Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 n.7 Johannesburg Jul. 2011

JOURNAL PAPER

A conceptual approach to evaluating the political economics of mining in Africa and the sector's contribution to economic diversification

M.H. Solomon

Fellow, SAIMM

ABSTRACT

After the global financial crisis of 2008, African mining is entering a new phase of development. The rapid withdrawal of emerging market funding from the critical exploration and development industries provided a hiatus in funding, a gap which was quickly filled by Chinese and other Asian investors. While the continent is still economically dependent on its extractive industries, the prevalence of Dutch Disease has undermined Africa's ability to benefit fully from its mining, oil, and gas industries. While the extractive industries are closely related to many of the more fragile and failed states in Africa, it is equally true that the strongest states in Africa have mining-based economies.

This paper explores the possible linkages between mining, strong and weak political economies, and poverty in Africa. It draws the conclusion that neither Dutch Disease nor Resource Course is a given in resource-endowed countries, and that it can be avoided if the mining economies in these countries are actively integrated into their respective broader economies and used to foster economic diversification. The author asserts that given the capacity constraints of many African governments, it is contingent on mining companies to become integrally involved in catalysing diversification around their infrastructure and supply chains.

Keywords: African mining, resource curse, Dutch Disease, mining and economic diversification, mining and informal economies, mining and poverty alleviation.

Preface

As Africa approaches the next phase in its economic and political development, it has to be extremely careful to avoid falling yet again into the resource-curse trap that has plagued African economies since the competition for African minerals first started amongst the European powers more than 130 years ago. As with the previous phases of economic settlement, Africa is yet again poised to become the playing field of this new economic order which, as before, seeks commodities to fuel rapid economic development.

In this new phase, Africa has to plan for the leveraging of this investment into its mineral sector and the utilizing of the economic benefits of its mineral exports to China to diversify its economy.

As with the Cold War, Africa finds itself the centre of attention of political and economic powers which have no colonial history within the continent and little genuine interest in its economic and social welfare. It is, however, highly unlikely that Sino-American tension will develop into the cold war that resulted from the rivalry between the USSR and the USA, or the military conflict suffered by Africa during the First and Second World Wars. (Africans suffered more aggregate deaths and longer-term suffering from these alien confrontations than any of the powers that used their territory as a battleground in wars). The competition for commodities and the concomitant need for political influence, however, remains the name of the game. The rank and file in the trenches are the mining companies. Whether the common African people emerge as victims or beneficiaries of this process is to great extent a function of how these companies behave on the ground and conduct their business at a strategic level.

Sensible management of mining and its vertical and lateral linkages catalyses, enables, and enhances economic diversification. This provides for economic sustainability and consequently the mitigation or obviation of the resource curse syndrome. In order to achieve this it is necessary to engender, in policy makers and mining companies alike, a clear understanding of the total value chain associated with the minerals industry in Africa and its mechanisms, not just the muchvaunted backward and forward linkages.

Recognizing the capacity constraints of many African governments and their ability to undertake coherent integrated planning for economic diversification around mining activity, this cannot be left to policy makers and economic planners in emerging African mining countries alone. It is equally contingent on mining companies to understand that it is to their commercial advantage that mining provides this critical enabling environment for other forms of primary, secondary, and tertiary economy to take place.

The behaviour of the extractive industries contributes directly towards either stabilizing or destabilizing the political economies of the countries in which they have to operate. Mining companies investing in Africa and their shareholders must ultimately take responsibility for their role in ensuring Africa's economic future.

This paper makes no pretence at being a treatise on political or economic theory. Furthermore, the statistical methods used in demonstrating linkages or relationships are highly empirical and not academically robust. The analysis presented here seeks simply to demonstrate the relationship between well managed mining-based economies and overall economic development, and to contrast these with fragile or failed countries suffering from extractive industry-induced Dutch Disease.

It then sets out to establish a pragmatic approach to assessing the real economic impact that mining has on economies which mining companies can use in assessing the true economic and socio-economic impact of their projects. These assessments are pointless unless mining executives use them to inform their own economic sustainability policies and practice, and communicate the data derived to government policy makers and planners so that they can play their part in realizing the full value that mining has to offer the emerging economies of Africa.

Introduction

The fall of Lehman Brothers in September 2008 signalled a tipping point for Africa, the relevance of which few have truly appreciated. Africa is a battered continent that has suffered at the hands of foreign adventurers, intruders, traders, and colonial invaders for centuries. It has endured wars between global powers that were not even established as colonists within its shores. The original motives for colonization in the latter part of the 19th century were diverse. Livingstone and slave-trade abolitionists maintained that the answer to Africa's woes lay the triple alliance of Mammon, God, and social progress, and that trade, not the gun, would liberate Africa (Pakenham, 1991). More than a century later, this latter sentiment on trade still applies. Despite Livingstone's insights, the European phase of colonization was achieved by the gun and not trade, with God and social progress notably absent. The results of the industrialized countries' historic exploitation of and competition for Africa's mineral wealth are evident in the political and economic state in which the continent finds itself.

In order to make good policy, one should have an intimate understanding of history, and it is worthwhile to briefly consider the background to mining and its relationship to Africa's economic and political history, as it is entirely relevant to its future. The initial spate of economic colonization that followed the discovery of diamonds in South Africa in 1867 was followed by the carving up of Africa by the European powers at the Berlin conference in 1890 and the subsequent series of wars (the South African war and two World Wars) between these powers that spilled over into their respective African territories, causing immeasurable damage to Africans. Decolonization was followed by the Cold War between the USAs and Russia, which was primarily fought by proxy armies on African soil. Africa again bore the brunt of a geopolitical struggle that had very little to do with it, other than presenting the opportunity to rid itself of the obdurate and resilient remnants of colonial occupation such as the Portuguese and Apartheid governments.

The period of political and economic recovery that followed decolonization was accompanied by the vested attentions of the former colonial powers in the forms of development aid and continued investment in the industries that had been established during the colonial era. The postcolonial linkages with these former colonial powers did not terminate with the independence of the subject countries. Subsequent to the liberation of these former colonies, the business relationships established during the colonial era have to a great extent persisted and strengthened in many cases because of the historical business and economic relationships and cultures emanating from that period.

The poorly executed withdrawal of colonial administration was to a large extent accompanied by the collapse of infrastructure and the institutional capacity of African governments, which has severely hampered the process of economic recovery in Africa. The overt dependence on development aid and minerals-driven economies has led to widespread Dutch Disease on the continent (Dutch Disease is not caused only by minerals exports but also by development aid inflows), and this has restrained the competitiveness of its agricultural and manufacturing sectors, a factor that has been exacerbated by the failure of the Doha rounds (Collier, 2010).

Africa anticipated that with its liberation from its colonial oppression there was the reasonable expectation that this would lead to a better life for all. Despite the continent's rich inventory of natural resources, this has patently not happened. It is significant that 290 million of the world's poorest people that live in countries that have mineralsdriven economies (Collier, 2007) and that most of these are Africans. While colonializm and apartheid continue to be cited as the reasons for its plight, unfortunately the problems of Africa's ongoing poverty are more innate and fundamental. Africa might well have been decolonized, but in its wake the useful or beneficial freedom of its people is moot.

Political freedom for a large part of Africa has not been accompanied by economic development. This phenomenon is competently addressed by economist Amartya Sen (Sen, 1999), where he recognizes the empirical relationship between political freedom and economic development. In this context he refers to political freedom as being embodied in free elections and freedom of speech, and asserts that these are a prerequisite for the social opportunities of education and healthcare. These in turn form the basis of broad-based economic participation, which is critical for economic development. While Collier focuses on the resource curse syndrome, which is theoretically an economic disorder resulting from one dominant resource, based primary industry compromising the competitiveness of other export industries, Sen links the lack of political freedom in Africa to its economic constraints. These two views are of course closely related, and provide the point of departure for a discussion on the contribution that the minerals sector can make to economic recovery in Africa.

