Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Industrial Engineering

On-line version ISSN 2224-7890

Print version ISSN 1012-277X

S. Afr. J. Ind. Eng. vol.30 n.3 Pretoria Nov. 2019

http://dx.doi.org/10.7166/30-3-2238

SPECIAL EDITION

Innovating for Market Adoption in the Fourth Industrial Revolution

A.P. BothaI, II, *

IDepartment of Engineering and Technology Management, Graduate School of Technology Management, Faculty of Engineering, Built Environment and IT, University of Pretoria, South Africa

IITechnoScene (Pty) Ltd, South Africa

ABSTRACT

Will the market adoption of innovative products and services in the fourth industrial revolution require an alternative reality? This question is investigated in a concept paper in which new product adoption patterns, alternative innovation regimes that include intelligent machines as innovation partners with humans, disruption of the producer, the fourth industrial revolution consumer, and a fundamental change in business models are considered. Thought models are proposed in which these four entities drive a new concept of 'life-world' products through which consumers innovate for their own personalisation and customisation, manufacturing plants for volume products become algorithm factories, and the linear value chain is destroyed and replaced by the value network. This happens because the consumer becomes part of the value chain, and overlaps of producer and consumer functions as we know them merge into a new production ecosystem driven by social commerce. Innovation by the consumer takes away the producer's concerns about market adoption; they may now servitise innovation support. This paper is meant to stimulate academic debate and to initiate research that will validate the thought models it suggests.

OPSOMMING

Sal markaanvaarding van innoverende produkte en dienste in die vierde nywerheidsrevolusie 'n alternatiewe realiteit vereis? Hierdie vraag word ondersoek in 'n konsepsuele artikel waar nuwe produkaanvaardingspatrone, alternatiewe innovasiestelsels wat intelligente masjiene as innovasievennote met mense insluit, ontwrigting van die vervaardiger, die vierde nywerheidsrevolusie verbruiker, en n fundamentele verandering in besigheidsmodelle oorweeg word. Denkmodelle word voorgestel waar die vier entiteite n nuwe konsep van 'lewenswêreld' produkte aandryf, waar die verbruiker innoveer vir verpersoonliking en doelgemaaktheid, vervaardigingsaanlegte vir volumeproduksie algoritme fabrieke word, en die liniêre waardeketting vernietig word om deur die waardenetwerk vervang te word. Dit gebeur omdat die verbruiker deel van die waardeketting word en die vervaardiger- en verbruikersfunksies oorvleuel en saamsmelt in n nuwe produksie ekostelsel wat deur sosiale handel aangedryf word. Innovasie deur die verbruiker doen weg met bekommernisse van die vervaardiger oor markaanvaarding. Die vervaardiger mag nou verkies om innovasie ondersteuning as n diens aan te bied. Hierdie artikel is bedoel om akademiese debat te stimuleer en om navorsing te inisieer wat die denkmodelle se geldigheid sal ondersoek.

1 INTRODUCTION

One of the most challenging experiences any technology producer has is how to get their products and services into the market. They rely on innovation to make new products attractive, based on their understanding of what the market wants. The issue of market adoption has been studied at length, and business tactics have been developed to ensure that consumers prefer the offerings of a producer. This has led to theories of product diffusion, market adoption, business models, and value chain definition, all based on a clear value proposition for the client. The current manufacturing world stands to be disrupted by the fast penetration of the fourth industrial revolution (4IR). It is valid to ask the question: "Will the market adoption of innovative products and services in the fourth industrial revolution require an alternative reality?" This question is investigated in a concept paper in which new product adoption patterns, alternative innovation regimes that include intelligent machines as innovation partners with humans, disruption of the producer, the 4IR consumer, and a fundamental change in business models are considered. The paper chooses to talk about 'the producer' and 'the consumer'. The producer is the manufacturer, and the consumer is the client or customer and the end-user of the manufactured product. The consumer in the context of this paper is thus largely an individual or a community of individuals. The current thinking on innovation and market adoption is discussed, based on a literature review of new realities in market adoption, new innovation frameworks, the producer, the consumer, and business models, as influenced by 4IR. With this as a basis for understanding developing trends, thought models are developed and suggested, based on the four elements of producer and consumer; innovation and market adoption and their influence on business models; value chains; and value networks. Conclusions are made and recommendations are given for further use of the concepts suggested in the paper. It is meant to stimulate academic debate and to initiate research that will validate the thought models suggested.

