Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 n.7 Johannesburg Jul. 2011

JOURNAL PAPER

Subject concepts and issue outline

M. RossouwI; R. BaxterII

IXstrata, South Africa

IIStrategy Economics and Legal, Chamber of Mines of South Africa

Introduction

The paper sets out the strategic importance of South Africa's mining and minerals sector to the national economy. It relates how inexorable and accelerating urbanization and industrialization in emerging markets, especially in China and India, will translate into sustained demand for the minerals that South and southern Africa have in abundance.

It warns that while countries buying raw materials from South Africa use these inputs as the basis on which to build value-added, employment-creating industries, South Africa is failing to exploit the economic benefits inherent in its mineral wealth, exacerbating its shortage of skills.

Despite its preponderance of mineral resources, South Africa's mining industry has lagged behind those of other nations, with the industry's GDP actually contracting between 2001 and 2008. This paper reflects on the work of the Mining Industry Growth Development and Employment Task Team (MIGDETT), a tripartite team established to chart a new growth path for mining, in particular plotting High Road and Low Road scenarios for the sector. The profound implications of adopting either course of action in terms of value added to GDP and employment are analysed.

Noting that there is a new compact emerging between government, organized labour, and the industry, and a new shared commitment to achieving sustainable growth and meaningful transformation in the mining industry, this paper argues that the objectives of government's new Beneficiation Strategy is commendable and the Minerals Industry needs to engage towards broader endorsement endorsed by all role players. This is not to say that a material level of beneficiation is not already taking place in the country, particularly where the commercial opportunities are available. It is promoting further beneficiation particularly in the downstream area to help maximize the tremendous natural resource endowment of the country in areas for example such as chrome, manganese and titanium.

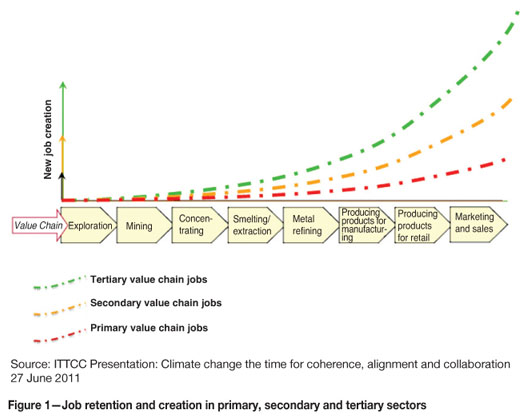

There is a need, however, to consider 'beneficiation' as up/down stream, secondary and tertiary economic activity potential that is created by the primary mining and beneficiation value chain. The current definition of beneficiation considers only downstream beneficiation which for South Africa is far too narrow. Figure 1 illustrates this reality.

While highlighting the challenges that have to be overcome to achieve meaningful beneficiation in base metals, the paper cautions that this type of beneficiation will be impossible if currently projected electricity price increases take effect and if the proposed carbon tax is implemented. The combined impact of these two added costs will, the paper suggests, simply progressively make beneficiation unprofitable and unaffordable.

The authors argue that there is a dearth of information with which to inform strategies and policies on the mitigation of greenhouse gases and the international undertakings that South Africa has made on carbon abatement. It makes the suggestion that the mining and minerals industries are uniquely equipped to lead a process of establishing a meaningful fact base on which practical climate-change policies can be based. The paper ends with a call to support mining-led initiatives to create such a knowledge base.

Overview of the southern African mineral economic environment and its competitiveness within the global minerals sector

Other sectors of the economy may have garnered a greater share of public and media attention in recent years, but there is no denying that the economies of southern Africa and the wellbeing of its people remain inextricably tied to the health of the mining industry.

