Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Industrial Engineering

On-line version ISSN 2224-7890

Print version ISSN 1012-277X

S. Afr. J. Ind. Eng. vol.33 n.4 Pretoria Dec. 2022

http://dx.doi.org/10.7166/33-4-2684

GENERAL ARTICLES

Leapfrogging pathway for Fourth Industrial Revolution: a case of process innovation within an automotive subsidiary firm

T.C. Moeketsi; T.P. Letaba*

Department of Engineering and Technology Management, University of Pretoria, South Africa

ABSTRACT

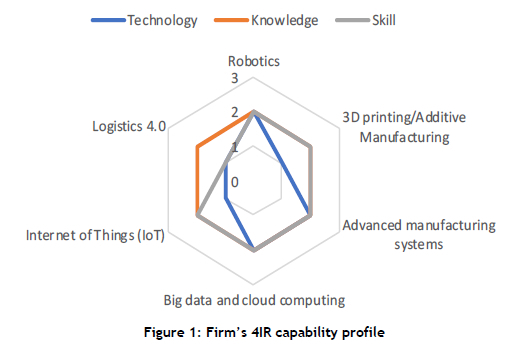

The relationship between Fourth Industrial Revolution technologies and innovation makes for an interesting case, as innovation seeks to unlock a level of competitiveness for its users, the extent of which is covered in this research paper. The premise of this study is that subsidiary firms lend themselves to the practice of process innovation. The focus of this study was on a South African automotive subsidiary firm, and a case study methodology was adopted. Data was collected in the form of questionnaire responses from specialists and interview feedback from managers in order to derive insights that would inform the state of firms' technological capabilities, the dynamics behind them, and the leapfrogging measures that might be taken. This study showed that the current state of technological capabilities in the sample firm ranged from inadequate to satisfactory. Three priority areas were defined: robotics, big data and cloud computing, and advanced manufacturing systems. The workers' mindsets were found to be a serious barrier to taking full advantage of Fourth Industrial Revolution technologies. This study covered measures that would be necessary to ensure a successful digital transformation, best realised through an incremental innovation strategy. The main metrics of firm competitiveness were outlined as quality, volume, and cost, all of which could be influenced by process innovations.

OPSOMMING

Die verhouding tussen Vierde Industriële Revolusie-tegnologieë en innovasie is interessant, aangesien innovasie poog om 'n vlak van mededingendheid vir sy gebruikers te ontsluit, waarvan die omvang in hierdie navorsingsartikel gedek word. Die uitgangspunt van hierdie studie is dat filiaalfirmas hulle tot die praktyk van prosesinnovasie leen. Die fokus van hierdie studie was op 'n Suid-Afrikaanse motorfiliaalfirma, en 'n gevallestudiemetodologie was gebruik. Data was ingesamel van vraelysreaksies van spesialiste en terugvoer van onderhoude met bestuurders ten einde insigte te verkry wat die stand van ondernemings se tegnologiese vermoë, die dinamika daaragter en die sprongmaatreëls wat geneem kan word, sou inlig. Hierdie studie het getoon dat die huidige stand van tegnologiese vermoë in die steekproeffirma gewissel het van onvoldoende tot bevredigend. Drie prioriteitsareas is gedefinieer: robotika, groot data en wolkverwerking, en gevorderde vervaardigingstelsels. Daar is gevind dat die werkers se ingesteldheid 'n ernstige struikelblok is om die Vierde Industriële Revolusie-tegnologie ten volle te benut. Hierdie studie het maatreëls gedek wat nodig sou wees om 'n suksesvolle digitale transformasie te verseker, wat die beste gerealiseer word deur 'n inkrementele innovasiestrategie. Die belangrikste maatstawwe van firma mededingendheid is uiteengesit as kwaliteit, volume en koste, wat alles deur prosesinnovasies beïnvloed kan word.

1. INTRODUCTION

Multinational companies are responsible for the employment of 30 000 to 59 999 workers on average [1]. These workers are dispersed in subsidiary firms across the globe, contributing to the aggregate output of the parent company. This is typical for manufacturing firms in the automotive industry: operations are located in various countries, outside of the headquarters, and decision-making about technology management is mainly centralised.

Prior to the 1920s, South Africa had a weak automotive industry that was characterised by a few sales of imported, fully-assembled vehicles [2]. According to Barnes [2], the South African automotive industry is nearing its centennial: it came into full effect in the 1920s, marked by the entry of Ford's vehicle production plant in Port Elizabeth in 1924, soon followed by General Motors in 1926. With the establishment of the multinational company, local subsidiary firms were mainly motivated by the Labourite Pact that the South African government introduced to develop the local motor industry. However, growth was quite sluggish. By the late 1930s, local supplier networks were still not developed and, although there was local ownership of the means of production in the automotive sector, these entities still identified with overseas parent companies.

Barnes [2] reports that low levels of locally produced content in the automotive industry became a main concern for the government in the 1950s. Components were being sourced from foreign countries, causing an upset in the country's balance of payments. It was under these conditions that the government tasked the Board of Trade and Industry to conduct an investigation into the state of the local automotive industry. This resulted in the Local Content Programme, which was rolled out in phases over the years that followed to increase vehicle build content that was sourced locally, and thereby to stabilise the balance of payments [3].

