Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.114 n.1 Johannesburg Jan. 2014

SAMPLING AND ANALYSIS PAPERS

Metal accounting and corporate governance

P.G. GaylardI; N.G. RandolphII; C.M.G. WortleyIII

IMetallurgical Consultant

IIConsultant, NSR Investments CC

IIIMetallurgical Consultant

SYNOPSIS

In the wake of the financial crisis that affected world markets in 2002, there has been an increasing international focus on corporate governance. Various corporate governance codes of practice have been introduced, such as the Sarbanes-Oxley legislation in the USA, the Combined Code in the UK, and King III in South Africa. This focus on corporate governance has increased since the most recent financial crisis in 2008, the effects of which are still being felt world-wide.

In the mining and minerals industry, reliable metal accounting is essential to sound corporate governance and is also becoming a focus of increased attention and concern, particularly as the figures generated by the metal accounting system feed directly into the financial accounts of mining companies. Mass measurement, sampling, and analysis provide the input data for the metal accounting system and sound corporate governance requires that the procedures used are based on best practice and that the data generated is accurate and handled correctly, transparently, and consistently to produce the accounting reports. The AMIRA Code of Practice for Metal Accounting has been widely adopted in the industry as a means to achieve this, and the compilers of the Code have conducted numerous metal accounting audits at operations, both in South Africa and abroad. These audits have shown that there is a real need for such a code of practice.

Keywords: metal accounting, AMIRA Code, corporate governance, risk management.

Introduction

Since the financial crisis in 2002 there has been increased focus on corporate governance. This has been reinforced by legislation such as the Sarbanes-Oxley Act in the USA, the Combined Code in the UK, and King III in South Africa.

Because accurate and precise metal accounting is a vital source of data for the financial accounts of a mining/metallurgical company, the need for a code on metal accounting was recognized in 2001 and a team was formed in 2003, under the sponsorship of several major mining houses, to produce such a code (the AMIRA Code of Practice for Metal Accounting). This code has subsequently been widely adopted in the industry and has been used as the basis of audits of numerous metallurgical plants both in South Africa and abroad.

Apart from the requirement for corporate governance, a further driving force for reliable metal accounting is the growth of toll treatment and joint ventures in the industry. Suddenly, the transfer of material from the mine to the concentrator, to the smelter, to the refinery is no longer necessarily along the value chain of a single company. This moves a company from a situation where money is being transferred from the left hand to the right hand pocket, which already results in heated arguments between the miner and the metallurgist but does not particularly affect the financial position of the overall company, to a situation where real money is being paid for an input to a plant and received for its output. Added to this is the fact that in most toll treatment transactions, the commercial agreement is based on the expected recovery of the metal(s) of interest, which requires the treatment company to have an accurate knowledge of this recovery. There are too many examples of a relatively new toll treatment company having an optimistic expectation of their recoveries based on previous poor metal accounting practices, and consequently the agreed recovery is not actually achievable. This results in a direct financial loss to the company. Best practice in metal accounting is, therefore, an even greater requirement for toll treatment companies and those in joint ventures.

Metal accounting

The AMIRA Code of Practice and Guidelines for Metal Accounting ('the Code') has been discussed in a previous paper (Gaylard et al., 2009) and will not be covered in detail here.

However, in the Code, metal accounting is defined as: 'The system whereby selected process data (pertaining to metals of economic interest) is collected from various sources including mass measurement and analysis and transformed into a coherent report format that is delivered in a timely fashion in order to meet specified reporting requirements.'

In line with this definition, the Code sets out a series of principles of metal accounting which are worth repeating here for ease of reference, as they encapsulate the entire discipline of metal accounting and were compiled in consultation with metal accounting practitioners in the industry and with members of the international accounting profession.

