Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Journal of the Southern African Institute of Mining and Metallurgy

versión On-line ISSN 2411-9717

versión impresa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.114 no.1 Johannesburg ene. 2014

SAMPLING AND ANALYSIS PAPERS

From metal to money: the importance of reliable metallurgical accounting

D. Seke

Lonmin Plc, South Africa

SYNOPSIS

Metal inventories are usually reported in financial statements of mining companies. However, the value of these inventories can be reliable only if the metals in stock are measured within acceptable tolerances. Reliable metal balancing requires accurate mass measurement, sampling, and chemical analysis.

Many mining companies are usually unable to validate the accuracy of metals in inventories at the end of their financial year. This is mainly due to poor mass measurement, sampling, and chemical analysis practices. This has an adverse impact on metallurgical accounting and metal valuation. In addition, it puts a lot of stress on external auditors, who have the duty to recommend the approval of the financial statements to the board of directors.

Although a full value chain of metal reconciliation includes the accuracy of Mineral Reserve definition and grade control at the mine, this paper discusses the implementation of best practices for mass measurement, sampling, and chemical analysis at processing plants. This is an important aspect of sampling and reconciliation that is required in order to improve the reporting of inventories in the financial statements of public mining companies.

Keywords: metallurgical accounting, corporate governance, sampling, analysis.

Introduction

Metal inventories are usually reported in financial statements of mining companies. However, the quantification of valuable metal contents in platinum group metal (PGM)-bearing products has historically been a challenge for PGM producers. Many systems and processes have been introduced to reduce variance and improve accuracy in the quantification of metal inventories.

According to the SAMREC Code (SAMREC, 2009) and the JORC Code (JORC, 2004), public companies are also required to review and publicly report on their mineral resources and ore reserves at least annually. A company must also promptly report any material changes in its mineral resources or ore reserves. SAMREC (2009) has defined a 'Mineral Resource' as a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, quality, and quantity that there are reasonable and realistic prospects for eventual economic extraction. The location, quantity, grade, continuity, and other geological characteristics of a mineral resource should be known, or estimated from specific geological evidence, sampling, and knowledge interpreted from an appropriately constrained and portrayed geological model.

According to SAMREC (2009) and JORC (2004), mineral resource estimates are not precise calculations, being dependent on the interpretation of limited information on the location, shape, and continuity of the mineral occurrence and on the available sampling results. Therefore, mineral resources are usually subdivided, in order of increasing geological confidence in respect of geoscientific evidence, into inferred, indicated, and measured categories (SAMREC, 2009). A 'Measured Mineral Resource' is that part of a mineral resource for which tonnage, densities, shape, physical characteristics, grade, and mineral content can be estimated with a high level of confidence (SAMREC, 2009). Since processing plants usually receive measured mineral resources from mining for further beneficiation into intermediate products or refined metals, a key objective of mineral reserve estimation is the successful extraction and delivery of a mineral resource for processing at the estimated grade.

Mining reconciliation is the comparison of an estimate (a mineral resource model, a mineral or ore reserve model, or grade control information) with measurement information or the official production from a processing or treatment plant (Morley, 2003). Mining reconciliation and grade control cannot be reliable if processing plants have inadequate sampling systems. AMIRA (2007) defined 'Metallurgical Balance' as the determination, through measurement, analysis, and computation, of the magnitude of each component of interest across an entire plant (Primary Accounting), or across each section of a process flow sheet (Secondary Accounting). According to AMIRA (2007), secondary accounting can be used to help identify where process inventory is located, where time lags are involved, or where any measurement problems exist, thereby improving primary accounting.

However, Pitard (1993) believes that a large majority of the sampling systems found on the market today, selected and installed by engineering firms, transgress the most elementary rules of sampling correctness. With the need to comply with tight corporate governance and financial regulations, the mining industry has to rely on correct sampling and analysis of valuable metals.

Following accounting scandals at some public companies, there have been increased requirements for financial statements to comply with corporate governance principles and practices. Regulations such as the Sarbanes-Oxley-Act of 2002, the Disclosure & Transparency Rules, the UK Corporate Governance Code, and the King III Code and King Report of 2009 are used by various listed mining companies when reporting to stakeholders.

Although a full value chain of metal reconciliation includes the accuracy of mineral reserve definition and grade control at the mine, this paper will discuss some aspects of corporate governance and the implementation of best practices for mass measurements, sampling, and chemical analysis at platinum group metals (PGMs) processing plants.