The local automotive industry was catapulted into globalisation with the introduction of the Motor Industry Development Programme in 1995 [3]. Barnes [2] notes a drastic increase in the multinational company ownership of assemblers from the mid-1990s. As a result, locally owned component manufacturers sought international partnerships through joint ventures and acquisitions. Barnes [2] states that, although the automotive industry was founded on the domestic market, exposure to the international market had shifted the industry's modus operandi: technological developments and advanced production capabilities became the order of business for increased competitiveness. The import-export complementation component of the Motor Industry Development Programme forced the outward orientation of the industry and, with this, the alignment of vehicle technologies in South Africa with those of the international automotive industry [2]. Locally based subsidiary firms are now compelled to benchmark with their counterparts and competitors across the globe. As a result, there has been an industry-wide increase in productivity, quality, and reliability performance from the mid-1990s to the mid-2000s [2]. Barnes [2] also argues that, although the literature presents a negative forecast of the South African automotive industry, ongoing investments by the remaining original equipment manufacturers prove that the recent Automotive Production and Development Programme has strengthened the industry's viability through incentives, thus fostering the development and competitiveness of the industry.

If we now fast-forward, the Fourth Industrial Revolution is a new force that shapes the competitiveness of automotive industries across the world. The First Industrial Revolution was characterised by mechanisation through water and steam power. The Second Industrial Revolution followed with mass production through electricity-powered production lines. Information technology and electronics then resulted in automation, bringing about the Third Industrial Revolution [4].

It is now generally accepted that the Fourth Industrial Revolution (also known as 'Industry 4.0') has started in the global manufacturing environment [5]. Industry 4.0 is defined as "a significant transformation of the entire industrial production by merging digital and internet technologies to conventional industry" [6]. Kapp [4] states that it is evident that the Fourth Industrial Revolution will have an impact on the South African automotive industry and beyond.

Subsidiary firms in the automotive industry face internal competition within their respective multinational companies. A competitive advantage must be gained to outperform their counterparts in first-world countries - sister firms that tend to have greater capabilities, given their proximity to stronger markets, often resulting in a higher investment allocation and more resources. Process innovation presents an opportunity to claim a competitive advantage.

In line with the problem statement above, the objective of this research was as follows:

• To develop a leapfrogging pathway that defines how automotive subsidiary firms could upgrade their current state of technology through emerging Fourth Industrial Revolution technologies to practise process innovation and gain a competitive advantage.

The objective gives rise to the following research questions:

• What is the current state of technological capabilities (in subsidiaries of the multinational companies in South Africa) versus Fourth Industrial Revolution capability requirements?

• What leapfrogging pathway could be developed in order to embed the Fourth Industrial Revolution capabilities?

The rest of this document covers this study's body of work. This is in the form of a literature review, a research method that outlines the approach taken in collecting and synthesising the data, a discussion of the results, and, finally, a conclusion that links the findings to the research questions of the study.

2. LITERATURE REVIEW

2.1. Competitive advantage through innovation strategies and innovation management

Innovation strategy is defined as the degree to and the way in which a firm uses innovation to deliver on its business strategy and performance growth [7]. Furthermore, the innovation strategy must be grounded in knowledge and facts, and be further supported by learning and creativity, which allows the firm the ability to deal with rapid change and to grow its creative capacity [8].

Bowonder, Dambal, Kumar and Shirodkar [9] found that a competitive lead could be reached by outwitting, outmanoeuvring, and outperforming competing firms through innovation: "It involves competitive analysis, competitive benchmarking, and competitor learning and evolving a roadmap to stay ahead of the competition." They list the following innovation strategies for gaining a competitive lead:

• Technology leveraging: the application of technologies developed in-house or externally to create a vast catalogue of products, services, features, or capabilities.

• Future-proofing: safeguarding the firm against obsolescence by exploring alternative and emerging technologies.

• Lean development: an elimination of or reduction in wasteful resource requirements.

• Partnering: using the compatibility fit with neighbouring firms to collaborate on innovation projects, thereby leveraging their resources and sharing the risks and costs.

Akhlagh, Moradi, Mehdizade, and Ahmadi [8] cited a list of more kinds of innovation strategy from the literature [10, 11] - namely, aggressive, analyser, futuristic, proactive, risk-taking, and defensive strategies. An aggressive strategy is defined as the one that takes a combative approach in seizing opportunities in the environment and that seeks to achieve a competitive advantage through the following [11]:

• First-mover advantage.

• Development of radical innovations ahead of the competition (regardless of their profitability).

• Prioritising innovation initiatives that present high risks and returns.

An analyser strategy is a problem-solving approach that provides management with insights into trends and events in their relevant spaces; it facilitates the identification of opportunity [11, 12]. A futuristic strategy entails charting long-term plans for firms and the industry at large through forecasting opportunities [13]; a focus on the future raises a firm's awareness of changes in the environment by presenting various views [11]. Droge, Calantone and Harmancioglu [14] defined a proactive strategy as the act of seeking out or creating opportunities in the form of innovation as a result of changes and developments in the environment. A risk-taking strategy relates to senior management's risk appetite [15]. A defensive strategy is viewed as the firm's method of defending its position in the market [16, 11].

It was shown that a proactive strategy promotes industry performance and diversity [8]; this finding was supported by studies in the literature that found that such as strategy provides structural flexibility in the industry. A proactive strategy was also shown to promote industry performance and diversity, which was aligned with the view that the strategy provides structural flexibility in the industry. With regard to an analyser strategy, the findings by Akhlagh et al. [8] indicated a strong positive effect on industry performance, and to a lesser extent on diversity. An aggressive strategy follows a similar pattern in its effects: its influence is strong on industry performance, yet it tends not to do well in relation to diversity. Akhlagh et al. [8] noted that a risk-taking strategy has a strong impact on the diversity of performance: it requires significant investments and shared participation to resolve uncertainty and possible organisational resistance.

