Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Acta Structilia

On-line version ISSN 2415-0487

Print version ISSN 1023-0564

Acta structilia (Online) vol.25 n.2 Bloemfontein 2018

http://dx.doi.org/10.18820/24150487/as25i2.3

RESEARCH ARTICLES

Evaluating credit accessibility predictors among small and medium contractors in the South African construction industry

Olanrewaju BalogunI; Justus AgumbaII; Nazeem AnsaryIII

IMaster's, Department of Construction Management and Quantity Surveying, University of Johannesburg, corner Siemert and Beit Streets, Doornfontein, 2028, Johannesburg, South Africa. Phone: + (27) 713 822 103, email: <lbalogun@uj.ac.za>

IIDepartment of Construction Management and Quantity Surveying, Durban University of Technology corner Botanic Road and Steve Biko Road, Block S3 level 2, Durban, South Africa. Phone: + (27) 713 373 2466, email: <justusa@dut.ac.za>

IIIDepartment of Building Sciences, Tshwane University of Technology, Pretoria, South Africa. Phone: + (27) 12 382 5242, email: <AnsaryN@tut.ac.za>

ABSTRACT

The importance of small and medium construction enterprises (SMEs) in the South African economy has been recognised. However, construction SMEs are faced with difficulties in accessing credit from financial institutions. Furthermore, past research has failed to reach consensus on the demographic and socio-economic factors that predict credit accessibility for construction SMEs in South Africa. This study determines the predicting demographic and socio-economic factors for credit accessibility for construction SMEs from financial institutions in South Africa. A quantitative research approach was used and data was collected, using a questionnaire survey from 250 construction SMEs who were conveniently sampled. The demographic and company profile factors predicting credit accessibility were modelled and set as the independent variables with credit accessibility to the construction SMEs as the dependent variable, irrespective of the amount obtained from financial institutions. The data was analysed using the Statistical Package for the Social Sciences (SPSS) version 22. Binary logistic regression analysis was used to analyse the predictors of obtaining credit. In the first model, the results revealed that the credit accessed irrespective of the amount and those who did not receive credit at all, when modelled with the conceptualised predictors suggested, showed no significant predictors of obtaining credit. However, in the second model, when the conceptualised predictors were modelled with full and partial credit, the results established that age group, current position in the organisation, tax number and location were good predictors of obtaining full credit. The findings of this study cannot be generalised across South Africa, as the study was conducted only in the Gauteng province. The value of this study informs owners of SMEs in the construction industry to provide their age and current position in the organisation when applying for credit. They should also provide the tax number and the location of the business in order to improve their chances of obtaining full credit from financial institutions.

Keywords: Credit accessibility, determinants of credit accessibility, full credit, small and medium enterprises

ABSTRAK

Die belangrikheid van klein en medium konstruksie-ondernemings (KMO's) in die Suid-Afrikaanse ekonomie is erken. Konstruksie KMO's word egter gekonfronteer met probleme om krediet by finansiële instellings te kry. Daarbenewens het vorige navorsing misluk om konsensus te bereik oor die demografiese en sosio-ekonomiese faktore wat krediettoeganklikheid vir konstruksie-KMO's in Suid-Afrika voorspel. Hierdie studie bepaal die bepalende demografiese en sosio-ekonomiese faktore vir krediettoeganklikheid vir konstruksie KMO's by finansiële instellings in Suid-Afrika. 'n Kwantitatiewe navorsingsbenadering is gevolg en data is ingesamel deur gebruik te maak van 'n vraelysopname onder 250 konstruksie-KMO's. Die demografiese en maatskappy profielfaktore wat krediettoeganklikheid voorspel, is gemodelleer en gestel as die onafhanklike veranderlikes. Krediettoeganklikheid vir die konstruksie KMO is die afhanklike veranderlike, ongeag die bedrag wat verkry is van finansiële instellings. Die data is geanaliseer deur gebruik te maak van die Statistical Package for the Social Sciences (SPSS) versie 22. Binêre logistieke regressie-analise is gebruik om die voorspellers van die verkryging van krediet te analiseer. In die eerste model het die resultate getoon dat die krediet wat toeganklik is ongeag die bedrag en diegene wat nie krediet ontvang het nie, wanneer dit gemodelleer is met die konseptualiseerde voorspellers wat voorgestel word, geen beduidende voorspellers toon van die verkryging van krediet nie. In die tweede model waar die konseptualiseerde voorspellers egter met volle en gedeeltelike kredietmodelle gemodelleer is, het die resultate bepaal dat ouderdomsgroep, huidige posisie in die organisasie, belastingnommer en werkplek goeie voorspellers was om volle krediet te verkry. Die bevindinge van hierdie studie kan nie oor Suid-Afrika veralgemeen word nie, omdat die studie slegs in die Gauteng-provinsie uitgevoer is. Die waarde van hierdie studie stel eienaars van KMO's in die konstruksiebedryf in kennis om hul ouderdom en huidige posisie in die organisasie te verskaf wanneer hulle om krediet aansoek doen. Hulle moet ook die belastingnommer en die ligging van die besigheid verskaf om hul kanse om volle krediet van finansiële instellings te verkry, te verbeter.

Sleutelwoorde: Bepalers van krediettoeganklikheid, krediettoeganklikheid, volle krediet, klein- en medium-ondernemings

1. Introduction

The term 'Small and Medium Enterprises' (SMEs) is defined by commonly used criteria such as the number of employees, total net assets, sales and investment level. The main criteria is the number of permanent employees in an organisation (Aduda, Magutu & Wangu, 2012: 205). Aduda et al. (2012: 205) define SMEs as companies that employ up to 300 employees and have total assets and sales of up to $15 million. However, in the South African construction industry, the term 'small enterprise' is defined as a company that employs 50 or less employees and has an annual turnover of less than R5 million. Medium enterprises employ between 51 and 200 employees and have less than R20 million turnover annually (RSA, 1996: 15).

