Services on Demand

Article

Indicators

Related links

-

Cited by Google

Cited by Google -

Similars in Google

Similars in Google

Share

South African Journal of Economic and Management Sciences

On-line version ISSN 2222-3436

Print version ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.22 n.1 Pretoria 2019

http://dx.doi.org/10.4102/sajems.v22i1.2944

ORIGINAL RESEARCH

Access to micro- and informal loans: Evaluating the impact on the quality of life of poor females in South Africa

Talita GreylingI; Stephanié RossouwII

ISchool of Economics, University of Johannesburg, Johannesburg, South Africa

IIFaculty of Business, Auckland University of Technology, Auckland, New Zealand

ABSTRACT

BACKGROUND: Since the early 1980s, many governments have investigated the possibility of utilising access to microloans as a pathway to grow economies out of unemployment and thereby improve people's quality of life. Studies that have previously investigated the impact of microloans found a positive effect on quality of life. Unfortunately, these mainly measure quality of life using monetary (income) measures rather than assessing the entire multidimensionality of quality of life

AIM: This article investigates the relationship between objective multidimensional income-independent quality of life (IIQoL) and having access to micro- and informal loans (M&ILs). Specifically, we focus on South Africa's most marginalised - 'poor females' and 'poor females residing in rural areas' - as their empowerment is a critical social objective aligned to that of international agencies

SETTING: This study investigates the relationship between IIQoL and access to M&ILs in South Africa

METHODS: We use a panel data set spanning four waves from 2008 to 2015 of the National Income Dynamics Survey. Principal component analysis is used to construct the IIQoL index and various panel and survey estimation techniques are applied in the regression analyses

RESULTS: M&ILs are significant and negatively related to IIQoL for both 'poor females' and 'poor females residing in rural areas'. This implies that those with loans failed to translate those monetary gains into higher levels of IIQoL over time

CONCLUSION: Access to M&ILs is not succeeding in raising the quality of life of South Africa's most marginalised groups. Without intervention and education programmes imbedded within microloan initiatives, the marginalised will not experience an increase in their non-income quality of life

Keywords: Quality of life; income-independent measures; microloans; informal loans; South Africa.

Introduction

In this article we investigate the relationship between micro- and informal loans (M&ILs) and income-independent quality of life (IIQoL) of poor females in South Africa. For the purpose of clarity, the study defines M&ILs as those loans of a small value given to people who do not have access to the formal credit market. We do this in order to determine whether access to these kinds of loans indeed succeeds in raising the quality of life of South Africa's most marginalised groups: 'poor females' and, more specifically, 'poor females residing in rural areas' (Bhorat, Naidoo & Van der Westhuizen 2006). This is important since from the early 1980s many governments have investigated the possibility of access to microloans as a pathway to grow economies out of unemployment and thereby improve people's quality of life. Duggan et al (2000) maintain that the groups targeted to participate in microloan initiatives are those seen as marginalised and excluded from the formal credit market. This is because they have no collateral to offer as security and must depend on professional moneylenders for informal loans (Kundu 2011). The intention of these initiatives is to enable borrowers, who are mostly women, to make more choices (empowerment), thereby ultimately allowing them to contribute to greater economic growth and development in their countries (Swain & Wallentin 2009). Additionally, Becchetti and Conzo (2013) argue that access to microloans has the ability to increase one's level of dignity, self-esteem, social recognition and life satisfaction. In essence, M&ILs are necessary to increase marginalised individuals' overall quality of life.

Previous studies analysed the relationship between microloans and quality of life mainly in developing countries, located in the regions of South/South East Asia including Malaysia (Chan & Ghani 2011), India (Banerjee et al. 2009; Kundu 2011), Bangladesh (Duvendack 2010), Thailand (Kaboski & Townsend 2005) and the Philippines (Karlan & Zinman 2010). Outside of this region, studies investigated microloans in Kenya (Dupas & Robertson 2013), Mexico (Banerjee, Karlan & Zinman 2015), Argentina (Becchetti & Conzo 2013) and Uganda (Afroze 2012), but there is still no clear-cut answer to the question whether access to credit markets through M&ILs improves the quality of life of borrowers (see Table 2-A1 in Appendix 1 for a summary).

On the one hand, mainstream studies such as Chan and Ghani (2011) and Afroze (2012) argue that microloans are successful in reaching the marginalised poor and increasing women's quality of life. It helps to create small and microenterprises in remote areas and significantly increases economic quality of life. These studies, as well as most of the existing literature (too many to discuss here), mainly measure quality of life using monetary (income) measures. Income measures, however, do not reveal the change in quality of life over a longer period, nor directly measure the outcomes of policy aimed to better human development (Proctor & Anand 2017).

On the other hand, studies such as Orso (2011), Banerjee et al. (2015), Van Rooyen, Stewart and De Wet (2012) and Wahab, Bunyau and Islam (2018) contradict mainstream studies claiming significant positive effects of microloans on poverty (economic quality of life). Orso (2011) found that microlenders themselves were biased in choosing areas that already have entrepreneurial ability and infrastructure, therefore ensuring a positive impact. Consequently, many studies suffer from weak methodologies. Banerjee et al. (2015) and Van Rooyen et al. (2012) were not able to find robust evidence of improvements in social indicators, such as child schooling or female empowerment. Duvendack et al. (2011) concluded that mainstream studies in favour of microloans had questionable results, due to lack of robustness tests and small sample bias.

The current article seeks to add to the existing microloan literature by being the first known study to investigate the relationship between M&ILs and an objective income-independent quality of life measure, constructed at a micro level. The study makes use of a large representative panel data set that allows us to use panel estimation techniques, which address criticisms raised against the use of cross-sectional data analyses used in previous studies (Orso 2011). Additionally, it adds to the relatively sparse array of studies focusing on (1) the sub-Saharan Africa region (see Van Rooyen et al. 2012) and (2) the importance of including informal loans in determining the success of credit initiatives (see Proctor & Anand 2017).

