Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.119 n.9 Johannesburg Sep. 2019

http://dx.doi.org/10.17159/2411-9717/2019/v119n9a6

PRESIDENTIAL ADRESS

The Saimm Scholarship Fund - (Registration Number It 6837/02) Annual Financial Statements For The Year Ended 30 June 2019

Trustees' responsibilities and approval

The Trustees are required to maintain adequate accounting records and are responsible for the content and integrity of the annual financial statements and related financial information included in this report. It is their responsibility to ensure that the annual financial statements fairly present the state of affairs of the Trust as at the end of the financial year and the results of its operations and cash flows for the period then ended, in conformity with the International Financial Reporting Standard for Small and Medium-sized Entities.

The annual financial statements are prepared in accordance with the International Financial Reporting Standard for Small and Medium-sized Entities and are based upon appropriate accounting policies consistently applied and supported by reasonable and prudent judgments and estimates.

The Trustees acknowledge that they are ultimately responsible for the system of internal financial control established by the Trust and place considerable importance on maintaining a strong control environment. To enable the Trustees to meet these responsibilities, the Trustees sets standards for internal control aimed at reducing the risk of error or loss in a cost-effective manner. The standards include the proper delegation of responsibilities within a clearly defined framework, effective accounting procedures and adequate segregation of duties to ensure an acceptable level of risk. These controls are monitored throughout the Trust and all employees are required to maintain the highest ethical standards in ensuring the Trust's business is conducted in a manner that in all reasonable circumstances is above reproach. The focus of risk management in the Trust is on identifying, assessing, managing and monitoring all known forms of risk across the Trust. While operating risk cannot be fully eliminated, the Trust endeavours to minimize it by ensuring that appropriate infrastructure, controls, systems and ethical behaviour are applied and managed within predetermined procedures and constraints.

The Trustees are of the opinion, based on the information and explanations given.by management, that the system of internal control provides reasonable assurance that the financial records may be relied on for the preparation of the annual financial statements. However, any system of internal financial control can provide only reasonable, and not absolute, assurance against material misstatement or loss.

The Trustees have reviewed the Trust's cash flow forecast for the year to 30 June 2020 and, in the light of this review and the current financial position, they are satisfied that the Trust has or has access to adequate resources to continue in operational existence for the foreseeable future.

The external auditors are responsible for independently auditing and reporting on the Trust's annual financial statements. The annual financial statements have been examined by the Trust's external auditors and their report is presented on page 776-777.

The annual financial statements set out on pagess 775-781, which have been prepared on the going concern basis, were approved by the Trustees on 26 August 2019 and were signed on its behalf by:

Trustees' Report

The Trustees have pleasure in submitting their report on the annual financial statements of The SAIMM Scholarship Fund for the year ended 30 June 2019.

1. The Trust

The Trust was registered on 11 November 2002 with a registration number IT 6837/02. The fund can sue and be sued in its own name.

The objective of the Trust is to promote, foster and advance the interest of minerals industry by providing the beneficiaries with funds to be used to support the education of student in the minerals industry.

2. Nature of business

The SAIMM Scholarship Fund was formed in South Africa with interests in the non-profit industry. The Trust operates in South Africa.

The objective of the Trust is to promote, foster and advance the interest of the minerals industry by providing the beneficiaries with funds to be used to support the education of students in the minerals industry and to collect monies and accept contributions in monies or otherwise by way of donations, bequests, or otherwise and to apply the same or the income therefrom for all or any object as set out.

The Fund has no full-time employees and is administered by The Southern African Institute of Mining and Metallurgy.

There have been no material changes to the nature of the Trust's business from the prior year.

3. Review of financial results and activities

The annual financial statements have been prepared in accordance with International Financial Reporting Standard for Small and Medium-sized Entities. The accounting policies have been applied consistently compared to the prior year.

Full details of the financial position, results of operations and cash flows of the Trust are set out in these annual financial statements.

4. Beneficiaries

The beneficiaries of the Trust are the minerals education departments of those universities and technikons in South Africa as determined by the Trustees.

5. Trustees

The Trustees in office at the date of this report are as follows:

Dr L.A. Cramer

R.D. Beck

M.H. Rogers

J.R. Dixon

6. Borrowing powers

In terms of the Trust Deed, the borrowing powers of the Trust are unlimited. However, all borrowings by the Trust are subject to Board approval as required by the Board delegation of authority.

7. Events after the reporting period

The Trustees are not aware of any material event which occurred after the reporting date and up to the date of this report.

