Servicios Personalizados

Articulo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares en Google

Similares en Google

Compartir

South African Journal of Industrial Engineering

versión On-line ISSN 2224-7890

versión impresa ISSN 1012-277X

S. Afr. J. Ind. Eng. vol.30 no.4 Pretoria dic. 2019

http://dx.doi.org/10.7166/30-4-2284

GUEST EDITORIAL

Guest Editorial: Driving Transformation From The Top: Distell's Journey To End-To-End Supply Chain Excellence

D. PetraroloI, *; R.C. EversonII

ICompetitive Capabilities International (CCi), South Africa

IIDistell, South Africa

ABSTRACT

Distell Group (a listed South African alcoholic beverage company) embarked on a business improvement journey that required a significant change to its supply chain structure and capability, which were inadequate to meet its 2020 strategic ambitions, to improve its performance levels. In partnership with Competitive Capabilities International (CCi), Distell developed and executed an end-to-end supply chain and excellence strategy to transform this function. This paper describes how this strategy, through four key strategic levers, effectively transformed its supply chain function as well as the resultant performance benefits that ensued, primarily in its South African operations.

OPSOMMING

Distell Group ('n genoteerde Suid-Afrikaanse alkoholiese drank-maatskappy) het 'n besigheidsverbeteringsreis ondergaan wat 'n noemenswaardige verandering aan die maatskappy se voorsieningskettingstruktuur en -vermoë vereis het. Die bestaande struktuur en vermoë was onvoldoende om die maatskappy se strategiese ambisies vir 2020 te bereik. In samewerking met Competitive Capabilities International (CCi) het Distell 'n end-totend voorsieningsketting- en uitmuntendheidstrategie ontwikkel en uitgevoer om hierdie funksies te transformeer. Hierdie artikel beskryf hoe hierdie strategie deur vier sleutelhefbome die voorsieningskettingfunksie en die resulterende vertoningsvoordele transformeer het. Die vertoningsvoordele, wat hoofsaaklik in die Suid-Afrikaanse bedrywighede realiseer is, word ook beskryf.

1 EXECUTIVE SUMMARY

When Distell's current group CEO Richard Rushton took over the reins in 2013, he soon realised that the group's supply chain performance and improvement levels were not strong enough to meet its 2020 strategic ambitions. This was despite satisfactory performance and continuous and incremental improvement in the early part of the decade.

The solution, Rushton believed, was a fundamental end-to-end transformation to enable the most efficient and effective global supply chain. It was therefore essential that Distell execute its strategy using an holistic and integrated approach. Confident of the company's strategic direction, Rushton tasked his leadership team with the execution of the strategy to realise the well-defined performance improvements.

Johan van Zyl joined Distell in July 2016 as Manufacturing Manager. Under his leadership, he facilitated the development of the manufacturing strategy and plant charters to align to, and support, the supply chain improvement strategy. Van Zyl was subsequently promoted to Supply Chain Director, to refine and advance the execution of the supply chain strategy.

Evidence from the 2016 business plan indicated that Distell's supply chain was not 'future fit', with a fragmented and inefficient supply chain, exacerbated by:

• Multiple sites that were historically coupled or interlinked

• A functionalised organisational design model with distinct leadership reporting lines for primary (processing) and secondary (packaging) production

Tacit knowledge was vested in only a few experts. Drawing from his operations experience, Van Zyl wasted little time in identifying the following supply chain change intents:

• Integrate manufacturing end-to-end operations

• Create technical centres of excellence [1]

• Build world-class procurement capability

• Develop and implement an aggressive supply chain network optimisation strategy

• Reduce reliance on a model based on exports from South Africa

• Implement sales and operations planning (S&OP) to streamline supply and demand

• Entrench supply chain excellence practices through the empowering excellence (E2) initiative

The supply chain change intents led to the formulation of four strategic levers:

1. Supply chain network optimisation

2. Demand, supply, and S&OP planning across the group

3. Procurement excellence

4. Empowering excellence

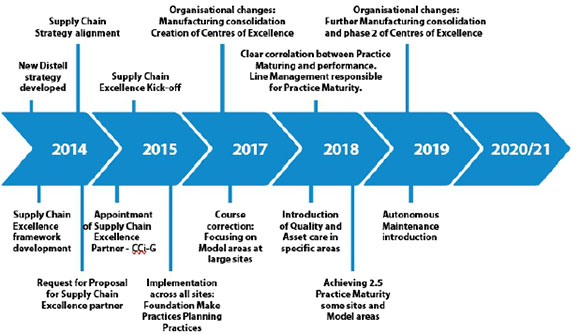

One of the elements of the empowering excellence strategic lever was to promote best practice through a full review of the continuous improvement programme, which gave rise to supply chain excellence and the E2initiative. (Distell had invested significantly in its continuous improvement manufacturing journey over the period 2004 to 2014, which resulted in significant functional benefits.)

In 2014, Distell embarked on the supply chain excellence strategy to transform the group. This strategy led to a partnership with Competitive Capabilities International (CCi), offering their TRACC integrative improvement methodology and platform, which was evaluated to be best aligned with Distell's strategic objectives.

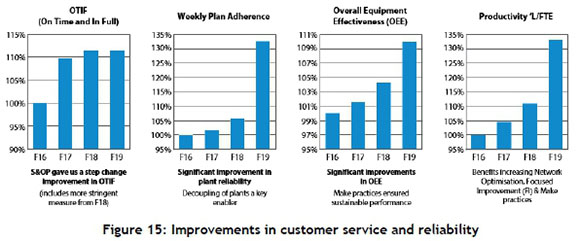

The performance results soon followed with improvements in customer service and reliability:

• 10 per cent improvement in 'on time in full' (OTIF)

• 32 per cent improvement in weekly plan adherence

• 25 per cent improvement in reliability

• 10 per cent increase in Overall Equipment Effectiveness (OEE)

• 30 per cent increase in productivity

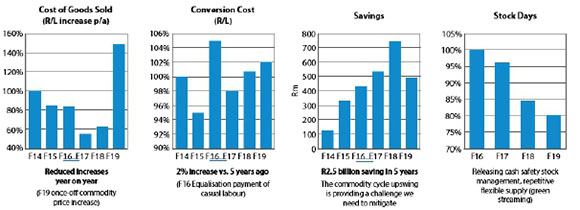

Improvements in cost and asset efficiency included:

• Between 20 and 40 per cent reduction in the cost of goods sold (CoGS) over five years

• Reduced conversion costs (two per cent increase in 2019 compared with 2014)

• Cost savings of over R2.5 billion ($174 million) across the supply chain over five years

• 20 per cent reduction in stock days

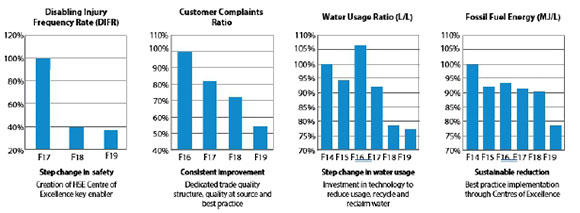

Improvements in safety, quality, and the environment included:

• 60 per cent step change in disabling injury frequency rate

• 45 per cent reduction in customer complaints

• 15-20 per cent reduction in water use

• 20 per cent reduction in fossil fuel use

The two supply chain initiatives - under the leadership of the second author as Group General Manager Supply Chain Excellence - aimed to ensure a highly reliable and efficient end-to-end supply chain that exceeded customer and stakeholder expectations. A key enabler of this process was a drive to 'standardise towards best practice'.

Supply chain excellence was Distell's approach to the optimisation of the entire supply chain, from product conception to delivery to the customer, so that year-on-year performance outperformed in a portfolio of metrics.

The supply chain's mission was "to enable Distell to successfully plan, procure, make and deliver products and brands to customers through talented people, appropriate technology and leading operational disciplines, processes and practices". This was "to ensure quality, overall cost efficiency, reliability, safety and a focus on sustainability in all that we do".

