Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.119 n.8 Johannesburg Aug./Jul. 2019

A perspective on how our mining and metallurgical industry has progressed over the past fifty years

Nicholas Adrian Barcza

The best interests of the country and its peoples are sadly often not well-served for various unfortunate reasons.

What affects and influences one's perspective of the mining and metallurgical industries?

One's perspective of the industry we work in changes over time as a function of our experience as well as from the interaction we have with colleagues locally and probably even more so with those internationally. Furthermore, the ever-changing environment continues to impact the context in which one sees things. Living mostly in South Africa through its changes in the past fifty years but also having the opportunity to travel extensively and work on projects abroad adds an invaluable richness to this more global perspective. One of the greatest challenges is how best to use this experience to endeavour to support the many potential opportunities in southern as well as sub-Saharan Africa. However, one has also to face the realities of how the best interests of the country and its peoples are sadly often not well served for various unfortunate reasons. Investment, education, regional stability, and good governance are some of the most critical considerations for the prosperity and survival of the region.

The mining and metallurgical industry in southern and sub-Saharan Africa changed significantly during the post-colonial and apartheid eras as a result of global and regional developments that have impacted the ownership of businesses, the technologies used, and products produced in a manner that was not envisaged even fifty years ago. Southern Africa's mining and metallurgical industry has progressed from one based mostly on diamonds and gold in the late 19th century to a much more diverse one that involves the production of a variety of other precious, base, and ferrous metals and minerals as well as coal and industrial minerals. The infrastructure and manufacturing capacity was largely developed to meet the needs of this industry during its growth phases, but even though the dynamics have changed there is still a need for more efficient and effective support systems in the region.

The rapid growth rate in Europe and North America after the end of the Second World War has been superseded to a large extent by the even more rapid rate in Asia over the past twenty-five years. This has impacted the development of mining and increased the export of raw materials from South Africa such as iron, chrome, and manganese ores, whereas conversely the gold industry has shrunk considerably.

There has been growth in the amount of local beneficiation into some intermediate added value products such as ferroalloys and steel and stainless-steel products, but this trend started to diminish by the early 2000s. However global growth in stainless steel has more than doubled since the mid-1990s reaching 50 Mt/a in 2018 with Southern Africa supplying much of the chromite, mostly to China, which now produces even more ferrochromium than South Africa based exclusively on imported ores. It's therefore doubtful as to whether China has a longer term sustainable competitive advantage in this product unless Southern Africa can't get its act together. South Africa's share of global stainless-steel production has also decreased instead of increasing, as was anticipated back in the 1990s when insufficient investment was made to achieve the necessary economy of scale of 1 to 2 Mt/a as well as not forming the international business partnerships with Asian companies in addition to those that already exist with some producers in Europe.

Added value creation in the mining and metallurgical industries and what has been achieved.

Drs Robbie Robinson and Peter Jochens had a major influence on Mintek becoming closely involved in the early days of the ferroalloy Industry in South Africa in the 1960s and 1970s. The Pyrometallurgy Research Group at the University of the Witwatersrand was established at that time followed a few years later by the Pyrometallurgy Division at Mintek, largely due to their foresight and endeavour. The timing was driven by the needs and opportunities in Southern Africa for the rapidly growing international demands for ferrochromium and ferromanganese, mostly in Europe, North America, and Japan during that era. A further consideration was the realization that the economics of production were favoured by building larger furnaces close to the sources of the ores, electrical power, and coal needed for reducing agents such as coke and char. However, these rapid developments resulted in a number of technical challenges that the suppliers of this equipment, who were mainly from Europe, could not fully resolve as they too were going up a learning curve in terms of scale-up and the application to different ore types. The demand for appropriate research and development work to support the industry grew significantly during this period and Mintek as well as several of the local Universities was involved in addressing and assisting to resolve these problems. The Mintek Minstral (now FurnStar) furnace controller is a prime example that contributed to major improvements in performance, especially of the larger high-power submerged arc furnaces.

The Ferroalloys Producers Association (FAPA) was also instrumental in supporting this research and development initiative and the instigation, together with the SAIMM and Mintek, in founding INFACON in 1974 that has its fifteenth Congress in Cape Town in March 2018 and has been an invaluable vehicle for technical exchanges that benefitted the ferroalloy industry globally.

Dr Louw Alberts followed Robbie Robinson as Mintek's President and very much supported Mintek's continued role as one of the Science Councils, namely to foster research and development in the mineral and metallurgical sectors of the country. This resulted in him obtaining funding for several major initiatives. One of these was the establishment of the DC plasma arc furnace pilot plant facilities that set the stage for a number of breakthrough technologies in the following twenty-five years and beyond this. This led to Mintek, together with Samancor Chrome, being presented with the AS&TS award for the successful implementation of DC furnace smelting technology of chromite fines, which has now been scaled up to over the 65 MW power level and continues to be improved.

