Serviços Personalizados

Artigo

Indicadores

Links relacionados

-

Citado por Google

Citado por Google -

Similares em Google

Similares em Google

Compartilhar

South African Journal of Economic and Management Sciences

versão On-line ISSN 2222-3436

versão impressa ISSN 1015-8812

S. Afr. j. econ. manag. sci. vol.21 no.1 Pretoria 2018

http://dx.doi.org/10.4102/sajems.v21i1.1531

ORIGINAL RESEARCH

Informal financial transactions and monetary policy in low-income countries: Interpolated informal credit and interest rates in Malawi

Harold Ngalawa

School of Accounting, Economics and Finance, University of KwaZulu-Natal, South Africa

ABSTRACT

BACKGROUND: Official monetary data usually exclude informal financial transactions although the informal financial sector (IFS) forms a large part of the financial sector in low-income countries.

AIM AND SETTING: Excluding informal financial transactions in official monetary data, however, underestimates the volume of financial transactions and incorrectly presents the cost of credit, bringing into question the accuracy of expected effects of monetary policy on economic activity.

METHODS: Using IFS data for Malawi constructed from two survey data sets, indigenous knowledge and elements of Friedman's data interpolation technique, this study employs innovation accounting in a structural vector autoregressive model to compare monetary policy outcomes when IFS data are taken into account and when they are not.

RESULTS: The study finds evidence that in certain instances, the formal and informal financial sectors complement each other. For example, it is observed that the rate of inflation as well as output increase following a rise in either formal financial sector (FFS) or IFS lending. Further investigation reveals that in other cases, the FFS and IFS work in conflict with each other. Demonstrating this point, the study finds that a rise in FFS interest rates is followed by a decline in FFS lending while IFS lending does not respond significantly and the response of FFS and IFS loans combined is insignificant. When IFS interest rates are raised, total loans decline significantly.

CONCLUSION: The study, therefore, concludes that exclusion of IFS transactions from official monetary data has the potential to frustrate monetary policy through wrong inferences on the impact of monetary policy on economic activity.

Introduction

The principal objective of Malawi's central bank as stipulated in the Reserve Bank of Malawi (RBM) Act of 2013 is:

to implement measures designed to influence the money supply and the availability of credit, interest rates and exchange rates with the view to promoting economic growth, employment (and) stability in prices. (Malawi Government 2013:5)

It is important, therefore, that the monetary authorities understand the process through which monetary policy affects economic activity, in order to achieve this objective.

As in most low-income countries, monetary authorities in Malawi do not include informal financial transactions in official monetary data. For the purposes of this study, informal finance is defined as legal but unregulated financial activities that take place outside official financial institutions and are not directly amenable to control by key monetary and financial policy instruments (see Chipeta & Mkandawire 1991; Ngalawa 2014; Soyibo 1997). The primary reason for the omission of informal financial transactions in official monetary data is the absence of the data. In some instances, data are available but from once-off surveys. In other instances, where the data are available from more than one survey, the surveys are at irregular intervals and the data may not be comparable (Ngalawa 2016).

In most high-income countries, the informal financial sector (IFS) is practically non-existent. In nearly all low-income countries, however, the IFS is very large (see for example African Development Bank 1994; Chipeta & Mkandawire 1991). There is also evidence that the sector has been growing relative to the formal financial sector (FFS) in some of these low-income countries (see for example Aryeetey 1994; Bagachwa 1995; Chipeta 1998; Chipeta & Mkandawire 1991; Soyibo 1997). To the extent that official monetary data do not include informal financial transactions, the volume of aggregate financial transactions is underestimated and the cost of credit is incorrectly reported, bringing into question the timing and effect of monetary policy on economic activity (Ngalawa 2014, 2016).

The primary objective of this paper, therefore, is to investigate the difference in the impact of monetary policy when IFS data are included and when they are excluded. The paper employs IFS data constructed by Ngalawa (2014) using two survey data sets, elements of indigenous knowledge and principles of the Friedman method of interpolating time series from related series (Friedman 1962). This is the first study that the author is aware of that examines the impact of monetary policy on economic activity taking into account the IFS. The study argues that exclusion of IFS transactions in official monetary data has the potential to frustrate monetary policy through wrong inferences on the impact of monetary policy on economic activity.

The rest of the paper is organised as follows: The 'Economic background and monetary policy: An overview of Malawi' section is an overview of Malawi's economic background and monetary policy framework. The 'Formal and informal financial markets' section reviews the literature on the interaction of formal and informal financial markets. The 'Methodology' section presents a structural vector autoregressive (SVAR) model used for analysis. Estimation results are discussed in the 'Estimates and inferences' section and a summary and conclusion follow in the last section, namely, 'Summary, conclusions and policy implications'.

Economic background and monetary policy: An overview of Malawi

Malawi is a small landlocked country (118 000 km2) in south-east Africa bordered by Mozambique to the south, east and west, Tanzania to the north-east and Zambia to the north-west. When the country attained independence from the British (Empire) in 1964, three resources were identified as primary sources of economic growth: fertile agricultural soils, abundant unskilled labour and plentiful water supply (see Ngalande 1995). The Malawi Government put the first two resources into use by developing the agricultural sector and exporting unskilled labour to the mineral rich countries of Northern Rhodesia (Zambia), Southern Rhodesia (Zimbabwe) and South Africa.

Malawi's economy is dominated by the agricultural sector, which accounts for nearly a third (27.89%) of the country's gross domestic product (GDP) (2016 estimate). Agriculture, in turn, is for the most part driven by smallholder farming. It is estimated that 84% of agriculture value-added in Malawi comes from smallholder farmers, who on average own only 1 ha of land, still cultivate using hoe technology, and rely heavily on family labour (Chirwa & Matita 2012). The large smallholder agricultural sector partly explains the existence of a large informal sector in the country, which is a domicile of large informal financial transactions that tend to have an important influence on the country's financial system.

