Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Industrial Engineering

versão On-line ISSN 2224-7890

versão impressa ISSN 1012-277X

S. Afr. J. Ind. Eng. vol.26 no.2 Pretoria Ago. 2015

GENERAL ARTICLES

Integrated model for supplier selection and performance evaluation

M.C.B. de AraújoI, *; L.H. AlencarII

IFederal University of Pernambuco Recife, Brazil, mariacreuza.araujo@ufpe.br

IIFederal University of Pernambuco Recife, Brazil,lhazin@ufpe.br

ABSTRACT

This paper puts forward a model for selecting suppliers and evaluating the performance of those already working with a company. A simulation was conducted in a food industry. This sector has high significance in the economy of Brazil. The model enables the phases of selecting and evaluating suppliers to be integrated. This is important so that a company can have partnerships with suppliers who are able to meet their needs. Additionally, a group method is used to enable managers who will be affected by this decision to take part in the selection stage. Finally, the classes resulting from the performance evaluation are shown to support the contractor in choosing the most appropriate relationship with its suppliers.

OPSOMMING

'n Model vir die seleksie van leweransiers en vir die beoordeling van dié wat alreeds aan die maatskappy verbonde is, word voorgestel. 'n Simulasie van die voedselindustrie in Brasilië is gedoen, omdat hierdie sektor 'n belangrike rol in die Brasiliaanse ekonomie speel. Die model integreer die leweransierseleksie- en beoordeelfases; dit is belangrik sodat 'n maatskappy vennootskappe met leweransiers, wat aan die maatskappy se vereistes voldoen, kan aangaan. Verder word 'n groepmetode gebruik om belanghebbende bestuurders toe te laat om insette tot die besluitneming tydens die leweransierseleksiefase te lewer. Laastens word terugvoer van die leweransierbeoordeelfase gebruik om die maatskappy te steun in die keuse van 'n gepaste verhouding met sy leweransiers.

1 INTRODUCTION

The competitiveness of an organisation is increasingly associated with its ability to establish and maintain a cooperative relationship with its suppliers. Besides, according to Bevilacqua et al. [1], an organisation needs to have the capacity to choose adequate suppliers. As a result, companies seek lasting relationships in order to establish partnerships with a smaller number of vendors with greater quality and credibility. According to Zeydan et al. [2], at the same time as lowering costs, firms work continually with suppliers to reduce product design periods, improve quality, reduce lead time, and generate greater innovation through better design and increased flexibility. Moreover, suppliers can have either a very positive or a very adverse impact on the overall performance of an organisation [3]. So finding good partners is a vital issue for the management of a company.

The analysis of suppliers aims to assess their impact on the pricing, quality, risk, and delivery capabilities of any firm [4,5], has a direct financial and operational impact on the business [6], and adds value to end-customers [7]. Consequently, decisions about suppliers are fundamental to successful supply chain management [8]. For these reasons, how best to develop relationships with suppliers has been a topic of considerable research effort in supply chain management [9].

Amin and Razmi [10] assert that most research studies have focused on selecting or evaluating suppliers separately. However, it is essential to use integrated methodologies to select the suppliers who will be contracted, and to evaluate the performance of those that already work with a company. Thus, because several factors relate to this analysis, it can be characterised as a multicriteria decision aid problem [2,11,12], and it is therefore necessary to determine the relative importance of the criteria [13].

This study thus puts forward a multicriteria decision aid model to assist companies to select suppliers, to evaluate the performance of those that work with them, and, based on this evaluation, to provide information about the type of client-supplier relationship that must be established between the parties. Thereafter, a simulation of the model that was conducted in a Brazilian company in the food industry, which has great importance for the economy of country, is described.

The food industry was chosen for many reasons. First, food supply chains are an important subset of the broader supply chain environment due to their importance to global and local populations, economic prosperity, and the vulnerablity of food supply chains [14]. Second, food has a direct effect on customers' health, which prompts the need for products to have high levels of quality. Moreover, according to Ni-Di and Ming-Xian [15], the emphasis on the quality of resources, on delivery time, and on costs adds a high level of complexity when outsourcing and making decisions on selecting suppliers. The Brazilian Association of Food Industries [16] has stated that there are thirty-two thousand formal enterprises in the sector, the turnover of which was equivalent to 9 per cent of Brazil's gross national product in 2011; and it has noted the importance of selection and performance evaluation in this industry.

This paper is organised as follows. Section 2 reviews the literature on multicriteria methods used to select and evalute suppliers. Section 3 describes the model proposed, and Section 4 illustrates it by way of a numerical simulation. Section 5 presents the conclusions of this research.

