Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 n.11 Johannesburg Nov. 2011

JOURNAL PAPER

Value creation in the resource business

J.M. Garcia; J.P. Camus

Mining Engineering Division, The University of Queensland, Australia

SYNOPSIS

This paper highlights several management practices from the oil and gas industry to support the proposition that financial performance in the finite, non-renewable resource business relates more to upstream rather than downstream activities. Based on the analysis of nine oil and gas companies, this study supports a previous study involving fourteen mining companies that showed reserves growth is one of the main levers of value creation in mining. Interestingly, this study also finds that the oil and gas industry has been historically more profitable than mining. The reason, it is argued, is that oil and gas companies count on management practices that focus primarily on the upstream segments of the business, compared to the traditional downstream focus of mining. This paper delves into these ideas to conclude that what mining may need to improve its competitive advantage is a new organizational framework. Another conclusion is that the upstream management focus is vital not only for strategy formulation in the resource business, but also for policy formulation in economies based on the export of finite, non-renewable resources.

Keywords: Value creation, mining, value chain, mineral resource management, resource business, non-renewable resources, oil and gas, mine planning, mining value chain.

Introduction

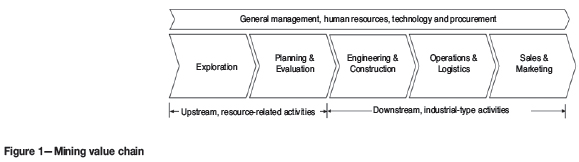

To understand how value is created in mining, Camus et al.1 set out a research study that modelled the business using the value chain framework proposed by Harvard University professor Michael Porter 2. Their model considers the primary activities that deal with the value chain, which are overarched by some support activities providing transversal services and other common resources to the business, as depicted in Figure 1.

Upstream are the resource-related activities that embody the holistic function of mineral resource management. The aim of this function is to discover mineral resources and transform them into economically mineable mineral reserves in the most efficient and effective way. Its output is a business plan that defines the fraction of the mineral resources that is worth mining (mineral reserves), along with the mine plan designed to extract these reserves.

Downstream activities are accountable for the execution of the business plan. These industrial-type activities begin with the project management task, with responsibility for the engineering and construction component of the plan. Following is the operations management unit, accountable for the production component of the plan. At the end is the marketing function responsible for market development and revenue realization.

In the mining industry, there is a deeprooted belief that value creation rests primarily on the downstream, industrial-type activities that focus on production and costs, which in turn determine earnings. Instead, the research by Camus et al. proposes that value in mining is mainly the result of effective management of the upstream, resource-related activities that focus on mineral reserves growth. Recently, Standard & Poor's-one of the world's largest providers of investment ratings and financial research data-has also raised this point in a white paper3:

'Analysing a mining company is a bit different from analysing most companies. Mining companies are valued not according to earnings so much as assets, and so factors such as material reserves and production must be taken into account'.

Because of the lack of public domain information, the proposition that value in mining is more upstream than downstream is supported indirectly. The idea is to compare over time variations in the company share price plus dividends with variations in company mineral reserves plus production. In business parlance, the former variable is commonly known as Total Shareholder Return (TSR), whereas the latter is effectively the mining company's upstream output, defined here as Total Reserves Increment (TRI).

Figure 2 shows both indices, TSR and TRI, for each of the fourteen mining companies in the previous study1 over the period 2000-2008. The axes of the graph are in logarithmic scale to allow a better view of the whole results, which include the sample average for both indices. The results seem to confirm the hypothesis that leading companies that surpass the group's average TSR in the period also exceed the group's average TRI. There are two doubtful cases, but as Camus et al. suggest these are transitional companies in the process of converting promising mineral resources into mineral reserves, which the market anticipates. The sample adequately represents the worldwide mining industry, as eight out of the fourteen companies surveyed belong to the then world's top ten market capitalization list released by PricewaterhouseCoopers4, a global consulting firm.

