Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.113 n.3 Johannesburg Mar. 2013

CONFERENCE PAPERS

Navigating above-the-ground risk in the platinum sector

A. Lane; R. Kamp

The Monitor Group, Johannesburg, South Africa

SYNOPSIS

The socio economic risks of mining in South Africa have been emerging for some time now, and have been brought into sharp relief by recent events in the platinum sector. The slow pace of social upliftment in the country has lead to widespread social unrest with consequent calls for different forms of resource nationalism. Fundamentally, the key stakeholders are not fully aligned, and are not engaging productively. This poses significant above-the-ground risk to mining companies. Measuring social impact, deploying inclusive solutions and engaging effectively with stakeholders are three ways in which mining companies can mitigate this risk.

Keywords: platinum, mining, community, socio-economic impact, stakeholders, conflict, labour unrest, social licence to operate, investment, Africa.

The emerging market context

As the 'next wave of globalization brings billions more people into modern economic activity' (Kelly and Weber, 2012, p. 17), the attractiveness of emerging markets as investment destinations is growing. This trend coincides with expectations that the global middle class will more than double by 2030, with an associated rise in living standards (Rhode and Davos, 2012). Asian countries are expected to host 64 per cent of the global middle class in 2030, compared to their 2012 base of 30 per cent. While a large portion of Asia's population enters the traditional middle-class bracket, billions more people in other developing economies, particularly in Africa, will be brought into modern economic activity, 'but starting at a much lower income base' (Kelly and Weber, loc. cit.). Spending capacity is expected to be distributed across a large section of the population, from what is currently called the 'bottom of the pyramid' to the traditional, and far wealthier, middle class. The great majority of emerging-market consumers will fall somewhere in between these two categories.

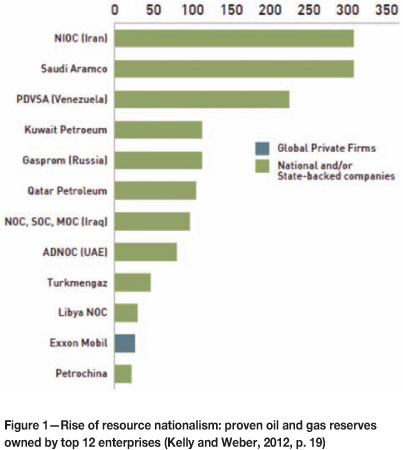

With the changing global economic landscape, a variety of threats will become apparent. An increase in economic and resource nationalism is a reality as governments in emerging economies try to protect and drive domestic growth to satisfy the increasing demands of populations that are expecting improved standards of living. Resource nationalism is already evident in the oil and gas industry, in which 11 of the top 12 enterprises, ranked according to ownership of proven oil and gas reserves, are national and/or state-backed companies (Figure 1).

There are many recent examples of governments taking protectionist stances with regard to their resources, including the move by the Argentinean government to seize a majority stake of Repsol's oil and gas operations, YPL, in Argentina (Reuters, 2012), and the threat by Zambia's president to halt all copper exports from Zambia (South Africa, December 2011). For the private sector, ensuring that their operations add value to the countries in which they operate is imperative to preventing such actions by governments looking to consolidate power and contain social unrest by satisfying the economic needs of their populace (Kelly and Weber, 2012, p.18).

The increasing role of governments in emerging market economies, specifically China, in driving investment has the potential to change the dynamics of the global economy and how multinational organizations operate. Sovereign wealth funds are being more frequently used as a strategic tool to drive economic growth, particularly by ensuring access to minerals and resources key to the economic development of the investing nation.

'As governments (return) to the centre of the competitive game' their policies 'will be key determinants of what firms will be empowered to do - or prohibited from doing' (Kelly and Weber, 2012, p. 23).

The opportunity in Africa

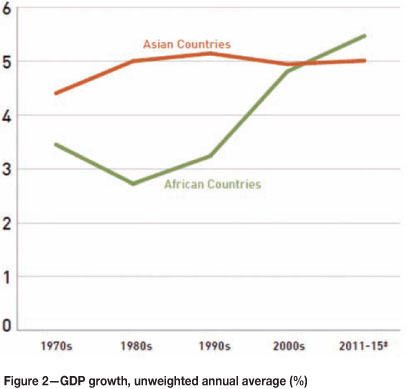

Africa's opportunity is now. Forecasts suggest that Africa's average GDP growth rate will overtake that of Asia over the next five years and continue to rise as Asia's reaches a plateau (The Economist, Jan. 2011; Kelly and Weber, 2012, p. 17).

