Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.120 n.9 Johannesburg Sep. 2020

http://dx.doi.org/10.17159/2411-9717/1240/2020

SAMCODES PAPERS

RPEEE (Reasonable Prospects for Eventual Economic Extraction): The critical core to the SAMREC Code

N. Lock

Consulting Geologist, Johannesburg, South Africa. https://orchid.org/0000-0002-1532-5364

SYNOPSIS

Reasonable Prospects for Eventual Economic Extraction (RPEEE) is the critical basis for effective implementation of the SAMREC Code as it applies to Mineral Resources, and implicitly to Mineral Reserves that are derived from Mineral Resources. This implementation follows the founding principles of materiality, transparency, and competence.

The SAMREC definition of a Mineral Resource specifically includes RPEEE. SAMREC provides guidance for all minerals on what RPEEE means, with some specific additional guidance for diamonds. SAMREC instructs the Competent Person that RPEEE must be demonstrated through reasoned assessment of multiple technical and non-technical parameters, and with disclosure in reporting. A recommended chapter in a CPR includes a sub-section for RPEEE.

SAMREC definitions and guidance are presented with discussion of the factors that must be assessed to demonstrate RPEEE. Comparison with guidance in other reporting countries and examples of actual practice are presented.

Keywords: reporting codes, Mineral Resources, definitions, disclosure, SAMREC.

Introduction

Reasonable Prospects for Eventual Economic Extraction (RPEEE) is perhaps the decisive basis for effective implementation of the SAMREC Code (SAMREC, 2016a). It is the critical core of the work processes leading to the declaration of Mineral Resources and Mineral Reserves, and is mandatory.

Notwithstanding the importance of the assessments required to demonstrate RPEEE, it is a step in the estimation process that in the past has been overlooked by default. This is perhaps because mathematical models play such an important role in our work practices today. Also, there is too often an implicit assessment of economic viability without provision of the supporting assessment that the layperson or investment adviser needs to bolster confidence in their judgement of the public disclosure.

While real-world work practices often fall well short of good practice in this regard, the SAMREC Code sets out clear definitions and provides guidance for the assessment of RPEEE that, if followed as required, results in clear and confident disclosure for the intended readers. The SAMREC Code also now introduces the concept of 'if not, why not' in Clause 6 with respect to the provisions of Table I. These aspects at the core of the code are described and discussed, together with comparison from other national codes and examples from published reports.

RPEEE in the SAMREC Code

What does the acronym mean? While it is easy to state that RPEEE means Reasonable Prospects for Eventual Economic Extraction, as a starting point in the discussion here, it will be helpful to break up the acronym, word by word, for clear and concise understanding. R: Reasonable - using good judgment

P: Prospects (for) - possibility (not proven) of meeting with success in the future

E: Eventual - happening or existing at a later time

E: Economic - making a profit, or ability to attract investment

E: Extraction - excavation and extraction of minerals (as a practical matter) such as those containing metals or diamonds.

The SAIMM has adopted the Oxford English Dictionary as a standard for spelling; the implication must be that this dictionary also provides a preferred meaning for words. While the SAMREC Code makes no reference to a specific dictionary, the reader is advised that meaning may be of great importance, especially the meaning of the word 'reasonable' that appears multiple times in the code.

'Reasonable' means: 'Having sound judgement; fair and sensible; based on good sense.' Put another way: 'Able to reason logically.' All these synonyms suggest or imply a process, and process is a core aspect of the SAMREC Code. The process need not be prescriptive but allows our vastly disparate work practices in the mining industry to strive for a common purpose of conveying public disclosure that is comprehensible to the 'investors or potential investors and their advisers.'

'Prospects' means: 'The possibility or likelihood of some future event occurring.' It can also mean: 'Chances or opportunities for success or wealth.' In either case the meaning falls short of something proven. But, fundamentally for the mining industry, it also means: 'A place likely to yield mineral deposits.'

'Eventual' means: 'Occurring or existing at the end of or as a result of a process or period of time.' The crux of the meaning for our industry is the word 'time.' The SAMREC Code provides discussion in the guidelines, in relation to the timeline for development, which is often very different for bulk commodities compared to other commodities, like gold, for which significantly shorter timelines may be expected. 'Economic means: 'Relating to economics or the economy' or 'Justified in terms of profitability.' SAMREC is very clear that 'A Mineral Resource is not an inventory of all Mineralisation Reasonable assessment of the information is required to move a Mineral Deposit (as defined in the SAMREC Glossary) to a Mineral Resource, with economics being at the centre of that assessment. Economic in this context, in the author's opinion, should not mean just one dollar over a threshold, but extends to the realm of ability to attract investment. 'Extraction' means: 'The action of extracting something, especially using effort or force', with mineral extraction provided as example. In our industry the something being extracted is minerals, and extraction is the holistic process from the source (rock) to the market. Nevertheless, there are inevitably different methods of extraction for different minerals, each of which may impact comparative economic viability.

