Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Economic and Management Sciences

On-line version ISSN 2222-3436

Print version ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.25 n.1 Pretoria 2022

http://dx.doi.org/10.4102/sajems.v25i1.4534

ORIGINAL RESEARCH

The relationship between investor tax preferences and the payout methods of JSE listed companies

Rudie NelI; Nicolene WessonII; Lee-Ann SteenkampII

ISchool of Accountancy, Faculty of Economic and Management Sciences, Stellenbosch University, Stellenbosch, South Africa

IIStellenbosch University Business School, Faculty of Economic and Management Sciences, Stellenbosch University, Bellville, South Africa

ABSTRACT

BACKGROUND: Investor tax preference parameters have been included as an explanatory variable for changes in payout methods in developed countries. There is, however, a lack of research in this area in developing countries. Tax reform in South Africa - comprising a change in the tax regime and successive increases in tax rates - offers a unique setting to examine investor tax preference parameters as a contribution to literature

AIM: This study investigated the relationship between investor tax preference parameters (of individuals, corporates, and institutions) and payout methods (namely dividends, capital distributions, additional shares, and share repurchases

SETTING: The study used data collected in respect of companies listed on the Johannesburg Stock Exchange (JSE) in South Africa for the financial reporting periods ranging from 2012 to 2019

METHOD: A regression analysis of panel data was employed to relate the changes in payout methods to changes in profits, investor tax preference parameters, the lagged levels of variables, and ownership concentration dummy variables

FINDINGS: The empirical evidence of this study revealed that investor tax preferences affected dividends as a payout method. This accordingly suggests that the tax differential of dividends and capital gains affect the supply of dividends in South Africa

CONCLUSION: The study contributes empirical evidence in support of the taxes and tax clienteles theory from a developing country perspective. This could suggest that tax reform in a developing country, in this case, South Africa, has a more pronounced effect on payout methods than in developed countries

Keywords: dividends; payout methods; tax preference; investor tax preference; tax preference parameters; taxes and tax clienteles.

Introduction

Payout policy is central to corporate finance as it dictates the amount and method elected for distribution and could affect valuation, investment decisions and the taxes investors would pay (Farre-Mensa, Michaely & Schmalz 2014). The lack of consensus on the motivations for paying dividends, described as the dividend puzzle, remains unresolved despite much research and extensive debate (Al-Najjar & Kilincarslan 2019). Empirical evidence in respect of taxes and tax clienteles theory as an explanation for dividend relevance provides mixed support and is characterised by sparse research from emerging markets (Baker & Jabbouri 2016). Further research is also warranted on whether the differential taxation of dividends versus capital gains affects the supply of dividends (Farre-Mensa et al. 2014). The term 'investor tax preference parameters' refers to the preference for dividends relative to capital gains and incorporates the shareholding of different categories of investors in a company (Geiler & Renneboog 2015; Poterba 2004).

South Africa, an emerging market and developing country, provides a unique setting to incorporate investor tax preference parameters in empirical research due to tax reform. Tax reform in South Africa has been extensive owing to a change in the tax regime from a company-level secondary tax to an investor-level dividends tax during 2012, which was followed by successive increases in tax rates. The change in tax regime during 2012 resulted in the possibility of dividend tax arbitrage arising for the first time in South Africa, as only certain investors are exempt from dividends tax (Marcus & Toerien 2014). Payout methods other than dividends (namely capital distributions, additional shares, and share repurchases) could result in capital gains tax, dividends tax, or a combination of both. Conflicting tax preferences of investors for different payout methods are further pronounced in South Africa as a result of the differential tax rate on dividends and capital gains tax (Nel & Wesson 2021). Descriptive evidence suggests that, since the introduction of dividends tax in South Africa, corporate investors would prefer dividends and individual investors would prefer capital gains when tax is the only consideration (Toerien & Marcus 2014). Explanatory evidence based on the dividend growth during 2012 and 2013 has also been submitted that JSE-listed companies with higher corporate shareholding grew dividends significantly faster than other companies (Badenhorst 2017). Subsequent to these South African studies, further increases in the applicable tax rates occurred, which further pronounce the differential of taxation on dividends and capital gains, and afford an opportunity to incorporate investor tax preference parameters in South African literature. A literature review did not reveal any evidence of prior studies on the effect of investor-level tax reform on the payout policies of JSE-listed companies with reference to the tax preference of investors for different payout methods. Empirical evidence in respect of the effect of investor-level tax reform on payout policies would, in turn, contribute to the debate regarding the dividend puzzle by investigating tax as an explanation for payout methods elected by companies.

The objective of the present study is to investigate the relationship between changes in payout methods and changes in investor tax preference parameters since the introduction of dividends tax in South Africa during 2012. Accordingly, this study will investigate how companies respond when faced with the conflicting tax preferences of investors - which could be of interest to researchers, investors and those charged with fiscal responsibility (Badenhorst 2017). An understanding of investors' preferences and corporate payout behaviour is further submitted as a prerequisite to efficient policy formulation (Chazi, Theodossiou & Zantout 2018). This study is, to the researchers' knowledge, the first to investigate the effect of investor tax preference parameters on payout methods in South Africa since the introduction of dividends tax in 2012. The findings of the present study make four novel contributions to the extant body of knowledge. Firstly, empirical evidence from South Africa, an emerging market and developing country, could enable a comparison to be made with other developing countries (Aivazian, Booth & Cleary 2003; Mollah 2011). Findings could further contribute to the limited empirical research concerning the dividend puzzle in sub-Saharan Africa (Arko et al. 2014). Secondly, the data collected in respect of investor tax preference parameters are not available in a commercial financial database and could serve as the basis for further research. Thirdly, the distinction between registered and beneficial shareholding applied in the data analysis of the present study may provide additional insights as these types of shareholding differ in nature. Fourthly, the study also incorporates ownership concentration as a determinant for changes in payout methods - an aspect that has not previously been considered in a South African context.

Literature review

This study is grounded in the traditional theories of dividend relevance, in which taxes represent a major market imperfection and support payout policies as relevant in determining a company's value. In finance literature, dividend relevance theories have been extensively researched within major theories and explanations, such as the bird-in-the-hand (i.e. that investors would prefer the certainty of dividend payments to the possibility of substantially higher future capital gains), taxes and tax clienteles, signalling, agency costs, behavioural explanations, company life-cycle theory and catering theories (Baker & Weigand 2015). The taxes and tax clienteles theory centres on the notion that the after-tax return of payout shapes investors' payout preference and, in turn, investors select a company that pursues their preferred payout policy (Baker, Kapoor & Jabbouri 2018). The literature review commences with an overview of the definitions and findings of previous studies in respect of dividend tax preference parameters and investor tax preference parameters and concludes with an overview of the literature in respect of ownership concentration.

