Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.115 n.11 Johannesburg Nov. 2015

http://dx.doi.org/10.17159/2411-9717/2015/v115n11a10

PAPERS OF GENERAL INTEREST

A proposed approach for modelling competitiveness of new surface coal mines

M.D. BudebaI; J.W. JoubertII; R.C.W. Webber-YoungmanI

IDepartment of Mining Engineering, University of Pretoria, Pretoria, South Africa

IIDepartment of Industrial and Systems Engineering, University of Pretoria, Pretoria, South Africa

SYNOPSIS

Cost estimation for surface coal mines is a critical practice that affects both profitability and competitiveness. New mines require these costs to be estimated using available information before a project begins. The competitive advantage of a new mine depends on it being both efficient and cost-effective. Low-cost producing mines have a higher chance of survival in a low-price environment than do high-cost producers. The competitiveness and profitability of a coal mine is based on the costs of production and the supply position on the cost curve. There is no single method of cost estimation, and the available methods consider only one or a few variables, leaving out multiple variables that could significantly affect the estimation of mine costs. Mining companies are thus searching extensively for a method that will increase accuracy in the estimation and evaluation of mining projects

This paper highlights the shortcomings of the available approaches and proposes a data envelopment analysis method to develop a frontier for effective surface coal mines, and the use of a parametric method for modelling the costs and productivity of new mines to ensure effective competitiveness. The models will extend the capability of estimation and the accuracy of estimates using the efficient decision-making units, by considering the optimal mine-specific and external variables affecting costs.

Keywords: cost estimation, competitiveness, surface coal mine, DEA

Introduction

Coal contributes 25% of the world's primary energy needs, after fuel oil, which contributes 35%. The world energy demand, estimated over the period 1990 to 2030, is expanding at a cumulative annual growth rate (CAGR) of 1.7% (Schernikau, 2010, p. 14). This emphasizes the need for enhancing the production of existing mines, as well as opening new mines in order to increase the supply of coal.

According to the 2011 International Energy Agency report, coal demand is projected to increase at a rate of 2.8% from 2010 to 2016. The demand will be driven primarily by countries outside of the Organisation for Economic Co-operation and Development (OECD, led by China and India, whose economies are growing rapidly. For example, China's demand for coal for power stations is projected to grow at a CAGR of 5.2%.

Mines are the only source of coal. Coal can be mined either by surface or underground mining methods the choice of which depends on both technical and economic evaluation results. Generally, a near-surface coal deposit is mined using surface mining methods, and a deep deposit by underground methods.

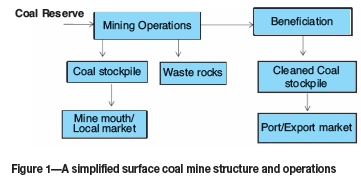

Mining of coal begins once the mineable coal reserve is determined; depending on the chosen method, coal reserve is an input to the mine operations, and the output incudes coal which is stockpiled at the mine then supplied to the power station. For surface mines in particular, the other outputs include waste rock that deposited in waste dumps or in the mined-out areas. Coal for export undergoes cleaning in a washing plant to remove the organic matter and other impurities that may affect its quality in order to upgrade it to the requirement of the market. The entire operation can be presented in a simplified process as indicated in Figure 1.

New surface coal mines can consider supplying coal to three types of markets, viz. local markets, export markets, or a combination of both local and export markets. Costs have to be estimated for a new mine to evaluate its competitive position compared with existing producers. Cost estimation has to be done using available information.

Cost estimation practices affect the decisions made regarding new mine projects, and underestimating or overestimating costs can result in poor decision-making that may lead to considerable financial losses through, e.g., overcapitalization of the project, adverse effects on the share price, lower than expected return on investment, non-delivery on project expectations, capital items purchased affecting outputs, and high operating costs delaying positive cash flow.

Cost estimation involves prediction of the capital and operating costs. Capital cost estimates in mining include, for example, estimating equipment costs, pre-production stripping costs, and working capital and other fixed costs. The operating cost estimates involve costs that will be spent in production. These include costs of drilling, blasting, excavation, hauling, administration, and beneficiation. Cost estimates are used, for example, in mine planning for determining the optimal pit size with the highest net present value (Leinart and Schumacher, 2010). When this optimal pit is mined, it should generate a profit.

