Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.122 n.12 Johannesburg Dec. 2022

http://dx.doi.org/10.17159/2411-9717/1647/2022

PROFESSIONAL TECHNNICAL AND SCIENTIFIC PAPERS

The spillover effect of industrial action on the profitability of platinum mining companies

B. CekiI; M.L. PududuII; K. MohajaneII

IDepartment of Financial Accounting, University of South Africa, South Africa. https://orcid.org/0000-0002-9827-0732

IIDepartment of Financial Governance, University of South Africa, South Africa. ORCID: M.L. Pududu: https://orcid.org/0000-0002-5523-749X; K. Mohajane: https://orcid.org/0000-0002-4367-9549

SYNOPSIS

This study was aimed at determining the effects of industrial action on profitability in the South African platinum mining sector. We compared companies where employees engaged in industrial action (affected companies) to strike-free companies (competing companies). Industrial action refers to strikes by rock-drillers, as these strikes typically result in the shutdown of production at the mines affected. A t-statistics analysis of significant differences in revenue and earnings of affected and non-affected platinum companies was conducted using data from platinum mining companies listed on the Johannesburg Stock Exchange from 2011 to 2015. Contrary to international studies, which suggest that the spillover effects of industrial action positively affect competing companies, our findings show that profits in the platinum sector decrease significantly during strike periods for both affected and competing companies. The results indicate industrial action is a threat to the profitability of all companies, and that employee demands should be prioritized and negotiated before they result in industrial action. Improved dialogue between management, labour unions, and employees in the platinum mining industry is recommended. The study contributes to the scanty literature on the effect of industrial action on the profitability of mining companies in a developing economy.

Keywords: industrial action, profitability, platinum mining, mining industry.

Introduction

The mining industry is a significant contributor to the South African economy. It employs more than 1.4 million, a number higher than all the other industries in South Africa (Mnwana, 2015; Moloi, 2015; Chambers of Mines of South Africa, 2014). The platinum sector is the major contributor to the GDP in the mining industry, followed by the gold mining sector (Mnwana, 2015). However, the mines have been plagued with crippling and costly labour strikes. The Lonmin plc platinum strike that lasted for six weeks in 2012 resulted in the death of 34 mineworkers (Thomas, 2018). A subsequent strike in 2014 led to a five-month shutdown in the operations of six large platinum miners (Bohlmann, van Heeden, and Dixon, 2015; Alexander, 2013). The cost of these strikes to the affected mining companies is estimated at approximately a 23 billion South African rand in lost revenue and R10.7 billion in employee earnings (Bohlmann, van Heeden, and Dixon, 2015).

There is little information in the literature on how strikes in the platinum mines affect the profitability of competing platinum companies that did not have strikes. Profitability in this study refers to revenue and earnings before interest, tax, depreciation, and amortization (EBITDA). The strikes considered here relate to industrial action by underground rock-drillers; these strikes usually lead to the production shut-down of the affected mines. Affected companies refers to companies that suffered strikes, while competing companies refers to companies that did not have strikes.

The motivation for the study is to shed light on the effect of strikes on the profitability of companies affected and the spillover effects on competing companies. Most platinum mining companies not affected by strikes did not disclose spillover effects of the strikes, nor did they disclose strikes as a high-risk factor in their financial statements, hence the need to investigate spillover effects (Moloi, 2015) and to ascertain whether strikes are a risk factor that should be disclosed in the financial statements. Similar studies on the spillover effect of strikes on competing companies in industries other than mining have been done internationally, and shown conflicting results; these are briefly discussed below.

McDonald and Bloch (1999) found that strikes in a manufacturing company in Australia had a significant positive effect on the profitability of competing companies that did not suffer strike action.

