Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.118 n.9 Johannesburg Sep. 2018

http://dx.doi.org/10.17159/2411-9717/2018/v118n9a1

PRESIDENTIAL ADDRESS

Presidential Address: Towards the future: African Mining Vision, Mining Phakisa and the SAIMM

A.S. Macfarlane

Co-Director, Mandela Mining Precinct, Johannesburg, South Africa

SYNOPSIS

Recent political winds of change blowing through the African continent have created the hope of a new dawn for the mining industry, and a renewed impetus to support the African Mining Vision.

South Africa finds itself well positioned to support the African Mining Vision, and the Mining Phakisa process has laid a solid foundation for the country to play a key role in the attainment of the Vision. Furthermore, the renewed focus on the National Development Plan has increased the need for the mining industry in South Africa to reinvigorate itself, and to be a key contributor to gross domestic product once again.

The Phakisa outcomes have resulted in renewed support for research and development within the mining industry, as well as support for localization in the manufacture of mining equipment, for domestic use and for export to the rest of the continent. Further emphasis is being placed on stimulating alternate businesses near mining communities, through the establishment of small- and medium-sized enterprises.

In the area of research and development, the recent establishment of the Mandela Mining Precinct bears testimony to these renewed efforts by the State, industry, and other stakeholders in developing a vision for Mining 2030.

All of these thrusts are based on the principles of collaboration, open innovation, transparency, and transformation. None of them will be achievable without capacity building, capability creation, and development.

It is within this spirit of collaboration and journey of renewal that the Southern African Institute of Mining and Metallurgy must find its place and the supportive role that it can play.

The incoming President of the SAIMM has been deeply involved in the Phakisa process, and continues to be involved in the research and development initiatives, as well as working with transformation, empowerment, and health and safety issues in the industry.

This Address will therefore unpack the vision and objectives of the African Mining Vision, in terms of how the Mining Phakisa in South Africa aligns to it and how the Institute can and should play a supportive role in the Mining 2030 vision. The SAIMM, being the Southern African institute as it is, can play a pivotal role in supporting skills upgrading, gender equality in the industry, transformation and empowerment, research and development, and social upliftment in mining-based communities.

Introduction

The Presidential Address by our outgoing President, Professor Sehliselo Ndlovu (Ndlovu, 2017) emphasised the need for collaboration in research and between universities. She noted in her conclusion that 'The key to success in an economic downturn is the development and application of innovative, cost-effective exploration, mining and mineral processing technologies that can ensure sustainability and return on investment. Industry-academic partnerships can go a long way towards facilitating such achievements during these periods. The major benefits that can be gained from such a partnership are in three distinct areas: student training, research, and entrepreneurial activities, which can lead to the transfer of both technology and knowledge'. Her address, with its focus on collaboration and capacity development, forms a perfect backdrop to this one, and the two addresses are perfectly aligned.

This Presidential Address describes the work that has been done to establish research and development capacity and capability, to support the sustainability of the South African mining industry, and the journey that is required to be followed if these efforts are to be sustainable and aligned to national and international imperatives.

By way of introduction, it is informative to review such international and national issues, as well as industry imperatives.

R&D as part of a greater vision : the African Mining Vision

The vision of the African Mining Vision, as defined by Antonio Pedro, Director, Sub-regional Office for Eastern Africa United Nations Economic Commission for Africa (Pedro, 2013) is:

'Transparent, equitable and optimal exploitation of mineral resources to underpin broad-based sustainable growth and socioeconomic development'.

The AMV is based on a number of 'tenets' and some of these have been extracted in order to set a context for R&D and industrialization in Africa, and South Africa in particular. Those of particular relevance are:

► Using comparative advantages to build dynamic comparative and competitive advantages: a developmental, transformative, knowledge-driven, and integrated mining sector with downstream, upstream, and sidestream linkages

► Optimal exploitation of finite resources at all levels (large- and small-scale) and of all types (high and low value, including nonmetallic minerals)

► Fostering sustainable development principles based on environmentally and socially responsible mining, which is safe and includes communities and all other stakeholders

► Building human and institutional capacities towards a knowledge economy that supports innovation, research, and development

► Promoting good governance of the minerals sector in which communities and citizens participate in decision-making and in which there is equity in the distribution of benefits

► Unbundle the 'minerals complex' (from exploration to fabrication, markets, and mine closure) to identify entry points for local participation, particularly in the provision of good and services.

These tenets give important direction to the development of a South African research, development, and innovation ecosystem in a continental context. Such direction needs to satisfy the internal needs of the South African economy, and of the mining sector (if it is to be repositioned as an important contributor to the GDP), and also those of the mining equipment and capital goods sectors. The encouragement of localization of supply offers the opportunity to develop internal capacity and capability, and to position South Africa favourably in the export market into Africa, and beyond.

The National development Plan 2030

The National Development Plan (NDP) (National Planning Commission, 2013) is a long-term South African development plan, developed by the National Planning Commission in collaboration and consultation with South Africans from all walks of life. Introducing it on 19 February 2013 Minister Trevor Manuel said 'The plan is the product of thousands of inputs and perspectives of South Africans ... It is a plan for a better future; a future in which no person lives in poverty, where no one goes hungry, where there is work for all, a nation united in the vision of our Constitution'.

The objectives of the National Development Plan are as follows:

► Uniting South Africans of all races and classes around a common programme to eliminate poverty and reduce inequality

► Encourage citizens to be active in their own development, in strengthening democracy, and in holding their government accountable

► Raising economic growth, promoting exports, and making the economy more labour-absorbing

► Focusing on key capabilities of both people and the country

► Developing capabilities include skills, infrastructure, social security, strong institutions, and partnerships both within the country and with key international partners

► Building a capable and developmental state

► Building strong leadership throughout society that works together to solve our problems.

In regard to the research, development, and innovation agenda, the NDP states that South Africa's competitiveness will rely on national systems of innovation that permeate the culture of business and society. Innovation and learning must become part of our culture. This will require interventions spanning from the schooling system through to shop-floor behaviour, to R&D spending and commercialization. Public policy should focus on R&D in existing areas of competitive advantage where markets are set to grow. These include high-value agriculture, mining inputs and downstream processing, innovation to meet environmental and energy-efficiency objectives, and financial services, among others.

In her budget vote speech in Parliament on 9 May 2018, the Honourable Minister of Science and Technology, Mmamoloko Kubayi-Ngubane (one of our honorary Presidents) said 'we aim to advance the goals of the National Development Plan by harnessing science, technology and innovation for the socio-economic development of all South Africans.' (Kubayi-Ngubane, 2018), She went on to say 'Honourable Members, science, technology and innovation are fundamental not only to achieving the goals of the National Development Plan, but also for implementing the 2030 Agenda for Sustainable Development adopted by UN member states in 2015 She acknowledged in her speech that South Africa currently spends 0.7% of its GDP on R&D, a figure which is less than half that of the global target of 1.5% and well below the rate of expenditure of South Africa's BRICS counterparts.

Reaching these targets is a vital component of the work of the Department of Science and Technology (DST), which has commissioned a new White Paper on Science, Technology, and Innovation, the premise of which is that science, technology, and innovation are vital for shaping an inclusive and sustainable South African society. The draft White Paper seeks, among other things, to take advantage of opportunities presented by global megatrends such as the emergence of new technologies, including artificial intelligence and additive manufacturing.

Reference in her speech to the mining industry being a focus area within the RDI landscape further gives direction to the work that has been done, and which continues to be the focus of the Mandela Mining Precinct.

