Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.119 n.5 Johannesburg May. 2019

JOURNAL COMMENT

The changing landscape of elements being mined and beneficiated leading up to and beyond 2020, and what this could mean to sub-equatorial Africa and globally

The exploitation of minerals and metals over the centuries has been driven by many factors, including perceived value due to rarity and functionality in applications such as adornment, coinage, military and domestic uses, as well as in construction and manufacturing of products our forebears (and some of us) could probably never have dreamt of. This revolution has impacted our everyday lives, but we are also facing some of the unintended consequences, such as climate change.

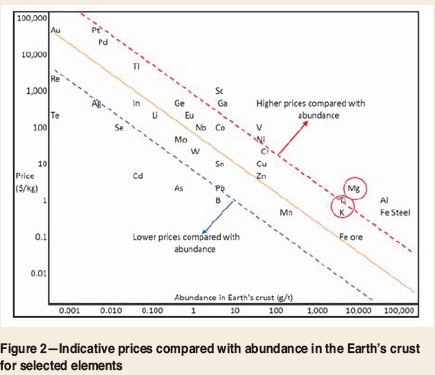

There is an almost logarithmic relationship between the level of concentration of the elements in the upper crust of the Earth and the value or price, as well as the quantities produced and the demand. The relationship was characterized for many years by gold at the top of the list, but with other precious metals of the platinum group being added as they became identified and exploited during the past couple of centuries. However, with the advent of advanced materials, high-tech electronics, and battery (EV) technologies and developments in related industries, numerous additional ultra-low concentration and rare earth elements have begun to challenge, and could possibly in some cases even supersede, some of the precious metals.

There are also two much less scarce elements of interest that are conspicuous by their lying above the average trend line, namely magnesium and titanium. Both are reasonably abundant and occur at concentration levels of up to 40% and 50% as the carbonate and oxide respectively. However the cost of producing these metals is relatively high due to the energy-intensive processes required. This has contributed to them being used perhaps less than they could be. A number of technology improvements have been proposed, but none have been scaled up so far, including Mintek's Thermal Magnesium Process (MTMP), which was operated on a pilot scale at close to atmospheric pressure instead of a vacuum. However the biggest impact on magnesium production in the past 25 years has been the manner in which the informal Chinese economy has apparently enabled the main reducing agent, ferrosilicon (FeSi), to be supplied at almost half the price of that in most other regions. This has contributed to China producing up to 80% of the global magnesium supply of close to 1 Mt/a and has brought this ultra-light metal (density 1.7 t/m3) closer to the trend line referred to above.

While the use of magnesium in the transportation industries, including aerospace, offers reductions in fuel-based CO2 emissions in the longer term, its production from dolomite and FeSi does have an ongoing negative impact. The main question is whether this current economy of low-priced FeSi and the use of dolomite is a sustainable approach. Current magnesium prices in China are around US$2-2.50 per kilogram, but realistically prices should be closer to double this if production costs in China are normalized to compare with other regions. The uncertainty in this matter is probably impacting on growth potential, and this situation is unfortunate due to the positive effects of magnesium's strength and lightness on fuel and energy saving, even when compared with aluminium (density 2.7 t/m3). A better approach to the production of magnesium is almost certainly needed.

Furthermore, there is also a close relationship between magnesium and titanium, since magnesium is the reducing agent for converting TiCl4 into titanium metal. Although Mg is recycled by electrolysis of the MgCl2 formed and the Cl produced is recycled to reductively chlorinate the TiO2 to TiCl4, a lower Mg price would lower that of Ti too as some of the recycled Mg needs to be replaced to make up losses. However, an increase in the magnesium price would also impact that of titanium, as would the price of an important alloying element such as vanadium were it to increase as a result of the potential demand for use in a new generation of high-power storage batteries.

There are large resources of magnesium in the equatorial region of Africa, where the Congo River could potentially provide up to 500 GW of electrical energy from hydropower. Previous studies have considered the distribution of over 300 GW in the Southern African region, which could resolve the well-known current power supply issues. The magnesium in Central Africa is contained in significant carnallite deposits that are being evaluated for potash production, and could also in principle produce up to a million tons of magnesium per year. Investment in these mega projects, together with the promotion of the increased use of lightweight elements and those that result in high-strength lighter components being manufactured, can significantly reduce emissions of greenhouse gases. Surely these are some of the considerations that need to be worked on, together with renewable and energy-efficient solutions, as a top priority for the sustainability of the planet.

