Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.123 n.1 Johannesburg Jan. 2023

http://dx.doi.org/10.17159/2411-9717/1506/2023

PROFESSIONAL TECHNICAL AND SCIENTIFIC PAPERS

Development status of coal mining in China

X. LiuI; L. LiII; Y. YangI

IState Key Laboratory of Water Resource Protection and Utilization in Coal Mining, China Energy Investment Corporation, Beijing. ORCID: X. Liu: http://orcid.org/0000-0003-4339-7207

IISchool of Energy and Mining Engineering, China University of Mining and Technology-Beijing, Beijing 100083, China

SYNOPSIS

Coal mining in China is facing the transition from output to quality. Based on the total mining capacity and average production, the current situation of coal mining at mine, city, and province levels is analysed, and data in support for the layout of sustainable mining development and the optimization of output provided. The results show that 87% of China's coal is mined by underground methods, with an average production capacity of 0.93 Mt/a per mine. Open pit mining accounts for 13%, with an average mine production capacity of 5.73 Mt/a. The average mining capacity of coal mines in China is 1.05 Mt/a, with 1181 coal mines with an average capacity less than 0.3 Mt/a, accounting for 35% of the total coal mines but contributing only 4.51% to output. They are distributed in about 48 cities in six provinces, seriously restricting the transition to green coal mining. The coal industry should speed up the closure of small coal mines in key provinces and cities, eliminate outdated production capacity in the central region, increase the speed and proportion of coal resources moving westward, and promote high-quality development of coal mining.

Keywords: coal mining, production capacity, sustainable mining, price indices.

Introduction

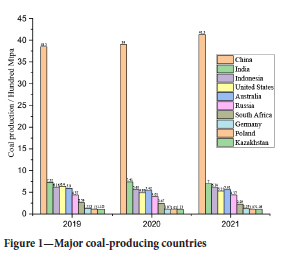

Coal is the lifeblood of industry. The world's annual output is nearly 8 Gt/a. Ten countries - China, India, Indonesia, the USA, Australia, Russia, South Africa, Germany, Poland, and Kazakhstan - produce more than 100 Mt/a and account for 95% of the world's total output. China, the largest producer, accounts for half of world production, (Figure 1).

The large amount of coal production in China is related to national conditions. China's resource endowment is rich in coal, but lacking in oil and gas, and coal resources account for more than 68% of primary energy production in the long term. Until 2020, coal accounted for 67.2% of China's total energy, while oil and gas supplied only 6.8% and 6% respectively, as shown in Figure 2.

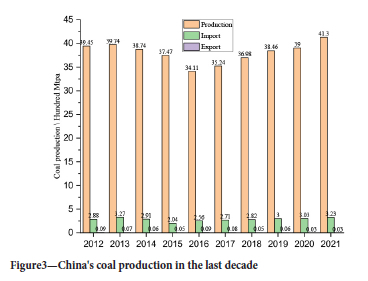

China has always emphasized food and energy security. Coal is the mainstay of China's energy security, and coal guarantees stable domestic prices and smooth operation of the economy. The active and controllable role of coal is reflected in two main aspects. Firstly, capacity can be increased or decreased according to the national demand. For example, during the 2016 energy surplus, the state required coal mines to organize production according to 276 working days, resulting in a 16% drop in production to 3.41 Gt/a. Secondly, China's coal-to-liquids (CTL) industry uses coal as a raw material to produce oil and petrochemical products by either a direct or an indirect coal liquefaction process, with capacities of 1 Mt/a and 4 Mt/a respectively. The current international and regional situation is profoundly complex and changeable, and various challenges and uncertainties have increased significantly. In the first half of 2022, coal production reached 2.19 Gt. Variations in production over the last decade are shown in Figure 3.

