Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.122 n.2 Johannesburg Feb. 2022

http://dx.doi.org/10.17159/2411-9717/1586/2022

PROFESSIONAL TECHNICAL AND SCIENTIFIC PAPERS

Local procurement in the mining sector: Is Ghana swimming with the tide?

A. Atta-Quayson

School of Economics, University of Johannesburg, South Africa. https://orcid.org/0000-0003-2483-8484

SYNOPSIS

Since 2012, Ghana has been implementing local procurement regulations in the mining sector to broaden and deepen linkages between mining and other sectors of the economy. The regulations have been implemented in collaboration with the mining industry. This paper offers an in-depth analysis of how the local procurement regulations and related initiatives have been implemented so far. Primary data gathered with semi-structured interviews and secondary sources of data indicate a steady improvement in both in-country procurement and local manufacturing of inputs for the mining industry. There are, however, some challenges relating to tariff structure and support (financial and technical) for local suppliers and manufacturers to meet high standards and demands of the mining industry. This calls for a well-thought-out strategy and programme of activities to sustain and improve on progress made.

Keywords: local procurement, local content, mining, minerals, Ghana.

Background

In the run-up to the 2008 World Economic Crisis, global demand for and prices of minerals and metals increased rapidly, resulting in increases in production and profits of mining companies1(PriceWaterhouseCoopers, 2007). In most developing countries (especially in Africa) where foreign capital and multinational companies dominate ownership structure of mining companies, most of these profits did not benefit local economies where mining takes place. The marginal increases in tax revenues (the main focus of most countries) that accrued to governments in these countries and the poor linkages (backward, sideways, and forward) between mining activities and local economies meant that the mining industry's contribution to social and economic development objectives was less certain and contested in many countries (AU and UNECA, 2011). The mining industry's weak linkages to other sectors of the economy contribute to its characterization as an enclave and fuel public discontent about the sector's high environmental cost and limited developmental contributions (Bank of Ghana, 2003; Larsen, Yankson, and Fold, 2009; Akabzaa, Seyire, and Afriyie, 2007; UNECA, 2004, African Union Commission, 2008; Botchie, Dzanku, and Akabzaa 2008).

The years after the World Economic Crisis, therefore, witnessed increased calls for changes to the mining framework in ways that can enhance and optimize local developmental benefits associated with exploitation of mineral resources, culminating in 2009 in the adoption of the ECOWAS Minerals Development Policy (EMDP) in 2009 by the Economic Community of West African States (ECOWAS) and the African Mining Vision (AMV) by the African Union. The AMV aspires to fundamentally change the mining regimes operative on the continent, 'integrating the [mining] sector more coherently and firmly into the continent's economy and society' among other objectives (UNECA, 2011). The adoption of the EMDP and AMV reflected, and in other cases influenced, efforts and initiatives in many African countries to optimize local returns to mining sector activities. Increasing local procurement became one of key measures resource-rich countries adopted to increase the benefits to their economies from resource extraction, beyond securing optimal rents (royalties, taxes, shares, and other revenues) (AU and UNECA, 2011; Amoako-Tuffour, Aubyn, and Atta-Quayson, 2015). Although mining laws have historically required that preference must be given to local goods and services, they were largely not enforced. Over the past decade, however, there have been further regulatory provisions to enhance local procurement of goods and services in countries such as Burkina Faso, Ghana, Mali, Guinea, Senegal, South Africa, Tanzania, Zambia, and Zimbabwe.

Ghana's local procurement regulations in the mining sector (primarily Legislative Instrument 2173) were adopted in 2012 as part of six regulations approved by the government to give further meaning and support to the enforcement of the 2006 Minerals and Mining Law (Act 703). In the 2006 mining law, and its 1986 predecessor, there are provisions that prescribe for mining companies, in the conduct of their operations, to prioritize employment of Ghanaians and utilization of local goods and services. While mining companies prioritized employment of Ghanaians2 as prescribed by the law, the situation with utilization of local goods and services left a lot to be desired. A report published by the World Bank, it is indicated that 'despite existing capacity and the potential to create further capacity ... there is limited participation in mining supply chains by companies based in West Africa' and called on governments in the region 'to set the appropriate policy and regulatory contexts to encourage local procurement' in the mining sector' (World Bank, 2012, pp. viii-ix).

This paper is a follow-up from an earlier assessment on Ghana's approach to local content and value addition in both the mining and oil and gas sectors (Amoako Tuffour et al., 2015) and a more elaborate technical report on local content and value addition in Ghana's mining and oil and gas sectors by Atta-Quayson (2017) under the auspices of the African Centre for Economic Transformation's Africa-wide Local Content and Value Addition in Minerals, Oil and Gas Sectors project. Subsequent to these two reports, the author has critically followed developments in Ghana and on the continent regarding local procurement in the mining sector and engaged various stakeholders on the matter, providing the motivation for this paper. By focusing on the mineral sector alone, the paper aims at providing a more in-depth assessment of how the 2012 local procurement regulations and related initiatives have been implemented so far. With the benefit of additional implementation years, this paper seeks to assess if the country is making good progress and what measures will be needed going forward to sustain the progress made. The current work thus contributes to the literature on local content and local procurement by analysing further institutional data and interviews, leading to actionable measures and policy recommendations that can help improve Ghana's local content and procurement initiatives.

Research methodology

The epistemological objective of this study is to analyse the implementation of local content and local procurement regulations and related initiatives in Ghana in order to contribute to the growing literature on local content and local procurement; as well as offer novel recommendations to deepen linkages between the mining sector and other sectors of the economy. A mixed methods approach, comprising both quantitative and qualitative techniques, was therefore adopted for the study making use of both primary and secondary sources of data. Primary data was gathered using semi-structured interviews with key stakeholders in the minerals sector in person, by phone, and via email. Two rounds of interviews were conducted with representatives of mining companies, supply service providers, state regulatory agencies, NGOs, and academics. The first round took place in 2015/2016 as part of an Africa-wide eight-country project to compare local content in the minerals and oil and gas sectors undertaken by the African Centre for Economic Transformation (ACET). The other round of interviews with stakeholders was undertaken in 2019. The secondary sources of data relied on include journal articles, news articles, policy documents, laws, company reports, annual performance of mining sector reports by the Ghana Chamber of Mines (GCoM), the Minerals Commission's 2019 annual report, and institutional data among others. Following the analysis of the performance of the mining industry in relation to local procurement, the approach to local procurement in the oil and gas sector as well as successes chalked is briefly presented as a basis of identifying actionable measures and policy recommendations to improve local procurement in the mining sector.