2 INTRODUCTION

In early 2013, strategic imperatives and the challenge of responding to the ongoing financial crisis prompted Richard Rushton, newly appointed Distell Group CEO, to design an end-to-end supply chain [2] optimisation strategy with the aim of transforming Distell into a truly global alcoholic beverages leader. He recognised that a fragmented supply chain, current performance realities, combined with industry and competitive benchmarking data, made a compelling argument for the need for change.

Spurred on by this realisation, Rushton created a "burning platform" for change, based on the following factors:

• A leadership awareness that a fundamental supply chain transformation was mission-critical to Distell's future success

• A significant gap between corporate aspirations and supply chain delivery

• The additional complexity created by both a large product/brand portfolio, and a fragmented, unaligned network dispersed across 88 locations in South Africa alone

• The need to ensure data integrity, accuracy, and availability with the right information in the right place at the right time

• Outdated processes and practices resulting in sub-optimal disciplines and routines

These factors also called for a fundamental change in mindset and behaviour to address a culture that did not support world-class excellence. There was a real need to institutionalise a mindset of accountability, consequence, continuous change, and improvement.

Confident of Distell's strategic direction, and based on the burning platform for change, Rushton recognised that Distell required an holistic and integrated approach to enable the most efficient and effective supply chain.

A paradigm shift was required to achieve the 2020 strategic ambitions, which included:

• Growing revenue

• Increasing the EBITDA margin

• Growing EBITDA and EBITDA Compound Annual Growth Rate (CAGR) growth

• Step change return on net assets (RONA)

• Delivering Economic Value Add (EVA) in line with the value-based management model (VBM) [3], which includes a firm's cost of capital in its calculations

The 2020 strategic ambitions were reflected in Distell's corporate strategy [4]:

Significant supply chain strategic and financial aspirations were required to achieve these ambitions. Some of these metrics included:

Improvements in cost and asset efficiency:

• Reduced cost of goods sold (CoGS)

• Reduced conversion costs

• Cost savings

• Reduction of stock days

Improvements in customer service and reliability:

• On time in full (OTIF)

• Improved reliability

• Improved OEE

• Productivity

Improvements in safety, quality, and environment:

• Reduced disabling injury frequency rate (DIFR)

• Fewer customer complaints

• Reduced water and fossil fuel use

3 CHALLENGES

In 2014, Distell was facing a potential crisis. Increased competition in the marketplace and declining cider growth, and an unresponsive and fragmented supply chain, resulted in the group lacking organisational agility. The supply chain was simply not 'future fit'.

Despite protected growth in the alcohol beverage industry, the realities of current performance and practices revealed that the continued level of supply chain performance, although satisfactory, would not enable the achievement of the 2020 ambitions.

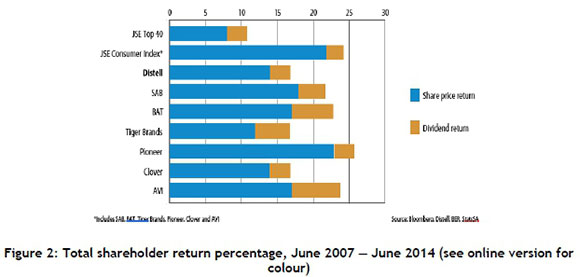

Furthermore, considering the significant investment in marketing, technology, research, and innovations, the supply chain performance was still lagging. Uncompetitive performance was evident in poor reliability, working capital, and asset turn measures. Fragmented procurement 'spend management' and double handling led to high transport costs and quality risks, and a large number of Stock Keeping Units (SKUs) brought complexity and inefficiency. To top it off, the total shareholder return was substantially lower than that of Distell's competitors and the Johannesburg Stock Exchange (JSE) consumer index by quite a margin.

When comparing Distell's cider volume with its revenue trend, it was evident that, historically, cider revenue growth had not kept up with the volume growth rate. Lower margins were due to a mix of tactical pricing decisions and above-inflation increases in excise taxes alongside increased supply chain costs.

Stockholding (days of stock) had been 'flat' over the previous five years, compounded by erratic stock levels and stock availability.

A limited recall in 2014 had raised questions about Distell's ability consistently to produce quality products, according to standardised best practice. This, combined with poor planning systems and capabilities, posed a further significant risk. Rapid deployment of a production and distribution capability in Africa beyond South Africa was required.

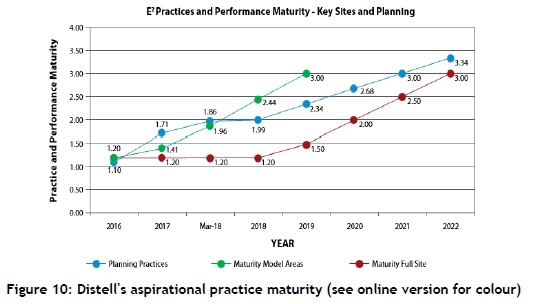

While there was evidence of 'pockets of excellence' within the supply chain, there was a lack of consistent application of standards and leading practices across the end-to-end supply chain. This was further evidenced in the E2platform's baseline practices assessment, which indicated an overall maturity score of 1.46 on its five-point scale. In summary, the overall performance accentuated the need for a step change to realise competitive advantage.

4 SUPPLY CHAIN PRINCIPLES AND OPPORTUNITIES

After consolidating the challenges the supply chain faced, the team developed the following principles to inform the overall supply chain strategy:

• A highly efficient, competitive, optimised, and end-to-end supply chain that executes consistently in accordance with leading disciplines and practices

• Production close-to-market for the 'scale' part of the business, in accordance with an operational excellence value proposition, leveraging efficiency, and cost optimisation as primary levers

• Production close-to-source for the 'luxury/craft' part of the business, enhancing its heritage and provenance credentials - using value optimisation, high quality, innovation, and small batch production as primary levers

• Quality owned at source and assured through built-in quality gates

• A consolidated network, driving:

o economies of scale (centralise what belongs together, manage for efficiency)

o centre-led procurement, with centralised procurement wherever possible and appropriate

o economies of skill (competent, committed leadership, and people enabled by appropriate information and technology)

o integrated planning across the supply chain, enabled by technology

o economies of scope (focused capabilities relevant to the products being produced and distributed; reduced complexity)

• Differentiated modes of production and channel experiences for luxury/craft and scale components

• Optimised logistics that drive down cost and increase market responsiveness (reduced time to market)

• A commitment to 'on time in full to the customer', with aligned KPIs and accountability

• Market responsiveness - the ongoing reduction of time-to-deliver to markets and customers

• Disciplined 'flexibility within a framework' - consistent systems, operating procedures, and practices configured to local context

• 'Serve and protect' - internal customer-centricity to support market-facing business units with the power to 'push back' when supply chain integrity is compromised

• Flow and measurement, visible throughout the value chain

Opportunities

• Leverage 'economies of scale' to reduce cost and increase efficiency

• Improve S&OP processes and practices

• Improve forecast accuracy and production planning

• Leverage centralised planning, procurement, and network optimisation capability

• Optimise transport and logistics management

• Retain and develop talented people to ensure world-class performance

• Employ the latest information technology systems to make informed operational decisions

• Optimise portfolio of SKUs

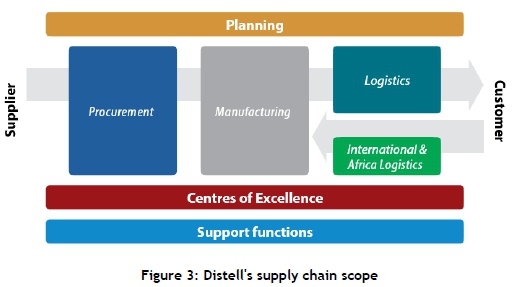

5 SUPPLY CHAIN SCOPE

The scope of the Distell supply chain incorporated planning, procurement, manufacturing, and logistics, and was supported by centres of excellence and support functions.

The future scope of the supply chain would be extended upstream to incorporate Distell's vineyards and some key suppliers, as well as extended downstream to incorporate secondary logistics through increased direct deliveries and responsiveness to customers.

