Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Economic and Management Sciences

versão On-line ISSN 2222-3436

versão impressa ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.21 no.1 Pretoria 2018

http://dx.doi.org/10.4102/sajems.v21i1.1962

ORIGINAL RESEARCH

High inventory levels: The raison d'être of township retailers

J. Orpha Cilliers

Department of Entrepreneurship, Supply Chain, Tourism, Transport and Logistics Management, College of Economic and Management Sciences, University of South Africa, South Africa

ABSTRACT

BACKGROUND: This study investigates the cardinal role of optimal inventory decision-making in the performance of small formal retailers in Soweto, constituting a projected, lucrative retail environment.

AIM: The research question was how Soweto small retailers make inventory decisions to promote their income growth and age of the business. For this study, a descriptive research design was followed.

SETTING: The universe of the study comprised all the formal small, medium and microenterprises located in Soweto township.

METHODS: Using probability sampling, the sample size was set at 650 businesses. Of the 650 completed questionnaires, the responses of 297 respondents operating in the retail grocery and retail general stores sectors were analysed quantitatively using exploratory factor analyses, cluster analysis and cross-tabulation.

RESULTS: This study showed that being more inclined to proactively maintain a high level of inventory could result in positive business performance in terms of both growth in income and age. Younger businesses (less than 5 years) could grow if they decide to stock up on sale items, purchase more items for sale, provide for customers' fluctuating demands and buy more stock to save on transport costs. Purchasing less or the exact amount of stock as what can be sold within a month could be detrimental to the performance of general and grocery retailers in Soweto.

CONCLUSIONS: The results also show that if retailers want to grow and exist for 5 years and more, they should consider both proactively maintaining a high level of inventory and doing so with ease. In this study, the older (5 years and older) business groups were mostly owned by older people, who showed a tendency to establish themselves in stand-alone shops or smaller shopping centres. Older businesses also tend to buy stock daily or weekly, or when stock is low. These older businesses without income growth were mostly family businesses who displayed contentment with the status quo of business performance and seemed to lack entrepreneurial skills.

Introduction

The retail sector is critical in a community's economic and social welfare, by providing consumers with choices and services (Ligthelm 2008:37). In South Africa, population growth forms the key driver behind retail growth (Prinsloo 2014:6). Retail intermediaries have the vital role of being the final businesses in a supply chain and linking manufacturers to consumers, while performing various value-adding activities which are mostly driven by customers' need for convenience (Prinsloo 2014:1). Value-adding influences the market offering and thus the inventory decisions made by retailers. For example, retailers provide consumers an assortment (in terms of brands, designs, colours, prices) of products and services to choose from, at one location. They also perform bulk-breaking by satisfying consumers' need for goods in smaller quantities. Another value-adding activity relates to on-shelf availability, which allows consumers to purchase products when the need arises, thus allowing households to keep small inventories at home. Finally, retailers add value by providing services to customers that make the buying decision easier and more informed, such as credit, product information and display of merchandise (Ligthelm 2008:38; Prinsloo 2014:1).

According to Hatten (2016:177), small retailers compete on operational excellence (best or lowest price), product leadership (best product, high quality) and customer intimacy (long-term relationship through superior service). Allen (2012:330) confirms that successful retailers realise that the ultimate goal of supply chain management is to be customer driven, that is, to provide the exact level of service that the customer expects at a minimal cost and understand what is important to customers, what level of service they expect and what performance level they are willing to pay a premium for. Effective supply chain management can potentially lower the costs of inventory, transport, warehousing and packaging, while increasing customer satisfaction (Longenecker et al. 2014:414).

Unfortunately, worldwide, most new entrants to retailing have no experience of retail selling and learn through experience and replicating what others do (Honig, Karlsson & Hägg 2014:97; Yang 2016:2; Yordanov 2015:50). Lebusa (2013:76), Choto, Tengeh and Iwu (2014:93-94), as well as Malebana and Swanepoel (2015:109) note that South Africa is faced with a need for more skilled entrepreneurs to run these businesses efficiently. New entrants thus need the mentorship of older, established business people (Matabooe, Venter & Rootman 2016:2). Kesavan and Kushwaha (2014:2118) found that retailers in general benchmark their inventory performance against other organisations in the same industry or against their competitors to guide decisions; thus the need to learn from and emulate counterparts is confirmed. With regard to opportunities to learn from competitors, Badenhorst-Weiss and Cilliers (2014:13) found that older, growing Sowetan small businesses tended more than younger, stagnating businesses to perform regular competitor analysis. This study attempts to identify what the owners of younger Sowetan businesses can learn from their older, more established counterparts with specific reference to inventory decision-making. The research question thus emerging is how small retailers in Soweto make inventory decisions to promote income growth and become older (mature or established). The subsequent secondary objectives are (1) to identify possible profiles among Soweto grocery and general small retailers with regard to inventory decision-making, (2) to determine the relationships between cluster membership and demographic (education and owner age) and business variables (location, frequency of inventory purchases, future perspective, and reasons for starting) and (3) to provide retailers in Soweto showing negative (or no) growth with guidelines on inventory decision-making based on the inventory decision patterns displayed by older counterparts with income growth.

Background

In this section a short overview of the history, opportunities and challenges of the township retail environment is provided to illustrate the circumstances behind inventory decision-making by township retailers in their quest for survival. In the pre-1994 South African retail landscape, choices in townships were limited and dominating small, often informal, convenience businesses offered basic household necessities to relatively low-income earners. Lebusa (2013:76) explains that most small retail outlets (including formal traders) were historically established out of desperation, rather than by identifying and exploiting a gap in the market; thus, such business owners lacked the business skills required when the country moved to a new promising dispensation. Lebusa (2013:77) describes a survivalist mentality that originated (and still drives business decision-making) during those years, where a lack of focus on return on investment stemmed from a lack of business skills training - by not being truly entrepreneurial, those businesses' prospects for growth were diminished.

At that stage only a small portion of consumer spending was done in townships. This worldwide phenomenon, where residents prefer to shop elsewhere is called 'outshopping' (see Papadopoulos 1980:41). Prior to the development of local retail centres, township dwellers travelled long distances and spent a substantial part of their disposable income on transport costs, causing a leak of income from townships (Gauteng Quarterly Bulletin 2012:26). The lack of efficient retail infrastructure in townships thus had a far more negative impact on poorer households than more affluent ones (Ligthelm 2008:37). The progression of many South African consumers into middle-income groups postapartheid changed the dynamics of township shopping patterns, leading to substantial growth in retail infrastructure and facilities in townships, and expanding retail choices offered by formal businesses (Ligthelm 2008:39, 51). Lebusa (2013:76) and Beneke (2014:22) report that post 1994, the majority of inhabitants refused to leave the townships, which resulted in substantial market potential in these areas for consumer goods and services. Consequently, entry into this previously untapped emerging market of 'inshoppers' not only proved lucrative to national retailers, especially supermarkets (Ligthelm 2008:37, 41), but also positively impacted consumers by cutting down on travel costs and time (Gauteng Quarterly Bulletin 2012:26). With the entrance of bigger retail stores, many owners of small retail businesses lost market share, struggling to adapt, compete and survive due to lack of business skills (Lebusa 2013:76; Ligthelm 2008:52). Township customers who used to support small grocery retail shops due to convenience and smaller quantities being offered started to support the supermarkets and malls, which offered more variety and lower prices based on increased affluence and higher mobility (Strydom 2015:467). At that stage survival for township small businesses seemed to lie in changing the small business model towards effective customer service, with a small dedicated assortment of merchandise, satisfaction of emergency needs, selling in small units and extension of credit facilities (Ligthelm 2008:52).