In South Africa, SMEs contribute not only to the economy, but also, together with co-operatives, towards defeating the scourges of unemployment, poverty and inequality (Small Enterprise Finance Agency (SEFA), 2016). During 2017, R1 billion was injected in the South African economy to assist 43,000 SMMEs and co-operatives. This amount, in turn, helped create and maintain close to 56,000 jobs (SEFA, 2017).

Despite the importance of SMMEs to the South African economy, the small and medium construction enterprises (SMEs) sector is still described as, to a large extent, underdeveloped; lacking the sophistication enjoyed by larger well-established contractors; left on the periphery of the mainstream economy, and not participating fully in the economy (Department of Public Works, 1999). Martin (2010) opines that SMEs face a lack of competencies, including knowledge of pricing procedures, contractual rights, and obligations; law, management techniques, and principles, as well as technology. Furthermore, the Construction Industry Development Board (CIDB, 2008) indicates that SMEs' formal education is based on construction trade training such as carpentry, plumbing, electrical installation, and bricklaying. It can be argued that this level of training might impede SMEs' knowledge of financial management. Other studies in South Africa have revealed that capacity and financial resources are major challenges among SMEs (Fatoki, 2014; Agumba, Adegoke & Otieno, 2005). According to Grimsholm and Poblete (2011), SMEs are not able to access finance or credit, thus stifling their growth and capability.

It is vital to note that the concept of credit is predated by the use of money. This can be traced to as far back as the Code of Hammurabi, established in approximately 1750 B.C. (Nagarajan, 2011: 109). From its beginnings, credit has been used as a selling tool, to bind customers to a particular vendor, and to allow them to acquire more substantial goods for which they do not have the necessary capital (Mandell, 1990). The theory of credit suggests that financial institutions would be more willing to extend credit if, in case of default, they could easily enforce contracts by forcing repayment or seizing collateral.

To some extent, the amount of credit in a country would depend on the existence of legislation that protects the creditors' rights on proper procedures that lead to repayment (Aduda et al., 2012: 203).

It is accepted that SMEs are a vehicle of economic empowerment in the construction and other industries in South Africa. However, they are faced with numerous constraints to enable them to maximize their economic potential. Furthermore, construction SMEs find it difficult to access the credit for which they applied, let alone any credit at all. It can be unequivocally indicated that there is a paucity of studies in South Africa to establish the determinants predicting full credit and partial credit accessibility and to assess the determinants predicting construction SMEs' accessing the credit or not. Lack of consensus on the predictors of credit accessibility among SMEs is a problem that must be solved. To find solutions for the predictors of credit accessibility for construction SMEs, it was important to determine the factors that prevent construction SMEs from accessing credit. To do so, the socio-economic and demographic determinants predicting full credit accessibility for SMEs from financial institutions were assessed and evaluated by means of regression statistics testing whether participating SMEs received full credit, part of the credit, or no credit at all.

2. Literature review

2.1 Challenges preventing SMEs from accessing credit

According to Alhassan & Sakara (2014: 33) and Bondinuba (2012: 25), the factors that stifle SMEs from accessing credit include informational barriers, lack of management expertise, high default rate, and monitoring. Banks face these challenges in lending credit to SMEs. Bondinuba (2012: 25) found that the main challenges that make it difficult for SMEs to access finance include policy regulation, inadequate financial infrastructure, stringent collateral security requirements, and a lack of institutional capacity of the SMEs sector. Kayanula & Quartey (2000) and the World Bank Report (2014) established that the non-availability and cost of finance as well as the legal framework and policies regarding investment, together with a lack of proper bookkeeping among SMEs, fail to provide the right support infrastructure to facilitate SMEs lending by the financial institutions in Ghana.

Angela and Motsa Associates (2004) as well as Foxcroft, Wood, Kew, Herrington and Segal (2002) reveal that entrepreneurs face several problems in their efforts to access and borrow finance for business purposes, particularly from banks. The main problems are a lack of collateral, refusal to use own collateral, failure to make a remarkable own contribution, blacklisting, failure to review attractive financial records and/or lack of business plans, and high risk of small entrepreneurs.

In South Africa, banks advance four main reasons for their reluctance to extend credit to small enterprises, namely high administrative costs of small-scale lending, asymmetric information, high-risk perception, and lack of collateral (Mazanai & Fatoki, 2012: 60). The Organization for Economic Cooperation and Development (OECD) (2006: 9) argues that the difficulties that SMEs encounter when trying to access financing can be due to an incomplete range of financial products and services, regulatory rigidities or gaps in the legal framework, or a lack of information on both the bank's and the SME's side. Banks may avoid providing financing to certain types of SMEs, in particular, start-ups and very young firms that typically lack sufficient collateral, or firms whose activities offer the possibilities of high returns, but at a substantial risk of loss (OECD, 2006: 11-12).

2.2 Predictors of credit accessibility

Kimutai and Ambrose (2013) establish that most of the commercial banks ration credit, in order to reduce risk and to avoid the risk of adverse selection and moral hazard. Therefore, the key factors that influence credit rationing by banks are loan characteristics, firm characteristics, and observable characteristics.

Critical factors such as the availability of a business plan, collateral, maintenance of a good relationship (networking), managerial competency, a good credit score (capacity to pay; experience in credit use), and the borrower's character (attitude towards risk) define the requirements for SMEs to have access to financial institutions and bank credit (Aduda et al., 2012; Fatoki, 2014; Fatoki & Odeyemi, 2010). Together with financial activities such as business registration, documentation/recording, and asset ownership (Nkuah, Tanyeh & Gaeten, 2013), the profile of the business terms of number of employees, size, sector and form of the business in the economy form some of the crucial factors to be successful in accessing bank finance (Alhassan & Sakara, 2014; Kira & He, 2012; Musamali & Tarus, 2013).

