Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.115 n.6 Johannesburg Jun. 2015

PLATINUM CONFERENCE PAPERS

Strategic and tactical requirements of a mining long-term plan

B.J. Kloppers; C.J. Horn; J.V.Z. Visser

Lonmin Platinum, South Africa

SYNOPSIS

The long-term plan (LTP) in a mineral resource company is defined by the quality of the mineral resource and represents the result of a series of trade-offs to fulfil internal organizational as well as external business and legislative requirements, ensuring ultimate delivery on the defined organizational strategy.

The LTP should as a whole align to a coherent and well-defined organizational strategy, working towards a clearly defined objective while still allowing a tactical response to short-term requirements of the organization. The ability to respond tactically to changes in environment, like the unprecedented five-month strike in 2014 on the platinum belt following the 2012 Marikana incident, is a measure of the flexibility of the plan given the agreed strategy.

This paper describes the Lonmin process of linking company strategy with long-term planning, tactical planning, and the execution of the plan through an annual planning cycle to maximize organizational flexibility. This flexibility enables mining companies to respond to the many internal and external forces that impact on both strategy formulation and delivery of results that meet shareholder expectations.

Keywords: planning cycle, long-term plan, organizational strategy

Introduction

The strategic long-term plan (LTP) of a mineral resources company can be described as the scheduled mining plan for the available mineral resource area based on current knowledge of the orebody and its mineral resource classification. The long-term robustness of the strategic plan is typically impacted by a combination of changing economic, market, and technical environments. Therefore the LTP has to be updated and reviewed on an annual basis, resulting in a near-term tactical as well as long-term strategic plan in response to changes (Smith, 2011).

The annual update of the LTP ensures fulfilment of legislative and statutory requirements of the Mine Works Programme in terms of the Mineral and Petroleum Resources Development Act (DMR, 2002) as well as the resource classification in the mineral resources and reserves statement in terms of the South African Code for the Reporting of Exploration Results, Mineral Resources, and Mineral Reserves (SAMREC, 2007).

An integrated mining company must include in the strategic LTP all the activities of mining, including those related to mineral processing and beneficiation as well as commercial marketing and sales. The LTP therefore has to be more than a mere technical mining document of what is planned to be mined where and how in the future - the LTP becomes a strategic tool to guide the entire organization into the future.

The strategic LTP needs to be an aligned view of the organization's future outlook: a long-term plan delivering on the company's strategic intent, balanced by a short-term tactical plan.

Different planning horizons

Long-term planning focuses on strategy, determining the 'where' or destination in future, while short-term planning focuses on the execution process representing the 'how' to get there in the short term. Long-term strategic planning is supported by shorter term operational planning, also referred to as tactical planning.

Kear (2006) states that tactical and strategic planning are done in two very different planning environments, with different levels of an organization with different skill sets working in these distinct environments. These environments are also referred to as the 'realms of planning' by Lane et al. (2010), where three worlds within planning are presented as strategic planning, capital planning, and operation planning.

Strategic planning

Kear (2006) states that strategy is the broad plan to attain some objectives in the future and that strategic planning focuses on identifying those objectives with a view of more than 10 years ahead. Smith et al. (2008) describe strategic planning as dealing with components of the business and decisions that deal with long-term value generation. Strategic planning can also be described as a process of selecting options or making choices of what the long-term goal should be. In the analogy where strategy determines the destination, strategic planning will involve certain trade-offs of alternative destinations identifying the most desirable long-term destination.

To be successful, the long-term strategy needs to be constantly assessed in the light of short-term progress made towards the intended destination, which in turn is determined by the tactical plan within an ever-changing business environment.

Tactical planning

The tactical plan can be described as the short-term or operational plan aimed at solving the 'how' of getting to the strategic destination. Smith et al. (2008) describe tactical planning as a process that is interlinked with strategic planning and revolves around the routine operational planning requirements, ensuring delivery on the long-term strategy. This requires that operational performance be tracked and measured with regard to its alignment with strategy, and corrective action taken when required. It is during the execution phase of the tactical plan that executives are faced with the challenges of enabling the overall strategy.