The Minerals Council South Africa, a critically important stakeholder in the mining industry in South Africa, says in its Facts and Figures Pocketbook 2017 (Minerals Council South Africa, 2017a):

'As mining depths increase and conditions become more challenging, there is an urgent need to modernise the industry. Mechanisation is one pillar of modernisation. Modernisation is not simply mechanisation. It is a process of transition and transformation of the mining industry of yesteryear to that of tomorrow, Modernisation will be driven by technological innovation, which in turn needs to be driven by Research and Development. To be successful, the approach to modernisation must be holistic, and be conducted in a systems and people-centric manner. The three key enablers of modernisation are research and development, where massive investment is required, a mining capital goods development programme to turn research effort into development and implementation, and a transition roadmap for modernisation that includes sustainability, impact assessments of future mining scenarios and accelerated skills development of employees in local communities'.

The recent tragic incidents that have resulted in a disturbing regression in mine safety performance in South Africa, along with announcements of cutbacks and retrenchments, have prompted the Honourable Minister of Mineral Resources to express his concern over these trends, and the trends to put operations on 'care and maintenance'. He has also expressed concern over sustainability and community development and engagement, all of which support the need for developing a sustainable RD&I ecosystem for the minerals industry in South Africa.

The Address takes these contexts into account, in describing the journey towards the Mandela Mining Precinct and the modernization of the industry.

The state of the industry and the need for R&D

It is well documented in papers from around the world that successful economies invest strongly in research and development, and that there is a strong correlation between growth, productivity, and R&D activity.

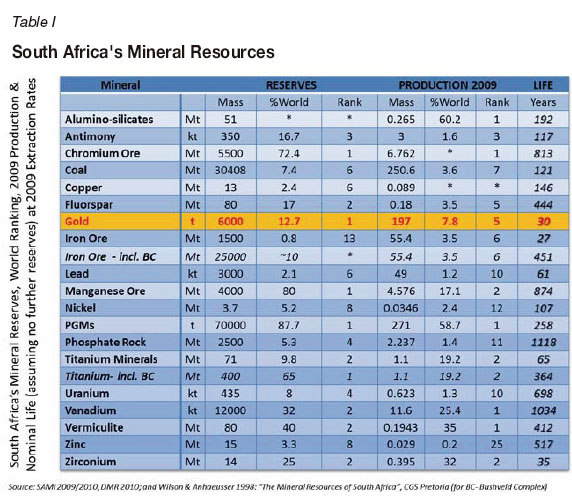

The decline in the prosperity of the mining industry in South Africa is also well documented. From being one of the major mineral-producting countries in the world, South Africa now finds itself in a very different position in terms of market share of production, despite still having a considerable mineral resource endowment. This is indicated in Table I, which shows the remaining reserves, and the percentages of world reserves and production, as reported by the Council for Geoscience (2013). What is not clear from this table is whether the data actually refers to Reserves, or to Resources. It would appear, however, that it does refer to Resources given the well-known fact that South Africa contains 80% of the world manganese resources, a figure which is reflected in the table. If this data does refer to Resources, then economic factors need to be applied in terms of costs and cut-off grades, each of which will depend on the mining method applied. A further indicator that the data is more than likely referring to Resources is the well-rounded numbers in terms of mass.

However, whichever is the case, the table does indicate that considerable potential exists if appropriate extraction methods can be designed and applied, such that reasonable percentages of these Resources can be turned to account.

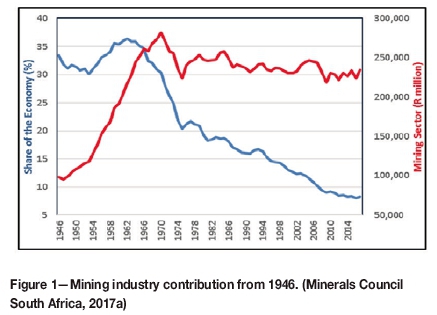

The mining industry in South Africa contributed R312 billion to the gross domestic product in 2017, representing 6.8% of the economy. A look at the data since 1946, as shown in Figure 1, illustrates a relatively static contribution since 1970, but a significantly decline in percentage terms against other industries (Minerals Council South Africa, 2017a)

The industry employed 464 667 people directly in 2017, which in fact was a slight increase (by 1.6%) over the year before. This is despite the fact that 30 000 jobs have been lost since 2014, largely in the gold sector.

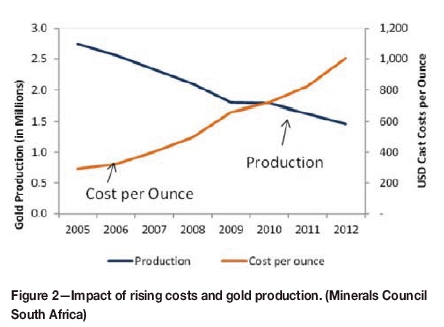

After the discovery of gold on the farm Langlaagte by George Harrison in 1886, gold became the core of the South African economy, with a peak production of 1000 tons in 1970. This had reduced to just over 250 tons by 2007, further shrinking to 138 tons in 2017. In 2017, some 175 770 people were employed in the sector, compared to 280 000 in 2007.

So, given the 6000 tons of Resources, why is this the case? The answer to this question lies in the combination of declining grades, increasing input costs, declining productivity, and relatively static prices. The impact on the unit cost of production, as production has declined, and the cut-off grade, is dramatic. This is illustrated in Figure 2.

Platinum was discovered in 1924, prior to the discovery of the Bushveld Complex, and various small companies (Premier Rustenburg Platinum, Erstegeluk Platinum Mines, and the Rustenburg Platinum Company) were amalgamated into Johannesburg Consolidated Investment Co. Ltd in 1926. Production grew in the 1960s and 1970s, but the real expansion came after 2001.

According to Africa Mining IQ (n.d.) South Africa, which boasts 80% of the world's PGM Resources, has 84 platinum projects/operations, held by 11 companies. At March 2018, 21 of these were operational, one had been closed, and six were under care and maintenance. The remainder are in various stages of development, from grassroots to construction. Price trends for platinum, which indicate a steady rise after 2001, provide the reason for the significant growth in the industry and investment in these projects. This scramble for new production soon led to the realization that the market would be over-supplied, and prices tumbled to where they are now. Employment in the PGM sector remained static between 2007 and 2017, between 180 000 and 200 000, and currently standing at 175 770 employees.

Platinum Resources (Table I) are estimated at 70 000 tons, representing 258 years of mining potential. However, the reality of Reserves is very different, with at least 70% of the industry unprofitable at current prices. The problem for the platinum industry is therefore one of costs and prices, and the ability of mines to survive in a market that does not show many signs of price improvement, unless new markets are found.

While most known PGM Resources are covered by existing mining rights, these Resources usually have a cut-off based on depth (usually 2500 metres). This cut-off is based on the assumption that mining below these depths using current methods is not economically or ergonomically possible, because of the severe geothermal gradient, which is double that in the Witwatersrand goldfields.

The platinum industry has responded to these economic challenges through the introduction of mechanization, but only in areas where the orebody is amenable to mechanization. In such cases, efficient operations exist, as at Two Rivers for example, but attempts to 'retrofit' mechanization into conventional operations through 'hybrid' methods have generally been unsuccessful because of existing system constraints. In addition, the massive reefs of the northern limb of the Bushveld Complex may be exploitable by opencast mining, as is the case at Mokolokwena, or by highly mechanized and modernized methods for underground mines, such as at IvanPlats and the Waterburg deposit. However, the majority of PGM mining is currently done through conventional shafts, set up for conventional mining, and the productivity decline has been consistent and enduring.

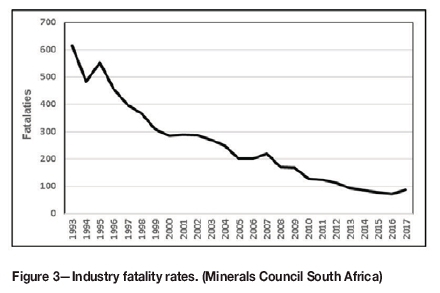

Safety and health challenges remain in the South African mining industry, despite significant improvement over the years. Figure 3 shows a steady decline in fatality rates since 1993, but with a disturbing reversal in 2017 and to date in 2018. In 2017, a major contributor to the upturn was the PGM sector, whereas the current poor performance is largely attributable to the gold industry.

