Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.118 n.8 Johannesburg Aug. 2018

http://dx.doi.org/10.17159/2411-9717/2018/v118n8a6

SOCIETY OF MINING PROFESSORS 6TH REGIONAL CONFERENCE

Limits to artisanal and small-scale mining: evidence from the first kimberlite mines

W.P. Nel

University of South Africa

SYNOPSIS

The number of people involved in artisanal and small-scale mining (ASM) has grown quickly to about 40.5 million, compared to 7 million in industrial mining. Furthermore, the ASM sector is contributing significantly to global mineral supply and new opportunities are arising for ASM in an evolving mining ecosystem. Given this growth trend, it is important to ask whether ASM is likely to be successful in the mining of all types of orebodies. The history of early South African diamond mining suggests that the mining of a massive ore deposit by numerous artisanal and small-scale miners is likely to result in poor safety conditions as the depth of mining increases. Early photographs taken at the Kimberley mine showed a very uneven pit floor with leads-lags between the claims. This raises the question of why neighbouring miners did not ensure safer working conditions for each other. Two models described in the paper illustrate why there is likely to be a lack of cooperation and coordination between miners to address this and other safety-related problems. The dynamics of multiple claim holders mining next to one another at increasing depths are analysed, and it is shown that a consolidation of claims into a single firm per kimberlite pipe was required for improved planning, coordination, safety, efficiency, and sustainability.

Keywords: artisanal and small-scale mining (ASM), coordination, mine management and economics, mine safety, rules, Theory of the Firm.

Introduction

Diamonds are mined from alluvial deposits, kimberlite pipes, and lamproites by artisanal miners and firms of different sizes. Humanity has known diamonds for thousands of years, and diamonds were first mined in countries such as India and Brazil from alluvial deposits. It was, however, the 1867 discovery in South Africa that resulted in a big increase in the global supply of diamonds and the launch of the modern diamond market (Janse, 2007; Levinson, 1998). 'Dry diggings' in kimberlite pipes located in South Africa during the second half of the 19th century led to Emil Cohen's suggestion that such diggings were conducted in cylindrical 'pipes' that represented volcanic conduits for diamonds that were brought up from many kilometres below the Earth's surface.

Kimberlitic and related magma types such as lamproites are the primary sources of diamonds (Levinson, 1998; Robb, 2005). Because this fact was initially unknown to the diggers, they approached such diggings in a similar manner to 'wet' (alluvial) diggings, expecting to reach bedrock after a few feet (Turrel, 1987; Meredith, 2008). The dynamics of these diggers, mining next to one another at increasing depths, are analysed in this paper and an attempt is made to illustrate that the consolidation of claims into a single mine per kimberlite pipe was required for improved planning, coordination, safety, and efficiency. History shows that the mining of a single kimberlite pipe at increasing depths by multiple claim-holders next to one another is not sustainable over the full potential life of such an orebody.

In its early years, before the existence of South African mining companies such as De Beers, the diamond mining industry consisted of hundreds of individual diggers and claim owners who were initially self-regulated by rules that, for example, opposed concentration of ownership and thus kept barriers for new diggers to enter the industry at very low levels. The diggers elected persons to represent them on 'Miners' Committees', which were responsible for making and enforcing rules. These Miners' Committees, representing hundreds of individual digger-entrepreneurs, were the first form of organization on the South African diamond fields. The focus of this paper is on how it became necessary, despite the initial anti-consolidation ('anti-monopoly') rules, for ownership at the level of a single kimberlite pipe to be consolidated. The result was that all the claims on a specific kimberlite pipe became consolidated under a few large owners, including companies, and eventually by a single company.

The mining of claims at increasing depths resulted in increased safety risks, associated loss of life, and water inside the pit, requiring greater cooperation and coordination between the hundreds of individual claim-holders. The fortunes of claim owners varied and some diggers may have had little or no working capital to address such problems.