According to the Malawi National Statistical Office (2005), an estimated 98% of the household loans in the country in 2005 originated from the IFS while only 2% were from the FFS. In 2011, the proportion of household borrowing from the IFS declined to 88% while household borrowing from the FFS increased to 12% (Malawi National Statistical Office 2012). Underlining the large size of the IFS in the country, a study by Chipeta and Mkandawire (1991) revealed that in 1989, the IFS in Malawi was larger than the FFS when measured in terms of credit extended to the private sector. Chipeta and Mkandawire (1991) arrived at the same conclusion by comparing savings mobilised by the formal and informal financial sectors.

Monetary policy plays an important role in the management of the Malawi economy. The RBM Act stipulates that one of the principal objectives of the central bank is to influence money supply, credit availability, interest rates and exchange rates in order to ultimately promote economic growth, employment and price stability (Malawi Government 2013).

Monetary policy in Malawi can be compartmentalised into three distinct regimes, namely financial repression (1964-1986), financial reforms (1987-1994) and financial liberalisation (post 1994). The first phase described as a period of financial repression starts at independence in 1964 when the country's monetary authorities imposed direct controls on credit and interest rates. In line with government's policy of promoting the agricultural sector, authorities in Malawi accorded preferential lending rates and quota credit allocations to the agricultural sector. The country also adopted a fixed exchange rate system and imposed price ceilings on selected commodities.

During the period of financial reforms (1987-1994), the country embarked on a phased financial liberalisation programme targeted at enhancing competition and efficiency in the financial sector. This was a response to the country's failure to adjust quickly to a deep recession early in the 1980s, which exposed structural weaknesses in its macroeconomic framework (see Gondwe 2001). The reforms included partial deregulation of lending rates in July 1987 and deposit rates in April 1988, abolition of credit ceilings in 1988, abolition of preferential lending rates to the agricultural sector in January 1990, complete deregulation of interest rates in May 1990 and repealing of the RBM Act of 1964 and Banking Act of 1965 in May and December 1989, respectively.

The financial liberalisation phase can be generalised as the post-February 1994 period. Throughout the 1980s to the early 1990s, the country undertook extensive financial sector reforms, which culminated in the floatation of the local currency, the Malawi kwacha (MWK), in February 1994. Thereafter, the monetary authorities removed exchange control regulations, allowed for the establishment of foreign exchange bureaux, introduced foreign currency denominated accounts, established a forward foreign exchange market and started the trading of foreign exchange options and currency swaps (see Ngalawa & Viegi 2011).

The first available estimates of the IFS in Malawi were from the Chipeta and Mkandawire (1988) survey. Chipeta and Mkandawire (1988) revealed that in 1988, the IFS was larger than the FFS as measured by credit extended to the private sector or savings mobilised by the formal and informal financial sectors. In 2005, the Malawi National Statistical Office reported that 98% of all household loans in the country were from the IFS. This figure dropped to 88% in 2011 (Malawi National Statistical Office 2012).

Formal and informal financial markets

Many studies have demonstrated that the formal and informal financial sectors in low-income countries are interlinked (see for example Bolnick 1992; Bose 1998; Chipeta & Mkandawire 1991; Hoff & Stiglitz 1993, 1994; Khoi et al. 2013; Ngalawa & Viegi 2013). Using a dynamic stochastic general equilibrium (DSGE) framework calibrated on Malawi data for the period 1988 to 2005, Ngalawa and Viegi (2013) showed that total formal and informal sector loans are complementary in quasi-emerging market economies (QEMEs). Formal and informal sector credit are complementary when an increase in demand for credit in one sector is accompanied by an increase in demand for credit in the other sector for the economy to remain in equilibrium (see also Chipeta & Mkandawire 1991; Ngalawa 2016). Accordingly, increasing investment financed by FFS credit will lead to additional productive capacity that can only be utilised with investment financed by IFS credit (see Aryeetey 1994; Chipeta & Mkandawire 1992). Thus, increasing the use of FFS credit increases demand for IFS credit (Ngalawa & Viegi 2013).

Ngalawa and Viegi (2013) demonstrated that while formal and informal financial sector credit are complementary in the aggregate, they are substitutes in a borrowing firm's utility function. Khoi et al. (2013) found similar results in a study of Vietnam. Using 2011 survey data from a sample of households selected out of 15 villages in 13 communes that had microcredit programmes operating at least since 2002 in the Mekong River Delta of Vietnam, Khoi et al. (2013) showed that an increase in demand for informal credit increases the probability of borrowing from the formal sector, which is consistent with the complementarity hypothesis of formal and informal financial markets. Khoi et al. (2013) further argue that the high interest rate differential between the two markets leads households that borrowed in the informal market to take out a formal market loan to repay or roll over the informal debt. Underscoring the high interest rate differential, they point out that IFS interest rates in Vietnam are five times higher than FFS interest rates.

Some studies have gone further to show that interest rates in the formal and informal financial sectors do not necessarily change together in the same direction. Ngalawa and Viegi (2013) have shown that under certain circumstances in QEMEs, interest rates in the formal and informal financial markets respond to a monetary policy shock by moving in diametrically opposed directions, with the implication that monetary policy may be frustrated by the nature of interest rate interaction between the two sectors (see also Ngalawa 2016). Studies carried out by Chipeta and Mkandawire (1991, 1992), Chimango (1977) and Bolnick (1992) also report that interest rates in the IFS in Malawi are not driven by the FFS.

