Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.116 n.2 Johannesburg Feb. 2016

http://dx.doi.org/10.17159/2411-9717/2016/v116n2a4

PAPERS - MINING BUSINESS OPTIMIZATION CONFERENCE

A simultaneous mining and mineral processing optimization and sustainability evaluation prepared during a platinum project prefeasibility study

S.F. Burks

MAC Consulting

SYNOPSIS

This paper develops themes explained at two SAIMM platinum conferences. Optimization techniques can be used to significantly increase the value of mining businesses by enabling better long-term planning decisions. Open pit and underground mine design, mine scheduling, cut-off grade and blending, stockpiling, and the linking of these to flexible elements of the metallurgical recovery processes are all evaluated together. Transport or sale of intermediate products and the requirements of the product metal markets can also be considered. Experience shows that net present value (NPV) can be increased significantly, usually even before the expenditure of significant amounts of project capital. Recent studies of NPV have aimed to simultaneously evaluate the impact of the optimized financial solution on the non-financial features of a project or operation.

The case study presented comprised a commercially orientated review of the prefeasibility study designs and cost estimates of a platinum group metal (PGM) project in South Africa, followed by value chain optimization and sustainability studies of the project carried out simultaneously to identify potential value uplifts to be gained and guide the owners' team going forward into the feasibility study phase. Some of the major aspects of the project that were found to have significant potential to add value included enhancement of the business model by the application of activity-based costing and theory of constraints, focus on the highest net value portions of the orebody in the early years of production, enhanced and optimized scheduling of the underground mining operation, application of dynamic grind and percentage mass recovery from ore to flotation concentrate (also known as percentage mass pull) to optimize revenue, application of elevated cut-off grades early in the life of mine, matching of the mining and processing capacity, expansion of the operation subject to capital availability, and installation of downstream processing facilities subject to regional third-party capacities.

The investigation of non-financial project features focused on demonstrating that a financially optimized solution could also have a number of other benefits. These are mentioned briefly in the paper, which aims to present the status of the project at an early stage of its development.

Keywords: sustainable health and safety, productivity, efficiency, project delivery, mechanization, optimization, tunnelling technology, rock cutting and boring

Introduction

Many software packages exist to optimize various parts of a mining business in isolation. However, it is rare for companies to optimize all parts of their operation or portfolio simultaneously. In the past ten years some optimization specialists have focused on expanding the boundaries of integrated optimization, concentrating on issues faced by large and complex mining and processing operations. Burks and Whittle (2010) introduced these techniques at the 4th International Platinum Conference. Using advanced techniques, an integrated geological, mining, processing, transport, and product model can be constructed. This is manipulated mathematically to optimize the values of those variables that are considered negotiable. Utilizing this procedure, it is possible to develop long-term plans that maximize the value of large geological and technical plant asset portfolios. Significant improvements in net present value (NPV) of the business have been demonstrated in many cases.

This methodology is very suitable for application to the PGM (platinum group metal) and related sectors of the mining industry. Whittle Consulting (an Australian company), assisted by its regional associates, recently completed an optimization study of a platinum project in South Africa (Burks et al., 2014, 2015). In this paper, the author discusses some of the optimization techniques and mechanisms applied, and briefly refers to some of the main conclusions and recommendations.

A reminder - what is enterprise optimization?

Enterprise optimization, a term coined by Whittle Consulting, can help to solve the production schedule challenges of mining and processing operations with multiple pits, mining faces, and underground mines, multiple metal or mineral products, stockpiling and blending opportunities, and alternative processing options. The combination of these features creates significant long-term planning and analytical problems and opportunities that often exceed the capabilities of commercially available mining optimization software.

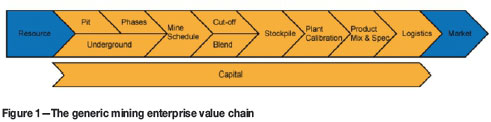

Simultaneous optimization aims to address all steps in the value chain and all assets in the enterprise portfolio together, and does this while also considering all time periods of the planned operation, as discussed by Burks (2012). This is a crucial additional complexity that differentiates mining from other businesses. An orebody is a depleting resource; when we decide what to mine and process in one period, we constrain the available options for all future periods.