2 CURRENT THINKING ON INNOVATION AND MARKET ADOPTION FOR 4IR

A literature survey was conducted using the Scopus, Web of Science, and Science Direct databases to determine what is currently being discussed on new innovation and market adoption styles. The searches were conducted in the titles, keywords, and abstracts, and included the following combinations of search terms: market adoption model and Industry 4.0; market adoption and innovative products; market adoption; market dynamics and Industry 4.0; market adoption and 4IR; innovative product adoption in 4IR markets. The searches were done for articles from 2014 to the present.

The discussion that follows highlights some of the current thinking on market adoption, innovation frameworks, producers, consumers, and business models in 4IR.

2.1 4IR market adoption

Rader et al. [1], although not referring directly to 4IR, describe the notion of a new theory of the adoption of mobile technology devices based on the concept of experience in a 'life-world', instead of just the adoption of innovation by consumers. Consumers, instead of adopting new innovations once-off and as a discrete product, now view these devices as something that lives with them over time. This transition is non-linear and often erratic, and the experience of lifestyle change is more than only a product experience. Consumers leverage the functional capabilities of the product in response to their everyday life activities. Their lives transpire in a fundamentally different way than before the product was acquired. Technology has now started to change the fundamental way in which people do things, and affects the way they live their lives. This is ecological change - more than just using the functionality of a product to accomplish a certain task. The innovation of such products should include the social-cultural-economic context, thus leading to new product development models. Technological innovation should now consider that technology is no longer independent and neutral, but an integrated, dynamic, and value-adding shaping force to human life. Technology is now intimately embraced as physically contiguous with human beings. Marketing this type of technology brings the producer and the consumer very close to each other. Close integration in the consumer's 'life-world' also brings new meaning to a product life cycle. End-of-life scenarios will now start to focus on continuous upgrade or improvement while in use, without necessarily replacing the product at life-cycle maturity.

The life-world experience of innovation adoption is in strong contrast to the classical adoption inhibitors, which are either passive or active. Passive innovation resistance is based on a generic tendency to resist anything new. Such people choose to preserve the status quo. Active innovation resistance takes place when a person who is not necessarily negative towards new innovations evaluates a product, finds that the attributes are not in line with their expectations, and develops functional and attitudinal barriers towards the product. This resistance mostly transpires because the consumer was not involved with the innovation.

2.2 New innovation frameworks for 4IR

The attention on innovation is shifting to new models in the context of 4IR and the resulting Industry 4.0, which describes the manufacturing environment. Dean and Spoehr [2] explore this in their review of 4IR innovation and manufacturing policy in Australia. A theoretical distinction is sometimes made between 'process innovation' and 'product innovation'. A good explanation of the different types of innovation and different innovation processes is given by Botha [3] and Edwards-Schachter [4]. Process innovation concerns production techniques, the organisation of work, and business model innovations. According to Dean and Spoehr [2], it is in process innovation that jobs are being threatened by increasing automation and intelligent machines. Product innovation deals with the creation of new products, industries, and sectors. Here jobs may be positively impacted, mostly through creating services that facilitate product consumption. Digital innovation becomes highly integrated with business model innovation, which in turn is focused on disruption, and does not concern the long-range goals of product innovation. Product innovation focuses on the development of new markets and jobs in digitally connected supply and value chains. This development is against the worker trend rather to follow a ' gig' economy and become private contract workers. This has an influence on the physical and digital migration of workers, re-industrialisation in a national economy, and off-shoring of manufacturing where outsourcing stays the norm. The workplace is shifting from the physical factory to the workspace in the Cloud. Advances in artificial intelligence (AI) make this even more possible and practical.

Botha [3] proposes a mind model for intelligent machine innovation in which, in the 4IR context, three innovation agents will emerge: human innovation as we know it; human-machine co-innovation; and autonomous machine innovation. These three innovation agents will be applied in different innovation regimes, based on the open and proprietary innovation domains, and addressing grassroots innovation and systematic innovation modes. Intelligent machine innovation will be applied both in business creation and in formalising knowledge. Specialist and generalist knowledge will merge where complex innovation, both at the bottom of the pyramid and in corporate environments, will be facilitated by advanced machine intelligence, machine consciousness, machine conscience, and deep learning. Complexity at the edge of disruption, where different worlds meet, such as the consumer and the producer worlds, will be easily addressed where AI and data science are deployed. Not only will consumers be closer to contributing to innovation in the products and services they require, but they will also be enabled to perform this innovation assisted by intelligent machines. This will reinforce the social-cultural-economic context of innovation about which Rader speaks [1].