Greater interface and collaboration with the innovation function would be extended to ensure effective new product implementation.

These extensions would realise the intended end-to-end supply chain, with improved economies and customer experience, and would be in scope for the E2initiative.

Strategic and financial aspirations

The strategic objectives of supply chain excellence were to:

• optimise the flow of work from product conception through customer orders to delivery, by eliminating all sources of waste

• shift from a product-based to an integrated supply chain business

• develop, adopt, and consistently implement best practice across the whole of the Distell supply chain

Standardised supply chain structures, policies, principles, processes, practices, tools, and metrics were uniformly applied, continuously improved, and regularly reviewed against best practice within an optimised global supply chain network. This was established to achieve performance improvements in cost and asset efficiency, customer service and reliability, and improvements in safety, quality, and the environment.

6 STRATEGIC INITIATIVES

To address the challenges and increase total shareholder return, Distell needed an holistic and integrated approach to enable the most efficient and effective supply chain. In addition, for it to be a truly global alcoholic beverages leader that could compete effectively and sustainably in its selected markets around the world, Distell required its supply chain successfully to deliver:

• in full - as per customer requirements

• reliably - on time as per commitments, and at the appropriate levels of agreed quality

• responsively - in line with acceptable lead times from time-of-order to time-in-market

• at the right price

• with the appropriate levels of customer communication and assurance

These were simply the base requirements and 'tickets to the game' for the Distell supply chain. An intense, focused investment of time and resources was needed to ensure that the supply chain rose to this level within a short period of time.

In a supply chain orientated towards lowest cost, where competitiveness is essential, efficiency was a core imperative. This orientation required procurement to be based on 'just in time' [5] principles to minimise working capital and storage requirements. Production needed to be scheduled, based on sales expectations for the length of the production cycle using a model based on 'make to forecast'. Competitive positioning was based on best relative price and perfect order fulfilment.

6.1 Supply chain success factors

In order to achieve these aspirations, Distell required an efficient supply chain model containing the following success factors:

• An optimised SKU portfolio to reduce the number of 'high variation, low demand' SKUs that create complexity throughout the value chain - particularly in production and distribution

• Reductions in set-up times and distance between raw material sourcing and production to reduce input cost

• Consolidation of production and distribution assets to ensure maximum efficiency, focused management attention, focused deployment of scarce skills, and reduced value leakage

• Centre-led procurement with centralisation and integration to ensure real, tangible scale benefits

• Production in close proximity to markets, wherever possible, to increase responsiveness and decrease the cost of distribution while maintaining economies of scale

• Extra capacity in outbound logistics to absorb demand peaks without affecting the ability to meet customers' expectations

• A culture of accountability and a focus on a small number of key metrics - well-balanced to ensure that unintended consequences do not occur

• Collaborative programmes with suppliers to look at ways to work together to reduce overall input costs and improve responsiveness to unpredictable surges in demand

6.2 Supply chain model

The future Distell supply chain model will embody the best aspects of both 'efficient' and 'agile' supply chain models. It will also be aligned with four key aspects of the Distell corporate strategy:

1. Through a relentless process of driving network optimisation, centre-led procurement, operational efficiency, and supply chain excellence, cost savings and increased levels of responsiveness will be delivered that will result in a real decrease in CoGS over an extended period of time. This will enhance Distell's competitive advantage in the local South African market, in its export markets, and in the regional markets around the world where Distell seeks to have greater influence over its route-to-market and the 'last mile' with targeted customers and consumers.

2. Using outstanding design, consultative solutions development, and flexible, disciplined execution, the supply chain will deliver the best possible support to Distell's aspiration for African market leadership. This will include building a pan-African supply chain that delivers efficient local scale production. It will also build the differentiated distribution capability required for the future success of Distell's luxury portfolio.

3. With innovative product and process design based on 'design for value' principles, the supply chain will enable margin enhancement to improve Distell's aggregate margin in line with its own future financial aspirations.

4. Through a global, world-class supply chain perspective and the development of unique technical and technological expertise, the supply chain will embrace all of Distell's current assets, and apply them in pursuit of its aspiration to be a regional market leader in at least one region outside of Africa. This means that it will also build the capability required to bring about a 'scaling up of excellence' in any future mergers or acquisitions.

The supply chain model was enhanced by outlining the aspirations of Distell's stakeholders.

6.3 Stakeholder winning aspirations:

• The Distell supply chain being considered by stakeholders and competitors to be a genuine source of competitive differentiation and advantage, supporting Distell's unique brand and product portfolio

• Supply chain people working in high-performing, self-directed teams and collaborating spontaneously across functional boundaries

• Supply chain being recognised for its sustainability initiatives that deliver real benefits to Distell and the communities within which it operates

• Supply chain leadership being diverse and reflective of the societies within which Distell operates

• Supply chain people being talented, competent, and highly engaged

• Governments valuing the work Distell does to maximise local participation

7 SUPPLY CHAIN EXCELLENCE OPTIMISATION PROGRAMME

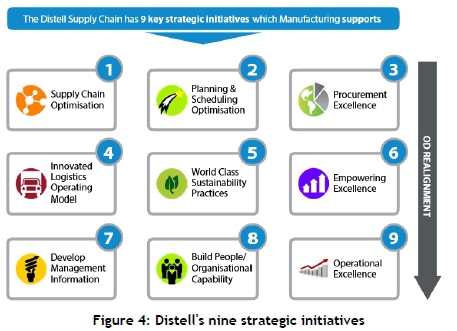

In order to deliver on the success factors, the model, and stakeholder aspirations, Distell has to develop a programme and methodology to support capability across supply chain practices, the network optimisation design, and the centres of excellence. The supply chain excellence (SCE) optimisation programme has been formulated with the following important inflection points for change within the supply chain strategy:

Over the three- to four-year period in focus, a number of these initiatives have changed to suit new and evolving imperatives. In essence, though, these initiatives represent the supply chain excellence (SCE) optimisation programme.

These strategic initiatives have led to the formulation of supply chain excellence with four critical levers, which are outlined below in more detail:

1. Supply chain network optimisation

2. Demand, supply, and S&OP planning best practices across the group

3. Procurement excellence

4. Empowering excellence

7.1 Supply chain network optimisation

7.1.1 Strategic issue: Supply network fragmentation

Distell supply chain operations (production, logistics) were spread over a large number of geographical regions. Essential movement of raw material, working capital, and finished goods through the current network incurred high levels of fixed and variable costs, and ultimately inefficiency. The implementation of a focused network design and a rationalisation exercise to give effect to this design were foundational requirements for success.

Distell has a rich and proud portfolio of diverse brands and SKUs. This wide SKU portfolio, however, has led to a diluted sales and marketing focus, and compromised individual SKU and mix profitability. Furthermore, the wide portfolio range has led to inefficiencies and unnecessary costs across the supply chain.

7.1.2 Strategic initiative: Optimised and consolidated supply chain network

The purpose is to decrease supply chain complexity and related inefficiency, as well as increasing individual SKU and mix profitability. This lever ensures that the current fragmented supply chain network is consolidated and rationalised to remove duplication, inefficiency, and low value-adding activities. There is a need both to optimise the current supply chain network, and to build a reliable, efficient, and well-capacitated supply chain for the future.

7.1.3 Focus areas:

• Optimise the product portfolio for simplicity, especially returnable bottles

• Challenge processing and networking philosophies to unlock consolidation potential

• Challenge the orthodoxies by applying the following key principles:

o Produce close to source

o Bottle close to market

o Create end-to-end integrated manufacturing facilities

o Decouple plants to create a shored and more reliable supply chain

• Set up in-market supply chains in selected African countries

• Optimise the export free-on-board (FoB) model out of South Arica

• Create 'scale' distribution centres with full product portfolios to enable 24-hour replenishment lead times in South Africa

• Realise progress and benefits, and reduce working capital by decoupling manufacturing plants

• Install new technologies to save, recycle, and reclaim water, and use solar energy to reduce non-renewable energy footprints

• Brand, wine-pools, and blends rationalisation, consolidation, and standardisation

• Extend the above to include second-tier (bottles, closures, cartons, gift packs) and third-tier (bulk intrinsic, dry goods) inputs into the supply chain

• Refine and implement a consensus process and business rules constantly to manage a dynamically optimised SKU range

• Address the proliferation of the Distell SKU range, with large numbers of SKUs making a limited contribution

Structurally, the South African supply chain was significantly influenced by a past segment-based orientation towards wine, spirits, and Ready To Drinks (RTDs), as well as differentiated structures for primary and secondary production. This created some duplication of overheads, contributed to a siloed way of operating, and was not in line with the strategic orientation towards differentiated scale and luxury brands capabilities.