Africa's economy

In describing the possible antidotes to Dutch Disease, it is useful to have some sense of the economic and operating environment in which mining companies must operate on the continent. Africa is home to the poorest countries on the planet. Current statistical estimates of the economic state of Africa indicate that it currently has a total population of one billion people1, 41% of whom are under the age of 15. The African GDP income per capita is just 10% of the world average, which is an indictment on the economic management of the continent given the nature of its natural resource inventory and the fact that the continent has some 60% of the world's arable land. While there is much said about the commodity pull effect of the urbanization process in Asia (primarily India and China), little cognisence is given to what is happening in Africa and the fact that this continent already has 52 cities of more than 1 million people, as compared to Europe with 35 and China with 211. By 2025, 47% of the African population will be urbanized. While the nature of this shift may well be different in that African urbanization is predominantly informal while Chinese urbanization is more structured in the sense of built environment and supporting infrastructure, African urbanization nevertheless has major implications for infrastructure, food security, and consumption on the continent. .

The African economy is still primarily agrarian and is 90% informal. The fact that Africa has a market for its own products cannot be discounted in the resource demand scenario (Mahajan, 2008). Estimates of the future demographic profile of the continent suggest that by 2025 the African population will have reached 1.4 billion, expanding to 2.1 billion by 2050. Consumer spend on the continent will have reached US$1.4 trillion within an aggregate GDP of 2.6 trillion (Ernst and Young, 2011). Despite these encouraging growth trends, Africa still attracts less than 5% of global FDI projects (Ernst and Young, 2011). African growth has been assisted by a longer-term process of economic and regulatory reform that has occurred across much of the continent since the end of the Cold War. Despite this, Africa is nevertheless still prone to the problems of resource curse, and it is this ongoing self-perpetuating malady that needs to be addressed.

The unfortunate perception that Africa is in economic and political turmoil has undeniable elements of truth, but this is neither universal nor irredeemable, nor is it a given that African governments are unable to manage their resource wealth (Collier, 2010). It is encouraging that six African economies were among the ten fastest growing economies in the last decade (Ernst and Young, 2011). It remains the harsh reality, though, that Africa's continued growth is contingent on global economic development, and its relationship to the global economy is still primarily premised on its natural resource wealth.

This time around, the core driver of mining activity is the global supply-demand mechanism currently dominated by Asian growth, and this has major implications for the nature of investment in the African minerals sector.

Asian investment in Africa

There has been much speculation that, relatively recently freed of political and administrative colonialism and with Asian (Chinese and Indian) interest rapidly developing, Africa is now headed for a period of economic neocolonialism. The fear is that with the rapid rise in Chinese and Asian interest in the continent and their increasing influence on African governments, the traditional Western investors in the continent's resources sector (and their home governments) are now feeling materially threatened. This development has the propensity to create new geo-global political tensions (Rachman, 2010).

These impending tensions may not be restricted to Western and Asian competitive interests but possibly extend to competition between the Asian investors themselves. China and India naturally have to solicit political influence, and in so doing will inevitably pit themselves against the traditional players (Europe, the United Kingdom and its Commonwealth partners Australia, New Zealand and South Africa, Germany, Portugal, and France) seeking to defend their established interests and their historical political turf in Africa.

The principal difference between traditional investment and the new Asian guard is the short-termist nature of Western style investment. This contrasts starkly with the long-term horizons of Asian investment philosophy, where 20–30 year planning horizons are common. These supercede short-term economic fluctuations. In this context it is unsurprising that following the flight of high-risk, growth orientated emerging market investment funds from Africa in the two years following the 2008 Western economic debacle, China took full advantage of the vacuum left by Western investment and moved extraordinarily quickly to fill that gap (Deloitte, 2010).

At a higher political level, after two decades of cooperation, rivalries between the world's greatest economic powers, China and the United States, are rising again, political tensions are simmering and the prospect of an outright economic conflict is imminent. Spectator columnist Gideon Rachman, commenting on this looming post-financial crisis and Chinese opportunism, quotes a colleague as saying that 'Nobody spots blood on the water faster than the Chinese' (Rachman, 2010). The rapid response of the Chinese to the flight of emerging market capital from the African exploration and mining sector is testament to this economic pragmatism, and from the African perspective this is far from a negative consequence of the global economic crisis. The dominant demand for minerals is in China (Lennon, 2011) and a direct relationship between Africa and China without the intermediation of European or North American companies makes commercial sense, provided of course that this new relationship is not exploitative, which is the basis of the neocolonial concern.

The ubiquitous discussion on China is overworked and tedious but unavoidable in the debate on the future of mining in Africa for the next 30 years, given the rapid increase in Chinese interest in the continent. The lengthy gestation of mining projects and the necessary development of associated infrastructure suits the Chinese model of economic assistance (Brautigam, 2009). In the implementation of its economic policy for Africa, the manner in which China's investment in the extractive sectors in Africa is manifested. Contrary to the neo-colonial concern about China, there is every indication that China's concessionary investment and loan policies will be highly advantageous to Africa (Davies, 2010). Whether or not this investment will mitigate or exacerbate the continent's resource curse dynamic is debateable, as it is too early in the new phase of investment to draw any conclusions about whether China will meet international standards on resource governance and environmental management of its African operations and investments (Shankelman, 2010).

The resource curse and Africa

Resource curse, on which there is a huge body of literature, opinion, and debate, is by no means a purely economic mechanism, nor is it inevitable in countries that have little alternative but to rely on the exploitation of their mineral assets to escape from the limitations of poverty. Many academics and anti-mining lobbyists regard the onset of the syndrome as a given in emerging economies reliant on mineral endowments. This is not necessarily the case for resource-endowed countries in Africa (Collier, 2010).

Central to this assertion is that economic development (or lack thereof) and political stability in Africa are critically juxtaposed. The demise of colonialism, the fall of the Berlin Wall and the eradication of Apartheid, all of which happened decades ago, remove the convenience of these as current causalities for the economic travails of the continent. Africa's political circumstance and stability is starkly linked, both positively and negatively, with the presence and management of mineral resources and the mineral rents generated by mining activity, which must include oil and gas for the purposes of this argument.

Mineral resources endowment has an almost binary impact on African politics, much more so than in other developing environments: countries with well managed mineral-based economies are stable and strong, while those with kleptocratic and corrupt governments tend to fail. The stable political economies of the continent, are virtually all countries with established or developing mineral-based economies. Such countries would include South Africa, Botswana, Namibia, Tanzania, Mozambique, Zambia, Nigeria, and Ghana.

By the same token, a large percentage of fragile states and failed economies in Africa also have mineral-based economies. Angola, Sierra Leone, the Democratic Republic of Congo, Cote d'Ivoire, Equatorial Guinea, and now Libya are all testament to this phenomenon. The causes of failure are often related to the resource-curse or Dutch disease syndrome, and may not necessarily be associated with civil war. The 'resource curse' is perhaps the most important explanation for the failure of states (Di John, 2011), and has been written on and critiqued extensively. There is no question of the association of corrupt leadership and the occurrence of Dutch Disease in the extractive economies in Africa, and the nature of the resulting failure or non-failure of states resides in academic debates on functionalist theories of the state. These centre on models of patrimonial2 versus clientelist3 politics, detailed discussion of which falls well outside the scope of this paper.

This said, the dynamics of the politics of failed states are extremely pertinent here, as whichever of the two models is used to describe the failed states, invariably political patrimony is founded on access to the economic rents generated by the extractive industries. Companies active in these sectors cannot completely absolve themselves of the responsibility for this ease of access.

Corrupt misuse of rents generated by a country's mineral resource endowment for personal and political benefit is commonplace. The subject of mineral rents has been discussed comprehensively by Cawood and Minnit in the Journal of July 2002, where they are defined as 'the present value of the future stream of net revenues that mineral deposits can generate over time, where net revenues are the difference between total revenues and total costs and costs include a competitive return on investment' (Cawood, 2002). As this often occurs with the active or tacit compliance of the large and well known multinational companies granted the right to the exploitation of these resources, the credibility of the sector is legitimately open to question. The undeniable role that the extractive industry companies have played in accommodating rent-seeking activities amongst the political leaders of Africa's minerals-endowed fragile states has led to the establishment of imperatives such as the Extractive Industries Transparency Initiative (EITI) and the World Economic Forum Partnership Against Corruption Initiative (PACI), which seek to combat these practices. Subscription to these imperatives by companies is low and by host governments, even lower. There are only five African countries4 that are compliant with the EITI requirements, and 20 mining companies5 which operate in Africa that are signatories.

