Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

Journal of the Southern African Institute of Mining and Metallurgy

On-line version ISSN 2411-9717

Print version ISSN 2225-6253

J. S. Afr. Inst. Min. Metall. vol.111 n.7 Johannesburg Jul. 2011

JOURNAL PAPER

Threats to the South African minerals sector : an independent view on the investment environment for mining

F.T. Cawood

School of Mining Engineering, University of the Witwatersrand

ABSTRACT

This article offers a personal and independent view on the threats to the sustainability of the South African minerals industry. It argues that if the six identified threats of insufficient spending on research and development, general standard of education, nationalization, inadequate infrastructure, Aids prevalence and labour inefficiency are not acted upon as a matter of urgency, the future of the mining industry, along with its important contribution to the economy, is at risk.

Keywords: South Africa; investment environment; sustainability; research and development; education; nationalisation; infrastructure; transport; electricity; aids; labour; mining industry; contribution to economy; mineral resource; industry risk; government; public perception; mining company; investment destination; competitive industry.

Introduction

Fundamental economic theory dictates that once a mineral resource is mined, that resource is gone for good. There is therefore only one opportunity to make the most of each mineral resource. For this reason, mineral development requires careful regulation by government and prudent management of the resources by companies. The mining business is essentially a complex process of converting a nonrenewable natural resource into reproducible capital. Each mine is unique in respect of costs, mining method, processing, and market requirements. The industry is also particularly risky, which requires governments to understand the need for stability of terms, security of tenure, and protection against expropriation. Once the investment is made, the capital is captive, leaving companies at the mercy of governments, and despite wider public perception, the mining process does not necessarily end with a pot of gold in the hands of the mining company. An orebody becomes valuable only after extraction and transformation into a product that is of some use in the markets. The secret from government's perspective is to allow a sufficient flow of funds through to investors so that they do not leave the country for other, more attractive, investment destinations. When exploring why companies would leave South Africa, one needs to consider the main threats to the sustainability of mining as a competitive industry.

Inadequacy of R&D spending in South Africa

Expenditure on research and development (R&D) is a key indicator of government and private sector efforts to obtain a competitive advantage. According to the OECD Factbook 20101, countries like Turkey, Portugal, and China have experienced double-digit growth rates in R&D spending in recent years. Figure 1 shows that the average spending on R&D for the OECD is 2.3% of GDP, while countries like Sweden and Finland, who successfully converted their economies from resourcedbased to knowledge-based, spend 4% of GDP on R&D. In comparison, South Africa's spending on R&D is 1% of GDP2.

Our industry has many problems covering a broad spectrum, which brings me to the concept of a sustainable mining industry. In addition to the 'soft' topics such as the societal licence to practice, sustainability also requires fundamental research in many technical areas. Depleting reserves and declining grades pose challenges to industry's sustainability because future mining can be done only in one direction—deeper down, breaking more volume relative to the valuable part of the orebody. The easy pickings are gone, and the increasing technical complexity of the next generation of mining projects will require better education and fundamental research leading to testing and developing mechanized solutions. Here it is necessary to emphasize the development part of R&D—or as it is jokingly referred to in South Africa, R&Deeee ... as this is the point where mining research has been stuck since the Chamber of Mines Research Organisation (COMRO) closed. It will require skill, knowledge, research, and technology to open new reserves, develop the necessary infrastructure for the optimal use of our minerals, and then to design mines smarter (i.e. more production at less cost without compromising worker health and safety, the environment, and at the same time delivering public benefits). This will not be easy considering the fact that mineral grades are likely to continue their declining trend – hence the need for new knowledge through research and better understanding of current knowledge through education programmes. Looking at the issue this way, universities must deliver innovative problem-solvers to industry. While it is right to send a student to university to study for a first qualification, industry must also appreciate that it is wrong to send someone to our postgraduate programme for a 100%taught Masters qualification, as these students do not add to the required body of knowledge. Postgraduates must arrive at university with a question that needs to be answered, and it is then our duty to return these students - not only with an answer, but also with a qualification.