The SAMREC Guidelines provide pertinent discussion, specifically following the definition of a Mineral Resource. This will be elaborated further below.

Definitions

What does SAMREC tell us? Clauses 24 and 67 provide the definitions for the general case and for diamonds.

A 'Mineral Resource' is a 'concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade, or quality and quantity that there are reasonable prospects for eventual economic extraction.' This definition excludes brines containing soda ash as in Botswana, or lithium as in Argentina, but these types of deposit were encompassed in SAMREC 2007 when the single word 'solid' was omitted. It is possible liquids may be included again in the future.

A 'Diamond Resource' is a concentration or occurrence of diamonds of economic interest in or on the Earth's crust in such form, quantity (volume/tonnage), grade and value that there are reasonable prospects for eventual economic extraction."

These clauses continue, 'Any (Diamond) Mineralisation that does not have demonstrated reasonable prospects for eventual economic extraction may not be included in a Mineral (Diamond) Resource.'

Guidelines or guidance

Guidelines, or guidance, as discussed here, is as defined in the Introduction to the SAMREC Code (Clause 2). Clause 24 continues after the definition of a Mineral Resource with several paragraphs of Guidelines text to discuss context and meaning that support and explain the very clear-cut statement that 'A Mineral Resource is not an inventory of all Mineralisation.'

The Competent Person preparing a public report must absorb these Guidelines and make them central to everyday work practices. It is not the purpose here to include those Guidelines in full; however, some key points can be made to aid understanding and implementation.

RPEEE 'should be demonstrated through the application of an appropriate level of consideration of the potential viability of Mineral Resources.' The word 'appropriate' is used liberally throughout the SAMREC Code but is not defined generally, or in each case of usage; in this instance it should be taken to relate to risk or confidence where a qualitative low, medium, or high confidence corresponds to Inferred, Indicated, or Measured Resource categories respectively. The consideration must be based on a reasoned assessment, as will be elaborated below. While this may include technical assumptions, these must be presented and justified.

'The determination of RPEEE should be based on the principle of reasonableness and should be justifiable and defendable. The assumptions used to test for reasonable prospects should be reasonable and within known/assumed tolerances or have examples of precedence.' While SAMREC Table II, Guidelines for Technical Studies, relates to Scoping, Pre-Feasibility, and Feasibility Studies, the tabulation may provide some insight into understanding limits or ranges for precision, accuracy, and confidence. For example, the Capital and Operating Cost accuracy ranges are given as ±25-50%, ±15-25%, and ±10-15%, and the Risk tolerance as High, Medium, and Low respectively. Precision (and accuracy) in resource estimation should include reference to the quality of the analytical data as assessed through a quality assurance and control programme.

Where untested practices are applied, their use must be justified by the Competent Person. To use a hyperbolic example, an iron meteorite with nickel content perhaps as high as 25% would require a unique 'mining' practice to recover and extract the nickel. While no longer just science fiction, the practical solutions are far from economically viable.

As an example of another scenario, even though nickel is normally sourced from sulphide or laterite deposits, consideration of silicate-hosted deposits (e.g. olivine) is becoming a technical possibility (Santos et al., 2015) and similar processes investigating CO2 sequestration may give these investigations prominence in the foreseeable future. However, until such time, these laboratory experiments would qualify as untested practices requiring justification, not just chemically but also at a production scale to demonstrate the economics.

Interpretation of the word 'eventual' may vary depending on the commodity, mineral involved, or legal tenure. Bulk commodities such as coal and iron ore are typically planned and mined with very long timelines in mind, perhaps extending over many decades. This would be in stark contrast to most precious and other metals projects, for which short timelines of up to about two decades may be more appropriate. In discussing the importance of 'eventual' for these contrasting commodities, the impact of price and markets over the intended project timeline is almost certain to be paramount and deserving of qualifying comment.

