Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.112 n.9 Johannesburg Jan. 2012

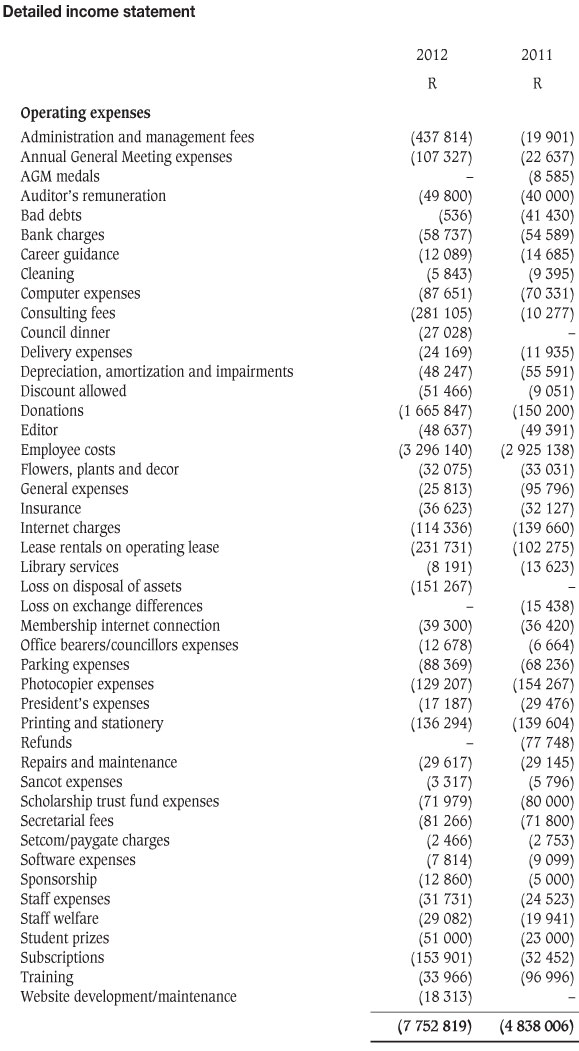

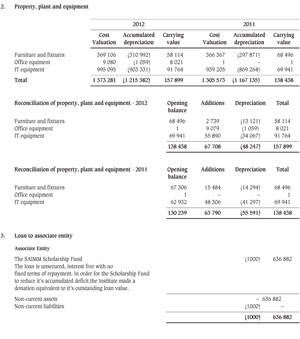

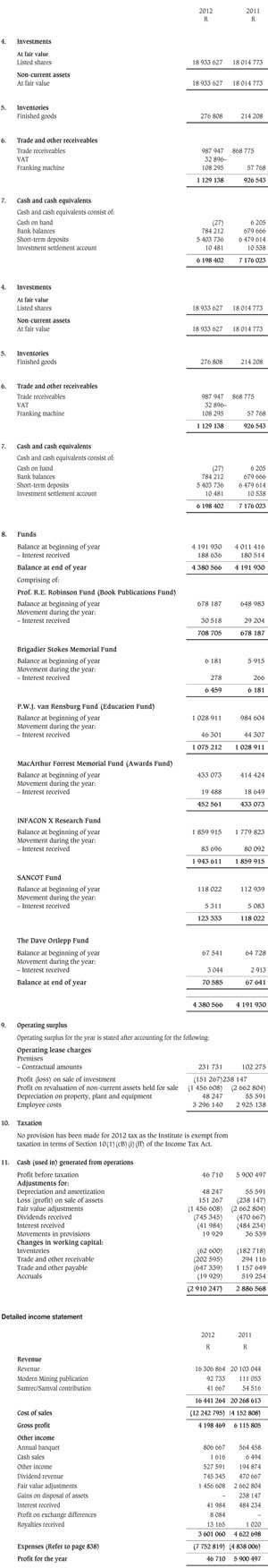

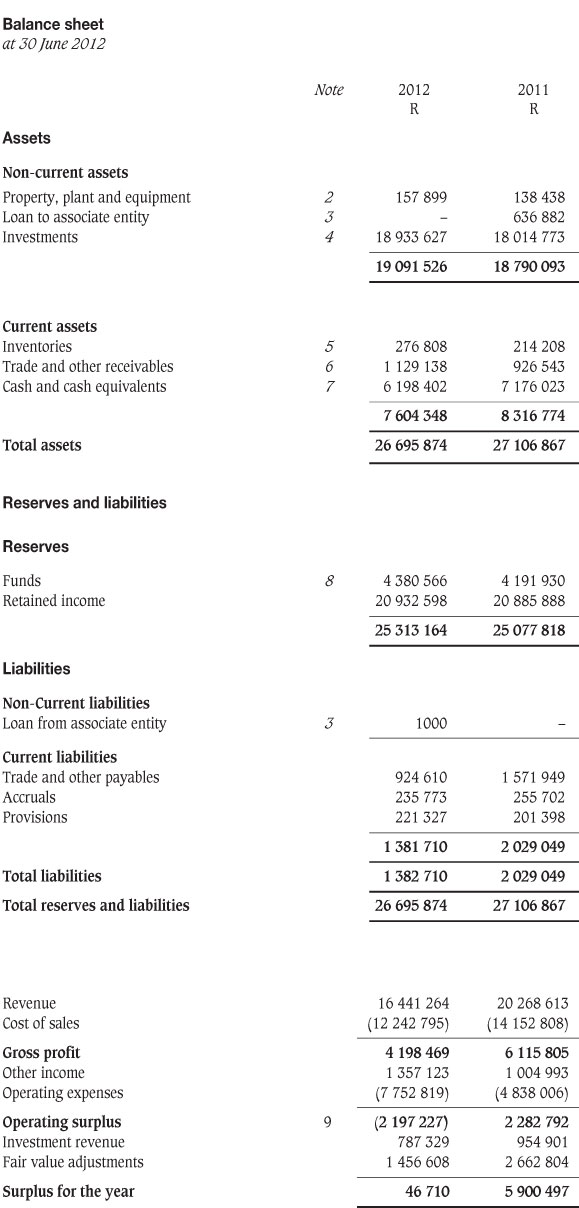

ANNUAL FINANCIAL STATEMENTS

The Southern African Institute of Mining and Metallurgy

Annual Financial Statements

for the year ended 30 June 2012

Council members' responsibilities and approval

The council members are required to maintain adequate accounting records and are responsible for the content and integrity of the annual financial statements and related financial information included in this report. It is their responsiblity to ensure that the annual financial statements fairly present the state of affairs of the Institute as at the end of the financial year and the results of its operations and cash flows for the period then ended, in conformity with the accounting policies appropriate to the Institute. The external auditor is engaged to express an independent opinion on the annual financial statements.

The annual financial statements are prepared in accordance with the accounting policies appropriate to the Institute and are based upon appropriate accounting policies consistently applied and supported by reasonable and prudent judgements and estimates.

The council members acknowledge that they are ultimately responsible for the system of internal financial control established by the Institute and place considerable importance on maintaining a strong control environment. To enable the council members to meet these responsibilities, the council set standards for internal control aimed at reducing the risk of error or loss in a cost-effective manner. The standards include the proper delegation of responsibilities within a clearly defined framework, effective accounting procedures, and adequate segregation of duties to ensure an acceptable level of risk. These controls are monitored throughout the Institute and all employees are required to maintain the highest ethical standards in ensuring the Institute's business is conducted in a manner that in all reasonable circumstances is above reproach. The focus of risk management in the Institute is on identifying, assessing, managing and monitoring all known forms of risk across the Institute. While operating risk cannot be fully eliminated, the Institute endeavours to minimize it by ensuring that appropriate infrastructure, controls, systems, and ethical behaviour are applied and managed within predetermined procedures and constraints.

The council members are of the opinion, based on the information and explanations given by management, that the system of internal control provides reasonable assurance that the financial records may be relied on for the preparation of the annual financial statements. However, any system of internal financial control can provide only reasonable, and not absolute, assurance against material misstatement or loss.