When assessing retail growth trends and township consumer preferences (for the period relevant to this study), growth reports on the South African retail performance for the period 2013/2104 showed that retailers experienced lower growth than in 2012 (Stanlib 2013), which was attributed to slowing consumer income, lack of job growth and eroding consumer spending power. StatsSA (2015) confirmed that retail growth declined to 4.5% in 2012, 2.5% in 2013 and 2.4% in 2014. Beneke (2014:21) and Prinsloo (2014:6) state that since the typical township resident can be categorised in the lower end of the Living Standards Measure (LSM 1-5), this vast population forms a viable market for fast-moving retail consumer goods and township shopping centres. Prinsloo (2014:2) notes that despite the increased number of convenience stores in townships over the past decade, major gaps exist for small centres (up to 3000 m) within walking distance from large residential communities, since larger community-type centres tend to focus on taxi ranks and pedestrian areas. Prinsloo (2014:7) further foresees shopping centre development accelerating, especially in bigger, trendsetting townships. However, the resultant strong commitment of grocery retailers to be better represented will require small, independent formal retailers to become more competitive. According to Gauteng's Provincial Treasury (Gauteng Quarterly Bulletin 2012:34-35), growth and survival in retailing depends, among others, on balancing the challenges and opportunities posed by lower sales retail figures due to rising food prices, major retail skills shortage, consumers' increased demand for convenience, and potential growth in the food industry. Beneke (2014:21) describes the typical township retailer as being small, underequipped with a point-of-sale system and refrigeration facilities, carrying low levels of stock and, most importantly, often being geographically dispersed. Such geographic dispersion makes it increasingly challenging and expensive for suppliers to deliver, which in turn leads to higher prices, lower customer satisfaction, limited variety and low stock levels (Beneke 2014:21). Not being able to deliver on convenience will inevitably cause township retailers to lose their grip on competitiveness (see also Narayan & Chandra 2015:22 who researched Indian food and grocery retailers). Beneke (2014:22) reports that 75% of township residents continue to buy from spaza shops on a daily basis, due to their convenience and proximity, despite having access to general dealers, situated in both business and residential areas, which carry a wider range of products and encourage self-service.

In summary, the development of retail centres, population growth, the viability of the consumer goods market, the need for convenience, the entrance of supermarket chains, the increased costs of distributing products to widespread retailers and the resultant low levels of stock have seen spaza shops evolved into being the main retailers in townships due to their convenience and location. This has put increased pressure for survival on formal independent grocery and general dealers, and coupled with their reported lack of skills their continued survival is in doubt. From the above, the reason for focusing on formal small, medium and microenterprises (SMMEs) is evident, which is confirmed by the findings from previous studies in Soweto by Ligthelm (2008, 2009) stating that since survivalist businesses lack true entrepreneurialism and do not contribute to wealth creation, research should rather focus on formal, independent businesses. Furthermore, the focus on formal SMMEs in this study also supports the aim of the 2013 SME Growth Index, namely to understand the driving forces behind the formal sector as a more transformative contributor to wealth creation, economic growth and innovation than informal survivalist businesses (SBP 2013:1). The aim here is to determine what inventory-related decisions could contribute to the survival of formal township grocery and general small retailers.

Literature review: Inventory-related decisions made by small retailers

According to literature, small retailers base their decisions about the level and type of inventory items to keep not only on balancing costs and service delivery, but also on consumers' preference (in terms of convenience shopping, the different elements of the product offering, and on-demand availability of items). The discussion below confirms the interrelationship between these variables.

Convenience

Having inventory items available conveniently is influenced by complex location decisions. A key location factor for retail businesses is the point of maximal demand for products and services, which is described by Sevtsuk (2014:375) as a location in close proximity to both customers in need of the offering and other retailers selling complementary items. Since retailers are the last point of contact with final consumers in the supply chain, they should be located conveniently near the place where customers want to purchase items (Scarborough 2012:539). Prinsloo (2014:2) stresses that convenience shopping is the result of more frequent shopping of quality and variety products in smaller grocery baskets at local retailers. Retailers who mainly offer so-called convenience goods require a location close to their target customers to prevent customers easily substituting competitive brands when the need arises (Petty et al. 2012:264). Few customers are willing to repeatedly travel long distances just to shop. The role of the transport network is crucial: if customers are inconvenienced, the store's trading catchment area is reduced; therefore, any retailer's prime consideration is sufficient customer traffic (Allen 2012:309; Scarborough 2012:546). Sevtsuk (2014:374) proposes the availability of retail and service establishments within walking range from homes and workplaces key to achieving sustainability - environmentally, socially and economically - within these neighbourhoods

The small business retailer should have a thorough understanding of the scope of its trade catchment area from which customers can be drawn over a reasonable timespan. The primary variables influencing the scope of the trading catchment area are the type and size of the business and the type of closely located competitors. A convenience store with a general line of merchandise, which can be found almost anywhere, has a small trading catchment area because it is unlikely that customers will drive across town to purchase items that are available closer to their home or business. On the other hand, if a retailer offers specialised products and a wide selection, and also has knowledgeable salespeople, it may draw customers from a great distance. As a rule, the larger the store, the greater its selection and the better its service, the broader its trading catchment area. Businesses that offer a narrow selection of products and services tend to have smaller trading catchment areas (Scarborough 2012:549).

According to the Soweto Retail Strategy (City of Johannesburg 2005:36), the ideal for a township (like Soweto) lies in locating retailers conveniently close to the households they serve, to improve the overall functioning of the city: there is less need to commute, better use of land and a more equitable balance in the distribution of value-add across the metropole. In township areas characterised by low vehicle ownership and underdeveloped transport systems, poorer inhabitants either walk or use taxis to go shopping. In the absence of retail outlets, township dwellers shop at nearby urban retail outlets rather than in township shops, or workers tend to shop close to their places of work, which are primarily located outside townships. This unique situation fosters an environment where local residents buy from local stores, which are typically owned by familiar fellow residents. The locations of such outlets are based upon the business founders' proximity to their homes (Stokes & Wilson 2017:349). Schaper et al. (2014:44) state that small business owners and their businesses are often attached to a specific place for historical, practical and symbolic reasons which makes the local (and regional) socio-economic environment a major determinant and outcome of the entrepreneurial activity. Small business owners get to know their customers and neighbourhood on a personal level and build personal networks (Tornikoski, Gerbasi & Molecke 2015:243-244), which allows them to provide individualised service and to obtain first-hand knowledge of customers' wants and needs. The competitive advantage of speciality products, personalised service and quality, could enable them to compete with bigger businesses' lower prices (Hatten 2016:14). Also, the rapport retailers build with their customers is vital, causing customers to be willing to pay more for a product when they know the business owner is a good steward in the community. Scarborough (2012:545) points out the synergistic advantage when a small business's image fits in with the surrounding community or character of a town, and the needs and wants of its residents. In this regard, Kwon, Heflin and Ruef (2013:980, 1000) confirm that the social trust stemming from the community to which entrepreneurs are connected contributes substantially to entrepreneurship.

Product offering

When deciding on the type and quantity of product offerings, Scarborough (2012:72-75) advises small businesses to consider the characteristics of the products they sell (uniqueness, savings in terms of time, money and energy, environmental friendliness, and convenience), and the pricing they offer (low prices or value). Hatten (2016:296-297) adds that small businesses can excel by offering superior product selection, service and variety (this aspect being one way a business can outshine it competitors, but product proliferation increases the need for tight inventory control to avoid a cash crisis). In terms of townships, Ligthelm (2008:52) previously promoted a change to a small business model offering effective customer service with a small, dedicated assortment of merchandise and limited number of units, even at reduced turnover. Petousis (2014), from TGi at Ask Afrika (an independent local market researcher), however, states there is no one-fits-all approach to serving modern township shoppers, who enjoy owning quality goods and are prepared to pay extra for those goods. Increased competition exposes township residents to greater variety, making them more selective buyers (Petousis 2014), thus it is a misconception for retailers to believe township communities would purchase downscaled products.