In South Africa, educational achievement, investment in production costs, access to market information, and membership of the cooperative negatively influence access to credit, specifically for entrepreneurs in the farming industry (Etonihu, Rahaman & Usman, 2013; Pandula, 2011). A separate study by Chauke, Motlhatlhana, Pfumayaramba and Anim (2013) found that the predictors for credit accessibility by smallholder farmers were attitude towards risk, distance between lender and borrower, perception on loan repayment, perception on lending procedures, and total value of assets (Chauke & Anim, 2013; Dzadze, Osei Mensah, Aidoo & Nurah, 2012). Gender, marital status, lack of guarantor, and high interest rates predicted access to credit among rural framers (Ololade & Olagunju, 2013: 20). These factors might be different from those in the construction sector, hence reinforcing the need for the study.

Other factors such as membership with business association, capital, and economic conditions were considered to be moderately important in availing credit to SMEs (Aduda et al., 2012; Pandula, 2011).

In view of these discussions, it is evident that a wide range of factors set the profile of lenders and predict credit accessibility to financial institutions. These factors can be grouped into the demographic and company profile factors that predict full credit accessibility from financial institutions for lenders.

2.3 The demographic and socio-economic determinants of credit accessibility

For the purposes of this article, the demographic and socioeconomic determinants of gaining credit accessibility for SMEs were set as gender, age group, current position of the owner, type of business ownership, business tax number, location of the company, and collateral/security.

2.3.1 Gender

According to Wilson (2017), gender plays a significant role in accessing credit. A number of studies have shown that, in SMEs, females are more constrained and face more obstacles than their male counterparts in accessing credit (Carter, 2011; Roper & Scott, 2009). In their study of SMEs regarding the impact of gender on accessing credit, Irwin and Scott (2010) established that females obtain credit more easily compared to their male counterparts. It can, therefore, be argued that gender predicts credit accessibility.

2.3.2 Age group

The perception that a particular age group tends to behave differently from other age groups means that, for instance, older SMEs' owners/managers mostly appear to be at risk (Nakano & Nguyen, 2011) and do not want to apply for bank loans. Younger SMEs' owners/managers are perceived to be innovative and good performers; hence, they could attract credit accessibility. Several studies have investigated the effect of the applicant's age on access to credit, with mixed results, mainly on the significance of the effect. Studies conducted by Fatoki and Odeyemi (2010) and Slavec and Prodan (2012) show that age does not have a significant effect on access to credit. However, contrary to the above findings, Nguyen and Luu (2013) demonstrate that age does have a significant effect on credit accessibility. Despite the mixed results, age group will be considered a predictor of credit accessibility for this study.

2.3.3 Current position

According to the report of Business Partners (2011), the level of the position of the directors, manager, or owner in a company can determine the loan or credit the organisation can secure. The reason for this is that credit seekers with higher positions in a company and high levels of management position can access credit easily. Therefore, it can be suggested that the current position of the applicant in his/her organisation will predict credit accessibility.

2.3.4 Types of business ownership

Beck, Asli and Maria (2008) found that the legal status and corporate structure (i.e., public, private or foreign-owned) at the start-up of businesses have an influence on lending money from financial institutions. Coleman and Cohn (2000) found evidence supporting a positive relationship between credit leverage and sole trader on access to credit. Similarly, Freedman and Godwin (1994: 242) suggest that sole traders are greater users of bank credit. Thus, the form of business ownership influences credit accessibility.

2.3.5 Tax number

Coolidge (2012) infers that SMEs employing workers were more likely to express a likelihood to register for tax than sole proprietors with no employees. It is imperative to note that SMEs, who kept complete financial records on paper and computer, were more likely to report an intention to register for tax than those who did not keep such records. Furthermore, SMEs who agreed that Government gives a good return on taxes paid in the form of government services reported a much higher likelihood of tax registration. According to the South African Revenue Services (SARS) (2015), tax registration is a pathway to having a tax number. Hence, it can be argued that this will aid in credit being provided by the financial institutions, as the enterprise is deemed a legal entity.

2.3.6 Location of the business

According to Berger and Udell (2006) and Gilbert (2008), SME firms that are geographically nearer to lending institutions are more likely to gain access to the financial institution. This means that financial institutions can utilise available qualitative information more easily to establish the credibility of the SME applicants. Fatoki and Asah (2011) support this and affirm that SMEs located in towns are more successful in accessing credit compared to those in rural areas. These studies, therefore, propose that the location of the business predicts credit accessibility.

2.3.7 Collateral security

In lending agreements, collateral is a borrower's pledge of specific property to a lender to secure repayment of a loan (Joan, 1995). The collateral serves as protection for a lender against a borrower's default. If a borrower defaults on a loan, that borrower forfeits the property pledged as collateral. The lender then becomes the owner of the collateral. Joan (1995) established that collateral is a major determinant of credit accessibility by SMEs.

3. Research method and design

This study determined the predictors for gaining full credit accessibility for construction SMEs from financial institutions in South Africa. A quantitative research design was adopted, in which the use of structured questionnaire surveys enables researchers to generalise their findings from a sample of a population (Creswell, 1994). In this study, using logistic regression analysis, the socio-economic and demographic data from construction SMEs in South Africa were used to test and set the predictors of accessing full credit. In the questionnaire, factors preventing SMEs from accessing credit from financial institutions were rated and then ranked as the list of constraints experienced by SMEs from accessing credit (Creswell, 2005).

3.1 Sampling method and size

A list provided by the CIDB shows a total of 5,000 grade 1; 5,000 grade 2; 2,461 grade 3; 2,797 grade 4, and 1,758 grade 5 registered construction SMEs in South Africa, resulting in a population of 17,016. Non-probability convenience sampling was used to select participants from this population who were registered with the CIDB, but located in the city of Johannesburg Metropolitan Municipality, city of Tshwane Metropolitan Municipality, Ekurhuleni Metropolitan Municipality, and the West Rand District Municipality as grade 1 to 6 contractors. From this list, a total sample of 250 SME contractors were selected for this study. This sample size is supported by the sample size table of Israel (1992), at a sampling precision of +/-7%. The table gives recommended sample sizes for general research activities, applicable to any defined population. From the table, the recommended sample size for a population of >15,000 is 201. This recommendation validates the sample size of 250 as efficient for the population of 17,016 (Israel, 1992: 3).

