost (Alabi, 2015: 105; Alabi et al., 2018: 46-47; PWC, 2016; Uma et al., 2019: 113). Since the deregulation of the Naira in 1986, the currency has continued to depreciate against the currencies of major trading partners. The implication of this is that the prices of imported building materials have been on the increase, as reflected in the cost of housing construction and prices of the finished good, a house. It has been documented that slight variations and/or fluctuations in prices of building construction materials could greatly affect the overall cost of building (Dada & Oyeranti, 2012).

Completing construction projects within the estimated time and cost is an indicator of efficiency, but the process of construction is subjected to many unpredictable and changing factors that come from different sources (Ismail et al., 2012; Ugochukwu et al., 2014). These sources include the performance of the parties involved, resource availability, and the prevailing economic situation, including foreign exchange volatility (Olawale & Sun, 2010: 511-513; Kulemeka et al., 2015). The financial situation of construction organisations can be adversely affected when the currency of exchange rates fluctuates (Ling & Hoi, 2006). It has been documented that one of the predominant causes of delay for construction projects is financial difficulties experienced because of the fluctuations in foreign exchange rates (Ismail et al., 2012: 4968-4970; Kanu & Nwadiubu, 2020: 59-60; Okoli, Mbah & Agu, 2016: 6-7; Olawale & Sun, 2010: 511-513). As noted by Ugochukwu et al. (2014: 872), the construction industry in Nigeria has experienced a challenging period owing to the exchange rate volatility. Therefore, projects that would have helped uplift the standard of living have either been abandoned or did not take off at all, due to inadequate funds and the rising cost of construction materials (Izobo-Martins et al., 2018: 194).

3. METHODOLOGY

3.1 Research design

The study examined the relationship between foreign exchange rates and the price of building materials in Ibadan, Nigeria, to determine the effects of the nexus on the cost of housing construction. A correlational research design was adopted for this study to collect retrospective longitudinal data (Robins, 1988: 315-316; Creswell, 2014). The longitudinal approach, a method used in collecting continuous and trend data over an extended period (Caruana et al., 2015: 537) was used to obtain data on foreign exchange rates, and the cost of building materials for the study. The method was deemed appropriate and versatile in the collection of repeatable data and allows for the documentation of quantitative trend data (Venkatesh & Vitalari, 1991: 124). The survey covered a period from 1999-2021.

3.2 Sampling method

Information on sources and prices of building materials was obtained from the records of building materials dealers in Iwo Road, Ibadan. The choice of building material dealers in the Iwo Road area, Ibadan, stems from the fact that large numbers of building material dealers are found in this location, which serves as the central market for building materials in Ibadan. Virtually all types of building materials required in housing production are sold along this corridor of the city. From the preliminary survey carried out, 108 building materials points of sales were identified and disaggregated into six distributor/wholesale outlets and 102 retail shops. Further investigation revealed that the majority of the retail outlets/shops were either owned or under the control and/or direct supervision of the six major wholesalers/ distributors (Uchekinze Nigeria Ltd, Tony Anne Nig. Ltd, Jontana Nig. Ltd, Macfoster Builders Station, B Fams Nig. Ltd, and Demmy Super Build Mart). It is important to note that, in a typical Nigerian major market corridor, the major distributors and wholesalers also have their hands in the pie as market intermediaries and retail outlets to maximise their market share and sphere of influence (Ladipo, Alarape & Nwagwu, 2013: 135; Odia & Dakare, 2019: 139).

3.3 Data collection

The six major wholesalers and distributors serve as the one-stop shop for builders and buyers of building materials. Information on the average prices of building materials was retrospectively collated and documented from the sales receipts of the building materials distributors from 1999-2021. The data obtained were subjected to an aggregated transformation process involving the conversion of the raw data from the six major wholesalers and distributors of building construction materials into a cleansed, validated, transformed through differencing and made stationary in ready-to-use format (Bond & Fox, 2001; Osborne, 2019). The data on the foreign exchange rate was obtained from the CBN statistical bulletin, the National Bureau of Statistics, and other existing literature.

3.4 Data analysis

Data were analysed using descriptive and inferential statistics. The descriptive analyses calculated the percentage variations in foreign exchange rates and prices of building materials and showed the results over two 10-year interval periods.

For inferential analysis Pearson Product Moment Correlation, t-test, as well as simple and multiple linear regression analyses at p< 0.05 was used to find correlations between exchange rates, prices of residential building materials and residential building construction costs. To analyse the difference in the cost of the two types of dominant cement in Nigeria (Lafarge and Dangote) and the price of locally made metal doors and imported doors, a paired samples t-test with p=0.05 was done to compare the mean of cases, and to find any correlations between the cases examined (Ross & Willson, 2017: 17). Pearson Product Moment Correlation is best used in determining a linear relationship between the two variables (Coffman, Maydeu-Olivares & Arnau, 2008). According to Gujarati and Porter (2009: 20), correlation coefficients (r) measure whether there is a linear relationship between two variables. It has values between -1 and 1, where:

• -1 indicates a perfectly negative linear correlation between the two variables.

• 0 indicates no linear correlation between the two variables.

• 1 indicates a perfectly positive linear correlation between the two variables.

For this study, a Pearson's correlation test with p=0.05 was done to find any significant relationship between exchange rates and prices of building materials. However, to measure the real relationship between different variables when time-series data is analysed, the collected data were transformed, using the first and second differences in making the data stationary. This implies that the change in one variable is tested against the change in another variable to accurately predict the causal relationships between the variables through a correlation test.