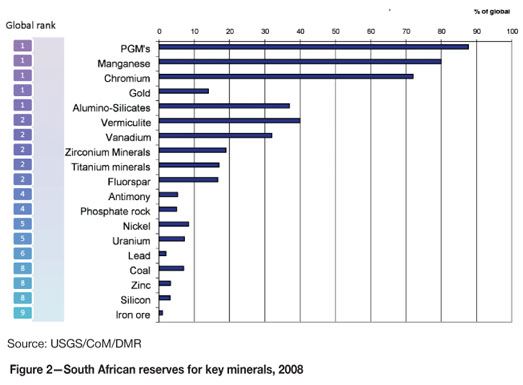

This is true for virtually all SADC member states, and is particularly the case in South Africa. Recently a Citibank report stated that South Africa has the world's largest in situ non-energy mineral resource base. Let us briefly remind ourselves of the remarkable wealth at our disposal: South Africa has 87% of the world's platinum group metals and 80% of its high grade manganese. We have over 70% of the chromium ever identified on the planet and 40% of its vermiculite, as well as a third of the vanadium. We still possess almost 15% of known gold reserves and, even in this day and age, prospecting for gold continues within the borders of South Africa. Then there are resources including iron ore and coal where our share, as a percentage of the world's deposits, is relatively small but which are still important, even strategic, contributors to our economy. (Figure 2)

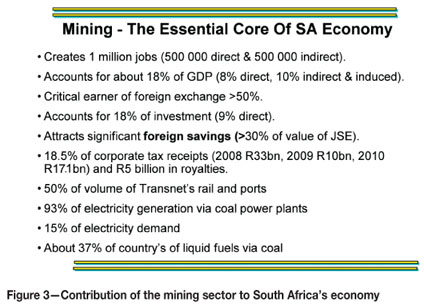

In strict economic terms, mining and the minerals complex are absolutely key to South Africa's current and future prosperity. The primary value chain alone accounts for 500 000 jobs directly and indirectly creates another 500 000 jobs giving a total contribution of 1 000 000 jobs created for the economy. It produces almost a fifth of GDP and pays a similar percentage of corporate tax. It accounts for half of all traffic moved by Transnet and 94% of the power generated in this country. The value of mining companies listed on the JSE is R1.9 trillion, which represents 43% of the total market capitalization of the exchange and therefore helps create wealth for millions of South African pension fund holders and investors, while at the same time attracting significant foreign capital flows that help unlock our mineral potential. And, perhaps most critically, more than half of our export earnings are derived from mining and mineral products. (Figure 3)

In the last 16 years, and despite the 2008 global financial crisis, South Africa has succeeded in raising its economic growth rate to an average of 3.3% per annum. Over the past decade the growth has mostly been driven by the creditfuelled, demand-driven, imbalance creating non-tradable side of the economy, which is not sustainable over the long-term. This type of growth mostly creates employment for semiskilled and skilled workers. Unfortunately, the tradable export sectors growth rates have languished. These sectors normally create employment for un-skilled and semi-skilled workers, and the slow growth rate in these sectors has therefore created a structural mismatch in the labour market.

If we want higher, more balanced and more labour absorbing economic growth, we have to get our export sectors to grow at a much faster pace. This is where the mining sector fits in. Why? Because mining has a very large foreign exchange earning potential, GDP multiplier, and employment-creation footprint—and we have the resources to underpin that growth for decades to come.

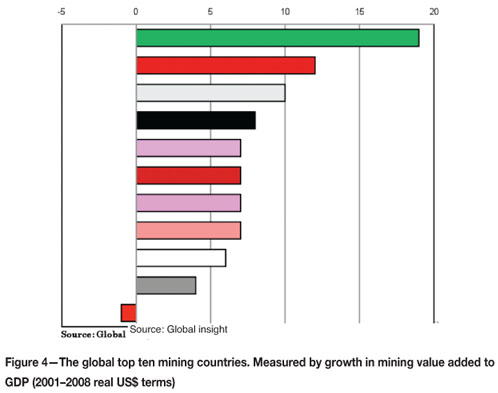

We have an abundance, of many of the minerals the world needs. We have resources from which we earn more than 50% of our foreign exchange that will last for generations, yet in recent years our mining industry has been amongst the worst performing in the world. Between 2001 and 2008 China grew its mining sector's GDP by 19%, Chile upped its output by 12%, and Russia by 10%. Most of our peers posted increases of 5% or better. But between 2001 and 2008, during one of the greatest minerals booms in history, South Africa's mining sector actually contracted—by approximately 1% per annum. Had we grown by the world average of 5%, we would have added 45 000 direct mining jobs in South Africa. The reality is that we shed jobs. There was more bad news: from 2003 to 2008 our share of international exploration expenditure slumped from 6% to 3%. (Figure 4)