Liu and Meng [5] did a case study on innovation models in electrical vehicles, comparing Toyota, Tesla, and BYD Auto1. These approaches contained common aspects that are important to innovating for new technology product adoption in a fast-changing market brought about by 4IR. These include: creating a connected innovation ecosystem across the industry; creating an awareness of the new paradigm of transport by users and supplying supporting infrastructure; different companies following different innovation paths, albeit in the same industry to address different standards sets; and recognising that business model innovation is key. This suggests that innovation is not bound by the realms of the individual manufacturer.

Edwards-Schachter [4] also points out that business model innovation is influenced by new forces such as: innovation platforms in the post-industrial technologies; focusing on the bottom-of-the-pyramid to enter new markets in developing countries; and having a sustainability orientation by focusing on the triple bottom line, which includes economic, environmental, and societal sustainability.

2.3 The 4IR producer

Lean production has emerged as a way of integrating humans in the manufacturing process, doing continuous improvement, and focusing on value-adding activities by avoiding waste; eliminating waste, such as defects requiring rework; avoiding unnecessary processing steps; minimising the movement of materials or people; minimising waiting time; applying just-in-time principles to avoid excess inventory; and eliminating overproduction. The question is now posed by Mrugalska and Wyrwicka [6]: how may lean production and Industry 4.0 co-exist? They state that Industry 4.0 is characterised by three phenomena: a smart product that contains information about itself and its state of production; a smart machine that communicates with other smart machines and the network; and an augmented operator, referring to the automation of knowledge. The linkage between lean production and Industry 4.0 is suggested to be as follows: Smart products are context-aware, adaptive, self-organised, proactive, and have the ability to support themselves along the whole life cycle. This relates to continuous improvement under lean principles. Smart machines collect data, communicate, and improve the process - which brings it in line with avoiding mistakes. Augmented operators reduce the time between failures and optimising production time. With this level of product smartness, the author of this paper asks whether a localised smart factory is still needed in 4IR, or whether products may be produced at point-of-use.

Cloud-based manufacturing for on-demand products is an emerging technology that will change the shape of manufacturing in 4IR. It involves the rapid configuration of an architecture of loosely connected modular manufacturing devices to make highly customised products [7]. Cloud manufacturing services are self-organising, fault tolerant, and on-demand. For this, they need to have the following characteristics: connectedness, context awareness, intelligence and, as a shared resource, the ability to pay for used services. This means that, with the aid of AI and big data, a consumer with no design or manufacturing experience or skills can give the instruction to a cloud-based manufacturing service: "Make me a transporter that will fit in my backpack to allow me to cover longer distances during my hiking vacation". Legacy-based manufacturing systems will be stuck in paradigms of existing transporters - such as a mountain bike - but 4IR cloud-based systems will immediately have information on location, terrain, weight of the backpack, itinerary, physical strength and health of the consumer, etc., and may come up with a drone that 'carries' the backpack and assists the hiker to cross rivers or steep inclines.

2.4 The 4IR consumer

The 4IR consumer has access to advantages not known before. High levels of integration in products and the autonomous exchange of information lead to real-time requirements changes. Smart products provide relevant information about their status and utilisation patterns, and may suggest improvements in use to optimise value [8]. The consumer will play an increasingly large role in the customised production and real-time adaptation of products. The manufacturing industry, as we know it, will suffer the greatest impacts from 4IR. The new manufacturing paradigm allows for decentralised and digitalised production, in which the production elements control themselves and respond to changes in the environment, including customer need. The production vision is now shifted from mass production to mass customisation, increasing the level of complexity and changing the notions of economy of scale and economy of scope forever. One of the aims of 4IR is to have customised products available at the same price as mass production can offer today. To include the consumer in product innovation requires a new understanding of consumer innovativeness. In a study on new product adoption in the Chinese market, Chao et. al [9] found that innovative products do not always diffuse readily into markets. Innate consumer innovativeness does not contribute to getting new products accepted in a market. However, domain-specific innovation, which relates to consumer-specific interest, makes it easier. A stronger driver of product adoption, however, is the desire for uniqueness. This relates to the 'life-world' notion discussed earlier. Vicarious learning is also said to assist in new product adoption. This, coupled with a hyper-connected society, makes new product absorption easier. The 'must-also-have' social aspect of product ownership, together with life-style enhancement, are becoming two major drivers for consumer product adoption in the 4IR era, sometimes defining communities. The platform for this type of market penetration is social commerce - a form of e-commerce involving social media that assist the online buying and selling of products and services. It relies on user-generated input, real-time information, location-based data, and contextual information, all useful for servitisation - that is, services and solutions offered by manufacturers that supplement their traditional product offerings. Innovative products that have these features embedded will penetrate the market more easily, as shown by a recent study on electrical vehicles [10]. A product thus becomes a hub for commerce itself. Social relationships form an important part in consumer purchasing decision-making, and the market sectors are not obvious anymore, but virtual, and follow the self-organising of consumers with similar social needs. Perception becomes a strong driver of the adoption of new products, and perceived enjoyment replaces perceived ease-of-use. System security, information quality, and technical reliability contribute further to adoption. Returning to the example of electrical vehicles, adoption is also related to the availability of a supporting infrastructure. Charging infrastructure for electrical vehicles is perceived to be not as well developed as the gasoline infrastructure, holding back adoption. The adoption of successful innovative 4IR products is often influenced externally in the ecosystem, where utilities are still under development (e.g., 5G products). Although the risk of the non-availability of infrastructure may always have been there, assumptions are made that older, entrenched infrastructure can be expected to be in place, thus becoming a hindrance to new product adoption - a vulnerability that the markets have not addressed adequately.

