Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of Transport and Supply Chain Management

On-line version ISSN 2310-8789

Print version ISSN 1995-5235

JTSCM vol.17 Cape Town 2023

http://dx.doi.org/10.4102/jtscm.v17i0.894

ORIGINAL RESEARCH

Optimising inventory, procurement and production with excess demand and random parameters

Purnawan A. WicaksonoI; Sutrisno SutrisnoII; Solikhin SolikhinII; Abdul AzizII

IDepartment of Industrial Engineering, Faculty of Engineering, Diponegoro University, Semarang, Indonesia

IIDepartment of Mathematics, Faculty of Science and Mathematics, Diponegoro University, Semarang, Indonesia

ABSTRACT

BACKGROUND: Manufacturing and service industries in many sectors face extraordinary situations, such as excessive demands and uncertain prices during the post-pandemic period. In this situation, ordinary decision-making support is no longer suitable.

OBJECTIVES: This study aims to propose new mathematical programming in the form of probabilistic dynamical optimisation that can be used for optimising integrated inventory, procurement and production planning. The problem contains multiperiod, multisupplier, multiraw material and multiproduct. Furthermore, several parameters, including prices and costs were assumed to be probabilistic with some known probability distributions.

METHOD: The expectation of the profit was maximised in the model and the uncertain programming algorithm was used to calculate the optimal decision. The laboratory scaled computational experiments were also conducted with some randomly generated data

RESULTS: The results showed the proposed model successfully provided the optimal decision. This included the optimal amount of each observation period and raw material parts to be sold to each supplier and stored in the inventory. It also included the optimal amount of each product brand to be produced and stored with the maximal expectation of the profit earned for the whole optimisation horizon time.

CONCLUSION: The proposed decision-making support can be used by the decision-makers and managers in industries.

CONTRIBUTION: A novel decision-making support is provided, which can be used to solve integrated inventory, procurement and production with excess demand and random parameters.

Keywords: after pandemic; recovery time; decision-making; probabilistic programming; production planning; raw part procurement; supply chain.

Introduction

A supply chain of raw material products involves many parties from the upstream (suppliers) to the downstream (buyers). During the coronavirus disease 2019 (COVID-19) pandemic, there was a significant increase in prices, specifically for food and healthcare products (Bai et al. 2022). Moreover, there was a very high demand for certain products, and some buyers could not purchase some products needed (Gonzatto Junior et al. 2022). Similar extraordinary situations also occur for some products or services, such as tourism and hospitality during the post-pandemic era. Other events that can lead to similar situations include crises, such as wars. These conditions cause uncertain prices and excess demand; hence ordinary decision-making support can no longer suit the situation. To solve this problem, the decision-makers or managers need a new approach to make optimal decisions. Therefore, the object of this study is the supply chain composed of three parties, namely inventory systems or warehouses, procurement departments and production units. These parties need to be optimised in an integrated way to gain maximal profit.

Mathematical programming is a good approach for dealing with the optimisation of certain processes, especially in businesses (Kallrath 2021). Some fields have been benefiting from this approach, such as chemical production (Gelain et al. 2020; Pierott et al. 2021; Sanghvi et al. 2021; Shutaywi & Shah 2021), financial management (Barroso, Cardoso & Melo 2021; Faia et al. 2021; Gutiérrez 2021; Perez et al. 2021), energy (Dehghani & Yoo 2020; Guo et al. 2021; Liu et al. 2021; Okolie et al. 2021; Zhou et al. 2021) and agriculture production systems (Caicedo Solano, García Llinás & Montoya-Torres 2022). Therefore, mathematical programming has successfully provided optimal solutions for the problems in these sectors.

Several models have been proposed to solve the procurement problem with certain specifications. Nonlinear mathematical programming was formulated (Ware, Singh & Banwet 2014) to solve the problem with a single supplier network. Meanwhile, a slightly more complex model was proposed by Ahmad & Mondal (2016) for two-echelon supply networks. Further models were developed for more complex specifications, such as integration with carriers (Chulkova & Salapateva 2022), risk optimisation (Chen & Zou 2017; Firouz, Keskin & Melouk 2017), backup sourcing (Papachristos & Pandelis 2022) and blockchain technology environment (Yadav & Prakash Singh 2022), artificial intelligence and internet of things (Raja Santhi & Muthuswamy 2022), among others.

Some models were also developed for managing inventory systems and planning production by independently solving problems. The models solve problems in various environments, such as uncertain selling duration (He et al. 2022), decentralised schemes (Meneses, Marques & Barbosa-Póvoa 2023), sustainability awareness (Zarte, Pechmann & Nunes 2022), multi-site production units (Wang, Wang & Chen 2022) and others.

A model that integrates all three parties of inventory system and/or warehouse, procurement department and production unit for handling extraordinary situations, such as excess demand and probabilistic parameters, has not been developed. Therefore, this study aims to address this problem. It also introduced the dynamic-probabilistic mathematical programming that can be used as decision-making support for managing inventory, procurement and production planning in an integrated way. The laboratory scale experiment results will be discussed to support the proposed model. For further details about the contribution of this study compared with existing works, see Table 1.