For bulk commodities that require large infrastructure investment and possible government involvement, the mineralization may be more effectively described and reported within the United Nations Framework Classification for Resources 2009 and 2019 (UNFC) (UNECE, 2013, 2019). This scheme facilitates classification in a Rubik's Cube with axes of geological knowledge, project feasibility, and socio-economic viability. Mapping between SAMREC and other CRIRSCO Codes, and UNFC-2009 (UNECE, 2015) demonstrates the linkage between what is described as Exploration Results in SAMREC and the UNFC-2009 equivalents of 'Additional Quantities in Place', 'Exploration Projects', and 'Non-Commercial Projects'. The Additional Quantities may relate, for example, to the greater coalfield, beyond the current extent of drill delineation, for which it is not unreasonable to anticipate expanded formal resources in the future; the fuzzy logic bridging Inferred Mineral Resources and Additional Quantities may aid visualization of the need and understanding of the word 'eventual.' In any or either case it is imperative that there is a full discussion to the extent this is needed to support the concept of 'eventual'.

Diamond Guidelines

The particulate nature of diamond mineralization is one feature among many that differentiates diamond mineralization from that of most other commodities. The definition of a Diamond Resource in Clause 67 is a modification of the definition of a Mineral Resource in Clause 24, in recognition of these special circumstances for diamonds that are documented in the SAMREC Diamond Guidelines (SAMREC, 2016b). Specifically, for diamonds, the phrase 'grade or quality and quantity' is substituted by 'quantity (volume/tonnage), grade and value.'

Further guidance for Clause 67 states that 'In order to demonstrate that a Diamond Resource has reasonable prospects for economic extraction, some appreciation of the likely stone size distribution and value is necessary, however preliminary. '

Inferred Diamond Resources (Clause 68) are qualified in the SAMREC Diamond Guidelines as of 'Low' confidence, not 'no confidence', nor a 'guesstimate'. At an absolute minimum, RPEEE must be demonstrated. It is noted that although most Inferred Mineral Resources (including diamonds) are reasonably expected to be upgraded to Indicated Mineral Resources consequent on additional exploration, it must not be assumed that such upgrading will always occur.

For most metallic minerals the concept of 'eventual economic extraction' is normally restricted to 20 to 30 years, and frequently to much shorter periods. For Diamond Mineralization (especially alluvial deposits), as defined in Clause 65 of the SAMREC Code, the development timeline is typically short, and the word 'eventual' must not be an excuse to apply an unreasonably long time frame for the assessment of RPEEE. The Competent Person shall discuss this.

How do we achieve RPEEE?

Any achievement is the consequence of taking certain actions, often predetermined actions. In this case, the SAMREC Code Clause 24 provides the guidance, following the definition of a Mineral Resource, that a 'Reasoned Assessment' of a specific list of techno-economic assumptions likely to influence economic extraction should be the subject of the Competent Person's opinion. These are enumerated as geological, engineering (mining and processing), metallurgical, legal, infrastructural, environmental, marketing, socio-political, and economic issues.

SAMREC Table I, Section 4 details more specific guidance for the Estimation and Reporting of Exploration Results and Mineral Resources. Section 4.3 deals with Reasonable Prospects for Eventual Economic Extraction and subsections (i) to (vii) state that for each issue the Competent Person must 'Disclose and Discuss'. In addition, Section 4.3 (viii) requires that any material risks should be discussed. As an example of a material risk, Lock and van der Merwe (2003) described a portion of the Mineral Resource that was traversed by a rural gravel road, thus sequestering the resource. However, provisional approval had been granted by the relevant authorities to reroute the road, and thus access to the resource was restored. Although the risk still existed at the date of the report, the disclosure discussion provided the necessary solution. No doubt the reader could point to other projects with more significant risks.

Appendix 1 of the SAMREC Code includes a Recommended Table of Contents for a Competent Person's Report. Although the Table of Contents is provided only as a guide, it is intended to include all the requirements of Table I of the Code. The Table of Contents, Chapter 7 Mineral Resource Estimates, includes as subsection 7.3, Reasonable Prospects for Eventual Economic Extraction. Therein is the opportunity to present all the disclosure and discussion. It is quite possible that many aspects for discussion have already been referred to elsewhere in the CPR, but drawing the issues together in summary form and in a single place makes comprehension of the assessment process so much easier for the reader.

Australian JORC Code

The JORC Code (JORC, 2011) and its guidelines are very similar to the SAMREC Code. The JORC Code is perhaps more precise in providing the guidance that 'The basis for the reasonable prospects assumption is always a material matter, and must be explicitly disclosed and discussed by the Competent Person within the Public Report using the criteria listed in the JORC Table 1 for guidance.' The JORC requirement for commentary on an 'if not, why not' basis in the JORC Table I Report Template reinforces the mandatory nature of the reporting of reasonable prospects.