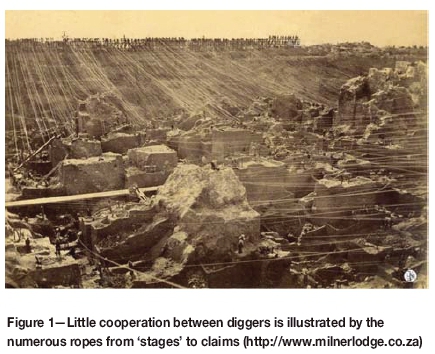

Claim and concessionary holders did not cooperate much, as can be seen from the duplication of equipment such as windlasses and 'stages' in Figure 1. The photograph was taken at a time when the roadways were removed because they had become unstable and posed a safety risk. The photograph also illustrates that digging at the different claims proceeded at different rates, giving rise to leads-lags and an uneven pit floor. Williams (1905) describes the scene at Colesberg Kopje as a 'jumble of holes, pits and burrows with no attempt to secure any system or union in mining'.

This case study illustrates that, under certain conditions, large-scale mining may result in greater efficiencies and lower safety risks than small-scale mining. This paper is about organizational change on the early South African diamond fields, the dynamics of numerous owners mining side by side, and contributing to the still incomplete Theory of the Firm (Demsetz, 1988).

The growth of informal mining and the need for formalization

The purpose of this section is to provide some background information on the latest developments in artisanal mining and the associated challenges.

The increased number of people involved in artisanal mining can be ascribed to a number of causes. One is that not enough jobs are created in the formal economies of certain countries. This is the situation in Zimbabwe, where many citizens left the country and others had to find a way of making a living in the informal sector of the economy because of depressed conditions in the formal sector. According to one source the informal economy of Zimbabwe, estimated to be larger than 60% of the gross domestic product (GDP), is now the second biggest in the world. This can be compared with the most developed economies, those of Switzerland and Austria, where the informal sector comprises only 7.2% and 8.9% respectively of the GDP (Medina and Schneider, 2018).

In South Africa many job losses have occurred in the minerals industry and this may be one reason why illegal mining by the so-called zama-zamas has increased. Today, infrastructure such as shafts created by large-scale miners is used by artisanal miners to extract some value from orebodies that large mining companies, with high fixed costs, are no longer able to do. The identification of such niches by artisanal miners has resulted in the expansion of the mining ecosystem. According to Omarjee (2017), South Africa has more than 6 000 abandoned mines, some of which are currently been exploited by artisanal miners.

Although artisanal mining has advantages such as the generation of income for its participants, it also has certain disadvantages. Apart from the various potential problems arising from informal mining not adhering to some or all of government's safety- and environmental-related laws and regulations, there is also an impact on government income because it is relatively easy for the informal sector not to pay taxes and get away with it. There is, therefore, a need to formalize informal mining, not only to broaden the tax base of government but also to improve the working conditions of such miners.

Two recent initiatives to legalize and/or formalize informal mining are those by the Department of Mineral Resources (DMR) of South Africa and by Birrell Mining International, who re-opened the Klipwal gold mine in KwaZulu-Natal. The DMR recently announced an initiative to legalize the extraction of diamonds from 'floors' at Ekapa, and at Klipwal former zama-zamas are now working for the mine (Wood, 2017).

There are, however, limitations to ASM. At the first kimberlite mines consolidation and formalization of mining took place to improve safety and working conditions. The mining of large, massive orebodies at depth by artisanal miners is, therefore, not recommended based on arguments in this paper.

From alluvial to kimberlite diamond mining: 'The orebody dictates'

The purpose of this section is to illustrate that whereas alluvial diamond deposits could be successfully mined by artisanal miners, that was not the case for the mining of kimberlite pipes at depth.

Alluvial diamonds were mined at the Deccan diamond fields of India, in Brazil, and the Urals before the exploitation of alluvial fields in South Africa started in the 1860s (Williams, 1905). The diggers in South Africa initially mined diamonds from claims along the banks of the Orange and Vaal rivers at places such as the Mission Station of Hebron, the kopje (hill) near the Klip-drif camp (later called BarkleyWest), and Pniel (Joyce, 1988; Williams, 1905). These were all alluvial diggings.