If well-executed, innovation strategies can lead to improved competitiveness, shown through such aspects as a company's improved productivity and efficiency. Lee and Sang-Mok's [17] study explored the trends in productivity across various types of innovation that occur in the manufacturing industry - namely, product innovation, product improvement, and process innovation. The authors defined 'product innovation' as new product offerings that mark a significant shift from existing offerings, with the aim of penetrating new markets or extending existing ones. Process innovation, on the other hand, entails making significant changes to the production processes that deliver existing products with the aim of reducing costs, waste, defects, or lead time, or increasing production efficiency [18].

A firm's efforts to reduce costs and defects or to make gains in efficiency (process innovation) inevitably and instantly result in a growth in productivity [19]. Process innovation is also said to concern production techniques, the organisation of work, and business model innovations [20]. Lee and Sang-Mok [17] made the following discoveries:

• Firms with process innovation demonstrate a superior performance in productivity.

• Product innovation tends to drive down productivity in the short term compared with other types of innovation.

Several innovation pathways must be kept in mind when conducting innovation management. Most notably, the 'continuous innovation' style of innovation management was found to be key for South African subsidiary firms that stand out.

2.2. The contributory role of the subsidiary firm within the multinational company

Birkinshaw, Hood and Jonsson [21] investigated the contributory role of subsidiary firms in multinational companies, and reported the following findings:

a) The combination of internal resources with initiative results has a strong and positive impact on the subsidiary firm's role as a contributor.

b) There is a strong link between subsidiary initiative and leadership and an entrepreneurial culture.

c) The subsidiary firm's contributory role is also influenced by its level of autonomy and by low levels of local competition.

A conclusion was reached that multinational companies' subsidiaries not only contribute to firm-specific advantage creation, but can also drive the process.

Innovation pathways characterise factors that influence innovation activities and, in a way, determine the outcome of the innovation process [22]. Tiwari and Kalogerakis [22] studied the prevalent innovation pathways and trajectories in India's auto component industry, and showed that, in the design and development process, firms that use modern and digital technologies achieve very high levels of process and resource efficiency. The study identified the following innovation pathways:

a) Innovation autonomy

b) Key aspects of a typical innovation project

c) The impact of firm size

d) A strong focus on process innovation

e) The role of policies and regulations

f) The question of mindset

The factors that influence a subsidiary firm's innovation levels, amidst its role in the multinational company, have been outlined. Autonomy and the strength of a subsidiary firm's network have been found to be enablers of innovation, and subsidiaries are more inclined to undertake process innovation, leaving product innovation and research and development (R&D) to the parent company.

2.3. Fourth Industrial Revolution technologies and process innovation

Drath and Horch [23] reported that the concept of Industry 4.0 was first introduced at the 2011 Hannover Fair. They stated that it entails the integration of advanced technology spaces, resulting in key improvements to industrial processing, engineering, material consumption, supply chain, and life-cycle management.

In Stancioiu's [6] view, the Fourth Industrial Revolution technologies that are applicable in a manufacturing environment are:

a) Cyber-physical systems;

b) The Internet of Things (IoT); and

c) Cloud computing.

Fourth Industrial Revolution technologies are argued to bring about a paradigm shift in production, in that they would lend greater autonomy to the existing robotic systems in managing production, leading to greater efficiency within the process as less staff would be required to achieve the same output or better [24]. It was found that modern and digital technologies enable firms to reach high levels of efficiency in processes and resources. However, the technological state of South African subsidiary firms was not indicated in the literature. The current study identified cyber-physical systems and additive manufacturing technologies as Fourth Industrial Revolution technologies that boost flexibility in production processes. Lee [25] defined cyber-physical systems as "systems consisting of physical components with computational functionalities, as for instance mechanisms that are controlled or monitored by algorithms running on computers". Mueller [26] argued that such systems provide a suitable infrastructure/tooling for additive manufacturing, a process in which layers of material are joined to generate products following the patterns found in the databases of 3D models. Furthermore, in comparison with traditional fabrication processes, additive manufacturing exhibits significant advantages - for instance, reducing delays between designing, producing in a just-in-time way, and delivering products to consumers.

Huang, Zhong and Tsui [27] identified IoT as a supporting technology within cyber-physical systems' infrastructure. IoT compiles data, rendering a better representation of the state of the system. This assessment of the system is given further precision through a connection with cloud computing, which is an improvement in data-processing capacities, given that production activities generate large volumes of data and that large data-processing facilities are required - a case of 'big data'. According to Elgendy and Elragal [28], "big data analytics is the use of advanced analytic techniques against very large, diverse data sets that include structured, semi-structured and unstructured data, from different sources, and in different sizes from terabytes to zettabytes".

The literature was explored further for a comprehensive understanding of the Fourth Industrial Revolution and how its technologies could be leveraged in partnership with humans and processes in order to derive numerous benefits - benefits that would extend to the manufacturing industry. Cyber-physical systems and additive manufacturing technologies were cited as Fourth Industrial Revolution technologies that enable process innovation through enhanced flexibility that results in just-in-time delivery from the design stage all the way to production and receipt by the customer.

Rossit, Tohmé and Frutos [24] identified cyber-physical systems and additive manufacturing technologies as Fourth Industrial Revolution technologies that boost flexibility in production processes. They can be defined as "systems consisting of physical components with computational functionalities, as for instance mechanisms that are controlled or monitored by algorithms running on computers" [26]. Such systems provide suitable infrastructure/tooling for additive manufacturing [26].

Process innovation may be defined as "the implementation of a new or significantly improved production, service or delivery method" [29]. Process innovations are typically developed with a view to increasing efficiency, thereby decreasing unit costs, improving quality, or delivering improved/updated products [18].

