Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

African Human Mobility Review

versão On-line ISSN 2410-7972

versão impressa ISSN 2411-6955

AHMR vol.1 no.2 Cape Town Mai./Ago. 2015

ARTICLES

An Evaluation of the Determinants of Remittances: Evidence from Nigeria

Temitope J. LaniranI; Daniel A. AdeniyiII

IGraduate Assistant at the Centre for Petroleum, Energy Economics and Law, University of Ibadan, Nigeria and a Doctoral Researcher at the Bradford Centre for International Development, University of Bradford, United Kingdom. Email: lanirantemitope@gmail.com

IIAssociate Programme Officer at the Centre for Petroleum, Energy Economics and Law, University of Ibadan, Nigeria and a Doctoral Researcher at the Institute for Social Development, University of the Western Cape, South Africa. Email: adeolu.adeniyi@yahoo.com

ABSTRACT

International remittances have grown to become an integral source of finance for development. Existing literature posits that there is an association between remittances and growth in developing countries. Economic growth models highlight the importance of capital accumulation and high level financial flows, the inadequacy of which characterizes developing countries and often explains their fate. It is argued that remittances will provide a panacea to the serious poverty experienced in such developing economies by increasing financial flows and household income, which in turn stimulates consumption, savings, economic growth and ultimately development. The robustness of this relationship is, however, often questioned. Indeed, the propensity of remittances to achieve these aspirations very much hinges on the determining factors motivating the remitters and the magnitude of the remittances. Hence, given the significant flows of remittances to the developing countries, this study attempts an analysis of the determinants of remittances to Nigeria. Key macroeconomic variables with theoretical potentials of influencing the level of remittances received were subjected to econometric model testing using time series data from 1980 to 2013. The results indicate that the level of remittances received is more a function of portfolio motives than other macroeconomic factors.

Keywords: migration, motivation, investment, growth, development.

Introduction

International remittances have increasingly grown to become an integral source of finance for development. Remittances represent a vital source of income for poor households and a significant contributor to the gross domestic product (GDP) of nations, especially developing countries. Evidence abounds that money sent home by emigrants makes up quite a large share of the revenue of most developing economies, sometimes larger than that of official development assistance (Gupta, 2005; Hagen-Zanker & Siegel, 2007; Singh et al., 2010; Costantinescu & Schiff, 2014; World Bank 2014a; 2014b). Irrespective of the financial crisis plaguing the world, globally remittances have grown rapidly, especially between 1990 and 2000, and then trebled in the following decade, reaching US$335 billion in 2008 and US$489 billion in 2011 (UNCTAD, 2012). In 2013, remittances to developing countries accounted for 74.5% of global remittances; these countries received remittance inflows in the region of US$404 billion. This figure was three times the size of official development assistance and, with the exception of China, remittance flows to developing countries were significantly larger than total foreign direct investment (World Bank, 2014a).

It is indeed a truism that poverty is pervasive throughout the world and often palpable in most developing countries. Globally, it is estimated that 14.5% of the world's population live in conditions of extreme poverty. In Nigeria, the situation is much worse, as 62% of the nation's population are in extreme poverty (World Bank, 2015). When living standards are low and chances of improvement few and far between, people resort to leaving the shores of their own country in search of better opportunities. Migration and remittances thus go hand in hand as migrants transfer funds back to their country of origin from their destination country. The number of emigrants from Nigeria as a percentage of the population, according to the World Bank (2011), was 0.6% as at 2010. In 2013 Nigeria received remittance inflows of around US$21 billion (World Bank, 2014b), representing 0.4% of the nation's GDP. Evidently therefore, remittances to Nigeria represent a significant source of foreign exchange.

Few studies have been carried out on the determinants of remittances to Nigeria. Most of these studies have tended to lay emphasis either on the micro level or have distinguished the determinants of remittances to urban or rural areas. However, the macroeconomic determinants of remittances to Nigeria remain relatively unknown. This study seeks to assess the macroeconomic determinants of international remittances in Nigeria.

Background to Remittances in Nigeria

Over the years, migrants' remittances to Nigeria have increased steadily and have now become a significant proportion of the financial inflows into the nation. This is partly due to the increasing numbers of Nigerians in diaspora, for, as Constantinescu and Schiff (2014) point out, an increase in international migration is a major factor driving the growth of global remittances. Nigeria has a population of about 173 million (World Bank, 2014a), accounting for nearly one-fourth of the total population in sub-Saharan Africa and ranking as the seventh most populous nation in the world (World Bank, 2014b).

Among the developing economies, Nigeria is the fifth largest recipient of remittances and the largest in Africa, receiving a total of US$21 billion in remittances in 2013. Indeed, Nigeria became the largest recipient of remittances in sub-Saharan Africa in 1990, and since 2006 has been the largest recipient in Africa, including North Africa (Nyamongo et al., 2012). According to the World Bank (2014a), Nigeria's remittance receipts in 2014 were projected to be US$22.3 billion. This represents an amount that is US$14.4 billion higher than the combined sum received by the other top ten largest recipients of remittances in sub-Saharan Africa. Second to Nigeria, in sub-Saharan Africa, is Senegal with total remittance receipts of US$1.7 billion - just 7.6% of the total remittances to Nigeria. The foregoing has made Nigeria a consistent feature in the remittance discourse.

Determinants of Remittance: A Review of the Literature

The international remittance literature has highlighted several motives driving migrants to send remittances and these are usually addressed at the micro or macro level. At the micro level, on the one hand, the three rationales that motivate migrants' remittances are altruism, self-interest and contractual motives. On the other hand, remittances are categorized at the macro level based on the assumption that flows of international remittances can be countercyclical, procyclical or acyclical.

