Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.116 n.6 Johannesburg Jun. 2016

http://dx.doi.org/10.17159/2411-9717/2016/v116n6a10

PAPERS - COOPER COBALT AFRICA CONFERENCE

Copper solvent extraction: Status, operating practices, and challenges in the African Copperbelt

K.C. SoleI; O.S. TinklerII

IConsulting Hydrometallurgist, Johannesburg, South Africa

IICytec Solvay Group, Tempe, AZ, USA

SYNOPSIS

Although the first large-scale application of copper recovery by solvent extraction took place in Zambia in the early 1970s, it is only in the last decade that this technology has become widely employed in this part of the world and is now a mainstay unit operation in copper hydrometal-lurgical flow sheets. The mineralogy of the ores of the African Copperbelt, and hence the characteristics of African leach liquors, differs significantly from those in Chile and the southwestern USA, where copper solvent extraction has had a long and successful history. These differences provide operators, metallurgists, reagent vendors, and engineers with many challenges: new approaches are needed to adapt solvent-extraction technology for successful implementation in this region. This paper examines typical operating practice in the African Copperbelt, discusses differences compared with other parts of the world, and looks at some of the challenges and opportunities presented by these flow sheets.

Keywords: copper, solvent extraction, African Copperbelt, operations, review

Introduction

Following the success of the Rancher's Bluebird and Bagdad solvent extraction and electrowinning (SX-EW) operations in Arizona in the late 1960s, the Tailings Leach Plant at Chingola, Zambia, became the first large-scale copper SX plant in the world, commissioned in 1974. Despite the equipment design now being outdated, this plant still continues to operate successfully, indicating the versatility and adaptability of this technology. Today, there are some 75 copper SX operations worldwide with cathode production above 10 kt/a. The top ten producers currently account for about 40% of the global 4.3 Mt/a SX-EW copper production. South America (predominantly Chile and Peru) is the largest copper cathode-producing region, with annual production of some 2 Mt. The Central African Copperbelt (Zambia and the Democratic Republic of Congo (DRC)) is second, with cathode production of 1.2 Mt/a, and North America (USA and Mexico) third, producing close to 0.8 Mt/a Cu (Solvay Cytec data, 2014). The remaining 0.35 Mt/a comes from all other regions combined (referred to as 'Rest-of-World').

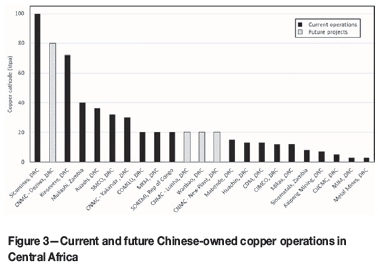

Current operations in Zambia and the DRC are summarized in Figure 1. The industry in this region is characterized by a few very large (>200 kt/a) operations, owned by major multinational corporations, and a large number of small (3 to 20 kt/a) plants, mainly Chinese-owned.

This paper examines typical SX operating practice in the African Copperbelt, discusses differences compared with other parts of the world, and looks at some of the challenges presented by the conditions, as well as innovations in flow sheets, reagents, and operating conditions that have been introduced in these circuits.

Copper SX: a truly adaptable process

Distinct characteristics emerge when one examines copper SX on a regional basis. Table I compares characteristics of the pregnant leach solutions (PLS) in Central Africa with those of North America, South America, and other parts of the world where copper SX is practiced. The nature of the PLS varies considerably (0.23 to 43 g/L Cu), depending largely on the type of process and geographic location (Sole et al., 2013). The versatility of this technology is indicated by its ability to cope with large variations in copper grade as well as selectively recover copper from widely varying PLS compositions. Extreme examples include Mexicana de Cananea (Mexico), which processes a feed containing 2 g/L Cu and 45 g/L Fe, and Cobre Las Cruces (Spain), which recovers >40 g/L Cu from a PLS background of >50 g/L Fe.

Copper grades are typically lowest in the southwestern USA, where the industry is mature and many operations have been in production since the mid-1980s. The ores are mainly lower-grade mixed oxide and secondary sulphide, containing 0.2 to 0.3% acid-soluble copper. The operations are typically heap and dump leaching, with permanent pads (rather than on-off pads) to minimize operational costs. The SX circuits are often configured for series-parallel or all-parallel operation, as this maximizes copper production by treating high volumes of low-grade PLS. At most sites, the high PLS flow rates give extraction organic-to-aqueous (O:A) flow rate ratios well below 1:1, so extraction stages operate in aqueous-phase continuity-a feature that is unusual in other parts of the world. These operations are characterized by efforts to minimize operating costs and extend the profitable life of mine for as long as possible. There is an emphasis on minimizing organic losses and maximizing organic recovery (e.g., by increased retention time in the raffinate pond and use of equipment such as Pacesetter coalescers, Jameson cells, and pond skimmers).

Chilean operations process mainly oxides with an acid-soluble copper grade of 0.4 to 0.8%. Many of these are located in the Atacama Desert, where the predominant mineral, atacamite (Cu2Cl(OH)3), gives levels of chloride in the PLS as high as 40 g/L. The presence of >30 mg/L Cl is detrimental to copper EW (Lakshmanan et al., 1977), so SX circuits usually have a wash stage to limit chloride transfer to the electrolyte. Several sites also have high levels of nitrates in the PLS. Nitrate is a strong oxidizing agent, which presents severe challenges associated with accelerated reagent degradation. Processing is mainly by heap, dump, and run-of-mine (ROM) leaching. An acid cure is common to increase leach recovery. Heap leaching of primary and secondary sulphides is becoming more common; primary sulphides frequently give elevated levels of Fe in the PLS so reagent selectivity is particularly important.