A plant's history of process technology innovation contributes to a firm's manufacturing-based ability to support a competitive advantage because the plant is where a firm's physical resources and human and organisational capital resources intersect [19]. Bates and Flynn [30] supported this notion, stating that, when technological innovations are based on human and organisational capital, they cascade into further innovations that lead to a firm's competitive advantage.

Process innovations lead to extra productivity growth - a trend that has been observed for several years, followed by a decline in productivity growth and a complete standstill if innovation stops altogether [31]. Cyber-physical systems and IoT respectively are key in monitoring and digitising physical processes for autonomous machine decision-making and offering a platform for machine-human interaction [6]. The decision-making that Stancioiu [6] refers to is indicative of a self-optimising system/body of processes.

Kasparov and Greengard [32] detailed a chess match held in Spain in 1998, when an experiment called 'advanced chess' was held. Each player was equipped with artificial intelligence (AI) software that ran computations that predicted possible moves and counter-moves by the opponent (i.e., likely scenarios), allowing the chess player to focus efficiently and accurately on strategy and ideation. Their findings were that, once players were equipped with a personal computer (PC), they were less likely to make tactical blunders. It was found that the combination of amateur players with ordinary computers trumped the superhuman chess-specialist computer. Another finding stemmed from the observation that, contrary to the expectation that the victor would be an advanced chess champion paired with a highly capable chess-specialist computer, it was a pair of amateur chess players partnered with three ordinary chess computing systems that emerged victorious. The systems were loaded with four years of the players' personal strategies, and determined which player's strategy had a higher rate of success in any given scenario. The authors concluded that the process that is deployed when humans have the aid of AI computing is far more important than the skillset of the player or the capability of the computing system. As a result, Kasparov's Law was formulated: "weak human + machine + better process was superior to a strong computer alone and, more remarkably, superior to a strong human + machine + inferior process" [30]. It has been reported that human error presents a solid case for AI because of its precision [33].

2.4. Technological leapfrogging to Industry 4.0

Once the firm's current state is known and understood, there needs to be a strategy of ensuring the speedy implementation of Fourth Industrial Revolution capabilities, which is referred to as 'leapfrogging' [34]. Leapfrogging is also referred to as what happens when countries that are newly industrialised proceed to use advanced technologies without following the steps taken by their predecessors [35]. From the literature, Wang and Kimble [35] identify four generic patterns for leapfrogging, aside from the normal linear path:

a) Catching up: the normal route to technological development, followed at an accelerated pace.

b) Stage-skipping leapfrog: forgoing one of the steps in the normal route.

c) Path-creating leapfrog: finding an alternative route to the normal path.

d) Paradigm-changing leapfrog: a pathway that follows a breakthrough strategy, which is harder to emulate, and offers those who can execute it a more longstanding advantage [36].

Findings made by Balcet and Ruet [37] on Indian companies show that, in the pursuit of technological upgrades and catch-ups, alliances and acquisitions have been key enablers.

Considering that new technologies are not always immediately or widely adopted from the outset, the diffusion process may be rather tedious. Perkins and Neumayer [38] investigated the conditions that were suitable for the rapid diffusion of advanced and novel technology. Their study cited two conditions: latecomer advantage, and openness to international trade and investment. 'Latecomer advantage' refers to the phenomenon of firms enjoying the benefit of learning from the mistakes and progress (i.e., the research and development) of first-mover firms; while 'openness to international trade and investment' indicates a situation in which growth in trade and investment results in an increase in the supply and demand of emerging technologies. Furthermore, Wang and Kimble's [35] case study on how the Japanese firm Sony not only caught up with but also overtook prominent American radio manufacturers demonstrates how catch-up and leapfrogging methods can be used as a way for a newcomer firm to overthrow dominant players for a lead position.

Research was found on leapfrogging emerging countries to an Industry 4.0 state and on the dynamics at play in doing so. However, research has seldom been conducted on how South African subsidiary firms within the automotive manufacturing industry could leapfrog to an Industry 4.0 state with a view to implementing process innovation. This gap in the literature presents an opportunity for research.

3. RESEARCH APPROACH

Two data-gathering tools were used in this study: an online quantitative survey, and qualitative interviews. The survey was primarily aimed at specialists across the main production cores and supporting business units of the automotive subsidiary company that was selected for this case study. The questionnaire for the quantitative survey was subdivided into three parts: 'Participant profiling', 'Technological capability profiling', and 'Process 4.0: Leapfrogging Insights'. The case company had a total workforce of about 3 000 (most of whom were operators on the shop floor), and the specialist group made up an estimated 20% of that number.

To consolidate the views of the specialists and to aid the analysis and interpretation of the quantitative results, the interviews were conducted with their superiors - that is, participants who were on different levels of leadership (section leaders, managers, and general managers). The responses gathered from the interview questions generated qualitative insights that supplemented the quantitative study. These insights covered topics on frameworks of competitiveness, the current state of process innovation, how its effectiveness was measured, and what weaknesses process innovation might address through Fourth Industrial Revolution-related technologies, among others.

A capability profile was derived from the capability analysis in which the required Fourth Industrial Revolution capabilities were ranked in terms of priority and urgency, according to an indication given by the participants. The combined input taken from the specialist capability profiling, prioritisation, and management insight was reconciled and used to fit the appropriate leapfrogging pathway framework to the Fourth Industrial Revolution capabilities that were lacking.

A case study approach such as that adopted in this study is often criticised for a lack of scientific rigour and transferability [39] to the overall sector or, as in this case, to subsidiary multinational companies. However, Varela, Lopes and Rodrigues [39] argue that, despite this weak point, this type of study is useful for validating and constructing a theory. Indeed, the findings of this study were a useful exploration that could be tested on a much broader sample in related future studies.

