Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

African Human Mobility Review

On-line version ISSN 2410-7972

Print version ISSN 2411-6955

AHMR vol.2 n.1 Cape Town Jan./Apr. 2016

ARTICLES

Xenophobia, Price Competition and Violence in the Spaza Sector in South Africa

Laurence PiperI; Andrew CharmanII

IDepartment of Political Studies, University of the Western Cape, Cape Town, South Africa, 7535. Email: lpiper@uwc.ac.za

IISustainable Livelihoods Foundation, Cape Town, South Africa, 7800. Email: andrew.charman@livelihoods.org.za

ABSTRACT

The last decade has seen growing awareness of violent attacks against foreigners in South Africa. This includes attacks against foreign traders in the townships where they are portrayed as 'taking over' by out-competing South African traders on price. Central to township trade are neighbourhood grocery or convenience stores colloquially known 'spaza' shops. Drawing on evidence from surveys with over 1000 spaza shopkeepers from South Africa's three main cities, this article makes the case that business competitiveness does not correspond simply with being foreign or South African. While Bangladeshi and Somali shops were, on average, cheaper than South African shops, Zimbabwean and Mozambican shops were actually more expensive. Further, there is also no easy correspondence between being foreign or South African and the experience of violent crime. Some nationalities report levels lower than South Africans, and some higher.

However, there does seem to be a correlation between reported levels of violent crime and economic competitiveness: the nationalities whose shops are more expensive reported lower levels of violent crime, while those whose shops are cheaper reported higher levels. This suggests that the chance of being violently targeted is less about nationality, and more about whether you keep prices low and (presumably) profits high. However, the reality is more complicated as the nature of the crime experienced by the more successful shopkeepers differs by nationality. Hence, Somali shopkeepers endure much more violent crime than Bangladeshi shopkeepers. Not only do these findings challenge the myth that all foreign spaza shops are more competitive than South African shops, but also the assumption that all foreign shopkeepers experience the same levels and, especially, forms of violence.

Keywords: Informal economy, retail business competition, migration, nationality, xenophobia.

Introduction

The last ten years has seen growing public awareness of violent attacks against foreign shopkeepers in South Africa, especially those who run spaza shops. Notably, most xenophobic attacks have occurred in poor, black urban settlements called townships that were created as dormitories for cheap labour under apartheid (Fauvelle-Aymar & Segatti 2011), and which remain the first point of settlement for most migrants into the city, including those from the rest of Africa. As the most densely populated and often poorest areas in the country, townships have high levels of unemployment and significant levels of informal economic activity. Central to the informal economy of the township is the spaza shop, or neighbourhood grocery or convenience store, which is the second most common form of informal micro-enterprise in South African townships after alcohol retail establishments known as 'shebeens' (Charman et al. 2013).

In the last ten years, the spaza sector has witnessed the rise of foreign ownership, principally by migrants from the rest of Africa, but also by Bangladeshi and other South Asian migrants (Charman et al. 2012). This change of ownership has impacted on township life in several ways, and is often cited as one reason behind the xenophobic attitudes and attacks evident in South Africa, especially since 2008. Hence, popular explanations of violence against foreigners include allegations that foreign migrants are taking jobs, women, state grants and other social opportunities that rightly belong to South Africans only. After the large-scale attacks on more than 100 small businesses in Port Elizabeth in 2013, the Global Post reported that 'many people accuse "foreigners" of taking their jobs, or of putting South African shopkeepers out of business by undercutting their prices' (Conway-Smith 2013). Similarly, in 2012, the Somaliland Press reported that mobs tell Somalis to leave South Africa, in part because they 'fear that they will take their jobs, townships, businesses and eventually their country' (Hussein 2012).

Claims that foreigners are illegitimate competitors for scarce resources are made frequently around the world. This is currently evident in the UK, from UKIP (UK Independence Party) and the reaction by the Conservative Party on the immigration issue. Other examples abound, from countries including Belgium (Zagefka et al. 2007), Israel (Pedahzur & Yishai 1999; Semyonov et al. 2002), Germany (Wimmer 1997), Turkey (Zagefka et al. 2007), the United States (Citrin et al. 1997) and South Africa (Crush 2008 & Everett 2011). Notably, although often dismissed as not the real or main reason behind xenophobic attacks both internationally (Wimmer 1997) and in South Africa (Hickey 2014), there is evidence that foreign traders have impacted on the local informal economy of the urban township and informal settlements. This impact is manifest both in the increasing number of foreign-run shops, but also by competition with South African shopkeepers on price (Africa Unite 2007; Department of the Premier 2007). Hence, a number of studies (Charman et al 2012 & Gastrow & Amit 2013) have identified competition on price as a central reason for the rise of the Somali spaza owners and the decline of South African-run shops.