1. The metal accounting system must be based on accurate measurements of mass and metal content. It must be based on a full check in-check out system using the best practices as defined in the Code, to produce an ongoing metal/commodity balance for the operation. The system must be integrated with management information systems, providing a oneway transfer of information to these systems as required

2. The system must be consistent and transparent and the source of all input data to the system must be clear and understood by all users of the system. The design and specification of the system must incorporate the outcomes of a risk assessment of all aspects of the metal accounting process

3. The accounting procedures must be well documented and user friendly for easy application by plant personnel, to avoid the system becoming dependent on one person, and must incorporate clear controls and audit trails. Calculation procedures must be in line with the requirements set out in the Code and consistent at all times with clear rules for handling the data

4. The system must be subject to regular internal and external audits and reviews as specified in the relevant sections of the Code to ensure compliance with all aspects of the defined procedures. These reviews must include assessments of the associated risks and recommendations for their mitigation, when the agreed risk is exceeded

5. Accounting results must be made available timeously, to meet operational reporting needs, including the provision of information for other management information systems, and to facilitate corrective action or investigation. A detailed report must be issued on each investigation, together with management's response to rectify the problem. When completed, the plan and resulting action must be signed off by the Competent Person

6. Where provisional data has to be used to meet reporting deadlines, such as at month ends when analytical turn-around times could prevent the prompt issuing of the monthly report, clear procedures and levels of authorization for the subsequent replacement of the provisional data with actual data must be defined. Where rogue data is detected, such as incorrect data transfer or identified malfunction of equipment, the procedures to be followed, together with the levels of authorization must be in place.

7. The system must generate sufficient data to allow for data verification, the handling of metal/commodity transfers, the reconciliation of metal/commodity balances, and the measurement of accuracies and error detection, which should not show any consistent bias. Measurement and computational procedures must be free of a defined critical level of bias

8. Target accuracies for the mass measurements and the sampling and analyses must be identified for each input and output stream used for accounting purposes. The actual accuracies for metal recoveries, based on the actual accuracies, as determined by statistical analysis, of the raw data, achieved over a company's reporting period must be stated in the report to the Company's audit committee. Should these show a bias that the company considers material to its results, the fact must be reported to shareholders

9. In-process inventory figures must be verified by physical stocktakes at prescribed intervals, at least annually, and procedures and authority levels for stock adjustments and the treatment of unaccounted losses or gains must be clearly defined

10. The metal accounting system must ensure that every effort is made to identify any bias that may occur, as rapidly as possible, and eliminate or reduce to an acceptable level the source of bias from all measurement, sampling and analytical procedures, when the source is identified.

In the textbook on metal accounting that was produced as one of the deliverables of the AMIRA P754 Project 'Improving Metal Accounting' (Morrison, 2008), metal accounting, together with reconciliation, is further defined as 'the estimation of (saleable) metal produced by the mine and carried in subsequent streams over a period of time. The comparison of estimates from different sources over a defined period is called reconciliation. Over the life of a mine, metal accounting and reconciliation constitute an audit of the mineral resource'.

The accounting process is also described (Morrison 2008) as combining a broad range of technical areas, including sampling and assaying; mass and volume measurements, including stockpiles and precise flow measurements; mathematical and statistical analysis; geological modelling, for reconciliation to the mine; effluent characterization for environmental monitoring and control purposes; and a detailed knowledge of pyro- and solution-chemistry, where smelters and refineries are involved.

The primary objective of the AMIRA P754 Project was to improve the auditability and transparency of metal accounting from mine to product and, by so doing, to assist in good corporate governance. The project was initiated shortly after some of the world's greatest financial scandals were exposed and there was increased awareness of the need for better reporting standards in all spheres of business. In line with this, the International Council on Metals and Minerals (ICMM) developed a statement of ten principles of good practice, three of which can be related directly to metal accounting:

1. Implement and maintain ethical business practices and sound systems of corporate governance

2. Implement risk management strategies based on valid data and sound science

3. Implement effective and transparent engagement, communication and independently verified reporting arrangements with our stakeholders.

At the time, a number of common problems with metal accounting were noted:

►There was no standard procedure for metal accounting

►The function was often seen as ancillary to satisfactory operation and was, as a result, handled by junior, inexperienced technical staff or by clerical staff with no technical background

►There was a lack of awareness and attention to the precision of mass measurement, sampling, and analysis

►Calculation of metal recoveries was often inconsistent and open to distortion

►Measurement and reporting of metal lock-up figures was inconsistent and established methods were often changed to suit current reporting requirements

►There was perceived to be a potential for the manipulation of accounting figures

►Senior management and the boards of companies were inadequately informed about the accuracy and reliability of the metal accounting figures reported to them and, by them, to the shareholders of their respective companies.

The primary aim of the Code, therefore, was to provide a set of standard generic procedures and guidelines for all aspects of metal accounting, from measurement and sampling to data handling and reconciliation and reporting of results. The second aim of the Code was to facilitate risk management by enabling an operation to quantify, manage, and minimize the level of risk to which it could become exposed through failures and shortcomings in its metal accounting system.