4. ANALYSIS OF RESULTS

4.1. The bearing of the Fourth Industrial Revolution and process innovation on competitive advantage

In this section, the competitive advantage that is sought by subsidiary automotive manufacturing companies is discussed in the context of the findings that were made, followed by a discussion of the process innovation that was said to predict the competitive advantage. Last, the Fourth Industrial Revolution capabilities that enable the practice of process innovation are discussed.

As the literature has found, a firm's survival is contingent on its competitiveness. Competitiveness distinguishes the firm as an asset in the production network [2]. It came as no surprise, then, that the firm's competitiveness was found to be a focus in all of the departments that were covered within the case company. The key performance indicators (KPIs) were structured to reflect high levels of competitiveness, allowing functions to be able to benchmark with their counterparts (internally and internationally). Several departments showed that developing internal indicators that served as enablers of the corporate level's overall KPIs might be best practice. While on the topic of best practice, it was observed that departments that served as supporting functions tended to engage with the core business functions. The feedback from these internal customers helped to determine the level of performance that was expected from the supporting functions. The following question might arise: 'How then would the core business functions (i.e., the production cores) be measured?' Ultimately, the production cores have to satisfy the markets (i.e., the actual customer); and, to this end, external reports such as the Harbour Report exist.

It became apparent that the KPIs across all production cores would have to address the following criteria:

a) Quality;

b) Volume; and

c) Cost

Those criteria are in line with the most important outputs that the participant specialists identified as benefits that could be derived from process innovation. Cost reduction, defect reduction, and cycle time reduction are also cited in the literature as some of the benefits arising from process innovation [17]. In addition, most of the specialists indicated that their roles entailed process changes; and this was in line with the premise in the literature that process innovation is predominantly practised at the firm level of subsidiary companies [40].

All levels of management responded positively to practising process innovation, albeit in different ways that were in accordance with their respective functions. There seemed to be an underlying pattern or common focus, however. The exercise of process innovation appeared to be driven by the plant's mandate to do more with less and by the joint need to do better. Both pointed to the need for efficiency. Further to this commonality, the current processes were reviewed first. Management's response in this regard indicated that the firm was quite strong in understanding the existing processes, and this was supported by the specialists' responses to the survey, where they indicated that such understanding was the least neglected activity in the development of new processes. In the supporting functions, it appeared that the review was done on a schedule basis (i.e., proactively), whereas in the production cores it was triggered by problems (i.e., reactively). This indication by managers was further supported by findings from the specialists' survey responses, in which the majority stated that problems stemmed from commissioning faults at the start of production. Once reviewed, the processes would be probed for opportunities to improve them. The specialists also indicated that process innovation in the production cores was likely to be triggered by the opportunities for improvement that were identified by the shop floor workers. In both cases of process innovation (the production cores and the supporting functions), it became evident that standards limited what aspects might be innovated. The majority of the specialists, however, maintained that the firm was merely implementing continuous improvements rather than innovating, whereas a significant group (almost equal in numbers) maintained that the firm adopted incremental innovation. Both pointed to an iterative approach to process improvements in varying degrees.

Once process innovation has been realised, it follows that the gains made have to be shown to be in line with the objectives of the exercise; and so management indicated the ways in which they measured the effectiveness of process innovation initiatives in their respective functions. A significant narrative that came through in the interviews was the act of being intentional about process innovation: outlining the measurement instruments/indicators for the process innovation at the start of the project on which the team would embark. These indicators might be linked to existing KPIs. This not only created a clarity of purpose, but also ensured that there were no misgivings about the success level of the innovation. It was also revealed that the tracking of adherence to the 'new' process would serve as an enabler and as the indicator of the process innovation's effectiveness. This is a very valid point, in the sense that, in the absence of adherence, the new process might demonstrate low levels of effectiveness; whereas, if it is just that it is not being practised, adherence is not only an enabler: it is also a critical success factor that rests on buy-in and change management. These are two topics that the specialists ranked to have opposing levels of importance (i.e., buy-in was ranked first, while change management was ranked last).

An important point that was derived from management was that the role of technology as a key driver in process innovation was realised only if the technology was adopted and exploited to that end (i.e., that it served process innovation). Shortfalls in the existing processes presented opportunities for process innovation. All of the managers indicated that this opportunity could be exploited through Fourth Industrial Revolution technologies. It emerged that, in a production environment, subjectivity is not well received with regard to quality topics, and that it is best to have Fourth Industrial Revolution systems that embed objectivity in the identification and determination of the severity of quality issues. This need for objectivity extends to technical issues, where a clear distinction must be made between technical failure because of human intervention and system failure.

What is more, the transparency of the quality status of units going out to customers (internal and external) is paramount to ensuring the firm's competitiveness through quality - a topic that might very well be addressed through the Fourth Industrial Revolution. Furthermore, it became evident that administrative and manual aspects of the processes threatened the firm's efficiency, resulting in the misuse of resources such as human capital. It is in this regard that Fourth Industrial Revolution tools, such as robotic process automation and the smart automation of production systems (such as the dynamic routing of vehicle variants), could come into play.

The competitive advantage that is derived from the Fourth Industrial Revolution is not only widely accepted; the Fourth Industrial Revolution is viewed as a leverage for positioning functions better across the firm. The leverage might be sustained; however, the longevity of the competitive advantage is subject to how long the technology (with application to a process innovation) is held exclusively. This finding is in line with Akman and Yilmaz's [11] study that outlines an aggressive strategy for competitive advantage that is grounded in the first-mover advantage.

