Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.113 n.1 Johannesburg Jan. 2013

MINERAL ECONOMICS

Considerations for the resource nationalism debate: a plausible way forward for mining taxation in South Africa

F.T. Cawood; O.P. Oshokoya

School of Mining Engineering, University of the Witwatersrand, Johannesburg, South Africa

SYNOPSIS

This article is a continuation of a series of publications by the authors on the international debate on resource nationalism, with specific reference to South Africa. Previous outcomes have shown that mine nationalization is not a solution for South Africa, and that maintaining stability of the current mineral and tax regimes is fundamental. It will not be wise to replace existing law and policy instruments until there is a better understanding of the distinction between fact and public perception about the impact of the current system. The new scheme of state custodianship linked to a mining royalty that effectively targets economic rents provides for effective resource use. The methodology in this article is to consider how South Africa's mineral tax regime can be tweaked to achieve optimal management and benefit from mineral extraction and associated rents by avoiding changes feared by investors. The major finding is that the current suite of instruments can be considered a suitable platform for optimal management of resource rents. However, it will be necessary to first investigate ways of improving the mineral beneficiation intent of the royalty structure, and secondly investigate whether the mineral rent portion of the royalty formula can be ring-fenced for the purpose of establishing a sovereign wealth fund.

Keywords: South Africa, resource nationalism, mining taxation, resource rent.

Introduction

In the current economic era, one of the major influences on the understanding of optimal mineral development is sustainable development (SD). SD can be defined as a concept that ensures that mineral resource development is commercially and economically viable, meets market demands for minerals, provides an environmentally responsible society, benefits the social interests of its citizens, assures economic growth, and supports effective governance. Its goals focus on contributing to the wellbeing of the present generation without destroying the potential for satisfying the wellbeing of future generations (as interpreted from the 1987 UN definition1). These goals would be achieved by managing and maintaining an equitable balance between the costs and benefits of mining and mineral resource development. It is now widely expected that the primary purpose of mining, like all other forms of economic activity, should, therefore, not only focus on creating wealth for the satisfaction of human needs, but also ultimately contribute to social welfare. The perceived lack or absence of social benefit caused the re-emergence of another old issue -resource nationalism (RN), to once again become a major consideration in the 21st century. However, in opposition to the negative application of RN (through nationalization) in the 1960s and 1970s, the current behaviour of RN must be understood in the context of a global search for the meaning of optimal mining3. In South Africa, the minerals sector is required to support and contribute to SD- a fundamental principle of the mining law framework4. Therefore, the focus of this paper is to elucidate RN considerations for the South African mineral fiscal regime in a SD context.

South African mining companies are already paying more taxes (relative to turnover) than other companies in the economy because of a combination of income tax and the recent introduction of mining royalties3. However, despite the facts indicating that these RN instruments, within the existing tax law and policy framework, already collect resources rents, it is suggested that the policy framework does not effectively distribute rents as benefits to citizens. Claims of non-delivery of benefits have caused public anger, and coupled with public unawareness of facts, these claims resulted in a fierce debate on whether mines should be nationalized. Hitherto, the political rhetoric needed an informed debate on resource nationalism, as the ANC (South Africa's ruling party) carried out further research on the state's role in mining. The result was the ANC SIMS (State Intervention in the Mineral Sector) report. The SIMS reports debunked the use of nationalization to achieve RN and recommended, amongst other things, that:

A Minerals Commission might be a better mechanism for regulating the industry

A Minerals Commission might be a better mechanism for regulating the industry

More economic linkages should be created from the mineral sector

More economic linkages should be created from the mineral sector

A resource rent tax (RRT) be introduced

A resource rent tax (RRT) be introduced

A sovereign wealth fund (SWF) be created and funded by proceeds of the RRT. The SIMS report recommends a structure to stabilize tax revenues, to invest in southern African regional trade infrastructure, to establish a development fund to invest in exploration, to conduct human development, minerals research and development of mining technology, minerals beneficiation hubs, and so forth.

A sovereign wealth fund (SWF) be created and funded by proceeds of the RRT. The SIMS report recommends a structure to stabilize tax revenues, to invest in southern African regional trade infrastructure, to establish a development fund to invest in exploration, to conduct human development, minerals research and development of mining technology, minerals beneficiation hubs, and so forth.

