Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.114 n.11 Johannesburg Nov. 2014

MINING ENVIRONMENT AND SOCIETY CONFERENCE 2013

A quantitative method for selecting renewable energy projects in the mining industry based on sustainability

M. Mostert

SRK Consulting, Johannesburg, South Africa

SYNOPSIS

Mining companies sponsor a range of non-core, corporate social responsibility projects to adhere to social and labour plans and environmental management prerequisites that form part of a mining licence application. Some companies go above and beyond such projects, sponsoring initiatives that generate renewable energy through solar power, wind energy, natural gas, etc. The challenge for these companies is to choose between a variety of projects to ensure maximum value, especially in times when the economic climate might be less favourable for such projects. The focus of this research was to analyse the concept of sustainability as it exists today, and to apply that to the triple bottom line accounting method in an attempt to quantify the sustainability of a project. Research was done on the methane burn-off project at Sibanye Gold's Beatrix Mine to establish how such projects are planned and financed, and what impact they have on the triple bottom line of a company. The financial bottom line is, by definition, one that executives understand. This paper also proposes a quantitative method for defining the social and environmental bottom lines as well. By considering the financial, social, and environmental values, the study attempts to determine a monetary value for a sustainable renewable energy project. This monetary value can be compared to similar values obtained for other sustainable renewable energy projects under consideration. The research suggests that monetary value alone is not enough to base a sustainable decision on, and qualitative measures are suggested for use in conjunction with quantitative methods. The selection method proposed should assist the board of a mining company to choose the most sustainable option and the project that will add the greatest value to the company across all three bottom lines. It will also provide increased justification for such renewable energy projects, even in periods of harsh or uncertain economic climates.

Keywords: renewable energy, sustainability, project evaluation, triple bottom line.

Introduction

Mining companies are well versed in the quantitative methods of evaluating and selecting mining projects that will give the most competitive return on investment. However, when the project under review is a sustainable, socially responsible project there are additional factors that should be considered in combination with the net present value (NPV) and internal rate of return (IRR). The social and environmental impacts of the project play an equally large role in the viability of the project as the financial parameters. Gold Fields, for instance, has many socially responsible, sustainable projects globally. This paper focuses on one of the renewable energy technology (RET) projects that Gold Fields had decided to implement. The methane burn-off project is situated at Beatrix Gold Mine, which currently belongs to Sibanye Gold after the unbundling of some of Gold Fields' South African operations into the new company. However, since the project was initiated by Gold Fields, this paper refers to that company as the owner of the project. The justification for the investment and the criteria that are used to decide on a specific project competing for funding are discussed. Additionally, other factors are considered that should be a part of the decision-making process. Finally, a decision checklist is proposed to assist mining companies in choosing between these types of projects. The checklist is based on the overarching concept of sustainability to ensure that all three of the bottom lines are duly considered. It is suggested that a quantitative approach alone would not do the process justice, due largely to the qualitative nature of the social and environmental factors. The proposed checklist makes provision for a qualitative evaluation of projects in addition to the quantitative aspects for the sake of substance over form and in the interest of integrated reporting.

The triple bottom line (TBL) reporting framework is used to derive three basic criteria against which to evaluate a project:

> Financial - Is the RET project financially viable?

> Financial capital - Is the technology proven? (Manufactured capital)

> Social - Is it good for the community? (Social and human capital).

Moral responsibility

A large part of the reason mining companies undertake sustainable, non-mining projects is to demonstrate moral and social responsibility. Demonstrating this responsibility is vital in obtaining a 'social license' to mine, i.e. the agreement with society to allow a mining project to go ahead. Echenique (2012) states that Aristotle (384-323 BC) was the first to draw up a theory on moral responsibility.

According to Eshleman (2009), moral responsibility entails being worthy of a particular kind of reaction, whether it be praise or blame, for having performed a certain action. He argues that judgement of responsibility requires that the behaviour or deed of the protagonist is governed by an 'interpersonal normative standard of conduct that creates expectations between members of the shared community', and that moral responsibility is an inherently social notion. Thus, holding someone responsible means addressing a fellow member of a certain moral community (Stern, 1974).

Considering the literature on the nature of moral responsibility, the reader could be at risk of oversimplifying the nature of corporate social responsibility and the investment required in this regard as simply the reaction to potential consequences of negative social impact. In other words, companies will only do good out of fear of negative social reaction, i.e. of obtaining bad publicity and losing the social license to mine.

The reason that drives companies to increase their moral responsibility is not the question here. The fact remains that, through social pressure, the mining industry has taken moral responsibility for its actions. Industry is responsible and accountable to society.

Sustainability as a value

It is challenging to find some sort of socially acceptable and understood value for a company's social responsibility and investment, and its environmental impact, taking into consideration the risk of oversimplification when a monetary value is assigned to unknown quantities such as social and environmental capital.

The value by which RET projects will be measured in this paper is 'sustainability'. This sustainability value is a hard-to-define value that takes into consideration all three of the bottom lines (People, Profit, Planet) as well as the Five Capitals (Financial, Manufactured, Social, Human, and Natural) to compare different RET projects with one another. By finding a way to value social, environmental, and human capital in terms of financial capital it may be possible to persuade the investor that sustainability is not just the domain of the philanthropist, but also of the hard-core businessman.

Understanding sustainability: the triple bottom line

In the mid-1990s Elkington (1994) strove to measure sustainability in a framework of his design. This framework incorporated social and environmental factors in the typical dimensions of business success (Taylor et al., 2006). By focusing on comprehensive investment results with respect to performance along the interrelated dimensions of profits, people, and the planet, TBL line reporting can be an important tool to support sustainability goals.

The TBL approach can be defined as an accounting framework that incorporates three dimensions of performance: social, environmental, and financial. This differs from traditional reporting frameworks since it includes ecological (or environmental) and social measures, to which it can be difficult to assign appropriate means of measurement (Slaper and Hall, 2011). The TBL principles are also commonly referred to as the 'three Ps': Profit, People, and Planet. Savitz (2006) defines TBL as '[capturing] the essence of sustainability by measuring the impact of an organization's activities on the world ... including both its profitability and shareholder values and its social, human and environmental capital'.

For the purposes of this paper the TBL approach is used as the foundation. The TBL approach leads to the three main questions:

- Is the RET project financially viable? (Profit)

- Is it good for the community? (People)

- How will it impact the environment? (Planet).

