Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of the Southern African Institute of Mining and Metallurgy

versão On-line ISSN 2411-9717

versão impressa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.121 no.12 Johannesburg Dez. 2021

http://dx.doi.org/10.17159/2411-9717/1378/2021

PROFESSIONAL TECHNICAL AND SCIENTIFIC PAPERS

The South African mining royalty regime: Considerations for modifying the system to balance its competing objectives

P.O. AkinseyeI; F.T. CawoodII

ISchool of Mining Engineering, University of the Witwatersrand, South Africa

IIWits Mining Institute, University of the Witwatersrand, South Africa

SYNOPSIS

Mineral royalties are one of the oldest forms of mining taxation, and were initially introduced to extract economic rents from mining. Over time, the royalty regime has become more complex as it was identified as an important policy instrument that can achieve more multi-faceted outcomes. Such a multi-tiered approach in the use of the royalty instrument is also the case with South Africa. With South Africa's new mineral royalty regime now in place for ten years, it is perhaps time to assess its impact and effectiveness.

To carry out this assessment, an econometric evaluative study was undertaken using four major commodities in South Africa, namely gold, platinum, iron ore, and coal. The study explored five different policy options for government to consider and tested them to determine the most favourable one that will realize the regime's policy objectives. After the assessment, two major options stood out. Hence, this paper seeks to highlight which of the two options is the most favourable for consideration by policymakers. Based on that study, we find that the current structure is effective, but also recommend that the factors in the formula for refined minerals be 'modified' to reduce the capped profitability ratio from the current 60% to 30% and the maximum royalty rate for refined minerals from 5% to 3%. The minimum rate of 0.5% during times of depressed mineral prices and no or low profitability will not be affected.

Keywords: mineral royalty, beneficiation, policy option, royalty formula, royalty regime, policy objectives.

Introduction

There is a significant variety of fiscal instruments available for policymakers to select from in the international resource taxation policy field. Mineral royalties fall in a category called 'special taxes', along with other instruments available to governments when they exercise national sovereignty over natural resources within their territories. Otto et al. (2006) summarized and discussed the range of royalty instruments and quasi-taxes encountered internationally and how these affect investors, government, and civil society. Many jurisdictions, including South Africa, have since then updated their royalty regimes to align the fundamental royalty principles with national policy imperatives (Cawood, 2010). Mineral royalties are usually charged on some definition of turnover value, which results in a small percentage change translating into a big change on the actual royalty amount. Royalties therefore could affect mining pay limits and consequently, influence investor decisions on where and when to invest. This makes mineral royalties a controversial topic. Otto et al. (2006) observed that 'across the globe, no type of tax on mining causes as much controversy as a royalty tax'. The role of public policy is to optimize mineral resource development by balancing investor interests with the need to utilize sovereign assets in the best interest of society, while still allowing investors a fair return on their investment.

Mineral royalties in South Africa are governed by the Mineral and Petroleum Resources Royalty Act (MPRRA, Act 28 of 2008) and by its Administration Act 29 of 2008. The two Acts were implemented in 2010, which year was the first time that royalties were governed by the national revenue authority (South African Revenue Service - SARS). Before 2010, mineral royalties were set, administered, and collected by the department responsible for mineral development and not by the more efficient revenue services parastatal. Recently, the Davis Tax Committee (DTC) reviewed the efficiency of the corporate income tax structure in South Africa. The DTC also considered the competitiveness of the mining tax regime, including the relatively new mining royalty system that was introduced in 2010. Several concerns were raised during the investigation, with most of them being about the complexity of the MPRRA rather than the competitiveness or affordability of the royalty system. The DTC commented that the mineral royalty regime 'is very new and that there is little by way of data to measure its success at this stage' and that 'the Treasury benchmarks the design of the royalty to best international practice'. The final recommendation was to retain the current royalty dual formulae structure, allowing for future refinement of the factors in the royalty formula, but only after a rigorous economic analysis by the National Treasury' (DTC, 2016).

Having the recommendation of the DTC in mind and accepting the structure of the royalty formulae as leading practice, there is therefore a need for further analysis of the factors used in the two formulae to establish if refinement thereof is required and how such changes will affect the policy objectives of the royalty system. In this regard, Oshokoya (now Akinseye) investigated the policy implications after econometric analysis of the factors within the two formulae (Akinseye, 2019).

In conducting the econometric analysis, the methodology used in the 2019 study involved the econometric evaluation and analysis of five different policy options. To facilitate this investigation, four major commodities in South Africa (gold, platinum, iron ore, and coal) were selected. After testing the five different policy options, two main beneficial options for the government were identified, but one of them stood out as the most desirable for achieving the regime's major policy objectives. The approach used was special because it demonstrated how the use of mining/refining companies' financial information can econometrically allow for the modifying of various parameters of the royalty formulae, thereby resulting in several policy options for consideration.

