Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Acta Structilia

On-line version ISSN 2415-0487

Print version ISSN 1023-0564

Acta structilia (Online) vol.29 n.2 Bloemfontein 2022

http://dx.doi.org/10.18820/24150487/as29i2.3

RESEARCH ARTICLE

Factors militating against cooperative societies' contributions to housing development in Osogbo, Nigeria

Ayodeji Ajayi

Urban and Regional Planning, Osun State University, Osogbo, Osun State, Nigeria. Phone: +234 7033871651, email: ayodeji.ajayi@uniosun.edu.ng, ORCID: http://orcid.org/0000-0001-6104-2632

ABSTRACT

Various strategies are being deployed to address finance for housing development in Nigeria. However, few localised studies have examined factors hindering the performance of cooperative societies to assist with housing development. The article aims to investigate the barriers that hinder cooperative societies' involved in housing delivery in Osogbo and Olorunda local government areas of Osogbo, Osun State, Nigeria. The study used a quantitative research design, with a questionnaire survey. Using the multi-stage sampling technique, 110 cooperative societies were selected across the local government areas and the structured questionnaire was administered to one member in each selected cooperative society. Data collected was analysed using descriptive statistics (frequency table) and Principal Component Analysis (PCA). Results of the communality values based on PCA showed that financial and land regulation, loan management, and credibility of co-operators are the factors affecting the ability of cooperative societies in funding housing development in Osogbo. The study concluded that cooperative societies have a significant impact on housing delivery in Osogbo.

Based on these findings, it is clear that, if cooperative societies are well supported by government policies such as public-private collaborations on land acquisitions, urban housing production challenges could be reduced.

Keywords: Cooperative societies, housing delivery, housing finance, public-private collaborations, Nigeria

ABSTRAK

Verskeie strategieë word ontplooi om finansiering vir behuisingsontwikkeling in Nigerië aan te spreek. Min plaaslike studies het egter faktore ondersoek wat die prestasie van koöperatiewe verenigings belemmer om met behuisingsontwikkeling te help. Die artikel poog om die struikelblokke te ondersoek wat koöperatiewe verenigings verhinder om betrokke te wees by behuisingslewering in Osogbo en Olorunda, twee plaaslike regeringsgebiede van Osogbo, Osun-staat, Nigerië. Die studie het 'n kwantitatiewe navorsingsontwerp gebruik, met 'n vraelysopname. Deur die multi-stadium steekproeftegniek te gebruik, is 110 koöperatiewe verenigings regoor die plaaslike regeringsgebiede geselekteer en die gestruktureerde beskrywende opname is op een lid in elke geselekteerde koöperatiewe vereniging geadministreer. Data is ontleed deur gebruik te maak van beskrywende statistiek (frekwensietabel) en hoofkomponentanalise (PCA). Resultate van die gemeenskapswaardes gebaseer op PCA het getoon dat finansiële en grondregulering, leningsbestuur, en die geloofwaardigheid van samewerkers die faktore is wat die vermoë van koöperatiewe verenigings in die finansiering van behuisingsontwikkeling in Osogbo beïnvloed. Die studie het tot die gevolgtrekking gekom dat koöperatiewe verenigings 'n beduidende impak op behuisingslewering in Osogbo het. Gebaseer op hierdie bevindinge, is dit duidelik dat as koöperatiewe verenigings goed ondersteun word deur regeringsbeleide soos byvoorbeeld openbare-private samewerking oor grondverkrygings, kan stedelike behuisingsproduksie-uitdagings verminder word.

1. INTRODUCTION

Globally, people save for long-term or borrow money either to build or buy their houses or to finance housing projects. Housing development is multifaceted, involving a series of linked stages such as preparation, production, acquisition, servicing, and maintenance carried out by several key players such as government (public), private, formal and informal sectors (Adeoye, 2018: 31). Finance is needed to develop housing, and government involvement in housing predicates on the premise that most of the citizenry do not have access to necessary funds to effect housing development. According to Olujimi et al. (2021), housing is an important contributor to a nation's economy, having a backward linkage to land markets, building materials, tools, furniture, and labour market. It has forward linkage with the financial markets (mortgage debt accounts for a large proportion of household debt) and supports the efficient functioning of the domestic and international financial market (Olujimi et al., 2021).

The Pison Housing Company (2010: 15) affirmed that there were approximately 10.7 million houses in Nigeria in 2007, and 60% of Nigerians were homeless. In addition, Pepple (2012: 229) noted that the housing deficit in Nigeria in 2012 was approximately 17.5 million units. It was reported, in 2017, that over 108 million Nigerians were technically homeless (The Guardian, 2017). According to Furtherafrica, (2021), "Nigeria's housing deficit currently stands at between 17-22 million units and to stem this tide, 700,000 houses would need to be built every year over the next 20 years''. Several scholars have pointed out that the housing stock in Nigeria is below what is expected in terms of quality and quantity (Adedire & Adegbile, 2018: 126; Akande, 2021: 36).

To redress the unacceptable housing stock situation, the Nigerian Government decided to review and update the Draft National Housing Policy and that of the National Urban Development Policy in September 2011, based on all relevant facts affecting the housing sector (FRN, 2011). This review was necessitated to achieve affordable housing that will raise home ownership to approximately 50%; improve Nigeria's Human Development Index (HDI) ranking; expand the construction sector and the mortgage market; significantly reduce poverty in households; increase the productivity and quality of lives of the citizenry, and improve the housing sector contribution (to over 20%) of Nigeria's GDP, as envisioned in Vision 20:2020 (FRN, 2011). Nigeria is yet to meet these milestones because of rural-urban migration, insecurity, surge in population figures and inconsistencies in the government's responses. All of these are worsening the housing situation in the country, to the extent that economic development and the welfare of the citizens are adversely affected (Furtherafrica, 2021).

Although affordable housing can be achieved through both home ownership and renting, only a small percentage of Nigerians have access to procure decent housing (Olujimi et al., 2021). Similarly, the aftermath of COVID-19 and inflation in Nigeria have eroded Nigerians' disposable income amid rising rental values (The Nigerian Tribune, 2022). Most of the tenants and those seeking new homes are finding it difficult to cope with surges in rental values of apartments and homes in major Nigerian cities (The Nigerian Tribune, 2022). In trying to meet their housing need in the face of the multifaceted problems surrounding housing affordability and access, most of the households rely on self-financing through own equity, loans and gifts from friends and family, remittances from abroad, and contributions from co-operative societies (Oyalowo, 2018).