Emphasis in the JORC Code and the 2001 AusIMM Bulletin 23 (Mineral Resource and Ore Reserve Estimation - The AusIMM Guide to Good Practice) appears to be on the cut-off grade as the primary basis for the mathematical assessment of economic prospects. It is beyond the scope of this paper to discuss the sometimes complex formulations for estimation of cut-off grade, but both the SAMREC and JORC Codes also specify the inclusion of non-geological parameters in the assessment.

Reasonable Prospects is not just derived from a mathematical equation; in the previous section the author discussed the case of diamond-bearing gravels under a public road, and argued for resource declaration because provisional authority was granted. As an example of a situation where a matter beyond the geology, mining, and processing has great importance in a contrary sense, Border and Butt (2001) advise that 'Ownership may determine whether a volume of mineral is a Mineral Resource.' They continue, 'An example of [this point] is where a limestone is suitable only for cement manufacture, and the local cement market is being accommodated by an existing production facility. If the local kiln owner chooses to use only limestone produced by an associated company, any other limestone deposit, even if technically superior, may not be a Mineral Resource, as it may not have the required "reasonable prospects for eventual economic extraction". It may have prospects in the distant future (when the kiln owner's limestone resource is exhausted or when the economic parameters change) but unless these events are considered likely to occur within the next 20 years or so, the deposit has no significant present value and therefore, in the opinion of the authors, should not be quoted as a Mineral Resource under the JORC Code'. This of course is the opinion of Border and Butt (2001); there may well be other opinions or options for the example described but the point being made is that a thought process should always be applied. There may be a fine balance between attributing present value through a resource declaration, and possible future value when opportunity opens. In this example, the emphasis was placed on the relationship between deposit owner and kiln owner, whereas the possibility that the deposit owner had more expansive plans is almost disregarded. However, if the latter were the case the planned alternative market would need explicit discussion.

Canadian CIM definition standards

Canada has taken a different path to public report disclosure and code compliance. The CIM (Canadian Institute of Mining, Metallurgy and Petroleum) Definition Standards (CIM, 2014) are relatively simple in comparison with the SAMREC and JORC Codes. However, CIM Definition Standards are incorporated by reference into the Canadian National Instrument 43-101 (National Instrument 43-101, 2014), a part of statutory law in Canada. When working to prepare a report for Canadian compliance, familiarity with these two documents is essential.

RPEEE is included in the definition for a Mineral Resource in the CIM Definition Standards where guidance for the arithmetic estimate of cut-off is provided. However, other parameters are not explicitly mentioned and RPEEE is not mentioned once in National Instrument 43-101, although it is implicit in the Section 3.4 Requirements Applicable to Written Disclosure of Mineral Resources and Mineral Reserves.

CIM has provided considerable guidance away from the formal Code and National Instrument documents. Discussion articles have been published in the CIM Magazine and by the CIM Reserve Definitions Committee, including specific guidance on RPEEE by Gosson and Smith (2007) and CIM (2009, 2015). This guidance covered the following matters that are discussed in the next section with project examples:

> Cut-off grade

> Long-term metals/commodity prices

> Lerchs-Grossman (LG) pit captures the required considerations of location, deposit scale, continuity and assumed mining method, metallurgical recovery, operating costs, and reasonable long-term metal prices

> An LG pit is not a regulatory requirement, but good for advanced projects. It is popular in Canada but care should be exercised for possible pitfalls from misuse of the parameter metrics

> The grade shell method for underground mineralization

> Qualified person (QP) can demonstrate RPEEE by comparison with analogous mine operations, for early stage assessments

> QP opinion on margin of revenue over potential capital as discussed by Waldie (2009)

> QP should consult other QPs to augment experience in determining RPEEE. This could be provided with internal peer review in a company.

These matters all fall within the geological, engineering, and economic parameters and assumptions listed for reasonable assessment under the SAMREC Code, even though not explicitly stated there.

Project examples

In providing several project examples, it is intended that the main matters for reasoned assessment can be illustrated in as simple a way as possible. Much of the work that is required to fulfil the obligation to demonstrate reasonable prospects is already part and parcel of good practice in estimating Mineral Resources and Reserves. However, too often this work is scattered across, or hidden away in the body of, a report in such a way that the reader may have difficulty in finding the critical inference. If the reader is, as will often be the case, an investor or adviser with limited time for little more than the executive summary, then bringing RPEEE assessment together in a single body of text will make an average report into a good report. A specific subsection in a report chapter on the estimation of Mineral Resources (and Reserves) is a recommendation in Appendix 1 of the SAMREC Code; among the three codes discussed here, SAMREC is the only Code to be explicit in this way, although in practice many companies reporting to other codes also follow this practice - for example Johnson et al. (2010) below.