This study's first contribution, of constructing an objective multidimensional income-independent quality of life measure, recognises the argument put forth by Stiglitz, Sen and Fitoussi (2010) that quality of life is a multidimensional concept. One can no longer simply rely on real income per capita (economic) and non-income domains (social indicators) as quality of life achievement should also be considered. Lutafali and Khoja (2002) argue that low levels of quality of life encompass a perpetual state of chronic deprivation with respect to education, health, housing, service delivery and a deeply rooted lack of self-esteem (non-income quality of life). The problem though is that social indicators are strongly correlated with income measures and therefore an argument can be made that social indicators are redundant (Drèze & Sen 1991) and that one could simply return to using income measures (see McGillivray 1991). To properly ascertain quality of life achievement from non-income indicators, one must remove the variance from those social indicators explained by income. This type of measure will more directly address the outcomes of policy and thus the development of human welfare, in as much as it addresses 'the ends' rather than 'the means'.

In saying this, one must not overlook the significance of utilising objectively measured indicators when measuring our non-income quality of life. Stiglitz et al. (2010) argue that objectively measured indicators, such as the ones used in the construction of the Human Development Index (HDI), are still popular among policymakers. This could be because they are useful when sudden, rudimentary, short-run, aggregate inferences are required. Objectively measured indicators are also deemed more receptive, faster to reflect change, cheaper and less complex to collect. Lastly, there is the presumption that objective measures are more adaptable to quantification, as they are observable. Veenhoven (2004:21) argues that objectively measured indicators are important, as they reflect the 'actual state of problems and the effects of attempts to solve these'. Therefore, our income-independent quality of life measure consists of objectively measured non-income indicators, from which the income variance is removed.

Therefore, against this backdrop, the study seeks to achieve the following research objectives:

· Construct a composite objectively measured income-independent quality of life (IIQoL) index at a micro level.

· Analyse the relationship between M&ILs and IIQoL for the whole sample.

· Determine whether the same relationship that was found between M&ILs and IIQoL for the whole sample holds for the sub-samples 'poor females' and, more specifically, 'poor females in rural areas'.

· Compare the results obtained from analysing the 'poor female' sub-sample to a similar 'poor male' cohort, to determine the extent of similarity (if any) between access to M&ILs and IIQoL for sub-samples defined by gender. This is important since literature suggests that females typically spend their M&ILs on education and health, whereas males traditionally end up satisfying current consumption needs (Karlan, Osman & Zinman 2016). This could indicate that females' usage of these M&ILs play a more significant role towards development than those of males.

The study will achieve the above by using a panel data set spanning four waves from 2008 to 2015 of the National Income Dynamics Survey (NIDS) and utilising various panel and survey estimation techniques. Our results indicate that access to M&ILs is negatively related to IIQoL for all samples analysed. This implies that many who did have access to these kinds of loans failed to, over time, translate those monetary gains into higher levels of IIQoL.

This leads us to conclude that micro- and informal loans do not raise the quality of life of South Africa's most marginalised groups - 'poor females' and, more specifically, 'poor females residing in rural areas'. We find this to be in line with the work done by Pronyk et al. (2008) and Bateman (2015), who found that M&ILs do not decrease the exceptionally high levels of unemployment and poverty, but instead further impoverish these groups. Additionally, M&ILs create negative changes in an individual's family relations (some males misuse resources, there is a higher frequency of domestic abuse and women are not being empowered), increased time pressure and a decreased participation in social activities.

The rest of the article is structured as follows. The next section contains an outline of the methodology used, whereas Section 'Data and variables' describes the data and the selected variables. The results and analyses follow in Section 'Results', while the article concludes in Section 'Conclusions'.

Methodology

We structure the methodological section as follows:

· The composition of the IIQoL index.

· The model and the estimation techniques.

Methodology followed to construct the composite income-independent quality of life index

We follow the method proposed by McGillivray (2005) to develop a non-income composite index. The index differs from McGillivray's (2005) in that it focuses on quality of life measured at a micro level rather than a macro level. The essence of this method is to extract the first principal component from selected social indicators, using principal component analysis (PCA), that explains the most variance in the data set. In line with the OECD's handbook (2008), the first extracted component represents an objectively weighted composite index, in this instance of non-income quality of life. Secondly, we regress the composite index on the natural log of household income per capita. Lastly, we retain the residual, μi, from this regression and interpret it as an individual's income-independent quality of life (IIQoL). This estimated function of the composite non-income quality of life index can be expressed as:

where Qit is the composite non-income quality of life index for individual i in period t (t = 2008 to 2015); and lnyit is the natural log of household income per capita for the same individual i in the same time period t, with μit being the residual term. This residual term μit is a purely statistical construct and is defined inter alia as IIQoL, which is central to our analysis and by definition orthogonal with respect to lnyit. To test the choice of PCA to weight the composite index, we also developed an index in which we applied equal weighting. Correlating the two indices, we find the Pearson's correlation coefficient to be 0.94. We prefer and report the results using the PCA method of weighting, as it weights the independent variables according to the most variance explained in the data.

To prove that our newly constructed IIQoL is indeed independent of income, we correlate it with both objective and subjective monetary measures of well-being (other than income). Low correlations are an indication of this independence of the newly constructed index.

Model and estimation techniques

The generic model estimated (equation 2) applies to: (1) the whole sample, (2) a sub-sample of 'poor female' respondents, (3) a sub-sample of 'poor females residing in rural areas' respondents and to compare findings based on gender (4) a sub-sample of 'poor male' respondents:

where Yit is the IIQoL, β1Xit is a vector of demographic and economic variables including the variable of interest M&ILs, and the idiosyncratic individual error term is given by εit.

To estimate the specified model in equation (2), we use panel data estimation techniques and adjust these for the complex sampling design. Cluster corrections are necessary, as the assumption that our sample is extracted by means of simple random sampling is not adhered to. We deal with the cluster correction at the geographical level, assuming that people within a similar cluster might have similar levels of quality of life and therefore similar needs for microloans. Additionally, we make use of panel weights to correct for attrition.

To determine the most appropriate estimation technique between fixed effects (FE) and random effects (RE), we make use of the Hausmann test. Based on the results, we reject the null hypothesis which states that the difference in coefficients is not systematic (chi2 = 1754.67; p = 0.000) and therefore we estimate the model using FE. Although panel data estimation techniques have the benefit, over cross-sectional estimation methods, to address endogeneity, which arises from omitted variables and measurement errors, it does not address simultaneity. Therefore, to test for endogeneity arising from simultaneity, we make use of instrumental variable (IV) regressions using the FE estimator. In saying this, the data set did not offer a suitable option to instrument M&ILs, our variable of interest. For that reason, following Cameron and Trivedi (2010) we instrument M&ILs by its lagged variable. With the IV regression, we find the instrument to be strong, with the Kleibergen-Paap Wald F statistic = 222.998 and the Stock-Yogo weak ID test's critical value being 10%. However, testing for endogeneity, the Durbin-Wu Hausman test shows that the variable of interest, M&ILs, is not endogenous (p = 0.4304). Therefore, we do not pursue the matter further and interpret the pooled ordinary least squares (POLS) (in the case of time invariant variables) and the FE models.