De Fusco and Fuess (1991) found that strikes in the Australian airline industry had a significantly negative effect the market value of the affected companies, and a significant positive effect on market value for competing companies. Kramer and Vasconcellos (1996) found no significant effect of strikes on the market value of competing companies in the US vehicle manufacturing industry. These studies were conducted in developed countries and on industries other than mining. South African studies on industrial action in the mining industry have examined the national economic effect of strikes in platinum mines, while others examined strike effects on financial statement disclosures (Bohlmann, van Heeden, and Dixon, 2015; Moloi, 2015). For example, Bohlmann, van Heeden, and Dixon (2015) found that the 2014 platinum mining strike in South Africa had a negative effect on the economy which will continue into the future. The Bohlmann, van Heeden, and Dixon (2015) study was an economy-wide study, and the results may differ when considering the effect of strikes on profitability at the company level. Therefore, the present study extends the existing literature by providing a developing country context and focusing on an industry not yet examined.

The strikes considered in previous studies were of short duration compared to those in the present study. For example, the 2014 platinum strike lasted for five months compared to an average of three days for strikes in international studies (Bohlmann, van Heeden, and Dixon, 2015; Dabscheck, 1991; Neumann and Reder, 1984). The length of a strike may have a spillover effect on the profitability of competing companies. Profitability in previous studies was measured using a profit cost margin (i.e. profit divided by total income) (McDonald and Bloch, 1999), while this study uses earnings before tax, interest, depreciation, and amortization (EBITDA) as a measure of profitability. EBITDA is a better measure of profitability because it excludes fixed costs such as depreciation and amortization (Bouwens, Kok, and Verriest, 2019). Revenue was used to examine if there is a significant difference between the revenues of the affected and competing mines.

Considering the previous studies discussed, it is of interest to examine the following research question:

Is there a spillover effect on the profitability of competing mining companies due to strikes in affected mining companies in the platinum mining sector?

The findings will provide insight to managers, shareholders, and other stakeholders regarding whether strikes in mining companies affect the competing mining companies' profitability.

Background: Industrial action in the South African mining sector

Mineworkers generally have a low level of education; they work long hours, often under adverse health and safety conditions and are easily exploited by mining executives attempting to maximize profit margins (Mnwana, 2015; Alexander, 2013). Mineworkers live under poor conditions as they cannot afford a reasonable standard of living with their low wages while supporting big families at home (Mnwana, 2015). Even skilled mineworkers such as engineers and artisans suffer stress related to remuneration and fringe benefits, and fatigue due to long working hours (Thasi and van der Walt, 2020; Pelders and Nelson, 2019).

Low wages have always been the root cause of the mining strikes. For example, the 2012 strike at Lonmin Platinum plc, which resulted in the deaths of 34 mineworkers, was a strike over wage demands (Mnwana, 2015; Alexander, 2013). The mineworkers were demanding wages of R12 500 (which is $892 using an average exchange rate for 2016 of R14 to the US dollar), which would amount to at least three times the wages they were earning at the time (Antin, 2013). Another significant strike in the platinum sector took place in 2014, again due to unmet wage demands, and lasted for five months. The affected companies were Anglo American Platinum Ltd, Lonmin Platinum plc, and Impala Platinum Holdings (Bohlmann, van Heeden, and Dixon, 2015; Moloi, 2015; Alexander, 2013; Kaonga and Kgabi, 2011). The mineworkers were still demanding a basic wage of R12 500. The strike ended when management agreed to increase wages by R1 000 for the next three years and reach the R12 500 wage demand by 2017 (Sinwell, 2019).

Literature review

Most research on strikes focuses on the causes, duration, costs and benefits of strikes, and political dynamics (Onyembukwa, 2021; de Kadt, Kanu, and Sands 2020; Benya, 2015; Chinguno, 2015; Mnwana, 2015; Stewart, 2013; Alexander et al., 2012; Barchiesi, 1999). There is a small body of literature based on international studies that reports mixed results regarding the effect of strikes on profitability of both affected and competing companies (Kramer and Vasconcellos, 1996; de Fusco and Fuess, 1991). A recent South African study considered the effect of strike announcements on company value instead of the effect of strikes on profitability of affected and competing firms (Afik, Haim, and Lahav, 2019).