This is an opportune moment to briefly discuss commodity prices, whether these be for diamonds, gold, copper, or nickel. Although the selection of a specific commodity price might seem to demand the adoption of objective criteria, this is often not the case. Commodity prices used for the estimation of Mineral Resources are often more optimistic than for the rigorous approach in determining a price for Mineral Reserve estimation. The estimator's discretion and experience are paramount, even when the most optimistic outcome may be preferred.

For diamonds, valuation requires considerable skill and expertise because diamond value/price is deposit specific. It is not intended to discuss this further here; however, it is worth noting that the discussion for metals is not practicable for diamonds. The alternative for diamonds that has been followed in many cases is to reference the advice of diamond market experts, either through published predictions or specific contracted opinion.

For most metals, prices can be found from multiple freely available online website sources based on the London Metal Exchange or other marketing organizations. Prices change by the minute but daily, weekly, or monthly records may be adequate to use for assessments of RPEEE. How to use the price data in the public record is discussed in CIM (2008, 2015) and Waldie (2009).

McDonald (2016) has provided an important recent perspective from a South African viewpoint. Some of his analysis overlaps with the discussion here. The main point he makes is that the uncertainty in forecast prices and exchange rates may impact seriously on the expectation for ±10% confidence limits in Feasibility Studies. Although his study is directed towards Mineral Reserves, his conclusions are equally valid for cut-off grades and Mineral Resource estimates.

Figure 1 is a chart of the ten-year gold price from 2009 to 2019. It is presented here to illustrate some of the points discussed by Waldie (2009). If a gold mineral deposit were estimated in March 2012 using the then current gold price of about US$1 674 per ounce, the Mineral Resource declared would be significantly overestimated because of the fall in price over the following three years. Although this fall may not have been expected, the estimate clearly was at risk, and suitable qualifying statements should be applied if a current metal price is adopted.

An estimate at the same date but using a three-year trailing average of US$1 320 per ounce, a US Securities and Exchange Commission guideline, would more closely match the future of the project estimate. However, a similar trailing average estimate for March 2015 would overestimate resources compared to the March 2015 current price of $1 179 per ounce. In general, a three-year trailing average in a rising market will underestimate resources; in contrast, in a falling market this method will overestimate resources. Note this guideline should be used advisedly and with careful qualifying statements.

A long-term average (say ten or twenty years) may remove much of the annual price volatility, but comparison using current and long-term average prices will highlight material deviation in asset value for producing mines as long as all prices for comparison are in real terms.

Waldie (2009) also suggests the application of a 'Margin over Cash Cost of Production', but this may only be appropriate for producing mines when resource or reserve updates are undertaken and where short-term fluctuations in metals prices encourage mining of lower grade areas during price upturns, and high-grading during price declines. Producing mines will generally have their own benchmarks for this purpose, but there are several global research and consulting firms that provide cost analysis research that major companies may avail themselves of (e.g. CRU https://www.crugroup.com/, AME Research https://www.uk.amegroup.com/, or Wood Mackenzie https://www.woodmac.com/).

A very simple method may be to consider peer group consensus. A Competent Person with access to a database of contemporary reports can quickly find this time-dependent consensus as the average of the prices used in a group of reliable estimates. There are commercial services available that can undertake this consensus research, for example Consensus Economics (https://www.consensuseconomics.com/about/).

It is lastly worth mentioning that certain commodities and/ or projects rely on contract pricing. A good example is uranium, where the project timeline and financing hurdles require the consideration of eventual price to be locked in at an early stage of development.

Discovery Metals Limited

Discovery Metals was an ASX-listed company operating the Boseto mine in the Kalahari Copper Belt of northwest Botswana. Reference is made here to a 2013 news release of the company (Discovery Metals Limited, 2013) although, sadly, the operations have closed since then.

In line with the requirements of the revised JORC Code of 2012, Discovery's news release included a Table I attachment that provides a detailed technical summary of the project with required comments on an 'If not, why not' basis. Table I here is an extract from the JORC Table I, Section 3 Estimation and reporting of Mineral Resources, as an example of the open pit cut-off parameters used to define Mineral Resources.

Table II is an extract from JORC Table I Section 4 Estimation and Reporting of Ore Reserves.

While the many other matters for a reasoned assessment were not included in this assessment of cut-off grade, the core requirement for economic extraction was established.