In some countries, governments have intervened in the formal sector in an attempt to provide cheap credit to households, usually in the agricultural sector. The expectation is that farmers would shift from the IFS as their primary source of credit to the FFS, which would force IFS interest rates down. This, however, has not happened (see for example Basu 1994; Bell 1990; Siamwalla et al. 1990). In a theoretical exposition conducted between 1995 and 1997, Bose (1998) maintains that there is evidence that interest rates charged by the IFS have been relatively unaffected by FFS interest rates, which are substantially below those charged by the IFS. Hoff and Stiglitz (1993, 1994) have argued that the cheap credit in the FFS may result in an increase, rather than a decrease, in the IFS interest rates.

Several studies have also found that funds flow between the formal and informal financial markets (see Bolnick 1992; Bose 1998; Ngalawa & Viegi 2013). Often, creditors in the IFS have access to funds in the FFS. As suppliers of loans, IFS creditors usually possess enough assets to qualify as creditworthy to the lending institutions in the formal sector and in many countries, credit from suppliers is routinely financed with bank loans or overdrafts (Bose 1998). Funds have also been observed to flow in the reverse direction, from the informal to the formal financial sector (Ngalawa 2016). A study carried out in 1992 on Malawian data by Bolnick (1992), for instance, reports that even the moneylender stores liquidity in the bank.

It is clear from the foregoing discussion that while nearly all low-income countries do not include informal financial transactions in official monetary data for policymaking, the literature is awash with studies arguing that the formal and informal financial sectors interact (see Chipeta & Mkandawire 1991; Khoi et al. 2013; Ngalawa & Viegi 2013). Clearly, the formulated policies are unlikely to achieve their intended objectives if policy outcomes are different depending on whether monetary data include IFS transactions or not. Unfortunately, none of the studies that the author is aware of has attempted to investigate the differences in the impact of monetary policy when IFS data are included and when they are excluded. This is the knowledge gap that this study attempts to fill. Employing IFS data constructed by Ngalawa (2014) using two survey data sets, elements of indigenous knowledge and principles of the Friedman method of interpolating time series from related series (Friedman 1962), this study argues that exclusion of IFS transactions from official monetary data has the potential to frustrate monetary policy through wrong inferences on the impact of monetary policy on economic activity.

Methodology

Introduction

Since Sims's (1980) pioneering work, vector autoregression models (VARs) and structural vector autoregression models (SVARs) are considered benchmarks in econometric modelling of monetary policy transmission (Borys & Hovarth 2007; Ngalawa & Viegi 2011). While natural experiments would be ideal, the real world does not provide for this option and SVARs are the only other way experiments can be performed (Christiano, Eichenbaum & Evans 1998). SVAR experiments aimed at measuring the effect of monetary policy on economic activity have traditionally involved setting apart monetary policy shocks and tracking the response of macroeconomic variables to the monetary policy impulses. Since the objective of this study is to understand monetary policy outcomes, tracing them through the inclusion and exclusion of the IFS alongside the FFS within a country's monetary policy framework, the SVAR stands out as the most appropriate method for analysis.

Structural vector autoregression model

Following Ngalawa and Viegi (2011), the monetary transmission process in Malawi can be described by a dynamic system whose structural form equation is given by:

A is an invertible (n × n) matrix describing contemporaneous relations among the variables; yt is an (n×1) vector of endogenous variables such that yt= (y1t, y2t, …, ynt); Ω is a vector of constants; Φi is an (n × n) matrix of coefficients of lagged endogenous variables (∀i = 1,2,3, …, p); B is an (n × n) matrix whose non-zero off-diagonal elements allow for direct effects of some shocks on more than one endogenous variable in the system; and mt are uncorrelated or orthogonal white-noise structural disturbances. Thus, the covariance matrix of μt is an identity matrix E(μt, μt)=1 (see Ngalawa 2016).

Feedback inherent in the SVAR equation makes it impossible to directly estimate equation 1 (see Enders 2004). Nonetheless, the information in the system can be recovered by estimating a reduced-form VAR implicit in the primitive equation. Pre-multiplying equation 1 by A−1 yields a reduced-form VAR of order p, which in standard matrix form is written as:

Ψ0 = A−1Ω, Ψi = A−1Φi and εt = A−1B μt is an (n × 1) vector of error terms assumed to have zero means, constant variances and to be serially uncorrelated with all the right-hand-side variables as well as their own lagged values although they may be contemporaneously correlated across equations. The variance-covariance matrix of the regression residuals in equation 2 is defined as Σ = E(εt, εt). Given the estimates of the reduced-form VAR in equation 2, the structural economic shocks are separated from the estimated reduced-form residuals by imposing restrictions on the parameters of matrices A and B in equation 3:

Equation 3 is derived from equation 2. To identify matrices A and B, the study adopts structural factorisation, an approach that uses relevant economic theory to impose restrictions on the elements of matrices A and B (see Bernanke 1986; Bernanke and Mihov 1998; Sims 1986; Sims & Zha 2006). Seven variables are included in the SVAR, namely output (GYt), consumer price level (CPt), commercial bank loans (BLt) (experiments are also carried out with IFS loans (IFSLt) and total loans (TOTLt), which is the sum of bank loans and IFS loans), exchange rates (XRt), aggregate money supply (M2t), bank rate (BRt) (experiments) are also carried out with IFS interest rates (IFSIRt) and reserve money (RMt). The structural shocks in equation 3 are identified according to the following scheme:

The non-zero coefficients aij and bij in matrices A and B, respectively, show that any residual j in matrices εt and mt, in that order, has an instantaneous impact on variable i. Output and consumer prices in the first two equations are assumed to be sluggish in responding to shocks to monetary variables in the economy. This proposition is based on the observation that most types of real economic activity may respond only with a lag to monetary variables because of planning delays and inherent inertia (Karame & Omedo 2002; Ngalawa & Viegi 2011). Proposed by Bernanke and Mihov (1997), the validity of this argument has been supported by a number of studies (see for example Becklemans 2005; Cheng 2006; Karame & Olmedo 2002; Vonnak 2005).