The altruism rationale holds that remittance flows increase as the migrants' income as well as extent of altruism increases and vice versa. It also predicts that a 1% increase in the migrant's income associated with a 1% decrease in the recipient's income will increase transfer by 1%. This implies that high income migrants will remit more and low income recipients will obtain more. Remittances also increase both by the extent of closeness between the migrant and the receiving household and the migrant's aim to return. Also, as the number of migrants in a family increases the remittances from a given migrant decrease (Funkhouser, 1995). While some studies have found the foregoing to be true (see, for example, Lucas & Stark, 1985; Carling 2008), quite a few studies have opposed the altruistic motive for sending remittances. Altonji et al. (1997) using data on personal private transfers and accounting for cash constraints, number of relatives, and uncertainty, rejected the null hypothesis and estimated a transfer-income derivate. Their results showed that consumption allocation was dependent on the allocation of income.

Remittances for self-interest are usually motivated by the desire to enhance social status, keep the connection with parents for inheritance purposes, or as investment either towards the future or with the intention of returning back to the home country. For instance, the investment may take the form of harnessing the human capital of the migrant's own children by remitting money to fund their education back home. Furthermore, a migrant may remit home to his parent in a bid to ensure that he is also taken care of in his old age or he may desire to invest in housing or livestock at home, in which case a family member back home may serve as the agent. While the latter is what Hagen-Zanker and Siegel (2007) refer to as the demonstration effect, the former has the effect of enhancing the migrant's social status at home.

Remittances could also be driven by contractual motives, in which case remittances serve either as a form of exchange, loan repayment or coinsurance. In an effort to evade the problem of market failures in the home country, the new economics of labour migration (NELM) theory posits that a migrant leaves his or her home country to enter a non-correlated labour market to take advantage of the opportunities in the host country. Such migrants help their households in the home country to overcome shocks while the migrants may also receive support during times of unemployment in the host country. As such, remittances are bound to increase in response to shocks or a reduction in income of households. Aggregate remittances, Singh et al. (2010) note, would thus be a function of income in the home country, wages in the host country and the total number of migrants. Remittances may also be seen as a form of loan repayments used in investing in human capital or expenses acquired in the process of migrating. The exchange theory is such that the quantity transferred increases as the quantity of services rendered increases but it reacts indefinitely to an exogenous increase in the beneficiary's prior-transfer income.

From the foregoing, the altruistic and exchange motive thus differ in terms of possibility for remittance. Cox et al. (1998) held that in the altruistic scenario the prospect of transfer lowers with the receiver's income but this is not so in the exchange scenario. This is because public transfers do not crowd out private transfers but rather prompt an increase in private flows received by recipients. However, if imperfect information exists, the migrants' wages might be fixed according to an evaluation of their efficiency. On the other hand, since recipients are protected against economic downturn through remittances, this may lead to moral menace (reducing their search for a job, reduction in labour output or investing in risky ventures) due to information asymmetry.

In a study that focused on altruism versus exchange (repaying loans for educational expenses) from parents to their offspring and vice versa in Peru over the 1980s, Cox et al. (1998) controlled for marital status, sex, education and for transitory and permanent transfers. Their probit result indicated that child-to-parent transfer was inversely related to the parent's income. They thus concluded that the exchange framework was stronger than that of altruism. They further found evidence transfers are in most cases to the sick and unemployed, which is consistent with the altruistic motive. They also found that private and public transfers are supplements rather than substitutes, in contrast to Jensen (2004), who argued that public transfers crowd out private flows in South Africa.

Becker (1974; 1991) examined the economics of households and the allocation of income among members of the family using the family as the unit of economic measurement. In a bid to analyse the "bequeath behaviour" of parents, he found that in making economic decisions, parents consider their children's reduced future utility. Aggarwal and Horowitz (2002) on the other hand aimed at deriving a model to test the assumptions related to the altruism and insurance motivations for remitting using data from Guyana. They found that the remittances of individual migrants reduce as the number of migrants in a household increases. This implies that remittances were motivated more by altruistism than insurance - to boost consumption levels and induce reciprocity.

In another vein, remittances are categorized at the macroeconomic level on the basis that remittance flows can be countercyclical, procyclical or acyclical. Remittance flows are classified as countercyclical if they serve as insurance, family safety nets or compensatory transfers (Gupta et al., 2009; Singh et al., 2010). It is assumed that remittances will act counter-cyclically in response to periods of hardship in the home country, hence migrants will remit more to their households during such periods. Remittances are procyclical if they are driven by investment and profit motives, and acyclical if driven by implicit motives such as family aid and other social responsibilities (Giuliano & Ruiz-Arranz, 2009). Remittances behaving procyclically are premised on the "optimization of investment" motive of migrants. This is what is referred to as the portfolio approach, in which case remittances respond positively to favourable macroeconomic indicators in the migrant's home country.

Indeed, empirical evidence on the relationship between the cyclicality of remittances and (economic) conditions in the countries of origin has been inconclusive. In terms of the association between remittances and income in countries of origin, some studies (such as El Sakka & McNabb, 1999; Chami et al., 2005; Mishra, 2005; Bouhga-Hagbe, 2006; Yang & Choi, 2007; Buch & Kuckulenz, 2009; Singh et al., 2010) have found a negative relationship between the two phenomena, hence there is evidence of counter-cyclicality as remittances increase with a reduction in income in the home country. On the other hand, some studies found evidence that remittances behaved either procyclically (see, for instance, IMF, 2005; Lueth & Ruiz-Arranz, 2007; Lin, 2011; Constantinescu & Schiff, 2014) or acyclically (Sayan, 2006; Yang, 2008). Remittances were also found to have increased in response to natural disasters (Clark & Wallsten, 2003; Gupta, 2005; Ratha, 2006; Yang & Choi, 2007; Yang, 2008; Jackman, 2013) and economic crisis (Hysenbegasi & Pozo, 2002; Kapur & McHale, 2005; Halliday, 2006). Similarly, Black et al. (2004) observed an increase in remittance flows to Ivory Coast during periods of conflict. Nabar-Bhaduri (2013) noted that remittances increased significantly to Sri Lanka since the 1980s in response to the civil war that broke out in 1983. The World Bank (2014a) observed an increase in remittance receipts to Haiti in response to an earthquake and to Pakistan as a result of devastating floods in 2010.