4. FINDINGS

4.1 Foreign exchange rate in Nigeria

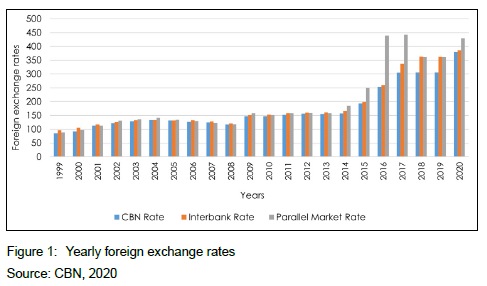

Results in Figure 1 show that exchange rate fluctuation is a period in which the value of domestic currency appreciates or depreciates. The fluctuation has implications for the overall economy of a nation, especially the price of imported goods. Owing to changing government policies, the Nigerian foreign exchange market is known for its high level of fluctuation. A larger part of the housing construction materials is imported; therefore, fluctuation in the exchange rate will have an effect on the construction cost of a building. For example, in 1999, the Central Bank of Nigeria's official exchange rate was N85.6/dollar. In 2000, it depreciated to N92.5/dollar and the official rate increased in 2001 to N113.12/dollar. Naira depreciated further to N133/dollar in 2004. However, it increased from N131.65/dollar in 2005 to 127.38/dollar and N124.61/dollar in 2007. The exchange rate increased to N117/dollar in 2008 because of the foreign exchange rate stabilisation policy aimed at increasing the value of the Naira.

The foreign exchange rate increased to N147/dollar in 2009 and this fluctuated slightly from 2011 to 2014 to range between N152/dollar to N156/dollar and increased to N193/dollar in 2015. From 1999 until 2015, a pseudo-fixed exchange rate policy was adopted by the government to fix the Naira/dollar exchange rate to below the N200 threshold.

In late 2015, the fixed exchange rate policy was discarded to allow a floating exchange rate policy. The floating exchange rate policy led to the removal of government control to allow the forces of supply and demand to regulate the exchange rate. Whenever prices are regulated by market forces in Nigeria, it often leads to huge volatility. Hence, the exchange rate increased beyond the N200 Rubicon by increasing from 193/dollar to N253.2 in 2016 and N306/dollar in 2018. In 2020, the Naira was further devalued to N386/ dollar. The interbank rates were slightly higher, as the exchange rates were 259.66/dollar, 336.89/dollar, 362.38/dollar, 362/dollar, and 386/dollar in 2016, 2017, 2018, 2019 and 2020, respectively. In the parallel market, the exchange rates were N443, N361, N361, and N430 in 2017, 2018, 2019 and 2020, respectively. In summary, between 2000 and 2010, the CBN, interbank, and parallel market rates increased by 72%, 59%, and 70%, respectively. The rates for CBN, interbank, and parallel market rates were 149%, 145%, and 172%, respectively, between 2011 and 2020. Figure 1 shows the yearly foreign exchange rates in Nigeria.

Based on the trend analysis of the foreign exchange rate during the period (1999-2021) under review, two rates dominated the trend. The first was when Nigeria was operating a fixed exchange rate (1999-early 2015), which was regulated by the government, and the second was the era when a floating exchange rate was introduced (2015-2020). During the former era, the Nigerian Government ensured that the rate was below N200/US$1 but during the latter era, the rate increased from N253//US$1 2016 to N306/ US$1 in 2018 and increasing to N380/US$1 in September 2020.

4.2 Prices of residential building materials

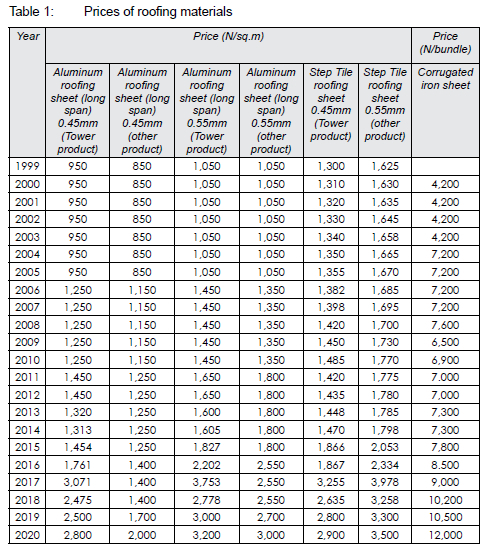

The trends in the prices of roofing sheets in Nigeria, as shown in Table 1, indicate an upward price movement from 1999 to 2020. The price of corrugated iron sheets, which was N4,200 per bundle between 1999 to 2003/2004, increased to N7,600 in 2008 and was sold for N12,000 in 2020. The price (per sqm) of aluminium roofing sheet (long span) 0.45mm (Tower product) was N950 between 1999 to 2005, but it increased from N1,250 in 2006 to 2010 and increased further to N1,450 in 2011 and sustained price till 2012. The price decreased to N1,320 and N1,313 in 2013 and 2014, respectively; it increased to N1,454 in 2015 and maintained this trend at N2,475 per unit cost in 2018. Between 2019 and 2020, it increased from N2,500 to N2,800. In addition, there has been an increase in the price of other brands and sizes of roofing sheets such as aluminium roofing sheet (long span) 0.55mm (Tower product), step tiles roofing sheet 0.45mm (tower), step tiles roofing sheet 0.55mm (tower), waterproof membrane 4mm thick Italian membrane, aluminium roofing sheet (long span) 0.45mm (other product), and aluminium roofing sheet (long span) 0.55mm (other product). This implies that the cost of roofing materials increased consistently from 1999 until 2020.

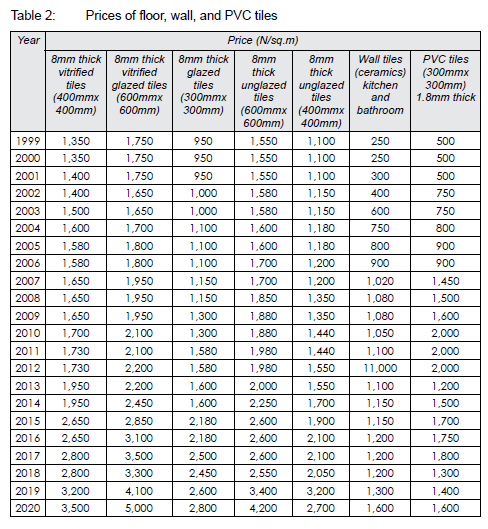

The unit price of 8mm thick vitrified tiles (400mmx400m) increased by 26% between 2000 and 2010 and further increased by 102% from 2011 to 2020. The unit prices of 8mm vitrified glazed tiles (300mmx300mm) increased by 20% between 2000 and 2010 and by 138% between 2011 and 2020. For the unglazed (600mmx600mm), the percentage unit price increased by 21% from 2000 to 2010 and 112% from 2011 to 2020, respectively.