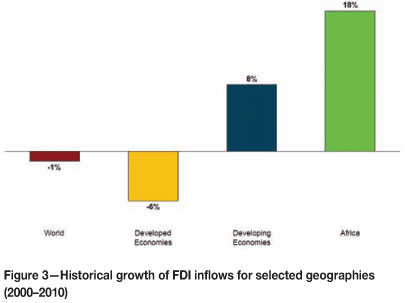

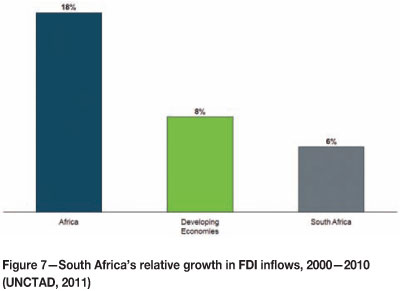

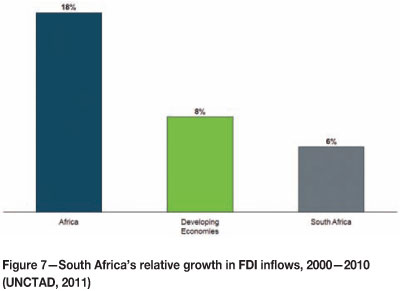

Foreign direct investment (FDI) into Africa has risen rapidly over the past ten years and has outstripped both the developing and developed world (UNCTAD, 2011). This supports the statement that the greatest opportunities in today's global economy lie in developing economies, particularly in Africa. Investment into Africa's mining sector, most notably from China, is also increasing and promises to support future development within the sector, as well as the economies of mineral-rich African nations that can offer an attractive and stable investment environment (Business Monitor International, 2012).

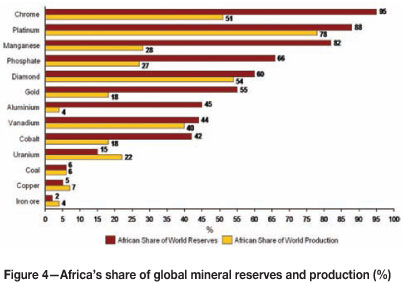

Huge amounts of mineral wealth are held in Africa, with more than half of the world's reserves of gold, platinum, and chrome, and large quantities of diamonds. Uranium mining is expected to increase dramatically, particularly in Namibia and Tanzania, while coal and iron ore will continue to play an important part in the Mozambican and South African mining sectors respectively (Business Monitor International, 2012). Yet, in spite of this, Africa's mineral production lags significantly behind its reserves across a number of minerals. This can be attributed to historical underinvestment in African mineral exploration. 'In 1991, for example, Africa collectively commanded only 5 per cent of the world's exploration and development expenditure' (Reggio and Lane, 2012).

However, over the past two decades Africa has seen a steady climb in its mineral exploration and development budget, which exceeded 13 per cent of the global total in 2010. This is a promising signal for mining in Africa and its future production volumes.

Despite these positive developments, miners in Africa face various challenges - both below and above the ground. The below-ground risks are well understood by mining companies. These include the depletion of easy-to-mine reserves and the necessity to move operations to more challenging locations, in terms of both geography and geology. This has increased the safety risks of mining as it often takes place deeper underground, raising exploration and production costs, as well as increasing the difficulty and cost of logistics, particularly when operating in remote, landlocked locations with limited access to infrastructure.

Above-ground risks present a different set of challenges, can be quite costly, and are often more difficult to mitigate than those below the ground. Four such risks are especially prevalent.

High levels of political instability and corruption - Sub-Saharan African economies typically appear at the top of indices of political risk and at the bottom of indices of global transparency. Thirteen of twenty-seven 'very high risk' countries featured in the 2009 Political Instability Index were sub-Saharan African economies (Economist Intelligence Unit, 2009), while Transparency International's 2010 Corruption Perception Index cited 30 sub-Saharan economies as having high levels of corruption (Transparency International, 2010). These measures are indicative of the risks and institutional challenges that investors face when investing in sub-Saharan Africa.