Cost estimation is a challenging practice that is affected by project uncertainties which, if poorly considered, could result in a wrong project evaluation. Such uncertainties include stripping ratio, seams with complex metallurgical characteristics, mines located in isolated regions, lack of access roads, electricity and water supplies, unfavourable climate, and the challenges of mountain topography (Shafiee, Nehring, and Topal, 2009; Shafiee and Topal, 2012). To use but one example, any significant change in the stripping ratio affects the cost of stripping (Jaeger, 2006). The aforementioned are but some of the issues affecting the competitiveness of new mine investments.

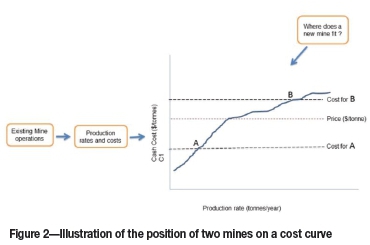

Investing in projects or resource companies, given the volatility of commodity prices, calls for consideration of the project's position on the cost curve (Rudenno, 2009, p. 135). The cost curve is a plot of costs versus the cumulative production rates of mines in production. The curve is used by existing mines to determine their competitive position relative to other mines producing the same commodity.

To illustrate the application of a cost curve to determine mine competitiveness, Figure 2 shows an example of two mines, A and B. Mine A is at the lower point of the cost curve and mine B is at the higher position. Needless to say, mine A, operating at low level on the cost curve, has a better chance of economic survival during times of low commodity prices than the high-cost producers.

New mine operators desire to be on the low portion of the cost curve. A new mining project's competitiveness in the market depends on both monetary and non-monetary factors. New mines are faced with problems of combining technical design and economic parameters to generate value for the stakeholders (Mohnot, Singh, and Dube, 2001). When the operation begins, most mine management teams are focused on minimizing costs instead of being efficient and planning effectively in order for them to be competitive.

There is no unique method for cost estimation in mining projects. Mining companies are thus searching comprehensively for a method that will increase accuracy in the estimation and evaluation of mining projects (Shafiee and Topal, 2012). The available cost estimation approaches are limited to investigating one or a few variables, while ignoring other independent variables that might affect the cost estimates.

Hager (2012) suggests that a simplistic investment model is required to help determine the costs and competitive position of a new mine among existing producers. The model should consider unique project-specific variables and challenges, such as, for instance, the remoteness of the mine and the business environment in which it will operate. Dehghani and Ataee-pour (2012) state that mining companies do not know, with absolute certainty, how much they will be able to spend tomorrow, let alone next month or next year. Costs should thus be estimated using a method that will incorporate the effect of deposit-specific variables (such as quality and geography) as well as other external variables (such as policy and inflation) affecting costs during operation.

It is the aim of this paper to develop and propose an approach using data envelopment analysis (DEA) to develop models that can be used to create a frontier for efficient performing mines, then use the efficient mines to develop models for predicting productivity and effective costs for new mines, assuring competitiveness. The models should also assist investors in carrying out comparative analyses and making sound investment decisions in the present competitive business environment.

Literature review

A new mine can operate only once the economic feasibility study indicates that the project will be profitable. These mines require their costs to be estimated using the available information, and a decision is then made, based on the costs and other factors affecting profitability, on whether or not to proceed with development.

Some authors have discussed variables affecting costs in surface coal mines. Gordon (1976) asserted that: physical conditions, costs of the labour, capital resources, regulations, technical progress, and price changes all produce shifts in the costs of mining over time, regardless of the specific mining conditions themselves.

Schneider and Torries (1991) state that the cost of producing clean coal of a specific quality depends on a combination of geological conditions, that is, the quality of the unprocessed coal and the cost of beneficiating the coal. Haftendorn, Holz, and Hirschhausen (2012) also suggest that the main factors affecting mining production costs are geological. These factors include the seam thickness, inclination, and the nature of the rock hosting the seam.

On the other hand, Smith (2012) highlights one aspect in creating sustainable value in a mineral and metal company as being knowledge of the fixed physical nature of the mineral asset, such as the type and nature of mineralization, depth below the surface, shape, extent and dip, and surface topography. This makes for optimal efficiency and technical solutions for mining and recovery, and hence maximizes cash flow.

The International Energy Agency report on the world energy outlook (IEA, 2011 p. 52) indicates that the future costs of coal production will depend on inputs such as fuel and steel prices, exchange rates, the geological conditions of the coal deposit, as well as environmental and land legislation in coal exporting countries. These are also factors that cause variations of costs from one country to another. In addition, the lack of affordable labour and emission penalties also affect the economic viability of mining.