Executive's dilemma

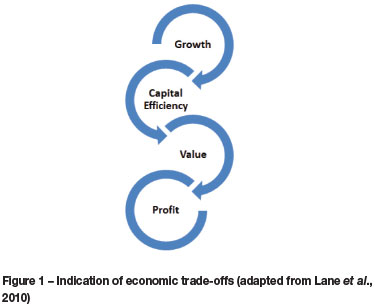

Identification of the appropriate long-term strategy involves trade-offs between a desired future state and the cost of opportunities lost as a result of choosing the specific future state. These trade-offs have been described as the 'executive's dilemma' by Lane et al. (2010) with the question 'what should the strategic objective be?' A modification of their model of the executive's dilemma is depicted in Figure 1.

This model deals exclusively with issues in the economic realm with reference to production levels, capital efficiency, value, and profit. The dilemma lies not in the fact that tradeoffs exist between the economic drivers, but rather in understanding the opportunity cost of options given up due to the selection of a strategy based on a specific economic driver.

Table I outlines potential trade-offs that may exist when following a strategy to maximize value based on a single economic driver. The strategic intent shown for each of these drivers viewed in isolation will enhance long-term value.

Clear trade-offs exist between the economic drivers when the strategic intent is to maximize value, since various combinations of these drivers or components of cash flow can be used to maximize value. It should also be noted that tactical requirements sometimes have to be traded off against long-term strategic requirements. The need to preserve cash in a severe short-term downturn of the economy will trigger a 'cash conservation' tactical plan, while the long-term strategy might still require capital investment in future growth based on a bullish long-term view.

The true dilemma in identifying and selecting the appropriate long-term objectives is much broader than just the economic realities. The trade-offs that require the highest level of analysis due to uncertainty and risk fall outside of the financial realm where the financial impact is driven by non-financial factors. It is in these areas of decision-making where economic modelling and scenario planning taking risk and uncertainty into account plays an important role -identifying and quantifying the potential economic impact of non-financial decisions in diverse scenarios.

The discipline of economic modelling makes trade-off decisions in this realm less complex because of the ability to express the impact of various decisions in terms of a common monetary value using a process of scenario analysis and ranking (Ballington et al., 2004).

Triple bottom line (3BL)

The need to understand and measure the impact of business is focused not only on the financial, but also the environmental and social spheres of influence as described by Spreckley (1981), who identified a need for 'social enterprise audits' in an attempt to highlight a more holistic impact of execution of a business strategy. Over time this need for broader reporting and measurement gave rise to the phrase 'triple bottom line', which was coined by Elkington in 1999 and comprises profits, people, and environment (Elkington, 1999). This concept has since gained tremendous momentum in management and business literature.

Measuring a strategy against the triple bottom line by including people and the environment is particularly apt in the mining industry. One only has to consider the recent industrial action in the platinum belt, which highlighted the socio-economic impact of mines on their surrounding communities and how the general well-being of the communities affects labour productivity. These spheres have the potential to disrupt the ultimate delivery of the strategy, thus proving some of the trade-offs made in selection of the strategy obsolete if not considered at the onset.

Model of key strategic drivers

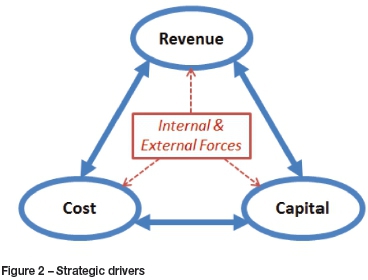

Strategy formulation, building on the models of a triple bottom line and the notion of an executive's dilemma (answering the question 'what should the strategic objective be?'), should therefore be considered against an expanded set of drivers that includes economic drivers as well as internal and external forces.

Expanding on the model of the executive's dilemma, by bringing in the realities of the non-financial factors in the 3BL model, ensures better informed evaluation of options traded off by capturing potential risks that would otherwise not have been identified as opportunity costs when viewing economic drivers exclusively. The factors to be traded off in determining strategy can collectively be referred to as strategic drivers; internal forces are identified as a proxy for people and external forces are used as a proxy for environment from the 3BL model.

In the adapted model depicted in Figure 2, the economic trade-offs are still as important, being the trade-off to best generate free cash flow and ultimately value. The emphasis changes by also considering the non-financial factors related back to 3BL.

This system of strategic drivers is in a perpetual state of flux. The strategic trade-off of how to best generate value by harmonizing the economic drivers is constantly influenced by changing internal and external forces or drivers of strategy.

