Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

Journal of the Southern African Institute of Mining and Metallurgy

versão On-line ISSN 2411-9717

versão impressa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 no.11 Johannesburg Nov. 2011

JOURNAL PAPER

Investigation of factors influencing the determination of discount rate in the economic evaluation of mineral development projects

S-J. ParkI; I.I. MatunhireII

IMasters Student at University of Pretoria

IIFormer Senior Lecturer with University of Pretoria and now a Senior Mining Engineer/Project Manager with TWP Projects

SYNOPSIS

When evaluating mining investment opportunities, one should consider the risks associated with mineral exploration and development. These are commonly classified as technical, economic, and political risks, and are accounted for in the investment decision by changing the discount rate. Thus, a company may use different discount rates associated with varying risks in order to compensate for the variability of success. The discount rate has a tremendous effect on the economic evaluation of mineral projects. Even when all other factors used as inputs for calculating the NPV (net present value) are equal, the project under consideration may be accepted or rejected depending upon the discount rate. Determining a realistic discount rate for a given project is therefore the most difficult and important aspect of cash flow analysis. It should be determined with the consideration of proper technical, economic, and political conditions surrounding the specific project undergoing economic evaluation. One key problem for determining the appropriate discount rate is that it typically depends more on subjective perception of the degree of risk or other experience factors than on a systematic approach. Thus, this study aims to identify, analyse, and document the type, role, and impact of risk factors influencing the determination of discount rates, and then to determine discount rate by using the aforementioned factors.

Keywords: discount rate, risk factors, economic evaluation, mine development.

Introduction

Mining is based on the minerals on or buried in the ground. Mining involves large risks, while requiring heavy capital investment with relatively long payback periods when compared with other business sectors. Thus careful assessment and decisions are required when investing in mining in order to reflect the distinctive characteristics of the sector. Investment decisions in mining projects are made after an economic evaluation, which is common in most business ventures. The construction of a realistic investment model is required in the evaluation of a proposed mine project. This investment model should include significant variables that are not fixed or known with certainty, such as the length of time and the cost not only to obtain the necessary permits, but also for the actual development of the mine and plant, and whether the ore deposit is economically viable. Owing to the fact that there is no comprehensive projection of the possible relevant variables, one is therefore obliged to estimate these in the decision-making process. To arrive at a solution to the project evaluation problem, one will need to determine the level of discount rate for each project within an acceptable margin of error. The discount rate for a given project is typically determined by using risk-free market rates plus a market risk premium adjusted in relation to the volatility of the investment compared to the market. In practice, however, the discount rate is still subjective and dependent on corporate or other experience factors. These factors are usually determined by top management and then handed down to the departments responsible for the immediate evaluation of projects. This study will address the nature and scope of risk and uncertainty factors influencing the determination of the discount rate and use analytical techniques to determine appropriate discount rates for use in the economic evaluation process. The quantitative methodology for discount rate is tested using a case study of a Madagascar mining project.

Factors influencing the determination of discount rate

The magnitude of uncertainties in mine development projects are generally larger than in most other comparative industries. On the basis of exploration drilling information, a decision must be reached about development of a mine, its capacity in terms of rate and level of output, a processing plant, and a smelter/refinery complex. Uncertainty can arise in the estimates of reserves and their average metallic content, in the expected metal demand and prices for the mineral, and in any other aspects of the operation. Future revenues and costs associated with mineral development cannot be calculated accurately because the factors that determine these revenues and costs are impossible to know with certainty at the time of the investment. During initial exploration, for example, many outcomes are possible, ranging from no indication of commercial mineralization to geological evidence that eventually leads to a producing mine. During the development of a deposit, initial ore reserve estimates may have to be revised, thus altering estimates of future production and revenues. During production, mineral prices may be higher or lower than predicted at the time of investment, leading to higher or lower revenues than anticipated. These factors can be grouped into three categories of mineral-development risk according to the cause of the risk: technical risks, economic risks, and political risks1.

Technical risks

The technical risks are divided into the following three subcategories: reserve risk, completion risk, and production risk.