That safety and health issues are increasingly important to shareholders, employees and the State is clear in the light of class actions, and the determination of the Department of Mineral Resources to attain the safety and health milestone targets.

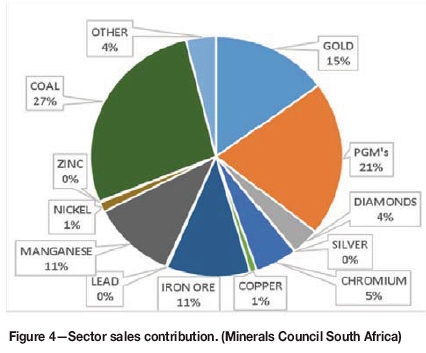

Figure 4 shows the contribution of various commodities to total sales in 2017, illustrating that while coal takes the most significant share (27%), gold (15%) and PGMs (21%) are also major contributors. Although gold sales have diminished significantly since 1970, both gold and PGM sales still remain extremely important to the South African economy, and since they are still the major employers in the mining industry, these sectors need to find ways to exploit remaining resources cost-effectively and safely.

It is for these reasons that the 'burning platform' for the South African mining industry is in the gold and PGM sectors, where the majority of operations utilize conventional underground, tabular mining methods, which are labour-intensive and increasingly inefficient. While excellent research work has been done in the past through programmes such as DeepMine on rock engineering designs, refrigeration, and rope technology, very little has changed in the stoping area of these operations, apart from the implementation of hydropower to a limited extent.

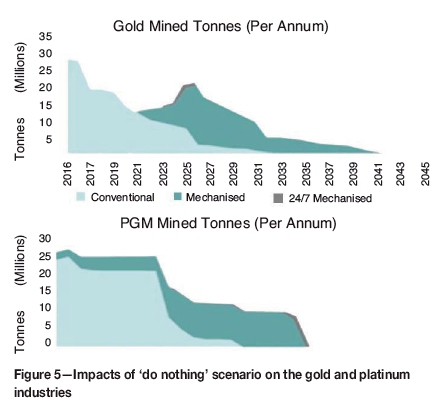

In order to illustrate the precarious position of the gold and platinum industries, in 2015, as input to the Mining Phakisa, a project was carried out that entailed consolidating the published Mineral Resources of the major gold and PGM mining companies and then, through economic modelling, applying modifying factors to these Resources. The modifying factors included conservative metal price and cost forecasts, and assumed that mining would continue at existing productivity levels using conventional methods. The outcome, which is shown in Figure 5, illustrates that if operations continue as they are, a steady decline in viable gold operations will occur through to the mid-2020s, while the platinum industry will face a crisis at about the same time. These declines are due to the closing of marginal operations due to the combined effects of costs, prices, and grades.

The conclusion from this work and the trends in the mining industry are clear. Research and development is urgently needed to find safer, healthier, and more efficient ways to exploit lower grade and deeper reefs in the gold and PGM industries, if the industry is to be sustainable and if the remaining resources can be exploited.

Exploring the productivity metric

According to Wikipedia, 'A productivity measure is expressed as the ratio of output to inputs used in a production process, i.e. output per unit of input.' Unfortunately, in mining everyone has a different view of what productivity means, and it is therefore important to default to this definition, to define productivity as the unit cost of production. Once that is done, the unit cost of production can be seen as a lagging indicator, which is driven by a complete tree of leading indicators that include people, systems, technologies, and capital. Each of these in turn can then be unpacked to determine where the maximum benefits can be gained, in terms of applying research and development, to improve overall productivity.

The history of R&D in the South African mining industry

Figure 6 depicts the history of mining research in South Africa. Initial research started in 1934, with the formation of the 'Minerals Research Laboratory' at the Department of Metallurgy and Assaying, at the University of the Witwatersrand. This was the forerunner of what is now Mintek.

According to du Plessis (2015):

'in 1960, the Chamber members werefrom the gold and coal mines; platinum miners were not members of the Chamber. At that time, the gold mining members (which therefore had an interest in hard-rock mining) were Anglo American, Anglovaal, Gold Fields, General Mining, JCI, Rand Mines, and Union Corporation.

'Thegold mining industry enjoyed a boom period between 1960 and 1980, with the industry employing more than 800 000 people. The major technological problems then faced by the industry related to safety and occupational health, particularly the risks arisingfrom rockbursts and rockfalls, dust, and the low productivity of mineworkers. The industry accordingly sponsored research to address these issues. At that time, work was undertaken by Wits University, the Bernard Price Institute, the CSIR, Mintek, and the Chamber of Mines Laboratories. Rand Mines had its own formal in-house laboratory. All these organisations conducted research along discipline lines such as mathematics, physics, chemistry, metallurgy and medicine.'

The need for a dedicated mining research organization in South Africa was recognized following the inquiry into the Coalbrook disaster, which highlighted the need for systematic research. The Chamber of Mines Research Organisation (COMRO) was established in 1964 and served as both a mining research laboratory and a physical sciences laboratory. In the early to mid-1970s, COMRO had a 10-year research programme to address current and anticipated future problems, in deep-level gold mines in particular. This was a fully privately-funded organization, being funded by the Chamber of Mines member companies. At its peak in 1989, according to du Plessis (2015), funding amounted to R481 million, equivalent to R581 million in today's terms.

COMRO, as reported by Lowit (2015), at its peak employed up to 1000 staff drawn from around the world, with laboratory facilities and capital equipment that enabled it to stay at the leading edge of mining technology development. COMRO was a world leader in mining patents, both in terms of volume and quality. Lowit ascribes the success of COMRO to it being a 'one-stop shop' that dealt with:

► Research and development

► Development of on-site demonstration models of new products

► The manufacturing sector such that the transition from test model to mass production was seamless

► IP and commercialization issues.

Lowit concludes by stating that 'essentially for close on 30 years COMRO was the benchmark and the gold standard for industry - research collaboration and RD&I in the mining sector globally'. However, in the late 1980s, CoM member companies started to feel that the work of COMRO was drifting away from industry needs, and that specific work could be done by the establishment of in-house research capacity. As the first company withdrew from COMRO, so the dominoes fell, and the demise of the model was imminent.

Recognizing this, the work of COMRO continued under CSIR Miningtek (later the Centre for Mining Innovation -CMI) through programmes such as DeepMine, FutureMine, PlatMine, and the establishment of Coaltech. These were specific programmes, jointly funded by participating companies, universities, and CSIR Miningtek.

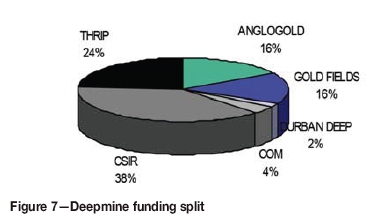

DeepMine, for example, had a budget of R66 million (Figure 7), funded jointly by industry, the CSIR, and THRIP, with the industry contribution being 38% of the total (Diering, 1999).The model, as a public-private partnership, was successful, and the programme delivered practical, applied research outcomes that were widely accepted by industry.

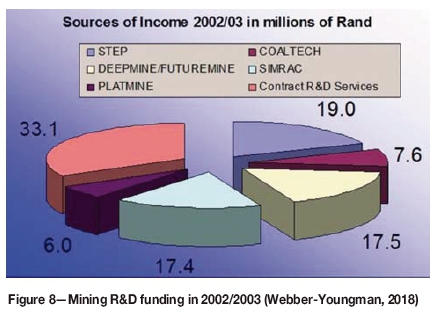

Subsequent programmes, including FutureMine and PlatMine, were less widely accepted, and mining companies were persuaded to continue their own research in-house. Thus, according to Webber-Youngman (2018) funding into industry programmes had fallen to R100.6 million in 2002/2003 (Figure 8), or R255 million in 2018 money.