By the end of December 2018, China had 3373 fully-licensed coal mines with a total output of 3.53 Gt/a, with an average production capacity of 1.045 Mt/a /mine, comprising 0.93 Mt/a per mine for underground mining and 5.73 Mt/a per mine for open-pit mining (National Energy Administration, 2019. Coal mining is carried out in about 25 provinces, mainly concentrated in 176 urban areas, the details of which are shown in Table I, and the mining level distribution is shown in Figure 4. It is worth stating that the history of Taiwan's coal mines spans about 125 years, from the first officially operated coal mine by the Chinese Qing Dynasty government in Baduzi, Keelung, in 1876, to the closing of the last coal mine around 2000.

At present, the regional distribution and technology level of coal mines in China vary greatly, and advanced and outdated coal mining technology coexist. There are 41 working faces of 10 Mtp/a in China, including 25 underground and 16 open pit. However, there are also 1181 mines with an annual output of less than 0.3 Mt/a (1176 underground and five open pits), accounting for 35% of the total number of coal mines but only 4.51% of the total output. This shows a serious imbalance between quantity and output. In order to advance the national three-year action plan for the special rectification of work safety, in the next three years, small coal mines with an output of less than 0.3 Mt/a will be disposed of by category and more efforts will be made to close them. By 2022, the proportion of large coal mines in China will reach more than 70%. At the same time, the level of mechanization, information, automation, and intelligence of coal mines will be improved. There are 41 coal mines with an output of 10 Mt/a or more in China, with a combined production of 666.4 Mt/a (Ministry of Emergency Management, 2020).

In this paper we consider coal mining from three levels: mine, city, and province, which provides data support for the proactive strategic layout of coal resources in China.

Types of coal mining in China

Mining type

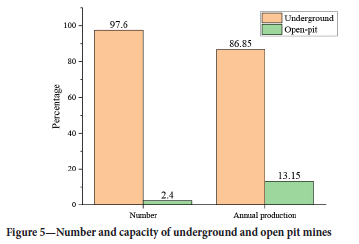

Due to national conditions and geographical differences, coal mining is dominated by underground mines, accounting for 87%of the total output. The production capacity of underground and open pit mines is shown in Figure 5 and Table II.

Underground mining

China has 3292 underground coal mines with a total output of 3063 Mt/a and an average production capacity of 0.93 -Mt/a. The distribution by capacity is shown in Figure 6.

One quarter of the underground mines are classified as high-yielding (>1 Mt/a). Production capacity is mainly concentrated in those mines with an annual output of 1 Mt/a or less, and the contribution to output is low, which seriously drags down the coal mining level. The greatest number of mines (1288, 39%) are in the category 0.3-1 Mt/a, contributing 24% of the underground output. There are 1176 mines with a production capacity of less than 0.3 Mt/a, accounting for 36% of the total number of underground mines, and the output contribution is only 4.5%. The mainstay of China's coal output is the mines with an annual output of over 1 Mt/a, among which 803 have an annual output of 1 to 10 Mt/a, accounting for 24% of the total, and the output contribution is as high as 59.9%. There are 25 mines (less than 1% of the total) with an annual output of 10 Mt/a or more, the output contribution of which is 11.6%.

The smaller mines (<0.3 Mt/a) are concentrated mainly in the- southern and eastern regions. Mining at this small scale causes serious safety, economic and ecological problems. The current focus of production capacity reform is therefore to close mines of less than 0.3 Mt/a capacity, reduce the number of mines in the 0.31 Mt/a category, and increase the number of mines with production capacity of more than 1 Mt/a.

Open pit mining

There are 81 open pit mines, with a total output of 463 Mt/a and an average production capacity of 5.73 Mt/a. Open pit mines are concentrated in nine provinces, with Inner Mongolia, Xinjiang. and Shanxi accounting for 95% of the open-pit output. Production varies widely, with Inner Mongolia producing 290 Mt/a, while Guangxi produces only 200 kt/a. The number of medium-capacity open pit mines (0.3-10 Mt/a) is large, but the number of high- and low-capacity mines is small.Nevertheless, open pit mines with a capacity of over 10 Mt/a make a substantial contribution to the total output, as shown in Figure 7.

