Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of the Southern African Institute of Mining and Metallurgy

versão On-line ISSN 2411-9717

versão impressa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.116 no.2 Johannesburg Fev. 2016

http://dx.doi.org/10.17159/2411-9717/2016/v116n2a3

PAPERS - MINING BUSINESS OPTIMIZATION CONFERENCE

Business optimization for platinum mining projects and operations

P.J. Petit

Independent Consultant

SYNOPSIS

The complex planning required to achieve any planned production yields multiple and dissociated responses over the life of project (LOP). The customary decision-making process negates the possibilities of developing optimized and integral solutions from operating levels up to business and strategic levels. This results in an inefficient project or overall underperformance of the operation.

In the project setting, disconnected trade-offs and improved performance studies become inadequate, because they are site-specific and use only a few comparative parameters. They are often based on a small data-set.

Decisions taken to achieve overall objectives require the correct determination and dissemination of key performance indicators (KPIs). The KPIs indicate efficiency in operation, whereby the marginal rate of technical substitution corresponds to the rate of production. It is the necessary condition for optimization. Performance realization for sustain-ability follows optimization modelling, the latter often being presented with financial results such as business net present value (NPV). It considers techno-financial constraints and provides a strategic and aligned outlook of KPI decisions for an enhanced and integrated outcome.

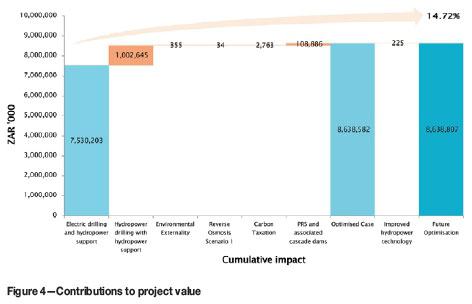

This paper explains a mining case study that is rendered efficient, and through business optimization (BO) short-term and sustainable targets are reached. Business optimization increases the NPV by 14.7%. This is achieved by challenging conventional decision-making associated with maximizing business value by including environmental externalities within the LOP.

Keywords: business optimization, key performance indicators, valuation methodologies, multiple-criteria decision-making (MCDM), analytical hierarchical process (AHP), environmental externalities

Introduction

Mine operators and engineers are compelled to review the way they look at projects due to changing mining conditions, legislative issues, rising electricity costs, and the constrained supply of skills in South Africa.

Pre-feasibility studies and valuation methodologies to assess such impacts are becoming increasingly important. For example, in a hard-rock mining operation, cost control is applied by reducing blasting. However, this increases the overall cost of the operation, because poorly fragmented ore increases material handling demands. There is a decreased throughput due to damage to conveyors and transfer chutes, or poor skip utilization. Ultimately, milling costs increase substantially.

The inclusion of the long-term effects on indirect stakeholders and mercurial policies have also been overlooked in performance studies. The quantification of social and environmental risks/benefits for all stakeholders at the end of the life of project (LOP) have been influencing the way in which decisions are made. Life-cycle activities (cradle-to-grave), beyond the boundaries of the operation, can no longer be omitted. When these are disregarded, the project undergoes multiple iterations leading to semi-optimal operation.

Hence, there is an increased focus on performance realization for sustainability, and cash flows are starting to incorporate the economics pertaining to the external environment. These costs are labelled external because they are not directly accounted for in production output rates.

Therefore, to understand and encompass the real value of a project or operation, re-selecting KPIs (originally identified in a base case) to support the overall performance of the operation has become a necessity.

What is business optimization?

Business optimization (BO) adopts methodologies to select the best alternatives to simultaneously increase the benefits and reduce the risks. It is conducted across the mining value chain activities of a depleting resource. BO also aims to improve the financial outcomes of the business and to ensure long-term gains for all stakeholders.

In the literature, BO has focused primarily on mining and processing solutions. Without the impact that engineering activities can provide, improvements have been relative, and bottlenecks, mostly technical constraints, have been mostly viewed in terms of a capital injection, instead of an alternative engineering solution, with the potential for additional or unforeseen benefits at minimal cost.

What are environment externalities?

An increased concern for decreasing and deteriorating natural resources has resulted in the environment being valued as an asset. This asset, external to the direct project outcomes, includes the atmosphere, water sources, and land. It is 'operationalized' through explicit changes in its environmental status.