Although the SIMS report contains useful recommendations, the authors believe that patience is needed because the new regime is starting to make an impacts. Government should not be too hasty to change the system by introducing more and new instruments; instead it should maintain stability of the rules governing mineral development in South Africa. Some of the SIMS recommendations could be heeded, but the following must first be addressed:

Governance and corruption

Governance and corruption

Increased regulatory and compliance capacity of the DMR

Increased regulatory and compliance capacity of the DMR

Understanding how the new royalty regime actually impacts on mining revenues and rents

Understanding how the new royalty regime actually impacts on mining revenues and rents

The need to inform the public of the many existing resource nationalism instruments in the mineral and tax law and policy frameworks.

The need to inform the public of the many existing resource nationalism instruments in the mineral and tax law and policy frameworks.

Maintaining stability would give the government room to further investigate mechanisms for better delivery of public benefits, by realizing more optimal ways to use and manage the rents and benefits which its existing mineral law and fiscal framework are designed to extract. From the backdrop of having a significant amount of RN instruments ingrained in South Africa's mineral regime and proposition of stability in the administration of these laws, the focus of this paper is more on highlighting ways to optimize its existing mineral tax law and policy instruments.

Considerations for South Africa's mining tax regime

The instruments contained in South Africa's mining tax regime that could be interpreted as resource nationalism instruments include the following:

General tax compliance and minimizing exemptions from taxes

General tax compliance and minimizing exemptions from taxes

The sliding-scale nature of the gold income tax formula

The sliding-scale nature of the gold income tax formula

Mineral royalties

Mineral royalties

Diamond export levy

Diamond export levy

Special treatment of mine development capital

Special treatment of mine development capital

Ring-fencing of expenditure

Ring-fencing of expenditure

International rules on transfer pricing and residence-based taxation.

International rules on transfer pricing and residence-based taxation.

It is understood that taxation is important; first, to government because it uses it as the least risky and most secure way to claim its share of resource rents and manage fiscal flows for economic development; second, it is important to the public, who expect socio-economic benefits; and third, to companies, whose relatively short-term profit goal is required for rewarding investors. From the state's perspective, all resource rents can be taxed away without influencing the investment decision because the bonus is a direct result of resource and market characteristics. However, companies take a different view and argue that entrepreneurship optimizes the return and without allowing a significant portion of the rents to go their way, there will be no incentive to skilfully employ the factors of productions. These different perspectives on sharing of resource rents must take into consideration the peculiar risky nature of the mining business, and it is advised that miners and their investors must be respected for their unusual appetite for taking risks.

With this in mind, and knowing that it is unlikely that the perfect taxation regime will ever be developed, mineral fiscal policy-makers now favour the use of progressive taxes aimed at capturing rents, while combining fiscal policy with linkages issues. This would facilitate a transition from natural-resource dependency to a knowledge-based industrialized economy. The combination of tax and linkages has set the stage for tweaking the current system to allow for economic linkages and effective management of resource rents through a SWF. Many lessons can be learnt from countries like Norway, Australia, Botswana, China, and Chile that already have forms of SWFs. Issues of perceived non-delivery of benefits by the mining sector are matters relating to revenue management rather than revenue collection. The SIMS recommendation of a 50% RRT, over and above the existing rent-capturing instruments, is considered inappropriate. The existing tax law and policy framework already collects significant rents from this sector3. Furthermore, there is no justification in either the SIMS report or in the actual amounts collected from mining companies that a RRT will be more efficient than the current system, neither is there any evidence to suggest that a RRT will achieve the desired developmental objectives. Therefore, the introduction of a RRT would add to mining companies' tax burden, current confusion, and be a disincentive to invest in South Africa.

The existing royalty is a powerful resource nationalism instrument

This section takes a deeper look at the current royalty regime in order to confirm that it is a more efficient instrument for collecting resource rents than a RRT. In moving South Africa beyond mining to becoming a fully industrialized economy, we require the broadening of economic linkages. This move is in line with the African Mining Vision (AMV)6 Programme of Action for realizing linkages and diversification and requires that value-addition policies and strategies be developed to leverage mineral extraction and processing operations into broader economic developmental outcomes. In light of this, the Mineral and Petroleum Resources Royalty Act (MPRRA)7 provides beneficiation (refining) incentives. The intent is to facilitate mineral processing by encouraging mining companies to move up the value chain to become refiners. The MPRRA has an ad valorem sliding-scale formula method of charging royalties after classification as either refined or unrefined mineral resources. It imposes self-adjusting royalty rates according to the level of refinement and profitability. The rates for refined and unrefined minerals are calculated as follows:

