Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Industrial Engineering

On-line version ISSN 2224-7890

Print version ISSN 1012-277X

S. Afr. J. Ind. Eng. vol.29 n.4 Pretoria Dec. 2018

http://dx.doi.org/10.7166/29-4-1951

CASE STUDIES

A performance evaluation of competitive focuses in the furniture industry

C.G. CamfieldI; M.A. SellittoII, *

IFederal Institute of Rio Grande do Sul, Bento Gonçalves, Brazil

IIProduction and Systems Engineering Graduate Program, UNISINOS, Sào Leopoldo, Brazil

ABSTRACT

The purpose of this article is to assess the strategic performance of manufacturing of a company in the furniture industry located in Southern Brazil. We used a cybernetic approach to conduct the study and a tree-like structure formed by five competitive priorities weighted by the Analytic Hierarchy Process. The difference between importance and performance informs if the operation is successful or if it fails. The most significant failures are the time to implement modifications in products, the dependability of suppliers, small capacity to change the production volume and mix, and the lack of after-sales services to meet customers' requirements.

OPSOMMING

Die doel van hierdie artikel is om die strategiese vervaardigingvertoning van 'n maatskappy in die meubelindustrie in die suide van Brasilië te assesseer. 'n Kubernetiese benadering is tydens die studie gevolg en gebruik om die boomagtige struktuur deur die vyf mededingende prioriteite geweeg deur die analitiese hiërargieproses te vorm. Die verskil tussen die belangrikheid en vertoning bepaal of die bedryf sukses behaal en of dit misluk. Die mees noemenswaardige mislukkings is die tyd wat dit neem om veranderinge in produkte te implementeer, die betroubaarheid van verskaffers, lae kapasiteit om die produksievolume te verander en te meng en die tekort aan na-verkope kliëntediens.

1 INTRODUCTION

The Brazilian furniture industry is mainly located in the southern region of the country. Its southernmost state, Rio Grande do Sul (RS), has 2,750 furniture companies, which represent 13.3 per cent of Brazilian companies. In 2015, RS produced 18.4 per cent of the total furniture manufactured in the country, and was responsible for 31.1 per cent of exports. RS produced approximately 85.3 million pieces, invoiced BR$ 6.73 billion (1 BR$ = US$ 3.5 by the time of the study), and exported more than US$ 183 million, according to IEMI [1]. Among other characteristics, the Brazilian furniture industry contributes to the reduction of environmental damage by taking advantage of waste generated in other industries and reducing its own generation of waste [2,3].

Due to the evolution of the market and the insertion of the industry into global supply chains, companies in the Brazilian furniture industry now compete according to new priorities - other than reducing prices and designing novelties. Companies also compete in other ways: they compete by product quality, mainly through reducing variability; they also compete by product cost, mainly through reducing losses; they compete by increased flexibility, mainly through the ability to produce lots of different sizes and product mixes economically [4]. Moreover, the organisations of the industry can also compete in the speed of the manufacturing process [5] and reliability in meeting the delivery deadline [6]. In this sense, the competitive advantage in the Brazilian furniture industry depends heavily on the content of the manufacturing strategy [7].

Compatibility between the content of the production strategy and the competitive priorities of the company is essential to increase the strategic performance - that is, the degree to which the strategic objectives are achieved [8]. Moreover, competitive priorities and the contribution of the manufacturing system to the competitiveness of the industry have been recurrent themes in the operations management literature since the 1970s and 1980s [9,10].

In this sense, competitive priorities may be key criteria for formulating production strategies. Their influence is crucial for understanding how companies make decisions to align their internal actions with external objectives [10]. A direct relationship between competitive environment, business strategy, competitive priorities, and organisational performance can be observed in manufacturing companies [11]. Therefore, competitive priorities and structural decisions must be aligned with performance assessment to create the competitive capabilities necessary for a firm to survive in the current competitive environment [12].

Thus the assessment of the results generated by the execution of the formulated strategies can be decisive for the control of the strategic performance. The strategic context has brought vital intangible elements to the competitive landscape of the industry that are difficult to measure directly. To measure and evaluate intangible elements and latent variables usually observed in strategic problems, methods and models based on multiple decision criteria can be applied [13]. For example, models supporting measurement and performance evaluation and methods of organisation of variables and latent constructs based on multicriteria have appeared in the literature and motivated research over the last few years [14, 15, 16, 17].