The majority of Australian leach-SX-EW operations have come to the end of their operating lives, so the Rest-of-World region is now characterized by expansion in countries such as Laos, Myanmar, Kazakhstan, and China. Olympic Dam, one of the last remaining Australian operations, has complex metallurgy (copper is produced as a byproduct of uranium) and a life-of-mine of at least 200 years (Russell, 2014). The Rest-of-World locations are often very remote, with difficult logistics. Some of the flow sheets are complex, comprising pressure leaching as well as agitated tank leaching, and there is a wide variation in the types of leach solutions that are processed by SX.

The African operations have the advantage of high ore grades (3 to 5% acid-soluble Cu), and consequently significantly higher PLS copper grades than found in other regions (43 g/L Cu design at Kamoto Copper Company, for example). Although the predominant oxide minerals, such as malachite, chrysocolla, and heterogenite, are easily leachable, acid consumption varies considerably from site to site and even within orebodies-in some cases, rendering even high-grade orebodies uneconomical. After crushing and grinding, leaching is usually carried out at slightly elevated temperature (35 to 45°C) in agitated tanks, which results in dissolution of almost all the acid-soluble copper in a matter of hours, rather than months or even years in the case of heap leaching. The feed to leaching can be whole ore, oxide concentrates, roasted sulphide concentrates, or tailings.

An additional feature of DRC operations is that the orebodies often contain significant quantities of cobalt, usually produced as an intermediate cobalt hydroxide product that is further refined in Europe or China. A few operations produce cobalt cathode after solution purification. Logistics in this region remain very difficult, with most reagents having to be transported by road from South Africa, Namibia, or Tanzania. Many sites have therefore installed sulphur-burning plants to produce their own sulphuric acid on site from elemental sulphur.

It is evident from the above discussion that copper SX is practiced very differently in different parts of the world and that each region has its own unique challenges that require innovation and adaptability to ensure the consistent and profitable production of high-quality copper cathode.

The copper SX-EW landscape in Central Africa

Zambia

The first large-scale copper SX plant in the world was commissioned at the Nchanga Tailings Leach Plant (TLP) in Zambia in 1974, with a daily production of 200 t Cu cathode (Holmes et al., 1976). The mixer-settlers, configured as four trains each comprising three extraction and two stripping (3E-2S) stages, are long and narrow (aspect ratio of 2.9:1) and the mixers have a design residence time of 3 minutes. Given the constraints of the extractants at the time that TLP was designed, multiple stages of extraction and stripping were necessary to achieve the desired copper recovery. With advances in equipment design and extractant formulations, the largest modern-day mixer-settlers could process about 85% of the TLP's total PLS flow in a single 2E-1S circuit!

Largely unknown in the history of African metallurgy is that the first aldoxime reagents (the ACORGA P-5000 Series) were developed by ACORGA Ltd, which was a joint venture between Anglo American Corporation of South Africa and the UK's Imperial Chemicals Industries (ICI) (a forerunner of what is today the multinational company, Cytec Solvay) (Tumilty et al., 1977). The first commercial aldoxime extractants were produced for use in copper SX and exhibited many advantages in extracting power, kinetics, and selectivity over then-existing reagents. Although extractant chemistry, stability, and performance have improved significantly since that time, aldoximes (with a stripping modifier) still form the basis of some 66% of copper cathode production today.

Development of the industry and current operations

Located 10 km from Ndola, the Bwana Mkubwa SX-EW plant (BMML) was established by First Quantum Minerals (FQM) in 1998 to process oxide tailings from dams in the area. In 2003, the plant was redesigned and expanded to process oxide ore from the Lonshi deposit, located some 35 km away in the DRC. At its peak in 2005, BMML produced just under 50 kt cathode (FQM, 2006). First Quantum halted operations at BMML between 2008 and 2010 and reopened for about a year in 2010. Although this plant no longer operates, it provided a pioneering example to the industry of how rapidly, inexpensively, and simply copper SX flow sheets could be installed and run profitably.

Kansanshi Mine, 80% owned by FQM subsidiary Kansanshi Mining plc, reached commercial production in April 2005. It is the largest copper mine in Africa and the eighth-largest in the world, with capacity of 400 kt/a Cu (210 kt/a by SX-EW) and, unusually for this region, 130 000 oz/a Au (FQM, 2015). Ore treatment is flexible to allow for variation in ore type, with processing possible through an oxide circuit, a sulphide circuit, and a transitional ore 'mixed float' circuit. Sulphide ore is concentrated by crushing, milling, and flotation (Chongo and Ngulube, 2015). Oxide ore is treated via crushing, milling, flotation, leaching, and SX-EW to produce sulphidic and gold-bearing flotation concentrates, as well as electrowon cathode copper (FQM, 2015). The hydrometallurgical circuit employs both pressure and atmospheric leaching steps, and has five SX circuits and three tankhouses. The site also has its own dedicated acid plants. The autoclave leach results in relatively high levels of iron(III) reporting to the PLS. It is well known that ferric iron deteriorates current efficiency in EW and this plant has battled with transfer of iron to the electrolyte (Mwale and Megaw, 2011).