The quality of education

Discussion about the general quality of education in South Africa stems from the requirement for mines to have access to skilled labour and to recruit staff with the potential to become skilled and productive. The Global Competitive Index (GCI)3 quantifies the ability of a country to compete on the world business stage. Figure 2 illustrates that South Africa currently has an adequate rating, but there is a deteriorating trend year-on-year. It is getting harder for South Africa companies to compete with their peers in other countries. Alarmingly, the 2010 GCI fingers our education system as part of the problem. The quality of education in South Africa is ranked 130th out of 139 countries. The standard of mathematics and science is even worse South Africa ranks 137th. How can this level of education support a world class mining industry in a sustainable manner?

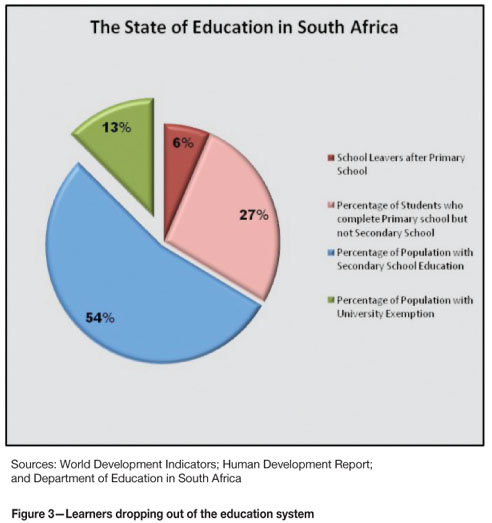

The country cannot afford to deny this problem any longer, and drastic intervention is necessary because the problem does not end with the schooling system. The undeniable truth is that South Africa needs to improve its standard of education. Figure 3 provides a clue on how this could be done. According to the World Development Indicators of 2010, six out of every 100 primary school children will not make the transition to secondary school in South Africa. This is unacceptable because the children dropping out of the education system at this early age are destined for a life of unemployment and poverty. Those going to secondary school, but dropping out before the national senior certificate. They, according to the Human Development Report4, represent a further 27 of the initial 100, making the total drop-out number 33. Of the 67 children leaving secondary school with a national senior certificate, only 13 will qualify for university acceptance, according to the Department of Education in South Africa5. This is unacceptable for a country that needs to improve skills levels, and research and development output. Intervention should start with pre-school education, so that education can start on the first day of Grade 1 in order to prepare the children for success at a secondary school level, not only primary school. Over time, the number of children who drop out after primary school must be reduced to zero, while the percentages completing secondary school and gaining university exemption must be increased significantly. This will allow systematic growth of the green section. Apart from increasing the numbers, the quality must also improve so that many more students can succeed with their university studies. Universities can no longer hide unacceptable drop-out rates behind protection of standards. The whole education system needs an overhaul.

Political noise on nationalization

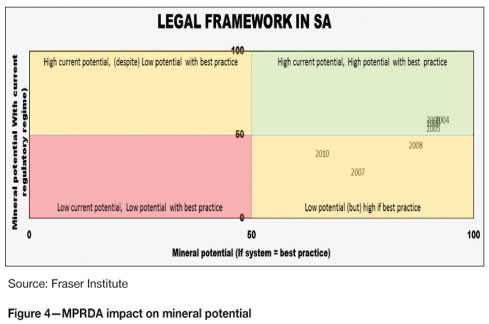

Listening to some of the statements on this topic, it becomes clear that there is confusion on what nationalization means in the South African context. Before entertaining that ideology, one should first get an update on the 'goodness' of the existing mineral law and policy framework. The surveys of the Canadian Fraser Institute6 could be utilized for this purpose. Considering that the new mineral law and policy framework was implemented when the MPRDA7 became effective in 2004, performance should be tracked since then. Figure 4 plots our mineral potential on the horizontal axis. South Africa is on the right hand side of the graph, which is indicative of a country with an above-average resource base. The vertical axis shows how our mineral potential is influenced by mineral law and policy. It shows that the regulatory regime is pressing South Africa downwards, and as a result its ranking has been migrating in the wrong direction since 2004, despite our mineral potential. In summary, when it comes to mineral regulatory framework, the chart convincingly illustrates that the country does not live up to the potential of its mineral resources. There is a problem with the administration of the mineral law and policy framework in South Africa. Security of tenure has deteriorated significantly since 2004, as the uncertainty in the administration of the MPRDA and the risk of land claims, fuelled by the nationalization threats, increased. Perhaps because of government's inability to administer the existing regulatory framework for wide public benefit, and possibly industry's inability to adequately inform the public of its benefits, the situation has resulted in unnecessary alarm. The crux of nationalization is the role of the state in mining. If that role is to operate a mine or mines this poses no problem. However, if the intention is to expropriate without compensation, there is every reason for fear.