In this case study, environment externalities arise when activities or events of the mining producer have external (indirect) unintended beneficial or negative effects on other producers and/or consumers. Environmental externalities include:

> Residuals such as reject products, waste rock, discharge water, and air pollution

> Intangibles such as irreversible changes and environmental damage

> Incommensurables, including the effects of an activity/event that are, with some effort, assigned monetary value.

Business optimization approach and the multiple-criteria decision-making process

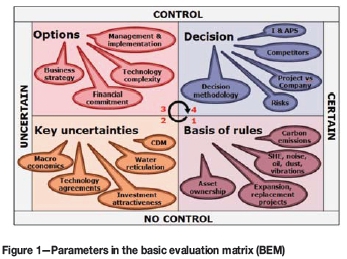

A basic evaluation matrix (BEM) can be used to optimize a base case and to cater for external objectives. Due to time constraints, the tendency is generally to revert to 'engineering judgement' or previous experience, biased towards satisfying the perceived dominant parameter at that point in time. This approach has several shortcomings.

> It is based on trade-off studies that are site-specific

> Primary cost-related drivers are used, which are based on a small data-set

> Power and water studies omit ancillary usage and reticulation possibilities.

No single parameter can be viewed in isolation, due to the direct or indirect relationships that exist between parameters, as shown in Figure 1. The collection of data from other operations also has the capacity to provide insight into, or validate, parameters to potentially render them certain/controllable.

Certainty depends on the information base and its quantification, which can facilitate decision-making. Controllable parameters allow decisions to be easily enumerated, unlike parameters susceptible to externalities. An increase in uncertainty across parameters, with fluctuations between the extremes of control, makes decision-making complex and results in multiple outcomes (scenarios).

The parameters in Figure 1 were assigned realistic and numeric ratings for the base case. This revealed inefficiencies and resulted in the implementation of alternative engineering solutions. The exercise was repeated to render the base case efficient.

Subsequently, applying the principles of financial mechanics modelling, a comprehensive techno-financial model (TFM) was built. The TFM incorporates activity-based costing with some costing based on first-principles costing methodology. Sensitivities, scenarios, and realistic risk profiles were applied to simultaneously determine the impact of both technical and cost drivers, and their throughput effect at business level. This method has the potential to yield unexpected KPIs.

KPIs that became prominent were power savings, the capacity and the quality of the water source (the supply), the water consumption rates and reticulation routes, and the influence of environmental taxes. These KPIs led a re-based reference for design enhancement and operating initiatives that could potentially lead to optimization.

The revised base case was then optimized to yield a solution that was holistic (with consideration of externalities) at operating, business, and strategic levels. With BO, engineering (non-mining) solutions were integrated to ensure that non-process infrastructure, supporting services, and all throughput processes were considered. Environmental, social, and other legislative aspects were encompassed in this iterative exercise such that each iteration took into account the strengths, weaknesses, opportunities, and threats (SWOT) of the solutions generated.

Replacement cases, alternatives, and options were introduced and subject to decision-making techniques. The results were transferred to a business optimization matrix (BOM) of the project or operation.

The remainder of this paper illustrates the BO approach and the multiple-criteria decision-making process in a typical project.

Mining case study example

The team, tasked with a greenfield platinum project with a life of project (LOP) of 13 years, wishes to optimize its underground mining methodology to firstly reduce power and secondly, to lower its impact on an open water source.

Electricity consumption is to be kept to a minimum, due not only to rising electricity prices, but also to constraints on allocation. In the case of water, the open source is utilized not only by the mine, but also by the local community for domestic consumption. Due to the semi-arid climate in the area, the volume of the open water source is anticipated to diminish significantly over the LOP. Consequently, the nitrate-nitrogen concentration of the water supply and the nitrate load generated by the mine are to be considered.

The base case (Case 1) established on the reserve layout was generated by:

> Use of a traditional hard-rock tabular mining method, namely hand-held electric drilling with hydropower support, the latter as was practised at Bokoni and Twickenham platinum mines

> Omitting any consideration for environmental externalities by initially maintaining the open water source at constant volume, with no seasonal fluctuations. The life-cycle monthly water extraction was also kept constant In this instance; however, this allowed the initial condition for inflow and outflow characteristics of nitrate concentration and nitrate amounts to be set.

> Neglecting de-nitrification

> Disregarding the impending carbon tax

> Omitting the impact of the underground engineering footprint.