Research methods and designs

Problem setting

Suppose a manufacturing and service industry is planning to produce several brands in the future with periodic time, the products will be made of raw materials purchased from different suppliers. The industry has warehouses to store products and raw material parts to be used for future productions along the time horizon of interest. There are situations where the demand for products could be excessive; therefore, the industry does not have to fully meet the demand. Furthermore, several parameters are uncertain even though their probability distributions are known. The problems include how many units of each product brand should be produced at each production period, how many units of each raw material part should be purchased from each supplier, and how many units of each product brand and raw material part should be stored in the warehouse at the end of each production period such that the expectation of the profit along the production time horizon is maximal. Further details about the specifications and assumptions of the problems are listed as follows:

-

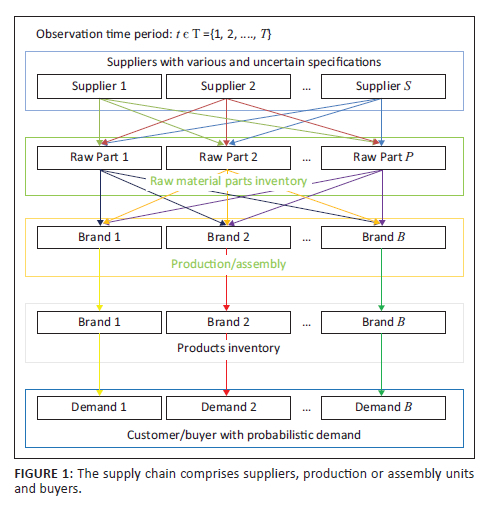

The flow of the raw material parts and the products is illustrated in Figure 1. Three types of parties are involved in the supply chain, namely suppliers, warehouses and production units. The product buyers are also included even though they are considered a passive party.

-

Each party has its maximum capacity and should be satisfied by the decision of the decision-makers. A supplier has maximum capacity in supplying raw material parts. The warehouse has a maximum capacity for storing raw material parts and products. Meanwhile, the production unit has a maximum capacity for producing products.

-

Each supplier has its characteristics in terms of performance, such as raw part prices, capacities and qualities. Prices tend to be uncertain in extraordinary situations such as post-pandemic. In this study, prices are assumed to be probabilistic under the data availability assumption, which is used to formulate the probability distribution functions.

-

Raw parts from suppliers might be rejected by the manufacturer because of damages or under qualification. The rate for rejected raw parts is naturally uncertain and assumed as a probabilistic parameter under the assumption that the manufacturer has historical data. In particular, some raw parts could be late in the delivery process because of the sudden unavailability of the suppliers. The rate for late delivery is also uncertain and assumed to be a probabilistic parameter.

-

For completeness, the performance of the production unit is also uncertain, making some of the products to be under qualification; therefore, they cannot be sold to buyers. The rate for underqualified products is assumed to be probabilistic.

-

Product selling prices are also assumed to be uncertain in extraordinary situations such as pandemic. Prices could suddenly change following some factors, such as demand and government measures.

-

In this problem, the decision-makers need to decide the optimal raw parts to be purchased by each supplier, the number of products to be produced by the manufacturer, as well as the raw parts or products to be stored in the inventory such that the profit for the whole supply chain activity is maximal. The planning is not only for one period but multiple, while the decision is made for the whole planning horizon.

-

The demand for the products is assumed to be higher than the production capacities. This commonly occurs in extraordinary situations for some particular products, such as medicines during pandemic or tourism after pandemic. In this case, the demand does not have to be fully satisfied because of the production capacity limit of the manufacturer.

-

It is assumed that there is no intermediate party such as distributor between the product inventory and the buyers.

-

In general, no lead time between suppliers and manufacturers is assumed. This means that raw material parts that are ordered at a certain observation time period are arrived in the manufacturer at the same observation time period. However, late deliveries are still possible, and some raw material parts could be delivered in the next time observation period. There might be lead time between manufacturer and buyers; however, it is assumed that buyers do not concern with this, and thus it is not taken into account in the model.

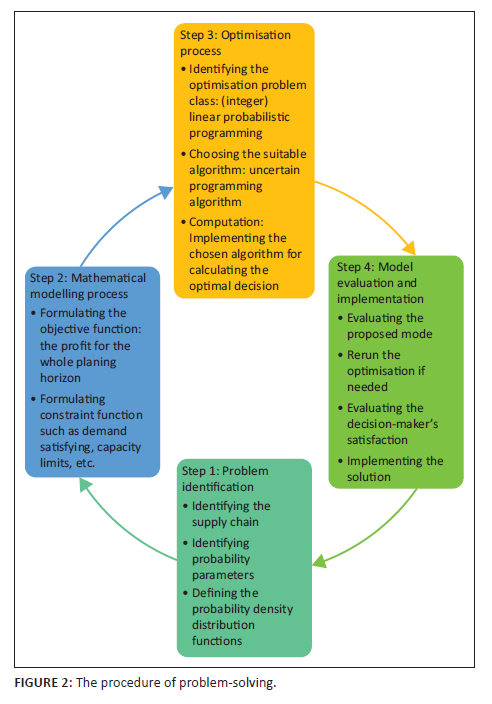

The methodology implemented in this study is shown in Figure 2. Four steps were employed in the problem solving and each corresponds to a particular subproblem that needs to be solved.