At the time when alluvial diggings first started in South Africa, nobody knew that the rock that later came to be called kimberlite was the primary source of diamonds. Diamond-bearing kimberlites were soon found at a number of places such as the De Beers, Kimberley, Dutoitspan, and Bultfontein mines and were called 'dry diggings' because they were not closely associated with rivers. It was at Dutoitspan that a digger discovered that the kimberlite rock was, unlike alluvial diggings, not restricted in depth down to the bedrock of a river. The mining of diamond-bearing ground at Dutoitspan at deeper levels resulted in ground slides and rockfalls. It soon became clear that the artisanal and small-scale way of mining claims situated at alluvial deposits were not suitable for the mining of kimberlite pipes at deeper levels. The differences and similarities between the two types of ore deposits and mining methods are summarized in Table I.

Table I briefly describes some of the characteristics of alluvial versus kimberlite mining. When the first 'alluvial' miners started to mine kimberlite pipes they had no prior knowledge of the nature of the orebody, the implications for mining, and how mining practice had to be changed as depths increased beyond those they were used to at alluvial claims. It could be argued that these changes led to the transition from ASM to large-scale, capital-intensive mining associated with the firm as organizational structure over the years, as the depth of mining increased and underground mining methods had to be used to exploit the massive vertical orebodies at ever-deeper levels. Such a situation is well encapsulated by the slogan 'the orebody dictates', which is a basic tenet of the so-called 'Harmony Way' (Lanham, 2006).

Self-governance and regulation: the rules of the game

The hundreds of digger-entrepreneurs on the South African diamond fields were initially self-governed through organizations such as 'Diggers' Committees' (Williams, 1905, p. 146) and/or the Diggers' Mutual Protection Association (Worger, 1987).

Such organizational structures served the diggers' interests as a group through a system of voting and rules. According to Williams (1905) these rules worked remarkably well despite being simple in nature. However, as the depth of mining increased and safety and working conditions deteriorated, some of the rules had to be changed in an attempt to address such conditions. Some of the rules on the South African diamond fields may have been proposed by diggers who were involved in previous rushes, for example the Ballarat and Californian gold rushes.

In this paper the word 'rule' is broadly used to include not only laws and regulations promulgated by government, but also self-regulating type rules introduced by a group or industry. Most, if not all, self-governing diggers had rules related to claim size. The sizes of claims varied; at Colesberg Kopje (The Big Hole), for example, it was 31 by 31 feet. Colesberg Kopje was divided into more than 400 claims as a result of this. Some of the claims at Colesberg Kopje were later split up by concessions, bargains, and sales (Williams, 1905). Another related rule was that a digger was allowed one claim only (Worger, 1987). At Dutoitspan it was two claims per digger, probably because Dutoitspan was a poorer mine and, therefore, the demand for claims must have been lower (Payton, 1872; Turrell, 1987). Combined, these rules had the purpose of accommodating as many diggers as possible and of opposing concentration of ownership. They initially helped to keep entry barriers for new diggers (or artisanal miners) at very low levels. Any person who wished to do so could become a digger because they were not excluded by high capital barriers - only simple equipment such as shovels, picks, and sieves was used and, therefore, the extraction process was initially labour- rather than capital-intensive (Worger, 1987). Another objective of the rules may have been to keep down rivalry for claims. It seems that the rules worked well on the early diamond fields in comparison to the situation of illegal miners on Gauteng's East Rand today, where groups of illegal miners are turning on one another (Payton, 1872; Magwedze, 2017; TimesLIVE, 2017).

Another rule, referred to here as the 'Use it or lose it' rule, was applied when a claim was not worked for three days (Worger, 1987), or eight days at Dutoitspan (Payton, 1872).

This rule may have had more than one objective, one related to the opening up of ownership while another may have been an attempt to eliminate excessive leads-lags between claims, which are clearly visible in Figure 1. One exception, and one change of rules, are listed in Table II.

The focus of this paper is on how it became necessary, despite the initial anti-consolidation (anti-monopoly) rules and the inertia that opposes change, for ownership at the level of a single kimberlite pipe to be consolidated. The result was that all the claims of a specific kimberlite pipe passed into the hands of a few large owners, including companies, and eventually to a single company.