Mopani Copper Mines (MCM) produced 212 kt of copper (including refined copper from third parties) in 2013, representing a 13% year-on-year increase. The Nkana site has two SX circuits: one treats the PLS from an oxide leach; the other was used to remove copper in the cobalt circuit until the cobalt plant was closed in 2014. The Mufulira site has three SX circuits that treat a blend of heap- and vat-leaching solutions. Vat leaching is unusual in modern flow sheets- Mantos Blancos in Chile is the only other plant currently employing this technology (Schlesinger et al., 2011).

Although Glencore halted production at Mopani in September 2015, pending improved copper prices, several mining capital projects (Synclinorium Shaft at Nkana, Mufulira Deeps, Mindola Deeps) remain in progress and will ultimately extend mine life by 20 to 25 years (Mining Technology, 2016a).

Chambishi Metals, located near Chambishi, is one of the oldest plants in the region. It was commissioned in 1978 and privatized in 1998. In one of the more interesting flow sheets, the plant treats Cu/Co sulphide concentrates imported from DRC via a roast-leach-SX-EW process. The newly built SX circuit ensures the delivery of a low-copper feed solution to the cobalt refining circuit and the production of high-purity copper cathode. The cobalt purification process involves lime precipitation followed by SX and ion-exchange processes for zinc and nickel removal, respectively, before cobalt is electrowon, degassed, and crushed to produce London Metal Exchange (LME)-grade cobalt metal.

China Non-Ferrous Metals Company (CNMC) started the Sinometals leach plant in 2008. Located near Kitwe, this plant processes a variety of copper-containing raw materials. Through its subsidiary Luanshya Copper Mines (LCM), CNMC also operates the Muliashi SX-EW operation that was commissioned in 2012. Muliashi produces cathode approximately 40 kt/a) from both agitated and heap-leach circuits.

Challenges and future prospects

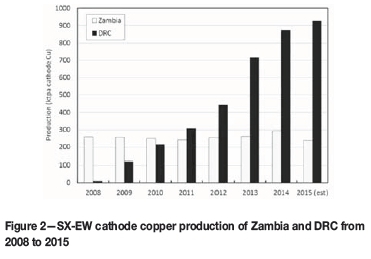

Until 2012, Zambia was the largest copper producer in Africa, but it has since been overtaken by the DRC, particularly with respect to cathode copper (Figure 2). Zambian mining policy has travelled the path from assets being held by privately owned companies, through nationalization during the 1960s, and back to private ownership again in 2000 (Limpitlaw, 2011; Sikamo et al., 2015). The lack of success of the nationalization policies has been strongly articulated by the Minister of Mines (Kapembwa, 2014): it is now well accepted that the economy, productivity, and health and safety performance fare far better under corporate management. Today, the Zambian government retains a minority interest in most of the large projects and mines through its holding company, Zambia Consolidated Copper Mines Investment Holdings plc (ZCCM-IH). Under a law passed in January 2015, Zambia's mining royalty rate increased more than threefold, which put enormous pressure on operating copper mines (Hill, 2014a). With the depressed commodity price, the new law was revised in early 2016 to prevent multiple mine closures and mass layoffs (Hill, 2016).

As in many Southern African countries, electricity supply is an increasing source of concern. The national producer, ZESCO, has 2200 MW capacity and produces some 90% of demand, but is increasingly under pressure as additional mining projects come online. In particular, commissioning of FQM's Sentinel mine and smelter in 2015 has significantly constrained supply. This Kansanshi smelter is more recently exacerbated by a two-thirds drop in hydroelectric output as a consequence of the regional drought. The national regulator granted an electricity tariff increase of 28% in 2014 (Hill, 2014b) and a further tariff increase of 26% was implemented in 2016 (Mining Technology, 2016b).

Democratic Republic of Congo

Development of the industry and current operations

The DRC is widely considered to be one of the richest countries in the world with respect to natural resources. It contains commercially viable quantities of some 50 commodities, including one-third of the world's cobalt and 10% of the world's copper.

Although hydrometallurgy had been employed in the DRC by Union Minière du Haut Katanga and its successor company, Gecamines, since the 1950s, it is only very recently that SX-EW has become commonplace. Some of the first companies to move back into the country in the early 2000s operated furnaces that produced 97 to 99% blister copper from high-grade copper oxide ores while others built leach-direct EW operations. In both cases, the intention was to minimize capital costs and recoup their investments as fast as possible by producing copper on a short lead time. Cathode produced by direct EW was of poor quality, but facilitated cash flow for further expansions and upgrading. The first large-scale modern SX-EW facility was commissioned in 2008. Since then, the industry has expanded rapidly and there are now over 20 operations producing copper via this route and almost as many projects in development.