Mathematical notations

A bunch of mathematical symbols is used to denote the parameters, decision variables and some values. The notations are categorised based on their classes as follows:

Indices:

• Planning period : t ∈ T = {1, 2, …, T}

• Type of raw parts : p ∈ P = {1, 2, …, P}

• Index of suppliers : s ∈ S = {1, 2, …, S}

• Brand of products : b ∈ B = {1, 2, …, B}

Decision variables:

-

The amount of raw part p to be procured by a supplier s at purchasing time t: Xtsp

-

The amount of raw part p to be stored in the inventory at time t with

as the initial inventory level:

as the initial inventory level:

-

The amount of product brand b to be produced at production time t: Ytb

-

The amount of product brand b to be stored in the inventory at time t with

as the initial inventory level:

as the initial inventory level:

-

Binary decision variables indicating whether the supplier s is selected to supply raw parts along the planning time horizon of interest, 1 when yes, and 0 otherwise: Zs

-

Binary variable indicating the supplier s is selected as a new supplier over the planning time horizon: (1) when yes or (0) otherwise: Ws

-

The number of deliveries needed to transport raw material parts from supplier s to the manufacturer at purchasing time t: Sts

Probabilistic parameters (input variables):

-

Demand for product brand b at selling time period:

-

Production or assembly cost to make one unit product brand b at production time t:

-

Selling price for one unit of product brand b at selling time t:

-

Price of one-unit raw part p at supplier s at purchasing time t:

-

The percentage or rate of the late delivered raw part p ordered to supplier s at purchasing time t:

-

The percentage or rate of the defected raw part p ordered to supplier s at purchasing time t:

-

One truck delivery cost for transporting raw parts from supplier s at purchasing time t:

-

The percentage or rate of the amount of underqualified product brand b at production time t:

Fixed parameters (input variables):

-

Raw part b's amount needed to make one product brand b: RPpb

-

Maximum capacity of each truck used for transporting raw parts from suppliers at purchasing time t: Ct

-

Suppliers' maximum capacity in supplying raw part p at purchasing time t: SCtsp

-

Order cost to supplier s for the whole optimisation horizon time: Ots

-

Cost to penalise one unqualified raw part p at purchasing time t: PDtp

-

Cost to penalise one delayed raw part p at purchasing time t: PLtp

-

Cost for making a new contract to supplier s: NCs

-

Inventory cost of one-unit raw part p per time: HPtp

-

Inventory cost of one-unit brand b per time: HBtb

-

Capacity of the inventory for storing raw part p at time t: MPtp

-

Capacity of the inventory for storing product brand b at time t: MBtb

Auxiliary notations:

-

Expectation value of its argument: E[·]

-

Parameter ζ is probabilistic and normally distributed with mean μ and standard deviation σ: ξ∼ N(μ, σ2)

The probabilistic and fixed (crisp) parameters are input variables of the model. The probability distribution function of each probabilistic parameter is specified by the decision-maker based on historical or observation data, whereas values for fixed parameters are specified by the decision-maker based on the observation or the contract.

Mathematical optimisation model

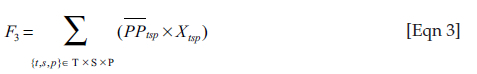

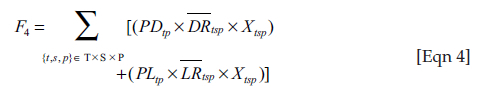

The mathematical model is aimed to maximise the expectation of the total profit gained from the production activities for the whole planning time horizon t = 1, 2, …, T. The expected profit contains the following income and cost components:

-

The total income from selling all products for all planning time horizon:

-

The total production cost for all products in all planning time horizon:

-

The total purchasing cost for all raw parts in all planning time horizon:

-

The total penalty cost for all defective and late delivered raw parts for all planning time horizon:

-

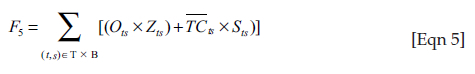

The total cost to order and transport raw parts for all planning time horizon:

-

The total contract-making cost for all selected suppliers over the planning horizon:

-

The inventory cost for all parts stored in the warehouse over the planning horizon:

-

The inventory cost for all products stored in the warehouse over the planning horizon:

Based on the problem's specifications and assumptions defined in the Research method and designs section, the objective function and the profit are maximised subject to the following constraint functions:

-

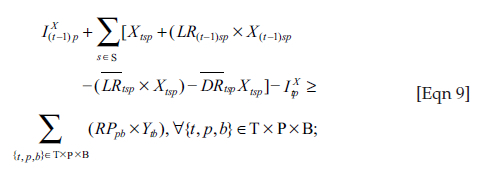

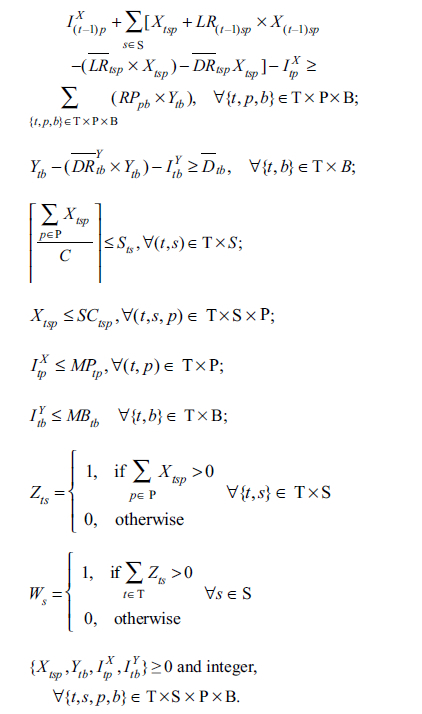

Raw parts demand satisfaction: At every period of production activity, the available raw parts should satisfy what is needed for production. The available raw parts are counted as the parts in the inventory stored from the previous period plus the arriving parts from suppliers. This also includes late delivered raw parts from the previous period minus late delivered and rejected parts at the current period minus the parts stored in the inventory for the next period. This should not be less than the raw parts needed for production and it is modelled as follows:

where  is the initial raw part inventory level for raw part type p.

is the initial raw part inventory level for raw part type p.