From these objectives, and from the basic principles listed above, it is obvious that metal accounting must be a component of a company's risk management programme and, as such, plays a major role in sound corporate governance.

Corporate governance

Wikipedia has the following definition:

'Corporate governance involves regulatory and market mechanisms, and the roles and relationships between a company's management, its board, its shareholders and other stakeholders, and the goals for which the corporation is governed. Lately, corporate governance has been comprehensively defined as 'a system of law and sound approaches by which corporations are directed and controlled focusing on the internal and external corporate structures with the intention of monitoring the actions of management and directors and thereby mitigating agency risks which may stem from the misdeeds of corporate officers.'

As mentioned above, the financial world was rocked by a series of major financial scandals in the late 1990s and the first few years of the 21st century, including cases involving the mining industry. These scandals, and the financial crises that followed them, prompted many governments to compile codes of sound corporate practice to protect shareholders and the general public from exposure to severe financial risk caused by fraud and malfeasance on the part of company management and directors. These codes were given legal backing, compelling companies to comply, and leading to the above definition. In the USA in particular, the code was enshrined in the Sarbanes-Oxley Act, which requires that all companies quoted on American stock markets will comply with the law or face prosecution.

The South African Institute of Directors has described the Sarbanes-Oxley legislation as a 'one size fits all' act, demanding mandatory legal compliance, and which is not a logical approach because of the differing size of businesses and the different conditions under which they operate. The cost of compliance with the law is high and, in 2008 after six years in which the Act had been in operation, the cost of compliance with one section alone (404 - verification of internal controls) was estimated to have been approximately US$264 billion, and the total cost of compliance to have far exceeded the entire costs involved in the write-off of the assets of the three companies involved in the major scandals that prompted the promulgation of the Act. Perhaps the most significant and unquantified cost associated with the Act can be attributed to the fact that boards of directors become focused on compliance rather than on the strategic direction of their business.

In the UK, corporate governance practices became defined in the Combined Code, which itself was developed from the Cadbury Report by Sir Adrian Cadbury. The Combined Code informed the development of the King III Report, which was published as a successor to the King I and II reports and was prepared in anticipation of the promulgation of the new Companies Act in 2010. The King III Report focuses on the way in which companies have positively or negatively affected the economic life of the communities in which they operate, and how they work to enhance the positive aspects of their operations and improve the negative aspects. It provides companies with a recommended course of conduct but allows for the selection of alternative practices, which have to be explained and justified in order to ensure compliance. The principles of good governance imply that directors and management act in the best interests of the company at all times and any failure to meet a recognized standard of governance, even if not legislated, may render a board or individual directors liable at law.

The King III report sets out a series of guiding principles relating to the duties and responsibilities of the board of directors: corporate citizenship (leadership, integrity, and responsibility), risk management, internal audit, sustain-ability reporting and responsibility, compliance with laws and regulations, managing stakeholder relationships, and fundamental and affected transactions including conflict of interest and disclosure of interests. Specific principles which impact on metal accounting are:

1.2 The Company must act as and be seen to be a responsible citizen

1.3 The Board must cultivate an ethical corporate culture

1.4 Strategy, risk, performance and sustainability are inseparable

1.5 The Board is responsible for risk management

1.11 The integrity of financial reporting

1.12 The effectiveness of internal financial controls

1.13 Full and timely disclosure of material matters concerning the company

1.15 Establishing an effective compliance framework and processes

3.4 The Audit Committee is responsible for the integrity of stakeholder reporting of interim and final financial results

4.3 Risk management must be practised by all staff as part of their daily activities

4.8 There must be on-going risk assessments to ensure the protection of the company's reputational risk

5.1 The internal audit must be effective and risk-based

5.2 The internal audit must provide a written assessment on internal controls, performance and risk management.

Many of these principles are covered in the AMIRA Code of Practice, including risk management, reporting, controls, internal and external audits, protection of the company's reputational risk, and full and timely disclosure of material matters. It follows, therefore, that a company operating in the mining and minerals industry cannot have sound corporate governance if there are shortcomings in its metal accounting system. The authors of this paper were involved in the compilation of the AMIRA Code and have since conducted metal accounting audits at a variety of mining and mineral operations in southern Africa and further afield. The following section provides a number of examples of metal accounting practices or failures that were observed during these audits and which could negatively affect corporate governance in the companies concerned and could constitute a reputational and compliance risk.