On-demand availability of products and customers' confidence

The availability of product items is one of the crucial variables in developing an overall store image (Koul & Mishra 2013:84). On-demand or on-shelf availability refers to retailers' ability to respond to customers' demand for products immediately (Moussaoui et al. 2016:516-517). This means the desired inventory items must be in store to meet customers' expectations, that is, in a saleable condition (right goods) during convenient business hours (right time) and at a convenient location (right place). The service level retailers provide will determine the level of inventory. Balancing varying retail demand levels (discussed below) while fulfilling the on-demand availability of customers is challenging. Key in customer service is not only the probability of having the product available upon demand, but also the reliability of the retailer to deliver the promised service. If demand and supply planning is ineffective, retailers will have to resort to expensive ad hoc logistics arrangements or marking down the oversupply of goods (Moussaoui et al. 2016:517).

Inventory levels

Inventory is essential in a supply chain to address the imbalance between the supply and demand of products (Chopra & Meindl 2016:61). Inventory is also critical for retailers' financial performance, comprising a substantial portion of their balance sheets (Katz & Green 2014:522; Kesavan & Mani 2013; Monczka et al. 2016:621-622; Wisner, Tan & Leong 2016:209). As mentioned earlier, depending on the service levels retailers wish to render, they adjust their inventory levels: higher service levels imply that customers can be confident that sufficient inventory items are available.

Although inventory decisions differ based on the type of inventory (cycle, safety and seasonal), the decision ultimately depends on the levels of inventory needed in store. When ordering cycle inventory, the amount and frequency of inventory required should be considered (Islam et al. 2013:3-4). Purchasing cycle inventory in bulk should be traded off against increased carrying and opportunity costs. Beneke (2014:30) reports that township retailers are unique, requiring smaller volumes at higher delivery frequencies at lower cost, while the World Bank (2014:173), by contrast, found that some township businesses coordinate when purchasing inventory in bulk, to gain the advantage of economies of scale - something they would not be able to do on their own. Discounts (or markdowns) are commonly used by small businesses to reduce levels of old, slow-moving or damaged stock, rewarding customer loyalty, launching new products or services and matching competitors' prices (Scarborough 2012:375). However, discounts, special offers and sales to help improve demand and cash flow are often misused by small businesses, who overlook the real increase in volume that is required to make up for discounted prices. Since it is more profitable to sell fewer items at a higher price, Stokes and Wilson (2017:432) argue that sales seem not to be ideal for small businesses. In contrast, Scarborough (2012:375) states that experienced business owners understand the importance of shedding slow-moving inventory during end-of-season sales, even if they must resort to markdowns.

Balancing the level of safety inventory to prevent a loss of sales on the one hand (Coyle et al. 2013:324), and buffer against unpredictable customer demand on the other hand (Baker & Canessa 2009:425; Bowersox et al. 2013:48) remains challenging (Baily et al. 2008:164). The World Bank (2014:207) reported that almost 20% of business owners in townships cannot purchase excess (safety) inventory due to insufficient storage space.

Although the purchase of grocery items is usually limited to small quantities (especially in townships), demand in retailing varies depending on the day of the week and the time of year. A retailer will, therefore, carry additional seasonal inventory in anticipation of future customer demand or in preparation for an event. The challenge lies in finding a balance between the number of inventory items needed to satisfy unpredictable demand seasonality, and the cost of carrying such additional inventory (Pienaar & Vogt 2012:218). Unfortunately, retailers worldwide seem to lack the skills to incorporate demand seasonality into their store ordering and shelf replenishment (Ehrenthal, Honhon & Van Woensel 2014:527).

In order to remain competitive, inventory items should rather be bought daily or weekly. The problem is that even when businesses start growing, business owners do not have sufficient resources to purchase goods for sale in sufficient quantities to trigger significant discounts. Even if they purchased the required quantities, they often lack the space to store the inventory (Allen 2012:332), as mentioned above.

Although inventory generally represents the largest capital investment for small businesses, few owners use formal methods for optimal inventory management. As a result, some small businesses carry not only too much inventory, but also too much of the wrong kind of inventory (Scarborough 2012:618).

From a macroeconomic view, retail inventory investments (and levels) increase during economic expansion periods and decrease during contraction periods (Kesavan & Kushwaha 2014:2118). The main finding of these authors' research among public retailers in the United States was that stock out and the inventory holding costs facing retailers have significant explanatory power over the observed differences in inventory investment behaviour across retailers during economically turbulent times. The influence of economic changes should thus be considered when retailers make inventory-related decisions as higher inventory costs would imply smaller profits and eventually lower inventory levels. Kesavan and Kushwaha (2014:2120) concluded that retailers can improve inventory management by benchmarking inventory performance, preferably against similar retailers. Similarly, retailers in townships can learn to improve inventory performance from other township businesses which value rendering high service levels - the focus of this study.

Research methodology

Research design

Soweto, a township in the greater Johannesburg area of Gauteng province in South Africa, served as the research area in this study for the following reasons. Gauteng is the economic hub of the country, contributing the largest share (26.5%) of the country's retail industry. The province houses 45% of the country's shopping centres and contributes (together with the wholesale sector) to addressing the unemployment problem by employing about 27% of the country's youth (Gauteng Quarterly Bulletin 2012:36). As the most populous area in South Africa, with 1 271 628 inhabitants, Soweto is a key retail growth point (as Prinsloo 2014:6 mentioned, population growth is a key driver of retail growth). Johannesburg, as the biggest metropole, is boosted by the 3.7% that Soweto contributes to the gross domestic product (GDP) of the province. According to StatsSA (2012), in 2011 Soweto consisted of 355 331 households and the economically active residents (15-64 years) constituted 71% of inhabitants. Based on spending power of R5 billion annually, this area emerged as a lucrative business opportunity for large retailers and a resultant increase in formal SMMEs (Steyn 2013). In fact, the SMMEs in the township form the backbone of development initiatives by the City of Johannesburg's Mayoral Committee for Economic Development. Despite showing the third-highest absolute increase in population, this area has also been described as the third poorest in the Growth and Development Strategy 2040 (City of Johannesburg 2011).

For this study, a descriptive research design was followed, using a multidimensional approach to investigate various aspects related to the functioning of small businesses. The study area encompassed all formal business areas and stands, including shopping malls, large shopping areas (outside shopping malls) and all smaller shopping centres and single demarcated business stands in the township and its industrial areas. The universe of the study comprised all the formal SMMEs located in Soweto. Formal businesses form part of the official economy of the country and operate from permanent structures with relatively sophisticated infrastructural, financial and technological systems, and are incorporated into the country's formal economic and fiscal reporting structures.

The inclusion criteria used for the sample were that the business be: (1) independent, with any of the following ownership structures: sole proprietor, partnership, cooperative, close corporation or company, and (2) located on a business stand or conducting business from a fixed brick-and-mortar structure.

Sample elements

The sample elements of each SMME were either the owner or manager of the business who was responsible for the business decision-making.

Sample plan design

The lack of an up-to-date list of formal small businesses in Soweto made determining the exact population size for the study impossible. As a result, probability sampling using a stratified sampling method was followed. The lack of a properly defined population resulted in the use of central limit theory, which postulates that using a sufficiently large number of respondents will result in an approximately normal distribution (Van Zyl 2014:178-180). Within the research budget limits, the sample size was set at 650 businesses. The total sample was allocated according to the following SMME segments.

Shopping malls

In total, up to 100 formal SMMEs were to be interviewed in any or all of the following large shopping malls (primary shopping centres): Bara Mall, Maponya Mall, Jabulani Mall, Dobsonville Mall, Naledi Mall and Protea Mall. All SMMEs meeting the inclusion criteria and who were willing to participate were interviewed.