This development is important economically as competition on price is not a practice historically embraced by South African township traders (Charman & Petersen 2007), whose motivations for trading are not necessarily 'reducible to the idea of "maximisation of profit"' (Neves & Du Toit 2012: 131). In addition, this development is important politically in that it forms a point of potential social conflict that can be used to justify xenophobic attacks. For example, in a recent article in The Star on 13 June 2014, Landau and Freemantle (2014) describe how xenophobic attacks are motivated by a discourse that blames a group for an individual's alleged crimes. They cite the case of 'marauding groups' making their way through Mamelodi, and forcing foreigners, especially foreign shopkeepers, to leave the township 'largely unencumbered by resistance from the police or residents.' Landau and Freemantle (2014) point out that these mobs often escalate out of banal conflicts between individuals, a practice they liken to 'Sippenhaft', a term popularised during the Nazi regime that literally means 'kin liability', and holds a whole group of people responsible for an individual's purported crime. The point is that the increase in foreign-owned spaza shops, ostensibly at the expense of South African shopkeepers, can form an issue on which this kind of xenophobic discourse can fixate, and around which mobilisation and violence can occur (Hickel 2014).

Notably, Landau and Freemantle (2014) point out that the possibility of this kind of xenophobic mobilisation exists due to institutional failure on the part of the state, not least around formal policing. Further, this institutional failure is exacerbated by the reluctance of the police to take the problem of xenophobia and xenophobic attacks seriously. Writing on Politicsweb on 19 June 2014, Peter Fabricius argues that the 'South African government mostly dismisses xenophobic violence as "ordinary criminality." Perhaps that explains why it now seems to be becoming routine in South Africa - almost accepted as an inevitable part of the South African way of life, like other violent crimes.'

Consequently, what follows in this article takes great care to interrogate carefully, systematically, and in ways well supported by evidence, claims about price competition and violent crime in the spaza sector and their relationships with nationality. What emerges is a picture very different from popular discourse in at least two respects. First, the notion that the 'foreign' shopkeeper out-competes the South African shopkeeper is largely inaccurate. If one compares spaza shops on price then South Africans are actually slightly cheaper on average than Mozambicans and Zimbabweans, although more expensive than Bangladeshi and Somali shopkeepers. Further variation is evident by area and by product. Second, the idea that foreign shopkeepers bear the greatest burden of violent crime is also not sustained by the evidence. Once again we found that reported levels of violent crime fo r shopkeepers varied by nationality where South Africans reported higher levels of crime than Mozambicans and Zimbabweans, but less than Somalis and Bangladeshis. Again, more variety is introduced by area and form of violence. Lastly, where there is a correlation between price and violent crime, the nature of the crime differs significantly by nationality, suggesting that variables other than price also matter.