Mountain Province Diamonds Inc - Gahcho Kué

Kimberlite Project

It is common practice in Canada (and sometimes elsewhere) to make use of mining software to quickly create an open pit mine model with several simple techno-economic parameters that define potential viability (Gosson and Smith, 2007). The resulting 3D clipping of mineralized blocks inside the defined frame are then cumulated to give a resource tonnage and grade. While this approach to assessing RPEEE may well be fitting for advanced exploration projects close to Feasibility Study, application to early stage projects may be questionable because the techno-economic parameters will likely be generic, thus introducing an element of risk that becomes masked by the perception of computer capability. The adage of 'garbage in, garbage out (GIGO)' must be avoided.

Gahcho Kué is a kimberlite diamond mine located in northern Ontario, Canada, jointly owned by De Beers and Mountain Province Inc. The Inukshuk Capital Corp./Mountain Province Mining Inc. joint venture began exploration in the area in 1992 and found the first kimberlite (5034) in 1995. De Beers Canada Inc. entered the joint venture in 1997, now on a 51/49 equity basis, and three new kimberlite discoveries (Tesla, Tuzo, and Hearne) joined 5034 to form the main Gahcho Kué kimberlite cluster. A maiden Diamond Mineral Resource was reported in 2003.

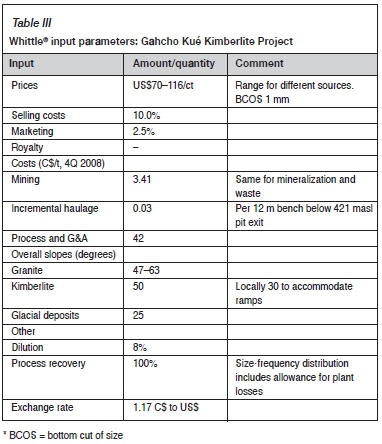

A Diamond Resource estimate for the Definitive Feasibility Study on the Gahcho Kué Kimberlite Project, Northwest Territories, Canada, prepared for Mountain Province Diamonds Inc. and De Beers Canada Inc. by JDS Mining & Energy Inc. (Johnson et al., 2010) applied the LG Pit method. The techno-economic parameters used are listed in Table III. Note that the range in diamond price is the consequence of summarizing the parameters for three separate kimberlite pipes, each with distinct diamond populations.

It is also worthy of note that the parameters for the Diamond Resource estimate were not the same as those for the Diamond Reserve estimate; this was partly the consequence of the requirement to exclude all Inferred Resources for the Diamond Reserve estimate, but also a consequence of improved understanding of other factors as the engineering study progressed. This distinction is important, not as an impediment to future extraction of the Inferred Resources, but as a matter of code compliance limiting Resource to Reserve conversion only to the higher confidence resource categories.

Vaaldiam Mining Inc. - Braúna Kimberlite Project

The Braúna kimberlites in Bahia State of northeast Brazil were discovered in 1990 as part of a De Beers regional programme that began in 1980. The De Beers work progressed slowly until the project was eventually sold to Majescor for US$500 000 in 2004. Vaaldiam Mining Inc. took over payments for Majescor and assumed full ownership of the project from 2007. Vaaldiam initiated a more aggressive field programme that ignored the small size and lowish grade which had put De Beers off.

Vaaldiam had completed a bulk sample programme of nearly 5 000 t in 2010 and recovered some 1 000 ct of diamonds. These results were the basis for a maiden Mineral Resource report in late 2010. Vaaldiam moved quickly to undertake a scoping study, or Preliminary Assessment as it was called in Canada at that time. Coffey Mining's Brazil office was contracted to undertake this work (Lock et al., 2011) which was filed in Canada on www. sedar.com in 2011.

The assessment of RPEEE was made primarily through comparison with similar diamond operations familiar to the reporters in Africa. The following text from Lock et al. (2011) listed the African operations and the online economic source information.

the in situ value of the South Lobe kimberlite, based on current bulk sample information, is US$83.1/t. Brazil does not have a current kimberlite diamond mine in operation to compare with but reference to a selection of projects in Africa point to a much higher in situ value for realistic prospects:

> Petra Diamond - Koffiefontein Mine US$25.8/t (http://www.petradiamonds.com/o/p_sa_koffie.php)

> Petra Diamonds - Williamson Mine US$10.8/t (http://www.petradiamonds.com/o/p_tz_williamson.php)

> Gem Diamonds - Letseng Mine US$29.4/t (http://www.gemdiamonds.com/b/resources.asp)

> Gem Diamonds - Gope Project US$30.7/t (http://www.gemdiamonds.com/b/resources.asp)

> Lucara Diamonds - AK6 Project US$42.7/t (http://www.lucaradiamond.com/s/Botswana-AK6DiamondResource.asp)

The average for these projects and mines is US$27.9/t. The lowest at US$10.8/t is still well in excess of the Braúna 3 North Lobe in situ value.