Three types of consolidation on the South African diamond fields

Three types of consolidation occurred fairly early in the South African diamond industry. They are briefly discussed below.

► The consolidation of ownership of numerous claims at a specific kimberlite pipe, for example at the Big Hole (Kimberley Mine). This form of consolidation resulted in a transition from ASM to large-scale mining (LSM), the latter being closely associated with the firm as form of enterprise and organizational unit.

► The consolidation of ownership of various kimberlite mines, for example the consolidation of the De Beers, Kimberley, Bultfontein, and Dutoitspan mines into De Beers Consolidated Mines (DCM). This resulted in diamond production being confined to fewer producers. A number of persons linked this type of consolidation of ownership to monopolistic practices (see, for example, Montpellier, 1994).

► The consolidation of diamond sales through, effectively, one selling organization. At one time the Central Selling Organisation (CSO) controlled 90% of the world's diamond sales. This consolidation of sales had been described as 'cartel-like behaviour' (Bergenstock, 2001, p. 2; Reekie, 1999; Montpellier, 1994)

It is important to differentiate between these types of consolidation because different reasons are behind each type and the impact ranges from local to global. The cartel-like behaviour that DCM and the CSO were accused of is linked to the aim of controlling global diamond supply. Although the monopolistic behaviour that DCM was accused of cannot be achieved without the first type of consolidation, this paper illustrates that other, completely different reasons and dynamics were behind the first type of consolidation. It is a type of consolidation that should not raise any red flags with a Competition Commission or when anti-competitive laws are designed, as there are sensible reasons behind it. One of the reasons why this type of consolidation is often overlooked in the general literature is because it is of a more technical nature, whereas the second and third forms of consolidation are linked to issues related to market structure, which is much more commonly reported on and more widely applicable to all types of industries.

Differences in diggers' incomes gave rise to an uneven pit floor

Differences in the income and expenses of diggers may explain a number of things, for example, the uneven pit floor illustrated in Figure 1 and the associated safety risks. The incomes of diggers probably differed because of the non-homogenous diamond distribution in a specific kimberlite pipe. Williams (1905, p. 150) confirmed that neighbouring claim owners often had different budgets and some diggers could not sustain themselves for long on the diggings, which were described as 'gambling speculation'.

Diamond quality and grade varied greatly between the kimberlite pipes (Williams, (1905) but, more significantly, the distribution of diamonds in a single kimberlite pipe could be highly erratic, with little or no consistent evidence of a decreasing relationship between grade and depth (Nixon, 1995; Robb, 2005). Clement (1982) studied the De Beers, Wesselton, Dutoitspan, Bultfontein, Finsch, and Koffiefontein kimberlite pipes and reported on grade variations within and among discrete intrusions in the pipes, each pipe being made up of multiple magma intrusions over time. It seems that during each intrusion, different degrees of mixing with the host rock occurred, probably as a result of turbulence and convection. Evidence shows grade differences between different intrusions at a specific depth in a pipe. The DB3 kimberlite intrusion at De Beers was of a higher grade than the other intrusions over a significant part of the pipe, for example (Clement, 1982).