To test the robustness of our results, we also run regressions on individual non-income quality of life indicators, including education, health and housing (Table 1-A1 in Appendix 1). Similar results on the relationship between M&ILs and the individual social indicators are indicative of robust results. One should keep in mind that it is not ideal to use these individual social indicators to represent quality of life, as they are one dimensional and, secondly, they are not income-independent.

In all analyses, we run diagnostic tests as appropriate. With the exception of the age and age-squared variables, there is no evidence of multicollinearity. However, we find evidence of heteroscedasticity and this problem is addressed by making use of robust standard errors.

Data and variables

Data

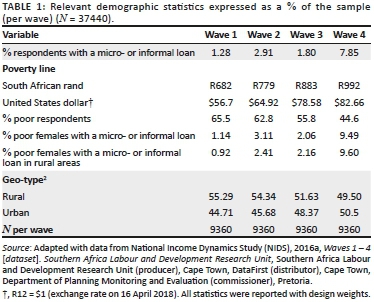

The data used in this article comes from the first four waves of the National Income Dynamics Survey (NIDS), spanning the period 2008-2015. The NIDS is a face-to-face longitudinal survey, which is repeated with the same individual household members, every 2 years (NIDS 2016b). This data set focuses on the livelihoods of individuals and households over time. The reason for choosing the NIDS data set is because it provides rich data on non-income quality of life indicators at a micro level, which is not the case with other national surveys. The analysis is restricted to a balanced panel - adults 18+ years old (wave 1), who were successfully interviewed in all four waves and includes 9360 individuals in the four waves amounting to 37 440 observations. Table 1 provides the summary statistics for a select number of demographic variables in the balanced panel.

As seen in Table 1, there is a significant increase from 2008 to 2015 in the share of the population engaging in the M&IL market from 1.3% to 7.9%, although there was a minor decrease in wave 3. This finding of increased dependence on M&ILs holds for each of the cohorts of interest - 'poor females' and 'poor females residing in rural areas'. The rate of increase in M&ILs among the poor cohorts compared to the whole sample is 3.5% higher on average. This higher level of activity by the poor could be interpreted as a higher number of individuals accessing the only financial service they are able to. This tendency to rely on loans is not uncommon in South Africa, with household debt as a percentage of nominal disposable income persistently remaining at high levels of more than 70% over the last decade (SARB 2019).

The percentage of the population that falls below the upper1 poverty line declined significantly from 65.5% to 44.6% over the same time period. This is also true for females, as poverty decreased from 69% in wave 1% to 50% in wave 4 and among females in rural areas, where poverty decreased from 81% in wave 1% to 64% in wave 4. Notably, the percentage poor among the females and females in rural areas is higher than the percentage poor in the whole sample. However, although poverty rates decreased, we cannot conclude that higher levels of M&IL participation caused a decrease in poverty directly. Simanowitz (2010) argues that it would be very difficult to prove the positive effects of microloan initiatives on increasing the quality of life for South Africans, since many who participate are also recipients of welfare payments.2

With regard to the different geographical areas included in the sample: we refer to respondents residing in either rural or urban areas. In this article, people residing in rural areas are highlighted, as they are typically more marginalised and represent a substantial proportion of the whole sample: 44.71% in wave 1 to 50.5% in wave 4. Almost all inhabitants of rural areas are of African descent (on average 99.98%) as well as females (67%).

Selection of variables

Non-income quality of life variables

As discussed in Section 'Methodology followed to construct the composite income-independent quality of life index', in order to derive an IIQoL measure, the first step is to construct a composite non-income quality of life index. To select the variables included in the index, we are careful not to stray too far away from the original HDI. The reason for this is that the domains of health and education are well documented as contributing the most to individuals' perceived quality of life (see also Land, Michalos & Sirgy 2012; McGillivray 2005). Added to this, both the United Nations (UN) and the World Bank (WB) (UN publications: Series F, No. 49, 1989; Series F, No. 18, 1975 and 2015) have placed significant importance on education, health and the development of basic infrastructure pertaining to housing, water and sanitation. These are seen as the breakthrough policy areas needed to achieve higher non-income quality of life in developing regions. These three domains also reflect the South African government's investment priorities as stipulated in the 2017/2018 budget (National Treasury 2017) and form an integral part of their National Development Plan (NDP) (National Planning Commission 2012).

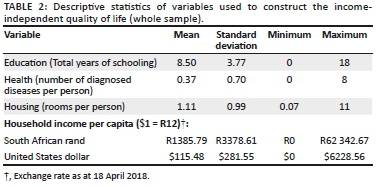

Against this backdrop, together with the goal of using objective indicators at a micro level (see Section 'Introduction' for discussion), the non-income quality of life index includes the three objectively measured indicators below. This index is ultimately regressed on household income per capita (see Table 2 for descriptive statistics):

· To represent the domain of literacy, years of education is selected. The level of education is measured as the total number of years in school and varies between no schooling up to 18 years of education (reflecting postgraduate qualifications).

· With regard to the development of basic infrastructure, the study uses the number of rooms in the house per person (consequently, also a proxy for the quality of housing, i.e. more rooms per person increase the quality of housing).

· Objectively measured health. Here, the study sums up the number of diseases with which a person has previously been diagnosed. These diseases include asthma, high blood pressure, cancer, diabetes, heart problems, stroke, tuberculosis and any other diseases that are not mentioned in the list (for example HIV). To test the validity of this indicator we correlate it with the variable 'perceived health status of a person' and find that it is statistically significant and positively correlated (Spearman's correlation coefficient = 0.4).

Variables selected for the regression analyses

The selection of the independent variables included in the regression analyses is based on an extensive literature review (see Section 'Introduction'), as well as the availability of data. However, the reader is reminded that no previous studies have been done on the relationship between IIQoL and the independent variables of choice. Thus, the expected relationships discussed below are based on the results of quality of life - or subjective well-being - studies.