The previous model evinces that the disciplined growth of mineral resources and their effective conversion into mineral reserves underpins the creation of value in the mining business. This research also suggests that the structures, processes, and systems used by mining companies to manage their mineral resources (the upper part of the value chain) play a pivotal role in their effectiveness. This issue is not always addressed appropriately in the mining industry, as review of more than 80 case studies on mining companies, growth strategies confirms5. Instead, growth achievement seems to be more associated with production increase and cash costs reduction, these case studies suggest.

Consequently, there seems to be wide room for innovation and developments in these areas.

To extend the scope of the previous research to the resource business at large, this study incorporates the oil and gas industry into the analysis. To this purpose, the next section presents a comparative analysis of both sectors-their different realities, problems, and evolutions-to thus set the stage for the following section that addresses the upstream/ downstream concept widely used in the oil and gas industry. The subsequent section replicates the previous mining survey in the oil and gas industry. The penultimate section discusses the organizational implications of these results, which then gives way to some concluding remarks.

A different reality

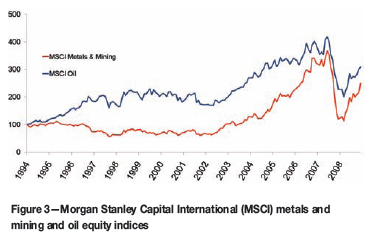

Despite mining being called an industry of the 'old economy', it plays an important role in today's world economy. Similarly to the oil and gas industry, mining is a large and global business. This means that nearly all nations are impacted by the way that this market develops. An interesting feature of mining is that despite the latest resource supercycle that spanned from 2003-2008, it lagged behind the oil and gas industry in terms of long-term shareholder value creation. It seems that mining was much better at 'digging holes in the ground than unearthing returns for their shareholders'6.

A comparison of price equity indices between mining and oil and gas over the last 15 years confirms the previous assertion, as illustrated in Figure 3. The gap between both sectors is notably marked prior to thesupercycle. This phenomenon was noticed by Crowson7, who at the time claimed 'that the mining industry's profitability has been poor for most of the past two decades.' As Figure 3 also shows, this trend reverted somewhat during the last five years. Rather than mining management dexterity, it seems that the main explanation is the skyrocketing commodity prices that impacted mining profitability more favourably compared to oil and gas. Nonetheless, it is worth noting that both oil and metal price indices followed a similar path over the period 1994-2001, when the oil industry clearly outperformed the mining industry.

Interestingly, the mining industry and the oil and gas industry have many commonalities, perhaps the most important being that both are based on exhaustible resources. These are becoming increasingly difficult to find, particularly in developed economies. In the drive to secure energy supplies, international oil companies (IOCs) and national oil companies (NOCs) are facing intense competition for upstream access in emerging markets. As a result, the focus in seeking new deposits has shifted from stable economies to developing countries. Although the latter are less predictable geopolitically, some of these countries present considerable hydrocarbon potential8.

The mining industry situation is not that different in this respect, although the role that national mining companies play in shaping the industry is less relevant than in the oil and gas sector. The low levels of explorations in the past three decades, and the preoccupation with cost control and efficiencies at existing operations during much of the same period, have resulted in a limited supply of good quality projects in companies' pipelines. This became evident with the unanticipated rapid development of the largest emerging economies, which caused a sudden increase in both metal prices and the development costs of mining projects. For example, BHP Billiton has estimated that these costs have double in real terms during the past thirty years9. Moreover, most of the world-class mining projects are now located in challenging areas of the globe, facing problems of infrastructure as well as political and legal uncertainties.

Despite the commonalities in both sectors, the oil and gas industry seems to have been more innovative in the way of organizing its business. The reason for this can be found in the profound transformation that the oil and gas sector experimented about 30 years ago. The shocks of 1974 and 1979/80 transformed the business environment of the oil and gas industry from one of stability to one of turbulence. As a result, the international oil majors were forced to reformulate their strategies and redesign their organizations to reconcile flexibility and responsiveness with the integration required to exploit the resource advantages of giant corporations10.