Empirical conclusions on the relationship between other related macroeconomic indicators and remittances have also been a mixed bag. While El-Sakka and McNabb (1999) and Singh et al. (2010) found a negative and significant relationship between interest rate differentials, Adams (2009) observed a significantly positive relationship between investment-induced remittances and real interest rates. Gupta (2005) and Chami et al. (2009), however, found in India and the developing countries respectively, that remittances and interest rates were not significantly correlated. In terms of exchange rate, Yang (2008) noted that Filipino emigrants sent less money when the Philippines currency depreciated. Contrastingly, Lin (2011) observed that remittances reduced in Tonga as the country's currency appreciated. Straubhaar (1986) and Chami et al. (2008), however, found that exchange rate variations did not affect flows of remittances.

Investigating the relationship between financial development and remittances, Freund and Spatafora (2008) used both transaction costs and the presence of a dual exchange rate system as proxies for financial development and observed that they both have a significant effect in reducing remittance flows. Using the presence of a black market exchange premium as a proxy for financial development, El-Sakka and McNabb (1999) observed a negative relationship between the foregoing and remittances. Evidently, the relationship between inflation and remittances in the literature is also not homogeneous. While El-Sakka and McNabb (1999) observed that remittance flows to Egypt increased with the country's inflation, Buch and Kuckulenz (2009) in their study of remittances to developing countries found an insignificant relationship between remittances and inflation. The latter authors opined that bad macroeconomic conditions could lead to emigration while they could inherently also reduce the origin country's rate of return. The foregoing, they concluded, may inadvertently lead to a vagueness of the effect of inflation on remittances.

Although a number of studies have been carried out on the determinants of remittances in Nigeria, most of these have focused on the microeconomic determinants of remittances (see for instance, Nwosu et al., 2012; Olowa et al., 2012). Nevertheless, Ajayi et al. (2009) and Ojapinwa (2012) analysed the macroeconomic determinants of remittances in Nigeria using the OLS method. The OLS approach is however prone to endogeneity problems. This research attempts an analysis of the macroeconomic determinants of remittances using the vector error correction model.

Methodology

The methodological approach utilized is a log specified model. The series used for the analysis are annual time series data expressed in natural logarithms with the sample period 1980-2013, and were sourced from the World Bank and the International Monetary Fund. The variables were log transformed considering the exponential growth pattern of some of the observations so as to avoid spuriousness in the relationship. Each variable was subjected to unit roots testing, using the Philip Perron (PP) unit root test. This choice is based on the advantage of PP test specifically when dealing with financial observations. PP test is unique in dealing with serial correlation and heteroskedasticity in errors. It corrects for serial correlation and heteroskedasticity in the errors by directly modifying the test statistics. PP unit root test is robust to general forms of heteroskedasticity in the error term ut, and does not require specified lag length. The Johansen co-integration test was then carried out to determine if the series are co-integrated. The presence of co-integration suggests long-run relationships among variables. Based on the finding of the unit root test and order of integration of the observations, we carried out a Vector Error Correction (VEC) analysis. This is consistent with Huana and Vargas-Silva (2005). They argued that the vector error correction model (VECM) is robust enough to handle endogeneity challenges between macroeconomic determinant variables and remittances. A crucial methodological issue in the literature on remittance determinants is the problem of non-stationarity. If there are at least two non-stationary series, chances are high for a spurious regression, albeit still having a reasonably high R2 value suggesting goodness of fit of model. Consequently, we identified the use of the ordinary least square as a weakness of some of the existing literature on remittance determinants using time series (see El-Sakka & McNabb, 1999; Aydas et al., 2005; Ajayi et al., 2009; Ojapinwa, 2012). We also tested for causality using the Granger causality test framework.

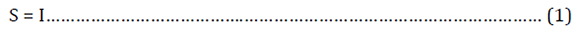

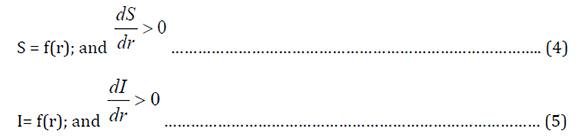

The empirical model used is derived from previous studies such as Buch and Kuckulenz (2009) and Singh et al. (2010), and this was adapted to suit the Nigerian context. Although Buch and Kuckulnez (2009) made use of illiteracy rate, population and age dependency ratio, we made use of school enrolment on the presumption that it gives an insight into the former variables. We also introduced home country deposit rate to our analysis. This is based on the classic theory of savings which has its foundation on two cornerstones; Say's law of supply and the quantity theory of money. These theories posit that Savings (S) and Investment (I) are equal. That is,

Both savings and investment are functions of interest rate (r);

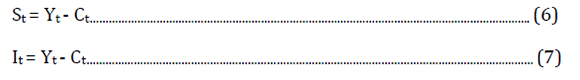

Given that an individual's income is either consumed or saved. Keynes (1936) wrote in his general theory that "saving and investment are necessarily equal".

Therefore S=I

It is logical to say that the marginal propensity to consume (MPC) and the marginal propensity to save (MPS) must be equal to unity.

That is,

Going fUrther, we presume that the home country's deposit rate can influence emigrants to keep their savings in their home country.