The external auditor is responsible for independently reviewing and reporting on the Institute's annual financial statements. The annual financial statements have been examined by the Institute's external auditor and his report is presented on page 825.

The annual financial statements set out on pages 825-837, which have been prepared on the going concern basis, were approved by the council and were signed on their behalf by:

Signed by: J.N. van der Merwe 15 August 2012

President Date:

Signed by: J.L. Porter 15 August 2012

Treasurer Date:

Report of the independent auditor

To the members of The Southern African Institute of Mining and Metallurgy

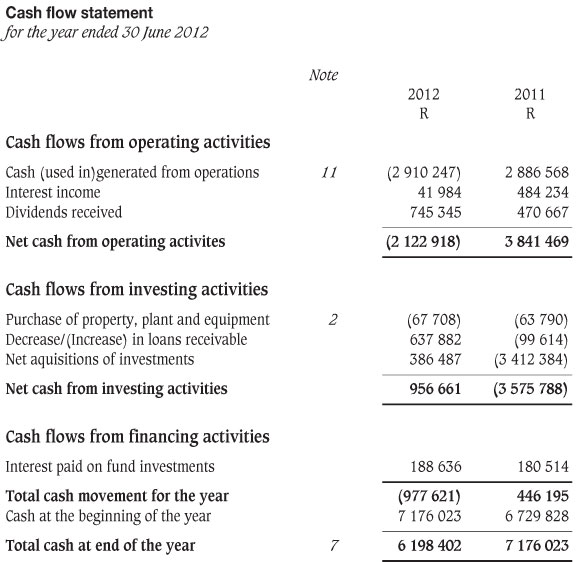

I have audited the annual financial statements of The Southern African Institute of Mining and Metallurgy set out on pages 823 to 837, which comprise the statement of financial position as at 30 June 2012, the statement of comprehensive income, statement of changes in reserves, and statement of cash flow for the year then ended, and a summary of significant accounting policies and other explanatory notes, as set out on pages 825 to 837.

Council members' responsibilty for the Annual Financial Statements

The Institute's council members are responsible for the preparation and fair presentation of these annual financial statements in accordance with the accounting policies appropriate to the Institute and for such internal control as the council members determine is necessary to enable the preparation of annual financial statements that are free from material misstatement, whether due to fraud or error.

Auditor's responsibility

My responsibility is to express an opinion on these annual financial statements based on my audit. I conducted my audit in accordance with International Standards on Auditing. These standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the annual financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the annual financial statements. The procedures selected depend on the auditor's judgement, including the assessment of the risk of material misstatement of the annual financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Institute's preparation and fair presentation of the annual financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the annual financial statements.

I believe that the audit evidence obtained is sufficient and appropriate to provide a basis for my audit opinion.

Opinion

In my opinion, the annual financial statements present fairly, in all material respects, the financial position of The Southern African Institute of Mining and Metallurgy as at 30 June 2012, and its financial performance and its cash flows for the year then ended in accordance with the accounting policies appropriate to the Institute.

Supplementary information

Without qualifying my opinion, I draw attention to the fact that supplementary information set out on pages 836 to 837 does not form part of the annual financial statements and is presented as additional information. I have not audited this information and accordingly do not express an opinion thereon.

AUDITOR: R.H. Kitching

Chartered Accountant (S.A.)

Registered Accountant and Auditor

Accounting policies

1. Presentation of annual financial statements

The annual financial statements have been prepared in accordance with accounting policies appropriate to the Institute. The annual financial statements have been prepared on the historical cost basis, except for the measurement of certain financial instruments at fair value, and incorporate the principal accounting policies set out below. They are presented in South African Rands.

These accounting policies are consistent with the previous year.

1.1 Significant judgements and sources of estimation uncertainty

In preparing the annual financal statements, management is required to make estimates and assumptions that affect the amounts represented in the annual financial statements and related disclosures. Use of available information and the application of judgement is inherent in the formation of estimates. Actual results in the future could differ from these estimates which may be material to the annual financial statements. Significant judgements include:

Provisions

Provisions were raised and management determined an estimate based on the information available.