Selection of mining technology

Subsequent to the establishment of the base case, the mining design was changed from a half-level approach to block mining. A typical underground decline layout consists of a decline cluster feeding sub-levels of geometric consistency. The mine re-planning resulted in a decline cluster feeding a scheduled series of blocks, thus promoting access to higher grades of ore earlier on in the LOP. The lower value blocks are bypassed, and accessed later in the LOP. Although this was a substantial task for mine planning and scheduling, this considerably reduced the mining footprint and development costs. However, other challenges remained.

The production drilling equipment in the base case (Case 1) was no longer viable in terms of real-time changes for the LOP. (The electrical equipment was assessed on a lease agreement for the LOP). Alternative recognized and tested drilling methods were proposed, as follows:

> Alternative case (Case 2): hydropower drilling with hydropower support, with an open-circuit system, powerpacks in the crosscut and high-pressure pipe reticulation in the stope. The drills are driven by the water, which is then discarded and pumped out of the stopes, as performed at Northam Platinum, Twickenham, Dwarsrivier, Karee, and Amandelbult mines

> Alternative case (Case 3): electric drilling with localized compressed air support - new alternative.

Application of AHP for selection ofstoping methodology

A multiple-criteria decision-making process known as the analytical hierarchical process (AHP) was applied to select the mining technology. The AHP expresses the relative values of a set of criteria of different parametric units, within a matrix, to rank or eliminate cases by

> Listing of systematic and unsystematic criteria

> Rating each criterion out of 10 in an inverse square matrix

> Including all project and production personnel.

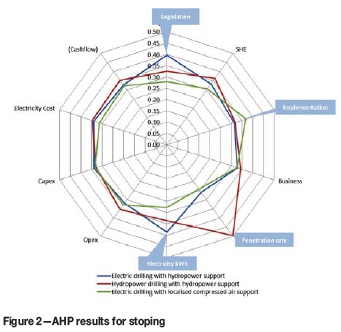

The pertinent outcome, shown in Figure 2, was derived by using a set of pairwise comparisons configured in the BEM. These comparisons were used to obtain the weights of importance (ranking) for the drilling technology decision, and the relative performance measures of the alternatives, known as relative values (RVs), in terms of each individual decision parameter.

In Figure 2, the core of the graph represents 0% or lowest ranking, and the greater the distance from the centre, the better the score, and thus the more preferable the solution as represented by the higher percentage.

In the AHP results, the penetration rate was the dominant parameter for the LOP. The penetration rate is sensitive across drilling methods, and it affects parameters such as energy delivery to the rock face; water consumption; capital expenditure; safety, health, and environment (SHE); and technology phase change and its implementation. The above-mentioned parameters can be controlled, but they are affected by other parameters, namely projected production performance, electricity cost, and legislation, the latter of which cannot be controlled.

Variable penetration rates experienced at existing operations are adverse to the production objectives for the LOP. Due to the variability of the rock conditions, and the option to access the UG2 Reef at a later stage, consistency in the penetration rates to achieve the production cycle was imperative.

Electricity consumption also showed a significant variability, based on the variability of drilling time per hole at the stoping face, while operating costs were of lesser value in the AHP results. Electricity consumption was identified in view of the relation between energy consumption and greenhouse gas (GHG) emissions and the proposed carbon tax anticipated for introduction in July 2016.

Implementation complexity and specialist maintenance across the re-planned mining layout rendered the base case drilling methodology unviable for the LOP under consideration in the project, as shown in Figure 2.

Legislative and SHE aspects pertaining to noise, oil, and dust generation were all satisfied in each case.

Low water consumption was a prerequisite in the selection of the base case and for the alternative cases. Subsequently, it formed part of electricity consumption since water requires energy to reach the mining blocks and water reticulation affects implementation. It was noted that low water consumption at the mine contributes to community benefits, and indirectly to creating a micro-economic zone for community-generated income in the vicinity of the project.

The AHP results for stoping indicated that the preferred option was hydropower drilling with hydropower support (Case 2), mainly because of consistent penetration rates experienced at existing operations and test results across rock conditions. Reduced labour requirements with better penetration rates were an operating cost consideration. Subsequently, this permits for the up-skilling of rock drill operators (RDOs) and engineering crews.

In addition, since the mine plan has been de-constrained from half-levels to mining blocks, the modular configuration of the hydropower solution eases relocation of equipment. A closed-circuit water reticulation system is also possible when remote blocks are drilled far from the decline cluster.