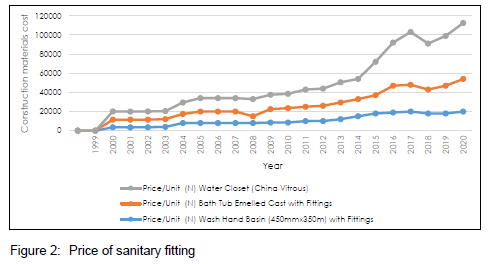

The price of a wash-hand basin (450mmx350mm), bathtub enamelled cast and water closet (China vitreous) with fittings per unit increased by 143%, 88%, and 76%, respectively, from 2000 to 2010. The same items' unit prices increased by 100%, 127%, and 225% between 2011 and 2020, as shown in Figure 2.

Between 1999 and 2010, the unit price of a metal door with a glass double door (2.1mx1.2m) decreased by -7% from 2000 to 2010 and increased by 56% between 2011 and 2020, as shown in Table 3. The unit price of a locally made metal double door (2.1mx1.8m) remained unchanged from 2000 to 2010 and increased by 22% between 2011 and 20C0. Turkish double door (2.1mx1.8m), Turkish single door (2.1mx1.2m), and Turkish single door (2.1mx0.9m) unit prices increased by 23%, 40%, and 56%, respectively. The cost of aluiminium sliding door (1800mmx2100mm) per unit increased by 7% between 2000 and 2010 to 41% from 2011 to 2020. Table 3 also shows that a unit cost of aluminium sliding windows (1.2mx1.2m) increased from 2000 to 2010 by 15% and by 79% between 2010 and 2020. The same trend was observed for aluminium sliding windows of various dimensions: 600mmx600mm, 900mmx1200mm, and 1800mmx1200mm.

Electrical fittings and wires were divided into three categories, namely cables, sockets, and switches. The unit price of a coil of 16mm 4 core pure copper cable, as per Table 4, increased by 50% and 183% between 2000 and 2010, and between 2011 to 2020, respectively. The same trend is captured for 1.5mm cable, 16mm copper, 2.5mm cable and 18mm aluminium cable with 111%, 275%, 211%, 175%, and 112% increases in 2020, respectively.

The unit price of the 13amps double socket, 1-way gang switch and 4-way gang switch increased by 39%, 88%, and 100% from 2000 to 2010, respectively. A trend of 140%, 100%, and 133% was also recorded between 2011 and 2020 for the item listed. For the water-heater switch and distribution board, the unit prices increased from 50% to 233% and 56% to 221% between 2000 to 2010 and from 2011 to 2020 for the water-heater switch and distribution board, respectively.

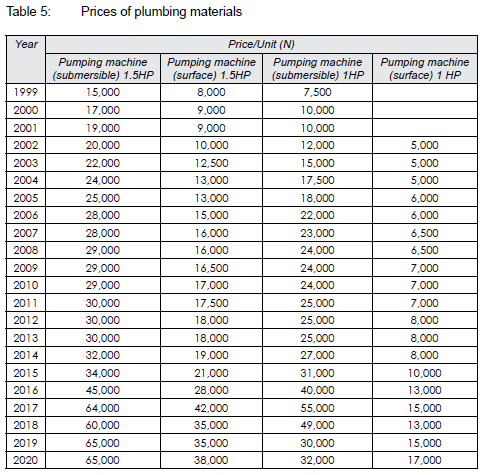

Using 1999 as the base year, the price of 1.5 HP surface and submersible pumping machines increased by 102.9% between 1999 and 2010 and 168.5% between 2011 and 2020. The price of 1HP surface and submersible water pumps increased on average by 140% between 1999 and 2010 and by 85.43% between 2011 and 2020.

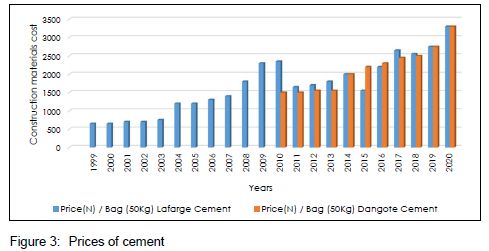

The unit price of a bag of Lafarge cement (50kg), as shown in Figure 3, increased by 262% from 2000 to 2010 and by 100% from 2011 to 2020. The unit price of a bag of Dangote cement (50kg) increased by 120% from 2011 to 2020.

4.3 Correlations between exchange rates, prices of residential building materials and residential building construction costs

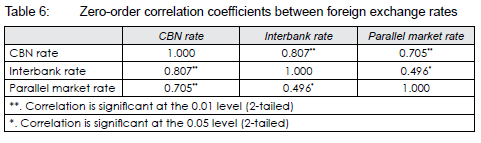

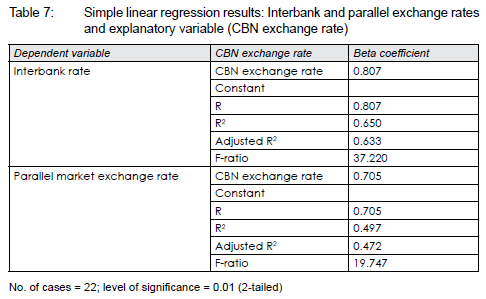

Investigation revealed that the CBN exchange rate affected the interbank rate as well as the parallel exchange rate positively. The resulte of the zero-order correlation analysis,as per Table 6. revealed a positive correlation between the CBN exchange rate and the interbank exchange rate (r=0.807); the CBN exchange rate and the parallel exchange rate (r=0.705), and the interbank exchange rate and the parallel exchange rate (r=0.496). The simple linear regression results (see Table 7) show that the CBN exchange rate was a significant explanatory variable for the interbank rate (r2=0.650) and the parallel exchange rate (r2=0.497). For this study, this meant that when the CBN exchange rate positively increased by 1 value, the interbank and the parallel market exchange rates rose by exchange rate values of 0.807 and 0.705, respectively. The F-ratios (37.220 and 19.747) were significant, showing that tee simple linear regression equations were reliable.