Despite being an informal and private source of housing finance, cooperative societies give their members short-term funding for housing development. In some instances, apart from the issuance of housing loans to their members, cooperative societies embark on actual building construction, where members are encouraged to save towards purchasing and owning their personal homes. The foregoing aligns with Oyalowo (2018: 15), who defines cooperative housing as varied interventions in housing supply by any type of co-operative societies, through direct construction for renting or sales, at market or subsidized rates, for the benefit of members and non-members alike. The basic element of cooperative housing is that people pool their financial resources together voluntarily, in order to meet their common economic and social needs and aspirations through a democratically controlled enterprise, organised and operated on cooperative principles (Majee & Hoyt, 2011: 50).

A number of studies have been conducted on cooperative societies' intervention in housing provision in Nigeria. For instance, Adeboyejo & Oderinde (2013: 62) carried out an empirical assessment of the internal structural organization of the cooperative societies' social housing delivery. The results show that cooperative societies had a high level of formalization, internal structural organization, and democratic content. They were also determined to be stable, viable, and effective in resource mobilization for sustainable housing delivery (Adeboyejo & Oderinde, 2013: 62).

Another study used the case-study approach in understanding the experience and responsibility of cooperative societies in poverty alleviation in a southwestern region of Nigeria. The study observed a strong association between educational status and co-operative membership; moreover, a positive relationship was found between increased asset base of respondents and membership of co-operative societies with land ownership (Aderounmu, Oyedemi & Adeleke, 2014: 2).

Ibem & Odum (2011: 25) examined cooperatives society's roles in securing land for urban housing in Nigeria, with the affirmation that co-operatives play a significant role in addressing urban land and housing crisis confronting low-income people. In addition, Adedeji & Olotuah (2012: 23) asserted that the involvement of cooperative societies in housing provision has been successful. By contrast, Ndubueze (2009) stated that cooperative societies are yet to make any significant impact on the Nigerian housing sector development. Literature also shows that there are cooperative housing intervention methods, including acquisition, allocation, processing of land and title documents, as well as construction material procurements (Yakubu, Salawu & Gimba, 2012: 1427).

Other activities of cooperative societies are collaborative partnerships with built-environment professionals in providing housing schemes, granting loan facilities to members, as well as interior design and furnishing (Adedeji & Olotuah, 2012: 24). In some instances, cooperative societies provide home ownership schemes, rental loan schemes, and funding for property development (Oloke et al., 2017). Likewise, they provide general loans, housing construction loans, specific loans for land acquisition, special loans for renovation of existing buildings, and collective purchase of land for building construction (Ibem & Odum, 2011: 26; Azeez & Mogaji-Allison, 2017: 40).

Despite the abundance of information on the activities and modus operandi of different types of cooperative societies in Nigeria, only a few specific studies have addressed the factors influencing the ability of cooperative societies to fund housing development in medium-sized cities in Nigeria (Oyewole, 2010: 245; Mazadu, Muhammad & Iroaganachi, 2021: 3009), hence the relevance of this article. This article, therefore, aims to examine the factors militating against cooperative societies in funding housing development in Osogbo with a view to providing information that could inform housing policy in addressing housing stock deficit in Nigeria. The specific objectives were to analyse the administrative/management structure of the selected cooperative societies and identify factors militating against cooperative societies in financing housing development in Osogbo.

2. LITERATURE REVIEW

To understand cooperative societies' contributions to housing development in Osogbo, Nigeria, it is important to introduce the concepts used in this article. These include, historical background of cooperative societies, housing finance, land availability, and urban housing development.

2.1 Historical background of cooperative societies

Cooperative societies are formed, in order to achieve social or economic objectives. Therefore, the formation and operations of the Equitable Pioneers of Rochdale Society (EPRS), in 1844, signalled the genesis of cooperatives globally. This is recognized as the first modern cooperative because cooperative principles were developed there (Abell, 2004). The Rochdale Society provided a model template of cooperative business, which was established between 1850 and 1855; a flourmill, a shoe factory, and a textile plant, which was quickly emulated throughout England. Afterwards, similar organizations in France, Germany, Belgium, Austria, Italy, Denmark, Finland, Norway, and Sweden began to use the cooperative business model (Abell, 2004).

The history of cooperative societies in Nigeria pre-dates independence. It was begotten by traditional collective saving methods as 'ajo' among the Yorubas in the south-west, 'Isusu' among the Ibos in the south-east, and 'Adashi' among the Hausas of northern Nigeria. The quest for the formation of formal cooperative forms emerged through the desires of Agege Planters' Union in 1907, in South-west Nigeria who were motivated with the desire to curtail the exploitative tendencies of the colonial masters. This led to the emergence of other cooperative associations such as the Egba Farmers' Union and the Ibadan Agricultural Society (Ogungbemile, 2010: 2; Oyalowo, 2018).

Given the importance and relevance of cooperative societies in Nigeria, a formal and legal framework has been instituted to guide their operations (Onuoha, 2002: 11). This is contained in the Nigerian Cooperative Societies Decree 90 of 1993. According to Enete (2010: 149), this enabled the creation of Director of Cooperatives at federal and state levels and the Department of Cooperatives under different ministries. In the same study, the author further affirmed that, in a bid to promote the formation and growth of cooperatives in Nigeria, the above-mentioned law does not restrict cooperatives to any particular activity, as long as the overall objective is the promotion of its members socio-economic interests (Enete, 2010; Ibem & Odum, 2011: 26).

Cooperative societies have fundamental rules and principles that are entrenched in constitutions. Some of these tenets are self-help, self-responsibility, democracy, equality, equity, and solidarity. Inherently, executive members and administrators as well as ordinary members draw their operational guidelines from these documents. In addition, their values are shared by the key stakeholders such as the cooperators, the cooperative leaders, and the cooperative staff and determine their way of thinking and acting (Hoyt, 1997). Dogarawa (2010) opined that the creation of the International Cooperative Alliance (ICA), in 1985, facilitated friendly and economic relations between cooperative organizations of all types, nationally and internationally.

The ICA served worldwide as the final authority because of its acceptance by cooperators throughout the world, its role in defining cooperatives, and for determining the underlying principles that motivate cooperative enterprise. In 1995, the ICA amended the cooperative principles from six to seven, in order to guide cooperative organizations at the beginning of the 21st century. The principles include voluntary and open membership; democratic member control; member economic participation; autonomy and independence; education, training and information; cooperation among cooperatives, and concern for community (RBCDS, 1995; Dogarawa, 2010). It is thus safe to say that a cooperative society consists of a group of people who have voluntarily come together to enhance their quality of life by working together for the interest of all and to address needs that require significant capital (Hoyt, 1997; Oyalowo, 2018: 15).