where

Y% = annual rate of payment calculation = a + b

Y% = annual rate of payment calculation = a + b

a = minimum rate = 0.5%

a = minimum rate = 0.5%

b = 4.5% or 6.5%, depending on level of refinement and profitability. It quantifies the rent targeted by the formula

b = 4.5% or 6.5%, depending on level of refinement and profitability. It quantifies the rent targeted by the formula

EBIT slides the rate between (a) and (a+b)

EBIT slides the rate between (a) and (a+b)

a + b = the maximum rates of 5% and 7%, for refined and unrefined production respectively.

a + b = the maximum rates of 5% and 7%, for refined and unrefined production respectively.

The royalty amount is equal to Y% multiplied with the base that approximates gross sales. Research was conducted by Oshokoya8 to assess the impact of some of the policy intents of the MPRRA. Using a platinum case study, the research focused on the beneficiation (refining) policy objective. She found that the rent-collection aspect of the royalty regime seems satisfactory and would not necessarily deter investment. It allows for equitable sharing of economic benefits between state and mining companies, as royalties are charged in-sync with economic cycles. The effectiveness of the new royalty system is illustrated in Figure 1 and Table I).

Table I demonstrates the importance of mining fiscal flows to the South African economy in relation to other sectors. Mining taxes increased from R10 billion in 2009 (the year before the Royalty Act was introduced) to R25.7 billion in 2011 (the year after the Royalty Act was introduced).

Figure 1 and Table I illustrate that the impact of the new royalty regime, which came into force in March 2010, was already visible in the 2011 statistics. The mineral sector is certainly becoming more important to the national economy. Cawood9 estimated that the expected impact of the Royalty Act is about an 8% rise in mining's contribution to company taxes or, stated alternatively, in boom times mining taxes are expected to rise by about 50% after the introduction of the new royalty regime. This prediction proved to be realistic as the actual rise was 47% from 2010 to 2011. The statistics, therefore, suggest that additional resource rent taxation is not necessary.

In assessing the beneficiation intent of the MPRRA, Oshokoya found that the imposition of this regime is in accordance with global trends of using fiscal instruments to encourage sector initiatives such as realizing industrialization. The methodology used by her8 to assess the beneficiation intent was based on Bradley's10 and Cawood's9 analysis. The Western Australian royalty system specifies that royalty rates are scaled downward with successive stages of processing - from mine head production until the refined stage (Table II).

The system also assumes the cost required per stage of processing, which cost is also expressed as a share of final refined product price. Figure 2 represents a summary of Bradley's conclusions on which the Western Australia's royalty system is based.

From Figure 2, it is observed that the beneficiation policy objective is realized when the unrefined rate shifts down to the refined rate, which implies that there is a negative relationship between the royalty rate and unit price. The area A represents the royalty savings which accrues to the mine for taking on refinement. Of this area, value added to a mine's profitability is given as the difference between the price received for final product and the total cost required to bring production to this desired state of mineral processing. Based on Table II and Figure 2, if the price for refined product is higher than the specified value, but processing costs and royalty rates remain the same (which means that area A would increase), there would be significant value-add to the developer whose royalty payment is charged based on refined production10. However, if the refined product price is lower than the prescribed value, the reverse would be true. Furthermore, if processing costs are higher than prescribed values, the value-added portion reduces, thereby causing the reduced royalty rate for processed minerals to be a disincentive. Bradley concluded that the crux of the matter is whether the amount of value added is significant enough to motivate the miner to go ahead with the investment decision to refine. Such value-addition investment decisions can only be justified when the difference in unit price less value-addition cost is greater than the additional costs incurred in refined production. In other words, since the value of concentrate is deemed to be 50% of the price for refined metal, and an additional cost is required to take concentrate to refined metal stage, if the amount of value added is not significantly greater than this cost, it would not be worthwhile to invest in bringing on a refining facility.