7.1.4 Objectives:

To establish and maintain a lean, agile supply chain network that optimises assets, limits or controls costs, and increases overall efficiency, with the following objectives:

• Continuously ensuring an optimal and most efficient supply chain network

• Maintaining a supply chain network design capability that can calculate and provide data to enable decision-making to support the supply chain and corporate Distell strategy

• Short-term step change in overall network efficiency - raw material supply, production, distribution, and release to manufacturing (RTM)

• Continuous optimisation of the supply chain network

• Modelling of Distell's global end-to-end supply chain, inclusive of distribution and RTM, for future (five-year) capacity planning and optimisation

7.1.5 Winning aspirations:

• Rationalised, integrated, and optimised network is in place, delivering world-class products at competitive costs with the appropriate quality, and enabling responsive delivery in line with customer needs and expectations

• Factories focused on scale production are highly automated and employ people largely for value- added, knowledge-based work

• Network optimised around scale without compromising heritage of luxury brands

• Production locations optimised to contribute significantly to network optimisation without compromising production technology

• Network reflects 'new' value streams of scale and luxury

• Optimised network both regionally and internationally

• Capacity utilisation optimised for delivery reliability (higher reliability may require lower capacity utilisation)

Distell has management control of all production facilities that primarily produce Distell products and brands for Distell-owned entities. This ensures that Distell is able to switch production flexibly between facilities, is able to maintain constant quality and efficiency, and is able to forecast, plan, and produce using its own unique technology.

7.1.6 Key deliverables:

The network optimisation design used internal capability to manage and generate significant cost savings, create a shorter supply, and de-link supply changes.

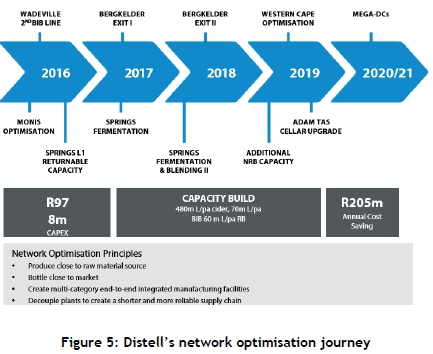

The supply network optimisation journey reflects the timeline, the investment decisions, and the returns to improve the supply chain network. The R978 million CAPEX investment has realised breakthroughs with an annual cost saving of R205 million, and working capital reduction.

The diagram below reflects the optimisation journey, most notably the significant investment made over the past four years to consolidate, integrate, and optimise the Distell network. Note the resulting additional capacity and annualised cost savings.

In the Distell integrated annual report 2018 [6], Richard Rushton comments on the group's investment in accelerated network optimisation as follows:

We have also invested R978 million in network optimisation since 2014 to build additional capacity of 480 million litres of cider, 70 million litres of wine served in 'bag-in-box' (BIB) and 60 million litres of returnable bottles. This resulted in an annual cost saving of R205 million, with plans for further consolidation and optimisation of our network in South Africa and the UK.

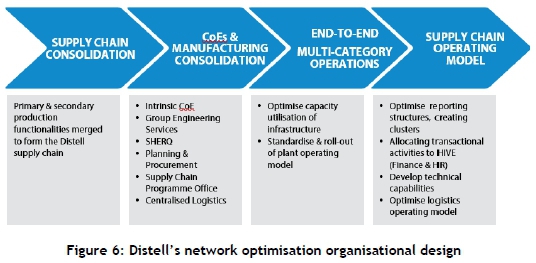

In addition to the network optimisation journey, changes have been made to the organisational design. These changes, reflected in the diagram below, are:

• Consolidated primary and secondary production into one

• Created centres of excellence for intrinsics, engineering, Safety, Health, Environment, Risk & Quality (SHERQ), logistics, planning, procurement, and a programme office

• Created multi-category manufacturing plants

• Defined the supply chain operating model

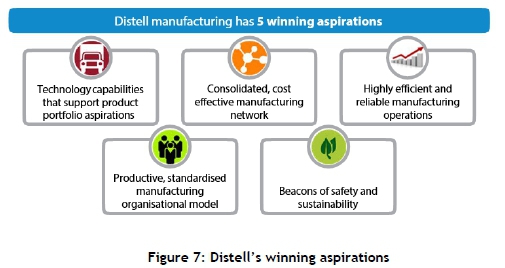

In addition, under the leadership of the supply chain director, Johan van Zyl, a five-year manufacturing strategy was developed in 2016 to outline the manufacturing strategic imperatives [7]. The five winning aspirations were aligned to the corporate and supply chain strategies.

To cascade the manufacturing strategy and create differentiated plant charters, a process was facilitated across the 12 manufacturing plants, in partnership with CCi's senior vice president (the first author), which also created focused factories, supported by appropriate performance indicators.

The collective capabilities of the manufacturing operations will be distributed and exhibited across various plants and operations with their unique core and supporting characteristics.

The process has resulted in a focused manufacturing grid, and the clustering of plants into four distinct charter types:

• Focused flexibility

• Dual processing

• Focused processing

• Specialised support

One-page plant charters have been formulated to outline the charter description, the differentiated technical and organisational capabilities, and network synchronisation.

7.1.7 Results:

All the winning aspirations have been met. The Distell network has been optimised around scale, without compromising the heritage of luxury brands. Capacity utilisation has also been optimised, and reliability improved.

This optimisation has resulted in improved flexibility and reduced working capital. The capacity footprint and interdependencies have transformed the orthodox way of thinking, and helped to 'bust myths'. The network has been optimised both regionally and internationally.

7.2 Planning and scheduling optimisation

7.2.1 Strategic issue: Poor forecasting accuracy and integrated production planning

Inaccurate long- and medium-term forecasting, coupled with a fragmented approach to production planning, led to sub-optimised raw material and finished goods holding and other associated costs throughout the supply chain. It also resulted in the inefficient use of production capacity. Forecast and S&OP processes were not as accurate, well-supported, or technology-enabled as they could be. This resulted in poor reliability, high stock levels, and unnecessary supply chain costs and sub-optimised use of production assets.

7.2.2 Strategic initiative: Improve supply chain reliability and optimise working capital levels

The aim was to achieve optimal use of production assets through improved, integrated, and technology-led forecasting, S&OP, and production planning to improve reliability and working capital.

7.2.3 Focus areas:

• Improve customer service through the introduction of the OTIF measure

• Improve forecast accuracy by ensuring collaboration between demand and supply, and integrating five-year, one-year, and operational forecasts

• Reduce working capital by improving efficiency and planning to leverage instantaneous capacity in peak periods, rather than building extensive stock

• Improve stockholding by changing the management rules of safety stock, and improving the stock holding of the right products

• Reduce write-offs or obsolescence

• Develop an integrated production planning system

• Reach consensus on planning business rules and metrics

7.2.4 Winning aspirations:

• One planning function supported by an integrated ICT backbone with clear visibility across the full Distell value chain

• Planning and forecasting is integrated and aligned with a full value chain focus

• Planning is informed by accurate forecasting, and optimises the use of all supply chain resources and assets

• Accurate information required to support S&OP is readily and timeously available

• Clear S&OP trade-offs are made at a senior leadership level to inform intelligent decision-making

• Parallel In, Parallel Out (PIPO) and new product launches with failure write-offs that are reduced by 75 per cent

• Forecasting is accurate and supported by demand and supply side algorithms that constantly 'learn' from reality - these algorithms are considered valuable intellectual property, and are a source of competitive advantage and differentiation.