These variables, descriptive statistics presented in Table 3, are:

· Micro- and informal loans, the variable of interest: In order to derive said variable we consider loans from micro and informal moneylenders, such as Mashonisas3) and informal loans from friends and family. We exclude any formal loans, such as those from commercial banks. The survey asks whether a respondent has a loan, with a 'yes' or 'no' response option. If a respondent answer in the affirmative, we code it as 1 and 0 in the alternative. From Table 3, it can be seen that only 3.3% of all respondents (1238 out of 37 440) is classified as 'with' a loan. Of this 3.3% with M&ILs, the majority is classified as being poor (56%) and the dominant gender of the poor cohort is female (63%). As discussed in Section 'Introduction', there are those that find that M&ILs are successful in developing microenterprises and therefore increase economic (income) quality of life, but when it comes to increasing quality of life using non-income indicators, such as education and health, there is a clear point of contention.

· Geographical type: The classifications are urban built-up or rural areas (see Section '3.1. Data' for descriptive statistics). The expected relationship between the geographical type and IIQoL is inconclusive. Regarding rural areas, the respondents can either have a higher or lower IIQoL compared to their urban counterparts. This is because of the increased burden placed on infrastructure by an influx of destitute individuals into urban centres, which can leave urban dwellers' IIQoL worse off than their rural-dweller counterparts (Bhuiyan & Ivlevs 2017). Conversely, the lack of amenities in rural areas can leave these respondents' IIQoL worse off than those of the urban respondents (Alemu 2012).

· Race: South African inequality and even poverty can be attributed to racial discrimination and in particular to apartheid. This is seen as an important determinant of IIQoL (Van der Berg 2011). Here African is the reference, since it constitutes the largest demographic group, totalling nearly 87% of the entire population. Since South Africa is still struggling to rectify the inequality caused by apartheid, the expectation is that Africans have a lower IIQoL than most of the other ethnic groups. It should be noted that the Asian/Indian ethnicity cohort for the balanced panel is very small. One must therefore take care when interpreting results for this group as it might be biased, and the interpretations limited.

· Gender: Male (estimated at 5.1 million4 is the reference. Approximately 60% of the respondents are female (8.5 million). The expectation is that South African females, being the largest cohort, will have a higher level of IIQoL, on average, than their male counterparts. This is the general assumption in the subjective well-being and happiness literature (Becchetti & Conzo 2013; Kundu 2011).

· Age and age2: The average age of the sample is approximately 37 years. A U-shaped relationship is revealed in the subjective well-being literature between age and well-being with relatively high levels of well-being reported for young people, lower for the middle ages and subsequently higher again in their later years (Frijters & Beatton 2012).

· Trust: In previous research it is shown that higher levels of trust are positively related to individual and collective quality of life (Kuroki 2011). Interesting to note that approximately 67% of the sample believe it is unlikely that a neighbour will return a lost wallet.

· Relative income: This is derived from a question that asks a household to compare their income to that of other households in their neighbourhood. If a household classifies their income above average, a positive relationship to IIQoL is expected (Clark, Frijters & Shields 2008). Only 9% of the sample believe their income is higher than the average of their neighbours.

· Household expenditure per person: Here we expect to find a positive relationship to IIQoL (DeLeire & Kalil 2010).

· Employment (being employed is the reference): The positive effects of employment on quality of life are well documented and we expect a similar relationship regarding IIQoL (Winkelmann & Winkelmann 1998). In saying this, only 38% of the sample indicated being employed, on average.

· Safety: A positive relationship between an individual's feeling of safety, measured against the perceived frequency of theft in the community and IIQoL is expected (Cheng & Smyth 2015).

Results

The results section reports on: (1) the IIQoL index derived through PCA and (2) the estimation results.

Principal component analysis

Firstly, to construct our IIQoL index, we apply PCA to our selected non-income quality of life variables: years of education, rooms in house per person (proxy for quality of housing) and objectively measured health. We extract the first component, which explains 58% (eigenvalue = 1.60) of the variance, deemed acceptable for the construction of a composite index (see Naudé, Krugell & Rossouw 2009; Greyling & Tregenna 2016). Secondly, we regress the non-income quality of life index on the natural log of household income per capita to derive the residual. The residual is what we identify as objectively measured IIQoL.

To prove the independence of our IIQoL measure from income, we correlate it to both objective and subjective measures of monetary well-being: expenditure per person and self-reported relative income. We find the correlation coefficient significant, though at very low levels of r = 0.10 and r = 0.07. At these low levels of correlation, we assume the independence of the IIQoL index and accept it as a good measure of IIQoL.

Figure 1 expresses the IIQoL of different groups as a percentage of the maximum IIQoL in South Africa. We find the mean IIQoL of the average citizen to be relatively low at 53.3%. This is not surprising, seeing that South Africa is a developing country with high levels of inequality and poverty. What should be noted is that within each of the samples represented - all South Africans, poor females, poor males and poor females in rural areas - those 'with' a M&IL have between 2% and 3% lower levels of IIQoL than those 'without'. The sub-samples 'poor females' and 'poor females residing in rural areas', experience the lowest levels of IIQoL relative to the rest of the country.

Comparing the poor female and male sub-samples, males 'with' and 'without' M&ILs enjoy higher levels of IIQoL than their female counterparts. In general, the IIQoL for males is higher than for females and, the IIQoL for poor males 'without' these kinds of loans is even higher than the IIQoL as determined for the whole sample.

These initial results suggest possible negative effects of participating in the M&IL market on those it was supposedly created to help, and it also alludes to the existence of a gender gap. These possible relationships as well as the associated implications will be further investigated in Section 'Results (dependent variable = IIQoL)' as other factors might also be at play.

Results (dependent variable = income-independent quality of life)

We find the estimated models for the sample as a whole and the sub-samples statistically significant (p = 0.00). To interpret the results, we use the FE estimations, although in the event of time invariant variables we also refer to the POLS results (see Table 4).

Table 4 reveals an interesting result, namely that M&ILs are statistically significant and negatively related to IIQoL for all sub-samples, except for 'poor males' in which the relationship is negative, but not significant. Therefore, we assume that South Africans in general 'with' M&IL have a lower IIQoL than those 'without'. The not significant relationship to the 'poor male' sub-sample implies that M&ILs, controlling for all other factors, are not related to their IIQoL. Based on previous research (Karlan et al. 2016), it seems that poor men involved in the M&IL market use the funds to provide for current consumption expenditure needs, which is not related to non-income quality of life, explaining the not significant result. In contrast, as females are mostly the primary caretakers of children, they often spend their M&ILs in sectors related to the non-income quality of life of their children, such as education, housing and health.