Methodology

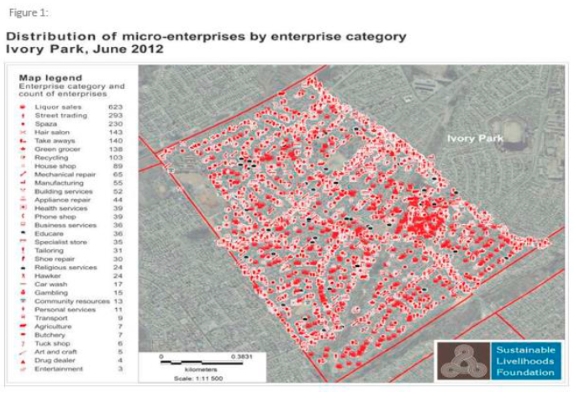

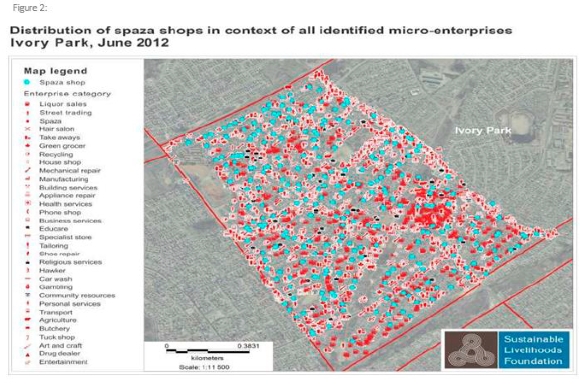

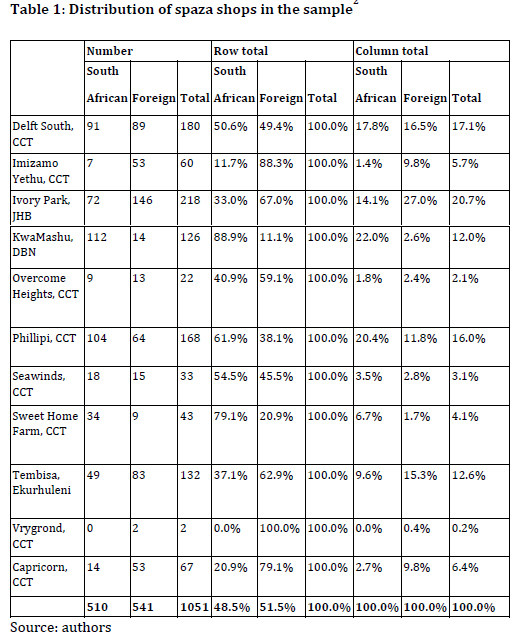

The data used in this article comes from surveys conducted with over 1050 spaza shopkeepers nationwide. More specifically, the data comes from eleven local-area censuses conducted in townships and informal settlements in Cape Town, Gauteng and Durban by the Sustainable Livelihoods Foundation (SLF) from 2011-20131. In each of the eleven sites, a team geo-located each identifiable business on each street, and conducted semi-structured surveys with all the traders from each of the main business types, including spaza shops. The surveys were conducted by the SLF team in English, or in the language of the respondent where possible (the team included isiXhosa, Afrikaans, Isizulu and Somali speakers). Across the whole sample, the survey revealed shopkeepers from the following countries: Angola, Bangladesh, Burundi, DRC, Egypt, Ethiopia, Lesotho, Mozambique, Namibia, Pakistan, Rwanda, South Africa, Tanzania and Zimbabwe. Figure 1 is an example of the entire census for one area, Ivory Park, in Gauteng. The spaza shops are highlighted in Figure 2. The areas and number of spaza shops by nationality are described in Table 1 below.

If one examines Table 1, it is clear that Ivory Park accounts for the highest share of the overall sample (20.7%), followed by Delft South (17.1%) and Phillipi (16.0%). Vrygrond accounts for the lowest share (0.2%), followed by Overcome Heights (2.1%) and Seawinds (3.1%). Looking at the South Africans only, it is interesting that Ivory Park no longer accounts for the largest share, but it is rather KwaMashu (22.0%), followed by Phillipi (20.4%) and Delft South (17.8%). In contrast, looking at the foreigners only, the Ivory Park share is the highest (27.0%), followed by Delft South (16.5%) and Tembisa (15.3%). In terms of row, it is notable that the South African share is clearly dominant in KwaMashu (88.9%), Sweet Home Farm (79.1%) and Phillipi (61.9%). However, the foreigners' share is more dominant in Vrygrond (100.0%, note that there are only two respondents), Imizamo Yethu (88.3%), Capricorn (79.1%) and Ivory Park (67.0%).

Development Southern Africa.

Notably, while the data for each site is SLF census data, and therefore is representative of the site, the collation across the eleven sites does not constitute a representative national sample. Thus, while the sheer size and spatial spread of the sample is suggestive, as are the recurring spatial patterns in respect of business types (for example spaza shops are always evenly spread across a settlement), it is not a basis from which to generalise statistically to the rest of the country. Hence, while we can have near absolute levels of confidence in the claims in respect of each site, we cannot have the same confidence when speaking of the country as a whole.

The key data used in this article is not spatial data but rather the data collected from surveys with over 1050 shopkeepers across the eleven sites. This data is linked to two main variables: prices of key products and experiences of violent crime. In terms of prices we asked each shopkeeper the price of their 12 most common products, namely: 1 litre milk, 6 eggs, a loaf of white bread, a half loaf of white bread, 250g sugar, 500g sugar, 340ml Coke, 1.5 litre Coke, Jive, Double O, premium cigarettes and economy cigarettes. These items form the basis of a price comparison across site and by nationality that allow us to interrogate the claim that foreign shopkeepers are more price competitive than South Africans. In terms of violent crime, we asked each shopkeeper to list each incident of the following for the previous five years: murder, attempted murder, armed robbery, theft, assault, arson and harassment. This data forms the basis of analysis of levels of violent crime across the sample and by nationality too.

Three key assumptions inform the subsequent analysis. The first assumption is that foreign shop keepers are first generation migrants. While we did not ask this in the surveys, we are confident that this is overwhelmingly the case both from our experience in the field, but also from the fact that, due to the racist policies of the apartheid era, migration into South Africa's townships from the rest of Africa only began on any scale in the late 1990s. The second assumption is that shops with cheaper prices will not only outcompete more expensive rivals in terms of attracting more customers, but also be more profitable due to higher turnover. Indeed there is strong qualitative evidence to this effect from both Somali and South African shop keepers in a previous study (Charman et al. 2012: 66-7). The third assumption is that reporting on experiences of crime is the same across all types of respondents. While there are problems with this, as some foreign shop keepers may feel more vulnerable than locals and thus be less likely to report issues, we attempted to counter this by using Somali surveyors for Somali respondents, and by verifying mull reports of crime with the neighbours of the shopkeepers.

Unpacking Spaza Competitiveness

In what follows the article unpacks the sample of shopkeepers spatially and by nationality, demonstrating both that South Africans constitute the single largest nationality in the sample, and that very different nationalities are found in each of the three cities. This is the first way in which the 'foreign' can be disassembled in terms of spaza shops in South Africa. Second, the article examines the amount of stock found in spazas by nationality, demonstrating that some nationalities (Zimbabweans and Mozambicans) hold less stock than South Africans, suggesting fewer resources, while others hold more. Further, the article compares the average price of products, demonstrating that for a basket of the top 12 goods Somali and Bangladeshi shopkeepers are the cheapest, but that Zimbabweans and Mozambicans are more expensive than South Africans. Both these insights further disassemble the foreign/South African distinction. Indeed, the only products on which all foreigners out-compete South Africans on average price are 6 eggs and economy cigarettes. Notably, against the mainstream view, South Africans out-compete most foreigners on prices of 1l milk and the loaf of white bread.