Dividend tax preference parameters and investor tax preference parameters

When considering the tax position of each investor type, both the taxes on dividends and capital gains should be considered (Geiler & Renneboog 2015; Lie & Lie 1999). Tax preference parameters consist of dividend tax preference parameters (based solely on tax rates) and investor tax preference parameters (a function of tax rates and shareholding).

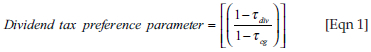

Dividend tax preference parameters are defined by Poterba (2004) as:

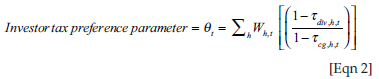

Where τdiv is the marginal tax rate on dividends and τcg is the marginal tax rate on capital gains. Dividend tax preference parameters depict the preference for dividends relative to capital gains based solely on tax rates. Investor tax preference parameters expand on dividend tax preference parameters by including the shareholding of companies, based on the data of each company. Investor tax preference parameters at time t are consequently depicted as θt and defined by Poterba (2004) as follows:

Where Wh,t refers to the percentage shareholding of investor h at time t. Investor tax preference parameters consequently express the relative tax burden of dividends versus capital gains for different categories of investors in a company.

Poterba (2004) considered federal data for the period 1929 to 2003 (74 years) in respect of households and funds in the United States of America (USA). Corporate investors were excluded from the specification as corporate investors could invest for strategic reasons, resulting in a dividend policy that is, at best, expected to be a second-order consideration (Desai & Jin 2011). Short-run changes in tax preference parameters were, however, found by Poterba (2004) to have a small and statistically insignificant effect on aggregate dividends. Poterba (2004) used aggregate data to study how a change in the weighted-average tax preference parameter affects aggregate dividend payments (Desai & Jin 2011). Consequently, Poterba's (2004) evidence was at the macro level, whereas subsequent studies (Desai & Jin 2011; Geiler & Renneboog 2015) provided evidence by calculating tax preference parameters based on the data of each company, not at a macro level. Desai and Jin (2011) in their study in the USA for the period 1980 to 1997 (17 years) classified institutional shareholding, based on the clients that the institutions serve, as dividend-averse and non-dividend-averse. The analysis of Desai and Jin (2011) provided direct evidence of the presence of dividend tax clienteles based on the heterogeneity, across companies, in payout policies and classification of institutional shareholding. Geiler and Renneboog (2015) considered the payout data of companies listed in the United Kingdom (UK) for the period 1997 to 2007 (10 years). Geiler and Renneboog (2015) included three different tax preference parameters (for individuals, pension funds, and corporate investors). Three studies from developed countries have accordingly considered the effect of investor tax preference parameters on dividends (Desai & Jin 2011; Geiler & Renneboog 2015; Poterba 2004). Two of these studies (Geiler & Renneboog 2015; Poterba 2004) concluded that short-run changes in tax preference parameters have a limited effect on the aggregate dividend payout methods.

Ownership concentration

This study will include dummy variables in respect of ownership concentration, which was not included in the model estimated by Geiler and Renneboog (2015). An analysis of the relationship between large shareholders, indicative of ownership concentration, and dividend policy is submitted as important to better understand dividend policy (Truong & Heaney 2007). The tax preference of investors, in turn, has been recognised as relevant when considering ownership concentration (Booth & Zhou 2017; Peyer & Vermaelen 2016). The inclusion of ownership concentration in the model of Geiler and Renneboog (2015) would therefore expand the investigation on the relationship between investor tax preferences and changes in payout methods. In empirical studies relating to dividend policy, ownership concentration is measured in terms of the Herfindahl ownership concentration index (HOCI), which is based on the shareholding of the top five shareholders in companies (Gonzalez et al. 2017; Harada & Nguyen 2011), as well as the top shareholder category in a company (Truong & Heaney 2007). High ownership concentration companies are those whose Herfindahl index is above the median value of the index for all companies (Arora & Srivastava 2019). Previous South African studies have considered ownership concentration in relation to capital structure, corporate performance and agency costs (Dube 2018; Qopana 2018), with only a limited focus on dividend policy under the previous tax regime prior to the introduction of dividends tax in 2012 (Abor & Fiador 2013; Arko et al. 2014). This study aims to extend the literature by investigating the effect of ownership concentration on payout methods under the dividends tax regime in South Africa.

Research methodology and design

An empirical study, which is explanatory in nature, was pursued in which quantitative data were analysed. A regression analysis of panel data was conducted to relate the annual changes in payout methods to annual changes in corporate profits, changes in investor tax preference parameters, the lagged levels of the explanatory variables, and ownership concentration dummy variables. The regression model is based on Poterba (2004) but originally dates back to Lintner's partial adjustment models (Geiler & Renneboog 2015). The regression model was refined by Geiler and Renneboog (2015) for an investigation based on the data of each company. In the present study the model specified by Geiler and Renneboog (2015) was further refined in the following respects:

-

The present study employs a variation of the model to also investigate changes in payout methods other than dividends (the aggregate of capital distributions, additional shares, and share repurchases). Payout methods other than dividends could serve as a substitute for dividends and warrant further investigation of the effect of investor tax parameters on payout methods other than dividends.

-

The study includes a distinction between registered and beneficial shareholding. A distinction between registered (or overall) and beneficial shareholding was made in recognition of the two different sources of information (the data sources are elaborated on under the data collection section).

-

The study included the tax preference parameters of institutions that are not limited to pension funds. Institutional investors in South Africa could be grouped based on the flow-through principle for tax purposes (in which beneficiaries are taxed rather than the institutions investing on behalf of the beneficiaries).

-

The study included ownership concentration dummy variables. Investigating the relationship between ownership concentration and dividend payout could contribute to an understanding of the effect of taxes on dividend payout methods.