International studies

A study conducted on the US airline industry found that a strike negatively affects the share price of an affected company, while the profits of a competing company are positively affected (de Fusco and Fuess, 1991). However, the authors caution that the results could be different for manufacturing companies, which can build up inventory before the strike. This is impossible in the airline industry. Therefore, a follow-up study by Kramer and Vasconcellos (1996) examined the effect of strikes on share returns of competing companies in the vehicle manufacturing industry over time. They used event analysis to study the share returns of the strike-free companies in the same industry before, during, and after the strike. Kramer and Vasconcellos (1996) found that the strike-hit companies were negatively affected but insignificantly so, which may be due to stockpiling prior to the strike. The positive spillover to the competing companies was not statistically significant. Another study, in the Australian manufacturing industry, revealed that strikes result in increased profitability for competing companies (McDonald and Bloch, 1999).

Neumann (1980) studied the effect of strikes on company value as measured by the stock market and found that a strike initially had a negative effect, but a positive one after the strike ended. He also found that the effect on the value of the affected companies was negative but insignificant because the market anticipated the strike (Neumann, 1980). Becker and Olson (1986) also examined the effect of strikes on a firm's share price by conducting an event analysis and found an insignificant negative effect of strikes on the share price of the affected company. Afik, Haim, and Lahav (2019) found that an announcement of an impemding strike had a negative effect on the value of Israeli companies. Therefore, the literature shows that strikes do not have a significant negative affect on the affected companies, but do positively affect the competing companies.

In summary, earlier international studies suggest that strikes have a negative effect on the affected company's profitability and a positive effect on the competing companies' profitability.

South African research on the effect of mining strikes on affected companies

Most studies on mining strikes in South Africa focus on the political and human resource dynamics (Onyebukwa 2021; de Kadt, Johnson-Kanu, and Sands 2020; Schultz, 2020; Rodny-Gumede and Swart 2020 Tinsley, 2019; Bavu, 2015; Benya, 2015; Chinguno, 2015; Mnwana, 2015; Alexander, 2013; Stewart, 2013). The few studies that examined the effect of strikes on profitability and share value only looked at affected mining companies. these are briefly discussed next.

Bhana (1997) examined the effect of strikes on the shareholder value of the affected companies. The study found that the value of shares decreases at the announcement of the strike and during the strike, and does not increase significantly at the end of the strike. Seedat (2013) found that share prices of affected gold mining companies steadily decreased before, during, and after the strike. The decrease began as soon as the strike was announced. At the economy level, Bohlmann, van Heeden, and Dixon (2015) predicted that the negative effect of the five-month platinum belt strike in 2014 on the South African economy would continue to be felt for the next 20 years.

The few studies done in South Africa suggest that the affected mining companies are negatively affected by strikes, but are silent on the spillover effect of strikes on competing companies. The current study is aimed at closing this gap in the literature. We also investigate the spillover effect of strikes in the mining industry in the context of a developing economy; a topic that does not appear to have been examined in the literature. As mentioned above, the international studies found a positive spillover effect of strikes on competing companies. Therefore, the hypotheses for the study are:

1 Competing platinum mining companies' revenue is affected by strikes at the affected platinum mining companies.

2 Competing platinum mining companies' EBITDA is affected by strikes at the affected platinum mining companies.

Theoretical framework

The theory of the offset factor is adopted in the study. This theory, which is also called Christenson's theory, states that the effect of work stoppages due to industrial action on the production of the striking company should be offset by competing companies not striking (Paarsch, 1990; Christenson, 1953). Paarsch (1990) adds that the competing companies should increase output, resulting in more sales. Paarsch also found that when there is no excess production from competing companies and the strike is prolonged, the prices of the products increase. This theory is applied in the current paper because a similar concept is studied - whether industrial action that affects production affects the profitability of competing companies in the platinum mining sector. The principles of this theory support the hypotheses stated above.