Internationally, the United Nations recognizes the significant role of housing cooperatives in housing delivery. According to UN-Habitat (2002: 9), "cooperative societies support social cohesion and stability and give life to the concepts of corporate responsibility and citizenship. They provide essential services, ranging from housing to health care that strengthen community development." Therefore, the cooperative model of housing delivery has been used in the Global North and South across countries such as Italy, United States of America, United Kingdom, Zambia, Sweden, Pakistan, Philippines, Denmark, Norway, Canada, and South Africa with significant success (Abdulkareem, Ogunleye & Ajayi, 2020: 79).

2.2 Housing finance

Housing finance is fundamental to housing delivery. Funding for housing development comes from either the private or the public sector (Olujimi et al., 2021). The private sector provides the bulk of finances for home building from the early period of human existence to the modern period (Oyalowo, 2018). In some instances, a hybrid model (public-private partnership) is developed to funnel resources into housing projects (Olujimi et al., 2021). As stated in the Draft National Urban Development Policy of September 2011, housing finance "is the engine that drives the housing sector and generally refers to the money required for the development of housing units, provision of housing infrastructure and purchase or acquisition of housing units" (FRN, 2011: 52).

From an economic standpoint, Warnock and Warnock (2008: 240) argue that "demand for housing finance is a derived demand for housing, which in turn depends on the rate of household formation and income levels, while the supply side stresses the provision of housing finance by a lender as well as the mobilization of funds within an economy to ensure that lending institutions have ample access to the fund". In order to make the housing finance mechanism effective, houses must be affordable to households, funds should be accessible with ease, and the financial institutions need to be sufficiently viable to mobilise housing developers (Nubi, 2008: 2; Amao & Odunjo, 2014: 102).

Universally, different types of strategic interventions in housing finance have been observed among the cooperatives. Olayinka et al. (2017) assert that cooperative housing finance models in the Global North can be classified into four categories. First, the market rate or equity cooperatives, where members do not own a specific piece of property but a share in the cooperative corporation that owns the estate. Secondly, a limited-equity cooperative that meets members' housing needs by combining the equity contribution of cooperators with grants or subsidies from supporting institutions to provide housing units for its members. Thirdly, the leasing cooperative which takes a long lease from an investor, a landlord, or a nonprofit organisation and operates the building collectively as a cooperative. Fourthly, the mutual housing association, a non-profit corporation set up to develop, own, and operate housing (Olayinka et al., 2016, cited in Mazadu, Muhammad & Iroaganachi, 2021: 3009). In another related study, the International Cooperative Alliance (2012) affirms that direct financial assistance is given to housing cooperatives in Austria, through 'Housing Promotion Schemes'. The assistance includes long-term and low-interest rates public grants or mortgages that cover 20%-60% of housing construction costs.

Similarly, the Canadian government assists housing cooperatives with low interest on loans for 50 years through direct lending from the Canada Mortgage and Housing Corporation. The Canadian government also makes grants available to housing cooperatives that are targeted towards reducing the costs associated with construction (International Co-operative Alliance, 2012).

Evidence from the African perspective also shows that cooperative societies adopt various methods in financing housing development, according to the United Nations Centre for Human Settlements (Habitat) International Cooperative Alliance (UNCHS, 2001). For example, in Kenya, Katheru rural housing cooperative society gives housing loans to its members. The main security for the loans is the crop that is marketed through the society. In Zimbabwe and Tanzania, work-based cooperative societies operate whereby employees come together in groups as societies to give housing loans to their members (UNCHS, 2001, cited in Oyewole, 2010). According to the International Cooperative Alliance (2012), Egyptian housing cooperatives can receive a minimum of 25% discount on all State-owned parcels of land, and this could rise to approximately 50%, subject to the approval of the Minister of Finance. Egyptian laws also compel the State to facilitate loans towards the acquisition of land by housing cooperatives (International Cooperative Alliance, 2012).

In a bid to drive housing development in Nigeria, the Nigerian Building Society (NBS) was established in 1956 to mobilise savings from the public for housing loans. The NBS, which was given the mandate to mobilize savings from the public for purposes of granting housing loans, became the Federal Mortgage Bank of Nigeria (FMBN) in 1977 (FRN, 2011). However, the transformation failed to yield the desired results because housing finance structure remained largely undeveloped and could not cope with changing conditions and increasing demands. Moreover, inconsistencies in government policies as well as the ineffective operational modalities of both the Federal Mortgage Bank of Nigeria and the Primary Mortgage Institutions also contributed to its failure. From the foregoing, it is obvious that there is a need to provide alternative models for housing finance such as those provided by cooperative societies.

It is noteworthy to mention the recent efforts by the Nigerian government in partnering with cooperatives to fund housing development. With the inauguration of the National Housing Cooperative Development Scheme (NHDS), Nigerian workers are encouraged to organize themselves into cooperative societies. They are required to acquire titled land, architectural designs, as well as a planning permit to access mortgage loans at 9% interest rate per annum, with tenures of up to 30 years from the Federal Mortgage Bank of Nigeria (This Day Newspaper, 2020).

2.3 Land availability and urban housing development

One of the most cited factors by scholars, both local and international, is the difficulty to access land for sustainable housing development (Ibem & Odum, 2011: 30; Adeboyejo & Oderinde, 2013: 79; Azeez & Mogaji-Allison, 2017: 42). Access to secured land is crucial and significant in housing development. As reported by the Food and Agriculture Organization (FAO) of the United Nations (2002), globally, issues of land ownership are complex and vary from one region to another.