Supply costs of coal for the international market depend on a combination of mining costs, domestic transport costs, and port handling costs, also known as free-on-board (FOB). These costs measure the mining company's competitive position for export relative to other producers and suppliers of coal. Looking at the supply costs in particular, it is therefore imperative to understand how the deposit's unique characteristics, economic variables, and environmental regulation influence the cost estimates for new projects, whether producing coal for export, domestic consumption, or both markets.

Mine cost estimation approaches

Most approaches to cost estimation require that a production rate be estimated first. The production rate used in some cost estimation approaches was proposed by Taylor in 1977, and is known as Taylor's Rule. This method is presented in Equation [1]:

which can be rewritten in general form (Long, 2009) as:

where C is the capacity in metric tons per (the production rate), a and b are coefficients to be estimated, and T is the reserve tonnage.

Long (2009), in his review of Taylor's Rule using 1195 mines as a data-set, obtained different model coefficients, that is, the elasticity of capacity denoted by a was found to be less than the 0.75 originally suggested by Taylor. Two criticisms were also raised during the re-evaluation of this model, namely the fact that it is an inhomogeneous model because it was developed from mines producing different commodities, and also it is not deposit-specific. The relationship between the reserve and capacity is inelastic in nature, as opposed to the original assumption of elasticity. The possibility of changes in technology was also not assessed in this model. For example, certain deposits may require specialized technology in order to be extracted and processed, and this can, in turn, affect the estimates of the production rate.

Another method for production rate determination is that of multiple economic analyses. This involves a series of production rate iterations and computing the cost of each. The production rate that results in the maximum net present value (NPV) is hence chosen for the mine. This technique requires the iteration of each scenario of production rates in order to determine the one generating the maximum NPV (Leinart and Schumacher, 2010).

The available approaches for surface mining cost estimation can be grouped into the following categories: statistical approaches, online methods, and comparative and itemized methodologies. The approaches range from estimating the cost of an individual piece of equipment to the average and total costs of mining.

Statistical approaches

Capital and operating cost estimation approaches in this category include O'Hara models; multiple regressions based on principal component analysis; an econometric model; and the use of single-variable regression models included in mining cost estimation handbooks. Examples of these handbooks include: CAPCOSTS, for mining and mineral processing equipment costs and capital expenditures; CANMET, for estimation of pre-production and operating costs of small underground deposits; and a cost estimation handbook for the Australian mining industry (Sayadi, Lashgari, and Paraszczak, 2012).

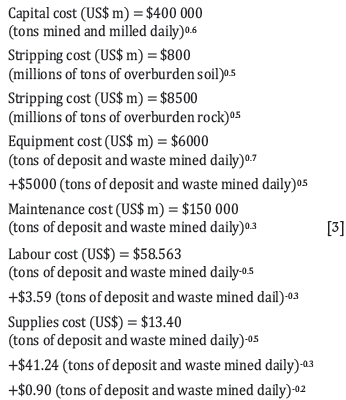

O'Hara methods can be represented as a set of equations. Equation [3] shows the main equations estimated by O'Hara in 1980 (Shafiee and Topal, 2012).

The equations express cost as a dependent variable, and production rate as an independent variable. These models were prepared in the 1980s, and therefore should be updated to accommodate the escalation of costs using cost indices that have been computed based on general inflation in the US economy. The index updates mining costs such as mine and mill labour, machinery, and heavy equipment (Shafiee and Topal, 2012).

Conversely, O'Hara models, when applied to estimate, for example, the costs of mining two deposits of equal reserve size with different geological conditions, obtain the same answer for the two deposits. This is unrealistic since factors affecting mining costs, like intrinsic characteristics of the deposit such as depth, dip, and quality, are not taken into consideration. Shafiee et al. (2009) also highlighted another shortcoming of O'Hara models with regard to the expansion of the equations according to the lifespan of the mine.

As mentioned above, CAPCOSTS, developed by Mullar and Poullin in 1998, CES, prepared by US Bureau of Mines (USBM), and the cost estimation handbook for the Australian mining industry are some of the available handbooks for cost estimation in mines. They are based on single-variable regression models. The general equation used in each of the aforementioned can be written in the form indicated in Equation [4].

where Y is the cost to be estimated, A and B are coefficients to be estimated, and X is an independent variable such as capacity or horsepower.