Corporate governance: practical examples from industrial audits

Until now, due to codes such as JORC and SAMREC, the focus has been on the accurate estimate of reserves and resources, but it is predicted that there will be a growing emphasis on how efficiently and effectively that resource is treated through a metallurgical process. In toll treatment the resource is the purchased input material. This will require the unbiased (with an acceptable precision) metal accounting of all of the metals of commercial value, which means that the three legs of the metal accounting tripod - namely mass measurement, sampling/sample preparation, and analysis -must all be unbiased, with known and acceptable precisions.

Sampling

It has been stated that a correctly designed, installed, and maintained mechanical sampler will, over the longer term, provide unbiased samples. Unfortunately, there are very few examples where this harmony is achieved, and even fewer where the precision of the sampling system has been measured and known to be fit for purpose.

A regular example is the spear sampling of purchased, or produced, flotation concentrate. During transfer of concentrate by truck, segregation of moisture will occur. Depending on the moisture level and distance travelled, this will either result in the presence of free water, or the moisture will move to the bottom of the concentrate bed. A spear sampler, which can only sample the surface of the concentrate, will always give a biased sample with respect to moisture and probably other analytes as well. Consequently the calculation of dry tons will be biased and the purchasers of toll concentrates will have immediately placed themselves at risk on receipt of the concentrate.

The most common examples of poorly designed mechanical samplers are the use of parallel blades on radial samplers, cutter gaps of less than 10 mm, and cutter speeds far in excess of 0.6 m.s-1.

Because of their high density, minerals of economic interest, such as base metal sulphides and those containing gold and the platinum group metals (PGMs), readily separate from the gangue material. For example, in a process pulp stream on a launder ahead of a cross stream sampler, these minerals settle to the bottom of the launder. It is important, therefore, that the cutter head is installed so as to collect the drips from the bottom lip of the launder; otherwise the sample will be biased low in relation to these minerals.

Pulp feed into a Vezin sampler is usually via an inlet pipe from which the pulp stream flares out. The cutter head must, therefore, be positioned as close as possible to the pipe in order to sample the whole stream.

A major reason for biased samples is the complete lack of maintenance of sampling installations. This has resulted in numerous examples of partially or wholly blocked sample cutter heads. There are also instances where the cutter head has broken off or has been badly damaged. The miracle in these situations is that the sample bucket still contains that shift's sample.

Contributing to dirty and blocked sample cutters is the lack of a convenient water supply; if this is not available the samplers will not be cleaned.

Of course the most important requirement is the regular inspection, at least once per shift, of all sampling systems to ensure that they are operating satisfactorily and are clean.

Sample management

Sample containers must be designed to retain the whole sample, including moisture when this is an important parameter. Samples of materials such as concentrate filter cake have been stored in open containers for 8 hours at temperatures up to 40°C when the moisture value is required for the dry tons calculation. On receipt at the laboratory, all of the moisture in the sample containers must be removed with an adsorbent paper and added to the drying tray. High-sulphide materials must be dried at temperatures not exceeding 105°C, because above this temperature there is an increasing possibility that chemical changes will occur in the sample, resulting in a biased moisture analysis. Drying at 200°C to shorten the drying time is certainly not best practice.

Consideration must be given to the size of the sample and the distance it must be carried to the sample preparation facility. This is best illustrated by stop-belt sampling of run-of-mine (ROM) samples, which can require samples of several hundred kilograms, and pulp samples, which are often collected in 20 l buckets and are 75% full at the end of a shift. These samples will not reach the sample preparation facility intact if the distance is too far.

Sometimes pulp samples are pressure filtered on the plant, as recommended, so that only a filter cake has to be taken to the sample preparation facility. However, occasionally newspaper or brown wrapping paper is used as the filter medium rather than the correct filter paper. This will bias the sample due to the loss of fines and the attempted 'cost saving' is completely lost in the waste of the cost of the subsequent analysis.

Separate sample preparation areas are required for samples of different grade materials because of the danger of cross-contamination. After all, very little contamination is required of a tailings sample at 0.5 g.t-1 by a PGM concentrate at 50% for the tails to be significantly biased.