To test the robustness of this negative relationship between M&ILs and IIQoL, we test it using the individual indicators of quality of life. However, these single indicators of education, health and housing, suffer from the critique of being income dependent and unidimensional (as discussed in Sections 'Introduction' and 'Methodology'), contrary to our IIQoL index (OECD 2008; Saltelli et al. 2007). Notwithstanding this, the results in Appendix 1 (Table 1-A1), are similar to those reported in Table 4, in that these individual indicators of quality of life are statistically significant and negatively related to M&ILs.

The estimation results pertaining to the whole sample indicate both a gender and geographical inequality when it comes to IIQoL. Male respondents are deemed better off than females, which confirms the initial findings in Section 'Principal component analysis'. Turning to the geographical area, as expected, the IIQoL of respondents residing in rural areas is lower than that of their urban counterparts. This is in line with the literature which suggests that females, and more specifically females residing in rural areas, are more marginalised than other groups (Bhorat et al. 2006; Kirsten 2011). This finding emphasises the importance of addressing the second and third research questions (see Table 4, columns 3 - 5).

The time variable for waves 2 to 4 is significant and negative for the whole sample indicating that the IIQoL decreased from wave 2 to wave 4. The reasons for the decrease in IIQoL, from wave 2 to wave 4, are associated with health (as time goes by it is more likely that a person was exposed to more health-related problems) and factors related to housing, such as service delivery. However, the wave variable is not significant for the poor sub-samples, except for wave 2 for the 'poor female' respondents. The poor might be less affected by the lapse in time as their health, type of housing and service delivery could have been less affected or not affected at all. One should remember that respondents in rural areas report to be healthier than those in urban areas. Furthermore, the housing of the poor is basic with limited services; thus the deterioration thereof is much less likely than for their richer counterparts.

In terms of race, the POLS results show that Coloureds have lower levels of IIQoL, whereas White South Africans experience higher levels, relative to Africans. This is indicative of the persistent inequality in access to health, housing and educational services, attributed to the racial discrimination of the old apartheid regime (Van der Berg 2011).

Age performed as expected in explaining IIQoL for the whole sample as well as the sub-samples 'poor females' and 'poor females residing in rural areas'. This statistically significant and positive quadratic (U-shaped) relationship is not surprising, since the young generally have higher levels of health while the older respondents have better housing and more assets and access to service delivery than those in their middle ages. Therefore, it mirrors the findings from the subjective well-being literature (Frijters & Beatton 2012). In saying this, the opposite holds true if only the sub-sample 'poor males' is considered, with both the young and old experiencing lower levels of IIQoL than those in their middle ages. This might be since many of the middle-aged men are employed and residing in urban areas, which is positively correlated to IIQoL relative to the young and the old, who might not be employed and likely residing in rural areas, which is commonly accepted to be related to lowers levels of IIQoL.

Trust, which is an important determinant of IIQoL, is only positive and significant for the sub-sample 'poor females in rural areas'. This is not surprising since women staying in rural areas are seen as having better social capital in the form of stronger bonds, that is, links to people based on a sense of common identity ('people like us') (Keeley 2007). This trust also forms the basis of their IIQoL as they depend on one another for support (child caring, toiling of lands) and survival (sharing of basic necessities) (Mutopo 2014; Vercillo 2016).

Employment is statistically significant and, against expectations, negative for the whole sample as well as for the 'poor female' sub-sample. South Africa suffers from very high levels of unemployment and very limited employment opportunities. In the whole sample we find 68% of the respondents are unemployed and among 'poor females' this percentage is higher at 84%. The fact that being employed is negatively related to IIQoL contradicts theory, although in the South African context, where the social welfare system is very well developed, it might be plausible.

More than 67% of the whole sample and 83% of the 'poor female' sub-sample reported to be recipients of some kind of social welfare grant. These grants are mostly dependent on a means test. Therefore, if a person is employed, they might earn more than the means test and lose their right to the grant. Those that are employed earn an average wage of R3560 per month and 'poor females' earn R1070. If household size is considered, the mean wage income per household for the whole sample is R1170 and for 'poor female households' it is R445 per month. Thus, their income is very low and travel costs to their place of work present a real cost associated with working, which could sometimes be more than half of their earnings.

Now, if individuals make use of the welfare system, we find the average household income per month per person to be R283 and for 'poor females' lower at R220. As the mean income earned is relatively low, the opportunity cost to work is high, and therefore respondents might prefer to be unemployed and receive a grant. They then have more time to spend on improving their IIQoL. This situation reflects the unintended disincentive of a social welfare system to discourage productive employment (Blau & Robins 1986; Camissa 1998; Keane 1995; Weaver, Shapiro & Jacobs 1995). This dependency on government grants is not sustainable or conducive to development, especially if the unemployment rate is already high.

Contrary to the above results, employment is not statistically significant in either the 'poor male' or the 'poor female residing in rural areas' sub-samples. This implies that being employed is not related to the IIQoL of 'poor males' and 'poor females residing in rural areas'. As already mentioned, females are the primary caretakers of relatively large households, thereby shouldering most of the responsibility regarding children's education and health care. This means that a large portion of their time is spent on household and childcare duties. At the same time, these unskilled females, a common phenomenon in rural areas, have very few real employment opportunities. This means that it is unlikely that they will be employed and therefore employment is not related to their IIQoL. As for the 'poor male' sub-sample, there are relatively few job opportunities for unskilled labour and they do not have the main responsibility of caring for children. Therefore, they most likely also earn some type of government grant, which makes them indifferent to being employed or unemployed.

Safety, measured as the likelihood of being a victim of a crime, rated on a scale from likely to very unlikely, is significant and positive for all samples. This indicates the importance of safety to the IIQoL of all South Africans, who are being impacted by crime on a daily basis both in the form of property (housing) and bodily harm (health).

Lastly, the results pertaining to the 'poor female' and 'poor male' sub-samples clearly contradict general populace5 in the subjective well-being literature, which shows that females often have higher levels of well-being than males. Since 2008, the South African Social Attitude Survey (SASAS) shows that females indeed do report lower levels of quality of life than males in South Africa (HSRC 2010). Kirsten (2011) points out that 'African females living in rural areas' is the most deprived demographic group in South Africa and that, even after 20 years of redistribution policies, their level of quality of life is still unacceptable. May and Norton (2012) argue that African women, in general, do not have control over their own income which excludes them from the decision-making process and the threat of violence remains a major form of control by men over women. This indeed, corroborates our findings and highlights the plight of this gender in terms of:

· greater employment discrimination (71% are unemployed compared to 29% of males)

· wage gap (Hinks 2010)

· abuse (Posel & Rogan 2012)

· higher levels of responsibility towards dependents.