-

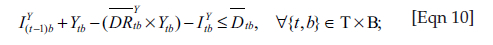

Products' demand constraints: The available products do not have to fully satisfy the demand. However, the decision-makers can set how big the demand should be satisfied. This is mathematically formulated as follows. For every period, the products produced at the current time minus underqualified products minus products that will be stored in the inventory to be used in the next period could be less than the demand:

where  is the initial product inventory level for brand b.

is the initial product inventory level for brand b.

-

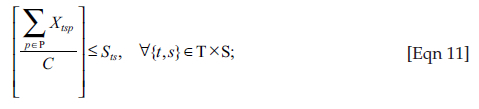

The number of delivery calculations: For every period, the number of deliveries from each supplier is calculated based on the capacity of one unit truck used and on the amount of each raw part purchased by the corresponding supplier. This is mathematically modelled as:

-

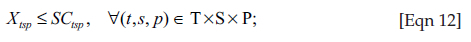

Suppliers' capacity limitations: At any period, the amount of the purchased raw parts to the supplier s cannot be higher than the supplier's maximum capacity. This is formulated as:

-

Inventory capacity limitations: At any period, the amount of each raw part type and product brand stored in the inventory cannot be higher than the inventory's maximum capacity. This is formulated as:

-

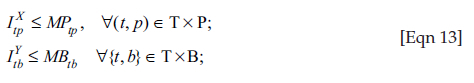

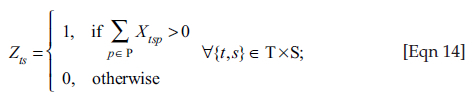

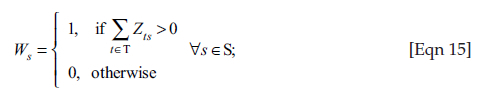

Selected suppliers' indicators for order cost calculation: At a certain period, when a supplier is selected to supply some raw parts, its selection indicator variable will be 1 or 0 otherwise. This is used for calculating the order cost in the objective function and is formulated as:

-

Selected suppliers' indicators for making new contract cost calculations: For the whole planning time horizon, when a supplier is selected at least once, the indicator variable will be 1 or 0 otherwise. This is used to calculate the new contract-making cost with the selected suppliers. A new contract cost is not needed when a supplier has selected before. This is formulated as:

-

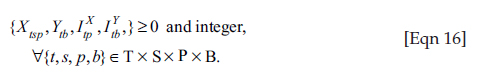

Integer and non-negativity constraints: All decision variables are non-negative. Therefore, when all or some decision variables are integers, they can be handled by the following constraints. This is not true for some cases and not all decision variables should be an integer. This can be seen in the forthcoming managerial insights discussion, which is modelled as:

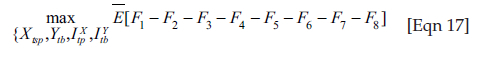

The mathematical modelling is now complete and can be rewritten as the optimisation problem:

subject to:

The given mathematical optimisation belongs to the probabilistic linear integer programming class and can be solved by using an uncertain programming solver. The details of the technical procedures are presented in (Liu 2015).

Probabilistic programming

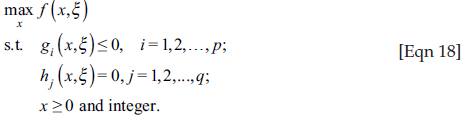

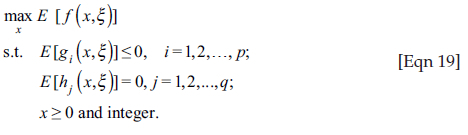

Let the vector x = (x1, x2, … xn) ∈ ℝn be the vector of decision variables. For uncertain parameters, let ξi, i = 1, 2, …, m be their probabilistic/random parameters/variables and  the probability density functions. These probabilistic parameters can be denoted as the vector ξ = (ξ1, …, ξm). Considering the optimisation problem containing probabilistic parameters with f(x, ξ): ℝn+m → ℝ as its objective function will be the maximised subject to the constraint functions gi (x, ξ) ≤ 0, i =1, 2, …, p and hj (x, ξ) ≤ 0, j =1, 2, …, p. All or some decision variables can be set to be integers. Also, all the decision variables are considered integers and non-negative. This optimisation problem can be rewritten in the complete form as:

the probability density functions. These probabilistic parameters can be denoted as the vector ξ = (ξ1, …, ξm). Considering the optimisation problem containing probabilistic parameters with f(x, ξ): ℝn+m → ℝ as its objective function will be the maximised subject to the constraint functions gi (x, ξ) ≤ 0, i =1, 2, …, p and hj (x, ξ) ≤ 0, j =1, 2, …, p. All or some decision variables can be set to be integers. Also, all the decision variables are considered integers and non-negative. This optimisation problem can be rewritten in the complete form as:

The common approach for solving this uncertain programming is to convert it into deterministic equivalent programming by taking the expectation of the objective and constraint functions. The technical details are presented in a study by Liu (2009). The following deterministic equivalent programming is converted as follows:

In this way, the expectation value of the objective function is now maximised instead of its real value. Therefore, the algorithms for solving deterministic optimisation problems can be used.

Computational experiment results

Computational experiments were carried out in a laboratory to implement the proposed model with randomly generated supply chain data. The performance of the proposed mathematical model was discussed to evaluate the results.

Parameter setting

For the supply chain illustrated in Figure 2, six suppliers were considered, namely S1, S2, S3, S4, S5 and S6. They supplied two types of raw parts, namely P1 and P2, which were subsequently used to produce three products with brands B1, B2 and B3.