In this paper, which is mainly based on the findings of the Akinseye (2019) study, as well as previous studies by Oshokoya (2012) and Cawood and Oshokoya (2013a, 2013b), we aim at providing South African policymakers with a desirable option for 'modifying' and improving the current mineral royalty system in order to achieve its intended goals. The various sections of the paper reflect the process that leads up to the policy option that is proposed. The beginning sections give a description of the royalty regime, examine whether or not the system has been successfully implemented, and state the reason why modification of the system could be considered. The latter sections discuss the policy options that could be available for 'modifying' the regime, and finally present the recommended policy option that is most likely to facilitate the realization of the policy's objectives.

The South African royalty regime for mining

More than ever, the capture of a greater direct share in the wealth potential of mineral development, along with obtaining more socio-economic linkages, has topped the agenda of many mineral-rich countries. This re-emergent drive has instigated many governments to revise mineral policy and fiscal instruments as well as renegotiate contractual terms, to ensure the realization of more economic linkages from their mineral resources.

With the South African government not being left out of this initiative, one of the ways that it aimed at effectively obtaining more benefits from the development of its natural resource endowments for present and future generations was through the enactment of the MPRRA (Oshokoya, 2012). Based on the provisions of South Africa's Minerals and Mining Policy 1998 and the Mineral and Petroleum Resources Development Act, 2002 (MPRDA), as well as 'a most informative internal economics analysis...', the National Treasury designed the mechanism of the MPRRA to satisfy some criteria (Department of Minerals and Energy, 1998; MPRDA, 2002; DTC, 2016). These criteria are economic efficiency, rent collection and government risk, as well as administration and compliance costs. Hitherto, the main objectives of the MPRRA are generally as follows:

1. To compensate the State for the permanent extraction of the country's non-renewable mineral resources through royalty payments for the benefit of the National Revenue Fund (PwC, 2009a).

2. To target mineral rents.

3. To facilitate the achievement of the government's objective of promoting local beneficiation of its minerals (Akinseye, 2019).

The MPRRA specifies that royalty payments are to be charged when [mineral and petroleum] resources are transferred or sold in accordance with the MPRDA's provision for State custodianship over its mineral resources (National Treasury, 2008). The royalty payments collected by this instrument represent an additional revenue stream to the government in conjunction with corporate income tax (CIT) receipts, because both payments are collected in the same time cycle. With the royalty regime being designed to collect both royalties and mineral rents during times of profitability, this avails more opportunity for the mining sector to contribute to the enhancement of the socio-economic wellbeing of citizens. Also, this royalty instrument was viewed by National Treasury as one of the ways by which the government could achieve its beneficiation objective, so that industrialization and economic growth and development could be linked to mineral extraction.

The MPRRA stipulates that royalties are charged via a dual ad valorem, sliding-scale formula1 method, after a distinction is made between 'one of two physical conditions - after some processing (unrefined minerals) or after the "final" refined condition (refined minerals)' (National Treasury, 2008). In this regard, the condition of the mineral as either refined or unrefined is specified in either Schedule 1 or 2 of the Act. In addition to this, the Act makes provision for cases in which a mineral resource can potentially/ valuably be transferred either as a Schedule 1 product or Schedule 2 product (idem). Those types of minerals are listed under both Schedules. Dual-listed minerals are viewed as 'refined' only if they are produced to the 'refined' or beyond the 'refined' condition specified in Schedule 1. On the other hand, dual-listed minerals that fail to meet Schedule 1 specifications are viewed as unrefined (idem). Hence, the rates for refined and unrefined minerals are calculated thus:

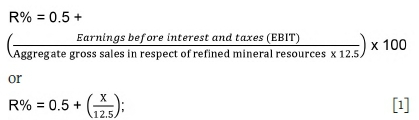

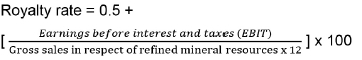

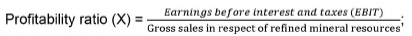

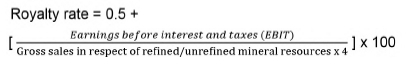

Refined minerals:

and

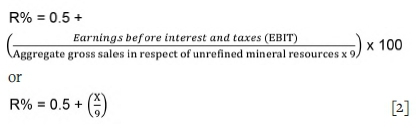

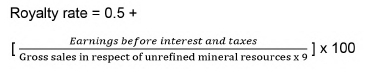

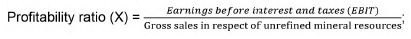

Unrefined minerals:

where

➤ R% = Royalty rate.

➤ Minimum royalty rate payable for all minerals = 0.5%. This minimum royalty charge ensures that the government (as custodian) always receives some level of royalty payments for the depletion of non-renewable resources, even in times of low profitability (Strydom, 2012).

➤ Maximum royalty rates payable at maximum profitability (100%) are 5% and 7% of gross sales for refined and unrefined minerals respectively, in that year of assessment. The reduced royalty rate of 5% is a reward for incurring additional costs on value addition (Oshokoya, 2012).

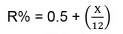

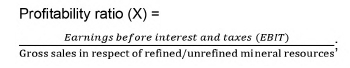

➤ X = profitability indicator (ratio) i.e

➤ Maximum value of X for both refined and unrefined mineral producers ~ 60% per year of assessment.

