Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 n.7 Johannesburg Jul. 2011

JOURNAL PAPER

Mineral supply from Africa: China's investment inroads into the African mineral resource sector

M. Ericsson

Mineral Economics, Luleå University of Technology, also Senior Partner of Raw Materials Group.

Introduction

'Rare earths 'will not be bargaining instruments'' was stated in a headline in China Daily of 29 October 2010. The Chinese government is trying to fend off the persistent accusations from Japan, the USA, and Europe that it is manipulating the supply of these so called 'critical' metals to gain political and economic advantages. The critics maintain that China has taken the rest of the world hostage by controlling 97% of the resources of rare earths. These elements are crucial in a number of high-tech applications. They are not impossible to substitute, but difficult to do so effectively.

The name 'rare earth' is a misnomer, as even the least abundant is 200 times more common in the Earth's crust than gold. They are, however, difficult to find in economic concentrations. The Chinese near-monopoly over the rare earths, together with China's scramble for other resources in Australia, Africa, and elsewhere around the world, is seen as an example of a Chinese strategy to take control of vital metal resources. The Chinese are also accused of using unfair and sometimes illegal business practices in this fight for resources. Practices which, critics claim, put the Chinese interests above the interests of the host countries, in particular in Africa.

But how important is the Chinese influence over African mine production, and what degree of control do the Chinese exert over global mineral and metal production? Is the Chinese grip on the 'critical metals' as serious and dangerous as it is presented?

The following discussion piece is aimed at shedding some factual light on the issue of the Chinese lack of natural resources and its implications globally and in Africa in particular. The discussion points at problems with Chinese presence in Africa, but also recognizes the potential advantages for African countries in being able to create healthy competition between traditional investors and new 'south-south' investors, whether they be from China, India, or Brazil.

Mineral supply from Africa and Africa's share of the world's remaining strategic resources

The diversity of minerals present in Africa is well-known, particularly if both developed and undeveloped mineral deposits are taken into account. It is evident that minerals of potential value for a variety of applications are present in most countries in Africa. More than half of the countries on the continent regard mining as an important economic activity and are producing minerals for an international market outside Africa. For certain minerals (bauxite, chromium, cobalt, diamonds, gold, manganese, phosphate, platinum group metals, and titanium among them), Africa's reserves and production are significant in world terms. While in some instances (chromium, cobalt and PGMs, for example), production or reserves are concentrated in a few countries (South Africa, the DRC, and Zambia), much of the continent's mineral production and reserves are spread out among a large number of countries. There are also cases (such as with copper and iron ore) where the volumes produced and exported from Africa are significant for world industrial consumption, even though these do not represent a large proportion of global production1. The paradox of Africa's mineral and natural resource wealth, on the one hand, and the pervasive poverty of its people on the other, remains a deep and oft-noted feature of its landscape2.

What is, however, much less understood is the diminishing role of African mining in the global supply of minerals and metals. In 1984 the total value of African production of metals at the mine stage was 19.5% of the total global value. In 2007, however, that figure had decreased by roughly half to 10.3%. In the same period, African production of gold declined by 30% from 713 t to 498 t, and copper production by 38 % from 1 405 kt to 870 kt. This decline was mostly due to the fall in copper production in the then Zaire and the declining gold production in South Africa. None of this was offset by increasing production elsewhere in Africa.

In the mid-2000s it was clear that the two major regions which were underexploited and held the best opportunities for future exploration efforts were Africa and Siberia. In the early 2010s Russia had effectively been shut off from the exploration world again, and the main hopes are now pinned on Africa.

Mineral commodities of strategic and investment interest to China

China has become the world's largest mining nation by far, overtaking Australia and rapidly increasing its domestic production during the past 5–7 years. In 2008 China accounted for 14.8% of the total value at the mine stage of metals produced in the world. Australia is in second place, followed by Chile and Brazil. If coal were to be included, China's lead would increase as it is by far the most important coal producer in the world (Figure 1).

