Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Journal of the Southern African Institute of Mining and Metallurgy

versión On-line ISSN 2411-9717

versión impresa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.114 no.10 Johannesburg oct. 2014

GENERAL PAPERS

Outsourcing in the mining industry: decision-making framework and critical success factors

C.J.H. Steenkamp; E. van der Lingen

Department of Engineering and Technology Management, University of Pretoria, South Africa

SYNOPSIS

Theoretically, the main driver behind a mining operations' sourcing decision should differ from company to company, and within a company from project to project, but in reality it often relates to cost. Research confirms that there are a number of factors, including cost, to consider when choosing between in-house and outsourced mining. While the literature is rife with factors to consider, little information exists on how to apply these in practice and the relative importance of the different factors to be considered.

A study was conducted to determine whether mining is truly a core competency for a mid-tier commodity specialist mining company. Furthermore, a decision-making framework for mining operations sourcing was developed, and the critical success factors that should be adhered to if outsourced mining is chosen were determined.

The research showed that owner mining is not a core competency for the mining company investigated. A decision-making framework was developed using the order winner/order qualifier structure, which can be used to facilitate the mining sourcing decision. The most important tools at the disposal of a mine owner's team to manage a contractor miner are the social and output control mechanisms, according to the critical success factors study.

Keywords: insourcing, outsourcing, contractor, mining, decision-making, critical success factors.

Introduction

Outsourcing strategies have been viable in organizations since the 1980s (Hätönen and Ericksson, 2009), and gained significant momentum during the 1990s (Morgan, 1999; Corbet, 2004). Fill and Visser (2000) consider outsourcing as one of the most widely adopted practices followed by firms. Firms started to outsource functions that were not considered their area of expertise in order to become more cost-efficient (Porter, 1996). A number of authors have argued whether or not outsourcing can be viewed as strategy. In the publication 'What is Strategy?' Porter (1996) strongly protests that outsourcing is a tool and not, in and of itself, a strategy. In contrast to this, outsourcing is defined as a strategic decision (Embleton and Wright, 1998; Gottschalk and Solli-Saether, 2005). Mclvor (2000) goes as far as to say that outsourcing can succeed only if carried out from a strategic perspective, and by fully integrating it with an organization's larger corporate and operational strategy. Regardless of the different opinions in the literature, most authors agree that outsourcing is an important tool for implementing rapid strategic change.

Outsourcing has further become an international phenomenon in order to provide businesses with a competitive edge in a global market. Several publications report on various aspects of international outsourcing, e.g. expansion and development path (Mol et al., 2004), partnership model (Kedia and Lahiri, 2007), drivers of offshore business processes (Kshetri, 2007), skills-intensive tasks and wage inequality (Anwar et al., 2013). Although international outsourcing related at some stage mainly to the manufacturing sector, such as changing the production location to obtain a capital-labour trade-off, it progressed to service-based and knowledge-based outsourcing, such as advanced information technology design, legal services, medical diagnostics, etc. (Parkhe, 2007). Recent publications indicate a tendency to return manufacturing to home countries due to rising labour costs in originally preferred countries, such as China, India, and Mexico (Eichler, 2012; Pearce, 2014; Kazmer, 2014).

Outsourcing is prevalent in the retail and manufacturing industries (Bryce and Useem, 1998; Kazmer, 2014), whereas mining is one of the industries with the lowest propensity for outsourcing (Embleton and Wright, 1998). The supposition can be made that this is due to the fact that, historically, mining has been quite a protected industry, unlike manufacturing and retail where the fierce competitive environment has forced companies to be innovative with regard to their business models. In a commodity-based business such as mining, outsourcing has become a potential solution to overcome two main challenges, namely cost and the acquisition and retention of skilled people (Deloitte Management Consulting, 2012). In apparent contradiction with conventional outsourcing theory, which dictates that companies should focus outsourcing efforts on non-core competencies, many mining companies have considered outsourcing their mining operations i.e. drilling, blasting, loading and hauling - the very core of their business (Quelin and Duhamel, 2003).

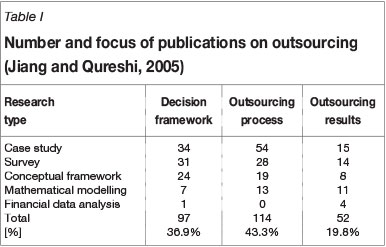

Table I shows a summary of the literature on outsourcing in general (Jiang and Qureshi, 2005). The literature is dominated by research focusing on the outsourcing process with the outsourcing decision, the focus of this research, and outsourcing results lagging behind. Popular research methodologies include surveys and conceptual framework, which will form the basis of the research methodology of this study as well.

While the literature is rife with long lists of factors to consider, little to no information exists on how to apply these in practice and the relative importance of the different factors to be considered (Quelin and Duhamel, 2003). The opportunity therefore exists to develop a framework for deciding between outsourcing and insourcing of core mining operations.

A study was conducted to determine whether mining is truly a core competency for a specific mid-tier geographic commodity specialist mining company and evaluate this against the perceptions among management. A decisionmaking framework for mining operations sourcing was developed. The study further set out to determine the critical success factors (CSFs) that should be adhered to if outsourced mining is the decision. The objectives of this study are to:

► Determine whether mining is truly a core competency for a mid-tier geographical commodity specialist and evaluate this against the perceptions among management in such a company

► Develop a decision-making framework for mining operations sourcing for future mining projects, which includes a prioritized list of factors to consider

► Determine the CSFs that should be adhered to if outsourced mining is the chosen option.