Perhaps the most notable change was the implementation of a new operating model. This was based on the dissection of the business into two distinctive areas-upstream activities, which encompass the finding and development of new resources, and downstream activities, which involve the industrial transformation of raw resources into end products. Hence, the application of the value chain model was implemented successfully across the whole sector with a particular focus on the upstream segment of the business.

After a period of divestment and restructuring occurring from 1982 to 1992, possibly as a result of the new operating model, an important consolidation process occurred in the oil and gas sector during the 1990s. Among the most notable mergers that took place during the four years from 1998 to 2002 are Exxon with Mobil, British Petroleum (BP) with Amoco, Total with Petrofina, Chevron with Texaco, and Conoco with Phillips Petroleum.

Coincidentally, during the same period, almost all these oil giants also shed their mining subsidiaries, businesses they had entered in previous decades to diversify their portfolios. Some of these transactions are Shell's sale of Billiton, BP's disposal of Kennecott, and Exxon's sale of its 50 per cent interest in the massive El Cerrejon coal mine in Colombia and its copper mining operations in Chile (Disputada).

For similar reasons, some years later the mining industry followed an analogous consolidation. Thus, over the first decade of this century, a large number of mergers and acquisitions took place in the mining sector. In this case, the most notable companies involved were BHP, which acquired Billiton and then Western Mining; Rio Tinto which bought North Ltd and later Alcan; Anglo American, which acquired Disputada, Kumba, and more recently Minas Rio in Brazil; Xstrata, which acquired Mount Isa and then Noranda/Falconbridge; Vale, which bought Inco, and Freeport-McMoRan, which acquired Phelps Dodge. The consolidation has been more rapid in the gold sector, and now relatively new actors are leading the industry-Barrick, Goldcorp, Kinross, and Newcrest, for instance. It seems that mining was trying to take back control of its destiny, after being dropped from the eyes of institutional investors, and needed to merge in order to acquire critical mass in financial markets9.

Unlike the oil and gas industry, the latest significant consolidation of the mining industry was not preceded by a more radical organizational refurbishment to focus the business on its core activity. Perhaps the only notable change in big mining corporations was the creation of product or customer groups, coordinated by a centralized bureaucracy commonly known as headquarters. However, how value is created within these groups and where it really comes from is still unclear under this model.

The model adopted by the oil and gas industry, which gave way to a new era of growth and value creation for the fossils fuels industry, is the theme of the analysis of the next section.

Upstream/downstream in the oil and gas business

Oil and gas producers divide their business into two large segments; upstream activities accountable for exploration and production, and downstream activities responsible for the crude transformation, petrochemical business, and marketing. Figure 4 presents a value chain as would be applied generically to the overall oil and gas business.

The value chain concept has been ingrained in the oil business parlance for several years. This practice, shaped in the 1980s, was aimed at symmetrizing each activity's influence and weight when the oil sector faced one of the most difficult periods in history. As a consequence of the oil crisis, the transaction costs of intermediate markets fell, while the costs of internal transfer rose. Royal Dutch Shell was the first company to free its refineries from the requirement to purchase oil from within the group. Between 1982 and 1988, all the oil majors granted operational autonomy to their upstream and downstream divisions, placing internal transactions onto an arms-length basis. Upstream divisions were encouraged to sell oil to whichever customers offered the best prices, while downstream divisions were encouraged to buy oil from the lowest cost sources.

During the decade, all major oil players completed a steady evolution from the fully integrated scheme to a twoarm business scheme. In doing so, oil firms adopted new reporting systems for gathering and tracking relevant information to adequately assess business performance. A detailed analysis of the upstream/downstream earnings ratio shows that most of the oil majors nearly doubled the weight of their upstream operations in less than two decades, as depicted in Figure 5. Currently, international oil majors such as Exxon, BP, and Shell still show ratios in the top quartile and close to 100% for the almost exclusive upstream-focused companies, such as Saudi Aramco and Apache Corp.

