Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of the Southern African Institute of Mining and Metallurgy

versão On-line ISSN 2411-9717

versão impressa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.118 no.12 Johannesburg Dez. 2018

http://dx.doi.org/10.17159/2411-9717/2018/v118n12a8

PAPERS OF GENERAL INTEREST

New approach to evaluate the TOWS matrix and its application in a mining company

I. Černý; M. Vaněk; J. Hubáček

Faculty of Mining and Geology, VSB - Technical University of Ostrava, Czech Replublic

SYNOPSIS

SWOT analyses and the closely related TOWS matrix are frequent starting points for an organization to develop its strategy. The paper deals with the evaluation of the TOWS matrix and presents three novel approaches to evaluate the different factors of the TOWS matrix, namely (1) approach to evaluate the factors with identical weights; (2) approach to evaluate factors with their weights determined within the different quadrants of the TOWS matrix; and (3) approach to evaluate factors with weights determined within the whole TOWS matrix. The third approach has two variants. The proposed approaches to evaluate the TOWS matrix were tested on a SWOT analysis of a significant mining company in the Czech Republic. The results imply that the strategy W-T (weaknesses-threats) is recommended in three cases, while the strategy S-T (strengths-threats) is recommended once. The paper may be valuable for managers responsible for strategic planning.

Keywords: strategy, SWOT analysis, TOWS matrix, evaluation methods, mining company.

Introduction

The process of human needs gratification has been closely connected with raw material resources of the planet. In the contemporary socio-economic conditions, the task of the mining company managers, apart from extracting mineral resources, is to meet the owners' intents.

The managerial work itself becomes very complex. In mining companies in particular, the complexity is augmented by the characteristics of the business. Undoubtedly, the key factor is that mineral resources cannot be renewed or relocated. Stojanovi (2013) characterizes mining projects as involving great investments in finance and time, as well as consecutive decisions and a 'complex mosaic of numerous unknown factors that affect the value of the project'. He adds that mining projects are typified by a 'number of geological, technological, technical, economic, environmental, social, and financial risks' (Stojanovi, 2013).

Inter alia, the managerial work may also be intese due to the dynamic internal and external conditions for the existence of any company (Vanek, 2014). This tallies with Peter Drucker's prediction in 1969; that the times at the turn of the millennium could be expected to be turbulent (Drucker, 1969).

In addition, looking at a mining company in the context of the Eurozone debt crisis, the specific conditions may be aggravated by disturbances in the real economy. Vilamová (2012) claims that the avoidance of risk in the financial sector reduces the availability of credit, thus slowing economic growth and increasing unemployment. The key to investment and private consumption may be seen in restoring confidence in the financial market (Vilamová et al., 2012).

To be able to succeed in such demanding and complex conditions, management need to adopt responsible attitudes based on decision-making processes grounded in reliable information. In case of strategic management, the relevant information may be gained through a set of strategic analyses, such as Porter's model, BSG model, PESTEL, or SWOT analysis.

Special attention is paid here to SWOT analysis. We believe SWOT analysis has a somewhat privileged position among strategic analyses worldwide. SWOT is the acronym for strengths, weaknesses, opportunities, and threats. Earlier, the original acronym 'SOFT' stood for satisfactory (good in the present), opportunity (good in the future), fault (bad in the present), and threat (bad in the future) (Humphrey, 2005).

Later, a modification by Weihrich (1982) led to TOWS (SWOT backwards) in the format of a matrix, matching the internal factors (strengths and weaknesses) of an organization with its external factors (opportunities and threats) to systematically generate strategies to be undertaken (Hannah, 2011).

Although the SWOT analysis does not consist of the mere breakdown of the different strengths and weaknesses, opportunities and threats, the breakdown of the interest area items represents the only output of the analysis. An evaluation of the analysis and the determination of the assessed entity's position in the TOWS matrix are often absent. Therefore, the analysis results may not accurately define a suitable strategy arising from the given or predicted internal or external environments.