Strategic outsourcing decision factors

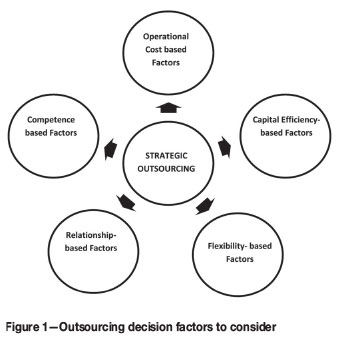

The context within which outsourcing decisions are made is extremely important, and making the decision on cost alone is dangerous and short-sighted (Fill and Visser 2000). Mclvor (2000) proposes a couple of factors that should form the framework within which a company should make outsourcing decisions, e.g. cost analysis, associated risks, supplier influences, and strategic intent. Recent research by Freytag et al. (2012) defines three major categories that should be used when evaluating outsourcing decisions, namely (i) cost-based, (ii) competence-based, and (iii) relationship-based. Quelin and Duhamel (2003) do not place as much emphasis on relationship-based factors, and split cost considerations into two categories, namely (i) operational costs and (ii) effective use of capital. They also add flexibility-based factors as a separate category. The approaches of Freytag et al. (2012) and Quelin and Duhamel (2003) were combined for the purposes of this study, as shown schematically in Figure 1.

Operational cost-based factors

Transactional cost theory and the drive for efficiency has long been the dominant reason for outsourcing (Holcomb and Hitt, 2007). Any organization, but particularly commodity organizations like mining companies, strives to minimize production and transaction costs. Companies sometimes outsource a function to convert a fixed-cost operation into a variable-cost operation (Freytag et al., 2012), thereby minimizing the risk of a negative profit margin under low production volumes. Often the decision on project issues is not made on the best fit, but more on the sensitivity of the project business case. In order to consider cost comparisons, one must take care to evaluate outsourcing on par with internal capabilities and their associated costs (Embleton and Wright, 1998). The one area of concern, according to Kirk (2010), is the redundancy in overheads - as both the owner and contractor will require some management and administrative functions, even under a fully outsourced mining model.

Capital efficiency-based factors

In addition to minimizing low volume risk, companies prefer to outsource functions that depend heavily on fixed investment in order to avoid spending large amounts of capital (Quelin and Duhamel, 2003). In mining operations, for example, conducting the function in-house means that the company needs to invest capital at start-up in order to acquire a mining fleet (trucks, excavators, dozers, etc.) and then periodically replace these assets as they age, which requires additional capital. A mining contractor will model this, and build the capital requirement into their variable rate; thereby smoothing cash flow and converting capital spent into a variable operational expenditure. The work by Kirk (2010) substantiates this further, saying that for mining companies, the main consideration from a corporate perspective is the availability, accessibility, and cost of capital. The key difference between owner and contractor mining rests in the former being heavily capital-intensive initially, but potentially lower cost in terms of operational expenditure over the life-of-mine.

Flexibility-based factors

Mining is an industry with a number of variable influences, from geology and labour conditions to the seasons and commodity prices. Flexibility-based factors historically come second only to cost when outsourced mining is motivated, with various aspects to be analysed. Each mining project is unique, and presents its own unique complexities and challenges. Kirk (2010) suggests that projects with a relatively short life-of-mine (five years or less) and with widely varying mining rates will be suitable candidates for outsourced mining. Holcomb and Hitt (2007) indicated that flexibility-based factors become a higher priority in organizations operating in a market where technology is the basis of competitive advantage, and with significant technological uncertainty. In the mining industry, the tendency is to move from labour-dependent, largely manual technologies to automated methods, resulting in mining contractors partnering with equipment suppliers to enable them to access new technologies.

Competence-based factors

From a competence-based perspective, various factors need to be considered. A company should look for opportunities to (i) protect and develop its core competencies internally, even at a slightly higher transactional cost, and (ii) look to balance and sharpen its competitive edge by outsourcing non-core competencies to best-in-class service providers (Freytag et al., 2012). By accessing more efficient and potentially more value-creating capabilities a firm can fundamentally change its competitiveness in the marketplace. Holcomb and Hitt (2007) support the contention that firms should form alignments with outsourcing partners in order to gain access to complementary capabilities or competencies. Complementary competencies are defined as those that not only supplement a company's internal core competencies, but have the ability to enhance them as well. During times of industry-wide shortages of skills, outsourcing can further alleviate the need to invest in expensive individuals, (Kirk, 2010). Mining is one of the industries where the attraction and retention of talent is one of the main operational challenges.

Relationship-based factors

Outsourcing decisions are not made on cognitive reasons alone (Webb and Laborde, 2005). No company is truly a sole entity, and this is considered under the relationship-based grouping of factors. Outsourcing, if applied correctly, can create bonds and network an organization in such a way as to increase productivity (Freytag et al., 2012). The strategic relationship between client and vendor becomes quite important. Holcomb and Hitt (2007) indicate that goal congruence, or the degree of overlap between the two parties' strategic and operational objectives, must be considered. In order for a win-win relationship to exist and be sustained, objectives must be aligned (or more specifically, alignable). Managing capabilities, even if not under the direct operational control of the managing party, is in itself also a capability (Loasby, 1998). A company considering outsourcing a function should evaluate its own ability (as a core competency) to manage such an arrangement.