In the third equation, commercial bank loans are presumed to be contemporaneously affected by all variables in the system. According to Blundell-Wignall and Gizycki (1992), expectations of future activity form an important determinant of credit demand. Assuming current output, price level, exchange rates, interest rates and money supply provide an indication of what is expected in the future (Becklemans 2005) and because economic agents are indeed forward-looking, commercial bank loans may respond contemporaneously to all variables in the system.

The financial sector in Malawi lacks depth and is weakly integrated into global markets. It is safe, therefore, to assume that information delays will be prevalent, forcing players in the foreign exchange market to respond with a lag to changes in interest rates, commercial bank loans and monetary aggregates. This study, therefore, postulates that exchange rates respond contemporaneously to changes in the level of output and consumer prices only and with a lag to movements in interest rates, commercial bank loans and aggregate money supply. Besides being an asset price, the exchange rates also account for movements in external factors such as oil prices and interest rates on the international market.

The fifth equation is a standard money demand function. The equation postulates that demand for money in the country makes aggregate money supply respond contemporaneously to changes in consumer prices, output and interest rates, but not to changes to other variables in the system, akin to Sims and Zha (2006). The last two equations constitute the monetary policy feedback rule. Consistent with Ngalawa and Viegi (2011), the study assumes that the country employs hybrid operating procedures, with the bank rate and reserve money as operating targets of monetary policy. In this framework, both interest rates and reserve money are expected to contain information about monetary policy (Bernanke & Mihov 1997; Ngalawa 2016; Ngalawa & Viegi 2011).

The monetary policy feedback rule is based on the assumption that information delays impede policymakers' ability to react immediately to economic activity and price level developments (Karame & Olmedo 2002). Both the bank rate and reserve money, therefore, do not respond immediately to output and consumer prices. The bank rate, specifically, responds contemporaneously to changes in the exchange rates only. While exchange rate data are available in real time, data on other variables, including commercial bank loans and monetary aggregates, are usually available to the monetary authorities with a lag. Reserve money, on the other hand, is assumed to respond contemporaneously to all monetary variables because, by its definition, this information is inherent in the monetary aggregate (see Ngalawa 2016).

Interpolation of informal financial sector credit and interest rates for Malawi

The study employs interpolated IFS credit and interest rates from Ngalawa (2014). Using two survey data sets, namely the Second Integrated Household Survey for Malawi (IHS2) carried out in 2005 by the Malawi National Statistical Office (NSO) and the Chipeta and Mkandawire survey of 1988, Ngalawa starts with a linear interpolation of IFS credit between the two periods followed by a split of the IFS credit data into agricultural and non-agricultural components. To introduce trend into the agricultural sector component of the IFS credit, Ngalawa constructs weights describing agricultural sector activity using rainfall data from six weather stations purposely selected to cover a lowland area and a highland area in each of the country's three regions.

The non-agricultural component of IFS credit, on the other hand, is separated into rural and urban components. A weighted average of tobacco production and the index of industrial production are used to construct weights for trending the rural and urban components. To account for changes in the ratio of industrial production to agricultural production during the sample period, annual proportions of tobacco production and manufacturing (as proxies for agricultural and industrial production, respectively) in gross domestic product (GDP) are used to calculate a weighted average of the two weighting variables.

The agricultural and non-agricultural components of IFS credit are aggregated into the final interpolation of IFS credit. The data are seasonally adjusted using time series regression with autoregressive moving average (ARIMA) noise, missing observations, and outliers (TRAMO) and signal extraction in ARIMA time series (SEATS), with a forecast horizon of 12 months.

Interpolation of IFS interest rates is based on four stylised facts. Interest rates in semi-formal and formal financial sectors are believed to change together in the same direction; interest rates on loans given by moneylenders, friends, relatives, neighbours, traders, grocers, local merchants and grain millers, according to Chipeta and Mkandawire (1991) and Chimango (1977), are determined by custom and traditional values; friends, relatives, neighbours, traders, grocers, local merchants and grain millers do not charge interest on loans (see Chipeta & Mkandawire 1991) and moneylenders charge 100% interest per period of time, usually a month, described by Chimango (1977) as 'every pound makes another pound' (see Ngalawa 2014).

Six credit market segments are identified from IHS2 and the Chipeta and Mkandawire (1988) survey, namely friends, relatives and neighbours; grocers, traders, merchants and grain millers; moneylenders; community funds; microfinance; and employers (see Ngalawa 2014). Assuming that total credit in the IFS varies according to the interpolated data, the proportion of credit attributed to each market segment is assumed to change from the position reported in the Chipeta and Mkandawire survey to the position in IHS2 following a linear trend. A weighted average of the interest rates in each market segment makes up the interpolated IFS interest rates. The weights are constructed from the size and interest rates of each market segment.

Data, data sources and measurement of variables

The study employs monthly time series data for the period January 1988 to December 2005. The starting date has been chosen to capture the period when monetary authorities in Malawi migrated from using direct measures of monetary control to using indirect measures. The cut-off date corresponds to the date when the interpolated IFS data are available. Major sources of data include the RBM, the NSO of Malawi, the Malawi Meteorological Department and the University of Malawi. Data for IFS credit and interest rates are obtained from Ngalawa's (2014) interpolation summarised in section 'Interpolation of IFS credit and interest rates for Malawi'.