What went wrong? How did the country that has the world's greatest share of minerals slip up so badly? It's no secret that international investors—who are being actively wooed by prospectors and developers around the globe— have begun to take an increasingly jaundiced view of putting their capital into South Africa. This was tellingly borne out by the release, earlier in 2011, of the latest Fraser Institute rankings, which showed that South Africa had slipped to 67th position out of 79, putting it in a dubious ballpark it shares with overtly investor-hostile environments like Venezuela and Zimbabwe. Obviously, mutterings and even sloganeering from political podiums about nationalisation have done nothing to improve sentiment, but there are other very real concerns.

Enter the Mining Industry Growth Development and Employment Task Team (MIGDETT), a tripartite body created in 2008 by the leadership of the Department of Mineral Resources (DMR), organized labour, and organized business. MIGDETT had two mandates: one to focus on mitigating the effects of the global financial crisis on mining; the second to reposition the industry for sustainable growth and meaningful transformation. In the second key objective the stakeholders developed two tracks of work, one investigating the factors affecting the competitiveness of the RSA mining sector and the other focused on the impediments to more meaningful transformation in the sector.

The competitiveness study highlighted a number of areas that were affecting the ability of the RSA mining sector to take advantage of the commodity boom. Significant infrastructure constraints (electricity and rail) combined with challenges in the regulatory framework, a volatile currency, and skills constraints all served to hold the industry back.

A World Economic Forum (WEF) study showed the factors undermining our competitiveness as an investment destination compared to a basket of other mining states. According to the WEF, we score badly on the inefficiency of our bureaucracy, a poorly educated labour force, crime and restrictive labour regulations. There are shortages of skills and our productivity remains stubbornly low. But the picture is not all bad: we are more competitive than the average in terms of our work ethic, the stability of our regulatory environment, and the taxation regime.

Overall, we are favourably ranked by how easy it is to do business in South Africa compared with other mining countries. Our financial and investment systems are relatively sophisticated, and our infrastructure is considered adequate compared to many other markets, although, of course, there are serious concerns about rail and electricity.

The regulatory framework has also contributed to the malaise, with long waiting times for licenses, a degree of regulatory uncertainty, and bureaucratic inefficiencies impacting on investment in the sector. The licensing impasse and the frustrations that flowed from it are, of course, well known and beyond the scope of this paper. However, there have been indications in recent months, including pronouncements by Minister Shabangu and much-anticipated legislative amendments, that give measured reason for hope.

In the immediate short-term there appear to be any number of emerging reasons to hope that South Africa's mining industry might have turned the corner; that it is set to resume the growth trajectory one would expect of it. Encouraging noises are emanating from the public sector; there is a commitment to beef up resources within the Department of Mineral Resources (DMR) and resolve the licensing challenges that stymied new developments for so long. There are even tentative signs that Transnet might be moving in the right direction and there is no doubt that the authorities and industry are embarking on a more constructive dialogue, and starting to find common ground.

MIGDETT has set itself an objective that by 2014 South Africa must be back in the top half of the Fraser Institute rankings.

The task team has already done a great deal of work. A realistic assessment, as well as various detailed studies on the factors inhibiting our sector's growth, have been completed and released. Meanwhile, the Mining Charter has been revised, prospecting moratoriums in eight provinces have been lifted, and a sectoral growth strategy has been finalised and submitted to Cabinet. The mining sector is now back on the top 5 sector priority list of government and greater focus is being applied to tackling the constraints holding the sector back. We can now reasonably expect that the upper echelons of government will give mining and minerals the prioritised attention they deserve given their importance to all South Africans. This country's mining industry, it would seem, is ready to embark upon a new high road to growth and job creation.