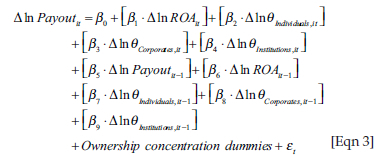

The regression model estimated in this study is:

Where Δ ln Payout methodsit represents the natural log of changes in payout methods (ordinary dividends and payout methods other than dividends) as the dependent variable for each company-year observation. The natural log of current changes in corporate profits with a return on assets (ROA) as proxy and represented by Δ ln ROAit. Calculated investor tax preference parameters are depicted by θ (Equation 2) and the natural log of changes in current investor tax preference parameters is represented by Δ ln θIndividuals,it, Δ ln θCorporates,it, and Δ ln θInstitutions,it. The lagged levels of variables are represented by ln Payout methodsit-1, ln ROAit-1, ln θIndividuals,it-1, ln θCorporates,it-1 and ln θInstitutions,it-1. Ownership concentration dummy variables include the HOCI and the top shareholder category in a company (being either an individual, corporate or institution).

All regression variables were transformed to natural log and first differencing was applied in line with studies of Geiler and Renneboog (2015) and Poterba (2004). Panel data sets have been argued to be most useful when controlling for time-constant unobserved features which might be correlated with the explanatory variables in a model (Wooldridge 2013). Pooled ordinary least squares (OLS), first differencing, fixed effects and random effects are the different estimation methods for unobserved effects in a panel data model (Wooldridge 2013). First differencing was applied in the present study to control for unobserved effects in line with Geiler and Renneboog (2015). First differencing enables the use of standard OLS analysis on the differences (Wooldridge 2013).

Regression results were analysed based on the sign and the significance levels of coefficients rather than inference based on the size of coefficients. The only inference based on the comparison of coefficients was to evaluate the importance of each investor tax preference parameter, relative to each other, in explaining changes in payout methods. The significance of variables was evaluated using t-statistics and the calculated probability (p-value). The significance of the results was interpreted at the 90, 95 and 99 per cent confidence intervals. This study focused on the interpretation of the short-run effect (or short-run elasticity) of a change in tax preference on a change in dividends which is captured, in line with Poterba (2004) and Geiler and Renneboog (2015), by the coefficients of current investor tax preference parameters, being β2, β3, and β4 in Equation 3. The long-run effect (or long-run elasticity) of a change in tax preference on a change in dividends is captured, in line with Poterba (2004) and Geiler and Renneboog (2015), by the negative lagged levels of tax preference parameters divided by the lagged levels of dividends. The long-run effect of a change in tax preference on a change in dividends depicts the sensitivity of payout methods towards tax changes over the long term. The long-run effect of a change in tax preference on a change in dividends was only considered for comparison with the findings of Geiler and Renneboog (2015) to allow for a comparison between a developing country (South Africa) and a developed country (the United Kingdom).

Target population and sample

The target population comprised JSE-listed companies with reporting periods from 2012 to 2019. Companies were selected according to the following criteria: (i) companies with listed ordinary and/or N-class shares; (ii) companies with their primary listing on the JSE; (iii) companies listed on the JSE main board and not in the basic resources and finance sectors; and (iv) companies listed for the full duration of the period 2009-2015. Companies listed in the basic resources and finance sectors were excluded owing to unique accounting policies regarding capital investments and financing (Wesson et al. 2018). Companies listed from 2009 to 2015 were included to focus on companies listed at least three years before and after the introduction of dividends tax in 2012. Companies that delisted after 2015 were included to eliminate potential survivorship bias (Mans-Kemp & Viviers 2015). In total, 116 companies were included in the population comprising 33 large companies, 43 medium-sized companies, and 40 small companies based on market capitalisation during 2012. The company size classifications (small, medium, and large) of the JSE during 2012 were applied, namely, large companies represented by companies with a market capitalisation exceeding R10 bn; medium size companies with a market capitalisation exceeding R1 bn but not exceeding R10 bn; and small companies with a market capitalisation of R1 bn or less (SA Shares 2019).

Purposive non-probability sampling was applied based on four aspects: (i) the exclusion of observations with a negative ROA; (ii) the availability of shareholding data; (iii) observations with no change in payout methods other than dividends; and (iv) observations during the 2019 financial years of companies affected by the COVID-19 pandemic. To resolve the issue of negative earnings in a log-log specification, observations with a negative ROA were excluded in line with the study of Geiler and Renneboog (2015) and Poterba (2004). If the required shareholding data were not available in respect of a company for more than one year, such company-year observations were excluded. For shareholding data that were only unavailable for one year, missing data for that one year were added by replacing the missing year with half of the movement in shareholding from the preceding year to the subsequent year. Missing data were added for a total of 10 company-year observations based on registered shareholding1. Owing to the infrequent nature of payout methods other than dividends, this study included only company-year observations with changes in payout methods other than dividends (namely capital distributions, additional shares, and share repurchases) for purposes of data analysis, resulting in all company-year observations with no change in payout methods other than dividends, being excluded. Lastly, for two companies the data in respect of the 2019 financial years were excluded due to dividend payout which was cancelled or reduced as a result of the COVID-19 pandemic in terms of relief afforded to JSE-companies (JSE 2020a, 2020b).

In conclusion, the initial population comprised 928 company-year observations (116 companies), from which only certain company-year observations were included based on the sampling applied. In respect of dividends, 482 company-year observations based on registered shareholding (70 companies) and 739 company-year observations based on beneficial shareholding (104 companies) were included in the final sample. In respect of payout methods other than dividends, there were 482 company-year observations in total based on registered shareholding, of which only 233 observations (35 companies) had changes in other payout methods (resulting in the exclusion of 249 observations with no change in other payout methods). In respect of beneficial shareholding, there were 739 company-year observations in total, of which only 356 observations (51 companies) were identified as having changes in other payout methods (resulting in the exclusion of 383 observations with no change in other payout methods).

Data collection

Payout methods data

Payout methods data in this study comprised of ordinary dividends and payout methods other than dividends (the aggregate of capital distributions, additional shares, and share repurchases). Payout methods data compiled by Nel and Wesson (2021) were employed and expanded on by the inclusion of the 2019 financial years of selected companies. Payout methods data were accordingly compiled based on the consolidation of an existing dividend database (Nyere & Wesson 2019) and a share repurchase database (Steenkamp & Wesson 2020). Following the data collection method described in the previous studies (Nel & Wesson 2021; Nyere & Wesson 2019; Steenkamp & Wesson 2020), data were collected from disclosed annual financial statements and announcements via the Security Exchange News Service (SENS) of the JSE. The annual financial statements used to capture payout methods data were retrieved from the IRESS financial database.

Return on assets ratios

The return on assets ratios, which serve as a proxy for profitability, were obtained from the IRESS Expert financial database.