2.5 4IR business models

Different business models are emerging in the context of 4IR. The author speculates later that the Osterwalder business model canvas [11], which is widely used in industry, may no longer be appropriate to define a business model in a non-linear value chain, which refers to the preference of value networks over value chains. Business model innovation may have to be redefined in the context of market adoption and innovation in 4IR. Dijkman et al. [12], in their paper on business models for the Internet of Things (IoT), have used the Osterwalder model to describe a business model. The Internet of Things (IoT) is a critical building block of 4IR, connecting objects with each other. These may be physical (sensors, actuators, machines, people, etc.) or cyber-based (data, analytics, information, models, etc.). The Osterwalder model considers customer segments, value propositions, distribution channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure. Dijkman et al. [12] found that they could describe a business model for the IoT on this framework. The value proposition is the most important building block of this business model, confirming the experience of the consumer in the 'life-world' as outlined by Rader et al. [1]. However, a deviation in the customer relationship area of the business model for 4IR innovation indicates that co-creation will drive business, since customers can innovate their own products. Product functionality includes the remote monitoring of products and feeding information to the consumer on usage patterns, energy consumption, and improvement of use. Business models thus add personalisation and context through information gained over time. This stimulates the transition from classical manufacturing to servitisation as enterprises embed new value through adding services to their products [13]. Convergence is achieved in manufacturing when digital technologies result in the integration of services so that both the consumer and the producer in 4IR benefit [14]. The key partnership aspects of the conventional business model increase in importance, to the extent that producers will hardly find it possible to manufacture a product on their own without outsourcing, adding to complexity in the value network. The focus is shifting to increasing value in the network for the entire ecosystem, and not only focusing on profit for the individual manufacturing enterprise. New business models, brought about by 4IR, will thus shift the focus to a service orientation, networked ecosystems, and user-driven innovation (design) and manufacturing, resulting in smart products and services [15].

IoT has a major impact on future business models, especially where servitisation is included. These expansions are typically add-ons to the business model, where IoT is used to enable additional functions or personalised services in existing physical products or services; sharing, where customers pay for using or accessing a product for a limited time, allowing different users to benefit from the product; usage-based business models, where IoT is used to measure the amount of product usage and allow customers to pay for actual usage; solution-oriented business models, where IoT enables supporting core operations or expanding business capabilities [16].

3 THOUGHT MODELS ON FUTURE INNOVATION AND MARKET ADOPTION FOR 4IR

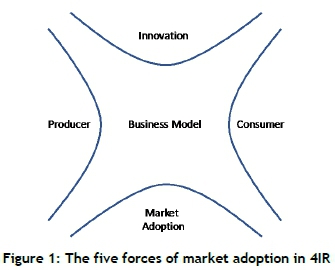

In this section, the interplay among the four forces (innovation, market adoption, producer, consumer) that impact on the business model in 4IR is discussed. They are jointly put in a thought model to assist making sense of the shifts in the market adoption of innovation in 4IR.

3.1 The basic thought model

The basic model, with the isolated forces, is shown in Figure 1.

The four forces are juxtaposed around the business model. The business model is described in the normal way that current business models are described, and typically considers value creation, value capture, and value delivery [15]. The business model is characterised by several configurations, the best known being that of the Osterwalder Business Model Canvas [17], described in section 2.5.