There are 36 open pit mines in the 1-10 Mt/a category, accounting for 44.4% of the total number of mines but only 30.08% of the output contribution, which is lower than the average level. There are 24 mines (29.6% of the total) with a production capacity of 0.3-1 Mt/a, contributing only 2.78% to the output, which is much lower than the average level. Five mines (6.2% of the total) have a capacity of less than 0.3 Mt/a, with an output contribution of less than 0.1%. There are 16 open pit mines with positive output contributions, all of which have a production capacity of more than 10 Mt/a, and for which the output contribution is as high as 67.06%. Based on the comprehensive comparison, it can be seen that the production capacity level of open pit mines is seriously polarized. The low contribution rate of mines with a production capacity of less than 10 Mt/a affects the average mining level. The lower the production capacity, the more obvious it is. Therefore, it is necessary to speed up the closure of open pit mines with a production capacity of less than 1 Mt/a.

City ranking of China's coal mining

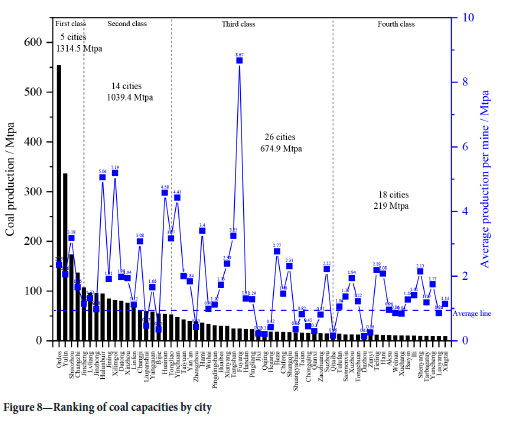

There are about 176 cities in China engaged in coal mining, and due to regional differences, the output varies greatly. There are about 63 cities with coal production capacities of more than 10 Mtp/a, with a combined capacity of 3248 Mt/a, accounting for 92% of total production. The distribution of mining by city is shown in Table III. Based on the national average coal production capacity of 1.045 Mt/a, the urban mining levels are shown in Figure 8.

Ordos, Yulin, Shuozhou, Changzhi, and Jincheng are among the cities that produce more than 100 Mt of coal annually. With a combined output of 1314.5 Mt/a, about 25% of total coal production, these five cities are the 'capitals' of modern coal mining. Among them, Shuozhou has the highest annual coal output and Jincheng the lowest, but all of them are better than the national average capacity. There are 14 cities with an annual coal output of 50-100 Mt/a, with a combined output of 1039.4 Mt/a, which can be regarded as the core cities for coal mining. The average capacity in this group varies widely. Xilingol has the highest annual coal output and Liupanshui the lowest. There are 26 cities with a coal production capacity of 15-50 Mt/a, with a combined output of 674.9 Mt/a, which can be regarded as the reserve force of modern coal mining cities. There are still 113 cities with less than 10 Mt/a capacity, and their combined capacity is 278.29 Mt/a.

The level of urban coal mining depends not only on the output of coal, but also on the number of coal mines. Fuyang has the highest annual coal output, while Dazhou has the lowest, with 34% of the cities in this echelon below the national average. Ordos, the city with the largest coal output, has a large number of coal mines (237). However, after calculating the average value, its production capacity is lower than that of Fuyang. The reason is that Fuyang has only three coal mines (annual output 11.4, 9.6, and 5 Mt/a), and its production capacity is higher after calculating the average value. Secondly, Xilingol, Hulun Buir, Huainan, and Baoji have higher average coal production capacities. Xilingol has 16 coal mines, including four open-pit mines with an output of 10 Mt/a and three open-pit mines with an output of more than 5 Mt/a, raising the average coal production capacity in the region. Hulunbuir has 19 coal mines, and its average production capacity is high because it has two open-pit mines of more than 20 Mt/a. The average production capacity of 16 coal mines in Huainan was increased after the elimination of two low-yielding mines. Baoji has only two coal mines (annual output 5 and 4 Mt/a) and its average coal production capacity is relatively high.