Opaque regulations - While mining regulation is evolving in Africa, changes to existing regulations often lead to lengthy periods of bureaucratic difficulties, and significantly raise the investment risk. Significant disruption can result, particularly as new frameworks typically require a number of revisions and adjustments as they are implemented, leaving companies in a situation where their obligations are unclear. This adds to the potential for corruption and poor governance and threatens the stability of operations. Further complicating the regulatory environment is that regulations often change with each successive regime change.

Poor enforcement capacity - Even in instances where mining regulations have been rewritten or advanced, governments often have trouble enforcing them. Monitoring and enforcement of new regulations still falls largely to the private sector (GRAMA, 2003).

Great expectations - Hope is widespread that mineral abundance will translate into prosperity for Africans. However, this has rarely been the case and mineral wealth has become associated with inequality, rather than with poverty alleviation and socio-economic progress. The inability of governments to capitalize on the resources of their countries has led to community frustration and social unrest in many areas. In turn, governments and communities have heightened their demands on mining companies to provide relief to poverty-stricken communities.

Exacerbating these above-the-ground risks is the fact that the three constituent parties involved in mining have their own, often competing, agendas (Figure 5).

National governments seek tangible economic benefits from mineral development. These benefits start with direct taxation and royalties and extend to injections of capital into infrastructure development. Local beneficiation is a focus through value-chain development and the multiplier effect this has for job creation, as are demands for direct social spend. The primary metric for governments tends to be GDP per capita, although tax revenues, job creation, and human development indicators are also important.

Local communities seek to limit the disruption that mineral development will cause to their economic, social, and cultural context, and want access to the opportunities presented by mining developments. Community expectations relate to employment creation and improvements to community infrastructure, as well as education and skills training. The primary metric for this group tends to be quality of life, broadly measured by income and access to (or quality of) services.

Mining companies want to optimize levels of production, maximize revenues, and manage costs. Crucial to their continued operation is that they be granted a license to operate for the duration of the life of mine. The primary metrics for this group tend to be output and profitability.

Within this triangle, a number of inherent tensions arise. For example, the country-wide revenues and benefits national governments seek may clash with communities' desire to see disproportionate socio-economic benefits locally (in many cases because communities find the government incapable of delivering social benefits to them). Similarly, a government's demands for infrastructure investment may conflict with a mining company's cost-efficiency goals. And a local community's desire for economic participation and employment in the mine may limit the productivity and operational efficiency an international company seeks.

The end result of this tangled web is typically dysfunction and tension. Governments are not seeing the beneficiation they desire, and often struggle to stimulate economic development and diversify their economic base. Local communities, let alone national populations, are not seeing the reinvestment of resource windfalls toward the social programmes they demand. Companies making significant outlays to meet the demands of both governments and local communities see their money being wasted and not making the level of social impact required. Often they find themselves in the predicament of having to renegotiate the terms of their mineral exploration rights, despite these outlays.

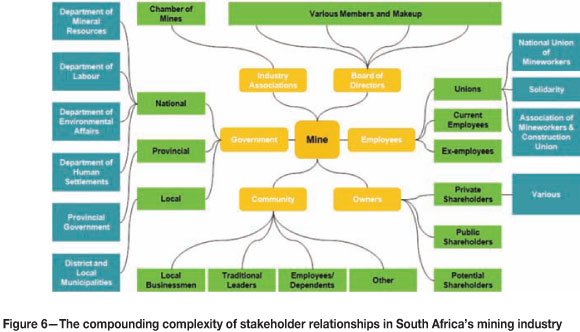

Creating winning strategies within this environment is difficult due to the stakeholder complexities described above. A further breakdown of the stakeholders involved in mining can be seen in Figure 6. This diagram is typical of the set of stakeholders present for mines operating in South Africa, and illustrates the complexities of stakeholder relationships within the mining sector. These complexities become further compounded as one breaks out each stakeholder group into its individual components. This is true for both external stakeholders and for internal stakeholders within the mine's own management and operating divisions.

South Africa's position in Africa: opportunities and challenges

South Africa is well-placed within Africa as one of the most developed economies on the continent. It was ranked second for ease of doing business amongst sub-Saharan African countries and thirty-fifth globally, out of 183 participating countries in 2012 (IFC and World Bank, 2012). Despite this, there are clear signals that the country is losing its competitive edge.

A primary indicator is the failure of South Africa to attract an increasing proportion of the total FDI flowing into African and developing economies (Figure 7). The growth of FDI inflows in Africa between 2000 and 2010 was triple that of South Africa's FDI growth, pointing to an investor climate that is favouring previously untapped markets and shying away from a country that, based solely on levels of physical infrastructure and mineral resources, should be far more attractive than it is proving to be.