The causes of economic, political, and social failure in Africa are complex and it is not the intention to begin to address these here. It is sufficient for the purposes of this discussion to accept that while minerals have been the root cause of much of Africa's economic and political failure and its resultant suffering and poverty, responsibly managed mining and the behaviour of the mining companies that are active in these volatile political environments have the propensity and capacity to assist in reversing this malaise.

With notable exceptions such as China, economic development and political freedom are closely linked. Political freedom relies on the political restraint (accountability) of a country's leadership by its people, and within this context, political restraints tend to be imposed by people enjoying a higher level of per capita income. Economic development induces healthy institutional change (ibid) and strong institutions underpin a stable political economy. The extractive industries provide the impetus for this higher per capita income, but it is not a given that every country that plays host to a mining or oil and gas industry will necessarily fall victim to Dutch Disease. It is much more a question of the management of the extractive industry's rents that determines whether the resource-rich country will succeed or fail economically, politically, or socially.

The empirical correlation between mining activity and poverty alleviation

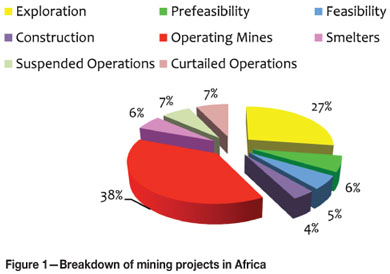

Economic success or failure needs to be qualified. The evaluation of GDP is of extremely limited value as it is a function of the size of the economy, which is of course infinitely variable and contingent on a number of factors. The measurement GDP per capita is a more useful measure of economic health, but it still fails to describe the economic benefit accruing to, and socio-economic health of, the country's citizens. In a very cursory study of 46 African countries, an attempt was made to establish whether there was a direct correlation between mining activity and poverty. Mining activity was measured in terms of active projects as opposed to financial turnover. This approach was taken as it is inappropriate to relate a relatively new mining economy such as Tanzania with an established mining economy such as that of South Africa.

Some 1600 mining projects were identified and used as a basis for the correlative analysis by producing scatter graphs of mining activity by country against a range of economic indicators. The distribution of the various categories of mining activity is shown in Figure 1.

In the analysis that follows, no distinction is made between the various types of mining activity or the economic value of the mining operations. The intention was to use the number of projects to identify those countries that had high levels of mining activity and therefore mining prospectivity.

Of the 46 African countries used for the exercise, eight were considered mining countries, 15 oil and gas-based economies, and the balance of 23 did not depend on extractive industries. Scatter diagrams of the level of mining activity, oil and gas and non-extractive economies were plotted against GDP, GDP per capita, and the Human Development Index. These results are to be taken as indicative rather than statistically robust.

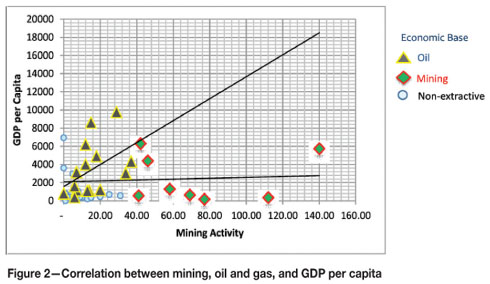

In testing for the differential correlation between mining activity (Raw Materials Group, 2011) and other forms of economic activity (Figure 2) it is quite clear that while mining economies (with the notable exceptions of South Africa, Botswana, Namibia, and Ghana) have a marginal advantage over non-extractive led economies, the GDPs per capita (International Monetary Fund, 2009) of the oil and gas economies are substantially higher than those of either the mining economies or the non-extractive economies.

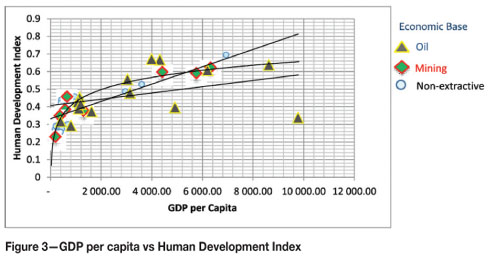

However, the GDP per capita does not provide any measure of poverty. The resource curse theory maintains that countries with extractive industries tend to have levels of poverty relatively higher than those with non-extractive economies. The approach used here was to test the levels of correlation between the income-generating capacity of a country against the economic circumstance of its people in the three respective economic orders by using the Human Development Index (HDI) (UNDP, 2008). This was done by plotting GDP per capita against HDI as shown in Figure 3.

Here one sees a distinct level of tight clustering between the higher GDP per capita countries and the higher HDIs of the mining and non-extractive economies. There is much more scatter within the oil and gas economies, symptomatic of a lack of coherency in the economic management of economies with oil and gas resources. This randomness may be symptomatic of their vulnerability to resource curse. It is notable that there is little difference in the pattern of correlation between GDP per capita in the mining countries and the non-extractive economies, indicating that on the whole the presence of mining activity in Africa does not necessarily represent an advantage; whereas logically, in the absence of strong manufacturing and service sectors in Africa, it should. This needs to be addressed and rectified if mining-related resource curse is to be avoided. The corollary to this, though, is that there is no demonstrable advantage shown by the non-extractive economies over the mining economies, contradicting many of the theories that resource curse and mining are inevitable bedfellows.

It is equally notable here that of the top ten countries with an HDI of higher than 0.5 (on a scale of 0–1), seven have extractive driven sectors, of which only three are mining. By way of comparison, Japan has an HDI of 1.0, the USA 0.943, France 0.976, and the UK at 0.946. On the other end of the scale one has the DRC at 0.239 and Zimbabwe at 0.098 (Appendix A).

The HDI positioning of South Africa at 0.597, being substantially lower than Gabon at 0.648, is notable. Gabon and Botswana are the only African countries ranked in the top 100 HDI scores, while South Africa comes in at 112. With the exception of seven countries, all sub-Saharan African countries fall within the low Human Development rankings. Irrespective of the poor HDI rankings it is patently clear that in the African context, it is the mining countries that have the higher HDIs. Furthermore, it is a significant issue within the resource curse debate that all of the larger mining economies in Africa have relatively stable political economies. This is demonstrably not the case with the oil and gas economies.

As is demonstrated in Figure 2, while there is a strong correlation between GDP per capita and HDI, there is no clear relationship between mining and GDP per capita.

In seeking a more direct linkage between mining activity and economic development and its relationship with poverty alleviation, one needs to understand how the HDI rating is calculated. While there are 50 components to the calculation of this index, there are very few that can be realistically influenced by mining company policy and practice. This means that other more practical approaches need to be taken to influence the improvement of HDI. From the empirical indications drawn from the schedule in Appendix A, the greatest correlations between the higher HDI mining countries and the HDI component elements were unsurprisingly:

➤GDP per capita

➤Population living below $1.25 per day (%)

➤The multidimensional poverty index

➤Life expectancy at birth (years)

➤Mean years of schooling (adults)

➤Adult literacy rate (both sexes) (% aged 15 and above).

One notable anomaly was the expenditure on public healthcare as a % of GDP, where Zimbabwe and Zambia had relatively high percentages of GDP spent on healthcare but this did not reflect in life expectancy or infant mortality. This suggests either rampant corruption in those sectors or incompetent and inefficient levels of service delivery.

Mining, Infrastructure, and HDI

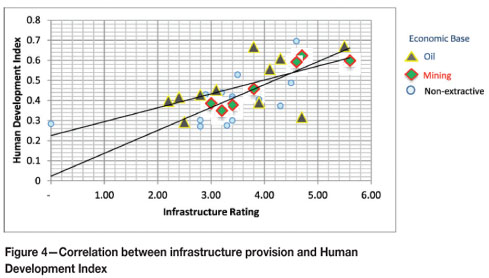

One area that is not covered in the HDI calculations is infrastructure. In order to test the relationship between extractive activity, HDI, and infrastructure, the levels of infrastructure development provided in the World Economic Forum's Global Competitiveness Report (World Economic Forum, 2010) were then plotted against HDI. Of all the factors tested, the closest correlation was found here (Figure 4).

