Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 n.9 Johannesburg Sep. 2011

SCHOLARSHIP TRUST FUND

Annual financial statements

Audit Report

To the members of The SAIMM Scholarship Fund

I have audited the annual financial statements of The SAIMM Scholarship Fund set out on pages 643 to 648 which comprises the trustees' report, the balance sheet as at 30 June 2011, the income statement, statement of changes in reserves, cash flow statement for the year then ended, as well as a summary of significant accounting policies and other explanatory notes.

Trustees' responsibility for the annual financial statements

The trustees are responsible for the preparation and fair presentation of these annual financial statements in accordance with the accounting policies of the fund. This responsibility includes, designing, implementing, and maintaining internal control relevant to the preparation and fair presentation of the annual financial statements, that are free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditor's responsibility

My responsibility is to express an opinion on these annual financial statements based on my audit. I conducted my audit in accordance with International Standards on Auditing. Those standards require that I comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the annual financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the annual financial statements. The procedures selected depend upon the auditor's judgement, including the assessment of the risk of material misstatement of the annual financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the fund's preparation and fair presentation of the annual financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the fund's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by the trustees, as well as evaluating the overall presentation of the annual financial statements.

I believe that the audit evidence obtained is sufficient and appropriate to provide a basis for my audit opinion.

Opinion

In my opinion, the annual financial statements present fairly, in all material respects, the financial position of the fund at 30 June 2011 and the results of its operations and cash flows for the year then ended in accordance with the accounting policies of the fund.

Supplementary information

The supplementary schedule set out on page 648 does not form part of the financial statements and is presented as additional information. I have not audited this schedule and accordingly do not express an opinion on it.

Robert Henry Kitching

Registered Auditor

The Southern African Institute of Mining and Metallurgy

The SAIMM Scholarship Fund (Registration number IT 6837/02)

Financial statements

for the year ended 30 June 2011

Trustees' responsibilities and approval

The trustees are to maintain adequate accounting records and are responsible for the content and integrity of the annual financial statements and related financial information included in this report. It is their responsiblity to ensure that the annual financial statements fairly present the state of affairs of the fund as at the end of the financial year and the results of its operations and cash flows for the period then ended, in conformity with the accounting policies of the fund. The external auditors are engaged to express an independent opinion on the annual financial statements.

The annual financial statements are prepared in accordance with the accounting policies of the fund and are based upon appropriate accounting policies consistently applied and supported by reasonable and prudent judgements and estimates.

The trustees acknowledge that they are ultimately responsible for the system of internal financial control established by the fund and place considerable importance on maintaining a strong control environment. To enable the trustees to meet these responsibilities, the trustees set standards for internal control aimed at reducing the risk of error or loss in a cost-effective manner. The standards include the proper delegation of responsibilities within a clearly defined framework, effective accounting procedures, and adequate segregation of duties to ensure an acceptable level of risk. These controls are monitored throughout the fund and all employees are required to maintain the highest ethical standards in ensuring the fund's business is conducted in a manner that in all reasonable circumstances is above reproach. The focus of risk management in the fund is on identifying, assessing, managing, and monitoring all known forms of risk across the fund. While operating risk cannot be fully eliminated, the fund endeavours to minimize it by ensuring that appropriate infrastructure, controls, systems, and ethical behaviour are applied and managed within predetermined procedures and constraints.

The trustees are of the opinion that the system of internal control provides reasonable assurance that the financial records may be relied on for the preparation of the annual financial statements. However, any system of internal financial control can provide only reasonable, and not absolute, assurance against material misstatement or loss.

The annual financial statements set out on pages 643–648, which have been prepared on the going concern basis, were approved on 2 August 2011 and are signed by:

| Financial statement signed by: | Financial statement signed by: |

| M.H. Rogers | R.P. Mohring |

| ________________________________ | ________________________________ |

| Chairman | Vice-chairman |

Trustees' report

The trustees submit their report for the year ended 30 June 2011. This report forms part of the annual financial statements.

1. Registration

The fund was registered as a trust on 11 November 2002 with registration number IT 6837/02. The fund can sue and be sued in its own name.

2. Review of activities

Main business and operations

- The principal objects of the fund are to:

(1) support and promote, foster and advance the interests of the minerals industry by providing the beneficiaries with funds to be used to support the education of the students in the minerals industry;

(2) to collect monies and accept contributions in monies or otherwise by way of donations, bequests or otherwise and to apply the same or the income therefrom for all or any of the objects set out in (1) above.

- The principal address of the fund is 5th Floor, Chamber of Mines Building, 5 Hollard Street, Johannesburg. The fund has no full-time employees and is administered by The Southern African Institute of Mining and Metallurgy.