➤ F (factor) = 12.5 and 9.0, which determine maximum rates for refined and unrefined minerals respectively.

➤ EBIT = Earnings before interest and taxes. It is realized from the sum of gross sales after adding recoupments under the Income Tax Act 1962 (ITA) less operating expenditure less capital expenditure in the year incurred and any other amounts that are deductible in terms of the ITA.

➤ Aggregate gross sales: This is the royalty base and is defined as arm's length gross sales value in the transfer of all mineral resources, as defined in Schedule 1 and 2 of the Act (PwC, 2009b). As with EBIT, various inclusions and exclusions are applicable.

➤ The royalty rate determined in terms of the formula for refined minerals must not be below 0.5% nor exceed 5%, while the royalty rate determined in terms of this formula for unrefined minerals must not be below 0.5% nor exceed 7%.

➤ Royalty amount = Royalty base x R%.

Payments of royalties are due semi-annually and are estimated on a basis similar to provisional tax for income tax purposes (PwC, 2009b). It is noteworthy that these mineral royalties are deductible for income tax purposes (Strydom, 2012).

It is important to note that the formula provisions of the Act automatically recognize downstream beneficiation of mineral products. This is because the Act allows for the reduction of royalty rate as beneficiation increases in order to compensate for the significant additional costs that are incurred as a mineral is refined, even though a refined product has higher sales value, which leads to a higher tax base than that of an unrefined mineral. Hence, through the Act's definition of value, acknowledgment of profitability, and automatic recognition of the downstream mineral beneficiation, this further indicates that the royalty system aligns with the government's objective to promote local beneficiation of South Africa's minerals (Cawood and Minnitt, 2001: Portfolio Committee on Finance, 2008). As indicated previously, the design of the regime and its provisions bring South Africa's mining legislation in line with prevailing international norms, in which taxation instruments are used not only for revenue collection but also to encourage or discourage the promotion of various economic sector initiatives (PwC, 2016).

With the regime being in existence for about 10 years and knowing that a country's legal/regulatory environment is a key determinant for investors when considering investment destinations, it was deemed necessary to assess whether its implementation has been successful (or not). This would also give an indication of the impact of some of its policy intents on investment decisions. The next sections consider the success (or otherwise) of the implementation so far and give a lead as to whether the system requires some adjustments to achieve better results.

Considerations for modifying the system

The authors (Oshokoya, 2012; Cawood and Oshokoya, 2013a, 2013b) carried out studies using data from Statistics South Africa (Stats SA) of mining taxes that included royalty payments in the years 2004 to 2009 (before 2010, when the royalty regime became effective) to 2011 to measure and monitor the success of the system. Akinseye (2019) expanded these studies up to 2017, as indicated in Figure 1.

The deductions from the assessments indicated that the mining fiscal flows to South Africa's economy were significant in comparison to other sectors. Additionally, data showing the tax to turnover contributions of the mining sector and all other economic sectors in general, presented in Table I, indicated that the royalty regime has resulted in mining companies paying more taxes than other economic sectors, with the combination of income tax and mining royalties. This deduction was supported by the fact that the tax to turnover contributions of the mining sector in all the years (2010-2017) were almost twice as much as the tax to turnover contributions of all other sectors. Even in the year 2015, when the mining sector generally functioned at no profitability2 (as depicted by the 'negative' profitability ratio - EBIT to Revenue), the mining sector was still a major tax contributor to South Africa's economy in comparison to all the other economic sectors.

These deductions highlighted that the rent collection aspect of the royalty regime appeared to be effective (especially in times of good commodity prices). Also, the deductions indicated that the regime did not necessarily deter investment because it allowed for equitable sharing of economic benefits between the State and mining companies. This was because royalties are charged in-sync with economic cycles and the ability to pay is taken into consideration

With the equitability, economic efficiency, neutrality, and rent collection characteristics of the royalty regime proven as being effective, investigations on the regime's beneficiation (refining) policy objective were conducted. In summary, the findings of those investigations by these authors were that:

➤ The economic linkage objective of the regime was in line with global trends of using fiscal instruments to encourage or discourage private sector initiatives3

➤ The MPRRA's beneficiation incentive was insufficient and not likely to encourage miners to become refiners.

Conclusively, Cawood and Oshokoya (2012, 2013, 2013b) recommended that even though the beneficiation provisions appeared to be unable to realize the mineral beneficiation objective of the South African government, the initiative should not be terminated. Instead, further studies should be carried out to investigate ways of improving the design of the regime to achieve its policy objectives. Their recommendations tallied with the recommendations of the interim report of the DTC (2016), that '...various aspects of the mineral royalty regime still needed to be improved...'. The possibility of modifying some of the parameters of the royalty regime presented a way of making headway to obtain optimal results4.

These findings and recommendations, along with the continued indication that one of the ways that the South African government planned on encouraging the establishment of more beneficiation companies/projects through incentives like lowering royalty rates for such projects, indicated the need for modifying the MPRR system. The next section, which is largely based on Akinseye's 2019 study, describes the methodology used for modifying the system and the resultant policy outcomes available for consideration.