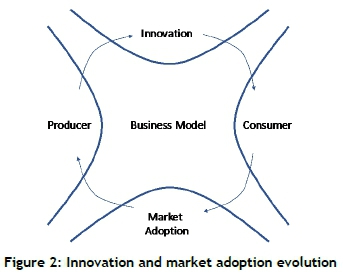

3.2 Innovation and market adoption cycle

In the configuration shown in Figure 2, the producer applies innovation (technological, market, service, etc.) in-house, and presents a value proposition to the consumer. The consumer then adopts this innovation according to the well-understood adoption curve of psychographic buyer behaviours: innovators, early adopters, early majority, late majority, and laggards [18], later popularised by Geoffrey Moore as 'crossing the chasm' in referring to marketing and selling high-tech products to mainstream customers [19].

The cycle continues, and the next generation of products with updated or new features are presented to the consumer, based on customer relationship management as an integral part of the business model. Notably, the worlds of producer and consumer, and of innovation and market adoption, are still isolated.

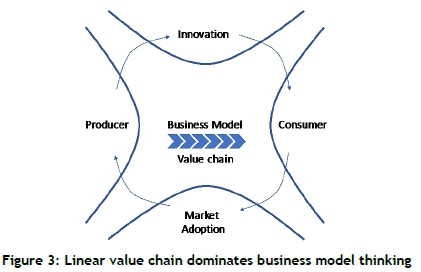

3.3 Linear value chains

The value chain concept used before 4IR was linear and, to a large extent, it still dominates the thinking of both scholars and practitioners. It is illustrated in Figure 3.

This value chain is described from the upstream to the downstream, originally influenced by beneficiation thinking, in terms of which minerals are refined into final products. This thinking applies where a product is completely manufactured by a single producer, or well-defined parts of the product manufacturing are outsourced to external producers. The product is then assembled before being shipped to the consumer. The consumer is the end user and receives a complete product. This kind of linear thinking does not apply to 4IR business models, where the consumer uses cloud manufacturing and takes part in the specification and manufacturing of the product. This behaviour is enhanced by the ecosystem approach of adopting a product or service.

3.4 Innovation with the consumer

As consumer demand for customisation grew and the consumer became informed about different options, a shift in this thinking - albeit still using the same business model based on a linear value chain - started to emerge. In this new dynamic, illustrated by Figure 4, the innovation is split into innovation by the producer for the consumer (market push) and innovation with the consumer (market pull).

The consumer is not satisfied that the producer has the ability to address their needs in a one-sided relationship where the producer is the sole provider of innovation. The consumer thus becomes more selective, and adopts what they believe has been customised. To facilitate the adoption of the product in the market, the producer also realises that new production methods are required to do the customisation, and to integrate its solution with that of - possibly several - other producers. This leads to product modularisation and compatibility to push market adoption. The consumer is also more open to adoption, since customised design and integration with other products in the ecosystem are possible, providing a pull-effect on market adoption.

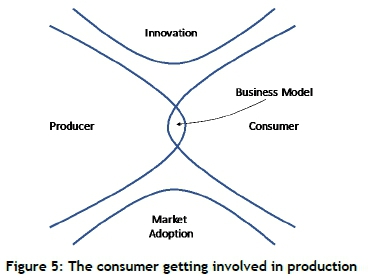

3.5 The advent of 4IR and the consumer becoming the producer

The emergence of cloud manufacturing, and the personalisation of everything (personal computers, personal printers, personal fabrication, personal energy) results in the consumer becoming involved in partial or full manufacturing of the product. This not only changes the role of the producer, but also influences the business model that addresses the producer-consumer relationship. The consumer is now, so to speak, inside the value chain and partly responsible for it. Figure 5 shows this overlap of producer and consumer in production. This phenomenon occurs when, for example, the consumer starts using personal factories based on 3D printing or additive manufacturing. This becomes part of the 'think-it-make-it' culture. The consumer visualises a product, uses design tools accessible from the Internet or an app, and chooses materials to make it in, say, a 3D printer. The role of the producer now changes drastically, away from final product supplier, to one of materials specification and innovation (design) support. This is the beginning of the algorithm industry, in which traditional product suppliers become suppliers of method and process rather than of products. The knowledge of how to do it still resides with the producer, but doing it shifts to the consumer. This underwrites customisation and rapid manufacturing at the speed of consumer thought. Producer innovation now shifts to supporting consumer innovation, and market adoption is driven by knowledge transfer, ease of production, and customisation to an individual 'life-world' rather than product choice. The producer business model is starting to evolve rapidly into value addition at the knowledge level through servitisation, and not at the physical manufacturing level.