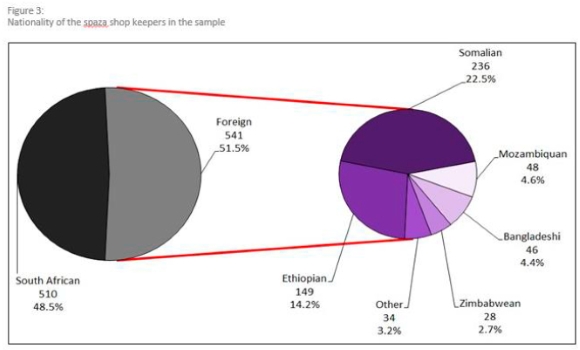

a.Nationality and spatiality

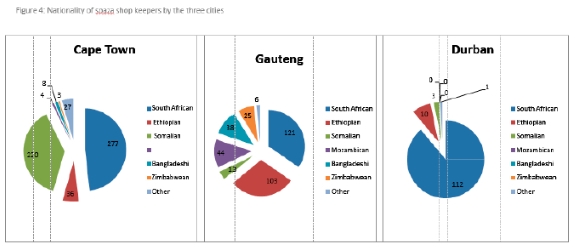

To begin with the nationality of shopkeepers, Figure 3 demonstrates that 510 of the 1051 (48.5%) respondents are South Africans, and the remaining 541 (51.5%) are foreigners. Taken as a whole then, the sample is divided roughly 50:50, South African to foreign, but actually there are more than double the number of South Africans shopkeepers than the 236 Somali shopkeepers, who constitute the second most common nationality. Furthermore, as revealed in Figure 4, when unpacked spatially, the distribution of nationalities varies tremendously by city where 220 of the 236 (93%) Somali shopkeepers are found in Cape Town, 103 of 149 (70%) Ethiopian shopkeepers are in Gauteng, as were 38 of 46 (83%) of Bangladeshi shopkeepers. Therefore, the identity of 'foreign' shopkeepers differs quite profoundly from area to area, and is of little use in identifying the actual nationalities involved in any city. Thus, 'foreign' shopkeepers in Johannebsurg are very different nationalities from 'foreign' shopkeepers in Cape Town.

b.Spaza stock

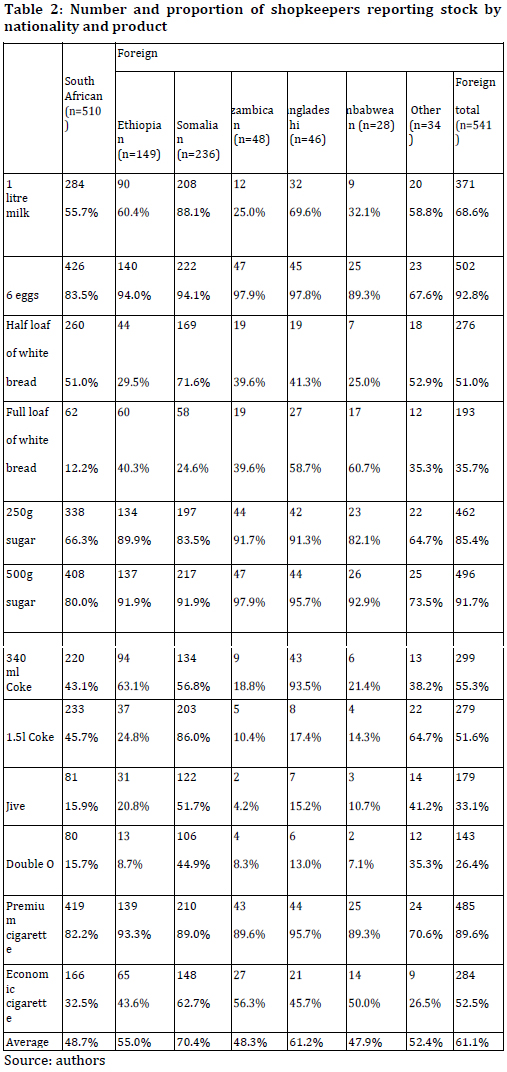

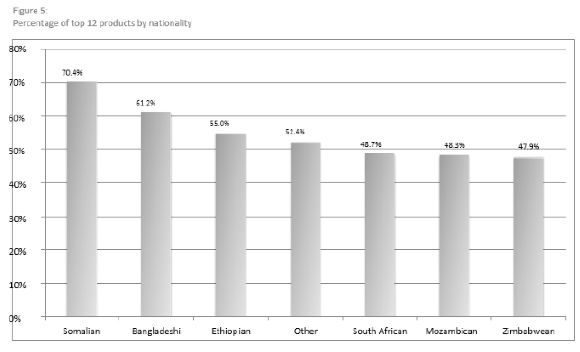

While spaza shops stock a wide variety of goods, we identified the 12 most common products from our survey. Moreover, if one analyses the extent to which shopkeepers have these 12 items in their shops, and break this down by nationality as in Table 2 and in Figure 5, then once again the South African versus foreign contrast quickly breaks down. Instead, we find that South Africans are more likely to have a half loaf of white bread on their shelves than most other nationalities. Conversely, Somalis and Ethiopians are more likely to stock sugar than most other nationalities, and Mozambicans and Bangladeshis almost always have eggs in their stores. Further, if one treats the 12 products as a basket of goods, then South Africans generally have more stock than Zimbabwean and Mozambican shopkeepers but less than other nationalities. Also notable, the Somali and Bangladeshi - and perhaps the Ethiopian - shopkeepers have significantly more on the shelves than other nationalities.