Expert literature, for example Robbins (2007), Koontz (1990), Certo (2003), shows that authors usually pay attention to the description of SWOT analysis, but ignore its evaluation. An exception may be seen in the publication 'Marketing Management' by Kotler and Keller (2012), where to evaluate the opportunities he uses the attractiveness and probability of success, threats are evaluated by means of impact and probability of occurrence, and strengths and weaknesses are assessed by means of performance and importance of relevant areas. However, Kotler's approach does not result in a precise or unambiguous position in the TOWS matrix.

For this reason, we decided to search for such an approach that could help strategic managers to forsee which strategies to formulate for the companies they manage, and subsequently implement these in practice. As we do not want to limit ourselves to the theoretical level, we apply the proposed method to a particular company - OKD, a.s. (OKD, joint-stock company), one of the biggest mining companies in the Czech Republic.

2014 was a year of crisis for OKD as they faced bankruptcy. The management decided to redress the prevailing structural situation of the company. A SWOT analysis and its evaluation may be interesting not only for the management, but also for the wider expert public. The aim of this paper is to present the authors' approach to SWOT analysis evaluation and one practical application, on OKD, a.s.

Methods and materials

Being a well-known method for strategic analysis, the SWOT analysis or TOWS matrix is often described in expert literature on management. For details, see for example Robbins (2007), Koontz (1990), and Certo (2003).

The paper pays attention to the evaluation of the SWOT analysis and TOWS matrix. A SWOT analysis in organizations is usually prepared as a list of factors in the different areas of interest. When evaluating the factors, companies may encounter problems in determining the unambiguous weights of the different factors, and thus they assess them as equally substantial. Or, the factor weights are decided using decision-making processes in groups (e.g. brainstorming) based on paired comparison of the factors (Saaty's method, Fuller's triangle) within the four quadrants of the TOWS matrix. Nevertheless, the determination of factor weights (preference) on the grounds of paired comparison of factors belonging to various TOWS matrix quadrants is not a common practice.

The major aim of the authors here is to offer the expert public, and especially the business sector, a complex approach to the evaluation of the TOWS matrix. To meet this need, we used the procedures and methods described in Table I.

The mining company under consideration

We decided to verify the proposed approaches to TOWS matrix evaluation using a SWOT analysis of the mining company OKD, a.s. OKD is the sole producer of hard coal (bituminous coal) in the Czech Republic, and operates in the southern part of the Upper Silesian Coal Basin in the Ostrava-Karviná coal district. According to the official company website, OKD prospects for, extracts, processes, and sells hard coal with low contents of sulphur and other impurities. The coal is used as fuel, for coke production, in the chemical industry, and many other sectors (Raska, 2014).

Currently, OKD operate three active mines and one mine is on care and maintenance. The mining operations are listed below:

> Mining operation 1 (mining sites SA, Lazy, and Darkov)

> Mining operation 2 (mining sites North and South)

> Mining operation 3 (mining sites Staric and Chlebovice)

The Frenstát Mine is on care and maintenance.

Between 2009 and 2014 the annual production was about 8-11 Mt of coal suitable for coking or as energy coal.

As of 31 December 2013, OKD had 11 763 employees and another 3 200 people worked through contractor companies. The economically mineable reserves of the company as of 31 December 2013 exceeded 64 Mt.

Selected economic performance parameters for 20092013, are presented in Table II.

Table III gives the SWOT analysis of the company.

Results

We prepared three approaches to evaluate the different factors of the TOWS matrix:

> Approach to evaluate the factors with identical weights

> Approach to evaluate factors with their weights determined within the different quadrants of the TOWS matrix

> Approach to evaluate factors with weights determined within the whole TOWS matrix.

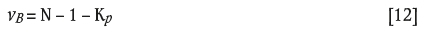

The first approach builds upon the fact that it is not possible to compare factor preferences either within each quadrant, i.e. S, W, O, T, or among the different quadrants. All the factors in each quadrant (S, W, O, T) have identical significance (weight, preference).

where: v is the weight of each factor; N the total number of factors from all quadrants (S, W, O, T) of the TOWS matrix; PS the number of factors in the S quadrant; PW the number of factors in the W quadrant; PO the number of factors in the 0 quadrant; and PT the number of factors in the T quadrant.