China has quickly become a major producer of many metals and minerals. Since 2006 China has become, inter alia, the largest gold producer (270 t); the largest zinc producer at over 3 000 kt; the largest aluminium smelter, 13 Mt compared to number two Russia at 4 Mt. The country also has a near-monopoly on rare earths, tungsten, and other metals. At the same time China is the predominant driver of global metal demand, and in spite of swiftly increasing domestic production, China's dependence on mineral imports is rapidly increasing3.

In this brief review iron ore is used as an example of the precarious situation in which the Chinese find themselves at present. Iron ore is fairly typical of the many other metals where Chinese import dependence has grown in spite of vigorous efforts to increase domestic production.4 The specific geological parameters of China, with few high-grade deposits of substance, have to a large extent determined the structure of the Chinese iron ore industry, where small and medium-size mines account for most of the production. Depletion of deposits and declining competitiveness have resulted in a growing share for the larger mines. Around 40 major mines accounted for 34% of production in 2009, compared to only 17% in 2007. Average grades have declined in the major mines as well. The average grade of Chinese production is likely to be considerably lower than the 30% often assumed, and the production grade in its major mines is less than 25%. It is probably lower still in the small and medium-sized mines.

The aggregate number of iron ore mines in China is large, as is number of corporate entities owning and managing them. Most major and medium-sized mines are owned and operated by the major steel companies, most of which are state-owned with only a few of the major or medium mines being truly independent. Collectives and privately held entities account for a large, although falling, share of production.

With steel production expected to increase and domestic ore production falling, China has two alternative ways of securing its import needs:

➤ investing in joint ventures in iron ore production abroad

➤ securing long-term contracts at set price levels.

As in the past, both routes will be used to secure future supplies. An alternative is for the Chinese to embark on grassroots exploration in order to secure new sources of iron ore. To facilitate this the Chinese Ministry of Finance has established a special fund for overseas exploration aimed at securing the raw material needs of Chinese companies. So far, however, most of these funds have been used for merger and acquisition activities abroad, and the exploration activities have been insignificant. It is probable, however, that exploration activities will become much more important and it is only a matter of time before greenfield discoveries will be made by Chinese exploration companies. In Africa, Chinese exploration for iron ore has been reported in a few countries, including Algeria where the Gara Djebilet project has been studied. In Gabon, where China National Machinery & Equipment Import & Export Co was cooperating with Vale and Eramet until mid-2006 in the Belinga project, the other partners were ousted when the Chinese offered a concessional loan of US$500 million for the construction of a port and railway. In Liberia, the Wugang Group has taken over a 60% interest in the Bong project that was held by the China African Development Fund. The rehabilitation of the mine is estimated to cost US$ 26 billion. In Madagascar, the Guangdong Foreign Trade Group and Jinxing International Holdings have jointly acquired the Sulala project. Wugang has also acquired 21.5% of the MMX group with extensive iron ore holdings in Brazil. Another Brazilian project with Chinese interests is the SAM project in Minas Gerais. In Indonesia, Qingdao Luyang Xinda Trade Company has invested into an iron ore project. Chinese investors have also been studying Swedish projects. The pace of investment into iron ore increased considerably in the first half of 2010. The coverage of the search is truly global. But in spite of these fairly recent efforts, Chinese control over overseas mineral production is at best marginal when considered on a global scale.

Estimated level of Chinese investment in the African mining industry

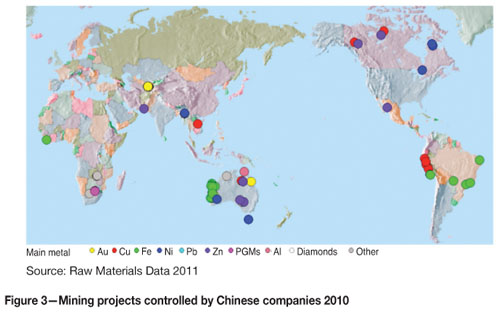

The total value of metal production controlled by Chinesebased companies outside China in 2009 was considerably less than 1% of the total value of metal production in the world.5 This is much less than that controlled by Canadian, Australian, or UK-based mining companies, for example. Included in this figure are only mines which are already producing and in which Chinese owners have at least shared control, i.e. decisive influence over strategic issues for the company or mine, not necessarily a majority, but more than a marginal holding. If the holdings in mines in Africa alone are considered China's share of control over total world mining drops even further, probably below a tenth of a per cent, as the overwhelming majority of Chinese investments into operating mines have been made in its neighbouring countries such as Mongolia, Vietnam and others and in Australia, mostly in search for iron ore deposits (Figure 2).