Smaller shopping centres (outside malls)

Smaller shopping centres in the survey area were selected randomly, with the instruction that at least 50 SMMEs be interviewed in each of the following stratified segments:

-

Shopping centres with two to five businesses, with no more than two businesses interviewed per centre. Stand-alone shops were included in this segment.

-

Shopping centres with between 6 and 10 businesses, which were selected at random, and every second business after that in the specific centre.

-

Tertiary shopping centres with between 11 and 20 businesses in the centre; any business was selected at random, and every third business after that in the specific centre.

-

Secondary shopping centres with more than 20 businesses in the centre; any business was selected at random, and every third business after that in the specific centre.

Industrial areas

At least 50 manufacturers were to be interviewed in industrial areas. Due to the relatively small number of industrial SMMEs in the study area, all respondents willing to participate were interviewed.

Research instrument (questionnaire)

The questionnaire covered a multidisciplinary range of functional areas in business management and the demographics of the respondents.

Research findings

Of the 650 completed questionnaires, the responses of the 297 respondents operating in the retail grocery and retail general stores sectors were analysed using a quantitative approach. This group constituted 45.6% of the study population. According to the central limit theory, for sufficiently large samples (n = 30), the sample means will be distributed around the population mean approximately in a normal distribution. Even if the population is not normally distributed, the distribution of sample means will be normal if there is a large enough set of samples (Cooper & Schindler 2014:366-376). The reasons for focusing on these two retail types are based on the history of retailing in Soweto, the basic needs of mainly inshoppers being satisfied by these retailers, the high demand for food and clothing products, the dire need for small retailers to be more competitive due to the foreseen, increasingly high representation of major grocery retailers in Soweto, and the role of general dealers in serving inshoppers with a wider variety and more advanced self-service facilities, as discussed in literature.

Profile description of the SMMEs interviewed in Soweto

Regarding the key profile aspects of the retail general store and retail grocery respondents, the following can be observed:

-

Age: The majority (30%) of business owners or managers were between 31 and 40 years of age. Overall, 87.6% of respondents were in the category 18-60 years (the general age of economically active individuals).

-

Level of education: The majority of respondents (54.5%) had some form of secondary schooling up to Grade 12; 32.4% had a tertiary qualification.

-

Status of the business: The majority (77.4%) were involved as sole proprietors.

-

Distance to nearest shopping mall: A mere 3% were situated in a shopping mall, whereas 17.9% were more than 3 km from the nearest shopping mall. The majority (48.5%) preferred a location of between 1 km and 3 km from the nearest shopping mall.

-

Reason for starting the business: The main reason was seizing a business opportunity (35.7%), followed by 30.6% who indicated unemployment as the main reason. A substantial number (22.9%) of respondents cited taking over a family business.

-

Physical location: The majority of retailers (47.2%) were established in smaller shopping centres (with between two and five adjacent businesses). Only a few respondents were situated in a stand-alone shop (15.8%) and other smaller shopping centres with between 6 and 10 surrounding businesses (17.2%). The results clearly showed that these businesses tend to refrain from opening shop in the bigger shopping centres and malls.

-

Age of the business: The majority of respondents (55.6%) had been involved in the business for more than 5 years, that is, successfully operating an SMME. The findings are in line with the general rule of thumb used by practitioners, as well as international statistics, that most small businesses fail within 5 years of start-up. Small Business Administration (2014), a United States government agency supporting small businesses, as well as official statistics in the United Kingdom (as quoted by Deakins & Freel 2012:19), shows that 50% of small business cease trading by the fifth year. Ligthelm (2008:49) also used 5 years to indicate business maturity, while Lebusa (2013:76) concurs that local small retail outlets tend to fail within the first 3 to 5 years.

-

Growth in turnover or sales: The growth pattern in the preceding year of 23.6% of respondents was positive, while 76.1% managed to remain the same size or experienced a decrease in turnover (sales) in the past year.

Inferential analysis

After descriptive analysis, the owner or managers' inventory decision patterns were analysed by studying selected inventory statements. Exploratory factor analyses became necessary to reduce the data in an attempt to identify whether any clear factors emerged. A cluster analysis followed for identifying possible profiles within the data. Finally, cross-tabulation was performed to determine the relationships between cluster membership and education, age of the owner, location of the business, frequency of inventory purchases, future perspective, and reasons for starting the business.

Inventory statements

Several inventory statements - self-designed and with different ordinal scales - were included in the questionnaire. On some statements, respondents had to indicate whether they 'never', 'sometimes' or 'always' performed the specific activity, and on others they had to indicate the extent to which they agreed with a statement or had to rate the importance of a statement regarding inventory decisions. To investigate the possibility of data reduction on the different inventory statements, exploratory factor analyses were done to identify any clear factors. Principal component extraction with varimax rotation was thus conducted on four groups of statements: (1) inventory in the business, (2) marketing aspects related to inventory, (2a) product offering and (2b) convenience level, and (3) availability of products to consumers. The appropriateness of conducting factor analyses was confirmed with the Kaiser-Olkin measure of sampling adequacy that ranged between 0.5 and 0.756, and was the same or above the recommended threshold of 0.5. Bartlett's test of sphericity significance was p = 0.000 for all four analyses conducted. The factor analysis identified three factors for the inventory in the business statements and one factor respectively for product offering, convenience level and availability of products to customers, based on the eigenvalue criterion of values larger than 1, and it explains respectively 61.49%, 77.46%, 59.22% and 63.1% of the variance. For the values of the final factor loading, see Table 1.

Five of the six factors were labelled (see Table 2) as maintaining a low inventory level, ease of maintaining higher stock levels, proactively maintaining higher stock levels, product offering, and convenience level. For the sixth factor, the Cronbach's alpha value was below 0.6 (0.41); therefore, it was decided to rather consider the two items separately, as on-demand product availability and customer confidence in sufficient stock levels. Factor-based scores were subsequently calculated as the average value for the items included in each factor.

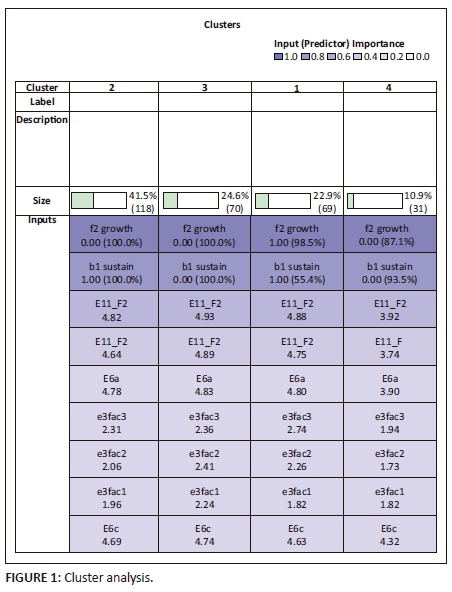

Cluster analysis

After performing factor analyses, five main inventory factors and two items were identified. A cluster analysis was subsequently performed to identify possible profiles within the data. With this exploratory analysis technique, a set of objects can be grouped so that clusters can be identified that show similar characteristics. The variables considered in the cluster analysis were the five factors, two items, business growth and the age of the business. In this case, a two-step cluster analysis was performed using the SPSS v23 software package. Four clusters were identified (see Figure 1). The two elements crucial in forming the clusters were the growth pattern and the age of the business. The decision to focus on these elements are in line with Strydom's (2015:473) research on Soweto businesses, where surviving businesses were characterised by income growth and years in operation. It can be safely assumed that business size and age are related variables. Although the relationship between size and age is by no means linear, Deakins and Freel (2012:221) suggest that in general the more the business grows (i.e., the bigger it is), the more likely it is to survive another period (i.e., the older it is). Deakins and Freel (2012:220) stress the accepted wisdom that small businesses grow faster than large businesses, and that younger businesses grow faster than older businesses.

