Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

Journal of the Southern African Institute of Mining and Metallurgy

versión On-line ISSN 2411-9717

versión impresa ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 no.10 Johannesburg oct. 2011

COMMENT

Nationalization and mining: lessons from Zambia

D. Limpitlaw

Independent Mining and Environmental Consultant

Industrial mining in Zambia started in the 1930s when the world class copper deposits near the border with Katanga were developed. The discovery of these deposits began at the turn of the century when the first claims in the Copperbelt were pegged at Chambishi, north of what became the town of Kitwe1. World War I and the difficulties of raising sufficient capital for such large scale undertakings delayed the exploitation of these deposits. Following this hesitant start, a large copper mining complex was built, resulting in the development of five major towns, all highly dependent on the mining and beneficiation of copper and cobalt. Copper became so important to the country that, on independence, the only non-mining town to make it onto a list of the top six was the capital, Lusaka.

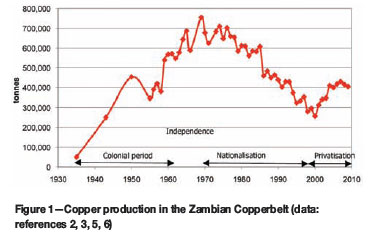

From commissioning of the mines to the end of the colonial period in 1964, copper production increased to just over 640 000 t annually2(see Figure 1). After the establishment of the new Zambian state, production continued to increase, supported by a benign legislative environment and strong international copper prices. The government of Kenneth Kaunda was intent on improving the conditions of the rural poor and reducing unemployment in urban areas. To this end, the government embarked on an ambitious project of refocusing Zambia's economy away from the colonial role of commodity supply to one of decentralized mass employment. The Copperbelt industrial complex was key to the success of this approach, and in 1969 the Zambian State acquired a 51 per cent stake in Zambia's two main copper producing companies: Roan Selection Trust and Rhodesian Anglo American Corporation. The former became Roan Consolidated Mines Ltd (RCM) and the latter became Nchanga Consolidated Copper Mines Ltd (NCCM). In the year they were nationalized, the mines produced at least 720 000 t of copper† and employed approximately 48,000 workers (see Figure 2)2-4. The subsequent economic policies of the Zambian Government depended heavily on the state's ability to monopolize the proceeds of copper mining.

By the mid-1970s, the mines were experiencing poor profitability. This was due to collapsing copper prices, coupled with the re-focus of management away from production for profit to production to guaranteeing employment and the delivery of social services. The payment of substantial development dividends to the state reduced the copper mines' ability to re-invest in the infrastructure required to maintain efficient mining. The ensuing economic crisis in the Copperbelt resulted in the amalgamation of RCM and NCCM into Zambia Consolidated Copper Mines (ZCCM) in 1982. ZCCM's Copperbelt mining operations consisted of five mining divisions: Konkola in Chililabombwe, Nkana in Kitwe, Nchanga in Chingola, and Mufulira and Luanshya in towns sharing their names.

In 1984, Zambia's entire economy was experiencing a depression, in part due to the long-term decline in copper prices. Employment was falling, imports were declining and foreign debt was on the increase (USBM2, 1984). The budget deficit increased to US$150 million. Foreign debt of $2.6 billion had to be restructured. By 1986 a noticeable decline in copper production resulted in the closure of many mining units and led to the implementation of a five-year plan to revive the company8. This was not successful, and by the end of the 1980s the Nkana Division, capable of producing 5 Mt of copper ore per annum, was only producing 2 Mt. Similarly, Mufulira was producing 1.8 Mt instead of 2.5 Mt8.

By 1987 Zambia had to agree to harsh economic measures in order to access financial assistance from the IMF. These included cuts in the civil service, loosening control of interest rates and the elimination of price subsidies (USBM2, 1987). The price of food increased to the point where riots broke out in Kitwe. Zambia broke off negotiations with the World Bank which then cancelled aid to the country. The Kwacha collapsed and Zambia's external debt ballooned to $ 5.8 billion. At one point, Zambia was paying 95% of its foreign exchange earnings to service debt.

In the early 1990s, the government announced its intention to sell at least 49% of its share in all parastatals, including ZCCM (USBM2, 1991). By this stage heavy foreign debt was crippling the economy.

Throughout much of its history, ZCCM lacked the capital to upgrade its operations, and by the end of the 1990s, when most operating units were privatized, little exploration had been carried out for 25 years. Shortages of spare parts and over-use of old equipment affected production. In addition, ZCCM failed to modernize and continued the colonial practice of providing virtually all services within some of the mining towns. In Kalulushi, for example, the parastatal was responsible for water reticulation, waste removal, health care, security, and other municipal services. ZCCM had become a state within a state.

One of the primary arguments advanced for state ownership of the Copperbelt mines was the provision of secure employment. The graph in Figure 2 shows that this was a failure. The state miner, ZCCM, managed to neither safeguard jobs nor the value of those jobs. In the 1990s, a mine employee told me that he had bought a new plastic bucket to water his garden in Chingola. When he realized that he was paid the equivalent of less than 50 plastic buckets per month, he left his job at ZCCM.

The process of privatization was finally started in 1996 after a few failed attempts. The first round of bidding went badly and the operations, considered by Zambians to be the jewels in the crown, were not scooped up. Anglo American was one of the few diversified mining heavyweights interested in operating the old ZCCM mines. Anglo struggled to find a joint venture partner but eventually brought Codelco of Chile, ironically a state-run miner, on board. Before the deal was concluded, Codelco pulled out due to political considerations in Chile, and Anglo was left without a major partner. The state of disrepair of the mines and short-term fluctuations in the copper price further reduced the profitability of the Anglo's newly acquired operations, the proceeds from which were supposed to keep the existing mines afloat while the new Konkola Deeps mining project was developed. The upshot was the disinvestment of Anglo from the Copperbelt within a short time.