The literature offers many studies that approach similar issues. We highlight some of these studies: Sellitto and Walter [18] evaluated the performance of a manufacturer according to competitive criteria; Siriram [19] presented a model of improvement in the systems of prediction in the industry through competitive factors; Phusavat and Kanchana [20] identified manufacturing companies' competitive priorities and their implications for industrial development; Pesic, Pesic, Ivkovic, & Apostolovic [21] used a strategic approach to industry; Chi, Kilduff & Gargeya [22] analysed the relationships between the characteristics of the business environment, competitive priorities, supply chain structures, and business performance. Silva, Finardi, Forneck & Sellitto [23] comparatively analysed and qualitatively evaluated the competition priorities in three supply chains of the petrochemical industry; Saarijärvi, Kuusela, & Spence [24] used peer comparison to help managers of a supply chain to decide on the importance of competitive priorities consistently; Bulak and Turkyilmaz [12] evaluated the performance efficiency of small and medium-sized enterprises in Turkey using competitive priorities; Thürer, Godinho Filho, Stevenson & Fredendall [25] examined the competitive capacities of small and medium-sized manufacturing companies and the link between capabilities and performance in manufacturing; and Gölec [26] developed a system to calculate the strategic priorities in a manufacturing system.

Based on such considerations, the research question is: how can we assess the strategic performance of a company in the furniture industry? The purpose of this article is to assess the strategic performance of a company in the furniture industry located in Southern Brazil. The research method is quali-quantitative modelling. The qualitative part defines the multi-criteria for the assessment, which are the company's competitive priorities. The quantitative part uses the analytic hierarchy process (AHP) to distribute importance among the criteria according to its effectiveness in achieving the strategic priorities of the company. The specific objectives of the article are: (i) construction of a weighted tree-like structure, formed by constructs and indicators, capturing the essential elements of the competitive priorities for the production strategy of the company; (ii) application of the structure in the case and calculation of the overall strategic performance; and (iii) discussion of the application, providing guidelines to improve the manufacturing performance of the company.

The paper is organised into five sections. Section 2 presents a brief review of competitive priorities and performance assessment in manufacturing. The research methodology is presented in Section 3. The results and discussion are presented in Section 4. The paper concludes with Section 5.

2 COMPETITIVE PRIORITIES AND PERFORMANCE ASSESSMENT IN MANUFACTURING

Production strategy involves a set of goals, policies, and constraints. Adapting processes and improving basic capabilities are the primary objectives of executing a production strategy, to achieve the competitive priorities assigned to the manufacturer. Such skills can create a competitive advantage for the company in the industry in which it operates [26]. Swink, Narasimhan & Wang [27] have shown empirically that the integration of strategy, manufacturing, customers, and suppliers improves production capacities and the overall performance of the business. Kristal, Huang & Roth [28] have shown that there is a positive correlation between competitive priorities on the one hand, and revenue and market share on the other hand.

In this sense, competitive priorities are the goals that companies intend to realise in order to achieve or maintain a competitive advantage in the industry [10]. The assessment of the competitiveness of manufacturing includes the assessment of performance in reaching competitive priorities [25]. The most commonly used competitive manufacturing priorities are cost, quality, delivery time, and flexibility [29]. The four priorities can be expressed in operation goals: reduce the cost of production and distribution of products (cost); reduce variability in products and improve their performance (quality); reduce deadlines (delivery speed) and increase the capacity of meeting these deadlines (delivery reliability); and increase the capacity of reaction to changes in order quantity, in order mix, and in product specification (flexibility) [30]. In this article, the following competitive priorities express the manufacturing objectives: reducing cost, increasing quality, increasing dependability, increasing flexibility, and facilitating innovation [31]. Table 1 summarises the concepts researched in the literature on competitive priorities.

One of the most important features of a set of competitive priorities is to specify the strategic performance expected from the manufacturing function in supporting the execution of the overall strategy of a company in the industry [49]. Dynamic behavior analysis and the need for multicriteria to describe the manufacturing performance become important. Therefore, there is a need for a flexible methodology to define and to prioritise the strategic variables for performance measurement in manufacturing [49]. It must also consider that the evaluation of a strategic performance behaves like a cybernetic machine: the strategy predefines goals; then a convenient instrument measures the current results; and finally, using feedback cycles, the current results are compared with the objectives, controlling the actions, trying to modify the results, and bringing the system closer to its objectives.

Competitive priorities can bridge the gap between the strategic objectives of the company and the manufacturing operation [50]. For example, a previous study [51] presented structures to measure the degree of achievement of priorities in the manufacturing operation, tested in case studies [52]. In this case, performance measurement of the priorities can be thought of as a hierarchical structure of latent variables, with specific calculation methods for each variable. These structures consist of a top-end term - strategic performance - supported by latent constructs - the competitive priorities. A set of correlated field indicators must capture the essence of the competitive priorities [53, 13]. Previous studies demonstrated that indicators belonging to he same construct are expected to be highly correlated, whereas indicators of different constructs are expected to be weakly correlated [54,55].