It has been shown that opportunities for improvement and problem-solving drive process innovation initiatives (in the support functions and production cores respectively) to address the three main indicators of competitiveness: quality, volume, and cost. The Fourth Industrial Revolution has the potential to enable the practice of process innovation, given that it is fully embraced by the end-users.

4.2. Current capabilities, in view of a leapfrog to Fourth Industrial Revolution capabilities

As the reader might recall, the research questions of this study focused on the technological capability status of a subsidiary firm versus Fourth Industrial Revolution capabilities, and on the leapfrogging measures that would have to be taken in order to reach Industry 4.0 status. The next part of this article spells out the findings of this study in that regard.

Fourth-Industrial-Revolution support for process innovation has been quantified in terms of the capability assessment. Among the production cores, the body shop boasts technological capabilities across the broadest range of Fourth Industrial Revolution technologies. This finding was corroborated by the body shop's management ,as they cited various Fourth Industrial Revolution tools that were currently deployed in support of process innovation, from prescriptive data analytics to AI cameras, predictive analysis, and machine learning. This finding was to be expected, given that the body shop had been declared to have the highest level of automation by plant facts and figures (according to the number of robots it had versus its labour force).

It was clear from the interviews that the capacity to be innovative and to be an agent for digital transformation was embedded in some of the roles and in some circles in the firm. The most explicit innovation-focused circle was the Innovation Council and its substructures. However, it was not systematically embedded, and it did not permeate the firm's organisational structure. With that said, the specialists affirmed that the firm had the capacity to innovate. Most of the specialists indicated that the channel that the firm used to grow its innovation capacity was robust knowledge-management systems. This pointed to the firm acquiring and creating new knowledge and intellectual property, and applying it to some degree. To whatever degree that was applied, there was a wide library of knowledge on which to draw. To a lesser extent, the firm had an innovative work climate that fostered collaboration and leveraged worker know-how in building its innovation capacity.

With regard to the Fourth Industrial Revolution capabilities that the firm lacked, the dominant theme that emerged from management was that there was a lack of desire among the workers to acquire knowledge on the subject of the Fourth Industrial Revolution (and thus a lack of knowledge and the necessary skillsets). This lack of desire constituted a barrier to the firm's digital transformation. What made this barrier so formidable was that, without any level of interest (let alone the absence of knowledge and skills), any technology that was acquired would only be integrated into the system with minimal user adoption, as happens in the case of big data that is generated (via business intelligence tools) but is not interpreted or applied for the business's benefit. Thus such technologies become sunk costs that only accrue a loss for the firm. The knowledge and training content could be provided by the firm; but without any basic interest from the target audience (i.e., the workers), the true absorption of Fourth Industrial Revolution technologies would remain difficult. The specialists indicated that the dominant barrier to Fourth Industrial Revolution implementation was a lack of investment (i.e., capital allocation); they referred to the skill issue as the second dominant barrier. What could be inferred from this was that it might be difficult to justify funding an advanced technology when there was already a bias (i.e., a mindset issue) against it that might stem from the gatekeepers (whom the specialists identified as the dominant decision-makers) who allowed it to trickle down to the workers. This point was linked to another barrier identified in the study: the fact that the firm sampled in this study was a low-cost (and low-volume) plant compared with its counterparts in the production network; and the awareness of this drove managers to be more cautious about (and perhaps wary of) Fourth Industrial Revolution initiatives. On a national scale, however, it would also be worth noting (as highlighted by management) that South Africa is a cheap-labour economy and that, as a third-world country, it is important to ensure job security, which is perceived to be in conflict with the Fourth Industrial Revolution, as the widespread narrative is that the Fourth Industrial Revolution displaces people from their jobs.

In addressing the presumed bias that the funding gatekeepers in management might have against Fourth Industrial Revolution initiatives, understanding the criteria that the project had to meet for management to buy into it was an important link to make. The main theme that emerged in this regard was that process innovation in the Fourth Industrial Revolution would have to make a direct and clear contribution to an existing KPI, which in-turn would drive the firm's competitiveness (which is assessed on a scale of quality, volume, and cost, as previously mentioned).

The act of engaging with global counterparts for the Fourth Industrial Revolution and process innovation benchmarking (among other topics) emerged as commonplace and widely practised across the firm. The study revealed that Fourth Industrial Revolution technologies and process innovations were usually acquired from the global production network rather than being developed in-house. Perhaps this finding stemmed from the possibility that the counterpart plants were bigger and were relied upon more owing to their perceived (and in some cases, proven) credibility and, given their larger size (in production volume, workforce, and other resources), they tended to allocate more investment spend to Fourth Industrial Revolution technologies and to have a higher risk appetite. Therefore, the technologies would first be tested there before they were introduced to a low-cost plant that had a lower risk appetite. This finding re-enforced the point made by Lim et al. [41] that developing countries are technology colonies.

How, then, should the firm proceed with Industry 4.0, if at all? The managers sampled in this study addressed the topic of digital transformation and whether they had a strategy to execute it; but again that issue linked back to running a low-cost plant, which seemed to support the managers that had no intention to undertake full digital transformation - most of whom ran production cores (which tended to innovate reactively, as highlighted earlier in this study). As for the support functions (who were found to innovate proactively), the plans were in place.

5. CONCLUSIONS

The current state of the technological capabilities in South African automotive subsidiary firms was found to be equally balanced between the 'poor' and the 'satisfactory' levels. Deliberate measures would have to be taken to raise the technologies to a level of high capability. The priority areas have been clearly defined in this study - the top three being robotics, big data and cloud computing, and advanced manufacturing systems.