The idea was that through the CSIR, the capacity and capabilities of COMRO would be secured for the country. However, the CSIR was unfortunately unable to retain the COMRO researcher base; neither could it maintain the organization's relationship with industry or its specialized facility and capital equipment. Carlow Road and other COMRO facilities were eventually mothballed. The closure of COMRO, and Miningtek and the disaggregation of CMI were perhaps the most important events that impacted on the country's current mining RD&I capacity and capabilities and its future potential.

Various initiatives have been established that are aimed at providing finance for specialist areas of research. These include health and safety research through the Safety in Mines Research Advisory Committee (SIMRAC) and the Mine Health and Safety Council and its Centre of Excellence. At universities, various centres have been established, such as the Centre for Mechanised Mining Systems and the Centre for Sustainability in Mining at Wits, the Wits Mining Institute, and the Mining Resilience Research Centre at the University of Pretoria.

During recent years, State funding for mining R&D through the DST has been directed mainly at the Council for Geoscience and Mintek. Lowit (2015) explains:

'Of programme 5's 1.6 billion Rand budget a mere 54million Rands is set aside for the Mining and Beneficiation Unit. This budget covers operating expenses andfundingfor the establishment and running of research networks which actually conduct sectoral R&D. The research network budget of R41.25m is dominated by the Advanced Metals Initiative which receives 96% of the unit's total R&D budget. Mining receives R750 000 (1.8%) and Geo Sciences R500 000 (1.2%). This skewing of support is equally visible when it is considered that MINTEK received a R277 million grant from government in 2014/2015, while The Council for Geoscience (CGS) received R287m in the samefinancial year. No equivalent was invested in mining extraction activity. These allocations are reflective of DST's and the broader government's view of the role of the minerals value chain in the South African economy and a very specific view on how a resource based economy should be leveragedfor growth.'

Professor Philips, in the SAIMM Journal of 2014, (Phillips, 2014) concluded that:

'At present there is no organization or institution commanding sufficient respect from the mining industry to be the leader or custodian of the necessary research. Should it be a government department that initiates a revival of mining engineering research? Should it be the Chamber of Mines, or the CSIR, or indeed a consortium of universities? Time will tell, but time is also running out and the store of knowledgefrom previous research is dissipatingfast.'

Lowit (2015) makes two important observations from the statistics of the last few years. The first is that post-2007 and the financial crisis, there has been a steady increase in private sector expenditure on R&D. In particular, the mining industry increased its share of this (increased) expenditure from 6% in 2004 to 15% in 2013. The second is that since 2009, there has been a major shift from 'experimental' to applied R&D.

The conclusions to be drawn from these observations are that:

► Mining companies had 'ridden the crest of the wave' during the commodity supercycle, during which profits were abundant, and shareholders received superior returns

► Any experimental or fundamental research was largely done through universities

► After the end of the supercycle, companies were forced to find innovative ways of ensuring survival, after a period when little work had been done on applied research. Hence the uplift in applied research done with OEMs and on-mine application.

The author's analysis of R&D spend by mining companies during this period substantiates this, with a collective private expenditure of R635 million in 2015, of which R580 million was direct funding, the remainder being indirect in the form of of grants and chairs. The spread of this expenditure was very uneven, with companies such as AngloGold Ashanti (through the AngloGold Technology and Innovation Consortium) and Anglo American spending the bulk of the money.

According to Singh (2018):

'Prior to the Mining Phakisa in October 2015, South African had no single strategy for mining extraction RD&I. The Department of Science and Technology (DST) had developed a draft document called "Development of a South African research agenda for mining andgeosciences" and at the same time, the Department of Mineral Resources (DMR) had commissioned a study "A Technology Innovation Roadmap for the South African Minerals Industry" which was also a draft. The CSIR was tasked by the Deputy Minister, Mr. Godfrey Oliphant, following a series of workshops in early 2015 to consolidate these two strategies into one document and update with inclusions of more recent developments. The resultant document called the South African Mining Extraction Research, Development Innovation (SAMERDI) Strategy approved by the DST in June 2015, resulted in funding being increasedfrom R 0.75 million to R 6.7 million for the 2016/17 financial year (FY).'

The programme which was thus developed contained a listing of research projects ranging from fundamental to applied research, but which did not have major industry support or involvement.

In 2014, an industry forum was formed, known as the 'Centre for Technology Innovation in Mining', in an attempt to revitalize collaborative research from an industry perspective. Unfortunately, this initiative did not gain traction due to various issues relating to governance being unresolved.

So, how much should be invested in R&D? A generally accepted global benchmark is that 1.5% of the GDP should be invested in R&D. In South Africa, this would equate to R56.7 billion. Currently this figure is around 0.7%, or R21.84 billion. For mining, with a contribution of R312 billion to the GDP in 2017 (Minerals Council South Africa, 2017a), this would equate to R4.68 billion.

Clearly, to ramp to these levels from a base of R750 000, would be impossible and unaffordable. However, as part of the NDP and Vision 2030, this objective should be reached by 2030, if not before.

The current need for research and development: safety, health, and productivity

Various attempts have been made (but failed) to illustrate the widely held belief that the mining industry can be revived only if serious funding is directed towards mining research in South Africa. Traditionally, such research would have been aimed at deep-level mining requirements, involving rock engineering, ventilation, hoisting, and technology research. However, times are changing and we find ourselves in the midst of the Industrial Revolution 4.0, and the exponential rate of change occurring in the communications and digital space. These changes have been embraced in areas like the financial services sectors and aerospace, but the mining industry is playing catch-up.

Luis Canepari, Vice President of Technology at GoldCorp (Canepari, 2018), when asked to describe GoldCorp's future vision of mining, said:

'We believe the mining industry has been slow to adopt technology, slow to innovate, creating an opportunityfor Goldcorp to leapfrog. Core to our future mining technology strategy and roadmap, is the intent to create the technology foundation that will enable us to leapfrog - in terms of maximizing production, increasing efficiency, reducing waste, increasing safety, and contributing positively to the stakeholders engaged in our business. As a business, Goldcorp thinks about its future mining operations in terms of the net asset value growth opportunity that will result from technology applications and data insights across all parts of our operations. We know that this will mean reshaping the business and optimising all aspects of operations, it will touch everything that we do.'

This comment comes from a tech-savvy North American mining company, and emphasises the level of catch-up that is required in the mining industry compared to other industries and sectors. This reality is even harsher when painted against a South African conventional mining backdrop.

Canepari goes on to say:

'The environment that we are moving to is one that is fully autonomous, electrified, optimizedfor a smaller environmentalfootprint that uses less fresh water and energy, and is 100% connectedfrom the beginning. We are making investments now that are moving towards this future. Our future has a heavy focus on sustainability - in terms of power and water consumption, on minimizing waste and on ensuring the communities near our operations continue to see both social and economic benefits as a result of our operations.'

The term 'Industrial Revolution 4.0' is used to describe a further development in the management and control of the entire value chain process in mining or manufacturing, enabled by data. The transition to 4.0 is described by Deloitte (2018) as being a shift from Industrial Revolution 1.0, starting with the first mechanical weaving loom in 1784, to the first assembly line in 1870 (2.0), to the first programmable logic control system in 1969 (3.0), to the fourth industrial revolution characterized by cyber-physical production systems, and the merging of real and virtual worlds.

BMI (2017) indicated in a research report that 'Miners will increasingly invest in technology integration, including automation and internet connectivity, to improve competitiveness in a volatile mineral price environment. Major diversified miners, with the largest budgets, operating in developed markets capable of providing widespread internet access and skilled labour, will drive this trend.' Such moves into automation and connectivity are exemplified by the following observations from BMI.