Finally, a complete strategic system suitable for manufacturing should provide elements for decision-making and corrective actions, in a process that requires data collection, processing, and aggregation with appropriate frequency and sufficient accuracy. This system must consider key elements, such as generic definitions for the strategy, competitive priorities and strategic rationales that support the strategy, structural and infrastructural decisions that materialise the priorities at the shop-floor, and field indicators that feedback the results [56, 14, 15, 16, 57]. Figure 1 summarises the systemic action of strategic measurement and control of performance in manufacturing systems, in a cybernetic approach [49].

In view of this, it can be pointed out that different competitive priorities tend to have a different efficacy in achieving the strategic objectives when establishing cause and effect relationships, which supposedly take place in manufacturing activities. Given the cause-effect relationships, we can define a set of strategic actions that are expected to materialise in the company's universe of results. A tree-like structure assesses the company's performance of the competitive priorities, and a set of financial and non-financial metrics assesses the overall performance of the manufacturing, closing the loops. The comparison between the objectives and the feedback produces the deviations that corrective actions must bridge [49].

3 RESEARCH METHODOLOGY

This study evaluated the performance of the competitive priorities of a furniture industry in the South of Brazil, using the analytic hierarchy process (AHP) method. The AHP is a logical multi-criteria decision-making technique that allows decision-makers to model complex problems based on mathematics and human psychology [58]. AHP relies on a table of preferences according to which policymakers assign attributes among all the possible subsets of two criteria in a complete set of n criteria, resulting in a preference matrix. The company belongs to the largest and most modern group of designed furniture manufacturers in Latin America. The company's headquarters are located in Bento Gonçalves. In the design furniture industry, the need for competitiveness has become more pronounced in recent years. The company has a network of 700 authorised retailers, producing and selling four exclusive brands to meet different consumer requirements. The manufacturing is fully automated, following mass customization operation strategy. In 2012, the company launched an initial public offer (IPO), which confirmed the excellence of the corporate governance system, its management principles, and its full compliance policy. This study focuses only on the internal loop - the strategic performance loop. Our interest concentrates on the competitive priorities and strategic rationales, the strategic actions, and the tree-like structure. Initially, a meeting was held with the company's managers about the competitive priorities: cost, quality, flexibility, deadline, and innovation. Four managers with MBA degrees participated (R1, R2, R3, R4); they hold positions as logistics, manufacture, quality, and purchasing managers respectively. They were asked about the concept of competitiveness, the competition in the industry, and how they interpret the scenario in which the company operates. From the information given by this focus group, a questionnaire was constructed. This was then given to the same managers in order to evaluate the importance of the variables of the competitive priorities.

The questionnaire was administered with the managers using Qualtrics software, through which the group evaluated the company in relation to the factors being studied. The managers organised the priorities in groups, presenting the respective justifications and completing the tree-like assessment structure using the sub-priorities according to a five-point scale [1 = very good; 0.75 = good; 0.5 = fair; 0.25 = bad; 0 = very bad]. Next, the production manager evaluated the competitive priorities and judged the relative importance of the constructs' flexibility, quality, innovation, delivery, and cost, with the support of the AHP, arriving at a weighting of these factors, represented by the matrix of preference. After collecting the answers, a consistency ratio was obtained that confirmed whether the values assigned to the comparisons were consistent. All the prioritisation calculations with the AHP were performed using Assistat software.

The matrix of preference was then built, prioritising the competing priorities for performance. With the answers to the questionnaires and the prioritisations, a numerical value was obtained that corresponded to the performance of the company, and the calculation of the gaps. A comparison was then made of the performance results of the critical factors of the competitive priorities (with their potential influence), and the performance gaps. Finally, a comparison was made of the critical factors of competitive priorities with their potential for influence, and the performance gaps. In order to assess the gaps for strategic control, the following rule was considered: the larger the gap, the more important the indicator of strategic control. The researchers and managers then discussed the gaps, defining a set of corrective actions that were more likely to enhance the strategic performance of the manufacturing function of the studied company.