The silhouette measure of cohesion and separation was 0.3, which indicated a fair cluster quality.

Cluster 2 represents 41.5% of the respondent group, and although this group of retailers showed a negative growth pattern (staying the same or contracting during the past year) they managed to survive for 5 years and longer (100% of cluster respondents in both cases). Cluster 3, which represents 24.6% of the respondent group, not only contracted or stayed the same during the past year, but were also young, that is, in business for less than 5 years (again 100% of respondents in both cases). The same pattern was seen with cluster 4 (constituting only 10.9% of respondents), but in this case they represented 87.1% of this cluster group in terms of negative or no growth and 93.5% in terms of young businesses (age < 5 years). Cluster 1, which formed 22.9% of the respondent group, was the only cluster to show an overall positive performance, with 98.5% of the group showing growth in income during the past year, and 55.4% being in businesses for 5 years and longer.

When comparing cluster 3 (showing no or negative growth and existing for less than 5 years) with cluster 1 (showing positive results on both income growth and business age), the biggest contrast is in the inclination to proactively maintain high inventory levels. Overall, cluster 3 had the highest mean values on almost all variables, except proactively maintaining a high inventory level. Cluster 1 showed the second highest mean values on four variables among all the cluster groups, and the highest mean value (2.74) of all clusters showed on the factor labelled proactively maintaining a high inventory level. In terms of maintaining low inventory levels and customers' confidence in having sufficient stock, cluster 1 showed similar values (though marginally different) compared to other clusters. Thus, being more inclined to proactively maintain a high level of inventory could result in positive business performance (in terms of growth in income and age). A negative or no growth picture for young businesses (cluster 3 and cluster 4) can be turned around if these retailers decide to focus on the following inventory-related aspects: stocking up on sale items from suppliers, purchasing more items for sales held at the store, making provision for customers' fluctuating demands and buying more stock to save on transport costs.

When comparing mean values within clusters, note that although cluster 3 shows marginally higher mean values (2.36 and 2.41) for proactively maintaining a high level of inventory and ease of maintaining a higher level of inventory respectively than maintaining a low level of inventory (2.24); the substantial inclination of the successful cluster 1 in terms of proactively and easily maintaining high levels (2.74 and 2.26 respectively) instead of low levels (1.82) is proof of the importance of making the correct decision of maintaining high levels of inventory. Therefore, an inclination to purchase less than or the exact amount of stock that can be sold within a month (due to being too expensive) could be detrimental for the performance of small general and grocery retailers.

When comparing clusters 1 and 2, both groups existed for 5 years and longer, but group 2 showed no or negative growth, while group 1 showed positive growth. The differences in terms of the mean values between proactively maintaining a high or a low level in inventory highlights the difference between these clusters. Cluster 2 is marginally more (mean value of 1.96) inclined than cluster 1 (mean value of 1.82) to maintain a low level of inventory. This is in line with cluster 1 being the more inclined (mean value of 2.74) than cluster 2 to proactively keep a high level of inventory (mean value of 2.31). The same pattern is seen with the differences between these clusters regarding the ease with which high levels of inventory are maintained. Both clusters 1 and 2 are inclined to focus more on proactively maintaining high levels of inventory and maintaining such high levels with ease, although cluster 1 stands out as the overall cluster which is most inclined to proactively maintain high levels. The conclusion is that if retailers want to grow and exist for 5 years and more, they should proactively maintain a high level of inventory and do so with ease (i.e. keep more stock than is sold monthly, easily obtain more stock from suppliers, have the capacity to store and access stock, and collaborate with a competitor to bargain for lower prices).

Despite clusters 2 and 3 both showing no or negative growth during the past year, they differ in terms of years in existence, with cluster 2 the older of the two groups. When analysing the mean values, cluster 2 (age 5 years and more) is less inclined to focus on the following three aspects: (1) product offering (a variety of quality products) - a mean value of 4.64, compared to 4.89 for cluster 3; (2) ease of maintaining higher stock levels (more stock than is sold monthly, easily obtaining more stock from suppliers when out of stock, the capacity to store and easily access excess stock, collaborating with a competitor to bargain for lower prices) - a mean value of 2.06, compared to 2.41 for cluster 3; and (3) maintaining a low level of inventory (buying less stock or the exact quantity that can be sold monthly, not buying more stock as it is expensive) - a mean value of 1.96, compared to 2.24 for cluster 3. Despite the younger group 3 not showing growth, they seem to focus on the right aspects, which might give them the opportunity to grow in future. The lower values obtained by the older group 2 may reflect this group's tendency to be satisfied with their status quo to survive, who do not necessarily pay attention to the aforementioned aspects which could potentially result in growth. There was a marginal difference between mean values of clusters 2 and 3 in terms of convenience (4.82 and 4.93 respectively), on-demand product availability (4.78 and 4.83 respectively), proactively maintaining high levels of inventory (2.31 and 2.36 respectively), and customers' confidence in having sufficient stock levels (4.69 and 4.74 respectively).

Group 4, which sketches the bleakest picture of all four groups, scored the lowest mean values on all seven variables. This shows that, for these young businesses, their inventory decisions contributed to their poor performance in growth in income. They were the least inclined to focus on convenience, their product offering, on-demand product availability or customers' confidence in having sufficient stock levels, and this negatively influenced their performance. Although having also scored the lowest mean value on maintaining a higher level of inventory, proactively (1.94), and easily (1.73), and maintaining a low level of inventory (1.82), the marginal difference between the mean values on these variables within this group could indicate indecisiveness about the number of items to be kept in store.

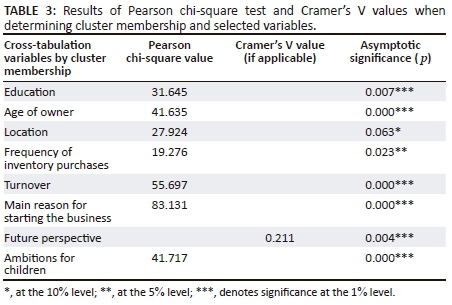

The relationship between cluster membership and demographic and business characteristics

Three of the four groups showed no or negative growth, with two groups being young businesses. Although similarities existed between groups (groups 3 and 4 were young businesses with negative or no growth; groups 1 and 2 were able to survive for 5 years and longer despite opposite growth patterns), these groups had different answers on the inventory variables that resulted in the different clusters. Contingency table analysis was performed to determine the relationships between cluster membership and education, age of the owner, location of the business, frequency of inventory purchases, future perspective, and reasons for starting the business. Strydom (2015:473) specifically highlights the importance of business age, operating an established business in a small existing shopping centre with 10 or more stores, being further away from large malls, a higher educational level, and owner's maturity in age as predictors of small business longevity. The results of this study indicate statistically significant relationships between all variables and cluster membership. Since both variables in the cross-tabulation are nominal, the Pearson chi-square test was used. Where it could not be used (i.e. where more than 20% of cells had an expected frequency of < 5), the Cramer's V value - a measure of the strength of the association between the two variables - and its associated significance value were used (see Table 3).