Leinart and Schumacher, (2010) and Sayadi et al. (2012) argue that most of these cost estimation models use single regression to estimate mineral industry costs. The other significant variables are overlooked, making these models obsolete, and updating them may result in substantial errors.

Long (2011) conducted a study for estimating costs for porphyry deposits. The author found that capital cost depended on the mineral processing rate, stripping ratio, and the distance from the nearest railroad. These factors should therefore be considered before commencing mining construction. In terms of the operating cost, the stripping ratio was the only variable affecting the cost, which best explains the stripping account for up to 40% of operating costs. Long (2011) also suggests that the next step is to test the relationship of the variables and costs for other types of deposits that use different mining and mineral processing methods.

Multiple linear regression, based on the principal component analysis method, has been used in estimating capital and operating costs for individual types of equipment such as backshoes, loaders, and shovels (Oraee, Lashgari, and Sayadi, 2012; Sayadi et al., 2012). According to this method, cost is estimated by considering bucket size, digging depth, dump height, machine weight, and horsepower. The estimation procedure first omits the correlation between independent variables, which can influence the final cost estimates, by using principal component analysis, and then estimates the capital and operating costs of the equipment.

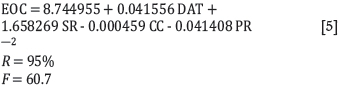

Shafiee et al. (2009) and Shafiee and Topal (2012) proposed a model for estimating total operating costs. The Shafiee et al. model is indicated in Equation [5].

where EOC is the estimated operating cost (cost per tonne), DAT is the deposit thickness (in metres), CC is capital cost (million dollars in 2008 terms), PR is the daily production rate (kt), and SR is the stripping ratio. The model has ±20% accuracy as compared to real data used and has significance.

The model uses a few of the many variables identified by scholars such as Gordon (1976) and Schneider and Torries (1991) that affect the operating costs of coal mines. The inclusion of more variables identified will improve accuracy of cost estimates.

Another cost estimation approach is the Australian Coal Cost Guide, an internally generated cost guide providing a standard for coal cost estimation in Australia. It applies to the Australian environment, and was developed based on Australian coal mines. If this guide is used by other countries, cost variations will need adjustment (Shafiee and Topal, 2012).

Cost estimation in coal mines has also been highlighted by Chan (2008), who discusses Coalval, a tool that was developed by the US Geological Survey (USGS) for the valuation of coal properties. Chan (2008) argues that the tool does not consider characteristics such as the geology of the seam, which is one of the variables affecting mining costs.

Online approaches

This approach includes the Mine and Mill Cost Calculator and Mine Cost. The Mine and Mill Cost Calculator utilizes an InfoMine equipment cost database which tabulates equipment costs in the USA. This database can be used to calculate the predicated cost of equipment for the specific project. Mine Cost is a second online method that consists of spreadsheets and curves for capital and operating costs. Online methods simply estimate the total mining cost of a specific mine, but it is not clear how the costs are obtained. These methods simply generate the final total cost estimates (Shafiee et al., 2009; Shafiee and Topal, 2012).

Comparative approach

This involves the study of an existing mine with similar characteristics and operational conditions to the mine whose cost is to be estimated. The average operating cost is modified. There is no clear guideline for the cost adjustment reflecting the condition of the mine under evaluation. It is also termed an analogous method of cost estimation, suggesting a comparison between similar operations, but care must be exercised since accounting practices also vary (Hustrulid and Kuchta, 2006).

Itemized approach

According to Darling (2011), three major steps are considered in the itemized method of cost assessment. Firstly, a conceptual mine plan should be developed using the available information, covering pit outlines, haul routes, depth of waste dump, and process plant location. Secondly, parameters of materials involving capital should be estimated. And thirdly, the itemized method requires the estimator to apply known unit costs for labour, equipment operation, and other facilities in order to finalize the cost estimates.

The above approach can, however, lead to inaccurate estimates because some costs (for example, the operating costs for equipment for a new project) require quotes from the original equipment manufacturer (OEM). The equipment cost is affected by the conditions in which the machine is to operate (Hoskins and Green, 1977, p. 79). Using the OEM can thus be a source of error in estimation. Adjusting cost to local condition is very optimistic and has not been standardized as yet.

Examples ofcost and production rate estimation problems

Forecasts have progressively deviated from actual costs and productivity in existing operations. Studies and examples on cost and budget estimates have indicated overruns or underruns in mining companies for decades.