Overview of the mining sector in Ghana

Ghana is endowed with a wide range of mineral resources such as gold, bauxite, manganese, diamonds, iron ore, clays, salt, kaolin, mica, colombite-tantalite, chromite, silica sand, gravel, stone, quartz, and feldspar (Minerals Commission, 2014; USGS, 2016). The country's focus has been on traditional minerals (gold, manganese, bauxite, and diamonds), led by gold which has accounted for over 90% of mineral revenues and over a third of export revenues for two decades since the mid-1990s. In many African countries, including Ghana, pre-colonial and post-colonial mining have been undertaken largely by foreign capital and focused on a narrow range of minerals that serve as raw materials for western countries (Organization of African Unity, 1980). Consequently, mining has historically been undertaken largely as an enclave activity with few linkages to other sectors of the economy (Bank of Ghana, 2003; Larsen, Yankson, and Fold, 2009). During the mining sector reforms in Ghana and other developing countries (as part of the ERPs/SAPs), the World Bank advised African countries to focus on 'maximizing tax revenue from mining over the long term, rather than pursuing other economic or political objectives' (World Bank 1992, p. x). Consequently, the colonially-created mining regimes that perpetrate enclave mining have largely remained in Africa (AU and UNECA, 2011). Data on mining activities in Ghana mostly concerns traditional minerals, making an assessment of the sector's role and contribution to the economy usually focused on these minerals. Furthermore, available institutional data exists only for variables such as total production, foreign exchange earnings or export receipts, government revenues obtained from the sector, employment, and broad levels of local spend (irrespective of where these goods and services are produced). In 2020 Ghana produced 4 million ounces of gold3 (down from 4.6 million ounces in 2019), 2.4 Mt of manganese4 (a decline by 56.2% from the 5.383 Mt produced in 2019), 25 292 carats of diamonds5 (down from 33,789 carats in 2019), and 1.162 Mt of bauxite (up from 1.116 Mt), contributing 7.5% per cent to Ghana's GDP (Ghana Chamber of Mines 2021). The mining sector's contribution to domestic revenue (primarily through corporate income taxes, mineral royalties, and employee income tax) increased marginally from GHC4.013 billion in 2019 to GHC4.172 billion in 2020, constituting 18.1% (ibid.) in 2020. Proceeds from exports of minerals amounted to US$6.998 billion (up from US$6.678 billion in 2019) and accounted for 48.4% of merchandise exports in the year (ibid.).

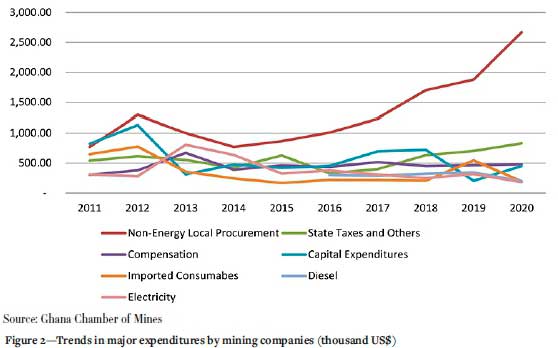

According to the GCoM, the total expenditure on non-energy goods and services procured by member companies from in-country suppliers and manufacturers amounted to US$2.7 billion in 2020, while their spend on consumables directly imported by the mines, as well as capital expenditures, amounted to US$194.2 million and US$450.4 million respectively in 2020 (Ghana Chamber of Mines, 2021). While a relatively substantial amount is spent on goods and services procured locally, many of these goods and services are imported. In 2020, members of the Chamber of Mines directly employed 8760 workers (down from 10 109 in 2018 and 20 268 in 2012), most of them Ghanaians (Ghana Chamber of Mines, 2021, 2019). The fast-dwindling direct employment in the sector is a result of staff retrenchments and increasing casualization of employment occasioned by miners such as AngloGold-Ashanti, Goldfields Ghana Limited, and Golden Star Resources over the period. In 2020, producing members of the Chamber engaged 25 603 contractors or casual workers (Ghana Chamber of Mines, 2021), more than three times the number directly employed. The resort to staff retrenchment and casualization has been protested (often violently) by workers, the Ghana Mineworkers Union, and other civil society organizations. Casualization affects not only quality of work, remuneration, and security, but also government revenues.

The relatively low level of contribution by the minerals sector to the GDP (7.5% in 2020) and employment raises concerns of ordinary Ghanaians as well as the government as far as developmental benefits from the mining sector are concerned (Atta-Quayson, 2017). Even though GCoM asserts that the sector's contributions to taxes and foreign exchange are on the high side, the government differs in opinion. In May 2018, the Vice President indicated that the country obtains little benefit from its mineral wealth and called for a review of the mining fiscal regime6, expressing surprise that the country had earned almost nothing in dividends since 2012 from its 10% stake in most mines (Dontoh, 2018). The Vice President also noted that 'we have now begun conversations about the process of making sure every single bar of gold leaving our shores is properly weighed, tested, valued and accounted for', adding that the government was considering a legislation that requires at least 50% of annual gold output to be refined locally within five years (emphasis added) (Kpodo, 2018). The Minister for Mines' remarks when announcing planned special audits of mining operations in the country also highlight widespread discontent among the populace and government over the benefits that accrue to the country from mining.

'The mining sector is an important contributor to the economy of this country but we have been short-changed for a long time now. As a government, we feel strongly that our royalties, taxes and rents have not been properly recorded and accounted for, so we are going to do an audit of all companies that engage in mining to be able to determine the real picture on the ground to be able to reverse this ugly trend' (Ngnenbe, 2018).

The case with foreign exchange earnings is no different. Cognizant of the imperative on the part of mineral right holders to service loans, pay dividends, and procure inputs and equipment, Section 30 of the Minerals and Mining Act of 2007 (Act 703) allows mining companies to retain a percentage of their export revenues in offshore accounts to meet these exigencies, for which foreign exchange 'would otherwise not be available without the use of the earnings'. The exact percentage to be retained offshore must be negotiated, but the law requires that it should not be less than 25% and therefore can go as high as 80% (for most companies) and previously pre-negotiated 100% for companies with development agreements such as Newmont. In lieu of this, only a fraction of mineral export revenues are returned to Ghana and for the year 2020 the Chamber of Mines reported that its producing members returned 71% cent of their revenues to Ghana (Ghana Chamber of Mines, 2021). In 2013, the Public Accounts Committee of Parliament expressed shock during a public hearing that on average mining companies retain 80% of their export revenues in offshore accounts (Arku, 2013) . While the GCoM disputed the claim, concerns about the foreign exchange retention policies in the mining sector continue to linger.

Local procurement: Conceptual and analytical framework

The idea and importance of local procurement can be linked to the generalized approach to linkages theory by Hirschman, which promotes industries with strong interdependence or linkages to other sectors of the economy (Hirschman, 1958, 1977). Linkage in this context was defined as 'investment generating forces that are set in motion, through input-output relations, when productive facilities that supply inputs to that line or utilize its outputs are inadequate or non-existent' (Hirschman, 1977, p. 72). Though historically the mining sector has not had sufficient linkages to other sectors of the economy, resulting in the enclave characterization of the sector or the enclave thesis (Bloch and Owusu, 2011; Hanlin 2011), there has been strong interest in this area by resource-endowed countries over the past decade, focusing mainly on local procurement. The World Bank, in collaboration with West African governments and players in the mining industry, produced an analytical framework for assessing progress in expanding local procurement in the mining sector (World Bank, 2012).