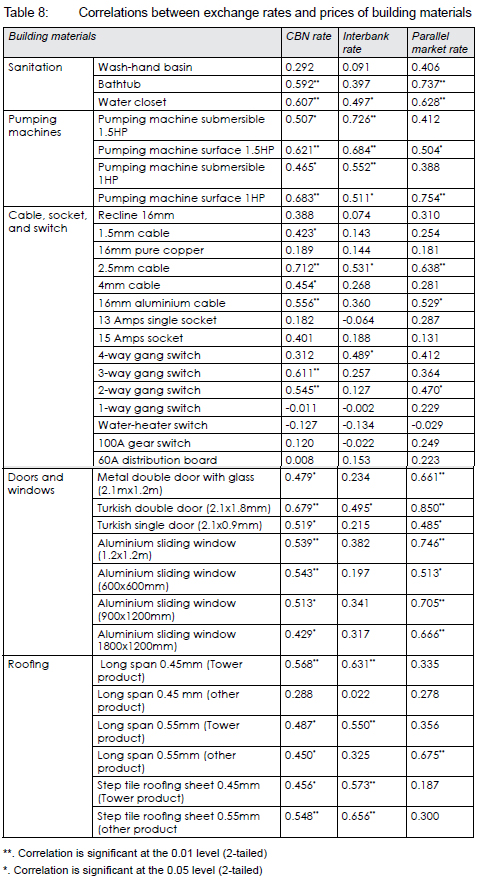

Results from the Pearson Product Moment Correlation analyses in Table 8 show a positive correlation between changes in exchange rates and changes in the prices of most of the building materials. The correlation between the CBN exchange rate and the prices of Tower's long-span aluminium roofing sheet (0.45mm) was r=0.568; the interbank exchange rate and the prices of Tower's long-span aluminium roofing sheet (0.55mm) was r=0.631, while the correlation with the parallel market exchange rate and the prices of Tower's step tile aluminium roofing sheet (0.45mm) was not significant. The significant correlation coefficients for other long-span products range between r=0.450 and r=0.675. The increase rate in the prices of residential building materials between 2010 and 2020, when Nigeria commenced a floating foreign exchange rate, became apparent in the trend analysis, as prices increased significantly. The increase in prices of sanitary fittings could not be unconnected with the fluctuations in the CBN exchange rate. The correlation between the CBN exchange rate and the price of bathtub enamelled cast with fittings was r=0.592 and the water closet (China vitreous) was r=0.607. The correlation between the interbank rate and pumping machines of various types are as follows: pumping machine (submersible), 1.5HP (r=0.726); pumping machine (surface), 1.5HP (r=0.684); pumping machine (submersible), 1HP (r=0.552), and pumping machine (surface), 1 HP (r=0.511).

Correlation coefficients between the CBN exchange rate, on the one hand, and various types of cables, on the other, are as follows: 1.5mm cable (r= 0.423); 2.5mm cable (r= 0.712); 4mm cable (r=0.454), and 16mm aluminium cable (r=0.556). Positive correlations existed between the CBN exchange rate and the prices of 3-way gang switch (r=0.611) and 2-way gang switch (r=0.545).

Similarly, positive correlations exist between the CBN exchange rate and the prices of imported doors. The correlation between the CBN exchange rate and the metal door double door (2.1mx1.8m) was 0.479. The correlation coefficient (r=0.696) was slightly higher for imported Turkish double doors (2.1mx1.8m). The correlation coefficient between a single (2.1mx0.9m) Turkish-made metal door with glass and the CBN exchange rate was r=0.519. The analysis revealed a positive relationship between the CBN exchange rate and the different types of aluminium sliding windows: 1.2mx1.2m (r=0.539); 600mmx600mm (r=0.543); (900mmx1200 mm (r=0.513), and 180mmx1200mm (r=0.429).

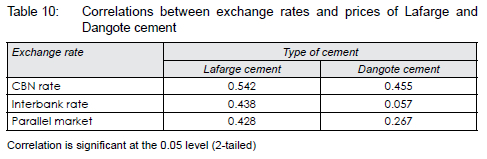

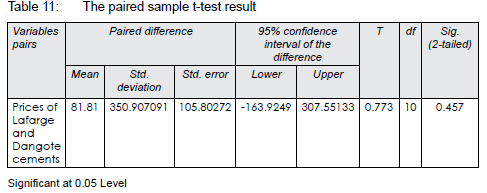

The correlation results in Table 10 show that, from 2011, there has not been any significant difference (p>0.05) between exchange rates and the prices of Lafarge and Dangote types of cement. In Table 11, results from the paired-sample t-test (p=0.457) show that there was no significant average difference between the prices of Lafarge and Dangote types of cement (t=0.733, p>0.05). On average, Lafarge cement prices were 81.18 Naira per unit higher than Dangote cement prices (95% CI [-163.9249, 307.5513]).

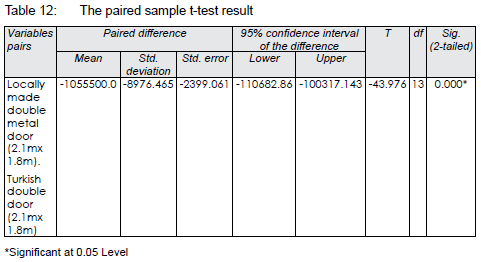

In Table 12, results from the paired-sample t-test show that, from 2011, there was a significant average difference between the prices of the locally made metal double door (2.1mx1.8m) and the Turkish double door (2.1mx1.8m) (t=-43.976, p=0.000). On average, locally made double metal door prices were 105,55 Naira per unit lower than Turkish double door prices (99% CI [-110682.86, -100317.143]).