However, the FAO identified four major categories of land tenure, namely private, communal, open access, and state ownership. Under the private ownership, rights are assigned to private entities such as an individual, a married couple, a group of people, or a corporate body such as a commercial entity or non-profit organization. "For example, within a community, individual families may have exclusive rights to residential parcels, agricultural parcels, and certain trees. Other members of the community can be excluded from using these resources without the consent of those who hold the rights'' (FAO, 2002: online). The second category is communal in nature. Under this setting, "a right of commons may exist within a community where each member has a right to use independently the holdings of the community; for instance, members of a community may have the right to graze cattle on a common pasture" (FAO, 2002: online). The third category of land tenure is open access and varies significantly from other types because specific rights are not assigned to any one and no one can be excluded. This typically includes marine tenure, where access to the high seas is generally open to anyone; it may include rangelands, forests, and so on, where there may be free access to the resources for all. An important difference between open access and communal systems is that, under a communal system, non-members of the community are excluded from using the common areas (FAO, 2002). The most common type is state-owned, where property rights are allocated to selected consultants in the public sector. For example, in some countries, forest lands may fall under the control or jurisdiction of the state, whether at a central or decentralized level of government. As asserted by Odum & Ibem (2011: 30), "inadequate supply of land for cooperative housing development and tenure insecurity are the major constraints to effective housing delivery systems in many developing countries, including Nigeria".

Sarfoh et al. (2017) affirm that land disputes are the most reported challenge facing cooperative societies in the Greater Accra Metropolitan Area, Ghana, in their bid to provide housing delivery. Litigations manifest in several forms, from multiple sales of land to contestation of ownership by different families/traditional authorities, to resistance from charlatans, to long duration of litigation by the courts. The authors opine that the litigation issues expose these cooperative societies to serious vulnerability as member contributions are used for such investments (Sarfoh et al., 2017). Meanwhile, in Egypt and India, cooperative societies are given preferential access to public lands and other public support, thus reducing the challenges of cooperative associations with land acquisition to a large extent (International Cooperative Alliance, 2012).

In instances where access is not an issue, the high cost of land was identified as one of the major constraint to housing production. Unlike cooperative societies, whose budget could be limited and the demand for land is driven by the needs of members for immediate housing development, private land investors usually have deeper pockets and sometimes lock down land in choice locations in urban areas. This development is unhealthy for housing development because the parcels of land are bought for speculative purposes and later sold at exorbitant prices. Consequently, cooperative societies might be forced to source for land in remote locations where land is cheaper, but lack the basic facilities and amenities. This assertion is substantiated by Fruet (2005: 304) who reports that cooperative societies, mostly low-income earners, occupied squatter settlements in Porto Alegre, Brazil, illegally. Parts of the city that are least developed, with hardly any or no amenities, are usually acquired, as these parcels are relatively cheaper (Fruet, 2005: 310).

In Nigeria, "a major shortcoming has been with ownership rights under the Land Use Act 1978, which confers ownership of all land to the Governors of each state and is a substantial deterrent to housing and housing investment in Nigeria. In actual fact, this right of occupancy is endorsed with a Certificate of Occupancy issued to the recipient. This often delays and adds significant costs to the registration process'' (Agbola, 1987: 114). Therefore, availability of land needed for co-operatives to meaningfully intervene in housing supply, is under threat and deserves special consideration. Thus, the various policymakers will need to address the challenge of improving the supply of affordable housing (Oyalowo, 2018). Although some scholars have examined the roles of cooperative societies in housing development, few contextual studies exist and this study aims to fill this gap in the literature.

3. METHODOLOGY

3.1 Research design

The purpose of this study was to assess factors influencing the ability of cooperative societies to fund housing development in Osogbo, Nigeria. In order to generalize the findings of this study from a segment of the population, quantitative research design along with a structured questionnaire survey was used to elicit information from respondents (Creswell, 2014). The descriptive survey attempts to provide large volumes of data that can be analysed for frequencies, averages, and patterns (Bless, Higson-Smith & Sithole, 2018: 16). The questionnaire set 15 variables that are barriers to fund housing development. Principal Component Analysis (PCA) was used to validate and reduce these variables to smaller factors pivotal to cooperative societies' roles in housing delivery. Rossoni, Engelbert and Bellegard (2016: 201) affirm that PCA can be used to extract factors, in order to summarise the data into a manageable number of factors based on the highest eigenvalues.

3.2 Population, sample, and response rate

A list of 1055 cooperative societies in the city, obtained from the Ministry of Trade and Cooperative Investment in Osogbo, forms the population for the study. The 1055 identified societies were stratified between the two local governments in Osogbo, the capital city of Osun State, based on their business addresses across Olorunda and Osogbo local government areas. Osogbo Local Government area had 825 registered cooperative societies, while there were 230 in the Olorunda Local Government area. However, during a reconnaissance survey, many of them were not found at their stated addresses; this may have been due to relocation, or discontinuity in their operations, or inconsistencies in documentation. Thus, a total of 437 cooperative societies were physically identified at their addresses. From this list, purposive sampling technique (Creswell, 2014: 50) was adopted to select 180 registered societies; one respondent from each society was selected for questionnaire administration. Of this number, 152 were returned, but only 110 were correctly filled in and valid for the purpose of this study; this represented a response rate of 61%. Although the sample size is not valid and not within the recommended sample size of 205 for a population equal to or above 440 (Krejcie & Morgan, 1970: 608), these 437 cooperative societies with traceable physical addresses, substantiate the size of the sample.

3.3 Data collection

One hundred and eighty (180) self-administered questionnaires were sent out between August 2019 and January 2020. Prior to the date of data collection, the researcher sought the date when these societies met and obtained permission from executive members before selection and questionnaire administration. During their meeting days, the questionnaires were administered by random selection of one respondent from each society. The questionnaire for this study had three sections. A preamble gave the necessary background information on the study and instructions to be followed by the respondents. The first section elicited general information about the respondents and their societies such as year of establishment, source of income, the administrative purpose, and the management structure. The second section, made up of variables influencing the ability of cooperative societies to fund housing development in Osogbo, was based on a 5-point Likert rating scale. Respondents were requested to rate the level of how they perceived the items as barriers to fund housing development.

3.4 Analysis and interpretation of the data

The data obtained from both primary and secondary sources were coded and analysed using Version 22 of the Statistical Package for Social Science (SPSS). The general information about the respondents' position within the society, the year and purpose of establishment, and their source of income were analysed using simple descriptive statistics. To rank the factors militating the ability of cooperative societies to fund housing development in the study area, measures were rated on a five-point Likert scale; 5 = Not a barrier at all (>1.00 and <1.80); 4 = Somewhat a barrier (>1.81 and <2.60); 3 = Neutral (>2.61 and <3.40); 2 = Moderate barrier (>3.41 and <4.20), and 1 = Extreme barrier (>4.21 and <5.00). Likert-type or frequency scales use fixed choice response formats and are designed to measure attitudes or opinions (Bowling, 1997). The Principal Component Analysis (PCA) was used to extract factors pivotal to cooperative society roles in housing delivery. This study adopted the assertion made by Hair et al. (2014) in selecting eigenvalues criterion to determine the maximum number of factors to retain in the model. Using a PCA criterion of initial eigenvalues greater than 1, the orthogonal varimax rotation and factor loading of 0.4 was considered to be good, as it had 30% overlapping variance. A range from 0.2 to 0.4 is the optimal inter-item correlations mean (factor loading) for the factor to be reliable (Pallant 2013: 134, cited in Bamfo-Agyei, Thwala & Aigbavboa, 2022: 11). Cronbach's Alpha value for the fifteen items was 0.850, which exceeded the minimum of 0.70 recommended by Hair et al. (2014).