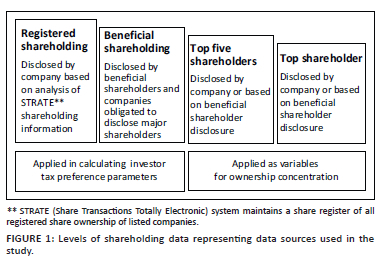

Investor tax preference parameters

The calculation of investor tax preference parameters (Equation 2) is a function of dividend tax preference parameters (Equation 1) and shareholding. Dividend tax preference parameters are based solely on tax rates which were obtained from tax pocket guides published by the South African Revenue Service (SARS n.d.) in respect of each tax year of assessment. Shareholding data included overall shareholding (registered shareholding), shareholding reported as beneficial (beneficial shareholding), top five shareholding, and the top shareholder for each company-year observation, as illustrated in Figure 1. The registered shareholding information disclosed by JSE-listed companies represents the overall shareholding of which only a portion is required to be reported as beneficial shareholding. To promote transparency between the company and shareholders, registered shareholders are obligated, in terms of section 56 of the Companies Act 71 of 2008 (Republic of South Africa 2009), to disclose to a company where a person other than the shareholder has a 'beneficial interest' in shares held by the registered shareholder (Norton Rose Fulbright 2017). Accordingly, not all registered shareholders are obligated to report beneficial shareholding, as reporting is only required for shareholding exceeding certain thresholds (three per cent or five per cent). In this study, a distinction between registered and beneficial shareholding was made in recognition of the two different sources of information - registered shareholding maintained by Share Trading Transactions Totally Electronic (STRATE) and beneficial shareholding data disclosed by registered shareholders.

In respect of registered shareholding, JSE-listed companies disclose an analysis of shareholding (which includes a shareholder spread and a distribution of shareholders) in their annual financial statements. The disclosure of a distribution of shareholders (or shareholders analysis) could extend to disclosure of different categories, including banks, brokers, custodians, close corporations, endowment funds, individuals, retail investors, private investors, directors, empowerment, insurance companies, mutual funds, other corporations, private companies, public companies, retirement funds, share trusts, trusts, nominees, and other trusts. In this study the different categories of registered shareholding disclosed by companies in the distribution of shareholders were grouped into individuals, corporates, and institutions:

-

Individuals are considered to be natural person shareholders. Retail shareholders of a company could include individual shareholders, companies, and family trusts (Johnston 2019). As the disclosure of the distribution of shareholders includes the declaration of companies as a separate category, retail shareholders were classified as individual shareholders. Family trusts were also categorised as individual shareholders as such a trust would be for the benefit of individual beneficiaries. 'Empowerment' as a category in the distribution of shareholders could include a share trust or share scheme. A typical example of a share trust is one established for the benefit of employees as a share incentive initiative (Fouché 2012). Share incentive plans are submitted to encourage employees to take ownership of their company and increase their performance by aligning the interest of individuals with that of shareholders (Hunt 2014). Any share trust (or empowerment trust) and share scheme were therefore submitted to be for the benefit of individuals and were categorised as individual shareholders.

-

Corporates are considered as public companies, private companies, and close corporations, as disclosed in the distribution of shareholders analysis. Close corporations were categorised as corporate shareholders, since a close corporation is included as a company, as defined in section 1 of the Income Tax Act 58 of 1962 (Republic of South Africa 2020) for tax purposes. Furthermore, it was investigated whether a company or close corporation represented the empowerment category to be classified as a corporate shareholder.

-

Institutional shareholders include asset owners (typically pension funds and insurance companies) and asset managers (who traditionally manage pooled share portfolios on behalf of clients and asset owners) (Johnston 2019). Desai and Jin (2011) in their study in the USA utilised data on institutional shareholders combined with data on the tax preferences of the clients those institutional investors serve. South African institutions are also required to disaggregate holdings, which are then reported to the Financial Surveillance Department (FinSurv) of the South African Reserve Bank; however, such data are not publicly available (Thomas 2017). Owing to data availability, the present study did not attempt to infer the tax position of institutions based on the tax position of the clients they serve. All investor categories, apart from those included as individual shareholders and corporate shareholders, were classified as institutional shareholders and were calculated as the remaining percentage of shareholding (i.e. 100 per cent less individuals shareholding less corporates shareholding).

Beneficial shareholding data were collected from shareholder history reports, as compiled by Refinitiv Eikon (previously Thomson Reuters) from the filings of shareholders and with only investments of beneficial shareholders being processed (Thomson Reuters 2016). The shareholder history reports include the classification of shareholder type and sub-type and enabled the following classification of investors as individuals, corporates, and institutions:

-

Individuals were represented by the 'individual investor' sub-type. In this study, the beneficial holding of a share trust, share scheme, or family trust was seen as benefiting individual beneficiaries and was therefore categorised as individual shareholding. It was noted - in data collected from Refinitiv Eikon - that share trusts and schemes are classified as corporation or holding company in the shareholder history reports. This classification of a share trust or share scheme as a corporation or holding company was reclassified to individual investor for this study.

-

Corporates were represented by the 'corporation' sub-type.

-

Institutions comprised the remaining beneficial shareholding (i.e. beneficial shareholding not categorised as individuals or corporates).

Beneficial shareholding cannot exceed registered shareholding as only holdings exceeding the reporting threshold are required to be reported as beneficial. Shareholding data collected confirmed the mean percentage of beneficial shareholding for each category (13.52% for individuals, 20.23% for corporates, and 35.23% for institutions) as lower than the mean percentage of registered shareholding for each category (19.97% for individuals, 23.58% for corporates, and 56.47% for institutions). Institutional shareholders have also been noted as accounting for most of the overall volume of shareholding on the JSE in South Africa (JSE 2016). Shareholding data collected confirmed the mean registered shareholding of institutions as the majority of registered shareholding (being 56.47% of total registered shareholding).

Ownership concentration dummy variables

For each company-year observation, the HOCI was calculated per company as the square of percentage shareholding held by the top five shareholders (Figure 1) and high (low) ownership was identified on the basis of the median HOCI (Harada & Nguyen 2011). A binary variable of '1' was applied to indicate company-year observations with high ownership concentration and '0' as low ownership concentration. Data collected in respect of the top shareholder included the category of top shareholder (individual, corporate, or institution) in terms of the description of categories under the shareholding data collection method. A binary variable of '1' was applied to indicate company-year observations with a top individual, corporate, or institution shareholder. A binary variable of '0' was similarly applied when the top shareholder was not an individual, corporate, or institution.