Overview of corporate governance

This section summarizes sections of the Sarbanes-Oxley-Act of 2002, The UK Corporate Governance Code, the King Code of governance, and the AMIRA Metal Accounting Code that can be used to improve transparency in the reporting of financial statements of mining companies.

Sarbanes-Oxley Act of 2002 (SOX)

The Sarbanes-Oxley Act of 2002 (SOX) is a Public Law 107-204 that was passed by the US Congress and signed into law by President George W. Bush on 30 July 2002 (US Securities and Exchange Commission, 2002). SOX introduced major changes to the regulation of financial practice and corporate governance in the United State of America. SOX was enacted in response to accounting and management scandals at major American listed companies such as Enron, Tyco International, and WorldCom. The main objective of SOX was to protect investors by improving the accuracy and reliability of corporate disclosures (US Securities and Exchange Commission, 2002). The Act is based on the 'comply or else' approach - all companies, regardless of their size, have to comply, and those that fail to comply by the due date are penalized.

The Sarbanes-Oxley Act of 2002 established many new requirements, including those governing the composition and responsibilities of audit committees. SOX is arranged into eleven titles. As far as compliance is concerned, the most important sections of SOX can be summarized as follow (US Securities and Exchange Commission, 2002):

►The CEO and CFO carry a primary responsibility for company reports filed with the US Security Exchange Commission (SEC). They have to certify the financial reports, and report on the completeness and accuracy of information contained in the reports, as well as the effectiveness of underlying controls

►Management has to assess the effectiveness of internal controls over financial reporting

►External auditors have to attest to management's representations and to report directly to the Audit Committee

►The company's auditors cannot also provide consulting services for the company

►Penalties of fines and/or up to 20 years' imprisonment for altering, destroying, mutilating, concealing, falsifying records, documents, or tangible objects with the intent to obstruct, impede, or influence a legal investigation

►Penalties of fines and/or imprisonment for up to 10 years on any accountant who knowingly and wilfully violates the requirements of maintenance of all audit or review papers for a period of 5 years.

The UK Corporate Governance Code

The first version of the UK Corporate Governance Code was published under the Cadbury Report in 1992. The Cadbury Report, also known as the Report of the Committee on the Financial Aspects of Corporate Governance, was a response to major corporate scandals associated with governance failures in the UK. Subsequent to the Cadbury Report, two more versions of the UK Corporate Governance Code were published by the Financial Reporting Council (FRC) in 2010 and 2012, respectively (Financial Reporting Council, 2010, 2012).

According to the Financial Reporting Council (2012), the 'comply or explain' approach is the trademark of corporate governance in the UK and has been in operation since the Code's beginnings. The London Stock Exchange requires all companies with premium listing in the UK, whether they are incorporated in the UK or elsewhere, to state whether they are complying with the Code and to give reasons for any areas of non-compliance. However, smaller listed companies may judge that some of the provisions are disproportionate or less relevant in their case. Some of the provisions of the Code do not apply to companies below the FTSE 350. However, such companies are encouraged to adopt the approach in the Code (Financial Reporting Council, 2012).

Since the Code is based on the 'comply or explain' approach, it recognizes that an alternative to following a provision may be justified in particular circumstances if good governance can be achieved by other means (Financial Reporting Council, 2012). However, the reasons for alternatives should be explained clearly and carefully to shareholders. The explanation should indicate whether the deviation from the Code's provisions was limited in time and when the company intended to return to conformity with the Code's provisions (Financial Reporting Council, 2012).

The Code is based on five main principles that include leadership, effectiveness, accountability, remuneration, and relations with shareholders (Financial Reporting Council, 2010, 2012). The principles relevant to this paper can be summarized as follows:

►Each board should have an audit committee composed of non-executive directors

►The board should present a fair, balanced, and understandable assessment of the company's position and prospects

►The board should establish formal and transparent arrangements for considering how they should apply the corporate reporting, risk management, and internal control principles and for maintaining an appropriate relationship with the company's auditors

►The audit committee should monitor the integrity of the financial statements of the company and any formal announcements relating to the company's financial performance, reviewing significant financial reporting judgements contained in them.

In addition to the 'comply or explain' requirement in the Listing Rules, the Code includes specific requirements for disclosure which must be provided in order to comply (Financial Reporting Council, 2012). Failure to comply may render a board or individual director liable at law.