4 RESULTS AND DISCUSSION

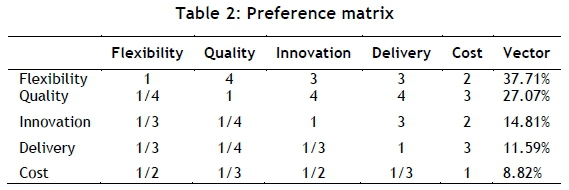

With the use of the AHP method and the prioritisation of competitive priorities (cost, quality, delivery, flexibility, and innovation), the competitiveness of the industry can be visualised using the preference matrix in Table 2. In this table, a vector represents the relative importance of the five competitive priorities. One of the main features of AHP is the calculation of CR, the consistency ratio - the probability that the construction of the preference matrix was done randomly, not after a rational decision process. The proponents of the AHP state that if CR < 10 per cent, it can be considered satisfactory, and the judgement is a manifestation of a rational decision process. Otherwise, the decision is inconsistent, restarting the process. In this case, CR equals 2.34 per cent, which is a satisfactory value. Table 2 shows the preference matrix, the relative importance vector and CR, calculated by Assistat with the mean judgements of the four managers. We rearranged the table according to the importance of the vector components.

The importance vector informs the distribution of importance between the priorities. This distribution is about the mode the company decided on to compete in the market. The company currently attributes much more importance to improvements in flexibility (37.71%) than to cost reduction (8.82%) to remain competitive in the industry. So the managers' justifications, in relation to the competitive priorities, are the following:

• For costs, the managers believe that, if the company needs to reduce prices to win orders, the company should: (i) improve efficiency in the production line, (ii) reduce labour costs with the aid of automation, (iii) reduce the cost of raw materials and energy, (iv) reduce the cost of after-sales services, and (v) have an accurate cost accounting system;

• For quality, the body of management believes that, if the company needs to improve quality to win orders, the company should: (i) reduce variability in the processes, (ii) improve the manufacturability of the products, (iii) increase the reliability of the products, (iv) reduce delay, rejection, and rework in the materials received from suppliers, and (v) reduce the need for after-sales service;

• For flexibility, the body of management believes that, if the company needs to increase flexibility to win orders, the company should: (i) complete the modifications of products requested by customers more quickly, (ii) introduce new products in the market more quickly, (iii) modify the productive capacity more quickly, according to the market's demands, (iv) modify the production mix more quickly, according to the market's demands, and (v) modify the production lot size more quickly, according to the market's demands;

• For delivery time, the body of management believes that, if the company needs to increase dependability to win orders, the company should: (i) be more reliable in meeting order quantities, (ii) be more reliable in meeting due dates, (iii) reduce the promised mean time for deliveries, (iv) customise packages, and (v) improve the performance of the distribution channel; and

• For innovation, the body of management believes that, if the company needs to promote innovation to win orders, the company should: (i) develop more entirely new products, (ii) meet more customers' requirements in developing new products, (iii) introduce new features in current products, (iv) introduce environmentally friendly features in current products, and (v) improve process technology.

When analysing the decision tree-like structure for the strategic performance assessment that is based mainly on the rationales, it can be stated that priorities cannot be directly measured, but are captured by a set of indicators, given that those indicators capture the essence of the rationales. We uniformly distributed the importance between the indicators of the same priority: each indicator had 20 per cent of the priority's importance. The top term is strategic performance. The fourth part of the methodology produced the assessment of the indicators according to a five-point scale. Table 3 shows the tree-like structure for the strategic assessment of the manufacturing process and the results of the assessment (pp means percentage points, which is different from %).

In the final step, the researchers and managers discussed the gaps. The most important elements for strategic control are the gaps: the bigger the gap, the more important the indicator in strategic control. Figure 2 shows the gaps of the indicators, in percentage points (pp).

In analysing the gaps (Figure 2) it is noticed that the greater gap is for the F1 priority (the time to implement product modifications); that is, it is the company's greatest strategic weakness. The second major weakness is the Q4 priority (reliability of current suppliers). Then follow priorities F3 (ability to change production volume), F4 (capacity to change the production mix), and Q5 (need for after-sales services). Given this, it is noted that, if the company decides to improve its strategic performance, these five indicators must be pursued and addressed through corrective actions. It is important to note that no indicator showed a high standard deviation, meaning that the managers understood the concepts and rationales involved. A large standard deviation could indicate a lack of uniformity in the judgements, due to different understandings, knowledge, and beliefs about manufacturing priorities.

In order for the company to use the co-competitive priorities to increase its manufacturing strategic performance, it should mainly consider the following five actions, derived from the evaluation: (i) reduce the time of implementation of modifications in the products; (ii) increase the reliability and service level of the supplier network; (iii) reduce the economic order quantity without a significant cost increase; (iv) increase the number of different items that can be produced together; and (v) implement and standardise after-sales services such as vendor and installer training, technical assistance to retailers and customers, and maintenance and recovery of materials already shipped.

