Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of the Southern African Institute of Mining and Metallurgy

versão On-line ISSN 2411-9717

versão impressa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.117 no.7 Johannesburg Jul. 2017

http://dx.doi.org/10.17159/2411-9717/2017/v117n7a1

YOUNG PROFESSIONALS CONFERENCE

Multi-stakeholder collaboration to unlock the potential of deep-level mining in South Africa

K.M. Letsoalo

Chamber of Mines of South Africa

SYNOPSIS

South Africa's narrow-reef mining operations are facing challenges such as volatile commodity prices, operational cost increases in excess of inflation, health and safety issues, and depletion of less geologically complex reserves. These challenges have resulted in declining production profiles for many mining companies. Data collected and modelled from South Africa's three principal gold mining companies, AngloGold Ashanti, Harmony Gold, and Sibanye Gold, indicates that 592 Mt of mineable gold resources remain, with up to 496 Mt of potential reserves available if miners adopt mechanized systems. These resources have the potential to extend the life of gold mining operations beyond the year 2045. A similar situation exists in the platinum sector, where 360 Mt of production can be exploited with the application of non-conventional mining methods.

During investigations as part of the Phakisa initiative, it was noted that current industry challenges require solutions that are specific to the South African tabular mining environment. These solutions include increasing local mining research and development capacity, encouragement of local equipment manufacturing and associated procurement, and technology and skills transfer. Owing to the magnitude of the changes required to establish a sustainable mining industry, stakeholders agreed to a collaborative approach through a public-private partnership.

This paper seeks to provide a background to the Mining Phakisa initiative and the drivers behind collaboration of various stakeholders to ensure sustainability of the South African deep-level mining industry. The collaboration drivers are discussed by highlighting challenges in South Africa in relation to mining.

Keywords: narrow-reef mining, sustainability, mining R&D, public-private partnership, technology readiness.

Introduction

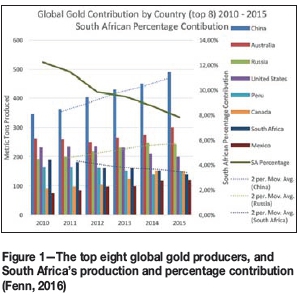

Modern commercial mining in South Africa dates back to 1846 with the exploitation of copper in Namaqualand. The economic viability of the venture was hampered by the remote location of the deposit, adverse geological conditions, poor excavation stability, and the extraction method used. South Africa's deep-level mining operations find themselves in a similar situation today. Increased geotechnical and rock engineering challenges, increased mining depth, low productivity, and dwindling available mineral reserves are some of the factors contributing to the economic impediment of the platinum and gold mining sectors. Figure 1 indicates South Africa's contribution to the global production of gold. Historically, South Africa was the largest gold-producing country, but it has now dropped to seventh place.

Fenn (2016) concluded that the trends presented in Figure 1 do not coincide with those seen in other emerging economies. Emerging economies like China and Russia have a positive production growth, while that for South Africa is negative. South Africa's contribution to global production of gold declined by 7.89% between 2014 and 2016. Despite the decline in production, South Africa's reserves of the following commodities are ranked number one the in world, (Hermanus, 2016) :

► PGMs (87.7%)

► Chromium (72.4%)

► Manganese (80%)

► Titanium (65%)

► Gold (12.7%). '

The available mineral resources in South Africa, particularly platinum and gold, justify a change in mindset and approach towards metalliferous mining. The value of existing resources depends on the extraction methods and the efficiency of mining operations. Without a change in these, South Africa's mining outputs will continue to decline.

The state of the South African mining industry

Declining employment

The mining industry in South Africa is considered as one of the key employers, with approximately 450 000 people directly employed in the sector, each employee having at least nine dependants (Chamber of Mines, 2014). The industry shed 47 000 jobs between 2012 and the first quarter of 2015, which had an indirect impact on 423 000 people. Statistics South Africa (Stats SA) (2016) indicated that employment in the mining industry continues to decline, with eight consecutive quarterly decreases since the fourth quarter of 2014.