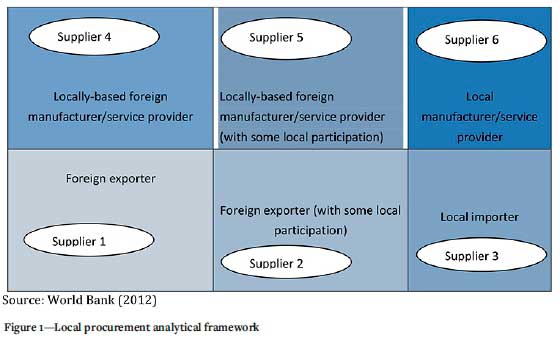

The framework categorizes suppliers of goods and services to the mines based on four key factors: participation of citizens (in ownership, management and employment of supplying firms), extent of value add that take place locally, proximity of the supplying firm to the mine, and the size of the supplying firm (Figure 1).

Optimizing developmental returns from mining and local procurement/content policies in Africa

In the aftermath of the first boom in commodity prices in the 21st century (Conceicao and Marone, 2008) which eased following the World Economic Crisis in 2008, there has been a marked rise in the adoption of local procurement and local content policies and regulations in resource-dependent developing countries. Characterized as 'the greatest commodities boom in recent history" (Conceicao and Marone, 2008, p. 2), it was fuelled by strong demand by China and other emerging countries, spanning a longer period and affecting more commodities. In the process, it raised awareness among governments and citizenry on the insufficiency of developmental returns that accrue from the exploitation of their resource endowment. In Africa, the UNECA and AfDB organized what they described as the 'Big Table' in 20077to discuss how to enhance the developmental benefits from the exploitation of natural resources (especially mineral resources) on the continent. This was followed by a Ministerial Conference in 2008 which adopted the Africa Mining Vision (AMV) and affirmed 'commitment to prudent, transparent and efficient development and management of Africa's mineral resources to meet the MDGs, eradicate poverty and achieve rapid and broad-based sustainable socio-economic development' (AU and UNECA, 2011, p. 5).

At the heart of the AMV, adopted by AU Heads of State and Government in February 2008, was the need to the transform the mining sector from 'colonially-created enclave features' by 'integrating the sector more coherently and firmly into the continent's economy and society" (AU and UNECA, 2011, p. 9). Among the various strategies offered by the AMV in pursuit of its objectives is the optimization of mineral-based linkages through local procurement and local content policies and regulations. Since the adoption of the AMV, regional blocs and mineral-rich countries have taken steps towards the transformation of operative mining regimes with the aim of optimizing the developmental benefits through the design and implementation of local procurement and local content policies and regulations, among others.

The Economic Community of West African States adopted the ECOWAS Minerals Development Plan (EMDP)8 in May 2011 in line with the AMV and which sought to, among other things, support Member States to adopt local procurement and local content policies as a means of increasing local procurement of goods and services, technology transfer, and development of local entrepreneurship. About a decade prior to both the AMV and EMDP, the Southern African Development Community (SADC) had developed in 1997 a regional mining protocol which came into force in 2000 and sought, among other things, to share information among member countries and enhance the technological capacity of the mining sector. In 2006, the SADC was supported by the UNECA to develop a framework to harmonize mining policies, standards, legislative and regulatory instruments within the region.

Following the adoption of the AMV, the University of Cape Town and the Open University implemented the Making the Most of Commodities Programme (MMCP). The MMCP produced about a dozen working papers that described the state of affairs regarding linkages between the commodities sector (copper, diamonds, gold, oil and gas, mining services, and timber) and the local economies in eight African countries (Angola, Botswana, Gabon, Ghana, Nigeria, South Africa, Tanzania, and Zambia) (Kaplinsky, Morris, and Kaplan, 2011; Morris, Kaplinsky, and Kaplan, 2012). Although the MMCP sought to challenge the 'enclave thesis' and the 'negative view of the commodities sector' on the continent, most of the papers produced rather affirmed the weak linkages and poor developmental returns that accrue to African countries from the exploitation of their natural resources. One of such papers which focused on the entire continent concluded that local suppliers are seldom used, resulting in non-development of an indigenous service and supply sector to any significant extent outside of Ghana and South Africa (Hanlin, 2011). The author cites, among other reasons, the multinational nature of extractive companies operating in Africa and the endemic systems existing in these companies that predetermine procurement routes as responsible for the situation, effectively excluding the relatively well-developed South African mining service sector from engaging in a significant proportion of the procurement process (ibid.).

The MMCP concluded that 'policy in both the private and public realm was a prime factor holding back the development of linkages' and in order to deal with the problem required the closing of three sets of misalignments between policy and practice: within the corporate sector, within the public sector, and between the public and other stakeholders involved in linkage development (Kaplinsky, Morris, and Kaplan 2011; Morris, Kaplinsky, and Kaplan, 2012). The authors further identify and discuss three contextual factors that influence the breadth and depth of linkages: ownership, infrastructure, and capabilities. A couple of years following the implementation of the MMCP, the African Centre for Economic Transformation undertook an eight-country (Burkina Faso, Ethiopia, Ghana, Mozambique, Namibia, Nigeria, South Africa, and Zambia) comparative study on local content in the mineral and oil and gas sectors, focusing on trends in company responses to emerging policies and regulatory frameworks (African Centre for Economic Transfromation, 2017). The study observed that among the eight countries Nigeria and South Africa had pursued with varying success local content and value addition longer than the other countries. Using a four-pillar definition for local content, it was found that while all study countries had requirements in place for local procurement and employment, only a few had requirements for local ownership (usually via the state) and use of local financial institutions.

Local procurement policies and regulations in the mining sector are not an entirely new phenomenon. The Provisional National Defence Council Law 153 of 1986 had a provision with the title 'Preference for local products and employment of Ghanaians' which require mining firms to give preference in employment of Ghanaians, materials and products made in Ghana, and service agencies located in Ghana, 'to the maximum extent possible and consistent with safety, efficiency and economy'. However, these first-generation local procurement provisions in the mining sector could not either be effectively enforced or yield the desired outcome for various reasons. For example, in Ghana, the same law which had local procurement provisions also provided exemptions from import duties and other taxes on imported products and materials required for mining operations. Coupled with a weak manufacturing sector and economy-wide challenges (relating especially to infrastructure, technology, and finance), it is understandable why first-generation local content provisions could not be enforced or produce expected outcome.