Reserve risk-Reserve risk, determined both by nature (the distribution of minerals in the earth's crust) and the quality of ore-reserve estimates, reflects the possibility that actual reserves will differ from initial estimates. A complete understanding of the geology of the deposit is imperative to estimate accurately the distribution, grade, and tonnage contained in reserve estimates

Completion risk-Completion risk reflects the possibility that a mineral development project will not make it into production as anticipated because of cost overruns, construction delays, or engineering or design flaws

Production risk-Production risk reflects the possibility that production will not proceed as expected as a result of production fluctuations caused either because of problems with equipment or extraction processes, or because of poor management. Technical risks are at least partly under the control of the organizations active in mineral development.

Economic risks

The economic risks are divided into the following three sub categories: price risk, demand/supply risk, and foreign exchange risk

Price risk (revenue risk)-Price risk is the possible variability of future mineral prices. Mineral prices are normally determined by the economic law of supply and demand. Mineral prices, together with production levels, determine revenues from mining. Thus, to the extent that actual future prices differ from the prices expected at the time of the cash flow analysis, actual revenues and profits will differ from those expected.

Demand/supply risk-The dynamic economic environment has increased the difficulty in achieving reliable demand forecasts. The market demand/supply risk is the variability of future market demand/supply for minerals. General economic conditions directly impact on the fluctuation in demand. To the extent that actual and expected mineral demands differ, actual mine production and revenue are affected. A case in point is the recent economic downturn which started in 2008, resulting in a number of mining operations closing down or cutting back on production.

Foreign/exchange risk-Foreign exchange rate risk is the natural consequence of international operation in a world where relative currency values move up and down. Rates of foreign exchange have a major influence on the costs and revenues in US dollars, of firms operating in countries with different currencies, as well as the costs of firms sourcing equipment in currencies other than the US dollar.

Political risks

The political risks are determined by the action of governments and reflect the possibility that unforeseen government actions will affect the profitability of an investment. Potential actions include nationalization and changes in regulations concerning, for example, the environment, taxation, or currency convertibility. These political risks are divided into the following four subcategories: Currency convertibility, environment, tax, nationalization

Currency convertibility-Currency convertibility affects guaranteed freedom of capital transfer.

Environment-Environmental regulations affect the economic viability of mineral projects in three different ways1. First, they often increase the costs of mining and mineral processing by requiring, for example, scrubbers on smelter smokestacks that reduce the amount of sulfur dioxide emitted into the air, or plastic liners at the base of tailings ponds that minimize the release of toxic heavy metals into adjoining ground and surface water. Second, environmental regulation often increase the time spent on non-mining activities, such as conducting environmental baseline studies, filing environmental impact statements, and applying for mining permits and waiting for their approval. Corporate social responsibility and sustainable development would be included as requirements when applying for mining permits. Third, regulations often increase the risks associated with an investment in mining, because of the discretionary authority that some regulations vest in government agencies to halt development or mining even after significant expenditures have been made.

Tax-Although mining companies know what the tax regimes are upfront, tax remains a risk as governments may, from time to time, want to review mining taxes. Recent examples are Australia and Zambia. There are other regimes that are currently considering reviewing mining taxation. Increased taxes affect operating costs and reduce the profits.

Nationalization-In mineral-producing countries, nationalization is pursued to acquire control over mining companies operating in the country. Nationalization becomes a risk if no compensation is paid. Examples exist where governments have expropriated property without compensation.

Proposed quantitative methodology for discount rate

From the review of factors influencing the determination of discount rate carried out, it is concluded that the quantitative methodology for discount rate should be a process of identifying potential risk, analysing risks to determine those that have the greatest impact on mineral development, and determining the discount rate. It is therefore imperative to find a method whereby all mining risks, together with their probability and impact, and an understanding of the combined effect of all risks attached to the cash flow and the rate of return can be determined. Thus a way or a procedure of calculating risk scores is required. Heldman2 proposed that the quantitative methodology for discount should consist of the following steps:

Identifying risks

Developing rating scales

Determining risk values

Calculating risk scores

Determining discount rate.

These steps will be discussed briefly in the following section of the paper.