2 MULTICRITERIA METHODS FOR SUPPLIER SELECTION AND PERFORMANCE EVALUATION

With increasing competition, companies need to find ways of managing their business that result in the continuous improvement of their performance with customers. There has been increasing recognition of the need for a firm to work closely with its supply chain partners in order to optimise its business activities [17].

In this context, the ability to create close relationships with their fundamental suppliers is essential to improve the overall performance of the supply chain, and to help firms to achieve lower product costs, to reduce time-to-market, to improve quality, to introduce advanced technology, or to improve service delivery. One important issue for this type of relationship is how best to select suppliers who will adequately meet the needs of the firm, and how to evaluate their performance in order to choose those with whom the firm should create long-term relationships.

Supplier selection and performance evaluation are considered to be multicriteria problems. The nature of these problems is both widely diverse and complex because of the type of solutions to be investigated and the methodological approaches that can be used to address them [18]. Because of this, according to Ho et al. [19], several approaches to multicriteria decision aid have been proposed to select and evaluate suppliers.

Several authors have proposed models that include the following for supplier selection: ANP (analytic network process) and AUGMECON (augmented e-constraint method) [8]; fuzzy inference [20,21]; AHP (analytic hierarchy process) and DEA (data envelopment analysis) [22]; AHP [23]; and ELECTRE (ELimination Et Choix Traduisant la REalité) [24].

Nevertheless, supplier selection is considered to be a group decision problem [11,25,26] because it is essential to take account of the preference of several decision-makers (DMs) whose activities will be affected by the choice of suppliers. Therefore, some group decision methods are used when selecting suppliers [5,11,26].

For supplier evaluation, Chen et al. [11] used fuzzy PROMETHEE for a group decision problem to evaluate four potential suppliers to a bank, in order to improve the decision process of outsourcing. Dagdeviren and Eraslan [27] used PROMETHEE in their studies too. Lin [12] proposed an integer method for supplier evaluation and optimal allocation of orders, using ANP and FPP (fuzzy preference programming) to measure the weights of selected suppliers, and MOLP (multi-objective linear programming) to allocate the quantities of optimal orders to each supplier.

The integration of the processes of selecting suppliers and evaluating their performance is very important to an efficient relationship with suppliers. However, in the literature review, few papers with this integration were found: Wang [5] presented a 2-tuple-based evaluation method to measure the performance level of suppliers. As a result, their performance was classified as 'perfect', 'promising', 'moderate', or 'bad'; and, in line with this classification, it was recommended what kind of relationship firms should have with these suppliers. Schramm, F. and Morais [28] proposed a model based on SMARTER (simple multi-attribute rating technique extended to ranking) to select suppliers in the building industry, and evaluated the suppliers that the model selected.

The major contribution of this paper is to construct an integrated multicriteria model for the phases of both selecting suppliers and evaluating their performance. In the selection phase, the model enables the firm to choose between using a single DM and group decision-making, and takes restrictions on resources into account. Finally, the classification of suppliers in the evaluation phase is essential to support firms and to note what type of relationship they should build with the contracted suppliers. This can help a firm to improve its overall performance and, consequently, its competitiveness.

3 PROPOSED MODEL

3.1 Identification of the organisation's objectives

The first phase of the decision process consists of identifying the organisation's goals in relation to its suppliers (Figure 1). Determining these objectives is essential so that suitable partners that are able to meet its business needs will be chosen.

The first step is to identify the actors who, directly or indirectly, are affected by the process. If the preferences of individuals are convergent, the group can choose one person to be the DM who will use a simple decision method; but if there is divergence over their preferences, the use of group decision procedures is necessary. Therefore, a committee of DMs who are familiar with the company's internal and external needs should be created. The phase of determining the pre-selection and selection criteria then takes place. Subsequently, the company obtains an overview of its objectives.

In this context, the criteria used were those identified by Viana and Alencar [29] in a survey carried out with food companies listed in the ABIA (Brazilian Association of Food Industries). It was determined that the pre-selection criteria would be those mentioned by more than 50 per cent of the respondents when asked what criteria should be used in the preselection of suppliers. The selection criteria would be those mentioned by more than 40 per cent of the respondents when asked what criteria to use when selecting long-term suppliers. The criteria presented in both classes were allocated to the category in which they had obtained the highest percentage of citations.

The pre-selection criteria are delivery (PC1), price (PC2), geographical location (PC3), production capacity and facilities (PC4), and compliance with company procedures (PC5). The selection criteria are: commitment (SC1), credibility (SC2), efficiency (SC3), quality of product/service (SC4), technical capabilities (SC5), flexibility (SC6), cooperation capability (SC7), and impression made through personal contact (SC8).