In the South African context, for the purpose of carrying out an economic analysis similar to that done by Bradley's team, a model was developed based on Bradley's approach9. The model factored in the differences between the unique features of the Western Australian and South African royalty regimes, in light of the MPRRA's profitability (EBIT) and minimum royalty level components. Figure 3 depicts such analysis in which royalty rates vary with price.

The price index in Figure 3 represents the sales price for final product (either unrefined or refined). This index was used as a proxy for gross revenue and it is made up of different proportions of production costs plus EBIT (profit). For example, at price index of 100, the proportion of production costs is equal to sales price received, implying that no profit was made and, therefore, the royalty rate of 0.5% would still be paid by the producer at this price index. Furthermore, it should be noted that the reduction in price indices implies that the lower the price index, the lower the proportion of production costs in relation to sales price is, and conversely, the higher the EBIT portion8. Therefore, at each level of price index, the royalty rate that the producer would pay is specified. Also, area B depicts the royalty savings that would accrue to the developer that takes on refinement. However, comparing the South African regime with Bradley's work on the Western Australian system, this area B available to support value-add, is smaller than A.

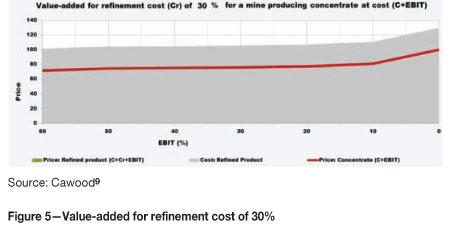

The price received for refined product (indexed at 100%), being expressed as a combination of cost of concentrate plus cost of refinement plus EBIT, is varied against different levels of refinement costs - 10% and 30% of the price of final product, to determine the amount of value that would be added to the miner-turning-into-refiner. It was found that value-add diminishes as the proportion of refinement cost increases (Figures 4 and 5).

In Figure 4, value-added starts at about 5% profitability and continues increasing to a profitability of about 20% (reading the graph from right to left). Between 20% and 60% profitability, the magnitude of value-add remains fairly constant. The expectation that the magnitude of the value-add must exceed the (10%) refinement cost (indicated by the grey section above the red line), is met above an EBIT of about 10%. From Figure 5, where refinement cost constitutes 30% of sales price, no value is added at any rate of profitability. Therefore, it can be concluded that with the current parameters of the royalty formulae, when refinement cost is more than 10% of total price, value is added. However, value reduces as the refinement cost component increases and by the time it gets to 30% of the sales price, value is destroyed when miners refine their production. Considering the cost required for refinement (Table II suggests that such cost is in excess of 30%), the South African royalty regime is unlikely to motivate miners to become refiners.

In addition, Oshokoya8 carried out further econometric analyses to assess the MPRRA's beneficiation policy intent. It was observed that the 'before and after' effects of the application of the royalty formula on EBIT and profitability, indicated that during both good and bad times it was more advantageous to miners to produce concentrates rather than refined products. However, when a stand-alone assessment for royalties paid was carried out as shown in Figure 6, it was observed that significant royalty savings were obtained on refined products, as opposed to that of unrefined products. This royalty savings is depicted by the area S.

The savings in Figure 6 were obtained because smelting and refining ongoing capital expenditure were not factored in. When the capital required to bring concentrates to the refined state was added, these savings were wiped out from 2008 - as shown in Figure 7.

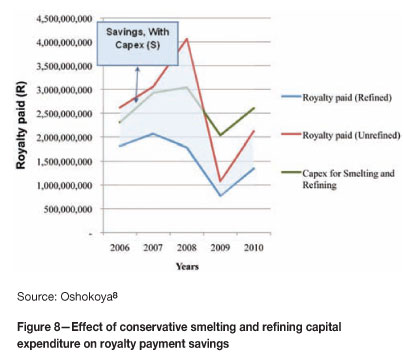

The analysis and results from Figures 6 and 7, which check the effect of total cost (inclusive of capital) on the royalty savings, were based on actual data obtained from the annual reports of the platinum case study. One can argue that there was a temptation in 2008 to overspend on costs as a result of higher revenues, which caused savings to disappear. However, conservative analyses on smelting and refining capital expenditure were also carried out. Here, the substantial capital costs expensed from 2008 were reduced to R1.26 billion (Figure 8). This (average) amount was used for years 2008 to 2010, resulting in more savings, which savings disappeared in 2009 and 2010.