Over the past decade, a new generation (second generation) of local procurement policies and regulations has emerged as a means of optimizing developmental returns from mining by way of expanding and deepening linkages between mining and other sectors of mineral resource-rich economies. Thanks to the two main factors that have contributed to their emergence - a poor record relating to the enclave thesis of mining industry and lopsided benefit-sharing regimes in favour of largely foreign mining firms (ACET, 2017) - the second generation of local procurement policies and regulations seem to have found favour with mining companies and better prospects. The AMV, which has been influential in these policies and regulations, has been widely and openly welcomed by mining companies who have pledged their commitment to its realization. In February 2016, an African Mining Vision Compact was forged between industry and African governments on the sidelines of the 2016 'Investing in African Mining Indaba' in South Africa (Kotze, 2016) . Given that local procurement is at the heart of the AMV, the gesture illustrates favour with the industry, which is interested in improving its image. While this is welcome and necessary for the success of the second-generation of local procurement policies and regulations, it is not sufficient. What is needed is regular assessment of how the secondgeneration local procurement policies and regulations are being implemented, continuing challenges, and how best to resolve them.

In the last few years, there has been a growing interest in and focus on how these policies and regulations have been designed and implemented, bringing to the fore a number of issues and perspectives that affect their success. Kragelund (2017) offers an assessment of local content policy implementation in Zambia focusing on relevant policies at the macro-, meso-, and micro-level, noting the limited effect of these policies due to poor alignment with the broader legal practices in the sector. The study further identifies a lack of clear definition of local content, voluntarism, inclusion of a small proportion of mines and suppliers, and inadequate support of political and economic elites in the country (Kragelund, 2017). Kragelund (2020) further illustrates how efforts by the Zambian government to rank higher on the Doing Business Indicator has influenced the government policies that are inimical to broadening and deepening linkages through the implementation of local content policies in the mining sector. The study further identifies an imbalanced power relationship in favour of multinational mining companies against the Zambian state, which weakens the state's bargaining power when negotiating terms of investment agreements (Kragelund, 2020).

In a two-country case study involving Ghana and the Democratic Republic of Congo (DRC), Geenen (2019) challenges two mainstream assumptions about local content literature regarding creation of production linkages following the provision of an enabling environment by the state and the thinking that local content is beneficial for local people. The study finds that power holders use local content as political instruments to enhance accumulation of profits and control of resource rents, citing the complex political circumstances within which these policies are implemented (Geenen, 2019). In the two countries, employment opportunities and contracts were found to have been handed to political elites unfairly and largely as a means to winning local legitimacy, gaining a social license to operate, and compensating for environmental pollution. Such a phenomenon, though unfortunate, inimical to local content policies, and needing to be addressed, is not surprising as it reflects the widespread patronage and competitive clientelist political settlements that characterize many developing countries, including Ghana and the DRC.

Greenen's (2019) study further reflects the considerable potential for corrupt practices in the pursuit of local content. Similar findings have been made by Kalyuzhnova and Belitski (2019) who demonstrate, using an econometric approach, that implementation of local content policies in Kazakhstan facilitates corrupt behaviour. The dangers of corrupt behaviour in the pursuit of local content are discussed by Lima-de-Oliveira (2020) using the Petrobas scandal as a case which involved billions of dollars in kickbacks and resulted in the country's wealthiest businessmen and former politicians such as the former president, former speaker of parliament, former finance minister, and former governor of Rio de Janerio being jailed. The study finds that following the revelation of the corrupt behaviour associated with the country's implementation of local content policies, many of the local content-related programmes and requirements have either been dismantled or severely cut since 2017 (Lima-de-Oliveira, 2020).

Despite the concerns with corruption as discussed above, there is a glimmer of hope as initial findings from the implementation of local content in Ghana's oil and gas sector have been largely positive and demonstrative of the potential of local procurement initiatives. Ayanoore (2020) demonstrates that a resource nationalist government can effectively collaborate with pro-local content elites to establish strict local procurement targets and effectively enforce them to broaden and deepen linkages between the oil sector and the broader Ghanaian economy. At the heart of this feat was the institutionalization of the Local Content Committee made up of a range of stakeholders united by the need to achieve greater local content targets in the oil and gas sector (Ayanoore, 2020). By the end of 2016, just about three years from the passage of local content and local participation regulations, the government reported high local participation among the four categories of firms in the upstream value chain defined by the law: primary contractor, tier 1 subcontractor, tier 2 subcontractor, and tier 3 subcontractor. Despite the high financial and technical requirements of the primary contractor and tier 1 subcontractor categories, the government 'lobbied' IOCs to pre-finance 5% participating equities of local firms (leading to the establishment of 10 E&P equity partnerships between IOCs and Ghanaian firms) while 87 local firms were engaged in joint ventures by international service companies. The other two categories, requiring lower financial and technical capabilities, were dominated by Ghanaian companies (Ayanoore, 2020).

Overview of Ghana's local content and procurement regulations and other initiatives

Ghana's Minerals and Mining Policy calls for the promotion of 'linkages (backward, forward and side-stream) to minerals produced in the country to the maximum extent possible' (Government of Ghana, 2015). In 2012, Ghana's parliament adopted a set of six regulations 'to give meaning' to a law passed six years earlier. Among these regulations were three that are related to local content in the mining sector: Minerals and Mining (General) Regulations, 2012 (LI2173), Minerals and Mining (Support Services) Regulations, 2012 (LI2174), and Minerals and Mining (Licensing) Regulations, 2012 (LI2176). Whereas the general regulations (LI2173) remain the key local procurement regulations, the support services regulations (LI2174) and licencing regulations (LI2176) have some consequences for local content in the mining sector. The licensing regulations enforce key aspects of the general regulations on various prospective licensees, such as their proposals regarding procurement of local goods and services and the employment and training of Ghanaians in the mining industry.

The support services regulations, on the other hand, outline procedures for registering with the Minerals Commission as mine support service providers, classify mine support service providers into two categories (A and B), and stipulate benefits available to registered service providers. While class A mine support services are open to both Ghanaians and non-Ghanaians, Class B mine support services are reserved exclusively for Ghanaians. Class A support services are much broader and deeper in terms of linkages to the mining sector than Class B (Table I). The support services regulations offer different benefits or concessions to the two categories of service providers. Class A providers are eligible for concessionary (lower) import duties in respect of importation of mining inputs or items on the Mining List9, immigration quotas in respect of expatriate personnel (this also applies to mineral right holders), and receipt of payment for services rendered in foreign currency, subject to the Commission's recommendation and the central bank's approval. The only benefit or concession available to Class B providers is the receipt of payment in foreign currency, subject to the Commission's recommendation and the central bank's approval.

The general mining regulations represent the main local content requirements in the mining sector. The relevant sections of the regulations are contained in the first two sub-regulations and focus on recruitment of expatriates and employment and training of Ghanaians as well as local procurement of mining inputs. Among other prescriptions related to employment of Ghanaians, mineral right holders, support service providers, and licensees to export or deal in minerals are required by the regulations to develop a 5-year renewable plan to be approved by the Commission that spells out recruitment of expatriates and employment and training of Ghanaians to replace expatriates. The second sub-regulation of the general regulations deals with procurement of goods and services with Ghanaian content to the maximum extent possible subject to efficiency, safety, and economy. This requires that the 5-year procurement plan, renewable annually (to deal with possible changes in the procurement list, if any), is submitted within a year of passage of the regulations or commencement of operations for approval by the Commission.