Critical success factors for contractor mining

The benefits of contractor mining are not always achieved, even when the model suits the project perfectly. Dunn (1998) provides examples where, after substantial periods under the contractor mining model, companies have concluded that owner mining is significantly cheaper, has marginally lower risk, and in general is better value for money. In a survey conducted by Deloitte Consulting (2012) 48% of respondents have at some stage terminated an outsourcing contract, and in a third of these cases ended up insourcing the function. It is thus believed that the benefits of contractor mining are not a given, but are heavily dependent on choosing the right contractor, setting the appropriate incentives through contracting, and implementing the business solution correctly.

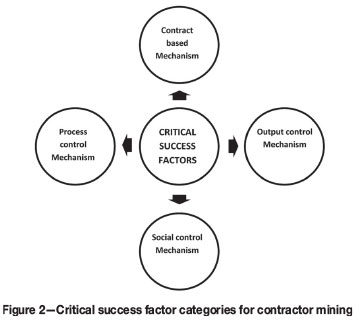

According to Kang et al. (2012), the appropriate control mechanisms should be in place in order to ensure the realization of outsourcing benefits. They group these into three categories, namely (i) process control mechanisms, (ii) output control mechanisms, and (iii) social control mechanisms. However, the foundation of a successful outsourcing arrangement starts with the development of a comprehensive and intelligent contract (Webb and Laborde, 2005). In this study, contract-based factors will be added as an amendment to the Kang et al. (2012) mechanisms (Figure 2).

Contract-based mechanisms

According to Kirk (2010), contracts between owners and mining contractors have become more detailed. This is a result of both parties acquiring additional experience, and in a number of occasions learning some expensive lessons in how to manage a win-win contractor mining relationship. CSFs under this category (Webb and Laborde, 2005) include:

► A fair and mutually beneficial contract

► Adequate incentive schemes, both gains and penalties -and how these will be shared between owner and service provider

► Flexibility in the contract to allow for changes to scope and conditions.

There is, however, still widespread disagreement on the best practice in structuring these contracts, with some owners still employing the traditional schedule-of-rates contract and others moving towards a more cost-plus-profit arrangement, and in some extreme cases even offering equity in the mining owner company. In addition to this, various incentive and penalty schemes have also been employed, with varying success.

Process control mechanisms

Process control mechanisms focus on the vendor's method, i.e. the process through which the service provider delivers (Kang et al., 2012). CSFs under this category include:

► Standard operating procedures

► Formalization of roles and responsibilities on all positions

► Training on the outsourcer's processes, procedures, methodologies, and policies

► Extensive reporting from service provider to owner on standards and performance

► Support (formalized within the employee performance contract) of internal functional employees - without which no outsourcing arrangement can thrive (Webb and Laborde, 2005). Not having this in place often leads to employees of the outsourcer feeling threatened.

Output control mechanisms

Output control mechanisms are focused on the goals and objectives of the outsourced process (Kang et al., 2012). CSFs under this category include:

► The establishment of goals and objectives. It is important to focus on measurable objectives to ensure clarity of expectations (Webb and Laborde, 2005)

► Recovery plans when outcomes are at risk

► Regular reviews of contractor performance - including a detailed reporting schedule - on all required levels

► A strong group of contract management specialists to manage deviations from the contract (Embleton and Wright, 1998).

Social control mechanisms

Social control is most prevalent in outsourcing arrangements driven by the need to innovate (Kang et al., 2012). CSFs under this category include:

► Shared values and beliefs, driven by a mutual respect and cultural fit between the contractor and owner. The service provider should fitinto the culture of the outsourcer (Webb and Laborde, 2005)

► Vendor relationship management is often stated to be the single most important factor to any outsourcing arrangement (Parsa and Lankford, 1999). The longevity and success of an outsourcing model is dependent on the success or failure of the client/vendor relationship (Webb and Laborde, 2005)

► Strong communication channels, both formal and informal. Clients appreciate when service providers communicate with them in a proactive manner, and vice versa (Webb and Laborde, 2005)

► Senior management support and continuous involvement.

Quelin and Duhamel (2003) state that frequently cited outsourcing benefits cannot be divorced from the efforts and investments required to continuously monitor and control the service, and as such all four control mechanisms discussed above will be considered as part of this research.

Research propositions and hypotheses

Mining tested as core competency

The first proposition evaluates mining as a core competency using the criteria of Quinn and Hilmer (1994). They use the following dimensions to evaluate whether a function is core:

(i) Skill or knowledge sets, not products or functions: Based more on intellectual property and knowledge than on physical assets

(ii) Flexible long-term platforms capable of adaptation or evolution: This competency evolves over time, and creates flexibility, rather than inhibiting it

(iii) Limited in number: Most successful organizations target only two or three core competencies. For mining companies it has been suggested that only two core competencies are required for success -financing and management (Hamel and Prahalad, 1996)

(iv) Unique sources of leverage in the value chain: Core competencies often fill gaps in the industry where severe knowledge deficiencies exist, for which the company has been specifically positioned through investment

(v) Areas where the company can dominate: Typically the areas where an organization can significantly outperform its peers. According to Stacey et al. (1999), core competencies can be identified by asking the following questions: What does the organization do better than anyone else? What does the organization do so well that it will be able to sell this as a service to other companies? Where does a company achieve best-in-class status?