The three matrices of the TBL do not have a unit of measure in common. Some commentators (Rogers and Hudson, 2011; Roe, 1984; Laszlo, 2008) argue that there are harmonies along the TBL elements and that an impact or investment in a specific bottom line may influence the others. When profits are measured in dollars, how can social capital and environmental or ecological health be measured? Finding a common unit of measurement is challenging. Accountants might advocate monetizing the dimensions, which are, after all, sometimes referred to as types of capital. It can be argued that a cost can be allocated to factors like social welfare or environmental damage. Many try putting a dollar value on 'green' or social factors. Another challenge is to find a way to assign an objective value to aspects such as lost wetlands or extinct species. Human emotion, like with so many other things, seems to add intrinsic value to these dimensions even before the balance sheet is completed.

Another solution might be to calculate the three Ps in terms of an index. As long as there is a universally accepted accounting method allowing for comparison between entities, this could be a way of reporting on 'People' and 'Planet'. Slaper and Hall (2011) refer to the Indiana Business Review's 'Innovation Index', but the authors admit that there is some subjectivity to the process, which presents itself especially in the weighting of the indexes. They comment: 'Would each "P" get equal weighting? What about the subcomponents within each "P"? Do they each get equal weighting? Is the people category more important than the planet? Who decides?'

Five Capitals model

The idea of using capitals other than financial capital was first explored by Forum for the Future (2012). The premise is that there are five types of sustainable capital from which the goods and services we need to improve the quality of our lives are derived. Figure 1 shows a diagram of the Five Capitals model of sustainability.

This model shows that there are five main capitals, or values, to consider in a sustainable society. If the manufactured and financial capitals were to be removed, the social, human, and natural capitals would continue to exist. However, if the natural capital was to be removed (i.e. destroyed), the other capitals would cease to exist. As such it is necessary to view the entire system holistically when a decision is made that affects mankind.

Porritt (2007) argues that capitalism is, and will for the foreseeable future be, the world's driving economic principle. He maintains that rather than fighting this, it is better to harness the power and momentum of capitalism to secure a sustainable future. It follows that the mining industry should apply some of its wealth to create a sustainable future.

Question 1: Is the project good for the bottom line?

Financial capital

The financial capital criterion has traditionally been the test of whether a project is viable. Evaluating a project's future cash flows and its promise of growth against the company's internal hurdle rates determines whether a project is viable. New techniques for capital budgeting have been developed. These are, inter alia: strategic options (Kester, 1986), scoring methods (Nelson, 1986), fuzzy logic approaches (Zimmermann, 1991), and discounted cash flow (DCF) modified methods (Azzone and Bertele, 1991). Traditionally, however, the two main criteria for financial viability have been net present value (NPV) and its counterpart, the internal rate of return (IRR) as part of the DCF process (Maccarrone, 1996).

The essence of sustainable development and the accounting thereof lies not in financial viability alone, but also in its impact on society (its social capital), as well as it impact on the environment (Burritt and Schaltegger, 2010). If we accept that capitalism is currently the main driving force in our society, then we have to accept that it is the financial viability of a project that will make a board of directors view it in a favourable light. The aim of this paper is not to argue for a change in the nature of capitalism, but to find a way of adding to it to ensure that sustainability becomes a major focus of the mining industry and inherent in decision-making processes for RET projects.

Hence the first question revolves around the financial viability of a project: does the project add value to the bottom line?

Answering question 1 - Is the project financially viable?

A full NPV and IRR calculation must be done in order to compare the project with others vying for funding. The IRR is the initial hurdle. Only if the IRR of a project is above the internal hurdle rate of a company should the project's NPV be measured against that of another to find the most valuable project.

For RET projects, however, the impact on the other four capitals should be considered. RET projects might not show profitable returns when financial capital is considered. When the other two bottom lines are considered, the true value of the project in terms of a sustainability value is considered and this value might make the project viable.

Manufactured capital

The concept of manufactured capital has been defined by the Forum for the Future (2012) as the physical, built machinery and infrastructure related to a project. The value of manufactured capital lies in its efficiency and effectiveness. It is in this area that the expertise of various players is needed to ensure that the project is successful.

Mining, electrical, mechanical, and civil engineers are all part of the array of engineering expertise that is found on a mine. It is only through collaboration between these disciplines and the hard work of artisans that a large mining project can be sustained. When venturing into the realm of sustainability projects, this engineering expertise needs to be complemented and amplified by the pure sciences, especially where the project is ground-breaking or new to the mining environment. In the case of the methane burn-off project it quickly became clear that the applicable manufactured capital was assured of viability and value only in close collaboration with various science disciplines.

Manufactured capital adds a new dimension to the concept of the TBL. The sustainability of a project depends not only on the financial viability, but also on the value and quality of the manufactured capital. It is in this sense that the Forum for the Future expands on the concept of the TBL. Instead of the first bottom line being purely a financial question, this is now expanded to incorporate manufactured capital.

The data for the methane burn-off project at the Beatrix gold mine was supplied by Gold Fields.

The Beatrix methane burn-off project

Beatrix gold mine is an intermediate-level mine in the Free State Province of South Africa. The mine has the highest methane emission rate of any gold mine in the country (Du Plessis and Van Greuning, 2011). Mining operations liberate this methane from underground sources, from where it dissipates in the atmosphere. The total methane emission rate for the entire mine is reported to be in the order of 1600 l/s. Beatrix has a history of gas accumulation that has led to a number of underground explosions. Following the last explosion in 2001, a number of recommendations were made. One of these was to consider extracting the methane from the mine in order to render the mine atmosphere safe. This is the crux of a project that has resulted in a method for not only improving safety at Beatrix, but also for generating electricity.

The contribution of methane gas to global warming and climate change is estimated at 20 times that of carbon dioxide. The Beatrix methane burn-off project is in fact a carbon project under the Clean Development Mechanism (CDM) of the Kyoto Protocol.

Technical aspects of the methane burn-off project

The aim of the project is to capture and extract the underground gas and use it in a sustainable manner by generating electricity. Through this process the atmospheric conditions underground will be vastly improved, as will the financial bottom line of the mine owing to the generation of cheap electricity.

Beatrix gold mine is situated 40 km south of the city of Welkom and 280 km south of Johannesburg (Figure 2).

Production from stoping operations amounts to 225 000 t/month. An air flow rate of 1 826 kg/s and 60 MW of refrigeration are required to maintain acceptable environmental conditions. The methane gas emits from deep-seated sources through geological features such as faults, fissures, and dykes. The concentration of methane emitted varies from 82% of the atmosphere, but can be as much as 90% (Du Plessis and Van Greuning, 2011).

It is impossible to extract all the methane because of the layout of the stoping operations and the widely spread methane intersections. It was therefore decided to target high-emission areas. The project has two phases, the first one being the capture of methane emitting from the mining operations and piping it to the surface, where it is flared. The second phase is the installation of Jenbacher electrical generation plants (Figure 3) that will convert the methane gas to electricity. Any excess methane is flared.

Financial capital - Following the money

The technical viability of the project was proven in concept by means of a technical feasibility study and underpinned the solid performance record of the Jenbacher generators.