Identifying risks-The first step in the determination of discount rate is identifying all the potential risks that might arise in the mineral development project. The identification of risk and attitudes towards it are very important in the life of a mine. The following risks should be considered:

- Technical risk: reserve, completion, production

- Economical risk: price, demand, foreign exchange

- Political risk: currency conversion, environment, tax, nationalization.

Developing rating scales-The risk scale assigns high, medium, or low values to both probability and impact. Most risks will impact cost, revenue, time, or scope to a minimum.

Determining risk values-The way to create a risk scale is to assign numeric values to both probability and impact so that an overall risk score can be calculated. Risk is associated with events in the future and, therefore, very difficult to measure objectively. To overcome this difficulty it is suggested that one uses the quantitative risk analysis method. The quantitative risk analysis method assigns not only high, medium, low values but also assigns numeric values to both probability and impact, so that an overall risk score can be calculated. Cardinal scale values are numbers between 0 and 1.0. Probability is usually expressed as a cardinal value.

Calculating risk scores-The risk, the probability, and the impact can be listed into a table as individual components, as shown in Table I.

The total risk score could be calculated by multiplying the probability by the impact. Using the reserve risk, for example, this risk has a low probability of occurring but a medium impact. Therefore, the risk score is calculated with 0.1×0.5 for a final value, also known as an expected value, of 0.05. Total risk scores are calculated by summing each risk score and converting risk premium.

Determining the discount rate-The rate of discount can be regarded in two ways. In the first case, if a company raises funds from external sources, the discount rate is regarded as the cost of the capital. It is the percentage rate of return that the firm must generate to compensate the investors, who supply funds to the company rather than investing in another company or activity.

Secondly, if a company uses internal funds, the discount rate is regarded as the opportunity cost. This opportunity cost, therefore, is the best rate of return the company could earn by investing its money elsewhere. In an ideal world both scenarios should provide the same return on capital, as one would be using the same shareholders' funds. The greater the risk, the higher the discount rate should be, raising the discount rate reduces the NPV of a set of cash flows. Determining the risk-adjusted discount rate is the most difficult aspect of cash-flow analysis where it is important to determine discount rate by the systematic method.

The risk premium

A risk-adjusted discount rate may be developed by using a risk-free rate of return, plus a subjectively determined risk premium, which is expected to compensate the investors for the extra risk involved. In practice the selection of a risk-free rate of return is relatively simple. In the majority of cases, the yield on US Government bonds, under non-inflationary conditions, is adopted as the risk-free rate of return3. The real problem involves the selection of the risk premium, which must be sufficient to compensate for the additional risks associated with the investment at hand. When determining an appropriate risk premium, all risks affecting the discount rate should be considered. This, however, is an extensive exercise and will encompass a greater number of risks, which makes the determination very difficult to work through and use. Furthermore, there are significant difficulties in structuring an involved analysis with many factors, for the obvious reason that it is complex and multifaceted. In order to facilitate the implementation of the determination, one has to focus on a definite number of key risks such as technical, economic, and political risks. To determine risk premium, an expected value (risk score) as calculated in the previous section has to be converted to an overall value and risk premium. The determination of risk premium is incumbent on the impact of the factor and the potential possibility of its affecting the success of the mineral development.

The risk-adjusted discount rate

Put simply but rather crudely, we can represent a riskadjusted discount rate as follows:

Risk-adjusted discount rate = risk-free rate of return + risk premium

The risk-free rate of return-for mineral development projects, it is advisable to use a 10-year bond that yields 1.2 per cent

The risk premium-can range between 6~20 per cent.

The application of these numbers to the risk-adjusted discount rate formula yields the following risk-adjusted discount rate for mineral development projects.

Risk-adjusted discount rate = risk-free rate of return + risk premium = 1.2% + 6-20% = 7.2-21.2%

Thus, the risk-adjusted discount rate required by mining companies ranges between 7.2 and 21.2 per cent.

Case study

This case study is based on the development of the Ambatovy Project, a nickel mine in Madagascar. This project gives an example of the risks considered in selecting a discount rate. The variables considered included exploration, reserve calculation, construction phase, the operation, and the sales of the product. The discount rate for the Ambatovy project was selected by using the quantitative methodology explained in the previous sections to assess the economic viability of the project.