Despite the decline in employment, gross earnings paid to employees across the mining sectors increased by R30 million in the quarter ending June 2016. The total gross remuneration increased by 6.3% (R31 billion) compared to the previous year (Statistics South Africa, 2016). The total earnings by employees in the mining industry amounted to R523 billion between June 2015 and June 2016 (Statistics South Africa, 2016).

The platinum wage strike in 2012 was one of the major reasons behind the decline in employment statistics. During the Mining Phakisa Lab it was noted that the mining sector is still recovering from the 515 971 man-days that were lost due to industrial action between 2012 and 2013.

Contribution to the gross domestic product

Mining's contribution to the GDP is linked with, and measured on, production output, which has declined in recent years. Mining contributed close to 21% to the GDP in 1970, but this figure had fallen to 7.7% by 2015. Gold and uranium were the main commodities in 1970, accounting for 17% of the 21% contribution. Structural factors in the sector, rather than falling commodity prices, have been the main cause of the decline in GDP contribution over recent years (Pirouz, 1999). The infrastructure on most of the gold operations is over 20 years old, and this, coupled with mine design and layout, has constituted the biggest challenge to production output.

Resources and reserves

South Africa's mineral resources are still considered to be among the foremost in the world, but deep-level operations are facing challenges with the depletion of easily accessible resources. Geological surveys indicate that South Africa has approximately 1.9 billion ounces of remaining gold resources (Chamber of Mines South Africa, 2015), only 0.2 billion ounces of which have been converted into reserves. This leaves the country with close to 1.7 billion ounces of gold resources that have the potential to be converted into reserves. However, significant changes in the extraction methods will be needed in order to economically exploit these resources.

Approximately 1.4 billion ounces of platinum resources are available in South Africa, and only 0.2 billion ounces have been mined to date (Chamber of Mines South Africa, 2015). Half (0.7 billion ounces) of the remaining platinum resources are at a depth between 2 and 4 km, and are potentially economically viable. Like gold operations, significant changes are required in the extraction methods to render these resources economically viable. The deepest platinum operation is currently just below 2.2 km, and ventilation and geothermal heat are among the major challenges.

Productivity

Productivity in the South African mining industry peaked in the year 2000, with gold and platinum production at 2 kg and 2.3 kg per person, respectively. However, the industry has experienced a decline in productivity levels since then, and productivity is currently at its lowest point. According to Singh (2016), platinum output per worker declined by 49% between 1999 and 2014, while the real labour cost per kilogram increased by 309%.

Research

South Africa's Chamber of Mines Research Organisation (COMRO) was considered to be one of the best mining research organizations in the world. COMRO was established in 1964 to carry out research on a collaborative basis on behalf of member companies of the Chamber of Mines South Africa. COMRO experienced a funding reduction in the late 1980s, which led to its closure in 1992, resulting in the loss of South African researchers to countries like Australia and Canada.

DeepMine, PlatMine, and FutureMine are some of the collaborative research programmes that were established between 1998 and 2005, after COMRO (Rupprecht, 2017). These programmes, which were set up to operate over fixed periods, were introduced to address specific mining challenges, including the mining of gold at depths greater than 3000 m. The funding and scale of these programmes were not equivalent to that of COMRO.

Following the closure of COMRO, mining companies such as Anglo American took it upon themselves to conduct in-house research. This has proven to be a challenge during commodity price slumps. It was noted during engagements with mining companies that research projects are the first to suffer budget cuts during price slumps. From a national perspective, in-house research initiatives do not assist with capacity-building because this type of research is focused on competitive advantage and business sustainability, as opposed to the sustainability of the sector as a whole.