From this graph one can also see the disparity between the mining countries with higher infrastructure ratings and those with lower ratings and the respective correlative relationships with HDI. If one regards the individual countries in the higher infrastructure/HDI groups, it is again unsurprising that they are the same as those countries with higher levels of education and public healthcare.

The most important aspect of Figure 4, however, is the correlation between infrastructure and human development and well-being. As the objective here is to inform thinking on the role of the mining sector in promoting stable political economies in their areas of operation, the most pragmatic area in which this can be achieved is in the planning, design, and management of mining-related infrastructure in such a way that it delivers maximum social and economic benefit.

The final step in this analysis is to examine the empirical relationship between the extractive economies and diversification. As theory around Dutch Disease is founded strongly on the premise that mineral commodity exports tend to suppress the competitiveness of the agriculturale and manufacturing sectors, countering this tendency is obviously the key to mitigating or averting the syndrome. Economic diversification is the obvious remedy for this.

The conundrum then becomes one of enhancing the competitiveness established by the presence of mining activity by pre-emptively planning for both the vertical and lateral integration of the mining economy into the broader economy of the host country in a highly structured way. This fundamentally encompasses the planning, at project development stage, for diversification of the mining infrastructure concurrent with mining operations, in order to ensure the catalysation of sustainable economic activity that will be materially supported by these operations. This early and structured integration is also necessary to allow related and unrelated economic activities stemming from pioneering mining operations the time to take root and assume their own critical mass before the underpin provided by mining wanes with the depletion of mineral inventories though exploitation.

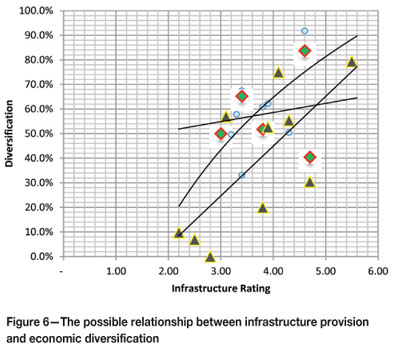

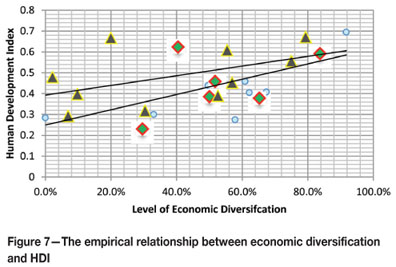

Consistent with the concept of structured integration, Figure 7 appears to support the assertion that the level of mineral exports encourages infrastructure development, and in addition to this, there is a clear linkage between the levels of infrastructure provision and economic diversification.

Following on these associations, Figure 8 demonstrates a correlation between economic diversification and HDI. It is notable from a political economic perspective that economic diversification in those countries that have well organized and established mining sectors (South Africa, Namibia, Ghana, and Botswana) promotes stable political economy.

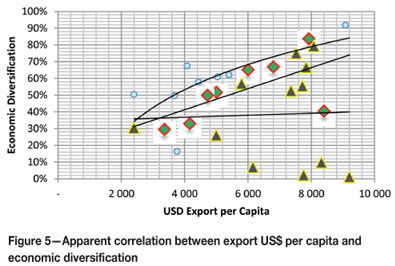

Figure 5 demonstrates that there is a clear relationship between the levels of diversification in mining economies and the levels of exports per capita. This suggests that the greater the macroeconomic contribution of mining to the export economy, the greater the level of diversification within the host economy, with notable exceptions.

Mining and diversification

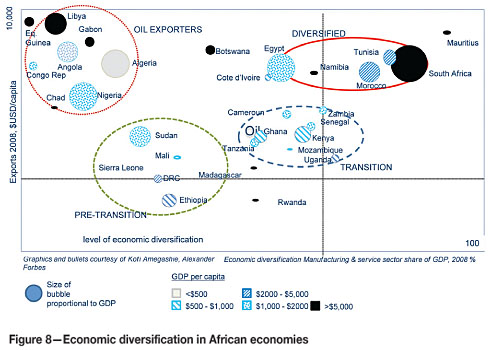

Following on these associations, it would be desirable that, given the demonstrable economic multipliers of mining activity, the harnessing of these multipliers should be evident in the levels of economic diversification of a well-managed economy of a mining-host country. It would follow from such an argument that economic diversification in those countries that have well organised and established mining sectors (South Africa, Namibia, Ghana and Botswana), would tend to promote stable political economy.

There is much work to be done in conclusively demonstrating this principle and the author makes no pretence in having done sufficient analytical work here to make that assertion. The graphs and figure used here (Figure 5, Figure 6, Figure 7, and Figure 8) are not statistically or academically sound, but are included purely to demonstrate the principle of comparing levels of economic diversification with other mining-related factors that may have contributed to diversification.

With ther rudimentary data used in Figure 5 the graph suggests that there may be a relationship between the levels of diversification in mining economies and the levels of exports per capita. It is conceivable from this apparent correlation that the greater the macroeconomic contribution of mining to the export economy, the greater the level of diversification within the host economy, with notable exceptions.

This trend demonstrated by mining is not as prominent in the oil and gas economies. This may indicate that the oil and gas economies are more prone to Dutch Disease than the mining economies. This is logical to the extent that the mining sector is invariably more labour intensive than the oil and gas sector, as well as having a more diverse range of intermediate inputs and infrastructure requirements. The development of industries catering for these intermediate inputs is a critical component for economic diversification and played a vital role in the development of South Africa's minerals-energy complex (Fine, 1996)

It is also true that most of the African countries categorized as transition economies have developing mining industries. Figure 7 appears to support the concept that a high level of mineral exports encourages infrastructure development and there is a strong relationship between the levels of infrastructure provision and diversification.

Following on these associations, Figure 7 suggests a correlation between economic diversification and HDI. It is notable from a political economic perspective that economic diversification in those countries that have well organised and established mining sectors (South Africa, Namibia, Ghana, and Botswana) are good examples of this.

It would be instructive to look at the countries themselves and see how they fare in relation to one another in the continuum between Dutch Disease-related fragile or failed economies and healthy, diversified economies with stable political regimes. This is neatly summarized in Figure 8 which categorizes a number of African countries into single commodity-dominated economies, pre-transition, transition and fully diversified economies.

In Figure 8 it is notable that South Africa is the only mining economy to be considered fully diversified, although many of the other mining countries (Botswana, Zambia, Ghana, Tanzania, Mozambique, Mali, and Cameroun) are very markedly in transition to becoming diversified economies. It is remarkable from cross referencing this diagram with the scatter graphs that those countries with higher levels of economic diversification are also those with well-developed mining industries.

One can also see here that other mining-related economies, many of which are or in the past have been regarded as fragile or failed states (Siera Leone, Mali, DRC and Rwanda), are in pre-transition.

Mining as a pioneering industry in catalyzing and supporting economic diversification

The concept of mining as a pioneering industry in Africa is an important one. In those countries that have experienced postcolonial damage or destruction of physical infrastructure and/or are subject to civil conflict, mining is virtually the only primary industry that is sufficiently resilient and riskorientated to invest and establish much-needed primary economic activity. One will find mines being established in deep rural areas or zones of high conflict, where other forms of primary industry (agriculture and tourism, for example) will simply not adapt or attract investment interest.

In these environments, the establishment of a mining project invariably establishes local physical, social, commercial, and industrial infrastructure, as well as primary economic activity and wealth creation. Very simply, this provides the enabling environment for other forms of primary, secondary, and tertiary activity to develop. This said, these activities do not spontaneously arise.