One of the world's largest SX-EW operations is Tenke Fungurume Mining (TFM), located between the two rural towns of these names. TFM has one of the richest orebodies in the world and huge effort and resources were poured into the development of a flow sheet for this project in the 1970s. At that time, the project was far advanced and the emerging technology of SX was a crucial component. With the outbreak of a series of civil wars in (then) Zaire, all mining projects ceased from the mid-1970s. It is only since about 2004 that the political situation in DRC has stabilized sufficiently for adventurous multinational companies to start reinvestment in this region. Tenke, which started operation in 2009 and expanded in 2013, is today considered the flagship operation of the Copperbelt, with 2014 production of 203 kt Cu and 13.2 kt Co as Co(OH)2. Under the management of US-based Freeport McMoRan, it also boasts amongst the best safety records in the region and lowest cash operating costs (US$1.15 per pound net of cobalt credits) (Freeport McMoRan, 2014). In May 2016, Freeport announced the sale of this asset to China Molybdenum (Wilson, 2016).

Two other major DRC operations are Glencore-owned Kamoto Copper Company (KCC) and Mutanda Mining, both located near Kolwezi at the far end of the Copperbelt. KCC's Luilu plant started production in the 1950s under Union Minière du Haut Katanga and was considered a world-class operation at that time. It fell into disuse and disrepair during the war years, but was restarted in 2008 using the original flow sheet. The process comprised agitated leaching of oxide concentrate and roasted sulphide concentrate followed by precipitation separations and direct EW. The first of three SX circuits was brought online in December 2012 and production today is entirely by SX-EW. The plant now has a design capacity of 300 kt/a Cu and produced 200 kt Cu and 2.78 kt Co cathode in 2014 (Katanga Mining, 2014). Glencore placed this operation on care and maintenance in September 2015, pending improved commodity prices.

Mutanda Mining started as a greenfield project in 2010. It is located on one of the richest deposits in this country and has gone through several expansions since start-up. Today, this operation, which treats whole ore by agitated leaching and heap leaching, boasts four SX circuits and seven EW tankhouses, with a design capacity of 200 kt/a Cu. Production in 2014 was reported as 197 kt Cu cathode and 14.4 kt Co as Co(OH)2 (Fleurette Group, 2015).

Located near KCC, Sicomines is the first large Chinese operation in DRC. Commissioning started in mid-2015, and the first phase of the project will produce 35 kt/a Cu cathode. The second phase, starting in mid-2016, will increase this to 150 kt/a. The plant will also produce Co(OH)2. As shown in Figure 3, there are numerous other small Chinese operations in DRC, most producing 12 to 20 kt/a Cu cathode. MKM (La Minière de Kalumbwe Myunga) produces 20 kt/a Cu cathode and 600 t/a Co(OH)2. Comilu (Compagnie Minière de Luisha) started production in 2015 with a design capacity of 14 kt/a cathode using a heap leaching-SX-EW flow sheet and is currently operating at about 50% of design. CIMCO (Congo International Mining Company) currently produces 500 to 1000 t/month cathode, also via heap leaching-SX-EW. Shituru Mining Company (SMCO), located outside Likasi, was commissioned in 2012 and produces 35 kt/a copper cathode by agitated leach-SX-EW.

The Chinese-owned Mineral & Metals Group (MMG) operates Kinsevere, located near Lubumbashi. This started as a dense medium separation plant producing concentrate, but today the flow sheet comprises SX and EW, producing above 70 kt/a copper cathode. The available oxide ore is depleting and feasibility studies are currently underway to process sulphide material in the future.

Ruashi Mining, owned by China's Jinchuan Group (following the 2011 acquisition of Metorex), is located on the outskirts of Lubumbashi. The operation has a long history of copper and cobalt mining, going as far back as 1911. The modern operations have been in production since 2005. These comprise three open pits and copper is produced by leach-SX-EW following flotation concentration of the oxide ore-an unusual unit operation, but one that is employed in a few DRC flow sheets. Copper recovery is maximized by operating high- and low-grade SX circuits. Ruashi produces its own sulphuric acid and SO2 to reduce the need to purchase acid and sodium metabisulphite (SMBS) that is required to reductively leach cobalt (III) from heterogenite. Cobalt is produced as Co(OH)2 by precipitation with MgO. Ruashi currently produces 38 kt/a Cu and 4.4 kt/a Co (Metorex, 2015).

Chemafs Usoke plant in Lubumbashi produced 15.2 kt Cu and 2.0 t Co in 2014 (Shalina Resources, 2015). The SX-EW equipment was brought from the old Mount Gordon site in Australia in 2007 when that plant closed and has considerable capacity available (31.5 kt/a). Chemaf originally produced cobalt as CoCO3, but today cobalt is mainly sold as Co(OH)2, produced by precipitation with MgO. A cobalt EW pilot facility produces 50 t/a cobalt cathode of 99.9% purity. Their nearby Etoile plant is nearing completion and is designed to produce 20 kt/a Cu and 3.8 kt/a Co.

Tiger Resources' Kipoi project is located between Lubumbashi and Likasi and currently produces 25 kt/a copper cathode by heap leach-SX-EW. Following several years of operating a heavy-media separation plant, the SX-EW plant was successfully commissioned in May 2014.

The Roan Tailings Reclamation (RTR) project is currently under construction near Kolwezi and will produce 77 kt/a cathode copper during its first phase of operation, currently targeting Q4 2016 for first metal production. The flow sheet is an agitated leach followed by SX-EW. The plant will also produce 14 kt/a Co as Co(OH)2. In contrast to most other DRC operations, this tailings material contains significant qualities of zinc. Because tailings are treated, mining costs are negligible for this project and operating costs are expected to be very low, providing resilience for the operation in times of depressed commodity prices.