(vi) Elements important to customers in the long run: Companies should ask themselves if their customers and shareholders care that they perform this function

(vii) Embedded in the organization's systems: Core competencies are not determined by a couple of particularly talented employees, but rather by systems and practices that are standard and that surpass the employment history of these talented employees.

H1: The tested reality will show mining operations as a non-core competency for the company under investigation

H2: There will be a difference in perception and tested reality - miners will believe that mining is a core competency.

Choosing between owner and contractor mining

The second research proposition relates to the development of a decision-making framework, using the outcomes of an order-winner/order-qualifier analysis. This framework shows under which conditions owner mining has the upper hand in the mining sourcing decision, and under which scenarios it will not. Generic decision frameworks can be misleading, as the reason behind an outsourcing decision will very much depend on what an organization is trying to achieve. The following hypotheses are made with regard to the mining sourcing decision:

H3: Operational cost-based factors will emerge as order qualifiers rather than order winners for a specific model (insourced or outsourced mining)

H4: Capital efficiency-basedfactors will be an order winner for contractor mining

H5: Flexibility-basedfactors will be an order winner for contractor mining

H6: Competence-basedfactors will emerge as order qualifiers rather than order winners for a specific model (insourced or outsourced mining)

H7: Relationship-basedfactors will be an order winner for owner mining.

Critical success factors for contractor mining

The third research proposition is to determine and prioritize the four CSFs in the event that outsourced mining is the chosen alternative. The top-priority CSFs should be evaluated against a mining company's internal capabilities to ensure that if contractor mining is chosen as the preferred scenario, the internal workings of the firm support the success of this strategy.

H8: Contract-based mechanisms will be high-priority critical success factors

H9: Social mechanisms will emerge as high-priority critical success factors

H10: Output mechanisms will be prioritized relative to process control mechanisms.

Research methodology

All research techniques have inherent inadequacies, and as such are best applied in conjunction with other techniques in order to counter these shortcomings, also known as triangulation. The methods chosen for this research includes findings from literature, the sample survey, and judgement task or nominal group (Barry et al., 2009) methods.

The objectives for the judgement task as part of this study were:

► Discuss and group the various factors (potential order winners and order qualifiers) that should be considered by a mine owner when choosing between owner and contractor mining

► Discuss and group the various CSFs that should be in place in order to ensure that contractor mining achieves its theoretical benefits.

The findings from the literature, as well as the outcomes of the judgement task conducted, were consolidated in a survey, structured as a combination of a questionnaire and a structured interview. The questionnaire consisted of four sections, namely one for the respondent's details and one on each of the three research propositions. This research instrument was then used in gathering data from 80% of the relevant heads of departments and general management of a mid-tier geographic commodity specialist mining company. The sample was stratified on three dimensions of the organization to ensure a complete data-set is gathered:

► Mining type-managers from both underground and open cast operations

► Departments-respondents from various departments, including mining, beneficiation, finance, and engineering

► Seniority-heads of departments (middle management) and general management.

Results

Respondents included managers from both underground (28%) and opencast (72%) operations. This is also representative of the ratio of the number of operations of this mid-tier mining group. A good balance between the different functional backgrounds was accomplished and the percentage feedback from the different departments consists of mining (22%), finance (22%), plant (17%), engineering (6%), and general management (33%). The ratio of senior management to heads of departments was 11:14. It is believed that the stratified sample adheres to the requirements of the research methodology and can thus be considered as a fair representation of the population of the whole mid-tier mining company. However, care should be taken not to assume the validity of these results for all mining companies. The results of the investigation are discussed along the lines of the three research propositions.

Mining tested as core competency

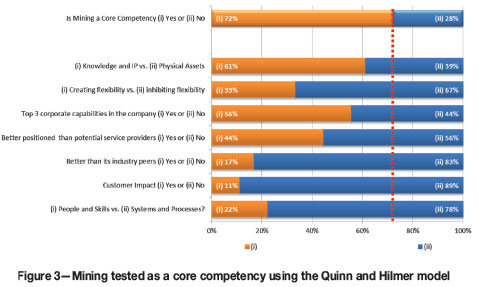

Figure 3 shows a consolidated summary of the findings of research proposition 1; testing mining as a core competency. The majority (72%) of respondents indicated that they believe that owner-operated mining is a core competency for the mid-tier geographic commodity specialist mining company. This number was then used as the cut-off point for the testing of this fact through the Quinn and Hilmer model.

It can be seen that on all seven dimensions of the Quinn and Hilmer model, the response frequency is biased towards owner-operated mining as a non-core competency (as measured against the 72% cut-off). The average of the responses on the 7 dimensions is 35% in favour of core competency, i.e. 65% in support of the fact that mining is a non-core competency - a clear conflict with the management teams' articulated perceptions.

By way of example, Quinn and Hilmer state that a company's core competency must be important to the customers in the long run; in other words, companies should ask themselves if their customers and shareholders care that they perform this function. Only 11% of respondents indicated that this is the case for owner-operated mining (see dimension titled 'Customer Impact (i) Yes or (ii) No' in Figure 3), and as such this question presents strong evidence that mining is a non-core competency.

H1 and H2 are discussed in the light of the research findings on proposition 1, summarized in Figure 3.

H1: The tested reality will show H1 is accepted mining operations as a non-core competency for a mid-tier mining company.