While the presence of mining activity creates a local market for supplies of agricultural produce where this is possible, it is the mining-related goods and services which serve to support and provide the opportunity for the establishment of agricultural enterprise. As the suppliers of intermediate inputs for mining are invariably located in the cities, transport and communications infrastructure to and from the mine are usually the first forms of infrastructure to manifest with a new mining project. This has obvious advantages for commercial farmers, as trucks bringing goods to the mine site are usually empty on the return journey and therefore provide readily available routes to the main markets in the cities for their agricultural produce.

In addition to this, one sees the development of strip economies take place along these transport routes. This provides further economic benefit, primarily to the rural informal economy in the vicinity of mines. Finally, the bulk of the economic benefit of mining does not take place locally, but in the cities themselves. This is more often than not overlooked by government planners and mining companies alike, who are fixated by the concept of facilitated local development in their social and labour plans or mineral development agreements. This is a distraction from the appreciation of the larger economic multipliers from mining, which do not manifest locally.

Mapping the direct linkages between individual mining projects and the broader economy in countries hosting mining projects

Having established the close parallels between mining development, infrastructure provision, economic diversification, and HDI, it is to necessary explore these linkages at the project level. Mining companies can and do influence economic impact in the manner in which they conduct their operations.

Corporate social investment (CSI) is one level of interface between a mining company and its host communities. The problem with CSI is that it is totally reliant on the continued operation of mining activities. However, it contributes little to the economic sustainability of mining activity, which is a function of the level of economic integration that is achieved during the currency of mining operations and its effectiveness in catalyzing other forms of economic development. Integration expedites the metamorphosis from mining to the level of economic diversification that defines an economy in transition.

The traditional vertical backward and forward linkages of mining are well understood. These are ubiquitous in the mining economic development strategies that permeate the political rhetoric of African governments, and more often than not completely ignore the inconvenient truths of supply chain and beneficiation economics. However, it is the lateral integration of mining economies into the catalyzation (through the prescient diversification planning for infrastructure and supply chain) of unrelated primary economic arenas that should be the next field of endeavour for development economists. There is very little discussion of these concepts, let alone lively debate on how they could be achieved.

In order to better understand the possibilities for greater economic leverage from mining, data from mining operations juxtaposed with government statistical data can easily and pragmatically be used to map the demography of impact (local and remote communities affected by the establishment of a mine). These data provide real and useful measures of the macro-economic, socio-economic, and environmental dimensions of mining at various levels of society and the economy.

Mining and economic planning: lessons from South Africa and Botswana

Following on these associations demonstrates a correlation between economic diversification and HDI. It is notable from a political economic perspective that economically diverse countries generally have well organized and established mining sectors. South Africa, Namibia, Ghana, and Botswana are good examples of this. Botswana has an arid climate and has far fewer economic alternatives than Ghana, Tanzania, or Mozambique. However, Botswana has a major competitive advantage in diversifying its economy because of the manner in which it has used its mining rents to develop widespread infrastructure and social services such as education and healthcare.

Unlike many sub-Saharan African countries such as Tanzania, Ghana, and Mozambique, South Africa has a mature mining industry, and the role of the industry is well defined in the country's macro-economic structure. While the industry in South Africa contributed only 8% directly and 14% indirectly to the country's GDP in 2000, it accounted for 59% of merchandise exports (32% primary minerals and 27% beneficiated minerals) and provided some 45% of South Africa's total foreign exchange earnings.

The modern economy of South Africa is founded on mining, which commenced at a large scale with the development of copper in Namaqualand in 1851. Because of the remoteness of Springbok, where the large mines operated for over 130 years, and the proximity of the workings to Port Nolloth, the copper industry did nothing to foster economic development in South Africa. Intermediate inputs arrived by sea from Britain accompanied by Welsh and Cornish miners, and the copper product went back on the return voyages. It was the discovery of diamonds in Kimberley in 1867 that kick-started the modern South African economy. After the unsubtle shifting of the border between the Cape Colony and the Boer Republic of the Free State to conveniently incorporate Kimberley into the Cape, the Cape Government built a railway line between Cape Town and Kimberley. This line was supplemented by a line connecting Kimberley to Port Elizabeth on the East Coast. Initially these lines were intended to provide supply lines for mining equipment and consumables from Britain to the diamond fields. However, the railway lines opened up the interior of the country and provided the agrarian Boers who had fled British government en masse in the 1830s with the opportunity to establish a viable commercial agricultural sector supplying both the mines and the port cities. It was the country's first incidence of import substitution.

The discovery of gold in Johannesburg in 1885 provided the next economic impetus to the country's development. In Kimberley, the consolidation of the artisanal workings of diamond fields6 had left the control of the now large diamond mines in the hands of a few individuals, who used this capital for the development of the gold mines. The short extension of the Cape railway line to Johannesburg accelerated the development of the mines, which relied initially, like Kimberley, on the supply of mining equipment and intermediate inputs from Britain. As the gold mining industry grew and supply lines rapidly became cumbersome and uneconomic, the establishment of the first substantial secondary and tertiary sectors occurred in close proximity to Johannesburg. This comprised the second critical phase of import substitution and the start of the diversification and industrialization of the modern South African economy, which has resulted in the powerful mineral economic complex that it is today (Fine, 1996).

It is important in the context of mining-related economic diversification that the financing for the early secondary and tertiary sectors was sourced predominantly from the mining companies or the so-called Randlords in their personal capacities. The six larger mining companies7 all became diversified investment houses. At the time of political transition in the early 1990s, these companies literally owned some 70% of the formal sector economy through their shareholdings in businesses across the economic spectrum.

Because of more than a century of mining-catalyzed economic diversification, South Africa is at a very different economic point in its social and economic history to that of countries like Tanzania, Ghana, Mozambique, and Mali. Macro-economically, it has to plan for and economically accommodate the downscaling of its mining industry, rather than its development. However, the lessons South Africa has learned from the socio-economic and environmental distress caused by mine closure and the manner in which the country is attempting to deal with the issues are very instructive for other sub-Saharan African countries, who not only need to take South Africa's lead in economic diversification, but need to plan for their respective industries' ultimate demise.

In this respect, Botswana is arguably the best example in the world. A mining-dominated economy, it has risen from being one of the globe's poorest countries in 1970 to being one of the most rapidly developing and best respected economies in Africa. Still a transition economy, it has focussed its efforts on a concerted economic diversification imperative.

Mining accounted for 38 % of GDP in 2005, and the sector is by far the most important contributor to GDP. Mining and mineral-processing activity provide more than 50% of the Botswana government revenues.

This contribution has been slowly declining from almost 40% in the early 1980s. Diamond mining accounts overwhelmingly for the largest part of mining's contribution to total GDP. At a macro-economic level, Botswana's exports are totally dominated by the mineral sector: diamonds accounted for 79%, copper and nickel for 4.5% and soda ash for 0.9% in all 83% of exports in 2005. The mineral dependence has decreased marginally over the last decade from 87% in 1990. With the closure of a car assembly plant in 2000, the prominence of minerals as the economic driver of the country's economy has increased over the last decade.

The importance of the mining sector is evident, and the need to diversify to reduce the vulnerability to unpredictable changes in the international markets for the commodities that Botswana produces is obvious. This further underlines the need for Botswana to continue to attract investment in exploration and to create an attractive environment for the mining industry. In this sense it is similar to Tanzania.

Botswana's success does not lie in the effectiveness of the country's mining code, but in the economic planning around the mining industry. Botswana and Tanzania both have economic development visions ('Long-Term Vision for Botswana—Towards Prosperity for All' and 'Vision 2025' respectively) but very different economic planning frameworks. There are remarkable differences here: both Botswana's 'Long-Term Vision' and the National Development Plan 10 are well structured documents demonstrating a very good understanding of what resources are available for economic growth and how they are to be mustered.

Consistent with the imperative to leverage mining rents for economic diversification, the carefully laid out 10th Botswana National Development Plan ('NDP 10') (Botswana Ministry of Finance and Development Planning, 2007) creates an excellent example of planning for the constructive use of mining rents to promote diversification. In stark contrast to the Botswana plan, mining has one obscure reference in the Tanzanian Vision 2025 statement, and is not mentioned at all in the country's poverty reduction strategy.