While South Africa did improve by one position from 2011 to 2012 on the Doing Business Survey, the individual metrics used to determine its overall rank, showed a mixed overall performance. There are a number of areas that are of major concern for the nation and its overall business environment.

The primary area of concern is South Africa's inability to provide adequate electricity. Regulatory issues are also problematic as the ease of trading across borders from South Africa is shown to be difficult, as is the enforcement of contracts. Regulatory uncertainty within the South African context is having a disruptive influence on the stability of the economy and on the confidence that investors are placing in South Africa. A core factor contributing to this uncertainty is the populist rhetoric around the nationalization of mines and other sectors of the economy. Despite the ruling party's insistence that wholesale nationalization of mines is not on the government's agenda, the recently released State Intervention in the Minerals Sector (SIMS) report, commissioned by the ANC to investigate the possibility for national- ization and its alternatives, has raised concern within the mining industry, as even if nationalization does not take place it is clear that government is set on increasing the economic benefit that it receives from the industry.

The possibility of additional pressure being put onto the mining sector is deeply unsettling to investors and to mining companies alike, and does not provide the stable economic platform necessary for the long-term investments required in the mining industry.

While South Africa's GDP accounted for a significant proportion (32 per cent) of the total GDP of sub-Saharan Africa in 2010, it has contracted by 15 per cent from 47 per cent in 1994 (World Data Bank, 2012). This can be attributed to both the strengthening of the economies of other sub-Saharan African countries, as well as to the weakening of South Africa's dominant position in the sub-Saharan African economic landscape.

The South African mining sector

South Africa holds a significant proportion of global and African mineral reserves for a number of valuable minerals. The nation holds the largest reserves of platinum, gold, chrome, and manganese ore, and the second largest reserves of zirconium, vanadium, and titanium (US Geological Survey, 2011). It is a leading global producer of platinum group metals (PGMs), gold, diamonds, base metals, and coal, and holds reserves that span the five major mineral categories, namely: precious metals and minerals, energy minerals, non-ferrous minerals and metals, ferrous minerals, and industrial minerals (SAInfo, 2012).

The mining sector is critical to the South African economy and is the 5th largest contributor to national GDP (StatsSA, 2012). Mining's contribution to GDP has increased from 7.1 per cent to 8.8 per cent between 1993 and 2011. However, this increase is likely due to decreases in the contribution made by other sectors, particularly manufacturing, which dropped by 7.3 per cent over the same period, and stagnation in the contributions to GDP from most other sectors. The most valuable minerals in terms of sales value are coal, PGMs, gold, and iron ore.

Yet there is a stark contrast between the mineral wealth of the country and the poverty in which the majority of mining communities live. The proximity and visibility of mines and the large amounts of capital available to them have made the mining sector a primary target for politicians and other sectors of civil society who believe that it is the responsibility of the mining sector to promote the development of these communities. The failure of South Africa's government, and in particular local government, to successfully develop these communities has placed additional pressure on mines to take the lead in the socio-economic development (SED) of the areas in which they operate. This increased pressure is evident in the additional regulations forcing mining companies to contribute more directly to social development, particularly in the form of the revised Mining Charter and its delineation of the roles and responsibilities, as well as targets, for the mining sector in terms of socio-economic development.

Community unrest and protests have also been of concern as communities have taken to the streets to express their dissatisfaction with the impact that mines are having on their lives, and more recently these protests have resulted in deaths. This is primarily related to issues of local employment and procurement, as well as the communities' perception that SED programmes are having insufficient impact.

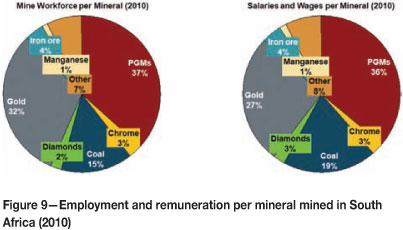

The state of the platinum industry in South Africa

South Africa is the largest producer of PGMs globally and is estimated to have the greatest PGM reserves on the globe, accounting for 96 per cent of total reserves (US Geological Survey, 2011). Within South Africa, PGMs generate the highest revenue of all minerals, accounting for 26 per cent of mining revenue and of the R930 billion market capitalization of the top 39 mining companies listed in South Africa, platinum miners accounted for the greatest proportion at 40 per cent in 2011 (PriceWaterhouseCoopers, 2011). The PGM mining sector is the largest employer within the mining industry, employing 37 per cent of the total mining and quarrying workforce, and contributing the greatest total amount in salaries and wages at R26.7 billion in 2010 (SA Chamber of Mines, 2011).