Not a single dimension from the Quinn and Hilmer model tested above the 72% cut-off level. In fact, five of the seven dimensions did not even receive a 50% response rate in favour of mining as a core competency. This supports what was found in the literature, in particular the work of Hamel and Prahalad (1996) that signifies that offen business functions (such as management, financing, and resource acquisition) rather than technical functions (such as mining, geology, surveying, etc.) are core competencies of mining corporates.

The literature showed that not all non-core competencies should be outsourced, but rather evaluated for outsourcing (Quinn and Hilmer, 1994; Leavy, 2004; Stacey, 1999). This, together with the fact that Hypothesis 1 is true, renders research proposition 2 relevant, i.e. mining is proved to be a non-core competency, and it should be evaluated as a candidate for outsourcing, necessitating the development of a make-or-buy decision framework.

H2: There will be a difference in H2 is accepted perception and tested reality -miners will believe that mining is a core competency.

There is a clear conflict between the respondents' articulated opinion of owner-operated mining as a core competency (72% of respondents) and the evidence tested against the Quinn and Hilmer model (35% over the seven dimensions). This is to be expected, as miners will believe that the owner's ability to operate a mining operation should be the core competency of a mining company. However, the prevalence of so many mining companies already employing a model of full or partial outsourced mining clearly proves that this is not always the case. The research conducted on proposition 1 in this study supports this fact conclusively.

Choosing between owner and contractor mining

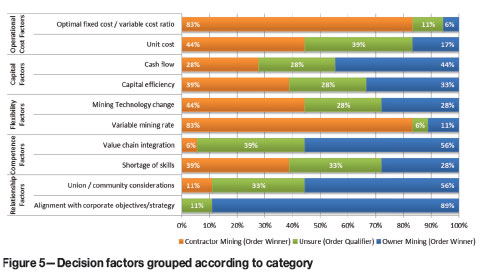

Figure 4 shows a consolidated summary of the finding of research proposition 2; choosing between owner and contractor mining. The data has been ranked from factors most strongly supporting contractor mining (order winners for contractor mining) to factors most strongly supporting owner mining (order winners for owner mining). The proportion of respondents that listed the factor in question as indecisive towards a particular model (titled 'It Depends' on the questionnaire) is also indicated under the category 'Unsure (Order Qualifier)'. Figure 5 shows the same data as in Figure 4, but grouped according to decision factor category (Figure 1), as developed by combining the work of Freytag et al. (2012) and Quelin and Duhamel (2003).

A decision-making framework was developed using the order winner / order qualifier structure. Table II summarizes the findings on research proposition 2 into a decision model. Care should be taken in the extrapolation of these findings to a different time and/or context, as order qualifiers and order winners are highly dependent on market context, and will change over time.

Hypotheses 3 to 7 are now discussed in the light of the research findings on proposition 2, as summarized in Figures 4 and 5 and Table II.

H3: Operational cost-based factors will emerge as order qualifiers rather than order winners for a specific model (insourced or outsourced mining).

H3 is rejected

Elements of the hypothesis were proved true, but there was not sufficient evidence from the data to determine if operational cost-based factors will in all instances be an order qualifier. With regard to the 'Unit Cost factor, the hypothesis is supported to be true, i.e. the response rates are not biased towards a particular mining sourcing model so as to indicate the factor as an order winner for that model. However, with regard to the 'Optimal Fixed/Variable Cost Ratio1, contractor mining was shown to have this factor as an order winner. The finding on 'Optimal Fixed/Variable Cost Ratio as an order winner for contractor mining can be explained as follows. For small to medium-sized mines the 'Optimal Fixed/Variable Cost Ratio leans towards more variable costs, as it is difficult to dilute fixed cost on a low-volume operation. Clearly, contractor mining has a higher proportion of variable cost, and this benefits small/medium sized operations in this regard. However, large to mega-sized mining operations can effectively dilute fixed cost, which will lead to higher profit margins. Under these circumstances, the 'Optimal Fixed/Variable Cost Ratio leans to having more fixed costs, with owner mining thus a better option.

All the respondents came from mines that can be classified as small/medium sized operations (producing 4 Mt or less per annum, with a LOM less than 5 years), which would be the reason why these respondents listed 'Optimal Fixed/Variable Cost Ratio as an order winner for contractor mining. Keeping this in mind, 'Unit Cost is included as an order qualifier in the decision-making model. 'Optimal Fixed/Variable Cost Ratio is included as an order winner for contractor mining, specifically in the context within which this study was conducted.

H4: Capital efficiency-based factors H4 is rejected will be an order winner for contractor mining.

The data shows a very balanced result, with a large proportion of respondents listing these factors as order qualifiers, and the rest split between order winners in favour of the two mining sourcing models. This finding can be substantiated as follows: contractor mining requires the mine owner to spend less capital, because the contractor will build the capital requirements into its rates, thereby effectively converting capital expenditure into operational expenditure. Over the life of the mining project, this will not necessarily have any impact on the net present value (NPV) of the project, unless there is a substantial difference in the costs structure of the contractor, compared to that of the mine owner.

Furthermore, the decrease in capital expenditure does not guarantee that an alternative investment exists with a better business case, which would lead to an increase in capital efficiency. When taking a portfolio view, spending capital on an owned fleet might be a better investment than spending it on a different project in the mine owner's portfolio.