3.6 Innovation and market adoption in 4IR

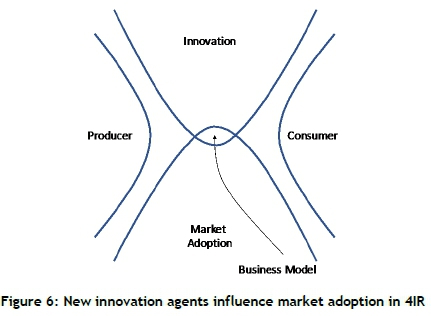

Another major shift in innovation adoption that will be brought about by 4IR is caused by the fact that the consumer now does more product innovation than the producer. This will change the passive and active innovation resistance, since manufacturing is now not done for the consumer, but by the consumer, and acceptance is driven by the consumer's own innovation. This is illustrated conceptually in Figure 6.

The producer must find a new way of assisting the consumer to innovate. The solution may lie in the different innovation agents discussed in section 2.2. It is likely that innovation will shift from human only (the producer), to human-machine co-innovation (the consumer assisted by innovation intelligence supplied by the producer), to autonomous machine innovation (intelligent machines using a digital twin of the consumer to suggest personalised innovations).

3.7 Disrupting producer business models

In the discussion in sections 3.5 and 3.6, it became clear that the boundaries between producer and consumer and between innovation and market adoption are becoming blurred. By now the producer has lost full control over innovation and production. This affects the traditional views of adding value on a linear value chain. The consumer gets involved much earlier in the value chain, and becomes part of it as a production influence and not merely as a user and client. It is natural that a product or a service will be more readily accepted when the user (consumer) has been part of its innovation for customisation. This means that market adoption will be inherent in the ease with which consumers themselves innovate, and not whether the innovation of the producer is acceptable to the consumer. Figure 7 illustrates a conceptual model of this merging of roles of producer and consumer. The consumer makes the product with the knowledge assistance of the producer, using appropriate materials, manufacturing processes, innovative conceptualisation, and design. In effect, process innovation and production innovation are separated between the producer and the consumer, reducing the passive and active innovation resistance and ensuring that products are adopted in the 4IR markets.

The business model based on supply, value addition, demand, and cost and revenue is now disrupted. It is not about the adoption of a product any more, but about the formation of alliances between the producer, or several producers, and the consumer, such that the knowledge for the different aspects of producing a customised or personalised product may come from many different sources. Integration is now inherent before production and not after, as in the assembly of parts to build a product. The producer will increasingly, in servitisation mode, sell knowledge about materials and production algorithms, and provide innovation assistance to the consumer. The consumer will take over the role of the producer to manufacture the product at point-of-use, and incorporate their own innovation that may be assisted by the producer. This will lower the barrier for product adoption in the market, since the consumer will be responsible for their own innovation and build a product that was accepted before being produced.

3.8 New business models based on value networks

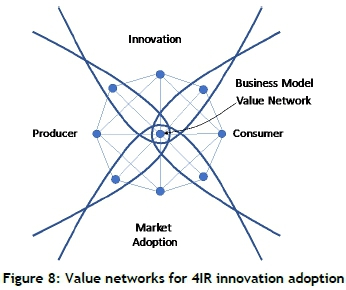

The business model disruption described above in section 3.7 leads to the disappearance of linear value chains, and the introduction of the value network illustrated in the conceptual model in Figure 8.

The producer can now deliver value to the consumer by letting go of the ownership of production and enabling the consumer to produce. This enabling will require key partnerships in the business model that will supply materials - not to the producer, but directly to the client. It may also involve lining up innovation agents (people on their own, people co-innovating with intelligent machines, and autonomous innovation by intelligent machines). Key resources will include those that prepare and deliver materials for personal manufacturing. Key activities will focus on the development and distribution of production algorithms, including standards. This will influence the cost structure for the producer, in the sense that many of the costs could be directly diverted to the consumer, or else the producer could adopt the servitisation principle and manage all the required production elements as a service to the consumer. A dramatic change in the classical business model will take place on the customer relationship side. The consumer, as customer, will now require relationships with a multitude of suppliers in a networked configuration and, to be successful, will need to maintain those relationships. Channels for product distribution are almost non-existent in the new value network configuration. Products are not distributed to an end user, but manufactured at point-of-use by the consumer. Channels for innovation support, raw materials, and production algorithms will be digitalised in 4IR and be available through the Internet, with materials being delivered using existing distribution networks for Internet business. None of the personal manufacturing takes place on a large scale, and volumes and weight are not considered to be inhibitors of distribution. Consumer segments are now determined by social groupings and consumers aligning with each other (based on 'life-world' experience) that are not traditional living standards measure (LSM) marketing groups, or geographically or culturally co-located. The revenue streams are fragmented to the suppliers on the value network (with e-commerce based payments), and they are not the concern of the classical producer any more, except for those that adopt servitisation and provide turnkey manufacturing support services. The value proposition is now entirely focused on the consumer and on what value they derive from choosing to do personalised and customised production. Fast product availability, in a form that has been accepted by the user before production, is the largest value added. This eliminates uncertainty about product acceptance and adoption for the producer, and involves the consumer directly in innovating their ideal solution.