c. Pricing

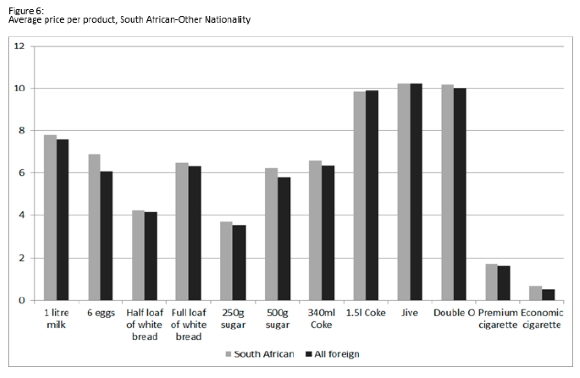

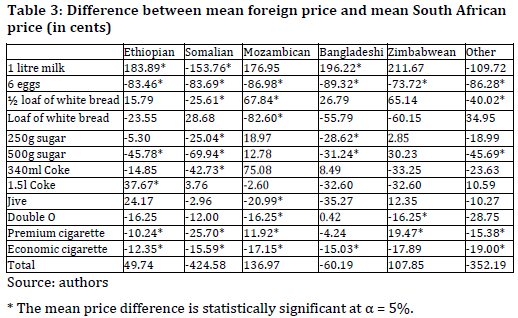

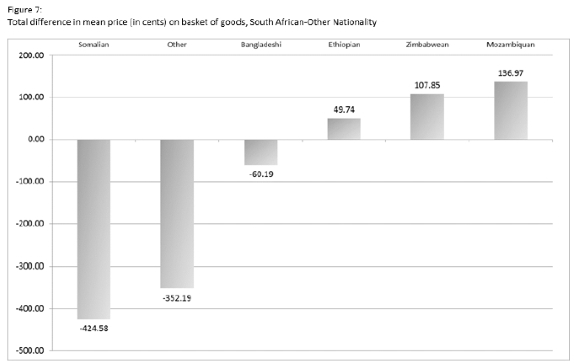

At the centre of the claim that foreign shopkeepers out-compete South Africans is the idea of price competition, specifically the claim that foreign shopkeepers have lower prices than South Africans. This appears to be confirmed by Figure 6, where foreign prices are slightly cheaper than South African, with the exception of Coke. However, once one disaggregates this by product and nationality, the contrast breaks down. Hence, as can be seen from Table 3, only on eggs and economy cigarettes are all foreign traders cheaper on mean price than South Africans, but South Africans are cheaper on 1l milk and a loaf of white bread than almost all other nationalities. Perhaps more tellingly though, on 24 of a total of 72 prices, South Africans are cheaper than all others, suggesting that the real difference on average prices is not large.

This claim is confirmed by Figure 7 which compares the mean price per product between South African shopkeepers and those of other nationalities. Here the difference in mean price on a basket of goods is significant, with Somalis being the cheapest by over R4. Critically however, South Africans are mid-table, with only Somali, Bangladeshi and other smaller nationalities being cheaper. Somewhat remarkably, given the common discourse, Ethiopian spaza shopkeepers are more expensive across a basket of goods, with Mozambicans and Zimbabweans at the bottom of the list at over R1 more per basket.

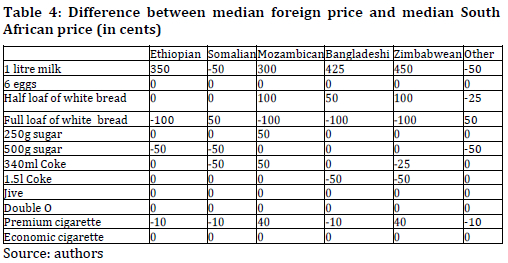

This picture is confirmed by a comparison of the difference between South African and other nationalities on median price per product, as in Table 4. The key point here is that there is no difference on median price by nationality for 40 of the 72 possible prices, or 56% of all price comparisons. Indeed, if one removes milk and bread, the remaining median price differences are less than 50c. In sum, price differences are generally small, and those that do exist, do not follow the South African/foreign divide. Hence South Africans sell the cheapest milk and Bangladeshi's sell the cheapest Coke.

Note: It is only possible to test whether the foreign price is statistically significant from the South African price at the mean (see Tables 5 & 6), but not at the median.

In conclusion, our analysis suggests that Somalis and Bangladeshis have the most stock, and are cheaper on average than others, whereas Zimbabweans and Mozambicans have the least stock and are more expensive on average. Overall though, price differences are small as suggested by the convergence on median prices. The one partial exception to this may be Somalis who are relatively more competitive than Mozambicans and Zimbabweans. So there is an asymmetry in the data that may be worth further exploration - especially given the findings of the following section.