'The benefits of applying technology to mining operations are clear: increased efficiency lowers costs, improved safety records and lesser waste and environmental impact. Over 2015-2016, at the bottom of the commodity price bust, miners turned to technology to cut costs and improve performance to better withstandfuture price volatility. For instance, in 2016, top copper miner Codelco increased the 'innovation budget' to USD75mnfrom USD60mn in 2015 and in December of 2016 created the Codelco Tech unit to drive innovative efforts. In September 2016, top gold miner Barrick Gold partnered with Cisco to develop aflagship digital operation at the Cortez mine in Nevada which will inform the eventual global rollout. Industry leader Rio Tinto rolled out the Processing Excellence Centre in Brisbane, Australia, and autonomous fleet utilisation in 2015.'

In the VCI (2017) 'Innovation State of Play' survey, for which some 800 respondents in the global mining industry were interviewed, the top responses to the question 'which macro-trends will have the biggest impact on the industry over the next 15 years? were 'technological change and disruption' (62%) and 'technically aware generation entering the workforce' (37%).

These are global perspectives, but what about Africa, and South Africa? The 2017 VCI survey focused on the view of South African CEOs and this showed a subtle but important difference, in that while these CEOs recognized the importance of embracing the digital revolution for competitiveness, their views are tempered by the impacts on labour-intensive operations and surrounding communities, all coupled with the need for skills development. The 'Innovation State of Play, Africa' report by Deloitte (2016) states 'Definitively, now is the perfect time to take African mining into an age where technological and organisational sophistication meet social conscience.'

These views could be the 'view from the top', so what about the 'view from the bottom'?

Any discussion around 'modernization' is a difficult one, because everyone in the conversation has a different view on what it means for South African operations. What may be possible to make an open pit operation globally competitive through automation and artificial intelligence is not possible in older, underground operations. There is thus a need to create a common vision of what modernization means for the very people that it will affect.

South Africa's mining landscape, particularly in the gold and platinum sectors, is populated in the main with labour-intensive operations using methods that have remained relatively unchanged for scores of years. The notion of automated operations in a conventional tabular mining environment is difficult to visualize, and virtually impossible to implement in practice. The result is that, for these operations, modernization involves a combination of changes in the way people work, the tools that they use, the way they communicate, and the way the system is to be optimized.

These realixations help to define the research focus.

Any R&D work that is to be done for the industry always involves an impact on people, whether this means reskilling, new learning, restructuring, new work cycles, job transfer, or the impact of modernization.

Traditionally, at best, this involved some form of consultation with labour and its representatives. At no point, because of the impact on people, was this legitimate without the full and active involvement of labour and its representatives, in the subject and objective of research and development, and the involvement of operators in design and implementation.

During the Phakisa process, this became patently obvious, but not all labour organizations from the mining sector were present. As a result, limited mandating from labour for the process was obtained. This is obviously problematic in terms of legitimacy and buy-in in the future.

It is therefore essential that the following be achieved.

► All stakeholders must be involved in a fully transparent and meaningful way, that respects their respective mandates, from the start

► A common understanding of the purpose and meaning of modernization is essential, so that a common vision can be developed

► A process of impact assessment, that leads to an acceptable win-win objective, must be developed, jointly

► The work of developing and managing the transition to modernization through research, development, technology transfer, and implementation must be led and shared equitably

► Involvement must be active at every level, from strategic to operational at the mine face, from strategic planning to operator involvement in design.

Mineral resources available: beware of sterilization

As was alluded to earlier, a basic premise for the need for R&D is to have a base of available Mineral Resources to which the R&D can be applied. Research work was done going into Phakisa that indicated that existing gold Resources amount to 592 million tons, based on published information. Where these are situated is illustrated in Figure 9. At average production rates, this is equivalent to 11 new mines. (Minerals Council South Africa, 2017)

In platinum group metals, 360 million tons of production is available (Figure 10), the equivalent of eight new mines.

Obviously, these numbers are sensitive to cut-off grade, and so the R&D work must find methods to unlock these Resources. More recent work, yet to be finalized, indicates that these numbers are seriously understated, in that other mining companies' resources are not included, and there are significant resources held by exploration companies. These figures are not available for publication at present.

R&D and the value chain

In identifying the needs for R&D it is clear, given past funding commitments to R&D, that the mining extraction phase is where the focus is required. This must clearly take account of upstream and downstream work in the value chain, but needs to focus on the mining value chain in particular. Within this context, it is also clear that in order to satisfy the needs of industry in the short, medium, and long term, a mix of fundamental and applied research is required.

Industry needs analysis has indicated that the focus for R&D should be on the development of appropriate mining systems, including emphasis on people, processes, and technologies. Thus, R&D projects need to be integrated into system design and development, with the necessary fundamental and sapiential research to enable and support such design. This also includes the involvement of the OEMs, through the Mining Equipment Manufacturer's Association of South Africa (MEMSA) to enable the identified technologies to be developed through to commercialization.

This, then, illustrates that a multidimensional matrix of R&D needs to be developed, with the required resources being sourced from organizations that can supply such expertise. This requires a further dimension in the programme design, which involves collaboration between researchers, research organizations, and research activities.

The revival: new beginnings through the Mining Phakisa

'Phakisa' in seSothu means 'hurry up', and the aim of the Phakisa labs or workshops was to involve all stakeholders in intensive discussion, in order to develop plans ranging from high-level concepts to operational actions and budgets. The Phakisa process was initiated by the Office of the Presidency, and the Phakisa lab concept was taken from examples in Malaysia for focusing on key areas within the economy in order to support the National Development Plan.

In his Budget Vote address to Parliament in July 2014, Former President Zuma said 'The journey towards prosperity and job-creating growth involves radical change in the manner in which we undertake planning, implementation and monitoring. On Saturday, 19th July, we launched Operation Phakisa, an innovative programme that brings together for the first time, many stakeholders to plan a major economic project.'

The first lab focused on the oceans industries, and the outcomes of this Phakisa were well publicized. The second focused on 'Scaling up the Ideal Clinic Initiative across the Country' and was led by the Department of Health.

Some 120 delegates participated in the Mining Phakisa, representing the State, organized labour, industry, academia, NGOs, communities, and traditional leaders, and including people up to Ministerial and CEO level.

The lab, which lasted for five weeks, was characterized by robust and open discussions, and developed five workstreams. These were:

► Reviving investment into mining

► Cluster employment

► Win-win beneficiation

► Sustainable communities

► Advancing the cluster.

These workstreams achieved varying levels of success, with the first two achieving the least (due to unresolvable differences of opinion on issues associated with the Mining Charter and the lack of a National Skills Development Plan). The third and fourth streams landed on pilot projects only, while the last one, Advancing the Cluster, achieved the most traction. It was also the one where the most constructive engagement happened, and it is likely that this was because, in relation to the other workstreams, this one, having a longterm view, was probably perceived as the least risky.

One very important outcome of the process was the establishment of new relationships that had not existed before. These included relationships with the Department of Science and Technology (DST), the Department of Trade and Industry (dti), the Department of Planning, Monitoring and Evaluation (DPME), National Treasury, mining equipment manufacturers, and the South African Capital Equipment Export Council (SACEEC).

The coalition of the willing

The building of these relationships created a 'coalition of the willing' whereby a common commitment to proceed was established, despite the fact that the outcome report of the Phakisa was not published (and still has not been).This has seriously impacted on the credibility of the work since Phakisa, in terms of the support of certain stakeholders. It was agreed that a public-private partnership should be formed and that the first work would be to co-develop the R&D programme and to form the mining equipment manufacturers into a dti-funded cluster.

Since previous efforts had failed over arguments around governance and structural issues, the 'learning by doing' approach was taken and the vision and strategy established, leaving the bureaucratic issues to be sorted out later. This turned out to be a master-stroke.

Interestingly, where the process required the development of detailed budgets (known as '3 feet plans'), these indicated the need for funding of the order of R300 million to R400 million per annum, which coincidentally is in line with the estimates put forward by du Plessis, and referred to earlier (see Figure 11).