Dust loss will bias the sample, because the dust will invariably be a different grade to the bulk of the sample. An example of this is PGM-bearing converter matte, where the fines were completely devoid of PGMs and their loss, therefore, biased the remaining sample high. The use of enclosed milling systems, such Sieb and LM2 mills, rather than vertical spindle pulverizers, is to be encouraged.

Paper or rubber sheet rolling should be discouraged because of the danger of dust loss during these operations and the possibility of unmixing the denser mineral particles. In fact, if the sample division is done using spinning rifflers then the mixing of samples is unnecessary.

Analytical protocols detailing, for example, custody transfers, sample quantities, analyses required, analytical methods (with their expected accuracies and precisions), and turnaround and storage times should be in place between the customer and the laboratory for all samples received by the laboratory.

Analysis

The laboratory is generally the only department in a mine/metallurgical operation that routinely measures its accuracy and precision by the use of certified reference materials (CRMs), QC samples, and replicate analyses respectively. It is then regularly chastised because the values achieved are not 'good enough', without any thought being given to the mass measurement and sampling/sample management stages of the metallurgical accounting chain. Consequently, effort and cost is wasted improving the analysis when this is already the best measurement, which will have little effect on the overall variance of metallurgical accounting.

Two areas where laboratories can improve their operations are:

► Use of CUSUM graphs-Most laboratories use some form of statistical analysis of their results, including the use of Shewhart control graphs, but the use of CUSUM graphs is much more sporadic. CUSUM graphs are an excellent tool for detecting bias in an analytical procedure and are recommended for routine use in laboratories

► Calibration of analytical Instruments-Often driven by the claims of instrument manufacturers, laboratories have slipped into the bad habit of using too few standards in the calibration of their analytical instruments. Calibrations frequently use only two or three standards, when the recommended minimum is seven, and the calibration is further degraded by having the top standard at least a factor of two above the next closest standard.

Mass measurement

Accurate and unbiased mass measurement is as important as correct sampling, sample preparation, and analysis in order to measure the mass of the material being toll treated. Unfortunately, this is often neglected or poorly conducted, especially in determining the dry mass, and bias errors are present. Incorrect determination of the mass will not only cause over- or underpayment of the amount of metal received, but can also give rise to erroneous recovery calculations.

The treatment terms and metal recoveries of the various materials of value are specified in commercial contracts. It is quite common for the purchaser's weights and analyses to be accepted. However, it is vitally important for the mass to be measured accurately at both supplier and purchaser.

Moisture and bulk density measurement

It is rare in the industry that the determinations of moisture levels and bulk densities of the material being treated are representative of the mass being weighed. This is especially true in the case of ores, concentrates, and granulated mattes. In the case of ore, measurement is difficult and values are usually assumed, and in the case of the others the sampling is poorly performed and moisture changes occur. The position is even worse in the case of the values used for stocks and stockpiles to determine the mass. Bulk densities can easily vary by 20% for the same material depending on the particle size and distribution, method of dumping, degree of consolidation etc.

Mass measurement of ore

There are some operations in which ore owned by one company is treated by another. In these cases, the only practical solution to measuring the mass of ore treated is in-motion rail weighing or conveyor belt weighers. This equipment is capable of reasonable accuracies providing best practices for selection, installation, and calibration as detailed in the AMIRA Code and the textbook (Morrison 2008) are followed and the equipment is kept well maintained and clean, which is often not the case. An example has been observed where a brick had been placed on the weighbridge in order to boost the tonnage and produce a biased reading, and cases of poor installation and housekeeping are common.

As this involves a custody transfer, this equipment should be certified and material tests conducted to calibrate the equipment. In some cases different ores are treated that often have different properties and moisture contents and may pass over the same mass measurement equipment in batches. For toll treatment of ore, facilities such as calibration bins and/or diversion chutes should be installed to conduct bulk tests regularly, and moisture samples should be taken of the different ores to avoid a biased allocation of dry tons to the treated ore. On many audits conducted by the authors, historic constant moisture values are assumed and yet a large variation can be seen on observation. The assumed figure can easily be incorrect by 1-2%, causing the dry tonnage to be over- or underestimated by the same amount. Taking a moisture sample requires either use of a suitable automatic sampler or regular belt cuts adjacent to the belt weigher. The latter method has the advantage of also providing a crosscheck on the tonnage read by the weigher.