The second approach proceeds from the fact that it is possible to determine factor weights within the different quadrants (S, W, O, T) of the TOWS matrix by comparing their preferences, but not by comparing the factor preferences from different quadrants (Vanek et al., 2014).

Expert literature offers several options to evaluate the first phase of the SWOT analysis (e.g. Saaty's method, Fuller's triangle, evaluation according to Kotler). We decided to evaluate the SWOT analysis of the studied company using the weighting evaluation method, where the weights were set using the method of paired comparison and the Fuller's triangle.

The evaluation process using weights is grounded in the following steps:

> Fuller's triangles are constructed for the different evaluated quadrants (S, W, O, T) of the TOWS matrix based on the number of identified factors and facts.

> A paired comparison of factors and facts is carried out for the different quadrants of the TOWS matrix. The preferred factors and facts are marked (e.g. in colour, in bold). If factors in a pair have identical preferences, we mark both.

> According to their preferences, the absolute weights of the factors and facts are determined as follows:

where:

viis the weight of the i factor/fact in the given quadrant under evaluation (S, W, O, T)

Piij= 1 - preference of i > preference of j it is a bivalent variable (0, 1) that expresses the factor preference in the paired comparison of the factors i and j

i is the index of factor/fact in the given quadrant (S, W, O, T) i = {1......n}

j is the index of factor/fact in the given quadrant (S, W, O, T) j = {1......n}

sn is the number of factors/facts in the given quadrant under evaluation (S, W, O, T).

> Next, we determine a scoring number for the evaluated quadrant of the TOWS matrix as the sum of the weights of the different factors and facts:

where:

Hx is the scoring number for the evaluated quadrant X

X is the quadrant under evaluation (S, W, O, T)

vi is the weight of the i factor/fact in the evaluated quadrant X

i is the index of factor/fact in the evaluated quadrant X n is the number of factors/facts in the evaluated quadrant X.

> Finally, we determine a scoring number (H) for the individual strategic types (i.e. S-O, S-T, W-O, W-T) as the product of the scoring numbers of the different quadrants of the TOWS matrix, as expressed by the Equations [5]-[8]:

It is clear that the maximum scoring number for the different strategic types defines the inquired quadrant of the matrix and thus the relevant strategic type (ST):

The third approach builds on the fact that it is possible to compare the factor preferences within the different quadrants of the TOWS matrix as well as among the quadrants at the same time (e.g. the significance of a certain factor from the area 'S' is much higher than that from the area 'T'). It is advisable to subject the approach to modelling using two variants.

The first variant consists of the classification of all factors from the quadrants S, W, O, T of the TOWS matrix into categories, among which preferential relations are clearly given. This means that the categories are not indifferent to preferences. However, it also holds true that all the factors within each category are indifferent to preferences, i.e. they have identical significance (weight). In the sector under condideration, i.e. the mining industry, it is possible to arrange the different factors of the S, W, O, T quadrants into clearly set categories of preference as follows.

> Politicalfiactors have the top priority. These are, for instance, support for sustainable mining or of other systems of subsidies to overcome unfavourable barriers to business development, cost, and natural and environmental barriers. However, political factors are not taken into account in this paper as the Czech government has not clearly declared long-term support for the mining industry. If the government showed a green light for the mining industry as a strategic sector, this factor/these factors could be attributed to the quadrant of Opportunities.

> Business and cost factors represent the second top priority. There is accessibility and availability of raw materials, competition in the studied area, purchasing power of citizens and organizations, etc. Among the business and cost factors, there are clearly T1, T2, T5, T6, and W5 (Table III).

> Natural and environmental/actors rank third among the preference group factors. We can classify herein safe mine operations with excess exploitation in the studied area, and urban and landscape attractiveness of the area in question. Among the natural and environmental factors, there are T3, T4, T7, and W2 (Table III).

> Other/actors (unclassified) include all factors that cannot be allocated unambiguously (Table III).