If a project is technologically viable it will need funding. It is vital then that the methods of financial viability testing are understood and applied to the project. The financial model consisted of two phases, both of which were dependent on the revenue received from carbon emission reduction (CER) sales. Carbon emission reduction units, also known as carbon credits, are traded as commodities through the CDM. The United Nations Framework for Climate Change [UNFCC] approved the project design document for registration under the CDM in October 2008 (Du Plessis and Van Greuning, 2011).

Gold Fields was fortunate enough to find a buyer for the CERs very early on in the project design. The value of the CERs makes up an invaluable part of the financial bottom line of the project. The carbon credits are hedged. The buyer pays Gold Fields for the carbon credits at the beginning of the year. Until 2016, Gold Fields plans to sell 1.7 million CERs to the European energy trading company Mercuria Energy Trading SA under forward contracts.

Phase one of the project - flaring only

The first phase of the project consisted only of methane burn-off through flaring. Net cash generation for the project ramps up to R31 million per annum, resulting in a NPV of R229 million over 21 years. An IRR of 45.66% is generated in the first phase. Bearing in mind that this project does not necessarily carry the same risks as a long-term mining project, the IRR is comparatively high.

Phase two of the project - electricity generation

The second phase of the project consists of electricity generation through the Jenbacher plants. The emission reductions in this phase are not as high as in phase one of the project, with the result that the carbon emission sales are lower and CER revenue is less. However, there is a cost saving on Eskom electricity, which is added to project revenues. Electricity revenues are calculated at R27 million per annum. Added to the R20 million revenue from carbon credits sales, total project revenues exceed R47 million per annum.

This results in an NPV of R325 million over 21 years, with an IRR of 54.12%. This is 10% higher than the phase one IRR and proves the financial feasibility of the phase two addition.

Concluding question 1 - Financial and manufactured capital

A crucial part of financial viability is the technical viability of the RET technology. An in-depth study and thorough research must be undertaken to ascertain whether the technology employed in the project will actually work as planned. Only when the viability of the manufactured capital (the effectiveness of the technology) is considered in addition to the financial viability of the project (in terms of IRR and NPV) can the first question truly be answered.

An RET project is good for the bottom line of the company when the technology works, the IRR is above the internal hurdle rate, and the NPV favourable.

Question 2: Is the project good for the community?

Corporate social investment and responsibility

Corporate social investment (CSI) can be seen as encompassing all projects that are external to the normal business activities of a company and not directly for the purpose of increasing profit. CSR projects utilize company resources to benefit and uplift communities and are not primarily driven as marketing initiatives.

CSI value is widely recognized, i.e. reputation improvement, compliance with government regulations, competitive advantage, stakeholder appeasement (Hall and Vredenburg, 2004; Kassinis and Vafeas, 2006). CSR is an umbrella concept that refers to an organization's total responsibility towards the business environment in which it operates (Moir, 2001). However, there is no consensus on the value added to shareholders by CSR/CSI initiatives.

A report by McKinsey and Company (2009) states clearly that 'no consensus has emerged to define whether and how such programs create shareholder value, how to measure that value, or how to benchmark financial performance from company to company'. The report remarks that there are notable differences in opinion between chief financial officers (CFOs) and investors as to how much value these programmes create, which specific environmental, social, and governance activities create value, and whether such programmes are a proxy for good management. It is anticipated that environmental, social, and governance programmes will create more and more value over time. This potential highlights the importance of developing a better matrix and resolving the gap in understanding between CFOs and investors.

The problem with the CSR/CSI approach is that measuring the value of a project in terms of its social value is highly subjective. 'When doing a valuation, CFOs and investors alike say they count the effects on some stakeholders much more than effects on others; further, different stakeholders matter to the two groups. Most CFOs and investment professionals who don't integrate environmental, social, and governance considerations into their evaluations of corporate projects - or who don't do so fully - agree that the contributions are either too indirect to value or that the available data are insufficient. Indeed, few CFOs or investment professionals found value in external rating, ranking, or reporting standards or guidelines to assess the effects of environmental, social, and governance programs, with the exception of certain certification or accreditation standards' (McKinsey, 2009).

Especially in Africa, with its wide range of cultures and peoples, a project's value is in the eye of the beholder. A concentrated solar power plant supplied by a new investor may, for example, generate enough electricity to supply the community as a whole, but the loss of grazing land for the project's footprint may represent a greater loss to the community than the gain in electricity.

Porter and Kramer (2011) provide an interesting example. They start their report by stating that the capitalist system, in its current form, is under siege. Many commentators agree, and the literature abounds with various rethinks of the current capitalist system (Barnes, 2006; Young, 2003; Pirson and Lawrence, 2009; Porritt, 2007). Porter is of the opinion that the legitimacy of business has in recent years fallen to levels not seen previously and that a large part of the problem seems to be an outdated approach to value creation. Companies take a short-term view of value creation and in so doing miss customer needs, overlook the well-being of their customers, and ignore the depletion of natural resources and the economic distress of the communities they operate in.

According to Porter and Kramer (2011), 'Companies must take the lead in bringing business and society back together. Yet we still lack an overallframeworkfor guiding these efforts and most companies remain stuck in a "social responsibility" mind-set in which societal issues are at the periphery, not the core. The solution lies in the principle of shared value, which involves creating economic value in a way that also creates value for society by addressing its needs and challenges.'

The idea of creating shared value transcends CSR, philanthropy, and even sustainability. It should, in Porter and Kramer's opinion, not be at the periphery of what companies do but at the heart (Porter and Kramer, 2011). They argue that the CSV approach calls for a re-imagining of the lines between society and corporate performance. This is supported by Michelini and Fiorentino (2011) and Yunus (2010, 2008). Porritt feels that 'Capitalism is an unparalleled vehicle for meeting human needs, improving efficiency, creating jobs and building wealth. But a narrow conception of capitalism has prevented business from harnessing its full potential to meet society's broader challenges:

At the root of creating shared value (CSV) is the idea that the competitiveness of a company and the well-being of the surrounding community are closely intertwined. It should be a symbiotic relationship. According to Porter and Kramer, there are three ways a company can create shared value:

> Reconceiving products and markets

> Redefining productivity in the value chain

> Building supportive industry clusters at the company's locations.

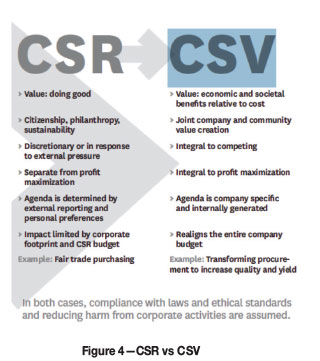

Porter and Kramer are at pains to explain the difference between CSV and CSR, as shown in Figure 4. 'CSV should take precedence over CSR in guiding the investments of companies in their communities. CSR programmes focus mostly on reputation and have only a limited connection to the business, making them hard to justify and maintain over the long run. In contrast, CSV is integral to a company's profitability and competitive position.'