According to the results, the company struggles to meet customer preferences and turn them into new product requirements. Thus, to achieve better strategic performance, the company must implement an information system to mitigate this weakness, the operations of which must be shared with retailers and customers. With the information system, the company's designers can gather information in a systematic way, turning it into the requirements and functionalities of new products. Considering that the company is part of a cluster of furniture companies (mainly from the same geographic region), cluster participants should focus on joint development until the cluster collectively meets the level of service demanded by customers of the company being studied, which is a global leader in the industry. The company should invoke the support of regional entities and universities for a collective improvement of performance.

To reduce the number of economic orders without a significant cost increase while increasing the number of different items that can be produced together, we note that, although the company operates a fully automated production line, its production management systems have not yet fully exploited the technological resources available. The technical team received adequate training on the implemented technology, but the results are only partially satisfactory. The company should seek adequate advice on technological issues fully to exploit the automated facilities that are available. Finally, when analysing, implementing, and standardising sales services - such as training suppliers and installers, technical assistance to retailers and customers, and maintenance and recovery of materials already shipped - it was noticed that the company still does not have clarity on the importance of after-sales service. The company must modify the set of services it offers in accordance with the new policies. The definition of such policies goes beyond the scope of this study. The details of implementing the plan also go beyond the scope of this study. More research should focus on it.

Action plans should thus eliminate, or at least reduce, the five identified gaps, allowing new gaps to gain relevance and become more important. Those new gaps should then motivate new corrective action plans. With the repetition of the assessment and control process, the gaps are expected to reach zero on an on-going basis, until strategic performance eventually reaches its maximum value. The continuous application of the instrument can address new priorities and objectives in a continuous cycle of information and control.

5 CONCLUSION

The objective of this article was to evaluate the strategic performance of the manufacturing of a furniture company located in the south of Brazil, with the support of the AHP method, in order to assign importance among the criteria according to their effectiveness in reaching the strategic priorities of the sector. In view of this, it was possible to construct a weighted tree structure, identify the gaps between importance and prioritisation, discuss their application, and give guidelines to improve manufacturing performance by presenting corrective actions. Based on the results found in Tables 2 and 3, the company considers that flexibility is decisive for strategic performance. By comparing the priorities between actual importance and perceived importance, they discovered the shortcomings (Figure 2), which were clearly presented and discussed, with the presentation of the five goals most likely to improve the strategic performance of the company's production.

The limitations of this study relate to the chosen method. As it did not include a follow-up on the execution of the suggested actions, with a new evaluation after a period, it is not possible to say whether the study included the strategic control of the manufacturing. The object of the study was only the performance assessment, the information phase, and not the control phase. A delimitation was the study of a single company, with few respondents; this did not allow the reliability and unidimensionality of the questionnaire to be verified. The validity of the study is thus limited to the studied company. Further and more extensive research should extend the results to the industry. Another limitation was the use of qualitative indicators, relying on the opinion of experts and admitting some degree of subjectivity in the assessment. Further studies can also admit quantitative, objective indicators.

The study has managerial implications for the company. The most important implication is that managers now have a systematic and objective tool for setting goals and reallocating resources to reach strategic goals, using competitive priorities. This form of evaluation is dynamic, and can accompany the changes that the actions provoke in the strategic performance of the company, and future changes in the strategic scenario in which the company operates, since they are represented by key indicators and the analysis of gaps, measured by difference [important - performance]. In this case, the company can vary the building weights and indicators of the priorities. Eventually, the importance of the indicators of each construct should change if major changes also occur in the strategic execution of the company. Finally, if the competitive priorities of the company's manufacturing operation change radically, new constructs must come in, and obsolete constructions must be removed from the instrument. Another implication is that the company can provide an information system to support the execution of strategic performance evaluation on an ongoing basis.

As a suggestion for new research, we point to the use of other multicriteria methods, mainly those of the French school, like such as PROMETHEE or ELECTRE, that differ from the AHP of the American school, which is currently used. We also point to longitudinal case studies in the industry, involving the execution of correction plans and new measures of performance, and the extension of the study to encompass the entire strategic control cycle. Finally, the main suggestion derived from this study is to do a survey of the industry, to provide a suitable amount of data that is sufficient to refine the assessment tool. Factor analysis, Cronbach's alpha, and other multivariate statistical methods can help to assess the validity and reliability of the assessment instrument, allowing for improvements that can turn the tool into a usable instrument on a larger scale than that supported by the current study.