Bullock (2011) analysed cost variation of eight different studies, the smallest study involved 16 projects and largest one involved of 60 projects covering period 1965-2002. The author found that the average minimum overrun of 22% and the highest of 35% for all studies. The study that involved 60 projects showed, 58% of the projects had overrun ranging between 15% to 100%.

Van Aswegen and Koster (2008) conducted a qualitative study of the South African mining industry. Questionnaires were sent to 144 middle and senior managers and directors of leading mining and consulting companies; 49% responded. It was found that there was a gap between feasibility study estimates and actual figures during project execution, with cost deviation, schedule deviation, number of project scope changes, and accuracy of prediction of operational performance as contributing factors. Cost deviation contributed significantly to this gap at 98.5% followed by schedule deviation (97.1%), number of project scope changes (92.8%) and accuracy of prediction of operational performance (89.9%).

In mine planning, forecasts have not been met and returns on investment are lower than predicted. The majority of projects (80-90%) will exceed the budget cost and will not deliver the expected benefits (Lumley and Beckman, 2009). More often, the planned production rate has not been achieved due to technical deficiencies in the planning process, planner's optimism, and 'strategic misrepresentation' (deliberate deception).

Considering case studies carried out by Lumley (2011), many mines assume mining production rates that are higher than the best practice. For example, in Australia, a shovel underperformed by 7% in 2008, resulting in under-recovery of coal by 996 000 tons. Lumwana Copper Mine in Zambia is another example of a mine exhibiting poor performance. The mine expected to achieve full production from 2009, but did not meet this deadline. This failure is attributed to the fact that there was an overestimation of equipment hours (Lumley and Beckman, 2009).

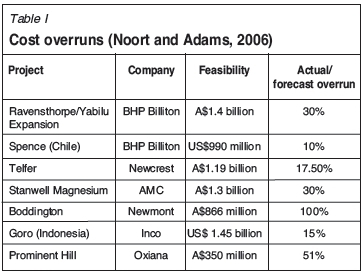

Cost overrun examples can be observed when the final project capital cost is related to capital cost estimate in the feasibility study. For example, 60 mining projects studied for the period 1980-2001 had an average cost overrun of 22%, with half exhibiting over 20% overrun. The reason for these results was established as being largely due to optimism and poor cost estimation (Noort and Adams, 2006). Other examples of mining cost overruns have been summarized by Noort and Adams (2006), as indicated in Table I.

Approximate of 70% of mining megaproject overspent by more than 25% relative other projects with similar scope (competitiveness), besides cost overruns, schedule overruns, and operational problems, within two years of start-up (Merrow, 2011; PWC, 2012).

The examples discussed indicate how mining projects, both new and operational, are failing to meet target production rates and reveal cost estimation problems. The reasons for this have been identified as poor estimation techniques, optimism, and technical problems. A new methodology - which takes into account the deposit characteristics, mine operation location, as well as the influence of legislation and economic factors - is thus of paramount importance. This methodology will enable the estimator to improve cost and competitiveness before the project moves into production.

Proposed approaches for cost estimations for a new project

The competitive advantage of a new mine depends on its being both technically efficient and cost-effective. Measuring the relative efficiency of each mine helps to understand the best-performing mines. New mines will not survive in the current business environment unless they are competitive.

Data envelopment analysis (DEA) is proposed for determining the efficiency of surface coal mines. Thereafter, the application of a parametric method is proposed to develop models predicting the productivity efficiency and effective production costs for new mines. The method will be used to determine the frontier of efficient mines among the operating mines in a given coal production region.

DEA is a nonparametric method for measuring the efficiency of an operation, and was introduced by Charnes, Cooper, and Rhodes in 1978 (Cooper et al., 2007). DEA involves multiple inputs and outputs of decision-making units (DMUs) that use similar inputs and generate similar outputs in the construction of an efficient frontier, which is an envelope determined by the Pareto-efficient DMUs (Joubert, 2010). For example, a DMU can be a mine among mines producing a specific commodity; these mines should have similar inputs such as number of employees, size of equipment, and operating hours per shift; and the output can be tons of ore produced. In DEA methodology, the quantity of inputs used and outputs generated may vary from one DMU to another.

DEA uses a linear programming technique to determine the piecewise frontier of efficient DMUs. DEA does not need a pre-defined function when determining efficiency, but instead uses the data of each DMU to determine the relative efficiency.