Strategic planning will result in a plan that best matches the economic drivers to deliver on a single long-term strategic view, with some flexibility to alter course based on changes in the environment. Tactical planning will, however, be bombarded by the turbulent environment due to short-term changes in the internal as well as external strategic drivers like industrial action or exchange rate and commodity price volatility.

This change in external and internal forces in the short term requires that the strategic intent be re-assessed on a continual basis to ensure alignment between where the strategy aims to go and what the tactical implementation allows. In some instances, the changes in the short-term drivers might require drastic changes in tactical execution having a material impact on delivery of the strategic LTP. This would require a total overhaul of the strategy, for example, the impact of the five-month strike on the platinum belt and changes in the industrial relations climate, which could trigger a strategic move towards mining methods with increased reliance on mechanization and reduced labour dependence.

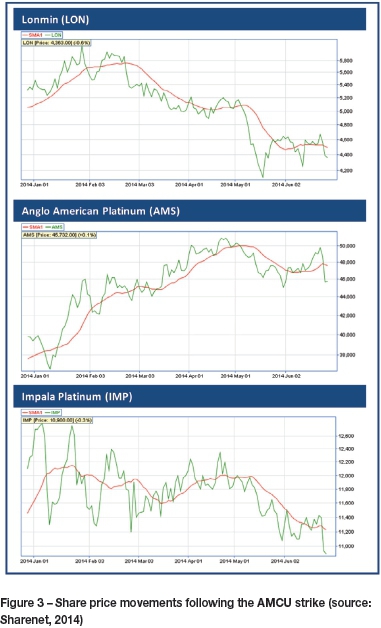

The unprecedented five-month Association of Mineworkers and Construction Union (AMCU) strike that took place from January to June in 2014 is an example of an external force that has to be evaluated in strategic planning. The loss of production had significantly different results on the share prices of the three companies concerned. Although the mining operations of all the companies in the Rustenburg area ground to halt as a result of the strike (i.e. external factors were the same), the share prices behaved very differently as can be seen in Figure 3.

This may be explained by the difference in internal factors and specific trade-off in economic drivers within each company, as well as the market sentiment regarding the vulnerability of the companies as a result of the strike. The strategic and tactical responses of these companies will be better understood in the years to come.

Changes in the strategic outlook after an event like the prolonged strike prompted discussions in the media of a mechanization solution to reduce the reliance on labour, mitigating the increasing risk associated with labour relations in the platinum industry. In this instance, any decisions to change towards mechanization will have to be evaluated in the context of the broader strategy by means of scenario planning.

Scenario planning

The strategic plan has a long-term view based on a specific scenario, a selected future view as translated through internal business assumptions (labour productivity, cost inflation etc.), as well as external global assumptions (commodity prices, exchange rates, inflation indices etc.). Scenario planning allows testing of various alternative strategies (or different plan versions supporting the same strategy).

Multiple explicit scenarios are generated during the scenario planning process, each based on a different future view. Each of these scenario plans is tested for valuation under different global assumption sets. A key output of the scenario-based planning process is the identification of the specific scenario plan or grouping of scenario plans resulting in the maximization of an agreed objective function. In mining, the objective function is almost always maximization of shareholder value within the context of the accepted risk profile of the organization.

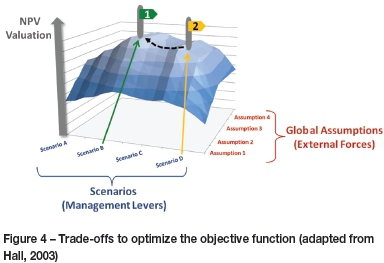

A scenario-based valuation analysis, using the 'hill of value' methodology adapted from Hall (2003) is depicted in Figure 4. Multiple scenario plans are generated by changing the internal management levers available in long-term planning (production rates, project sequencing, mining methods etc.), each supporting a different future view. In this illustrative example a valuation is generated for each combination of a scenario plan and global assumption set, and the resultant valuation for each combination depicted on a surface diagram.

The diagram in Figure 4 allows identification of the optimal scenario that will maximize value, being 'scenario B' indicated by 'flag 1' at the highest point. If the current strategic LTP is represented by 'scenario D' resulting in the lower valuation indicated by 'flag 2', further analysis can be done to determine how to best progress the strategic LTP to 'scenario B' in order to maximize value.