3.2 Response rate

From the sample of 250 construction SMEs, a total of 179 SMEs completed and returned the questionnaire survey responses in the period August to November 2015, resulting in a response rate of 71.60%. According to Moyo and Crafford (2010: 68), contemporary built-environment survey response rates range between 7% and 40%, in general.

3.3 Data collection

A structured questionnaire was distributed using the drop-and-collect method as well as electronically via email to a selected sample of 250 SME contractors in the Gauteng province, South Africa. The topics on accessing full credit used in the questionnaire were extracted from reviews of the literature, resulting in the formulation of a questionnaire divided into three sections. Section one, on the respondent's profile, obtained personal information on age, gender, population group, education qualification, marital status, current position, and years of experience in business. Section two obtained the company profile information, which included location of the business, ownership, construction industry development board (CIDB) grading, number of full-time employees, and requirements of financial institutions (e.g., collateral and tax number). These socio-economic and demographic data form the independent variables used in the binary logistic regression analysis. Section three sets questions that rate the factors preventing SMEs from accessing credit. To reduce the respondent's bias, closed-ended questions were preferred for section three (Akintoye & Main, 2007: 601).

The questionnaires were completed anonymously. The collection of the data and the presentation of the results cannot harm the respondents or their employing organisations in any way.

3.4 Data analysis and interpretation of findings

The Statistical Package for Social Sciences (SPSS) version 22 was used to perform the binary logistic regression analysis (Pallant, 2013). Logistic regression is recommended over linear regression when modelling dichotomous responses, allowing the researcher to estimate probabilities of the response occurring (Hosmer & Lemeshow, 2000).

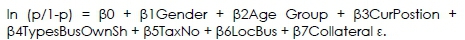

To analyse the socio-economic and demographic data, the logistic regression coded these independent variables as gender (male 1 and female 2); age group (30 years and below 1, 31 years to 39 years 2, 40 years to 49 years 3, and 50 years and above 4); current position (director 1, owner 2, manager 3, and manager/owner 4); ownership (sole proprietorship 1, partnership 2, limited partnership 3, limited liability company 4, and corporation (for-profit) 5; tax number (No, 0, and Yes, 1); location of business (city of Johannesburg Metropolitan Municipality 1, city of Tshwane Metropolitan Municipality 2, Ekurhuleni Metropolitan Municipality 4, and West Rand District Municipality 4); collateral (No, 0, and Yes, 1).

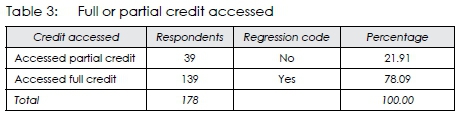

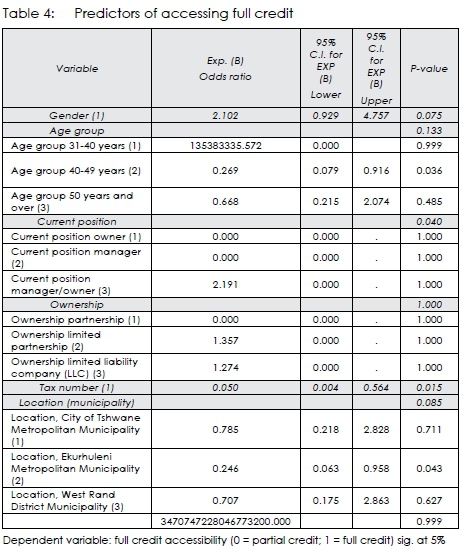

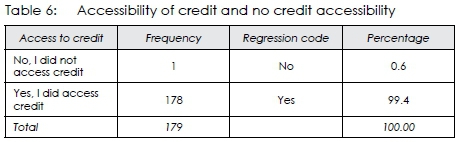

For the analysis of credit accessibility, the logistic regression coded the dichotomous responses as "yes" = 1 and "no" = 0. The regression analysis modelled the dependent variables into two tests. In test one (Table 4), the predictors of accessing full credit were defined as "Yes" = having accessed full credit, and "No" = having accessed part of the credit. In test two (Table 6), the predictors of accessing credit were defined as "Yes" = accessed credit; and "No" = did not access credit.

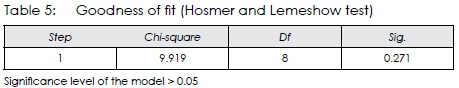

To test whether the data used in the model was good enough for the binary logistic regression, the Hosmer-Lemeshow goodness-of-fit test was used. This test (Table 5) compares the observed and expected frequencies of events and non-events in order to assess how well the model fits the data (Hosmer & Lemeshow, 2013). For this study, the significance level was set at 0.05. This means that, if the p-value for the goodness-of-fit test is higher than 0.05, the model can be used for statistical analysis.

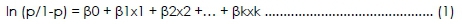

To predict the independent variables' influence on credit accessibility (dependent variables), mathematical model 1 was set up as:

where p is the estimated probability of passing, and x1, x2,...,xk are independent variables.

The specific logistic regression was modelled as follows:

(p/1-p) is the odds ratio, where (p) is the probability of the response occurring divided by (1-p), which is the probability of it not occurring. To find a relationship between the dependent and independent variables, the maximum likelihood of the odds ratio's values is defined as: >1 (positive association); =1 (no association), and <1 (negative association). In reporting the level of significance (p-value), a value of >0.05 means that the independent variable shows little significance to be set as a predictor to gain full credit and a value of <0.05 means that the independent variable shows a strong significance to be set as a predictor to gain full credit.