7.2.5 Key deliverables:

Distell has implemented the following supply chain planning TRACCs:

1. Demand planning to increase forecast accuracy and process adherence

2. S&OP to increase OTIF and reduce stock days to realise savings of R50 million

3. Supply planning to increase Master Production Schedule (MPS) adherence and reduce stock days

S&OP planning practices were introduced to create effective collaboration across the supply chain. Accountability and responsibility were driven with rigour. Demand forecasting from sales and predictive capability were enhanced. A systematic approach resulted in improved reliability in the supply chain, stock reduction, and cash savings.

The results:

• An improved maturity of practices, as shown by the E2maturity score

• Demand reviews are routine in all three regions, and all are taking ownership of their demand signals (short-term focus) - focus remains on process compliance, forecast approach, priorities, and methods

• A quarterly global demand review forum has been initiated, and should support longer-term views (five years) as this approach is progressed

• Supply reviews are in place and are starting to add value - focus is on mapping key supply planning practices (MPS, Manufacturing Requirements Planning (MRP))

• S&OP consensus decision-making is active, although attendance of all stakeholders remains challenging - a review of purpose and attendees will be required, as well as the introduction of higher level (EXCO) S&OP processes

• Started S&OP policy work, including inventory policy, asset care planning, capacity planning, etc.

7.3 Procurement excellence

7.3.1 Strategic issue: Fragmented procurement management

Current procurement processes are uncoordinated and fragmented, resulting in an inability to consolidate negotiating and contracting, as well as leveraging any cost optimisation opportunities. Current procurement practices across the group do not leverage and maximise Distell's total procurement spend.

7.3.2 Strategic initiative:

Centrally leveraged, planned, and coordinated procurement management while empowering localised procurement functions.

7.3.3 Focus areas:

• Codify and implement clear strategic sourcing principles

• Develop category management capability; resource and align procurement structure

• Facilitate value engineering programme

• Implement a skills development programme (suppliers and procurement team)

• Continually re-evaluate Category Advisory Boards (CABs)

• Develop and implement measurement tools to monitor purchasing efficiency

• Develop and implement a real-time information system to enable the above

7.3.4 Winning aspirations:

• Vertical and horizontal centralisation of procurement activities that can be optimised through scale, skill, and knowledge

• Category management is embedded in procurement, and the strategic sourcing process is delivering maximum value to the business

• Procurement is a strategic business partner and assists the business to achieve its strategic and business goals

• Procurement is resourced with highly competent professionals who source best-in-class solutions and obtain the most competitive value for Distell

• A procurement operating model is in place, targeted at minimising risk for the internal control environment and external security of supply

• A supplier management strategy is in place, ensuring security of supply, with effective supplier development programmes across business boundaries

• Day-to-day procurement is highly responsive and supported by automated shared service hubs/ contact centre

• Procurement contributes significantly to Distell's Broad-Based-Black-Economic-Empowerment (B-BBEE) scores and ratings by applying an integrated preferential procurement programme

7.3.5 Results:

Major contributor to the R2.5 billion savings realised over the last five years

• Reduced CoGS

• Improved B-BBEE scores and ratings

• Preferential procurement spend implemented

7.4 Empowering excellence

7.4.1 Strategic issue:

While there was evidence of good practice being driven within some parts of the supply chain, there was a lack of consistent application of best practice standards across the supply chain as a whole. These standards needed to be entrenched as non-negotiable standard operating procedures, from which deviation would not be permitted.

7.4.2 Strategic initiative:

E2is Distell's framework and platform that has enabled it to build on established best practice and operationalise appropriate standardised leading practices to ensure:

• a deliberate effort to move towards supply chain excellence

• an integrated set of best practices for both production and the supply chain

• a standardised, maturity-based journey to becoming a world-class organisation

This lever has required Distell to implement and institutionalise a supply chain excellence approach that enables the development, adoption, and consistent implementation of appropriate leading practices across the end-to-end supply chain. It encompasses operating disciplines that include standardised supply chain structures, policies, principles, processes, practices, tools, and metrics - all of which are uniformly applied and regularly reviewed against requirements and leading practice.

7.4.3 Focus areas:

• Promote best practice through a full review of its continuous improvement programme

• Lead class performance on key metrics supported by leading practices

• Reduce cost through focused (FI) and continuous improvement (CI) by >R25 million per annum

• Clear governance structures with accountabilities and responsibilities

• Clear on what is fixed in the Distell Way, and what is locally standardised (but against best practice)

• An integrated supply chain maturity approach

• Review the supply chain organisational design to:

o Decentralise decision-making

o Empower accountability and ownership (e.g., one general manager per facility)

o Adapt the structure to best practice in supply chain

o Establish centres of excellence and communities of practice

7.4.4 Winning aspirations:

• From product conception, through customer orders and delivery, all sources of waste are minimised or eliminated

• Leading practice is standardised across the supply chain, for all functions - guided autonomy applies

• Standardisation leads to functional excellence, which leads to integrated, end-to-end excellence

o standards are used as a basis for rigorous challenge and continuous improvement through the application of the Plan-Do-Check-Act (PDCA) cycle [8]

• Planning is integrated in a manner that balances demand planning and supply planning

• Agile and flexible supply chain to respond in real time to fluctuating demand patterns for both scale and premium products

• Supply chain able to mass produce and mass configure simultaneously

• Balance struck between decentralised and centralised procurement activities, leveraging scale

• Data is automatically turned into information and ultimately into intelligence

7.4.5 Key deliverables:

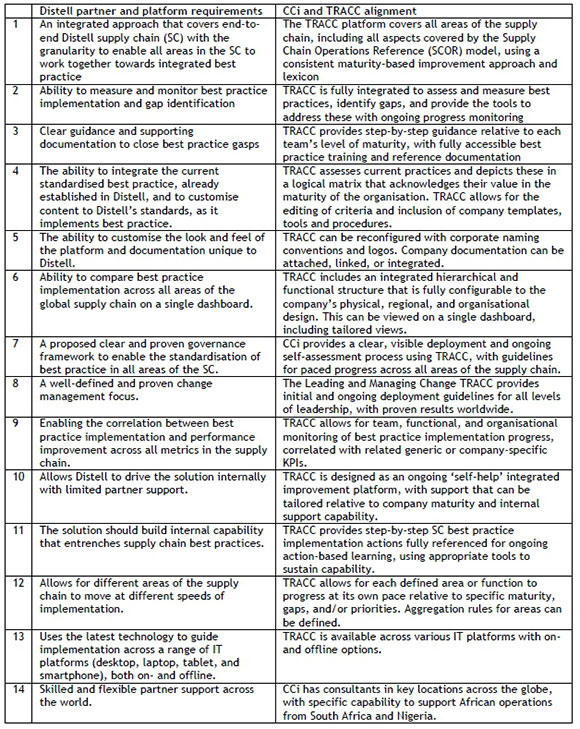

To realise the paradigm shift required, Distell went out to the market to source a partner that could provide an holistic and integrated supply chain solution. With a defined set of criteria, Distell required a partner with a proven track record and an implementation platform.

After an extensive search, Distell concluded that Competitive Capabilities International (CCi) and their TRACC integrative improvement methodology best aligned with its objectives. CCi was selected to partner with Distell in their supply chain optimisation strategy and E2approach.

The table below shows the CCi and TRACC integrative improvement platform alignment to Distell's partnership and platform requirements: [9]

8 CCI AND TRACC

TRACC is an integrative improvement solution, developed and supported by the global consulting firm CCi. The firm was founded 30 years ago and boasts an impressive array of some of the world's largest and best-known organisations as its clients. A number of them have remained CCi clients for several decades.

During the earlier years, CCi recognised the value of codifying its knowledge of lean and world class manufacturing (WCM) [10] to empower organisations to manage their own continuous improvement journey. The power of an integrated, self-directed intervention was soon realised by a number of global companies, and TRACC was subsequently embraced by clients in Australasia, China, Europe, and the US.