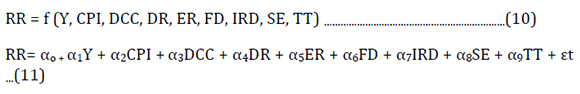

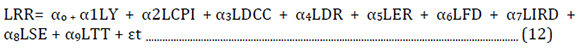

The model is specified as follows:

The model was therefore log transformed to derive:

Where RR = Remittances

Y=Income per capita

I= Inflation

DCC = Domestic credit

DR = Deposit rate

ER = Exchange rate

FD = Financial deepening

IRD = Interest rate differential

SE = Secondary school enrolment

TT = Openness

αo = constant

εt = Error term

Research Findings and Presentations

Correlation Analysis

Theoretically, migrants may remit money to help stabilize the income of their relatives and loved ones at home. We therefore expect that income levels will increase as remittances increase. Also it is expected that as school enrolment increases, capacity to remit will increase but the need to remit will reduce over time. Ideally, it is expected that the need to remit will reduce as domestic credit increases on the assumption that the economy will have more liquid currency in circulation boosting domestic income levels through increased investment, hence, more jobs. As inflation increases there will be a need to remit more as money loses value. Also, as the value of domestic currency appreciates, more remittances will be needed to keep up with the reducing value of foreign currency to domestic currency. It is important to note that, for economies with inadequate domestic production of goods and services, the consumption pattern is often skewed towards importation. For such economies, fluctuations in exchange rates are bound to have implications for inflation. In the event of appreciation in the value of foreign currency, it is expected that more units of domestic currency will be needed to purchase a unit of foreign currency for the purpose of importation for consumption. The additional cost will therefore be spread over each unit of good. In the case of deposit rate, the expected relationship becomes more dependent on the motive for remitting. If remitting is altruistic, not much impact on the deposit rate will be expected.

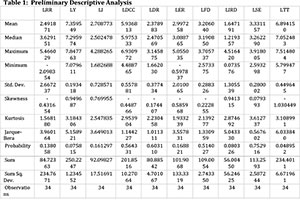

From our study, data for remittances are found to be positively correlated with most of the other variables and significantly correlated with some but not all the variables (Table 2). We found a positive and significant correlation between remittance levels and income, exchange rate, interest rate differential, secondary enrolment and openness, while the relationship between remittances and deposit rate was positive but insignificant. On the other hand, we found a negative and insignificant correlation between remittances and inflation, domestic credit as well as financial deepening.

Unit Root Test

Based on the nature of the data used, as indicated in Table 1, we observe an upward trend in the series, meaning that the means of the time series change over time and signalling the possibility of the data not being stationary in its natural form. To adjust for this, we transformed the series to first differenced logarithmic form. In validating these statistically, we subjected the data to a formal stationarity test using Philip Perron (PP) unit root test. We subjected the variables to PP test individually. We tested for the symptoms of unit roots following the systematic procedure advanced by Enders (1995). The results reveal that the variables are not stationary at level. The result for the first differenced series of all the variables revealed they are stationary, inferring they are of order 1 The results of the PP unit root test are presented in Table 3.

Co-integration Test

We then proceeded to subject the data to a co-integration test. The co-integration test signifies whether a long-run relationship exists between the variables of the model, hence a signal for causality (Engle & Granger, 1987; Hendry, 1986; Gujarati & Porter, 2009). The rule of thumb in co-integration testing suggests that based on likelihood ratio, trace statistics and Max-eigen values greater than their critical value connotes a rejection of the null hypothesis. This is in addition to the assumption that probability values should be less than 0.05. From the result presented in Table 4, it is clear that co-integrating equations exist. Using the trace test, it indicates eight co-integrating equations at the 0.05 level. The Max-eigen value test indicates six co-integrating equations at the 0.05 level. We thus conclude, based on the results that a long-run relationship exists among the variables.

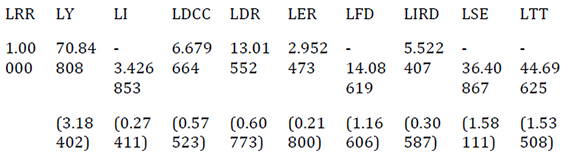

The normalized co integrating coefficients (standard error in parentheses) is therefore specified as:

The foregoing implies that, in the long run, there is a positive relationship between remittance and income, domestic credit, deposit rate and exchange rate as well as interest rate differential, while there is an inverse relationship between remittance and inflation, financial deepening, school enrolment and openness.

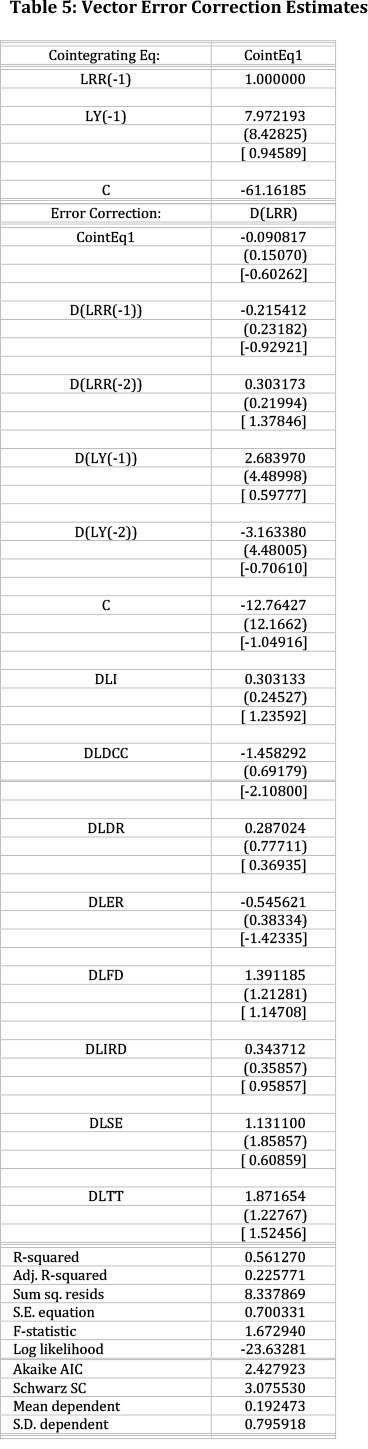

Vector Error Correction Analysis

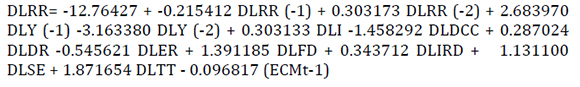

The vector error correction analysis result, as depicted in Table 5, shows that in the short run there is an inverse relationship between exchange rate, domestic credit, first lag of remittance and second lag of income. The other variables have a positive relationship with remittance.