Currently, the Government of Zambia retains a minority interest in most of the large projects and mines through its holding company Zambia Consolidated Copper Mines Investment Holdings plc (ZCCM-IH).

Turning decrepit mining infrastructure around is very difficult. Even with the privatization programme, poverty in Zambia deepened in the 1990s. In 1991, 70 per cent of the population was estimated to live below the poverty line9. This had increased to 73 per cent by 199810and was exacerbated by the privatization and retrenchments that occurred towards the end of that decade. In 1998 the Mine Worker's Union of Zambia (MUZ) estimated that it had 37 000 members compared to 60 000 in 19789. By the end of 1999, privatization resulted in a total of 8 329 employees being retrenched, leading to the disruption of nearly 42 000 livelihoods if a figure of five dependants per employee is assumed.

Zambia's experience has lessons for South Africa. Once a mine asset is run down, it is very expensive, difficult, and time-consuming to get it into efficient production again. These are not factories that can be turned off and on again. Unserviced machinery falls apart and becomes useless, workings collapse, and shafts flood, skilled managers and operators get jobs elsewhere, and the task of re-starting becomes exponentially more difficult with the passage of time. In Zambia the contribution of mining to GDP fell from 32.9 per cent in 1973 to about 7.7 per cent in 2003, a decline of nearly 77 per cent11even after the privatization of ZCCM was largely complete. From the start of the privatization process until 2004, US$1.4 billion was invested in the mining sector11. Even this large amount only managed to restore copper production to 400 000 t in 2004, just over half of the historical peak tonnage. In 2009, Zambian copper production amounted to 405 000 t (USGS7, 2009).

Mining is a high risk, capital intensive industry that requires access to large numbers of highly skilled people, most of whom are motivated by personal gain. There are very few examples of efficiently run state-owned mines that make a positive contribution to their country's economy, the copper operations of Chile's Codelco being the exception. Chile's success in running nationalized mines is in no small part due to the fact that Chilean mining schools have historically produced more than double South Africa's number of mining engineering graduates. These Spanish-speaking engineers are also less mobile than South African graduates in the English language dominated world of mining.

Removal of the risk/reward profit motive will accelerate the current flight of skills to other mining locations-already the Australians pay a substantial premium over local salaries for mining engineers. This will leave South Africa unskilled, uncompetitive, and begging for international buyers for the now rundown mines, with nothing but ruined assets to sell.

As Zambia has shown, one decade is not enough time to recover from confusing the role of the State with that of private capital. If nationalization is the only way to lift the majority of the country's people out of poverty and deprivation, then South Africa had better commit substantially more resources to producing mining professionals: engineers, metallurgists, and geologists as well as operators, to run these state owned enterprises, because the people currently employed will soon be enticed away by overseas competitors.

References

1. MENDELSOHN, F. The Geology of the Northern Rhodesian Copperbelt.MacDonald, London, UK, 1961. 523 pp. [ Links ]

2. US BUREAU OF MINES. Minerals Year Books, 1964-1991. http://uwdc.library.wisc.edu/collections/EcoNatRes. Accessed 20 Jun 2011. [ Links ]

3. HYWEL D. D. Zambia in Maps. University of London Press, London, UK. 1971. [ Links ]

4. BURAWOY, M. The colour of class on the copper mines. African Advancement in to Zambianization. African Social Research, Zambian Papers, no. 7. Van Velsen, J. and Henderson, I. (eds.). Institute for African Studies, University of Zambia, Lusaka, Zambia, 1972. 121 pp. [ Links ]

5. NORTHERN RHODESIA CHAMBER OF MINES. Year Books 1956-1963. Kitwe, Northern Rhodesia. [ Links ]

6. MACFARLANE, A. Managing mineral wealth-the contribution of the mining and minerals sector to the economic development of southern Africa. Mining, Minerals and Sustainable Development Southern Africa. Research topic no.5: Mining, minerals and economic development: the transition to sustainable development in southern Africa. Johannesburg, South Africa, 2001. 127 pp.

7. US GEOLOGICAL SURVEY. Minerals Year Books 1997-2009. The Mineral Industry of Zambia. http://minerals.usgs.gov/minerals/pubs/country. Accessed 6 Jun 2011. [ Links ]

8. KWANGA, S. A case study on the privatization of Zambia Consolidated Copper Mines. Mining, Minerals and Sustainable Development Southern Africa. Research topic no.5: Mining, minerals and economic development: the transition to sustainable development in southern Africa. Johannesburg, South Africa, 2001. 29 pp.

9. HANSUNGULE, M., FEENEY, P., and PALMER, R. Report on land tenure insecurity on the Zambian Copperbelt. Oxfam GB, Zambia. 90 pp. [ Links ]

10. CIVIL SOCIETY FOR POVERTY REDUCTION. Poverty reduction strategy paper for Zambia. http://www.sarpn.org.za. Accessed 20 Oct. 2002. [ Links ]

11. GOVERNMENT OF ZAMBIA. The Fifth National Development Plan: 2006-2011. Chapter 15: Mining. Lusaka, Zambia, 2005. 51 pp. [ Links ].

Paper received Aug. 2011; revised paper received Sep. 2011.

© The Southern African Institute of Mining and Metallurgy, 2011. SA ISSN 0038-223X/3.00 + 0.00.

† Some authors, such as Burawoy, list the figure as 755 000 t. The USBM lists it as 720 000 t