Challenges and future prospects

Electrowinning of copper is very energy-intensive (approx. 2.1 MWh/t Cu). Decades of infrastructure decay in DRC have left an electricity supply that is unreliable, both from the viewpoints of availability and stability. Power failures up to six times per day are not uncommon. Many operations supplement their power requirements using diesel generators, which adds significantly to operating costs. Fortunately, this situation should improve steadily, as mining companies make investments in the regional power grid. The Congo River is estimated by the United Nations to be able to supply the electricity needs of the entire continent by hydroelectric power (International Rivers, 2015a). The proposed Grand Inga scheme, if all seven phases are eventually implemented, will supply 40 000 MW-twice the generating capacity of the world's largest hydroelectric plant, the Three Gorges in China (Pearce, 2013). In 2013, Inga produced 115 MW DC, which increased to 250 MW in 2014. The Inga-3 project is expected to start by 2020 and will eventually supply a further 4800 MW (of which South Africa will take 2500 MW) (International Rivers, 2015b). Reliable and sufficient electricity supply is vital to the successful revitalization of the economy, and particularly the mining industry.

Transport infrastructure also creates huge challenges in this region. Almost all capital equipment and operating consumables must come in by road transport, either from Namibia, South Africa, or Tanzania, a distance of 2200 to 3000 km. Typical overland transit times range from 10 to 20 days. As a comparison of the impact of transport on operating costs, MMG report that the cost of sulphuric acid at Kinsevere is almost double that at their Sepon operation, which is situated in a remote location in Laos. There are no operating railways in the DRC Copperbelt, but initiatives are underway to bring in rail transport from the deep-water port at Walvis Bay, Namibia (Njini, 2014), and from Dar es Salaam, Tanzania (The Guardian, 2013). Onerous and expensive visa requirements, excessive landing fees (leading to expensive airfares), and difficult travelling conditions are also an impediment to foreign investment and expertise.

The economic and political stability of the country still presents unacceptable risk for many investors. The DRC has the near-lowest nominal gross domestic product (GDP) per capita in the world. In 2014, DRC had the second-lowest Human Development Index of 187 ranked countries (UNDP, 2014) and is also one of the lowest-ranked countries on the Corruption Perception Index (Transparency International, 2014).

On the positive side, the Copperbelt orebodies are incredibly rich by global standards: tailings sent to waste are typically of much higher grade than the feeds of many older operations in North and South America-which, nevertheless, are able to operate profitably. There is enormous potential for improved productivity, recovery, and throughput in these operations. The lowest labour costs of all copper-producing countries (World Salaries, 2015) give ample opportunities for operations to drive themselves down the cost curve and become competitive in global terms. Mutanda is already one of the five lowest-cost producers in the world.

Significant opportunities also exist to capitalize on the large-scale production of cobalt. The demand for cobalt is increasing because its main applications are technology-based and in high-temperature alloys. The price of cobalt is likely to increase more than that of copper in the short to medium term.

Central African copper SX-EW technical characteristics and challenges

Agitated leach flow sheets

Because of the high grade of the Central African ores and their readily acid-leachable minerals, leaching is generally carried out in agitated tanks, in contrast to the percolation (heap, dump, and ROM) leaching of most North and South American operations. The upside of agitated leaching is that the residence time required is of the order of hours (rather than months or years) and high PLS tenors can be achieved. The downside, however, is that extensive washing of the leach residue is required to minimize copper (and cobalt) losses to the tailings solids. Multiple countercurrent decantation (CCD) units are required, with the associated need to introduce flocculants and other settling-enhancing chemicals into the PLS, which may detrimentally impact the physical behaviour of the SX organic phase. A further disadvantage of solid-liquid separation by CCD is the high levels of total suspended solids (TSS) that report to the PLS and which greatly increase crud formation and the associated losses of extractant and diluent. In percolation leaching systems, the ore bed itself acts as a filtration medium, so TSS values are much lower (see Table I).

A unique flow sheet configuration, developed as a consequence of agitated leaching and the large washing requirements, is the so-called Split Circuit, the patent for which is held by BASF (Kordosky and Nisbett, 2005; Nisbett et al., 2008). The relatively high-copper tenor PLS generated from the leaching circuit is passed through several stages of CCD for solid-liquid separation. The overflow from the first thickener reports to a high-grade SX circuit, which is operated to maximize copper throughput. The acid-containing raffinate is returned to the leach. The diluted PLS generated by washing through the remaining CCD stages reports to a low-grade SX circuit, which is operated to maximize copper recovery and minimize the amount of copper reporting to the final raffinate. This raffinate is used for washing, which allows some further copper recovery from any incompletely leached solids and utilization of the 'free' acid that has been generated by SX. In some flow sheets, a portion of the low-grade raffinate is neutralized and discarded, so any associated copper represents a loss to tailings.

Extractant choices and consumptions

The most widely used extractants are modified and non-modified aldoxime-ketoxime blends, e.g. LIX 984N from BASF Corporation and ACORGA OPT5510 and OPT5540 from Cytec Solvay Group. Some plants in Zambia also use modified aldoxime reagents successfully.