It is therefore deduced that capital efficiency-based factors are order qualifiers in the mining insourcing versus outsourcing decision. This finding contradicts the work by Quelin and Duhamel (2003) and Kirk (2010), both of whom advocate the decrease in capital expenditure as a strong argument, i.e. order winner, for outsourcing.

H5: Flexibility-basedfactors will be H5 is rejected an order winner for contractor mining.

H5 could not conclusively be proved, i.e. there was not sufficient evidence from the data to determine if flexibility-based cost factors will in all instances be an order winner in favour of contractor mining. With regard to the 'Variable Mining Rate factor, the hypothesis is supported to be true, i.e. the results show that contractor mining acquired a high frequency of positive responses - enough to classify the factor as an order winner for that model. This was to be expected, and is supported by Kirk (2010), who listed variability in mining rate required as a key argument in favour of contractor mining. However, with regard to 'Mining Technology Change', contractor mining has a slight advantage over owner mining according to the research respondents, but not by a large enough margin to prove that model has a clear advantage in absolute terms.

Changing technology will in the future become progressively more important in the mining industry, which according to Holcomb and Hitt (2007) will increase the importance of this decision factor. Currently, however, technology in the mining industry is fairly standard, due to the industry being highly averse to change. Under these conditions, it is to be expected that such a factor will be an order qualifier (Hill, 2000), as was found in this study. It is concluded that 'Variable Mining Rate is an order winner for contractor mining, and that 'Mining Technology Change is an order qualifier.

H6: Competence-basedfactors will H6 is rejected emerge as order qualifiers rather than order winners for a specific model (insourced or outsourced mining).

H6 was proved partly true. The mining industry faces extreme difficulties with regard to attracting and retaining talent. Mine owners and contractors experience this difficulty more or less to the same degree; they compete in the same labour market and offer similar employee value propositions. It is thus no surprise that the respondents were divided in their opinion on the 'Shortage of Skills' factor, with 33% listing this factor as an outright order qualifier. This finding is in contradiction with the work by Kirk (2010), who advocates contractor mining as a mitigation action that mine owners can take to overcome the industry-wide shortage of skills. It is believed that the reason for this lies in the difference in context within which the work was done -Kirk's study was conducted on the contractor mining industry in Australia, which has a much more mature professional services sector than South Africa.

Owner mining did, however, emerge as having an advantage in terms of 'Value Chain Integration'. The respondents believed that the integration of a mining contractor into the larger resources extraction value chain will not happen as smoothly as in the case of owner mining. Reasons cited for this include differences in incentives between mine owner and contractor, as well as sub-optimal communication channels. These will again be discussed as CSFs (under research proposition 3). It is concluded that ' Value Chain Integration' is an order winner for owner mining, and that 'Shortage of Skills' is an order qualifier.

H7: Relationship-basedfactors will beH7 is accepted an order winner for owner mining.

A large majority of respondents believe that an owner-operated mining operation is better equipped to manage its relationship with the community in which it operates, as well as its relationship with the corporate to which it reports. From this finding, as well as the focus group that was conducted as verification for the research instrument, it is concluded that the importance of the relationship-based factors cannot be overstated, especially in the South African context. It is, however, a topic that is often overlooked, as was done by Quelin and Duhamel (2003), who focused mostly on operational cost- and capital efficiency-based factors. It is concluded that 'Union/ Community Considerations', as well as 'Alignment with Corporate Objectives/Strategy' are order winners for owner mining.

Critical success factors for contractor mining

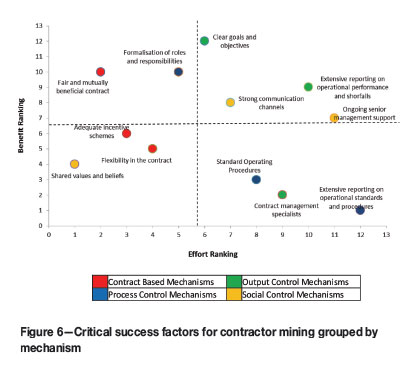

Figure 6 shows the consolidated findings on research proposition 3 - CSFs for contractor mining. The different mechanisms behind the CSFs (see Figure 2) are indicated using a colour scheme.

Figure 6 has been divided into four different regions:

► Priority 1-CSFs with high benefits requiring little effort to implement. These should be the focus of a management team entering a contractor mining arrangement

► Priority 2 (two regions)-CSFs with high benefits but requiring a high-level effort to implement, as well as CSFs with low benefits but requiring a low-level effort to implement. These should be a secondary focus of a management team entering a contractor mining arrangement

► Priority 3- CSFs with low benefits requiring a high level of effort to implement. These can be deprioritized for implementation purposes.

It was found that the most important tools at the disposal of a mine owner's team to manage a contractor miner are the social and output control mechanisms. Firstly, a mine owner must understand the objectives and strategic intent behind outsourcing the mining operation. If the objectives of such an operational strategy are not understood, it is likely that they will not be achieved. It is believed that this is currently not the case in the mid-tier geographic commodity specialist mining company, as indicated by the conflict found regarding research proposition 1. Secondly, communication between owner and contractor, as well as ongoing senior management involvement, should be a priority. The mine owner should focus on the output of the contractor, and leave the process by which that output is produced to the contractor to manage.

H8: Contract-based mechanisms will H8 is rejected be high-priority critical success factors.