Introduction

Located in Madagascar, the Ambatovy project is a worldclass, large tonnage nickel project that is positioned to be one of the world's biggest lateritic nickel mines in 2013. Sherritt, the project operator, has a 40 per cent ownership position, Sumitomo and Korea Resources each have a 27.5 per cent stake, and the project's engineering contractor, SNC-Lavalin, has a 5 per cent interest. Ambatovy is a long-life lateritic nickel project with annual design capacity of 60 000 tons of nickel and 5 600 tons of cobalt. The mine life is currently projected to be 27 years. The Ambatovy mine site is located 80 kilometres east of Antananarivo (the capital of Madagascar) near the city of Moramanga. It is within a few kilometres of the main road and rail system connecting Antananarivo and the main port city of Toamasina on the east coast. The project will consist of an open-pit mining operation and an ore preparation plant at the mine site. The slurried laterite ore will then be delivered via a pipeline to a process plant and refinery located directly south of the port of Toamasina.

Figure 1 and Figure 2 show the map of Madagascar and the project area respectively.

Development plan

Mineral reserves

125 million tones @ 1.04% Ni, 0.10% Co (0.8% nickel cutoff)

- Additional 39.4 million tones @ 0.69% Ni, 0.064% Co

- Potential to increase reserves with additional drilling.

Mining method

4 separate open pits

Mine limonite and low magnesium saprolite 'LMS' after stripping overburden of 3 m from the surface

Mine ore delivered by truck to ore preparation plant

Ore then conveyed to scrubber where water is added to slurry the ore

Slurry thickened and delivered to pipeline.

Transportation of ore

Ore transformed in a slurry form at the Ore Preparation Plant is transported through the pipeline buried 1.5 m below the surface to the processing plant

Pipeline is 220 km long and 600 mm in diameter

Single pump station at mine site is installed to transport the slurry ore while using the gravity as a dragging force since the elevation difference is about 1,000 m.

Processing and refinery

Project to utilize only proven metallurgical processes, all process unit operations can be found elsewhere operating on a commercial scale

High Pressure Acid Leaching technique is used to produce nickel briquette and cobalt.

This process is separated into two parts where pressure leach is applied to produce mixed sulphides and the stage where the mixed sulphides are smeltered and refined.

Capital expenditure (Capex): U$2,500 millions

Operating expenditure (Opex)

Average Opex during 27 yrs of mine life

- Ni - 1.99US$/lb (with credit, 0.97U$/lb)

10-year average after ramp-up period: operating expenditure

- Ni - 1.75US$/lb (with credit, 0.77U$/lb).

Determining the discount rate for the Ambatovy Project

Potential risks associated with the project are:

Technical risk(reserve, completion, and production risk)

Economic risk(price, demand, and foreign-exchange risk

Political risk (currency convertibility, environment, tax, and nationalization). Effects of possible technical, economical and political risks on the project's schedule, budget, resources, deliverables, costs and quality are evaluated by the high-medium-low rating scales. The effects of potential risks on cost, revenue, time or scope are evaluated on the high-medium-low scale. Probability scales and risk impact scales of the Ambatovy Project are shown in Table II.

Determining risk values for the Ambatovy project

Numeric value needs to be applied in the probability and impact as explained in the previous section in order to calculate risk score of the project at the second stage. However, this process is very hard to carry out objectively with a view to calculating a value that represents a possible risk in the future.

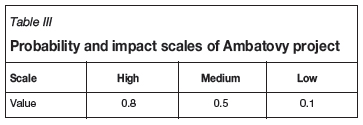

Therefore, the quantitative risk analysis method was used to obtain the risk value of 0 and 1.0 for the probability and impact, as shown in Table III.

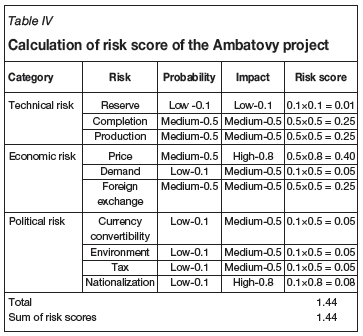

Calculating risk scores for the Ambatovy project

The risk, the probability, and the impact can be listed as individual components as shown in Table IV. Risk score can be calculated by multiplying the probability of the risk by the impact reviewed in the previous section.