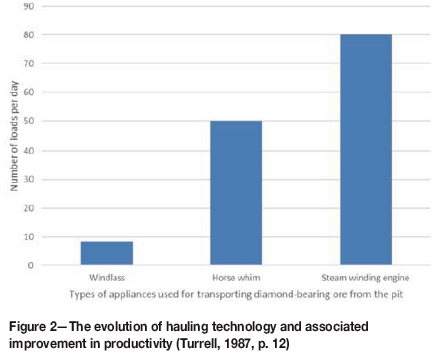

The non-homogenous distribution of diamonds in the first kimberlite pipes probably explains, largely, why some claim owners were luckier or more successful than others -some claims generated better cash flows than others and therefore some diggers received a better return on their labour. Such claims would have been valued higher than those that generated lower cash flows. It is known that some claims were subdivided, and it is therefore quite possible that labour was more concentrated in those areas of the pit, resulting in a faster extraction rate and thus giving rise to an uneven pit floor as illustrated in Figure 1. It is probable that high-income claims were in demand and that some owners subdivided and sold them as another source of income. High-income diggers would have been more able to afford the hiring of additional labour and introducing some labour specialization. In contrast, other claims may have been worked by a single digger who had to climb out of the pit once a container was filled with ore to process it somewhere outside the pit. Diggers who earned more could afford better equipment over time as technology evolved. In 1877, hauling at the Kimberley Mine was done by a mixture of steam winding engines, whims, whips, and windlasses, pointing to the fact that many diggers did not have the capital to acquire the latest technology (Turrell, 1987). Figure 2 illustrates why diggers who could afford the latest technology had a better chance of mining at higher rates. The different depths at which neighbouring claims were worked created a safety risk, somewhat similar to that created initially by the roadways. There was no financial incentive for one digger to wait for a neighbouring, lagging digger to catch up and therefore that type of cooperation and coordination did not take place. Much of the information in this paragraph has been used to construct model 1 in Figure 3.

The causes listed in Figure 3, together with a lack of adequate incentives and the type of authority exercised within a firm to enforce a higher level of planning and coordination between neighbouring workings, resulted in the uneven pit floor illustrated in Figure 1. A model to illustrate the impact of erratic diamond distribution in a kimberlite pipe and how that contributed to this situation is depicted in Figure 3. Diggers did not sample their claims and therefore the average grades of the hundreds of individual claims are unknown. Figure 3 is therefore just a schematic of how grades may have varied between claims, based on the fact that kimberlite pipes generally consist of several discrete bodies that differ in diamond grade and quality (Bliss, 1992). In the model illustrated in Figure 3 grades are divided into just high or low. Other categories such as intermediate grade could be added. That was not done because an additional grade category may not significantly improve the model's value in explaining the uneven pit floor.

As the claims at Colesberg Kopje progressed deeper, a number of problems were experienced. The pit had to be dewatered, slope stability problems increased, and falls of waste rock, which had to be removed from some of the claims, contributed towards increasing costs. Furthermore, the weathered kimberlite (yellow ground) found on the surface turned into blue ground below about 30-60 feet in depth (Meredith, 2008, p. 26). Diamonds were not as easily extracted from the unweathered blue ground. The solution to this problem was to spread the ground out for a few weeks on pads (also called 'floors') to decompose. Some claim owners did not, however, have the working capital to let the blue ground lie in the open for a few weeks. Williams (1905) described the situation as follows:

'The blue ground exposed to the air crumbled away by degrees, but the miners were rarely patient enough to wait for this disintegration, preferring quick returns by pulverising the ground with their shovels and mallets. This was hard work and costly, from the loss in imperfect pulverisation. But the diamond seekers were poor men who could scarcely afford to hold any stock of bluegroundfor the sake of increasing returns, even if they had been able to guard it.'

Although diggers did not need much capital, initially, to enter the diamond industry they had to generate income to cover certain expenses. One of the costs was related to a shortage of water at the diamond fields, which was addressed by sinking more pits (Williams, 1905). In addition to running costs, all diggers incurred an economic cost as well, called opportunity cost - the cost of forgoing income that could have been earned by spending their time, energy, and skills on another venture or working for wages.

From the above it is clear that the problems that diggers experienced increased with depth, and so did their expenses. The higher expenses were not necessarily compensated for by increasing grades as the depth of mining increased (Robb, 2005). This was probably one of the reasons why more efficient ways had to be found to mine kimberlite pipes at deeper levels.

Other safety risks and the struggle to solve them

A number of different safety risks arose at the open-pit workings of the Big Hole (Kimberley Mine). One of the earlier risks was associated with weathered kimberlite, which is loose and friable. Loaded carts travelling on the early roadways sometimes toppled over and plunged with the driver, cart, and mule into the pit. This led to the removal of the roadways between the claims as the average mining depth increased and the introduction of other means of transportation such as windlasses, 'stages', whims, and later steam winding engines.