From an economic perspective, the importance of the platinum sector to the South African economy cannot be underestimated. However, an array of challenges faces platinum miners. The platinum mining sector has arguably been the hardest hit by the strained relationships described above. In turn, the presence of South Africa's platinum mines in some of the poorest parts of the country, affected by the apartheid legacy, contributes significantly to the strain on the relationship between government and mines as the responsibility for the development of these communities is passed between both parties. Government interventions forcing mines to increase the extent of their SED activities are felt acutely by the platinum sector in these areas and are placing undue pressure on profit margins.

Monitor's research indicates that stakeholder relationships are not well managed by the industry. This has led to vastly differing opinions amongst mine, community, and local municipality representatives as to the efficacy of the SED programmes put in place by mines and the ability of mines to target the correct focus areas identified by communities as being of greatest concern to them. A reliance on engaging with local municipalities as a proxy for community representation by many companies is failing, as there is a clear gap between the perceptions of community representatives and representatives from municipalities.

The need to engage directly with communities, as well as all other stakeholders, is apparent and provides the best opportunity for establishing positive working relationships between mines and their stakeholders, particularly the communities in which they operate.

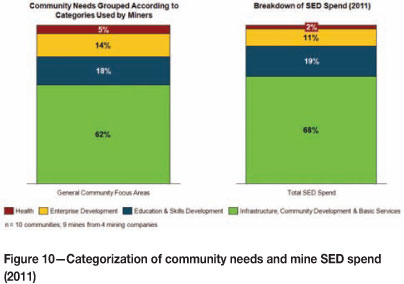

Mines are making large investments in SED. The top seven platinum miners in South Africa spent close to half a billion rand on SED in 2011. There is a degree of alignment regarding the areas on which mines are spending and the general focus areas that communities indicate as being of priority (Figure 10).

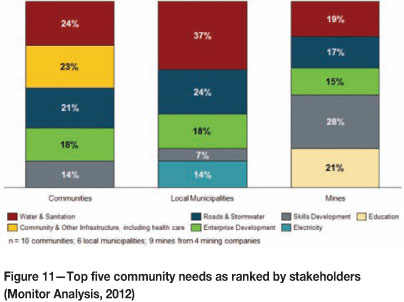

However, a closer investigation reveals significant disparity between the specific needs identified by mines, communities, and local municipalities (Figure 11).

This suggests that, while mines have an overall understanding of the needs of communities, this understanding appears superficial in that it does not encompass the specific needs cited by individual mine communities.

Also evident in the breakdown of SED spend shown in Figure 10 is the disproportionate amount of money going to infrastructure-related projects. Such investment is skewed towards the short-term with a focus on the creation of immediate and visible impact, as opposed to investment into projects that could have lasting long-term impact on communities and support their development to the point where they are no longer economically dependent on mines. This does not negate the need for investment into community infrastructure, but highlights the importance of developing a balanced SED portfolio that incorporates long-term community sustainability as a primary goal.

The disparity between what mines and local municipalities perceive compared to what mine communities believe is a strong indicator that stakeholder relationships are not being managed successfully. While the reality on the ground is that it is difficult to meet all community needs, as well as being challenging to identify true community representatives, solutions need to be put in place to address this disparity. Also, despite being the elected leaders and official representatives of their communities, local municipalities do not always have sufficient resources or the capacity to successfully intermediate between communities and mines, leaving the onus on mining companies to institute effective tools for direct community engagement.

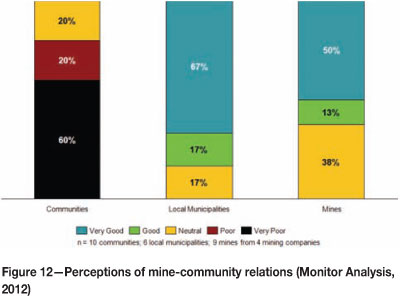

A powerful example of the misalignment between mines and their communities is illustrated in Figure 12. Mine representatives appear unaware of the extent of the negative relationship that exists between themselves and communities.