Methodology

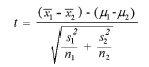

The quantitative method is employed for the study using secondary data from audited financial statements of platinum mining companies, which can be regarded as reliable. Robust t-statistics were used to examine the statistical significance of the difference in the mean revenue and mean EBITDA for affected mining companies compared with competing companies (Papangkorn et al., 2021). T-statistics have been used in accountancy to determine if there is a significant difference between the mean of two groups (Dalci et al., 2013). Revenue and EBITDA figures of the companies were scaled by total assets to minimize the risk of outliers (Smith and Wright, 2004). T-statistics were used because the number of observations is less than 30 per sample for both affected and competing mining companies (15 and 20 companies respectively). The data has been standardized to follow a normal distribution in order to minimize the risk of outliers, in line with the method of Smith and Wright (2004).

The companies included in the study are platinum mining companies listed on the Johannesburg Stock Exchange (JSE) between 2011 and 2015. Financial information was extracted from audited financial statements available from the INET BFA expert database (formerly McGregor), consisting of all JSE-listed companies' financial statements and operating information. Strikes took place in 2012 (25 days) and 2014 (106 days). Three mines had strikes in 2012, and five were strike-free. In 2014, four mines had strikes, and four mines did not. The standard formula used to compute the t-statistics (Cressie and Whitford, 1986) is:

where

N1 = Number of observations in affected mining companies sample

n2 = Number of observations in competing mining companies sample

μ1 = Population mean of observations in affected mining companies sample

μ2 = Population mean of observations in competing mining companies sample

X1 = Mean of observations in affected mining companies sample

X2 = Mean of observations in competing mining companies sample

521 = Standard deviation of affected mining companies sample

s22 = Standard deviation of competing mining companies sample

This is a standard formula used to compute the t-statistics for observations in the samples such as revenue, EBITDA, their mean values,- and standard deviations.

Results and discussion

In Table I, N represents the number of observations for affected and competing companies. Three companies had strikes over the five years, resulting in 15 observations for affected companies in strike period 1. There are 20 observations for the four companies that were strike-free in strike period 2 over the 5-year period. The average mean, standard deviation, and standard error values are presented in scaled monetary values (rands). The confidence interval shows the lower and upper limits of scaled amounts expected for revenue and EBITDA.

Hypothesis 1: Revenue

Based on the t-statistic = 5.16 and p-value = 0.000 (see Table I), the results show that the mean revenue difference between affected and competing platinum companies is statistically significant at the 1% level. Therefore, the results suggest that the revenue reported by platinum mining companies that experienced strikes is significantly different from that reported by strike-free companies. This difference may be due to a significant decrease in the revenue of the affected companies (Anglo American Platinum, Lonmin Platinum, and Impala Platinum Holdings) due to the 106 strike days in 2014 (Bohlmann, van Heeden, and Dixon, 2015). Competing mining companies (Royal Bafokeng Platinum Ltd, Atlasta Resources Corp., Jubilee Platinum plc, and Northam Platinum Ltd) saw an increase in revenue, although it was not significant.

The results agree with prior studies, so hypothesis 1 is accepted. De Fusco and Fuess (1991), found a similar result in the US airline industry, where the share price of an affected company was negatively affected by the strike and there was a positive spillover effect on the profitability of the competing companies. McDonald and Bloch (1999) found a similar result. The results also echo the principles of the offset theory, which suggests that lack of supply of products from the affected company is offset by increasing sales from competing companies (Paarsch, 1990). However, in the case of the platinum sector, because the revenues of the competing companies are small compared with the affected companies, the overall difference in revenue is negative, as discussed next, and which supports the findings of Bohlmann, van Heeden, and Dixon (2015).