Scenario planning creates an understanding about the problem at hand through a process where assumptions and mental models about the future are critically examined, leading to a better understanding of the uncertainties facing the business (Cardoso and Emes, 2014). Scenario planning is not done to predict the future, but simply to understand what various future states could look like (Schoemaker, 1995).

Smith et al. (2008) describe how scenario planning can also be used to communicate the inherent uncertainty in investment decision-making, ultimately leading to a better understanding of possible future world views and consequently strategy formulation. The aim of scenario planning is therefore to better understand and communicate different views of potential future states. The scenario planning process allows for informed adjustments to the strategic and tactical plan to proactively adapt to changes in the environment.

Scenario planning supporting evaluation of long lead time investments in natural resources has a long history, with Royal Dutch/Shell using it extensively as far back as the 1970s (Schoemaker, 1995). A 2009 report by the World Economic Forum in association with the International Finance Corporation and Mckinsey & Company (World Economic Forum, 2009) focused on scenario planning in the mining and metals sector, highlighting key areas where scenario planning can add value to:

➤ Enhance the robustness of a chosen strategy

➤ Improve strategic decision-making by revealing uncertainties and allowing for proactive planning

➤ Improve understanding of uncertainties by revealing the links and trade-offs between strategic drivers

➤ Increase planning flexibility and ability to cope with change

➤ Facilitate multi-stakeholder engagement and understanding in the planning environment.

Scenario planning allows the impact of different future views to be ranked and compared side-by-side at the current decision point. In the mining industry, economic modelling and net present value analysis are commonly used to express scenarios at the decision point. The commercial use of economic modelling and net present value analysis to assess the impact on value of multiple scenarios, allowing comparison and ranking, is well documented (Ballington et al., 2004; Lane et al., 2010). Economic modelling forms an integral part of long-term decision-making at Lonmin Platinum, consequently enhancing decision-making in the scenario planning and strategy formulation process (Hudson et al. 2008).

Scenario planning is a constant process that supports study work in the project pipeline, evaluation of the long-term impact of tactical plans, the formulation of guidelines to the budgeting process, and ultimately to evaluate and support strategy formulation. The ever-enduring scenario planning process needs to be linked to a fixed business cycle to provide specific feedback at specified points in the cycle. Scenario planning without these links and feedback loops can easily evolve into 'planning for the sake of planning that over time becomes far removed from what is achievable in a tactical plan.

Long-term planning cycle at Lonmin

Lonmin's long-term plan has evolved over time and many of the leading practices described by Smith et al. (2006) and Smith (2011) have been introduced into the planning cycle.

The requirements of structured planning according to a repeatable cycle are not unique to South African mining. The strategic planning cycle is also identified as one of the main features of the planning process at major oil and gas companies. Grant (2003) identified in his analysis of strategic planning within a turbulent environment experienced by the oil majors (similar to the current environment of South African mining) that the cycle is to a large part generic between organizations surveyed. The cycle identified follows the path of strategic planning feeding planning guidelines to budget and long-term planning ending with reviews and a feedback loop back to strategic planning. This cycle can be compared to the planning cycle proposed in the strategic framework for South African platinum mining by Smith (2011) in his doctoral thesis.

The planning cycle allows for multiple feedback loops between each of the stages in the process. This allows development of a tactical plan that keeps track of the requirements of the strategy on the one hand, but also feeds the tactical and operational limitations back into the process of strategy formulation. The planning cycle should be designed in such a manner that it allows information to flow freely between the tactical and strategic levels, with the ability to adapt strategy if the environment dictates it, but also to inform strategy when tactical execution needs to deviate from strategy.

Figure 5 illustrates how strategy is linked to the tactical short-term plan (or two-year budgeting cycle) at Lonmin.

The Lonmin strategy drives strategic planning through a mine extraction and processing strategy that aims at the optimal extraction of the available mineral resource. This is done through the management of a project pipeline, where projects (mostly shafts and concentrator projects) are ranked as part of a portfolio optimization process establishing which projects are prioritized, considering the availability of capital and value these projects generate.