Mining Phakisa outcomes

The first significant outcome from the Phakisa process was the commitment from the CEOs representing the mining companies on the Council of the (then) Chamber of Mines (now the Minerals Council South Africa) to the principle of open innovation in the South African mining industry R&D space. Only a few projects were ring-fenced as 'closed' due to IP issues, but it was agreed that the MMP would have access to in-house R&D projects, and that the information could be shared among other members.

A second, significant outcome was the commitment between the dti, the OEMs, and the SA Capital Equipment Export Council to establish a cluster development programme (CDP) to coordinate the efforts of local mining equipment manufacturers to increase their capacity and capability in terms of local and international markets.

A third commitment was to coordinate the SAMERDI programme that had been developed between the CSIR and the DMR with industry needs, so as to have a single R&D programme for mining that had the support of all stakeholders. Previously, such coordination and collaboration would have been met with scepticism; but still, throw-away comments like 'don't do research just for the sake of getting a piece of paper or a PhD' abounded.

The funding landscape

While the 3-feet plans identified the need for some R400 million in funding for R&D annually, it was quite clear that this would not be readily forthcoming, especially since some of the other workstreams identified funding requirements that were orders of magnitude higher.

It was not clear at this stage where R&D funding could be sourced, and the existing landscape for R&D direct funding and incentives was investigated.

Examination of the state vehicles to provide R&D funding showed a complicated landscape that applied across the board, to all industries, and thus any mining R&D or mining equipment manufacturing funding application would have to compete with applications from other industries. Such competition would be difficult, given the perception in many quarters that mining was a 'sunset industry', despite the Phakisa outcomes.

Investigations revealed the following funding options to be available (COVA, 2016).

► Section 11D incentive: Expenditure incurred in the discovery of novel, practical and non-obvious information or devising, developing or creating any invention, design or computer programme or any knowledge essential to the use of the invention, design or computer programme. Deduction increased to 150% for expenditure incurred on or after 2 November 2006 up to October 2022. Pilot plants or prototypes qualify for this allowance.

► Technology for Human Resource Programme: THRIP supports all companies undertaking science, engineering and technology research in collaboration with educational institutions and will consider the support of projects in which the primary aim is to promote and facilitate scientific research, technology development, and technology diffusion, or any combination of these. THRIP will contribute between 30% and 50% of the funds invested by a company in research projects. For all SMME and all SMME and B-BBEE partners the THRIP funding will contribute between 100% and 200% of the funds invested. The maximum level of THRIP funding per grant holder will be set at R8 million across any number of projects per annum.

► Support Programme for Industrial Innovation: Promote technology development in South Africa through provision of financial assistance to all South African registered enterprises in manufacturing or software development that engage in development of innovative, competitive products and/or processes. Maximum incentive of R5 million under matching scheme. Partnership scheme provides for repayable grant of over R10 million subject to Intellectual Property ownership Issues.

► Manufacturing Competitiveness Enhancement Programme: Providing assistance for participants in the manufacturing and engineering sector, including conformity assessment agencies. This incentive programme is not available to start-ups or companies without at least one year's manufacturing track record. Maximum incentive of R15 million on product development costs.

► Technology Innovation Agency Programmes: This incentive uses a flexible returns structure be it royalty, equity, convertible loans or combinations thereof, structured as appropriate for each investment.

► Manufacturing Competitiveness Enhancement Programme: Cluster: Support to clusters and partnerships of firms, engineering services and conformity assessment services in the manufacturing industry to define and implement collaborative projects related to production and marketing that will enhance productivity and competitiveness. Grant is limited to R50 million. Pilot projects can qualify.

► National Industrial Participation Programme: NIP is an obligation on all suppliers who provide goods and services to Government that have an imported content of $10 million and above to participate in some form of economic activity through either investment to raise production capacity and competitiveness in strategic sectors of the economy; export promotion; R&D collaboration; technology transfer; and acquisition.

Discussions with mining companies and OEMs revealed the following problems with these funding options.

► The reclamation of incentives is a difficult process, and time-consuming to the extent that refunds or tax relief only become available in a different financial period, if at all. Thus many companies do not bother to enter such claims.

► Access to funds is very onerous and difficult, not only in terms of the effort required and the criteria to be satisfied, but also in terms of the reporting requirements after the award of funds.

► Funds generally require industry contributions up to 50%. This is problematic for industry unless the incentives are accessible.

► Funding windows open and close, sometimes leaving inadequate time to make applications, and sometimes out of synch with budget, academic, and business cycles.

These concerns indicate a need to establish a dedicated funding agency or model that can serve as an easily accessible, user-friendly, one-stop-shop for the mining value chain, similar to that of the automotive industry, where the Automotive Investment Scheme makes targeted grants to support the growth and development of the automotive sector.

In terms of private sector support and mentorship, according to Engineering News (2 February 2018), a R3.5 billion venture fund is being established this year, aimed at boosting black economic empowerment in the automotive manufacturing industry, supported by BMW, Ford, Nissan, Mercedes Benz, Toyota, Isuzu, and Volkwagen.

Developments since Phakisa

The fundamental requirements for a successful R&D programme are:

► Research money

► Support and commitment.

► Research people

► Governance

► Research topics

► Sites and data to do research.

The manner in which these have been secured since Phakisa is covered below.

The Phakisa process delivered a collective commitment to proceed with the work of Advancing the Cluster, and the main features of this demonstrated commitment were as follows.

Funding commitment

The first monetary commitment to the Phakisa outcome came from the DST. The original site of COMRO, at Carlow Road, had become the property of the DST. In the days of MiningTek, it was used by the CSIR, but after the move and incorporation into the CSIR in Pretoria, the site became vacant. At one stage there was consideration to sell the property for urban development, but the DST then pledged that the site and buildings would be made available to the R&D effort. In this regard, the CSIR would be the landlord of the property, with a rental being paid to the CSIR. As a result, the site was opened in 2016, and researchers and support staff started to move in.

The Chamber of Mines (now the Minerals Council South Africa) had been through a process of reinvention, and part of this process involved demonstrating support from the mining industry towards research, development, and innovation, driven by the Vision 2030, which is described in a position paper on 'People-centred modernisation in mining; (Minerals Council South Africa, 2017b).

The area of modernization has demonstrated support from the chief executives of the Minerals Council South Africa, who have agreed on the strategic objective of promoting innovation, research, and development for the mining sector by facilitating collaborative efforts in innovation that will contribute to achieving zero harm and sustainable, viable, and socially acceptable mining into the future (Minerals Council South Africa website).

In order to back this statement, the Minerals Council South Africa pledged financial support to fund a modernization consultant and an intern, as well as various supporting programmes.

The principle of open innovation that had been agreed allowed the individual expenses of mining companies on their own R&D efforts to become shared. This represents a serious financial commitment to the R&D programme, but the DST saw this as 'in-kind' contribution, rather than 'money on the table'. Despite this, the contribution of experience and knowledge of individual companies to the collective is highly significant.

The next tranche of financial commitment came from the dti. The desire had been expressed at Phakisa to establish a cluster development programme (CDP) for the Mining Equipment Manufacturers of South Africa (MEMSA), in order to stimulate the cluster and to encourage local supply chain development and export potential. The dti pledged R8.4 million to cluster development, which enabled MEMSA to be formed as a Cluster and a registered entity. This required MEMSA to action a series of tasks, which included:

► Advocacy - government and mining industry

► Marketing South African capacity via a range of media, exhibitions, and an interactive website

► Networking and growth sessions

► Information dissemination

► Facilitate equipment testing (with the Mining Precinct)

► Skills development and technology development

► Supply chain development

► Benchmarking and improving manufacturing performance.

The DST had pledged support to research and development in its White Paper, and specifically to the mining industry.