The procurement plan must address the following three things: the targets for local procurement of items on the procurement list, prospects for local procurement, and specific measures or support to providers or suppliers to 'develop the supply of local goods and services'. The Commission shall make available a procurement list with goods and services with Ghanaian content that must be procured in Ghana. There is no definition of Ghanaian content in the regulations and the goods and services on the procurement list need not be locally produced. However, the sub-regulation mandates that in assessing tenders for items on the procurement list, bids with the highest level of Ghanaian participation (based on ownership and management) shall be selected where bids are within 2% of each other by price. There are reporting requirements and sanctions involving payment of full customs import duty to the Commission for items on the procurement list that are directly imported. Further, there is a fine of US$10 000 for each month of the first two months of non-compliance in terms of obtaining approval of the procurement plan, and subsequently the same amount per day that the breach continues.

In 2011, the International Finance Corporation (IFC), Minerals Commission (MC), and GCoM entered into an MoU to develop a NSDP. Three years thereafter, the NSDP was designed as a three-year intervention programme aimed at building the management and technical capacity of 35 local suppliers in the mining supply chain in order to increase their participation in the mining industry. It is, however, unclear if the NSDP was implemented. In November 2017 the Africa Minerals Development Centre (AMDC), ACET, and Hanover-based German Institute for Geosciences and Natural Resources (BGR) jointly held a two-day workshop in Accra during which another National Suppliers Development Programme was launched by the Vice President of Ghana. Led by the AMDC, this NSDP seemed different from what had been contemplated earlier by the IFC, MC, and GCoM. Again, it is unclear if this NSDP is being implemented. Despite the GCoM's involvement in these efforts, on 3 July 2020 it put out a call for proposal seeking to recruit a consultant to develop a framework and strategy for positioning Ghana as a hub of mining support services in the sub-region by exploring means of supporting firms in Ghana to provide competitive and quality goods and services to the mining industry. This raised questions about the two versions the NSDP earlier contemplated in the country.

Influenced largely by the need to compensate for negative externalities, create a positive image in the eyes of catchment communities, and obtain a social license to operate (Atienza, Arias-Loyola, and Lufin 2020; Nwapi 2015) rather than a deep-seated motive to broaden and deepen linkages, almost all mining companies operating in Ghana have created programmes or initiatives that seek to ensure that catchment communities are given preference in employment and procurement of goods and services. As signature programmes or initiatives of mining companies, they differ from one company to the other in terms of scope and depth.

Local procurement in the mining sector: Is Ghana swimming with the tide?

This section presents and analyses trends in local procurement of goods and service by the mining industry in Ghana following the 2012 adoption of the general regulations, that were updated with the local content and local participation regulations in 2020. Arguably, local procurement of goods and services (especially those produced in-country and largely by the citizenry) holds the largest potential for broadening and deepening linkages between the mining sector and other sectors of the economy in Ghana and therefore enhancing the contributions of mining to inclusive growth and development. In 2020, producing members of GCoM spent $2.67 billion (about 51.93% of mining revenues) on local procurement of goods and services. Out of this amount, $198.95 million and $180.40 million were spent on diesel and electricity respectively while expenditures on imported consumables and capex stood at $194.18 and $450.39 respectively (Ghana Chamber of Mines 2021). This compares with $830.2 million and $479.7 million spent on statutory payments to the state (taxes and workers' pension payments) and workers' salaries in 2020, respectively (ibid.).

In relation to emoluments, there is deep-seated concern about wide disparities and inequalities in the mining industry as the top 10% of the staff population was recently reported to be earning about half of overall basis salary while a few expatriates and management staff earn about two-thirds of mining industry's wealth (Ankrah et al., 2017). An earlier report citing a study by the Ghana Mineworkers Union also indicated that 90% of mineworkers' share of wage income is less than 10% of that of the highest paid staff (Ghana News Agency, 2015). It is, however, generally believed (and flowing from Hirschman's linkages theory) that spending on locally produced goods and services tends to create greater multiplier effects than spending on statutory payments and salaries. In light of this, the analysis that follows will focus mainly on procurement of goods and services by mining companies. Figure 2 shows the trend in the major categories of expenditure that mining companies make in the course of their operations.

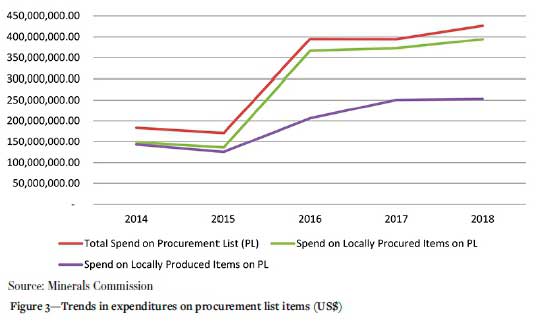

For Ghana, the vision is to ensure that as much as possible of the $2.67 billion spending on locally procured inputs in 2020 is actually made on goods and services (excluding diesel and ~ electricity) that are produced locally and meet some level of 'Ghanaian content' as far as ownership, management, and general staffing of the producing firms are concerned. This was the vision of the government of Ghana when, in 2012 and 2020, relevant regulations were passed to promote job creation through the use of local expertise and products (local goods and services) in the mining industry value chain (Government of Ghana, 2012, 2020). In accordance with the general regulations, the Minerals Commission published the first procurement list with eight items in 2013. The performance of the industry regarding these items in 2014 and 2015 is presented in Table II. Out of the almost US$184 million total spend on items on the procurement list in 2014 (this is less than a quarter of total expenditures incurred by mining companies on local procurement of non-energy goods and services, which amounted to about US$771 million), US$148 million worth of those items was obtained from in-country suppliers and manufacturers, with US$143 million (78% of total spend) on locally manufactured goods. And out of US$171 million total spend on items on the procurement list in 2015 (which is less than a fifth of total spend by miners on local procurement of non-energy goods and services which amounted to US$866 million), about US$136 million of items were procured locally, out of which US$126 million worth of items (representing 73% of total spend) were locally produced.

The data on grinding media and electrical cables deserves some comment. In 2015, the country's installed capacity for producing grinding media could meet about half of industry demand. One of the three local manufacturers was in the process of adding a third plant in order to double installed capacity and be able to manufacture other sizes and specifications of grinding media to meet the requirements of other miners. With that expansion, local manufacturers could meet all the demand in the sector. In interviews two producers expressed concern about power (not regularly available and expensive) and payment of import duties and other taxes on importation of steel bars used in producing grinding media, whereas mining companies are exempt from paying import duties and related taxes when directly importing grinding media. They called for incentives (such as export subsidies) to enable them to maintain the local market and increase exports (which had been started by those local producers on a small scale).