Dazhou (Sichuan), Southwest Guizhou Autonomous Prefecture (Guizhou), Zunyi (Guizhou), Qujing (Yunnan), Jixi (Heilongjiang), and Qitaihe (Heilongjiang) are cities with annual coal output of 10 Mt, but the average production capacity is less than 0.3 Mt/a. Their common characteristics are low total coal output, a large number of mines, and low average coal production capacity, which are the key points for optimization and reform. In general, there are 44 coal mines with an average production capacity of more than 1.045 Mt/a, accounting for about 70% of the major coal-mining cities.

Generally speaking, in China, the greater the capacity, the more stringent environmental and ecological protection requirements, and the higher the overall efficiency. It can be seen that there is still much room for improvement in both the number and average coal production capacity of coal mines.

China's economy is mainly concentrated in the south, and coal mining is mainly in the north. The areas of coal production and consumption are adversely distributed, and since the transportation cost is high, the low-capacity coal mines in the south have remained in production. With advances in technology and the construction of west-east power transmission lines, five clean energy bases have been established in the north to transport coal south, and the small mines are about to be closed.

Interprovincial coal production level

Provincial coal output and capacity

China has 25 provinces and municipalities directly under the Central Government engaged in coal mining, and their output and capacities vary greatly due to their wide geographical distribution. The output status and average coal production capacities are shown in Figure 9.

Eight of China's major coal-producing provinces (Shanxi, Inner Mongolia, Shaanxi, Xinjiang, Guizhou, Shandong, Henan and Anhui) produce more than 100 Mt/a of coal, and can be regarded as the first echelon of coal production. Among them, the production capacities of Guizhou and Henan are lower than the national average.

There are 11 provinces in the second echelon of coal production, with outputs between 10 and 100 Mt/a. These are Heilongjiang, Ningxia, Hebei, Sichuan, Gansu, Yunnan, Liaoning, Jilin, Chongqing, Jiangsu, and Hunan, among which Hunan, Sichuan, Heilongjiang, Yunnan, Chongqing, and Jilin have significantly lower outputs than the national average. The coal output of the third echelon is relatively low, and is concentrated mainly in six provinces, namely Jiangxi, Guangxi, Qinghai, Fujian, Beijing, and Hubei. Except for Beijing, the coal outputs of these provinces are all lower than the national average. From the perspective of coal output and average production capacity, the six provinces in urgent need of reform are Jiangxi, Hubei, Hunan, Sichuan, Fujian, and Heilongjiang. The mines account for 27% of capacity, but the coal output contribution is only 5% and the average coal production capacity is less than 0.3 Mt/a.

Similarly, taking the average coal production capacity of 1.045 Mt/a as the baseline, the provinces at the higher level are Shanxi, Inner Mongolia, Shaanxi, Xinjiang, Shandong, Anhui, Ningxia, Hebei, Gansu, Liaoning, Jiangsu, Qinghai, and Beijing. The main reason for the high average coal production capacity of these provinces is that they have geographical advantages, good coal storage conditions. and large reserves, which are the main areas that the coal mining strategy is concerned with. Another reason is that outdated production capacity is constantly eliminated and the mining level is improved, such as in Shandong, Beijing, Jiangsu, and other regions.

The provinces with low average coal production capacity are mainly located in southern China, with complex geographical conditions, low total production, and many coal mines, which should be paid close attention in the future coal production capacity reform. In order to implement this reform, the country put forward the requirement of classification management of coal mines with an annual output of less than 0.3 Mt/a. Jiangxi Provincial Administration of Coal Mine Safety has developed an implementation plan for classified disposal of coal mines less than 0.3 Mt/a in the province. The implementation plan clarifies the overall requirements, main tasks, and safeguard measures, and calls for the accelerated closure of coal mines with an annual output of 0.9 Mt/a or less in Pingxiang city, and the resolute elimination of mines with an annual coal output of 0.9 Mt/a or less that do not meet the standards of industrial policy, safety, environmental management, and amount and quality of resources (National Coal Industry Network, 2020a).