From Figure 8, it can be observed that in years 2006 to 2008, value would have been added to the miner-turned-refiner's financial position, provided this producer had incurred moderate smelting and refining capital costs. However, for 2009 and 2010, even with conservative capital expenditure, the regime's reduced royalty rate for refined production would not have been an incentive for spending the refinement capital. From this analysis, it can be reasoned that the regime's beneficiation incentive will encourage miners to become refiners only during commodity boom periods. Therefore, Oshokoya's final conclusion was that the MPRRA's beneficiation incentive was insufficient and not likely to encourage platinum miners to become refiners. Hitherto, seeing that the equitability and efficiency characteristics of the MPRRA were briefly proven to be sound, and although the beneficiation provisions appeared to be incapable of realizing the mineral beneficiation objective of the South African government, it was recommended that this initiative should not be discarded. Instead, further studies could be undertaken to investigate ways of improving the design of the regime to achieve its policy objectives. This recommendation suggests that one option is that the parameters of the royalty formula could be tweaked to enable the miner-turning-into-refiner to 'save' on royalty payment, by ensuring that the expenses incurred when refining are offset by the value-add to the mining business.

Management and distribution of resource rents

Having established that the South African government already receives a fair contribution from its mining sector due to the different taxation schemes imposed on it, the question arises ... why is this perceived not to result in delivered benefit? There are many potential answers to this question, for example:

The public does not know how much mining companies are contributing to the fiscus

The public does not know how much mining companies are contributing to the fiscus

Ineffective administration of the MPRDA

Ineffective administration of the MPRDA

Corruption leading to the leakage of benefits

Corruption leading to the leakage of benefits

Lack of government capacity to disseminate benefit.

Lack of government capacity to disseminate benefit.

In ensuring efficiency in the delivery of benefits, the focus should be on investigating and improving the existing resource nationalism instruments, rather than sweeping changes to the system. Singh and Evans stated that 'countries need to rethink how they will reinvest this wealth into long-term sustainability'11. In order to achieve this national objective, some mineral-rich governments have set up initiatives such as sovereign wealth funds (SWFs) to serve as vehicles to contribute to economic development. Norway, for instance, has displayed success in outgrowing natural resources dependence and converting extractive industry rents to more productive capital12.

In Africa, the AMV implementation phase strategically placed, as its first programme cluster of activities, the effective use and management of resource rents extracted from a sustainable and well-governed mining sector to transform the continent's social and economic development path. Its action plan states that, in order to achieve this, African states have to, first, channel financial inflows from mining into long-term physical and social capital and second, include systems that allocate part of the mineral revenues to communities and local authorities near mining areas. The necessary activity to achieve this is to 'explore strategies for investing windfall earnings and mineral rent into sovereign wealth funds including stabilizationfunds and infrastructure funds'14. The SIMS preference for efficient taxation instruments instead of equity participation as a means of collection of rents for delivery of benefits to its citizens is supported, especially if captured rents could be reinvested in a SWF to maximize long-term development to also benefit future generations. However, in the opinion of the authors, there might be problems with the proposition to use RRT. Although the RRT appears to have much appeal in theory and a number of countries have experimented with it, there is not much published evidence of its successes as a significant revenue-raiser in practice. According to Sunley and Baunsgaard13, some reasons for the dysfunction of the RRT include:

Difficulty of designing a RRT truly aimed at rents

Difficulty of designing a RRT truly aimed at rents

Difficulty in implementing the tax, particularly in the choice of valuation methodology, appropriate threshold rate of return (discount rate) and the rate of tax

Difficulty in implementing the tax, particularly in the choice of valuation methodology, appropriate threshold rate of return (discount rate) and the rate of tax

Increased possibility of tax avoidance, especially in countries with weak tax administration dealing with multinationals having extensive knowledge and capacity in this area

Increased possibility of tax avoidance, especially in countries with weak tax administration dealing with multinationals having extensive knowledge and capacity in this area

'Noise' created by having too many tax instruments.

'Noise' created by having too many tax instruments.

Based on the above facts, coupled with the impact of yet another change to the fiscal regime, there is no need to 'reinvent the wheel' and create further investment and administrative confusion through the addition of RRT. Therefore, seeing that the country already receives significant rents from its existing instruments, more rents would be targeted if the new MPRRA could provide for the rent portion of the royalty to be ring-fenced and used to finance a SWF. Also, with the royalties being at the first stream of income generation, capturing of the rent portion is not only calculated but assured from the beginning. This would be one example of sustained rent-capturing in a near-optimal manner.