DEA has been successfully applied since its inception. For example, it has been used in evaluating the performance of various operations, including production planning, airport performance, agricultural economics, bank performance, research and development performance, and other applications (Li et al., 2012). Selective examples on the application of DEA in coal mine investment efficiency evaluation have been identified by Fang et al. (2009) and Reddy et al. (2013), and these are presented in Table II.

The studies indicate successful application of the DEA in the coal mining industry. However, most of the applications have ignored inputs of non-discretionary variables such as the influence of inflation, exchange rate, inclement weather, and labour issues. For competitiveness, the efficiency score should include the influence of these variables and the set-up of the market structure, which includes the supply of coal to domestic power plants. In addition, both domestic and export markets should be investigated.

Efficiency measurements

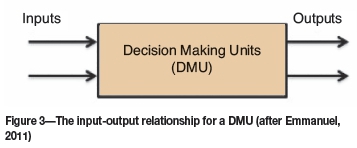

According to Farrel (1957), 'When one talks about the efficiency of a firm one usually means its success in producing as large as possible an output from a given set of inputs. Provided all inputs and outputs were correctly measured, this usage would probably be accepted.' Efficiency therefore refers to the use of inputs to produce maximum outputs. Efficiency can be illustrated by Figure 3, which shows an example of the decision-making unit consuming two inputs to generate two outputs.

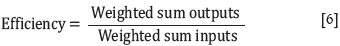

According to Talluri (2000), efficiency can be expressed by Equation [6].

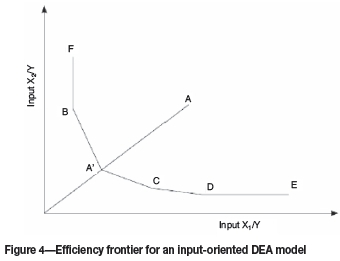

For illustration purposes, consider A, B, C, D, E, and F as an envelope of efficiently operating mines referred to as decision-making units (DMUs) in Figure 4. This envelope is also known as a envelope. The efficient DMUs are A, B, C, and D. DMUs E and F are weakly efficient because they use excess inputs which can be reduced to the level of B and D respectively while still producing the same outputs. A is technically an inefficient DMU.

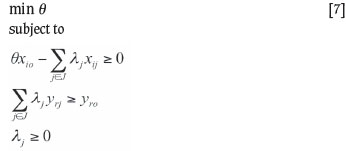

Consider a set of n DMUs using similar type of inputs to generate similar type of outputs, for each DMUj, j = (1...n) using m inputs xijand generating s outputs yrj . The input-oriented envelopment model for determining the efficient DMUs under the assumption that same amount of change in inputs results to same amount of change in outputs, also known as constant return to scale (CRS), is computed using the generic envelopment model in Equation [7].

In the above: θ is the efficiency score, xiois the amount of inputs of the DMUs under evaluation, yrois the total outputs of DMUs under evaluation, I is the vector of inputs, R is the vector of outputs, and J is the vector of number of DMUs. Equation [7] is solved n times equal to the number of DMUs. If variable return to scale is considered the condition Σλ = 1 is added in Equation [7]

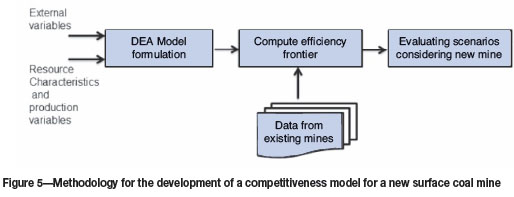

Efficiency modelling of a new surface coal mine

The methodology for modelling involves the use of identified variables from different sources in the literature. These variables will be categorized as external, resource characteristic variables, and production variables. These will form the inputs and outputs in the stage of DEA formulations. Figure 5 summarizes the development of the DEA models formulation, productivity, and effective cost models for competitiveness of new coal mines. Data will be collected from coal-producing regions; the sources of data include available mine databases, publically available annual reports, and technical papers published about coal mine costs and performance. The efficient frontier will be computed by applying the models developed and the use of the coal mines data-sets collected. Each surface coal mine will be regarded as a DMU in this research. The models for predicting production and effective costs of a new mine will be developed from the envelope of efficient mines. The scenario evaluation of a new mine will be conducted considering a new mine.