Technology in narrow-reef mining

Narrow-reef mining methods, technology, and mechanized equipment have not changed much over the last century, despite the productivity fluctuations. There have been three significant innovations (Pickering, 2004):

► The introduction of hand-held pneumatic rock-drills around 1970, which were designed to replace rig-mounted units. Industry is currently exploring the potential of electrohydraulic drills

► Scraper winches were introduced in the 1920s to replace shovels for moving rock. Most mining operations today rely on scraper winches for rock moving in stopes

► Hydraulic props were introduce in the 1960s as a form of yielding support, and are still used in the industry today.

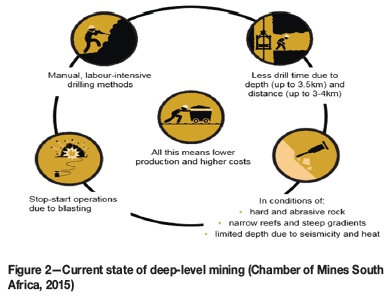

The minimal changes in the technology used in conventional mining reflect the lack of overall change in deep-level operations over the years. Narrow-reef metalliferous operations in South Africa are still cyclical and labour-intensive; production activities are interdependent and a significant amount of labour is required to complete a production cycle. The cyclical nature of the operations, as shown in Figure 2, is inherent in the drilling and blasting process that has been used since the early 1900s. Mining a panel in a mechanized mine (e.g. a manganese mine) requires only six or so crew members, while in a conventional mining operation an average crew of 14 members is required to complete the production cycle. The underground coal mining industry has introduced new technologies like continuous miners, resulting in improved safety and productivity.

New developments: the Phakisa initiative

The Phakisa initiative is a multi-stakeholder collaborative process that was convened by the government of South Africa. Operation Phakisa was designed to address and fast-track implementation of solutions that are critical to national development (Department of Planning, Monitoring and Evaluation, 2016). The programme involves a range of key stakeholders, including government, private companies, and research organizations in the sectors that plan and oversee the implementation of initiatives. The intention is for the initiatives to have a positive impact on economic growth and society. The areas of focus include mining, the oceans, and education.

The idea adopted by the South African government based was on a Malaysian development programme called the Industrial Collaboration Programme (ICP). The aim of this programme is to reaffirm government's commitment to the development of national technology, industry, and the economy (Malaysia Government, 2013). ICP is designed to improve Malaysia's competitiveness in the global market, supported by a systematic development strategy and a holistic view of the economy (Malaysia Government, 2013).

Like the ICP, the objective of the Phakisa initiative is to 'develop collaborative interventions that will ultimately have tangible impacts on the short- and medium-term challenges faced by the mining cluster. These interventions need to take into [account] economic and socio-economic historical, structure, and immediate challenges that exist in the cluster. Collaboration should be entrenched in the institutional mechanisms that will be applied to address the challenges' (Operation Phakisa, 2015).

The goal of the Mining Phakisa is to intervene as far as possible to keep the industry afloat during commodity price slumps. Additional goals include putting in place initiatives that will position the mining cluster on a firm foundation to grow, transform, and optimize the contribution of the industry to the economic and social development of mining-related communities and the country as a whole.

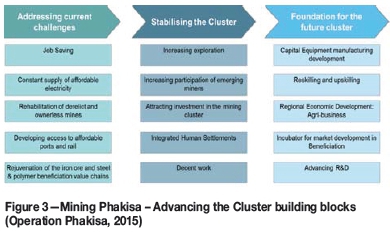

The execution of the Mining Phakisa outcomes is built on a three-phase horizon, as seen in Figure 3. The first phase includes addressing the challenges that are currently experienced by the cluster (these challenges are not limited to those presented in the diagram). Once the current challenges are addressed, the next phase would involve stabilizing the cluster in order to yield results over the medium to long term. The last phase is focused on setting up initiatives that are geared towards developing the future South African mining industry. The lack of upfront timeframes on the building blocks of the Phakisa initiative constitutes a shortfall of the initiative. The author is of the opinion that the foundation for the future cluster should be the primary building block, supported by the stabilizing and addressing of current challenges.