Hydropower drilling with hydropower support was also deemed advantageous for short-term planning in the event of unforeseen events (geotechnical), and for long-term planning if mining of the UG2 Reef is later considered.

Electric drilling with localized compressed air support (Case 3) was discarded from a technical perspective. Multiple compressors stationed at simultaneously mined blocks aggregated to higher electricity consumption and maintenance requirements than a surface compressor unit/station. Independent supply of air from surface to refuge chambers in the mining blocks was also a technical and cost constraint. The extent of compressed air delivery to the remotely mined blocks will still be subject to pipe leakages.

Financial valuation of AHP selection (real terms)

Strategic project planning, based solely on the perceived primary parameter, namely capital, did not offer the most advantageous solution. Although the NPV confirms the technical decision in Table I, namely Case 2, if the capex and opex were the only parameters considered for the decision, Case 2 would not have been selected. Hence, viewing these financial parameters collectively yielded a counterintuitive outcome, and contradicted the selection of the original KPIs. The business NPV and the peak funding requirements also confirm the techno-financial decision.

Effect of the mining operation on a natural resource

The selection of the stoping method cannot be confined to within the boundaries of the operation. In this project, an increased concern for decreasing raw water availability and deterioration of water quality has led to water being 'operationalized'.

Environmental externalities arise when activities of producers, or consumers, have external (indirect) unintended beneficial or negative effects on other producers or/and consumers. Negative inter-temporal externalities occur when exhaustible resources are depleted. Therefore, the movement of water was 'operationalized' from source to sink.

In this case study, the open water source is subject to water pollution, irreversible changes, and environmental damage. The mine discharges minewater with a nitrate content into a simultaneous water source and sink. All consumers of this polluted water incur rising costs of treating water for consumption, and within the operation, increasing production costs and secondary operating costs occur, such as health claims, and other private- and social-related costs.

Prior to costing denitrification solutions, the project team took measurements of the pre-project nitrate concentration. The pre-project capacity of the open water source was approximately 28 000 Ml The laboratory results indicated elevated nitrate concentrations at 35.0 g/Ml The SANS nitrate concentration allowance for the project as per SANS Class 1 is 10.0 g/M

The natural increase in nitrate concentration in the open water source at the end of LOP, for a reduced water source volume is projected at 39.4 g/Ml Over and above this realization, the mine planned to discharge 4 Ml of water per month with a nitrate concentration of 75.0 g/Ml

Regulatory mechanisms are enforceable on the mining company. Penalties are implementable if the nitrate concentration/threshold in this common-property resource reaches 38.0 g/Ml during the LOP. The pollution charge is a function of the concentrations of pollutants above this prescribed limit. Hence, measures to reduce the reliance on the open water resource and reduce the nitrate load in the discharge waste water were imperative. The impact on the overall project capital estimate was also to be limited.

Limiting the impact on the open water resource

A water balance of the open water source over the LOP was developed, and included on-site water recycling activities and recirculation flows. In the majority of projects, the water balance usually focuses on internal water movement and storage capacities, but excludes the impacts on the external supply (the open water source).

Once the comprehensive water balance was completed, the water pollution in the BAU base scenario (do-nothing scenario) was generated by initially maintaining the open water source at constant volume (no fluctuations). This allowed the initial condition for inflow and outflow characteristics of nitrate concentration and nitrate amounts to be set. The capacity of the open water source was then fluctuated monthly over the LOP. An assumption was made that water was mixed uniformly over a fluctuating open water source volume. Thereafter, a climatic change (successive series of dry seasons) was inserted in the last six years of the LOP. The LOP water extraction was kept constant at 36 Ml month.

With these conditions, the monthly nitrate concentration of the open water source, volume inflows (replenishment), and outflows (depletion) were calculated over the LOP by using transcendental calculations (non-algebraic functions). In this project, the pollution was generated from a stationary/point source, the underground mine.

Internalizing environmental externalities

The completion of the BAU base case provided the opportunity to generate water- and energy efficient possibilities. The mining activity, water consumption, and discharge by the operation have direct and indirect consequences on project capitalization. The incentive existed to abate the release of pollution by introducing cost-effective denitrification technologies.

Several denitrification processes were investigated. Based on the design criteria of the project, reverse osmosis (RO) was deemed the most suitable to treat high-nitrate water for the LOP and to ensure compliance with regulatory nitrate concentration levels. Additional benefits include effective desalination with comparatively moderate operating costs.