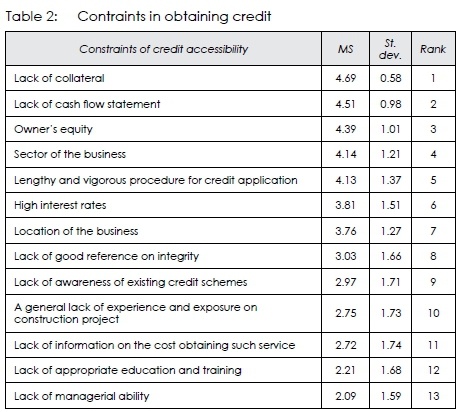

The factors preventing SMEs from accessing credit were measured using a 5-point Likert scale. Likert-type or frequency scales use fixed choice response formats and are designed to measure attitudes or opinions (Bowling, 1997). For the purposes of analysis and interpretation, the following scale measurement was used regarding mean scores (MSs), where 1 = Strongly disagree (> 1.00 < and <1.80); 2 = Disagree (> 1.81 and < 2.60); 3 = Neutral (> 2.61 and < 3.40); 4 = Agree (>3.41 and < 4.20), and 5 = Strongly agree (>4.21 and < 5.00). The data were captured using the SPSS program, upon which the findings were reviewed against the foregoing literature review.

3.5. Limitation(s) of the study

The study cannot be generalised across South Africa, as the study was conducted only in the Gauteng province.

4. Results and discussions

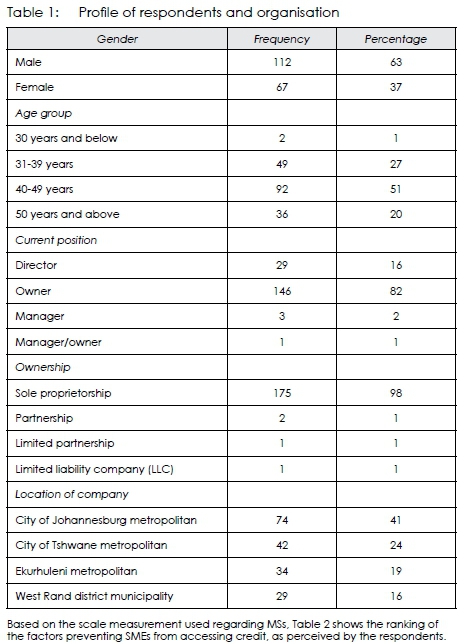

Table 1 shows the socio-economic and demographic data of respondents. Based on frequency of occurrence, the majority of the respondents were males (63%). The majority of the respondents was in the age group between 40 and 49 years of age (51%). Of the respondents, 82% occupied the position of owners, and 98% of the SMEs are sole proprietors. The majority (41%) of the SMEs were located in the city of Johannesburg metropolitan.

With a MS of 4.21 to 5.00, SMEs strongly agreed that lack of collateral, lack of cash flow statement and owner's equity impede SMEs from accessing credit from financial institutuions. Lack of collateral as a challenge is in line with the studies of Bondinuba (2012), Foxcroft et al. (2002) as well as Kayanula and Quartey (2000). Showing MS of 3.61 to 4.20, SMEs respondents agreed that the sector of the bussiness, lengthy and vigorous procedure for credit application, high interest rates, and location of the business contributed to their difficulty in obtaining credit. Furthermore, the SMEs respondents disagreed that lack of appropriate education and training, and lack of managerial ability are impediments to accessing credit. These two constraints showed a MS of between 1.81 and 2.60.

Table 3 shows the frequency results from the regression analysis on accessed credit in full or accessed only part of the credit. Based on the results, 39 (21.91%) of the respondents received part of the credit for which they applied, and 139 (78.09%) of the respondents obtained the full credit. Some SMEs not receiving the full credit for which they applied from the financial institutions is in line with the theory of credit rationing, as informed by Stiglitz and Weiss (1981). It can be argues that this theory is the demand of funds by small medium and micro enterprises (SMMEs) and the supply of funds (Mazanai & Fatoki, 2012). Furthermore, one respondent did not indicate whether the company received full or partial credit. However, Table 6 justifies this finding, as the respondent indicated that the company did not receive credit at all.

Table 4 shows the results of the binary logistic regression, in which the model tested demographic and socio-economic independent variables against the dependent variable (full credit accessibility) for their significance to be set as predictors of accessing full credit. With significance (p-value) levels of more than 0.050, gender (0.075) and type of ownership (1.000) did not predict full credit accessibility.

Reporting a significance level of less than 0.050, the results showed that the age group 40-49 years was more likely to receive full credit than applicants who were in the age group 30 years and below. This finding correlates with the findings of Nguyen and Luu (2013) as well as with those of Abdulsaleh and Worthington (2013: 38). It is interesting to note that applicants who are 30 years and younger are likely to receive partial credit rather than full credit. With a significance (p-value) level of less than 0.050, the current position predictor predicted full credit accessibility. The finding is in line with the findings of Business Partners (2011). However, it is interesting to note that no category of the current position held in the SMEs predicted full credit accessibility, as they all showed a significance (p-value) level greater than 0.05.

The study found that, when the SMEs provided their tax numbers, they had a greater probability of accessing full credit, compared to those who did not provide their tax numbers. The level of significance was less than 0.05 at 0.015, hence a strong predictor. Furthermore, the SMEs whose premises were in Location, Ekurhuleni metropolitan municipality in Gauteng province had a higher probability of getting full credit, compared to SMEs in the city of Johannesburg metropolitan municipality. This predicator was significant at 0.043, which was less than 0.05. The odds ratio showed that getting the full credit was 0.246 more than those SMEs in the city of Johannesburg. This finding is supported by Berger and Udell (2006) and by Fatoki and Asah (2014). Berger and Udell (2006) indicate that the geographic location of a firm's close proximity to the financial institution had an influence on the firm obtaining credit. On the other hand, Fatoki & Asah (2014) indicate that those in urban areas were more likely to obtain credit than those in rural areas. Therefore, it can be suggested that the location of the business is vital for credit accessibility.

Although the respondents ranked collateral as one of the variables that constrain credit accessibility, it is important to mention that, in the binary regression analysis, collateral did not show as a predictor of credit accessibility among construction SMEs. Therefore, collateral is not included in Tables 4 and 7, showing the results for predictors of accessing credit.