Formulating expected relationships

A summary of explanatory variables and expected relationships is provided in Table 1. The first explanatory variable was the change in the natural logarithm of profit (Δ ln ROAit). More profitable companies, based on ROA, were found to consistently pay higher dividends (Badenhorst 2017; Nyere & Wesson 2019) and high accounting profit was also submitted as a prerequisite for payout earnings by different payout channels (Geiler & Renneboog 2015). A positive relationship between changes in profit and changes in payout methods was expected.

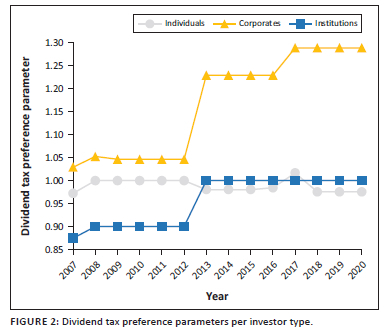

The second category of explanatory variables referred to the change in the natural logarithm of investor tax preference parameters, depicted as Δ ln θIndividuals,it, Δ ln θCorporates,it, and Δ ln θInstitutions,it. The expected relationship between changes in payout methods and changes in investor tax preference parameters was informed by the tax rate on dividends and capital gains tax. For this study, the dividend tax preference parameters (Equation 1) were calculated based on South African tax rates for individuals, corporates, and institutions (as illustrated in Figure 2). Individuals are represented by higher-rate individuals (individuals taxed at the highest marginal normal tax rate for each year of assessment) to demonstrate the maximum differential of tax between dividends and capital gains tax for individuals. Institutions are represented by funds, as funds are the majority institutional investor type on the JSE based on holdings (Thomas 2017). Based on dividend tax preference parameters displayed in Figure 2, the expected relationship between each of the categories of investor tax preference parameters and payout methods (dividends and payout methods other than dividends) was as follows:

-

Individual investors taxed at the highest normal tax rates only had a marginal dividend tax preference during 2017, with a marginal preference for capital gains tax above dividends tax noted for other years since the introduction of dividends tax in 2012. The bird-in-the-hand theory posits that investors could prefer the certainty of dividend payments to the possibility of substantially higher future capital gains (Baker & Weigand 2015). Individual investors could, in terms of the bird-in-the-hand theory, prefer dividends despite the marginal differences between dividends tax and capital gains tax rates. Furthermore, shares held by employees (individual investors) could also affect the likelihood that dividends will be paid, because executive compensation could be increased by allowing dividends to be paid on unvested restricted shares awarded (Minnick & Rosenthal 2014). The expectation is that tax preference parameters of individuals (Δln θIndividuals,it) would have a positive relationship with changes in dividends (and a negative relationship with changes in payout methods other than dividends) despite the marginal tax preference for capital gains tax observed in Figure 2.

-

Corporate investors had the highest dividend tax preference parameters (Figure 2) as a result of an exemption from dividends tax afforded and the increases in the effective rate of capital gains tax. The expectation is that corporate investor tax preference parameters (Δ ln θCorporates,it) would have a positive relationship with changes in dividends (and a negative relationship with changes in payout methods other than dividends) and, based on having the highest dividend tax preference parameters, are most likely to affect changes in dividends.

-

Institutional investors (represented by the tax position of funds) were tax-neutral since 2012 owing to an exemption from dividends tax and capital gains tax being afforded. Where institutional investors were the majority investors, a tax explanation for a positive relationship between dividend distribution and ownership concentration based on dividend preference has been reported (Short, Zhang & Keasey 2002). Institutional investors could also increase large companies' propensity to pay dividends (Jacob & Lukose 2018). The tax preference parameters of institutions could accordingly still be positively related to dividend payout despite the tax-neutral position since the introduction of dividends tax (as illustrated by a uniform dividend tax preference in Figure 2). The expectation is that institutional tax preference parameters (Δ ln θInstitutions,it) would have a positive relationship with changes in dividends (and a negative relationship with payout methods other than dividends) despite a tax-neutral position.

The third category of explanatory variables pertained to the lagged levels of variables. The lagged levels of dividends were found to be highly predictive but negatively related to aggregate dividend payout (Geiler & Renneboog 2015; Poterba 2004), based on which a negative relationship with changes in payout methods is expected. The lagged levels of profits (ln ROAit-1) indicate past profitability which could also inform current changes in payout methods to the extent that past profits are not distributed but retained for future expansions or dividends, based on which a positive relationship with changes in payout methods is expected. The lagged levels of investor tax preference parameters (ln θIndividuals,it-1, ln θCorporates,it-1, and ln θInstitutions,it-1), unlike past profitability, is not expected to affect current changes in payout methods, based on which no specific relationship with changes in payout is expected.

The final category of explanatory variables related to ownership concentration dummy variables and the category of top shareholders. This study explored whether high ownership concentration was a significant explanatory variable or not, without any expectation on the direction of relationships. The category of the top shareholder was also considered and the expected relationship differed depending on the category of shareholders. A top individual shareholder is expected to have a negative relationship in respect of changes in dividends (and a positive relationship in respect of payout methods other than dividends) owing to lower tax preferences for dividends if tax is the only consideration (Figure 2) and the sole aim is to maximise after-tax receipts and not the immediate cash receipts in terms of the bird-in-the-hand theory. A top corporate and institutional shareholder is expected to have a positive relationship in respect of changes in dividends (and a negative relationship in respect of payout methods other than dividends) owing to tax preferences for dividends, based on the applicable tax rates (Figure 2).

In summary, a positive relationship between changes in dividends and the majority of explanatory variables is expected. A negative relationship between changes in payout methods and the lagged levels of payout methods is expected, whereas a positive relationship between changes in payout methods and corporate profits (and the lagged levels of corporate profits) is expected. A negative relationship is expected between changes in dividends (and a positive relationship is expected between changes in payout methods other than dividends) and top individual shareholders.