Hypothesis 2: EBITDA

Based on the t-statistic = 0.48 and p-value = 0.636 (see Table I, the results show that the EBITDA difference between platinum mining companies that experienced strikes and those that were strike-free is not statistically significant (5% level).

Therefore, using EBITDA as a measure, hypothesis 2 is rejected. There is no significant difference; instead, there was a decrease in EBITDA across the entire platinum sector. There was also a decrease in the profitability of competing platinum companies. This finding is in line with Kramer and Vasconcellos (1996), who found no significant effect of strikes in the US vehicle industry on the market value of competing companies. The reasons for the overall decrease in EBITDA across the platinum sector were not considered in this research and will be a topic for future investigation. However, it is possible that salaries were increased across the industry to meet employee demands and avoid further strikes, among other reasons.

The results discussed above illustrate the importance of using different variables when measuring the effect of strikes on profitability. Previous studies similar to this used only profit cost margin as a measure of profitability (McDonald and Bloch, 1999) and found a positive spillover effect on the profitability of competing companies. This study used two variables to measure the effect of strikes on profitability: revenue and EBITDA. As indicated above, when revenue is used as a variable in determining if there was a significant difference between affected and competing companies, the results showed a positive difference for competing companies. This contrasts with the results when EBITDA is used; there was no statistically significant difference between the affected and competing companies' profitability, and the strikes negatively affected all companies in the sector.

In summary, based on the results above and in contrast with prior literature, the overall spillover effect of strikes on the profitability of platinum mines is negative. There was a positive spillover effect on revenues of competing companies, but the effect was not significant enough when costs are deducted from revenue, as seen from the negligible difference when EBITDA is used. Instead, all platinum mines experienced a decrease in profitability.

Conclusion

Whereas previous studies have shown that companies not affected by a specific strike in the same industry see a positive affect on profits, this study has shown the contrary. The spillover effect of strikes negatively affected the earnings before interest and tax of non-striking platinum mining companies. While the research shows the negative effect of strikes on the platinum mines' profitability, it does not pronounce on whether strikes are good or bad, as sometimes they are the only instrument available for employees to show their dissatisfaction. However, the findings suggest that it is in the interest of all mines in the sector to attempt to settle employees' demands before they result in a strike.

It is crucial to improve dialogue between management, labour unions, and employees to avoid costly strikes in the mining sector. We suggest that mining companies should also disclose strike risks in their financial statements, and how they will mitigate these risks, as this will create investor and stakeholder confidence, knowing that risk is adequately managed.

Further research to examine strikes and their effect on profitability in other mining sectors such as gold, iron ore, coal, and diamonds would be fruitful. Another useful research area would be to examine how increases in staff costs affect the profitability of the strike-hit mines to determine whether there is a positive effect on profitability when salary demands are met. It will also be of interest to assess if strikes benefit the employees and determine the bargaining power of labour unions.

References

Afik, Z., Haim, R., and Lahav, Y. 2019. Advance notice labour conflicts and firm value-An event study analysis on Israeli companies. Finance Research Letters, vol. 31. pp. 410-414. https://doi.org/10.1016/jirl.2018.12.005 [ Links ]

Alexander, P. 2013. Marikana, turning point in South African history. Review of African Political Economy, vol. 40, no. 138. pp. 605-619. [ Links ]

Alexander, P., Lekgûwa, T., Mmpoe, B., Dinwell, L., and Xezwi, B. 2012. Marikana: A view from the mountain and a case to answer. Jacana Media, Auckland Park, Johannesburg. [ Links ]

Antin, D. 2013. The South African mining sector: An industry at a crossroads. Economic Report South Africa, December 2013. https://southafrica.hss.de/fileadmin/user_upload/Projects_HSS/South_Africa/170911_Migration/Mining_Report_Final_Dec_2013.pdf [ Links ]