The coefficient of the error-correction term (ECMt-1) reflects the speed of adjustment from the short-run period to the long-run period. This is statistically significant and negative, as expected. The ECMt-1 value of -0.096817 implies remittance received is corrected from the short-run towards long-run equilibrium by about 9.7% annually.

The short-run equation is specified as follows:

In terms of diagnostic statistics in the short run, the estimated R square is approximately 56% and a moderate F-statics value is 1.67 suggesting an overall good fit and significance of the estimated model. Therefore, fitness of the model is accepted empirically. However, we attribute the difference existing in the long run and short run to disturbances/shocks that occur in the short run but are absent in the long run.

Granger Causality Test

After establishing that there exists a co-integrating relationship among our variables and specifying the error corrected model, we went a step further to identify if there is a causal relationship among our exogenous variables and remittances, and where it exists to identify its nature. This was done by employing the pairwise Granger causality test. The result is reported in Table 6.

We test whether the exogenous variables individually do not cause remittance and vice versa. Hence, we set up a null hypothesis to test 'non-causality'; that the variables (income, inflation, domestic credit, deposit rate, exchange rate, financial deepening, interest rate differential, secondary enrolment and openness) do not cause remittance.

Ηο:δ=0 (Y, CPI, DCC, DR, ER, FD, IRD, SE, TT does not granger-cause RR)

From the result, not much causality exists between the exogenous variables and remittance. We find, however, that where causality exists, it is unidirectional. This was found between exchange rate, deposit rate, openness and remittances. We find that the direction of the causality runs from the exogenous variables to remittance.

Therefore, we reject the null hypothesis and accept the alternative hypothesis for the variables of exchange rate, deposit rate and openness, and conclude that they do cause remittance flows to Nigeria.

Discussion

Our research finds heterogeneity among the remittance determinant dynamics in Nigeria. For income, we find a positive relationship for remittance and income levels in the long run and the first lag of the short run but negative for the second lag. The positive relationship is consistent with Lianos (1997) and El-Sakka and McNabb (1999). Similarly Omobitan (2012) found a positive relationship for remittance and income level for Nigeria. This suggests deviance from altruistic remittance, and an indication that remittance flow is procyclical.

The results reveal an inverse relationship between remittance and inflation in the long run. Interestingly, the short run reveals a positive relationship. The short-run relationship suggests that remittances received increase as price level in the recipient economy goes up. This is in consonance with the findings of El-Sakka and McNabb (1999). They opined that remittance increases with a country's price level using the Egyptian example. This suggests that remittance can serve as a response to day-to-day economic activities that affect recipients such as price fluctuations. However, the longrun result with an inverse relationship suggests a procyclical situation. This conforms with the findings on remittance to Latin America and the Caribbean from the USA by Aydas et al. (2005) and Orozco and Lowell (2005). Orozco (2004) argued however that magnitude of remittance is not affected by changes in price levels, using the case of the Dominican Republic.

The coefficient for domestic credit is negative in the short run and positive in the long run. The result corroborates the findings of Gani and Sharma (2013). They find an inverse relationship for lower-middle-income economies, but for upper-middle-income economies the relationship is positive. It is expected that in the long run countries grow to a steady state (Barro & Sala-i-Martin, 2004). This suggests that, as countries grow, domestic credit grows, thus explaining the long-run positive relationship. This explains our finding on the relationship between income and remittance. Migrants may remit to their home countries in order to invest in their growing economies.

We find a positive correlation between remittance and deposit rate. Similarly the long and short run are positive with a causal relationship running from deposit rate to remittance. This suggests a portfolio motive for remitting. Our findings suggest remittances are procyclical rather than countercyclical. We find a strong correlation between exchange rate and remittance and a causal relationship running from exchange rate and remittance. In the short run, we find an inverse relationship between remittance and exchange rate, inferring that, as domestic currency appreciates, remittance levels reduce. However, in the long run, we find a positive relationship for exchange rate, implying that as domestic currency depreciates migrants find it lucrative to remit. Yang (2008) found that Filipino migrants sent less foreign currency when the Asian financial crisis led to the depreciation of the Filipino peso, suggesting that migrants have a specified range of amounts of money they intend their families to receive. Our findings therefore reflect the possibilities of an investment portfolio choice in the home country (see Singh et al., 2010). Mouhoud, Oudinet and Unan (2008) opined that it is only when motivation to remit is altruistic that migrants will increase remittance in the face of currency depreciation in the country of origin.

We find an inverse correlation and long-run relationship for financial deepening and remittance, but a positive short-run relationship. Fajnzylber and Lopez (2007) found a positive coefficient for remittance but when it is in interaction with financial deepening it becomes negative; they suggested remittances can be substituted for by financial depth in stimulating economic growth. This suggests that remittances boost economic growth in developing economies with an underdeveloped financial system (see also Giuliano & Ruiz-Arranz, 2005).