Inventories

The inventories of publications are held and sold by the Institute for its own account and on behalf of its publishing partners who have underwritten some of the publications. The inventories are reflected in the financial statements at nominal value. The inventory of authors' gifts and stock held from conferences are carried at cost. Provision is made for impairment.

1.2 Property, plant and equipment

The cost of an item of property, plant and equipment is recognized as an asset when:

- It is probable that future economic benefits associated with the item will flow to the organization; and

- The cost of the item can be measured reliably.

Maintenance and repairs which neither materially add to the value of assets nor appreciably prolong their useful lives are charged against income.

Property, plant and equipment are carried at cost less accumulated depreciation and any impairment losses.

Depreciation is provided using the straight-line method to write off the depreciable amount of items, other than land, over their estimated useful lives, using a method that reflects the pattern in which the assets' future economic benefits are expected to be consumed by the organization. Depreciation is provided on leasehold improvements over the remaining period of the lease.

Item Useful life

Furniture and fixtures 5 years

Office equipment 5 years

IT equipment 3 years

Gains and losses on disposals are determined, by comparing the proceeds with the carrying amount and are recognized in surplus or deficit in the period.

The depreciation charge for each period is recognized in surplus or deficit. Medals, plaques, dies and banners are recorded at nominal values.

Accounting policies

1.3 Impairment of assets

The Institute assesses at each balance sheet date whether there is any indication that an asset may be impaired. If any such indication exists, the Institute estimates the recoverable amount of the asset.

If the recoverable amount of an asset is less than its carrying amount, the carrying amount of the asset is reduced to its recoverable amount. That reduction is an impairment loss.

An impairment loss of assets carried at cost less any accumulated depreciation or amortization is recognized immediately in surplus or deficit. Any impairment loss of a revalued asset is treated as a revaluation decrease.

1.4 Financial instruments

Initial recognition

The Institute classifies financial instruments, or their component parts, on initial recognition as a financial asset, a financial liability, or an equity instrument in accordance with the substance of the contractual arrangement.

Financial assets and financial liabilities are recognized on the Institute's balance sheet when the Institute becomes party to the contractual provisions of the instrument.

Financial assets and liabilities are recognized initially at cost; any transaction costs that are directly attributable to the acquisition or issue of the financial instrument are added to the cost.

Subsequent measurement

After initial measurement, financial assets are measured as follows:

- Loans and receivables and held-to-maturity investments are measured at amortized cost less any impairment losses recognized to reflect irrecoverable amounts.

After initial recognition, financial liabilities are measured as follows:

- Financial liabilities at fair value through surplus or deficit, including derivatives that are liabilities, are measured at fair value.

- Other financial liabilities are measured at amortized cost using the effective interest method.

Gains and losses

A gain or loss arising from a change in a financial asset or financial liability is recognized as follows:

- Where financial assets and financial liabilities are carried at amortized cost, a gain or loss is recognized in surplus or deficit through the amortization process and when the financial asset or financial liability is derecognized or impaired.

- A gain or loss on a financial asset or financial liability classified as at fair value through surplus or deficit is recognized in surplus or deficit.

1.5 Inventories

Inventories are measured at the lower of cost and net realizable value.

The cost of inventories comprises of all costs of purchase, costs of conversion, and other costs incurred in bringing the inventories to their present location and condition.

Net realizable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale.

Accounting policies

1.6 Provisions and contingencies

Provisions are recognized when:

- The Institute has an obligation at the reporting period date as a result of a past event;

- It is probable that the company will be required to transfer economic benefits in settlement; and

- The amount of the obligation can be estimated reliably.

Provisions are not recognized for future operating losses. Provisions are measured at the present value of the amount expected to be required to settle the obligation. The increase in the provision due to the passage of time is recognized as interest expense.

1.7 Revenue

Revenue is recognized to the extent that it is probable that the economic benefits will flow to the Institute and the revenue can be reliably measured.

Interest is recognized, in profit or loss, using the effective interest rate method. Donations are recognized as and when received.

Dividends are recognized, in profit or loss, when the Institute's right to receive payment is established.