Conservative scenario planning undertaken by experts within MIGDETT concluded that South African mining has a realistic possibility of growing by 3% to 4% per annum over the next decade and could create an extra 100 000 direct jobs by 2020. Underpinning this growth is the inexorable process of urbanization and industrialization that is transforming the world, most especially in the vibrant emerging economies of China, India, Brazil and southeast Asia. Today just over 3 billion people live in cities. By 2040 that number will have doubled; more than 400 million people will move to cities within the next decade alone.

As they do so, these people will need more and more of the minerals which we in southern Africa have so much of. In 2006, for example, China consumed 3 kg of copper per capita. But urbanized Chinese citizens demand more homes, offices, shopping malls, and schools. They also want more cars, refrigerators, and washing machines. This will require more copper—9 kg per capita according to most projections. And more steel—and their cars will have to be fitted with catalytic converters.

In plotting a future direction for mining, the scenario planners at MIGDETT sketched out Low Road and High Road scenarios. In the case of the Low Road, production remains constrained by existing bottlenecks (issues of regulation, infrastructure, investment, skills etc.) and costs continue to rise at historic rates.

Under the High Road scenario, costs are halved and existing bottlenecks are removed. In real terms, how does the difference between the High and Low Road scenarios impact on our economy? Using 2008 as a base year, the difference between the two scenarios in 2020 for just five commodities will be R240 billion in additional GDP and R160 billion in export earnings. The difference between these scenarios in terms of job creation is even more startling: 213 000 direct jobs (almost a 50% increase in the sector's current direct employment). (Figure 5)

Clearly, we simply have no choice; we owe it to our collective stakeholders, including our investors, our employees, and to all the people of South Africa not just to choose the High Road but to do everything in our power to keep progressing along that route. It will take a concerted and consistent effort from everyone—from mine managers and workers, from each and every official in the DMR, from union leaders and shop stewards—to keep us on the High Road. Fortunately, in recent months we have seen a change in the relationships between the industry, government, and labour. The effects of the economic meltdown and the consequences of our inability to grow our sector are slowly being grasped by all parties and we now see the emergence of a 'South Africa, Inc.' attitude, an attitude that seeks to find common ground and mutually beneficial outcomes, rather than the suspicion and antagonism that has characterized relations in the past.

Not only must South Africa, Inc. work in concert to remove bottlenecks and to keep the lid on costs; we need to think seriously and pragmatically about our position in the global commodities and minerals markets. Specifically, we need to get more serious about beneficiation. This is not to say that the country does not already have a substantial downstream beneficiation industry. Nearly all of South Africa's cement, 80% of its steel, 30% of its liquid fuels, 94% of its electricity, and a substantial portion of its fertilisers, plastics, polymers, etc., are produced in South Africa from locally mined minerals. We account for 20% of the world's fabrication of platinum catalytic converters and so on. Another R200 billion in sales value and 150 000 jobs are created in these downstream beneficiation industries. But in certain of the commodities, such as in manganese and chrome, we can do more and we want to do more.

In June this year the DMR released a Cabinet approved Mining Beneficiation Strategy Paper. To quote from this document:

➤ Although South Africa has steadily improved its ratio of beneficiated to primary products exported since the 1970s, these ratios are still well below the potential suggested by the quality and quantity of its mineral resources endowment

➤ It is impossible to overstate the importance of beneficiation to keeping the chrome and manganese industries travelling along the High Road, to transformation, higher value-addition, and job creation

➤ As already mentioned, South Africa possesses 80% of the world's high grade manganese. But we account for just 15% of global manganese supply. China, Brazil, and Australia have negligible manganese reserves but, between them, are responsible for over 40% of worldwide production.

We are exporting our raw chrome and manganese materials to countries that use them to grow their economies and to create jobs. At the same time they are creating skills, while our skills crisis remains unaddressed and only gets worse. Let us take the example of ferrochrome. We export our chromium ore to markets such as India and China, which use them to create the value-added products which we often end up buying from them. The accompanying graph shows how ferrochrome production in South Africa, India and China will grow between 2001 and 2015. Our production remains virtually static while the Indians will double theirs and the Chinese hike output exponentially. By simply exporting our raw materials we also exporting job opportunities and economic growth.