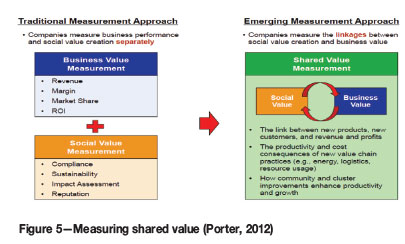

In researching how CSV is valued, it is clear that a hardline value cannot be put on shared value. Once the CSV concept has been entrenched in a company's ethics and business model it is easy to calculate the shared value retrospectively. In a presentation to the Shared Leadership Summit in 2012, Porter (2012) demonstrated the link between business and social value leading to shared value in the diagram shown in Figure 5. From this illustration it is evident that CSV is created in the overlap between business and social value.

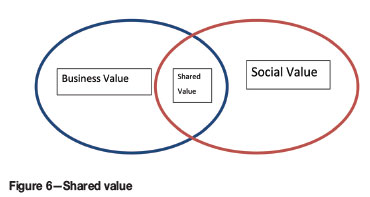

Porter's schematic can be simplified as shown in Figure 6, which clarifies the domain of shared value. Only where business and society both agree on the value of a project can there be shared value.

In attempting to establish shared value a mining company simply has to ask, that is engage with, stakeholders about what is of value.

Gold Fields subscribes to the AA1000 Stakeholder Engagement Standard 2011 (AA1000SES) and uses its principles to recognize the needs of all stakeholders in a specific area.

AA1000 Stakeholder Engagement Standard 2011

Stakeholder engagement is considered crucial to the sustain-ability and success of an operation (Ayuso et al., 2011). Stakeholder engagement can be defined as: 'The process used by an organisation to engage relevant stakeholders for a clear purpose to achieve accepted outcomes' (AccountAbility, 2011).

AccountAbility is a global organization that provides solutions to challenges in corporate responsibility and sustainable development.

In South Africa, as in other parts of the world, stakeholder engagement is a sensitive issue. It is essential that mining operations inform all stakeholders in detail about what it is going on in their operations and how proposed developments may affect stakeholders.

The origin of stakeholder engagement lies in crisis resolution. Companies have come to realize that engagement, transparency and quick responses to stakeholder concerns are vital to address external pressures.

For quality stakeholder engagement to be successful the three accountability principles: namely inclusivity, materiality, and responsiveness, must be honoured.

Inclusivity is defined as 'the participation of stakeholders in developing and achieving an accountable and strategic response to sustainability. It is also a commitment to be accountable to those on whom the organisation has an impact and who have an impact on it, and to enable their participation in identifying issues and finding solutions.' (AccountAbility, 2011).

Materiality is the process that determines the most relevant and significant issues for an organization and its stakeholders. It recognizes that certain issues are stakeholder-specific. What is important to the local community in a South American mining village may not necessarily be as important in rural Ghana. AccountAbility (2011) continues: 'Responsiveness is the decisions, actions, performance and communications related to those material issues.' Responsiveness is the company's reaction to materiality.

Before attempting the stakeholder engagement process it is necessary to define the purpose, the scope, and the stakeholders involved.

The stakeholder engagement process consists of four main steps, namely (a) planning, (b) preparing, (c) implementation, and (d) acting, reviewing, and improvement. These four steps form a continuous cycle in order to improve the engagement process.

Brand value

For several decades, a process much like the stakeholder engagement process discussed above has been implemented by the marketing industry to ascertain brand value, which is a measure of stakeholders' perceived value of a product. Testing brand value is exactly the same as testing a project's shared or stakeholder value. If brand value can be viewed as a measure of how much stakeholders 'like' an idea or a company, then it is also a useful measure for ascertaining a company's shared value.

According to Bick and Abratt (2003), 'brands ... makes them [customers] feel confident of their purchase decision. Managers have also become aware of the fact that the brand has become an important company asset, and focus is needed on the creation of brand equity.' Bick and Abratt draw a comparison between shared and brand value: 'As capital becomes less of a constraint on businesses there will be far greater emphasis on how capital is used to creatively differentiate the organisation. The point of differentiation (and the source of shareholder value) will flow from intangible assets'.

Shared value is an intangible asset or 'soft' concept that, like brand value, is difficult to quantify. Also, like brand value, shared value is a concept that has intrinsic stakeholder value and is a long-term asset to the company. If the community sees value in a project then, and only then, is shared value created.

Much work has been done on valuing brands. With the close link between shared value and brand value it is possible to identify a suitable method of brand evaluation and adapt it to quantify shared value.

Bick and Abratt (2003) assert that 'The benefit of ascertaining the correct brand value will ensure that resources are appropriately channelled to where they will deliver the greatest value .' That is, the crux of the matter for shared value as well: to identify the RET project that will have the most value and in which it will make the most sense to channel available funds.

Measuring brand value

A wide range of methods produce widely varying results. Bick and Abratt (2003) list the following five main methods:

> Cost-based approaches

> Market-based approaches

> Economic use or income-based approaches

> Formulary approaches

> Special situation approaches.

Measuring shared value - a forward-looking approach

The author proposes that, if some measure of shared value can be established through the engagement process (AA1000), a project can be seen as having shared value. There are three possible outcomes to community engagement:

1. The community does not perceive a project to have value. No shared value is established

2. The community considers the project to add value but to be too disruptive. The value of the project is not shared

3. The project is considered advantageous by both the company and the community, a symbiotic relationship exists in which all stakeholders draw value from the project. The project is then in the realm of true shared value, as per the overlapping area in Figure 7.

By applying the cost-based approach for brand evaluation the monetary shared value can be stated as:

Replacement cost of project (if shared value has been established) = Monetary shared value

Concluding question 2 - Human and social capital

If shared value is established, the project with the highest replacement cost, e.g. capital expenditure in monetary terms, is the project with the highest shared value. Comparing the cost of one project to that of another gives an unbiased, quantifiable measure of the shared value of that project and leads to a weighting metric.

If the stakeholder engagement process is followed, shareholders are assured when looking at the balance sheet that expenses reported under CSR strategies are creating shared value.

Social hurdle rate

Monetary shared value (MSV) is expressed in terms of money. MSV defines human and social capital through the sustainability value. The company could also set up internal hurdle rates for the required MSV. In other words, a MSV that automatically places projects in one of two categories: either creating sufficient MSV for the company to go ahead with the project, or not. This 'social' hurdle rate should only be a salient metric for comparing projects, because even if a project does not clear the internal hurdle rate set for MSV it might be more valuable than a competing project when the financial and environmental bottom lines are considered. If a certain project's MSV is below the company's internal hurdle rate for MSV the project should be identified as a possible risk and extra care should be taken in comparison with other projects. When MSV is considered in conjunction with financial capital, two of the three bottom lines are accounted for, i.e. Profit and People.