The King Report on Governance for South Africa and the King Code of Governance Principles (King III)

The Code of Governance Principles for South Africa 2009, also known as King III Code, was released in September 2009. King III has two documents: a Code of Governance (Institute of Directors in Southern Africa, 2009a) and a Report on Governance (Institute of Directors in Southern Africa, 2009b). The King III Code was supposed to substitute the King II Code on 1 March 2010. According to the Institute of Directors in Southern Africa (2009a), the update to the King II Code issued in 2002 came about due to changes to many pieces of South African legislation, specifically the Companies Act No. 71 of 2008, more stringent legislation in certain jurisdiction, and changes in global corporate governance standards and expectations of stakeholders.

The 'comply or explain' principle has been changed to the 'apply or explain' principle. King III applies to all entities regardless of the manner or form of incorporation or establishment, whether public, private, or the non-profit sector. In situations where the board or those charged with governance decide not to apply a specific principle and/or recommendation, this should be explained fully to the entity's stakeholders. Failure to meet a recognized standard of governance may render a board or individual director liable at law.

The main principles of the Code related to this paper can be summarized as follow:

►The board should act as the focal point for and custodian of corporate governance

►The board and its directors should act in the best interests of the company

►The board should ensure that the company has an effective and independent audit committee

►The audit committee should review and comment on the financial statements included in the integrated report

►The audit committee should engage the external auditors to provide assurance on the summarized financial information

►The audit committee is responsible for recommending the appointment of the external auditor and overseeing the external audit process.

In light of the three codes of governance summarized in this paper, it is believed that the audit committee, external auditors, and executive management of various mining companies may behave differently depending on the location of their primary listing and/or physical location of operations.

The integrity of metallurgical accounting reports in general, and metal inventories in particular, can be adversely affected by poor mass measurement, sampling, and chemical analysis. According to AMIRA (2007), the mining and metallurgical industry had recognized that accounting for metals across processing plants was not generally performed at a level required by currently acceptable corporate governance practices. The AMIRA P754 research team believed that it was important to emphasize on the need for metal accounting to be conducted to the level of financial accounting standards with respect to auditability and transparency (AMIRA, 2007).

AMIRA P754 Metal Accounting Code of Practice and Guidelines: Release 3

The Code of Practice for Metal Accounting is the outcome of the AMIRA P754 project, which was put in place in order to improve metal balancing and reconciliation (AMIRA, 2007). The third version of the Code of Practice for Metal Accounting was released in February 2007. The Code has ten principles and focuses on the need for all activities in the areas of mass measurement, sampling, sample preparation, and analysis to be carried out accurately and with an acceptable level of precision (AMIRA, 2007).

Since in-process inventory data is quantified by operation managers and then submitted to the finance department for further metal valuation, the following four principles of the Code (AMIRA, 2007) should be taken into consideration:

► The metal accounting system must be based on accurate measurements of mass and metal content. It must be based on a full Check in - Check out system using the Best Practices as defined in this Code, to produce an on-going metal/commodity balance for the operation. The system must be integrated with management information systems, providing a oneway transfer of information to these systems as required.

► In-process inventory figures must be verified by physical stock-takes at prescribed intervals, at least annually, and procedures and authority levels for stock adjustments and the treatment of unaccounted losses or gains must be clearly defined.

► Target accuracies for the mass measurements, the sampling and analyses must be identified for each input and output stream used for accounting purposes. The actual accuracies for metal recoveries, based on the actual accuracies, as determined by statistical analysis of the raw data, achieved over a company's reporting period must be stated in the report to the Company's Audit Committee. Should these show a bias that the Company considers material to its results; the fact must be reported to shareholders.

► The metal accounting system must ensure that every effort is made to identify any bias that may occur, as rapidly as possible and eliminate or reduce to an acceptable level the source of bias from all measurement, sampling and analytical procedures, when the source is identified.

In order to improve the transparency and auditability of metallurgical performance of mining companies, the Code has recommended that members of the risk/audit committee, senior corporate and operational management, and plant operation and laboratory staff be familiar with the AMIRA P754 Code and its attachments (AMIRA, 2007).

Platinum group metals companies

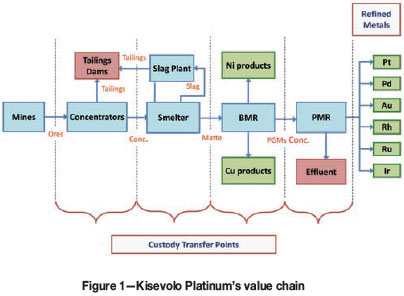

South Africa is the world's largest producer (approximately 80 per cent) of platinum group metals (PGMs). Anglo American Platinum, Impala Platinum (Implats), and Lonmin are the three major producers of PGMs in the world. These three companies have a vertically integrated operational structure that includes mining, concentrating, smelting, and refining, similar to that of Kisevolo Platinum (Figure 1).