3.2 Supplier selection

The proposed model is shown in Figure 2. The methodology is used to select and evaluate the performance of suppliers of strategic products, since these items attract the largest costs and risks when modifying suppliers. This phase sets out to select a subset of suppliers who meet the company's needs, based on the steps presented in Sections 3.2.1, 3.2.2, and 3.2.3 below.

3.2.1 Identification of strategic products and potential suppliers

The committee should identify the strategic products for the selection process and the potential suppliers of these products, who are then regarded as the alternatives to be considered in the decision model. The model will be used separately to identify the suppliers of each item to be purchased.

3.2.2 Pre-selection

Suppliers will be screened and evaluated in the multicriteria decision aid model. The committee should analyse which candidates meet the levels stipulated as acceptable in the pre-selection criteria. Only the suppliers with higher-than-satisfactory levels continue with the process.

3.2.3 Determination and application of the group decision method

The need to choose a method that considers qualitative and quantitative criteria, and that has non-compensatory logic aggregation, was noted. This is because companies normally want to select alternatives that perform acceptably in all the criteria. Thus the use of outranking methods is satisfactory in this situation. Additionally, supplier selection is normally carried out by a group of DMs. In this case, it is assumed that they have conflicting specific objectives, making it necessary to use a group multicriteria decision aid model.

In this stage, an adaptation of the PROMETHEE group method [30] is used, in which PROMETHEE II is replaced by PROMETHEE III in both individual and global evaluations. This choice occurs because PROMETHEE III considers actions that have net flows which are both very close as being indifferent, while PROMETHEE II would prefer one supplier over another, even if both presented very similar performances. Thus, in the context of supplier selection, PROMETHEE III is more appropriate. The PROMETHEE group adaptation is shown in Figure 3.

An integer programming method is used in the final selection stage. The method applied is the adaptation of PROMETHEE V proposed by Almeida and Vetschera [31]. It was used to select a subset of suppliers who meet the company's needs, in line with the constraints imposed.

According to Brans and Mareschal [32], this method has two steps: the outranking net flow is computed from PROMETHEE II; and the integer programme problem is constructed in order to consider the additional restrictions. In the PROMETHEE V adaptation [31], the optimal portfolio is determined by solving the following mixed integer optimisation problem:

maximize

Subject to restrictions

where:

where:

Φi is the net flow of alternative Ai,

xi is a dummy (when xi=0, the action does not stay in the portfolio; and when xi=1, the

action stays in the portfolio),

riis the number of resource units required by Ai,

R is the number of resource units available, and c is the number of items in the portfolio.

In this case, the authors initially proposed optimising portfolios of the same size, and defined a c-optimal portfolio as the best portfolio containing c items. Thereafter the c-optimal portfolios were ranked, using their resulting value to select the best one. Thus all the alternatives that could improve the performance of the portfolio would be inserted in line with the restrictions imposed.

3.3 Supplier evaluation

This phase sets out to evaluate the suppliers contracted by the firm, and assigns them to predetermined classes that help the DM to decide on the type of relationship to construct with each. In this stage, the evaluation will be carried out by one individual who knows and takes into account the preferences of the members of the committee, and who will define the evaluation criteria. Supplier evaluation occurs in the following steps:

3.3.1 Identification of evaluation criteria

The DM should determine which criteria are important for evaluating the performance of the suppliers with whom the company wishes to create a long term relationship after they have been contracted.

The criteria used for the food industry in this phase were collected by Viana and Alencar [29]. In this context, the criteria determined were those cited by more than 40 per cent of respondents when asked which criteria they consider when evaluating a supplier's performance. The criteria are: delivery (EC1), quality of product/service (EC2), compliance with company procedures (EC3), efficiency (EC4), technical capabilities (EC5), commitment (EC6), credibility (EC7), flexibility (EC8), and history of performance (EC9).

3.3.2 Determination and application of a multicriteria decision method

As to the choice of an acceptable method, it is important to note that the evaluation criteria can be quantitative or qualitative. In supplier evaluation, non-compensatory methods must be used because good performance in one criterion should not compensate for bad performance in another. Finally, the objective of this model is to assign the alternatives to predefined ordered classes. Therefore a multicriteria sorting method called PROMSORT (PROMETHEE Sorting) is used in this model. This method is suitable for this problem due to the following features, set out by Araz et al. [33]: it uses both 'limit profile' and 'reference alternative' concepts; offers the DM the flexibility to define an optimistic or pessimistic point of view; and guarantees the ordered categories.

3.3.3 Classification of suppliers

As a result of this method, the suppliers are classified into the three classes proposed by Aksoy and Õztürk [34]:

• Class A: Suppliers have good results from the evaluation of their performance, and the manufacturers continue to work with them and to establish a long-term relationship.