Policy options for modifying the system

According to the DTC (2016), '.three alternative options to the existing royalty regime were discussed as feasibilities, using a combination of proposals and options developed in the International Monetary Fund report and by the National Treasury'. Hence, in alignment with these initiatives, Akinseye carried out a follow-up study5 to her 2012 study to contribute to the discussion around finding alternative ways of modifying the royalty regime. The investigation6 that was conducted in 2019 resulted in the development of five policy options for the purpose of proposing 'pragmatic' and 'realistic' solutions/adjustments that could be applied to the regime in order to realize policy objectives.

One of the major focus themes of the 2019 research was to find better ways to optimize the beneficiation objective of the MPRRA by checking how its parameters could be adjusted to incentivize the cost side of mineral developers. This was proposed based on the reality that mineral producers are largely price-takers (because the prices received for their products are generally set by global market dynamics), coupled with the difficulty they face with regard to reducing production costs. Another focal issue of the 2019 study was how to use the MPRRA's rent-collection feature to establish a most favourable system of management and use of the rents collected. The expected result of this assessment was to highlight which of the MPRRA parameters could be readjusted/ modified for government to effectively realize its intended goals.

To adequately carry out the assessment, the methodology of this study aimed at addressing some of the shortcomings of the 2012 study. Some of these shortcomings included the type of financial data that was obtained and used, as well as the financial/ accounting calculations that were conducted. It was expected that the confidentiality issues encountered in 2012 study would be resolved at the beginning stages of the 2019 study, so that actual financial data for revenue, costs, and new processing facility capex could be obtained and used to portray a more realistic picture of the actual financial positions of producers. To this end, both the Department of Mineral Resources and Energy (DMRE) and SARS were approached between January and March 2017. They declined to release financial information of the mining companies and the researcher was advised to use relevant information available in the public domain. Therefore, the limitation imposed by confidentiality issues, which was experienced in the 2012 study, was also encountered in the 2019 study. Information for this study had to be obtained from the public domain (Integrated Annual Reports, analyst books etc.) as directed by SARS. For the purpose of this study, the analysis was carried out using models created in Microsoft Excel and IBM SPSS Statistics.

Based on the data obtained as at the time of the 2019 study involved carrying out econometric analysis7 in two phases. Both phases were applied to three other mineral sectors - gold, iron ore, and coal - as well as the PGM sector (as in the 2012 study)8. This was done to determine whether the conclusion of the 2012 study was PGM sector-specific or also applicable to the entire South African mining industry.

The application of these econometric procedures involved conducting tests of statistical significance and 'Realized Beneficiation incentive' (or royalty savings) on the current MPRR regime (hereinafter referred to as policy option 1). After testing this policy option, the general observation from the sectors' assessments in terms of Realized Beneficiation incentive was that only the steel/iron ore sector appeared to attain such royalty savings. For all other sectors assessed (except the peculiar case of gold), the application of the dual royalty formula showed mixed performance in terms of the Realized Beneficiation incentive. However, the mixed performance tended more towards the absence of any royalty savings for the minerturned- refiner (refiner) as the producer paid more royalties than the miner-only in the majority of the years that were assessed. The general observation that refiners appeared to pay more royalties than miners-only, despite the royalty regime's incentive of a lower royalty rate for refiners, was largely a function of the 'better' profitability of refiners compared to that of the miners-only. Hence, the implication was that the royalty formulae are at best a revenue-generating and rent-collection instrument. This result was supported by another assessment conducted under policy option 1, where only the royalty formula for refined minerals was applied to the gold sector. These deductions led to the generation of other policy options for the government to explore for modifying the formulae. These options, which involved the reduction of the maximum rate for refined minerals, and/or manipulating the F-factor of 12.5, are as follows:

1. Leaving the current royalty formulae as they are, despite the apparent inequity. This inequity, however, is by design so that miners are motivated to become refiners;

2. Reducing the royalty rate for refined minerals to increase its Realized Beneficiation incentive portion, thereby allowing the miner-only to continue to bear royalty penalty (as per the Act's specifications) in the current poor economic climate generally and for minerals in particular;

3. Using only the royalty formula for refined minerals for both classes of producers;

4. Using only the royalty formula for unrefined minerals for both classes of producers; and

5. Using a modified version of the royalty formula for unrefined minerals for both classes of producers (Akinseye, 2019).

These various policy options were examined to ascertain the most optimal way of adjusting the parameters of the royalty regime. The next sub-section gives details about the specific structures of the five policy options.

The structure of the five policy options Policy option 1

This option involved the application of the two current royalty formulae to the financial information of the two classes of producers in each of the four selected commodity sectors of the study. For the application of these formulae in this policy option, none of the parameters of the formulae were changed. The parameters of the formulae used in this option are as per the MPRRA (formulae 1 and 2).

Policy option 2

With the policy objective of incentivizing refiners in mind, this option involved modifying only the current royalty formula for refined minerals while leaving the current formula for unrefined minerals unchanged. Before statistical tests were carried out on this option, different aspects/parameters of the royalty formula for refined minerals that could yield more royalty savings were explored9.