Further costs analyses of the upstream-downstream specialization reveal broader insights in its implication for strategic considerations and interaction with the nonintegrated sector of the industry. There is no ambiguity in the effect of upstream cost asymmetries: the integrated firm with the lower upstream cost will produce more both upstream and downstream than the one with the higher upstream cost, but its downstream production will be less important relative to its upstream production11.

It is interesting to wonder why almost all oil and gas companies adopted a similar model and performed such an abrupt administrative change so quickly. The adoption of this innovation was perhaps a conventional response of companies in a mature industry facing severe adverse conditions or uncertainties. The 'herd behaviour' might be better explained using the institutional theory12, which postulates that companies facing the same set of environmental conditions usually follow an evolutionary path from diversity to homogeneity.

Even though the value chain and upstream/downstream concepts are ingrained in the resources lexicon, the mining business still remains fully integrated from exploration to sales. As a result, financial information such as capital investment and earnings is not calculated for the different segments of the value chain, let alone value. In their annual reports, mining firms report separate information only for product groups or business units.

In summary, this analysis suggests that the most critical activities in the oil and gas industry and the resource business at large are in the upper part of the value chain. It appears that companies that excel in managing the upstream segment are likely to generate a higher value. To gain further insights into this proposition, a study of value creation in the oil and gas industry was carried out. The outcomes of this study are discussed in the following section.

Value creation in the oil and gas industry

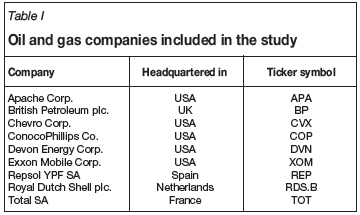

The model used in this assessment is essentially the same as previously described in the introductory section for the fourteen mining companies. The only distinction is the period of analysis-ten years, instead of eight considered in the abovementioned mining study-from 31 Dec 1999 to 31 Dec 2009. The central hypothesis is that oil and gas companies that excel in TSR over an entire economic cycle are those that also excel in increasing their reserves and production, referred to here as TRI. To prove this, a group of nine international oil and gas companies trading on the New York Stock Exchange (NYSE) were examined using similar parameters to calculate their respective TSR and TRI. These companies, listed in Table I, were chosen because their production and reserves data was easily accessible and they cover an ample spectrum, representing the oil and gas industry adequately.

Information on oil and gas reserves and production was obtained from the companies' annual reports. Crude oil reserves are usually reported in millions of barrels, whereas gas volumes are in billions of cubic feet. As almost all companies produce crude oil as well as gas, production and reserves are reported in millions of barrels of oil equivalent. Since the conversion ratio varies slightly across companies, this study uses 5 800 cubic feet as one oil equivalent barrel.

The comparison of TSR and TRI for the oil industry, the results of which are depicted in Figure 6, shows a similar correspondence to that of Figure 2. Although the correlation is not perfect, the overall results seem to corroborate the hypothesis that companies excelling in incrementing their reserve base in the period are those that also obtained higher returns to their shareholders.

Some companies' indices in Figure 6 appear to deviate slightly from the general trend. This may be explained by various reasons. First, the different way oil and gas companies report resources and reserves, which compared to mining companies is less homogenous across jurisdictions. Second, the state of the balance sheet that is not considered in the calculation of the indices and therefore not part of the analysis. This may mask, for instance, reserves acquired at the peak of the cycle using too much debt, which in case of a sudden downturn damages the share price of debt-laden companies more.

The reporting of reserves of oil and gas companies that trade on the NYSEis under the regulations of the US Securities and Exchange Commission (SEC). Disclosure rules, in this case, were set in 1978 and allow only the reporting of proved reserves. But this is just one category of the overall pool of oil and gas resources controlled by companies. The impediment to reporting less reliable reserves, which is supposedly aimed at protecting shareholder integrity, may discourage the market from operating more openly and transparently.