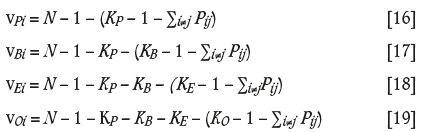

According to the abovementioned assumptions, we may determine the following weights:

where

vp is the weight of the political factors.

where vBis the weight of the business and cost factors; KP-is the number of political factors.

where: vEis the weight of the natural and environmental factors.

KB- is the number of business and costs factors.

where vO is the weight of other factors.

KEis the number of natural and environmental factors.

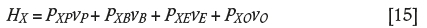

The scoring number for the evaluated quadrant of the TOWS matrix is determined as follows:

where

Pxpis the number of factors in the quadrant X (S, W, O, T) belonging to the category of political factors

Pxbis the number of factors in the quadrant X (S, W, O, T) belonging to the category of business and cost factors

Pxeis the number of factors in the quadrant X (S, W, O, T) belonging to the category of natural and environmental factors

Pxois the number of factors in the quadrant X (S, W, O, T) belonging to the category of other (unclassified) factors.

The scoring numbers for the different strategic types (S-O, S-T, W-O, W-T) are calculated according to Equations [5] to [8]. A strategic type is chosen according to Equation [9].

The second variant, similarly to the first variant of the third approach, lies in the classification of all factors from the areas S, W, O, T into categories, among which there are clear preferential relations (Equation [10]). In contrast to the first variant, it holds true for the second variant that all the factors which make part of the given category are mutually different, i.e. they differ in their significance. In principle, it is a combination of the third and second approaches, which increases the practical applicability of the SWOT analysis. The procedures to implement the variant may be set as follows.

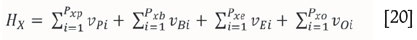

Partial factors within the individual categories have different preferences. Therefore, it is vital to determine the weights of the partial factors within the different categories as follows:

where vPiis the weight of the i political factor; vBiis the weight of the i business and cost factor; vEiis the weight of the i natural and environmental factor; voiis the weight of the i other (unclassified) factor; and Ko - is the number of other (unclassified) factors.

The scoring number for the evaluated quadrant X (S, W, O, T) of the TOWS matrix is determined according to Equation [20]:

The scoring numbers for the various strategic types (S-O, S-T, W-O, W-T) are calculated according to Equations [5] to [8]. A strategic type is chosen according to Equation [9].

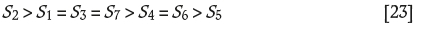

For the second variant, it is necessary to set up factor preferences within the categories based on transitivity. Transitivity arises from a specific SWOT analysis. Political factors are not examined herein, as explained above. For the business and cost factors, the hierarchy of preferences may be determined as follows:

The relationship stated above is grounded in the fact that the long-term fall in coal prices on the world market (T1) is unsustainable for the mining industry and cannot be influenced without political intervention. Therefore, it has the top priority. Factors (T2, W5, T5) that represent stagnation, uncertain sales, or an increase in input costs can be influenced, for example, by improving the industrial logistics and savings (sales may slacken even at good price levels). However, such factors are more significant than factor T6 (pressure to increase wages), which is much more easily influenced (e.g. by collective bargaining), especially in the regions of so-called 'old industry', where there is a general shortage of new jobs.

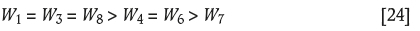

Natural and environmental/actors may be organized into a hierarchy as below:

The increasing requests by eco-activitists (T7) and changes in the general public's attitudes to the natural environment may have a political impact on decision-making about the strategic priorities and investments. This factor is very difficult to influence, and thus may be considered as the most important in the given category. Other environmental and natural factors (T3, T4, W2) are given by the natural conditions only, and it is thus difficult to identify which factor is the most significant.

The other (unclassified/actors) make up the biggest set of factors (about 19). Brainstorming must be used to assess these. The authors of this paper participated in the brainstorming session. In business, it is routinely possible to evaluate the different factors within the quadrants S, W, O, and T. However, the problem lies in the comparison of factors from different quadrants. Such a comparison is rarely done in business. As a result, the following two-stage process of factor comparison can be recommended.