TRACC content is deep (approximately 35 000 pages of structured codified advice, templates, training, and assessments). Both this content and the software platform through which it is delivered are constantly upgraded. Today, TRACC is used in more than 3 500 sites in over 70 countries, and has been translated into 14 languages.

The underlying philosophy of TRACC is that, to become world class, organisations should focus on improving their practices to enable sustainable long-term performance.

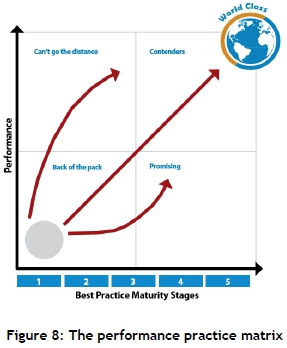

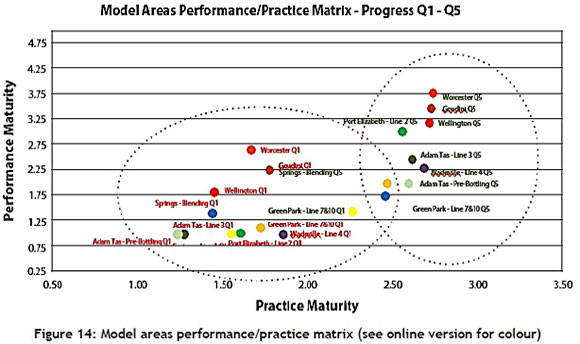

To be a truly world-class organisation, the performance practice matrix represents the fundamental philosophy on which E2is based.

Without performance and practice improvements, Distell acknowledged that they could not achieve world class sustainably. It was essential to drive performance, through both continuous improvement and breakthrough improvement projects.

To be sustainable, however, it was critical that these performance improvements were underpinned by embedding leading practices. It was also necessary to monitor practice implementation and to ensure that the focus was not on current performance, but on long-term, sustainable, market-beating performance.

Distell defined excellence as "a talent or quality which is unusually good and so surpasses ordinary standards. Excellence is striving to be outstanding in everything you do. Excellence is when people strive to be the best they can be" [11].

In manufacturing, the philosophy of Lean, the methodology of 6 Sigma, and the principles and practices of WCM are well-known, and they have enabled organisations to pursue excellence in manufacturing for decades.

The TRACC solution enabled Distell to undertake global benchmarking on two fronts: internally to identify best practice within the business, and externally to benchmark against world-class practices. A world-class organisation is defined in the TRACC material as one that continually does better than its competitors by ensuring that it:

• can always deliver the right quality product on time at the right price

• focuses on profitability and growth to improve the quality of life for all stakeholders

• develops empowered and motivated employees who are able to continually improve the way they work

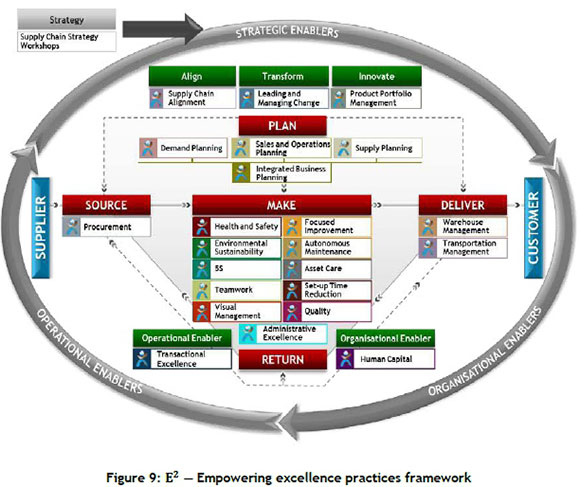

To ensure a consistent, efficient, and effective supply chain, the E2approach was adopted for standardised leading practices. It is Distell's platform to build on established best practices and ensure standardised leading practices across the business. These practices include:

• a deliberate effort to move towards supply chain excellence

• applying a deliberate continuous improvement philosophy

• an integrated set of leading practices for both production and the supply chain

• a standardised, maturity-based journey to becoming a world-class organisation

• a global evaluation system against which the application of leading practices and Distell standards may be measured and evaluated

• a direct correlation between leading practice execution and improved sustained performance

• a culture of empowerment and excellence

Distell invested in the TRACC operations and planning best practices and, through a phased implementation approach, has made steady progress towards world-class excellence.

The E2 empowering excellence practices framework ensured that leading practice standards and practices were developed, improved and uniformly applied. The framework incorporated leading and relevant elements of each of these bodies of knowledge in an integrated manner with extension in the wider supply chain. We're confident that we're on the right track to achieve supply chain excellence.[11]

Distell undertook its baseline maturity assessment in 2015 with a score of 1.47. Through an integrated supply chain maturity approach, it has achieved a maturity of 3.00 in foundation practices in model areas. The aim was to achieve Stage 1.5 foundation practices in all areas by June 2019, and Stage 3 maturity across full sites by 2022.

Appendix A provides additional information and a few photographs of Distell's implementation of the TRACC foundation practices.

In addition to all of these improved practices, Distell formalised and standardised supply chain metrics across all sites/areas. This enabled improved performance on key metrics supported by leading practices. Standardised supply chain structures, policies, principles, processes, practices, tools, and metrics are progressing well.

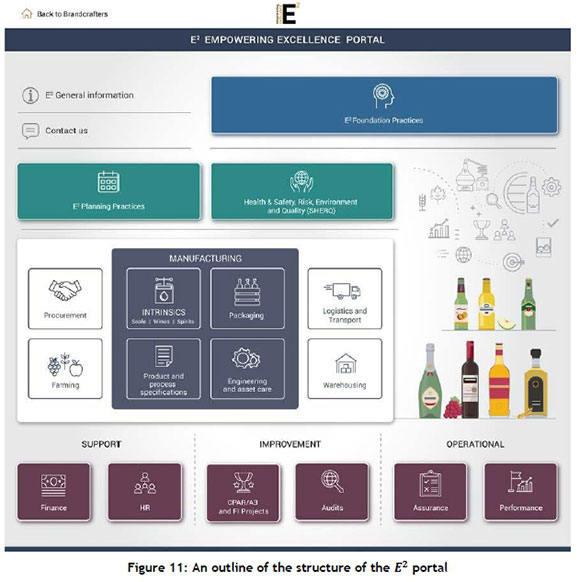

The Ε2portal was designed and developed to create an holistic and integrated platform to host all of Distell's leading practices and standards. It was further extended to incorporate support, improvement and operational standards, guides, and tools. The portal also hosts all SHERQ-related standards and practices. It is widely used across the business, and continues to evolve.

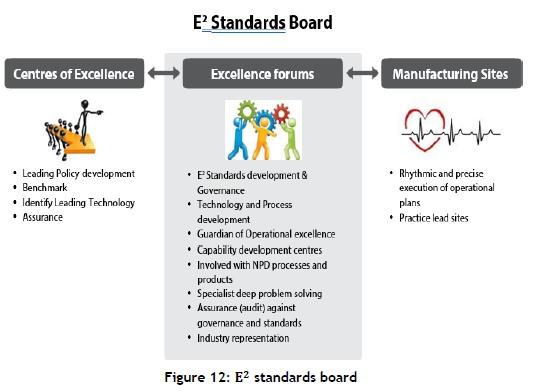

8.1 Organisational design: Centres of excellence and communities of practice

While the leading practices were being introduced, it was evident that Distell had not adequately optimised its centralised supply chain structures, and did not have 'centres of excellence' in place. An Organisational Design (OD) initiative was put in place to create an appropriate and aligned infrastructure to lead and support the supply chain optimisation process in order to realise the intended growth and profitability deliverables.