8. Going concern

The Trustees believe that the Trust has adequate financial resources to continue in operation for the foreseeable future and accordingly the annual financial statements have been prepared on the going concern basis. The Trustees have satisfied themselves that the Trust is in a sound financial position and that it has access to sufficient borrowing facilities to meet its foreseeable cash requirements. The Trustees are not aware of any material changes that may adversely impact the Trust. The Trustees are also not aware of any material non-compliance with statutory or regulatory requirements or of any pending changes to legislation which may affect the Trust.

9. Auditors

Genesis Chartered Accountants will continue in office.

Independent Auditor's Report

To the Trustees of The SAIMM Scholarship Fund

Opinion

We have audited the annual financial statements of The SAIMM Scholarship Fund set out on pages 778-781, which comprise the statement of financial position as at 30 June 2019, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the annual financial statements, including a summary of significant accounting policies.

In our opinion, the annual financial statements present fairly, in all material respects, the financial position of The SAIMM Scholarship Fund as at 30 June 2019, and its financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standard for Small and Medium-sized Entities and the requirements of the Trust Property Control Act 57 of 1988.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing. Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the annual financial statements section of our report. We are independent of the Trust in accordance with the sections 290 and 291 of the Independent Regulatory Board for Auditors' Code of Professional Conduct for Registered Auditors (Revised January 2018), parts 1 and 3 of the Independent Regulatory Board for Auditors' Code of Professional Conduct for Registered Auditors (Revised November 2018) (together the IRBA Codes) and other independence requirements applicable to performing audits of annual financial statements in South Africa. We have fulfilled our other ethical responsibilities, as applicable, in accordance with the IRBA Codes and in accordance with other ethical requirements applicable to performing audits in South Africa. The IRBA Codes are consistent with the International Ethics Standards Board for Accountants' Code of Ethics for Professional Accountants and the International Ethics Standards Board for Accountants' International Code of Ethics for Professional Accountants (including International Independence Standards) respectively. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Other information

The Trustees are responsible for the other information. The other information comprises the information included in the document titled 'The SAIMM Scholarship Fund annual financial statements for the year ended 30 June 2019, which includes the Trustees' Report as required by the Trust Property Control Act 57 of 1988 and the Statement of Comprehensive Income, which we obtained prior to the date of this report. The other information does not include the annual financial statements and our auditor's report thereon.

Our opinion on the annual financial statements does not cover the other information and we do not express an audit opinion or any form of assurance conclusion thereon.

In connection with our audit of the annual financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the annual financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed on the other information obtained prior to the date of this auditor's report, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Independent Auditor's Report

Responsibilities of the Trustees for the Annual Financial Statements

The Trustees are responsible for the preparation and fair presentation of the annual financial statements in accordance with the International Financial Reporting Standard for Small and Medium-sized Entities and the requirements of the Trust Property Control Act 57 of 1988, and for such internal control as the Trustees determine is necessary to enable the preparation of annual financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the annual financial statements, the Trustees are responsible for assessing the Trust's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the Trustees either intend to liquidate the Trust or to cease operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the Annual Financial Statements

Our objectives are to obtain reasonable assurance about whether the annual financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with International Standards on Auditing will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these annual financial statements.

As part of an audit in accordance with International Standards on Auditing, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the annual financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust's internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the Trustees.

• Conclude on the appropriateness of the Trustees' use of the going concern basis of accounting and based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Trust's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the annual financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause the Trust to cease to continue as a going concern.

• Evaluate the overall presentation, structure and content of the annual financial statements, including the disclosures, and whether the annual financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with the Trustees regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