Dr Aidan Edwards, also a Past President and CEO of Mintek, led the way during the 1980s and 1990s with the promotion of the potential benefits of added value in terms of job and wealth creation. He initiated a very significant effort to motivate added value in many areas of the mining and downstream industries and had to try to overcome the challenges of investment in the local production of added value products and the manufacture of industrial components for export. The stimulation and encouragement of a number of added value intermediate and end products was supported in a number of areas by both government and industry. However, this progress was sometimes tempered by the comment of local producers who often raised the concerns of not wanting to compete with their customers. This issue still appears to persist to some extent for historical reasons and due to overseas ownership of local mining and metallurgical operations.

Dr Paul Jourdan was also very much involved in encouraging job creation with a focus on the development of industrial zones in strategic areas, especially those that had not received as much support in the past as the more developed regions. A number of initiatives were proposed and studies carried out especially in underdeveloped areas such as the Eastern Cape, with the emphasis on the Coega Industrial Zone and Western Cape Coast. A number of major projects were evaluated in these regions with the involvement of the DTI and a number of industrial participants with valuable support from Mintek. However, only a few of the metallurgical-related projects have been implemented so far due to lack of investment and the global markets as well as a lack of competitiveness, especially when compared with producers in the rapidly growing Asian region.

This situation has in some ways become even more challenging as the price of most of the variable cost items to produce these products has increased significantly in Southern Africa owing to issues such as a lack of adequate longer-term planning, insufficient management experience, and an apparent shortage of funds to invests in these critical areas. The road to recovery needs to receive even more urgent attention if the situation is to become more conducive to investment and growth in these industries that have a large multiplier effect in terms of employment opportunities that the sub-Saharan region so badly needs.

Several added value projects that were evaluated and successfully implemented even though the reasons were sometimes not that apparent at that time included the following:

Aluminium in effect as a means of exporting electrical energy produced from coal but based on imported alumina, chromium chemicals (but not chromium metal), manganese chemicals (EMD) and metal, vanadium chemicals and alloys, titania slag (but not titanium metal), and zirconium ceramics and alloys. However, the further development of similar opportunities has been negatively impacted by the rapidly increasing electricity tariffs in recent years.

Added value products from precious metals, including three-dimensional coloured gold and platinum jewellery and automotive catalysts, achieved some success, the latter with some export incentives More recently advances in nanotechnology have been creating new opportunities but have a long way to go if a significant impact is to be made.

Other initiatives that were advanced in the 1990s include magnesium-based products for the automotive and aerospace industries that could be produced from dolomite resources located along the Western Cape coast. The technology is based on using locally produced ferrosilicon as the reducing agent using Mintek's atmospheric DC furnace and splash condenser technology (MTMP). This initiative was well supported by Anglo American, Eskom, and government, reaching the large pilot plantscale; but it requires a larger demonstration-scale facility to provide the design parameters and confidence for an industrial-scale plant. Magnesium steering wheels were produced in Atlantis but from magnesium imported from Brazil; local production on a larger-scale could stimulate a wider range of products being developed.

The strategic and critical minerals and metals eras and related technology developments

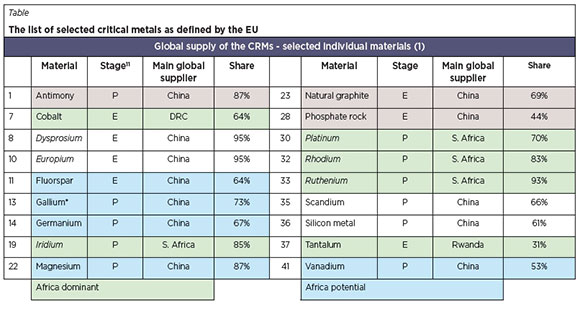

The strategic metals and ferroalloys of the 1970s up to the 1990s, such as chromium and vanadium, have largely given way to the current focus on critical elements such as rare earths, tantalum, and some of the others shown in the Table below. Many of these are driven by advanced technologies and the range of high-tech products that we use in our everyday life. Another reason is the need to increasingly use energy from renewable resources and for the more effective storage and transportation of electrical energy that has driven the so-called electric vehicle (EV) metals such as nickel, cobalt, lithium, and vanadium, as well as graphite in terms of purity and demand.

Abiel Mngomezulu succeeded Dr Paul Jourdan as President and CEO of Mintek and with his background in geology and experience in industry and also government, ensured that Mintek continued in its role as a leading provider of research, development and technology transfer. He also encouraged Mintek's involvement in overseas based initiatives such as the EU's Framework and Horizon 2020 programmes where Mintek was and continues to be a significant participant in a number of consortia-based projects - some of which relate to critical raw materials and technologies referred to in the EU initiatives (1). There are numerous ongoing benefits from interaction with leading universities and institutions as well as commercial organizations in a several counties within the EU where Mintek has built up special relationships.