Multivariate statistics

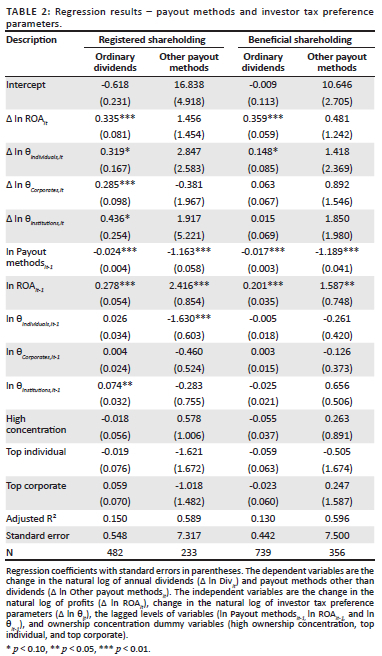

When testing the assumptions of the regression analysis, normal probability plots were inspected to assess the normality of data by considering the distribution of residuals. The models estimated in the present study also applied log transformation to all variables, in line with previous studies, which would aid in addressing the normality assumption. The Breusch-Pagan test was performed in respect of heteroscedasticity with the results found to be significant for registered shareholding (p-value of 0.04) and beneficial shareholding (p-value of 0.01), which indicated the need to adapt regression results for heteroscedasticity using White's robust covariance matrix. The Durbin-Watson statistics approximated two for registered shareholding (d-value of 1.83) and beneficial shareholding (d-value of 1.86) submitted as evidence of no autocorrelation of variables. The variance inflation factor for variables other than a top institutional shareholder ranged from 1.09 to 3.27 and indicated no multicollinearity between independent variables. The variance inflation factor of Top Institution was found to be collinear and Top Institution was therefore excluded for purposes of data analysis. In respect of outliers, the Grubbs test for outliers was performed on all variables. Each variable containing entries that were identified as outliers was winsorised by replacing the upper (lower) outlying entries with the value of the maximum (minimum) of the non-outlying observations plus 10% of the non-outlying interquartile range. The regression results estimated for Equation 3 using OLS are provided in Table 2.

Changes in profitability (Δ ln ROAit) and past profitability (ln ROAit-1) were found to have a statistically significant positive relationship with changes in dividends, in line with expectation and previous literature (Geiler & Renneboog 2015). Only past profitability (ln ROAit-1) was found to have a statistically significant positive relationship with changes in other payout methods, which suggests the retention of past profits (ln ROAit-1) as a more important determinant than changes in current profits (Δ ln ROAit). Previous payout methods (ln Payout methodsit-1) were found to have a statistically significant negative relationship with changes in dividends and other payout methods, in line with expectation and previous literature (Badenhorst 2017; Geiler & Renneboog 2015; Poterba 2004). These findings confirm the importance of profitability as well as past payout methods in explaining changes in payout methods.

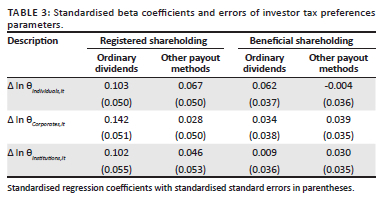

Different insights were obtained in this study based on registered shareholding and beneficial shareholding in respect of investor tax preference parameters. Changes in investor tax preference parameters were found to have a statistically significant positive relationship with changes in dividends based on registered shareholding only. The level of significance relating to corporate tax preference parameters (Δ ln θCorporates,it) was found to be higher than the other investor tax preference parameters considered. The standardised beta coefficient of corporate tax preference parameters (Δ ln θCorporates,it) was also observed as higher than the standardised beta coefficients of other investor tax preference parameters considered in relation to ordinary dividends based on registered shareholding (Table 3). The higher standardised beta coefficients in respect of corporates (Δ ln θCorporates,it) suggests that corporate tax preference parameters explained changes in dividends more than other investor tax preference parameters considered. The finding in respect of corporate investors supports the findings of Badenhorst (2017), which suggested that corporates could be more successful in lobbying for beneficial dividend changes than other investor types. Investor tax preference parameters based on beneficial shareholding were only found to be significant in one instance, being for individuals (Δ ln θIndividuals,it) at the 10 per cent level of significance in respect of ordinary dividends. This finding could suggest that beneficial shareholders could invest for strategic reasons, such as obtaining control, rather than maximising their after-tax receipt, which could result in tax preferences being less important.

In respect of ordinary dividends and based on registered shareholding (Table 2), the estimated coefficients implied a long-run effect on changes in dividends for investor tax preference parameters of 1.08 for individuals (−0.026/−0.024), 0.167 for corporates (−0.004/−0.024), and 3.08 for institutions (−0.074/−0.024). Geiler and Renneboog (2015) concluded that there was a long-run effect on changes in dividends with respect to investor tax preference parameters of 0.03 for individuals, −0.042 for corporates, and −1.58 for pension funds. The long-run effects on changes in dividends reported in the present study were higher than those noted by Geiler and Renneboog (2015), which suggested that, over the long term, dividend payout in South Africa seemed to be more sensitive to investor tax preference parameters than dividend payout in the UK.

Changes in investor tax preference parameters (Δ ln θIndividuals,it, Δ ln θCorporates,it, and Δ ln θInstitutions,it) were found not to have a statistically significant relationship with changes in payout methods other than dividends. Contrary to the findings in respect of dividends, the short-run changes of investor tax preference parameters were not found to have a significant effect on the aggregate changes in payout methods other than dividends. This finding suggests that tax is not a significant determinant of payout methods other than dividends. Payout methods other than dividends could be explained by other determinants. In respect of share repurchases (i.e. the main payout method other than dividends), shareholder heterogeneity, the size of the distribution, the level of company undervaluation, agency cost, and history of dividend payment have all been found to be significant determinants in the choice between share repurchases and dividend payments (Wesson et al. 2018).

In respect of ownership concentration, this study considered HOCI and top shareholders (as corporate or individual), however, none of the ownership concentration dummy variables was noted as statistically significant. A possible explanation could be that top shareholders invest for strategic reasons, which could result in tax not being a first-order determinant.

Conclusions and recommendations

Prior empirical evidence offers mixed support for taxes and tax clienteles theory as an explanation for dividend relevance (Baker & Weigand 2015). The present study contributes in respect of the theory of taxes and tax clienteles from a developing country perspective by exploiting data not previously included in South African literature. This study investigated the relationship between changes in investor tax preference parameters (of individuals, corporates, and institutions) and changes in payout methods (namely dividends, capital distributions, additional shares, and share repurchases).