Denitrification allows for containment, recycling, and recirculation of water on-site, and therefore the successive reduction of demand from the open water source. This eliminated cost penalties incurred due to accidental discharge of untreated water into the open water source.

Initial capital requirements were also curtailed because piping and pumping requirements from the open water source were scaled down, and continuous recirculation of water within the operation reduced the size of the water storage facilities (smaller footprint). Hence, the financial capital prerequisite was controlled because it will be easier to rehabilitate a smaller volume of water during the course of the operation, resulting in faster closure.

Actively mitigating the risk of the projected nitrate concentration in the open water source controlled the effect on natural capital, social capital, on-site capital requirements, and financial capital prerequisites.

Denitrification assessment

The nitrate treatment using RO was calculated for three scenarios as follows:

> Scenario 1-treatment of the water inflow into the open water source only (water volume discharged by mine)

> Scenario 2-treatment of water outflow from the open water source (water volume withdrawn by mine)

> Scenario 3-continuous treatment of water outflow from the open water source (continuous water volume withdrawn by mine).

The short- and long-term effects of the water treatment scenarios were calculated based on the monthly rates of depletion, dispersion/concentration/dilution, and replenishment, as well as the treatment investment costs per unit volume over the LOP.

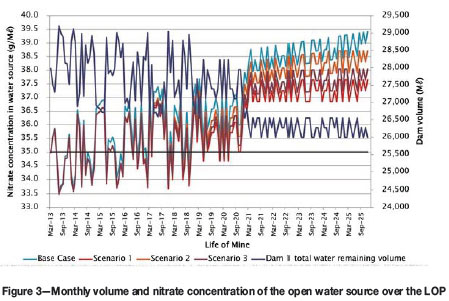

The change in the nitrate concentration in the open water source for the BAU base case and the three treatment scenarios is shown in Figure 3. The effect of climate change in the last six years is shown by the decreased volumes.

In the BAU base case, the initial nitrate concentration in the open water source was 35.0 g/Ml It increased to 39.4 g/Ml by the end of LOP as a result of the reduced dam volume (see previous section entitled Effect of the mining operation on a natural resource for further details). Thus, the smaller open water source volume towards the end of LOP has a significant impact on the water quality.

In Scenario 1, the nitrate concentration in the treated inflow (water discharged from mine) is 37.7 g/Ml with the implementation of a two-unit 5000 lh RO plant at the start of the project. The RO plant processes water from the operation until the project is self-contained.

The limitations of the ten-unit 5000 l/h reverse osmosis plant installed at the start of the LOP in Scenario 2 constrain the nitrate removal to a 36.0 Millionth throughput. Consequently, the process results in an open water source concentration of 38.8 g/Ml at the end of LOP. It is noted that this is above the regulatory limit of 38.0 g/Ml Hence, this scenario is unsuitable.

In Scenario 3, the ten-unit 5000 l/h RO plant is installed at the start of the LOP. Another three ten-unit 5000 l/h RO plants were phased-in every three years. This improved the result from Scenario 2, but it was insufficient to meet the imposed regulatory limit. At the end of LOP, the open water source concentration is 38.2 g/lM

The increasing fluctuation of the nitrate concentration as the project progresses shows the sensitivity to the volume of the open water source. It is noted that prior to the reduced open water source volume (prior to the climatic change), the nitrate concentrations in Scenarios 1 and 3 meet, or were within reach of, the regulatory value of 38.0 g/Ml The sudden reduction in the open water source capacity indicates the sensitivity of nitrate-moderating capacity of the open water source to its volume. This is an uncontrolled factor in this case study.

Consequently, the Scenario 1 solution was selected.

Carbon tax estimation

An analysis of all emission sources in this project was conducted. The carbon tax was calculated by aggregating the electricity consumption of the mining and engineering equipment used for the production cycle. An emission conversion factor was applied to determine the carbon equivalents.

The South African government has proposed a carbon tax of R120 per ton CO2e on Scope 1 emissions. 1 kg of CO2 is emitted for every kilowatt-hour of energy produced and consumed in South Africa. The tax will come into effect on 1 July 2016, and increase by 10% a year. It is anticipated that 60% of emissions will be tax-exempt for certain industries, and this threshold will apply in the first 5-year phase. The effective carbon tax ranges from R24.00 in 2016 to R35.14 per ton CO2e from 2020 onwards. Table II quantifies the effect of the carbon tax estimation on the NPV for each scenario.