The extractant concentration employed (Table II) obviously bears a direct relationship to the copper tenor of the PLS (Table I) and extraction efficiency required. Most of the African operations use significantly higher extractant concentrations than elsewhere: for example, Mutanda employs 35 vol.% extractant to process a PLS containing 22.5 g/L Cu, while KCC uses 33 vol.% for a PLS of 26 g/L Cu.

The high TSS levels in an agitated leaching PLS are responsible for crud formation in SX circuits. A consequence is that extractant consumption is much higher than would typically be expected for the processing of high-grade copper liquors. To illustrate this, Table III compares the reagent consumptions of three hypothetical, well-operated, mid-sized operations in Chile, the USA, and the DRC. In this comparison, the assumption is made that annual production is 46 kt and organic losses are the same (50 mg/L). Clearly, extractant usage in the African case should be significantly lower than in Chile or the USA. Actual usages are more in the 3 to 6 kg/t range: the difference is attributable to both higher entrained losses of organic and the significant organic losses associated with crud.

Interestingly, although several operations have mixer temperatures in the 35-45°C range, hydrolytic degradation of the extractant is seldom an issue. This can be attributed to the relatively high replacement or 'make-up' rate, as discussed above.

Diluent choice and consumption

Safety considerations, particularly flash point, dominate diluent selection. Despite the growing global tendency to minimize carbon footprint and use aliphatic diluents, in Africa, diluents containing higher aromatic content (8 to 25 vol.%) have been traditionally preferred for the enhanced solvating capacity that this offers for the higher extractant concentrations (Table II). A recent study, however, indicates that aliphatic diluents may potentially be used for these applications (Brown, 2015).

Of increasing concern to the regional industry is diluent availability. Until recently, all diluent has been supplied from the South African Petroleum Refinery (SAPRef); however, with advancing age, this refinery is suffering increasingly frequent and lengthy shutdowns (137 days of lost production in 2014), which is aggravating diluent supply. The other South African and Zambian refineries do not currently produce suitable products for this application and there is an increasing need to import alternatives. Although these offer suitable safety and chemical properties, imports obviously command a significant price premium and add to ever-increasing operating costs and lead times on orders. This issue will not be resolved in the short term and innovative solutions are required to ensure that the increasing diluent demands of Copperbelt users can be consistently and reliably met.

Suspended solids and crud management

The rate of build-up of crud, both at the settler interface and on the bottom of the settlers, is by far the most significant operational issue facing the African agitated leach-SX operations. To put it in perspective, heap leach operations typically deliver PLS containing <30 mg/L TSS, while-even after clarification-most agitated leach PLS will contain upwards of 50 mg/L and frequently over 100 mg/L TSS. If not actively managed, the crud will literally fill up the settlers over a six- to twelve-month period. Most agitated leach-SX operations regularly take individual settlers off-line to remove bottom crud. Minimizing the entry of solids into SX is obviously the best approach, although this is difficult to accomplish in practice. Several operations have installed pinned-bed clarifiers on the PLS streams; these have seldom been effective, although there are examples where TSS are consistently reduced to <20 mg/L.

Crud exacerbates losses of the organic phase and crud treatment systems are required to reclaim as much of these expensive reagents as possible. It is usually necessary to clay-treat any recovered organic phase before returning it to the circuit to avoid introducing organic degradation products or other detrimental compounds into the SX circuit. Although expensive, three-phase centrifuges and plate-and-frame filters have become standard equipment both to separate the organic phase from the solids and aqueous phase and to separate organic from clay. The solid component of crud ultimately reports to tailings disposal.

Impact of up- and downstream additives

Flocculants, coagulants, flotation chemicals, and similar reagents are surfactants. If the addition of these chemicals to upstream unit operations is not properly controlled, they can have severe detrimental impacts on the SX circuit. Because the SX process is interfacial-involving the transfer of Cu2+ ions across an aqueous-organic interface-its chemical and physical performances are strongly influenced by the presence of any foreign species that interfere with the interfacial characteristics. It is critical to evaluate the potential impact that the upstream introduction of a new reagent may have on the downstream SX performance.

The transfer of organics, such as mist suppressants and smoothing agents, from EW to SX via the return spent electrolyte can also have unintended consequences if not properly managed.

Impact of dissolved and hydrated silica species

African PLS often contain very high levels of dissolved or hydrated silica species. As is well known, silica can form polymeric structures under appropriate conditions of temperature and aging. These can significantly alter the viscosity of the solutions in the SX circuit, which impedes the transfer of copper ions across the aqueous-organic interface. Silica is usually also a major component of crud.

Coagulants can be used to remove colloidal silica and fine particles (less than 0.5 μΐη diameter). Coagulants are surface-active agents, so it is important to ensure that these do not interfere with the interfacial behaviour in the SX circuit. Neutral (uncharged) coagulants, which cannot be overdosed, are generally preferred. Liquid coagulants, rather than common powder-based solids, are safer to use (no inhalation hazard) and can be used directly without prior dilution. Chambishi has employed silica coagulants ahead of both their copper and zinc SX circuits to remove silica from the PLS and avoid severe clogging of their filters.