• Class B: They meet the needs of the company in some respects, but have several defects in their system and need to improve them. The firm needs to inform suppliers about these problems and about ways to solve them.

• Class C: They have poor results from the evaluation of their performance, and manufacturers stop working with them if they continue in this class for two consecutive reviews.

Performance evaluation must be done periodically to maintain the performance levels that companies desire. Therefore, after contracting other suppliers, the limit profiles should be redefined.

4 APPLICATION OF THE PROPOSED MODEL

This section presents a simulation of the proposed model in order to illustrate its use. Simulation is an interactive process, which has the advantage of revealing important information and new perceptions in relation to a problem. This enables improvements to be made to the model before it is applied in real situations.

For this application, a typical problem of supplier selection and evaluation was created. Suppose that a food company needs to select and evaluate suppliers of chocolate chip cookies - its main product. The industry wants to select suppliers with a balanced performance in all the criteria, and the power of each DM in the process is to be included. A logistics manager, who had worked for several years in a food industry, helped to measure weights and choose the preference functions and parameters used in the model for the numerical application.

4.1 Determining the firm's objectives and choosing the selection committee

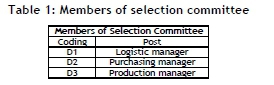

Various departments of the company with conflicting interests were involved in the supplier selection. A three-member committee was therefore simulated (Table 1), representing the sectors that influence the process.

The committee then determined the pre-selection and selection criteria (section 3.1).

4.1.1 Identification of the strategic products and of potential suppliers

The committee identified the strategic items for chocolate chip cookies: invert sugar (P1), cocoa powder (P2), chemical leavening agents (P3), and sodium acid pyrophosphate (P4). Since the multicriteria model for supplier selection can deal with only one product at a time, the simulation demonstrates the choice of the first item.

Next, ten potential suppliers were identified: S1, S2, S3, S4, S5, S6, S7, S8, S9, and S10. These are the alternatives to be considered in the decision model.

4.2 Selection process

4.2.1 Pre-selection

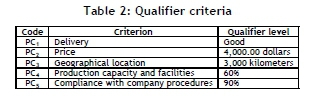

Once the qualifying criteria had been identified, a pre-selection of suppliers was made in relation to their performance against these criteria (Table 2).

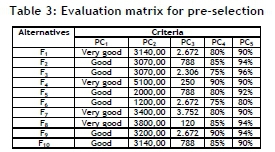

From the committee's evaluation of the suppliers' performance against the qualifying criteria, Table 3 was compiled.

According to Table 3, alternatives S4, S6, S7, and S10 performed below the qualifying level in some criteria, and were removed from the process.

4.2.2 Final selection

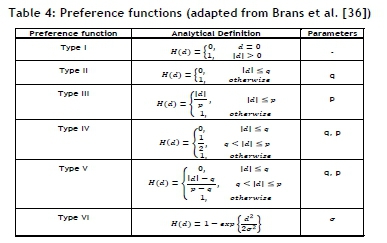

After defining which alternatives would remain in the selection process, each DM constructed an evaluation matrix (alternatives versus criteria), in which the alternatives for the model were generated. Thereafter, each DM determined the preference functions, which, according to Brans and Vincke [35], reflect a DM's preference between two alternatives, and are defined separately for each criterion. Brans and Vincke [35] proposed six functions for PROMETHEE (Table 4).

The function parameters have economic significance. Brans et al. [36] explain them:

• The indifference threshold (q) is the largest value of d for which the DM considers that the alternatives are indifferent;

• The preference threshold (p) is the lowest value of d for which the DM considers that there is a preference for one alternative over another.

• σ is a parameter connected with the standard deviation of the normal distribution.

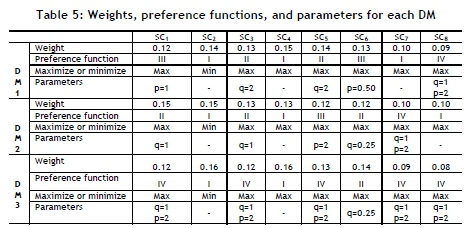

The data for DM1 were determined by a manager who works in the food industry; that for DM2 was identified based on Viana and Alencar [29]; and that for DM3 in accordance with research knowledge. The weights of the criteria, as well as the preference functions and the parameters for each criterion, are shown in Table 5.

PROMETHEE III was then used to provide a decreasing ranking of alternatives. The interval flows were calculated for each alternative, using α= 0.15. Since no intersections occur between intervals of alternatives with successive ordering, there is no indifference between the suppliers identified.