Regarding electrical cables, the country has world-class producers - Tropical Cables and Conductors Limited and Nexans Cables and Metals Limited. Yet mining companies have been very reluctant to source their electrical cables from these producers for various reasons. Electrical cables are very critical inputs, and engineering firms that construct mining plants often recommend particular specifications and brands. This makes it difficult for mining firms to ignore the advice of consulting firms with respect to electrical cables. Furthermore, even when mining companies want to try locally produced electrical cables the classifications (and specifications) make it difficult to buy from producers. For example, an electrical product with a particular specification can be classified differently by different producers in Ghana. This also presents a challenge to the mining companies when considering procuring electrical cables from local sources. The challenge regarding the use of local electrical cables by mining companies reflects lack of urgency and weak coordination among key state agencies (such as the Minerals Commission and Standards Authority). However, the GCoM has since taken steps to address the challenge by facilitating various meetings involving local producers of electrical cables, mining companies, and other state agencies such as the Standards Authority to address pertinent concerns including development of related standards.

In 2015 the procurement list was revised to include an additional 11 items, bringing the total to 19. The 2015 edition also stipulated penalties (5% for all items except electrical cables, which attracted 10% penalty) to be paid by mining companies who import these products. Instead of the penalty, some of the local producers interviewed suggested that those items should be removed entirely from the mining list. The list contains items that are exempted from import duties and related levies and charges. This has been identified as a major impediment to the expansion of local production for the mining sector. The performance of the industry is presented in Table III. In the year 2018, the total spend on procurement list items amounted to $426 million, which was about a quarter of the industry's total in-country purchases of goods and services (excluding diesel and power), which amounted to $1.702 billion in that year. Out of the total spend of $426 million on the items on the procurement list, $394 million (representing 92.4%) was procured in-country while $252 million (representing 59%) was spent on locally manufactured inputs.

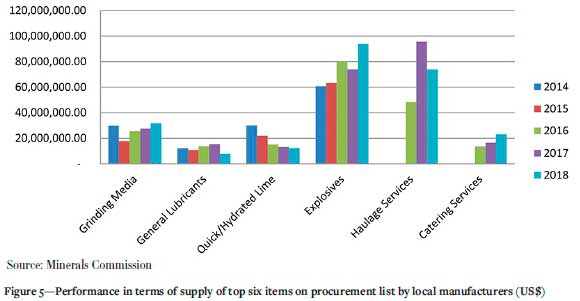

The inclusion of 11 additional items reduced the proportion of inputs locally produced on the procurement list for the mining industry from 80% and 73% in 2014 and 2015 respectively to 52%, 64%, and 59% in 2016, 2017, and 2018 respectively. In terms of value, six items are very important and make up about 97% of the total spend on procurement list items. These are grinding media, general lubricants, quick/hydrated lime, explosives, haulage services, and catering services. As regards haulage services, for example, the industry spends an average of US$185 million, almost entirely on local services, though less than half of that is offered by local firms while the remaining half represent 'imported' services. With respect to grinding media, local producers met between a third and half of industry demand over the same period. The performance as regards the other four items is excellent, with many of them meeting industry demand fully for most of the years. .

Over the period, it can be observed that the mining industry has acted contrary to the regulations by directly importing items that appear on the mining procurement list. In 2014, for example, $35.6 million worth of items on the list (falling to US$32.4 million in 2018) which should have been procured in-country were imported directly by the mining companies themselves. From Figure 3, it is clear that the mining industry has consistently been directly importing items on the tune of between US$30 million and US$35 million. This notwithstanding, the value of non-energy goods and services procured locally has been growing markedly. While the value of the first eight items hovered around US$180 million, increasing to about US$400 million when 11 other items were added to the list, the total spend on non-energy goods and services procured locally by the mining industry has increased from less than US$800 million in 2014 to over US$1.7 billion in 2018 (it reached over US$2.7 billion in 2020), see Figure 4. This raises some concerns and questions about the extent to which Ghana is swimming with the tide of local procurement in the mining sector.

It is worthy of note that the items on the procurement list are inputs that the country is supposed to have the potential to produce locally, yet locally produced goods and services met less than 60% of the total spend on those items between 2016 and 2018 (and less than 80% in 2014 and 2015). While this does not look bad in general, as grinding media, general lubricants, explosives, and catering services showed an overall increasing trend (Figures 5 and 6), there is some concern with quick/hydrated lime and haulage services. While locally produced quick/hydrated lime supply to the mines showed a decreasing trend (falling from US$30 million in 2014 to US$ 12 million in 2018), supply of haulage services by Ghanaian businesses increased from US$48 million in 2016 to US$96 million in 2017 (nearly double) but reduced to US$74 million in 2018. Similar mixed performance can be observed for the other items on the list. This requires a tailored supply chain development programme to carry local producers along.

While there is currently no supply chain development programme being implemented by the government to facilitate expansion in local production of items on the procurement list on a sustainable basis , there are questions surrounding the level of 'Ghanaian content' for those items that are locally produced. The dominance of international firms exclusively owned by non-Ghanaians in the mining suppliers' sector, such as Lycopodium, Atlas Copco, Boart Longyear, Sandvik, Liebherr, Mantrac/Caterpillar, African Explosives, Maxam, Carmeuse Lime Products, and Castrol, among others, is well noted (Bloch and Owusu 2011). To what extent are Ghanaians participating in firms producing these goods and services, in terms of ownership, management, and employment? Similar questions can be posed with respect to the other locally produced goods and services outside the procurement list. Responding to this question will require the Minerals Commission and GCoM to collate and share relevant data. Unfortunately, after collaborating with the World Bank (2012) to produce a relevant framework for measuring local procurement as elaborated in section 2, these agencies have yet to apply this template and publish the findings. On the issue of supply chain development, some attempts have been made in the past (as previewed under the overview of Ghana's local content and procurement regulations and other initiatives) but they have largely remained on the drawing board.

Ghana's approach to local procurement in the mining sector differs markedly from what pertains in the oil and gas sector, with implications for how far and how quickly gains can be realized. In the oil and gas sector, three categories of subcontractors or service providers have been recognized on the basis of capital (see Table IV). In contrast, the approach in the mining sector recognizes two classes of service providers as described above: class A for servicing large-scale mines and class B for servicing small-scale mines. The approach in the oil and gas sector allowed for greater participation of Ghanaians, especially in the tier 2 and tier 3 subcontractor categories. The Petroleum Commission intervened to implement high levels of joint venture equities benefiting 87 local companies at the tier 1 subcontractor level, while at the primary contractor level, international oil companies were lobbied to pre-finance 5% participating equities of local firms (Ayanoore, 2020). Another area of difference relates to the specification of local content levels for ten service categories over a period of time (see Table V). The mining sector approach has a 2% margin on bids with the highest level of Ghanaian participation based on ownership, management, and employment.