The bank rate (BRt) is defined as the rate at which the central bank provides short-term loans to commercial banks and discount houses in its function as a lender of last resort. The variable enters the SVAR as an instrument target of monetary policy. Experiments are also carried out with IFS interest rates (IFSIRt). Reserve money (RMt) is also employed as an instrument target of monetary policy in the SVAR. Components of RMt are identified as total cash reserves held by the central bank, vault cash in commercial banks and currency held by the non-bank public. The variable BLt captures commercial bank loans and advances and it enters the SVAR as an intermediate target of monetary policy. Experiments are also carried out with IFS loans (IFSLt) and total loans (TOTLt), which is the sum of commercial bank loans and IFS loans. Similarly, the exchange rate (XRt) enters the SVAR as an intermediate target of monetary policy. Middle nominal exchange rates of the Malawi kwacha vis-à-vis the United States dollar are used as a measure of XRt. Aggregate money supply (M2) is measured by the sum of currency in circulation, demand deposits and time deposits. The variable also enters the SVAR as an intermediate target of monetary policy.

Consumer prices (CPt) are measured by the all-items national composite consumer price index with the base year 2000. The variable enters the SVAR as a monetary policy goal. A measure of output (GYt) enters the SVAR as a monetary policy goal as well. Real GDP data (used as a proxy for GYt) for Malawi is, however, only available in annual frequency. This presents a case for interpolation. Several studies have used interpolated monthly GDP series in SVARs. Among them, Cheng (2006) used monthly production data of key sectors in Kenya to interpolate the country's annual GDP to monthly frequency, and Borys and Hovarth (2007) used the quadratic-match average procedure to interpolate GDP from quarterly to monthly frequency in the Czech Republic. This study employs the Friedman method of interpolating time series by related series to compute the required monthly GDP series from annual data.

All variables, with the exception of interest rates, are expressed in natural logarithms. They are also seasonally adjusted using TRAMO and SEATS with a forecast horizon of 12 months.

Estimates and inferences

Estimation results

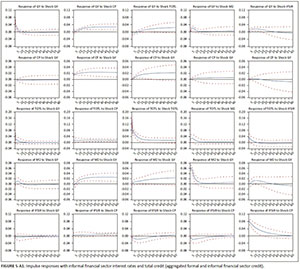

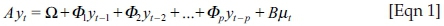

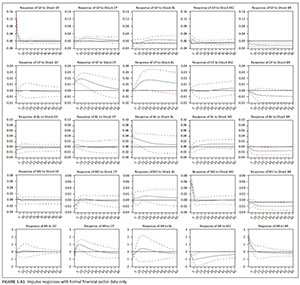

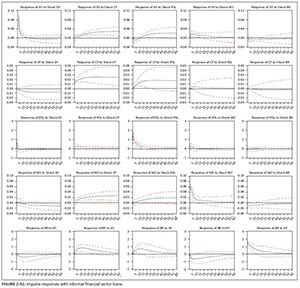

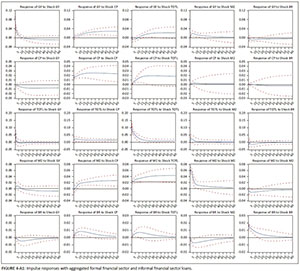

The estimations are carried out in five modular experiments. In the first experiment, only FFS data are used in a seven-variable SVAR. The variables include reserve money (RM), aggregate money supply (M2), bank rate (BR), aggregate output (GY), exchange rate of the Malawi kwacha vis-à-vis the US dollar (XR), consumer prices (CP) and commercial bank lending (BL). This estimation is used as a basis for comparison with other scenarios. In the second experiment, the SVAR is re-estimated with commercial bank loans replaced by IFS loans. The third experiment is a re-estimation of the SVAR with commercial bank loans replaced by IFS loans (IFSL) and the bank rate replaced by IFS interest rates (IFSIR). In the fourth experiment, the SVAR is re-estimated with commercial bank loans replaced by total loans (TOTL), an aggregate of FFS and IFS loans. The final experiment is a re-estimation of the SVAR with the bank rate replaced by IFS interest rates (IFSIR) and bank loans replaced by total loans (TOTL), a sum of FFS and IFS loans. Impulse responses from these experiments are presented in Figures 1-A1-5-A1 in Appendix 1.

The choice of an appropriate lag length in a SVAR is an empirical issue (see Gujarati 2003). Given the various criteria for choosing the lag length, this study settled for the Schwarz Information Criterion (SIC) for the simple reason that it imposes a harsher penalty for adding more lagged terms than other criteria, such as the Akaike Information Criterion. The model with the lowest SIC is deemed the most appropriate. A lag length of 2 was identified as the most appropriate in all the experiments that were carried out. At the chosen lag length (of order 2), all the eight inverse roots of the characteristic autoregressive (AR) polynomial have modulus less than 1 and lie inside the unit circle, indicating that the estimated SVAR is stationary or stable.

Experiment 1

Figure 1-A1 (in Appendix 1) presents impulse response functions of selected variables with FFS data only. The figure shows that a monetary policy shock characterised by an unanticipated increase in the bank rate leads to a significant decline in money supply, commercial bank loans and output, which is consistent with a priori theoretical expectations. The bank rate shock, however, is observed to have no significant impact on consumer prices. Figure 1-A1 (in Appendix 1) further shows that an unexpected increase in commercial bank lending causes output to increase significantly, peaking after about 2 years. Aggregate money supply and consumer prices also increase following the commercial bank lending shock. The figure also shows that monetary authorities respond to an unanticipated increase in consumer prices by increasing the bank rate. In addition, it is observed that money supply increases following a positive consumer price shock, which is a surprising result. A possible explanation for the money supply increase is that the monetary authorities may be attempting to accommodate the consumer price increase by increasing money supply. There is no evidence, though, that monetary authorities respond to an output shock characterised by a sudden increase in output.

Experiment 2

Impulse response functions of selected variables with FFS data plus IFS loans are presented in Figure 2-A1 (Appendix 1). The figure demonstrates that a monetary policy shock characterised by an unanticipated increase in the bank rate has no significant effect on IFS loans and consumer prices. The shock, however, leads to a significant decrease in aggregate money supply and national output. A monetary policy shock identified as a sudden increase in money supply leads to a significant decline in the bank rate and increase in output. There is, however, no significant change in IFS loans and consumer prices. An unexpected increase in informal financial sector loans, on the other hand, leads to a significant increase in output and consumer prices.