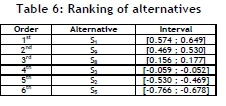

To create a global ranking of suppliers, a global evaluation matrix was compiled, comprising the alternatives cited, while the DMs represented the criteria. For this simulation, the members of the group have equal decision-making power, so the weight of each DM is 1 /3. The preference function is the usual criterion. The final order of the alternatives is given in Table 6.

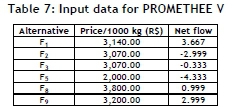

To select multiple suppliers, the global flows obtained in PROMETHEE II were used as an input to the adaptation of PROMETHEE V proposed by Almeida and Vetschera [31]. This identifies the best portfolio of suppliers from among the existing alternatives, in line with the constraints on resources.

The input data to the problem is the price offered by the suppliers for 1,000 kg of invert sugar and the net flows of each alternative (Table 7). The imposed restriction was the available cash flow for the contract, and that the company could only buy 1,000 kg from each supplier.

Initially, the solution of classical PROMETHEE V was calculated, using the scale transformation proposed by Mavrotas et al. [37]. Then there was a change of scale, in accordance with the method of Macharis et al. [30]. In the first case, the p-optimal portfolio included S1, S3, S8, and S9. In the second situation, the result was a portfolio comprising S1, S2, S3, S5, and S9. Subsequently, the values of optimal portfolios for each criterion were calculated. In this phase, the values of alternatives for each criterion were determined by a member of committee that synthesize the preferences of DMs. Thereafter, the averages were summed and the portfolio values for all criteria found.

The concordance indices were compared to choose the best one. It was noted that the c-optimal portfolio was better than the classical portfolio in 47 per cent of weights and the same in 10 per cent; so the former should be chosen. The supplier portfolio would thus comprise S1, S2, S3, S5, and S9. Although S2, S3, and S5 had negative flows, this did not mean that they had negative values, but rather that they were outranked by others. So these alternatives were incorporated into the portfolio to improve its global performance.

To verify the robustness of the model, a sensibility analysis was conducted from the variation in the weights of criteria for each DM. A variation of ±15 per cent in the weights of credibility and quality was allowed. When these weights were decreased, the results did not change. When they were increased in PROMETHEE III, the indifference between S1 and S9 was noted. The other alternatives remained in the same order. The result of PROMETHEE V was not modified. According to this analysis, the model was considered robust.

4.3 Supplier evaluation

In the performance evaluation, all the suppliers who are contracted to provide strategic products are analysed at the same time, because the objective of this phase is to discover the type of relationship that the firm should create with its suppliers, and because the result for one supplier does not influence the relationship of the firm with the others. Additionally, there is only one DM because the creation of a committee to make continuous evaluations would involve a very high cost.

Initially, the criteria that are important for the relationship between suppliers and clients were determined, as set out in the proposed model. Next, the alternatives of the model were identified. Suppose that the suppliers of all strategic products of the firm were considered. There were four suppliers of P1 (S1P1, S2P1, S3P1, S4P1), one for P2 (S1P2), three for P3 (S1P3, S2P3, S3P3) and two for P4 (S1P4, S2P4).

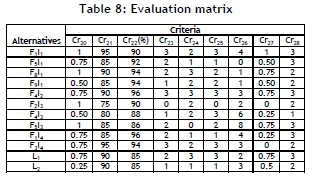

For the application of PROMSORT, an evaluation matrix was created (Table 8), considering the values of the criteria for the alternatives and limit profiles.

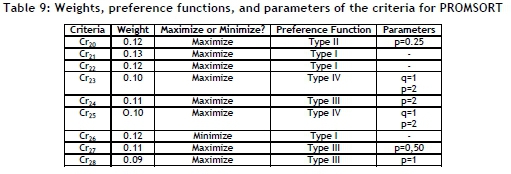

Then the DM determined the weights, preference functions, and parameters of the criteria, in accordance with his preferences (Table 9).

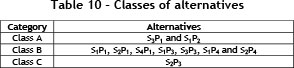

Thereafter the alternatives were compared with the limit profiles according to the outranking relation of PROMETHEE I, and the suppliers were sorted into the classes A, B and C accordingly. The resulting arrangement of the alternatives is shown in Table 10.

According to the results, the company should establish long-term relationships with S3P1 and S1P2. Alternative S1P1 is incomparable with L1. In this case, the classification of this alternative was made using a pessimistic vision, and S1P1 was assigned to Class B. The suppliers S1P1, S2P1, S4P1, S1P3, S3P3, S1P4, and S2P4 were good, but needed to improve in some aspects. Finally, S2P3 was a bad supplier, and the company needed to stop working with this supplier.