Education and cluster membership

The results indicate that a statistically significant relationship, at the 1% level of significance, exists between education and cluster membership. Across the groups, all members without schooling (100%) and those with grade 1-3 schooling (100%) fell in group 4 (businesses showing no or negative growth and being in business for less than 5 years). The bigger group 3 (70 members) who showed the same performance pattern as group 4 represented a relatively higher level of education, with group 3 representing 32.4% of the groups in grades 4-6 and 25.3% in grades 7-12, compared to the 11.8% and 9.1% of group 4 in the respective schooling categories. In terms of level of education, group 2 (older businesses with a negative or no growth pattern) showed the highest representation of all groups in three levels of education: grades 4-6 (47.1%), grades 6-12 (42.2%) and technical, trade or training of less than 3 years (49.2%). Group 1 (older businesses with a growth pattern) had the majority (41.4%) representation of all groups in the schooling level of university, college or training of more than 3 years. Groups 1 and 2 (who had survived for 5 years and more, despite showing opposite growth patterns), together represented 70.7% of the respondents on the level of technical, trade or training of less than 3 years, 65.5% on the level of grades 7-12 and 58.6% on the level of university, college or training of more than 5 years. In summary, survival of 5 years and more seems to be associated with higher education levels.

Age of the owner and cluster membership

The results indicate that a statistically significant relationship, at the 1% level of significance, exists between the age of the owner and cluster membership. When comparing the groups, the younger businesses (< 5 years) seem to be in the hands of relatively young owners, with the majority (42.2%) of those aged 31-40 in group 3 (young businesses with no or negative growth patterns). This is confirmed by the small representation of older age groups (> 51) in both groups 3 and 4. If one assumes that the economic activity of humans takes place between the ages of 18 and 60, 41.4% of group members aged 18-30 fall in group 2 (survival of 5 years and more, but no or negative growth pattern), which might indicate younger people who are continuing with a family business or doing business as it has always been done. Group 3 represents 42.2% of members aged 31-40, while group 2 represents 41.3% of members aged 41-50, 50% of members aged 51-60 and 75.8% of members 61 years and older. In group 1 (older businesses showing growth) the members are similarly spread in the age brackets of 31-60, with 29.2% aged 31-40, 27.7% aged 41-50 and 28.3% aged 51-60. The pattern observed when comparing groups is that the older respondents mainly form part of the group of surviving businesses that show no or negative growth (i.e. group 2). This finding could indicate that older business owners, who might be set in their ways, have managed to survive their businesses, but might be reluctant or unskilled to make business decisions that may lead to growth.

Location and cluster membership

The results indicate that a statistically significant relationship, at the 10% level of significance, exists between location and cluster membership. The majority (66.7%) of businesses in group 3 (younger businesses with no or negative growth) are located in shopping malls. They possibly face not only intense competition, but also the high costs typically associated with doing business in a big mall. Group 2 (older businesses with negative or no growth) represent the majority (43.6%) of businesses in stand-alone shops. Given that group 2 represents the older generation of business owners, with the majority of 73.5% older than 41 years of age, these owners' preference for stand-alone shops can be attributed to their traditional ways. However, group 2 also has the highest occupancy of all groups in the category being located in a shopping centre with two to five adjacent businesses or a shopping centre with 6-10 adjacent businesses (42% and 45.7% respectively). Group 2 also represents 50% of members located in shopping centres with more than 20 surrounding businesses. In centres with 11-20 and more than 20 surrounding businesses, group 1 represents 66.7% and 50% of the groups respectively. Group 1 members, however, seem cautious of moving to the big malls as they represent only 16.7% of groups in this category. In group 1, almost 60% (59.4%) are established in shopping centres with two to five adjacent businesses. As with group 2, group 1 represents the other 50% in the category of businesses located in shopping centres with more than 20 surrounding businesses. Neither group 3 nor 4 (younger businesses with no or negative growth) is represented in the categories of shopping centres with 11-20 or more than 20 surrounding businesses. Across the groups, younger businesses tended to strongly prefer to establish themselves in big, well-known malls. Some were located in shopping centres with fewer than 20 surrounding businesses. While groups 3 and 4 mainly preferred being located in big malls, groups 1 and 2 (surviving businesses) were established in stand-alone shops and shopping centres with few surrounding businesses.

Frequency of inventory purchases and cluster membership

The results indicate that a statistically significant relationship, at the 5% level of significance, exists between frequency of inventory purchases and cluster membership. All groups had the highest number of respondents buying on a weekly basis (67.7% in group 1, 62.7% in group 2, 48.6% in group 3 and 48.4% in group 4). Group 2 had the highest representation in terms of the following: it represented 36.7% of groups purchasing daily, 44.3% of groups purchasing weekly and 44.6% of groups purchasing when stock levels are low. Group 3 (younger businesses showing no or negative growth) stood out as purchasers of stock on a monthly basis (45.5%). Together, groups 1 and 2 represented 60% of groups purchasing daily, 70.6% weekly and 58.4% when stock is low, whereas groups 3 and 4 together represented 63.6% of groups buying monthly. The older businesses (groups 1 and 2) preferred to buy daily, weekly or when stock is low, whereas the younger businesses (groups 3 and 4) preferred to buy monthly.

Main reason for starting a business and cluster membership

The results indicated that a statistically significant relationship, at the 1% level of significance, exists between the main reason for starting a business and cluster membership. Group 2 represented 74.6% of members who had taken over a family business (confirmed by the subsequent findings related to owners' future perspective, which explains their inclination to do business the tried and tested way, and survive despite no or negative growth). Among the younger groups (2 and 3) showing no or negative growth, group 3 represented 46.6% of all members who had started their business while unemployed or having no income. Group 1's success (being older and growing) is proof of their ability to seize an opportunity (38.8%), while 62.5% of respondents indicated seizing an opportunity as the main reason for initially starting the business. The desperation of having no income or being unemployed could explain why 59.4% and 53.3% in groups 3 and 4 respectively started their own business, and now own businesses with no or negative growth. Group 2 also represented the majority (54.5%) who stated that supplementing their income was the main reason for starting a business, that is, it is not their main source of income, which could explain why their status of merely surviving without growth or even tolerating negative growth would suffice.

Future perspective and cluster membership

The results indicate that a statistically significant relationship, at the 1% level of significance, exists between future perspective and cluster membership. Here, respondents were asked to indicate where they see their business in 2 years' time. In all four groups, the majority of members preferred to continue with their businesses, which makes sense especially within group 1 (growing, older businesses) (87.7%). However, group 2 represented the majority of groups wishing to continue with business as is (41.5% of groups), stop the business to take up a waged job (100%), switch to another line of business (58.3%), hand the business to children and retire (80%) and sell the business and retire (75%). The general future perspective of this group seems to show signs of despondency and a readiness to retire. The high representation with plans to hand over the reins to the next generation and retire confirms that these businesses are owned by older businesspeople, who themselves inherited the business.

Conclusion

Against the backdrop of the history and current potential of township retailing, as well as the cardinal role of optimal inventory decision-making in small business performance, the research question addressed here was how Soweto small retailers make inventory decisions to grow their income and age of the business. The secondary objectives were (1) to identify possible profiles among Soweto grocery and general small retailers, with regard to inventory decision-making, (2) to determine the relationships between cluster membership and demographic (education and owner age) and business variables (location, frequency of inventory purchases, future perspective, and reasons for starting), and (3) to provide retailers in Soweto showing negative (or no) growth with guidelines on inventory decision-making based on the inventory decision patterns displayed by older counterparts with income growth. The data was analysed using exploratory factor analyses, cluster analysis and cross-tabulations.