The third edition of the local procurement list, published in 2018, departed from the previous editions by reserving certain services exclusively to Ghanaians. This suggests that in future, mining companies may be compelled to procure other goods and services from firms that are exclusively or majority owned by Ghanaians and with some specified level of Ghanaian participation in terms of employment and management. The new items added to the list are as follows: security services (exclusive Ghanaian directors and shareholders), legal services (exclusive Ghanaians), insurance services (strictly incorporated in Ghana), and financial services (strictly incorporated in Ghana). The rest are, contract mining (strictly incorporated in Ghana), fuel (exclusive Ghanaian directors and shareholders), activated carbon, cable bolt and accessories, split setts, rebars, mining mesh and cupels (Ministry of Lands and Natural Resources, 2018).

Notwithstanding the evolution in the local procurement policy, some local suppliers interviewed complained that they are unable to obtain contracts with mining companies despite recent efforts by the government to increase local content. This is largely a result of the high standards demanded of local suppliers by mining companies. Some local suppliers contend that meeting these standards requires time as well as support from the both the government and mining companies. An official of one of the local supplier firms added that 'the first-class supplier firms that mining companies are used to dealing with were not built overnight'. Further to these concerns is the recent increment in fees paid by local suppliers to obtain and renew permits. In July 2020, local mining contractors accused the Minerals Commission of collapsing their businesses with outrageous charges, following an increment about 500% in annual fees paid to the Commission (Tijnani, 2020).

Some local companies questioned the wisdom behind the local procurement and local content policy, describing the approach as narrow. In an interview with a local mining support services provider (and a member of the GCoM), one official questioned why the government wouldn't rather channel efforts being made to enhance local content into growing local mining companies to become multinational entities. He reasoned that once there are multinational mining firms that originate from the country, they will naturally deal more with local suppliers than is the case with the foreign multinationals that dominate the industry. As such, the challenges of enclave mining that local content policies and laws have been designed to address would be better dealt with if efforts are rather geared towards developing local mining giants.

In this regard, the state may consider the case of Botswana where an active state involvement in the mining sector (particularly diamonds) was leveraged for the growth of local SMEs in the sector. Furthermore, recent moves by the Minerals Commission to establish a medium-scale mining sector where current small-scale mining companies will be allowed to enter into joint ventures with foreign partners may also be explored .

Conclusions

Ghana's approach to local content in the mining sector has taken off in a collaborative spirit between regulatory authorities and mining companies. Since the general regulations were passed in 2012, in-country procurement by the mining industry has increased significantly (though most of the products are imported by third parties) along with a reduction in inputs directly imported by mining companies. Over the same period, locally manufactured inputs for the mining industry have steadily grown and in some cases meet the entire demand of the mining industry. However, local production of mining inputs as well as Ghanaian participation in both suppliers and manufacturers in terms of ownership is still on the low side. Evolution in the local procurement list, which allows for some inputs to be reserved exclusively for Ghanaian or meet some minimum 'Ghanaian content' requirements, as is the case in the oil and gas sector, has potential for improving the situation. Furthermore, there is need for a well-thought-out strategy and programme of activities to offer local manufacturers and suppliers needed support and guidance so they are able to meet the high standards and demands of the industry. Despite concerns about local procurement and local content initiatives in broadening and deepening linkages between mining and other sectors of the economy (see Geenen, 2019), the findings of this study support the view that local procurement and local content initiatives remain relevant. In light of this, the following actionable measures and policy recommendations are offered to expand and deepen local procurement in the Ghana mining sector:

(i) Revision and implementation of the National Suppliers Development Programme collaboratively developed by the IFC, the Chamber of Mines, and the Minerals Commission.

(ii) Removal of all goods and services that are on the mining procurement list from the mining list (list of products that are exempted from payment of import duties and related levies).

(iii) The Minerals Commission must be more proactive in sharing information and analysis pertaining to local procurement in the mining sector and collaborating with other state agencies to seek redress to critical challenges that local suppliers face.

(iv) The Minerals Commission must engage the Minerals Income and Investment Fund towards provision of cheaper finance (both in terms of debt and equity) for local suppliers with discipline and in ways that facilitate greater Ghanaian content in these firms.

References

Ablo, A.D. 2018. Scale, local content and the challenges of Ghanaians employment in the oil and gas industry. Geoforum, vol. 96, no. 6. pp. 181-189. doi: 10.1016/j.geoforum.2018.08.014 [ Links ]

African Centre for Economic Transfomation. 2017. Comparative study on local content and value addition in mineral, oil and gas sectors: Policies, legal and institutional frameworks-trends and responses in selected African countries. Accra. [ Links ]

African Union Commission. 2008. Plan of action for African acceleration of industrialization - Promoting resource-based industrialization: A way forward. Addis Ababa. [ Links ]

Akabzaa, T.M., Seyire, J.S., and Afriyie, K. 2007. The glittering facade: Effects of mining activities on obuasi and its surrounding communities. Third World Network, Accra. [ Links ]

Amoako-Tuffour, J., Aubyn, T., and Atta-Quayson, A. 2015. Local content and V\ value-addition in Ghana's mineral, oil, and gas sectors: Is Ghana Getting It Right? African Centre for Economic Transformation, Accra. [ Links ]

Ankrah, W.,P. Gbana, A-M., Adjei-Danso, E., Arthur, A., and Agyapong, S. 2017. Evidence of the income inequality situation of the mining industry in Ghana. Journal of Economics and Development Studies, vol. 5, no. 1. pp. 79-90. [ Links ]

Arku, J. 2013. Foreign companies retention of 100% earnings is wake-up call. Graphic Online, 21 Augusr 2013. [ Links ]

Atienza, M., Arias-Loyola, M., and Lufin, M. 2020. Building a case for regional local content policy: The hollowing out of mining regions in Chile. The Extractive Industries and Society, vol. 7. pp. 292-301. [ Links ]

AU and UNECA. 2011. Minerals and Africa's development: The International Study Group report on Africa's mineral regimes. United Nations Economic Commission for Africa, Addis Ababa. [ Links ]

Ayanoore, I. 2020. The politics of local content implementation in Ghana's oil and gas sector. The Extractive Industries and Society, vol. 7. pp. 283-291. [ Links ]

Bank of Ghana. 2003. Report on the mining sector. Accra. [ Links ]

Bloch, R. and Owusu, G. 2011. Linkages in Ghana's gold mining industry: Challenging the enclave thesis. MMCP Discussion Paper no. 1. The Open University, Milton Keynes, Buckinghamshire, UK. 43 pp. [ Links ]

Boakye, B., Cascaden, M., Kuschminder, J., Szoke-Burke, S., and Eric Werker, R. 2018. Implementing the Ahafo Benfit Agreements: Seeking meaningful community partcipation at Newmont's Ahafo gold mine in Ghana. Canadian International Resources and Development Institute, Vancouver. [ Links ]

Botchie, G., Dzanku, F.M., and Akabzaa, T. 2008. Open cast mining and environmental degradation cost in Ghana. Technical Publication no. 87. Institute of Statistical, Social and Economic Research, Accra. [ Links ]

Conceicao, P. and Marone, H. 2008. Characterizing the 21st Century first commodity boom: Drivers and impact. United Nations Development Programme, New York. [ Links ]