Experiment 3

Figure A3 (Appendix 1) shows impulse responses of selected variables, including IFS credit and interest rates. It is shown in the figure that an unexpected increase in IFS interest rates causes an instantaneous increase in IFS credit. Output also increases following the shock. Consumer prices and aggregate money supply, however, do not respond significantly to the shock. The figure further reveals that IFS interest rates do not respond significantly to shocks to any of the variables in the model (output, consumer prices, IFS loans and aggregate money supply).

Experiment 4

Figure A4 (Appendix 1) presents impulse responses of selected variables with aggregated formal and informal financial sector loans (total loans). It is observed in the figure that a bank rate shock has no significant impact on the total loans. Similarly, a shock to aggregate money supply attracts a weak response in the aggregate loans, which is barely significant only in about the third period. The total loans, however, increase significantly from about the fourth period and remain significant for all periods in the experiment, following a positive consumer price shock.

Experiment 5

Figure A5 (Appendix 1) shows impulse responses of IFS interest rates and total credit (the sum of FFS and IFS credit) plus other selected variables. The figure reveals that total loans increase significantly and instantaneously following a shock to IFS interest rates. IFS interest rates, however, do not respond significantly to a total credit shock.

Inferences

Several inferences can be drawn from the results of the five modular experiments. The impulse response functions in the experiments show that while a positive bank rate shock is followed by a decline in commercial bank loans, it has no significant effect on either IFS loans or total loans, and a positive aggregate money supply shock has no significant impact on either IFS credit or IFS interest rates, although it is followed by a decrease in FFS interest rates. This provides evidence that monetary policy may have no significant effect on IFS credit and interest rates. The impulse responses further reveal that a positive IFS interest rate shock leads to an instantaneous increase in IFS credit and total loans. It must be, therefore, that the non-responsiveness of IFS credit to a bank rate shock coupled with the positive relationship between interest rates and credit in the IFS outweigh the inverse relationship between commercial bank loans and a bank rate shock, so that, on balance, total credit does not respond significantly to a bank rate shock.

The positive relationship between IFS interest rates and IFS credit occurs probably because of a high positive correlation between IFS interest rates and real output. In the IFS, interest rates are perceived as a profit-sharing arrangement between a lender and a borrower. An increase in output, therefore, reflects higher expected returns and hence higher interest rates. The impulse responses indicate that a positive output shock is followed by an instantaneous and significant increase in IFS credit and total credit, which feeds back into higher output, which is reflected in higher IFS interest rates.

It is also observed that positive shocks to commercial bank lending and IFS credit lead to a significant increase in output. Not surprisingly, total output increases significantly following a positive shock to aggregate credit (the sum of formal and informal financial sector credit). It is, therefore, tempting for the monetary authorities to formulate and implement policies that will increase domestic credit, with the ultimate objective of stimulating economic growth. If the authorities choose to loosen monetary policy by reducing the bank rate in order to increase domestic credit and consequently accelerate the growth of real output, the results will be unexpected. As observed in the foregoing discussion, aggregate credit does not respond significantly to a bank rate shock if the IFS is taken into account. Accordingly, there is no reason to believe that output will be significantly affected (see Ngalawa 2016).

The impulse responses also reveal that consumer prices increase following a sudden increase in either commercial bank lending or IFS credit (or the sum of both). This suggests that credit (formal, informal or both) can be used as an intermediate target of monetary policy in the fight against inflation. The problem, as observed previously, is that if the IFS is taken into account, total loans do not respond to a monetary tightening characterised by a positive bank rate shock or a negative money supply shock. If the monetary authorities are unaware of the impact of the IFS, they may be misled into believing that an increase in the bank rate or a decrease in aggregate money supply will be followed by a decline in total lending, consequently easing pressure on consumer prices. If, on the other hand, they understand the role of the IFS, they will realise that increasing the bank rate will have no significant effect on total credit, and there will subsequently be no significant impact on consumer prices.

It is further observed in the impulse responses that output decreases significantly following a positive bank rate shock. This is consistent with a priori theoretical expectations. The impulse responses also reveal that output initially increases in response to an IFS interest rate shock. As argued previously, increasing IFS interest rates are associated with increasing output because they reflect increasing productivity or production. When productivity or production in the IFS is increasing, the return on investment is also increasing, which may be reflected in IFS interest rates. Thus, in an economy with a large IFS, the impact of interest rates on aggregate output cannot be generalised. A positive interest rate shock in the FFS depresses output, while in the IFS a positive interest rate shock (IFS interest rates) has a positive impact on output.

It is also demonstrated in the impulse responses that consumer prices do not respond significantly to either a bank rate shock, an IFS interest rate shock or an aggregate money supply shock. This confirms the findings of Ngalawa and Viegi (2011) that monetary factors may not be primary determinants of inflation in Malawi. The representative basket of commodities used for measuring national consumer price indices in Malawi puts a preponderant weight on food costs (45.2%), which indicates that structural rigidities in food production may be a more important determinant of inflation than monetary variables.

The impulse responses, however, reveal that consumer prices increase significantly following a positive commercial bank lending shock, an IFS lending shock and a total lending shock. This finding provides evidence that fluctuations in lending in the two sectors complement each other in influencing consumer prices.

Against the foregoing discussion, the study concludes that while the formal and informal financial sectors may complement each other in certain instances, they can also lead to diametrically opposing outcomes. It follows, therefore, that exclusion of IFS transactions in official monetary data may frustrate monetary policy through wrong inferences on the impact of monetary policy on economic activity.