For many years, the main thrust of economic policy in Botswana has been to diversify the economy, in order to reduce dependence on the mining sector in general, and diamonds in particular. The NDP9 and 10 focuses on import substitution as well as the development of new exports, of both goods and services. It recognizes the need for diversification to reduce the risks of dependency on a few major export commodities.

A further reason for diversification is that in relation to the overall Botswana population, the mining sector (particularly the highly mechanized diamond industry) employs relatively few people. The rest of the economy is much more employment-intensive, in providing both formal sector jobs and support for the informal sector, which accounts for 33% of the country's GDP (Schneider, 2004).

Botswana has already achieved considerable success with its economic diversification programme. Copper-nickel mining in the Selebi-Phikwe/Francistown area preceded the mining of diamonds in the 1970s, prior to which the Botswana economy depended heavily on exports of beef and wage remittances of migrant labour working on the South African mines. The rents from diamond mining in particular have been used to build infrastructure, and provide wide-scale education and training of the Matswana people, an important underpin for the country's diversification plan.

The National Development Plan 10 carefully maps out the short, medium, and long-term integrated development plan for the country, upon which the government is not only expected to deliver, but has the political will and the financial resources to do so.

At a comparative level, the most important lesson to be drawn from Botswana is the structured approach that is taken to managing the country's mineral sector, and the clear appreciation of the macro- and socio-economic roles that the industry plays. Ever cogniscent of the longer-term concerns around the viability of the diamond industry, the need to reduce the country's dependence on diamonds is its national economic priority. This clarity of sectoral development is seen in the long-term vision for Botswana expressed in an early document 'Towards Prosperity for All' (Botswana Presidential Task Group, 1997), which succinctly identifies the critical areas earmarked for diversification.

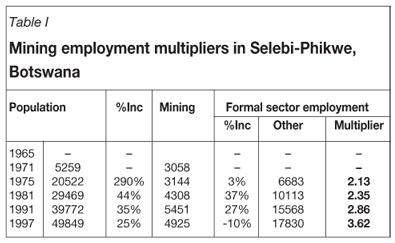

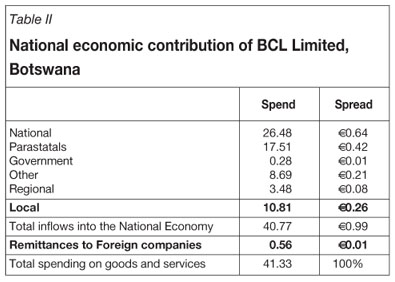

An excellent illustration of the economic multipliers of mining in Botswana emerged from a Sysmin study on the Bamangwato Concessions Limited (BCL) copper-nickel mine Selebi-Phikwe. The study was undertaken in 2001 by the Raw Materials Group in Sweden and the author was integrally involved in the analytical work. The study was requested by Botswana in order to assist the government in making a decision as to whether or not it should continue the approximately 50 million pula (US$7.2 million) a year subsidy to keep this loss-making mine operational.

Selebi-Phikwe is a mining town located in the Central District of Botswana. At the time of the Sysmin study in 2001 the town had a population of 49 849 (Wikipidea). The town is an administrative district, separate from the surrounding Central District. Nickel mining commenced at BCL in 1973, and this has been the primary economic activity since that time. The mining industrial complex includes a mine and a smelter. All operations are now deep-level underground mining.

Importantly, the mine has never been commercially successful, and as there is no other significant economic activity in the area, it is essentially an island economy. It therefore makes for an excellent case study in assessing economic multipliers.

At the most simplistic level, the employment multipliers are instructive. Starting from no local population whatsoever in 1971, Selebi-Phikwe now has a population of 52 000 people.

The importance of Table I lies in the calculation of the employment multipliers of 3.62 jobs in the local secondary and tertiary industry for every job on the BCL mine, the town's sole primary economic 'anchor tenant'. These ratios are often very difficult to determine as it is seldom that one is has a well documented 'island' economy where one is able to relate secondary and tertiary sector actively directly to mining alone. Selebi Phikwe provides one with this opportunity

The report preceded the economic flow exercise undertaken on a large South African precious metals mine described later in this paper, but used exactly the same methodology. Table II shows that even as a non-profitmaking mine, BCL contributed 41.33 million euros (US$58 million in current terms) to the Botswana economy, a substantial surplus on the US$7 million subsidy at the time the study was undertaken. Economically, it is an extremely important and almost unique example for governments of the importance of mining activity, even when it is marginal.

This is considerably less complex that that of the precious metals mine discussed in the next case study, signifying a far lower level of economic diversification in Botswana and perhaps lending support to the results shown. The spread of benefit from the South African mine is geographically and sectorally much more complex and impactive than the Botswana example.

Assessing the impact of the mining economy in the broader economy

In developing an understanding of the relationship between a mine and its host economy, it is enlightening to empirically map the economic flows from the mine into the surrounding economy both geographically and inter-sectorally. This is a vital planning tool, not only for mining companies and governments in appreciating the full scope of benefit from a new mining project or cluster, but also to assess the socioeconomic and macro-economic impact on closure of a mine or waning of a cluster.

In mapping these impacts, the underlying precepts directing any diversification strategy are tested against what is achievable and what is not. For example, a mine's social and labour plans may target 10% of their expenditure for local procurement, while the mapping of existing comparative operations could indicate that this is patently unachievable.

To illustrate the principle, the author undertook a detailed analysis on the economic impact that a single precious metals mine in South Africa had on the various levels of the economy. The exercise also looked at the mine's economic impact on the various areas that supply its labour.

The mine modelled is a large precious metal narrow reef underground operation in the North West Province of South Africa producing 7.5 million tons of ROM ore per annum yielding 700 000 ounces of metal. The mine employed 9318 people at the time of the economic evaluation undertaken by the author. The exercise constituted:

An analysis of 41784 procurement transactions that were categorized by:

➤Origin of manufacture of goods

➤Home office of services provided (in order to assess commissions or margins taken by local or regional branch offices or agencies)

➤Standard Industry Codes (SIC Categories) in order to assess cross sectoral benefits.

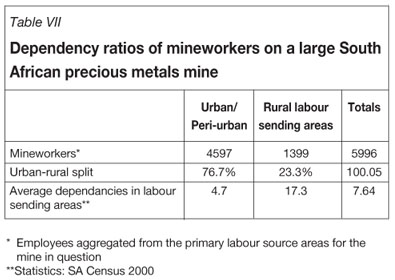

A comprehensive analysis of 5996 employee personnel records to establish:

➤Net Earnings

➤Discretionary incomes

➤Labour supplying area

➤Local families vs rural family commitments

➤Level of dependencies

➤Years of service.

A survey of mineworkers spending profiles to assess:

➤Level of wage remittances split to rural families

➤Percentage of wage packet spent in rural areas and on urban families local to mine site8

➤The split of the wage packet on food, shelter, discretionary purchases and services.

As with the mines procurement analysis, a rough estimate was undertaken as to the routing of various disbursements from wage packages from retailers, agents, and head office of the principal vendor (for example, cell phone expenditure would have been sold locally, through an agent in a local centre and the principal vendor, the cell phone service provider, in Johannesburg).

This demographic and geographic distribution of mine expenditure between procurement and wages was then juxtaposed to get a profile of total economic impact and split into four broad categories:

➤Salaries and wages

➤Procurement

➤Fiscal flows

➤Royalties

➤Socio-economic development.

Fiscal flows included corporate taxation and personal income taxes of employees, which were subtracted from the salaries and wages line. The salaries and wages reflected are effectively 'take-home' pay or discretionary spending amounts.

The aggregated results of the demography of both procurement spend and wage disbursements are summarized.

What is notable here is that some 70% of the mine's expenditure finds its way to the industrial, financial services, and corporate administrative districts in Gauteng. The tables put in perspective the difficulties associated with truly local expenditure. Ultimately the bulk of the wage packet reports to the central economic areas as well.