Another safety risk was due to poor slope stability and loose rock that fell into the open pit. Some of the rock surrounding the kimberlite pipe, called 'reef, consisting of decomposed basalt and shale (not to be confused with gold-bearing reef), was prone to breaking loose and falling down the pit (see Figure 4. When diggers started to mine the kimberlite pipes they had no prior knowledge about the depth of the orebody and did not intend mining it at great depths. As a result, at the Kimberley Mine they did not pay attention to slope angles and stability, as is done today during the creation and operation of a large open pit mine.

Reasons have been proposed in the previous section as to why an uneven pit floor existed and conditions deteriorated with depth of mining to such an extent that rules had to be changed. In this section, another reason and mechanism, that of 'different priorities', is briefly discussed and proposed as another cause of organizational change at the Kimberley Mine. In this second model, claim owners are divided into two groups namely the 'rim' and 'centre' owners, as illustrated in Figure 5.

Solving the problems of poor slope stability, falling 'reef', and water in the pit would have required a major undertaking because of the hundreds of separate holdings and different priorities, which complicated coordination of efforts at a pit-wide scale. One of the main tasks of the Mining Board appointed in 1874, and which replaced the original Diggers' Committee at the Kimberley Mine, was to solve the in-pit water and falling reef problems (Williams, 1905). One of the reasons why it was difficult to solve such problems is the conflicting interests, as illustrated by the simple model in Figure 5. Rock falling into the Big Hole affected diggers who had claims closer to the rim ('rim claims') of the pit much more severely and more often than those at the centre ('centre claims'). It seems that one of the largest rockfalls affected only about half the claims inside the pit and, therefore, incidents of rockfalls and rock accumulation were much less likely to affect persons who had claims in the middle of the pit (Williams, 1905). If each claim holder had to pay a levy to the Mining Board and each had a vote on how such money was to be used to address problems, then 'centre' miners would have allocated a significantly lower priority to reef removal compared to 'rim' miners because they were less affected. 'Centre' miners had rational reasons to 'free-ride' because 'rim' diggers had to remove the 'reef' from their claims anyway in order to get to the diamond-bearing blue ground and generate income.

The need for consolidation of ownership and organizational change

The numerous windlasses and stages for the transportation of ore from the pit to the surface (Figure 1) point to a lack of cooperation and coordination between claim holders with regard to transportation. Furthermore, the leads-lags in the same figure also point to coordination failure which resulted in poor safety and working conditions and associated incidents as claims were dug to deeper levels. In 1874 the Mining Board gave permission for the holding of up to ten claims by a single owner in order to address some of these problems, including that of poor economics (Williams, 1905). This relaxation of the first 'antimonopoly' rule of 'one claim per person' resulted in the combination and consolidation of claims, as illustrated in Table III. The 'ten claims per owner' rule was abolished later, by 1881 (Turrell, 1987). The required consolidation of ownership was an enormous task, which was made easier by the poor conditions at some claims and, therefore, the willingness of some claim owners to sell. Increasing costs with depth and increasing opportunity costs related to the discoveries of gold at Barberton and on the Witwatersrand also helped with the consolidation. Some diggers sold their claims and left for the goldfields.

The reduction in the number of entities that held claims at the Kimberley Mine to only three still did not result in holistic and optimal mine design because of jealousy, antagonism, obduracy, and a lack of cooperation (Chilvers, 1939). This resulted in a working arrangement that Chilvers (1939) described as 'most costly' to both the Central and French companies. After further consolidation and amalgamation processes De Beers Consolidated Mines Ltd finally became the single owner of the Kimberley Mine in 1888 (Turrell, 1987; Chilvers, 1939). Once above-ground operations became too dangerous and unproductive, mining proceeded by underground methods. The surface and underground sections were mined to depths of about 240 m and 1 100 m, respectively. The surface section of the Kimberley Mine is thought to be the largest hand-dug excavation on Earth.