It is very important that the company gives feedback about the performance evaluation to its suppliers, as a way for them to improve against the criteria for which their performance is bad, and to try to become a Class A supplier. In the case of Class C suppliers, the company should explain why it has stopped working with them.

Finally, to verify the robustness of the proposed model, a sensitivity analysis was conducted from the variation in criteria weights. A variation of ± 15 per cent in the weights of quality and flexibility was allowed. It was observed that the result was still the same in the two situations. Consequently, the proposed model is robust for small modifications in the weights of criteria.

5 CONCLUSION

This paper puts forward a multicriteria decision aid model to select suppliers and evaluate the performance of those already contracted. For this a methodological model was proposed. Although this systematic is based on the PROMETHEE family, the methods are normally used separately for a specific objective. The novelty of this approach is to

combine different methods - group PROMETHEE III, PROMETEE V, and PROMSORT -

considering the features of each method for each problematic addressed, to achieve the objective of the study. Moreover, the authors developed an adaptation of group PROMETHEE to help the DMs determine preference or indifference limits between the alternatives that seem appropriate to the supplier selection context.

The main advantage of this proposal over other methods is that it integrates the phases of selecting and evaluating the performance of suppliers by using methods appropriate to the context. It is noted that there is a need for integrated models to cover these two stages, since unstructured selection processes may result in contracting suppliers who do not neet the company's needs. Also, even if the organisation has a structured selection process, when the firm does not evaluate supplier performance during the term of the contract, the performance can decrease over time, thereby adversely affecting the client. So the processes should be conducted in an integrated manner.

Other advantages of the proposed model are:

• In the selection phase the model uses a group decision multicriteria method to involve individuals from various departments of the organisation that are directly affected by the choice of suppliers;

• In the performance evaluation phase, it assigns contractors to pre-defined classes and determines what type of relationship the organisation should build with the suppliers of each of these classes.

After the systematisation process, the use of multicriteria methods was proposed. To select suppliers, an adaptation of group PROMETHEE was recommended. Thereafter, an adaptation of PROMETHEE V was used to select an appropriate subset of suppliers. Finally, in the performance evaluation, PROMSORT was used to assign suppliers to predetermined classes. Thus, some observations can be made about the model:

• The use of PROMETHEE methods leads to a model that is closer to reality, incorporates the qualitative and quantitative aspects of the process, is flexible, and is easy to understand;

• The group PROMETHEE allows weights to be assigned to DMs, reflecting their level of power in making the decision;

• The interval order of PROMETHEE III allows alternatives with insignificant differences in the net flow to occupy the same position;

• The use of the adapted method of PROMETHEE V when selecting multiple suppliers enables the maximum use of available resources;

• In the performance evaluation phase, the model meets the need to group suppliers according to their relationships with partners.

• The use of non-compensatory methods avoids choosing alternatives with a very high performance in one criterion and a very low one in another.

Finally, there was a numerical application of the model in the food sector. The criteria used were identified from the work of Viana and Alencar [29] in the food industries indexed in ABIA. The weights, functions, and other parameters were determined by a logistics manager from the food industry and the authors of this paper. Although the application was carried out in the food industry, the proposed model can be used in other kinds of organisations to improve the management of strategic suppliers and acquire long-term relationships with those that adequately meet the firm's needs.

Future research may consider the use of the model in other sectors of industry, the use of other procedures for assigning criteria weights, and the use of other multicriteria methods when applying the proposed model.

REFERENCES

[1] Bevilacqua, M., Ciarapica, F.E. & Giacchetta, G. 2006. A fuzzy-QFD approach to supplier selection, Journal of Purchasing & Supply Management, 12, pp. 14-27. http://www.sciencedirect.com/science/article/pii/S1478409206000100. [ Links ]

[2] Zeydan, M., Çolpan, C. & Çobanoglu, C. 2011. Combined methodology for supplier selection and performance evaluation, Expert Systems with Applications, 38(3), pp. 2741-2751. http://www.sciencedirect.com/science/article/pii/S0957417410008602. [ Links ]

[3] Ramanathan, R. 2007. Supplier selection problem: Integrating DEA with the approaches of total cost of ownership and AHP, Supply Chain Management: An International Journal, 12(4), pp. 258-261. http://www.emeraldinsight.com/journals.htm?articleid=1611268. [ Links ]

[4] Haleh, H. & Hamidi, A. 2011. A fuzzy MCDM model for allocating orders to suppliers in a supply chain under uncertainty over a multi-period time horizon, Expert Systems with Applications, 38(8), pp. 9076-9083. http://www.sciencedirect.com/science/article/pii/S0957417410013023. [ Links ]