Conclusions

The increasing demand for energy drives the supply of energy sources. Coal is one of most important sources of fuel. It is therefore expected that new mines will be established in order to increase the supply of coal and thus meet the demand. However, new mines will not be opened unless the economic evaluation is done accurately and the projects are proved to be profitable. Cost estimation is a critical component of the economic evaluation of mines, and underestimation or overestimation can result in the project being terminated.

Available methods do not fully capture the project characteristics and all the variables affecting cost, hence cost estimates at present do not adequately reflect project-specific variables.

This study describes and proposes the use of data envelopment analysis in the evaluation of efficiency and the development of benchmarks of efficient surface coal mines, based on a mine project's controllable and non-controllable variables. The benchmark surface coal mines will be used to develop predictive models of cost and productivity, which should in turn help to position a new mine in a competitive environment on the cost curve. The models should assist in the strategic planning of new surface coal mines, ultimately resulting in their competitiveness. These models are also beneficial to investors, assisting them in choosing the most lucrative project from the wide range of multiple projects with different characteristics, locations, and economic variables.

References

Bullock, R.L. 2011. Accuracy of feasibility study evaluations would improve Accountability. Mining Engineering, vol. 67, no. 4. p. 78. [ Links ]

Chan, M. 2008. Coal supply and cost under technological and environmental uncertainty. PhD thesis, Carnegie Mellon University. http://wpweb2.tepper.cmu.edu/ceic/theses/Melissa_Chan_PhD_Thesis_2009.pdf [Accessed 15 August 2013]. [ Links ]

Cooper, W., Seiford, L., and Tone, K. 2007. Data Envelopment Analysis: A Comprehensive Text with Models, Applications, References and DEA-Solver Software. 2nd edn. Wiley. p. 2. [ Links ]

Darling, P. 2011. Open Pit Mine Planning and Design. 3rd edn. Society for Mining, Metallurgy, and Exploration (SME), Littleton, CO. pp. 281-293. [ Links ]

Dehghani, H. and Ataee-Pour, M. 2012. Determination of the effect of operating cost uncertainty on mining project evaluation. Resources Policy, vol. 37, no. 1. pp. 109-117. [ Links ]

Emmanuel, T. 2011. Alternative methods for measuring efficiency and an application of DEA in education. Aston Business School. [Power Point presentation]. http://www.slideserve.com/lotus/alternative-methods-for-measuring-efficiency-and-an-application-of-dea-in-education [Accessed 15 Agust.2013]. [ Links ]

Fang, H., Wu, J., and Zeng, C. 2009. Comparative study on efficiency performance of listed coal mining companies in China and the US. Energy Policy, vol.37, no. 12. pp. 5140-5148. [ Links ]

Farrell, M.J. 1957. The measurement of productive efficiency. Journal of the Royal Statistical Society. Series A (General), vol. 120, no. 3. pp. 253-290. [ Links ]

Gordon, R.L. 1976. The economics of coal supply - the state of the art. Energy, vol. 1, no. 3. pp. 283-289. [ Links ]

Haftendorn, C., Holz, F., and Hirschhausen, C. 2012. The end of cheap coal? A techno-economic analysis until 2030 using the coal mod-world model. Fuel, vol. 102. pp. 305-325. [ Links ]

Hoskins, J. and Green, W. 1977. Mineral industry costs. Northwest Mining Association, Spokane, WA. p. 79. [ Links ]

Hustrulid, W. and Kuchta, M. 2006. Open Pit Mine Planning and Design. Wiley. pp. 116-137. [ Links ]

IEA. 2011. Medium-Term Coal Market Report 2011. p.52. http://www.iea.org/topics/coal/publications/ [Accessed 26 July 2013]. [ Links ]

IEA. 2011. Word Energy Outlook. http://www.iea.org/publications/freepublications/publication/name,37085,en.html [Accessed 2 Aug.2013]. [ Links ]

Jaeger, W.K. 2006. The hidden costs of relocating sand and gravel mines. Resources Policy, vol. 31, no. 3. pp. 146-164. [ Links ]

Joubert, J. 2010. Data envelopment analysis: An overview. Working paper 14, Optimisation Group, Industrial and Systems Engineering, University of Pretoria. [ Links ]

Leinart, J.B. and Schumacher, O.L. 2010. The role of cost estimating in mine planning and equipment selection. Mine Planning and Equipment Selection - MPES 2010. Australasian Institute of Mining and Metallurgy, Melbourne. pp. 69-80. [ Links ]