Conclusion and recommendation

Resource nationalism is already firmly entrenched in the mineral and tax regimes of South Africa. The purpose of this article is to effectively contribute to the fundamental discussion on resource nationalism and how South Africans benefit from its mineral riches. The major finding is that the current system can be tweaked to become an appropriate platform for further improvement and optimal management of resource rents. The recommendation is for the National Treasury to consider:

1. Further research on how the parameters of the royalty structure could be adjusted to encourage miners to become refiners, and

2. Using the mineral rent portion of the royalty formula as a ring-fenced sovereign wealth fund.

References

1. UN Report of The World Commission on Environment and Development. UNGA Resolution 42/187 of 11 December 1987 (96th plenary meeting). [ Links ]

2. Oshokoya, O.P. Mineral rents and sustainable development. Assignment submitted to the Degree of Graduate Diploma in Engineering for Mineral Economics MINN7014, School of Mining Engineering University of the Witwatersrand, South Africa, 2009. [ Links ]

3. Cawood, F.T and Oshokoya, O.P. Resource nationalism in the South African mineral sector: Sanity through stability. Journal of the Southern African Institute of Mining and Metallurgy, vol. 113, no. 1, 2013. pp. 45-52. [ Links ]

4. South Africa. Mineral and Petroleum Resources Development Act 28 of 2002 as amended, 3 October 2002. Government Gazette, vol. 448, no. 23922, (Date of commencement 1 April 2004). [ Links ]

5. African National Congress. Maximising the Developmental Impact of the People's Mineral Assets: State Intervention in the Minerals Sector (SIMS). http:// anc.org.za/docs/discus/2012/sims.pdf. [ Links ]

6. The African Mining Vision (AMV) was adopted by the African Union (AU) Heads of State in 2009. [ Links ]

7. South Africa. Mineral and Petroleum Resources Royalty Act 28 of 2008. Government Gazette, no. 31636, vol. 521. Assented to 17 November 2008 and signed into law 24 November 2008. (As amended). [ Links ] Mineral and Petroleum Resources Royalty (Administration) Act 29 of 2008. Government Gazette, vol. 521, no. 31642, 26 November 2008 (As amended). [ Links ]

8. Oshokoya, O.P. The New South African Mineral Royalty Formulae. Will It Encourage Miners To Become Refiners? Platinum Case Study. M.Sc. thesis, Faculty of Engineering and the Built Environment, University of the Witwatersrand, Johannesburg, 2012. [ Links ]

9. Cawood, F.T. An investigation of the potential impact of the new South African Mineral and Petroleum Resources Royalty Act. Journal of The Southern African Institute of Mining and Metallurgy, vol. 111, no. 7, 2011. http://www.saimm.co.za/Journal/v111n07p443.pdf. [ Links ]

10. Bradley, P.G. A report of the Mineral Revenues InquiryThe Study into Mineral (Including Petroleum) Revenues in Western Australia, Western Australia. Government Printer, Western Australia, 1986. vol. 1 and 2. [ Links ]

11. Singh, I. and Evans, J. Natural resource-based sustainable development using a cluster approach. http://www.omicc.ca/doc/Singh_anEvans (2009).pdf [Accessed April 2012], pp. 183 - 200:] [ Links ].

12. SWF Institute. Norway Government Pension Fund Global; NBIM. Retrieved from SWFI Network: http://www.swfinstitute.org/swfs/norway-government-pension-fund-global. 2012. [ Links ]

13. Sunley, E. M. and Baunsgaard, T. The Tax Treatment of the Mining Sector: An IMF Perspective. Retrieved 2011, from http://siteresources.worldbank.org/INTOGMC/Resources/sunley-baunsgaard.pdf. 2001. [ Links ]

14. African Union. Building a sustainable future for Africa's extractive industry: From vision to action: Action plan for implementing the AMV. pp. 13, December 2011. www.africaminingvision.org/amv_resources/AMV/Action%20Plan%20Final%20Version%20Jan%202012.pdf. [ Links ]

© The Southern African Institute of Mining and Metallurgy, 2013. ISSN2225-6253. Paper received, 1-2 August 2012.