Five work streams were established during the Mining Phakisa Lab workshops to design initiatives that will address the challenges faced by the mining industry. These five work streams are (Operation Phakisa, 2015):

► Cluster Employment work stream-the core responsibility of this group is to address issues around reskilling and upskilling of mineworkers, job saving initiatives, and decent work categorization

► Win-win Beneficiation work stream-this group is responsible for developing initiatives that will rejuvenate the iron ore, steel, and polymer beneficiation value chains. The group is also required to act as an incubator for market development in beneficiation

► Sustainable Communities work stream-focuses on the challenges around integrated human settlements, regional economic development (agri-business), and rehabilitation of derelict and ownerless mines

► Reviving Investment and Access to Affordable and Reliable Infrastructure-the initiatives that were mandated to this work stream include attracting investment in the mining cluster, increasing exploration, increasing participation of emerging miners, constant supply of affordable electricity, and development of access to affordable ports and rail transport

► Advancing the Cluster work stream-the key challenges that were mandated to this stream are the development of mining capital equipment manufacturing capability and mining-related research and development.

Current status

After the Phakisa Lab workshops, the Chamber of Mines South Africa (CoM) adopted an internal strategic framework for modernization. This modernization does not involve only mechanization or the gradual introduction of new technology, which are often associated with the replacement of people with machinery, resulting in direct job losses. The CoM considered modernization as a process of transition and transformation of the mining industry, involving (Chamber of Mines, 2016):

► Turning South Africa's mineral resources to account in the safest, most efficient, cost-effective, and sustainable manner possible

► Recognizing that people are at the heart of the industry, and focusing on improving skills, health, quality of life, and personal fulfilment of employees

►Conservation of natural resources, preservation and restoration of the environment

► Contributing to the development of local and labour- sending communities

► Transformation and growth as key imperatives for the mining industry and the nation.

A case study on the three principal gold mining companies (AngloGold Ashanti, Harmony Gold, and Sibanye Gold) indicated that, for a single mine, every 1 g/t reduction in the cut-off grade would result in 10 Mt of additional ore containing 200 t of gold being mined over the operation's extended life (Chamber of Mines, 2016). Margins are gradually closing in on narrow-reef operations due to challenges around operational costs and productivity, which sees the industry potentially closing around 2030. The study indicates that modernization of existing operation has the potential to extend the operational life of the sector beyond 2045 (Chamber of Mines, 2016) .

There were two strategic outcomes from the Mining Phakisa process within the Advancing the Cluster work stream:

► Mining R&D Programmes: a collaborative research and development model that focuses on a systematic approach to mining's R&D needs and enables the establishment of centres of excellence in collaboration with South African research institutions. The key focus of the research would be on addressing underground deep-level mining challenges

► Mining Equipment Manufacturing Cluster: a cluster that is embedded within other existing clusters and initiatives. The cluster will ensure that development requirements are translated into coherent R&D programmes, enabling local partnerships to develop and manufacture equipment for mining systems (Singh, 2016).

These strategic outcomes have gained substantial traction to date. A mining precinct has been established at the old COMRO facilities in Johannesburg. The precinct is intended to house local researchers, manufacturers, and mining companies on a project basis. This process will be coordinated by the Mining Hub, which is based on a 'hub-and-spoke' approach with all stakeholders playing collaborative roles. The concept of collaboration is embedded in the composition of the Mining Hub management structure. Key stakeholders include government, the mining industry, and manufacturers, who will jointly form a public-private partnership.

The primary objective of the Mining Hub is to act as a partner that advances the cluster by:

► Coordinating the research and development activities, with an initial focus on narrow-reef mining systems

► Facilitating skills development for future metalliferous mining systems

► Developing South Africa's mining equipment manufacturing capacity to address industry's equipment needs.

The hub-and-spoke model provides opportunities for broader research programmes to build capacity and capability in areas that constitute challenges to the mining industry, allowing the leveraging of existing strengths in various organizations.