Dontoh, E. 2018. Ghana begins audit of mining sector contracts as it seeks more revenues. Businesslive.co.za, 31 May 2018. [ Links ]

Geenen, S. 2019. Gold and godfathers: Local content, politcs, and capitalism in extractive industries. World Development, vol. 123. pp. 1-10. [ Links ]

Ghana Chamber of Mines. 2021. Annual Report 2020. Accra. [ Links ]

Ghana Chamber of Mines. 2019. Performance of the mining industry in Ghana 2018. Accra. [ Links ]

Ghana News Agency. 2015. Ghanaian mine workers cry over huge wage inequality. Ghana Business News, 31 August 2015. [ Links ]

Government of Ghana. 2012 Budget Statement and Economic Policy of Ghana. Accra. [ Links ]

Government of Ghana. 2012. Minerals and Mining (General) Regulations, 2012 (L.I. 2173). Accra, 20 March 2012. [ Links ]

Government of GHANa. 2020. Minerals and Mining (Local Content and Local Participation) Regulations, 2020 (L.I 2431). Accra, 15 October 2020. [ Links ]

Hanlin, C. 2011. The drive to increase local procurement in the mining sector in Africa: Myth or reality? MMCP Discussion Paper no. 4. The Open University, Milton Keynes, Buckinghamshire, UK. [ Links ]

Hirschman, A.O. 1977. A generalized linkage approach to development, with special reference to staples. Economic Development and Cultural Change, vol. 25. pp. 67-98. [ Links ]

Hirschman, A.O. 1958. The Strategy of Economic Development. 1958.Yale University Press, New Haven, CT. [ Links ]

Kaplinsky, R., Morris, A., and Kaplan, D. 2011. Commodities and linkages: Industrialisation in sub-Saharan Africa. The Open University, Milton Keynes, Buckinghamshire, UK. [ Links ]

Kotze, C. 2016. Africa Mining Vision Compact established between business and host governments. Mining Review Africa, 19 February 2016. [ Links ]

Kpodo, K. 2018. Ghana to tighten controls on gold exports to protect revenues. Reuters, 27 February 2018. [ Links ]

Kragelund, P. 2017. The making of local content policies in Zambia's copper sector: Institutional impediments to resource-led development. Resources Policy, vol. 51. pp. 57-66. [ Links ]

Kragelund, P. 2020. Using local content policies to engender resource-based development in Zambia: A chronicle of a death foretold? The Extractives Industries and Society, vol. 7. pp. 267-273. [ Links ]

Larsen, M.N., Yankson, P., and Fold, N. 2009. Does foreign direct investment (FDI) create linkages in mining? Transnational Corporations and Development Policy: Critical Perspectives. Sanchez-Ancochea, A.D. and Rugraff, E. (eds). Palgrave Macmillan, London. pp. 247-273. [ Links ]

Lima-de-Oliveira, R. 2020. Corruption and local content development: Assessing the impact of the Petrobras' scandal on recent policy changes in Brazil. The Extractive Industries and Society, vol. 7. pp. 274-282. [ Links ]

Minerals Commission. 2020. 2019 Annual Report. Accra. [ Links ]

Ministry of Lands and Natural Resources. 2018. Ghana: Government reviewing mining laws to enhance local content. https://allafrica.com/stories/201812060268.html [ Links ]

Morris, M., Kaplinsky, R., and Kaplan, D. 2012. One thing leads to another: Promoting industrialisation by making the most of the commodity boom in sub-Saharan Africa. Lulu.com [ Links ]

Ngnenbe, T. 2018. Ministry to audit mining companies to ensure they pay appropriate royalties, taxes. Graphic Online, 2 February, 2018. [ Links ]

Nwapi, C. 2015. Defining the 'local' in local content requirements in the oil and gas and mining sectors in developing countries. Law and Development Review, vol. 8, no. 1. pp. 187-216. [ Links ]

Organization of African Unity. 1980. The Lagos Plan of Action. Lagos. [ Links ]

PriceWaterhouseCoopers. 2007 Mine: Riding the wave, metals and mining, review of global trends in the mining industry. London. [ Links ]

Tijnani, H. 2020. Local mining contractors accuse Minerals Commission of collapsing their businesses with outrageous charges. Citinewsroom, 7 July 2020. https://citibusinessnews.com/2020/07/local-mining-contractors-accuse-minerals-commission-of-collapsing-their-businesses-with-outrageous-charges/UNECA. 2004. Minerals cluster policy study in Africa: Pilot studies of South Africa and Mozambique. Addis Ababa. [ Links ]

World Bank. 2012. Increasing local procurement by the mining industry in West Africa. Washington, DC [ Links ]

World Bank. 1992. Strategy for African mining. Technical Paper no. 181. Washington, DC. [ Links ]

Correspondence:

Correspondence:

A. Atta-Quayson

Email: aattaquayson@yahoo.com

Received: 29 Mar. 2021

Revised: 2 Dec. 2021

Accepted: 10 Jan. 2022

Published: February 2022

1 PriceWaterhouseCoopers reports that between 2002 and 2007 prices of minerals and metals rose by 260% and over the same period, the average net profits of the biggest mining firms increased by more than 1400%. Average profits of these firms were up more than 64% between 2005 and 2006.

2 This notwithstanding, the Ghana Mineworkers Union has raised concerns about the widening gap in emoluments between what is paid to local workers and expatriates, even for equal work done. The Union has also expressed misgivings about growing casualization of workers in the industry.

3 The large-scale sub-sector contributed 2.847 million ounces (representing a drop by 4.8% from the 2019 level) while the small-scale sub-sector contributed 1.175 million ounces (down from 1.588 million ounces in 2019) (Ghana Chamber of Mines, 2021)

4 The decline was due to a directive by the government to the only firm that produces manganese to stop operations, which led to suspension in production in the first quarter of 2020 (ibid.).

5 Production of diamonds by the only large-scale producer has been on suspension (ibid.)

6 In 2011 the government reported in its 2012 budget statement that recent studies revealed that the country loses about US$36 million each year through transfer pricing (Government of Ghana, 2011). The GCoM disputed this claim. Transfer pricing regulations have since been passed but non-availability of regional prices of goods and services impedes implementation of the regulations. The budget statement further noted that even though gold prices reached their peak levels ever in recent times, the country did not benefit at all from the price hikes (ibid.).

7 The Big Table was a meeting of ministers and senior officials from 11 mineral-rich African countries and representatives of the African Union, among other experts.

8 The adoption of the ECOWAS Minerals Development Policy followed an adoption of the ECOWAS Directive on the harmonization of guiding principles and policies in the mining sector in 2009, which also called on Member States with local content relevant sections.

9 The Mining and Minerals Law offers exemptions to mineral right holders from payment of import duties in relation to importation of plant, equipment, and mining consumables that are provided on the Mining List. The regulations extend similar concessions to Class A providers, but not to Class B.