This commitment was backed up by the pledge of funding for the SAMERDI programme from the DST, in terms of R27 million in FY 2017/18, R63 million in FY 2018/19, and R60 million in FY 2019/20. This funding was conditional on the Minerals Council South Africa contributing direct investment to SAMERDI. This was agreed between the Council members, and funding to the amount of R33 million was pledged for calendar year 2018.

This was announced in the DST Budget Vote speech in Parliament on 16 May 2017 when DST Minister Naledi Pandor said:

'Sustainable mining activities require a substantial investment in research and technology. Over the next three years, R150 million will be invested in re-establishing mining and mining equipment R&D.

This investment will help to restore the old CSIR mining researchfacility in Carlow Road, Johannesburg. This facility, known as the Mining Precinct, will be launched during the second quarter of this financial year. A number of mining-related associations and mining equipment manufacturers clusters are already working in the facility.'

During 2018, the DST pledged a further R60 million for FY 2020/21.

In summary, an annual funding amount averaging R100 million has been realized.

Collaboration and open innovation

As described earlier, the spirit and commitment to collaboration and innovation was established during the Phakisa process, and active participation of mining companies was engaged. The current membership of MEMSA consists of 19 South African companies.

Ongoing discussions between participants led to an agreement that the public-private partnership model should function as a 'Hub-and-Spoke' model, wherein a lean management hub would be established, that then created an R&D network with research organizations, universities, industry and industry sites, OEMs, and other resources. The Hub would be represented by the principal funders, these being the MCSA, the DST, the dti, the DPME, and the CSIR. This model was based on research work that identified best practices in similar organizations worldwide, as well as researching the successes and failures of previous attempts or organizations such as COMRO, CoalTech, and DeepMine.

The global search included the Canadian Mining Innovation Council (CMIC) and the Australian Industry Growth Centres Initiative developed through the Australian government's Department of Industry, Innovation and Science.

The following quote from CMIC was noted. 'From the beginning, CMIC was a volunteer organization with minimal infrastructure andfew paid employees. With that lean beginning, CMIC still managed to organize the largest collaborative projectfunded by NSERC, the Footprints Exploration program involving 14 universities and 26 companies rangingfrom majors to small technology providers. This program epitomizes CMIC goals - to facilitate broadbased collaborative research and innovation.'

The Australian model, more formalized than the CMIC, notes 'Growth Centres will lift the levels of collaboration between businesses, industry, research organisations and government in order to better capitalise on the excellent research and development undertaken and scientific knowledge generated in Australia.' Furthermore, 'The Growth Centres will work closely with state and territory programmes and industry associations to ensure activities delivered by each Growth Centre complements existing activities and services, and to leverage their networks, expertise and experience. One such growth centre established is the mining equipment, technology, and services growth centre'.

These studies indicate that successful hub-and-spoke models have been established elsewhere, and that there are serious learning points that could be incorporated into a South African model.

Further research into regional initiatives that aimed to stimulate regional economies through R&D (such as the Bothnian rim studies) illustrates how sectoral R&D activities can be extended to support regional economic development, through regional collaboration.

An important observation from all of these studies was that any collaborative R&D programme must be a part of a wider 'ecosystem' if it is to gain wide support and have a meaningful impact. This ecosystem should extend beyond the immediate focus of the R&D programme, and look in terms of a common strategic vision, and to matching with national and international imperatives.

The development of such an ecosystem and hub-and-spoke model required further work, so rather than wait for this to be developed and implemented, the decision was taken to proceed using the learning-by-doing principle, using the CSIR (then known as the Mining Precinct@Carlow Road) as the 'incubator' for the initiative. This enabled sign-off by a legal entity when contracts and MoUs were to be signed.

The CSIR then, as the incubator and legal entity, was used to assist in the development of policies, procedures, and governance structures, and to sign off on research contracts with the universities on behalf of the DST.

Some previous R&D initiatives were established in terms of competitive bidding for R&D contracts between research institutions. This created some degree of animosity and was not optimal for true collaboration. Therefore, in calling for 'spoke' organizations to become involved in R&D programmes, a collaborative model was formulated that called on the research organizations to collaborate on each programme, and to agree with each other on what their individual inputs would be, to enable the achievement of the objective of the programme and the collective. In terms of making collaboration work, this was a success, but resulted in some practical issues and perceptions in phase 1, which have been identified and are being addressed in phase 2. In particular, it resulted in university researchers offering small amounts of time within their busy schedules, with the result that delivery was problematic. The new model is explained below.

Research people

Since the heady days of COMRO, research capacity in South Africa, particularly as regards senior researchers, has dwindled, either due to retirement or moves offshore, as well as cutbacks in funding and research effort. Research work at universities has tended to become academic and fundamental, and is often criticized for irrelevance. Thus, new arrangements have been put in place to reconstitute research capacity and capability through collaborative arrangements (in the hub-and-spoke model) with research institutions. This has been added to through the employment of interns, who are on an intern research development programme, and with people sourced through the Young Professionals Council of the Southern African Institute of Mining and Metallurgy (SAIMM). These 'new' researchers are being coached by a panel of mentors, which consists of senior people drawn from a background in industry, academia, and research (the 'grey-haired club').

Formalizing involvement and governance

Despite not being a legal entity, the Hub has established a series of advisory and governance structures that are fit for purpose, to suit the requirements of the sponsors and interested and affected parties. It has, from the start, been important that clear mandates are delivered from industry. In order to do this, an Innovation Team was established, which initially advised and gave mandates for the Phakisa process, but which then formed an advisory panel to guide the technical programmes. This team consists of senior executives from the member companies of the MCSA. This team, in turn, is mandated by the individual company executives, as well as by the MCSA Board.

Additionally, each research programme has a Steering Committee, which is constituted of industry experts, and these committees meet bi-monthly to advise and sign-off on business plans and close-out reports, and to monitor progress. These committees have been supportive and successful.

A SAMERDI Steering Committee has been established, which consists of members from the DST, dti, MCSA, CSIR, DPME, National Treasury, and MEMSA, as well as the Hub Executive. At this stage, neither the DMR nor organized labour are included, but these are the subject of current discussions, as indicated below.

An Executive Team has been established, consisting of two co-directors representing the CSIR and the MCSA.

Within the Hub, each programme has a programme manager, with principal investigators, senior researchers, researchers, and interns.

The R&D programmes: research topics

Through intensive interaction with industry, six workstreams or programmes have been identified. The three core programmes represent different levels of modernization according to the status of candidate operations.

The first, called Longevity of Current Mining (LoCM), focuses on the opportunities that are available to research short-term solutions to improve current operations and return them to profitability. This programme is particularly important in discussions around job preservation and modernization.

The second programme focuses on mechanization of operations, where mechanization is appropriate (bearing in mind that current operations may be difficult to mechanize on a retrofit basis). There are examples of best practice in underground mechanization in Southern Africa (such as Two Rivers, Zimplats, Mimosa, Target, South Deep, and Bathopele, as well as in the diamond, coal, base metals, manganese and chrome industries), and these learnings need to be used to identify gaps for achieving global best practice (in an Industrial Revolution 4.0 context), so that whatever level an existing mechanized or hybrid system is at, it can be modernized. This involves mining methods and technologies that allow mechanized and autonomous mining of orebodies that cannot be mined using conventional methods because of cost, grade, safety, health, or mining cycle factors.

The third programme is a long-term programme that focuses on researching and developing continuous mining methods and technologies that allow mechanized and autonomous mining of orebodies that cannot be mined using conventional methods, either because of cost, grade, safety, health, or mining cycle factors.

Three cross-cutting programmes have been identified and actioned which support these three programmes.

The first of these is Advanced Orebody Knowledge, which is a programme aimed at creating real-time 3D models of the orebody and its geological setting. This is important for the proactive management of risks associated with geological structures, and to ensure that orebodies are well enough known to be able to apply capital-intensive mining methods. This programme is to be extended to include greater confidence in mine planning (design and scheduling), optimization studies, and process optimization through geometallurgy and ore flow management.