3.5 Limitation(s) of the study

It is important to note that the study was not conducted across Nigeria; therefore, the findings cannot be generalised.

4. RESULTS AND DISCUSSION OF FINDINGS

4.1 Cooperative societies and respondents' profile

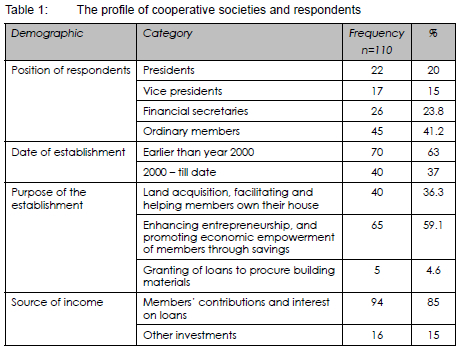

The profile of the selected cooperative societies were analysed, based on frequency of occurrence. Table 1 shows that, out of the 110 respondents sampled, the majority (41.2%) of them were ordinary members of these societies, while 35% were either presidents (20%) or vice presidents (15.0%) of these societies, and 23.8% of the respondents were financial secretaries.

The results show that most (63%) of the cooperative societies were established before year 2000 and this depicts that most of them have been in existence for at least 20 years and are still in operation. The purpose of forming cooperative societies varied according to the findings. The purpose of most (59.1%) of the cooperative societies is to enhance entrepreneurship and promote economic empowerment of members through savings, grants, aids, and loans. While 36.3% of the cooperative societies facilitate members to own their own houses, only 4.6% grant loans to procure building materials. The results revealed that 85% of the cooperative societies grew their financial base from members' contributions and interest on loans, while 15% obtained their income from other investments made.

4.2 Ranking of barriers

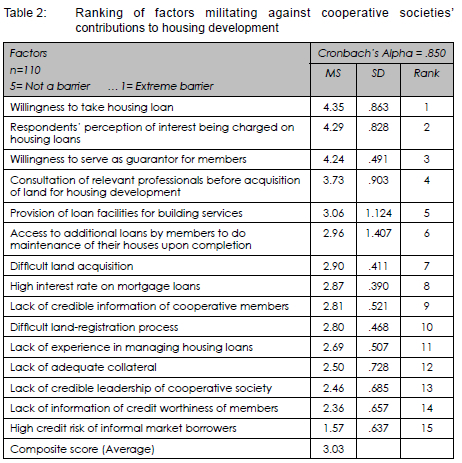

Further analysis was conducted to investigate factors militating against cooperative societies' contributions to housing development in Osogbo. In Table 2, a composite score average of 3.03 shows that all the 15 identified items were barriers facing co-operative societies in providing housing in the study area. The reliability statistics presented shows that the Cronbach's alpha was greater than 0.70 at .850, indicating acceptable internal reliability, as recommended by Hair et al. (2014).

With mean score ratings above 4.24, respondents did not perceive the willingness to take housing loans (MS=4.35), the interest being charged by cooperative societies on housing loans (MS=4.29), and their willingness to serve as loan guarantors for members (MS=4.24) as barriers to housing development using the cooperative strategy in the study area. This result might be because cooperative societies charge the least interest rates on credit facilities, compared to the formal financial sectors in the Nigerian financial system. These results are in agreement with the assertions made by Ankeli et al. (2020: 558) that cooperative societies charge the least interest rates on loans and allow for flexible loan repayment, as the loan repayment period can be re-negotiated from time to time, in order to reduce the financial stress on the debtor. As presented in Table 2, most of the respondents sampled were willing to take housing loans; this finding is similar to a study in Akure, south-western Nigeria (Olujimi et al., 2021), where most of the respondents who were members of cooperative societies secured loans (funds) from cooperative societies for their building projects. It is gratifying to know that the practice of loan defaulting was not prevalent in the study area, as evidenced by the willingness of members to serve as guarantors. A similar result was also reported by Olujimi et al. (2021), and the implication is that, if the management of cooperative societies is efficient, they can offer a reliable platform for their members to secure funding for housing development. Although potent internal mechanisms are used to dissuade members from defaulting, in some instances, guarantors and debtors are given the opportunity to renegotiate repayment options but, in some extreme cases, the defaulters' properties are confiscated. These findings show that members have some level of trust in their colleagues. However, consultation of professionals by cooperative societies before acquisition of housing sites was reported to somewhat inhibit housing delivery in Osogbo (MS=3.73). According to the results, lack of experience in managing housing loans (MS=2.69), lack of adequate collateral (MS=2.50), lack of credible leadership of cooperative society (MS=2.46), lack of information on credit worthiness of members (MS=2.36), and the high credit risk of informal market borrowers (MS=1.57) were extreme barriers to cooperative societies' contributions to housing development in Osogbo.

4.3 Principal component analysis of factors affecting the ability of cooperative societies to fund housing projects

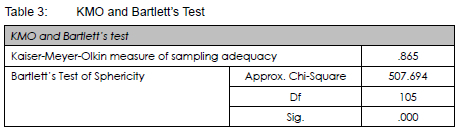

The need to ascertain the extent of adequacy of the data loaded for the study informed the use of Kaiser-Meyer-Olkin (KMO) and Bartlett's test. The KMO value obtained (see Table 3) was 0.865, which was higher than the minimum recommended value of 0.500 (Shrestha & Luo, 2017: 12).

Furthermore, the Bartlett's test of Sphericity has a significant value of p < 0.000, at 5% significant level. This test confirms that the data is suitable for factor analysis, as reported in Ola-awo et al. (2021: 17) and Pallant (2013).