Impact of high PLS and spent electrolyte temperatures on degradation

Agitated leaching systems, particularly those processing secondary sulphides, often operate above ambient temperature. As oxide deposits reach the end of their life and the processing of primary sulphides increases, an increasing prevalence of autoclave leaching is expected to be seen in this part of the world. The temperatures of autoclave-generated PLS are typically higher than those of atmospheric percolation leaching operations. Spent electrolyte is also typically at 40°C due to resistive heating of the electrolyte during electrodeposition. The effect of elevated temperature manifests in two ways. The main mechanism of diluent loss is via evaporation: the rate of evaporation increases with increasing temperature, leading to increased diluent consumption per ton of cathode produced. Elevated temperature also increases the rate of hydrolytic degradation of both extractant and diluent.

Aqueous and organic entrainment

One positive aspect of aqueous-in-organic entrainment- unique to Africa-is the transfer of cobalt from the PLS to the advance electrolyte. Copper EW typically requires 150 to 200 mg/L Co to be present in the electrolyte to assist with passivation of the anode and minimizing lead contamination of the cathode. This is usually added as cobalt sulphate salt and comprises a significant operating cost (US$3.50-4.00 per ton Cu) in North and South American operations. In Africa, the electrolyte typically contains some 2000 mg/L Co as a result of entrainment from the PLS (Sole et al., 2013) and no further cobalt addition is required.

Organic-in-aqueous entrainment represents the main source of extractant losses in these circuits. This is caused by crud formation and inefficient phase disengagement in settlers. Methods to recover organic include the installation of an after-settler, flotation columns, activated carbon columns, or other coalescing systems. The use of coalescence packs in loaded organic tanks assists with removal of entrained PLS ahead of the strip circuit. It is critically important to minimize the organic contamination of the advance electrolyte (target <30 mg/L entrained organic): not only does the presence of organic ruin the cathode appearance, but it has been responsible for several tankhouse fires in DRC in recent years.

Conclusions

As indicated in the discussions above, copper SX in Central Africa faces many challenges, but offers many significant opportunities in return. The current and planned expansions of existing operations and the proliferation of projects in various stages of development in the Copperbelt suggest that this region will become the dominant copper producer of the world within the next decade. The rich, extensive, and easily leachable orebodies, coupled with low labour costs, provide conditions for large operators to become among the lowest global cost producers. Hampering the rapid development of the industry are the ongoing (albeit improving) power supply situation, expensive and difficult logistics, lack of capacity in technical and management skills, corruption, and unhelpful government regulation and legislation. The many unique issues presented by this region are promoting innovation and the development of new and interesting flow sheets, all of which enhance the use of SX technology. Provided that the political environment remains stable, the long-term outlook for the copper industry in this part of the world is extremely positive for operators, suppliers, and engineering companies.

References

Brown, C.W. 2015. Physical property-performance relationships of commercial diluents in African copper solvent extraction conditions. Proceedings of the Copper Cobalt Africa Conference. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 269-280. [ Links ]

CHONGO, C. and NGULUBE, C. 2015. Development and optimisation of Kansanshi ore treatment. Proceedings of the Copper Cobalt Africa Conference. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 69-80. [ Links ]

First Quantum Minerals. 2006. First Quantum reports operational and financial results for three months and twelve months ended December 31, 2005. Press Release, 9 March 2006. [ Links ]

First Quantum Minerals. 2015. Kansanshi. http://www.first-quantum.com/Our-Business/operating-mines/Kansanshi/default.aspx [ Links ]

Fleurette Group. 2015. Fourth quarter and 2014 calendar year production report. http://www.prnewswire.co.uk/news-releases/fleurette-group-mutanda-mining-sarl-fourth-quarter-and-2014-calendar-year-production-report-291499461.html [ Links ]

Freeport McMoRan. 2014. Annual Report 2014. http://investors.fcx.com/files/doc_financials/annual/10_K2014.pdf [ Links ]

HILL, M. 2014a. Zambian mine royalty rise to cost 12,000 jobs, Chamber says. Bloomberg Business, 19 Dec. 2014. http://www.bloomberg.com/news/articles/2014-12-19/zambia-mining-royalty-increase-to-cost-12-000-jobs-chamber-says [ Links ]

HILL, M. 2014b. Zambian power surplus to shrink as copper mining expands. Bloomberg Business, 25 Nov. 2014. http://www.bloomberg.com/news/articles/2014-11-25/zambian-power-surplus-to-shrink-as-copper-mining-expands-1- [ Links ]

HILL, M. 2016. Zambia plans price-based royalty for ailing copper mines. Bloomberg Business, 17 Feb. 2016. http://www.bloomberg.com/news/articles/2016-02-17/zambian-cabinet-approves-lower-variable-copper-royalties [ Links ]

Holmes, J.A. Deuchar, A.D. Stewart, L.N., and Parker, J.D. 1976. Design, construction and commissioning of the Nchanga Tailings Leach Plant. Extraction Metallurgy of Copper, vol. II. AIME, New York. pp. 907-925. [ Links ]

International Rivers. 2015a. Grand Inga dam, DR Congo. http://www.internationalrivers.org/campaigns/grand-inga-dam-dr-congo [ Links ]

International Rivers. 2015b. The Inga-3 hydropower project.http://www.internationalrivers.org/campaigns/the-inga-3-hydropower-project [ Links ]

Kapembwa, J. 2014. Zambia has no intention of nationalising its mines - NOT AGAIN. The Southern Times Online, 28 Feb. 2014. http://www.southern-timesafrica.com/articles/9516/Zambia-has-no-intention-of-nationalising-its-mines-NOT-AGAIN--/#.VRUpGeGBdcA [ Links ]