Figure 1 illustrates this point. There is little or nothing that any enterprise can do to improve the resource in the ground or the international market for the products, but all the other steps illustrated in the figure can potentially be optimized.

Enterprise optimization concentrates on optimizing the NPV of businesses. NPV is the sum of discounted cash flows, normally calculated or forecast annually. It reflects the time value of money and is considered to be a metric for planning and measuring the performance of any business that will be understood and appreciated by executive management, shareholders and other investors, and all stakeholders.

Philosophically, many mining businesses struggle to identify clear and consistent objectives. For example, maximizing metal production, maximizing life of mine, minimizing costs, maximizing resource recovery from the ground, maximizing metal recovery from ore mined, and maximizing utilization of equipment are all often cited as being key objectives for operations. However, it is difficult to rank these against each other, and some of them conflict. Enterprise optimization therefore focuses on a single objective: to maximize the economic value of the business.

From a sustainable development perspective, the economic value represents the addition of financial capital to a project. The overall evaluation in this case included potential enhancements of the social, human and environmental capitals of the project, but this paper describes in detail only the work done to investigate possible increases in financial capital.

Application of optimization principles to a platinum project

This optimization study provided diverse challenges in several links of the production value chain. This real case study is used to illustrate the flexible nature of the optimization mechanisms and techniques applied. Unfortunately, since the analysis of the results identified operational strategies that could affect the valuation of the operation, the identity of the project as well as specific results could not be provided in this paper, which focuses on describing the approach and mechanisms tested and on the broad trends of the results.

In this study, the optimization work included the whole of the value chain between the resource in the ground and the sale of final metal products.

Definition of the project and its current status

The project is being developed on the northern limb of South Africa's Bushveld Complex. With the support of many partners and stakeholders, including local empowerment beneficiaries in the locality of the planned mine, employees, local South African entrepreneurs, and third-party investors, the owner's team is committed to building a safe, large-scale, mechanized underground platinum group and base metals mine.

The recently completed prefeasibility study (PFS) covered the first phase of development that would include the underground mine, a flotation concentrator, and other associated infrastructure to support initial concentrate production by 2019 (Anon, 2013, 2014). As Phase 1 is being developed and commissioned there will be opportunities to define the timing and scope of subsequent expansion phases.

Key features of the PFS included:

> Development of Phase 1 of a large, mechanized underground mine with associated processing plant and surface infrastructure

> Planned initial annual production rate of 433 000 ounces of 3PE+Au (platinum, palladium, rhodium, and gold) plus 19 million pounds of nickel and 12 million pounds of copper per year

> Estimated pre-production capital requirement of approximately US$1.2 billion, including US$114 million in contingencies, at a ZAR:USD exchange rate of 11 to 1

> The project would rank at the bottom of the cash cost curve at an estimated US$322 per ounce of 3PE+Au net of byproducts

> After-tax NPV of US$972 million at an 8% discount rate

> After-tax internal rate of return (IRR) of 13%.

The optimization study used the PFS parameters, preliminary designs, and results as a starting point. It commenced with a strategic assessment consisting principally of a two-day workshop attended by delegates drawn from all corporate and project disciplines likely to have any influence on the financial viability of the project. Optimization principles were discussed and explained, the current business plan of the project was presented, and the personnel who would be responsible later for providing information were identified.

The main items identified for further investigation in the subsequent enterprise optimization study by Whittle Consulting and a related sustainability (SUSOP) study delivered in parallel by JKTech included activity-based costing; theory of constraints; underground mine zone shapes, sizes, and sequence rules; mine scheduling; cut-off value policy; selective stockpiling; ore blending; grind-throughput-recovery variability in the metallurgical processing plant; dynamic concentrate mass pull; capital and period cost optimization; enhancement of the optimization model by consideration of the non-financial capitals (manufactured, social, human, and natural capital); and sensitivity to various external factors such as metal prices.