Question 3: How will the project impact on the environment?

The use of marginal abatement cost (MAC) curves is advocated in conjunction with an environmental impact assessment (EIA) to determine a project's impact on the environment. The fact that other methods of environmental impact assessment are not discussed here does not detract from their validity or importance. The anticipated end result of this work is a decision checklist that is easy to use, not overly onerous to complete, and also comparatively cheap. For this reason only the MAC curve is elaborated on.

Marginal cost curves

A MAC curve shows a schedule of abatement measures ordered by their specific costs per unit of carbon dioxide equivalent abated. Certain abatement measures can be put into action at a lower unit cost than others. The MAC curve is a valuable tool that illustrates either a cost-effectiveness or a cost-benefit assessment of measures where the benefits of avoiding carbon-emission damages are expressed by the shadow price of carbon (Moran et al., 2011).

MAC curve analysis is a method of determining optimized levels of pollution control across a range of environmental media (McKitrick, 1999). MAC curves are one of the favoured instruments for analysing the impacts of the implementation of the Kyoto Protocol and emissions trading (Klepper and Peterson, 2004). The MAC represents either the marginal loss in profits from avoiding the lost unit of emission, or the marginal cost of achieving a certain emission target given some level of output (Klepper and Peterson, 2004). Figure 8 shows a typical MAC curve.

The MAC curve is widely used for climate policy analysis in the context of a general equilibrium framework. An economy, as a whole, can be treated like a production plant. Hence, a MAC curve can be applied to an entire region.

In constructing an MAC curve, the abatement measures are ordered in increasing cost per unit of carbon dioxide abatement. The horizontal axis denotes the actual volumes abated over the period of the implementation of the technology measure. The figures below are examples of MAC curves.

Klepper and Peterson (2004) maintain that 'In a computable general equilibrium (CGE) model the marginal abatement cost is defined as the shadow cost that is produced by a constraint on the carbon emissions for a given region and a given time'. They go on to explain that this shadow cost is equal to the price of an emission permit in the case of emissions trading. This is the same cost that equals the price of one CER as sold by Gold Fields through Mercuria trading on the open market through the CDM of the Kyoto protocol. Through the use of a MAC curve it becomes possible to pin a direct cost to the abatement potential of a project. This abatement potential is in fact what is bartered on the open market. The relatively huge revenue that is generated by Gold Fields' Beatrix methane burn-off project is thus the result of the sale of the carbon abatement potential of that project. This leads to:

MAC = Net present value/greenhouse gas emissions saved from abatement measures during investment timeframe (Carbon Innovators Network, 2011) or:

Clean Development Mechanism

The CDM allows a country with an emission-reduction or emission-limitation commitment under the Kyoto Protocol to implement an emission-reduction project in developing countries. Such projects then earn saleable certified CER credits, each equivalent to 1 t of CO2, which count towards meeting Kyoto targets.

The CDM is the first global environmental investment and credit scheme of its kind, providing a standardized emissions offset instrument, CER (UNFCC, 2013). The aim of the CDM is to stimulate sustainable development and emission reductions, while at the same time giving industrialized countries a flexible tool with which to meet their emission reductions or carbon limitation targets. The Beatrix methane burn-off project is a typical CDM project.

Final selection of environmental valuation system with criteria

There are various methods of calculating what can only be described as a shadow cost, i.e. the intangible cost of what the environment means to the human race. During the feasibility or scoping study stage for a renewable energy project it becomes necessary to choose the most applicable tool. It is inevitable that some of the methods will be used in conjunction with each other, but it is the verifiable audit of the final value that is important.

It is very difficult to find one value that satisfies all commentators, since the value assigned to the environment is highly subjective. It is useful, however, to be able to calculate a value, even if that value is only considered to be the 'at least' value. This 'foundation' value should be seen as the fairest and most logically calculated value that makes sense to all stakeholders and on which there is agreement that more value be added but not decreased.

The South African mining industry is well versed in the use of environmental impact assessments (EIAs), the requirements for which are written into law through NEMA (The National Environmental Management Act, 107 of 1998). An EIA does not result in a final financial value for a project, but is a tool that identifies environmental hazards and the necessary mitigating projects. As such it is important that these projects, as well as the environmental management plan (EMP), are drawn up in such a manner that the cost of possible mitigation measures can be calculated. The EIA is only half of the process as it does not take into account the advantages a RET project can bring to the environment. An EIA should be undertaken in conjunction with at least one other environmental rating tool.

These two values should then be added to give a foundation cost for an RET project.

For any given renewable energy project then:

EMP + EIA + MAC = EBL

where

EMP = full financial cost of the environmental management plan

EIA = full financial cost of the environmental impact assessment

MAC = the marginal abatement cost of the project

EBL = the full economic cost of the renewable energy project to the environment (Economic Bottom Line).

Concluding question 3 - Natural capital

Expressing environmental impact in monetary value terms does not give a true reflection of the full impact of the project. The challenge lies in trying to place a quantitative value on qualitative measures. The value of animal and plant life, aesthetics, ecosystem services, and clean air etc. is subjective and may change over time for each person as personal values change.

Financial capital is a well understood, verifiable, and reproducible metric. By conducting an EIA and calculating the cost of the associated EMP, a financial cost is determined for the rehabilitation of the environment. Calculating the cost of the reduction or gain in ecosystem services likewise gives a financial value to the environmental side of the project. Finally, a MAC curve showing costs for the marginal abatement of carbon gives a cost for that metric as well.

By adding these three costs together a single monetary value is obtained with which to compare one project's environmental impact against another. The NPV calculation does include the cost of the EIA as well as the projected cost of the EMP. The fact that the natural capital calculation, as described above, as well as the NPV calculation both incorporate the EIA and EMP costs does not constitute double accounting. The NPV calculation reports under the Financial Capital 'silo' and the EIA cost calculation reports to the Environmental Capital 'silo', illustrating the fact that the two represent different metrics with which RET projects must be compared. If the EIA costs were to be reported only under the NPV calculation, the risk is that the full impact of the damage to the environment, as illustrated by the magnitude of the EMP+EIA figures, might go unnoticed if the NPV is positive and above the required hurdle rates.

Environmental hurdle rate

As with the financial and social questions, a hurdle rate can be set by the company to rate a project's environmental viability. The environmental hurdle rate should, just like the financial and social hurdle rates, be an indication of the company's appetite for environmental risk. If the EBL is higher than the internally acceptable EBL the company must not consider the project as an option or proceed with extreme caution.