Public interest in modifying the regulations for reporting oil and gas reserves information has intensified in recent years. Many business agents have noted that the previous rules did not serve the interests of investors well because the industry has changed in the more than 30 years since these rules were adopted. This has also been consistently denounced by engineering professional associations worldwide, as well as international accounting firms13.

Perhaps this claim was part of the reasons behind SEC's recent change to the regulations on oil and gas reporting that came into force in January 2010. Among the changes is a 12month average price that is now required (instead of the single-day price at year end) to calculate oil and gas reserves. New rules also direct companies to use first-of-the-month pricing to calculate the year's average, giving firms more time to prepare estimates. In addition, the number of different technologies that can be used to establish reserves has also been extended. This is useful to disclose non-traditional resources, such as bitumen, shale, and coal bed methane, as oil and gas reserves. Another important change is the optional disclosure of probable and possible reserves, which should give investors a richer insight into a company's longterm potential.

In relation to the financial aspect behind the oil and gas companies surveyed, it seems pertinent to comment on the two companies in Figure 6 that show a disparity in terms of both indices. These companies are British Petroleum (BP) and Conoco Phillips, both showing a relatively lower TSR compared to their relative higher TRI. Coincidentally, the two companies invested heavily in Russia during the 2000s. This effort allowed both companies to have access to enormous reserves that later proved to be difficult to develop because of problems with the Russian authorities and their business allies. These happen to be a few domestic oligarchic companies that allegedly use the help of Russian state authorities to act in their favour. To start cutting the losses inflicted by these unsuccessful businesses over the latest years, both companies are now selling out and downscaling involvement in Russia as state influence over the sector is growing.

The problems of BP seem to be aggravated by a series of safety and environmental issues that seriously affected the reputation of the company. The most notorious is an explosion at one of its US refineries in 2005, which killed 15 people and injured 170 more. Since then BP has suffered a series of other disasters. In 2006, several of its pipelines in Alaska sprang leaks, briefly forcing the closure of the USA's biggest oilfield and prompting oil prices to jump14. These incidents seem to be another cause of the BP poor share performance in the second half of the period under analysis. Towards the end of this period, BP reported a debt level of about $34.6 billion, with a total debt-to-equity ratio of 0.34, in line with its oil and gas peers. But to get to this point, BP had to shed its chemical assets, sell its US retail sites, and continue reducing its logistics footprint15.

Conoco Phillips has also suffered from a hefty debt. At the end of the period, the company reported a total debt of US$28.7 billion, with a total debt-to-equity ratio of 0.45, one of the highest among its peers16. This debt has been used to build a large, diversified resource portfolio, which according to the company will offer years of ongoing development potential. To seize these opportunities, late in 2009 the company announced a plan to divest approximately $10 billion in non-core assets to reduce debt and improve the balance sheet.

Another interesting case is Apache Corp, a medium-sized independent oil company, which multiplied its TSR almost eight times in the period. As expected, its corresponding TRI was multiplied about five times. Interestingly, Apache focuses solely on the upstream segment of the business. The Apache formula has been 'growth as a priority', and the company has done this consistently and successfully since the 1990s, even in a strongly cyclical oil and gas business17. Apache has a reputation of being not only an efficient operator, but also an operator that can squeeze profitable production out of assets that other companies have not been able to successfully utilize.

Incidentally, Figure 6 shows that the best performers are indeed those companies that are solely focused on the upstream (Devon, Apache). Beyond supporting the initial proposition, it suggests that reserves growth seems to be a much tougher assignment for those larger and less flexible companies. Yet, there is no evidence that access to prospective resources is easier for smaller players; or that they may gain any competitive advantage because of their size.

The importance of oil reserves applies not only to independent publicly listed companies that trade in open markets, but also to state-owned corporations. This is reflected in the fact that the world's 13 largest oil companies in terms of reserves are totally or partially state-owned18. These companies have access to open financial markets, and most of them are also publicly listed and operate worldwide.