The Theory of the Firm

The firm plays a central role in modern economic activity. Despite this and the contributions of numerous researchers, the Theory of the Firm (https://en.wikipedia.org/wiki/Theory_of_the_firm), which explains the nature of the firm, its behaviour, structure, and relationship to the economy, is still incomplete. A well-capitalized firm with competent management and a skilled workforce could have solved many of the problems experienced by the diggers. Such a firm could, for example, afford to build up a stock of blue ground that could be sufficiently exposed to the air before being processed in order to increase processing efficiencies. It could also appoint guards and take other measures to secure the ore while it lay on pads in the open air.

Today it is evident that the public-listed company has a huge role to play in large-scale mining (LSM) because of its capital intensiveness. The case study illustrates, however, that the role of the (mining) firm entails much more than just funding. It is also about centralized mine design and planning, the safety improvements that systematic mining offers, the economics of consolidation and central control, and so forth. It is therefore today unlikely that hundreds of diggers or claim owners would each have a small part of a deep-level, massive orebody. It is more likely for persons in developed countries to own shares in large listed mining companies either directly or through a pension fund, or to be employed by such a company.

The situation at the first kimberlite mines analysed in this paper points to the impossible task of successfully coordinating the actions of hundreds of individual claim owners as mining progresses to deeper levels. Even after a degree of consolidation took place and a few companies operated the Kimberley Mine, a number of problems persisted, such as the duplication of shafts. The mechanism proposed in Figure 3 applies not only to diamonds mined from kimberlites but all orebodies where grades vary throughout the orebody as indicated, for example, by gradetonnage relationships. The finding that a massive orebody should be controlled by one firm may even apply to minerals such as some industrial minerals, where the ore quality may be fairly uniform. If such a massive orebody were to be mined by two or more owners then it is unlikely that they would be able to optimally use and share infrastructure and standardize work hours, incentives, technologies, labour complement, and other variables that impact on the mining rate.

In summary, one of the main contributions that the analysis of the case study makes to the Theory of the (mining) Firm is the finding that centralized mine design, planning, control, and authority is required, effectively requiring ownership of a whole massive orebody, such as a kimberlite pipe, by a single firm to overcome the numerous problems described in this paper.

Conclusion

This paper has a number of objectives. One is to demonstrate that consolidation of mine ownership at the (massive) orebody level was required for reasons other than to create monopolies or cartels. It has also been shown that mechanisms exist that will undermine coordination between artisanal miners working adjacent claims in a massive orebody. The dynamics of artisanal miners working at the world's first kimberlite mines are drawn upon to illustrate the central thesis of this paper, which is that it is highly unlikely that massive orebodies can be mined safely and optimally by ASM at depth.

Experience gained from the changes in mine organization and scale of mining at the first kimberlite mines contributed significantly to accumulated knowledge in the areas of mining practice and mine management. The physical and economic conditions at a kimberlite pipe, or any other massive orebody, may result in various problems if such an orebody is subdivided into claims and mined by digger-entrepreneurs at deep levels. A single firm having management control over such an orebody can solve many of the problems related to ASM, especially that of coordination. The large-scale mining of a massive orebody at depth is very likely to result in greater mining and extraction efficiencies and improved safety, and also reduce unnecessary duplication of equipment. The author is not aware of any massive orebody currently being mined at depth by artisan miners unless centrally controlled. A rule for massive orebodies such as kimberlite pipes is therefore proposed: that the authority to oversee the implementation of a centrally designed mine plan for a massive orebody should be the responsibility of a single organization.

References

Bergenstock, D.J. and Maskulka, J.M. 2001. The De Beers story: are diamonds forever? Business Horizons, vol. 44, no. 3. pp. 37-44. [ Links ]

Bliss, J.D. 1992. Grade-tonnage and other models for diamond kimberlite pipes. Natural Resources Research, vol. 1, no. 3. pp. 214-230. [ Links ]

Chilvers, H.A. 1939. The Story of the De Beers. Cassell, London. [ Links ]

Clement, C.R. 1982. A comparative geological study of some major kimberlite pipes in the Northern Cape and Orange Free State. PhD thesis, University of Cape Town. [ Links ]

Demsetz, H. 1988. The theory of the firm revisited. Journal of Law, Economics, & Organization, vol. 4, no. 1. pp. 141-161. [ Links ]

Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF). 2017. Global trends in artisanal and small-scale mining (ASM): A review of key numbers and issues. International Institute for Sustainable Development, Winnipeg:. [ Links ]

Janse, A.J.A. 2007. Global rough diamond production since 1870. Gems & Gemology, vol. 43, no. 2. pp. 98-119. [ Links ]

Karim, S.A. 2016. Ekapa and Zama-Zamas fight over mining rights. https://www.groundup.org.za/article/ekapa-and-zama-zamas-fight-over-mining-rights/ [accessed: 7 November 2017]. [ Links ]

Lanham, A. 2006. North West gold-mine moves to profitability. Mining Weekly. http://www.miningweekly.com/article/north-west-goldmine-moves-to-profitability-2006-03-03 [accessed: 3 March 2006]. [ Links ]

Levinson, A.A. 1998. Diamond sources and their discovery. The Nature of Diamonds. Harlow, G.E. (ed.). Cambridge University Press. Chapter 4. [ Links ]

Magwedze, V. 2017. Illegal miners left horrified after mass murders. https://www.imf.org/en/Publications/WP/Issues/2018/01/25/Shadow-Economies-Around-the-World-What-Did-We-Learn-Over-the-Last-20- Years-45583 [accessed 31 october 2017]. [ Links ]

Medina, L. and Schneider, F. 2018 Shadow Economies Around the World: What did we learn over the last 20 years? IMF Working Paper, WP/18/17. https://www.imf.org/en/Publications/WP/Issues/2018/01/25/Shadow-Economies-Around-the-World-What-Did-We-Learn-over-the-Last-20-Years-45583 [accessed 21 August 2018]. [ Links ]

Meredith, M. 2008. Diamonds, gold, and war: The British, the Boers, and the making of South Africa. Simon and Schuster. [ Links ]

Montpelier, D.J. 1994. Diamonds are Forever? Implications of United States Antitrust Statutes on international trade and the De Beers diamond cartel. California Western International Law Journal, vol. 24, no. 2. p. 6. [ Links ]

Nixon, P.H. 1995. The morphology and nature of primary diamondiferous occurrences. Journal of GeochemicalExploration, vol. 53, no. 1-3. pp. 41-71. [ Links ]

Omarjee, L. 2017. How to close a mine and save money. https://www.fin24.com/Companies/Mining/how-to-close-a-mine-and-save-money-20170726 [accessed 20 November 2017]. [ Links ]

Payton, C.A. 1872. The Diamond Diggings of South Africa: A Personal and Practical Account. H. Cox, London. [ Links ]

Reekie, W.D. 1999. Diamonds: The Competitive Cartel. Free Market Foundation, Sandton, South Africa. [ Links ]

Robb, L. 2005. Introduction to Ore-forming Processes. Blackwell. [ Links ]

TimesLIVE. 2017. 200 die as mine shafts become killing fields in syndicate turf wars. http://www.dispatchlive.co.za/news/2017/03/08/200-die-mine-shafts-become-killing-fields-syndicate-turf-wars/ [accessed 31 october 2017]. [ Links ]

Turrell, R.V. 1987. Capital and Labour on the Kimberley Diamond Fields, 1871-1890. Cambridge University Press. [ Links ]

Wikipedia. (Not dated). Gold rush. https://en.wikipedia.org/wiki/Gold_rush [accessed 13 October 2017]. [ Links ]

Williams, G.F. 1905. The Diamond Mines of South Africa. B.F. Buck & Co., New York. [ Links ]

Wikipedia. Theory of the Firm. https://en.wikipedia.org/wiki/Theory_of_the_firm [accessed 1 August 2017]. [ Links ]

Wood, E. 2017. Goudmyn en zamas werk saam in KZN. Beeld, 6 June. p. 17. [ Links ]

Worger, W.H. 1987. South Africa's City of Diamonds: Mine Workers and Monopoly Capitalism in Kimberley, 1867-1895. Yale University Press. [ Links ] ♦

This paper was first presented at the Society of Mining Professors 6th Regional Conference 2018, 12–13 March 2018, Birchwood Hotel and Conference Centre, Johannesburg, South Africa