Interestingly, although Scenario 1 was selected based on the denitrification assessment, should Scenario 3 have been selected, a rebate would occur in the form of carbon offsets. This could be quantified in a trade-off study when clarity is obtained on the state of carbon trading and the South African carbon market. The capital investment and the penalty of exceeding the regulatory limit of 38.0 g/Ml by 0.2 g/Ml versus the carbon rebate potential will be valued in the future.

Underground water delivery, storage, and distribution system

Subsequent to the denitrification assessment, the underground mining and engineering water consumption and storage were considered as follows:

> Option 1-series of cascade dams per mining block established in the base case

> Option 2-open-ended feed from surface to a pressure break dam at the first production block. Fewer cascade dams, but with increased capacity, supplying multiple blocks are developed and pressure reducing stations (PRSs) are installed during block development, depending on the block mining scheduled and water requirements.

In the techno-financial analysis, Option 2 was selected. This option allowed for a smaller operating footprint and a greater flexibility for water storage. Piping and pump requirements could be minimized through salvage and reuse.

Financial valuation results of business optimization approach and the multiple-criteria decision-making process

The compounded decisions made for this project, using the BAU base case as a reference, yielded results that incorporate technical and financial considerations on parameters that affect the open water source. In Table III, the BAU base case with the selected mining technology is shown in the third column. The results, based on the three RO nitrate treatment scenarios, are progressed with the inclusion of the effect of the carbon tax, and then the selected underground water delivery storage and distribution system (Option 2).

The marginal cost of operating the RO plant was neutral, as compared to the BAU base case, hence proving that it is also a cost-effective solution across the scenarios. The operating costs included reagents, power, and maintenance. Small changes in nitrate concentration affect the relative treatment costs of delivering water for operations and denitrification. It tipped the financial case in favour of Scenario 1 and highlighted the importance of reducing the dependence of the open water source with the associated incoming water nitrate concentration (key driver).

Furthermore, this positive financial outcome offered the potential to improve and capitalize water storage and distribution for the block mining layout. This is a function of the higher risk profile when access to the open water source is restricted due to drought conditions, and it is also to be considered if the UG2 Reef is mined in the future.

The business NPV is marginally better for Scenario 1 than the other scenarios. Although the difference is moderate subsequent to the mining technology selection, the inclusion of the denitrification, carbon taxation, and the underground water delivery, storage, and distribution system are based on the effect the mining operation has on the open water source, and the requirement for the mining company to limit its impact on the deterioration of the open water source and to promote sustainability. This was achieved by re-selecting the KPIs to include environmental externalities and to support the overall performance of the operation over the LOP.

The context of such decisions was critical to the outcome of the BO process and project value contribution, as shown in Figure 4. An increase in NPV of 14.7% for successive and consolidated business enhancement was achieved for this case study.

It is not suggested that the solutions provided for this case study are applicable to variety of projects. However, it is likely that the results of the decision-making and valuation processes that took into account environmental externalities will be different from a process that is solely focused on project or operating cash flow comparisons.

The Six Capitals framework

In BO, the aim is to apply the best technical solutions to ensure that the production performance forecast prior to execution is achieved, and that no technical constraints influence the economic effect of the capital expenditure. This is because the financial and manufactured capitals are not the only capital aspects of the project or operation.

Within the Six Capitals framework, other capital items were actively addressed. The natural capital, namely the open water source, was stress-tested in terms of water volume and nitrate concentration. The reduced underground footprint was a result of block mining and an optimized underground water delivery, storage, and distribution system. It contributed to reducing the impact on the natural capital by creating a positive control, which in turn impacts on the social and relationship capital.

The implementation of a hydropower-based drilling method and the RO plant allowed for skills development and training, and cross-disciplinary opportunities for sustainable performance through product and equipment improvement. Thus intellectual and human capitals were satisfied.

The integrated opportunities from the Six Capitals framework improved the sustainable development (SD) performance.

Business case optimization

This paper examined the effects of the need to incorporate BO for projects and operations, in view of growing concerns pertaining to the environment and climate change, and micro-economic factors such as labour and skills shortages.

BO should be done in a systematic, integrated, and rigorous manner, as early as possible in the project life cycle to:

> Identify SWOTs and initiatives to enhance SHEQ and CSI

> Analyse cases, scenarios, and options against a reference (BAU base case)

> Rank and prioritize by measuring effectiveness

> Implement an action plan though decision-making

> Obtain support for the decisions made.