Having said that, the success of newly embedded technologies would be contingent on the desire of the workers to acquire knowledge of the applications and to develop skills that would enable them to exploit the knowledge and draw added value from Fourth Industrial Revolution technologies. It was found that this desire was lacking in the sample firm; and this issue cannot be bypassed en route to Industry 4.0 and digital transformation. In this regard, the importance of 'change management' rises to the surface. Change management would have to target not only the workers, but top management as well, given that the leadership drives the narrative underlying the firm's culture. A change management programme designed to shift the negative mindset about the Fourth Industrial Revolution would be suitable to address the issue. In the programme, points of concern would have to be covered. Owing to a lack of initial capital investment on the topic of the Fourth Industrial Revolution, the sample firm would do well, first, to focus on incremental innovation in its processes en route to digital transformation. This would complement the mindset shift towards accepting the Fourth Industrial Revolution, as a gradual migration would be at less risk of being met with resistance. Once the momentum was built and the results were demonstrated repeatedly, management's confidence would grow, and more capital investments might be allocated to Fourth Industrial Revolution technological-process initiatives. A positive finding that was made in the sample firm was that there was ongoing interaction between the firm and its global networks, and that this practice permeated all of its functions. Such collaboration would ensure that the firm did not lag too far behind in technological-process advancements, that it would be part of the dialogue about best-practices, and that this would drive the introduction of new initiatives to a significant extent. The viability of new Fourth Industrial Revolution technologies that are earmarked to support process innovations would best be gauged by whether the initiative addressed the three main measures of a subsidiary firm as outlined in this study: quality, volume, and cost.

To be truly competitive and to take on a 'market' leadership position, the firm's production cores must seek to be more proactive and less reactive in their approach to process innovation, sensing problems (perhaps by way of big data and prescriptive analytics) and systematically addressing them rather than doing so only when they have already occurred. Process innovation must be seen not as an auxiliary function, but more as a practice that is embedded in the modus operandi of day-to-day business.

To have the impression that this study was all-encompassing would be a fallacy. The true benefit of research might well stem from its snowball effect, such that work cascades from one author to the next. With this in mind, a topic for future research would be the development of a social framework for the integration of Fourth Industrial Revolution initiatives. In practice, it would be in vetting potential Fourth Industrial Revolution initiatives that subsidiary firms could employ a social impact index that would balance the social considerations of introducing a new technological process with its viability for the business. This would ensure that, over and above user-adoption, the integration of the new technological process was sustainable, given the labour-intensive nature and the union dynamics of South Africa, among various other social challenges.

REFERENCES

[1] Copenhagen Business School 2020. Employment practices of multinational companies in an organizational context. [online] Available at: <https://www.cbs.dk/files/cbs.dk/useful_link/final_accompanying_report.pdf> [Accessed 25 Apr-2020]. [ Links ]

[2] Barnes, J. 2013. Capital structure of the South African automotive industry: Historical perspectives and development implications. Transformation: Critical Perspectives on Southern Africa, 81(82), 236-259. [ Links ]

[3] Black, A. 1994. An industrial strategy for the motor vehicle assembly and component sector. Rondebosch: UCT Press. [ Links ]

[4] Kapp, J. 2018. The fourth industrial revolution: Assessing the intelligences of engineers in the South African automotive industry. Doctoral dissertation, Nelson Mandela University, South Africa. [ Links ]

[5] Schumacher, A., Erol, S. & Sihn, W. 2016. A maturity model for assessing industry 4.0 readiness and maturity of manufacturing enterprises. Procedia CIRP, 52(1), 161-166. [ Links ]

[6] Stancioiu, A. 2017. The fourth industrial revolution, Industry 4.0. Reliability & Durability, 1(19), 74-78. [ Links ]

[7] Gilbert, J.T. 1994. Choosing an innovation strategy: Theory and practice. Business Horizons, 37(6), 16- 21. [ Links ]

[8] Akhlagh, E.M., Moradi, M., Mehdizade, M. & Ahmadi, N.D. 2013. Innovation strategies, performance diversity and development: An empirical analysis in Iran construction and housing industry. Iranian Journal of Management Studies, 6(2), 31-60. [ Links ]

[9] Bowonder, B., Dambal, A., Kumar, S. & Shirodkar, A. 2010. Innovation strategies for creating competitive advantage. Research-Technology Management, 53(3), 19-32. [ Links ]

[10] Venkatraman, N. 1989. Strategic orientation of business enterprises: The construct, dimensionality and measurement. Management Science, 35(8), 942-962. [ Links ]

[11] Akman, G. & Yilmaz, C. 2008. Innovative capability, innovation strategy and market orientation: An empirical analysis in Turkish software industry. International Journal of Innovation Management, 12(1), 69-111. [ Links ]

[12] Entrialgo, M., Fernández, E. & Vázquez, C.J. 2013. Linking entrepreneurship and strategic management: Evidence from Spanish SMEs. Technovation, 20(8), 427-436. [ Links ]

[13] Chandy, R.K. & Tellis, G.J. 1998. Organizing for radical product innovation: The overlooked role of willingness to cannibalize. Journal of Marketing Research, 35(4), 474-487. [ Links ]

[14] Droge, C., Calantone, R. & Harmancioglu, N. 2008. New product success: Is it really controllable by managers in highly turbulent environments? Journal of Product Innovation Management, 25(3), 272-286. [ Links ]

[15] Gupta, V., MacMillan, I.C. & Surie, G. 2004. Entrepreneurial leadership: Developing and measuring a cross-cultural construct. Journal of Business Venturing, 19(2), 241-260. [ Links ]