Mass measurement of concentrate

Toll treatment of concentrate is common in both the platinum and base metal industries. The material can be transported in tankers in a slurry form, as moist filter cake, or as a relatively dry powder. It may also be transported considerable distances by road, rail, and in bulk by ship. Material is usually weighed several times during the transfer (on leaving the seller, at the port on loading, on offloading at the receiving port, and at the receiver's plant). Most of this weighing will be on weighbridges, which should be capable of good accuracy and precision. In the case of transport by ship, a draft survey is usually conducted and sometimes this is used as the commercial mass for the transaction. Irrespective of the contract terms, weighing should be conducted by both seller and purchaser and the variance between the two monitored. CUSUMS is a useful tool to carry this out.

The moisture content can change during transport, with the material either drying out or gaining moisture, depending on ambient conditions and exposure to the elements. Moisture will also migrate to the bottom of the load. In the case of slurries the solids will settle during transport. Thus the material must be correctly sampled to yield a representative moisture content. It is not uncommon for biases to be present as a result of poor sampling, as is shown in the example in Table I taken from several shipments of concentrates.

The wet tons (WMT) received is consistently slightly lower than the 'Survey', the difference averaging 0.77% over the nine batches shown, which is to be expected in a hot climate and bearing in mind that the draft survey is being compared with a weighbridge, which is likely to be more accurate. However, the dry tons (DMT) are consistently higher by an average of 1.55%, as a result of biased moisture samples. Thus the receiver is accounting for about 1% more concentrate than is actually received. The value of this is significant. In addition, the recovery calculation is distorted.

Mass measurement of matte and other materials

Matte and other materials are usually weighed (in 2 t bags or other containers) on platform bagging scales, which should be capable of accuracies of 0.2% or better. However, in the case of granulated matte it is not uncommon to observe the bags being weighed at the seller while free water is still draining from the bags. During transport, the residual moisture will gravitate to the bottom of the bags, or if they are stored in the rain the same occurs on receipt at the purchaser. Often only grab samples are taken. Thus biases can also occur similar to those shown for concentrate. It is important that weighing is carried out and suitable samples are taken by an automatic sampler by both seller on loading and purchaser on offloading (the 'home and away' system). The weights must be compared and monitored.

Mass measurement of stocks

The determination of the mass of material in stock is a source of many errors because it is impossible to measure the relative density and moisture of stockpiles and other stocks, even if a reasonable estimate of the volume is made (±5%). Thus periodically there can be a relatively large adjustment to the material in stock and metal balance. This results in errors in the accountability calculations and incorrect measures of performance. On occasion, the adjustment can be a tool to conceal problems or improve the metal balance as shown in this example in Table II of the month-end stock of reverts material in a smelter.

The steady increase in grade allocated over the six months is clearly artificial and will result in a substantial write-off when the stock is eliminated. The estimate of the tonnage of reverts will always be very inaccurate due to the heterogeneity and variable bulk density, and the material is impossible to sample unless it is crushed, weighed, and sampled by a suitable automatic sampler. The only time an estimate of stock of materials in a mining operation will be accurate is when it is zero. Thus stocks should be run regularly to zero by the use of parallel piles and the material measured in and out.

Recovery calculations

It is common practice for a recovery of the various metals to be guaranteed and paid for in a toll treatment contract. A bias in mass measurement will lead to incorrect recovery calculations and may result in the purchasing company bearing a financial loss. In the case of concentrators, the tailings mass is usually not measured but is calculated from the feed and product tonnages and assays. Thus it is even more important in this case that the feed and concentrate measurements are carried out correctly so that recoveries can be calculated, as check-in check-out is not being performed.

Toll treatment contracts

An example of a typical platinum concentrate toll treatment contract was presented in an earlier paper (Gaylard et al., 2012) which illustrates some of the problems associated with toll agreements. Standard commercial terms for these contracts are based on the receiver's mass and moisture measurements and analytical sample. The analytical sample is split and analysed by both the shipper and the receiver. Analytical results are exchanged on a pre-arranged date and if the results do not agree within specified limits, settlement is delayed until final metal values are agreed following re-analysis, analysis by an umpire laboratory, or by negotiation.