ACKNOWLEDGEMENTS

I, Clarissa Gracioli Camfield, would like to thank the Federal Institute of Education, Science, and Technology of Rio Grande do Sul - IFRS, Campus Bento Gonçalves, for the support received during the period of removal for Stricto Sensu qualification in the Doctoral Course in Production Engineering and Systems of the University of Vale do Rio dos Sinos - UNISINOS. And also to UNISINOS and the Coordination for the Improvement of Higher Education Personnel - CAPES for the scholarship received during the Course.

REFERENCES

[1] IEMI. 2015. Sector Report 2015 Furniture Cluster of Rio Grande do Sul. MOVERGS [Internet]. Available from: http://www.movergs.com.br/img/arquivos/movergs/dados-movergs_147.pdf [ Links ]

[2] Sellitto, M.A. & Luchese, J. 2018. Systemic Cooperative Actions among Competitors: the Case of a Furniture Cluster in Brazil. Journal of Industry, Competition and Trade, 18(4), pp. 513-528. doi:10.1007/s10842-018-0272-9. [ Links ]

[3] Hillig, É., Schneider, V.E. & Pavoni, E.T. 2009. Geração de resíduos de madeira e derivados da indústria moveleira em função das variáveis de produção, Production, 19(2), pp. 292-303. [ Links ]

[4] Sellitto, M. A., & Luchese, J. (2018). Systemic Cooperative Actions among Competitors: the Case of a Furniture Cluster in Brazil. Journal of Industry, Competition and Trade, 18(4), pp. 513-528. [ Links ]

[5] Tammela, I., Canen, A.G. & Helo, P. 2008. Time-based competition and multiculturalism: A comparative approach to the Brazilian, Danish and Finnish furniture industries. Manag. Decis., 46(3), pp. 349-64. [ Links ]

[6] Passos, C.A., Spers, R.G. & Wright, J.T.C. 2015. The efficiency and strategy of companies operating in the popular market: A study on the furniture industry in Brazil. J. Manag. Res., 7(4), p. 111. Available from: http://www.macrothink.org/journal/index.php/jmr/article/view/7880. [ Links ]

[7] Navas-Alemán, L. 2011. The impact of operating in multiple value chains for upgrading: The case of the Brazilian furniture and footwear industries, World Dev., 39(8), pp. 1386-1397. [ Links ]

[8] Barnes, D. 2002. The complexities of the manufacturing strategy formation process in practice. Int. J. Oper. Prod. Manag., 22(10), pp. 1090-111. [ Links ]

[9] Hayes, R.H. & Pisano, G.P. 2009. Manufacturing strategy: At the intersection of two paradigm shifts, Prod. Oper. Manag., 5(1), pp. 25-41. [ Links ]

[10] Boyer, K.K. & Lewis, M.W. 2002. Competitive priorities: Investigating the need for trade-offs in operations strategy. Prod. Oper. Manag., 11(1), pp. 9-20. [ Links ]

[11] Ward, P. & Duray, R. 2000. Manufacturing strategy in context: Environment, competitive strategy and manufacturing strategy, J. Oper. Manag., 18(2), pp. 123-138. [ Links ]

[12] Bulak, M.E. & Turkyilmaz, A. 2014. Performance assessment of manufacturing SMEs: A frontier approach, Ind. Manag. Data Syst., 114(5), pp. 797-816. [ Links ]

[13] Sellitto, M.A., Pereira, G.M., Borchardt, M., da Silva, R.I. & Viegas, C.V. 2015. A SCOR-based model for supply chain performance measurement: Application in the footwear industry, Int. J. Prod. Res., 53(16), pp. 4917-4926. [ Links ]

[14] Yeo, R. 2003.The tangibles and intangibles of organisational performance, Team Perform. Manag. An Int. J., 9(7/8), pp. 199-204. [ Links ]

[15] Tuomela, T.S. 2005. The interplay of different levers of control: A case study of introducing a new performance measurement system, Manag. Account. Res., 16(3), pp. 293-320. [ Links ]

[16] Garengo, P., Biazzo, S. & Bititci, U.S. 2005. Performance measurement systems in SMEs: A review for a research agenda, Int. J. Manag. Rev., 7(1), pp. 25-47. [ Links ]

[17] Chenhall, R.H. & Langfield-Smith, K. 2007. Multiple perspectives of performance measures, Eur. Manag. J., 25(4), pp. 266-282. [ Links ]

[18] Sellitto, M.A. & Walter, C. 2006. Avaliação do desempenho de uma manufatura de equipamentos eletrônicos segundo critérios de competição, Produção, 16(1), pp. 34-47. [ Links ]