We find a positive relationship for remittance and interest rate differential in all periods. This corroborates with the findings of Mouhoud et al. (2008). They opined that the impact of interest rates in determining remittance levels occurs mostly on investment motivation. They argued that it is expected to have a positive coefficient for investment motives since it depicts the deviation of domestic interest rate from the international interest rate which in this study was captured with the LIBOR.

We also controlled for level of skill and education as an insight into the wage level of potential migrants using school enrolment level. We expect a positive coefficient since better education levels will attract better remuneration in the host country and as such improve migrants' capacity to remit funds. We find an inverse relationship in the long run and a positive relationship in the short run. Buch and Kuckulenz (2009) opined that, since education is often used as a proxy for development level in an economy, chances are that high illiteracy level (i.e., low school enrolment) will increase the need for remittances. Going further, we propose that since education is a process involving time, it is possible to find what was derived from our analysis; that in the short run, an increase in educational level will lead to better wage-earning abilities, hence increasing remittance level. In the long run we find the inverse of the foregoing. Since better education attracts better wages, and education is a proxy for development, we conclude that there would be less drive to migrate in the long run as the recipient economy develops.

Our findings on openness reveal a positive relationship in the short run but an inverse relationship in the long run. The positive relationship in the short run attests to the high uncertainty associated with developing economies like Nigeria in connection with the benefits of openness for robust economic policies addressing the competitiveness of Nigeria in the global world. This aligns with the works of Omobitan (2012). While openness is usually linked with liberalization and is often seen as a catalyst for national income, remittances on the other hand improve the income levels of the recipients' households. There is, however, contradicting evidence as to whether openness itself is good or bad. Although most discussion on the subject gives the impression that openness is a tool for growth in developing economies (see Easterly, 2001; Shafaeddin, 2005), systematic quantification attempts have however failed in identifying openness as a crucial driver of growth for developing economies (Rodriguez & Rodrick, 1999; Bouet et al., 2006).

Sundaram and Von Armin (2008) argued further that it can distract developing economies from industrializing. Drawing from the literature, it can be deduced that economies can optimize openness if they have some form of comparative advantage, as witnessed in China and India (Pacheco-Lopez & Thirwall, 2009). Alessandrini et al. (2011) alluded to the Indian experience claiming that openness helped in improving India's specialization in industries with medium- to high-technology content thereby generating a comparative advantage in them and enjoying a global growth in demand.

Pacheco-López and Thirlwall (2009) argued that there can be gains from specialization and openness, but they noted however that the gains depend on the achievement of two basic conditions which are rarely met. The first is that the process of resources reallocation should not disrupt full employment. They backed this with Keynes's (1936) assertion that if people lose their jobs in one sector as a result of specialization and free trade, the other sectors should be able to absorb them. The other notion is that the trade liberalization process in itself does not alter the balance of payments equilibrium, although they noted that evidence abounds in many developing countries for imports rising above exports. This explains the long-run inverse relationship between remittance and openness. We conclude that if openness follows the conditions put forward by Pacheco-Lopez and Thirlwall, (2009), then there will be less need to remit as recipient household income levels will increase with openness.

Conclusion

This paper analyses the determinants of remittances to Nigeria using data from 1980 to 2013. The literature is inconclusive on the selected variables, hence this study. Our findings indicate that remittance receipts in Nigeria are largely influenced by portfolio options rather than altruism as they seem to respond positively to differentials in exchange rate, deposit rate and interest rate. In other words, remittance flows to Nigeria are procyclical in nature rather than countercyclical. The study further indicates that remittances appear to respond to the level of openness in the home country. We also find causality running from deposit rate, exchange rate and openness in Nigeria.

This paper does not capture the contributions of remittances to economic development or welfare, as this can be done best using disaggregated data. Furthermore, our data captures largely the formal channel leaving informal channels uncaptured. According to Ratha (2006), informal channels account for about 50% of remittances. This data challenge remains a bane of remittance studies at the macro level and warrants caution in policy formation. Boothroyd and Chapman (1988) highlight this as a common issue in the academic and research environment, especially in the fields of development issues and developing economies. Perhaps access to more robust data in future will provide better insight into the foregoing phenomena.

ACKNOWLEDGEMENTS

The authors acknowledge the insightful comments of Saheed Layiwola Bello of the Centre for Petroleum, Energy Economics and Law, University of Ibadan, Nigeria.

References

Adams, R. H. 2009. The determinants of international remittances in developing countries. World Development, 37(1): 93-103. [ Links ]

Aggarwal, R., and Horowitz, A. 2002. Are international remittances altruism or insurance? Evidence from Guyana using multiple-migrant households. World Development, 30(11): 2033-2044. [ Links ]

Ajayi, M.A., Ijaiya, M.A., Ijaiya, G.T., Bello, R.A., and Adeyemo, S.L. 2009. International remittances and well-being in Sub-Saharan Africa. Journal of Economics and International Finance, 1(3): 78-84. [ Links ]

Alessandrini, M., Fattouh, B., Ferrarini, B., and Scaramozzino, P. 2011. Tariff liberalization and trade specialization: Lessons from India. Journal of Comparative Economics, 39(4): 499-513. [ Links ]

Altonji, J.G., Hayashi, F., and Kotlikoff, L. 1997. Parental altruism and inter vivos transfers: Theory and evidence. Journal of Political Economy, 105: 1121-1166. [ Links ]

Aydas, O.T., Neyapti, B., and Metin-Ozcan, K. 2005. Determinants of workers' remittances: The case of Turkey. Emerging Markets Finance and Trade, 41(3): 53-69. [ Links ]

Barro, R. and Sala-i-Martin, X. 2004. Economic Growth. 2nd edn. Cambridge, MA: MIT Press. [ Links ]

Becker, G. 1991. A Treatise of the Family. Cambridge, MA: Harvard University Press. [ Links ]

Becker, G.S. 1974. A theory of social interactions. Journal of Political Economy, 82: 1063-1094. [ Links ]

Black, R., Ammassari, S., Mouillesseaux, S. and Rajkotian, R. 2004. Migration and Pro-Poor Policy in West Africa. Working Paper C8. Brighton, Sussex: Centre for Migration Research, University of Sussex. [ Links ]

Boothroyd, R. and Chapman, W. 1988. Threats to data quality in developing country settings. Comparative Education Review, 32(4): 416-429. [ Links ]

Bouet, A., Mevel, S., and Orden, D. 2006. More or less ambition in the Doha round: Winners and losers from trade liberalization with a development perspective. The World Economy: 1253-1280.