Five research thematic areas have been identified within the Mining Hub as the key quick-win programmes (Mining Hub, 2017):

► Advanced orebody knowledge: this entails the development and evaluation of techniques that will provide more detail in relation to reef position, structure, grade, and rock characteristics

► Modernization of current mining operations: the focus is on increasing the efficiency of extraction and improving occupational health and safety while reducing operational costs

► Platinum and gold mechanized mining: the development of a fully mechanized mining system that will allow for drilling and extraction of narrow reefs with minimum dilution. Mechanized mining in the platinum sector has progressed extensively over the last decade

► Non-explosive rock-breaking: this requires the development of complete mining systems for extraction that are completely independent of the use of explosives

► Real-time information management systems: the focus is on improving the quality of communication in the underground environment and developing data management systems that will enable informed decision-making.

The process of identifying research areas involved compiling a list of user requirement specifications (URS) post the Mining Phakisa Lab workshops. A detailed description of the operational challenges experienced by narrow-reef operations was compiled and grouped into the thematic areas listed above. In the process of gathering user needs, companies indicated R&D projects that they are currently undertaking. The intended outcome is to allow the sharing of information among companies and enable the involvement of research institutions on a collaborative basis. In the past, mining companies believed that research work was conducte purely for academic purposes. The process of identifying URS seeks to encourage more applied research that will directly address industry needs and build local capacity in research and manufacturing.

The outcomes of the manufacturing strategy have seen the establishment of Mining Equipment Manufacturing of South Africa (MEMSA), a Section 21 company comprising local manufacturers of mining equipment ranging from rail-bound to trackless. MEMSA is supported by the Department of Trade and Industry with aim of executing the recommendations of the Mining Phakisa. It is realized that linkages to the mining value chain such as local equipment manufacturing have the potential to increase overall economic growth, as opposed to total reliance on mining itself. The involvement of manufacturers in the collaborative forum will allow research outcomes to be developed into prototypes, and possibly new products.

Technology Readiness Level (TRL) for South African mining

Projects like mechanization of underground mines and introduction of new technology have been tried and tested in the past with minimal success. One of the factors that contributed to the failure of the projects includes the low maturity level of the technology and the resulting problems in adapting it to a production environment. Companies agreed to modify and adopt the National Aeronautics and Space Administration (NASA) version of Technology Readiness Level (TRL) for the South African mining industry. This will allow companies and other stakeholders to use a common language when describing mining projects and the maturity level of new technologies.

TRL is a tool used to measure and monitor technology maturity, from the conceptual stage to proving of the technology's capabilities and demonstration of the product. Technology is rated on a scale of 1 to 9, as seen in Table I. Initiatives that are TRL 6 and below are considered to be in the R&D phase, while those at TRL 7 and above are considered as manufacturing. This guides and informs the involvement of various government departments; the Department of Science and Technology would be more involved in initiatives that are below TRL 6 as they involve fundamental research, while the Department of Trade and Industry would be more involved in TRL7 and above as these levels relate to commercialization.

Table I illustrates the links between scientific concepts and the development of products that meet user needs. Learnings from the past indicated the gaps between researchers and mining operations. The flaws lay in the aim and outcomes of research. Mining companies believe that focus should be placed on applied research, and the adoption of TRLs will allow research work to satisfy both the user and the researcher. The process of developing stage-gates and a purpose across each TRL provides the end-user with tangible outcomes that can be measure during a project.

Conclusion

The paper has attempted to paint a comparative picture of South Africa's mining industry today in relation to the past. South Africa has ceased to maximize its mineral endowment benefits due to various challenges that have been discussed in the paper. These challenges presented themselves as key enablers to multi-stakeholder collaboration. For South Africa's mining industry to remain competitive and sustainable, there is a need to embrace a collaborative approach to addressing the immediate and future challenges.