The mining and processing extraction strategy provides top-down goals that form the guiding principles of the annual mining and processing long-term plans. The long-term plans in turn provide top-down goals to the two-year budgeting cycle. During the budgeting two-year period, short-term quarterly planning and control ensure that the tactical plans are executed according to the overall strategy.

The long-term planning cycle supports annual external reporting of mineral resource and mineral reserves as well as the mine works programme.

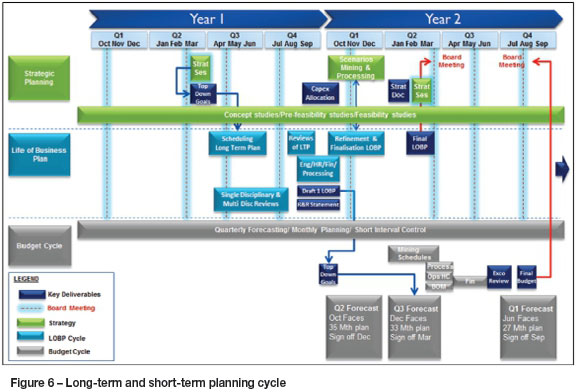

This cycle is unpacked in more detail in Figure 6, which shows how the feedback loops operate along a two-year timeline.

Three cycles are illustrated in Figure 6, the Strategic Planning Cycle illustrated horizontally across a two-year timeline, the Life of Business Plan Cycle illustrated in the centre, and finally the Budget Cycle across the same timeline.

Commitment to the overall long-term strategy is key to an organization's success. Horn (2012), in the development of a goal-setting measurement tool for the South African mining industry, found overwhelming evidence that goal-setting (in this case following a defined strategy) correlates positively with organizational commitment.

Strategic planning at Lonmin occurs annually with the gathering of the company executives in March, where top-down goals (TDGs) that are derived from this session feed into the scheduling of the mining LTP. The previous year's plan is used as a base and also provides input to the LTP. Lonmin makes use of a bottom-up planning process that allows ownership and organizational commitment.

Figure 6 further illustrates a process of single- and multi-disciplinary reviews to ensure governance and compliance with technical standards. This review and ownership process is unpacked in more detail in Figure 7.

Once the technical mining plan is complete with all the governance and quality assurance steps applied, a draft life-of-business plan (LOBP) is prepared for the executive committee (Exco). This new plan is used to update the capital ranking model, which allows for further optimization to establish the final LOBP. The final LOBP becomes the input document for the strategic session taking place in the following year, which leads to the cycle repeating itself. The outcomes of both the strategy session and the final LOBP are presented to the board in March of each year.

Figure 6 further indicates how the life-of-business planning cycle links to short-term planning. From Figure 6 one can see that the draft LOBP provides input through TDGs into the short-term budgeting cycle.

The draft LOBP through TDGs provides inputs in order to allocate available capital for the quarter 3 forecast plan, which is part of the two-year budgeting process. This plan makes use of the December mining face positions and a mining schedule of 33 months is planned. This schedule allows for two objectives to be achieved; firstly it provides for a 9-month short-term forecast of the current financial year in order to enable market guidance. Secondly, it enables a 24-month budgeting process. The plan is signed off in March of every year.

Two other short-term plans are formulated during the budgeting cycle, namely the quarter 2 and quarter 4 forecast plans. Both these plans enable refinement of the short-term plan and improve market guidance. These are tactical plans that respond to the many internal and external factors affecting the plan.

In summary, the Lonmin planning cycle enables strategic scenarios to affect short-term execution as well as feedback of how short-term internal and external forces may influence, and in some cases completely alter, the overall strategy of the company in a controlled, well-informed manner. The review and ownership of the plan is described in the next section.

Ownership and review of the LTP

Organizational commitment to the LTP at Lonmin is enabled through a bottom-up process where each shaft/operation generates its own LTP aligned with the previous LTP as well as TDGs, as illustrated in Figure 7.

At operational level the various line managers, which starts at mine overseer level together with the technical specialists (geology, planning, rock engineering etc.), are responsible for the shaft/operation LTP. The review, governance, and auditing of the LTP at shaft/operation level takes place through a series of single-disciplinary and multi-disciplinary reviews (SDRs and MDRs) by the Lonmin Group managers together with the line managers.

This process ensures ownership as well as strategic and tactical alignment within organizational governance and quality standards.