Anglo American Platinum Limited is a member of the Anglo American plc group and is the world's leading primary producer of PGMs. Anglo American Platinum is listed on the Johannesburg Securities Exchange (JSE), and its mining, smelting and refining operations are based in South Africa (Anglo American Platinum, 2012).

Impala Platinum, the second largest world producer of PGMs, has its primary and secondary listing on the JSE Securities Exchange and London Stock Exchange, respectively (Implats, 2012). Implats' main operations are situated in South Africa.

Lonmin is the third largest world producer of PGMs, with operations situated in South Africa. The company is listed on both the London Stock Exchange and the Johannesburg Securities Exchange (Lonmin plc., 2012).

Both Anglo American Platinum and Implats are guided by the principles of the King III Code of Corporate Governance, the South African's Companies Act of 2008, and the JSE Listings Requirements (Anglo American Platinum, 2012; Implats, 2012). Being an English-incorporated company with a premium listing on the London Stock Exchange; Lonmin is subject to the UK Corporate Governance Code published by the Financial Reporting Council in June 2010 and its supporting guidance (Lonmin plc., 2012).

All three companies have been using the AMIRA P754 Code of metallurgical accounting in order to improve transparency and auditability of metallurgical performance. The quantification and valuation of metal inventories of a typical PGM producer will be discussed in the following section.

Quantification and valuation of metal inventories

According to the AMIRA P754 Code, physical stocktakes and the determination of the plant stocks and total process inventory are an integral part of metal accounting (AMIRA, 2007). The operational processing of metal inventories, and ascribing value to either metal inventories or cost of sales, should be fundamental processes of mining companies. These are core to understanding business trends and financial performance, and fundamental for both internal reporting to management and for external reporting to shareholders and market analysts. Every mining company should conduct its stocktake at least once every year. The stocktake should be audited by both internal and external auditors.

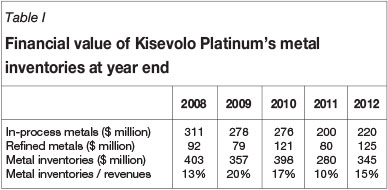

Metal inventories, as reported in annual financial statements of a typical PGM company, Kisevolo Platinum, which produces approximately two million ounces of PGMs per year, are presented in Table I.

Metal inventories presented in Table I were valued at the lower of cost and net realizable value as required by the International Financial Reporting Standards (IFRS). Table I indicates that metal inventories can represent approximately 10 to 20 per cent of the company's annual revenue. In addition, approximately 72 per cent of metal inventory was in process, while 28 per cent was in refined metals. While refined metals can be quantified accurately, in-process inventory is usually subject to errors due to mass measurements, sampling, and chemical analysis. Therefore, reporting on inaccurate metal inventories, without proper explanation, can mislead the board and senior executives when reporting on the financial position of the company.

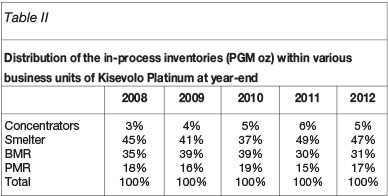

Table II shows the distribution of physical quantities of in-process inventories within various business units of Kisevolo Platinum at the end of each financial year. Table II shows that approximately 80 per cent of in-process inventories were at the smelter and at the base metal refinery (BMR) at the end of each financial year. A high level of uncertainty in the quantity of metal inventories can result in inaccurate valuation.

This paper will focus on the measurement of inventories at the smelter and BMR because of the high value of metal inventories locked in these two business units.

Metal inventories at the smelter

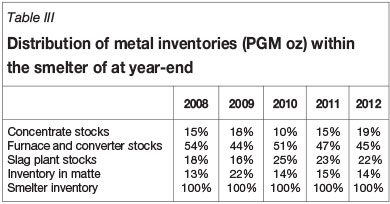

The distribution of metals inventories at the smelter is shown in Table III. It can be seen that furnace stocks, converter stock, and slag plant stocks contain the majority of metal inventories. Kisevolo Platinum's smelter has two distinct risk areas with regards to the accuracy of in-process inventories:

►A low- risk area where material is essentially in flotation concentrate and converter matte

►A high- risk area where stockpiles of reverts and high -value intermediate products (mainly converter slag) are stored for future processing.