Work done by Teixeira and Chambers (1995) summarises it nicely:

If there is a man in the household who is working, it is our tradition that he will bring home the money and give it to his wife to spend. If there is not enough in the month, she will have to run around borrowing or making a plan to ensure that her children's needs are met. (p. 43)

Conclusion

In this article, we investigate the relationship between micro- and informal loans (M&IL) and income-independent quality of life (IIQoL) in South Africa. We derive IIQoL through constructing an objectively measured index, which is independent of income and therefore satisfies all previous critique against non-income indicators of quality of life. This index allows us to more directly address the outcomes of policy for the development of human welfare, in as much as the outcome of policy should be measured by the 'the ends' rather than 'the means'. This is the first study, to the knowledge of the authors, for which an objective composite income-independent quality of life index, applied to a developing country at a micro level, was constructed.

In our analysis we specifically focus on 'poor females' and 'poor females in rural areas', as these are the most marginalised groups and their empowerment is a critical social objective aligned to that of international agencies and South Africa's NDP. M&IL initiatives are directed at the marginalised groups in the hope of increasing their quality of life. In order to gain a better understanding of gender and M&ILs, we also compare the outcomes of regression analyses based on a sub-sample of 'poor males' and 'poor females'.

In general, considering the whole sample, we find a statistically significant and negative relationship between M&ILs and IIQoL. This implies that many who had access to these kinds of loans in South Africa, irrelevant of being poor or non-poor, failed to translate monetary gains into higher levels of IIQoL over time. We find that females in general have a lower IIQoL than males, which goes against the general populace theory. The female respondents residing in rural areas, controlling for other factors, also achieve lower levels of IIQoL than their urban counterparts.

With regard to the focus of our study, the sub-samples 'poor female' and 'poor females residing in rural areas', we find the same significant and negative relationship between M&ILs and IIQoL. Notably, nearly double the number of 'poor females' compared to 'poor males' partake in these loans. 'Poor female' respondents with a M&IL are worse off than their fellow poor females who do not partake in this market. Interestingly, in the 'poor male' sub-sample the relationship with M&ILs, although negative, is not significant. These results allow us to compile a profile for the least desired demographic group in terms of IIQoL. They are female, of African descent, are classified as being poor, are more likely to be unemployed, have a M&IL and are the primary caregivers responsible for the non-income quality of life of children. This leads us to conclude that M&ILs failed in raising the quality of life for South Africa's most marginalised groups.

Policymakers who strive to increase the quality of life of the marginalised through allowing micro and informal lenders to operate within specific targeted areas, should also provide training, workshops on awareness creation, support programmes, proper debt counselling and government policy to enhance women empowerment, instead of merely relying on the provision of credit initiatives. These support programmes should focus on empowering individuals to allow them better accountability for the choices they make.

Finally, another area that deserves greater consideration from the South African government is regulation. In the absence of a well-functioning regulatory framework within which micro and informal lenders can operate, it will be harder to run flexible savings accounts and effectively provide intermediate finances. This lack of proper regulation could negate every potential to improve the conditions of recipients and ultimately the negative impacts of this industry will outweigh any positives.

Acknowledgements

Competing interests

The authors have declared that no competing interest exist.

Author's contributions

Both authors contributed equally to the manuscript.

Funding

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

Data availability statement

Data sharing is not applicable to this article as no new data were created or analysed in this study.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors.

References

Afroze, R., 2012, 'An early assessment of the BRAC Uganda microfinance programme: Estimate the changes of living standard', OIDA International Journal of Sustainable Development 5(8), 121-130. [ Links ]

Alemu, Z., 2012, 'Livelihood strategies in rural South Africa: Implications for rural development', in 2012 Conference, 18-24 August 2012, Foz do Iguacu, Brazil 125411, International Association of Agricultural Economists. [ Links ]

Banerjee, A., Duflo, E., Glennerster, R. & Kinnan, C., 2009, 'The miracle of microfinance? Evidence from a randomized evaluation', Working Paper 13-09. Massachusetts Institute of Technology, Cambridge, MA. [ Links ]

Banerjee, A., Karlan, D. & Zinman, J., 2015, 'Six randomized evaluations of microcredit: Introduction and further steps', American Economic Journal: Applied Economics 7(1), 1-21. https://doi.org/10.1257/app.20140287 [ Links ]

Bateman, M., 2015, 'South Africa's post-apartheid microcredit experiment: Moving from state-enforced to market-enforced exploitation', Forum for Social Economics 68(1), 69-97. https://doi.org/10.1080/07360932.2015.1056202 [ Links ]

Becchetti, L. & Conzo, P., 2013, 'Credit access and life satisfaction: Evaluating the nonmonetary effects of micro finance', Applied Economics 45, 1201-1217. https://doi.org/10.1080/00036846.2011.624086 [ Links ]

Bhorat, H., Naidoo, P. & Van der Westhuizen, C., 2006, 'Shifts in non-income welfare in South Africa: 1993-2004', Development Policy Research Unit Working Paper No. 06/108, University of Cape Town. [ Links ]

Bhuiyan, M.F. & Ivlevs, A., 2017, 'Micro-entrepreneurship and subjective well-being: Evidence from Bangladesh', viewed 05 December 2018, from https://www.researchgate.net/publication/321145791_Micro-entrepreneurship_and_subjective_well-being_Evidence_from_rural_Bangladesh. [ Links ]

Blau, D.M. & Robins, P.K., 1986, 'Labor supply response to welfare programs: A dynamic analysis', Journal of Labor Economics 4(1), 82-104. https://doi.org/10.1086/298095 [ Links ]

Cameron, A.C. & Trivedi, P.K., 2010, Microeconometrics using Stata, Stata Press, College Station, TX. [ Links ]

Camissa, A.M., 1998, From rhetoric to reform? Welfare politics in American politics, Routledge, New York. [ Links ]

Chan, S.H. & Ghani, M.A., 2011, 'The impact of microloans in vulnerable remote areas: Evidence from Malaysia', Asia Pacific Business Review 17(1), 45-66. https://doi.org/10.1080/13602380903495621 [ Links ]