5. DISCUSSION

Policies that will directly or indirectly affect housing production are relevant to, and important for the achievement of the sustainable development goals of a nation (UN-Habitat, 2020). For any policy to be relevant in transforming the society where it is enacted, it should be well-thought-out, inclusive, evidence-based, and responsive to societal real needs, as well as address social challenges associated with housing. One such policy change is the foreign exchange rates. This is the presence of a trade imbalance, negatively affecting the domestic prices of building materials (Olowe, 2009; Ugochukwu et al, 2017). The postulation of the theory of foreign exchange behaviour notes that a country experiencing inflation will have its currency devalued in terms of another country's currency, and the purchasing power of the country witnessing inflation drops (Manzur, 2018: 217; Njoku, 2015; Vo & Vo, 2023: 447).

The devaluation of the Naira in 2015, owing to a fall in the crude oil price (glut) in the world market, impacted on the economy of Nigeria and, in return, affected the purchasing power of the Naira. Thus, with the advent of the floating regime, prices of building materials and construction costs have continued to increase and the cost of construction within a period of two years can increase by about 30%. It has been documented that Nigerians depend on importing building materials (Agbola, 2005; Ugochukwu et. al., 2017: 97) and that foreign exchange rates affect the price of commodities such as building materials (Njoku, 2015; Ugochukwu, 2017). Owing to the increase in prices of construction material and a result of inflation, the construction sector of the economy is negatively impacted. With several components of the construction materials imported (the locally manufactured materials still rely on foreign components), building material prices are expected to continue to increase, unless proactive measures are put in place by the Government to address and/or cushion the effects of the changing foreign exchange.

Before the CBN's intervention in the I&E window in 2017, the Naira was traded as high as N480/US$ (Popoola, 2020: 20). With the CBN's interventions through the I&E window, the average Naira exchange rate to the dollar at the parallel market lowered to N420/US$ in the year 2020. However, owing to the commercial economy of Nigeria that is import-determined, this intervention cannot be sustained, as the demand for the dollar keeps increasing. As of 2022, a dollar was exchanged for 680 Naira at the parallel market (The Cable, 2023: online).

It is very complex to understand the operation of organised market arrangements for buying and selling foreign exchange in the floating regime in Nigeria. However, it is understood that the frequency of volatility and fluidity of the exchange rate from the beginning of the floating exchange rate raises concern about the effects of the volatility of the exchange rate on construction materials and commercial real estate returns in the country. As observed by Musarat et al. (2021: 411), a volatile forex market is one of the factors affecting the cost of real estate development and may lead to uncertainty in the estimation of the cost of developing projects. It is important to note that the trend analysis on the price of cement, a locally produced building construction material, showed that the price of cement did not change significantly with changes in exchange rates. The outcome of the price cement analysis is at variance with most of the imported building materials. Therefore, the foreign exchange rate volatility and depreciation of the Naira will continue to lead to an increase in the price of imported building materials and such action would have an impact on the construction cost and cost of supplying housing.

The forex rate has been fluctuating over the years and with the drastic increase in the foreign exchange rate between 2015 and 2020, individuals and housing investors are significantly affected by the increase in the cost of building materials (Olowe, 2009). Housing construction costs increased consistently between 1999 and 2020, and this could be due to inflation and national laws relating to minimum wage which also affected the wages of artisans in the country. Since construction cost per square metre is a function of prices of building materials, labour, and other exigencies, there is no doubt that, with the increasing price of building materials as a result of foreign exchange, construction costs will increase. This analysis confirms the opinion of Nwachukwu (2004) and Musarat et al. (2021) that the housing industry and the cost of construction are vulnerable to changes in material prices, due to forex volatility and inflation.

The increasing construction cost has implications for housing production, most especially in the urban centres (Musarat et al., 2021). For example, many Nigerians are working in paid (salaried) enterprises. The salary paid per month, especially in the public sector, has not increased significantly over the years in relationship with foreign exchange upward fluctuations. This has implications for purchasing power and funds set aside for housing construction in the face of inadequate access to mortgage financing. Ugochukwu et al. (2017) noted that there are elements of imported materials in any component of a building and many prospective homeowners in Nigeria will use imported materials for doors, tiles, and other fittings. This penchant may necessitate the need to seek foreign exchange to supply the materials in demand. Hence, where the forex market becomes volatile and deregulated, the prices of commodities, and building materials inclusive, will be on the increase, especially where citizens depend on imported goods (Caporale & Plastun, 2021; Chen, 2022; Ugochukwu et al., 2017). As homeowners in Nigeria depend on the use of imported building materials, whenever there is an increase in the forex rate, the price of building materials would be affected and, by implication, affect the cost of housing supply (Umoru et al., 2023). Therefore, there is a need to look inward through export substitution and investment in local production of most of the imported building materials.

The study hypothesised that the increasing price of building materials occasioned by the upward increase in foreign exchange rates may have implications on the ability to build. It is important to note that other constraints such as income, access to land, tenure security, interest rate, value-added tax, and import tariff, among others, were not considered in the study. Therefore, future studies should be conducted to investigate the effects of the listed variables in addition to foreign exchange fluctuation on housing production in Nigeria.

6. CONCLUSION AND RECOMMENDATION

Foreign exchange rates affected the prices of residential building materials and the overall construction cost. Where individual disposable income is constant and there is a persistent increase in the forex rate, which translates into an increase in the price of building materials and cost of construction per square meter, low- and medium-income earners will find it difficult to build good quality and affordable housing units. Incremental housing has become rampant and many ongoing housing projects have been abandoned. Thus, the housing supply has continued to decrease. Therefore, when setting foreign exchange policy, the government and the Central Bank of Nigeria should consider the effects of the policy on the major sectors of the economy, including the building construction industry.