BO is accomplished with committed implementation of the strategies that can be controlled and evaluated against relevant KPIs.

Acknowledgements

The author would like to acknowledge the contributions from Hilti, Hydro Power Equipment, Novatek, Anglo Platinum, and BRPM operations, and Platinum Group Metals Limited for facilitating access to study data.

References

Atael, M., Jamshidi, M., Sereshiki, F., and Jalali, S.M.E. 2008. Mining method selection by AHP approach. Journal of the Southern African Institute of Mining and Metallurgy, vol. 108, no. 12. pp. 741-749. [ Links ]

Barrick Sebedilo. 2008. Bankable feasibility study. Executive summary of the high level overview regarding the electric drilling option. April 2008. [ Links ]

Corder, G.D., Mclellan, B.C., and Green, S. 2010. Incorporating sustainable development principles into minerals processing design and operation: SUSOP. Minerals Engineering, vol. 23. pp. 175-181. [ Links ]

Coyle, G. 2004. The Analytical Hierarchy Process (AHP). Pearson Education, Glasgow. pp. 1-11. http://wwww.booksites.net/download/coyle/student_files7AHP_Technique.pdf [Accessed 12 March 2012]. [ Links ]

D'souza, F. 2002. Putting Real Options to Work to Improve Project Planning -Project analysis? Climb the decision tree. Harvard Management Update, vol. 7, no. 8. http://hbswk.hbs.edu/archive/3090.html [Accessed November 2014]. [ Links ]

Evans, R., Brereton, D., and Moran, C.J. 2006. Beyond NPV - a review of valuation methodologies and their applicability to water in mining. Proceedings of the Water in Mining Conference. Brisbane, QLD, 14-16 November 2006. Australasian Institute of Mining and Metallurgy, Melbourne. pp 97-103. [ Links ]

Flatt, V. Not dated. Adapting laws for a changing world: a systemic approach to climate change adaptation. http://ssrn.com/abstract=2042607 [Accessed September 2014]. [ Links ]

Kluge, P and Malan, D.F. 2011. The application of the analytical hierarchical process in complex mining engineering design problems. Journal of the Southern African Institute ofMining and Metallurgy, vol. 111, no. 12. pp. 847-855. [ Links ]

Musingwini, C. and Minnitt, R. 2008. Ranking the efficiency of selected platinum mining methods using the analytical hierarchy process (AHP). Proceedings of the Third International Platinum Conference 'Platinum in Transformation', Sun City, South Africa, 5-9 October 2008. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 319-326. [ Links ]

Peevers, R. and Whittle, G. 2013. Enterprise optimization for mining businesses. Proceedings of the SME National Convention, Melbourne, Australia, 27 February 2013. [ Links ]

Philibert, C. 1999. The economics of climate change and the theory of discounting. Energy Policy, vol. 27, no. 15. pp. 913-927. [ Links ]

Prokofieva, I., Lucas, B., Thorsen, B.J., and Carlsen, K. 2011. Monetary values of environmental and social externalities for the purpose of cost-benefit analysis in the EFORWOOD project. EFI Technical Report 50. European Forest Institute, Joensuu, Finland. http://www.efi.int/files/attachments/publications/eforwood/efi_tr_50.pdf [Accessed February 2016]. [ Links ]

Sankar, U. 2001. Environmental Externalities. 10th impression. Oxford University Press. pp 1-15. [ Links ]

Schoeman, J. and Steyn. A. 2003. Nitrate removal with reverse osmosis in a rural area in South Africa. Desalination, vol. 155. pp. 15-26. October 2003. [ Links ]

Triantaphyllou, E. and Mann, S.H. 1995. Using the analytical hierarchy process for decision making in engineering applications: some challenges. International Journal of Industrial Engineering: Applications and Practice, vol. 2, no. 1. pp. 35-44. [ Links ]

TWP Projects. 2009. Comparison for in-stope drilling: hand-held pneumatic drilling, electric or hybrid drilling for Lonmin Saffy shaft pre-feasibility study. WorleyParsons RSA, Johannesburg. [ Links ]

Whittle, G. and Burks, G. 2010. Simultaneous mining and mineral processing enterprise optimization for the platinum industry. Proceedings of the the Fourth International Platinum Conference, Platinum in Transition 'Boom or Bust, Sun City, South Africa, 11-14 October 2010. Southern African Institute of Mining and Metallurgy, Johannesburg. [ Links ]