Unpacking Violent Crime

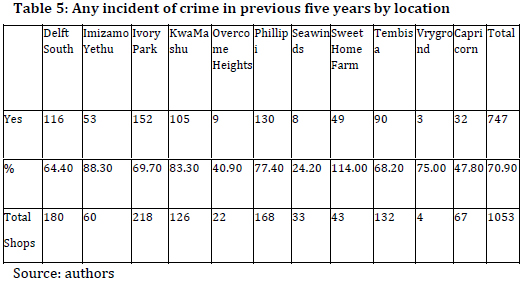

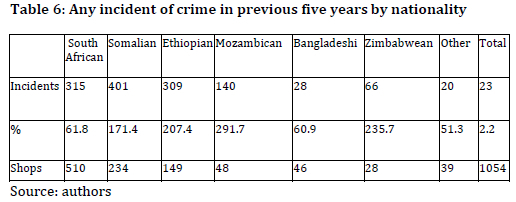

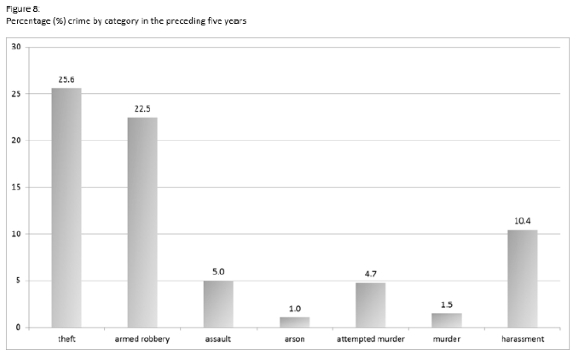

In this section the article unpacks the reported levels of violent crime against spaza shopkeepers in the last five years. It is critical to note that most shopkeepers had not been in the shop for all of the preceding five years, so actual levels of crime will be under-reported rather than over- reported. Nevertheless the levels of crime reported across our seven categories (theft, armed robbery, assault, arson, attempted murder, murder and harassment) were high. Hence, some 747 of a possible 1054 spaza shops, or 71%, had experienced at least one incident of crime in the preceding five years. Furthermore, of our seven types of crime, only theft can be argued not to involve the exercise of violence or the threat of violence. Hence, some 470 of 1054 or 45% of shops reported a violent crime in the preceding five years. This distinction will become important when considering the difference between Somali and Bangladeshi shopkeepers below. When unpacking all these incidents as per Figure 8 it is clear that theft is the most common crime, affecting over 25% of all shops, with armed robbery affecting nearly another quarter. In short, robbery, armed or not, constitutes nearly the majority of reported crimes from spaza shops, and is thus the greatest single risk that spaza shopkeepers face.

d. Spatiality and violent crime

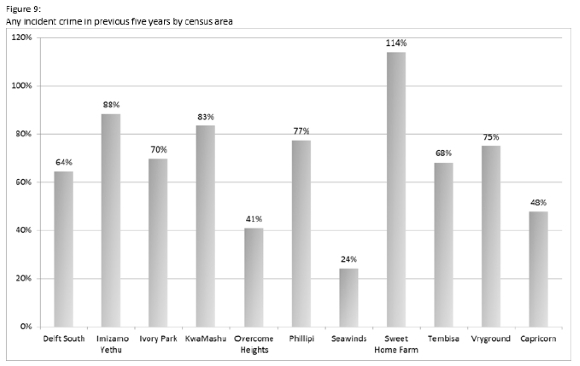

Aside from these generalisations, the experience of crime by spaza shopkeepers varies dramatically by area and nationality. Thus, as revealed in Table 5 and Figure 9, there is a significant difference in the extent of crime across our eleven sites, with Sweet Home Farm reporting 49 incidents at 43 spaza shops in the last five years (114%) and Seawinds coming in as the safest with just 24%. Further, this difference does not seem to correspond to settlement type as Overcome Heights is also a smaller informal settlement like Sweet Home Farm and had the second lowest crime rate at 41%. Perhaps there is some convergence in the larger townships, with Ivory Park, KwaMashu, Phillipi and Tembisa close to the 70% mark. Lastly, it seems clear that theft and robbery make the most important difference to these overall figures, as the top three sites of Sweet Home Farm, Imizamo Yethu and KwaMashu report combined theft/robbery figures of 67.5%, 63.3% and 62.7%, and the bottom three of Capricorn, Overcome Heights and Seawinds report combined figures of 31.3%, 36.4% and 18.2%.

e. Nationality and violent crime

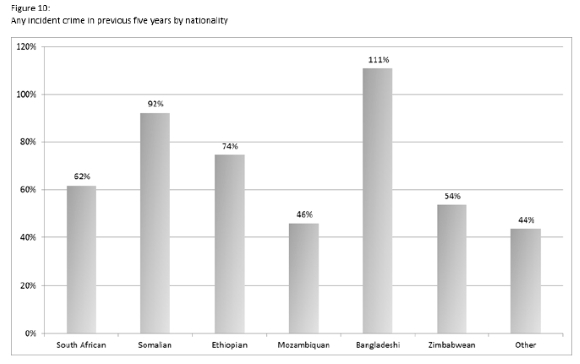

In addition to these spatial differences, Figure 10 reveals similarly divergent experiences of crime by nationality. Thus, in descending order, Bangladeshi, Somali and Ethiopian shopkeepers reported rates of 111%, 92% and 74% respectively, whereas the lowest affected groups were Zimbabwean, Mozambican and other foreign at 54%, 46% and 44%. South Africans are right in the middle at 62%. Immediately there is an obvious and suggestive correlation with the rank order of violent crime and the rank order of price competitiveness. First however, it is important to unpack more of the differences between Bangladeshi and Somali experiences of violent crime.