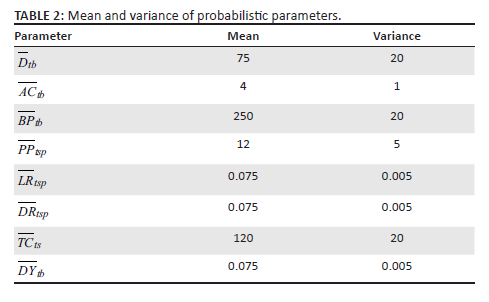

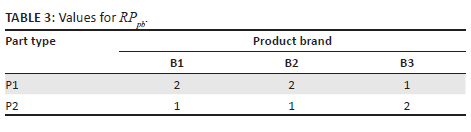

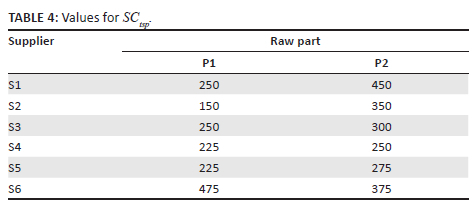

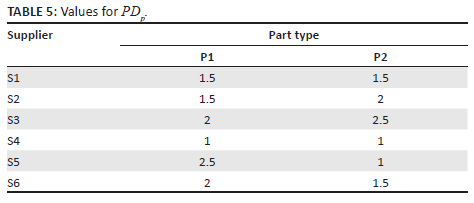

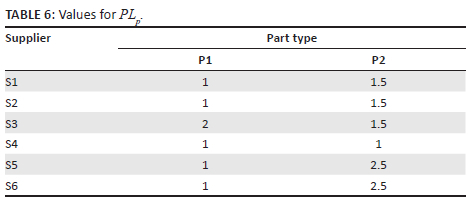

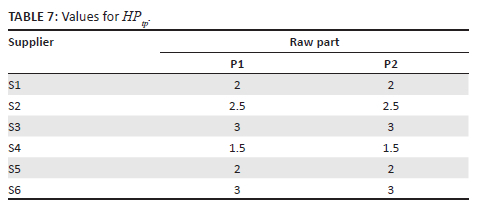

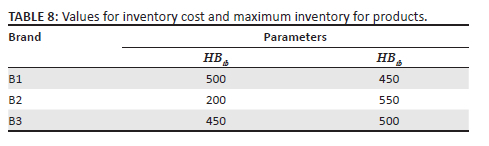

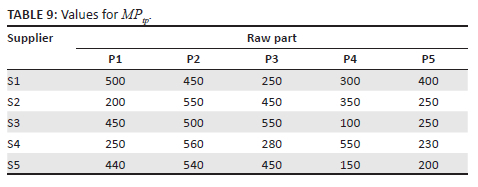

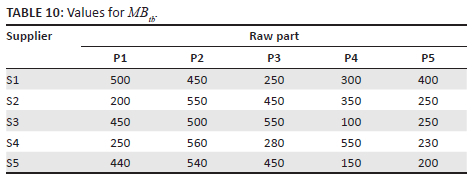

All the probabilistic parameters were considered normally distributed with randomly generated means and standard deviations. Meanwhile, values for certain parameters were randomly generated. The initial inventory level at period t = 1 is zero for all raw part types and product brands, that is,  . All of probabilistic parameters have normal probability distributions; their means and variances are shown in Table 2. Meanwhile, values of some fixed parameters are shown in Table 3, Table 4, Table 5, Table 6, Table 7, Table 8, Table 9 and Table 10.

. All of probabilistic parameters have normal probability distributions; their means and variances are shown in Table 2. Meanwhile, values of some fixed parameters are shown in Table 3, Table 4, Table 5, Table 6, Table 7, Table 8, Table 9 and Table 10.

In particular, the order cost is 25, 35, 20, 30, 30 and 35, respectively, for supplier S1, S2, S3, S4, S5 and S6. The truck's capacity Ct is 100 units per truck for each observation time period. Meanwhile, the new contract cost NCs is 25, 25, 30, 35, 30 and 30, respectively, for supplier S1, S2, S3, S3, S4, S5 and S6.

Ethical considerations

This article does not contain any studies involving human participants, and ethical clearance was not required for the research conducted.

Results and discussion

All computations were carried out in LINGO 19.0 optimisation software by utilising the uncertain programming package. The algorithm applied in the calculations was the generalised reduced gradient. This was used to solve the deterministic equivalent optimisation problem, which was combined with the branch and bound to calculate the integer solutions. The computer used in the experiment had regular specifications of a 3.0 GHz processor and 8GB RAM. In general, the higher the specifications of the computer the shorter the computational time. The numerical experiment was performed for six periods of observation. However, with these standard specifications, the computation was performed within a two-by-two period. This means the optimisation problem was solved for periods t = 1, 2, while the inventory level at t = 2 was used as the initial inventory level for the computation of t = 3, 4. Finally, the inventory level at period t = 3 was used as the initial level for the computation of t = 5, 6. Figure 3, Figure 4 and Figure 5 show the optimal decisions regarding the optimal raw part procurement, production and inventory management, respectively.

According to Figure 3, only some suppliers were selected to supply raw parts, for instance, at period 1, only suppliers S1, S2 and S4 were selected. Meanwhile, some were selected to supply only certain raw parts, for example, S1 and S2 supplied only raw part P1, while S4 supplied raw parts P1 and P2. This was because of the different performances of the various suppliers. Therefore, the mathematical model tried to determine the best combination as its optimal decision, which gave the minimal expectation of the raw part procurement cost for the whole optimisation time horizon.