Cheng, Z. & Smyth, R., 2015, 'Crime victimization, neighborhood safety and happiness in China', Economic Modelling 51, 424-435. https://doi.org/10.1016/j.econmod.2015.08.027 [ Links ]

Clark, A., Frijters, P. & Shields, M.A., 2008, 'Relative income, happiness, and utility: An explanation for the Easterlin Paradox and other puzzles', Journal of Economic Literature 46(1), 95-144. https://doi.org/10.1257/jel.46.1.95 [ Links ]

DeLeire, T. & Kalil, A., 2010, 'Does consumption buy happiness? Evidence from the United States', International Review of Economics 57(2), 163-176. https://doi.org/10.1007/s12232-010-0093-6 [ Links ]

Drèze, J. & Sen, A., 1991, Hunger and public action, Oxford University Press, Oxford. https://doi.org/10.1093/0198283652.001.0001 [ Links ]

Duggan, C., Immink, R., Kearney, P. & Shea, C.O., 2000, Enterprise creation by the unemployed in Ireland: The role of microfinance, International Labour Office, London. [ Links ]

Dupas, P. & Robertson, J., 2013, 'Savings constraints and microenterprise development: Evidence from a field experiment in Kenya', American Economic Journal: Applied Economics 5(1), 163-192. https://doi.org/10.1257/app.5.1.163 [ Links ]

Duvendack, M., 2010, 'Smoke and mirrors: Evidence from microfinance impact from evaluation of SEWA Bank in India', The School of International Development Working Paper No. 24, University of East Anglia, Norwich. [ Links ]

Duvendack, M., Palmer-Jones, R., Copestake, J.G., Hooper, L., Loke, Y. & Rao, N., 2011, What is the evidence of the impact of microfinance on the well-being of poor people? EPPI-Centre, Social Science Research Unit, Institute of Education, University of London, London. [ Links ]

Frijters, P. & Beatton, T., 2012, 'The mystery of the U-shaped relationship between happiness and age', Journal of Economic Behavior & Organization 82(2-3), 525-542. https://doi.org/10.1016/j.jebo.2012.03.008 [ Links ]

Greyling, T. & Tregenna, F., 2016, 'Construction and analysis of a composite quality of life index for a region of South Africa', Social Indicators Research 131(3), 887-930. https://doi.org/10.1007/s11205-016-1294-5 [ Links ]

Hinks, T., 2010, 'Gender wage differentials and discrimination in the New South Africa', Applied Economics 34(16), 2043-2052. https://doi.org/10.1080/00036840210124991 [ Links ]

Human Sciences and Research Council (HSRC), 2010, 'How South Africans rate their quality of life', HSRC Review 8(3), 2-4, viewed 06 March 2018, from http://www.hsrc.ac.za/uploads/pages/1278/HSRCReviewwwwproofsep2010.pdf. [ Links ]

Kaboski, J. & Townsend, R., 2005, 'Policies and impacts: An analysis of village-level microfinance institutions', Journal of European Economic Association 3(1), 1-50. https://doi.org/10.1162/1542476053295331 [ Links ]

Karlan, D., Osman, A. & Zinman, J., 2016, 'Following the money: Methods for identifying consumption and investment responses to a liquidity shock', Journal of Development Economics 121, 11-23. https://doi.org/10.1016/j.jdeveco.2015.10.009 [ Links ]

Karlan, D. & Zinman, J., 2010, 'Expanding credit access: Using randomized supply decisions to estimate the impacts', The Review of Financial Studies 23(1), 433-464. https://doi.org/10.1093/rfs/hhp092 [ Links ]

Keane, M.P., 1995, 'A new idea for welfare reform. Federal Reserve Bank of Minneapolis', Quarterly Review 19(2), 2-28. [ Links ]

Keeley, B., 2007, Insights human capital: How what you know shapes your life, OECD, Paris. [ Links ]

Kirsten, M.A., 2011, 'Improving the well-being of the poor through microfinance: Evidence from the Small Enterprise Foundation in South Africa', Dissertation presented for the degree of Doctor of Philosophy in the Faculty of Economic and Management Science at the University of Stellenbosch, viewed 17 November 2017, from http://scholar.sun.ac.za. [ Links ]

Kundu, A., 2011, 'Can microcredit and job under NREGS jointly bring more happiness to villagers?', The IUP Journal of Governance and Public Policy 6(1), 7-23. [ Links ]

Kuroki, M., 2011, 'Does social trust increase individual happiness in Japan?', The Japanese Economic Review 62(4), 444-459. https://doi.org/10.1111/j.1468-5876.2011.00533.x [ Links ]

Land, K.C., Michalos, A.C. & Sirgy, J., 2012, Handbook of social indicators and quality of life Research, Springer, Dordrecht. [ Links ]

Lutafali, S. & Khoja, F., 2002, Multidimensional poverty and expanding role of Microfinance Institutions, FMFB First Micro Finance Bank (AKDN) and Grameen Bank, viewed 15 August 2018, from http://saicon2011.ciitlahore.edu.pk/Economics/Dr.%20shabnam%20Lutafali.pdf. [ Links ]

May, J. & Norton, D., 2012, 'A difficult life: The perceptions and experience of poverty in South Africa', in V. Møller (eds.), Quality of life in South Africa, Springer Science and Business Media, Berlin. [ Links ]

McGillivray, M., 1991, 'The human development index: Yet another redundant composite development indicator?', World Development 19, 1461-1468. https://doi.org/10.1016/0305-750X(91)90088-Y [ Links ]

McGillivray, M., 2005, 'Measuring non-economic well-being achievement', Review of Income and Wealth 51(2), 337-364. [ Links ]

Mutopo, P., 2014, 'Belonging and rural livelihoods: Women's access to land and non-permanent mobility at Merrivale farm, Mwenezi district, Zimbabwe', Erdkunde 68(3), 197-207. https://doi.org/10.3112/erdkunde.2014.03.04 [ Links ]

National Income Dynamics Study (NIDS), 2016a, Waves 1 - 4 [dataset]. Southern Africa Labour and Development Research Unit, Southern Africa Labour and Development Research Unit (producer), Cape Town, DataFirst (distributor), Cape Town, Department of Planning Monitoring and Evaluation (commissioner), Pretoria. [ Links ]