Table 5 shows the statistical analysis of the goodness of fit of the conceptualised model. The significance was achieved at the p-value greater than 0.05 at 0.271. This suggests that the independent variables were correctly conceptualised in predicting the dependent variable. Therefore, the model was significant and can be used for statistical analysis.

Table 6 shows the results from the regression analysis on accessed credit or not accessed credit. Based on the results, only 0.6% of the SMEs did not have access to credit, while 99.4% of SMEs had obtained credit. Therefore, the majority of the respondents obtained credit. However, this finding is contrary to the findings of Fatoki and Odeyemi (2010) who found that, in South Africa, only 27% of SMEs obtained bank loans, while 73% did not obtain the credit.

Table 7 shows the results of the binary logistic regression, in which the model tested demographic and socio-economic independent variables against the dependent variable (credit accessibility) for their significance to be set as predictors of having access to credit or not having access to credit. With significance (p-value) levels of greater than 0.05, all the predictor variables in this test were not significant. Therefore, gender, age group, current position, type of business ownership, location of the business, and tax number were not good predictors of credit accessibility.

5. Conclusions

The study elicited data from construction SMEs personnel who are conversant with the credit accessibility within their enterprise. The analysed data results indicate that SMEs agreed that a lack of collateral/security, lack of cash flow statement and owners' equity prevent them from accessing credit. However, despite the constraints of accessing credit, which could be a stumbling block, the results show that the majority of the participating SMEs received credit, whether in full or partially. The construction SMEs that obtained credit partially can be impeded in their progress. It can be suggested that, when construction SMEs receive part of the credit, they might apply for credit in other financial institutions or request financial assistance from friends, in order to cover for the deficit.

The age and current position held within a construction SME predicted full accessibility to credit when applicants apply for credit from financial institutions. However, the results of current position do not suggest which specific position within the construction SME predicted credit accessibility. It is imperative to note that the study did not test who was responsible for applying for the credit. Hence, in terms of applying for the credit, the current position held by the participating respondents in their firms was not the credit applicant. Furthermore, tax number and location of the business in the Gauteng province were also predicators of full credit accessibility. However, the gender of the respondent, type of business ownership, and collateral (security) did not predict full credit accessibility by SMEs. However, when the predictors were modelled with whether the SMEs received credit or did not receive credit, the predictors were not good determinants.

6. Recommendations

Based on the conclusions, the study recommends the findings to different stakeholders, namely government, financial institutions, and construction SMEs.

6.1 Recommendations to government

The government needs to encourage construction SMEs to approach financial institutions to apply for credit, as the majority of the SMEs indicated that they obtained credit. Hence, the suggestion from literature that SMEs are not able to access credit can be rejected.

The government needs to be informed of the challenges indicated by the construction SMEs. These restrict them from receiving credit. These are collateral (security), owners' equity and cash flow statement. Hence, government could help construction SMEs overcome some of these challenges.

6.2 Recommendation to financial institutions

The financial institutions should be informed of the impediments indicated by the construction SMEs as constraints in accessing credit. These constraints are collateral (security), owners' equity, and cash flow statement.

6.3 Recommendation to construction SMEs

Construction SMEs should be informed that they should provide the age and current position in the organisation of the person applying for the credit. The information will enable the financial institutions to deal with owners and, in case they are checking older applicants, the age will assist. They should also provide the tax number and the location of the business. The tax number will indicate that the business entity is registered and is thus legal.

7. Further study

• Further research could determine if the findings of this research are consistent across different sectors. Since the study concentrated on SMEs in the construction sector in only the Gauteng province in South Africa, further research in other sectors will shed more light on the findings of this study.

• In addition, the need to replicate this research in the other eight provinces of South Africa in the construction industry will confirm if the results of this research can be generalised across the country.

• This study can also be carried out in other African countries for comparative purposes.

• Although the study establishes some predictors for access to full credit, not all the variables were good predictors. Therefore, a further study can be undertaken to justify these findings.

• The study proposes the use of stepwise logistic regression in future study.

References

Abdulsaleh, A. & Worthington, A. 2013. Small and medium-sized enterprises financing: A review of literature. International Journal of Business and Management, 8(14), pp. 36-54 . https://doi.org/10.5539/ijbm.v8n14p36 [ Links ]

Aduda, J., Magutu, O.P. & Wangu, G.M. 2012. The relationship between credit scoring practices by commercial banks and access to credit by small and medium enterprises in Kenya. International Journal of Humanities and Social Science, 2(9), pp. 203-213. [ Links ]

Agumba, J.N., Adegoke, I.O. & Otieno, F.A.O. 2005. Evaluating project management techniques in small and medium enterprises delivering infrastructure in South Africa construction industry. In: Proceedings of the 3rdPostgraduate Conference, Construction Industry Development, Eskom Convention Centre, Midrand, Johannesburg, South Africa, 9-11 October, pp. 52-65. [ Links ]

Akintoye, A. & Main, J. 2007. Collaborative relationships in construction: The UK contractor's perception. Engineering, Construction and Architectural Management, 14(6), pp. 597-617. http://dx.doi.org/10.1108/09699980710829049. [ Links ]

Alhassan, F. & Sakara, A. 2014. Socio-economic determinants of small and medium enterprises' (SMEs) access to credit from the Barclays Bank in Tamale-Ghana. International Journal of Humanities and Social Science Studies, I(II), pp. 26-36, September. [ Links ]

Angela Motsa & Associates. 2004. SMME finance sector background paper: A review of key documents on SMME Finance 1994-2004. Johannesburg: Fin Mark Trust. [ Links ]

Beck, T., Asli, D-K. & Maria, S.M.P. 2008. Bank financing for SMEs around the world: Drivers, obstacles, business models, and lending practices. Policy Research Working Paper 4785. World Bank, Washington, DC. [ Links ]