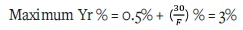

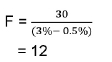

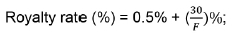

In seeking to modify this royalty formula for refined minerals, the maximum profitability ratio (X-factor) was changed from 56.3% (approx. 60%) (which is the specified maximum profitability ratio in the current MPRR regime) to 30%, and the F-factor for refined minerals was changed from 12.5 to 12. This modified maximum profitability ratio was based on the deductions from the comparisons between the maximum profitability ratios and the corresponding resultant maximum royalty rates of all the refined mineral producers in all the four commodity sectors that were assessed in the Akinseye (2019) study. The purpose of that comparative assessment was to determine the optimal profitability ratio or maximum royalty rate by which the formula was to be modified. After averaging the maximum royalty rates that were generated based on these maximum profitability ratios, the final optimal maximum royalty rate of 3% for refined minerals was selected. This was in line with the Competitive Investment Framework (CIF) study by Cawood (1999). This implied that by substituting the realized optimal maximum royalty rate of 3% and the modified maximum profitability ratio of 30% (which was a more realistic maximum profitability ratio for the mineral producers), along with the minimum royalty rate of 0.5% in the current royalty formula for refined minerals (i.e. formula 1), a new F-factor was obtained. This new F-factor was derived as follows:

By substituting new values for maximum Yr and X in the restated formula (Equation [1]):

Hence, the formulae for policy option 2 are stated as follows: For refined mineral resources:

or

or

where

Formula constant (F-factor) = 12

The royalty rate determined in terms of this formula must not be below 0.5% nor exceed 3%.

For unrefined mineral resources:

or

where

Formula constant (F-factor) = 9

The royalty rate determined in terms of this formula must not be below 0.5% nor exceed 7%; with maximum profitability ratio remaining at 60%.

Policy option 3

Based on the deduction from the assessment of policy option 1 that the royalty formulae are at best revenue-collection instruments, one of the policy options available to the government is to charge royalties using only one of the current formulae. The implication of this is that the current beneficiation intent of the Act would be forfeited. In this regard, policy option 3 involves charging mineral royalties by applying only the current formula for refined minerals (i.e. Formula 1, with none of its parameters changed) to both classes of producers. Choosing this option potentially has both positive and negative connotations for both government and investors. To fruitfully establish its impacts, it was important to test the option just like the other options.

Policy option 4

In this option, only the current formula for unrefined minerals (Formula 2) was applied to financial information of the two classes of producers in each commodity sector. None of the parameters in the current formula for unrefined minerals were changed in its application in this model. It should be noted that if government chooses this option, it will have to forfeit the beneficiation intent of the current Royalty Act, just like in option 3. Also, the choice of this option potentially has both positive and negative connotations for both government and investors. To fruitfully establish its impacts, it was important to test the option just like the other options.

Policy option 5

This option involved applying only one formula (a modified version of the formula for unrefined minerals) to both classes of producers. However, it should be noted that if government chooses this policy option, it will have to forfeit the beneficiation intent of the current Royalty Act, as in the case of policy options 3 and 4. To obtain this modified version of the royalty formula, the adjustment of some aspects/parameters of this royalty formula had to be explored10. The formula is stated as follows:

For all mineral resources,

or

where

Formula constant (F-factor) = 4

The royalty rate determined in terms of this formula must not be below 0.5% nor exceed 7%; with maximum profitability ratio being 26% (instead of 60%).

After the final modified formula was realized, statistical tests were carried out on this option just like the other options, to fruitfully establish its impacts.

Discussion of results

The outcomes of the tests conducted on these policy options are as follows:

➤ Policy option 1: The major result of assessing this policy option was that, if the South African government decides to keep the regime unchanged, there would be no 'loss' to the government. This is because the MPRRA in its current state would still effectively collect compensatory revenues for the exploitation of the country's non-renewable resources, as well as additional economic rents when the profitability of mining and refining companies is high.

➤ Policy option 2: To test this option, the modified formula for refined minerals based on the new parameters was applied to financial information on the refined mineral producers in those commodity sectors (except for the peculiar case of the gold sub-sector), just like policy option 1. On the other hand, the current formula for unrefined minerals (formula 2) was applied to the financial information of the miners-only in those sectors. The results indicated that the application of the dual royalty formula showed mixed performance for different commodities. As in option 1, the mixed performance tended more towards the absence of any Realized Beneficiation incentive for the miner-turned-refiner as the refiner paid more royalties than the miner-only in the majority of the years assessed, except for the steel/iron ore sub-sector, which appeared to obtain these savings. However, the royalty burden on the refiner in this option was much less than that in option 1. Hence, the implication is that although the royalty formulae appeared to be revenue- generating and rent-capturing instruments, option 2 was likely to provide more beneficiation incentives than option 1.