Bouhga-Hagbe, J. 2006. Altruism and workers' remittances: Evidence from selected countries in the Middle East and Central Asia. IMF Working Paper 06/130. Washington D.C.: International Monetary Fund. [ Links ]

Buch, C., and Kuckulenz, A. 2009. Worker remittances and capital flows to developing countries. International Migration, 48(5): 89-117. [ Links ]

Carling, J. 2008. The determinants of migrant remittances. Oxford Review of Economic Policy, 24(3): 581-598. [ Links ]

Chami, R., Barajas, T., Casimano, F., Fullenkamp, C., Gapen, M., and Montiel, P. 2008. Macroeconomic consequences of remittances. IMF Occasional Paper No. 259. Washington D.C.: International Monetary Fund. [ Links ]

Chami, R., Fullenkamp, C., and Gapen, M. 2009. Measuring Workers' Remittances: What Should Be Kept In and What Should Be Left Out? Washington D.C.: International Monetary Fund. [ Links ]

Chami, R., Fullenkamp, C., and Jahjah, S. 2005. Are Immigrant Remittance Flows a Source of Capital for Development? IMF Staff Papers. Volume 52, No. 1, Washington D.C.: International Monetary Fund. [ Links ]

Clarke, G., and Wallsten, S. 2003. Do Remittances Act Like Insurance? Evidence from a Natural Disaster in Jamaica. World Bank Working Paper. Washington D.C.: The World Bank. [ Links ]

Constantinescu, I.C., and Schiff, M. 2014. Remittances, FDI and ODA: Stability, cyclicality and stabilising impact in developing countries. International Journal of Migration and Residential Mobility, 1(1), 84-106. [ Links ]

Cox, D., Eserb, Z., and Jimenez, E. 1998. Motives for private transfers over the life cycle: An analytical framework and evidence for Peru. Journal of Development Economics, 55(1), 57-80. [ Links ]

Easterly, W. 2001. The lost decades: Developing countries' stagnation in spite of policy reform 1980-1998. Journal of Economic Growth, 6(2), 135-157. [ Links ]

El-Sakka, M.I., and McNabb, R. 1999. The macroeconomic determinants of emigrant remittances. World Development, 27(8), 1493-1502. [ Links ]

Enders, W. 1995. Applied Econometric Time Series. New York: John Wiley & Sons. [ Links ]

Engle, R.F., and Granger, C.W. 1987. Co-integration and error-correlation: Representation estimation and testing. Econometrica, 65. [ Links ]

Fajnzylber, P., and Lopez, J. H. 2007. Close to Home: The Development Impact of Remittances in Latin America, mimeo. Washington D.C.: The World Bank. [ Links ]

Freund, C., and Spatafora, N. 2008. Remittances, transaction costs and informality. Journal of Development Economics, 86(2): 356-366. [ Links ]

Funkhouser, E. 1995. Remittances from international migration: A comparison of El Salvador and Nicaragua. Review of Economics and Statistics, 77(1): 137-146. [ Links ]

Gani, A., and Sharma, B. 2013. Remittances and Credit Provided by the Banking Sector in Developing Countries. 93 pp. International Review of Business Research Papers, 9(3), 85-98. [ Links ]

Giuliano, P., and Ruiz-Arranz, M. 2009. Remittances, financial development and growth. Journal of Development Economics, 90(1): 144-152. [ Links ]

Gujarati, D.N., and Porter, D.C. 2009. Basic Econometrics. 5th ed.. New York: McGraw Hill. [ Links ]

Gupta, P. 2005. Macroeconomic Determinants of Remittances: Evidence from India. IMF Working Paper No. 05/224. Washington D.C.: International Monetary Fund. [ Links ]

Gupta, S., Pattillo, C.A., and Wagh, S. 2009. Effect of remittances on poverty and financial development in Sub-Saharan Africa. World Development, 37(1): 105-115. [ Links ]

Hagen-Zanker, J., and Siegel, M. 2007. The Determinants of Remittances: A Review of Literature. MGSoG Working Paper 2007/WP003. Maastricht: Maastricht Graduate School of Governance. [ Links ]

Halliday, T. 2006. Migration, risk and liquidity constraints in El Salvador. Economic Development and Cultural Change, 54(4): 893-925. [ Links ]

Hendry, D.F. 1986. Econometric modelling with cointegrated variables: an overview. Oxford Bulletin of Economics and Statistics, 48(3): 201-212. [ Links ]

Huang, P., and Vargas-Silva, C. 2005. Macroeconomic Determinants of Workers' Remittances: Host vs. Home Country's Economic Conditions. EconPapers: International Finance.