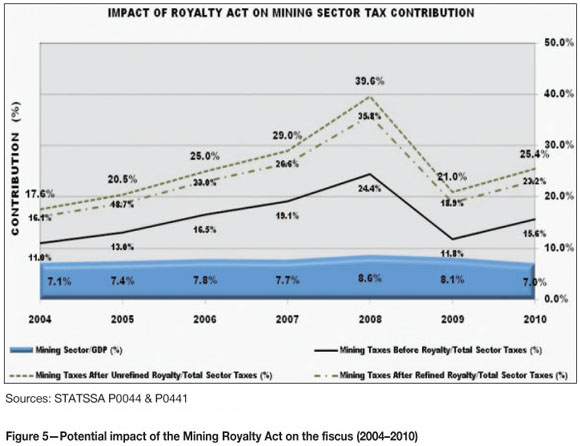

Despite the opposing opinions on the role of government, there is a unified view that the mineral wealth of the country should benefit its citizens. The combined effect of increasing participation of historically disadvantaged South Africans through the MPRDA, company income tax, and since March 2010, mining royalty collections, will achieve significant benefit for the country. Mining taxes in South Africa (at R16 billion in 2010) account for about 16% of total company taxes while mining's contribution to GDP is less than 10% (Figure 5). This suggests that mining companies already pay higher taxes than companies operating in other sectors of the economy. If one builds the new royalty regime into the statistics as published by StatsSA8, one finds that the mineral sector is about to become even more important to the national economy – without the need for nationalization. The expected impact of the Royalty Act is between R8 and R10 billion, which causes about an 8% rise in mining's contribution to company taxes. Stated differently, the royalty on its own will cause mining taxes in good years to rise by 50%. This is significant, and it is important that there is public knowledge and appreciation of this contribution. It will counteract the illinformed but popular political statements on nationalization and its perceived benefits.

➤ It is comforting to know that the role of the state cannot be increased without considering the following limitations, which question nationalization as a solution for South Africa:

➤ Providing for compensation as required by the Constitution to those private companies affected by such a scheme

➤ Developing state capacity to geologically explore new areas and operate mines more effectively than private companies

➤ Allowing the state access to the capital required to explore, build, operate, and close mines efficiently and responsibly

➤ Rebuilding the economy in the case of a failed state as a result of not being able to deliver on inflated public expectations.

Obvious questions are:

➤ Is it not better to give the new legislative framework the time to deliver on its policy objectives and to strive for greater efficiency, rather than keep on changing the rules of the game?

➤ Is it really worth risking an industry that accounts for a tenth of the national economy, provides direct employment to more than 500 000 workers, and earns in excess of a third of the country's foreign currency?

Access to reliable and affordable Infrastructure

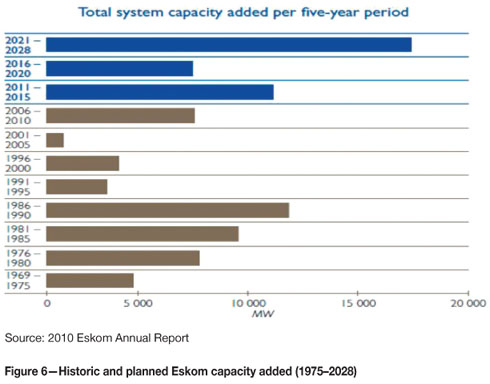

The new legal framework has raised the importance of adding value to production. It is more than an option for mining companies in the investment decision. Electricity availability is critical in this decision. It is far more complicated than merely passing a law that states companies must add value to production and through beneficiation grow the size of the economy and create jobs. For a developing economy to grow, it needs to be powered; and if electricity supply cannot keep up, the economy will level off or even start shrinking. Figure 6 illustrates total system capacity added to the Eskom grid over time as published in the 2010 Eskom Annual Report. After a long period of surplus supply at reasonable rates up to 1990, the chart shows a sharp drop for the period 1990–2005. After more than a decade of neglect, darkness struck in 2008 when the grid could no longer keep up with demand. Since then, Eskom has embarked on a campaign of first, limiting supply through targets in order to protect the grid; second, significant expansion of capacity by addition of power stations; and third, regular and steep upward adjustment of electricity prices by exorbitant margins.