Although Guizhou and Henan are major coal-producing provinces, their mining capacities are lower than the national average, so outdated coal mines should be eliminated as quickly as possible. In April, Guizhou province closed 254 legal coal mining operations with a capacity totalling 135 Mt/a as of end 2020 (Guizhou Province, 2020). In 2020, Henan province will eliminate coal overcapacity, close six coal, and promote high-quality development of coal mining (Henan Province, 2020).

Output and production capacity of open pit coal mines

There are 81 open pit coal mines, mainly located in nine provinces. China's opencast coal mining is concentrated in the three provinces of Inner Mongolia, Xinjiang, and Shanxi, with Inner Mongolia accounting for 64% of the country's output. The production capacity of open pit coal mines in China varies greatly, as shown in Figure 10.

Ha'erwusu open pit coal mine and Shenhua Baorixile Energy Co., both have a coal production capacity of 35 Mt/a, while that of No. 9 of No. 5 panel of Gulianhe mine and No. 3 of the Gulianhe mine, both of which are in the Greater Khingan Range, is only 50 kt/a and 40 kt/a, showing a serious polarization. Taking 5.73 Mt/a as the average production capacity of open pit coal mines in China, only Inner Mongolia and Shanxi are above this level, which shows the uneven distribution of output and production capacity of open pit coal mines. In order to improve the level of open-pit coal mining in China, urgent attention should be given to the reform of open pit coal mining in Guangxi, Heilongjiang, and Qinghai provinces.

China thermal coal price index (CTCI)

The price of thermal coal in China is closely related to coal production capacity, which indirectly reflects the balance between supply and demand. Northwest China is rich in coal resources and mining costs are low, but the local economy is underdeveloped and the coal supply is greater than the demand; Central China has a poor coal resource endowment, high mining costs, and a more developed economy, and the supply exceeds demand. Thus the price difference between these regions is large, which is why electricity is supplied to the east from the west.

The National Development and Reform Commission made it clear in its memorandum on curbing abnormal price fluctuations in the coal market that from 2016 to 2020, in order to prevent abnormal price fluctuations in coal, the state has established an early warning mechanism that classifies thermal coal prices into green, blue, and red categories. The green category (normal price) is 500~570 CHY per ton; the blue is 570 ~600 or 470~500 CHY per ton; and the red category is above 600 CHY per ton or below 470 CHY per ton. The CTCI of each province is an indicator of the competitiveness of coal mining to a certain extent. The distribution of CTCIs for provinces with large coal production capacities in the past six years is shown in Figure 11.

It can be seen that in the past six years, the national average thermal coal price was within a reasonable range only in 2017 and 2018, while in the other four years the price was relatively low, mainly due to oversupply. Due to geographical and regional economic development differences, Shandong, Henan, and Anhui have seen high coal prices, while prices in Xinjiang, Inner Mongolia, Shanxi, and Shaanxi have long been low, and the price advantage represents the potential of coal mining in the future. At the end of April 2020, China National Coal Group, China Huaneng Group, and State Power Investment Group formally signed the 2020 coal medium- and long-term contract, with the benchmark coal price of 535 CHY per ton. Coal power enterprises will successively complete the contract signing before 10 May 2020. Large coal enterprises should play a leading role in stabilizing the market and take effective measures to keep the price within the green range and prevent excessive price fluctuations (State Coal Industry Network,2020; National Coal Industry Network, 2020b).

In China, the greater the coal production capacity the higher the mining level, the lower the cost, and the better the benefit. Usually, this kind of coal mine is a nationally owned enterprise and guides the development of the coal market. Since 2016, China has promoted the supply of coal on a medium- and long-term contract basis and implemented the pricing mechanism of 'benchmark price plus floating price'. The benchmark price of 5500 large trucks of thermal coal was CNY 535 per ton from 2017 to 2021, and was adjusted to CNY 700 per ton in 2021.

Coal mine safety and costs

In China, with increasing investment in coal mine safety, the safety level has improved dramatically and the fatality rate per million tons of coal mined has decreased year by year, as shown in Tables IV and V.