➤ Policy option 3: As with the assessment of policy options 1 and 2, only the current formula for refined minerals was applied to financial information on the two classes of producers in each commodity sector. The observation from this assessment was that even though no Realized Beneficiation incentives accrued to the refiner in general, the magnitude of the royalty burden on the refiner was more than that of option 2 but the same as option 1. On the other hand, the royalty burden on the miner-only was less than that of options 1 and 2.

➤ Policy option 4: From the assessment on this option, it was observed that in addition to the fact that no royalty savings accrued to the refiner in general, the magnitude of the royalty burden on the refiner was more than that of options 1 to 3. On the other hand, the royalty burden on the miner- only remained the same as in options 1 and 2.

➤ Policy option 5: From the assessment of this option, it was observed that no Realized Beneficiation incentive accrued to the refiner generally. Also, the magnitude of the royalty burden on both classes of producer was more than that of options 1 to 4. This was due to the reduced maximum profitability ratio (from 60% to 26%) and maximum royalty rate parameters of option 5.

These results are summarized in Table II.

After making econometric evaluations of the five policy options, Akinseye (2019) carried out additional assessments and observations with respect to the value-added to the miner-turned-refiner, using different proportions of refinement costs as a percentage of sales price. These assessments were based on unpublished work by Cawood in which he sought to check the effect of different proportions of refinement cost (as a percentage of sales price) in terms of value-added (as deduced from Bradley's 1986 model) in the context of the peculiar provisions of the MPRRA. From the additional assessments, it was clear that of all the five options assessed in terms of Cawood and Bradley's model specifications/recommendations, option 2 stood out as the most satisfactory.

Implications of the policy options in terms of government imperatives

From the evaluations carried out on the five policy options for modifying the MPRRA, the study reiterated that the regime functioned more as a revenue-collection instrument than a beneficiation-fostering instrument. The implication of this is that from the perspective of the representative mining/refining companies used in the study (except the steel/iron ore sector), if the regime's current reduced rate provision for refined products is retained and is the only incentive given to motivate miners to become refiners, the Act's beneficiation objective would generally not be achieved.

Given a situation whereby the South African government was flexible about the topmost priorities/imperatives that the MPRRA is intended to satisfy, the options available for consideration can be summarized as follows.

1. If the most important purpose of the mineral royalty is to earn economic rent, then the government should leave the royalty system as it is currently (i.e. policy option 1). This is due to the fact that the revenue-collection benefit of this option to the government and the economy would hold irrespective of whether or not the royalty regime successfully motivates miners to become refiners.

2. If the most important purpose is to motivate miners to become refiners, then the government should leave the royalty formula for unrefined minerals as it is currently, but change the F-factor for the formula for refined minerals from 12.5 to 12 and cap the maximum royalty rate for refined production at 3% (as per policy option 2).

It should be noted that, as highlighted in Table II, if the government chooses to adopt this policy option, it stands a chance of motivating more mining companies to move up the mineral value chain by carrying out more mineral beneficiation than with option 1. This will hold because of policy option 2's beneficiation incentive of a reduced maximum royalty rate, from 5% to 3%, that refiners would be charged. Additionally, this policy option could potentially enable the collection of more royalties from refiners using the maximum royalty rate because more refining companies are likely to realize a maximum profitability ratio of 30% per period of assessment (specified by policy option 2) as opposed to a maximum profitability ratio of 60% per period.

3. If the most important purpose of the mineral l royalty is to earn more economic rent than is currently received, while relieving South Africa's primary mining sector in order to ensure its continued existence, then the government should to apply the royalty formula for refined production only (policy option 3) to both classes of mineral producers. As highlighted in Table II, if the government chooses to adopt this policy option, its application to both mining and refining companies would effectively still collect compensatory revenues for South Africa's non-renewable resources and economic rents for the government. Additionally, this policy option proposes to provide a 'gain' to the government due to the lesser royalty burden on the miner-only compared to policy options 1, 2, 4, and 5, because of the reduced maximum royalty rate (5% instead of 7%), thereby aiding the continued existence and survival of South Africa's primary mining sector. However, it is recommended that policy collected might be less than that under policy options 1, 4, and 5 because of the reduced maximum royalty rate (5% instead of 7%). Additionally, the downside of choosing this policy option would be that the government would have to forfeit its intent to use the MPRRA to encourage mining companies to engage in more mineral beneficiation activities.

4. If the most important purpose of the mining royalty is to earn much more economic rent than is currently received (more rent than policy option 3), then the government should to apply the royalty formula for unrefined production only (policy option 4) to both classes of mineral producers.

As indicated in Table II, if the government chooses to adopt this policy option, its application to both mining and refining companies would effectively still collect compensatory revenues for South Africa's non-renewable resources and economic rents for the government. Also, the magnitude of revenue collection might be greater than that of policy options 1, 2, and 3 because of the high maximum royalty rate of 7% that applies to all mineral producers. However, although this policy option would provide a monetary 'gain' to the government, the downside would be that the royalty burden on refiners would be greatly increased and government would have to forfeit its intent to use the MPRRA to encourage mining companies to engage in more mineral beneficiation activities.