Although the full environmental cost might not be accounted for in the EBL, it is clear that the project with the highest EBL does the most harm to the environment as well as the financial bottom line. The project with the lowest EBL is that project with the smallest impact on the environment and hence, from a purely environmental aspect, should be the favoured project.

The decision checklist

The following checklist is proposed by the author. The aim of this decision checklist is to assist in the choice of the most sustainable RET project.

Is this project good for the bottom line? - Financial and manufactured capital

> Does the project make engineering sense?

> Has a complete technical analysis of the project been done to determine its technical feasibility?

The aim of this step is to ensure that the project will work and that the underlying engineering principles are sound.

What are the NPV and IRR of the project? (FBL)

> Has a complete financial analysis been done to calculate the NPV and the IRR of the project?

This step needs to find the financial bottom line value of the project. This value (FBL) will be used to add to the project's societal value (SBL) as well as its environmental value (EBL). Because of the ambiguity of the IRR calculation, the NPV value will be used in further calculation. The IRR value should be used if a tiebreaker is required to choose between projects.

Is this project good for society? - Social and human capital

> Have all stakeholders been engaged?

> Has a recognized engagement standard, like the AA1000 Stakeholder Engagement Standard, been used to ensure that all stakeholders have been consulted properly and systematically?

> Has shared value been created?

If there is no perceived shared value, i.e. the community does not find value in the project, the perceived value applies only to the company and no shared value is created. In this case, it might make economic sense to terminate the project at this point and invest in an alternative project that increases the social investment of the company.

To what extent is the value created truly shared in the community?

What percentage of the sample population agrees to the shared value of the project? People in an area might be divided on the value of a project. Even if the majority finds that shared value is created and are happy with the project to go ahead there might be some that feel the project is not valuable. The percentage of value-finders must be noted in the comments column of the checklist.

If shared value is created, what is the capital expenditure of the company on the project? (SBL)

> Is this project good for the environment? (Environmental capital)

> Has an EIA for the project been conducted?

> What is the financial cost of the environmental impact study?

> What are the associated impacts of the project?

> What is the NPV of the EMP and all associated costs?

> Has a MAC curve been created for the project?

> What is the full abatement cost of the project?

Calculate the environmental bottom line using:

EMP + EIA + MAC = EBL

> What is the triple bottom line of the project?

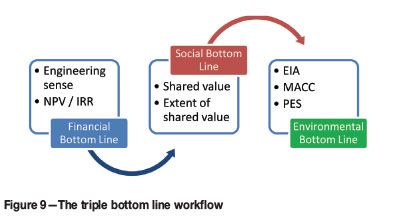

Figure 9 shows a simple diagrammatic workflow for the proposed TBL calculation

Commentary on the findings

Keeping the triple bottom line

There is a temptation to simply add the FBL and the SBL together and then subtract the EBL from that figure to obtain a value for a project that can then be compared to the value for another project that was calculated in the same way. In other words:

Total bottom line = Financial bottom line + Social bottom line - Environmental bottom line

or

TBL = FBL + SBL - EBL

Although this function would result in a single monetary bottom line value for the sustainability of the project across all three bottom lines, it has the risk of being skewed by any one of the variables that is much larger than the others. If, for example, the revenue for the project (FBL) is an order of magnitude larger than the environmental impact (EBL), the EBL figure would have a very small impact on the TBL. In this way a project that has a very high environmental impact but an even larger projected revenue will automatically beat a project that has a smaller revenue stream but also has a smaller impact on the environment.

It is necessary to report three separate bottom lines in the decision checklist and not combine the values.

Substance over form

Another risk to the process is the lack of disclosure of information. If the project is simply presented as a list of figures to be compared with one another, the board will not have enough qualitative information to base a decision on. It is necessary that each of the final answers to the three questions has a comments column. These comments will assist with decision-making by ensuring full disclosure but are also essential for the concept of 'substance over form'.

Principle 6.2 of the third King report on corporate governance (King III) states that 'Sustainability reporting should be focused on substance over form and should transparently disclose information that is material, relevant, accessible, understandable and comparable with past performance of the company' (IoDSA, 2009).

Substance over form is described by the International Accounting Standards Board (IASB, 2010) as 'Faithful representation means thatfinancial information represents the substance of an economic phenomenon rather than merely representing its legal form. Representing a legal form that differs from the economic substance of the underlying economic phenomenon could not result in a faithful representation'.

Qualitative assessment of the EIA

The EIA as described in the checklist is a decision-aiding tool and not a decision-making tool. An EIA is usually used as a tool to decide whether to continue with a project, but in the context of this work it is also used to choose between possible projects based on the impacts those projects might have on the environment. The decision-makers need to assess all three of the bottom lines before a choice between RET projects is made. In the spirit of substance over form it is again important to note qualitative data because the EBL figure alone does represent all the data. The EBL does give an indication of the monetary cost to the environment as a function of the mitigation costs of those impacts. The assessed impacts need to be disclosed in the final report. To ensure fairness and comparability between RET projects, the same ranking system for environmental impacts should be used for all projects under review.

Concluding the commentary

The final answers on the checklist should contain not only the data on the three bottom lines, but all substantive information that is necessary for the final decision-makers to come to an informed conclusion as to which project to fund.

A comments column must be added to all three of the bottom line figures to describe how they were calculated. This approach will ensure a quantitative as well as qualitative approach, thereby satisfying the principle of substance over form.

Application of the checklist

Timing

The author proposes that this checklist be integrated into the various phases of feasibility studies that are conducted in preparation for a RET project. It is common practice for a 'mini EIA' to be carried out before a full scoping study is started. Similarly, the scoping study is usually not as detailed as the full bankable feasibility study. The stakeholder engagement process can also be scaled down to get a preliminary take on stakeholder sentiment. All of this work should be integrated into the checklist as early as possible. These scaled down, early studies are for cost- and time-saving purposes. The same reasons count for a scaled down sustainability study utilizing the checklist.

Fairness, validity, and reproducibility

Some aspects of the checklist have a notable qualitative approach. In order for the process to be fair, valid, and reproducible it is essential that the same team is used to complete the checklist for all projects under review. This will not remove the qualitative aspect from the work but it will ensure that projects are compared fairly. If the team needs to be changed due to operational requirements, it is necessary that the new team members have the same academic qualifications and experience as the original team members. As with all scientific research, it is important to ensure that team members are as neutral and objective towards the outcome as possible.

It is suggested that at least one team member should be chosen each from the financial sciences, engineering sciences, social sciences, and environmental sciences. In this way each of the bottom lines can be represented by its own expert.