Further confirmation is provided by Lucara Diamonds' statement of US$17.2/t operating cost for the AK6 project.'

The Braúna project is located in Bahia State, where the climate and physiography are comparable to the African projects selected for comparison. Nevertheless, Vaaldiam were not encouraged by the predicted project returns and may have been negatively influenced by the much higher threshold rock value that determines RPEEE in Arctic Canada, where rock value of US$80 per ton or more may be required. Vaaldiam decided to divest of the project and thus missed out on developing Brazil's first hard rock diamond mine, which eventually happened under the new ownership of Lipari Minerãçao Ltda in 2016.

Discussion

The SAMREC Code 2016 contains the clearest statement to date, in both the definitions and guidelines, of the central place that RPEEE holds in achieving the profound objective of the 'required minimum standard for the Public Reporting of Exploration Results, Mineral Resources and Mineral Reserves.'

RPEEE is the critical core of our work processes, for without the assessment of RPEEE the outcome would be no more than an estimate of Mineralization, and the result of bad practice if reported as a Mineral Resource. RPEEE assessments require acceptable appreciation and application of all three founding Principles of SAMREC, namely materiality, transparency, and competence. 'Acceptable' in this context demands an understanding of what industry practice implies and the requirement for a minimum standard. We must all be reminded that perhaps the ultimate test of our work practices is the concept that 'a Competent Person must be clearly satisfied in their own minds that they are able to face their peers and demonstrate competence in the commodity, type of deposit and situation under consideration.'

The SAMREC Code requires that 'a Mineral Resource be not an inventory of all Mineralisation', that 'an appropriate level of consideration' be applied, and that 'the principle of reasonableness' be employed and should be justifiable and defendable. This code guidance can be condensed into three simple aphorisms:

> Declaring Mineral Resources is more than a mathematical model

> RPEEE requires reasoned Thought, Research, and Opinion

> Material, Transparent, and Competent Estimates will support the three 'R's: Reasonable, Robust, and Reliable.

Inappropriate extension of economic parameters to Mineral Resource reporting may lead to premature declarations of economic viability rather than potential for economic viability. Poor or non-adherence to compliance with the SAMREC Code is likely to lead to progressively more prescriptive requirements in our work practices in the future. Self-regulation is an important aspect of the professional associations in South Africa, through which registration is obtained. The Geological Society of South Africa (GSSA) and SAIMM, for example, have formal Codes of Ethics or Conduct with enforceable disciplinary procedures. These associations provide a pathway to Competent Person recognition, but there is also the clear statement in the Foreword to the SAMREC Code that the code 'is binding on members of these organisations'.

The GSSA and SAIMM both recognize that their complaints and disciplinary procedures may lead to serious cases being forwarded to the South African Council for Natural Scientific Professions (SACNASP) or the Engineering Council of South Africa (ECSA), the statutory bodies that link to a more severe legal environment. This linkage will not go away and it is thus incumbent on us to avoid this path by understanding our responsibility in Public Reporting.

As a final thought, it is worth consideration by SAMREC that there are many matters that can be identified and incorporated into workshops or seminars that delve into greater detail on specific subjects. RPEEE is deserving of one such workshop all to itself.

Acknowledgement

André van der Merwe of MSA is gratefully acknowledged for his review of a draft final manuscript shared before peer review by two anonymous independent reviewers. André's thoughtful comments provided for important improvement of the manuscript.

The anonymous peer reviewers are thanked for several thought-provoking comments that required consideration and contributed to final improvements in the manuscript.