It is not economically viable for mines to avoid the issue of effective stakeholder engagement, as recent protests by communities and unions have shown. Mine stoppages have led to significant losses in platinum production. One of the latest examples of union unrest caused one of the majors significant damage and almost halved the output of refined platinum from its operations over the first quarter of this year (Odendaal, 2012).

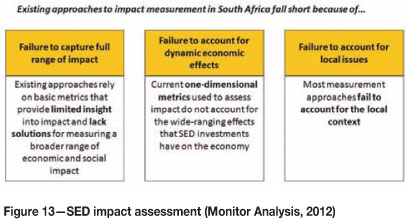

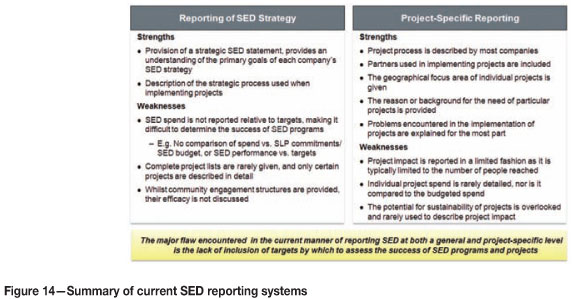

Despite the commitment of mines to the development of their surrounding communities, the reporting measures used to assess SED efficacy and success are limited and do not fully reflect the results of their SED programs. Unlike operational performance metrics, which are detailed and cover a variety of aspects of performance, SED performance is rarely tracked as effectively. This limits the ability of mines to accurately assess the impact that they are having and to identify strengths and weaknesses in their programmes to be built upon or corrected. The general areas in which impact measurement as performed by South African companies fall short are summarized in Figure 13.

The primary failing of South African platinum miners in their SED reporting is the lack of the inclusion of targets. As a result, it is difficult for stakeholders to assess the success of companies' SED endeavours, as laid out in their annual and social development reports. The strengths and weaknesses of both the general and project-specific reporting of SED by South African platinum miners are shown in Figure 14.

Recommendations

There are three key actions that platinum miners can take to help mitigate the challenges and risks of operating in the complex socio-political environment in which they find themselves. These actions are best taken together, as each solves for a specific issue and their outcomes will form an effective approach to meaningful and successful SED.

Effective measurement and reporting systems

The development and implementation of effective measurement and reporting systems is crucial to any solution to ensure that SED programmes have a high level of impact and that the needs of stakeholders are addressed, and are seen to be addressed.

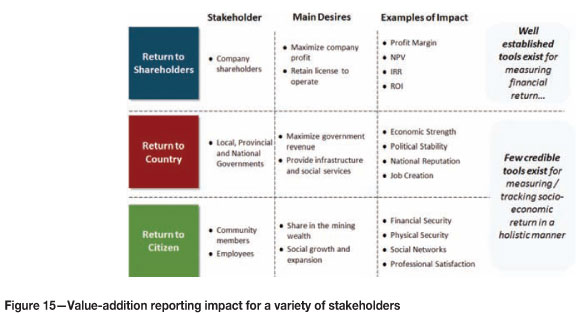

The measurement and reporting of SED must account for the differing ways in which each stakeholder views and measures value creation and impact. Sophisticated measures of showing return to shareholders exist and are well-suited to the needs of these stakeholders. However, there is a dearth of relevant reporting metrics to show the impact that mining operations have on the countries and communities in which they operate. Figure 15 summarizes the differences in requirements with regards to reporting on value creation across different stakeholders.

Inclusive solutions

In an inclusive development approach, an enterprise uses its resources or expertise to develop or support solutions that improve the community or region in which it is doing business. Inclusive solutions, done right, align the objectives and integrate the capabilities of all stakeholder groups, thus increasing the benefits for all parties.

Market-based solutions (MBSs), for instance, can help regions make a significant difference in the fight against poverty by delivering social impact in a sustainable way, at scale. MBSs engage poor people as customers, offering them socially beneficial products at prices they can afford, or as business associates-suppliers, agents, or distributors- providing them with improved incomes. Effective MBSs develop local value chains and allow local entrepreneurs to compete as primary suppliers in established value chains.

To date, MBSs have not been widely used in the mining industry. One of the best examples is the Anglo Zimele Fund, which was designed by Anglo American to be an independent investment vehicle for enterprise development. The fund was established 20 years ago to develop a network of small businesses to support Anglo's core business, but its autonomous structure allows the fund to pursue opportunities unrelated to Anglo American, including joint initiatives with government, NGOs, and other partners. Since its inception, the Anglo Zimele Fund has invested R318 million and supported more than 500 businesses.