Berger, A.N. & Udell, G.F. 2006. A more complete conceptual framework for SME finance. Journal of Banking & Finance, 30(11), pp. 2945-2966. https://doi.org/10.10167j.jbankfin.2006.05.008 [ Links ]

Bondinuba, F.W. 2012. Exploring the challenges and barriers in accessing financial facilities by small and medium construction firms in Ghana. Civil and Environmental Research, 2(6), pp. 25-35. [ Links ]

Bowling, A. 1997. Research methods in health. Buckingham, UK: Open University Press. [ Links ]

Business Partners. 2011. Investing in entrepreneurs. Making big things happen for small businesses. [online]. Available at: <https://www.businesspartners.co.za/en-za/corporate%20centre/Shareholder-Information/Documents/Financial-results/2011-Annual-Report.pdf> [Accessed: 28 May 2018]. [ Links ]

Carter, S. 2011. The rewards of entrepreneurship: Exploring the incomes, wealth, and economic well-being of entrepreneurial households. Entrepreneurship Theory and Practice, 35(1), pp. 39-55. https://doi.org/10.1111/j.1540-6520.2010.00422.x [ Links ]

Chauke, P.K. & Anim, F.D.K. 2013. Predicting access to credit by smallholder irrigation farmers: A logistic regression approach. Journal of Human Ecology, 42(3), pp. 195-202. https://doi.org/10.1080/09709274.2013.11906594 [ Links ]

Chauke, P.K., Motlhatlhana, M.L., Pfumayaramba, T.K. & Anim, F.D.K. 2013. Factors influencing access to credit: A case study of smallholder farmers in the Capricorn district of South Africa. African Journal of Agricultural Research, 8(7), pp. 582-585. [ Links ]

Coleman, S. & Cohn, R. 2000. Small firms' use of financial leverage: Evidence from 1993 survey of small business finances. Journal of Business Entrepreneurship, 12(3), pp. 81-98. [ Links ]

CIDB (Construction Industry Development Board). 2008. Construction health and safety in South Africa, status and recommendations. Pretoria: CIDB. [ Links ]

Coolidge, J. 2012. Findings of tax compliance cost surveys in developing countries. eJournal of Tax Research, 10(2), pp. 250-287. [ Links ]

Creswell, J.W. 1994. Research design, qualitative and quantitative approaches. London: Sage. [ Links ]

Creswell, J.W. 2005. Educational research. Planning, conducting, and evaluating quantitative and qualitative research. Thousand Oaks, CA: Sage. [ Links ]

Department of Public Works. 1999. White paper on creating an enabling environment for reconstruction growth and development in the construction industry, Government Printers, Republic of South Africa. [online]. Available at: <http://www.info.gov.za/whitepaper/1999/environment.html> [Accessed: 1 February 2017]. [ Links ]

Dzadze, P., Osei Mensah, J., Aidoo, R. & Nurah, G.K. 2012. Factors determining access to formal credit in Ghana: A case study of smallholder farmers in the Abura-Asebu Kwamankese district of central region of Ghana. Journal of Development and Agricultural Economics, 4(14), pp. 416-423. [ Links ]

Etonihu, K.I., Rahman, S.A. & Usman, S. 2013. Determinants of access to agricultural credit among crop farmers in a farming community of Nasarawa State, Nigeria. Journal of Development and Agricultural Economics, 5(5), pp. 192-196. [ Links ]

Fatoki, O, 2014. Factors influencing the financing of business startups by commercial banks in South Africa. Mediterranean Journal of Social Sciences, 5(20), pp. 94-100. https://doi.org/10.5901/mjss.2014.v5n20p94 [ Links ]

Fatoki, O. & Asah, F. 2011. The impact of firm and entrepreneurial characteristics on access to debt finance by SMEs in King Williams' Town, South Africa. International Journal of Business and Management, 6(8), pp. 170-179. https://doi.org/10.5539/ijbm.v6n8p170 [ Links ]

Fatoki, O. & Odeyemi, A. 2010. Which new small and medium enterprises in South Africa have access to bank credit? International Journal of Business and Management, 5(10), pp. 128-136. https://doi.org/10.5539/ijbm.v5n10p128 [ Links ]

Foxcroft, M., Wood, E., Kew, J., Herrington, M. & Segal, N. 2002. Global Entrepreneurship Monitor: South African Executive Report, Graduate School of Business: University of Cape Town. [ Links ]

Freedman, J. & Godwin, M. 1994. Incorporating the micro-business: Perceptions and misconceptions. In: Hughes, A. & Storey, D.J. (Eds). Finance and the small firm, London: Routledge, pp. 232-283. [ Links ]

Gilbert, B.A. 2008. New venture performance: Does location matter? [online]. Available at: <http://ftp.zew.de/pub/zew-docs/entrepreneurship/Gilbert.pdf> [Accessed: 28 May 2018]. [ Links ]

Grimsholm, E. & Poblete, L. 2011. Internal and external factors hampering SME growth: A qualitative case study of SMEs in Thailand. Unpublished Master's thesis, Gotland University. [ Links ]

Hosmer, D.W. & Lemeshow, S. 2000. Applied logistic regression. New York: Wiley. https://doi.org/10.1002/0471722146 [ Links ]

Irwin, D. & Scott, J.M. 2010. Barriers faced by SMEs in raising bank finance. International Journal of Entrepreneurial Behavior & Research, 16(3), pp. 245-259. doi.org/10.1108/13552551011042816. https://doi.org/10.1108/13552551011042816 [ Links ]

Israel, G.D. 1992. Sampling the evidence of extension program impact: Determining sample size. [online]. Available at: <https://www.tarleton.edu/academicassessment/documents/Samplesize.pdf> [Accessed: 29 May 2018]. [ Links ]

Joan, F.G. 1995. Banks and their customers. Dobbs Ferry, NY: Oceana Publications. [ Links ]

Kayanula, D. & Quartey, P. 2000. The policy environment for promoting small and medium-sized enterprises in Ghana and Malawi. Finance and development research programme, Working Paper Series, Paper No. 15, IDPM, University of Manchester. [ Links ]