Katanga Mining. 2015. Financial results Q4 2014. http://www.katangamining.com/~/media/Files/K/Katanga-miningv2/investor_relations/financialresults/res2014/q4-2014/mda-q4-2014.pdf [ Links ]

Kordosky, G.A. and Nisbett, A. 2005. Methods for improving the recovery of metal leaching agents. World Patent WO 2005012581 A2. [ Links ]

Lakshmanan, V.I. Mackinnon, D.J., and Brannen, J. M. 1977. The effect of chloride ion in the electrowinning of copper. Journal of Applied Electrochemistry, vol. 7, no. 1. pp. 81-90. http://rd.springer.com/article/10.1007/BF00615534# [ Links ]

Limpitlaw, D. 2011. Nationalisation and mining: lessons from Zambia. Journal of the Southern African Institute of Mining and Metallurgy, vol. 111. pp. 737-739. [ Links ]

Metorex Group. 2015. Ruashi Mining. http://www.metorexgroup.com [ Links ]

Mining Technology. 2016a. Glencore to invest $1.1bn to develop Mopani mine shafts in Zambia. Mining Technology, 31 Mar. 2016. http://www.mining-technology.com/news/newsglencore-to-invest-11bn-to-develop-mopani-mine-shafts-in-zambia-4852541 [ Links ]

Mining Technology. 2016b. Zambia increases power tariffs for mining companies. Mining Technology, 1 Feb. 2016. http://www.mining-technology.com/news/newszambia-increases-power-tariffs-for-mining-companies-4798074 [ Links ]

Mwale, M. and Megaw, D. 2011. Development of effective solvent-extration process control - low cost implementation value-addition to hydrometal-lurgical copper operations. Proceedings of the Sixth Southern African Base Metals Conference. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 353-365. [ Links ]

Nisbett, A., Peabody, S., and Kordosky, G.A. 2008. Developing high-performing copper solvent-extraction circuits: strategies, concepts, and implementation. Solvent Extraction: Fundamentals to Industrial Applications. International Solvent Extraction Conference ISEC2008, vol. 1, Moyer, B.A. (ed.). Canadian Institute of Mining, Metallurgy and Petroleum, Montreal, Canada. pp. 93-100. [ Links ]

Njini, F. 2014. Namibia may seek investors for DRC, Zambia rail to port. Bloomberg Business, 8 oct. 2014. http://www.bloomberg.com/news/articles/2014-10-08/namibia-may-seek-investors-for-drc-zambia-rail-to-port [ Links ]

Pearce, F. 2013. Hydropower megaproject to dam Congo River. New Scientist. http://www.newscientist.com/article/dn23589-hydropower-megaproject-to-dam-river-congo.html# [ Links ]

Russell, C. 2014. BHP Billiton chief Andrew Mackenzie says Olympic Dam in South Australia will be mined for 200 years at least. The Advertiser, 20 Aug. http://www.adelaidenow.com.au/ business/bhp-billiton-chief-andrew-mackenzie-says-olympic-dam-in-south-australia-will-be-mined-for-200-years-at-least/story-fni6uma6-1227029973661?nk=74bbba54dfd3216aa2ba705c4 5276353 [ Links ]

Schlesinger, M.E., King, M., Sole, K.C., and Davenport, W.E. 2011. Extractive Metallurgy of Copper, 5th edn. Elsevier. [ Links ]

Shalina Resources. 2015. Processing operations. http://www.shalinaresources.com [ Links ]

Sikamo, J., Mwanza, A., and Mweemba, C. 2015. Copper mining in Zambia-History and future. Proceedings of the Copper Cobalt Africa Conference. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 1-10. [ Links ]

Sole, K.C., Zarate, G., Steeples J., Tinkler, O., and Robinson, T.G. 2013. Global survey of copper solvent extraction operations and practices. Proceedings of Copper-Cobre 2013 Conference, vol. IV. Gecamin, Santiago, Chile. pp. 137-148. [ Links ]

The Guardian. 2013. DRC, Burundi and Tanzania discuss air, rail, water links. The Guardian, 28 Nov. 2013. http://www.ippmedia.com/frontend/?l=62051 [ Links ]

Transparency International. 2014. Corruption Perceptions Index 2014. https://www.transparency.org/cpi2014 [ Links ]

Tumilty, J., Seward, G., and Massam, J.P. 1977. The ACORGA P-5000 Series: A novel range of solvent-extraction reagents for copper. Advances in Extractive Metallurgy. Institution of Mining and Metallurgy, London. [ Links ]

United Nations Development Program. 2014. Human Development Report 2014. http://hdr.undp.org/sites/default/files/hdr14-report-en-1.pdf [ Links ]

Wilson, J. 2016. Freeport sells key copper mine for $2.7bn to China Molybdenum. Financial Times, 9 May 2016. http://www.ft.com/intl/cms/s/0/f222487c-15d3-11e6-b197-a4af20d5575e.html#axzz496ZDm8YK [ Links ]

World Salaries. 2015. Miner salaries - international comparison. http://www.worldsalaries.org/miner.shtml. [ Links ] ♦

This paper was first presented at the, Copper Cobalt Africa Conference, 6-8 July 2015, Avani Victoria Falls Hotel, Victoria Falls, Livingstone, Zambia.