Hysenbegasi, A., and Pozo, S. 2002. What Prompts Workers to Remit? Evidence using a Panel of Latin American and Caribbean Nations. Kalamazoo, MI: Western Michigan University. [ Links ]

IMF. 2005. World Economic Outlook. Washington D.C.: International Monetary Fund. [ Links ]

Jackman, M. 2013. Macroeconomic determinants of remittance volatility: an empirical test. International Migration, 51(S1): e36-e52. [ Links ]

Jensen, R.T. 2004. Do private transfers displace the benefits of public transfers? Evidence from South Africa. Journal of Public Economics, 88(1): 89-112. [ Links ]

Kapur, D., and McHale, J. 2005. Give Us Your Best and Brightest: The Global Hunt for Talent and its Impact on the Developing World. Washington D.C.: Center for Global Development and Brookings Institution. [ Links ]

Keynes, J.M. 1936. The General Theory of Employment, Interest, and Money. New York: Harcourt Brace. [ Links ]

Lianos, T.P. 1997. Factors determining migrant remittances: The case of Greece. International Migration Review, 31(1): 72-87. [ Links ]

Lin, H.H. 2011. Determinants of Remittances: Evidence from Tonga. IMF Working Paper WP/11/18. Washington D.C.: International Monetary Fund. [ Links ]

Lucas, R.E., and Stark, O. 1985. Motivations to remit: Evidence from Botswana. Journal of Political Economy, 93(5): 901-918. [ Links ]

Lueth, E., and Ruiz-Arranz, M. 2007. A Gravity Model of Workers' Remittances. IMF Working Paper 06/290. Washington D.C.: International Monetary Fund. [ Links ]

Mishra, P. 2005. Macroeconomic Impact of Remittances in the Caribbean. Washington D.C.: International Monetary Fund. [ Links ]

Mouhoud, E.M., Oudinet, J., and Unan, E. 2008. Macroeconomic Determinants of Migrants' Remittances in the Southern and Eastern Mediterranean Countries. Paris: Centre d'Economie de l'Université de Paris Nord. [ Links ]

Nabar-Bhaduri, S. 2013. Migration, remittances, development, and the civil conflict in Sri Lanka. In Remittance Flows to Post-Conflict States: Perspectives on Human Security and Development. Boston: The Frederick S. Pardee Center for the Study of the Longer-Range Future. [ Links ]

Nwosu, O.E., Fonta, M.W., Aneke, G., and Yuni, N.D. 2012. Microeconomic determinants of migrant remittances to Nigerian households. Economics Bulletin, 32(4): 3425-3438. [ Links ]

Nyamongo, E.M., Misati, R.N., Kipyegon, L., and Ndirangu, L. 2012. Remittances, financial development and economic growth in Africa. Journal of Economics and Business, 64: 240-260, 64, 240-260. [ Links ]

Ojapinwa, T.V. 2012. Determinants of migrants' remittances in Nigeria: An econometrics analysis. International Journal of Humanities and Social Science, 2(14): 295-301. [ Links ]

Olowa, O.W., Awoyemi, T.T., and Omonona, B.T. 2012. Determinants of remittance receipts in rural Nigeria. The Social Sciences, 7(1): 117-124. [ Links ]

Omobitan, O.A. 2012. Reconciling international migrants' remittances flow determinants: The case of Nigeria. European Scientific Journal, 8(19). [ Links ]

Orozco, M. 2004. Determinants of Remittance Transfers: The Case of the Dominican Republic, January 1999 to September 2003. Draft Research Notes on Determinants of Remittances Project. Washington, DC: Inter-American Dialogue. [ Links ]

Orozco, M., and Lowell, B. 2005. Transnational Engagement, Remittances and their Relationship to Development in Latin America and the Caribbean. Washington D.C.: Institute for the Study of International Migration, Georgetown University. [ Links ]

Pacheco-López, P., and Thirlwall, A. 2009. Has Trade Liberalisation in Poor Countries Delivered the Promises Expected? Studies in Economics 0911, Department of Economics, University of Kent.

Ratha, D. 2006. Trends, Determinants and Macroeconomic Effects of Remittances. In Global Economic Prospects 2006: Economic Implications of Remittances and Migration. Washington D.C.: The World Bank. [ Links ]

Rodríguez, F., and Rodrik, D. 1999. Trade Policy and Economic Growth: A Skeptic's Guide to the Cross-national Evidence. NBER Working Paper, 7081, National Bureau of Economic Research: Cambridge, MA.

Sayan, S. 2006. Business Cycles and Workers' Remittances: How Do Migrant Workers Respond to Cyclical Movements of GDP at Home? IMF Working Paper WP/06/52. Washington D.C.: International Monetary Fund. [ Links ]

Shafaeddin, M. 2005. Towards an alternative perspective on trade and industrial policies. Development and Change, 36(6): 1143-1162. [ Links ]

Singh, R. J., Haacker, M., Lee, K. W., and Le Goff, M. 2010. Determinants and macroeconomic impact of remittances in Sub-Saharan Africa. Journal of African Economies, 20(2): 312-340. [ Links ]

Straubhaar, T. 1986. The determinants of remittances: The case of Turkey. Weltwirtschaftliches Archiv, 122(4): 728-740. [ Links ]

UNCTAD. 2011. Report of the Expert Meeting on Maximizing the Development Impact of Remittances. Geneva: United Nations Conference on Trade and Development. [ Links ]

World Bank. 2011. Migration and Remittances Factbook. Washington D.C.: The World Bank. [ Links ]

World Bank. 2014a. Migration and Development Brief. Issue 23. Washington D.C.: The World Bank. [ Links ]

World Bank. 2014b. Migration and Development Brief, Issue 22. Washington D.C.: The World Bank. [ Links ]

World Bank. 2015. Ending Poverty and Sharing Prosperity. Global Monitoring Report 2014/2015. Washington D.C.: The World Bank. [ Links ]

Yang, D. 2008. International migration, remittances, and household investment: Evidence from Philippine migrants' exchange rate shocks. The Economic Journal, 118: 591-630. [ Links ]

Yang, D., and Choi, H. 2007. Are remittances insurance? Evidence from rainfall shocks in the Philippines. World Bank Economic Review, 21(2): 219-248. [ Links ]

Appendix