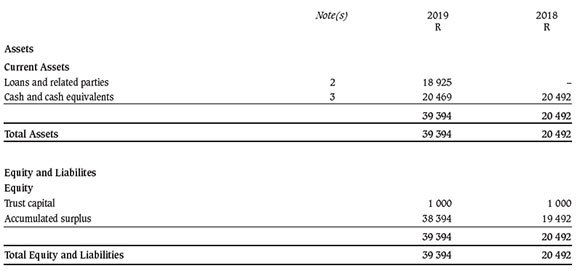

Statement of Financial Position as at 30 June 2019

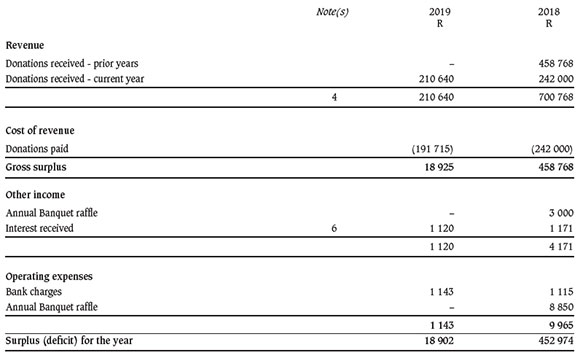

Statement of Comprehensive Income

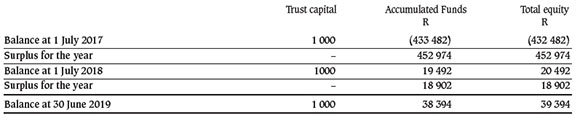

Statement of Changes in Equity

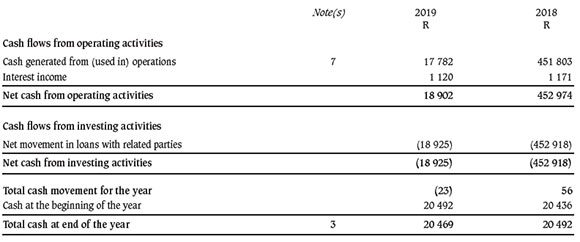

Statement of Cash Flows

Accounting Policies

1. Basis of preparation and summary of significant accounting policies

The annual financial statements have been prepared on the going concern basis in accordance with the International Financial Reporting Standard for Small and Medium-sized Entities. The annual financial statements have been prepared on the historical cost basis, except for biological assets.at fair value less point of sale costs, and incorporate the principal accounting policies set out below. They are presented in South African rands.

These accounting policies are consistent with the previous period.

1.1 Significant judgements and sources of estimation uncertainty

Critical judgements in applying accounting policies

Management did not make critical judgements in the application of accounting policies, apart from those involving estimations, which would significantly affect the annual financial statements.

Key sources of estimation uncertainty

The financial statements do not include assets or liabilities whose carrying amounts were determined based on estimations for which there is a significant risk of material adjustments in the following financial year as a result of the key estimation assumptions.

1.2 Financial instruments

Initial measurement

Financial instruments are initially measured at the transaction price (including transaction costs except in the initial measurement of financial assets and liabilities that are measured at fair value through surplus or deficit) unless the arrangement constitutes, in effect, a financing transaction in which case it is measured at the present value of the future payments discounted at a market rate of interest for a similar debt instrument.

Financial instruments at amortized cost

These include loans, trade receivables and trade payables. Those debt instruments which meet the criteria in section 11.8(b) of the standard are subsequently measured at amortized cost using the effective interest method. Debt instruments which are classified as current assets or current liabilities are measured at the undiscounted amount of the cash expected to be received or paid, unless the arrangement effectively constitutes a financing transaction.

At each reporting date, the carrying amounts of assets held in this category are reviewed to determine whether there is any objective evidence of impairment. If there is objective evidence, the recoverable amount is estimated and compared with the carrying amount. If the estimated recoverable amount is lower, the carrying amount is reduced to its estimated recoverable amount, and an impairment loss is recognized immediately in surplus or deficit.

Financial instruments at cost

Commitments to receive a loan are measured at cost less impairment.

Equity instruments that are not publicly traded and whose fair value cannot otherwise be measured reliably without undue cost or effort are measured at cost less impairment.

Financial instruments at fair value

All other financial instruments, including equity instruments that are publicly traded or whose fair value can otherwise be measured reliably, without undue cost or effort, are measured at fair value through surplus and deficit.

If a reliable measure of fair value is no longer available without undue cost or effort, then the fair value at the last date that such a reliable measure was available is treated as the cost of the instrument. The instrument is then measured at cost less impairment until management are able to measure fair value without undue cost or effort.

1.3 Tax

Current tax assets and liabilities

The Fund is exempt from taxation in terms of Section 18A of the Income Tax Ac

1.4 Revenue

Revenue comprises contribution received from donors and is recognized on receipt. Interest is recognized, in surplus or deficit, using the effective interest rate method.

1.5 Borrowing costs

Borrowing costs are recognized as an expense in the period in which they are incurred.

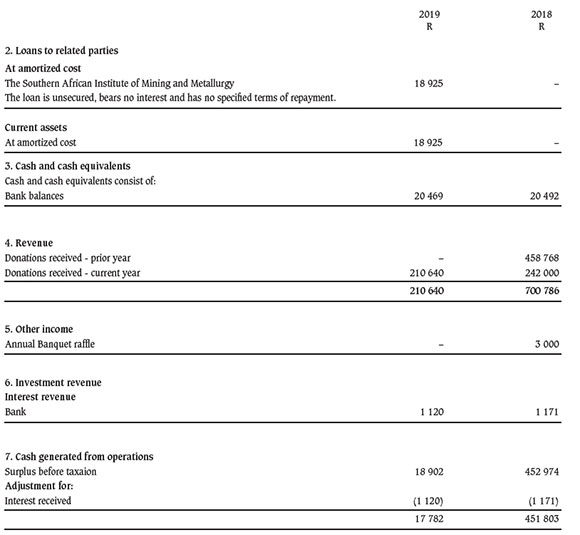

Notes to the Annual Financial Statements