Description of the optimization work completed in 2014 (Burks ef a/., 2014, 2015)

Methodology

The approach described is typical of many other similar optimization studies, except that in this case much more emphasis was placed on the optimization of mining zone shapes and cut-off grades and subsequent scheduling from the underground mine. The steps that were followed, mainly sequentially but sometimes in parallel, are outlined below:

> Resource model, operational, test work, and study information was collected from each project team department and incorporated into a single data input or business model to be used to prepare the input files for the proprietary Prober optimization software. In addition, the underground mine zone definition and annual mining schedules from the PFS report were also transferred, to be used for the initial stages of the optimization

> An activity-based cost (ABC) model was set up matching the overall PFS operating costs at the defined plant capacity but with some variance in the split between variable and fixed costs (usually fixed only for one annual period, and therefore referred to by Whittle Consulting as 'period' costs). Theory of constraints was applied to this ABC model by allocating all period and sustaining capital costs for the entire operation to the overall bottleneck in the system. For the scenario studied in the PFS this happened to be the power available for milling. In the optimization, the effect of this allocation is to make the processing of higher value (usually higher grade) ore though milling more preferential in the early years of the schedule before the annual discount rate significantly reduces the annual discounted cash flow

> A base case optimization was then prepared using proprietary software. This was compared with the project's current production and financial plan. Several of the input parameters were corrected in an iterative process until the optimization results corresponded well with the PFS expectations of operational and financial performance. The NPV of all other cases generated was compared to this base case. The results were presented using a consistent format including summary tables, dashboards, and waterfall charts to ensure that the owner's team could easily compare new results with earlier cases

> The next stage of work tested the mining and milling/flotation optimization mechanisms. The ore mining zone start dates and ramp-up schedules were reviewed and a few alternatives were proposed to enable a theoretical schedule with increased early annual cash flows to be generated. This will need to be tested for achievability by the mining consultants in the next phase of the project. Early optimization runs applied fixed processing parameters, with milling to a p80 of 74 μm (p80 is the term used to determine the grind size achieved during milling and is defined as the screen size in micrometres that 80% of the mill product would pass through) and 4% mass pull to final flotation concentrate. After this, variable grind versus recovery and concentrate mass pull versus recovery relationships based on test work or typical PGM industry experience were applied to determine the impact of allowing flexibility in the processing plant operation

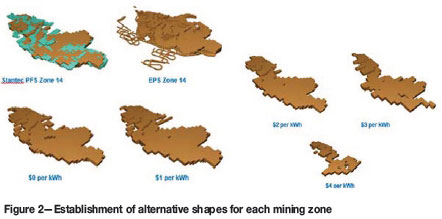

> An exercise to review and re-optimize the cut-off grade policy in each mining zone was now undertaken. For each zone, several alternative cut-off grade policies were applied to develop a series of zone variations for the ore and waste blocks falling within each zone as defined in the PFS. The shape and size of these alternative zones was reduced as the cut-off grade increased, as illustrated for mining zone 14 in Figure 2

> The new zone shapes were used to develop updated mining and processing schedules in Whittle Consulting's Prober optimization software package, comparable to the best of the previous set of runs based on the PFS base case, but with cash flows brought forward. Initially runs were done at constant cut-offs, with the ore from the re-optimized versions of the first 17 mining zones being those developed from the Indicated Resource category. Manual selections of different combinations of cut-off were then tested, and finally the entire database was imported into Whittle's proprietary Prober C software to apply a novel 'Evolutionary Solver' technique. This complex procedure enables the optimization software to learn and refine based on past results where options are presented as alternative scenarios (such as underground mine schedules based on different zone shape and cut-off grade combinations). In this case the optimum sequence yielding maximum NPV from the initial 17 mining zones proved to be a combination of the alternatives shown in Figure 2 for zone 14

> Several different combinations of size and start date of shafts and concentrator modules were then tested using the PFS mining zones as well as the optimized set of new zone shapes. The cases testing multiple shafts and processing modules with potential expansions of ore processed were enhanced firstly by adding additional ore zones from the Inferred portion of the resource, and then by adding dedicated smelting and base metal refining facilities to be constructed on or close to the project site

> Sensitivities to changes in the metal prices were prepared next. Unlike conventional sensitivity analyses that tend to leave the physical production data unchanged and simply adjust the financials, new optimization runs were prepared for each set of revised commercial parameters in order to test the influence of these on the optimized mining and processing schedules

> Several optimization runs were prepared making use of modified input parameters such as social costs, water and electricity consumption, and project permitting delays. These 'non-financial' capital issues were addressed in the parallel SUSOP study and the optimization model was then used to quantify their likely impact on financial capital.