The specified limits for analytical settlement are referred to as splitting limits, which are expressed as the maximum allowable percentage difference between the analyses from the two laboratories for each value metal. In the case of PGM concentrates, for example, these splitting limits vary from metal to metal, but the level of these limits is related to the performance of the sampling and analytical systems. For good corporate governance, it is essential that all parties to such a toll treatment contract should be aware of the level of financial risk to which each party is exposed with each shipment of concentrate through the level of the defined splitting limits. Clearly, the better the performance of each laboratory, the closer will be the splitting limits and the lower the risk associated with each shipment. However, improving analytical performance may prove to be too expensive in relation to the level of the risk involved, and the parties to the agreement may decide, because of this, to accept wider splitting limits. Nevertheless, corporate governance requires that this determination must be made and the audit committee must be satisfied that the risk is acceptable.

Another common problem with toll treatment of concentrates by smelters is control and measurement of concentrate inventory. Reliable measurement of stockpiles is difficult and the best measurement is obtained when the stockpile is empty. Many operations audited do not allow for this and only rarely have the opportunity to reduce their stockpile to zero, usually resulting in an unpleasant surprise and a major write-off of concentrate stocks, with a consequent negative effect on the company's balance sheet and financial results. Often, the unaccounted figure is exacerbated by losses due to wind and rain if the stockpile is not stored under cover.

Examples have also been observed of smelters that are toll treating concentrate on terms related to their operating performance and recoveries. However, the recovery figures are highly suspect because of flaws in their metal accounting systems, usually related to stockpile measurements. In particular, smelters with large stockpiles of revert materials have difficulty in arriving at a reliable recovery figure because of the measurement problems associated with such stockpiles, which are usually highly variable in composition, while the size of the component particles makes sampling extremely difficult. Smelters operating under these conditions quote commercial terms that have to match, or better, those of their competitors but, because of the shortcomings in their metal accounting systems, their entire operation is exposed to significant financial risk of which their senior management, audit committee, and board are unaware.

Measurement and reporting of performance figures

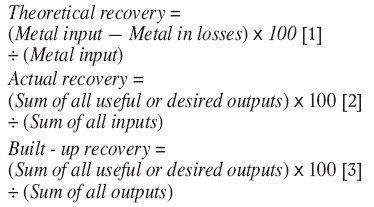

In all metallurgical operations, plant recovery is normally used as the prime measure of performance. However, there are a number of ways in which recovery can be measured. In the AMIRA Code, for example, three suggested formulae for calculating metal recoveries are proposed:

The Code does not prescribe which equation should be used. However, the Code does call for consistency in the use of such equations. Cases have been observed where the recovery formula has been changed without adequate thought or clearance from senior management, usually resulting in the reporting of a higher recovery figure that does not reflect any change in the performance of the operation concerned. In many instances, these recovery figures are reported in the published annual financial reports of companies, and a change in the method of calculation could expose the company to reputational and commercial risk.

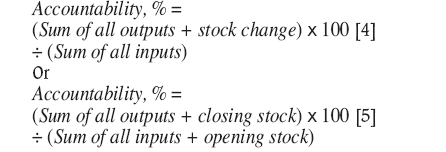

Recovery is often confused with accountability and, again, the Code has two formulae for calculating accountability:

Neither formula is prescribed, but Equation [4] is preferred as Equation [5] can mask current performance if the opening and closing stocks are significantly larger than the inputs and outputs of the accounting period concerned.

Instances have been noted where plants report recovery figures of 99% or greater, while at the same time reporting accountabilities of 94%, for example. In other operations, or in some cases, accountabilities have been adjusted to 100% through the use of built-up head grade calculations, after which recovery figures have been reported that can only be suspect.

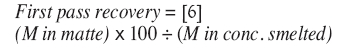

An illustration of what can go wrong if recovery calculation formulae are changed without adequate thought or investigation was provided by a base metal smelter that was audited. The smelter treated concentrate from the in-company concentrator on the mine as well as concentrate bought in from outside suppliers. The smelter produced a matte which was shipped to a refinery. The smelter also treated refinery scrap and residues as they arose. The smelter defined first-pass recovery as:

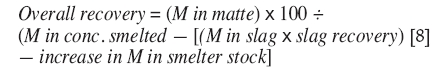

Overall recovery was determined using the equation:

In the above equations, M refers to the tons of value metals contained in the relevant process stream.