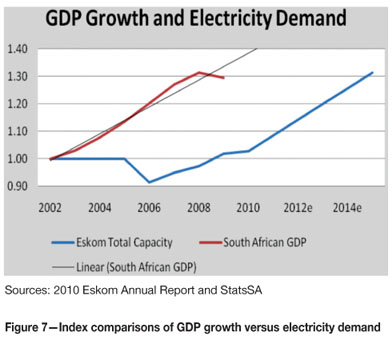

Figure 7 relates Eskom capacity with economic growth. Both variables are shown as an index, with one being 2002. One would expect the two lines to have a similar slope, but the lack of investment in electricity generation caused the gap between GDP growth and Eskom capacity to widen to the point that it became a threat for the growing economy. The response, of limiting supply by increasing electricity tariffs, is clearly no solution, in view of the necessity to continue growing the economy. Looking towards the future, the graph further illustrates that the current expansion plans will probably be sufficient to maintain historic GDP growth. The question is 'will it be sufficient if we want the economy to grow faster?' IRP 2010– 20309 admits that supply will continue to fall short of demand up to 2016, and our problems may remain for much longer if there are delays with the commissioning of the Kusile and Medupi power stations.

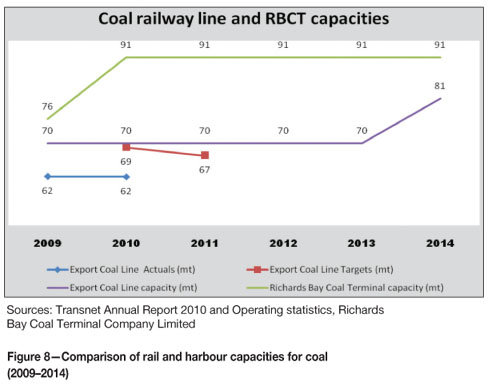

The minerals industry requires access to an efficient transport network consisting of harbours, railway, and roads. This becomes even more important in an environment of electricity supply shortages. If value cannot be added because of electricity constraints, export earnings become an attractive way of ensuring immediate and short-term economic benefit. According to the operating statistics of Richards Bay Coal Terminal Company Limited, the facility has a capacity of 91 million tonnes of export coal. The gap between the rail and terminal capacities in Figure 8 illustrates that the bottleneck is the rail capacity delivering coal to the port. Transnet's Annual Report for 2010 mentions that it plans to increase capacity by 2014 so that the rail capacity can catch up with Richards Bay Coal Terminal. Even if Transnet manages to obtain the additional investment capital, the gap will still be in the order of 10 million tonnes—and that is without considering the port storage capacity. A greater concern is the efficiency of the rail, which in 2010 caused a further 7 million tonnes of export revenue to be 'lost' for the country. Figure 8 illustrates that the Transnet risk is more than merely a long-run capital investment issue—there are also management and efficiency problems that need to be dealt with in the immediate run. The total cost to the country as a result is currently 30 million tonnes of export coal! COM statistics indicate that one job is created for every 3000 tonnes of coal sold. Stated differently, today's cost to the country because of the railway bottleneck is about 10 000 jobs in the coal mining sector alone.

Aids prevalence

Seventeen per cent of the world's population living with HIV, are South Africans10. The high aids prevalence rate causes life expectancy in South Africa to be 18 years shorter compared with the rest of the world, more time away from productive work due to sickness, and more importantly, results in many children not having parents to support their education. These reasons make HIV a priority of the national agenda. Apart from the associated cost to society, AIDS also hampers economic growth, because it reduces the pool of taxpayers during the years when they earn their maximum salaries. Years of denial at the highest level of government are continuing to haunt the country.