The most accessible and productive oilfields, including those in the Middle East and Russia, are now owned and operated solely by NOCs. In fact, between 2000 and early 2008, NOCs financially outperformed IOCs. NOCs have added more than twice as many reserves through new projects as IOCs have over the past five years19. This may indicate that the IOCs' value proposition has weakened and the future of their business model is increasingly challenged. And as the availability of 'bookable' reserves continues to diminish, the pace of growth of the major oil companies will likely suffer even more. As a result, less competent upstream companies will have a much more difficult time keeping their operations well funded6.

In conclusion, outcomes from the oil and gas study support the model for value generation in mining discussed in the introductory section1. Moreover, both studies give solid grounds to the proposition that value creation in the exhaustible resource business is driven mainly by reserves growth. The model, however, provides no details as to why some companies perform this activity better than others or how this could be executed more efficiently. Some ideas to advance in this direction are analysed succinctly in the following sections.

An organization for the upstream

Once the fundamentals of strategy are understood and a strategy is set, the focus of the discussion switches to getting the right organzation to execute this strategy. In the resources business this encompasses the design of the administrative structures, processes, systems, and people20. This is in fact what apparently made the difference in the oil and gas industry in the late 1980s.

Regarding the structures employed by oil and gas companies, it must be acknowledged that the way in which people are grouped reflects plainly the importance that these companies give to the upstream segment of the business. The relevance of the exploration and production role is crucial, and at such it has a great deal of authority in the oil and gas firm. This position could be pragmatically redefined in the mining business as the mineral resource executive.

However, in the mining business this role rarely exists. Although in many instances it is common to find an exploration role, it hardly ever has the visibility and empowerment to execute the mineral resource management function as described here. In fact, this holistic function is usually overlooked in the traditional mining company. And when it does exist, it is usually fragmented and its parts allocated in the different downstream segments of the business; generally reporting to more operative executives whose activities are mainly driven by costs.

Processes are critical to business success as they are meant to ensure that decisionmaking occurs within the right context and decision variables are adequately appraised. Perhaps the most relevant process in the exhaustible resource business is the planning process-at the corporate level and business unit level as well. This is because of the finite, nonrenewable nature of the mineral resource, which implies that alternative plans cannot be compared directly within a certain period. What is extracted in a certain period affects the extent and state of the remaining resource, so evaluations must extend over the life of the deposit and take into account variations in life as well as variations in schedules during the life.

Within this context it is much easier to assess the merit of an innovative tool called 'scenario planning', which found a breeding ground in the oil industry. This was created by Herman Kahn§ and implemented in business successfully by Royal Dutch Shell more than three decades ago. Scenario planning is a process for learning about the future by understanding the nature and impact of the most uncertain and important driving forces affecting the world. Its goal is to craft a number of diverging stories by extrapolating uncertain and heavily influencing driving forces. Shell uses scenarios to explore possible developments in the future and to test its strategies against potential developments.

Systems are also central to strategy implementation as these ensure that plans are properly evaluated and execution is adequately tracked. Resource companies use numerous systems, but for the strategy viewpoint the most relevant are the capital budgeting and resource allocation systems, together with the compensation system. In both areas there have been interesting innovations in the past few decades, economic evaluation being a case in point. The traditional deterministic systems used by most resource companies- based on discounted cash flow techniques and central estimates for the main input variables-are being gradually replaced by stochastic systems such as simulation, decision trees, and real options. These techniques are more suitable for the evaluation of strategic scenarios as well as individual projects, which in the exhaustible resource business should be evaluated not incrementally with respect to a present situation (base case) but integrally using the chosen scenario.

To ensure organizational success, all of these components of the organizational design have to be closely aligned with people. Having the right talented people is crucial not only for strategy implementation but also for strategy formulation. A company, therefore, must ensure that its multi-skilled workforce fits the needs of the firm's strategy and, moreover, that the business strategy is clearly understood across the organization. Leadership is all about this, and this capability plays a pivotal role in the successful formulation and execution of the strategy.