The building construction industry, as shown in the study, has been significantly affected by foreign exchange policy owing to the reliance on imported materials. To reverse the current trend of dependence by builders on foreign materials for housing production, the use of local building materials in housing development should be encouraged to ensure an adequate supply of housing and encourage low- and medium-income earners to build houses. Government policies and laws should encourage and support the use of local building materials by individual homeowners and government-sponsored projects. Consequently, the Nigerian housing policy should be reviewed periodically to make it functional and acceptable, with the incorporation of locally sourced raw materials that will facilitate the implementation of the blueprint of a building materials policy for Nigeria. In addition, access should be provided to locally produced building materials. Nigeria's 2012 National Housing Policy encourages research into, and the promotion of the use of locally produced building materials as a means of reducing housing costs. Therefore, the Nigerian Building and Road Research Institute (NBRRI) and the universities should engage actively in building materials research and the development of alternatives to the imported materials certified by the Standards Organisation of Nigeria (SON). The focus of the research and development should be on capacity building and the use of appropriate technology to facilitate local production. A larger percentage of materials to be used in the construction of government mass housing projects should be locally sourced, while the National Orientation Agency (NOA) should also intensify efforts to encourage the use of local building materials using mass and social media.

The NOA should also disseminate available research findings on locally made building materials and locally fabricated equipment that can be used for the provision of affordable housing. This will reduce builders' level of reliance on imported building materials for housing projects. Formulation of policy that will allow partnership with investors, experts, and foreign countries with the required competence and technical know-how, for the conversion of available raw materials into tasteful, durable, affordable and quality building materials for housing development should be encouraged and embraced by the government at all levels. The imposition of high tariffs and taxes on imported building materials should be adopted as part of measures by the Government to discourage building material importation. Building materials import substitute industries should be established with a form of tax relief for the producers of local building materials which will improve the economy in the long run, provide employment opportunities, lessen pressure on forex demand, reduce the cost of housing construction and supply and, by extension, lead to increase in housing supply.

ACKNOWLEDGEMENTS

The authors are grateful to the anonymous reviewers for their enlightening, constructive, and useful comments on the manuscript. The support of the major building materials distributors in providing data for the study is also appreciated.

REFERENCES

Adegun, O. & Olawale O. 2019. Self-help housing: Cooperative societies' contributions and professionals' views in Akure, Nigeria. Built Environment, 45(3), pp. 332-345. DOI: 10.2148/benv.45.3.332 [ Links ]

Agbola, T. 2005. The housing debacle. Inaugural lecture delivered at the University of Ibadan, Ibadan, Nigeria. [ Links ]

Agbola, T. & Kasim, O.F. 2017. Conceptual and theoretical issues in housing. In: Agbola, T. (Ed.). Housing development and management: A book of readings. Ibadan: Department of Urban and Regional Planning, University of Ibadan, pp. 19-86. [ Links ]

Ajayi, O. 2017. Factors affecting housing delivery in Lagos state, Nigeria. Journal of Sustainable Human Settlement and Housing, 1(1), pp. 41-54. [ Links ]

Alabi, A.M., Muraina, M.A. & Kasim, O.F. 2018. Private developers' participation in housing production and wetland encroachment along Lekki-Epe corridor in Lagos, Nigeria. Journal of Environment Protection and Sustainable Development, 4(3), pp. 46-54. [ Links ]

Alabi, M., Omirin O.J. & Kasim, O.F. 2017. Residents' perception on the impact of gatekeepers on access to housing resources and home ownership in Lagos State, Nigeria. Ethiopian Journal of Environmental Studies and Management, 10(7), pp. 836-846. [ Links ]

Alabi, O.R. 2015. Foreign exchange market and the Nigerian economy. Journal of Economics and Sustainable Development, 6(4), pp. 102-107. [ Links ]

Argyropoulos, E., Elias, N., Smyrnakis, D. & Tzavalis, E. 2021. Can country-specific interest rate factors explain the forward premium anomaly? Journal of Economics and Finance, 45(2), pp. 252-269. https://doi.org/10.1007/s12197-020-09509-5 [ Links ]

Barguellil, A., Ousama Ben-Salha, O. & Zmami, M. 2018. Exchange rate volatility and economic growth. Journal of Economic Integration, 33(2), pp. 1302-1336. http://dx.doi.org/10.11130/jei.2018.33.21302 [ Links ]

Bond, T.G. & Fox, C.M. 2001. Applying the Rasch model: Fundamental measurement in the Human Sciences. Mahwah, NJ: Lawrence Erlbaum. https://doi.org/10.4324/9781410600127 [ Links ]

Caporale, G.M. & Plastun, A. 2021. Daily abnormal price changes and trading strategies in the forex. Journal of Economic Studies, 48(1), pp. 211-222. https://doi.org/10.1108/JES-11-2019-0503 [ Links ]

Caruana, E.J., Roman, M., Hernández-Sánchez, J. & Solli, P. 2015. Longitudinal studies. Journal of Thoracic Disease, 7(11), pp. E537-E540. https://doi.org/10.3978/j.issn.2072-1439.2015.10.63 [ Links ]

CBN (Central Bank of Nigeria). 2020. Foreign exchange rate in Nigeria. [Online]. Available at: <www.cbn.gov.ng/rates/exrates.asp> [Accessed: 23 June 2020]. [ Links ]

Chen, Z. 2022. The impact of trade and financial expansion on volatility of real exchange rate. PLOS ONE, 17(1), e0262230. https://doi.org/10.1371/journal.pone.0262230 [ Links ]

Coffman, D.L., Maydeu-Olivares, A. & Arnau, J. 2008. Asymptotic distribution-free interval estimation: For an intraclass correlation coefficient with applications to longitudinal data. Methodology, 4(1), pp. 4-9. https://doi.org/10.1027/1614-2241.4.1.4 [ Links ]

Creswell, J.W. 2014. Research design: Qualitative, quantitative and mixed methods approaches. 4th edition. Thousand Oaks, CA: Sage Publications. [ Links ]