Another example is an entrepreneurial venture in South Africa that employs more than 50 local mining community residents to convert waste rock from mining operations to aggregate. The venture then sells the aggregate back to the mine. MBSs also have been used by mining companies to foster local participation in the supply of personal protection equipment, transport of both labour and materials, brickmaking, construction, and laying of pipes and tracks, to name a few.

Effective use of MBSs is far more prevalent in other sectors. Nestlé Pakistan uses an innovative MBS to help support local milk producers. The company collects milk directly from 160 000 small Pakistani farmers spread across 125 000 square kilometres of land primarily in Punjab. The end-to-end business takes in 500 million litres of milk a year, and in 2008 turned a net profit of $20.7 million on revenues of $456 million.

Stakeholder engagement

Stakeholder engagement is difficult, but is ever more crucial as community actions and strikes increasingly threaten the operability and profitability of mining operations, and as government intervention increases and regulations tighten. Failure to effectively pre-empt and address stakeholder concerns will continue to adversely affect the already tough operating conditions that platinum miners face.

Creating shared value for stakeholders and companies is the most effective way to approach stakeholder engagement. It is less about influencing or manipulating the viewpoints of stakeholders, and more about developing a deep understanding of stakeholders' issues and needs. Such an understanding enables companies to identify areas of overlap between their needs and those of their stakeholders.

This allows for the establishment of relationships in which all parties benefit, and trade-offs are made effectively and with minimal detriment to those involved.

An in-depth assessment of the stakeholder landscape is required to identify the various stakeholders to be engaged, what their key issues are, and what it is that they value most. Stakeholders should be grouped according to their similarities where possible. Examples of such groupings are by industry, by government departments, or based on identified needs. This aids in efficiently engaging a larger set of stakeholders with a single message and approach. However, while efficiency is important it is necessary to have at least a degree of customization for interactions with individual stakeholders. Such customization will be informed by the stakeholder assessment and knowledge gained through it. Determining the degree of influence that each stakeholder has with regards to the overall stakeholder landscape is important to allow the company to prioritize its available resources on the most influential players.

Developing specific and focused engagement plans and identifying the most appropriate points for intervention with each stakeholder is imperative to ensuring that communication is effective and reaches the correct audience. Doing this requires an understanding of what motivates each stakeholder and drives their individual behaviour patterns. This will enable the company to find common ground with stakeholders and to identify 'win-win' situations, whereby the needs of the company and those of the stakeholder can both be met.

Throughout the process of stakeholder engagement, the effective tracking of results is crucial to understanding the efficacy of the company's strategy and to providing insight into where improvements can be made. This is of particular importance, as stakeholder engagement is a long-term process and the methods of engagement used, as well as the needs of the stakeholders themselves, will change over time, requiring the evolution of stakeholder engagement processes.

Conclusion

As foreign investment grows in Africa, particularly within the minerals sector, various challenges will come to the fore. The primary challenges to be faced will come from national governments looking to protect their mineral wealth and to ensure that its extraction provides sufficient economic return to their economies and benefits for the electorate. Mining companies need to be proactive in their response to the above-ground risks that come with operating in the African context. This is particularly true for companies operating in South Africa and in the platinum sector, which is currently seeing the full extent of the damage that these risks can have on operations. The primary mitigating response proposed in this paper emphasises the need for the implementation of inclusive solutions, as well as for the development of effective stakeholder engagement strategies and measurement systems. These interventions will aid in the mitigation of above-ground threats that, if ignored, will have the inevitable effect of increasing operating costs, decreasing production, and straining profit margins to the point where operating in the South African context may become infeasible, despite the enormous value that South Africa's platinum reserves hold.

About Monitor

Monitor is an international consulting firm that works with the world's leading corporations, governments, and social sector organizations to drive growth. Monitor offers a range of services to deliver sustainable results: Strategy and Uncertainty, Innovation, Leadership and Organization, Marketing, Economic Security and Competitiveness, and Social Action.

Monitor brings leading-edge ideas, approaches, and methods to bear on clients' toughest problems and biggest opportunities.

© The Southern African Institute of Mining and Metallurgy, 2013.

ISSN 2225-6253. This paper was first presented at the 5th International Platinum Conference 2012, 18-20 September 2012, Sun City, South Africa.