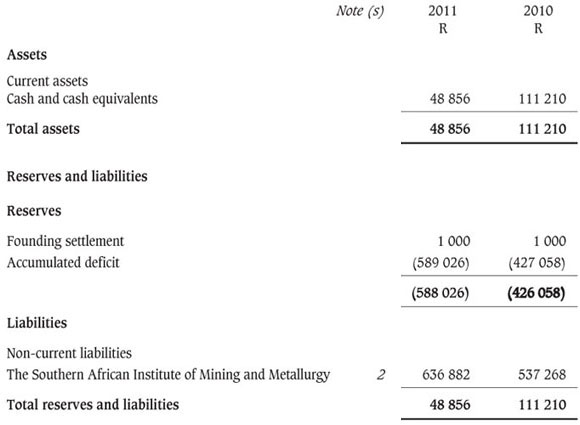

Balance sheet

at 30 June 2011

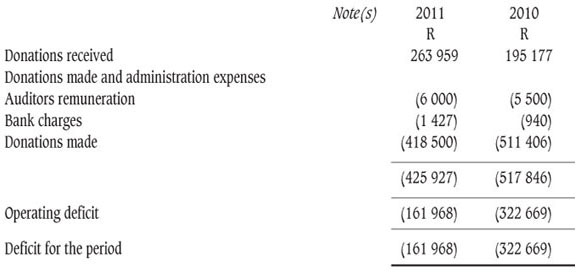

Income statement

for the year ended 30 June 2011

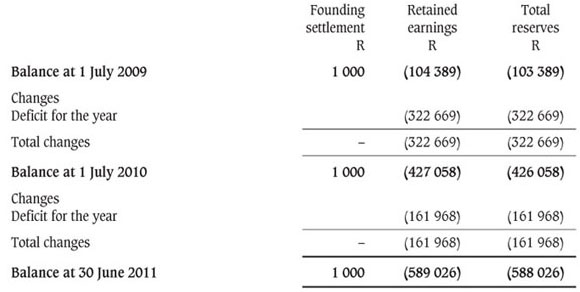

Statement of changes in reserves

for the year ended 30 June 2010

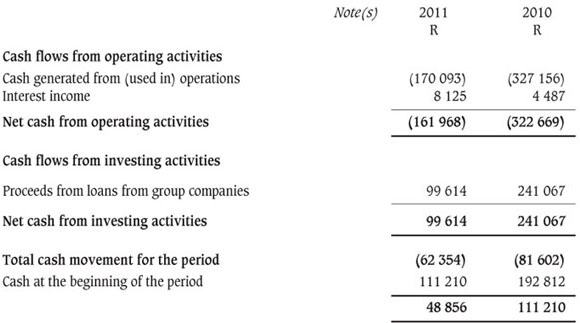

Cash flow statement

for the year ended 30 June 2011

Financial statements

for the year ended 30 June 2011

Accounting policies

1. Presentation of financial statements

The annual financial statements have been prepared in accordance with accounting policies of the fund. The annual financial statements have been prepared on the historical cost basis, except for the measurement of certain financial instruments at fair value, and incorporate the principal accounting policies set out below.

1.1 Significant judgements

In preparing the annual financial statements, the trustees are required to make estimates and assumptions that affect the amounts represented in the annual financial statements and related disclosures. Use of available information and the application of judgement is inherent in the formation of estimates. Actual results in the future could differ from these estimates, which may be material to the annual financial statements.

1.2 Financial instruments

1.2.1 Initial recognition

The fund classifies financial instruments, or their component parts, on initial recognition as a financial asset, a financial liability or an equity instrument in accordance with the substance of the contractual arrangement.

Financial assets and financial liabilities are recognized on the fund's balance sheet when the fund becomes party to the contractual provisions of the instrument.

Financial assets and liabilities are recognized initially at cost; transaction costs that are directly attributable to the acquisition or issue of the financial instrument are added to the cost.

Assets carried at fair value: the change in fair value shall be recognized in profit or loss or in equity, as appropriate.

1.2.2 Subsequent measurement

After initial recognition, financial assets are measured as follows:

-

Loans and receivables and held-to-maturity investments are measured at amortized cost using the effective interest method

-

Investments in equity instruments that do not have a quoted market price in an active market and whose fair value cannot be reliably measured, are measured at cost

- Other financial assets, including derivatives, at fair values, without any deduction for transaction costs, which may arise on sale or other disposal.

After initial recognition, financial liabilities are measured as follows:

-

Financial liabilities at fair value through profit or loss, including derivatives that are liabilities, are measured at fair value

- Other financial liabilities are measured at amortized cost using the effective interest method.

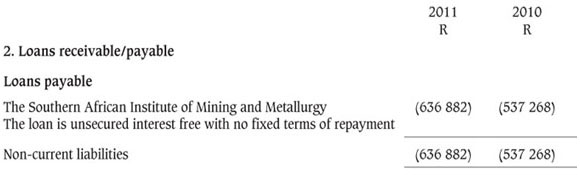

1.3 Loans receivable/payable

This includes the loan to The Southern African Institute of Mining and Metallurgy, which earns no interest and has no repayment terms. This loan is carried at cost.

1.4 Revenue

Revenue comprises contributions received from donors and is recognized on receipt.

Notes to the financial statements

for the year ended 30 June 2011

3. Taxation

The fund is exempt from tax in terms of Section 18A of the Income Tax Act.

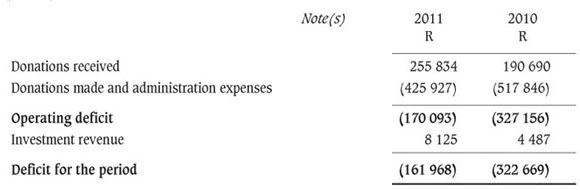

Detailed income statement

for the year ended 30 June 2011