This concluded the main part of the optimization study, in which over 150 Prober runs were completed over a seven-month period. The output of each run consisted of over 50 data tables and 70 charts illustrating trends in the key operating parameters as well as providing an overall financial analysis of the effect of changes in the input settings.

In December 2014 and January 2015 some supplementary optimization work was done to test the following:

> The effect of expected delays in the initial mining and processing of ore

> The impact of new flotation recovery data

> The influence of improved capital and operating cost estimates for downstream processing facilities

> The influence, on both NPV and peak funding requirements, of deferring development and commissioning of some of the shafts and concentrator modules by several years.

Qualitative description of trends observed in a typical prober run

Due to the sensitivity of the revised financial forecasts generated in this type of analysis, it is not possible at this stage to present the identity of the project or the full results of the final optimization runs that have been selected as a guide for the feasibility study team working on the next phase of project development. The charts and explanatory notes that follow are therefore intentionally not identified explicitly in terms of the input parameters that were applied to generate them, and they do not all refer to the same optimization run. Also, they have been amended by removing most of the production, grade, and monetary figures. These charts illustrate key trends in major production metrics that were observed in all completed optimization runs.

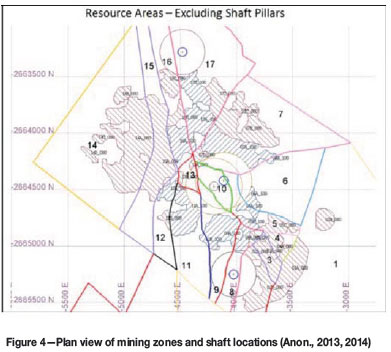

Figure 3 illustrates how the model was set up to enable the optimizer to schedule waste development, ore development, and ore extraction from production stopes in each zone, with built-in lags from initial waste development to the other phases of mining. This summary table was produced for each optimization run. It facilitated a very rapid visual check in each case to ensure that zone sequence rules in respect of the physical location of zones in relation to the shafts and the ability of the mining teams to access specific zones were being followed. The number of zones being mined in any year and the progression from waste development into ore mining could also be followed, enabling the amount of mining equipment and labour as well as the ventilation requirements to be inferred. Mechanisms of this type are important in any strategic optimization exercise to ensure that the solution being offered is likely to be practicable as the design and development of a project progresses.

Figure 4 is a plan view of the mining zones in relation to the planned shaft locations. This provides some context for the need to provide zone sequencing rules in the scheduling process. Clearly, some zones have to be mined before others in order to open up new areas and provide access to outer zones.

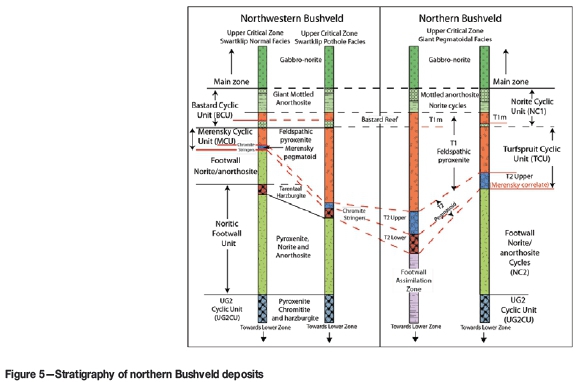

Figure 5 is an extract from the PFS report. The third column shows the stratigraphy of the reef in this specific orebody, with the T1, T2, Upper, and T2 Lower rock types being of interest.