The development of new projects is driven by many of the above considerations, and as expected, exploration activities increase at times of higher prices due to increased demand. However the lead time to finding new deposits and improving the delineation of existing ones often takes many years, by which time markets have usually changed. The junior resources companies and the funding of their activities play an important role in providing a source of new projects, due to the somewhat different risk profile they often have compared with the larger, more established and, understandably, more conservative, companies. However the juniors often face challenges in procuring the necessary funding based on what is usually a limited balance sheet. This, along with other factors, can result in projects stalling or sometimes even being abandoned or sold off for very little return. The production of co-and by-products such as Cu, Ni, and Co, Ni and Pd, and Pt and Pd can also impact these element balances, especially where they co-exist in the minerals being mined.

Nevertheless, at the end of the day a sufficient number of projects have to succeed out of a given investor's or group of investors' portfolios to justify their overall objectives of making a high enough return from the successful projects to more than justify the relatively higher risks and offset the failures. Even major mining companies have experienced costly technical and operational setbacks in the development and implementation of new projects in several cases for reasons that could, especially in hindsight, have been avoided. A stronger focus on the lessons learned (or sometimes not learned) is a theme that the SAIMM could consider for conferences and even schools, so that current and future generations can benefit from the learning curve.

Changes in demand for metals driven by developments in technology can also impact existing mining and processing operations, as well as longer-term exploration and the targeting of new project implementation. The relatively recent shift towards the use of palladium over platinum in autocatalysts (this has also occurred previously) is a case in point, with more far-sighted and flexible producers being able to better exploit the opportunity this type of change creates. The directions that need to be taken often come from a better understanding of changes in the downstream uses and related developments in advanced technologies.

There is also strong competition for funding from other industries, including natural resources. For example, the permitting of cannabis in several countries, has stimulated significant investment in this industry and potentially reduced that in mining projects to some extent.

Increasing pressure from environmentalists, and especially those concerned about climate change, is also having an impact, and it is yet to be seen whether this affects production more or less than that it does demand. These uncertainties contribute to the future challenges that our industry faces, and we need to work harder and smarter to address them with resources that are becoming increasingly scarce. However, on a more positive note there is enormous potential for regional and global cooperation to make a valuable contribution to lowering the impact on the environment by changing the dynamics in the production of many of the metals needed for sustainable growth, with the benefits of a major reduction in CO2 emissions over the next ten years.

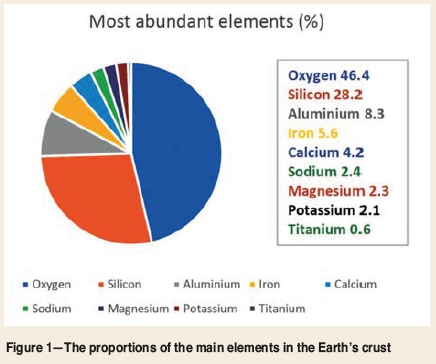

Figures 1 and 2 show the main elements in the Earth's crust as well as the relationship between abundance and the market prices. These are mostly based on data from 2018, or estimated where the data was not available or uncertain, and the information should be validated if any possible use is to be made of it. Magnesium, titanium, and potassium referred to above all feature among the top nine major crustal constituents.

These relationships, while well known over many years, have been studied further and reported in a number of publications, some of which are shown below.

N.A. Barcza

References

Jaffe, R., Price, J., Hitzman, M., and Slakey, F. 2011. Energy-critical elements for sustainable development, Physics & Society, vol. 40, no. 3. https://www.aps.org/units/fps/newsletters/201107/jaffe.cfm [ Links ]

Hurd, A.J., Kelley, R.L., Eggert, R.G., and Lee, M-H. 2012. Energy-critical elements for sustainable development. MRS Bulletin, vol. 37, no. 4. https://www.researchgate.net/publication/259420442_Energy-critical_elements_for_sustainable_development [ Links ]