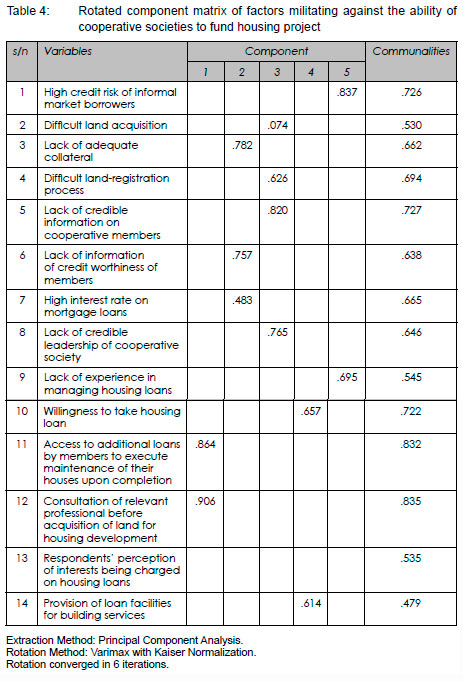

The matrix in Table 4 shows that, out of the fifteen initial variables, PCA extracted 14 variables on five components with factor loading above 0.4, with the possibility of militating against the ability of cooperative societies to fund housing projects. The excluded factor was willingness to serve as guarantor for members because its score was less than 0.4.

Presented in Tables 4 and 5 are the outputs after rotation showing the component matrix and total variance obtained. In the final analysis (see Table 5), five components with initial eigenvalues cumulatively explained approximately 66.747% of the total variations and should be retained. Factor one explains approximately 20.772%; factor two accounts for 15.380%, while the third and fourth factors explain 10.941% and 10.278 %, respectively. The fifth factor accounts for 9.376% of the variance in the model.

Factor 1: Facility management and professional expertise

The first factor, facility management and professional expertise (component 1), had two correlating variables with high loadings, including access to additional loans by members to do maintenance on their houses upon completion (0.864), and consultation with relevant professionals before acquisition of land for housing development (0.906). This factor was the most significant because it explains 20.77% of the variance observed. This result indicates that, regardless of the potentials of cooperative societies' efforts in reducing housing deficit, lack of professional expertise in managing construction processes inhibits effective housing development (Amao & Odunjo, 2014; Adedeji & Olotuah, 2012). The high factor loading of consulting relevant professionals prior to housing development in this study is indicative of their strategic roles to achieve successful cooperative housing strategy (Oloke, 2015).

Factor 2: Financial regulator

The second factor, financial regulator (component 2), with three correlated variable loadings, high interest rate on mortgage loans (0.483), lack of adequate collateral (0.782), and insufficient information on credit worthiness of members (0.757), explained 15.38% of the total variance. This outcome may be explained by the fact that cooperative societies are always willing and eager to assist their members in financing housing development, but insufficient information on credit worthiness of members poses a huge challenge to accessing funding from commercial banks. This suggests that cooperative societies are restricted only to members' monetary contributions, which limits the financial capacity of societies in funding housing (Olujimi et al., 2021). This finding is corroborated further by the assertion of Azeez & Mogaji-Allison (2017) that several cooperatives had problems sourcing funds from financing institutions for housing development.

Factor 3: Members' credibility and land acquisition

In the third factor, members' credibility and land acquisition (component 3), four correlated variables accounted for 10.94% of the total variance. These include difficulty in land acquisition (0.74), difficult land-registration process (0.626), lack of credible leadership of cooperative societies (0.765), and lack of credible information of cooperative members (0.820). This result has some implications for the development of housing in Nigeria. The bureaucratic bottlenecks of land administration currently operating in Nigeria makes it cumbersome for societies to easily secure and register them for housing development. Azeez & Mogaji-Allison (2017) also highlight the role of bureaucracy in curtailing the provision of housing by cooperative societies. Hence, efforts are required to unbundle this sector of the government for efficiency.

In addition, the result on problematic land-registration process may be linked to the corruptive tendencies of government agencies in Nigeria. This finding aligns with Safoh et al. (2017), affirming that cumbersome land registration and land disputes were the major impediments preventing Ghanaian cooperative societies in Greater Accra from effective housing development. Given the fact that access and securing land titles are critical parts of housing development, this result calls for urgent action from policymakers to redress this worrisome trend in Nigeria. Traditionally, mutual trust among members makes cooperative societies thrive. This is particularly important because low- and middle-income earners are the major beneficiaries of these housing loans. If this trust is broken, it might affect members' investment confidence in the organization and their financial capacity in funding housing development.

Factor 4: Loan propensity

The fourth factor, loan propensity (component 4), explains 10.27% of the variance and had two correlating variables, namely willingness to take housing loan (0.657) and provision of loan facilities for building services (0.614). This finding indicates that cooperative members are highly motivated to procure housing loans. This might also be related to the moderate interest rate being charged on loans. An earlier study opined that moderate interest rates act as stimulators to obtaining cooperative housing loans (Ankeli et al., 2020: 558). Therefore, cooperative societies that are solely focused on housing development should be encouraged and supported in this regard, in order to improve and concentrate their resources on reducing housing deficit. A related study by Oloke et al. (2017: 220) to evaluate the success rate of cooperative societies' housing provision in Lagos State, Nigeria, made a case for re-strategizing the involvement of cooperative societies in housing provision for better performance.

Factor 5: Ineffective loan management methods

The fifth factor, ineffective loan management methods (component 5), had two correlated variable loadings, namely high credit risk of informal market borrowers (.837), and lack of experience in managing housing loans (.695) that accounted for 9.37% of the variance. These two barriers relate to loan management, which is central to the success of cooperative societies in housing development. Furthermore, the lack of experience of cooperative executives in managing housing loans is a major factor limiting their success in housing funding. However, executive members' good managerial capability is likely to stimulate the confidence of members in their handling of the cooperative affairs. This result is in agreement with the submission that good management and the hope of obtaining loans at short notice boost savers' confidence (Ayedun et al., 2017: 67; Ankeli et al., 2020: 557).

5. CONCLUSION

The purpose of this study was to assess factors militating against the ability of cooperative societies to fund housing development in Osogbo. A total of 14 factors that are vital for housing delivery by cooperative societies were grouped into five components via PCA. Issues relating to the credibility as well as credit worthiness of cooperative societies' managers, land acquisition, ineffective loan management methods, financial regulatory, and professional expertise factor were the major encumbrances standing in the path of housing development in the study area. Although the findings of this study show that most of the cooperatives are viable and highly instrumental in housing development, more still needs to be achieved on improving and consolidating operational funds, because it limits their capacity to bankroll multiple housing projects.