National Income Dynamics Study (NIDS), 2016b, NIDS Panel User Manual, eds. M. Chinhema, T. Brophy, M. Brown, M. Leibbrandt, C. Mlatsheni and I. Woolard, viewed 20 March 2018, from http://www.nids.uct.ac.za/images/documents/wave4/20170227-NIDS-W4PanelUserManual-V1.1.pdf. [ Links ]

National Planning Commission, 2012, National Development Plan, viewed 16 September 2017, from http://www.poa.gov.za/news/Documents/NPC%20National%20Development%20Plan%20Vision%202030%20-lo-res.pdf. [ Links ]

National Treasury, 2017, Budget Review 2017, Republic of South Africa, viewed 23 November 2017, from http://www.treasury.gov.za. [ Links ]

Naudé, W.A., Krugell, W.F. & Rossouw, S., 2009, 'The non-monetary quality of city life in South Africa', Habitat International 33(4), 319-327. https://doi.org/10.1016/j.habitatint.2008.08.004 [ Links ]

OECD, 2008, Handbook on constructing composite indicators. Methodology and user guide, viewed 06 March 2018, from https://www.oecd.org/sdd/42495745.pdf. [ Links ]

Orso, C.E., 2011, 'Microcredit and poverty. An overview of the principal statistical methods used to measure the programme net impacts', Working Paper No. 180, February, POLIS, Universita' del Piemonte Orientale "Amedeo Avogadro" Alessandria. [ Links ]

Posel, D. & Rogan, M., 2012, 'Gendered trends in poverty in the post-apartheid period, 1997-2006', Development Southern Africa 29(1), 97-113. https://doi.org/10.1080/0376835X.2012.645645 [ Links ]

Proctor, J. & Anand, P., 2017, 'Is credit associated with a higher quality of life? A capability approach', Progress in Development Studies 17(4), 322-346. https://doi.org/10.1177/1464993417716359 [ Links ]

Pronyk, P. M., Harpham, T., Busza, J., Phetla, G., Morison, L. A., Hargreaves, J. R. et al., 2008, 'Can social capital be intentionally generated? A randomized trial from rural South Africa', Social Science & Medicine 67(10), 1559-1570. https://doi.org/10.1016/j.socscimed.2008.07.022 [ Links ]

Saltelli, A., Tarantola S., Campolongo F. & Ratto M., 2007, Sensitivity Analysis in practice, a guide to assessing scientific models, John Wiley & Sons, New York, viewed 21 November 2018, from http://www.jrc.ec.europa.eu/uasa/prj-sa-soft.asp. [ Links ]

Simanowitz, A., 2010, Progress against Terms of Reference report to Board of Directors, October, Unpublished report, Small Enterprise Foundation (SEF), Tzaneen. [ Links ]

South African Reserve Bank (SARB), 2019, Quarterly Bulletin, March 2019, SARB Economic Research and Statistics Department, Bulletin No. 291, SARB, Pretoria. [ Links ]

Stiglitz, J.E., Sen, A. & Fitoussi, J., 2010, Report by the commission on the measurement of economic performance and social progress, viewed 14 November 2017, from https://www.economie.gouv.fr/files/finances/presse/dossiers_de_presse/090914mesure_perf_eco_progres_social/synthese_ang.pdf. [ Links ]

Swain, R.B. & Wallentin, F.Y., 2009, 'Does microfinance empower women? Evidence from self-help groups in India', International Review of Applied Economics 23(5), 541-556. https://doi.org/10.1080/02692170903007540 [ Links ]

Teixeira, L. & Chambers, F., 1995, Child Support in Small Towns in the Eastern Cape, Black Sash Advice Office, Port Elizabeth, South Africa. [ Links ]

Wahab, H.A., Bunyau, W. & Islam, M.R., 2018, 'Microcredit for rural poverty alleviation and social well-being: A study of Sabah, Malaysia', Asian Social Work and Policy Review 12, 4-16. https://doi.org/10.1111/aswp.12133 [ Links ]

United Nations, 1975, Towards a system of social and demographic statistics, United Nations Publication, Series F, No. 18, UN, New York. [ Links ]

United Nations, 1989, Handbook on social indicators, United Nations Publication, Series F, No. 49, UN, NewYork. [ Links ]

Van der Berg, S., 2011, 'Current poverty and income distribution in the context of South African history', Economic History of Developing Regions 26(1), 120-140. https://doi.org/10.1080/20780389.2011.583018 [ Links ]

Van Rooyen, C., Stewart, R. & De Wet, T., 2012, 'The impact of microfinance in Sub-Saharan Africa: A systematic review of the evidence', World Development 40(11), 2249-2262. https://doi.org/10.1016/j.worlddev.2012.03.012 [ Links ]

Veenhoven, R., 2004, 'Subjective measures of well-being', WIDER discussion paper no. 2004/07, United Nations University, Helsinki. [ Links ]

Vercillo, S., 2016, 'Sustainable livelihoods and rural development', Canadian Journal of African Studies/Revue Canadienne des Études Africaines 50(2), 326-328. https://doi.org/10.1080/00083968.2015.1106713 [ Links ]

Weaver, R.K., Shapiro, R.Y. & Jacobs, L.R., 1995, 'Welfare', Public Opinion Quarterly 59, 606-627. https://doi.org/10.1086/269496 [ Links ]

Winkelmann, L. & Winkelmann, R., 1998, 'Why are the unemployed so unhappy? Evidence from panel data', Economica 65(257), 1-15. https://doi.org/10.1111/1468-0335.00111 [ Links ]

Correspondence:

Correspondence:

Stephanié Rossouw

stephanie.rossouw@aut.ac.nz

Received: 18 Dec. 2018

Accepted: 25 Apr. 2019

Published: 27 June 2019

1. To see the formal definition of South Africa's upper poverty line, please visit Statistics South Africa at www.statssa.gov.za/publications/Report-03-10-06/Report-03-10-06March2014.pdf.

2. Geographical type classifications are:

· Urban: a continuously built-up area that is established through township establishment such as cities, towns, 'townships', small towns, and hamlets.

· Rural: consists of traditional communities (communally owned land under the jurisdiction of traditional leaders) as well as farm lands (allocated and used for commercial farming, including the structures and infrastructure on it) (NIDS 2016b).

3. African term for a person or company that provides loans to consumers.

4. Derived using design weights.

5. Subjective well-being literature indicate that females have higher levels of quality of life than males (Kundu 2011, Becchetti & Conzo 2013).

Appendix 1