Labour efficiency

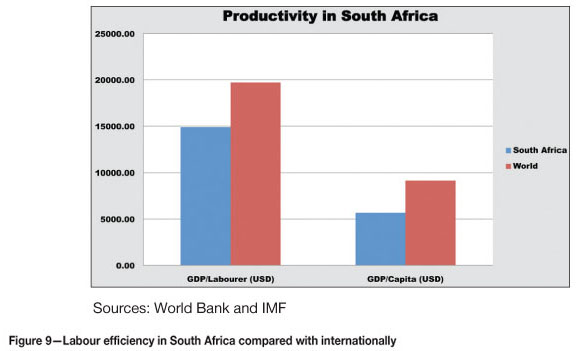

The World Bank11 and IMF12 economic statistics tell a story of inefficiency when productivity is measured by how much the average South African contributes to the economy over a year, and how such productivity compares with our competitors in the rest of the world. Although Figure 9 may be skewed as a result of the high unemployment rate, the numbers show that the situation is much more complicated. The productivity per labourer in South Africa is 25% less than the rest of the world. The recent PriceWaterhouse Coopers13 review of trends in the South African mining industry mentioned that employee costs are a fast-growing operating expense item for SA mines, and at 41% of all operating expenses, this is already the biggest contributor to working costs. It is a complex political issue, but a major threat to the mining sector. The current state of affairs is not sustainable. There might be a temptation to view the filling of the 25% gap from the perspective that we will achieve the same GDP with reducing the workforce by a quarter and then to make them more efficient. However, this would be wrong – think of the extra jobs that could be generated if the same workforce can inflate the economy by 25%.

Conclusion

This paper identified R&D, education, nationalization, infrastructure, aids, and labour inefficiency as threats to the sustainability of the South African minerals industry. If there were no denial of these threats, they would present us with opportunity. Denying these threats will prolong and worsen these threats at great cost to the country. Solutions are urgently required so that the South African mining industry can live up to the potential of the country's rich mineral inheritance. The opportunity is to create sustainable benefit from mineral development. For example:

➤ On R&D, there is the opportunity for research programmes to better understand and implement the concept of optimal mineral resource use in order to achieve an outcome that is aligned with the sector's potential. This should include development of patents and testing of prototypes

➤ On education, there is opportunity to improve the percentage of educated South Africans and raise the standard of all education and training programmes. This starts at a pre-primary school level, and will require significant investment in the education of teachers

➤ On nationalization, there is the opportunity for government to reassure investors that their investments are safe and that there is no threat of nationalization. There is also the opportunity for industry to promote itself and to communicate the benefit that it brings to the wider public good, as is being done by the current Real Mining series by Anglo American

➤ On infrastructure, there is the opportunity for government to ensure that the necessary inputs for optimal mineral use are in place, like energy availability and transport infrastructure at reasonable tariffs. This will allow mining companies to get on with the task of converting our resource wealth into cash, and to be competitive when doing so

➤ On aids, the mining industry is in many respects ahead of government programmes. Perhaps it is time for the Department of Health to learn from companies like Gold Fields on how to manage this threat so that this deadly trend can be turned around

➤ On labour inefficiency, the per capita productivity in South Africa is significantly less than our competitors. It is time to balance labour legislation with labour efficiency.

References

1. OECD Factbook 2010. Gross domestic expenditure on R&D as a Percentage of GDP. http://dx.doi.org/10.1787/820860264335, accessed March 2011. p. 151. [ Links ]

2. WORLD BANK. World Development Indicators. International Bank for Reconstruction and Development. 2010. [ Links ]

3. Global Competitiveness Report, World Economic Forum. 2010. [ Links ]

4. UNDP. Human Development Report 2010 (20th Anniversary Edition). The Real Wealth of Nations: Pathways to Human Development. United Nations Development Programme, 2010. [ Links ]

5. Education Statistics in South Africa 2009. Department of Basic Education, November 2010. [ Links ]

6. Survey of Mining Companies. Fraser Institute. 2010. [ Links ]

7. MPRDA, Mineral and Petroleum Resources Development Act 28 of 2002, 3 October 2002, Government Gazette, vol. 448, no. 23922, as amended (Date of commencement 1 April 2004). [ Links ]

8. STATSSA P0044 & P0441—Quarterly information 2004–2010, Statistics South Africa. [ Links ]

9. Integrated Resource Plan For Electricity 2010–2030, Revision 2 Final Report 25 March 2011. [ Links ]

10. WORLD BANK. Global Report, UNAIDS report on the global AIDS epidemic 2010; read with the World Development Indicators 2010. [ Links ]

11. World Development Indicators 2010, World Bank. [ Links ]

12. IMF. World Economic Outlook Database October 2010. [ Links ]

13. PricewaterhouseCoopers (PwC). SA Mine—Review of trends in the South African mining industry, 2011. Available from www.pwc.com/za. [ Links ]◆

Paper received Jul. 2011