5. If the most important purpose of the mining royalty is to earn much more economic rent than is currently received (more rent than under policy options 1 to 4), then the government should to apply the modified royalty formula for unrefined production only, which specifies that the F-factor for the formula be changed from 9 to 4, and cap the maximum royalty rate for refined production at 7% (policy option 5) for both classes of mineral producers. This implies that if government chooses this policy option, it can expect more mining companies and refining companies to pay royalties using the maximum royalty rate of 7% per year. However, with this policy option, government can still compensate the already 'penalized' refiners due to the added costs of refinement they incur as well as the downward pressure on revenues that they have been experiencing of recent, by allowing the royalty base to have more refinement costs deducted before applying the royalty rate.

Comparing these policy options to the findings and recommendations of the DTC and IMF, as stated in the DTC (2016) report in this respect, the following can be observed:

➤ Policy option 1 is in line with the DTC's '...preferred alternative of broadly retaining the current royalty system...'

➤ Policy option 2 is in line with the DTC's '...favour of a hybrid of the 1st and 2nd [IMF] options with an overall preference for option 2.'

➤V Policy options 3 to 5 are in line with the IMF's option 3 (except for changing the F-factor to 10.5); the DTC did not favour the IMF's option 3.

Conclusion and recommendation

This paper has highlighted the South African government's expectation from the enactment of the MPRRA, i.e. that more benefits should be realized from mineral development. Although revenue collection for depletion of renewable natural resources remains the primary objective, another benefit is mineral beneficiation - whereby more mineral producers would become mineral beneficiators/refiners. In deciding how successful the implementation of the regime in realizing its objectives has been so far, this paper suggests that the equitability, economic efficiency, neutrality, and rent collection aspects of the royalty regime are effective. However, the investigation of the regime's beneficiation (refining) policy objective indicated that the system requires some adjustment.

This paper presents different policy options that could be available for adjusting/improving the current mineral royalty regime for the achievement of its intended goals. Therefore, in maintaining its imperative of keeping to the dual formulae and all three main policy objectives of the MPRRA, it is recommended that policy option 2 is the most ideal option for consideration by NT. This option specifies that the current formula for unrefined minerals remains unchanged, while the parameters for the formula for refined minerals be changed to:

where the maximum profitability ratio (X-factor) is 30%, the F-factor for refined minerals is 12, and minimum and maximum royalty rates are 0.5% and 3% respectively-

Furthermore, in choosing this option for 'modifying' the system, government should take note of the following impacts.

➤ SARS will collect less royalties from companies that are already refining to levels specified in the MPRRA because of the lower maximum rate of payment (from 5% to 3%). Notwithstanding this apparent loss to government, a greater number of refiners would be paying royalties at the maximum royalty rate than is currently the case. This is because refiners will reach the maximum rate much quicker.

➤ The reduced maximum royalty rate for refiners will encourage more miners to become refiners, which will support for the government's beneficiation objective.

References

Akinseye, P.O. 2019. Modifying the South African mining royalty regime for optimal mineral resource use and management of mineral rents. PhD thesis, University of the Witwatersrand. [ Links ]

Bradley, P. 1986. Mineral Revenues Inquiry: final report. The study into mineral (including petroleum) revenues in Western Australia, vol. 1 and 2. Government of Western Australia. [ Links ]

Cawood, F. and Minnitt, R. 2001. A new royalty for South African mineral resources. Journal of the South African Institute of Mining and Metallurgy, vol. 101. pp. 91-5, [ Links ]

Cawood, F.T. 1999. Determining the optimal rent for South African mineral resources. PhD thesis Faculty of Engineering, University of the Witwatersrand. [ Links ]

Cawood, F.T. 2010. The South African Mineral and Petroleum Resources Royalty Act- Background and fundamental principles. Resources Policy, 35 March 2010. pp. 199-209. [ Links ]

Cawood, F.T. and Oshokoya, O.P. 2013a. Resource nationalism in the South African mineral sector: Sanity through stability. Journal of the Southern African Institute of Mining and Metallurgy, vol. 113. pp. 45-52. [ Links ]

Cawood, F.T. and Oshokoya, O.P. 2013b. Considerations for the resource nationalism debate: A plausible way forward for mining taxation in South Africa. Journal of the Southern African Institute of Mining and Metallurgy, vol. 113. pp. 53-59. [ Links ]

Cornish, L. 2015. Weak financial performance for SA mining sector in 2015 says PwC. Mining Review Africa. https://www.miningreview.com/top-stories/weakfinancial-performance-for-sa-mining-sector-in-2015-says-pwc/ [Accessed 5 July 2019) [ Links ]

Davis Tax Committee (DTC). 2016. Second and Final Report of the Davis Tax Committee on hard-rock mining for The Minister of Finance. December 2016. https://www.polity.org.za/article/davis-tax-committee-finalreports-2017-11-13 [Accessed: 10 July 2020]. [ Links ]

Department of Minerals and Energy. 1998. White Paper: A Minerals and Mining Policy for South Africa. October 1998. [ Links ]