Mining research organizations should strive to build centres of excellence in specific mining areas. The competitive culture in research cripples the capacity of research organizations and the country as the amount of available funding is reduced. Centres of excellence will allow stronger long-term partnerships with local universities and mining companies. Allowing end-users to define R&D needs will ensure a continuous network that will drive fundamental and applied research coherently.

The Mining Phakisa initiative presented an opportunity for stakeholders to develop programmes that will address issues such as productivity, safety, mine design, operational costs, and people issues. Collaboration will allow South Africa to build local capacity and design solutions that are suitable for local mining conditions. The concept of internal capacity-building will allow the industry to sustain itself.

It is recommended that time-frames are attached to the various Phakisa initiatives and communicated with a broader audience. The inclusion of various organizations affected by mining in South Africa in the Phakisa initiative will yield more positive results. As learnt from past technology and mechanization initiatives, people should form the centre of programmes. The success of any mining R&D and technology will rely entirely on the support of the workforce and surrounding communities.

In conclusion, South Africa must realize that the responsibility for a sustainable mining industry lies with everyone. The notion of relying on mining as a sole economic contributor has passed-mining should be used as a platform for developing secondary industries and industrialization initiatives for South Africa. Continuous understanding of the broader mining value chain by various stakeholders and South Africa's contribution to the value chain will ensure the sustainability of the industry.

References

Chamber of Mines South Africa. 2014. Mining in SA. http://www.chamberofmines.org.za/sa-mining [Accessed 31 October 2016]. [ Links ]

Chamber of Mines South Africa. 2015. Next generation mining: research for Mining Phakisa 8 September. Johannesburg. [ Links ]

Chamber of Mines South Africa. 2016. Modernisation: towards the mine of tomorrow. Johannesburg. [ Links ]

Department of Planning, Monitoring and Evaluation. 2016. Operation Phakisa. http://www.operationphakisa.gov.za/pages/home.aspx [Accessed 7 November 2016]. [ Links ]

Fenn, A. 2016. Unlocking value by reorganizing the operational. Proceedings of the Colloquium: New Technology and Innovation in the Minerals Industry, 9 June 2016. Southern African Institute of Mining and Metallurgy, Johannesburg. [ Links ]

Hermanus, M. 2016. Mine health and safety twenty years on, http://www.mine2030.co.za/downloads/send/3-fact-sheet/4-mine-health-and-safety-twenty-years-on [Accessed 7 November 2016]. [ Links ]

Malaysia Government., 2013. Policy and guidelines on industry collaboration program in government procurement. http://tda.my/wp-content/uploads/2016/03/ICPpolicyBI.pdf [Accessed 13 October 2016]. [ Links ]

Mining Hub. 2017. Charter documents. Johannesburg. [ Links ]

Operation Phakis. 2015. Mining Phakisa Lab Summary. Department of Planning, Monitoring and Evaluation, Pretoria. [ Links ]

Pickering, R. 2004. The optimization of mining method and equipment. Proceedings of the First International Platinum Conference 'Platinum Adding Value', Sun City, South Africa, 3-7 October 2004. South African institute of Mining and Metallurgy, Johannesburg. [ Links ]

Pirouz, J.F.a.F. 1999. The role of mining in the South African economy. Economic Research Southern Africa, Johannesburg. [ Links ]

Rupprecht, S.M. 2017. The need for material change in the South African mining industry. university of Johannesburg. http://hdl.handle.net/10210/93356 [Accessed 19 April 2017]. [ Links ]

Singh, N. 2016. Riding the perfect storm facing the mining sector. Proceedings of the Colloquium: New Technology and Innovation in the Minerals Industry Colloquium, 9 June 2016. Southern African Institute of Mining and Metallurgy, Johannesburg. [ Links ]

Statistic South Africa. 2016. SA jobs shrink in Q2. http://www.statssa.gov.za/?p=8574 [Accessed 31 October 2016]. [ Links ]

This paper was first presented at the 3rd Young Professionals Conference, 9-10 March 2017, Innovation Hub, Pretoria, South Africa.