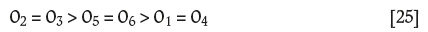

In the first stage, we compare the factors within the individual quadrants S, W, O, T based on transitivity.

Strengths

Weaknesses

Opportunities

Threats

No threats are classified in the 'other' factors.

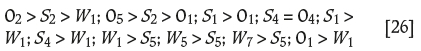

In the second stage, it is vital to compare the factors from the different quadrants S, W, O, and T making use of the transitivity characteristics. The algorithm arises from the comparison of the most preferred factors from the quadrants, and we continue with comparing at the lower level of preference according to transitivity.

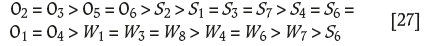

Based on the above stated relationships, from the two-stage process of factor comparison using the transitivity rules it is possible to determine an overall comparison of all factors from the different quadrants S, W, O, and T within the category of other (unclassified) factors as follows:

Discussion

The prepared SWOT analysis has become the point of departure to apply the proposed methods in the TOWS matrix evaluation.

We determined the preferences of the factors/facts in the paired comparison. Table III shows the weights of the items (in the round brackets, weights ranking to the different approaches are separated by a semicolon).

Table IV gives the scoring numbers for the TOWS matrix quadrants and strategic types calculated according to Equations [4] to [27].

Summing up the weights of the factors in the different quadrants of the TOWS matrix, we produced the scoring numbers for the quadrant, which were the points of departure to calculate the scoring numbers for the strategic types (see Table IV).

The results imply that the company managers face a decision whether to close the company or whether the company strengths should be used to suppress the threats. In the latter case, the state authorities could play a positive role and the impact of this could even boost the company strengths.

In three cases the company should enforce a total phase-out (Table III); only on the basis of the third approach, second variant, should the strengths of the company be exploited to suppress the threats. This difference is particularly due to the opportunity of comparing the different factors within the categories. It is clear that the majority of factors from quadrants S and W of the TOWS matrix are classified into the 'other' factors. Five out of six factors from quadrant S have a higher preference than the six factors from the quadrant W.

Nevertheless, it is apparent from the comparison of the scoring numbers for the strategic types in the third approach, second variant, that the difference between the optimal strategic type and the second-best variant is minimal.

Comparing our results with the real conditions of the company OKD, the results reflect the actual state of the mining company. Unfavourable economic results of OKD and the difficult financial situation of the owner, New World Resources (NWR), meant that the managers of both companies had to become crisis managers.

Since 2013 bankruptcy has been a real threat to OKD, as indicated in Table II. In August 2014 bondholders authorized NWR to undergo capital restructuring. The restructuring was also approved by courts in the UK and the USA. NWR and thus OKD were given a chance to stabilize their current situations and search for future solutions .

Conclusion

The managements of organizations are facing tough and complex decisions in the current turbulent economic conditions as strategies to ensure prosperity and success are difficult to formulate. The quality of a strategy undoubtedly mirrors the quality of strategic analyses carried out. The SWOT analysis is the key one as it considers both the internal and external conditions of an organization. The TOWS matrix, grounded in the SWOT analysis, thus may become a tool to formulate a suitable strategy.

Having studied the issues, we learn that the evaluation of the TOWS matrix is basically neglected. For that reason, we have prepared three approaches to evaluate the factors in the TOWS matrix (an approach to evaluate the factors with identical weights; an approach to evaluate factors with their weights determined within the different quadrants of the TOWS matrix; and an approach to evaluate factors with weights determined within the whole TOWS matrix).

The proposed approaches have been tested on the TOWS matrix of the mining company OKD a.s. We believe that the verification of the approaches was successful and confirmed our expectations. The functionality of the proposed approaches is also documented by the comparison of the evaluation conclusions with the real conditions in OKD a.s.

At this moment, it is too early to say whether those approaches will become common practice for users of SWOT analysis, as they need to be subjected to expert discussion. We are persuaded that the new approaches have a chance for success, namely with regard to the limited possibilities the TOWS matrix may currently offer to its users.