The literature review shows paradoxical viewpoints on small retailers' inventory decision-making: arguments for and against smaller volumes and buying in bulk (see discussion of Beneke 2014:30; Scarborough 2012:375; Stokes & Wilson 2017:432; World Bank 2014:173), limited and broad variety (see Allen 2012:332; Baker & Canessa 2009:425; Bowersox et al. 2013:46; Coyle et al. 2013:324; Hatten 2016:296-297; Lighthelm 2008:52; Petousis 2014; Scarborough 2012:549; World Bank 2014:207), and selling fewer items at higher prices and resorting to markdowns (see Scarborough 2012:375; Stokes & Wilson 2017:375). Despite this, the research results showed that being more inclined to proactively maintain a high level of inventory could result in positive business performance (in terms of both growth in income and age of the business). Younger businesses could thus turn around a negative or no growth picture if they move from indecisiveness about the number of inventory items to hold in store to a focus on stocking up on sale items from suppliers, purchasing more items for sales held at the store, making provision for customers' fluctuating demands and buying more stock to save on transport costs. An inclination to purchase less than or the exact amount of stock that can be sold in a month, due to it being too expensive, could harm the performance of small general and grocery retailers. The results also show that if small retailers want to grow and exist for 5 years and more, they should consider proactively maintaining a high level of inventory and maintaining such higher inventory levels with ease (i.e. keeping more stock than they sell monthly, easily obtaining more stock from suppliers, having the capacity to store and access excess stock, and collaborating with a competitor to bargain for lower prices). Carrying higher inventory levels requires good inventory management, which implies the following actions. It is recommended that small business retailers set par levels for stock items (i.e. the minimum number of items that should be on hand at all times) and closely monitor items with expiry dates to avoid unnecessary wastage. Seasonal items and items that might go out of style could also become dead stock resulting in lost income. Retailers should balance the variable cost of storage by ensuring that the right amount of the right items are stored. In order to determine optimal levels, cash flow and inventory management systems should be implemented and used. A basic First-in First-out system to move older items first or an ABC analysis to prioritise attention to higher value items can easily be implemented. Exact knowledge of items in stock, sales figures, projections of periods of low stock, demand predictions and replacement dates would guide retailers in determining the timing and amount of cash needed during reordering.

In this study, older respondents mainly ran surviving businesses, which showed no or negative growth. It can be concluded that older business owners might have succeeded in sustaining their businesses by doing business in the traditional way, but they might be reluctant or unskilled to make decisions that may lead to growth. Younger businesses should therefore expand their horizons and exploit opportunities to learn and implement modern management skills in order to succeed.

Across the groups, the owners of younger businesses strongly prefer to establish themselves in big, well-known malls. However, surviving (older) businesses were rather established in stand-alone shops and shopping centres with few surrounding businesses - township business owners prefer to be part of the community. Further, the owners of older businesses conservatively prefer to buy daily, weekly or when stock is low, whereas those of younger businesses prefer to buy monthly. Depending on their roots in local communities and the type of items kept, younger businesses should determine optimal location and order quantities.

Older businesses showing no or negative growth constituted the majority of respondents who had taken over a family business, as confirmed by their future perspective of retiring and handing over the business to their descendants, and with an inclination to do business the tried and tested way, surviving despite no or negative growth. The owners of older businesses (with no or negative growth) stated supplementing their income as the main reason for starting a business. That could explain why they proceed despite no or negative growth - the business is not their main source of income. Older entrepreneurs with growing businesses mainly started their venture by seizing an opportunity. Again it is recommended that younger business owners expand their horizons to identify lucrative business opportunities. This would require a perceptive mind, creativity and a drive to transform opportunities into sustainable businesses.

This study confirmed the findings in the literature (see discussion by Yang 2016:2; Matabooe et al. 2016:2; Kesavan & Kushwaha 2014:2118; Yordanov 2015:50; Honig et al. 2014:97) that retailers can improve their inventory management by following the example of similar retailers. Younger (and older) businesses with no or contracting growth can therefore benefit from emulating maturing businesses experiencing income growth. Formal and informal mentorship and business training sessions could benefit the less experienced business owners. This article presented a platform where successful inventory practices can be shared, since retailers tend to function in isolation within a shared community, without realising the benefit of collaboration or interaction. The value of collaboration and good relationships with suppliers to promote adaptability, inventory problem-solving and good inventory management should also not be underestimated. The study showed the benefits of carrying larger volumes of inventory in small grocery retail and general retailing outlets, where high customer service levels are demanded (even during economic decline) and highlighted how both young and established small businesses could forfeit growth if they refrain from adapting their inventory decision-making to benefit from lucrative retailing opportunities in townships.

Acknowledgements

Competing interests

The author declares that she has no financial or personal relationships that may have inappropriately influenced her in writing this article.

References

Allen, K.R., 2012, New venture creation, 6th edn., South-Western Cengage Learning, Ontario. [ Links ]

Badenhorst-Weiss, J.A. & Cilliers, J.O., 2014, 'Competitive advantage of independent small businesses in Soweto', Southern African Business Review 18(3), 1-21. [ Links ]

Baily, P., Farmer, D., Crocker, B., Jessop, D. & Jones, D., 2008, Procurement principles and management, 10th edn., Financial Times, Prentice Hall, Harlow, Essex. [ Links ]

Baker, P. & Canessa, M., 2009, 'Warehouse design: A structured approach', European Journal of Operational Research 193(2), 425-436. https://doi.org/10.1016/j.ejor.2007.11.045 [ Links ]

Beneke, J.H., 2014, 'Building sustainability into the township retail supply chain - An exploratory study of third party distribution', OIDA International Journal of Sustainable Development 7(9), 21-34. [ Links ]

Bowersox, D.J., Closs, D.J., Cooper, M.B. & Bowersox, J.C., 2013, Supply chain logistics management, 4th edn., McGraw-Hill Irwin, New York. [ Links ]

Chopra, S. & Meindl, P., 2016, Supply chain management: Strategy, planning, and operation, 6th edn., Pearson, Harlow, Essex. [ Links ]

Choto, P., Tengeh, R.K. & Iwu, C.G., 2014, 'Daring to survive or to grow? The growth aspirations and challenges of survivalist entrepreneurs in South Africa', Environmental Economics 7(4), 93-101. [ Links ]

City of Johannesburg, 2005, 'Soweto retail strategy', viewed 01 November 2013, from http://www.joburg.org.za/ [ Links ]

City of Johannesburg, 2011, 'Johannesburg growth and development strategy 2040', viewed 05 April 2017, from http://www.joburg.org.za/ [ Links ]

Cooper, D.R. & Schindler, P.S., 2014, Business research methods, 12th edn., McGraw-Hill, New York. [ Links ]

Coyle, J.J., Langley, C.J., Novack, B.J. & Gibson, B.J., 2013, Managing supply chains: A logistics approach, 9th edn., South-Western/Cengage, Mason, OH. [ Links ]

Deakins, D. & Freel, M., 2012, Entrepreneurship and small firms, 6th edn., McGraw-Hill Higher Education, Berkshire. [ Links ]

Ehrenthal, J.C.F., Honhon, D. & Van Woensel, T., 2014, 'Demand seasonality in retail inventory management', European Journal of Operational Research 238(2), 527-539. https://doi.org/10.1016/j.ejor.2014.03.030 [ Links ]

Gauteng Quarterly Bulletin, 2012, 'The retail industry on the rise in South Africa', viewed 20 October 2017, from http://www.treasury.gpg.gov.za/Documents/QB1%20The%20Retail%20Industry%20on %20the%20Rise.pdf [ Links ]

Hatten, T.S., 2016, Small business management, 6th edn., Cengage Learning, Ontario. [ Links ]

Honig, B., Karlsson, T. & Hägg, G., 2014, 'The blessing of necessity and advantages of newness', in A.C. Corbett & J.A. Katz (Ed.), Entrepreneurial resourcefulness: Competing with constraints, pp. 63-94, Emerald Group Publishing Limited, Bingley, UK. [ Links ]

Islam, D.M.Z., Meier, J.F., Aditjandra, P.T., Zunder, T.H. & Pace, G., 2013, 'Logistics and supply chain management', Research in Transportation Economics 41(1), 3-16. https://doi.org/10.1016/j.retrec.2012.10.006 [ Links ]