Even if we consider the projects in which Chinese investors currently have controlling interests, but which are not yet in production, the number and size of these future mines do not give support to the widespread impression that there is a rapidly increasing Chinese control over global mineral resources in general and of Africa in particular.6 While there will inevitably be Chinese operating mines and projects in Africa that are not included in the maps, even if they are added the conclusion will not change.

Given the present strong drive for further investments into overseas mining operations Chinese influence will undoubtedly increase in the future, but it is important to appreciate the that current levels of influence over world mine production by Chinese interests is only marginal, and it is highly unlikely that this will materially change in the near future.

The competitive impact of Chinese and other Asian investments on the 'traditional Western' investors in Africa

Given the nature of mergers and acquisitions in the mining industry and the considerable head start enjoyed by the traditional investors, it will inevitably take years before Chinese companies and China actually become a powerful global player in the mining industry. Also, contrary to the common perception of a Chinese Grand Plan for control over global mineral resources, it is a mistake to view the Chinese investors as a homogenous group. There is a wide variety of Chinese companies active internationally, from small aggressive companies seeking quick returns in the Congolese copper industry to major companies like Chinalco cooperating in partnership with the leading trans-national mining companies such as Rio Tinto. In this respect the Chinese are exactly like their Western competitors. From the point of view of African and other mineral-rich emerging economies, the strong demand for metals from China, and concerns in traditional industrialized countries in Europe, America, and Japan that their future supply might be threatened, this development represents new opportunities to create a vastly improved and more competitive investment environment. Provided that emerging countries have the institutional capacity and competence to manage both their mineral resources and the rents they generate, this should prove positive for these countries.

Given the small-scale nature of the bulk of the Chinese domestic mining industry and the prolific use of semi-mechanized technology, the Chinese have met with more serious problems in their overseas projects than they initially expected. The lack of experience of operating in foreign countries with different language, culture, and traditions makes it even more difficult for Chinese companies to succeed in their foreign projects. In some countries the often, but not always, poor Chinese interest in health and safety issues has caused serious accidents such as in Zambia. The corrupt traditions of some of China's provinces are also not always easy to do away with, but can create problems as well as short cuts.

Conclusion on whether Chinese companies will displace the traditional investors

It is an indisputable fact that Chinese economic growth drives global demand for minerals. Furthermore, while it is equally true that in spite of China being the world's largest mining nation and well ahead established mining countries like Australia, it nevertheless suffers a serious dependence on imports for copper, iron ore, nickel and other major metals. This gap is being covered by deliveries by the major international mining companies such as Vale, BHP Billiton, Rio Tinto, and Codelco. The Chinese reliance on imported metal supplies is a serious problem for the Chinese economy, both in terms of the cost for these imports and their economic and societal importance; more so than the dependence on China for rare earths is to the Western countries.

The current comparatively low levels of production of rare earths is more a function of recent rapid demand growth not meeting short-term supply requirements. This is due more to the gestation periods of 5–10 years for new mines than it is to the rarity of rare earth minerals and hence should not present a long-term supply problem. Thus far demand has been extremely limited and the global production tonnage of these metals is small, totalling only a few thousand tons annually. Total value of global run-of-mine production of rare earths is less than a few hundred million US dollars. Such small volumes and values are of limited interest to any of the major mining companies. When global demand for rare earths continues at a higher level than earlier, new mines will be opened and the Chinese monopoly will be broken. This will take some time because of the lengthy project gestation periods. While this will precipitate some price spikes, the price sensitivity to increased costs of, for example, the actual use of europium in liquid crystal displays is miniscule and the rare earths therefore remain relatively price- insensitive commodities.