Conclusion

Sustainable development has become an integral part of today's business world. Many sustainable projects take the form of renewable energy projects since in a power-hungry industry such as mining these projects can contribute the most. A major challenge lies in valuing sustainable projects. According to value theory, it is necessary to identify some value with which to compare projects. This value was called 'sustainability' for the purposes of this work. Choosing between renewable energy projects would be impossible without identifying one core value as a means of comparison.

The TBL accounting method was the first attempt at finding a common denominator for evaluating sustainability. This method was found to be inadequate to evaluate sustain-ability on its own. The TBL was then expanded by the work of Jonathon Porritt (2007) and the Forum for the Future (2012). Instead of countering capitalism, Porritt and the Forum for the Future built on the TBL method and identified five capitals - financial, human, social, manufactured, and environmental - on which a sustainable society is built. From the so-called Five Capitals model the idea is derived that a sustainable project should make financial, engineering, social, and environmental sense.

Gold Fields's Beatrix methane burn-off project was used as an example of the sustainability projects of a mining company.

Three questions are used to identify the sustainability of a renewable energy project. The first question concerns the advantages to the financial bottom line. An in-depth look was taken at Beatrix gold mine's methane burn-off project. By studying this example of an RET project, a good understanding is gained of how industry evaluates an RET project financially and technically. The financial evaluation concerns financial capital and the technical aspects concern manufactured capital as, described by the Forum for the Future (2012).

The next question investigated whether an RET project is good for the community. The concept of corporate social responsibility (CSR) was found to be a slightly dated method of determining a company's interaction with the community. Creating shared value is the new norm for attempting to evaluate the social good of a company. Measuring shared value when reviewing a project is a challenging task - a method to forecast the creation of shared value is proposed. The first step in ensuring shared value is to follow a robust stakeholder engagement process. For this the AA1000 Stakeholder Engagement Standard is used. If all the stakeholders find value in a RET project, the capital expenditure on the project should be deemed the monetary or economic value of social value. Shared value is quantified before commencing with a project.

The third question concerns the issue of whether an RET project is good for the environment. The EIA is considered as a longstanding method of auditing a project in terms of its environmental impact. The format and content of the EIA is legislated in NEMA. Unfortunately, however, an EIA is a highly subjective tool and one that does not necessarily lead to a specific economic value for environmental impact. Because the use of an EIA is dictated by law it is necessary to find additional methods of evaluation to obtain a more objective answer. Marginal abatement costs are proposed for use in conjunction with an EIA.

The author advocates the use of hurdle rates for all three questions. The financial hurdle rate is used to gauge the financial risk of the project. The social value, or MSV, is also suggested to have an internal company hurdle rate and gauges the company's appetite for creating shared value with the community through the project. However, even if no MSV is created through the project, it might still be meaningful to go ahead with the project as the other two capitals might create enough value. The environmental hurdle rate gauges the company's appetite for environmental risk. If the project has a higher EBL than the company's hurdle rate, the risk to the environment is too high to continue and the project should not be considered.

It is possible to calculate a monetary value for all three bottom lines, but these values do not necessarily reflect the full cost of that specific capital. These values are particularly useful as a metric to compare one project with another. The three bottom lines should be kept separate but juxtaposed with those of other projects to find the most sustainable RET project.

References

Accountability. 2011. AA1000 Stakeholder Engagement Standard 2011. www.accountability.org [Accessed 1 December 2012]. [ Links ]

Ayuso, S., Rodriguez, M.A., GarcIa-Castro, R., and Ariño, M.A. 2011. Does stakeholder engagement promote sustainable innovation orientation? Industrial Management and Data Systems, vol. 111, no. 9. pp. 1399-1418. [ Links ]

Azzone, G. and Bertelè, U. 1991. Techniques for measuring the economic effectiveness of automation and manufacturing systems. Manufacturing and Automation Systems: Techniques and Technology. CT Academic Press, Leondes. [ Links ]

BARNES, P. 2006. Capitalism 3.0. Berrett-Koehler, London. [ Links ]

BICK, G. and ABRATT, R. 2003: Valuing brands and brand equity: methods and processes. Journal of Applied Management and Entrepreneurship, vol. 8, no. 1. pp. 21-39. [ Links ]

Boyd, J. and Banzhaf, S. 2007. What are ecosystems services? The need for standardised environmental accounting units. Ecological Economics, vol. 63. pp. 616-626. [ Links ]

Burritt, R.L. and Schaltegger, S. 2010. Sustainability accounting and reporting: fad or trend? Accounting, Auditing and Accountability Journal, vol. 23, no. 7. pp. 829-846. [ Links ]

Costanza, R., Kubiszewski, I., Ervin, D., Bluffstone, R., Boyd, J., Brown, D., Chang, H., Dujon, V., Granek,E., Polasky, E., Shandas, V., and Yeakley, A. 2011. Valuing ecological systems and services. Faculty of 1000, Portland. [ Links ]

Daily, G. 1997. Nature's Services: Societal Dependence on Natural Ecosystems. Island Press, Washington, DC. [ Links ]

Daily, G. and Ellison, K. 2002. The New Economy of Nature: the Quest to make Conservation Profitable. Island Press, Washington, DC. [ Links ]

Du Plessis, J. and Van Greuning, D. 2011. Destruction of underground methane at Beatrix Gold Mine. Journal of the Southern African Institute of Mining and Metallurgy, vol. 111, no. 12. pp. 887-894. [ Links ]

Echenique, J. 2012. Aristotle's Ethics and Moral Responsibility. Cambridge University Press, Cambridge. [ Links ]

Elkington, J. 1994. Towards the sustainable corporation: win-win-win business strategies for sustainable development. California Management Review, vol. 36. pp. 90-100. [ Links ]

Ernst and Young. 2012. Excellence in Integrated Reporting Awards 2012. http://www.ey.com/zA/en/Services/Specialty-Services/Climate-Change-and-Sustainability-Services/2012---EIR---main-page [Accessed 1 February 2012]. [ Links ]

Eshleman, A. 2009. Moral Responsibility. The Stanford Encyclopedia of Philosophy (Winter2009Edition). http://plato.stanford.edu/archives/win2009/entries/moral-responsibility [Accessed 13 March 2013]. [ Links ]

Forum for the Future. 2012. Projects: Forum for the Future. http://www.forumforthefuture.org/project/five-capitals/overview [Accessed 12 January 2011]. [ Links ]

GE Jenbacher GmbH and Co. Not dated. Company Profile - GE Jenbacher GmbH and Co. https://information.jenbacher.com/index.php?{..1.1018}andlng=en [Accessed 12 December 2012]. [ Links ]

Gold Fields. 2012. Integrated Annual Report. Gold Fields Limited, Johannesburg. p. 3. [ Links ]

Gold Fields. 2010. Susainability Report. Gold Fields Limited, Johannesburg. [ Links ]