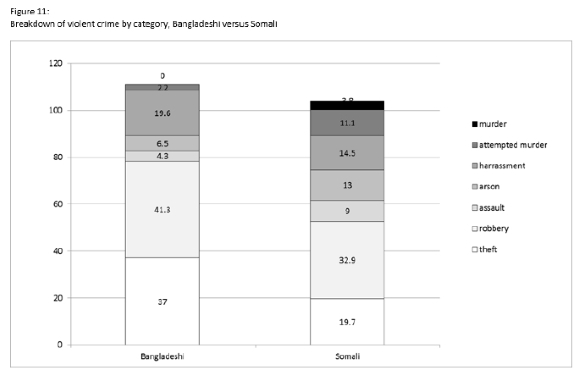

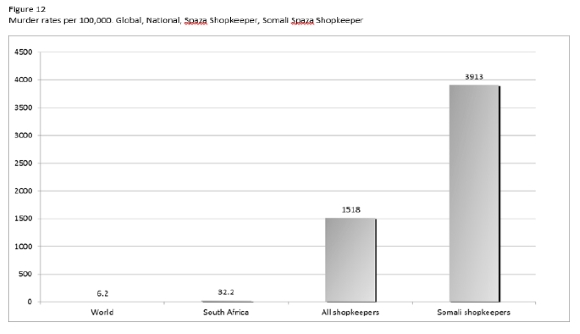

Bangladeshi shopkeepers reported higher crime levels than all other nationalities in the categories of theft, armed robbery, arson and harassment. Thus 37% of Bangladeshi shopkeepers report theft (South Africans are the next highest at 28%), 41% report armed robbery (Somalis are the next highest at 33%), 7% report arson (Ethiopians are the next highest at 2%) and 20% report harassment (Zimbabweans are the next highest at 18%). In contrast, Somalis are first in the categories of assault at 9% (Ethiopians are second at 5%), attempted murder at 11% (Ethiopians are second at 5%) and murder at 4% (South Africans are second at 1%). Hence, as confirmed in Figure 11, the nature of the violent crime experienced by the two most vulnerable groups, Somali and Bangladeshi, is quite different, with Somalis being exposed to significantly more extreme forms of violence. Indeed, as illustrated by Figure 12 which compares global murder rates per 100 000 (6.2), to the country (33.2), to all spaza shopkeepers in our sample (1518), to Somali shopkeepers (3913), it is clear that running a spaza shop is dangerous. The risk of murder increases to 46 times the national average, and for Somali shopkeepers to over 100 times higher than the national average.

In sum, the risk of violent crime does not subscribe to the South African/foreign divide often invoked in popular discourse, but varies by area, nationality and type of crime. The analysis suggests that cheaper, and presumably more profitable, shops are more likely to experience crime than more expensive profitable shops. However, this needs further research, given the significant difference in types of crime experienced by the more successful Bangladeshi and Somali shopkeepers. Other factors clearly impact on this relationship.

Conclusion

The main conclusion of this article is that speaking of spaza shops as foreign conceals more than it reveals, both in terms of business competition and in terms of violent crime. It simply is not true that foreign shops are out-competing South African shops, and conversely, that South African shopkeepers experience less violent crime than foreign shopkeepers. To make the point another way, accurate claims can only be made when they refer to some combination of nationality, area and product/form of violent crime. Further, it is notable that the cheaper shops do tend to report more crime than the expensive shops, suggesting an economic motive for most violent crime experienced by spaza shops. However, this correlation needs further exploration as the nature of the crimes experienced by Somali and Bangladeshi shop keepers differs significantly, with Somali shopkeepers enduring higher levels of violence. Perhaps this has something to do with business practice and violent entrepreneurship (Charman & Piper 2012; Liedeman 2013), or the spatial location of businesses, or perhaps with other factors like social integration (Gastrow & Amit 2012; Gastrow 2013). We simply do not know.

Lastly, and very importantly, the claim of a correlation between spaza price and violent crime is not a causal claim. In fact, it is not even a proper correlation as it is yet to be tested statistically. At best it is suggestive of a line of further research - albeit one that makes intuitive sense as one would expect shops perceived to have more money to be more targeted by criminals. Even more importantly, the claim of a correlation between spaza prices and violent crime is not to be confused with the claim that xenophobic attacks are motivated by economic reasons. Our unit of analysis in this study was the spaza shop not the xenophobic attack, and so we have not explored the latter at all, and hence are not claiming any relationship between xenophobic attacks and economic interests. This is a crucial distinction often lost in the discourse around spaza shops, xenophobia and xenophobic attacks, both on the side of the state and on the side of refugee rights groups. Rather, as noted in the introduction, the concern of this article is the way in which mundane daily conflicts between individuals can be seized upon by xenophobes and incorporated into xenophobic discourse to motivate and justify xenophobic violence.