Flotation concentrate and convert matte are properly sampled at the smelter custody transfer points. These custody transfer point are equipped with suitable mass measurement equipment (weighbridges and platform scales) and automated samplers.

However, stockpiles are often the largest source of error in metal accounting, both in estimating the dry mass and even more so in calculating the metal content. Even if the volume is surveyed by sophisticated techniques, accurate samples for bulk density and moisture are impossible to obtain and these values are variable.

Prior to 2010, Kisevolo Platinum's smelter used to survey all slag and reverts stockpiles in order to quantify the amount of metal in inventories. In 2010, external technical auditors recommended that reverts and converter slag be weighed using the slag plant weighbridge. These materials were also crushed. The extremely heterogeneous nature of revert materials made them highly prone to segregation and major sampling errors.

In 2008 and 2009, the uncertainties with regard to the smelter's in-process inventory were mainly due to the quality of mass measurements and the sampling systems used during stocktake. The smelter improved the mass measurement of stockpiles by weighing rather than surveying of reverts and converter slag. This has significantly decreased the uncertainty of the stated weight numbers, in comparison to applying a volume and a bulk density to a stockpile. The sampling system within the plant was also improved by installing suitable sampling points in the slag concentrator plant and a new sampler for the converter matte. These sampling points are properly maintained by dedicated staff members.

Since 2010, all slag has been collected by truck and weighed on the slag weighbridge, which is fully automatic. The slag is stored in different stockpiles, depending on the type, before being fed to the mill in the slag concentrator. All material removed from the converter aisle is weighed on the slag weighbridge and returned to stock in the smelter.

Although a running stocktake has become the accepted norm for stocktake methodology at the smelter, with the plant running as normal through the event, sampling and analysis of reverts still pose the biggest challenge due to the lack of a suitable certified reference material (CRM) on the market. In an ideal world, the best way to handle reverts would be to reprocess them at a rate similar to that at which they are produced.

Metal inventories - base metals refinery (BMR)

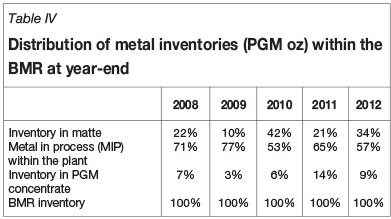

The distribution of metals inventories at the base metals refinery (BMR) is shown in Table IV. It can be seen that in general, the vast majority of BMR inventory is in metal in process (MIP) within the plant.

Kisevolo Platinum's BMR has two areas of risk with regards to the accuracy of PGM inventories:

►A low-risk area where material is essentially in converter matte and PGMs concentrate

►A high-risk area where values are in intermediate products (slurry, solution, and residues). These metal inventories are still in process within the BMR plant.

Converter matte is sampled using the smelter's sampling system, as discussed in the previous section. Inventory in PGM concentrate is sampled and analysed at the precious metals refinery (PMR). The primary sampling systems at the smelter and PMR are adequate for metallurgical accounting. The quantities of metal in converter matte and PGM concentrate are validated by internal measurements within the BMR using the 'home-and-away' philosophy.

Prior to 2009, the BMR had inadequate sampling systems (neither mechanically correct nor designed according to sampling theory principles) in place for effluents, nickel sulphate, copper, or autoclave vents. The solids derived from process intermediates such as cell slimes, scrap copper, slurry bags, or contaminated crystals could not be sampled with a high degree of confidence, purely because of the particle size distribution, variations in particle density, and associated PGMs. In addition, stocktake used to be carried out with the plant having very high slurry and solutions inventories.

When the BMR had very high slurry and solution inventories, tanks could not be emptied or the contents pumped from one tank to another to filter out contained solids. As solids tend to stratify in tanks or containers, no matter how good the mixing, the reported assays are dependent on the sample location. The large uncertainty range was proportional to the inventory. Therefore, despite the best attempts at procedural correctness, the metal inventories of the 2008 financial year were uncertain.

Since 2009, the BMR has adopted a bubble stocktake methodology, with the plant ceasing operations for the period of the stocktake. Wherever possible no liquor is taken onto stock as the sampling of liquors is inherently less accurate than the sampling of solids. With decreased liquor levels down to the 30-40 per cent range prior to the stocktake, it is possible to filter nearly all slurries in tanks. Sampling of solids is carried out within acceptable levels of accuracy. The large number of empty vessels or vessels with clear solution makes the inventories of these process vessels certain. In addition, the BMR has installed suitable sampling equipment at all secondary metallurgical accounting points in order to improve the accuracy of MIP.