Kimutai, C.J. & Ambrose, J. 2013. Factors influencing credit rationing by commercial banks in Kenya. International Journal of Humanities and Social Science, 3(20), pp. 244-252. [ Links ]

Kira, R.A. & He, Z. 2012. The impact of firm characteristics in access of financing by small and medium-sized enterprises in Tanzania. International Journal of Business and Management, 7(24), pp. 108119. https://doi.org/10.5539/ijbm.v7n24p108 [ Links ]

Mandell, L. 1990. The credit card industry: A history. Boston: Twayne Publishers. [ Links ]

Martin, l. 2010. Challenges faced by South African emerging contractors: Review and update. In: Proceedings of the Construction, Building and Real Estate Research Conference of the Royal Institute of Chartered Surveyors, 2-3 September. Dauphine Université, Paris, France, CD-ROM. [ Links ]

Mazanai, M. & Fatoki, O. 2012. Access to finance in the SME sector: A South African perspective. Asian Journal of Business Management, 4(1), pp. 58-67. [ Links ]

Moyo, A. & Crafford, G.J. 2010. The impact of hyperinflation on Zimbabwean construction industry. Acta Structilia, 17(2), pp. 53-83. [ Links ]

Musamali, M.M. & Tarus, K.D. 2013. Does firm profile influence financial access among small and medium enterprises in Kenya? Asian Economic and Financial Review, 3(6), pp. 714-723. [ Links ]

Nagarajan, K.V. 2011. The Code of Hammurabi: An economic interpretation. International Journal of Business and Social Science, 2(8), pp. 108-117. [ Links ]

Nakano, M. & Nguyen, P. 2011. Do older boards affect firm performance? An empirical analysis based on Japanese firms. The 6thAnnual Conference on Asia-Pacific Financial Markets (CAFM), Seoul, Korea, 2 December 2011. [ Links ]

Nguyen, N. & Luu, N. 2013. Determinants of financing pattern and access to formal-informal credit: The case of small and medium sized enterprises in Vietnam. Journal of Management Research, 5(2), pp. 240-259. https://doi.org/10.5296/jmr.v5i2.3266 [ Links ]

Nkuah, K.J., Tanyeh, P.J. & Gaeten, K. 2013. Financing small and medium enterprises (SMEs) in Ghana: Challenges and determinants in accessing bank credit. International Journal of Research in Social Sciences, 2(3), pp. 12-25. [ Links ]

OECD (Organization for Economic Cooperation and Development). 2006. The SMEs Financing Gap, Volume 1: Theory and evidence. Paris: OECD Publishing. [ Links ]

Ololade, R.A. & Olagunju, F.I. 2013. Determinants of access to credit among rural farmers in Oyo State, Nigeria. Global Journal of Science Frontier Research Agriculture and Veterinary Sciences, 13(2), pp. 17-22. [ Links ]

Pallant, J. 2013. SPSS, Survival manual: A step-by-step guide to data analysis using IBM, SPSS. 5th edition. London: Allen & Unwin. [ Links ]

Pandula, G. 2011. An empirical investigation of small and medium enterprises' access to bank finance: The case of an emerging economy. In: Proceedings of the ASBBS, 18(1), 22-28 February, Las Vegas, USA. San Diego, CA: American Society of Business and Behavioural Sciences, pp. 255-273. [ Links ]

Roper, S. & Scott, J.M. 2009. Perceived financial barriers and the start-up decision: An econometric analysis of gender differences using GEM data. International Small Business Journal 27(2), pp. 149171. https://doi.org/10.1177/0266242608100488 [ Links ]

RSA (Republic of South Africa). 1996. National Small Business Act, Act 102 of 1996. Pretoria: Government Printer. [online]. Available at: <https://www.thedti.gov.za/sme_development/docs/act.pdf> [Accessed: 28 May 2018]. [ Links ]

SARS (South African Revenue Services). 2015. My small business, companies registering for income tax. [online]. Available at: <http://www.sars.gov.za/AllDocs/Documents/Small%20business/Companies%20registering%20for%20Income%20Tax.pdf> [Accessed: 14 April 2018]. [ Links ]

SEFA (Small Enterprise Finance Agency). 2016. Investing in the growth and sustainability of SMMEs and co-operatives. Annual report. [online]. Available at: <http://www.sefa.org.za/Content/Docs/2016%20sefa%20Annual%20Report.pdf> [Accessed: 14 April 2018]. [ Links ]

SEFA (Small Enterprise Finance Agency). 2017. Investing in the growth and sustainability of SMMEs and co-operatives. Annual report. [online]. Available at: <http://www.sefa.org.za/Content/Docs/sefa%20Annual%20Report_2017.pdf> [Accessed: 14 April 2018]. [ Links ]

Slavec, A. & Prodan, I. 2012. The influence of entrepreneurs' characteristics on small manufacturing firm debt financing. Journal for East European Management Studies, 17(1), pp. 104-130. https://doi.org/10.5771/0949-6181-2012-1-104 [ Links ]

Stiglitz, J. & Weis, A. 1981. Credit rationing in markets with imperfect information. The American Economic Review, 71(3), pp. 393-410. [ Links ]

Wilson, B. 2017. Farmer vs farm wife: Which is most highly valued, 3 August 2017. [online]. Available at: <https://www.facebook.com/notes/brad-wilson/farmer-vs-farm-wife-which-is-most-highly-valued/1388893231148421> [Accessed: 28 May 2018]. [ Links ]

World Bank. 2014. Facilitating SME financing through improved credit reporting. Report of the International Committee on Credit Reporting, chaired by the World Bank, (Draft Version for Public Comments). [online]. Available at: <https://siteresources.worldbank.org/EXTFINANCIALSECTOR/Resources/282884-1395933501015/Facilitating_SME_financing_through_CR_public_comments_web.pdf> [Accessed: 10 April 2018]. [ Links ]

Peer reviewed and revised

*The authors declared no conflict of interest for this title or article