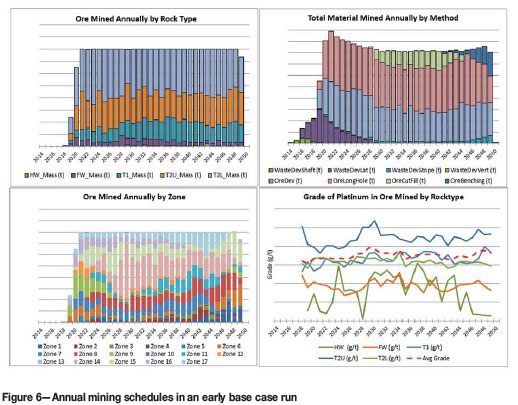

Figure 6 illustrates some features of the mining schedules of a typical optimization run. The first three charts are to the same scale and show respectively the tons of ore mined annually by stratigraphic rock type, the total tons of rock mined by method (vertical and lateral waste development, ore development, ore mining by one of three different methods planned), and the tons of ore mined by zone. The final chart in the bottom right-hand corner of Figure 6 shows the average platinum grade mined each year for each rock type. This particular run was used to establish the base case prior to optimization, and it can be seen that the logical sequencing of zones in the PFS based on their location meant that peak ore grade, usually closely correlated with net value, could only be achieved by about year 15 of the mining schedule.

One implication of the optimization process was that the metal grades mined in the early years of the schedule were increased. This was a consequence of a combination of the zone selection, mining schedule, cut-off grade, and stockpiling optimization mechanisms being applied. The net result was a benefit in early cash flow and NPV.

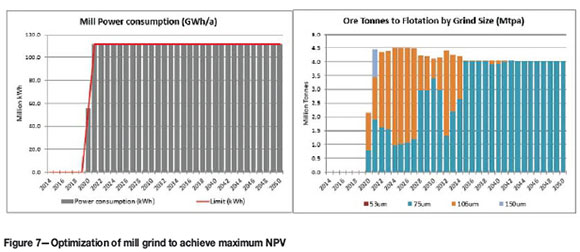

The PFS, and therefore also the base case for the optimization study, specified a main production shaft with a considerable excess of rock hoisting capacity compared to the ore treatment design capacity of the metallurgical plant. In this scenario, milling is the production bottleneck.

A comprehensive set of metallurgical test data was made available at the beginning of the optimization study, and this included milling and flotation test work providing information on the specific power consumption and metal recoveries possible at different grind sizes. As would be expected, metallurgical recoveries peaked at a mill product classification of about 80% passing 74 μm. However, the drop in recovery at 106 and 150 μm was relatively little, whereas the specific power consumption for these coarser grinds dropped off sharply. This introduced the opportunity to specify the system bottleneck as mill power available and allow the optimizer to select the optimum grind size each year to achieve maximum life-of-mine NPV.

Figure 7 shows the result from one Prober run. The annual power consumption (left-hand graph) always reached the red line, which indicates the maximum power limit. In other words, the bottleneck was limiting production, as should be the case. On the right-hand side, it can be seen that the optimization process selected a coarse grind for some of the ore in the first fifteen years of the schedule, allowing the recovery to drop while processing significantly more than the design target of 4 Mt/a of ore. In later years, as the head grade to the plant decreased it was necessary to increase recovery as much as possible to maintain a minimum concentrate grade to smelting, and this caused the optimizer to revert to a finer grind. Sufficient additional capital was added in runs with this mechanism to ensure that the downstream flotation circuit could process the additional material.

It should be noted that towards the end of the optimization study most of the runs considered an alternative scenario with shaft and plant capacity matched much more closely. In these cases the shaft became the bottleneck and the optimizations therefore always selected a grind size that would maximize metallurgical recovery.