4 DISCUSSION

The thought models developed in Section 3 indicate a fundamental shift, an alternative reality, in understanding innovation for market adoption in 4IR. The inherent nature of production as it is known today is challenged and disrupted, with the emphasis on the consumer taking control of making products at the point-of-use, aided by innovation. The role of the conventional producer - who aims at putting similar products into the market at the highest possible volume, and steering product and process innovation so that the consumer may like the product and adopt it - is fundamentally changed. The producer will be forced by 4IR to focus instead on process innovation and to support the consumer to take over the role of product innovation. Gone will be the days of product adoption, understood by the well-known adoption curve, in which the innovators and early adopters are targeted first in the hope that they will assist the producer to enter the mainstream markets of the early and late majorities. The notion of volume production is replaced by customised personal production, in which each product will have a design and functionalities tailor-made for the user. Market adoption now depends on experience in the 'life-world' of the consumer, who views products as lifestyle-shaping and -supporting companions. Market sectors are now defined by social groups that are virtually displaced globally, connecting people with the same taste and style, and that will promote a certain product genre to be customised for each user. Innovation takes place in the socio-personal context and shifts away from the producer to the consumer. This does away with passive and active innovation resistance, and fundamentally changes the role of innovation in production.

Innovation assistance to the consumer will originate from an evolution of human innovation to human-machine co-innovation, and to autonomous machine innovation with the advent of advanced machine intelligence. This will be at the disposal of consumers wanting to produce their own products. There may be a division of process innovation (remaining in the ambit of the producer) and product innovation (shifting to the consumer). This fundamentally influences product adoption, since it is assumed that, when a consumer has control over product innovation, these products that are personalised and customised will be readily adopted. Innovation now takes place in an ecosystem containing the producer and consumer as integral components, with choice shifting to the consumer. Cloud manufacturing of on-demand products - a phenomenon brought about by 4IR, and supported by 'personal factories' (think 3D printing as an example) - makes it possible for the consumer to enter this cyber-physical realm of a new production world that is dramatically removed from the norm of today. This development will be supported by social commerce, a new way of looking at e-commerce, and new channels of marketing.

The largest impact of personal manufacturing, though, will be on business model innovation. The deviation from the linear value chain to a value network is a logical outcome of such manufacturing disruption. The responsibilities and relationships are fundamentally redefined. Being part of an ecosystem of manufacturing, in which knowledge and algorithms are traded instead of physical products, and innovation is supported by new agents, will define the manufacturing world. The notion of a 'factory', even a 'smart factory', will be destroyed, and production will be distributed on a value network that will drive new ecosystems for 'making things'. With these 'things' being connected in the IoT context, many of the current product houses will turn to servitisation, and support the consumer with non-traditional services such as 'pay-for-use' and the product as a service. The manufacturing industry will be challenged with the largest disruption since Fordism.

5 CONCLUSION AND RECOMMENDATIONS

The work presented in this paper is of a conceptual nature. It offers a proposition that, through new forms of innovation and market adoption in 4IR, the manufacturing world may be at a tipping point. Its role and operations will be disrupted by the way consumers, exposed to 4IR technologies and behaviour, will see and use new products. The paper introduces some thought models for dealing with such a situation - not as a threat, but as an opportunity. The impact goes deepest when fundamental changes in business model innovation for producers are accepted: they will not be able to use classical business model thinking anymore, but will need to replace the notion of a linear value chain with a value network, which constitutes a new ecosystem in which producers and consumers (suppliers and customers) live. This ecosystem is driven by socio-cultural virtual association that creates 'life-worlds' where products live and morph with the consumer over time.

The intention of this paper is to stimulate thinking and encourage debate to test new paradigms that are suggested by applying future thinking based on technology development, the behaviour of people as consumers and producers, and events such as the massive migration towards 4IR. These notions should be subjected to the rigour of systematic research as the world of production evolves, and not just to opinion testing. It is a known fact that a plausible future is envisioned by considering the barriers of the past (resistance to change in manufacturing), the drivers of the present (4IR adoption), and the opportunities of the future (enhanced business and customer satisfaction) in a whole new world of innovation and product adoption.