Because of particular circumstances, the oil and gas industry counts on more appropriate practices to manage the upstream segment of the business that is core to its business strategy. Replicating this model in the mining business would require the consideration of the organizational design aspects previously discussed. The experience of the oil and gas industry, as well as additional research in the area, appears valuable for accomplishing this challenge. According to Bartlett, a promoter of a new managerial theory of the firm:

'[I]n the emerging organisational model, the elaborate planning, coordination and control systems are to be drastically redesign ... as management attention would shift towards the creation and management of process more directly to add value'21.

On the whole, the quest for value in the resource business would require a fundamental reappraisal of the way companies plan and execute their businesses. This means focusing more attention on real value-adding activities22. The existing or potential resources represent nearly all the value ascribed to resource companies. The ability to manage them, therefore, is the main competitive advantage that a resource company has over its peers.

Conclusion

This study provides additional evidence to validate the proposition that the main levers of value creation in the resource business are in the upstream activities. This function is more prominent in the oil and gas industry, but not clearly defined in the mining industry. Lately, though, there has been more awareness about this issue in mining. An example of this is the creation of the mineral resource management function, which has been adopted by some mining companies in South Africa and Chile, although not with the same scope and emphasis discussed here.

At the corporate level, this function should foster the increase in resources through exploration and acquisitions and prepare the ground for their successful transformation into economic reserves to replace those consumed. At the business unit level, it aims to expand the resource base in the nearby area and plan the resource extraction more integrally so that value is maximized.

An effective separation of the business value chain is critical to achieve the benefit of this view of the business in the resource sector. The oil and gas industry made an effort in this direction more than 30 years ago and it seems it was worthwhile. Although the extent of the upstream segment in the oil and gas business is perhaps excessive-as it includes development and production-it could be useful for the mining industry to consider this experience in any change effort.

Beyond the common processes and systems for managing the value chain, what requires fixing in the resource business is the proper measurement of value-over the whole value chain and at each segment as well. The main missing part is the resource market value, which is usually overlooked at the time of measuring value creation and, more importantly, when planning the resource exploitation. In effect, as a resource is depleted its market value usually decreases, and this fact has critical implications in the determination of its optimal rate of extraction and rate of recovery.

The use of market-based transfer prices for interbusiness sales seems to be a good option for an integrated company to measure value at each segment of the value chain. Thus, each segment is treated as an independent profit centre. For the upstream value measurement, the idea is to treat the resource as a capital asset and include its opportunity cost into the value equation. This notional cost refers to the option of selling the deposit and investing the proceeds elsewhere in a similar risk portfolio, which somehow has to be borne by the business. Successful value chain models need common and accepted methods to determine costs, margins, and investments23. In a valuedriven company, everyone along the value chain should use the same numbers, speaks the same language, and aims, towards the same set of goals.

Focusing the resource business on the upstream segment is vital not only for strategy formulation in the resource company, but also for policy formulation in economies based on the export of finite, non-renewable resources. A country is potentially more prosperous and stable when it counts on a substantial and diverse resource base. This is especially valid in these days with the rapid development of the most populous emerging economies, hungry for resources. In fact, the latest global financial crisis affected the USA and Europe more severely than resource-endowed countries such as Australia, Canada, Chile, South Africa, and Brazil.

To improve nations' competitive advantage, governments may need to consider better policies for the resource business. Aspects such as foreign investment, property rights, taxation, and accessibility appear to be critical to generate stability and thus create a more favourable climate for resource exploration and development.

Acknowledgements

The authors wish to thank the University of Queensland's Mining Engineering Division for its support for this research work. This show of gratitude is also extended to the Rio Tinto Group for its financial support to the UQ Mining Engineering Program, which makes possible these types of initiatives.