Barchiesi, F. 1999. The public sector strikes in South Africa: A trial of strength. Monthly Review, vol. 51, no. 5. pp. 15. [ Links ]

Becker, B.E. and Olson, C.A. 1986. The effect of strikes on shareholder equity. ILR Review, vol. 39, no. 3. pp. 425-438. [ Links ]

Bavu, S.B. 2015. The prevalent and violent industrial action in the mining industry: The need to curb the prevalent and violent strike action in South Africa PhD thesis, University of KwaZulu-Natal. [ Links ]

Benya, A. 2015. The invisible hands: Women in Marikana. Review of African Political Economy, vol. 42, no. 146. pp. 545-560. [ Links ]

Bhana, N. 1997. The effect of industrial action on value of shares listed on the JSE. Investment Analysts Journal, vol. 44, no. 3. pp. 43-49. [ Links ]

Bohlmann, H.R., van Heeden, J.H., and Dixon, P.B. 2015. The effect of the 2014 platinum mining strike in South Africa: An economy-wide analysis. Economic Modelling, vol. 51. pp. 403-411. https://doi.org/10.1016/j.econmod.2015.08.010 [ Links ]

Bouwens, J., de Kok, T., and Verriest, A. 2019. The prevalence and validity of EBITDA as a performance measure. Dans Comptabilité Contrôle Audit 2019/1 (Tome 25), pp. 55-105. Mis en ligne sur Cairn.info le 17/04/2019. https://doi.org/10.3917/cca.251.0055 [ Links ]

Chamber of Mines. 2014. Annual Report. https://www.mineralscouncil.org.za/industry-news/publications/annual-reports/send/15-archived/132-annual-report-2013-2014 [accessed 20 July 2016] [ Links ]

Chinguno, C. 2015. The unmaking and remarking of industrial relations: The case of Impala Platinum 2012 - 2013 platinum strike wave. Review of African Political Economy, vol. 42, no. 146. pp. 577-590. [ Links ]

Christenson, CL. 1953. The theory of the offset factor: The effect of labor disputes upon coal production. American Economic Review, vol. 43, no. 4. pp. 514-547. [ Links ]

Cressie, N.A.C. and Whitford, H.J. 1986. How to use the two sample t-test. Biometrical Journal, vol 28, no 2, pp. 131-148. [ Links ]

Dabscheck, B. 1991. A decade of striking figures. Economic & Labour Relations Review, vol. 2, no. 1. pp. 172-196. [ Links ]

Dalci, I., Arasli, H., Tumer, M., and Baradarani, S. 2013. Factors that influence Iranian students' decision to choose accounting major. Journal of Accounting in Emerging Economies, vol. 3, no. 2. pp. 145-163. [ Links ]

De Fusco, R.A. and Fuess, S.M. 1991. Effects of airline strikes on struck and nonstruck carriers. Industrial and Labor Relations Review, vol. 44, no. 2. pp. 324-333. [ Links ]

De Kadt, D., Johnson-Kanu, A., and Sands, M.L. 2020. Electoral accountability and state violence: The political legacy of the Marikana massacre. SocArXiv, 28 March 2020. doi:10.31235/osf.io/5uxzv [ Links ]

Kaonga, B. and Kgabi, N.A. 2011. Investigation into presence of atmospheric particulate matter in Marikana, mining area in Rustenburg Town, South Africa. Environmental Monitoring and Assessment, vol. 178, no 1. pp. 213-220. [ Links ]

Kramer, J.K. and Vasconcellos, G.M. 1996. The economic effect of strikes on the shareholders of nonstruck competitors. Industrial and Labor Relations Review, vol. 49, no. 2. pp. 213-222. [ Links ]

McDonald, J.T. and Bloch, H. 1999. The spillover effects of industrial action on firm profitability. Review of Industrial Organization, vol. 15, no. 1. pp.183-200. [ Links ]