REFERENCES

[1] Rader, S., Brooksbank, R., Subhan, Z., Lanier, C., Flint, D. and Vorontsova, N. 2016. Toward a theory of adoption of mobile technology devices: An ecological shift in life-worlds. Academy of Marketing Studies Journal, 20(3), pp. 38-62. [ Links ]

[2] Dean, M. and Spoehr, J. 2018. The fourth industrial revolution and the future of manufacturing work in Australia: Challenges and opportunities. Labour & Industry: A Journal of the Social and Economic Relations of Work, 28(3), pp. 166-181. [ Links ]

[3] Botha, A.P. 2019. A mind model for intelligent machine innovation using future thinking principles. Journal of Manufacturing Technology Management. EarlyCite. Accepted for publication. https://doi.org/10.1108/JMTM-01-2018-0021 [ Links ]

[4] Edwards-Schachter, M. 2018. The nature and variety of innovation. International Journal of Innovation Studies, 2, pp. 65-79. [ Links ]

[5] Liu. J. and Meng, Z. 2017. Innovation model analysis of new energy vehicles: Taking Toyota, Tesla and BYD as an example. Procedia Engineering, 174, pp. 965-972. [ Links ]

[6] Mrugalska, B. and Wyrwicka, M.K. 2017. Towards lean production in Industry 4.0. Procedia Engineering, 182, pp. 466-473. [ Links ]

[7] Lu, Y. and Xu, X. 2019. Cloud-based manufacturing equipment and big data analytics to enable on- demand manufacturing services. Robotics and Computer Integrated Manufacturing, 57, pp. 92-102. [ Links ]

[8] Pereira, A.C. and Romero, F. 2017. A review of the meanings and the implications of the Industry 4.0 concept. Procedia Manufacturing, 13, pp. 1206-1214. [ Links ]

[9] Chao, C.-W., Reid, M., Lai, P.-H. and Reimers, V. 2019. Strategic recommendations for new product adoption in the Chinese market. Journal of Strategic Marketing, https://doi.org/10.1080/0965254X.2018.1555545 [ Links ]

[10] Feng, B., Ye, Q. and Collins, B.J. 2019. A dynamic model of electric vehicle adoption: The role of social commerce in new transportation. Information & Management, 56(2), pp. 196-212. [ Links ]

[11] Oliveira, A.-Y. and Ferreira, J.J.P. 2011. Book Review: Business Model Generation: A handbook for visionaries, game changers and challengers, African Journal of Business Management, 5(7), https://academicjournals.org/journal/AJBM/article-full-text-pdf/BA71B6427744. [ Links ]

[12] Dijkman, R.M., Sprenkels, B., Peeters, T. and Janssen, A. 2015. Business models for the Internet of Things. International Journal of Information Management, 35(6), pp. 672-678. [ Links ]

[13] Paschou, T., Adrodegari, F., Rapaccini, M, Saccani, N., and Perona, M. 2018. Towards Service 4.0: A new framework and research priorities. Procedia CIRP, 73, pp. 148-154. [ Links ]

[14] Frank, A.G., Mendes, G.H.S., Ayala, N.F., and Ghezzi, A. 2019. Servitization and Industry 4.0 convergence in the digital transformation of product firms: A business model innovation perspective. Technological Forecasting & Social Change, 141, pp. 341 -351. [ Links ]

[15] Ibarra, D., Ganzarain, J., and Igartua, J.I. 2018. Business model innovation through Industry 4.0: A review. Procedia Manufacturing, 22, pp. 4-10. [ Links ]

[16] Suppatvech, C., Godsell, J., and Day, S. 2019. The roles of internet of things technology in enabling servitized business models: A systematic literature review. Industrial Marketing Management, https://doi.org/10.1016/j.indmarman.2019.02.016 [ Links ]

[17] Osterwalder, A., and Pigneur, Y. 2010. Business model generation: A handbook for visionaries, game changers, and challengers. John Wiley and Sons, Inc. New Jersey [ Links ]

[18] Beal, G.M. and Bohlen, J.M. 1957. The diffusion process. Iowa State College, Special Report 24, http://ageconsearch.umn.edu/bitstream/17351/1/ar560111.pdf. Accessed: 1 June 2019 [ Links ]

[19] Moore, G.A. 1995. Crossing the chasm - Marketing and selling high-tech products to mainstream customers. First edition. HarperCollins, New York [ Links ]

* Corresponding author: anthon@technoscene.co.za

1 BYD Auto Co., Ltd. is the automotive subsidiary of the Chinese BYD Company.