During the 18 years from 2004 to 2021, the safety production cost standards of coal production enterprises were adjusted twice, in 2004 and 2012, and a new revision is in progress starting in 2022. The investments in safety measures and corresponding drop in fatality rates are shown in Figure 12.

Conclusions

China is geographically diverse and has a variety of coal mining conditions. A large number (1181) of small mines with an annual production of less than 0.3 Mt account for 35% of the total production. The contributing rate of output is only 4%, which seriously restricts the sustainability. Jiangxi, Hubei, Hunan, Sichuan, Fujian, and Heilongjiang provinces are the main areas in which underground mining should be reduced, while Guangxi, Heilongjiang, and Qinghai provinces are the main areas to reform and optimize open pit mines.

China's average coal production capacity is 1.045 Mt/a per mine. The average coal production capacity of underground mines, which comprise 75% of the total number of mines, is 0.93 Mt/a, lower than the average level. The average coal production capacity of open pit coal mines is 5.73 Mt/a, and these mines account for 68% of production. The average coal production capacity of both underground and open pit mines has great potential for optimization.

China will transition from a major country to a leading country in coal mining, and switch the emphasis from output to quality. China should accelerate the strategic shift of coal in the west region, optimize the central region, and promote coal as a sustainable resource with an output that can be adjusted proactively.

Acknowledgements

The research work was supported by the CHN ENERGY Science and Technology Innovation Project (SHJT-17-38) and the National Natural Science Foundation of China (52004012).

References

Guizhou Province. 2020. Guizhou Provincial Administration of Resource. Announcement on the lawful production capacity of coal mines in the whole province in April 2020 [EB/OL]. 2020-04-03 [2020-04-30]. http://nyj.guizhou.gov.cn/xwzx/gsgg/202004/t20200403_55774909.html [ Links ]

Han Province. 2020. Provincial People's Government. Office of Henan leading group on eliminating overcapacity [EB/OL]. 2020-03-20 [2020-04-30]. https://www.henan.gov.cn/2020/03-20/1307488.html [ Links ]

Ministry of Emergency Management. 2020. Three-year Action Plan for Special Rectification of National Production Safety [EB/OL]. 2020-04-28 [2020-04-30]. https://www.mem.gov.cn/xw/bndt/202004/t20200428_350572.shtml [ Links ]

National Energy Administration. 2019. Notice no. 2 of 2019 [EB/OL]. 2019-315 [2019-04-30]. http://zfxxgk.nea.gov.cn/auto85/201903/t20190326_363a7.htm [ Links ]

National Coal Industry Network. 2020a. Jiangxi formulated a work plan for classified disposal of coal mines with an annual output of less than 0.3 million tonnes [EB/OL]. 2020-04-14 [2020-04-30]. http://www.coalchina.org.cn/index.php?a=show&c=index&catid=15&id=117072&m=content [ Links ]

National Development and Reform Commission. 2020. Price Monitoring Center of the National Development and Reform Commission, PRC. China thermal coal price index (CTCI) [EB/OL]. 2020-02-20 [2020-04-30]. http://jgjc.ndrc.gov.cn/dmzs.aspx?clmId=741 [ Links ]

State Coal Industry Network. 2020. China Coal Group, Huaneng, Guodian formally signed the 2020 Coal Medium and Long Term Contract [EB/ OL]. 2020-04-30 [2020-04-30]. http://www.coalchina.org.cn/index.php?m=content&c=index&a=show&catid=16&id=118422.[8] [ Links ]

National Coal Industry Network. 2020b. It is expected that the basic balance of supply and demand in the coal market will be slightly loose this year. [EB/OL]. 2020-05-07 [2020-05-09]. http://www.coalchina.org.cn/index.php?m=content&T [ Links ]

Correspondence:

Correspondence:

X. Liu

Email: liuxinjie@pku.edu.cn

Received: 6 Feb. 2021

Revised: 27 Jul. 2022

Accepted: 17 Oct. 2022

Published: January 2023