Summary, conclusions and policy implications

In nearly all low-income countries, official monetary data exclude informal financial transactions even though the IFS forms a large part of the financial sector. This exclusion occurs due to the non-existence of IFS data. However, excluding informal financial transactions in official monetary data underestimates the volume of financial transactions while the cost of credit is incorrectly reported, bringing into question the accuracy of expected effects of monetary policy on economic activity. Using IFS data for Malawi constructed from two survey data sets, indigenous knowledge and elements of Friedman's data interpolation technique, this study employs innovation accounting in a SVAR model to compare monetary policy outcomes in the country when IFS data is taken into account and when it is not.

Consistent with conventional theories, the study finds that output increases following a rise in either FFS or IFS lending. Similarly, inflation rates increase when lending rises in both sectors. In addition, it is observed that consumer prices in Malawi do not respond significantly to lending in either sector. These findings provide evidence that the two sectors complement each other. However, further investigation shows that FFS lending declines when the bank rate increases, while IFS loans are not responsive to bank rate variations and an aggregation of the two is unaffected by bank rate changes. When IFS interest rates are raised, total loans decline, suggesting that lending in the IFS responds to IFS interest rates and not to FFS interest rates. The study also finds that output declines following an increase in FFS interest rates, but increases when IFS interest rates go up. The study, therefore, concludes that exclusion of IFS transactions in official monetary data has the potential to frustrate monetary policy through wrong inferences on the impact of monetary policy on economic activity (see Ngalawa 2016).

Going forward, it is recommended that low-income countries with large informal financial sectors should start compiling data for informal financial transactions. These data may include IFS interest rates and loans, among others. However, this is a long-term solution. In the short term, the study recommends that monetary authorities can interpolate data for the IFS using the available pieces of data (e.g. surveys), tradition, indigenous knowledge and elements of Friedman's method of interpolating time series from related series, as suggested in this study. Adding the IFS and FFS data together as official monetary data is expected to improve policy formulation and implementation in these countries.

Acknowledgements

This article is based on a paper that was delivered at the Ninth Asia-Pacific Conference on Global Business, Economics, Finance and Banking held in Hong Kong SAR 11-13 August 2016. I gratefully acknowledge the comments received at the conference, as well as from South African Journal of Economic and Management Sciences (SAJEMS)'s anonymous reviewers, and the associate editor, who contributed to transforming the paper into a fully-fledged accredited manuscript.

Competing interests

The author declares that he has no financial or personal relationships that may have inappropriately influenced him in writing this article.

References

African Development Bank, 1994, African Development Report 1994, African Development Bank, Tunis. [ Links ]

Aryeetey, E., 1994, Financial integration and development in sub-Saharan Africa: A study of informal finance in Ghana, ODI Working Paper no. WP/78, Overseas Development Institute, London. [ Links ]

Bagachwa, M., 1995, Financial integration and development in Sub-Saharan Africa: A study of informal finance in Tanzania, ODI Working Paper Series, Overseas Development Institute, London. [ Links ]

Basu, K., 1994, Rural credit linkage: Implications for rural poverty, agrarian efficiency and public policy, Working Paper no. 54, Department of Economics Research Programme, London School of Economics. [ Links ]

Becklemans, L., 2005, Credit and monetary policy: An Australian SVAR, RBA Research Discussion Paper Series, 2005-06 (September), Reserve Bank of Australia, Sydney, pp. 1-29. [ Links ]

Bell, C., 1990, 'Interactions between institutional and informal credit agencies in Rural India', The World Bank Economic Review 4(3), 295-327. https://doi.org/10.1093/wber/4.3.297 [ Links ]

Bernanke, B., 1986, Alternative explanations of the money-income correlation, NBER Working Paper no. 1842, National Bureau of Economic Research, Cambridge, MA, pp. 1-62. [ Links ]

Bernanke, B. & Mihov, I., 1997, 'What does the Bundesbank target?', European Economic Review 41(6), 1025-1053. https://doi.org/10.1016/S0014-2921(96)00056-6 [ Links ]

Bernanke, B. & Mihov, I., 1998, 'Measuring monetary policy', The Quarterly Journal of Economics 113(3), 869-902. https://doi.org/10.1162/003355398555775 [ Links ]

Blundell-Wignall, A. & Gizycki, M., 1992, Credit supply and demand and the Australian economy, RBA Discussion Paper no. 9208, Reserve Bank of Australia, Sydney, pp. 1-48. [ Links ]

Bolnick, B., 1992, 'Moneylenders and informal financial markets in Malawi', World Development 20(1), 57-68. https://doi.org/10.1016/0305-750X(92)90136-J [ Links ]

Borys, M. & Hovarth, R., 2007, The effects of monetary policy in the Czech Republic: An empirical study, CERGE-EI Working Paper no. 339, Center for Economic Research and Graduate Education - Economics Institute, Prague, pp. 1-26. [ Links ]

Bose, P., 1998, 'Formal-informal sector interaction in rural credit markets', Journal of Development Economics 56, 265-280. https://doi.org/10.1016/S0304-3878(98)00066-2 [ Links ]

Cheng, K., 2006, A VAR analysis of Kenya's monetary policy transmission mechanism: How does the Central Bank's repo rate affect the economy?, IMF Working Paper no. WP/06/300:1.26, International Monetary Fund, Washington, DC. [ Links ]

Chimango, L., 1977, 'The moneylender in court', Journal of Social Science 6, 83-95. [ Links ]

Chipeta, C., 1998, 'Improving the intermediation role of the informal financial sector in Africa', paper presented at the United Nations Asia-Africa High-Level Workshop on Advancing Financial Intermediation in Africa, Port Louis, Mauritius, 20-22 April. [ Links ]

Chipeta, C. & Mkandawire, M., 1988, A survey of the informal financial sector, unpublished. [ Links ]