It is highly unlikely that that the Chinese dependence on imports supplied by both major and small mining companies for their supply of copper, iron ore, or phosphates and potash will diminish substantially in the near future. The prospects for growth in Chinese demand are much more likely. Of the enormous amounts of metals and minerals produced, copper and iron ore alone represent roughly half of the total value created in global metal mining. Chinese iron ore imports amount to over 500 Mt conservatively valued at US$50 billion. But there are also other strategic metals such as phosphates and potash which are crucial for the production of fertilizers and hence for Chinese food supplies and which also need to be taken into consideration in this import dependence scenario. The situation where China is dependent on a limited number of major transnational mining companies will therefore continue to be a much more serious risk for international conflicts in the future than the supply of rare earths.

It is also important to appreciate as well that North America, Australia, and Europe have their own interests to protect in Africa and Latin America, and much of the anti-Chinese sentiment is driven by these factors. These countries have enjoyed more-or-less unfettered dominance of the African minerals sector for the most part of the 20th century in sourcing cheap raw materials, so the resistance to Chinese competition from these quarters is understandable. However, from the African experience of Chinese mining investments to date, it is clear that there is a dire need for efficient resource administration in order to manage Chinese investment effectively. In South Africa, for example, Chinese investors are aware of this and have been watching regulatory developments with a great deal of interest and concern. Consequently, there is a tendency for Chinese investors to seek control of their investments in the African mining sector.

In conclusion, there are many misconceptions concerning the Chinese imperative to ensure security of supply for resources and hence its interest in African resources. It is, however, of major concern for China that it is not to be able to secure its supply of most of the economically important metals and minerals in the way the 'Western' countries have been able to do for decades. This said, the perceived threat of China to the 'Western' interests must be seen in its true context. The attempts by the Chinese to invest in new projects or to take control over established transnational mining companies have evoked strong but unjustified political concern in Australia, Canada, and elsewhere that is essence not supported by global production statistics.

While these misconceptions are widespread and more often than not unsubstantiated, they are exacerbated by the lack of clear and transparent statistics from China itself. It is critically important to establish better data on projects under Chinese control and the levels of their adherence to the technical, environmental, and sustainable development standards set by Western companies operating in Africa. It is equally important to engage the Chinese on these issues. It would appear that the Chinese perception is that they are at the mercy of a limited number of giant transnational mining companies that could hold China to ransom by controlling the production of metals such as iron ore, copper, potash, and others that are strategic to China's development, hence the Chinese imperative to secure its own sources of offshore supply.

The road forward is a two-way street that requires a large dose of reality on the part of both China and its Western counterparts. Failing this, the developing geopolitical tensions over Chinese interest in Africa's resource sector will continue unabated, and in the end it is Africa that will once again suffer at the hands of external economic powers over interests that have little to do with the continent and its people.

References

1. US Geological Survey. Geology and Non-fuel Deposits of Africa and the Middle East. http://pubs.usgs.gov/of/2005/1294/e/OF05-1294-E.pdf. [ Links ]

2. This whole section draws extensively upon the not yet published study Minerals and Africa's Development—a report of the International Study Group on Africa's Mineral Regimes for the African Union and UN ECA. To be published in late 2011. [ Links ]

3. Raw Materials Group. Raw Materials Data. Stockholm, 2011. [ Links ]

4. United Nations Conference on Trade and Development. The Iron Ore Market 2009–2011. Geneva, 2010. [ Links ]

5. Raw Materials Group. Calculation based on Raw Materials Data 2010, Stockholm, 2010. For definition of control and other parameters please see Raw Materials Data 2011. [ Links ]

6. POLINARES, H. Preliminary figures presented at the dissemination workshop, Paris, 1 June 2011. www.polinares.eu. [ Links ] ◆

Paper received Jul. 2011