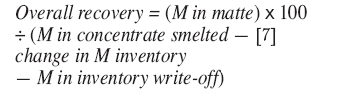

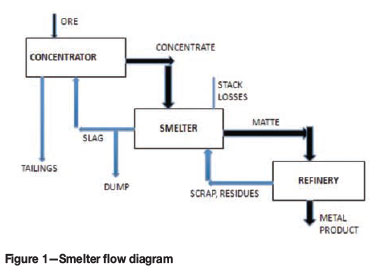

The smelter flow sheet was then changed and the majority of the slag stream was returned to the concentrator for retreatment to recover the contained metal values (Figure 1).

In order to give credit to the smelter for the resulting improvement in recovery, the overall recovery calculation method was changed to the following equation:

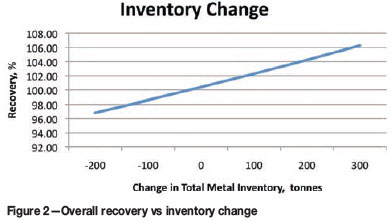

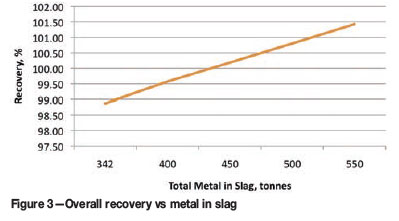

This change resulted in an increase of approximately 4% in the overall recovery for the year in which the change was made. On examining the new equation it was realized that both overall recovery equations were flawed in that an increase in inventory would lead to an increase in recovery. However, the revised equation was doubly flawed as an increase in both slag generation and inventory would combine to elevate reported recovery figures (Figures 2 and 3). In Figure 2 it can be seen that, keeping everything else constant, as the metals content of the inventory increases, the calculated overall recovery increases to a level in excess of 100%, while if the metals content of the inventory decreases, the calculated overall recovery decreases. Similarly, Figure 3 shows that an increase in the quantity of metals reporting to the slag stream leads to an increase in the calculated overall recovery percentage, while reducing the amount of metal in the slag lowers the reported recovery figure. Clearly, these trends are counter to good operating practice.

As the overall recovery was quoted in the company's annual report, the calculation had to be re-visited as the report would have reflected a significant increase in smelter overall recovery, whereas the performance of the smelter had deteriorated during the year in question. This could have had a negative effect on the company's reputation.

Summary and conclusions

Since the year 2000 there has been an increasing focus on corporate governance to the extent that sound corporate governance practices have been codified and made legal requirements for companies operating in various countries. In South Africa, we are fortunate to have the 'comply or explain' approach of the King III report. As discussed, metal accounting is an integral component of corporate governance, and a sound metal accounting system facilitates risk management, contributes to protecting the reputation of the company and also provides commercial advantages when dealing with third-party companies, particularly when commercial terms for toll treatment contracts are defined.

However, as shown in this paper and based on observations made during metal accounting audits conducted at a variety of operations, metal accounting systems are often found to be poorly operated and maintained, so that data generated by these systems is suspect. Because metal accounting is often seen as ancillary to the routine operation of a plant or mine, these shortcomings pass unnoticed but can place the operation at risk. In particular, where an operation such as a smelter is involved in toll treating or buying in concentrate from third-party companies, it is vital for the success and sustainability of that company that the metal accounting systems applied at the smelter comply with the provisions set out in the AMIRA Code of Practice for Metal Accounting to ensure sound corporate governance.

References

AMIRA International. 2007. P754: Metal Accounting: Code of Practice and Guidelines: Release 3. Melbourne, Australia. [ Links ]

Gaylard, P.G., Morrison, R.D., Randolph, N.G., Wortley, C.M.G., and Beck, R.D. 2009. Extending the application of the AMIRA P754 Code of Practice for Metal Accounting. Proceedings of the 5th Base Metals Conference, Kasane, Chobe, Botswana, 27-31 July 2009. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 15-38. [ Links ]

Gaylard, P.G., Randolph, N.G., and Wortley, C.M.G. 2012. Metal accounting in the platinum industry: how effective is it?. Proceedings of the 5th International Platinum Conference - A Catalyst for Change, Sun City, South Africa, 17-21 September 2012. Southern African Institute of Mining and Metallurgy, Johannesburg. pp. 673-694. [ Links ]

Institute of Directors in Southern Africa. 2009. Draft Report on Governance for South Africa. Johannesburg. [ Links ]

Morrison, R. (ed.). 2008. An Introduction to Metal Balancing and Reconciliation. University of Queensland. [ Links ]

Wikipedia. http://en.wikipedia.org/wiki/Corporate_governance ♦ [ Links ]