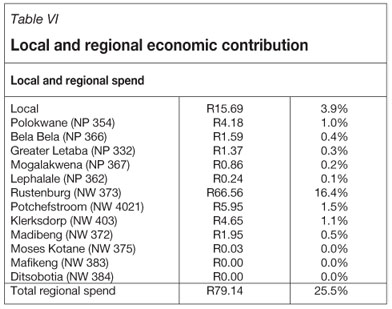

With the popular focus being on local development, Table VI demonstrates that, realistically, only around 5% of the expenditure remains in the area local to the mine and a further 20% resides regionally. These are important rules of thumb for mine management and project planners when negotiating with government on social and labour plans in the case of South Africa or mineral development agreements in other mining regimes in Sub-Saharan Africa.

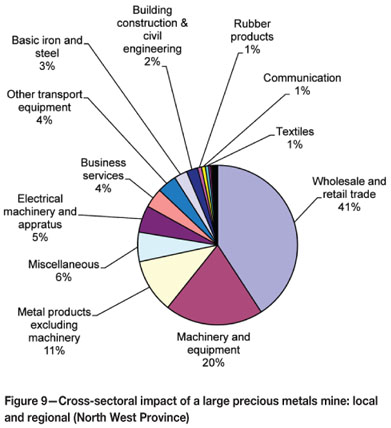

In developing an economic integration strategy it is crucially important to understand the ultimate geographic destination of the disbursements though procurement or wage earnings, as well as those sectors in those areas that can be expected to benefit from this expenditure by mines. The results as reflected in Figure 9 and Figure 10 are very instructive in this regard. Figure 9 represents the area local to the mine and regional to the mine in question, and provides a cross-sectoral profile of economic benefit. This has a heavy bias towards the wholesale and retail sectors and (one assumes) local business and engineering services.

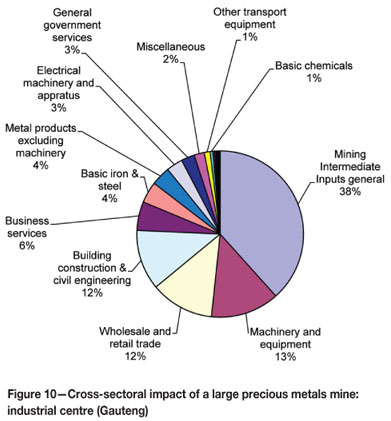

By contrast, the analysis of beneficiaries in the central business and industrial areas of Gauteng (Johannesburg, Sandton, Pretoria, and the East and West Rand) shows a strong bias towards mining intermediate inputs and largescale civil and engineering contractors. This is intuitive, but it is nevertheless useful to qualify the areas and quantify them in terms of absolute and proportional spend.

The final assessment in this exercise is that of socio-economic value, as it is invariably the most sensitive political area of interest. It is also almost invariably completely underrated. For example, when it is reported in the media that a mine has closed and so many thousand workers have been retrenched, few people begin to appreciate the enormous effect that this has not only on the area local to the mine but also on the rest of country.

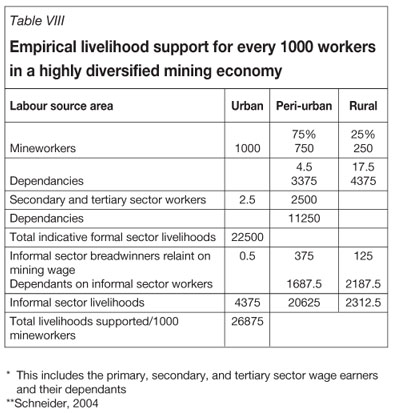

The result of extrapolating these figures into the actual levels of livelihood supported by the mining industry in South Africa is alarming. For the purposes of this exercise, an oft-quoted (but unqualified) formal sector employment multiplier of mining as 2.5 jobs9 is used.

This is probably conservative compared to the Selebi-Phikwe exercise, which showed that mining created 3.6 local jobs alone excluding the employment created at a regional and national level, which benefit from 70% of mine spend. The calculations show that, conservatively, the creation of every 1000 mining jobs results in the livelihood support of roughly 25 000 people.

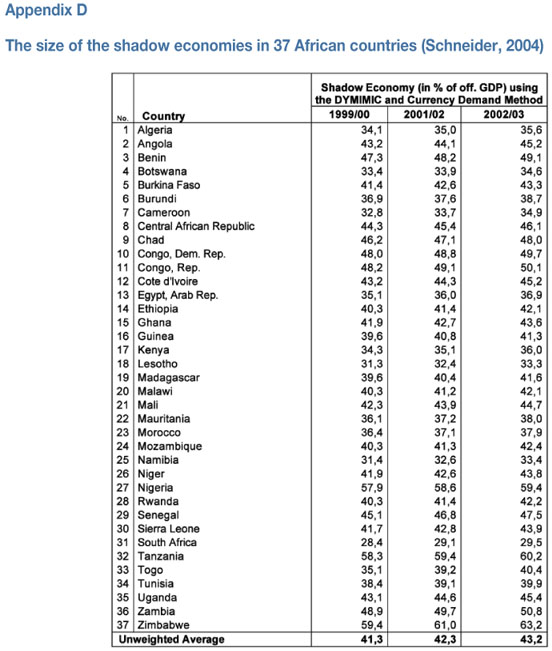

These include the effects of formal sector economic activity catalyzed by mining in the informal sector. The informal economy in South Africa constitutes 28% of the total GDP (Schneider, 2004), and according to South African labour statistics (Statistics South Africa, 2008) the ratio of formal to informal sector employment is 2.7 to one.

If one assumes for the purposes of this argument that there is only one breadwinner in the informal sector for every two mining jobs, i.e 20% of the official ratio, a conservative estimate of 27 000 formal and informal-sector supported livelihoods per 1000 mineworkers is estimated.

One must take into consideration that South Africa, as a diversified mining economy, has a higher ratio of formal sector breadwinners to that of less diversified mining economies such as Ghana (41.9%), Zambia (48.9%), and Tanzania (58.3%) (Schneider, 2004). This implies that the less diversified economies have a higher reliance on the lower-paying and less secure but larger informal sectors. This lends empirical credence to the relationships described, where the more diversified the economy, the higher the HDI of the mining country.

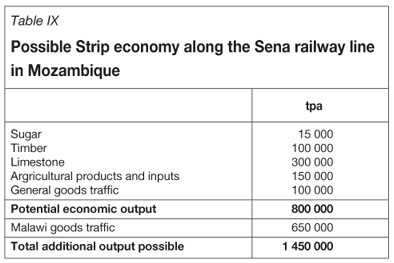

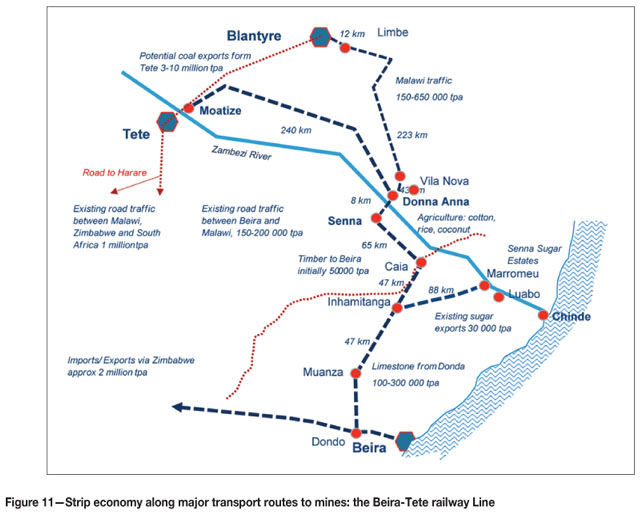

Mining and strip economies along transport routes: The Beira-Tete railway line as a case study

Anyone who has travelled to remote mines in Africa will attest to the strip economy that develops along the transport routes into the mine. Transport routes into a mine are important features in the infrastructure contribution that the mine makes to broader economic development throughout Africa. The associated strip economies are large and informal. It is consequently extremely difficult to quantify the extent of this activity, but it cannot be ignored.

One of the few quantifiable examples of the potential for mining transport-related strip economic development is the Beira-Tete railway line in Mozambique. The railway line has been controversial for decades as it is instrumental in the opening up of the Moatize coal fields near Tete, inland of Beira near the Zimbabwean and Malawian borders with Mozambique between Mutare and Limbe.