[19] Siriram, R. 2016. Improving forecasts for better decision-making, South African J. Ind. Eng., 27(1), pp. 4760. [ Links ]

[20] Phusavat, K. & Kanchana, R. 2007. Competitive priorities of manufacturing firms in Thailand, Ind. Manag. Data Syst., 107(7), pp. 979-996. [ Links ]

[21] Pesic, D., Pesic, A., Ivkovic, S. & Apostolovic, D. 2015. Fuzzification of the 'tows' strategic concept: A case study of the Magneti Marelli branch in the Serbian automotive industry, South African J. Ind. Eng., 26(1), pp. 203-217. [ Links ]

[22] Chi, T., Kilduff, P.P.D. & Gargeya, V.B. 2009. Alignment between business environment characteristics, competitive priorities, supply chain structures, and firm business performance, Int. J. Product. Perform. Manag. 58(7), pp. 645-669. [ Links ]

[23] Silva, B., Finardi, C., Forneck, M. & Sellitto, M. 2012. Comparative analysis and competitive priorities assessment in three supply chains from the petrochemical industry, Production, 22(2), pp. 225-236. [ Links ]

[24] Saarijärvi, H., Kuusela, H. & Spence, M.T. 2012. Using the pairwise comparison method to assess competitive priorities within a supply chain, Ind. Mark. Manag., 41(4), pp. 631-638. [ Links ]

[25] Thürer, M., Godinho Filho, M., Stevenson, M. & Fredendall, L. 2015. Small and medium sized manufacturing companies in Brazil: Is innovativeness a key competitive capability to develop ?, Acta Sci., 37(3), pp. 379-387. [ Links ]

[26] Gölec, A. 2015. A relationship framework and application in between strategy and operational plans for manufacturing industry, Comput. Ind. Eng., 86, pp. 83-94. [ Links ]

[27] Swink, M., Narasimhan, R. & Wang, C. 2007. Managing beyond the factory walls: Effects of four types of strategic integration on manufacturing plant performance, J. Oper. Manag., 25(1), pp. 148-164. [ Links ]

[28] Kristal, M.M., Huang, X. & Roth, A.V. 2010. The effect of an ambidextrous supply chain strategy on combinative competitive capabilities and business performance, J. Oper. Manag., 28(5), pp. 415-429. [ Links ]

[29] Ward, P.T., McCreery, J.K., Ritzman, L.P. & Sharma, D. 1998. Competitive priorities in operations management, Decis. Sci., 29(4), pp. 1035-1046. [ Links ]

[30] Dangayach, G.S. & Deshmukh, S.G. 2003. Evidence of manufacturing strategies in Indian industry: A survey, Int. J. Prod. Econ., 83(3), pp. 279-298. [ Links ]

[31] Vachon, S., Halley, A. & Beaulieu, M. 2009. Aligning competitive priorities in the supply chain: The role of interactions with suppliers, Int. J. Oper. Prod. Manag., 29(4), pp. 322-340. [ Links ]

[32] Ward, P.T., Bickford, D.J. & Leong, G.K. 1996. Configurations of manufacturing strategy, business strategy, environment and structure, J. Manage., 22(4), pp. 597-626. [ Links ]

[33] Ferdows, K. & De Meyer, A. 1990. Lasting improvements in manufacturing performance: In search of a new theory, J. Oper. Manag., 9(2), pp. 168-184. [ Links ]

[34] Vickery, S.K., Droge, C. & Markland, R.E. 1993. Production competence and business strategy: Do they affect business performance?, Decis. Sci., 24(2), pp. 435-456. [ Links ]

[35] Kathuria, R. 2000. Competitive priorities and managerial performance: A taxonomy of small manufacturers, J. Oper. Manag., 18(6), pp. 627-641. [ Links ]

[36] Takala, J. 2001. Analysing and synthesising multifocused manufacturing strategies by analytical hierarchy process, Int. J. Manuf. Technol. Manag., 4(5), p. 345. [ Links ]

[37] Nair, A. & Boulton, W.R. 2008. Innovation-oriented operations strategy typology and stage-based model, Int. J. Oper. Prod. Manag., 28(8), pp. 748-771. [ Links ]

[38] Jabbour, C.J.C., Maria Da Silva, E., Paiva, E.L. & Almada Santos, F.C. 2012. Environmental management in Brazil: Is it a completely competitive priority?, J. Clean. Prod., 21(1), pp. 11-22. [ Links ]