The Beneficiation Strategy is a good starting point but there is a need to take a much broader and integrated approach that includes the true value of our minerals, pricing of raw materials the competitiveness of the downstream beneficiation sectors. Factors such as the availability and cost of infrastructure, smart tape (not red-tape), the development of special economic zones, preferential tax treatment, access to key markets, the availability of the appropriate skills, etc., are all issues that need to be tackled.

Not the least of our challenges is the fact that we lack the skills to move from the more basic elements of the mining and minerals value chain to higher-end value-adding parts. One cannot simply take an, even experienced miner and retrain him or her overnight to become a metalworker. (As mentioned, our 'customers', by building and operating largescale beneficiating plants are organically growing these skills all of the time.) If anything, this fact underscores the vital importance of fixing our high-school and technical training systems.

Electricity price increases and carbon taxes are extremely serious, under-appreciated threats, not just to any beneficiation strategy but to the very existence of our industry. (Figure 6)

Taking the ferrochrome industry as an example and 2007 as a base year, where power and 'other' costs equalled 1.0, by this year electricity costs will have added 20% to operating costs (1.2). As envisaged by government's integrated resource plan, by 2013 this figure will have risen to 1.4 including the imposition of a carbon tax of R100 per ton of CO2 emissions. With an industry operating margin of 1.5, the incentive to invest and keep operating will be steadily eroded —until 2014 when that margin level is reached. Needless to say, the picture gets even bleaker after that.

The numbers reflected in the scenario above are not mere guesstimates but are based on historical industry data and electricity tariff increases and emissions taxes that have been formulated and promulgated. But this precision contrasts sharply—even diametrically—with the information that has informed our international commitments to reducing greenhouse gas emissions. Put simply, there was very little verifiable, reliable information on which South Africa based its Copenhagen undertaking to reduce CO2 output by 34% by 2020 (as against the 'Business as Usual' model).

One the one hand, government is plotting a strategy to boost beneficiation. On the other hand, it is making environmental promises that would make beneficiation simply unfeasible.

Clearly, as a nation and as an industry we need to reduce our carbon intensity per unit of output. But, as things stand, we simply don't have the requisite fact base needed to make informed decisions. First of all, we need an inventory of emissions with a base year on which reliable business-asusual projections can be made. Then we must work out, scientifically, which abatement opportunities exist in each industry and what their cost will be. Only then can policy principles and instruments be devised and the economic impact of the various different climate-change policies is mapped out. The lack of an appropriate carbon abatement cost curve means that we may be making the most expensive and economically damaging decisions on reducing our carbon footprint, as we do not have a fact base of the costs and benefits of the alternative options.

As they stand, government's carbon tax proposals represent a recipe for disaster for mining and other industries; South African simply cannot afford them, certainly not if it wants to create a sustainable, job-creating economy. So what is the alternative?

The alternative is that mining, working with government and labour (South Africa, Inc.), uses the new-found understanding in our industry to gather the necessary information and to make it available to the authorities for the drafting of policy. Our industry has greater resources in this field of research and a keener understanding of its importance than most. It is appropriate that we assume a leadership role.

We need to move with alacrity and there is no reason why we shouldn't. A road map already drawn up by ourselves which envisages a greenhouse gas inventory and analysis of abatement opportunities being completed by September this year. By November it is entirely feasible that the first draft of a new White Paper could be ready for release and that, early in 2012, the Treasury could release new draft tax proposals. But we need to do our homework carefully as a country, because getting things wrong means that the country will miss out on the benefits of maximizing components of the minerals value chain through beneficiation, due to inappropriate costs and requirements being placed on these downstream industries.

Copenhagen 17 or COP 17, is just around the corner, both literally and figuratively. The next round of climate-change talks is set to take place in Durban in November/December this year. AT COP 17 our representatives will need to show that South Africa is serious about coming up with workable, realistic commitments. But our internal processes towards developing our own White Paper Response on Climate Change and possible carbon tax measures must not be held captive to the timeframes of COP17. Rather we need to do our homework properly to realise a true movement towards a lower carbon economy, but without prejudicing our own economic growth and employment creation objectives. We can and must help them to show that we are serious about this task. The time to shape our future is now.◆

Paper received Jul. 2011