Conclusion

Strategic planning takes a long-term view and should constantly be broken down into tactical plans that can be implemented and monitored operationally. The process of formulating long-term strategy, testing the strategy in an operational plan, and providing feedback that influences future strategy should be embedded in planning and institutionalized in an annual planning cycle.

The Lonmin strategic long-term planning process described in this paper follows leading practices that enable ownership, tactical flexibility, and strategic alignment to ensure all stakeholder expectations are met.

The challenge to the industry is the ability of organizations to balance the requirement to respond quickly to volatile market conditions, like the prolonged platinum strike following the Marikana event, with the often time-consuming formal process which ensures quality, governance, and control of the strategic long-term plan.

References

Ballington, I., Bondi, E., Lane, G., and Symanowitz, J. 2004. A practical application of an economic optimisation model in an underground mining environment. Proceedings of the Orebody Modelling and Strategic Mine Planning Conference, Perth, WA, 22-24 November 2004. pp. 215. [ Links ]

Cardoso, J.F. and Emes, M.R. 2014. The use and value of scenario planning, Modern Management Science and Engineering, vol. 2, no. 1. pp. 19-42. [ Links ]

Department of Mineral Resources (DMR). 2002. Mineral and Petroleum Resources Development Act, Act 28. Government Gazette. 2002. Pretoria. [ Links ]

Elkington, J. 1999. Cannibals with Forks: The Triple Bottom Line of 21st Century Business. New Society Publishers, Stony Creek, CT. [ Links ]

Grant, R.M. 2003. Strategic planning in a turbulent environment: evidence from the oil majors. Strategic Management Journal, vol. 24, no. 6. pp. 491-517. [ Links ]

Hall, B.E. 2003. How mining companies improve share price by destroying shareholder value. Proceedings of the CIM Mining Conference and Exhibition, Montreal, Paper 1194. [ Links ]

Horn, C.J. 2012. Developing a measure for goal-setting in the mining industry in South Africa. Association of Mine Managers of South Africa. [ Links ]

Hudson, J.H.K., Maynard, M., and Kloppers, B. 2008. The application of economic modelling to enhance decision-making at Lonmin Platinum. Proceedings of the Third International Platinum Conference, Sun City, South Africa, 5-9 October 2008. Southern African Institute of Mining and Metallurgy. Johannesburg. pp. 343-348. [ Links ]

Kear, R.M. 2006. Strategic and tactical mine planning components. Journal of the Southern African Institute of Mining and Metallurgy, vol. 106. pp. 93-96. [ Links ]

Lane, G.R., Milovanovic B., and Bondi E. 2010. Economic modelling and its application in strategic planning. The 4th Colloquium on Diamonds -Source to Use, Gaborone, Botswana, 1-3 March 2010. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 161-172. [ Links ]

Schoemaker, P.J.H. 1995. Scenario planning: a tool for strategic thinking. Sloan Management Review, vol. 36, no. 2. pp. 25-40. [ Links ]

Sharenet 2014. Sharenet Java Technical Analysis Charts. http://www.sharenet.co.za/charts/index.php?load=LON [Accessed 23 June 2014]. [ Links ]

Smith, G.L. 2011. A conceptual framework for the strategic long term planning of platinum mining operations in the South African context. PhD thesis, university of the Witwatersrand, Johannesburg. [ Links ]

Smith, G.L. Pearson-Taylor J., and Andersen D.C. 2006. The evolution of strategic long-term planning at Anglo Platinum. Proceedings of the Second International Platinum Conference, Sun City, South Africa, 8-12 october 2006. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 301-305. [ Links ]

Smith, G.L., Surujhlal S.N., and Manyuchi K.T. 2008. Strategic mine planning- communicating uncertainty with scenarios. Proceedings of the Third International Platinum Conference. Sun City, South Africa, 5-9 october 2008. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 335-342. [ Links ]

South African Mineral Resource Committee (SAMREC). South Africa 2007. The South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (The SAMREC Code), 2007 Edition, amended July 2009. [ Links ]

Spreckley, F. 1981. Social Audit - A Management Tool for Co-operative Working. Beechwood College. [ Links ]

World Economic Forum. 2009. Mining & Metals Scenarios to 2030. Geneva. http://www.weforum.org/reports/mining-metals-scenarios-2030 [Accessed 19 May 2014]. [ Links ]