Dada, E.A. & Oyeranti, O.A. 2012. Exchange rate and macroeconomic aggregates in Nigeria. Journal of Economics and Sustainable Development, 6(13), pp. 228-236. [ Links ]

Dornbusch, R. 1987. Purchasing power parity. In: Eatwell, J. (Ed.). The new Palgrave dictionary of economics: Volume 3. New York: Stockton Press, pp. 1075-1085. https://doi.org/10.1057/978-1-349-95121-5_1834-1 [ Links ]

Engel, C. 2019. Real exchange rate convergence: The roles of price stickiness and monetary policy. Journal of Monetary Economics, 103, pp. 21-32. https://doi.org/10.1016/j.jmoneco.2018.08.007. [ Links ]

Gujarati, D. & Porter, C. 2009. Basic econometrics. New York: McGraw Hill Inc. [ Links ]

Iheme, J.O., Ekung, S.B. & Effiong, J.B. 2015. The effect of government policy on housing delivery in Nigeria: A case study of Port Harcourt low-income housing programme. International Letters of Social and Humanistic Sciences, 61, pp. 87-98. https://doi.org/10.18052/www.scipress.com/ILSHS.61.87 [ Links ]

IMF (International Monetary Fund). 2016. International Monetary Fund Executive Board concludes 2016 Article IV Consultation with Nigeria. Washington, DC: International Monetary Fund. [ Links ]

Isibor A., Ojo, J.A.T. & Ikpefan, O.A. 2017. Does financial deregulation spur economic development in Nigeria? Journal of Applied Economic Science, 8(54), pp. 2339-2350. [ Links ]

Ismail, A., Pourrostam, T., Soleymanzadeh, A. & Ghouyounchizad, M. 2012. Factors causing variation orders and their effects in roadway construction projects. Research Journal of Applied Sciences, Engineering and Technology, 4(23), pp. 4969-4972. [ Links ]

ITA (International Trade Administration). 2019. Nigeria - Country commercial guide. [Online]. Available at: <https://www.trade.gov/knowledge-product/nigeria-market-challenges> [Accessed: 23 February 2021]. [ Links ]

Izobo-Martins, O.O., Ekhaese E. & Ayo-Vaughan, K.E. 2018. Architects' view on design consideration that can reduce maintenance cost. Mediterranean Journal of Social Sciences, 9(3), pp. 193-200. DOI: 10.2478/mjss-2018-0061 [ Links ]

Kanu, S.I. & Nwadiubu, A. 2020. Exchange rate volatility and international trade in Nigeria. International Journal of Management Science and Business Administration, 6(5), pp. 56-72. DOI: 10.18775/ijmsba.1849-5664-5419.2014.65.1007 [ Links ]

Kasim, O.F. 2018. Wellness and illness: The aftermath of mass housing in Lagos, Nigeria. Development in Practice, 28(7), pp. 952-963. https://doi.org/10.1080/09614524.2018.1487385 [ Links ]

Ke, J-y. F., Shabbir, T. & Corona, J. 2018. The impact of exchange rate volatility on the industry-level geographic diversification of global supply chain network. International Journal of Logistics, Economics and Globalisation, 7(4), pp. 366-387. https://doi.org/10.1504/IJLEG.2018.097484 [ Links ]

Kulemeka, P.J., Kululanga, G. & Morton, D. 2015. Critical factors inhibiting performance of small- and medium-scale contractors in sub-Saharan region: A case for Malawi. Journal of Construction Engineering, vol. 2015, Article 927614. https://doi.org/10.1155/2015/927614 [ Links ]

Ladipo, P.K.A., Alarape, W.B. & Nwagwu, K. 2013. Empirical determinants of the choice of intermediaries by selected multinationals operating in Nigeria's food/drinks market. International Journal of Marketing Studies, 5(1), pp. 134-141. DOI: 10.5539/ijms.v5n1p134 [ Links ]

Ling, F.Y.Y. & Hoi, L. 2006. Risks faced by Singapore firms when undertaking construction projects in India. International Journal of Project Management, 24(3), pp. 261-270. DOI: 10.1016/j.ijproman.2005.11.003 [ Links ]

Makinde, O.O. 2014. Housing delivery system, need and demand. Environment, development and sustainability, 16, pp. 49-69. https://doi.org/10.1007/s10668-013-9474-9 [ Links ]

Manzur, M. 2018. Exchange rate economics is always and everywhere controversial. Applied Economics, 50(3), pp. 216-232. DOI: 10.1080/00036846.2017.1313960 [ Links ]

Musarat, M.A., Alaloul, W.S. & Liew, M.S. 2021. Impact of inflation rate on construction projects budget: A review. Ain Shams Engineering Journal, 12(1), pp. 407-414. https://doi.org/10.1016/j.asej.2020.04.009 [ Links ]

Nakamura, F. 2022. The origin of the law of one price deviations: Insights from the good-level real exchange rate volatility. Journal of International Money and Finance, 128, pp. 02717. https://doi.org/10.1016/j.jimonfin.2022.102717 [ Links ]

Njoku, J. 2015. Soaring exchange rate unsettles the construction industry. 3 March. The Vanguard Newspaper. [Online]. Available at: <http://www.vanguardngr.com/2015/03/soaring-exchange-rate-unsettles-construction-industry/> [Accessed: 15 May 2020]. [ Links ]

Nwachukwu, G.O. 2004. The impact of materials management on projects profitability and corporate survival. NIQS Quarterly Journal, 47(6), pp. 12-14. [ Links ]

Odia, E.O. & Dakare, O. 2019. Determinants of customer satisfaction with female market intermediaries. International Journal of Management, Economics and Social Sciences, 8(3), pp. 136-156. https://doi.org/10.32327/IJMESS/8.3.2019.9 [ Links ]

Okoli, T.T., Mbah, S.A. & Agu, O.C. 2016. Exchange rate volatility and inflation: The Nigerian experience. Journal of Economics and Sustainable Development, 7(10), pp. 6-15. [ Links ]