8.1.1 Focus areas:

• Create supply chain excellence organisational design

• Create centres of excellence (CoE) for all technical (engineering, packaging, and capital projects) issues in Distell

• A single group technical service (engineering, packaging ,and capital projects) that delivers value to Distell manufacturing as its key customer

• Standardised supply chain structures

• Functionalise CoE, providing strategic and functional leadership, direction, governance, standards, and support to production sites

This has led to CoE as an OD construct to optimise economies of skill and economies of scope, including the formulation of the Distell Supply Chain E2Collaborative Working Way:

8.1.2 Key deliverables:

• Establishment of packaging and engineering CoE with defined OD principles:

o Central coordination through standards with decentralised execution

o Custodianship of engineering and packaging skills, capability, and standards

o Functional integrity assured through formally constituted forums

o The performance of the CoE will be judged primarily on the integrity of the system, and secondly on on-site performance

• Group roles and responsibilities defined and communicated to key stakeholders

Another aim was to establish supply chain excellence as a CoE and support unit within the supply chain to assist with the championing and institutionalisation of leading supply chain practices. The SCE CoE comprises:

• Network optimisation - a unit set up to evaluate and build business cases to optimise Distell's supply chain network design

• Quality - a unit that supports the delivery of world-class quality standards in the supply chain

• Health and safety - a unit that supports the adoption of world-class health and safety standards in the supply chain

• Risk - a unit set up to evaluate, report, and mitigate, where possible, risks in the supply chain

• Environmental sustainability - a unit set up to support the adoption of environmentally friendly, sustainable standards in the supply chain (previously in the innovation division of Distell)

The supply chain excellence roles were defined in the following categories: assurance, stewardship, capability building, change enablement, and continuous improvement.

Assurance

Supply chain excellence protects Distell's reputation and licence to operate by assuring key operational standards, including environmental, health, safety, and quality.

Stewardship

Supply chain excellence empowers others to act wisely, effectively, safely, and efficiently as leading practice leaders and as designers of sound processes.

Capability building

Transfer the ability to do things effectively and efficiently.

Change enablement

Accelerate commitment, adoption of new systems and practices and behavioural change.

Continuous improvement

Empower others relentlessly to pursue improvement and excellence.

A key learning for Distell was that these roles should have been developed and introduced upfront.

8.1.3 The results:

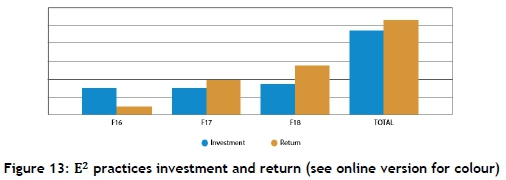

• Total Focused Improvement (FI) and planning savings in the three years to June 2018 - R48.6 million

Only considering return from 'yellow belt' projects, investment paid back in three years.

• Indexed investment and return over three years

• Investment includes TRACC and supply chain excellence managers' resourcing costs

• Return only reflects savings from focused improvement yellow belt project

• Other returns are reflected in end-to-end supply chain metrics

It was important for Distell to have a clear correlation between best practice implementation and performance. Wherever practices were implemented, the E2practice maturity and the performance were tracked. The next diagram shows the practice maturity and performance maturity increase, over 12 to 15 months, at the plants and model areas where practices were implemented. It is evident that there was a clear correlation between performance and practice maturity, with some progressing faster than others.

8.2 Timelines

The timeline below reflects the key interventions in the five-year Continuous Improvement (CI) journey:

9 THE RESULTS

Group CEO Richard Rushton summarised the performance results in the Distell integrated annual report 2018 as follows [12]:

• 95 per cent of our direct and indirect procurement is now managed centrally in line with global best practice

• Our network optimisation initiatives impact positively on efficiency and productivity

• Since 2015, we have increased employee productivity at a compound annual growth rate of 6.4 per cent

• Our training investment has increased by 14 per cent year-on-year

• We maintained our level 4 B-BBEE status following the revision of the codes

Noteworthy supply chain strategic and financial aspirations were required to achieve the strategic ambitions. The performance results are significant, and are reflected in each of the graphs that follow.

9.1 Improvements in customer service and reliability

• 10 per cent improvement in on time in full (OTIF)

• 32 per cent improvement in weekly plan adherence

• 25 per cent improvement in reliability

• 10 per cent increase in OEE

• 30 per cent increase in productivity

9.2 Improvements in cost and asset efficiency

• Between 20 and 40 per cent reduced cost of goods sold (CoGS) over five years

• Reduced conversion costs (two per cent increase in 2019 compared with 2014)

• Cost savings of over R2.5 billion ($174 million) across the supply chain over five years

• 20 per cent reduction in stock days

9.3 Improvements in safety, quality and environment

• 60 per cent step change in disabling injury frequency rate

• 45 per cent reduction in customer complaints

• 15-20 per cent reduction in water usage

• 20 per cent reduction in fossil fuel usage

10 LEARNINGS

The second author shared some of the key learnings at the TRACC and POMS Conference held in Cape Town in April 2019 [11]:

• Executive board support is essential, including an appetite for change and receptiveness to a new way of thinking

• Multi-functional value chain thinking is required

• Be prepared to make bold decisions - 'challenge the orthodoxies'

• Internal capacity is a key to success

• The power of teams - win as a team!

• Line management accountability is required from day one

• TRACC is an irreproachable methodology - people trust and see the depth in the solutions

• Time investment and commitment is a must

• Coaching is vital to reinforce practices

• Financial support and resources must be provided

• Learning all the content and developing expertise and depth of experience to become self-sufficient is a slow but rewarding process

• Profiles of good supply chain excellence people - i.e., industrial engineers with a proven performance track record combined with WCM skills, management skills, and excellent influencing abilities

• Recruitment of external talent, bringing in new blood with no 'baggage', but takes long to bring up to speed

• Different external (CCi) facilitators bring different expertise

The pitfalls of a transformation of this magnitude, and what he would have done differently:

• Cultural dynamics slowed down the process

• A long-term journey is required, as a traditional and slow-moving supply chain carries a huge resistance to change

• Be more analytical of time frames and of the time it takes to address and fix things

• Change organisational design and culture first to create distinct differences - Distell only embarked on its OD changes two years into the journey, and no OD was done at the shop floor level

• Establish upfront understanding and drive of accountability and ownership for CI at line management level versus supply chain excellence resources - it is an inhibitor when CI is seen as CoE's role

• Understanding of fundamental change is required to lead change - if need be, leadership changes are required

• Planning should have taken a more holistic approach versus a site-by-site and pilot approach

• An (incorrect) assumption that WCM was entrenched at the shop floor level, considering the previous 10-year investment, where the WCM foundation and capability was actually poor

• An upfront capability assessment should be done to measure the inherent capability

11 CONCLUSION

Distell has successfully executed a significant end-to-end supply chain turnaround, primarily in its South African operations. Despite the extent and complexity of the supply chain optimisation strategy - and within a very constrained consumer market - the business has made significant progress, as indicated in the performance results.

A post-implementation review of the Distell turnaround reported that a key reason for the success was the comprehensive approach to supply chain optimisation and the diligent execution of each strategic initiative. More broadly, the implementation of the standardised supply chain excellence approach has resulted in increased repeatability, consistency, and predictability of results - there are marked improvements across all performance areas.

CEO Richard Rushton says:

Distell's decentralised operating model, implemented over the past few years, has enabled us to respond rapidly to ever-changing consumer and competitive conditions in our priority market segments and countries. This model helps to reduce duplication and increase efficiency because the decision-making process resides in the respective regions.

Investments during the year focused mainly on the optimisation of our business networks, as well as increased capacity at our Springs and Worcester production facilities, which are our largest cider and brandy production sites, respectively. Our Springs facility is a model site for sustainable savings and efficiencies, featuring a range of green technology innovations. Looking ahead, he continues:

We are optimistic that there are still significant opportunities to build a modern, efficient and diversified alcoholic beverages business in wines, spirits, ciders and RTDs that can compete and deliver sustainable value and returns to all our stakeholders. Achieving this will require that we make the right strategic choices to ensure that we apply our limited resources in a wise and effective manner.

According to Rushton, three strategic initiatives are enabled by their business transformation initiatives: shaping an agile culture, creating sustainable business practices, and innovating 'beyond the bottle'.