[39] Swafford, P.M., Ghosh, S. & Murthy, N.N. 2006. A framework for assessing value chain agility, Int. J. Oper. Prod. Manag. 26(2), pp. 118-140. [ Links ]

[40] Dangayach, G.S. & Deshmukh, S.G. 2006. An exploratory study of manufacturing strategy practices of machinery manufacturing companies in India, Omega, 34(3), pp. 254-273. [ Links ]

[41] Martín-Pena, M.L. & Díaz-Garrido, E. 2008. A taxonomy of manufacturing strategies in Spanish companies, Int. J. Oper. Prod. Manag., 28(5), pp. 455-477. [ Links ]

[42] Wang, J. 2008. Relationships between two approaches for planning manufacturing strategy: A strategic approach and a paradigmatic approach, Int. J. Prod. Econ., 115(2), pp. 349-361. [ Links ]

[43] Leong, G.K., Snyder, D.L. & Ward, P.T. 1990. Research in the process and content of manufacturing strategy, Omega, 18(2), pp. 109-122. [ Links ]

[44] Naqshbandi, M.M. & Idris, F. 2012. Competitive priorities in Malaysian service industry, Bus. Strateg. Ser., 13(6), pp. 263-273. [ Links ]

[45] Dangayach, G.S., Deshmukh, S.G. 2000. Manufacturing strategy: Experiences from select Indian organizations, J. Manuf. Syst., 19(2), pp. 134-148. [ Links ]

[46] Robb, D.J. & Xie, B. 2001. A survey of manufacturing strategies in China-based enterprises, Int. J. Prod. Econ., 72(2), pp. 181-199. [ Links ]

[47] Theodorou, P. & Florou, G. 2008. Manufacturing strategies and financial performance: The effect of advanced information technology: CAD/CAM systems, Omega, 36(1), pp. 107-121. [ Links ]

[48] Jayaram, J. & Narasimhan, R. 2007. The influence of new product development competitive capabilities on project performance, IEEE Trans. Eng. Manag., 54(2), pp. 241-256. [ Links ]

[49] Sellitto, M.A. & Walter, C. 2005. Medição e pré-controle do desempenho de um plano de ações estratégicas em manufatura, Gestão & Produção, 12(3), pp. 443-458. [ Links ]

[50] Machuca, J.A.D., Ortega Jiménez, C.H., Garrido-Vega, P. & de los Ríos, J.L.P.D. 2011. Do technology and manufacturing strategy links enhance operational performance? Empirical research in the auto supplier sector, Int. J. Prod. Econ., 133(2), pp. 541-550. [ Links ]

[51] Stock, G.N., Greis, N.P. & Kasarda, J.D. 1998. Logistics, strategy and structure, Int. J. Oper. Prod. Manag., 18(1), pp. 37-52. [ Links ]

[52] Lee, V.H., Ooi, K.B., Chong, A.Y.L. & Seow, C. 2014. Creating technological innovation via green supply chain management: An empirical analysis, Expert Syst. Appl., 41(16), pp. 6983-6994. [ Links ]

[53] Sellitto, M.A., Borchardt, M., Pereira, G.M. & Gomes, L.P. 2012. Environmental performance assessment of a provider of logistical services in an industrial supply chain Theor. Found. Chem. Eng., 46(6), pp. 691703. [ Links ]

[54] Sellitto, M.A. 2018. Assessment of the effectiveness of green practices in the management of two supply chains. Bus. Process. Manag. J., 24(1), pp. 23-48. [ Links ]

[55] Sellitto, M., Borchardt, M., & Pereira, G. 2010. Modelagem para avaliação de desempenho ambiental em operações de manufatura. Gestão & Produção, 17(1), 95-109. [ Links ]

[56] Choudhari, S.C., Adil, G.K. & Ananthakumar, U. 2013. Configuration of manufacturing strategy decision areas in line production system: Five case studies, Int. J. Adv. Manuf. Technol., 64(1-4), pp. 459-474. [ Links ]

[57] Merchant, K.A. 2006. Measuring general managers' performances, Accounting, Audit. Account. J., 19(6), pp. 893-917. [ Links ]

[58] Gupta, S., Dangayach, G.S., Singh, A.K. & Rao, P.N. 2015. Analytic hierarchy process (AHP) model for evaluating sustainable manufacturing practices in Indian electrical panel industries, Procedia - Soc. Behav. Sci., 189, pp. 208-216. [ Links ]

Submitted by authors 23 /Mar 2018

Accepted for publication 17 Sep 2018

Available online 10 Dec 2018

* Corresponding author sellitto@unisinos.br