It was found that two contract-based mechanisms plotted in the 'Priority 3 category, and the remaining one in 'Priority 2' This is an extremely interesting and counter-intuitive finding. From follow-up discussions with some of the respondents, the following justification is put forward in support of this finding: The respondents believe that contracts with contractor miners have become standardized to such an extent that it has become very difficult to negotiate any contract that falls outside this standard. For this reason, the level of effort required is deemed to be so high relative to the other CSFs that this mechanism is deprioritized. This does not mean that the contract between mine owner and mining contractor is not important, in fact the 'Fair and Mutually Beneficial Contract critical success factor ranked second on the benefits ranking scale. It does, however, show that the industry has cemented the legal aspects of an outsourced arrangement to such an extent that it has become unfeasible to negotiate customized incentives, penalties, and flexibility into contracts.

H9: Social mechanisms will emerge H9 is accepted as high-priority critical success factors.

Two of the CSFs under this mechanism plotted under 'Priority 1'. One can understand that mining contractors perform better under a spirit of partnership between contractor and client. Communication between owner and contractor on all levels (including senior management) is paramount to a successful relationship. The one CSF that stands out here is 'Shared Values and Beliefs', which is plotted as 'Priority 3'. From follow-up discussions with research respondents, the following justification is presented for this anomaly.

The 'Shared Values and Beliefs' CSF is believed to be the single most difficult CSF to put in context, both because a cultural match is difficult to assess during the tender process, and because values and beliefs are virtually impossible to manipulate once the contractor has been chosen. This CSF is therefore deprioritized; not because it is not important, but rather because it is extremely difficult to influence.

H10:- Output mechanisms will be H10 is accepted prioritized relative to process control mechanisms.

Output-based mechanisms had two CSFs under 'Priority 1 and the third under 'Priority 2', while the CSFs pertaining to process control mechanisms are all plotted under 'Priority 2'. One of the benefits most frequently cited for outsourcing (Harland et al., 2005; Kedia and Lahiri, 2007) is that it enables organizations to focus on core competencies, i.e. to sharpen their strategic focus. Mine owners therefore does not wish to micro-manage the contractor, i.e. control how they conduct their business, as long as they deliver results to the level that was agreed.

It was expected that 'Clear Goals and Objectives' would feature high on the priority list. That is exactly what happened, with almost 80% of respondents listing this CSF under their top four with regard to potential benefits. This echoes with findings from the literature, with Embleton and Wright (1998), Gottschalk and Solli-Saether (2005), and McIvor (2000) all emphazing that the outsourcing arrangement is likely to fail if the party outsourcing the function does not understand what it aims to achieve through such an action.

Conclusions and recommendations

A decision-making framework was developed to facilitate the decision between owner and contractor mining. This contributes in a number of ways.

Firstly, most of the literature deals with outsourcing in the manufacturing, services, or retail environment - this study provides some theory and application relevant to the mining industry.

Secondly, most of the literature lists factors to be considered in the decision-making process without detailing how these factors should be assessed or prioritized. By applying the order winner/order qualifier framework, a model is developed that can be used to structure the make-or-buy decision specifically for mining.

Finally, although numerous studies list critical success factor (CSFs) for outsourcing, none could be found that prioritize these to assist management in the development of a focused implementation roadmap. The CSFs for the outsourced mining application were prioritized using a benefit/effort matrix that highlighted the critical elements that a mine owner management team should focus on to mitigate the risks of outsourcing a mining operation, thereby increasing the probability of success.

It is recommended that the decision-making model developed under research proposition 2 (the mining sourcing decision) be used to facilitate the make-or-buy decision process for mining operations. It is believed that this will result in a more structured approach and a holistic view compared to making the decision on a cost analysis only. This will result in a higher probability of making the correct decision, especially on greenfield mining projects.

The opportunity exists to expand the study to a wider population. This could include other mining companies, commodities, geographical contexts, and scales of operation. Also, since this study focused on the mining operation only. and excluded other core and peripheral activities in the commodity value chain such as beneficiation and logistics, the opportunity exists to conduct a similar study to develop make-or-buy decision models for these activities.

Acknowledgement

The authors would like to thank the Graduate School of Technology Management, University of Pretoria, for the opportunity to publish the results.

References

Anwar, S., Sun, S., and Valadkhani, A. 2013. International outsourcing of skill intensive tasks and wage inequality. Economic Modelling, vol. 31. pp. 590-597. [ Links ]

Barry, M.L., Steyn, H., and Brent, A. 2009. The use of the focus group technique in management research: the example of renewable energy technology selection in Africa. Journal of Contemporary Management, vol. 6. pp. 229-240. [ Links ]

Bryce, D. and Useem, M. 1998. The impact of corporate outsourcing on company value. European Management Journal, vol. 16. pp. 635-643. [ Links ]

Corbet, M.F. 2004. Outsourcing Revolution: Why it makes Sense and How to do it Right. Dearborn Trade Publishing, Chicago. [ Links ]

Deloitte Consulting. 2012. Global Outsourcing and Insourcing Survey Executive Summary, 2012. http://www.deloitte.com/assets/Dcom-UnitedStates/Local%20Assets/Documents/IMOs/Shared% 20Services/us_sdt_2012GlobalOutsourcingandInsourcing SurveyExecutiveSummary_050112.pdf [Accessed 20 March 2013]. [ Links ]

Dunn, S. 1998. Evaluating the use of contractors as a cost-cutting measure. PriceWaterhouseCoopers, Shine Meeting. [ Links ]