[16] Morgan, R.E. & Strong, C.A. 1998. Market orientation and dimensions of strategic orientation. European Journal of Marketing, 32(11/12), 1051-1073. [ Links ]

[17] Lee, K. & Sang-Mok, K. 2007. Innovation types and productivity growth: Evidence from Korean manufacturing firms. Global Economic Review, 36(4), 343-359. [ Links ]

[18] Llorca, V. R. 2002. The impact of process innovations on firm's productivity growth: The case of Spain. Applied Economics, 34(8), 1007-1016. [ Links ]

[19] Barney, J. 1991. Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120. [ Links ]

[20] Botha, A.P. 2019. Innovating for market adoption in the Fourth Industrial Revolution. South African Journal of Industrial Engineering, 30(3), 187-198. [ Links ]

[21] Birkinshaw, J., Hood, N. & Jonsson, S. 1998. Building firm-specific advantages in multinational corporations: The role of subsidiary initiative. Strategic Management Journal, 19(3), 221 -242. [ Links ]

[22] Tiwari, R., Fischer, L. & Kalogerakis, K. 2016. Frugal innovation in scholarly and social discourse: An assessment of trends and potential societal implications. Joint Working Paper. Leipzig and Hamburg: Fraunhofer MOEZ Leipzig and Hamburg University of Technology. [ Links ]

[23] Drath, R. & Horch, A. 2014. Industry 4.0: Hit or hype? IEEE Industrial Electronics Magazine, 8(2), 56-58. [ Links ]

[24] Rossit, D., Tohmé, F. & Frutos, M. 2019. An industry 4.0 approach to assembly line resequencing. The International Journal of Advanced Manufacturing Technology, 105(9), 3619-3630. [ Links ]

[25] Adams, R., Fourie, W., Marivate, V. & Platinga, P. 2020. Introducing the series: Can AI and data support a more inclusive and equitable South Africa? Pretoria, South Africa: Policy Action Network. [ Links ]

[26] Mueller, B. 2012. Additive manufacturing technologies: Rapid prototyping to direct digital manufacturing. Assembly Automation, 32(2). [ Links ]

[27] Huang, G., Zhong, R. & Tsui, K. 2015. Big data for service and manufacturing supply chain management. International Journal of Production Economics, 165, 572-591. [ Links ]

[28] Elgendy, N. & Elragal, A. 2014. Big data analytics: A literature review paper. Industrial Conference on Data Mining, 214-227. [ Links ]

[29] Centindamar, D., Phaal, R. & Probert, D. 2016. Technology management: Activities and tools, 2nd ed. London Palgrave McMillan. [ Links ]

[30] Bates, K.A. & Flynn, E.J. 1995. Innovation history and competitive advantage: A resource-based view analysis of manufacturing technology innovations. Academy of Management Proceedings, 1995(1), 235-239. [ Links ]

[31] Huergo, E. & Jaumandreu, J. 2004. Firms' age, process innovation and productivity growth. International Journal of Industrial Organization, 22(4), 541-559. [ Links ]

[32] Kasparov, G. & Greengard, M. 2017. Deep thinking, where machine intelligence ends and human creativity begins. London: John Murray Publishers. [ Links ]

[33] Lee, E. 2008. Cyber physical systems: Design challenges. IEEE International Symposium on Object and Component-Orientated Real-Time Distributed Computing, Florida, United States, 363-369. [ Links ]

[34] Iyer, A. 2018. Moving from Industry 2.0 to Industry 4.0: A case study from India on leapfrogging in smart manufacturing. Procedia Manufacturing, 21, 663-670. [ Links ]

[35] Wang, H. & Kimble, C. 2011. Leapfrogging to electric vehicles: Patterns and scenarios for China's automobile industry. International Journal of Automotive Technology and Management, 11(4), 312325. [ Links ]

[36] Charitou, C.D. & Markides, C.C. 2003. Responses to disruptive strategic innovation. MIT Sloan Management Review, 44(2), 55-63. [ Links ]

[37] Balcet, G. & Ruet, J. 2011. From joint ventures to national champions or global players? Alliances and technological catching-up in Chinese and Indian automotive industries. European Review of Industrial Economics and Policy, 3(1 ), 1 -28. [ Links ]

[38] Perkins, R. & Neumayer, E. 2005. The international diffusion of new technologies: A multitechnology analysis of latecomer advantage and global economic integration. Annals of the Association of American Geographers, 95(4), 789-808. [ Links ]

[39] Varela, M., Lopes, P. & Rodrigues, R. 2021. Rigour in the management case study method: A study on Master's dissertations. Electronic Journal of Business Research Methods, 19(1 ), 1-13. [ Links ]

[40] Damijan, J.P., Kostevc, C. & Rojec, M. 2010. Does a foreign subsidiary's network status affect its innovation activity? Evidence from post-socialist economies. Working Paper No. WP06/10. Madrid: Instituto Complutense de Estudios Internacionales (ICEI). [ Links ]

[41] Lim, C., Lee, J.H., Sonthikorn, P. & Vongbuyong, S. 2020. Frugal innovation and leapfrogging innovation approach to the Industry 4.0 challenge for a developing country. Asian Journal of Technology Innovation, 29(4), 1-22. [ Links ]

Submitted by authors 6 Dec 2021

Accepted for publication 17 Sep 2022

Available online 14 Dec 2022

* Corresponding author: petrus.letaba@up.ac.za

ORCID® identifiers

T.C. Moeketsi: 0000-0001-9563-1996

T.P. Letaba: 0000-0001-5799-6679