The findings in this study also have implications for housing development, since members' financial credibility is questionable. In order to boost members' confidence, leaders are encouraged to embrace information technology in the management of credit profiles of members.

Based on these findings, if cooperative societies are well supported by government policies such as public-private collaborations on land acquisitions, this could reduce the challenges of urban land and housing accessibility. This can encourage more local and foreign direct investments in the housing sector because investors will have more confidence and, in the long run, increase housing finance in the country.

Arising from this study, some suggestions are made for future studies. Only registered cooperative societies in Osogbo were considered in this study, which is a limitation. A broader context, including other cities and suburban areas in Nigeria, could also be examined.

REFERENCES

Abdulkareem, S., Ogunleye, M.B. & Ajayi, M.A. 2020. Assessment of effectiveness of housing intervention strategies of universities-based cooperative societies in south-west Nigeria. Environmental Technology & Science Journal, 11(2), pp. 74-85. [ Links ]

Abell, P. 2004. Cooperative movement. Encyclopedia Encarta. [ Links ]

Adeboyejo, A. & Oderinde, J. 2013. Housing cooperative societies and social housing delivery in Oyo State, Nigeria. International Journal of Cooperative Management, 16(2), pp. 61-75. [ Links ]

Adedeji, Y.M.D. & Olotuah, A.O. 2012. An evaluation of accessibility of low-income earners to housing finance in Nigeria. Journal of Scientific Research, 7(1), pp. 23-31. [ Links ]

Adedire, F.M. & Adegbile, M. 2018. Assessment of housing quality in Ibeju-Lekki peri-urban settlement, Lagos State, Nigeria. Acta Structilia, 25(1), pp. 126-151. https://doi.org/10.18820/24150487/as25iL5 [ Links ]

Adeoye, D.O. 2018. Factors influencing gender differentials in involvement in urban informal housing development process in south-western Nigeria. Ibadan Planning Journal, 7(2), pp. 30-41. [ Links ]

Aderounmu, R., Oyedemi, O. & Adeleke, M. 2014.The experience and responsibility of cooperative societies to poverty alleviation in Eruwa, Ibarapa region of south-western Nigeria. Developing Country Studies, 4(2), pp. 1-8. [ Links ]

Agbola, T. 1987. Institutional constraints on housing development: The urban areas of Nigeria, the land-use decree and the building plan approval process. Habitat International, 11(2), pp. 113-120. https://doi.org/10.1016/0197-3975(87)90061-0 [ Links ]

Akande, O.K. 2021. Urbanization, housing quality and health: Towards a redirection for housing provision in Nigeria. Journal of Contemporary Urban Affairs, 5(1), pp. 35-46. https://doi.org/10.25034/ijcua.2021.v5n1-3 [ Links ]

Amao, F.I. & Odunjo, O.O. 2014. Housing finance in Nigeria. Journal of Economics Sustainable Development, 5(27), pp. 101-104. [ Links ]

Ankeli, A.I., Nuhu, B.M., Popoola, N.I., Ankeli, U.C. & Ojeniyi, A.S. 2020. Housing development, poverty alleviation and cooperative societies: The nexus. International Journal of Research and Innovation in Social Science, 4(8), pp. 557-584. [ Links ]

Ayedun, C.A., Oloyede, S.A., Ikpefan, O.A., Akinjare, A.O. & Oloke, C.O. 2017. Cooperative societies, housing provision and poverty alleviation in Nigeria. Covenant Journal of Research in the Built Environment, 5(1), pp. 69-81. [ Links ]

Azeez, T. & Mogaji-Allison, B. 2017. Constraints of affordable housing through cooperative societies in tertiary institutions in Lagos State, Nigeria. Journal of Geography and Regional Planning,10(3), pp. 39-46. https://doi.org/10.5897/JGRP2016.0599 [ Links ]

Bamfo-Agyei, E., Thwala, D.W. & Aigbavboa, C. 2022. The effect of management control on labour productivity on labour-intensive works in Ghana. Acta Structilia, 29(1), pp. 1-25. https://doi.org/10.18820/24150487/as29i1.1 [ Links ]

Bless, C., Higson-Smith, C. & Sithole, S. 2018. Fundamentals of social research methods: An African perspective. 8th edition. Cape Town: Juta Company Ltd. [ Links ]

Bowling, A. 1997. Research methods in health. Buckingham, UK: Open University Press. [ Links ]

Creswell, J.W. 2014. Research design: Qualitative, quantitative and mixed methods approaches. 4th edition. Thousand Oaks, CA: Sage. [ Links ]

Dogarawa, A.B. 2010. The role of cooperative societies in economic development. MPRA Paper No. 23161. https://doi.org/10.2139/ssrn.1622149 [ Links ]

Enete, A.A. 2010. Registration of cooperatives with government in Enugu State, Nigeria: What difference does it really make? Outlook on Agriculture, 39(2), pp. 149-152. https://doi.org/10.5367/000000010791745376 [ Links ]

FAO (Food and Agriculture Organization) 2002. Module on forest tenure. Available at: <https://www.fao.org/sustainable-forest-management/toolbox/modules/forest-tenure/in-more-depth/en/> [Accessed: 12 June 2022]. [ Links ]

FRN (Federal Republic of Nigeria). 2011. National Housing Policy, Federal Government Press. Adopted on 15 December 2011. [ Links ]

Fruet, G.M. 2005. The low-income housing cooperatives in Porto Alegre, Brazil: A state/community partnership. Habitat International, 29(2), pp. 303324. https://doi.org/10.10167j.habitatint.2003.10.004 [ Links ]

Furtherafrica. 2021. Available at: <https://furtherafrica.com/2021/06/29/a-look-at-nigerias-housing-deficit/> [Accessed: 12 June 2022]. [ Links ]

Hair, J.F., Black, W.C., Babin, B.J. & Anderson, R.L. 2014. Multivariate data analysis. 5th edition. Upper Saddle River, NJ: Prentice Hall. [ Links ]

Hoyt, A. 1997. And then there were seven: Cooperative principles updated. Available at: <www.uwcc.com> [Accessed: 12 June 2022]. [ Links ]

Ibem, E.O. & Odum, C.O. 2011. The role of co-operatives in securing land for urban housing in Nigeria: A case study of NEPA District Co-operative Thrift and Loan Saving Association, Enugu. Journal of Co-operative Studies, 44(2), pp. 25-36. [ Links ]