Eichler, A. 2012. April 20. Manufacturing companies considering moving jobs back to the U.S. from China, survey finds. Huffington Post. www.huffing-tonpost.com/2012/04/20/manufacturing-companies-move-us-china_n_1441587.html [Accessed 5 June 2013]. [ Links ]

Embleton, P.R. and Wright, P.C. 1998. A practical guide to successful outsourcing. Empowerment in Organisations, vol. 6, no. 3. pp. 94-106. [ Links ]

Fill, C. and Visser, E. 2000. The outsourcing dilemma: a composite approach to make or buy decision. Management Decision, vol. 38, no. 1. pp. 43-50. [ Links ]

Freytag, P.V., Clarke, A.H. and Evald, M.R. 2012. Reconsidering outsourcing solutions. European Management Journal, vol. 30. pp. 99-110. [ Links ]

Gottschalk, P. and Solli-Saether, H. 2005. Critical success factors from IT outsourcing theories: an empirical study. Industrial Management and Data Systems, vol. 105, no. 6. pp. 685-702. [ Links ]

Hamel, G. and Prahalad, C.K. 1996. Competing for the Future. Harvard Business Review Press, Boston, MA. [ Links ]

Harland, C., Knight, L., Lamming, R., and Walker, H. 2005. Outsourcing: assessing the risks and benefits for organisations, sectors and nations. International Journal of Operations and Production Management, vol. 25, no. 9. pp. 831-850. [ Links ]

Hätönen, J. and Ericksson, T. 2009. 30+ years of research and practice on outsourcing - exploring the past and anticipating the future. Journal of International Management, vol. 15. pp. 142-155. [ Links ]

Holcomb, T.R. and Hitt, M.A. 2007. Toward a model of strategic outsourcing. Journal of Operations Management, vol. 25. pp. 464-481. [ Links ]

Jiang, B. and Qureshi, A. 2005. Research on outsourcing results: current literature and future opportunities. Management Decision, vol. 44, no.1. pp. 44-55. [ Links ]

Kang, M., Wu, X., Hong, P., and Park, Y. 2012. Aligning organizational control practices with competitive outsourcing performance. Journal of Business Research, vol. 65, no. 8, pp. 1195-1201. [ Links ]

Kazmer, D.O. 2014. Manufacturing outsourcing, onshoring, and global equilibrium. Business Horizons (in press). [ Links ]

Kedia, B.L. and Lahiri, S. 2007. International outsourcing of services: a partnership model. Journal of International Management, vol. 13. pp. 22-37. [ Links ]

Kirk, L.J. 2010. Owner versus contract mining. Mine Planning and Equipment Selection, vol. 1. pp. 437-442. [ Links ]

Kshetri, N. 2007. Institutional factors affecting offshore business process and information technology outsourcing. Journal of International Management, vol. 13, no. 1. pp. 38-56. [ Links ]

Loasby, B.J. 1998. The organisation of capabilities. Journal of Economic Behaviour and Organisations, vol. 35, no. 2. pp. 139-160. [ Links ]

Mcivor, R. 2000. A practical framework for understanding the outsourcing process. Supply Chain Management, vol. 5, no. 1. pp. 22-36. [ Links ]

Mol, M.J., Pauwels, P., Matthyssens, P., and Quintens, L. 2004. A technological contingency perspective on the depth and scope of international outsourcing. Journal of International Management, vol. 10, no. 2. pp. 287-305. [ Links ]

Morgan, J. 1999. Purchasing at 100: where it's been, where it's headed? Purchasing, vol. 127, no. 8. pp. 72-94. [ Links ]

Parkhe, A. 2007. International outsourcing of services: Introduction to the special issue. Journal of International Management, vol. 13. pp. 3-6. [ Links ]

Parsa, F. and Lankford, M.W. 1999. Outsourcing: a primer. Management Decision, vol. 37, no. 4. pp. 310-316. [ Links ]

Pearce, J.A. 2014. Why domestic outsourcing is leading America's re-emergence in global manufacturing. Business Horizons, vol. 57. pp. 27-36. [ Links ]

Porter, M.E. 1996. What is strategy? Harvard Business Review, vol. 74, no. 6. pp. 61-79. [ Links ]

Quelin, B. and Duhamel, F. 2003. Bringing together strategic outsourcing and corporate strategy: outsourcing motives and risks. European Management Journal, vol. 21, no. 5. pp. 647-661. [ Links ]

Quinn, J.B. and Hilmer, F.G. 1994. Strategic outsourcing. Sloan Management Review, vol. 35, no. 4. pp. 43-55. [ Links ]

South African Chamber of Mines. 2012. Putting South Africa First: Mining's contribution to South Africa.: http://chamberofmines.org.za/media-room/mining-publications [Accessed 12 September 2014]. [ Links ]

Stacey, T.R., Steffen, O.K.H, and Barrett, A.J. 1999. Outsourcing of professional services. Journal of the South African Institute of Mining and Metallurgy, vol. 99, no. 4. pp. 181-184. [ Links ]

Hill, T. 2000. Manufacturing Strategy: Text and Cases. 3rd edn. Irwin/McGraw-Hill, Burr Ridge, IL. [ Links ]

Webb, L. and Laborde, J. 2005. Crafting a successful outsourcing vendor/ client relationship. Business Process Management, vol. 11, no. 5. pp. 437-443. [ Links ]