Corporate investors had the highest tax preference for dividends of all categories of investors considered since the introduction of dividends tax in 2012 in South Africa due to an exemption from dividends tax being afforded and increases in the effective rate of capital gains tax. Regression results confirmed changes in corporate investor tax preference parameters as the most statistically significant in explaining changes in dividends, of all investor tax preference parameters considered. This finding contributed to literature in three respects. Firstly, short-run changes in corporate investor tax preference parameters were found to be statistically significant in explaining aggregate changes in dividends, contrary to previous studies from developed countries (Geiler & Renneboog 2015; Poterba 2004). This could suggest that tax reform in a developing country, South Africa, has a more pronounced effect on payout methods than in developed countries. Secondly, this finding provides empirical evidence that the tax differential of dividends and capital gains, as depicted by investor tax preference parameters in this study, affect the supply of dividends (Farre-Mensa et al. 2014). Thirdly, this finding expands on previous findings that suggest that corporate shareholders in South Africa could have greater success in lobbying for beneficial dividend changes than individuals (Badenhorst 2017).

In conclusion, the empirical evidence of the present study suggests an effect of investor tax preferences on dividend payout methods. The findings on how companies respond when faced with the conflicting tax preferences of investors could be of interest to researchers, investors, and those charged with fiscal responsibility (Badenhorst 2017). This evidence could also enable a comparison with other developing countries (Aivazian et al. 2003; Mollah 2011) in future research. The data collected in respect of investor tax preference parameters are not available in a commercial financial database and could serve as the basis for further research. The collection of ordinary dividend data and shareholding data, however, relied on annual financial statements and two financial databases (IRESS and Refinitiv Eikon) and a focus of future research could be to consider alternative data sources.

Acknowledgements

Prof. Daan Nel (Centre for Statistical Consultation, Stellenbosch University) for the statistical analyses performed in respect of this study.

Competing interests

The authors have declared that no competing interest exists.

Authors' contributions

R.N. was the primary researcher as part of his PhD study and N.W. and L.S. supervised the research project in their capacity as PhD supervisors.

Ethical considerations

The Departmental Ethics Screening Committee of the University of Stellenbosch Business School (USB DESC) confirmed that the research is exempt from ethical clearance. 07 May 2019.

Funding information

This research received no specific grant from any funding agency in the public, commercial or not-for-profit sectors.

Data availability

The data that support the findings of this study are available from the corresponding author, R.N., upon reasonable request.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Abor, J. & Fiador, V., 2013, 'Does corporate governance explain dividend policy in Sub-Saharan Africa?', International Journal of Law and Management 55(3), 201-225. https://doi.org/10.1108/17542431311327637 [ Links ]

Aivazian, V., Booth, L. & Cleary, S., 2003, 'Do emerging market companies follow different dividend policies from US companies?', Journal of Financial Research 26(3), 371-387. https://doi.org/10.1111/1475-6803.00064 [ Links ]

Al-Najjar, B. & Kilincarslan, E., 2019, 'What do we know about the dividend puzzle? - A literature survey', International Journal of Managerial Finance 15(2), 205-235. https://doi.org/10.1108/IJMF-03-2018-0090 [ Links ]

Arko, A.C., Abor, J., Adjasi, C.K.D. & Amidu, M., 2014, 'What influence dividend decisions of firms in Sub-Saharan African?', Journal of Accounting in Emerging Economies 4(1), 57-78. https://doi.org/10.1108/JAEE-12-2011-0053 [ Links ]

Arora, R.K. & Srivastava, A., 2019, 'Ownership concentration and dividend payout in emerging markets: Evidence from India', Global Business Review 22(5), 1276-1288. https://doi.org/10.1177/0972150918824953 [ Links ]

Badenhorst, W.M., 2017, 'Tax preferences, dividends and lobbying for maximum value', South African Journal of Economic and Management Sciences 20(1), 1-10. https://doi.org/10.4102/sajems.v20i1.1476 [ Links ]

Baker, H.K. & Jabbouri, I., 2016, 'How Moroccan managers view dividend policy', Managerial Finance 42(3), 270-288. https://doi.org/10.1108/MF-07-2015-0211 [ Links ]

Baker, H.K., Kapoor, S. & Jabbouri, I., 2018, 'Institutional perspectives of dividend policy in India', Qualitative Research in Financial Markets 10(3), 324-342. https://doi.org/10.1108/QRFM-07-2017-0067 [ Links ]

Baker, H.K. & Weigand, R., 2015, 'Corporate dividend policy revisited', Managerial Finance 41(2), 126-144. https://doi.org/10.1108/MF-03-2014-0077 [ Links ]

Booth, L. & Zhou, J., 2017, 'Dividend policy: A selective review of results from around the world', Global Finance Journal 34, 1-15. https://doi.org/10.1016/j.gfj.2017.07.002 [ Links ]

Chazi, A., Theodossiou, A. & Zantout, Z., 2018, 'Corporate payout methods-form: iInvestors' preference and catering theory', Managerial Finance 44(12), 1418-1433. https://doi.org/10.1108/MF-03-2018-0127 [ Links ]

Desai, M.A. & Jin, L., 2011, 'Institutional tax clienteles and payout policy', Journal of Financial Economics 100(1), 68-84. https://doi.org/10.1016/j.jfineco.2010.10.013 [ Links ]

Dube, T., 2018, 'An analysis of effects of ownership on capital structure and corporate performance of South African companies', Unpublished doctoral thesis, University of Pretoria, Pretoria. [ Links ]

Farre-Mensa, J., Michaely, R. & Schmalz, M.C., 2014, 'Payout policy', Annual Review of Financial Economics 6, 75-134. https://doi.org/10.1146/annurev-financial-110613-034259 [ Links ]

Fouché, C., 2012, 'Taxation consequences of providing shares to employees through a trust', Unpublished master's thesis, University of Pretoria, Pretoria. [ Links ]

Geiler, P. & Renneboog, L., 2015, 'Taxes, earnings payout methods, and payout channel choice', Journal of International Financial Markets, Institutions and Money 37, 178-203. https://doi.org/10.1016/j.intfin.2015.01.005 [ Links ]

Gonzalez, M., Molina, C.A., Pablo, E. & Rosso, J.W., 2017, 'The effect of ownership concentration and composition on dividends: Evidence from Latin America', Emerging Markets Review 30, 1-18. https://doi.org/10.1016/j.ememar.2016.08.018 [ Links ]

Harada, K. & Nguyen, P., 2011, 'Ownership concentration and dividend policy in Japan', Managerial Finance 37(4), 362-379. https://doi.org/10.1108/03074351111115313 [ Links ]

Hunt, K., 2014, 'Is Treasury broadening the divide between shareholders and employees: An analysis of the role taxation plays in share incentive plans', Unpublished master's thesis, University of Cape Town, Cape Town. [ Links ]