To achieve these initiatives, our team's focus is to defend and gain market share in South Africa and accelerate the roll-out of our route-to-market platforms in priority markets on the African continent. Internationally, our aim is to drive growth through bolstering our local route-to-market platforms and making selected investments in priority international markets.

Ultimately, we will strive to enhance our margins and sourcing for value through network optimisation and procurement efficiencies. This will be achieved against the backdrop of the Group's strategy to optimise organisational structures and accelerate decentralisation, resulting in a more agile and efficient company.

Referring to the transformation itself, Rushton admits that it's not easy:

It needs financial resources as well as organisational commitment. The good news is that we can all lift productivity with initiatives such as E2. I am convinced that the principles of E2can be applied successfully to any organisation. The results at Distell speak for themselves.

12 COMPANY BACKGROUND

The Distell Group is South Africa and Africa's leading producer and marketer of wines, spirits, ciders, fine wines and other ready-to-drink (RTD) beverages sold across the world. With a diverse portfolio of brands, Distell's products are priced across the pricing continuum to cater to a broad spectrum of consumers. Distell employs around 5 500 people, and has an annual turnover of R24.2 billion (about $1.7 billion).

With offices in London, New York, São Paulo, and Singapore, Distell's products can be enjoyed around the world via a network of agents in more than 80 countries. Distell has more than 40 trading and distribution outlets in South Africa (SA), as well as regional offices across the African continent. It is currently the second-largest cider producer in the world, and also has six wineries, seven distilleries, three Scotch single-malt distilleries, and nine bottling facilities (four of which are outside of South Africa).

REFERENCES AND BIBLIOGRAPHY

[1] Ferdows, K., 2006. POM Forum: Transfer of Changing Production Know-How. Production and Operations Management, Volume 15; Issue 1, pp. 1-9. [ Links ]

[2] Gartner, 2018. Unify End-to-End Supply Chain Processes With Supply Chain Convergence. 17 July. [ Links ]

[3] Young, S. D. & O'Byrne, S. F., 2000. EVA and Value Based Management: A practical guide to implementation. Europe: McGraw Hill Professional. [ Links ]

[4] Distell, 2019. Distell Integrated Annual Report 2019. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[5] Liker, J. K. , 2004. The Toyota Way: 14 Management Principles from the Worl's Greatest Manufacturer. 1 ed. s.l.:McGraw-Hill Education. [ Links ]

[6] Distell, 2018. Distell Integrated Annual Report 2018. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[7] Distell, 2016. Distell Integrated Annual Report 2016. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[8] Tague, N. R., 2005. Quality Toolbox. 2 ed. Milwaukee: ASQ Quality Press. [ Links ]

[9] Petrarolo, D., 2014. Workshop regarding TRACC Platform.Cape Town, TRACC Platform. DPetrarolo@ccint.net [ Links ]

[10] Schonberger, R. J., 2008. World Class Manufacturing: The lessons of simplicity applied. s.l.:Free Press (1771). [ Links ]

[11] Everson, R.C., 2019. End-to-End Supply Chain Improvement Journey. [Online] Available at: https://traccsolution.com/event/capetown2019/, RCEverson@distell.co.za [ Links ]

[12] Distell, 2018. Distell Supply Chain Report 2018. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[13] TRACC Solutions. 2019. TRACC Solutions. [Online] Available at: https://traccsolution.com/resources/ [ Links ]

[14] Bicheno, J. & Holweg, M., 2016. The lean toolbox: A handbook for lean transformation (5th ed.). UK: Picsie Books. [ Links ]

[15] Delisle, D. & Freiberg, V., 2014. Everything is 5S: A simple yet powerful lean improvement approach applied in a preadmission testing center. Quality Management Journal, Volume 4, pp. 10-22. [ Links ]

[16] Deming, W., 1982. Quality, Productivity, and competitive advantage. Cambridge: MA: MIT Center for Advanced Engineering Study. [ Links ]

[17] Distell, 2014. Distell Integrated Annual Report 2014. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[18] Distell, 2015. Distell Awards 2015. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[19] Distell, 2015. Distell Integrated Annual Report 2015. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[20] Distell, 2016. Distell Awards 2016. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[21] Distell, 2017. Distell Awards 2017. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[22] Distell, 2017. Distell Integrated Annual Report 2017. [Online] Available at: https://www.distell.co.za/investor-centre/annual-report/# [ Links ]

[23] Galsworth, G. D., 2013. Visual Workplace/Visual Thinking: Creating Enterprise Excellence through the Technologies of the Visual Workplace. 1 ed. s.l.:Visual-Lean Enterprise Press. [ Links ]

[24] Panchak, P., 2018. Building a performancedriven, people-centered leadership system. Target Magazine, pp. 32-37. [ Links ]

[25] Rother, M. & Shook, J., 1999. Learning to See: Value Stream Mapping to add value and eliminate muda. 1 ed. s.l.:Lean Enterprise Institute. [ Links ]

[26] Womack, J. P. & Jones, D. T., 1996. Lean Thinking: Banish Waste and Create Wealth in Your Corporation. New York: NY: Simon & Schuster. [ Links ]

[27] Womack, J. P., Jones, D. T. & Roos, D., 2007. The Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World Industry. s.l.:Free Press. [ Links ]

Submitted by authors 14 Nov 2019

Accepted for publication 25 Nov 2019

Available online 12 Dec 2019

* Corresponding author: DPetrarolo@ccint.net

APPENDIX A

Problem-solving

Core to E2is using problem-solving techniques to arrive at the root cause and to drive continuous improvement. In striving to solve problems, employees were encouraged to drive personal responsibility to contribute to a better workplace. With significant shifts in the organisational culture, the following improvements were achieved:

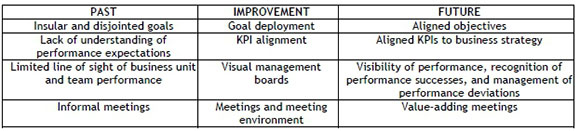

Visual management

Key performance metrics are identified for each work team, with agreed improvement targets. These are monitored through established visual display boards to illustrate the work area's performance. A daily operations review (DOR) at the start of every shift is used to communicate plans for the current shift and to review the performance for the previous 24 hours with the assignment of actions for performance deviations. The same DOR meetings are held at all plants, using visual management boards, and are viewed as highly valuable by the teams. Performance improvements in each work team have been realised as this practice matures and the team capability is enhanced.

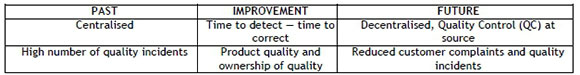

Quality

Product quality lies at the heart of all excellent supply chain operations. A focus on the 'ownership of quality at source' supported by the necessary 'check gates' was driven as a core fundamental in the future supply chain operating model. Quality requirements and responsibilities were redefined to ensure that sufficient infrastructure was available, and that continuous technology investments were made to prevent defects and process variability.

Focused improvement

Each production site implemented a loss and waste analysis with prioritised focused improvement projects. Key improvements and cost savings were realised through focused improvement (FI) and continuous improvement (CI). The total FI and planning savings for the three years to June 2018 amounted to R48.6 million, with only direct attributable savings accounted for. With a total investment of R42 million spent, Distell realised a net R6.6 million Return on Investment (ROI) in this particular strategic initiative.

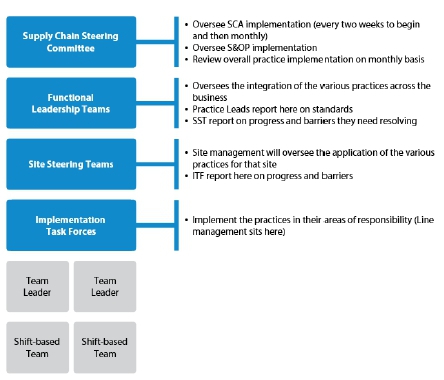

Governance

Clear governance structures have been established through steering committees, site steering teams, and implementation task forces, with clear accountabilities and responsibilities. The leadership team at Distell is fully committed to the supply chain excellence journey, and their change infrastructure is well-established and well-managed.