Katz, J.A. & Green, R.P., 2014, Entrepreneurial small business, 4th edn., McGraw-Hill, New York. [ Links ]

Kesavan, S. & Kushwaha, T., 2014, 'Differences in retail inventory investment behavior during macroeconomic shocks: Role of service level', Production and Operations Management 23(12), 2118-2136. https://doi.org/10.1111/poms.12048 [ Links ]

Kesavan, S. & Mani, V., 2013, 'The relationship between abnormal inventory growth and future earnings for US public retailers', Manufacturing & Service Operations Management 15(1), 6-23. https://doi.org/10.1287/msom.1120.0389 [ Links ]

Koul, S. & Mishra, H.G., 2013, 'Customer perceptions for store attributes: A study of traditional retail stores in India', Journal of Business & Economics 5(1), 79. [ Links ]

Kwon, S.W., Heflin, C. & Ruef, M., 2013, 'Community social capital and entrepreneurship', American Sociological Review 78(6), 980-1008. https://doi.org/10.1177/0003122413506440 [ Links ]

Lebusa, M.J., 2013, 'The prospects of making small retail outlets in the townships aggressively competitive', The Southern African Journal of Entrepreneurship and Small Business Management 6, 75-86. https://doi.org/10.4102/sajesbm.v6i1.34 [ Links ]

Ligthelm, A.A., 2008, 'The impact of shopping mall development on small township retailers', South African Journal of Economic and Management Sciences 11(1), 37-53. https://doi.org/10.4102/sajems.v11i1.376 [ Links ]

Ligthelm, A.A., 2009, 'Small business success and failure in Soweto: A longitudinal analysis (2007-2008)', Bureau of Market Research, University of South Africa, Pretoria. [ Links ]

Longenecker, J.G., Petty, J.W., Palich, L.E. & Hoy, F., 2014, Small business management: Launching and growing entrepreneurial ventures, 17th international edn., Cengage Learning, Mason, OH. [ Links ]

Malebana, M.J. & Swanepoel, E., 2015, 'Graduate entrepreneurial intentions in the rural provinces of South Africa', Southern African Business Review 19(1), 89-111. [ Links ]

Matabooe, M.J., Venter, E. & Rootman, C., 2016, 'Understanding relational conditions necessary for effective mentoring of black-owned small businesses: A South African perspective', Acta Commercii 16(1), 1-11. https://doi.org/10.4102/ac.v16i1.327 [ Links ]

Monczka, R.M., Handfield, R.B., Giunipero, L.C. & Patterson, J.L., 2016, Purchasing and supply chain management, 6th edn., Cengage, Boston, MA. [ Links ]

Moussaoui, I., Williams, B.D., Hofer, C., Aloysius, J.A. & Waller, M.A., 2016, 'Drivers of retail on-shelf availability: Systematic review, critical assessment, and reflections on the road ahead', International Journal of Physical Distribution & Logistics Management 46(5), 516-535. https://doi.org/10.1108/IJPDLM-11-2014-0284 [ Links ]

Narayan, G. & Chandra, R., 2015, 'Factors affecting the purchase of food and grocery products from modern retail stores: An empirical study', IUP Journal of Management Research 14(2), 7-23. [ Links ]

Papadopoulos, N.G., 1980, 'Consumer outshopping research: Review and extension', Journal of Retailing 56(4), 41-58. [ Links ]

Petousis, M., 2014, 'TGI enters townships', viewed 30 October 2016, from http://www.askafrika.co.za/sites/default/files/TGi%20enters%20townships.pdf [ Links ]

Petty, J.W., Palich, L.E., Hoy, F. & Longenecker, J.G., 2012, Managing small business: An entrepreneurial emphasis, 16th international edn., Cengage Learning, Mason, OH. [ Links ]

Pienaar, W.J. & Vogt, J.J., 2012, Business logistics management: A value chain perspective, 4th edn., Oxford, Cape Town. [ Links ]

Prinsloo, D.A., 2014, 'Retail trends in a very dynamic South African market', Urban Studies, viewed 30 October 2016, from http://www.urbanstudies.co.za/retail-trends-in-a-very-dynamic-south-african-market/ [ Links ]

SBP, 2013, 'Understanding women entrepreneurs in South Africa', SBP Alert 3, 1-10, viewed 19 October 2015, from http://www.sbp.org.za/uploads/media/SBP_Alert_Understanding_Women_ Entrepreneurs_in_SA.pdf [ Links ]

Scarborough, N.M., 2012, Effective small business management, 10th edn., Pearson Prentice Hall, Upper Saddle River, NJ. [ Links ]

Schaper, M., Volery, T., Weber, P. & Gibson, B., 2014, Entrepreneurship and small business, 4th edn., Wiley, Milton, Australia. [ Links ]

Sevtsuk, A., 2014, 'Location and agglomeration: The distribution of retail and food businesses in dense urban environments', Journal of Planning Education and Research 34(4), 374-393. https://doi.org/10.1177/0739456X14550401 [ Links ]

Small Business Administration, 2014, 'Office of Advocacy - Frequently asked questions', viewed 16 January 2015, from https://www.sba.gov/sites/default/files/advocacy/FAQ_March_2014_0.pdf [ Links ]

Stanlib, 2013, 'SA retail sales fell more than expected in April 2013', viewed 15 May 2017, from http://www.stanlib.com/EconomicFocus/Pages/SAretailsalesfellmorethan.aspx [ Links ]

StatsSA, 2012, Census 2011 statistical release, Statistics South Africa, Pretoria. [ Links ]

StatsSA, 2015, Retail sector growth losing steam, Statistics South Africa, Pretoria, viewed 03 March 2017, from http://www.statssa.gov.za/?p=4163 [ Links ]

Steyn, L., 2013, 'If it's survival of the fittest, Soweto will give you a run for your money', Mail & Guardian, 18 October, viewed 05 April 2017, from http://mg.co.za/article/2013-10-18-00-if-its-survival-of-the-fittest-soweto-will-give-you-a-run-for-your-money [ Links ]

Stokes, D. & Wilson, N., 2017, Small business management and entrepreneurship, 7th edn., Cengage Learning EMEA, Hampshire. [ Links ]

Strydom, J.W., 2015, 'David against Goliath: Predicting the survival of formal small businesses in Soweto', International Business & Economics Research Journal 14(3), 463-476. https://doi.org/10.19030/iber.v14i3.9210 [ Links ]

Tornikoski, E.T., Gerbasi, A. & Molecke, G., 2015, 'Personal networks and networking behaviour of small business owner-managers', in L.N. Scott (ed.), Small business in a global economy, pp. 243-264, Praeger, Santa Barbara, CA. [ Links ]

Van Zyl, L.E., 2014, Research methodology for the economic and management sciences, Pearson, London. [ Links ]

Wisner, J.D., Tan, K.C. & Leong, G.K., 2016, Supply chain management: A balanced approach, 4th edn., South-Western, Boston, MA. [ Links ]

World Bank, 2014, Economics of South African townships: Special focus on Diepsloot, The World Bank, Washington, DC. [ Links ]

Yang, N., 2016, 'Learning in retail entry, NET Institute, Working Paper No. 11-16', New York, NY. https://doi.org/10.2139/ssrn.1957992 [ Links ]

Yordanov, D., 2015, 'Growth challenges of food processing small-sized enterprises: Two cases from Bulgaria', Second cycle, A2E, Department of Economics, SLU, Uppsala, viewed 09 November 2017, from http://urn.kb.se/resolve?urn=urn:nbn:se:slu:epsilon-s-4637 [ Links ]

Correspondence:

Correspondence:

Orpha Cilliers

cillijo@unisa.ac.za

Received: 01 June 2017

Accepted: 20 Feb. 2018

Published: 23 May 2018