Chipeta, C. & Mkandawire, M., 1991, The informal financial sector and macroeconomic adjustment in Malawi, AERC Research Paper no. RP4, African Economic Research Consortium, Nairobi. [ Links ]

Chipeta, C. & Mkandawire, M., 1992, Links between the informal and formal/semi-formal financial sectors in Malawi, AERC Working Paper no. 14, African Economic Research Consortium, Nairobi. [ Links ]

Chirwa, E.W. & Matita, M., 2012, From subsistence to smallholder commercial farming in Malawi: A case of NASFAM commercialisation initiatives, Future Agricultures Working Paper no. 037, viewed 28 April 2017, from http://www.future-agricultures.org/publications/research-and-analysis/1566-from-subsistence-to-smallholder-commercial-farming-in-malawi-a-case-of-nasfam-commercialisation/file [ Links ]

Christiano, L., Eichenbaum, M. & Evans, C., 1998, Monetary policy shocks: What have we learned and to what end? NBER Working Paper no. 6400, National Bureau of Economic Research, Cambridge, MA, pp. 1-77. [ Links ]

Enders, W., 2004, Applied econometric time series, 2nd edn., John Wiley & Sons, Hoboken, NJ. [ Links ]

Friedman, M., 1962, 'The interpolation of time series by related series', Journal of the American Statistical Association 57(300), 729-757. https://doi.org/10.1080/01621459.1962.10500812 [ Links ]

Gondwe, S., 2001, 'The impact of liberalisation policies on commercial bank behaviour and financial savings in Malawi', unpublished MA thesis, University of Malawi. [ Links ]

Gujarati, D., 2003, Basic econometrics, 4th edn., McGraw-Hill, Boston, MA. [ Links ]

Hoff, K. & Stiglitz, J., 1993, 'Moneylenders and bankers: A model of fragmented credit markets with monopolistic competition', paper presented at the Econometric Society Meeting, Anaheim, CA, 5 January. [ Links ]

Hoff, K. & Stiglitz, J., 1994, Some surprising analytics of rural credit subsidies, mimeo., Department of Economics, University of Maryland, College Park, MA. [ Links ]

Karame, F. & Olmedo, A., 2002, 'The asymmetric effects of monetary policy shocks: A non-linear structural VAR approach', unpublished. [ Links ]

Khoi, P., Gan, C., Nartea, G. & Cohen, D., 2013, 'Formal and informal rural credit in the Mekong River Delta of Vietnam: Interaction and accessibility', Journal of Asian Economies 26, 1-13. https://doi.org/10.1016/j.asieco.2013.02.003 [ Links ]

Malawi Government, 2013, 'Reserve Bank of Malawi Act', Laws of Malawi 44(2), 1-19. [ Links ]

Malawi National Statistical Office, 2005, Second integrated household survey, Government Press, Zomba. [ Links ]

Malawi National Statistical Office, 2012, Third integrated household survey, Government Press, Zomba. [ Links ]

Ngalande, E., 1995, Malawi: Economic background, current problems and future prospects, Chancellor College Economics Department, Zomba. [ Links ]

Ngalawa, H., 2014, 'A portrait of informal sector credit and interest rates in Malawi: Interpolated monthly time series', African Finance Journal 16(2), 64-81. [ Links ]

Ngalawa, H., 2016, 'Monetary policy and interpolated informal sector credit and interest rates: Evidence from Malawi', Proceedings of the Ninth Asia-Pacific Conference on Global Business, Economics, Finance and Banking (AP16Hong Kong Conference), Hong Kong, 11-13 August, viewed 14 May 2017, from http://globalbizresearch.org/HongKong_Conference_2016_Aug/conference_paper.php [ Links ]

Ngalawa, H. & Viegi, N., 2011, 'Dynamic effects of monetary policy shocks in Malawi', South African Journal of Economics 79(3), 224-250. https://doi.org/10.1111/j.1813-6982.2011.01284.x [ Links ]

Ngalawa, H. & Viegi, N., 2013, 'Interaction of formal and informal financial markets in quasi-emerging market economies', Economic Modelling 31, 614-624. https://doi.org/10.1016/j.econmod.2013.01.005 [ Links ]

Siamwalla, A., Pinthong, C., Poapongsakorn, P., Satsanguan, N., Nettayarak, P., Mingmaneenakin, W. et al., 1990, 'The Thai rural credit system: Public subsidies, private information, and segmented markets', The World Bank Economic Review 4(3), 271-295. https://doi.org/10.1093/wber/4.3.271 [ Links ]

Sims, C., 1980, 'Macroeconomics and reality', Econometrica 48, 1-49. https://doi.org/10.2307/1912017 [ Links ]

Sims, C., 1986, 'Are forecasting models usable for policy analysis?', Federal Reserve Bank of Minneapolis Quarterly Review 10(1), 2-16. [ Links ]

Sims, C. & Zha, T., 2006, 'Does monetary policy generate recessions?', Macroeconomic Dynamics 10(2), 231-272. https://doi.org/10.1017/S136510050605019X [ Links ]

Soyibo, A., 1997, 'The informal financial sector in Nigeria: Characteristics and relationship with the formal sector', Development Policy Review 15(1), 5-22. https://doi.org/10.1111/1467-7679.00023 [ Links ]

Vonnak, B., 2005, Estimating the effects of Hungarian monetary policy within a structural VAR framework, MNB Working Paper no. 2005/1, Magyar Nemzeti Bank, Budapest, pp. 1-37. [ Links ]

Correspondence:

Correspondence:

Harold Ngalawa

ngalawa@ukzn.ac.za

Received: 25 Dec. 2015

Accepted: 09 Nov. 2017

Published: 23 Apr. 2018

Figure 1-A1 - Click to enlarge

Figure 1-A2 - Click to enlarge

Figure 1-A3 - Click to enlarge

Figure 1-A4 - Click to enlarge