Acknowledgement

The authors would like to thank their advisers for valuable information.This research was financed under the support of specific university research project no. SP2015/11, granted by the Ministry of Education, Youth and Sport of the Czech Republic.

References

Certo, S.C. 2003. Modern Management: Adding Digital Focus. 9th edn. Prentice Hall, Englewood Cliffs, NJ. [ Links ]

DRUCKER, P.F. 1969. The age of discontinuity: guidelines to our changing society. Heinemann, London. [ Links ]

Hannah, K., Ka Yin, Ch. Leung Chi, K., Sonbai, L., and Shu Chuen, T. 2011, A structured SWOT approach to develop strategies for the government of Macau, SAR. Journal of Strategy and Management, vol. 4, no 1. pp. 62-81. http://www.emeraldinsight.com/doi/pdfplus/10.1108/17554251111110122 [accessed 10 March 2015]. [ Links ]

Humphrey, A. 2005. SWOT analysis for management consulting. Stanford Research Institute Alumni Newsletter (SRI International), pp 7-8. http://www.sri.com/sites/default/files/brochures/dec-05.pdf [acessed 10 March 2015]. [ Links ]

JanIcek, P. and JÍSa, M. 2013. Expertní inzenýrství v systémovém pojetí (Expert engineering in system concept). Grada Publishing, Praha. [ Links ]

Koontz, H. and Weihrick, H. 1990. Essentials of Management. 5th edn. McGraw-Hill, New York. [ Links ]

OKD, A.S. 2009, 2010, 2011, 2012, 2013. Annual Reports. http://www.okd.cz/en/about-us/annual-reports [accessed 16 January 2015]. [ Links ]

OKD. (Not dated). About us. http://www.okd.cz/en/about-us [accessed 16 January 2015]. [ Links ]

Perzina, R. and Ramík, J. 2014. Microsoft Excel as a tool for solving multicriteria decision problems. Proceedings of the 18th International Conference on Knowledge-Based and Intelligent Information & Engineering Systems - KES2014, Gdynia, Poland, 15-17 September 2014. Procedia Computer Science, vol. 35. pp. 1455-1463. [ Links ]

RaSka, J. 2014. NWR dostalo od majitel dluhopis souhlas k provedení restrukturalizace (komentá ). http://www.fio.cz/zpravodajstvi/zpravy-z-burzy/151624-nwr-dostalo-od-majitelu-dluhopisu-souhlas-k-provedeni-restrukturalizace-komentar [accessed 10 March 2015]. [ Links ]

Robbins, S.P. and Coulter, M.K. 2007. Management. 9th edn. Pearson Prentice Hall, Englewood Cliffs, NJ. [ Links ]

Stojanovic, C. 2013. Evaluating investment projects in mining industry by combining discount method and real option valuation. Acta Montanistica Slovaca, vol. 19, no. 4. pp. 217-225. [ Links ]

Vanëk, M., Cerný, I., Hudecek, V., KrcmarskA, L., and MagnuskovA, J. 2014. SWOT analysis - point of departure for strategic managers. Proceedings of the 14th International Multidisciplinary Scientific GeoConference (SGEM2014) : GeoConference on Science and Technologies in Geology, Exploration and Mining, Albena, Bulgaria, 16-26 June 2014. Volume III. STEF92 Technology Ltd. pp. 591-598. [ Links ]

Vilamova, S., JanovskA, K., Kozel, R., VoznAkovA, I., and SvecovA, E. 2012. New trends in the management within the metallurgy firms. METAL 2012: Proceedings of the 21st International Conference on Metallurgy and Materials, Brno, Czech Republic, 23-25 May 2012. Tanger, Ostrava. pp. 1897-1903. [ Links ]

Weihrich, H. 1982. The TOWS matrix: a tool for situational analysis. Journal of Long Range Planning, vol. 15, no. 2. pp. 54-66. http://www.usfca.edu/fac_staff/weihrichh/docs/tows.pdf [accessed 10 March 2015]. [ Links ] ♦

Paper received Jun. 2015

Revised paper received Apr. 2018