References

Border, S. and Butt, B. 2001. Evaluation of Mineral Resources and Ore Reserves of Industrial Minerals - The Importance of Markets. Mineral Resource and Ore Reserve Estimation - The AusIMM Guide to Good Practice. Edwards, A.C. (ed.). The Australasian Institute of Mining and Metallurgy, Melbourne. pp. 389-394. [ Links ]

CIM. 2008. Questions resulting from CSA-CIM Committee Meetings (April 14, 2008). Prepared by the CIM Reserve Definition Committee, the CIM Estimation Best Practices Committee and some members of the Committee for Mineral Resources International Reporting Standards. Mineral Resources /Reserves and Valuation Standards. 2010. CIM Special Volume 56. Montreal. [ Links ]

CIM. 2009. Additional Guidance - Reasonable prospects for economic extraction -December 15, 2009. CIM Reserve Definitions Committee. Montreal. [ Links ]

CIM. 2014. CIM Definition Standards - For Mineral Resources and Mineral Reserves. Prepared by the CIM Standing Committee on Reserve Definitions. Adopted by CIM Council on May 10, 2014. Montreal. [ Links ]

CIM 2015. CIM Guidance on Commodity Pricing used in Resource and Reserve Estimation and Reporting. CIM Best Practices Committee. Montreal. [ Links ]

Discovery Metals Limited. 2013. Kalahari Copper Belt. Mineral Resources and Ore Reserves Update. ASX Announcement 22 July 2013. [ Links ]

GossoN, G. and Smith, L.B. 2007. Reasonable prospects for economic extraction. CIM Magazine. December/January 2007, vol. 2, no. 8. [ Links ]

Johnson, D.D., Makarenko, M., Meikle, K., Prince-Wright, R., Jakübec, J., and Jones, K. 2010. Gahcho Kué Project. Northwest Territories, Canada. Definitive Feasibility Study. NI 43-101 Technical Report. www.sedar.com. [ Links ]

JORC. 2012. Australasian Joint Ore Reserves Committee. Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. The Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists, and Minerals Council of Australia. http://www.jorc.org/docs/JORC_code_2012.pdf [ Links ]

Lock, N.P., Masun, K., Rodriguez, P.C., and Bainbridge, F. 2011. Braúna Kimberlite Project, Bahia, Brazil. Preliminary Assessment. NI 43-101 Independent Technical Report for Vaaldiam Mining Inc. Coffey Consultoria e Serviços Ltda. www.sedar.com. [ Links ]

Lock, N.P. and van der Merwe, A.J. 2003. Nooitgedacht Alluvial Diamond Project. Independent Resource Estimate of Diamondiferous Gravels, Tirisano Mine, North West Province, South Africa. Prepared by RSG Global for Etruscan Resources Inc., Mountain Lake Resources Inc., & Etruscan Diamonds (Pty) Ltd. www.sedar.com [ Links ]

McDonald, A. 2016. How good are metal price forecasts anyway? Proceedings of the SAMREC/SAMVAL Companion Volume Conference. Southern African Institute of Mining and Metallurgy, Johannesburg. [ Links ]

National Instrument 43-101. 2014. National Instrument 43-101 of the Ontario Securities Act, 1990. Ontario Securities Commission. [ Links ]

SAMREC. 2016a. South African Mineral Resource Committee. The South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (the SAMREC Code). 2016 Edition. http://www.samcode.co.za/codes/category/8-reporting-codes?download=120:samrec [ Links ]

SAMREC. 2016b. South African Mineral Resource Committee. SAMREC Guideline Document for the Reporting of Diamond Exploration Results, Diamond Resources and Diamond Reserves (and other Gemstones, where Relevant). (The SAMREC Diamond Guidelines). https://www.samcode.co.za/codes/category/8-reporting-codes?download=121:diamond-guideline [ Links ]

Santos, R.M., Van Audenaerde, A., Chiang, Y.W., Iacobescu, R.I., Knops, P., and van Gerven, T. 2015. Nickel extraction from olivine: Effect of carbonation pre-treatment. Metals, vol. 5, no. 3. pp. 1620-1644. [ Links ]

UNECE. 2013. United Nations Framework Classification for Fossil Energy and Mineral Reserves and Resources 2009, incorporating Specifications for its Application United Nations Economic Commission for Europe (ECE), Energy Series no. 42. [ Links ]

UNECE (2015) Bridging Document between the Committee for Mineral Reserves International Reporting Standards (CRIRSCO) Template and the United Nations Framework Classification for Resources (UNFC). United Nations Economic Commission for Europe. [ Links ]

UNECE (2019). United Nations Framework Classification for Resources. Update 2019. United Nations Economic Commission for Europe (ECE). Energy Series No. 61. [ Links ]

Waldie, C. 2009. What's your method? Selecting an appropriate commodity price. CIM Magazine. December 2009/January 2010, vol. 4, no. 8. [ Links ]

Correspondence:

Correspondence:

N. Lock

Email: norman.lock@yahoo.co.uk

Received: 5 Jun. 2020

Revised: 22 Jul. 2020

Accepted: 23 Jul. 2020

Published: September 2020