Determining the discount rate for the Ambatovy project

The risk premium

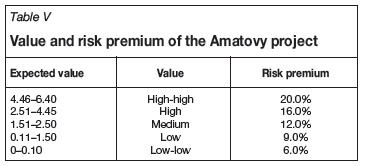

To determine risk premium, an expected value (risk score) as calculated in the previous section has to be converted to an overall value and risk premium. An overall value and risk premium for the Ambatovy project was determined as shown in Table V.

The risk premium is calculated at 9.0 per cent since the risk score of the project calculated in the previous section is 1.44, which falls between 0.11 and 1.50.

The risk-adjusted discount rate

As seen in the previous section, the risk-adjusted discount rate can be assessed by applying the risk-adjusted discount rate formula shown below:

Risk-adjusted discount rate = risk-free rate of return + risk premium

The risk-free rate of return - a 10-year bond that yields 1.2 per cent

The risk premium - 9.0 per cent.

Thus, the risk-adjusted discount rate required for the Ambatovy project is 10.2 per cent.

Conclusions

The Ambatovy study clearly demonstrates how one can arrive at a discount rate after taking all risks into account. The inherent disadvantage of this approach is that the selection of the risk premium is subjective and hence the reliability of the method is often suspect. The risk-adjusted discount rate is not the final criterion for a decision to invest in a mineral development project under consideration, although it is generally one of the motivating factors considered by the firm's management. The attitude of investors to risk-taking is entirely subjective and very difficult to express in quantitative terms. Investors who are not particularly averse to risk tend to choose the low level of discount rate, whereas the more cautious and risk-averse investors will usually tend to select the medium level of discount rate. The decidedly risk-averse investors will usually opt for a high level of discount rate.

References

1. GOCHT, W.R. ZANTOP, H., and EGGERT, R.G. International Mineral Economics. Springer-Verlag. Berlin Heidelberg. 1988. pp. 102-109, 123-124. [ Links ]

2. HELDMAN, K. Risk Management. Harbor Light Press, San Francisco, CA, vol. 205. pp. 12-31, 123-144, 153-162, 171-189. [ Links ]

3. WHITNEY. Investment and Risk Analysis in the Mineral Industry, Whitney & Whitney, Inc, Nevada, 1979. pp. 2.26-2.34, 5.3-5.6. [ Links ]

4. VALSAMAKIS, A.C., VIVIAN, R.W., and DU TOIT R, G.S. Risk Management, Heinemann, Sandton, South Africa, 2003. pp. 79-105. [ Links ]

2. FRYKMAN, D. and TOLLERYD, J. Corporate Valuation. Parson Education Limited, Harlow, Essex, UK, 2003. pp. 69-90. [ Links ]

3. Lane, K.F. The Economic Definition of Ore. Mining Journal Books Ltd, London, 1988. pp. 46-55. [ Links ]

5. KRAUSKOPF, K.B. Introduction to Geochemistry. 2nd edn. McGraw-Hill. New York, 1979. pp. 617-620. [ Links ]

6. RUDAWSKY, O. Mineral Economics. Elsevier, Amsterdam, 1986. pp. 22-31, 48-53, 78-80. [ Links ]

7. EDWARD S, P.J. and BOWEN, P.A. Risk Management in Project Organizations. Elsevier, Sydney, Australia, 2005. [ Links ]

8. Wanless. R.M. Finance for Mine Management, Chapman and Hall, London, 1983. [ Links ]

9. SKINNER, B.J. The frequency of mineral deposits. Transactions of the Geological Society of South Africa. Annecture to vol. 82, no. 16, 1979. p. 12. [ Links ]

10. HARGITAY, S.E. and YU, S.-M. Property Investment Decisions, Taylor & Francis, London, 1993. pp. 34-50. [ Links ]

11. VAN HORNE. Introduction to Financial Management, Prentice-Hall, New Jersey, 1986. pp. 162-165, p. 303. [ Links ]

Paper received Jul. 2009; revised paper received Aug. 2011.

© The Southern African Institute of Mining and Metallurgy, 2011. SA ISSN 0038-223X/3.00 + 0.00.