MPRDA. 2002. Mineral and Petroleum Resources Development Act 28 of 2002 as amended, 3 October 2002. Government Gazette, vol. 448, no. 23922, (Date of commencement 1 April 2004). [ Links ]

MPRRA. 2008. Mineral and Petroleum Resources Development Act No. 28 of 2008. [ Links ]

National Treasury. 2008. Republic of South Africa Explanatory Memorandum for the Mineral and Petroleum Resources Royalty Bill, 2008. National Treasury. [ Links ]

Oshokoya, O.P. 2012. The new South African mineral royalty formulae. Will all miners become refiners? Platinum case study. University of the Witwatersrand, Johannesburg. [ Links ]

Otto, J., Andrews, C., Cawood, F., Doggett, M., Güj, P., Stermole, F., Stermole, J., and Tilton, J. 2006. Mining royalties: A global study of their impact on investors, government and civil society. The World Bank Group, Washington DC. [ Links ]

Portfolio Committee on Finance. 2008. Mineral and Petroleum Resource Royalty Bill Response Document. http://www.treasury.gov.za/legislation/bills/2008/royalty/PCOF%20Response%20-%20Royaty%20Bil%20-%202008.pdf [Accessed July 2011]. [ Links ]

PwC 2016. Mineral and Petroleum Resources Royalty. http://www.pwc.co.za/en/tax/mineral-and-petroleum-resources-royalty.html [Accessed October 2017], [ Links ]

PwC. 2009a. The Mineral and Petroleum Resources Royalty Act: Putting it all together. https://www.pwc.co.za/en/assets/pdf/pwc-mineral-petroleum-royaltyact-putting-it-all-together.pdf [Accessed November 2011]. [ Links ]

PwC. 2009b. The Mineral and Petroleum Resources Royalty Act - Summary. http://www.pwc.co.za/en/assets/pdf/pwc-mineral-petroleum-royalty-act-summary.pdf (Accessed: November 2011). [ Links ]

Rossouw, A. 2015. A statement by PwC Assurance Partner. Weak financial performance for SA mining sector in 2015 says PwC. Cornish, L. Mining Review Africa. https://www.miningreview.com/top-stories/weak-financialperformance-for-sa-mining-sector-in-2015-says-pwc/ [Accessed: 5 July 2019]. [ Links ]

Stats SA. 2018a. Statistical Release P0044: Quarterly financial statistics (QFS) - December 2017. http://www.statssa.gov.za/publications/P0044/P0044December2017.pdf [Accessed April 2018]. [ Links ]

Stats SA. 2018b. Statistical Release P0441: Gross domestic product - Fourth quarter 2017. http://www.statssa.gov.za/publications/P0441/P04414thQuarter2017.pdf [Accessed April 2018]. [ Links ]

Strydom, B. 2012. South Africa - Mining and Petroleum Royalties - The imposition and calculation. of BOWMAN GILFILLAN. http://www.bowman.co.za/FileBrowser/ArticleDocuments/South-Africa-Mining-and-Petroleum-Royalties.pdf [Accessed April 2013]. [ Links ]

Correspondence:

Correspondence:

P.O. Akinseye

Email: tomi.akinseye@wits.ac.za

Received: 9 Sep. 2020

Revised: 18 Jun. 2021

Accepted: 28 Oct. 2021

Published: December 2021

ORCID:

P.O. Akinseye https://orcid.org/0000-0002-0519-5957

1 This dual sliding-scale formula mechanism imposes no specific royalty rates for any mineral, instead, it allows for self-adjusting royalty rates for minerals, according to the level of refinement and profitability (MPRRA, 2008)

2 According to Rossouw (2015), 'financial performance for the South African mining industry in 2015 was extremely challenging and downcast'. This challenging performance, which resulted in shrinking margins and impairment provisions, was largely due to 'local cost pressures, labour action, a continuing downswing in commodity prices and declining trend in market capitalization' (Cornish, 2015).

3 An example is the Scandinavian case of using policy instruments to promote the transition of their economies from raw-materials based to industrialized.

4 Expected optimal results are that increased benefits accrue to South Africa from mineral beneficiation [even in times of poor prices], thereby possibly increasing revenue from mining taxes plus royalties.

6 Some of the 'problematics' of the Act informed the rationale for this follow-up study (Akinseye, 2019).

7 This assessment was done irrespective of the fact that the realization of the positive influence of the beneficiation objective on mineral investments has been widely debated over time.

7 The specifics of how the econometric analysis of the 2019 study was modified to differ from that of the 2012 study are stated in chapter 5 of Akinseye (2019).

8 These four commodity sectors were identified as being substantial contributors to the South African economy and with the imposition of the MPRRA, their importance to the fiscus and the economy has become even greater. The major players in each selected commodity sector that possessed mining-only operations or both mining and refining operations in South Africa were presented as suitable representatives of the dual stages of processing per sector required in this study.

9 The details of how the parameters of the MPRRA formula for refined minerals were adjusted for this policy option can be found in chapter 8 of Akinseye (2019).

10 The details of how the parameters of the MPRRA formula for unrefined minerals were tweaked for this policy option can be found in Akinseye (2019).