Mnwana, S. 2015. Mining and community struggles on the Platinum Belt: A case of Sefikile Village in the North West Province South Africa. The Extractive Industries and Society, vol. 2, no. 3. pp. 500-508. [ Links ]

Moloi, T. 2015. A critical examination of risks disclosed by mining companies pre and post Marikana event. Problems and Perspectives in Management, vol. 13, no. 4. pp. 14-22. [ Links ]

Neumann, G.R. 1980. The predictibility of strikes: Evidence from the stock market. Industrial and Labor Relations Review, vol. 33, no. 4. pp. 525-535. [ Links ]

Neumann, G.R. and Reder, M.W. 1984. Output and strike activity in U.S. manufacturing: How large are the losses? Industrial and Labor Relations Review, vol. 37, no. 2. pp. 197-211. [ Links ]

Onyebukwa, C.F. 2021. The dilemma of natural resources and upsurge of conflicts in Africa: A cursory look at the Marikana management approaches in South Africa. Political Economy of Resource, Human Security and Environmental Conflicts in Africa. Palgrave Macmillan, Singapore. pp. 277-296. [ Links ]

Papangkorn, S., Chatjuthamard, P., Jiraporn, P., and Chueykamhang, S. 2021. Female directors and firm performance: Evidence from the Great Recession. International Review of Finance, vol. 21, no. 2. pp. 598-610. [ Links ]

Pelders, J. and Nelson, G. 2019. Contributors to fatigue at a platinum smelter in South Africa. Journal of the Southern African Institute of Mining and Metallurgy, vol. 119, no. 3. pp. 313-319. http://dx.doi.org/10.17159/2411-9717/2019/v119n3a11 [ Links ]

Paarsch, H.J. 1990. Work stoppages and the theory of the offset factor. Journal of Labor Economics, vol. 8, no. 3. pp. 387-417. [ Links ]

Rodny-Gumede, Y. and Swart, M. 2020. Marikana Unresolved: Massacre, Culpability and Consequences. City Press, Cape Town. [ Links ]

Schultz, C. 2020. The Marikana massacre and the unstable geographies of capital: spatialising financialisation. Politikon, vol 47, no. 1. pp. 42-61. [ Links ]

Seedat, A. 2013. The effects of strikes in the South African gold mining industry on shareholder value. PhD thesis, University of the Witwatersrand). [ Links ]

Sinwell, L. 2019. Turning points on the periphery? The politics of South Africa's platinum-belt strike wave in Rustenburg, Northwest and Northam, Limpopo, 2012-2014. Journal of Southern African Studies, vol. 45, no. 5. pp. 877-894. [ Links ]

Smith, R.E. and Wright, W.F. 2004. Determinants of customer loyalty and financial performance. Journal of Management Accounting Research, vol. 16, no. 2. pp. 183-205. [ Links ]

Stewart, P. 2013. Kings of the mine: Rock drill operators and the 2012 strike wave on South African mines. South African Review of Sociology, vol. 44, no. 3. pp. 42-63. [ Links ]

Thasi, M. and van de Walt, F. 2020. Work stress of employees affected by skills shortages in the South African mining industry. Journal of the Southern African Institute of Mining and Metallurgy, vol. 120, no. 3. pp. 243-250. http://dx.doi.org/10.17159/2411-9717/666/2020 [ Links ]

Thomas, K. 2018. 'Remember Marikana': Violence and visual activism in postapartheid South Africa. ASAP/Journal, vol. 3, no. 2. pp 401-422. [ Links ]

Tinsley, M. 2019. Constructing and contesting the post-apartheid state: Political discourse and the Marikana strike. Language, Discourse & Society, vol. 7, no. 2, pp.15-33 [ Links ]

Correspondence:

Correspondence:

B. Ceki

Email: ntoyab@unisa.ac.za

Received: 31 May 2021

Revised: 29 Jul. 2022

Accepted: 30 Aug. 2022

Published: December 2022