References

Africa Unite. 2007. Masiphumelele small business survey: A study for the Department of the Premier. Cape Town: Provincial Government of the Western Cape. [ Links ]

Citrin, J, Green, DP, Muste, C. & Wong, C. 1997. Public opinion toward immigration reform: The role of economic motivations. The Journal of Politics, 59: 858-881. [ Links ]

Charman, A. & Petersen, L. 2007. Informal economy study: Trade component. Micro economic development strategy. Research Report. Cape Town: Provincial Government of Western Cape. [ Links ]

Charman, A. & Piper, L. 2012. Xenophobia, criminality or violent entrepreneurship? Violence against Somali shopkeepers in Delft South, Cape Town, South Africa. South African Review of Sociology, 43(3): 81-105. [ Links ]

Charman, A, Petersen, L. & Piper, L. 2012. From local survivalism to foreign entrepreneurship: The transformation of the spaza sector in Delft, Cape Town. Transformation, 78: 47-73. [ Links ]

Charman, A, Petersen, L. & Piper, L. 2013. Enforced informalisation: The case of liquor retailers in South Africa. Development Southern Africa. 7 Aug. From <http://bit.ly/2a1FJrr> (Retrieved 23 June 2016).

Conway-Smith, E. 2013. Not Wanted Somalis in South Africa. Global Post. From <http://bit.ly/1dgyIbx> (Retrieved 23 June 2016).

Crush, J. (Ed). 2008. The perfect storm: The realities of xenophobia in South Africa. Southern African Migration Project. From <http://bit.ly/2aiRf2p> (Retrieved 23 June 2016).

Department of the Premier: Western Cape, 2007. Documenting and evaluation report: Masiphumelele conflict intervention, August 2006-March 2007. Cape Town: Provincial Government of the Western Cape. [ Links ]

Everett, D. 2011. Xenophobia, state and society in South Africa, 2008-2010. Politikon, 28(1), 7-36. [ Links ]

Fabricus, P. 2014. 'Is xenophobia becoming part of the SA way of life?' Politicsweb, June 19, 2014. From <http://bit.ly/2aeIaox> (Retrieved 23 June 2016).

Fauvelle-Aymar, C. & Segatti, A. 2011. People, space and politics: An exploration of factors explaining the 2008 anti-foreigner violence in South Africa. In: Landau, L. (Ed). Exorcising the Demons Within: Xenophobia, Violence and Statecraft in Contemporary South Africa. Johannesburg: Wits University Press. [ Links ]

Gastrow, V. & Amit, R. 2012. Elusive justice: Somali traders access to formal and informal justice mechanisms in the Western Cape. ACMS Research Report 38. From <http://bit.ly/2a2v2nN> (Retrieved 23 June 2016).

Gastrow, V. & Amit, R. 2013 Somalinomics: A case study on the economics of Somali trade in the Western Cape. ACMS Research Report 42. From <http://bit.ly/2adkZyh> (Retrieved 23 June 2016).

Gastrow, V. 2013. Business robbery, the foreign trader and the small shop: How business robberies affect Somali traders in the Western Cape. SA Crime Quarterly, 43: 5-16. [ Links ]

Hickel, J. 2014. 'Xenophobia' in South Africa: Order, chaos, and the moral economy of witchcraft. Cultural Anthropology, 29(1): 103-127. [ Links ]

Hussein, Q. 2012. From <http://bit.ly/2aeI3t9>. Somaliland Press. (Retrieved 23 June 2016).

Landau, L. & Freemantle, I. 2014. 'Mob Justice that's Based on Nationalisty', The Star, 13 June. From <http://bit.ly/2a1G8Km> (Retrieved 23 June 2016).

Liedeman, R. 2013 Understanding the internal dynamics and organisation of spaza shop operators: A case study of how social networks enable entrepreneurialism among Somali but not South African traders in Delft South, Cape Town. MA Thesis, Political Studies. Cape Town: University of the Western Cape. [ Links ]

Neves, D. & Du Toit, A. 2012. Money and sociality in South Africa's informal economy. Africa, 82(01): 131-149. [ Links ]

Pedahzur, A. & Yishai, Y. 1999. Hatred by hated people: Xenophobia in Israel. Studies in Conflict & Terrorism, 22(2): 101-117. [ Links ]

Semyonov, M, Raijman, R. & Yom-Tov, A. 2002. Labor market competition, perceived threat, and endorsement of economic discrimination against foreign workers in Israel. Social Problems, 49(3): 416-431. [ Links ]

Wimmer, A. 1997. Explaining xenophobia and racism: A critical review of current research approaches. Ethnic and Racial Studies, 20(1): 17-41. [ Links ]

Zagefka, H, Brown, R, Broquard, M. & Martin, S.L. 2007. Predictors and consequences of negative attitudes toward immigrants in Belgium and Turkey: The role of acculturation preferences and economic competition. British Journal of Social Psychology, 46: 153-1 [ Links ]

1 See http://livelihoods.org.za/informality/micro-enterprises/

2 The price tables 1 to 4 were generated by Dr Yu or Economics at UWC as part of our drafting an article on spaza prices and nationality, forthcoming as Piper & Yu. 2016. Deconstructing 'the foreign': The limits of citizenship for explaining price competition in South African spazas.