[5] Wang, W. 2010. A fuzzy linguistic computing approach to supplier evaluation. Applied Mathematical Modelling, 34(10), pp. 3130-3141. http://www.sciencedirect.com/science/article/pii/S0307904X10000491. [ Links ]

[6] Li, W., Cui, W., Chen, Y. & Fu, Y. 2008. A group decision-making model for multi-criteria supplier selection in the presence of ordinal data. IEEE International Conference on Service Operations and Logistics and Informatics, China. http://ieeexplore.ieee.org/xpl/login.jsp?tp=&arnumber=4682799&url=http%3A%2F%2Fieeexplore.ieee. org%2Fxpls%2Fabs_all.jsp%3Farnumber%3D4682799. [ Links ]

[7] Nyaga, G.N. & Whipple, J.M. 2011. Relationship quality and performance outcomes: Achieving a sustainable competitive advantage, Journal of Business Logistics, 32(4), pp. 345-360. http://onlinelibrary.wiley.com/doi/10.1111/j.0000-0000.2011.01030.x/abstract. [ Links ]

[8] Kirytopoulos, K. Leopoulos, V., Mavrotas, G. & Voulgaridou, D. 2010. Multiple sourcing strategies and order allocation: An ANP-AUGMECON meta-model. Supply Chain Management: An International Journal, 15(4), pp. 263-276. http://www.emeraldinsight.com/journals.htm?articleid=1865245. [ Links ]

[9] Li, W., Humphreys, P.K., Yeung, A.C.L. & Cheng, T.C.E. 2011. The impact of supplier development on buyer competitive advantage: A path analytic model. International Journal of Production Economics, 135(2012), pp. 353-356. http://www.sciencedirect.com/science/article/pii/S0925527311003495. [ Links ]

[10] Amin, S.H. & Razmi, J. 2009. An integrated fuzzy model for supplier management: A case study of ISP selection and evaluation, Expert Systems with Applications, 36(4), pp. 8639-8648. [ Links ]

[11] Chen, Y., Wang, T. & Wu, C. 2011. Strategic decisions using the fuzzy PROMETHEE for IS outsourcing, Expert Systems with Applications, 38(10), pp. 13216-13222. http://www.sciencedirect.com/science/article/pii/S0957417408007276. [ Links ]

[12] Lin, R. 2009. An integrated FANP-MOLP for supplier evaluation and order allocation, Applied Mathematical Modeling, 33(6), pp. 2730-2736. http://www.sciencedirect.com/science/article/pii/S0307904X08002060. [ Links ]

[13] Cheshmberah, M., Makui, A,. Seyedhoseini, S.M. & Yousefi, S. 2011. Analysing the impact of the product life cycle on the importance of outsourcing decision-making criteria: A manufacturing case study, South African Journal of Industrial Engineering, 22(2), pp. 216-226. http://saiie.iournals.ac.za/pub/article/view/27/22. [ Links ]

[14] Voss, M.D., Closs, D.J., Calantone, R.J., Helferich, O.K. & Speir, C. 2009. The role of security in the food supplier selection decision, Journal of Business Logistics, 30(1), pp. 127-155. http://onlinelibrary.wiley.com/doi/10.1002/i.2158-1592.2009.tb00102.x/pdf. [ Links ]

[15] Ni-Di, Z. & Ming-Xian, L. 2010. The choice and evaluation of agri-food supplier based on AHP. International Conference on Information Management and Evaluation, Cape Town. http://ieeexplore.ieee.org/xpl/login.isp?tp=&arnumber=5477699&url=http%3A%2F%2Feeexplore.ieee.org% 2Fxpls%2Fabs_all.jsp%3Farnumber%3D5477699. [ Links ]

[16] Brazilian Association of Food Industries (Associação Brasileira das Indústrias de Alimentação - ABIA), http://www.abia.org.br. [accessed 01/07/2012]. [ Links ]

[17] Ghatari, A.R., Mehralian, G., Zarenezhad, F. & Rasekhb, H.R. 2013. Developing a model for agile supply: An empirical study from Iranian pharmaceutical supply chain. Iranian Journal of Pharmaceutical Research, 12, pp. 193-205. http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3813359/?report=reader. [ Links ]

[18] Doumpos, M. & Zopoudinis, C. 2004. Multicriteria decision aid classification methods, Kluwer Academic Publishers, Netherlands. [ Links ]

[19] Ho, W., Xu, X. & Dey, P.K. 2009. Multi-criteria decision making approaches for supplier evaluation and selection: A literature review. European Journal of Operational Research, 202(1), pp. 16-24. [ Links ]