Regarding the production planning decision, Figure 4 shows the optimal decision on how much each product brand should be produced in each period following the dynamics of the demand. All product brand types need to be produced for each period except period three where B1 is better not to be produced. This is because it mathematically gives a better expectation of the profit, meaning that producing this product brand at this period gives less expectation of the profit.

Figure 5 shows the optimal decisions regarding inventory management for the raw parts and the products. For some periods, it is better to buy more raw parts and/or produce or products and store them in the inventory for future periods, for example, raw parts at period 1 and products at period 2. This is generally because of the holding cost, which is cheaper than the procurement and/or production cost. At some other periods, it is better not to store raw parts but to buy or produce the parts to be used. This is because of procurement and/or production cost, which is cheaper than holding cost in general. This optimal decision was generated by the optimisation model following the prices and/or costs for all periods. For the whole periods 1 to 6, the expected maximal profit generated by the mathematical optimisation model was 246862.37. This is the expectation of the profit. The actual profit would be known only after all uncertain parameters are revealed, and it could be higher or less than expected. This is the best decision-makers can do in dealing with uncertain optimisation.

The results can be examined when all uncertain parameters are already known by observing possible outcomes. Furthermore, the two possible outcomes that are presented in Figure 6 are considered. For the first possible outcome in scenario 1, the actual profit was 255023.39 where all demands were satisfied with no shortages, but overproduction. Meanwhile, for the second possible outcome in scenario 2, the actual profit was much less, that is, 238701.29. In this outcome, there was as many as 46 units shortage for product brand B3. Also, there were only two possible outcomes as simulations, and some others might still occur.

The proposed mathematical model and the computational experiment results left some topics of discussion for decision-makers while implementing the model. This is summarised in the following managerial insights:

-

The proposed model can be modified following the problem's specifications faced by the decision-makers. For example, only some decision variables can be considered integers while some others are following real numbers. This occurs when the unit of raw materials or products is non-integer.

-

Only normal probability distributions were used in the experiments of this study. Moreover, the decision-makers could use different probability distributions for some particular uncertain parameters. However, this will depend on the data and which probability distribution fits the data.

-

When the decision-makers still have time before using the decision generated by the model, the optimisation can be run multiple times. The LINGO 19.0 will generate different possible outcomes and could give different optimal decisions. The decision-makers can decide, which decisions will be implemented based on experience and intuition.

-

When the supply-chain problem is bigger, for example, with more suppliers, raw part types as well as product brands, the model will be bigger in terms of the variables and parameter numbers. In this case, both the computational time and the number of decision variables will grow exponentially. Therefore, a common computer might not be sufficient and a super-computer will be needed. Parallel computing techniques or metaheuristic algorithms could be implemented as alternatives.

-

The actual profit, in the end, could be different from the profit value provided by the mathematical model as the problem was solved under uncertainty of parameters. However, the provided profit value is mathematically optimal.

-

The proposed model can be slightly modified by following the specification of the problem. For example, some fixed costs can be added to the objective function. Some new constraint functions can also be added such as budget limitations and production capacities.

Summary and future works

A new mathematical optimisation model has been proposed in the form of probabilistic dynamical optimisation. This model can be used by the decision-makers in manufacturing and retail industries for optimising integrated inventory, procurement and production planning with excess demand or uncertain parameters. Furthermore, it is suitable for extraordinary situations, such as during or post-pandemic periods. The computational experiment results showed that the proposed model successfully solved the given problem.

Further studies are recommended to develop the proposed model in order to handle more parties in the supply chain, namely distributors and carriers. In particular, the size of the problem solved in the numerical experiment was relatively small, and thus common optimisation algorithms were sufficient to solve the corresponding optimisation problem. If the size of the problem is sufficiently large, metaheuristic-based algorithms could be developed to solve the problem. Another potential extension is developing the model with problems containing lead time delay, for example, lead time in transporting raw material parts from suppliers to the manufacturer.

Acknowledgements

Competing interests

The authors declare that they have no financial or personal relationship(s) that may have inappropriately influenced them in writing this article.

Author's contributions

Conceptualisation: P.A.W., S. Sutrisno, Methodology: P.A.W., S. Sutrisno, Formal Analysis: P.A.W., S. Sutrisno, S. Solikhin, Investigation: P.A.W., S. Sutrisno, S. Solikhin, A.A., Writing-Original Draft: S. Sutrisno, S. Solikhin, A.A.; Visualisation: S. Solikhin, A.A.; Project administration: P.A.W., Software: S. Sutrisno, S. Solikhin, A.A., Validation: P.A.W., S. Sutrisno; Data Curation: S. Solikhin, A.A., Resources: P.A.W., Writing-Review & Editing: P.A.W., S. Sutrisno, S. Solikhin, A.A.; Supervision: P.A.W., Funding acquisition: P.A.W.

Funding information

This study was financially supported by Universitas Diponegoro under RPI Research Grant 2022 Contract Number 185-83/UN7.6.1/PP/2022.