Goldman, R.L. 2010. Ecosystems Services: How People Benefit from Nature. Routledge, London. [ Links ]

Hall, J. and Vredenburg, H. 2004. Sustainable development innovation and competitive advantage: implications for business, policy and management education. Corporate Sustainability: Governance, Innovation Strategy, Development and Methods, vol. 6. pp. 129-40. [ Links ]

Institute of Directors of Southern Africa (IoDSA). 2009. King code of governance principles (King III). Johannesburg. p. 49. [ Links ]

International Accounting Standards Board (IASB). 2010. Conceptual Framework for Financial Reporting 2010, 60. IFRS Foundation [ Links ]

International Council on Mining and Metals. 2012. Projects - Mine closure and legacy. http://wwww.icmm.com [Accessed 6 January 2012]. [ Links ]

KASSINIS, G. and VAFEAS, N. 2006. Stakeholder pressures and environmental performance. Academy of Management Journal, vol. 49, no. 1. pp. 145-59. [ Links ]

Kester, C.W. 1986. An option approach to corporate finance. Handbook on Corporate Finance. Wiley, New York, NY. [ Links ]

Klepper, G. and Peterson, S. 2004. Marginal abatement cost curves in general equilibrium: the influence of world energy prices. Kiel Institute for World Economics, Kiel. [ Links ]

MACCARRoNE, P. 1996. organizing the capital budgeting process in large firms. Management Decision, vol. 34, no. 6. pp. 43-56. [ Links ]

McKinsey. 2009. Valuing Corporate Social Responsibility. McKinsey and Company, Brussels. [ Links ]

McKitrick, R. 1999. Derivation of the marginal abatement cost curve. Journal of Environmental Economics and Management, vol. 37, no. 2. pp. 306-314. [ Links ]

Michelini, L. and Fiorentino, D. 2012. New business models for creating shared value. Social Responsibility Journal, vol. 8, no. 4. pp. 561-577. [ Links ]

Millenium Ecosystem Assessment. 2005. Overview: Millenium Ecosystem Assessment. http://milleniumassessment.org/en/About.html [Accessed 1 March 2013]. [ Links ]

Moir, L. 2001. What do we mean by corporate social responsibility? Corporate Governance, vol. 1, no. 2. pp. 16-22. [ Links ]

Moran, D., Macleod, M., Wall, E., Eory, V., McViTTiE, A., Barnes, A., Rees, R., Topp, C.F.E., and Moxey, A. 2010. Marginal abatement cost curves for UK agricultural greenhouse gas emissions. Journal of Agricultural Economics, vol. 62. pp. 93-118. [ Links ]

Nedbank Capital. 2012. BettaBeta Be Green Exchange Traded Fund. http://www.capital.nedbank.co.za/nedbank/action/media/downloadFile?media_fileid=5442 [Accessed 30 October 2014]. [ Links ]

Nelson, C.A. 1986. A scoring model for flexible manufacturing systems project selection. European Journal of Operational Research, vol. 24. pp. 346-59. [ Links ]

Perrot-Maitre, D. 2006. The Vittel Payments for Ecosystems Services: a 'perfect' PES case? International Institute for Environment and Development, London. [ Links ]

Pirson, M. and Lawrence, P. 2009. Humanism in business - towards a paradigm shift? Journal of Business Ethics, vol. 93, no. 4. pp. 553-65. [ Links ]

Porritt, J. 2007. Capitalism: As if the World Matters. 2nd edn. Earthscan, London. [ Links ]

Porter, M.E. 2012. Creating shared value: the path forward. FSG Shared Value Leadership Summit. Boston, 31 May 2012. [ Links ]

Porter, M.E and Kramer, M.R. 2011. Creating shared value - how to reinvent capitalism and unleash a wave of innovation and growth. Harvard Business Review, Jan.-Feb. 2011. pp. 1-17. [ Links ]

Pratt, K. and Moran, D. 2010. Evaluating the cost effectiveness of global biochar mitigation potential. Biomass and Energy, vol. 34, no. 8. pp. 1149-1158. [ Links ]

Roe, D. 1984. Dynamos and Virgins. Random House, New York, NY. [ Links ]

Rogers, K. and Hudson, B. 2011. The triple bottom line - the synergies of tranformative perceptions and practices for sustainability. OD Practitioner, vol. 43, no. 4. pp. 3-9. [ Links ]

Savitz, A. 2006. The Triple Bottom Line. Jossey-Bass, San Francisco. [ Links ]

Schroeder, M. 2012. Value Theory. The Stanford Encyclopedia of Philosophy (Summer2012Edition). http://plato.stanford.edu/archives/sum2012/entries/value-theory [Accessed 20 March 2013]. [ Links ]

Slaper, T. and Hall, T. 2011. The triple bottom line: what is it and how does it work? Indiana Business Review, vol. 86, no. 1. pp. 4-8. [ Links ]

South African Government Gazette. 2010. National Environmental Management Act (Act 107 of 1998) Implementation Guidelines - Sector Guidelines For Environmental Impact Assessment. [ Links ]

South African National Biodiversity Institute. 2012. Resources. SANBI. www.grasslands.org.za [Accessed January 2013]. [ Links ]

Stern, L. 1974. Freedom, blame, and the moral community. Journal of Philosophy, vol. 71. pp. 72-84 [ Links ]

Taylor, A.C., Fletcher, T.D., and Peljo, L. 2006. Triple bottom line assessment of stormwater quality projects: advances in practicality, flexibility and rigour. Urban Water Journal, vol. 3, no. 2. pp. 79-90. [ Links ]

UNFCC. 2013. Clean Development Mechanism. http://unfccc.int/kyoto_protocol/mechanisms/clean_development_mechanism/items/2718.php [Accessed 13 March 2013]. [ Links ]

World Bank Group. 2012. The World Bank: GINI index. http://data.worldbank.org/indicator/SI.POV.GINI [Accessed 27 August 2012]. [ Links ]

Young, S. 2003. Moral Capitalism: Reconciling Private Interest with the Public Good. Berrett-Koehler, London. [ Links ]

Yunus, M. 2008. A World without Poverty: Social Business and the Future of Capitalism, Public Affairs. New York, NY. [ Links ]

Yunus, M. 2010. Building Social Business. Public Affairs, New York, NY. [ Links ]

Zimmermann, H.J. 1991. Fuzzy Set Theory and its Application. Kluwer Academic, Boston. [ Links ] ♦

© The Southern African Institute of Mining and Metallurgy, 2014. ISSN2225-6253. This paper was first presented at the, Mining, Environment and Society Conference 2013, 27-28 November 2013, Misty Hills Country Hotel and Conference Centre, Cradle of Humankind, Muldersdrift.