The railway was completely destroyed during the civil war in the 1970s and has been unserviceable since the conclusion of hostilities. The Mozambique government held the view that the mining companies that wished to exploit the Moatize coal should meet the cost of rehabilitating the railway line. This was not economically viable and consequently, the coal fields lay essentially unworked until Vale gained the rights to the mines in 2007. The Indian group Rites and Ircon in 2004 won the contract to repair the Sena railway, but the company has not met its delivery deadlines and Vale has announced that it is to transport its coal by road instead.

At the time of planning the rehabilitation in 2001, a Swedish rail transport specialist based in Johannesburg, Bo Giersing, made the point that the economic justification for the railway line should not be premised purely on the coal that would be carried on the railway, but on the broader economic impact of the railway line. He analysed the economic activity that had taken place along the line prior to its destruction in the civil war and asserted that this activity would resume once the railway was rehabilitated. The underlying premise was that the cost of the line should not be borne only by the mining company, but by the government or its development aid partners.

The case study demonstrates the economic multipliers in sectors totally unrelated to mining that are enabled by the transport routes catalysed by mining activity. The line would not only open up agricultural and agro-industry opportunities in cotton, sugar, and timber, but also other mining activity in limestone, associated cement manufacture, and dimension stone. The line is shown with the possible strip economic potential.

Conclusions

Mining spawns infrastructure and secondary and tertiary industries, which in turn provide service catalytic impetus for of economic activities such as agriculture, tourism, and other forms of natural resource exploitation. The economic sustainability of the resulting aggregate economy is contingent on the reduction of dependence of these new industries on the initial mining drivers.

This study has indicated that there are identifiable relationships between the levels of mining activity, infrastructure development, GDP per capita, and the concomitant diversification of economies. There are also strong indications that the more diverse the economies, the higher the respective Human Development Indices for those countries.

With proper planning, the extractive industries, particularly mining, can be avoided. However, the host countries in which new mining projects are bound to take place seldom have the capacity, experience, or expertise to undertake this level of planning to maximize the economic multipliers made possible by mining. Furthermore, no amount of regulation can dictate where and how mining companies procure the intermediate inputs they require to mine. These decisions are taken at management level.

It is in the interest of mining companies that their managements assist host governments in planning for economic diversification around mining activity. This process can be assisted by mapping the geography and demographics of economic flows from existing or comparative projects in order to structure realistic objectives for economic planning. Given the capacity constraints of most African governments hosting mining activity, it is contingent on mining companies to initiate these exercises and communicate the planning implications to the respective governments.

The business case for this effort lies in reducing capital and operating costs, thereby enhancing returns for investors. The sharing of infrastructure with other forms of economic activity cuts both capital and operating costs and gears the NPVs and IRRs of mining projects. Stable political economies make for lower political risk and therefore lower costs of capital and skills.

Finally, as southern African mining companies face stringent competition against Asian miners seeking acquisitions in Africa, responsible mining that benefits the African economy is a powerful differentiator.

References

BOTSWANA MINISTRY OF FINANCE AND DEVELOPMENT PLANNING. Macroeconomic Outline and Policy Framework for NDP 10. Republic of Botswana Government Printer, Gaberone. 2007. [ Links ]

BOTSWANA PRESIDENTIAL TASK GROUP. Towards Prosperity for All. Government of Botswana, Gaberone. 1997. [ Links ]

BRAUTIGAM, D. The Dragon's Gift. Oxford University Press, Oxford. 2009. [ Links ]

CAWOOD, F. a. Identification and distribution of mineral rents in Southern Africa. Journal of The Southern African Institute of Mining and Metallurgy, vol. 102, no.5, 2002. pp. 289–297. [ Links ]

COLLIER, P. The Bottom Billion. Oxford: Oxford University Press. 2007. [ Links ]

COLLIER, P. The Plundered Planet. Penguin, London. 2010. [ Links ]

Davies, D.M. How China is Influenceing Africa's Development. OECD, Geneva. 2010. [ Links ]

DELOITTE. Emerging from the Twilight: the next chapter of Chinese outbound M&A. Deloite Chinese Services Group, Beijing. 2010. [ Links ]

DI JOHN, J. Failed States' in Sub-Saharan Africa: A Review of the Literature. Real Instituto Elcano, Madrid. 2011. [ Links ]

ERNST AND YOUNG. Africa Attractiveness Report. 2011. [ Links ]

FINE, B.A. The Politcal Economy of South Africa. Johannesburg: The Political Economy of South Africa: from Minerals-Energy Complex to Industrialisation. 1996. [ Links ]

INTERNATIONAL MONETARY FUND. World Economic Outlook. World Bank, New York. 2009. [ Links ]

LENNON, J.A. Chinese Base Metals Outlook. Macquarie China Day. Macquarie First South Securities, Cape Town. 2011. [ Links ]

MAHAJAN, V. Africa Rising.: Wharton School Publishing, New Jersey. 2008. [ Links ]

PAKENHAM, T. The Scramble for Africa. Abacus, London. 1991. [ Links ]

RACHMAN, G. Playing with Fire. The Spectator, 30 October 2010. pp. 12–13. [ Links ]

RAW MATERIALS GROUP, Raw Materials Database. Raw Materials Group, Stockholm. 2011. [ Links ]

SCHNEIDER, F. The Size of the Shadow Economies of 145 Countries all over the World, First Results 1999–2003. Institute for the Study of Labour (IZA), Bonn. 2004. [ Links ]

SELEBI PHIKWE. (n.d.). Retrieved June 3, from Wikipedia: http://en.wikipedia.org/wiki/Selebi-Phikwe. 2011 [ Links ]

SEN, A. Development as Freedom. Oxford University Press, Oxford. 1999. [ Links ]

SHANKELMAN, J. Going Global: Chinese Oil and Mining Companies and the Governance of Resource Wealth. Woodrow Wilson International Centre for Scholars, Washington. 2010. [ Links ]

STATISTICS SOUTH AFRICA. Quarterly Labour Force Survey P2111. Statistics South Africa, Pretoria. 2008. [ Links ]

UNDP. Human Development Indices. United Nations, New York. 2008. [ Links ]

WIKIPIDEA. Selebi Phikwe. http://en.wikipedia.org/wiki/Selebi-Phikwe. Accessed 3 June 2011. [ Links ]

WORLD ECONOMIC FORUM. The Global Competitiveness Report 2010–2011. World Economic Forum, Switzerland. 2010. [ Links ]◆

1 Ernst and Young as per Demographic Indicators, www.africaneconomicoutlook.org, January 2011

2 Patrinomialism relies on the use of the resources of the State by its ruler to secure the exclusive loyalty support of administrative and military personnel. Political power is premised on the use of these State resources for personal benefit and there is little differentiation between the private and public spheres roles of the rulers in the application of these resources.

3 Clientelism, on the other hand, is a broader form of patrimony where leaders use State resources to provide economic opportunity to supporters in the form of credits, subsidies, and employment opportunities in order to secure their loyalty of such 'clients'. The objective is slightly more democratic than patrimonialism as it is commonly manifested in the use of State resources to secure for the benefit of the party responsible for dispensing with State patronage (Di John, 2011).

4 Niger, Central African Republic, Nigeria, Ghana, and Liberia

5 African Rainbow Minerals (ARM), Anglo American, AngloGold Ashanti, Anvil Mining, ArcelorMittal, AREVA, Barrick Gold Corporation, BHP Billiton, De Beers, Dundee Precious Metals, Gold Fields, Goldcorp, Kinross, Lonmin, Newmont, Oxus Gold, Rio Tinto, Vale, and Xstrata

6 The workings got too deep for individual claim holders to operate safely and viably

7 Anglo American, Rand Mines, Anglo Vaal, JCI, Gold Fields and Gencor

8 A large proportion of migrant mineworkers who had lengthy records of service had established local families in addition to their families in the rural labour supplying areas

9 In the formal secondary and tertiary sectors related to mining

Paper received Jul. 2011