Research and development together with the necessary experience can go a long way in ensuring we do better in the future, with some trial and error being inevitable as a consequence to some extent in testing the limits of science and engineering technology.

We need to capture the whole learning and experience curve in an effective manner for the future and the development of intelligent dashboards that have the ability to provide the advanced strategic inputs as well as support for complex decision-making processes for the future without the human race becoming overly dependent and losing the ability to still think for itself.

Some of the more advanced technologies that were identified in the 1980s and 1990s have progressed to the stage where their successful implementation is widely accepted, but in other cases there are some aspects of the work that is still in progress. One area is advanced sensing and sorting of minerals as a means of preconcentration of the ore; increasing the head grade can make a significant impact on the economics of a new project or improve the performance on an existing operation. Another is computer-based modelling and control of large submerged arc ferroalloy and DC arc furnaces, largely pioneered in South Africa during the scale-up from the designs and applications in several regions and the progression to open bath technologies for smelting fines. The consolidation of these models and what has been learnt from their application should be advanced by developing so-called intelligent dashboards that capture the integrated learning curve to support future generations working in our industry.

Lessons learnt and potential future opportunities

In spite of all this progress we still don't seem to be learning as much as we should from the experience of lessons learnt in the past fifty years; with several mega projects failing at a cost of tens of billions of dollars for reasons that, in many instances, could and should have been avoided. It would have only taken a small fraction of these losses to have been invested up front to avoid many of these failures had we asked and answered the right questions in the first instance. How can we get this right in the future?

One of the most important requirements of the engineering and related scientific fraternity's capabilities is the ability to apply the necessary level of judgement. This appears to have been sadly lacking in a number of projects over the years for various reason, where hindsight indicates that the problems experienced could in principle been avoided or minimized.

These projects, most of them outside South Africa, include the following: direct reduced iron and preheating of ilmenite in fluidized beds, the production of nickel intermediates in certain hydrometallurgical processes, carbothermic reduction for aluminium production, magnesium production from asbestos tailings, open bath smelting of silicon, electrolytic titanium production, and zinc metal recovery from electric arc furnace (EAF) dusts. The investment in these and other projects probably amounts to well over US$25 billion that could have been better spent on de-risking the technologies or establishing what the fatal flaws are before incurring the major capital investment costs. It seems as if there is never the money for this critical type of assessment in many such projects in advance. However, there is increasing hope for the future.

Things still to do on the metallurgical technology bucket List

»» Preheating and prereduction of chromite fines prior to smelting in an open bath with 'cloud cover' to minimize energy losses in a DC furnace and achieve a power consumption of less than 2 MWh/t ferrochrome to support the further local growth of this industry.

»» Demonstrate the continuous vapour phase transfer of magnesium between a DC furnace and a splash condenser at an operating scale of 25 MW with a high overall availability to support the establishment of a new local industry.

»» Scaling up of FeMn smelting to over 100 MW in a DC (SAF) submerged arc furnace using the optimum level of manganese ore pretreatment to achieve the economy of scale to support the further growth on the local industry.

»» Optimum use of nickel laterite ores to produce Ni and Co units using hydro-pyro process flow sheet integration and smelting based on using intermediate products to support projects in sub-Saharan Africa to supply the growing battery and other markets.

»» Mega-scale iron and vanadium production in the Bushveld Complex to supply the large potential for vanadium storage batteries and iron units for integrated iron, steel, and stainless steel production as well as high-purity iron powder for added value products.

»» Growth of stainless steel to 3 Mt/a in South Africa through Fe, Cr, and Ni process integration and product optimization including improved production methods for lower cost and more effective ferritic grades.

»» Maximising cobalt recovery to over 90% with an optimum integrated sensing and sorting based mineral processing and more effective pyro-hydro and advanced smelting and hydro-based iron removal technologies, also for the growing battery markets.

Finally, sub-Saharan Africa should strive to increase its production and be a more dominant producer of several of these critical materials in the table shown opposite and contribute more to those that can be found in the link to the reference below in the medium to longer term. Other elements such as chromium, manganese, and tin are close to meeting the criteria for this list too. The sourcing of the almost unlimited electrical power potential of the Congo river would in principle go a long way to addressing the current constraints in expanding the production of the ferroalloys from the world's most abundant resources of chromium and manganese as well as other important more advanced materials.

References

Study on the review of the list of Critical Raw Materials - Executive summary. Document date: 13/09/2017 - Created by GROW.DDG1.C.4 - Publication date: 13/09/2017 http://ec.europa.eu/docsroom/documents/25421U [ Links ]