[20] Lima Junior, F.R., Osiro, L. & Carpinetti, L.C.R. 2013. A fuzzy inference and categorization approach for supplier selection using compensatory and non-compensatory decision rules. Applied Soft Computing, 13(10), pp. 4133-4147. http://www.sciencedirect.com/science/article/pii/S0377221709003403. [ Links ]

[21] Ordoobadi, S.M. 2009. Development of a supplier selection model using fuzzy logic. Supply Chain Management: An International Journal, 14(4), pp. 314-327. http://www.emeraldinsight.com/iournals.htm?articleid=1798852. [ Links ]

[22] Kang, H. & Lee, A.H.I. 2010. A new supplier performance evaluation model: A case study of integrated circuit (IC) packaging companies. Kybernetes, 38(1), pp. 37-54. http://www.emeraldinsight.com/doi/pdfplus/10.1108/03684921011021264. [ Links ]

[23] Killince, O. & Onal, S.A. 2011. Fuzzy approach for supplier selection in a washing machine company. Expert Systems with Applications, 38, pp. 9656-9664. http://ac.els-cdn.com/S0957417411001928/1-s2.0-S0957417411001928-main.pdf?tid=e478ade2-03c8-11e5-b27c-00000aacb35e&acdnat=1432659887_79993360c63492a56b8d65b2edc58e26. [ Links ]

[24] Liu, P. & Zhang, X. 2011. Research on the supplier selection of a supply chain based on entropy weight and improved ELECTRE-III method. International Journal of Production, 49, pp. 637-646. http://www.tandfonline.com/doi/abs/10.1080/00207540903490171. [ Links ]

[25] Kahraman, C., Cebeci, U. & Ulukan, Z. 2003. Multi-criteria supplier selection using fuzzy AHP. Logistics Information Management, 16(6), pp. 382-394. http://www.emeraldinsight.com/iournals.htm?articleid=852246. [ Links ]

[26] Chen, Y. & Chao, R. 2012. Supplier selection using consistent fuzzy preference relations. Expert Systems with Applications, 39(3), pp. 3233-3240. http://www.sciencedirect.com/science/article/pii/S0957417411013194. [ Links ]

[27] Dagdeviren, M. & Eraslan, E. 2008. Supplier selection using PROMETHEE sequencing method. Journal of the Faculty of Engineering and Architeture of Gazi University, 23, pp. 69-75. [ Links ]

[28] Schramm, F. & Morais, D.C. 2012. Decision support model for selecting and evaluating suppliers in the construction industry. Pesquisa Operacional, 32(3), pp. 1-20. http://www.scielo.br/pdf/pope/v32n3/aop2412.pdf [ Links ]

[29] Viana, J.C. & Alencar, L.H. 2011. An exploratory study of supplier selection and evaluation techniques, 18th IE&EM International Conference, ChangChun. http://ieeexplore.ieee.org/xpl/articleDetails.isp?arnumber=6035432. [ Links ]

[30] Macharis, C., Brans, J. & Mareschal, B. 1998. The GDSS PROMETHEE procedure. Journal of Decision Systems, 7, pp. 283-307. [ Links ]

[31] Almeida, A.T. & Vetschera, R.A. 2012. Note on scale transformation in the PROMETHEE V method. European Journal of Operational Research, 219(1), pp. 198-200. http://www.sciencedirect.com/science/article/pii/S0377221711011283. [ Links ]

[32] Brans, J.P. & Mareschal, B. 1994. The PROMCALC & GAIA decision support system for multicriteria decision aid. Decision Support Systems,12, pp. 297-310. [ Links ]

[33] Araz, C., Ozfirat, M.P. & Ozkarahan, I. 2007. An integrated multicriteria decision-making methodology for outsourcing management. Computers & Operations Research, 34, pp. 3738-3756. [ Links ]

[34] Aksoy, A. & Õztürk, N. 2011. Supplier selection and performance evaluation in just-in-time production environments. Expert Systems with Applications, 38(5), pp. 6351-6359. http://www.sciencedirect.com/science/article/pii/S0957417410013424. [ Links ]

[35] Brans, J.P. & Vincke, P.H. 1985. A preference ranking organisation method: The PROMETHEE method for multiple criteria decision-making. Management Science, 31(6), pp. 647-656. [ Links ]

[36] Brans, J.P., Mareschal, B. & Vincke, P. 1984. A new family of outranking methods in multicriteria analysis: PROMETHEE. In Proceedings of IFORS Conference. Washington, United States. [ Links ]

[37] Mavrotas, G., Diakoulaki, D. & Caloghirou, Y. 2006. Project prioritization under policy restrictions: A combination of MCDA with 0-1 programming. European Journal of Operational Research. 171(1), pp.296-308. http://www.sciencedirect.com/science/article/pii/S0377221704006186. [ Links ]

* Corresponding author