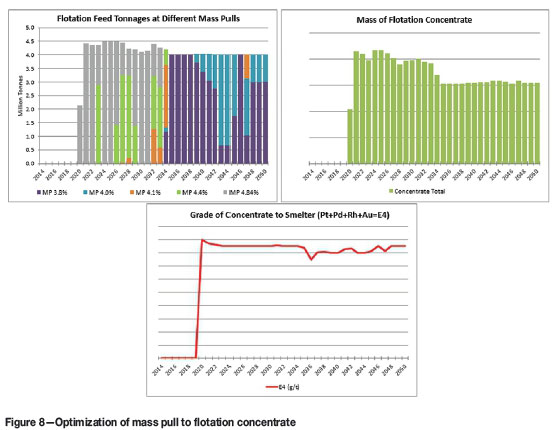

In any flotation process, metal recovery can be improved by increasing the mass pull from ore to concentrate. The PFS specified a fixed mass pull throughout the life of mine, but also referred to a minimum 3PE+Au grade that would be acceptable to toll smelters without incurring penalty charges. The optimization model was set up to increase cash flow by operating flotation at higher mass pulls while specifying that the minimum 3PE+Au grade would always be achieved. Figure 8 illustrates the variability that occurred in many runs when this mechanism was applied. It can be seen that in one year the optimization even incurred a penalty charge for low concentrate grade.

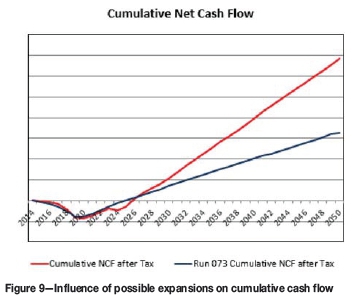

Figure 9 presents a comparison of cumulative undiscounted cash flow between the base case (blue) and one of the expansion cases studied (red). It was evident that it should be possible to fund at least a portion of any expansion from operating cash flow. However, the extent to which this would be possible would depend on the timing and size of the expansion as well as on metal prices and operational performance of the initial project after commissioning.

Conclusions of the optimization study

The study base case used the mining and processing plans already developed during the prefeasibility study. The potential NPV of the project could be influenced positively by:

> Applying theory of constraints to evaluate the orebody zones in terms of net value per bottleneck unit, resulting in the location of the most profitable ore being identified

> Applying a novel massive iteration process to test all possible combinations of net value applied to each mining zone, resulting in an optimized model for scheduling purposes, with distinct cut-off values defined for each zone

> Bringing forward revenue and cash flow using enhanced scheduling, cut-off grade, and stockpiling optimization techniques to the defined mining zones, subject to the technical limitations on mining defined in the PFS

> Application of dynamic grind to increase processing rates and dynamic mass pull to flotation concentrate to increase recovery where possible, both resulting in increased early cash flow.

Natural capital initiatives were identified with potential to reduce electricity and water usage per unit of metal produced in concentrate and also to introduce mining and backfilling practices to increase utilization of the resource in each zone over the life of mine. None of the non-financial 'capitals' (natural, manufactured, social, and human) were found to have a significant influence on NPV in this case.

The optimization study also considered different sizes and configurations of mining and processing operations. Some of the preliminary conclusions reached were:

> NPV of the project could potentially be increased by making more effective use of the mining infrastructure already planned for the project during the PFS. The development shaft could be converted to production to supplement the main shaft. By matching the ore processing capacity of the metallurgical plant to the total shaft hoisting capacity an optimized overall solution could be generated

> The peak funding requirements for the project could be reduced by commissioning an initial small-scale operation as early as possible, then constructing and operating expansions a few years later

> The possibility of building a dedicated smelter and base metal refinery was considered and investigations commenced. This should ultimately increase the amount of net cash generated by the operation, but would require significant additional capital expenditure.

References

Anon. 2013, 2014. Confidential prefeasibility study reports. [ Links ]

Burks, S.F. 2012. Case studies of simultaneous mining and mineral processing optimization applied to platinum and nickel operations. 5th International Platinum Conference, 'A Catalystfor Change', Sun City, South Africa, 17-21 September 2012. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 829-856. [ Links ]

Burks, S.F. and Whittle, G. 2010. Simultaneous mining and mineral processing enterprise optimization for the platinum industry. 4th International Platinum Conference. Platinum in Transition: 'Boom or Bust', Sun City, South Africa. 11-14 October 2010. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 329-338. [ Links ]

Burks, S.F. et al. 2014, 2015. Confidential enterprise optimization workbooks, presentations, and reports. [ Links ]