Jacob, C. & Lukose, P.J., 2018, 'Institutional ownership and dividend payout in emerging markets: Evidence from India', Journal of Emerging Market Finance 17(1S), 54S-82S. https://doi.org/10.1177/0972652717751538 [ Links ]

Johannesburg Stock Exchange (JSE), 2016, G lossary of investment and stock market terms - JSE, viewed 25 November 2020, from https://www.jse.co.za/investor-type/individual/glossary. [ Links ]

Johannesburg Stock Exchange (JSE), 2020a, 'COVID-19: Cancellation, changes and postponement of payment of dividends after declaration date', JSE Letter, 30 March. [ Links ]

Johannesburg Stock Exchange (JSE), 2020b, 'COVID-19: Payments of dividends', JSE Letter, 02 April. [ Links ]

Johnston, A., 2019, 'Directors' remuneration: To engage or not to engage?', Without Prejudice 19(2), 10-14. [ Links ]

Lie, E. & Lie, H.J., 1999, 'The role of personal taxes in corporate decisions: An empirical analysis of share repurchases and dividends', Journal of Financial and Quantitative Analysis 34(4), 533-552. https://doi.org/10.2307/2676233 [ Links ]

Mans-Kemp, N. & Viviers, S., 2015, 'The relationship between corporate governance and dividend payout ratios: A South African study', Management Dynamics: Journal of the Southern African Institute for Management Scientists 24(2), 20-35. [ Links ]

Marcus, M. & Toerien, F., 2014, 'The relative cost of internal vs. external equity in South Africa: The impact of capital gains and dividend taxes', Sou th African Journal of Accounting Research 28(1), 97-116. https://doi.org/10.1080/10291954.2014.11463129 [ Links ]

Minnick, K. & Rosenthal, L., 2014, 'Stealth compensation: Do CEOs increase their pay by influencing dividend policy?', Journal of Corporate Finance 25, 435-454. https://doi.org/10.1016/j.jcorpfin.2014.01.005 [ Links ]

Mollah, S., 2011, 'Do emerging market companies follow different dividend policies? Empirical investigation on the pre-and post-reform dividend policy and behaviour of Dhaka Stock Exchange listed companies', Studies in Economics and Finance 28(2), 118-135. https://doi.org/10.1108/10867371111137120 [ Links ]

Nel, R. & Wesson, N., 2021, 'The trend and composition of total payout over a period of tax reform: Evidence from JSE-listed companies', Acta Commercii 21(1), 1-11. https://doi.org/10.4102/ac.v21i1.882 [ Links ]

Norton Rose Fulbright, 2017, Ongoing beneficial interest shareholder and regulated company obligations under the Companies Act and JSE listing requirements, viewed 25 November 2020, from https://www.nortonrosefulbright.com. [ Links ]

Nyere, L. & Wesson, N., 2019, 'Factors influencing dividend payout decisions: Evidence from South Africa', South African Journal of Business Management 50(1), 1-16. https://doi.org/10.4102/sajbm.v50i1.1302 [ Links ]

Peyer, U. & Vermaelen, T., 2016, 'Political affiliation and dividend tax avoidance: Evidence from the 2013 fiscal cliff', Journal of Empirical Finance 35, 136-149. https://doi.org/10.1016/j.jempfin.2015.10.009 [ Links ]

Poterba, J., 2004, 'Taxation and corporate payout policy', American Economic Review 94(2), 171-175. https://doi.org/10.1257/0002828041301416 [ Links ]

Qopana, N.E., 2018, 'Investigation of dividend policy, corporate governance and agency costs on the Johannesburg Stock Exchange', Unpublished master's dissertation, University of the Witwatersrand, Johannesburg. [ Links ]

Republic of South Africa, 2009, Companies Act 71 of 2008. Government Printer, Pretoria. [ Links ]

Republic of South Africa, 2020, Income Tax Act 58 of 1962, Government Printer, Pretoria. [ Links ]

SA Shares, 2019, Defining mid cap, viewed 20 May 2021, from https://sashares.co.za/mid-cap-jse-index [ Links ]

Short, H., Zhang, H. & Keasey, K., 2002, 'The link between dividend policy and institutional ownership', Journal of Corporate Finance 8(2), 105-122. https://doi.org/10.1016/S0929-1199(01)00030-X [ Links ]

South African Revenue Service (SARS), n.d., Tax pocket guide' for each tax year, viewed 25 November 2020, from http://www.sars.gov.za. [ Links ]

Steenkamp, G. & Wesson, N., 2020, 'Post-recession share repurchase behaviour by JSE-listed companies: Transparent or not?', Journal of Accounting in Emerging Economies 10(3), 465-486. https://doi.org/10.1108/JAEE-02-2020-0040 [ Links ]

Thomas, L., 2017, Ownershi p of JSE-listed companies: Research report for national treasury, viewed 25 November 2020, from http://www.treasury.gov.za. [ Links ]

Thomson Reuters, 2016, Ownership FAQS - Filing sources, viewed 25 November 2020, from https://emea1.apps.cp.thomsonreuters.com/Apps/HelpViews/0.2.9/Default.htm#ownership_faq5.htm. [ Links ]

Toerien, F. & Marcus, M., 2014, 'The effect of South African dividend and capital gains taxes on share prices and investor expected returns', Journal of Applied Business Research 30(3), 895-908. https://doi.org/10.19030/jabr.v30i3.8574 [ Links ]

Truong, T. & Heaney, R., 2007, 'Largest shareholder and dividend policy around the world', The Quarterly Review of Economics and Finance 47(5), 667-687. https://doi.org/10.1016/j.qref.2007.09.002 [ Links ]

Wesson, N., Smit, E., Kidd, M. & Hamman, W.D., 2018, 'Determinants of the choice between share repurchases and dividend payments', Research in International Business and Finance 45, 180-196. https://doi.org/10.1016/j.ribaf.2017.07.150 [ Links ]

Wooldridge, J.M., 2013, Introductory econometrics: A modern approach, 5th edn., Cengage Learning, Boston, MA. [ Links ]

Correspondence:

Correspondence:

Rudie Nel

rnel@sun.ac.za

Received: 26 Jan. 2022

Accepted: 16 June 2022

Published: 31 Aug. 2022

1. As a robustness test the influence of the observations for which values were imputed/added was considered. The regression analyses were reperformed and the observations for which values were imputed/added were excluded - it was confirmed that the main findings of the present study were not affected by the exclusion of the observations for which values were imputed/added.