Conclusion and recommendations

At Kisevolo Platinum, the organization and coordination of stocktakes reside with the metal accounting department. Once the metals in inventories have been quantified using accurate mass measurement and analysis, the valuation of metal inventories is carried out by the finance department. The role of the external and internal auditors is to ensure that the stocktake procedure is followed and to validate materials transactions, stocks, and associated calculations. Any deviation from the procedure is noted and reported to the audit committee.

Based on the distribution of metal inventories with the various business units, it is recommended that Kisevolo Platinum focus on improving the accuracy of in-process inventories around the smelter and the base metal refinery (BMR). The biggest improvements associated with past versus recent stocktaking at the smelter lies with the weighing rather than surveying of reverts and converter slag. The BMR should continue to minimize the levels of liquorinventories during the 'bubble stocktake'.

A statistical analysis shall be undertaken by the metallurgical accounting department to establish the levels of confidence and precision of metal inventories and metallurgical balances across the plants.

The auditing culture has to be adopted by managers of various operations. There is a need for more communication between finance, operations, and metallurgical accounting in order to improve the accuracy and reliability of metal inventories reported in the financial statements.

Although most of these recommendations are known to plant operations worldwide, there is a need for a firm commitment to a culture of accountability among all participants in the measurement and analysis of metal inventories. Each participant must take responsibility, in collaboration with all others, for carrying out a fundamental role in this process. Inherent in the drive towards improving the accuracy of metal inventories is not only the need to comply with good governance, but also the opportunity to achieve a greater level of effectiveness in the production of saleable metals. For the accuracy of metal inventories to improve, senior management will need to focus more on the appropriate checks and balances.

References

AMIRA. 2007. AMIRA P754: Metal Accounting, Code of Practice and Guidelines: Release 3, February 2007. [ Links ]

Anglo American Platinum Limited. 2012. Annual report 2012. http://www.angloplatinum.com/investors/reports/2012.asp [Accessed 11 Feb. 2013]. [ Links ]

Financial Reporting Council. 2010. The UK Corporate Governance Code. June [ Links ]

2010. London. https://www.frc.org.uk/./img/revistas/jsaimm/v114n1/The-UK-Corporate-Governance-Code.aspx [Accessed 24 Jan. 2013]. [ Links ]

Financial Reporting Council. 2012. The UK Corporate Governance Code. September 2012. London. http://www.frc.org.uk/Our-Work/Codes-Standards/Corporate-governance/UK-Corporate-Governance-Code.aspx [Accessed 24 Jan. 2013]. [ Links ]

Impala Platinum Limited. 2012. Integrated annual report 2012. http://www.implats.co.za/implats/index.asp [Accessed 27 Feb 2013]. [ Links ]

Institute of Directors in Southern Africa. 2009a. King Code of Governance for South Africa 2009. http://www.iodsa.co.za/?page=kingIII [Accessed 11 Feb. 2013]. [ Links ]

Institute of Directors in Southern Africa. 2009b. The King Report on Corporate Governance in South Africa 2009. http://www.library.up.ac.za/law/docs/king111report.pdf [Accessed 11 Feb 2013]. [ Links ]

JORC. 2004. The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code, 2004 Edition). The Joint Ore Reserves Committee of The Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia. [ Links ]

Lonmin Plc. 2012. Annual report and accounts for year ended 30 September 2012. https://www.lonmin.com/annual_report_2012/ [Accessed 22 Jan. 2013]. [ Links ]

Morley, C. 2003. Beyond reconciliation - a proactive approach to using mining data. Proceedings of the Fifth Large Open Pit Conference. The Australasian Institute of Mining and Metallurgy, Melbourne. pp. 185-191. [ Links ]

Pitard, F.F. 1993. Pierre Gy's Sampling Theory and Sampling Practice: Heterogeneity, Sampling Correctness, and Statistical Process Control. 2nd edn. CRC Press, Boca Raton, FL. [ Links ]

SAMREC. 2009. The South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (The SAMREC Code), 2007 edition as amended July 2009. The South African Mineral Resource Committee (SAMREC) Working Group. [ Links ]

US Securities and Exchange Commission. 2002. Sarbanes-Oxley Act of 2002. http://www.sec.gov/about/laws.shtml#sox2002 [Accessed 12 Feb. 2013]. [ Links ]