Data availability

Data sharing is not applicable to this article as no new data were created or analysed in this study.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Ahmad, M.T. & Mondal, S., 2016, 'Dynamic supplier selection model under two-echelon supply network', Expert Systems with Applications 65, 255-270. https://doi.org/10.1016/j.eswa.2016.08.043 [ Links ]

Almeida, J.F.F., Conceição, S.V., Pinto, L.R., Oliveira, B.R.P. & Rodrigues, L.F., 2022, 'Optimal sales and operations planning for integrated steel industries', Annals of Operations Research 315(2), 773-790. https://doi.org/10.1007/s10479-020-03928-7 [ Links ]

Bai, Y., Costlow, L., Ebel, A., Laves, S., Ueda, Y., Volin, N. et al., 2022, 'Retail prices of nutritious food rose more in countries with higher COVID-19 case counts', Nature Food 3(5), 325-330. https://doi.org/10.1038/s43016-022-00502-1 [ Links ]

Barroso, B.C., Cardoso, R.T.N. & Melo, M.K., 2021, 'Performance analysis of the integration between Portfolio Optimization and Technical Analysis strategies in the Brazilian stock market', Expert Systems with Applications 186, 115687. https://doi.org/10.1016/j.eswa.2021.115687 [ Links ]

Caicedo Solano, N.E., García Llinás, G.A. & Montoya-Torres, J.R., 2022, 'Operational model for minimizing costs in agricultural production systems', Computers and Electronics in Agriculture 197(106932), 1-9. https://doi.org/10.1016/j.compag.2022.106932 [ Links ]

Chen, W. & Zou, Y., 2017, 'An integrated method for supplier selection from the perspective of risk aversion', Applied Soft Computing 54(Supplement C), 449-455. https://doi.org/10.1016/j.asoc.2016.10.036 [ Links ]

Chulkova, M. & Salapateva, S., 2022, 'Selection of a transportation option for the procurement of goods in small batches for own needs in order to increase the efficiency of operational planning', in 10th International Scientific Conference "TechSys 2021" Engineering, Technologies and Systems, AIP conference proceedings, vol. 2449, 070012-1, AIP Publishing LLCAIP Publishing, Plovdiv, Bulgaria, May 27-29, 2021.

Corominas, A., 2022, 'A model for designing a procurement-inventory system as a defence against a recurring epidemic', International Journal of Production Research 60(11), 3305-3318. https://doi.org/10.1080/00207543.2021.1919779 [ Links ]

Dehghani, M.J. & Yoo, C.K., 2020, 'Three-step modification and optimization of Kalina power-cooling cogeneration based on energy, pinch, and economics analyses', Energy 205, 118069. https://doi.org/10.1016/j.energy.2020.118069 [ Links ]

Faia, R., Pinto, T., Vale, Z. & Corchado, J.M., 2021, 'Portfolio optimization of electricity markets participation using forecasting error in risk formulation', International Journal of Electrical Power & Energy Systems 129, 106739. https://doi.org/10.1016/j.ijepes.2020.106739 [ Links ]

Firouz, M., Keskin, B.B. & Melouk, S.H., 2017, 'An integrated supplier selection and inventory problem with multi-sourcing and lateral transshipments', Omega 70(Supplement C), 77-93. https://doi.org/10.1016/j.omega.2016.09.003 [ Links ]

Gelain, L., Van der Wielen, L., Van Gulik, W.M., Geraldo da Cruz Pradella, J. & Carvalho da Costa, A., 2020, 'Mathematical modelling for the optimization of cellulase production using glycerol for cell growth and cellulose as the inducer substrate', Chemical Engineering Science: X 8, 100085. https://doi.org/10.1016/j.cesx.2020.100085 [ Links ]

Gonzatto Junior, O.A., Nascimento, D.C., Russo, C.M., Henriques, M.J., Tomazella, C.P., Santos, M.O. et al., 2022, 'Safety-Stock: Predicting the demand for supplies in Brazilian hospitals during the COVID-19 pandemic', Knowledge-Based Systems 247(108753), 1-10. https://doi.org/10.1016/j.knosys.2022.108753 [ Links ]

Guo, F., Li, Y., Xu, Z., Qin, J. & Long, L., 2021, 'Multi-objective optimization of multi-energy heating systems based on solar, natural gas, and air-energy', Sustainable Energy Technologies and Assessments 47, 101394. https://doi.org/10.1016/j.seta.2021.101394 [ Links ]

Gutiérrez, M., 2021, 'Making better decisions by applying mathematical optimization to cost accounting: An advanced approach to multi-level contribution margin accounting', Heliyon 7(2), e06096. https://doi.org/10.1016/j.heliyon.2021.e06096 [ Links ]

He, X., Xiang, J., Xiao, J., Cheng, T.C.E. & Tian, Y., 2022, 'An online algorithm for the inventory retrieval problem with an uncertain selling duration, uncertain prices, and price-dependent demands', Computers & Operations Research 148(105991), 1-14. https://doi.org/10.1016/j.cor.2022.105991 [ Links ]

Kallrath, J., 2021, Business optimization using mathematical programming, Springer International Publishing, Cham.

Kumar, S., Kumar, A. & Jain, M., 2020, 'Learning effect on an optimal policy for mathematical inventory model for decaying items under preservation technology with the environment of COVID-19 pandemic', Malaya Journal of Matematik 8(4), 1694-1702. https://doi.org/10.26637/MJM0804/0063 [ Links ]

Liu, B., 2009, Theory and practice of uncertain programming, 2nd edn., Springer-Verlag, Berlin.

Liu, B., 2015, Uncertainty theory, Springer Berlin Heidelberg, Berlin.