International Co-operative Alliance. 2012. Profiles of a movement: Co-operative housing around the world. CECODHAS Housing Europe. [ Links ]

Krejcie, R.V. & Morgan, D.W. 1970. Determining sample size for research activities. Educational and Psychological Measurement, 30(3), pp. 607610. https://doi.org/10.1177/001316447003000308 [ Links ]

Majee, W. & Hoyt, A. 2011. Cooperatives and community development: A perspective on the use of cooperatives in development. Journal of Community Practice, 19(1), pp. 48-61. https://doi.org/10.1080/10705422.2011.550260 [ Links ]

Mazadu, A.A., Muhammad, M.S. & Iroaganachi, N. 2021. Cooperators' satisfaction with cooperative society housing activities in Jos. Path of Science, 7(8), pp. 3007-3015. https://doi.org/10.22178/pos.73-4 [ Links ]

Ndubueze, O.J. 2009. Urban housing affordability and housing policy dilemmas in Nigeria. Unpublished PhD thesis submitted to the University of Birmingham. [ Links ]

Nubi, O.T. 2008. Affordable housing delivery in Nigeria. Paper presented at the Southern African Housing Foundation International Conference and Exhibition, 12-15 October, Cape Town, South Africa, pp. 1-18. [ Links ]

Ogungbemile, A.B. 2010. Cooperative practice and management. Ogun International Education Journal, 6(8), pp. 42-45. [ Links ]

Ola-awo, W., Alayande, A., Olarewaju, G. & Oyewobi, L. 2021. Critical success factors for effective internal construction stakeholder management in Nigeria. Acta Structilia, 28(1), pp. 1-31. https://doi.org/10.18820/24150487/as28i1.1 [ Links ]

Olayinka, C., Oloke, C., Ayedun, A.S. & Akunnaya, P.O. 2017. Empirical assessment of success rate of co-operative societies' housing provision in Lagos State, Nigeria. International Journal of Humanities and Social Science,7(3), pp. 246-252. [ Links ]

Oloke, O.C. 2015. Performance evaluation of co-operative provision in Lagos State, Nigeria. Unpublished PhD thesis, Covenant University, Ota, Nigeria. [ Links ]

Oloke, C., Ayedun, C., Oni, A. & Opoko, A. 2017. Empirical assessment of success rate of cooperative societies' housing provision in Lagos State, Nigeria. International Journal of Humanities and Social Science, 7(3), pp. 2220-8488. [ Links ]

Olujimi, J., Rotowa, O., Fasina,T., Ojo, B. & Bello, M. 2021.The willingness of cooperative societies to sponsor house ownership in Akure, Nigeria. Heliyon, 7(5), article number e06950. https://doi.org/10.1016/j.heliyon.2021.e06950 [ Links ]

Onuoha, E. 2002. A critique of the draft Cooperative Policy for Nigeria. Nigeria Journal of Cooperative Studies, 2(1) pp.10-17. [ Links ]

Oyalowo, B.A. 2018. An assessment of co-operative societies and housing supply in Lagos State. Unpublished PhD thesis in Estate Management, University of Lagos, Nigeria. [ Links ]

Oyewole, M.O. 2010. Housing development finance through cooperative societies: The case of Ogbomoso, Nigeria. International Journal of Housing Markets and Analysis, 3(3), pp. 245-255. https://doi.org/10.1108/17538271011063906 [ Links ]

Pallant, J. 2013. SPSS survival manual: A step-by-step guide to data analysis using IBM, SPSS. 5th edition. London: Allen and Unwin. [ Links ]

Pepple, A.I. 2012. Nigeria: Progress on improving the lives of slum-dwellers over the decade 2000-2010. In: Proceedings of the International Conference on Making Slums History a Worldwide Challenge for 2020, 26-29 November, Rabat, Morocco, pp. 288-294. [ Links ]

Pison Housing Company. 2010. Overview of the housing finance sector in Nigeria. Commissioned by EFInA and FinMark, Finmark Trust, 1, pp. 15-20. [ Links ]

RBCDS. 1995. What are cooperatives? Washington: Cooperative Information Report. [ Links ]

Rossoni, L., Engelbert, R. & Bellegard, N.L. 2016. Normal science and its tools: Reviewing the effects of exploratory factor analysis in management. Revista de Administração, 51(2), pp. 198-211. https://doi.org/10.5700/rausp1234 [ Links ]

Sarfoh, O.K., Kavaarpuo, G., Konadu, O.A. & Ayitio, J. 2017. Membership-based organisations and affordable housing delivery in the Greater Accra Metropolitan Area, Ghana. Final Draft Report. [ Links ]

Shrestha, A. & Luo, W. 2017. Analysis of groundwater nitrate contamination in the Central Valley: Comparison of the Geodetector Method, Principal Component Analysis and Geographically Weighted Regression. International Journal of Geo-Information, 6(10), article number 297, pp.125. https://doi.org/10.3390/ijgi6100297 [ Links ]

The Guardian 2017. 108 million Nigerian homeless. Available at: <https://guardian.ng/news/over-108m-nigerians-are-technically-homeless/> [Accessed: 24 March 2022]. [ Links ]

The Nigerian Tribune. 2022. Housing. Available at: <https://tribuneonlineng.com/housing-nigerians-lament-rising-rental-values-amidst-low- disposable-income/> [Accessed: 24 March 2022]. [ Links ]

This Day Newspaper. 2020. How Federal Mortgage Bank of Nigeria is leveraging cooperators to make homes possible for Nigerians. Available at: <https://www.thisdaylive.com/index.php/2021/08/11/> [Accessed: 24 March 2022]. [ Links ]

UNCHS (United Nations Centre for Human Settlements). 2001. Cities in a globalizing World. Global Report on Human Settlement. [ Links ]

UN-HABITAT (United Nations Human Settlements Programme). 2002. Report of the "Colloquium on Contribution of the Co-operative Sector to Housing Development", convened at Ankara Hilton Hotel, Turkey, 27-28 June 2002. [ Links ]

Yakub, A.A., Salawu, A.O. & Gimba, S.D. 2012. Housing delivery via housing cooperatives as a tool towards achieving national development: An empirical study. In: Proceedings of the 4th West Africa Built Environment Research (WABER) Conference, 24-26 July, Abuja, Nigeria, pp. 1427-1441. [ Links ]

Received: September 2022

Reviewed and revised: September-November 2022

Published: December 2022

DECLARATION: The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.