References

1. CAMUS, J., KNIGHTS, P., and TAPIA, S. Value generation in mining: a new model, Australian Mining. Technology Conference, Brisbane, 27-28 Oct 2009. [ Links ]

2. PORTER, M.E. Competitive Advantage: Creating and Sustaining Superior Performance. Free Press, 1985, New York, xviii, 557 p. [ Links ]

3. Standards&Poor's and Compustat White Paper: Mining Industry-Specific Data. 2008. [ Links ]

4. PricewaterhouseCoopers. Mine. Review of Global Trends in the Mining Industry. 2009. [ Links ]

5. PAYNE, M. and PAYNE, B. World Mining Companies-Strategies for Growth. Planning for the Years Ahead. vol. I, 2005. [ Links ]

6. DOSHI, V., NORDAHL, H., and DEL MAESTRO, A. Big oil's big shift. Strategy + Business Magazine, Booz & Co, 2 August, 2010. [ Links ]

7. CROWSON, P. Mining industry profitability? Resources Policy, vol. 27, no. 1, 2001. pp. 33-42. [ Links ]

8. ACCENTURE. Accessing Oil and Gas Reserves: Rethinking Upstream Offers by International Oil Companies. 2008. [ Links ]

9. HUMPHREYS, D. Industry Consolidation and Integration: Implications for the Base Metals Sector, GFMS Precious & Base Metals Seminar London, September 2006. p. 14. [ Links ]

10. GRANT, R. and CIBIN, R. Strategy, structure and market turbulence: the international oil majors, 1970-1991. Scandinavian Journal of Management, vol. 12, no. 2, 1996. pp. 165-188. [ Links ]

11. GAUDET, G., VAN LONG, N., and SOUBEYRAN, A. Upstream-downstream specialization by integrated firms in a partially integrated industry. Review of Industrial Organization, vol. 14, no. 4, 1999. pp. 321-335. [ Links ]

12. DIMAGGIO, P. and POWELL, W. The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. American Sociological Review, vol. 48, no. 2, 1983. pp. 147-160. [ Links ]

13. NEWMAN, P.J. and BURK, V.A. Presenting the full picture: oil and gas reserves measuring and reporting in the 21st Century, Deloitte Touche, 2005. [ Links ]

14. The ECONOMIST. BP: paying the price. 18 Jan 2007. [ Links ]

15. GERSON LEHRMAN GROUP. Independent oil companies outperform the supermajors. 2010. [ Links ]

16. PETROLEUM ECONOMIST. Conoco Phillips shrinks in order to grow. July 2010. [ Links ]

17. BLOOMBERG BUSINESSWEEK, Q&A: Apache's secrets of success. April 6, 2001. [ Links ]

18. The ECONOMIST. The rise of the hybrid company. 3 December 2009. [ Links ]

19. BOSTON CONSULTING GROUP, Upstream oil and gas: an evolving system. 2009. [ Links ]

20. CAMUS, J. Management of Mineral Resources: creating value in the mining business. Society for Mining, Metallurgy & Exploration, 2002. [ Links ]

21. BARTLETT, C. and GHOSHAL, S. Beyond the M-form: toward a managerial theory of the firm. Strategic Management Journal, vol. 14, 1993. pp. 23-46. [ Links ]

22. MACFARLANE, A. Leveraging the bottom line of your mining business through effective management of the mineral resource. Journal of the Southern African Institute of Mining and Metallurgy, 2007. [ Links ]

23. WALTERS, D., HALLIDAY, M., and GLASER, S. Added value and competitive advantage, 2002. Macquarie Business Research Papers. [ Links ] ♦

Paper received Nov. 2010; revised paper received Aug. 2011.

© The Southern African Institute of Mining and Metallurgy, 2011. SA ISSN 0038-223X/3.00 + 0.00.

§ Kahn's major contributions were the several strategies he developed during the Cold War to contemplate 'the unthinkable', namely, nuclear warfare, by using applications of game theory. Most notably, Kahn is often cited as the father of scenario planning.