Liu, R., Lin, Y., Xu, G., Li, Y., Premalatha, R. & Chandran, K., 2021, 'Optimized hybridized mathematical model for wastewater treatment and energy generation using microbial fuel cells', Sustainable Energy Technologies and Assessments 47, 101348. https://doi.org/10.1016/j.seta.2021.101348 [ Links ]

Martínez-Reyes, A., Quintero-Araújo, C.L. & Solano-Charris, E.L., 2021, 'Supplying personal protective equipment to intensive care units during the COVID-19 outbreak in Colombia. A Simheuristic approach based on the location-routing problem', Sustainability 13(14), 7822. https://doi.org/10.3390/su13147822 [ Links ]

Meneses, M., Marques, I. & Barbosa-Póvoa, A., 2023, 'Blood inventory management: Ordering policies for hospital blood banks under uncertainty', International Transactions in Operational Research 30(1), 273-301. https://doi.org/10.1111/itor.12981 [ Links ]

Okolie, J.A., Epelle, E.I., Nanda, S., Castello, D., Dalai, A.K. & Kozinski, J.A., 2021, 'Modeling and process optimization of hydrothermal gasification for hydrogen production: A comprehensive review', The Journal of Supercritical Fluids 173, 105199. https://doi.org/10.1016/j.supflu.2021.105199 [ Links ]

Papachristos, I. & Pandelis, D.G., 2022, 'Newsvendor models with random supply capacity and backup sourcing', European Journal of Operational Research 303(3), 1231-1243. https://doi.org/10.1016/j.ejor.2022.03.036 [ Links ]

Peng, J., Zhuo, W. & Wang, J., 2022, 'Production and procurement plans via option contract with random yield and demand information updating', Computers & Industrial Engineering 170(108338), 1-26. https://doi.org/10.1016/j.cie.2022.108338 [ Links ]

Perez, H.D., Amaran, S., Erisen, E., Wassick, J.M. & Grossmann, I.E., 2021, 'Optimization of extended business processes in digital supply chains using mathematical programming', Computers & Chemical Engineering 152, 107323. https://doi.org/10.1016/j.compchemeng.2021.107323 [ Links ]

Pierott, R., Hammad, A.W.A., Haddad, A., Garcia, S. & Falcón, G., 2021, 'A mathematical optimisation model for the design and detailing of reinforced concrete beams', Engineering Structures 245, 112861. https://doi.org/10.1016/j.engstruct.2021.112861 [ Links ]

Raja Santhi, A. & Muthuswamy, P., 2022, 'Pandemic, war, natural calamities, and sustainability: Industry 4.0 technologies to overcome traditional and contemporary supply chain challenges', Logistics 6(4-81), 1-32. https://doi.org/10.3390/logistics6040081 [ Links ]

Sanghvi, N., Vora, D., Patel, J. & Malik, A., 2021, 'Optimization of end milling of Inconel 825 with coated tool: A mathematical comparison between GRA, TOPSIS and Fuzzy Logic methods', Materials Today: Proceedings 38, 2301-2309. https://doi.org/10.1016/j.matpr.2020.06.413 [ Links ]

Shahed, K.S., Azeem, A., Ali, S.M. & Moktadir, M.A., 2021, 'A supply chain disruption risk mitigation model to manage COVID-19 pandemic risk', Environmental Science and Pollution Research 1-16. https://doi.org/10.1007/s11356-020-12289-4 [ Links ]

Shutaywi, M. & Shah, Z., 2021, 'Mathematical modeling and numerical simulation for nanofluid flow with entropy optimization', Case Studies in Thermal Engineering 26, 101198. https://doi.org/10.1016/j.csite.2021.101198 [ Links ]

Wang, K.-M., Wang, K.-J. & Chen, C.-C., 2022, 'Capacitated production planning by parallel genetic algorithm for a multi-echelon and multi-site TFT-LCD panel manufacturing supply chain', Applied Soft Computing 127(109371), 1-13. https://doi.org/10.1016/j.asoc.2022.109371 [ Links ]

Ware, N.R., Singh, S.P. & Banwet, D.K., 2014, 'A mixed-integer non-linear program to model dynamic supplier selection problem', Expert Systems with Applications 41(2), 671-678. https://doi.org/10.1016/j.eswa.2013.07.092 [ Links ]

Yadav, A.S., Pandey, S., Arora, T., Chaubey, P.K., Pandey, G. & Swami, A., 2021a, 'A Study of Ant Colony Optimization for travelling salesman problem under an effect of Covid-19 pandemic on Medicine Supply Chain inventory management', Ilkogretim Online 20(5), 1450-1460. [ Links ]

Yadav, A.S., Pandey, T., Tomar, V. & Kumar, N., 2021b, 'Tabu search problem application based economic impact of coronavirus pandemic on sugar industry inventory system for deteriorating objects with two-distribution center and waste-material treatment', Materials Today: Proceedings 51, 871-879. https://doi.org/10.1016/j.matpr.2021.06.277 [ Links ]

Yadav, S. & Prakash Singh, S., 2022, 'Modelling procurement problems in the environment of blockchain technology', Computers & Industrial Engineering 172(108546), 1-15. https://doi.org/10.1016/j.cie.2022.108546 [ Links ]

Zarte, M., Pechmann, A. & Nunes, I.L., 2022, 'Knowledge framework for production planning and controlling considering sustainability aspects in smart factories', Journal of Cleaner Production 363(132283), 1-12. https://doi.org/10.1016/j.jclepro.2022.132283 [ Links ]

Zhou, J., Wu, Y., Zhong, Z., Xu, C., Ke, Y. & Gao, J., 2021, 'Modeling and configuration optimization of the natural gas-wind-photovoltaic-hydrogen integrated energy system: A novel deviation satisfaction strategy', Energy Conversion and Management 243, 114340. https://doi.org/10.1016/j.enconman.2021.114340 [ Links ]

Correspondence:

Correspondence:

Purnawan Wicaksono

purnawan@lecturer.undip.ac.id

Received: 23 May 2023

Accepted: 18 Aug. 2023

Published: 20 Oct. 2023