The second is about people. A central theme in all initiatives is that modernization is people-centric. This being the case, nothing can be done without the inclusion of people in all levels and activities of the R&D. This includes developing a common understanding of what modernization means, impact assessments, change management processes, and extensive engagements. This programme is known as Successful Application of Technology Centred around People (SATCAP).

The third is Real Time Information Management Systems (RTIMS) which focuses on the digital revolution in mining. While a myriad of software developers and suppliers offer 'solutions', many of these are point solutions that create new problems of data integration and transmission complexity. This programme is aimed at designing fit-for-purpose RTIMS for the mining industry, and underground mining operations in particular.

Sites and data to do research

In the early technology readiness levels, research is conducted as desktop research, or at the laboratory or pilot scale. It is not difficult to provide sites and facilities for these activities, whether as dedicated facilities or at research institutions.

Surface testing facilities are also usually available, whether with OEMs, or on mine surface facilities, or at facilities such as Kloppersbos (a CSIR site near Pretoria used for coal gas explosion test work).

The difficulty arises when sites are needed where prototype units can be tested, and tested in production environments. While industry has offered many pilot sites for the testing of individual technologies, these too often become unavailable or inaccessible due to either production pressures, interference due to poor change management processes, or geographic spread.

A dedicated test mine therefore becomes a necessity in the interests of multiple stakeholders.

Meaningful research requires data, and although the principle of innovation encourages and allows access to data, sometimes data is still protected by intellectual property issues, or is in formats that are not compatible. Sometimes, data is protected by OEMS and cannot be accessed directly by the mining companies.

Delivery

The DeepMine programme took two years to develop before work commenced. By contrast, the SAMERDI programme, through the Precinct, took one year to develop, from February 2016 until March 2017, which is when phase 1 of the programme began. Phase 1 of the programme ran from 1 April 2017 until 31 March 2018, with close-out reports for each programme being completed and approved through Steering Committees by June 2018. Most of the work involved in phase 1 was in the form of reviews of past work, and the identification of research and development work to be done in phase 2, based on these baselines.

Phase 1 work led to the frightful conclusion that much previous research work was either lost and untraceable or was never documented at all. This provided a serious lesson, that all new work should be stored in a secure and open access virtual library, and that in the case of in-house R&D by mining companies, this information should be contained in close-out reports that could be stored for future use and reference. Already AngloPlatinum and AngloGold Ashanti have made such reports available.

Ever-expanding scope

Reference was made earlier to the development of an 'ecosystem', and experience has shown this to be exactly necessary. R&D work on finding solutions to mining problems 'within the mine fence' cannot be done in isolation from what is happening outside of the fence. This becomes particularly important when one considers what the impacts of modernization in the mine will be upon surrounding communities, and on local manufacturing and supply chain management.

Mines inevitably close at some stage. While the LoCM programme aims to keep operations open as long as the remaining resources can be exploited viably through modernization, other programmes aim to open access to new resources through implementing more advanced technology.

A clear aim of Phakisa is to nurture and increase local mining capital goods manufacturing industry's capability and capacity. Attention also needs to focus on the local supply chain for consumables, components, and services.

This prompts the question as to what 'local' actually means. In the context of the draft Mining Charter this would mean anything from the 'shadow of the headgear' to the provincial or national scale. In this context, 'local' opportunities exist for encouraging import substitution by investment into local manufacturing at each of these levels, at appropriate levels of capital intensity and complexity at each level. This offers the opportunity to develop 'companion projects' at local community level, where local SMEs can be developed to supply the mines, thus creating employment opportunities in poverty-stricken communities. Clearly, this requires intensive and meaningful dialogues to be established with such communities, with real value propositions.

In the African Mining Vision context, 'local' means the African continent. This supports the aims and ambitions of MEMSA to engage with companies investing in African mining and infrastructure, and to offer South African products of superior quality, equal levels of sophistication (if that is what the customer wants), and at competitive prices. South Africa, with its sound infrastructure, strong financial services sector, intellectual capital, and manufacturing capacity, along with its BRICS connections, should be well placed to be the gateway for these opportunities into Africa.

Clearly, these focuses require that research and development goes well beyond pure in-mine technology application, and extends on the one hand to all commodities, and on the other across the full value chain. They also require emphasis on the establishment of open, free trade markets in which South Africa can be competitive.

The five Phakisa workstreams alluded to earlier include sustainable investment, skills development, sustainable communities, and win-win beneficiation. In view of the fact that little work has been done in most of these workstreams, because of the interdependencies with the Advancing the Mining Cluster which cannot be realized because of this inactivity, the Precinct has had to engage in a number of activities that would have been included in these workstreams had they been pursued.

For example, the LoCM initiative now focuses strongly on efficiency, safety, health, and productivity, as well as attracting investment into new, mechanized, and modernized operations (workstream 1). It also has had to engage strongly in the area of skills development, through dialogue with universities, Technical and Vocational Education and Training (TVET) colleges, and the MQA, and ultimately with labour and communities.

In the area of sustainable communities, localization and the development of local agri-businesses on vacant land adjacent to mines and mining communities are also topics on the Precinct agenda.

Engagement is also active in the beneficiation area, through platinum beneficiation, and the stimulation of the local iron and steel value chain to support local capital goods manufacturing.

All of this being on the agenda of the SATCAP programme, for community and other stakeholder dialogues.

Thus it is clear that the scope of work of the Precinct is ever-increasing, but this 'scope creep' is in the national interest. Unfortunately, SAMERDI cannot cover the costs of these important areas of development, and therefore other funding sources must be explored.

Where we are now

A great honour was bestowed upon the Precinct when the Mandela Foundation gave permission for the Precinct to be renamed the Mandela Mining Precinct in 2017. This honour, supported by the Minerals Council and the State, not only gives recognition to the importance of the MMP, but also places pressure on the MMP to deliver in the national interest, in the name of Madiba.

The Precinct now has approximately 70 occupants, ranging from researchers and programme managers to learned societies, State representatives, and a value chain simulation facility.

The first phase of the SAMERDI programme is now completed, and work is under way on phase 2, with all close-out reports from phase 1 approved and business plans for phase 2 and beyond approved by the Technical Steering Committees. This in itself is proof that the governance structures are working well.

The collaborative structure that was established in phase 1 did not work well. It relied on universities nominating time that they could spend on research projects, in terms of each individual person's time. Where academics were involved, this conflicted with their teaching workload, and for researchers it meant that the time allocation was inadequate to ensure continuity and a material research effort. At worst, it was perceived as a 'labour broking' model that would not leave behind any meaningful capacity or capability development.

As a result, a new model has been proposed which relies on the establishment of Centres of Competence at universities, with a Centre, and effectively, a Chair, at one participating university for each programme. Although the Chair for a programme will be at one particular university, the research capacity will be spread across various institutions. Additionally, funding will be conditional on a major university 'twinning' with a historically disadvantaged university, to build capacity and capability there. This model will allow more dedicated time to be spent on research projects and will help with building sustainable research capacity and capability.

This model is still under discussion, but the concept has been accepted enthusiastically.

The research work that has been done in phase 1 has delivered successful results thus far. These include:

► High-resolution 3D modelling of chromitite stringers in PGM stope hangingwalls

► Definition of gaps and constraints in conventional mining cycles

► Identification, prioritization, and selection of 40 applicable stope modernization technologies

► Identification of root causes of lost blasts across industry

► Selection of candidate non-explosive continuous mining systems

► Development of an 'Internet of Things' reference architecture

► Opening of dialogues, engaging with all stakeholders, on the impacts of modernization.

This includes the establishment of bilateral discussions with, among others:

-

The Association of Mineworkers and Construction Union

-

The National Union of Mineworkers