Li, Y., Chen, Y., Liang, L., and Xie, J. 2012. Dea models for extended two-stage network structures. Omega, vol. 40. no. 5, pp. 611-618. [ Links ]

Long, K.R. 2009. A test and re-estimation of Taylors empirical capacity reserve relationship. Natural Resources Research, vol. 18, no. 1. pp. 57-63. [ Links ]

Long, K.R. 2011. Statistical methods of estimating mining costs. SME Annual Meeting and Exhibit and CMA 113th National Western Mining Conference 2011. pp. 147-151. [ Links ]

LUMLEY, G. 2011. Mine planners lie with numbers. http://www.scribd.com/doc/81005939/White-Paper-Mine-Planners-Lie-With-Numbers [Accessed 15 June. 2013]. [ Links ]

Lumley, G. and Beckman, R. 2009. Is technology helping get mine plans right? Australian Mining, vol. 177. [ Links ]

Merrow, E. 2011. Industrial Megaprojects: Concepts, Strategies, and Practices for Success. Wiley. [ Links ]

Mohnot, J.K., Singh, U.K., and Dube, A.K. 2001. Formulation of a model for determining the optimum investment, operating cost and mine life to achieve planned profitability. Mining Technology, vol. 110, no. 2. pp. 129-132. [ Links ]

NOORT, D. and ADAMS, C. 2006. Effective mining project management systems. Proceedings of the International Mine Management Conference 2006. pp. 87-96. [ Links ]

Oraee, B., Lashgari, A., Sayadi, A.R., and Oraee, B. 2012. Estimation of capital and operation costs of backhoe loaders. [ Links ]

PWC. 2012. Managing large-scale capital projects. http://www.pwc.com/gx/en/mining/school-of-mines/2012/pwc-managing-large-scale-capital-projects.pdf [Accessed 11 July.2013]. [ Links ]

Reddy, G T., Sudhakar, K., and Krishna, S.J. 2013. Bench Marking of Coal Mines using Data Envelopment Analysis. International Journal of Advanced Trends in Computer Science and Engineering, vol. 2, no. 1. pp. 159-164. [ Links ]

Rudenno, V. 2009. The Mining Valuation Handbook: Mining and Energy Valuation for Investors and Management. 3rd edn. Wiley. pp. 135-140. [ Links ]

Sayadi, A.R., Lashgari, A., Fouladgar, M.M., and Skibniewski, M.J. 2012. Estimating capital and operational costs of backhoe shovels. Journal of Civil Engineering and Management, vol. 18, no. 3. pp. 378-385. [ Links ]

Sayadi, A.R., Lashgari, A., and Paraszczak, J.J. 2012. Hard-rock LHD cost estimation using single and multiple regressions based on principal component analysis. Tunnelling and Underground Space Technology, vol. 27, no. 1. pp. 133-141. [ Links ]

Schernikau, L. 2010. Economics of the International Coal Trade. Springer, London. [ Links ]

Schneider, R.J. and Torries, T.F. 1991. Competitive costs of foreign and U.S. coal in North Atlantic markets. Mining Science and Technology, vol. 13, no. 1. pp. 89-104. [ Links ]

Shafiee, S., Nehring, M., and Topal, E. 2009. Estimating average total cost of open pit coal mines in Australia. Australian Mining, vol. 134. [ Links ]

Shafiee, S. and Topal, E. 2012. New approach for estimating total mining costs in surface coal mines. Mining Technology, vol. 121, no. 3. pp. 109-116. [ Links ]

Shu-Ming, W. 2011. Evaluation of safety input-output efficiency of coal mine based on DEA model. Procedia Engineering, vol. 26. pp. 2270-2277. [ Links ]

Smith, G.L. 2012. Strategic long-term planning in mining. Journal of the Southern African Institute of Mining and Metallurgy, vol. 12, no. 09. pp. 761-774. [ Links ]

Talluri, S. 2000. Data envelopment analysis: models and extensions. Decision Line, vol. 31, no. 3. pp. 8-11. [ Links ]

Van Aswegen, G.D. and Koster, M. 2008. From feasibility to reality: A predicament for the mining industry in South Africa. Management of Engineering & Technology, 2008 (PICMET 2008). Portland International Conference on Technology Management for a Sustainable Economy. IEEE. pp. 1351-1362. [ Links ]

Paper received Apr. 2014