Olawale Y.A. & Sun, M. 2010. Cost and time control of construction projects: Inhibiting factors and mitigating measures in practice. Construction Management and Economics, 28(5), pp. 509-526. https://doi.org/10.1080/01446191003674519 [ Links ]

Olowe, R. 2009. Modeling naira/dollar exchange rate volatility: Application of GARCH and asymmetric models. International Review of Business Research Papers, 5(3), pp. 377-398. [ Links ]

Oluyemi-Ayibiowu, B.D., Aiyewalehinmi, O.E. & Omolayo, O.J. 2019. Most critical factors responsible for cost overruns in Nigeria building construction industry. Journal of Multidisciplinary Engineering Science Studies, 5(2), pp. 2500-2508. [ Links ]

Onibokun, A.G. 1998. Urban housing in Nigeria. Ibadan: NISER. [ Links ]

Osborne, J. 2019. Notes on the use of data transformations. Practical Assessment, Research, and Evaluation, 8, Article 6. DOI: https://doi.org/10.7275/4vng-5608 [ Links ]

Oyediran, O.S. 2019. Institution and housing development: Mirage, magic and miracle of low-cost housing in Nigeria. Economic and Financial Review, 57(4), pp. 37-68. [ Links ]

Oyediran, S.O. & Odeniyi, A.B. 2009. Effect of foreign exchange rate on construction material prices in a developing economy. Construction Research, 3(1), pp. 1-11. [ Links ]

Peersman, G. & Van Robays, I. 2012. Cross-country differences in the effects of oil shocks. Energy Economics, 34(5), pp. 1532-1547. https://doi.org/10.1016/j.eneco.2011.11.010 [ Links ]

Popoola, N. 2020. Naira rebounds, exchanges for 420/$, speculators count losses. The Punch Newspaper, 3 September, p. 20. [ Links ]

PWC (PricewaterhouseCoopers). 2016. Seizing the opportunity: An economic assessment of key sectors of opportunity for UK businesses in Nigeria. London: PricewaterhouseCoopers. [ Links ]

Robins, L.N. 1988. Data gathering and data analysis for prospective and retrospective longitudinal studies. In: Rutter, M. (Ed.). Studies of psychosocial risk: The power of longitudinal data. Cambridge, UK: Cambridge University Press, pp. 315-324. [ Links ]

Ross, A. & Willson, V.L. 2017. Paired samples T-test. In: Ross, A. & Willson, V.L. (Eds). Basic and advanced statistical tests. Rotterdam: Sense Publishers, pp. 17-19. https://doi.org/10.1007/978-94-6351-086-8 [ Links ]

Schmitt-Grohe, S., Uribe, M. & Woodford, M. 2022. International macro-economics: A modern approach. Oxford, UK: Princeton University Press. [ Links ]

Schreyer, P. & Koechlin, F. 2002. Purchasing power parities - Measurement and uses. OECD The Statistics Brief, No. 3, pp. 1-8. [ Links ]

Taiwo, D.O. & Misnan, S.H.B. 2020. Factors influencing supply of affordable housing in Nigerian cities using confirmatory factors analysis. International Journal of Built Environment and Sustainability, 7(3), pp. 11-21. DOI: 10.11113/ijbes.v7.n3.499 [ Links ]

Taiwo, D.O., Yusoff, N.B. & Abdul Aziz, N.B. 2018. Self-help approach as one of the panacea for housing delivery dilemma in Nigeria. Journal of Computational and Theoretical Nanoscience, 24(5), pp. 3770-3776. DOI: 10.1166/asl.2018.11481 [ Links ]

The Cable. 2023. Naira briefly trades N632/$ at I&E window. [Online]. Available at: <https://www.thecable.ng/naira-sells-for-n632-at-official-market-as-demand-pressure-worsens> [Accessed: 11 June 2023]. [ Links ]

Ugochukwu, S.C., Eze, G.C., Akabogu, S.C. & Abubakar, B.H. 2017. The correlation between foreign exchange rates and prices of building materials in Nigeria, 2011-2017. The International Journal of Business & Management, 5(10), pp. 95-100. [ Links ]

Ugochukwu, S.C., Ogbuagu, G.O. & Okechukwu, F.E. 2014. An appraisal of the sources, quantities and prices of imported building materials in Nigeria. International Journal of Advanced Research, 2(9), pp. 871-889. [ Links ]

Uma, K.E., Obidike, P.C., Chukwu, C.O., Kanu, C., Ogbuagu, R.A., Osunkwo, F.O.C. & Ndubuisi, P. 2019. Revamping the Nigerian manufacturing sub-sector as a panacea for economic progress: Lessons from South Korea. Mediterranean Journal of Social Sciences, 10(4), pp. 111-123. DOI: 10.2478/mjss-2019-0057 [ Links ]

Umoru, D., Effiong, S.E., Ugbaka, M.A., Akhor, S.O., lyaji, D., Ofie, F.E., Ihuoma, C.C., Okla, E.S. & Obomeghie, M.A. 2023. Modelling and estimating volatilities in exchange rate return and the response of exchange rates to oil shocks. Journal of Governance & Regulation, 12(1), pp. 185-196. https://doi.org/10.22495/jgrv12i1art17 [ Links ]

UN-Habitat. 2020. World cities report. Nairobi, Kenya: UN-Habitat. [ Links ]

Venkatesh, A. & Vitalari, N. Longitudinal surveys in information systems research: An examination of issues, methods, and applications. In: Kramer, K. (Ed.). The information systems challenge: Survey research methods. London, UK: Harvard University Press, pp. 115-144. [ Links ]

Vo, H.L. & Vo, D.H. 2023. The purchasing power parity and exchange-rate economics half a century on. Journal of Economic Surveys, 37(2), pp. 446-479. https://doi.org/10.1111/joes.12504 [ Links ]

World Bank. 1997. Exchange rate economics. Working Paper No. 2, Growth commissioning. Washington, DC: The World Bank. [ Links ]

Received: August 2023

Peer reviewed and revised: October 2023

Published: December 2023

* Corresponding author

DECLARATION: The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.